Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold prior to the time the registration statement becomes effective. This document shall not constitute an offer to sell nor shall there be any sale of these securities in any jurisdiction in which such offer or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION—DATED MARCH 13, 2019JULY 2, 2021

PROXY STATEMENT OF ALTABANCORP | PROSPECTUS OF | |

GLACIER BANCORP, INC. |

MERGER PROPOSED – YOUR VOTE IS VERY IMPORTANT

Dear FNB BancorpAltabancorp Shareholders:

As you may know, the boards of directors of FNB BancorpAltabancorp (“FNB”AB”) and Glacier Bancorp, Inc., Kalispell, Montana (“Glacier”) have each unanimously approved a merger of FNBAB with and into Glacier, subject to approval by FNBAB shareholders and appropriate bank regulators. Immediately following the merger, FNB’sAB’s subsidiary The First National Bank of LaytonAltabank (the “Bank”) will be merged into Glacier’s subsidiary Glacier Bank (“Glacier Bank”), subject to approval of the appropriate bank regulators.

Under the terms of the Plan and Agreement of Merger, dated January 16, 2019May 18, 2021 (the “merger agreement”), each outstanding AB common share as of FNB commonthe effective time (including each share issued upon settlement of each unvested restricted stock unit) will be exchanged for 0.64740.7971 shares of Glacier common stock (the “per share stock consideration”), subject to certain adjustments.adjustments, with cash paid in lieu of fractional shares. The common stock of Glacier trades on The Nasdaq Global Select Market under the symbol “GBCI.” The common stock of AB trades on The Nasdaq Capital Market under the symbol “ALTA.”

The amount of Glacier commonper share stock exchanged for each share of FNB common stockconsideration is subject to adjustment in the event that the average closing price for Glacier common stock over a20-day period prior to closing is more than $46.63$74.15 or less than $32.44, or less than $34.47, if$49.43. In such stock price has also declined by ten percentage points more than the KBW Regional Bank Index. In that event either Glacier or FNB,AB, respectively, may provide notice to terminate the merger agreement, provided thatbut the merger agreement will not be terminated if either FNBAB or Glacier, as the case may be, elects to adjust the number of sharesconsideration to be issued in the merger, as described in this proxy statement/prospectus. Glacier may also elect to pay additional cash consideration in lieu of increasing the number of shares to be issued in the merger.

The merger agreement establishes a minimum requirement for FNB’s capital ($39,285,000) priorper share stock consideration is subject to the closing of the merger. If FNB’sfurther adjustment if AB’s closing capital, after being adjusted in accordance with the terms of the merger agreement, is less than the minimum required, which is $342,937,000 (subject to take into accountspecified adjustments). In any transaction expensessuch event, the per share stock consideration will be reduced on a per share basis in excessaccordance with the formula set forth in the merger agreement.

If AB’s closing capital, after being adjusted in accordance with the terms of amounts permitted under the merger agreement, is in excess of the minimum required, FNBAB may pay a special dividend to its shareholders in the amount of such excess. If FNB’s closing capital is less than the minimum required, the total Glacier stock consideration will be reduced by a number of shares equal in value to the difference between the required amount of FNB closing capital and the amount of the actual FNB closing capital, as adjusted.

Assuming for purposes of illustration only that the average closing price for Glacier common stock is $41.06,$[___], which was the closing price of Glacier common stock on March 11, 2019,[___], 2021, as quoted on the NASDAQThe Nasdaq Global Select Market, and that there is no reduction in the exchange ratio due to the FNB closing capital being less than the required amount, for each of your shares of FNBAB common stock,shares, you will receive 0.6474 Glacier sharesconsideration with an estimated current value of $26.58.$[___], consisting of 0.7971 shares of Glacier common stock.

Assuming the exchange of all outstanding FNBAB common stockshares for Glacier common stock in accordance with the merger agreement FNBand the per share stock consideration is not adjusted as described above, AB shareholders will, in the aggregate, ownreceive approximately 2.36%[___] shares of Glacier common stock in the merger, representing approximately [___]% of Glacier’s outstanding common stock followingafter taking into account Glacier shares to be issued in the merger.

