As filed with the Securities and Exchange Commission on December 9, 2011January 23, 2012

Registration No. 333-176784

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 23

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GENERAL MOTORS FINANCIAL COMPANY, INC.

(Exact name of registrant as specified in its charter)

(For co-registrants, please see Table of Additional Registrants on the next page.)

| Texas | 6199 | 75-2291093 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

801 Cherry Street, Suite 3500

Fort Worth, Texas 76102

(817) 302-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

J. Michael May, Esq.

Executive Vice President and Chief Legal Officer

General Motors Financial Company, Inc.

801 Cherry Street, Suite 3500

Fort Worth, Texas 76102

(817) 302-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

L. Steven Leshin, Esq.

Gregory J. Schmitt, Esq.

Hunton & Williams LLP

1445 Ross Ave., Suite 3700

Dallas, Texas 75202

(214) 979-3000

Approximate date of commencement of proposed sale of the securities to the public:As soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if smaller reporting company) | Smaller Reporting Company | ¨ | ||||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants

Exact name of registrant as specified in its charter (1) | State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification Number | ||||

AmeriCredit Financial Services, Inc. | Delaware | 75-2439888 | ||||

| (1) | The address of the guarantor is 801 Cherry Street, Suite 3500, Fort Worth, Texas 76102, and the telephone number is (817) 302-7000. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED DECEMBER 9, 2011JANUARY 23, 2012

Offer to Exchange up to $500,000,000 aggregate principal amount of new

6.75% Senior Notes due 2018,

which have been registered under the Securities Act,

for any and all of its outstanding unregistered 6.75% Senior Notes due 2018

Subject to the Terms and Conditions described in this Prospectus

The Exchange Offer will expire at 5:00 p.m. Eastern Time on , 2011,February 24, 2012,

unless extended

The Notes

We are offering to exchange, upon the terms and subject to the conditions of this prospectus and the accompanying letter of transmittal, our new registered 6.75% Senior Notes due 2018 for all of our outstanding old unregistered 6.75% Senior Notes due 2018. We refer to our outstanding 6.75% Senior Notes due 2018 as the “old notes” and to the new 6.75% Senior Notes due 2018 issued in this offer as the “Notes.” The Notes are substantially identical to the old notes that we issued on June 1, 2011, except for certain transfer restrictions and registration rights provisions relating to the old notes.

Material Terms of The Exchange Offer

You will receive an equal principal amount of Notes for all old notes that you validly tender and do not validly withdraw.

The exchange will not be a taxable exchange for United States federal income tax purposes.

There has been no public market for the old notes and we cannot assure you that any public market for the Notes will develop. We do not intend to list the Notes on any securities exchange or to arrange for them to be quoted on any automated quotation system.

The terms of the Notes are substantially identical to the old notes, except for transfer restrictions and registration rights relating to the old notes.

If you fail to tender your old notes for the Notes, you will continue to hold unregistered securities and it may be difficult for you to transfer them.

Consider carefully the “Risk Factors” beginning on page 16 of this prospectus.

We are not making this exchange offer in any state where it is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December , 2011.January 26, 2012.

| Page | ||||

| i | ||||

| i | ||||

| 1 | ||||

| 16 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 36 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 47 | |||

| 89 | ||||

| 96 | ||||

| 98 | ||||

| 115 | ||||

| 117 | ||||

| 123 | ||||

| 124 | ||||

| 125 | ||||

| 125 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus is an offer to exchange only the Notes offered by this prospectus and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of its date.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements”. Whenever you read a statement that is not simply a statement of historical fact (such as when we use words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “may,” “will,” “likely,” “should,” “estimate,” “continue,” “future,” or “anticipate” and other comparable expressions), you must remember that our expectations may not be correct, even though we believe they are reasonable. These forward-looking statements are subject to many assumptions, risks and uncertainties that could cause actual results to differ significantly from historical results or from those anticipated by us. We do not guarantee that any future transactions or events described in this prospectus will happen as described or that they will happen at all. You should read this prospectus completely and with the understanding that actual future results may be materially different from what we expect.

All cautionary statements made herein should be read as being applicable to all forward-looking statements wherever they appear. In this connection, investors should consider the risks described herein and should not place undue reliance on any forward-looking statements. You should read carefully the section of this prospectus under the heading “Risk Factors” beginning on page 16.

We assume no responsibility for updating forward-looking information contained herein or in other reports we file with the Securities and Exchange Commission (“SEC”), and do not update or revise any forward-looking information, except as required by federal securities laws, whether as a result of new information, future events or otherwise.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-4 under the Securities Act of 1933, as amended (the “Securities Act”), that registers the Notes that will be offered in exchange for the old notes. The registration statement, including the attached exhibits and schedules, contains additional relevant information about us and the Notes. The rules and regulations of the SEC allow us to omit from this document certain information included in the registration statement.

In addition, this prospectus contains summaries and other information that we believe are accurate as of the date hereof with respect to specific terms of specific documents, but we refer to the actual documents (copies of which will be made available to holders of old notes upon request to us) for complete information with respect to those documents. Statements contained in this prospectus as to the contents of any contract or other document referred to in this prospectus do not purport to be complete. Where reference is made to the particular provisions of a contract or other document, the provisions are qualified in all respects by reference to all of the provisions of the contract or other document. Industry and company data are approximate and reflect rounding in certain cases.

We file periodic reports and other information with the SEC. These reports and other information may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference room. In addition, our filings with the SEC are also available to the public on the SEC’s Internet web site athttp://www.sec.gov. You may also find additional information about us, including documents that we file with the SEC, on our website athttp://www.americredit.com. The information included or linked to this website in not a part of this prospectus.

i

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, we encourage you to read the entire prospectus, including the section describing the risks related to our business and to investing in the Notes entitled “Risk Factors” and our consolidated financial statements, including the accompanying notes, included elsewhere in this prospectus, before deciding to invest in the Notes.

In this prospectus, unless the context indicates otherwise, “Company,” “GM Financial,” “we,” “us,” and “our”refer to General Motors Financial Company, Inc. and its subsidiaries.

The Exchange Offer

We completed on June 1, 2011, the private offering of $500,000,000 of 6.75% Senior Notes due 2018. We entered into a registration rights agreement with the initial purchasers in the private offering of the old notes in which we agreed, among other things, to file a registration statement with the SEC within 150 days of June 1, 2011, to use our commercially reasonable efforts to cause the registration statement to be declared effective by the SEC within 210 days of June 1, 2011 and to use our commercially reasonable efforts to cause this exchange offer to be consummated within 30 business days of when the registration statement is declared effective by the SEC. You are entitled to exchange in this exchange offer old notes that you hold for registered Notes with substantially identical terms. If we fail to timely file the registration statement, the registration statement is not timely declared effective or we fail to timely complete this exchange offer, we must pay liquidated damages to the holders of the old notes until the deadlines are met. You should read the discussion under the headings “Prospectus Summary,” and “Description of the Notes” for further information regarding the Notes.

We believe that the Notes to be issued in this exchange offer may be resold by you without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to certain conditions. You should read the discussion under the headings “Prospectus Summary—The Exchange Offer” and “The Exchange Offer” for further information regarding this exchange offer and resale of the Notes.

General Motors Financial Company, Inc.

