The information in this joint proxy statement/prospectus is not complete and may be changed. We may not sell the securities offered by this joint proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction where an offer or solicitation is not permitted.

PRELIMINARY—SUBJECT TO COMPLETION—DATED JANUARY 22, 2019FEBRUARY 3, 2020

|   |

Proxy Statement/ProspectusJoint proxy statement/prospectus

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

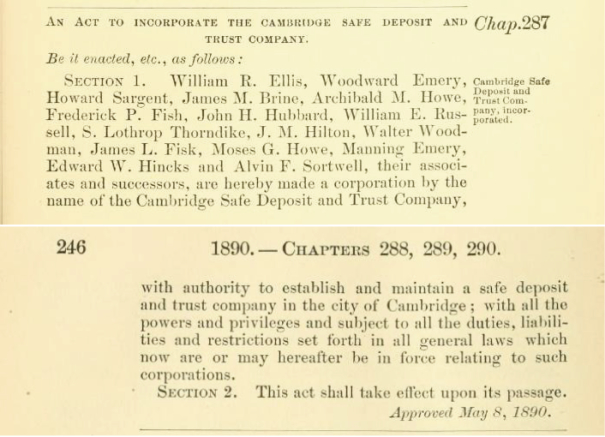

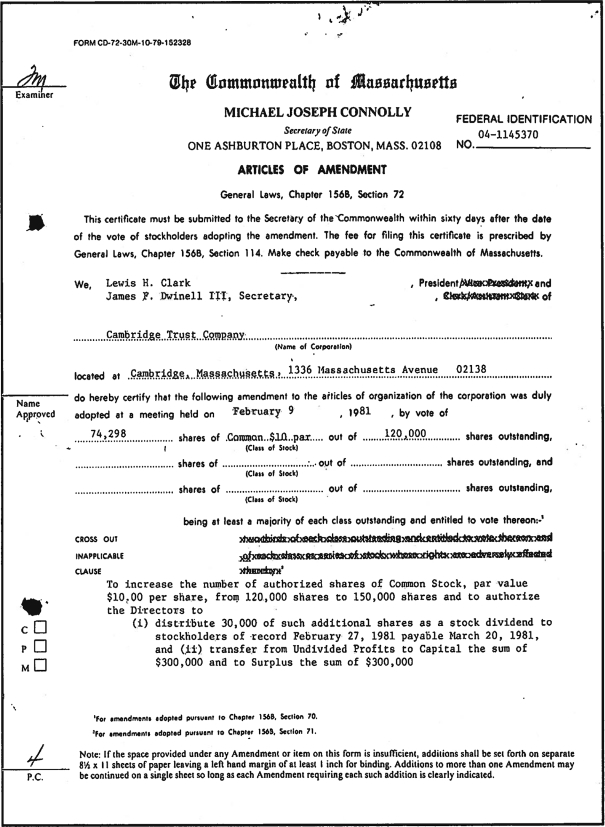

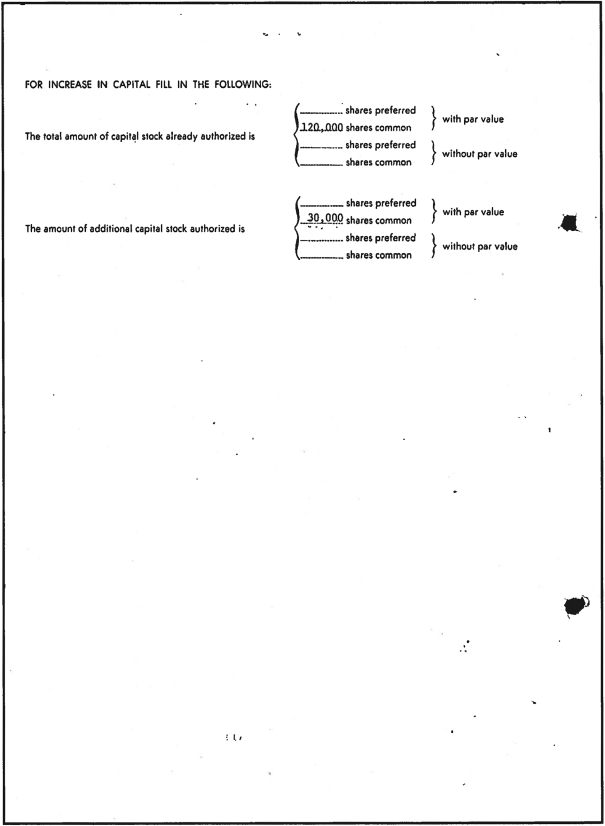

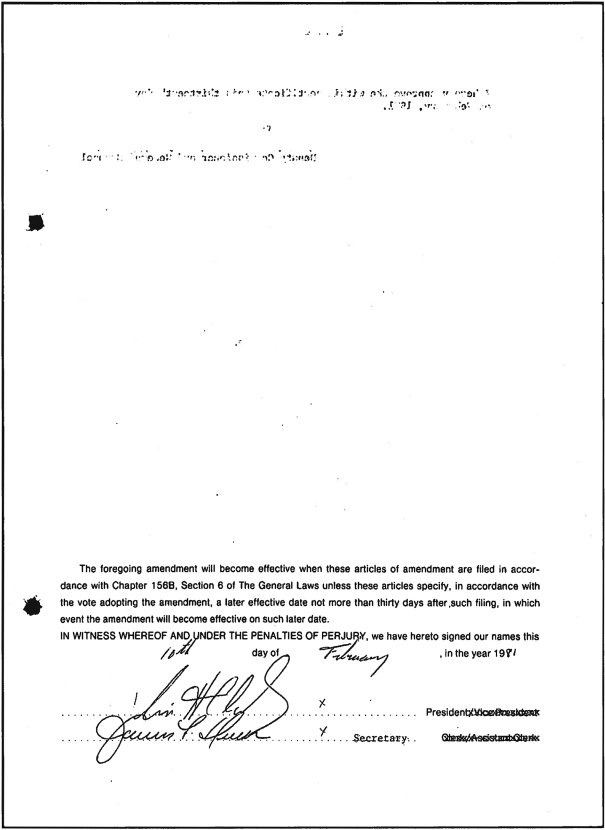

On December 5, 2018,2019, the boards of directors of Cambridge Bancorp, or Cambridge, Cambridge’s wholly-owned subsidiary, Cambridge Trust Company, Wellesley Bancorp, Inc., or Wellesley, and OptimaWellesley’s wholly-owned subsidiary, Wellesley Bank, & Trust Company, or Optima, each approved a merger agreement among Cambridge, Cambridge Trust Company, Wellesley and Optima,Wellesley Bank pursuant to which Optima(i) Wellesley will merge with and into Cambridge, with Cambridge as the surviving entity, and (ii) Wellesley Bank will merge with and into Cambridge Trust Company, with Cambridge Trust Company as the surviving the merger.entity.

Optima isWellesley and Cambridge are each holding a special meeting for itstheir respective shareholders to vote on the merger agreement.proposals necessary to complete the merger. The special meeting of Cambridge shareholders will be held at the Cambridge Trust Wealth Management office, 75 State Street, 18th Floor, Boston, Massachusetts 02109 on ,March 16, 2020, at 8:30 a.m., local time. The boardspecial meeting of directorsWellesley shareholders will be held at the Wellesley College Club, 727 Washington Street, Wellesley, Massachusetts 02482 on March 12, 2020, at 9:00 a.m., local time.

At the special meeting of Optima recommends that allCambridge shareholders, Cambridge shareholders will be asked to consider and vote “FOR” approvalon (i) a proposal to approve the merger agreement and the other transactions contemplated by the merger agreement, including the issuance of Cambridge common stock in connection with the merger (the “Cambridge merger proposal”), and (ii) a proposal to adjourn the Cambridge special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the Cambridge merger proposal (the “Cambridge adjournment proposal”). Approval of the merger agreement. The merger cannot be completed unless a majorityproposal requires the affirmative vote of holders of at leasttwo-thirds of the shares of OptimaCambridge common stock present in person or represented by proxy and entitled to vote at the special meeting of Cambridge shareholders. Approval of the Cambridge adjournment proposal requires the affirmative vote of at least a majority of the votes cast, in person or represented by proxy, at the special meeting. The board of directors of Cambridge recommends that all Cambridge shareholders vote “FOR” the Cambridge merger proposal and “FOR” the Cambridge adjournment proposal.