FNBAB will hold a special shareholders’ meeting to vote on the merger agreement on April 18, 2019,[___], 2021, at 10:00 a.m.[___] Mountain Time, atTime. This special meeting will be held in virtual format only. Detailed instructions for participation can be found in the Davis Conference Center located at 1651 North 700 West, Layton, Utah 84041.notice of special shareholder meeting that accompanies this proxy statement/prospectus. Whether or not you plan to attendparticipate in the special meeting virtually, please take the time to vote by voting over the Internet, by telephone or completing and mailing the enclosed form of proxy.Please give particular attention to the discussion under the heading “Risk Factors” beginning on page 14 for risk factors relating to the merger which you should consider.

The board of directors of FNBAB has unanimously recommended that you vote FOR approval of the merger agreement and the other proposals described in this proxy statement/prospectus.

/s/ Len E. Williams

Len E. Williams

President and Chief Executive Officer, Altabancorp

/s/ Richard T. Beard

Richard T. Beard

Board Chair, Altabancorp

Neither the Federal Deposit Insurance Corporation, Securities and Exchange Commission, nor any state securities commission has approved the securities to be issued by Glacier or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of Glacier common stock to be issued in the merger are not savings or deposit accounts or other obligations of a bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Deposit Insurance Fund or any other governmental agency. Such shares are not guaranteed by Glacier or FNBAB and are subject to investment risk, including the possible loss of principal.

This proxy statement/prospectus is dated March 13, 2019[___], 2021, and is first being mailed to

FNBAB shareholders on or about March 15, 2019.[___], 2021.

FNB BANCORP

12 South1 East Main Street, American Fork, Utah 84003

Layton Utah 84041

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF

TO BE HELD APRIL 18, 2019ALTABANCORPTM

TO THE SHAREHOLDERS OF FNB BANCORP:[ ], 2021

To the Shareholders of Altabancorp:

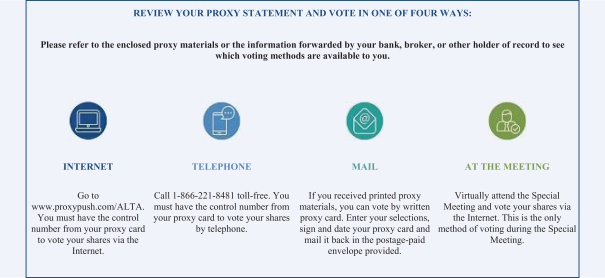

A special meeting of the shareholders of FNB BancorpAltabancorp (“FNB”AB”) will be held on April 18, 2019, at 10:00 a.m. Mountain Time, at the Davis Conference Center located at 1651 North 700 West, Layton, Utah 84041.[___], 2021. The special meeting will be held in a virtual meeting format only. Please visit the website www.proxydocs.com/ALTAand enter your control number to register to attend the meeting. The deadline to register to attend the virtual special meeting is [__], 2021, at 5:00 p.m. Mountain Time. You are encouraged to vote your shares by telephone, by completing and mailing the enclosed form of proxy, or online in advance of the special meeting but may also vote during the meeting by following the instructions available on the meeting website. The special meeting will convene at [___] Mountain Time for the following purposes:

| 1. | To consider and vote on a proposal to approve the Plan and Agreement of Merger, dated as of |

| 2. | To vote on an advisory (non-binding) proposal to approve the compensation that may become paid or payable to the named executive officers of AB that is based on or otherwise relates to the merger. |

| 3. | To approve one or more adjournments of the |

Holders of record of FNBAB common stockshares at the close of business on March 6, 2019,[___], 2021, the record date for the special meeting, are entitled to notice of and to vote at the special meeting or any adjournments or postponements of it. The affirmative vote of the holders of at least a majority of the outstanding shares of FNB’s outstandingAB’s common stock entitled to vote is required for approval of the merger agreement. To that end, FNB’sAB’s directors and executive officers and certain significant shareholders have signed agreements to vote their shares in favor of the merger agreement. SuchAs of the record date, such persons arewere entitled to vote 1,357,605[_________] shares representing approximately 42.95%[____]% of all outstanding shares of FNBAB common stock.shares. As of March 6, 2019,the record date, there were 3,160,969[__________] AB common shares of FNB common stock outstanding.

FNB shareholders have the right to dissent from the merger and obtain payment of the fair valueof their shares of FNB common stock under the Utah Revised Business Corporations Act (“URBCA”), Sections 1301 through 1331. A copy of the provisions regarding dissenters’ rights is attached asAppendix B to the accompanying proxy statement/prospectus. For details of your dissenters’ rights and how to exercise them, please see the discussion under “The Merger – Dissenters’ Rights.”