GM Financial, the captive finance subsidiary of General Motors Company (“General Motors” or “GM”), is a provider of automobile financing solutions with a portfolio of approximately $10 billion in auto receivables and leases as of September 30, 2011. We have been operating in the automobile finance business since September 1992. Our strategic relationship with GM began in September 2009 and includes a subvention program pursuant to which GM provides its customers access to discounted financing on select new GM models by paying us cash in order to offer lower interest rates on the loans we purchase from GM dealerships. GM acquired us for $3.5 billion on October 1, 2010.

We purchase auto finance contracts for new and used vehicles from GM and non-GM franchised and select independent automobile dealerships. As used herein, the term “loans” includes auto finance contracts originated by dealers and purchased by us. We primarily offer auto financing to consumers who typically are unable to obtain financing from traditional sources such as banks and credit unions. We utilize a proprietary credit scoring system to differentiate credit applications and to statistically rank-order credit risk in terms of expected default rates, which enables us to evaluate credit applications for approval and tailor loan pricing and structure. We service our loan portfolio at regional centers using automated loan servicing and collection systems. Funding for our auto finance activities is primarily obtained through the utilization of our credit facilities and through securitization transactions. Since 1994, we have securitized approximately $67.5 billion of automobile loans in 78 transactions through our securitization program.

We have historically maintained a significant share of the subprime auto finance market and have, in the past, participated in the prime sectors of the auto finance industry to a more limited extent. We source our business primarily through our relationships with automobile dealerships, which we maintain through our regional credit centers, marketing representatives (dealer relationship managers) and alliance relationships. We believe our growth and origination efforts are complemented by disciplined credit underwriting standards, risk-based pricing decisions and expense management.

As GM’s captive finance subsidiary, our business strategy includes increasing the amount of GM new automobile origination volume, while at the same time continuing to remain a valuable financing source for loans for non-GM dealers. In addition to our GM-related loan origination efforts, we offer a lease financing product for new GM vehicles leased by consumers with prime credit bureau scores exclusively to GM franchised dealerships in the United States, and recently began offering a lease financing product that covers the entire credit spectrum (prime and subprime). Evidence of our increasing linkage with GM can be seen in our results for the nine months ended September 30, 2011, during which our percentage of loans and leases for new GM vehicles increased to 39% of our total originations volume, up from 13% for the nine months ended September 30, 2010. Through the acquisition of FinanciaLinx Corporation (“FinanciaLinx”), an independent auto lease provider in Canada, in April 2011, we now also offer lease financing for new GM vehicles in Canada.

In the near term, we believe our business should benefit from favorable trends currently existing in the new and used automobile markets as the U.S. automotive industry rebounds, from strong capital markets and from improving general economic conditions and positive credit trends.

Loan Originations

Target Market. Most of our automobile finance programs are designed to serve customers who have limited access to automobile financing through banks and credit unions. The bulk of our typical borrowers have experienced prior credit difficulties or have limited credit histories and generally have credit bureau scores ranging from 500 to 700. Because we generally serve customers who are unable to meet the credit standards imposed by most banks and credit unions, we generally charge higher interest rates than those charged by such sources. Since we provide financing in a relatively high-risk market, we also expect to sustain a higher level of credit losses than these other automobile financing sources.

Marketing. As an indirect lender, we focus our marketing activities on automobile dealerships. We are selective in choosing the dealers with whom we conduct business and primarily pursue GM and non-GM manufacturer franchised dealerships with new and used car operations and select independent dealerships. We generally finance new and later model, low mileage used vehicles from GM and non-GM dealers. Of the contracts purchased by us during the nine months ended September 30, 2011, approximately 94% were originated by manufacturer franchised dealers, and 6% by independent dealers; further, approximately 53% were used vehicles, approximately 28% were new GM vehicles (not including new GM vehicles that we leased during these nine months) and approximately 19% were new non-GM vehicles. We purchased contracts from 11,969 dealers, of which approximately 28% were GM dealers for whom we financed a new GM vehicle, during the nine months ended September 30, 2011. No dealer location accounted for more than 1% of the total volume of contracts purchased by us for that same period.

Origination Network. Our origination platform provides specialized focus on marketing our financing programs and underwriting loans. Responsibilities are segregated so that the sales group markets our programs and products to our dealer customers, while the underwriting group focuses on underwriting, negotiating and closing loans. The underwriters are based in credit centers while the dealer relationship managers are based in credit centers or work remotely. We use a combination of regional credit centers and dealer relationship managers to market our indirect financing programs to our dealers, develop relationships with these dealers and underwrite contracts submitted by the dealerships. We believe that the personal relationships our credit

underwriters and dealer relationship managers establish with the dealership staff are an important factor in creating and maintaining productive relationships with our dealer customer base.

Manufacturer Relationships. We have programs with GM and other new vehicle manufacturers, typically known as subvention programs, under which the manufacturers provide us cash payments in order for us to offer lower interest rates on finance contracts we purchase from the manufacturers’ dealership network. The programs serve our goal of increasing new loan originations and the manufacturers’ goal of making credit more available and more affordable to consumers purchasing vehicles sold by the manufacturer.

Origination Data. The following table sets forth information with respect to the number of credit centers, number of dealer relationship managers, dollar volume of contracts purchased and number of producing dealerships for the periods set forth below (dollars in thousands):

| Nine Months Ended September 30, 2011 | Period From July 1, 2010 Through December 31, 2010 | Fiscal Years Ended June 30, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||

Number of credit centers | 16 | 15 | 14 | 13 | 24 | |||||||||||||||||

Number of dealer relationship managers | 153 | 110 | 99 | 55 | 104 | |||||||||||||||||

Origination volume(a) | $ | 4,517,675 | $ | 1,904,471 | $ | 2,137,620 | $ | 1,285,091 | $ | 6,293,494 | ||||||||||||

Number of producing dealerships(b) | 11,969 | 11,831 | 10,756 | 9,401 | 17,872 | |||||||||||||||||

| (a) | For the nine months ended September 30, 2011, the period from July 1, 2010 through December 31, 2010 and the year ended June 30, 2008, amounts include $672.4 million, $10.7 million and $218.1 million of contracts purchased through our leasing programs, respectively. |

| (b) | A producing dealership refers to a dealership from which we purchased a contract in the respective period. |

Credit Underwriting

We utilize a proprietary credit scoring system to support the credit approval process. The credit scoring system was developed through statistical analysis of our consumer demographic and portfolio databases consisting of data which we have collected over almost 20 years of operating history. Credit scoring is used to differentiate credit applications and to statistically rank-order credit risk in terms of expected default rates, which enables us to evaluate credit applications for approval and tailor loan pricing and structure. For example, a consumer with a lower score would indicate a higher probability of default and, therefore, we would either decline the application, or, if approved, compensate for this higher default risk through the structuring and pricing of the loan. While we employ a credit scoring system in the credit approval process, credit scoring does not eliminate credit risk. Adverse determinations in evaluating contracts for purchase or changes in certain macroeconomic factors after purchase could negatively affect the credit performance of our loan portfolio.

The proprietary credit scoring system incorporates data contained in the customer’s credit application, credit bureau report and other third-party data sources as well as the structure of the proposed loan and produces a statistical assessment of these attributes. This assessment is used to rank-order applicant risk profiles and recommends a price we should charge for different risk profiles. Our credit scorecards are monitored through comparison of actual versus projected performance by score. Periodically, we endeavor to refine our proprietary scorecards based on new information including identified correlations between receivables performance and data obtained in the underwriting process.