At the special meeting of Wellesley shareholders, Wellesley shareholders will be asked to consider and vote on (i) a proposal to approve the merger agreement.agreement (the “Wellesley merger proposal”), (ii) a proposal to approve, on an advisory(non-binding) basis, specified compensation that may become payable to the named executive officers of Wellesley in connection with the merger (the “advisory proposal on specified compensation”), and (iii) a proposal to adjourn the Wellesley special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the Wellesley merger proposal (the “Wellesley adjournment proposal”). Approval of the Wellesley merger proposal requires the affirmative vote of the holders of a majority of the shares of Wellesley common stock outstanding and entitled to vote on the proposal. Approval of each of the advisory proposal on specified compensation and the Wellesley adjournment proposal requires the affirmative vote of a majority of the votes cast on the proposal. The board of directors of Wellesley recommends that all Wellesley shareholders vote “FOR” the Wellesley merger proposal, “FOR” the advisory proposal on specified compensation and “FOR” the Wellesley adjournment proposal.

If the merger is completed, OptimaWellesley shareholders will be able to elect to receive either (i) $32.00 in cash, or (ii) 0.34680.580 shares of Cambridge common stock for each share of OptimaWellesley common stock they own on the effective date of the merger, subject to allocation and proration procedures that are intended to ensure that 95% of the total number of Optima shares outstanding immediately prior to the effective time of the merger will be exchanged for stock, and the remaining Optima shares will be converted into cash. Optimamerger. Wellesley shareholders will also receive cash in lieu of any fractional shares they would have otherwise received in the merger.

UnderAs described in more detail elsewhere in this joint proxy statement/prospectus, under the terms of the merger agreement, inif the event thatratio of (i) the average daily closing price of Cambridge common stock for a specified periodover the 20 consecutive full trading days prior to, and including, the 10th day before the closing of the merger to (ii) the closing price of Cambridge common stock on the last trading day preceding the first public announcement of the merger is both (1) less than $68.4980% and (2) 20 percentage points less than the comparable ratio for the NASDAQ Bank Index, Wellesley would have a right to terminate the merger agreement, unless Cambridge elects to increase the exchange ratio such that the implied value of the exchange ratio would be equivalent to the