Your vote is important. Whether or not you plan to attendparticipate in the special meeting please complete, sign, datevirtually, we encourage you to submit a proxy to vote your shares as promptly as possible in order to make certain that you are represented at the meeting. You may submit a proxy over the Internet, as well as by telephone or by completing, signing, dating and promptly returnreturning the accompanying proxy using the enclosed envelope. If for any reason you should desire to revoke your proxy, you may do so at any time before it is voted at the meeting.If you do not vote your shares, it will have the same effect as voting against the merger.

The board of directors of FNBAB has determined that the merger agreement is fair to, advisable, and in the best interests of FNBAB and its shareholders and unanimously recommends that you vote FOR approval of the merger agreement.agreement, FOR approval of the merger-related named executive officer compensation proposal, and FOR approval of the adjournment proposal. With regard to its recommendation that shareholders vote FOR approval of the merger agreement, the board of directors of FNBAB considered a number of factors, as discussed in “ Background“Background of and Reasons for the Merger” beginning on page 18.26. Such factors also constituted the reasons that the board of directors determined to approve the merger agreement and to recommend that FNBAB shareholders vote in favor of the merger agreement.

You will receive instructions on howImportant Notice Regarding the Availability of Proxy Materials for the

Special Shareholders Meeting to exchange your sharesbe held [____] 2021:

The proxy statement and notice of FNB common stock for the merger consideration promptly after the closing of the merger.special meeting are available at www.proxydocs.com/ALTA or from our Investor Relations website at www.altabancorp.com.

ALTABANCORP By Order of the Board of Directors, | ||||||

| American Fork, Utah, [_____] 2021 | Adelaide Maudsley, Corporate Secretary | |||||

Layton, Utah

March 13, 2019

REFERENCES TO ADDITIONAL INFORMATION

Both Glacier Bancorp, Inc. (“Glacier”), and Altabancorp (“AB”), file annual, quarterly and special reports, proxy statements and other business and financial information with the Securities and Exchange Commission (the “SEC”) electronically. The SEC maintains a website located at http://www.sec.gov containing this information. You can also obtain, free of charge, documents that Glacier files with the SEC at www.glacierbancorp.com under the tab “SEC Filings” or documents that AB files with the SEC at www.altabancorp.com in the “Investor Relations” section, under the heading “SEC Filings.” The information

provided on the Glacier and AB websites is not part of this proxy statement/prospectus and is not incorporated herein by reference. Copies of the documents that Glacier or AB, respectively, files with the SEC can also be obtained, free of charge, by directing a written request to Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary or to Altabancorp, 1 East Main Street, American Fork, Utah 84003, ATTN: Corporate Secretary.

Glacier has filed a registration statement on Form S-4 to register with the SEC Glacier common shares as specified therein. This proxy statement/prospectus is a part of that registration statement. As permitted by SEC rules, this document does not contain all of the information included in the registration statement or in the exhibits or schedules to the registration statement. You may read and copy the registration statement, including any amendments, schedules and exhibits, at the addresses set forth below. Statements contained in this document as to the contents of any contract or other documents referred to in this document are not necessarily complete. In each case, you should refer to the copy of the applicable contract or other document filed as an exhibit to the registration statement. This document incorporates important business and financial information about Glacier fromand AB that is not included in or delivered with this document, including incorporating by reference documents that Glacier hasand AB have previously filed with the SecuritiesSEC. These documents contain important information about the companies and Exchange Commission (“SEC”) and that are contained in or incorporated by reference into this proxy statement/prospectus. For a listing of Glacier documents incorporated by reference into this proxy statement/prospectus, please see the section entitledtheir financial condition. See “Where You Can Find More Information.” This information isThese documents are available for you to review at the SEC’s website athttp://www.sec.gov.

You may request copies of this proxy statement/prospectus and any of the documents incorporated by reference into this proxy statement/prospectus or other information concerning Glacier, without charge byto you upon written or oral request to the applicable company’s principal executive offices. The respective addresses and telephone or writtennumbers of such principal executive offices are listed below:

Glacier Bancorp, Inc. Kalispell, Montana 59901 | Altabancorp 1 East Main Street American Fork, Utah 84003 |

To obtain timely delivery of these documents, you must request directed to:

Glacier Bancorp, Inc.