In addition to our proprietary credit scoring system, we utilize other underwriting guidelines. These underwriting guidelines are comprised of numerous evaluation criteria, including:

identification and assessment of the applicant’s willingness and capacity to repay the loan, including consideration of credit history and performance on past and existing obligations;

credit bureau data;

collateral identification and valuation;

payment structure and debt ratios;

insurance information;

employment, income and residency verifications, as considered appropriate; and

in certain cases, the creditworthiness of a co-obligor. These underwriting guidelines, and the minimum credit risk profiles of applicants we will approve as rank-ordered by our credit scorecards, are subject to change from time to time based on economic, competitive and capital market conditions as well as our overall origination strategies.

Loan Servicing

Our loan servicing activities consist of collecting and processing customer payments, responding to customer inquiries, initiating contact with customers who are delinquent in payment of an installment, maintaining the security interest in the financed vehicle, monitoring physical damage insurance coverage of the financed vehicle, and arranging for the repossession of financed vehicles, liquidation of collateral and pursuit of deficiencies when appropriate. Our payment processing and customer service activities are operated centrally in Arlington, Texas. Our collection activities are operated through four regional standardized collection centers in North America (Arlington, Texas, Peterborough, Ontario, Chandler, Arizona and Charlotte, North Carolina).

U.S. and Canadian Leasing

In December 2010, we began offering lease financing for new GM vehicles leased by consumers with prime credit bureau scores from GM-franchised dealerships in the United States. During July 2011, we completed the nationwide rollout of our lease program for GM dealers in the U.S., including product offerings available for prime and subprime consumers. We had previously provided a limited new vehicle leasing product through certain franchised dealerships that we discontinued in 2008.

We market our lease program to GM-franchised dealerships through our existing origination network of regional credit centers and dealer relationship managers. We underwrite customer applications for leases in the credit centers using data contained in the credit applications and credit bureau reports, as well as other underwriting guidelines such as those used in evaluating applications for loans. We utilize a proprietary credit scoring system to support the credit approval process for subprime customer applications. We currently use a third-party servicer to service our U.S. lease portfolio, including the management of end-of-lease processes.

On April 1, 2011, we acquired FinanciaLinx, an independent auto lease provider in Canada. FinanciaLinx provides leasing programs to GM and other manufacturers through manufacturer subvention programs. Through FinanciaLinx, we intend to increase lease origination levels for new GM vehicles sold by GM-franchised dealerships in Canada. FinanciaLinx markets leasing programs to Canadian dealerships through its field personnel, and underwrites and services leases centrally from its principal business location in Toronto.

Financing

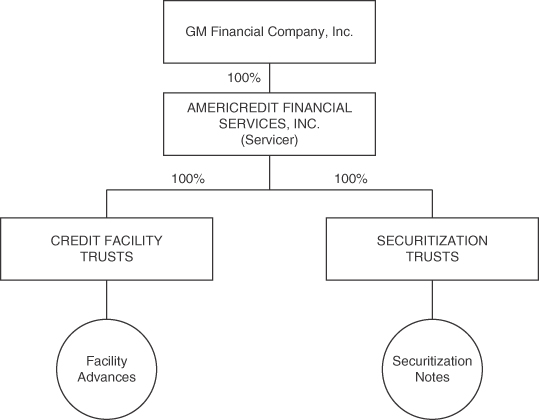

We primarily finance our loan and lease origination volume through the use of our credit facilities and, in the case of our loan originations, through securitization transactions.

Credit Facilities.Loans are typically funded initially using credit facilities that are generally administered by agents on behalf of institutionally managed commercial paper conduits. Under these funding agreements, we establish special purpose finance subsidiaries to facilitate our financing under these programs. While these subsidiaries are included in our consolidated financial statements, these subsidiaries are separate legal entities and the finance receivables and other assets held by these subsidiaries are legally owned by them and are not available to our creditors or creditors of our other subsidiaries.

Securitizations.We pursue a financing strategy of securitizing our automobile loans to diversify our funding sources and free up capacity on our credit facilities for the purchase of additional automobile loans. The asset-backed securities market has traditionally allowed us to finance our auto loan portfolio at fixed interest rates over the life of a securitization transaction, thereby locking in the excess spread on our loan portfolio. Proceeds from securitizations are primarily used to fund initial cash credit enhancement requirements in the securitization and to pay down borrowings under our credit facilities, thereby increasing availability thereunder for further contract purchases. Since 1994, we have securitized approximately $67.5 billion of auto loans, including five securitization transactions since January 2011 pursuant to which we issued $4.6 billion of asset-backed securities.

Competitive Strengths

We believe our competitive strengths include the following:

Automobile finance franchise with long-term track record

We have been operating in the auto finance industry since 1992, and currently provide loans on new and used vehicles purchased by consumers from both GM and non-GM franchised and select independent dealerships and, since our acquisition by GM, leases of new GM vehicles. We have historically maintained a significant share of the subprime auto finance market and have also participated to a lesser extent in the prime sectors of the auto finance market. During the nine months ended September 30, 2011, we originated loans through 11,969 producing dealers, of which approximately 28% were GM dealers for whom we financed new GM vehicles. We believe we are well positioned to take advantage of the favorable existing trends in the new and used automobile markets at both GM and non-GM dealerships, although we may not have as long of a relationship with our dealers that some of our competitors may have with them and we may not be able to offer the same financial products to those dealers as our competitors.

Strong relationship with our parent company, GM

As GM’s captive finance subsidiary, we benefit from greater access to GM dealerships, which we believe will drive increased origination volume from GM dealerships. We also believe that our volume will increase due to expanded product offerings, such as our lease program, in both the U.S. and Canada. Additionally, GM provides us with additional financial resources through a $300 million unsecured revolving credit facility and a tax sharing agreement, which effectively defers up to $650 million in taxes that we would otherwise be required to pay to GM over time, however, other captive finance affiliates of other major automobile manufacturers have greater financial resources and lower costs of funds. While we have no commitment, we expect that our revolving credit facility with GM will be extended and increased as necessary to support our liquidity. We believe our GM credit facility and our tax sharing agreement increases our overall financial flexibility and capacity for growth, although our close relationship with GM increases our dependence on the successes of GM.

Opportunity for future growth

Over the past 19 years, we have developed strong origination capabilities across a broad spectrum of the auto finance industry. As of September 30, 2011, we had approximately 13,900 dealerships with active dealer agreements, of which approximately 4,200 were GM dealerships and approximately 9,700 were non-GM

dealerships. These dealerships were serviced by 153 relationship managers and 16 credit centers. While we continue to originate loans through non-GM dealers, the volume of our new GM loan originations has increased substantially since we were acquired by GM. We have also expanded our product offerings to better serve our GM dealers. In December 2010, we began offering lease financing in the U.S. for new GM vehicles purchased by consumers with prime credit scores. By July 2011, our lease product offerings to GM dealers in the U.S. were expanded nationwide and cover the entire credit spectrum (prime and subprime). Through the acquisition of FinanciaLinx, an independent auto lease provider in Canada, we additionally offer lease financing for new GM vehicles in Canada. We expect to expand our business to include dealer wholesale and commercial lending in the U.S. and Canada.

Disciplined credit underwriting

We utilize a proprietary credit scoring system, which has been developed through statistical analysis of customer demographics and portfolio databases consisting of data which we have collected over our almost 20 years of operating history. This system rank-orders risk which allows us to effectively price our product offerings based upon our assessment of the applicant’s risk profile. In addition to utilizing our credit scoring system, we maintain other underwriting guidelines comprised of numerous evaluation criteria. Such evaluation criteria include:

an applicant’s willingness and ability to repay the loan, including consideration of credit history and performance on past and existing obligations;

credit bureau data;

collateral identification and valuation;

payment structure and debt ratios;

insurance information;

employment, income and residency verifications, as considered appropriate; and

in certain cases, the creditworthiness of a co-obligor.

In response to the unprecedented dislocation in the capital markets which occurred during the financial crisis in 2008 and 2009, we limited our originations to preserve liquidity. The reduction in volume primarily resulted from raising the minimum required custom credit score and tightening other loan characteristics, such as loan to value and payment to income. As a result, we have experienced cumulative loss performance on the 2009 and 2010 loan origination vintages that is trending better than performance on any prior vintages. While recent originations reflect a moderate increase in credit risk appetite, we do not expect the increasing mix of new GM business to substantially impact credit metrics.

Conservative balance sheet and strong liquidity position

As of September 30, 2011, we had total liquidity of $1.5 billion, including our $300 million unsecured revolving credit facility with GM that was undrawn as of September 30, 2011. We had a tangible net worth of $2.7 billion, equivalent to 22% of total assets and 24% of tangible assets at September 30, 2011. In addition to our strong liquidity position, we had a credit facility of $2.0 billion to support our loan origination program, and a $600 million credit facility to support our U.S. lease program as of September 30, 2011. In July 2011, we closed a C$600 million Canadian lease warehouse facility to support our lease program in Canada. We continue to finance the loans we originate through the securitization markets and, since January 2011, we have issued $4.6 billion of asset-backed securities through five securitization transactions.

Experienced management team

Our executive management team (including the CEO, CFO and the Company’s eight other Executive Vice Presidents) have an average tenure at GM Financial of approximately 14 years. All of the executive management team has remained in place subsequent to our being acquired by GM. In addition, we have had strong stability among the senior leaders in our origination, servicing and credit risk management groups. This stability has enabled the management team to gain experience operating our business across several economic cycles.

Business Strategy

Expand our business with GM dealers and preserve our non-GM dealer business

We believe we will be able to capitalize on the favorable trends currently existing in the new and used automobile markets. Current subprime auto finance market activity is at levels equal to approximately 50% of peak 2006-2007 volume levels, and vehicle manufacturers, including our parent, GM, have begun to rebound from recessionary levels of vehicle sales. As GM’s captive finance subsidiary, we intend to provide financing solutions to GM dealers in specific market segments that are at times underserved or that we believe may benefit from additional competition, including U.S. subprime loans, U.S. and Canadian leases and dealer wholesale and commercial lending. We expect that our volume of GM new originations and the percentage of our total originations represented by GM new vehicles will continue to increase. In addition, we will continue to remain a valuable financing source for subprime auto loans to non-GM dealers.

Maintain disciplined underwriting, credit risk management and servicing

We view our proprietary scoring model for credit risk assessment and risk-based pricing as key to properly executing our business strategy. In order to fully align with GM’s sales strategy, we have transitioned to five sales regions consistent with GM’s marketing regions and 16 credit centers located within those regions. These regionally focused credit centers underwrite both loans and leases, and house full sales and underwriting teams. We believe the regional presence provided by our credit centers enables us to be more responsive to dealer concerns and local market conditions. Our servicing activities are performed in four regional servicing centers. We utilize monthly billing statements, predictive dialing systems and behavioral assessment models to efficiently service our loan portfolio. These behavioral models help us develop servicing strategies for the portfolio or for targeted account groups within the portfolio.

Focus on maintaining strength of balance sheet and liquidity

As of September 30, 2011, we had available liquidity of $1.5 billion, including our $300 million line of credit with GM, and had credit facilities totaling $3.2 billion for new and used loan and lease originations in the U.S. and Canada. While we have no commitment, we expect that our revolving credit facility with GM will be extended and increased as necessary to support our liquidity. Furthermore, as of September 30, 2011, our balance sheet reflects tangible net worth of $2.7 billion, equal to 22% of total assets and 24% of tangible assets. As we grow our business, we expect to continue to focus on maintaining adequate levels of liquidity. We have historically financed, and expect to continue to finance, our business operations through a variety of sources including credit facilities, securitization transactions and unsecured term debt. We have a long history of successfully securitizing auto loans and anticipate continuing to use the securitization market as our primary funding source. Since 1994, we have completed 78 securitization transactions totaling over $67.5 billion of auto loans. We also intend to access the unsecured debt markets from time to time depending on prevailing conditions in the capital markets.

Corporate Information

We were incorporated in Texas on May 18, 1988, and succeeded to the business, assets and liabilities of a predecessor corporation formed under the laws of Texas on August 1, 1986. Our predecessor began operations in March 1987, and the business has been operated continuously since that time. Our principal executive offices are located at 801 Cherry Street, Suite 3500, Fort Worth, Texas, 76102 and our telephone number is (817) 302-7000.

Recent Developments

On November 9, 2011, we announced our September 30, 2011 quarterly operating results. Loan originations were $1.4 billion for the quarter ended September 30, 2011, up 1% sequentially compared to $1.3 billion for the quarter ended June 30, 2011 and up 42% compared to $959 million for the quarter ended September 30, 2010. Lease originations were $189 million for the quarter ended September 30, 2011, compared to $173 million for the quarter ended June 30, 2011. Loan and lease financing for new GM vehicles accounted for 39% of total originations volume for the nine months ended September 30, 2011, compared to 13% for the nine months ended September 30, 2010. Finance receivables totaled $9.4 billion and leased vehicles, net, totaled $564 million at September 30, 2011.

Finance receivables 31-to-60 days delinquent were 4.7% of the portfolio at September 30, 2011, compared to 6.2% at September 30, 2010. Accounts more than 60 days delinquent were 1.7% of the portfolio at September 30, 2011, compared to 2.5% a year ago. Annualized net credit losses (which include charge-offs and write-offs of contractual amounts on the pre-acquisition portfolio and is a non-GAAP measure, see Page 64 for reconciliation) were 3.0% of average finance receivables for the quarter ended September 30, 2011, compared to 5.4% for the quarter ended September 30, 2010. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Exchange Offer

The exchange offer relates to the exchange of up to $500,000,000 aggregate principal amount of outstanding old notes for an equal aggregate principal amount of Notes. The form and terms of the Notes are identical in all material respects to the form and terms of the corresponding outstanding old notes, except that the Notes will be registered under the Securities Act, and therefore they will not bear legends restricting their transfer.