49 Commons Loop

Kalispell, Montana 59901

ATTN: Ron Copher, Corporate Secretary

Telephone: (406)751-7706

Certain reports can also be found on Glacier’s website atwww.glacierbancorp.com.

Glacier’s common stock is traded on the NASDAQ Global Select Market under the symbol “GBCI.”

You will not be charged for the documents that you request.If you would like to request documents, please do so by April 11, 2019information no later than [ ], 2021, in order to receive them before the FNB special shareholders’ meeting.meeting of AB shareholders (the “AB special meeting”).

FNB

FNB does not have a class of securities registeredGlacier common shares, par value $0.01 per share, are traded on the Nasdaq Global Select Market, under Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”), is not subject tosymbol “GBCI,” and AB common shares, par value $0.01 per share, are traded on The Nasdaq Capital Market under the reporting requirements of Section 13(a) or 15(d) of the Exchange Act, and accordingly does not file documents or reports with the SEC.

If you have questions concerning the merger or this proxy statement/prospectus, would like additional copies of this proxy statement/prospectus, would like copies of FNB’s articles of incorporation or bylaws, or would like copies of FNB’s historical consolidated financial statements or need help voting your shares, please contact:

FNB Bancorp

12 South Main

Layton, Utah 84041

ATTN: Nic Bement

(801)813-1600symbol “ALTA.”

| Page | |||||||

| 1 | |||||||

| 68 | |||||||

COMPARISON OF CERTAIN RIGHTS OF HOLDERS OF GLACIER AND | |||||||

| 78 | |||||||

Appendix A – Plan and Agreement of Merger, dated as of May 18, 2021

Appendix B – Opinion of Keefe, Bruyette & Woods, Inc., Financial Advisor to Altabancorp

i

Why am I receiving these materials?

We are sending you these materials to solicit your proxy to vote in favor of the merger and to help you decide how to vote your shares of FNB BancorpAltabancorp (“FNB”AB”) common stock with respect to its proposed merger with Glacier Bancorp, Inc. (“Glacier”). The merger cannot be completed unless FNBAB receives the affirmative vote of the holders of at least a majority of the outstanding shares of FNB’sAB’s common stock. FNBstock entitled to vote on the matter. AB is holding a special meeting of shareholders to vote on proposals relating to the merger. Information about the special meeting is contained in this document. See “FNB“AB Special Shareholders Meeting.”

This document is both a proxy statement of FNBAB and a prospectus of Glacier. It is a proxy statement because the officers and board of directors of FNBAB (the “FNB“AB Board”) are soliciting proxies from FNBAB’s shareholders in connection with voting on the merger. It is a prospectus because Glacier will issue shares of its common stock in exchange for AB common shares of FNB common stock as the consideration to be paid in the merger.

What will FNBhappen in the merger?

In the proposed merger, AB will merge with and into Glacier, with Glacier surviving the merger. Immediately following the merger, Altabank (the “Bank”) will be merged into Glacier’s subsidiary Glacier Bank. Shares of Glacier will continue to trade on The Nasdaq Global Select Market, with the trading symbol “GBCI.”

What will AB shareholders receive in the merger?

Under the terms of the merger agreement, each AB common share (including each share to be issued upon settlement of FNB commoneach unvested restricted stock unit (“RSU”)) will be exchanged for 0.64740.7971 shares of Glacier common stock (the “per share stock consideration”), subject to adjustment as described below.certain adjustments, with cash paid in lieu of fractional shares.

Assuming for purposes of illustration only that the average closing price for Glacier common stock is $41.06$[___] (which was the closing price forof Glacier common stock on March 11, 2019)[___], and that there is no reduction in the exchange ratio due to the FNB Closing Capital (discussed below) being less than the required amount,2021), each share of FNBAB common stockshare would be exchanged for 0.7971 shares of Glacier common stock with a total value equal to $26.58.

If the FNB Closing Capital (as defined in the merger agreement) exceeds $39,285,000, subject to certain adjustments, FNB may, upon written notice to Glacier and effective immediately prior to the closing of the merger, declare and pay a special dividend to its shareholders in the amount of such excess.

If the FNB Closing Capital is less than $39,285,000, the total number of Glacier shares issued in the merger will be reduced by a number of shares equal in value to the differential between $39,285,000 and the actual FNB Closing Capital.$[___].