Securities to be Exchanged | On June 1, 2011, we issued $500,000,000 aggregate principal amount of old notes to the initial purchasers in a transaction exempt from the registration requirements of the Securities Act. The terms of the Notes and the old notes are substantially identical in all material respects, except that the Notes will be freely transferable by the holders except as otherwise provided in this prospectus. See “Description of the Notes.” |

The Exchange Offer | $1,000 principal amount of Notes in exchange for each $1,000 principal amount of old notes. As of the date of this prospectus, old notes representing $500,000,000 aggregate principal amount are outstanding. Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to certain third parties unrelated to us, we believe that Notes issued pursuant to the exchange offer in exchange for old notes may be offered for resale, resold or otherwise transferred by holders thereof (other than any holder which is an “affiliate” of the Company or certain subsidiaries of the Company within the meaning of Rule 405 under the Securities Act, or a broker-dealer who purchased old notes directly from us to resell pursuant to Rule 144A or any other available exemption under the Securities Act), without compliance with the registration and prospectus delivery requirements of the Securities Act, provided that such Notes are acquired in the ordinary course of such holders’ business and such holders have no arrangement with any person to engage in a distribution of Notes. However, the SEC has not considered the exchange offer in the context of a no-action letter and we cannot be sure that the staff of the SEC would make a similar determination with respect to the exchange offer as in such other circumstances. Furthermore, each holder, other than a broker-dealer, must acknowledge that it is not engaged in, and does not intend to engage or participate in, a distribution of Notes. Each broker-dealer that receives Notes for its own account pursuant to the exchange offer must acknowledge that it will comply with the prospectus delivery requirements of the Securities Act in connection with any resale of such Notes. Broker-dealers who acquired old notes directly from us and not as a result of market-making activities or other trading activities may not rely on the staff’s interpretations discussed above or participate in the exchange offer and must comply with the prospectus delivery requirements of the Securities Act in order to resell the old notes. |

Registration Rights | We sold the old notes on June 1, 2011, in a private placement in reliance on Section 4(2) of the Securities Act. The old notes were immediately resold by the initial purchasers in reliance on Rule 144A |

under the Securities Act. In connection with the sale, we, together with the guarantor, entered into a registration rights agreement with the initial purchasers requiring us to make the exchange offer. The registration rights agreement further provides that we must (i) file a registration statement with SEC within 150 days of June 1, 2011, (ii) use our commercially reasonable efforts to cause the registration statement with respect to the exchange offer to be declared effective on or prior to 210 days of June 1, 2011, and (iii) use our commercially reasonable efforts to cause the exchange offer to be consummated on or before the 30th business day following the effective date of the registration statement. See “Registration Rights.” |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, |

Withdrawal | The tender of the old notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any old notes not accepted for exchange for any reason will be returned without expense promptly after the expiration or termination of the exchange offer. |

Interest on the Notes and the Old Notes | Interest on the Notes will accrue from June 1, 2011 or from the date of the last payment of interest on the old notes, whichever is later. No additional interest will be paid on old notes tendered and accepted for exchange. |

Conditions to the Exchange Offer | The exchange offer is subject to certain customary conditions, certain of which may be waived by us. See “The Exchange Offer—Conditions of the Exchange Offer.” |

Procedures for Tendering Old Notes | Each holder of the old notes wishing to accept the exchange offer must complete, sign and date the letter of transmittal, or a copy thereof, in accordance with the instructions contained herein and therein, and mail or otherwise deliver the letter of transmittal, or the copy, together with the old notes and any other required documentation, to the exchange agent at the address set forth herein. Persons holding the old notes through the Depository Trust Company (“DTC”), and wishing to accept the exchange offer must do so pursuant to DTC’s Automated Tender Offer Program, by which each tendering participant will agree to be bound by the letter of transmittal. By executing or agreeing to be bound by the letter of transmittal, each holder will represent to us that, among other things: |

the Notes acquired pursuant to the exchange offer are being obtained in the ordinary course of business of the person receiving such Notes,

the holder is not engaging in and does not intend to engage in a distribution of such Notes,

the holder does not have an arrangement or understanding with any person to participate in the distribution of such Notes, and

the holder is not an “affiliate,” as defined under Rule 405 promulgated under the Securities Act, of the Company or the guarantor. We will accept for exchange any and all old notes which are properly tendered (and not withdrawn) in the exchange offer prior to the expiration date. The Notes will be delivered promptly following the expiration date. See “The Exchange Offer—Terms of the Exchange Offer.”

Exchange Agent | Deutsche Bank Trust Company Americas is serving as exchange agent in connection with the exchange offer. |

Federal Income Tax Considerations | We believe the exchange of old notes for Notes pursuant to the exchange offer will not constitute a sale or an exchange for federal income tax purposes. See “Certain United States Federal Income Tax Considerations.” |

Appraisal or Dissenters’ Rights | You will not have appraisal or dissenters’ rights in connection with the exchange offer. |

Regulatory Requirements | Following the effectiveness of the registration statement covering the exchange offer, no material federal or state regulatory requirement must be complied with in connection with the exchange offer. |

Consequences of Not Exchanging Old Notes

If you do not exchange your old notes for Notes in the exchange offer, your old notes will continue to be subject to the restrictions on transfer contained in the legend on the old notes. In general, the old notes may not be offered or sold unless they are registered under the Securities Act. However, you may offer or sell your old notes under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. If you do not exchange your old notes for the Notes in the exchange offer, your old notes will continue to be guaranteed by the guarantor.

Summary of the Terms of the Notes

Issuer | General Motors Financial Company, Inc. |

Securities Offered | $500,000,000 aggregate principal amount of 6.75% Senior Notes due 2018. |

Maturity Date | The Notes will mature on June 1, 2018. |

Interest Payment Dates | June 1 and December 1 of each year, beginning December 1, 2011. |

Interest | The Notes will accrue interest at a rate of 6.75% per year from June 1, 2011. |

Guarantor | The Notes will be guaranteed by our principal United States operating subsidiary, AmeriCredit Financial Services, Inc., or AFSI, on a senior unsecured basis and, under certain circumstances, certain of our other subsidiaries. See “Description of the Notes—Subsidiary Guarantee” and “—Certain Covenants—Additional Guarantees.” |

Ranking | The Notes will be our and the guarantor’s unsecured senior obligations. The Notes will rank equal in right of payment with all of such entities’ existing and future senior indebtedness and will rank senior in right of payment to all of such entities’ existing and future subordinated indebtedness; however, the Notes will be effectively subordinated to all of our and the guarantor’s secured indebtedness to the extent of the value of the collateral securing such indebtedness. The Notes will also be structurally subordinated to the indebtedness and other obligations of our subsidiaries that do not guarantee the Notes with respect to the assets of such entities. As of September 30, 2011, and after giving effect to the issuance of the Notes and the application of the proceeds, which included the retirement of our 8.50% Senior Notes due 2015, we and the guarantor had $501 million of indebtedness (of which none would have been secured indebtedness). As of September 30, 2011, our subsidiaries that will not guarantee the Notes had $7.6 billion of secured indebtedness and other liabilities and $10.3 billion of assets, and, after giving effect to the issuance of the Notes, 83% of consolidated total assets. |

Certain Covenants | The indenture governing the Notes contains a covenant limiting our ability to sell all or substantially all of our assets or merge or consolidate with or into other companies; and a covenant limiting our and our restricted subsidiaries’ ability to incur liens. These covenants are subject to a number of important limitations and exceptions and in many circumstances may not significantly restrict our or our restricted subsidiaries’ ability to take the actions described above. For more details, see “Description of the Notes—Certain Covenants.” |

Change of Control | Upon a change of control, we will be required to offer to purchase the Notes at a price equal to 101% of their principal amount plus accrued and unpaid interest, if any, to the date of purchase. See “Description of the Notes—Certain Covenants—Change of Control.” |

| If at any time the credit rating of the Company is investment grade from at least two out of three specified rating agencies, then this change of control covenant will cease to apply to the Notes. See “Description of the Notes—Certain Covenants—Change of Control.” |

Optional Redemption | We may redeem some or all of the Notes at our option at any time before maturity at the “make-whole” price described under “Description of the Notes—Optional Redemption.” |

Governing Law | The indenture is, and the Notes will be, governed by the laws of the State of New York. |

Risk Factors | Investing in the Notes involves substantial risks. You should carefully consider all the information contained in this prospectus prior to investing in the Notes. In particular, we urge you to carefully consider the information set forth in the section under the heading “Risk Factors” for a description of certain risks you should consider before investing in the Notes. |

Summary Historical Financial Data

The table below summarizes selected financial information (dollars in thousands, except per share data). After our acquisition by GM via our merger with an indirect wholly owned subsidiary of GM (the “Merger”), AmeriCredit Corp. (“Predecessor”) was renamed General Motors Financial Company, Inc. (“Successor”) and the “Summary Historical Financial Data” for periods preceding the Merger and for the period succeeding the Merger have been derived from the consolidated financial statements of the Predecessor and the Successor, respectively. The consolidated financial statements of the Predecessor have been prepared on the same basis as the audited financial statements included in our Annual Report on Form 10-K for the year ended June 30, 2010. The consolidated financial statements of the Successor reflect the application of “purchase accounting”. The following tables also present summary financial data for the nine months ended September 30, 2011 and 2010, which we derived from the unaudited condensed consolidated financial statements. In our opinion, this interim data reflects all adjustments, consisting only of normal recurring adjustments, necessary to fairly present the data for such interim periods. Operating results for interim periods are not necessarily indicative of the results that may be expected for a full year.

You should read this data in conjunction with, and it is qualified by reference to, the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements and the notes thereto, and the other financial information contained elsewhere herein.

| Successor | Predecessor | Successor | Predecessor | |||||||||||||||||||||||||||||||||||||||

| Period From October 1, 2010 Through December 31, 2010 | Period From July 1, 2010 Through September 30, 2010 | Fiscal Years Ended June 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | 2011 | 2010 | ||||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||

Operating Data: | ||||||||||||||||||||||||||||||||||||||||||

Revenue | ||||||||||||||||||||||||||||||||||||||||||

Finance charge income | $ | 264,347 | $ | 342,349 | $ | 1,431,319 | $ | 1,902,684 | $ | 2,382,484 | $ | 2,142,470 | $ | 1,641,125 | $ | 907,047 | $ | 1,020,772 | ||||||||||||||||||||||||

Other revenue | 16,824 | 30,275 | 91,498 | 164,640 | 160,598 | 197,453 | 170,213 | 108,686 | 74,630 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| 281,171 | 372,624 | 1,522,817 | 2,067,324 | 2,543,082 | 2,339,923 | 1,811,338 | 1,015,733 | 1,095,402 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Costs and expenses | ||||||||||||||||||||||||||||||||||||||||||

Operating expenses | 70,441 | 68,855 | 288,791 | 308,803 | 397,814 | 398,434 | 336,153 | 249,920 | 212,374 | |||||||||||||||||||||||||||||||||

Leased vehicles expenses | 2,106 | 6,539 | 34,639 | 47,880 | 36,362 | 1,283 | 39,446 | 20,847 | ||||||||||||||||||||||||||||||||||

Provision for loan losses | 26,352 | 74,618 | 388,058 | 972,381 | 1,130,962 | 727,653 | 567,545 | 134,935 | 198,527 | |||||||||||||||||||||||||||||||||

Interest expense | 36,684 | 89,364 | 457,222 | 726,560 | 858,874 | 696,600 | 419,360 | 139,729 | 294,678 | |||||||||||||||||||||||||||||||||

Restructuring charges, net | (39 | ) | 668 | 11,847 | 20,116 | (339 | ) | 3,045 | 42,651 | |||||||||||||||||||||||||||||||||

Acquisition expenses | 16,322 | 42,651 | 715 | |||||||||||||||||||||||||||||||||||||||

Impairment of goodwill | 212,595 | |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| 151,905 | 281,988 | 1,169,378 | 2,067,471 | 2,656,723 | 1,823,631 | 1,326,103 | 564,030 | 769,792 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Income (loss) before income taxes | 129,266 | 90,636 | 353,439 | (147 | ) | (113,641 | ) | 516,292 | 485,235 | 451,703 | 325,610 | |||||||||||||||||||||||||||||||

Income tax provision (benefit) | 54,633 | 39,336 | 132,893 | 10,742 | (31,272 | ) | 166,329 | 179,052 | 169,840 | 125,554 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net income (loss) | $ | 74,633 | $ | 51,300 | $ | 220,546 | $ | (10,889 | ) | $ | (82,369 | ) | $ | 349,963 | $ | 306,183 | $ | 281,863 | $ | 200,056 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Successor | Predecessor | Successor | Predecessor | Successor | Predecessor | Successor | Predecessor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period From October 1, 2010 Through December 31, 2010 | Period From July 1, 2010 Through September 30, 2010 | Fiscal Years Ended June 30, | Nine Months Ended September 30, | Period From October 1, 2010 Through December 31, 2010 | Period From July 1, 2010 Through September 30, 2010 | Fiscal Years Ended June 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | 2011 | 2010 | 2010 | 2009 | 2008 | 2007 | 2006 | 2011 | 2010 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Data: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loan origination volume | $ | 934,812 | $ | 959,004 | $ | 2,137,620 | $ | 1,285,091 | $ | 6,075,412 | $ | 8,419,669 | $ | 6,208,004 | $ | 3,845,258 | $ | 2,488,956 | $ | 934,812 | $ | 959,004 | $ | 2,137,620 | $ | 1,285,091 | $ | 6,075,412 | $ | 8,419,669 | $ | 6,208,004 | $ | 3,845,258 | $ | 2,488,956 | ||||||||||||||||||||||||||||||||||||||||||||||||

Lease origination volume | 10,655 | 218,082 | 34,931 | 672,417 | 10,655 | 218,082 | 34,931 | 672,417 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total origination volume | $ | 945,467 | $ | 959,004 | $ | 2,137,620 | $ | 1,285,091 | $ | 6,293,494 | $ | 8,454,600 | $ | 6,208,004 | $ | 4,517,675 | $ | 2,488,956 | $ | 945,467 | $ | 959,004 | $ | 2,137,620 | $ | 1,285,091 | $ | 6,293,494 | $ | 8,454,600 | $ | 6,208,004 | $ | 4,517,675 | $ | 2,488,956 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Portfolio Data: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance receivables | $ | 8,223,676 | $ | 8,675,575 | $ | 8,733,518 | $ | 10,927,969 | $ | 14,981,412 | $ | 15,922,458 | $ | 11,775,665 | $ | 9,069,292 | $ | 8,675,575 | $ | 8,223,676 | $ | 8,675,575 | $ | 8,733,518 | $ | 10,927,969 | $ | 14,981,412 | $ | 15,922,458 | $ | 11,775,665 | $ | 9,069,292 | $ | 8,675,575 | ||||||||||||||||||||||||||||||||||||||||||||||||

Average finance receivables | $ | 8,679,506 | $ | 8,718,310 | $ | 9,495,125 | $ | 13,001,773 | $ | 16,059,129 | $ | 13,621,386 | $ | 9,993,061 | $ | 8,958,549 | $ | 8,850,833 | $ | 8,679,506 | $ | 8,718,310 | $ | 9,495,125 | $ | 13,001,773 | $ | 16,059,129 | $ | 13,621,386 | $ | 9,993,061 | $ | 8,958,549 | $ | 8,850,833 | ||||||||||||||||||||||||||||||||||||||||||||||||

Average leased vehicles, net | 50,144 | 74,704 | 125,532 | 183,622 | 122,413 | 16,984 | 305,442 | 93,028 | 50,144 | 74,704 | 125,532 | 183,622 | 122,413 | 16,984 | 305,442 | 93,028 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average earning assets | $ | 8,729,650 | $ | 8,793,014 | $ | 9,620,657 | $ | 13,185,395 | $ | 16,181,542 | $ | 13,638,370 | $ | 9,993,061 | $ | 9,263,991 | $ | 8,943,861 | $ | 8,729,650 | $ | 8,793,014 | $ | 9,620,657 | $ | 13,185,395 | $ | 16,181,542 | $ | 13,638,370 | $ | 9,993,061 | $ | 9,263,991 | $ | 8,943,861 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net charge offs | $ | 120,142 | $ | 119,439 | $ | 705,388 | $ | 1,032,854 | $ | 1,000,046 | $ | 638,094 | $ | 467,386 | $ | 209,053 | $ | 387,097 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net credit losses(6) | $ | 120,142 | $ | 119,439 | $ | 705,388 | $ | 1,032,854 | $ | 1,000,046 | $ | 638,094 | $ | 467,386 | $ | 209,053 | $ | 387,097 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance receivables greater than 60 days delinquent | 211,588 | 215,583 | 230,780 | 383,245 | 434,524 | 331,594 | 235,804 | 164,357 | 215,583 | 211,588 | 215,583 | 230,780 | 383,245 | 434,524 | 331,594 | 235,804 | 164,357 | 215,583 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net margin as reflected in the income statements | 244,487 | 283,260 | 1,065,312 | 1,292,612 | 1,684,208 | 1,591,326 | 1,317,129 | 876,004 | 800,724 | 244,487 | 283,260 | 1,065,312 | 1,292,612 | 1,684,208 | 1,591,326 | 1,317,129 | 876,004 | 800,724 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net charge offs as a percentage of average finance receivables | 5.5 | % | 5.4 | % | 7.4 | % | 7.9 | % | 6.2 | % | 4.7 | % | 4.7 | % | 3.1 | % | 5.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net credit losses as a percentage of average finance receivables | 5.5 | % | 5.4 | % | 7.4 | % | 7.9 | % | 6.2 | % | 4.7 | % | 4.7 | % | 3.1 | % | 5.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delinquencies greater than 60 days as a percentage of finance receivables (based on contractual amount due) | 2.4 | % | 2.5 | % | 2.7 | % | 3.5 | % | 2.9 | % | 2.1 | % | 2.0 | % | 1.7 | % | 2.5 | % | 2.4 | % | 2.5 | % | 2.7 | % | 3.5 | % | 2.9 | % | 2.1 | % | 2.0 | % | 1.7 | % | 2.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Net margin as a percentage of average earning assets | 11.1 | % | 12.8 | % | 11.1 | % | 9.8 | % | 10.4 | % | 11.6 | % | 13.2 | % | 12.6 | % | 12.0 | % | 11.1 | % | 12.8 | % | 11.1 | % | 9.8 | % | 10.4 | % | 11.6 | % | 13.2 | % | 12.6 | % | 12.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Ratio of earnings to fixed charges (1) | 3.0x | 2.0x | 1.8x | (2 | ) | (3 | ) | 1.7 X | 2.1 X | 3.3X | 2.1X | 3.0x | 2.0x | 1.8x | (2 | ) | (3 | ) | 1.7 X | 2.1 X | 3.3X | 2.1X | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Percentage of total indebtedness to total capitalization (4) | 66.6 | % | 75.1 | % | 75.0 | % | 81.9 | % | 87.8 | % | 87.6 | % | 84.4 | % | 67.6 | % | 75.1 | % | 66.6 | % | 75.1 | % | 75.0 | % | 81.9 | % | 87.8 | % | 87.6 | % | 84.4 | % | 67.6 | % | 75.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating expenses as a percentage of average earning assets | 3.2 | % | 3.1 | % | 3.0 | % | 2.3 | % | 2.5 | % | 2.9 | % | 3.0 | % | 3.6 | % | 3.2 | % | 3.2 | % | 3.1 | % | 3.0 | % | 2.3 | % | 2.5 | % | 2.9 | % | 3.0 | % | 3.6 | % | 3.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Percentage of senior unsecured debt to total equity (4) | 2.0 | % | 20.0 | % | 20.2 | % | 23.0 | % | 42.9 | % | 38.0 | % | 10.0 | % | 13.2 | % | 20.0 | % | 2.0 | % | 20.0 | % | 20.2 | % | 23.0 | % | 42.9 | % | 38.0 | % | 10.0 | % | 13.2 | % | 20.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Successor | Predecessor | Successor |

| Predecessor | ||||||||||||||||||||||||||||||||||

| December 31, 2010 | June 30, 2010 | June 30, 2009 | June 30, 2008 | June 30, 2007 | June 30, 2006 | September 30, 2011 |

| September 30, 2010 | ||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 194,554 | $ | 282,273 | $ | 193,287 | $ | 433,493 | $ | 910,304 | $ | 513,240 | $ | 307,215 | | $ | 537,529 | |||||||||||||||||||||

Finance receivables, net | 8,197,324 | 8,160,208 | 10,037,329 | 14,030,299 | 15,102,370 | 11,097,008 | | 8,917,970 | | 8,147,086 | ||||||||||||||||||||||||||||

Total assets | 10,918,738 | 9,881,033 | 11,958,327 | 16,508,201 | 17,762,999 | 13,067,865 | | 12,306,734 | | 10,107,410 | ||||||||||||||||||||||||||||

Credit facilities | 831,802 | 598,946 | 1,630,133 | 2,928,161 | 2,541,702 | 2,106,282 | | 552,871 | | 617,415 | ||||||||||||||||||||||||||||

Securitization notes payable | 6,128,217 | 6,108,976 | 7,426,687 | 10,420,327 | 11,939,447 | 8,518,849 | | 6,901,572 | | 6,273,224 | ||||||||||||||||||||||||||||

Senior notes | 70,054 | 70,620 | 91,620 | 200,000 | 200,000 | | 500,000 | | 70,620 | |||||||||||||||||||||||||||||

Convertible senior notes | 1,446 | 414,068 | 392,514 | 642,599 | 620,537 | 200,000 | | 500 | | 419,693 | ||||||||||||||||||||||||||||

Total liabilities | 7,388,630 | 7,480,609 | 9,851,019 | 14,542,939 | 15,606,407 | 11,058,979 | | 8,500,719 | | 7,656,789 | ||||||||||||||||||||||||||||

Shareholders’ equity | 3,530,108 | 2,400,424 | 2,107,308 | 1,965,262 | 2,156,592 | 2,008,886 | | 3,806,015 | | 2,450,621 | ||||||||||||||||||||||||||||

Tangible net worth (5) | 2,429,697 | 2,400,424 | 2,107,308 | 1,965,262 | 1,946,406 | 2,008,886 | | 2,697,321 | | 2,450,621 | ||||||||||||||||||||||||||||

| (1) | Represents the ratio of the sum of income before taxes plus fixed charges for the period to fixed charges. Fixed charges, for the purpose of this computation, represents interest and a portion of rentals representative of an implicit interest factor for such rentals. |

| (2) | The amount of coverage deficiency for the year ended June 30, 2009 was approximately $0.1 million. |

| (3) | As a result of the $212.6 million of pre-tax write off of goodwill, the amount of coverage deficiency for the year ended June 30, 2008 was approximately $113.6 million. |

| (4) | Total capitalization and total equity for the Successor periods include the effect of approximately $1.1 billion of goodwill and other intangible assets recorded as a result of the merger with GM. |

| (5) | Tangible net worth is calculated as total equity less goodwill and other intangibles and is included here to provide information about our net worth excluding goodwill and intangible assets, as the balance sheet includes a significant amount of goodwill resulting from the acquisition of us by GM. Tangible net worth is not a measure determined in accordance with generally accepted accounting principles (“GAAP”) and should not be considered as an alternative to, or more meaningful than, total equity (as determined in accordance with GAAP). The reconciliation of our total equity to tangible net worth is as follows (in thousands): |

| (6) | For the Successor periods, net credit losses include charge-offs and write-offs of contractual amounts on the pre-acquisition portfolio, |

| Successor | Predecessor | Successor |

| Predecessor | ||||||||||||||||||||||||||||||||||

| December 31, 2010 | June 30, 2010 | June 30, 2009 | June 30, 2008 | June 30, 2007 | June 30, 2006 | September 30, 2011 |

| September 30, 2010 | ||||||||||||||||||||||||||||||

Total Equity | $ | 3,530,108 | $ | 2,400,424 | $ | 2,107,308 | $ | 1,965,262 | $ | 2,156,592 | $ | 2,008,886 | $ | 3,806,015 | $ | 2,450,621 | ||||||||||||||||||||||

Less: Goodwill and other intangible assets | (1,100,411 | ) | (210,186 | ) | (1,108,634 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

Tangible Net Worth | $ | 2,429,697 | $ | 2,400,424 | $ | 2,107,308 | $ | 1,965,262 | $ | 1,946,406 | $ | 2,008,886 | $ | 2,697,381 | $ | 2,450,621 | ||||||||||||||||||||||

| Average finance receivables are defined as the average daily receivable balance excluding the carrying value adjustment. |

In considering whether to exchange the old notes for Notes, you should carefully consider the risks described below with all of the other information included in this prospectus. If any of the adverse events described below were to actually occur, our business, results of operations, or financial condition would likely suffer. In such an event, the trading price of the Notes could decline and you could lose all or part of your investment. Additionally, this section does not attempt to describe all risks applicable to our industry, our business or an investment in the Notes. Risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Relating to the Exchange Offer

If you do not properly tender your old notes, you will continue to hold unregistered old notes and your ability to transfer old notes will be adversely affected.

We will only issue Notes in exchange for old notes that are timely received by the exchange agent together with all required documents, including a properly completed and signed letter of transmittal. Therefore, you should allow sufficient time to ensure timely delivery of the old notes and you should carefully follow the instructions on how to tender your old notes. Neither we nor the exchange agent are required to tell you of any defects or irregularities with respect to your tender of the old notes. If you do not tender your old notes properly, then, after we consummate the exchange offer, you may continue to hold old notes that are subject to the existing transfer restrictions. In addition, if you tender your old notes for the purpose of participating in a distribution of the Notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the Notes. If you are a broker-dealer that receives Notes for your own account in exchange for old notes that you acquired as a result of market-making activities or any other trading activities, you will be required to acknowledge that you will deliver a prospectus in connection with any resale of such Notes. After the exchange offer is consummated, if you continue to hold any old notes, you may have difficulty selling them because there will be less old notes outstanding. In addition, if a large amount of old notes are not tendered or are tendered improperly, the limited amount of Notes that would be issued and outstanding after we consummate the exchange offer could lower the market price of such Notes.

Risks Related to Our Business

The profitability and financial condition of our operations are dependent upon the operations of our parent, General Motors.

A material portion of our business, approximately 39% during the nine months ended September 30, 2011, consists of financing the sale of new GM vehicles. If there were significant changes in GM’s liquidity and capital position and access to the capital markets, the production or sales of GM vehicles to retail customers, the quality or resale value of GM vehicles, or other factors impacting GM or its employees, such changes could significantly affect our profitability and financial condition. In addition, GM sponsors special-rate financing programs available through us. Under these programs, GM makes interest supplements or other support payments to us. These programs increase our financing volume and share of financing the sales of GM vehicles. If GM were to adopt marketing strategies in the future that de-emphasized such programs in favor of other incentives, our financing volume could be reduced.

As of September 30, 2011, we had a $300 million unsecured revolving credit facility with GM. If this facility was no longer available, and we were unable to obtain similar funding elsewhere, our liquidity would be negatively impacted.

Our ability to continue to purchase contracts and to fund our business is dependent on a number of financing sources.

Dependence on Credit Facilities.We depend on various credit facilities to finance our purchase of receivables and leases.

At September 30, 2011, we had a warehouse credit facility to support new loan originations. This facility, which we refer to as our syndicated warehouse facility, provides borrowing capacity of up to $2.0 billion through May 2012. In May 2012, when the revolving period ends and if the facility is not renewed, the outstanding balance will be repaid over time based on the amortization of the receivables pledged until May 2013 when the remaining balance will be due and payable.

Additionally, we have a medium term note facility that reached the end of its revolving period in October 2009 and had $336.8 million outstanding at September 30, 2011. The outstanding balance of this facility will be repaid over time based on the amortization of the receivables pledged until October 2016 when any remaining amount outstanding will be due and payable.

In January 2011, we entered into a $600 million U.S. lease warehouse facility whose revolving period ends on January 29, 2012, at which time the lease payments and other leased assets will be used to pay down debt until 2017 and pricing will also increase if not renewed.

In July 2011, we entered into a C$600 million Canadian lease warehouse facility to support our leasing initiative in Canada. The revolving period ends on July 13, 2012, at which time the lease payments and other leased assets will be used to pay down debt until January 15, 2018 and pricing will also increase if not renewed.

We cannot guarantee that any of these financing sources will continue to be available beyond the current maturity dates on reasonable terms or at all. Additionally, as our volume of loan and lease originations increase, including an expansion of leasing volume in Canada, we will require the expansion of our borrowing capacity on our existing credit facilities or the addition of new credit facilities. The availability of these financing sources depend, in part, on factors outside of our control, including regulatory capital treatment for unfunded bank lines of credit and the availability of bank liquidity in general. If we are unable to extend or replace these facilities or arrange new credit facilities or other types of interim financing, we will have to curtail or suspend loan origination activities, which would have a material adverse effect on our financial position, liquidity, and results of operations.

Our credit facilities, other than the GM revolving credit facility, generally contain a borrowing base or advance formula which requires us to pledge finance contracts in excess of the amounts which we can borrow under the facilities. We may also be required to hold certain funds in restricted cash accounts to provide additional collateral for borrowings under the credit facilities. In addition, the finance contracts pledged as collateral must be less than 31 days delinquent at periodic measurement dates. Accordingly, increases in delinquencies or defaults on pledged collateral resulting from weakened economic conditions, or due to our inability to execute securitization transactions or any other factor, would require us to pledge additional finance contracts to support the same borrowing levels and to replace delinquent or defaulted collateral. The pledge of additional finance contracts to support our credit facilities would adversely impact our financial position, liquidity, and results of operations.

Additionally, our credit facilities, other than the GM revolving credit facility, generally contain various covenants requiring certain minimum financial ratios, asset quality, and portfolio performance ratios (portfolio net loss and delinquency ratios, and pool level cumulative net loss ratios) as well as limits on deferment levels. Failure to meet any of these covenants could result in an event of default under these agreements. If an event of default occurs under these agreements, the lenders could elect to declare all amounts outstanding under these agreements to be immediately due and payable, enforce their interests against collateral pledged under these agreements or restrict our ability to obtain additional borrowings under these facilities.

Dependence on Securitization Program.