The amount of Glacier commonper share stock exchanged for each share of FNB common stockconsideration may also be adjusted in certain circumstances ifbased on whether Glacier common stock is trading either higher or lower than prices specified in the merger agreement immediately prior to the closing of the merger, in order to avoid termination of the merger agreementagreement.

In addition, the per share stock consideration will be subject to reduction if the “AB Closing Capital,” as follows:

If the “average closing price” (determined over a 20 trading day period prior to the closing of the merger, calculated 10 days prior to the closing) of Glacier’s common stock exceeds $46.63, Glacier may terminatedefined in the merger agreement, unless FNB electsis less than the target of $342,937,000, subject to accept a reduction on aper-share basis ofcertain adjustments. In such event, the number of shares of Glacier common stock to be issued will be reduced on a per-share basis in accordance with the formula set forth in the merger.merger agreement.

Conversely, ifIf the “averageAB Closing Capital exceeds $342,937,000, subject to certain adjustments, AB may, upon written notice to Glacier and effective prior to the closing price” is (i) less than $34.47 and the price of Glacier common stock has underperformed the KBW Regional Banking Index by more than 10% or (ii) less than $32.44, FNB may terminate the merger, agreement, unless Glacier elects

|

On March 11, 2019, the closing priceamount of Glacier common stock was $41.06 per share.such excess.

By voting to approve the merger agreement, FNBAB shareholders will give the FNBAB Board the authority to elect to cause FNBAB to accept a reduction on aper-share basis of the number of shares of Glacier common stock to be issued in the merger if the Glacier average closing price exceeds $46.63$74.15, as described above.below. See “The Merger – Termination of the Merger Agreement.”

Assuming the exchange of all outstanding FNBAB common stockshares for Glacier common stock as per share stock consideration in accordance with the merger agreement FNBand the per share stock consideration is not adjusted as

described above, AB shareholders will own,receive an estimated 15,129,749 shares of Glacier common stock in the aggregate,merger, representing approximately 2.36%13.7% of Glacier’s outstanding common stock followingafter taking into account Glacier shares to be issued in the merger.

How are outstanding AB stock options and RSUs addressed in the merger agreement?

Under the terms of the merger agreement, when the merger agreement becomes effective (the “effective time”), each outstanding RSU under the People’s Utah Bancorp 2014 Incentive Plan, the Altabancorp 2020 Equity Incentive Plan and the People’s Utah Bancorp Amended and Restated 2008 Stock Incentive Plan (the “AB Stock Plans”) will automatically vest and be settled, and each AB common share issued as a result will have the right to receive the per share stock consideration and cash in lieu of fractional AB common shares. Outstanding options to purchase AB common shares under the AB Stock Plans (the “AB Options”), whether vested or unvested, will be automatically canceled at the effective time, and the holders of AB Options will be paid in cash an amount per share equal to the spread, if any, between (a) the product of the Glacier average closing price (as defined in the merger agreement) multiplied by the per share stock consideration and (b) the exercise price per share of such AB Option, net of any cash which must be withheld under applicable tax laws. Any AB Option that has an exercise price per share that is greater than the total consideration value per share will be cancelled without any payment.

Will I receive any fractional shares of Glacier common stock as part of the merger consideration?

No. Glacier will not issue any fractional shares of Glacier common stock in the merger. Instead, Glacier will pay you the cash value of a fractional share (without interest) in an amount determined by multiplying the fractional share interest to which you would otherwise be entitled by the average of the closing sales prices of one share of Glacier common stock on The Nasdaq Global Select Market for the 20 trading days ending on the tenth business day immediately preceding the effective date of the merger.

How soon after the merger is completed can I expect to receive my merger consideration?

Glacier will work with its exchange agent, American Stock Transfer & Trust Company, LLC, to distributecomplete the exchange of your AB stock certificates for consideration payable in the merger as promptly as practicable following the completion of the merger.

Will I be able to trade the shares of Glacier common stock that I receive in the merger bemerger?

You may freely transferable?

Yes. Thetrade the shares of Glacier common stock issued in the merger, will be transferable freeunless you are an “affiliate” of restrictionsGlacier as defined by Rule 144 under federalthe Securities Act of 1933, as amended. Affiliates consist of individuals or entities that control, are controlled by or are under the common control with Glacier, and state securities laws.include the executive officers and directors of Glacier after the merger and may include significant shareholders of Glacier.

When will the merger occur?

We presently expect to complete the merger during the secondfourth quarter of 2019.2021. The actual timing of the transaction is subject to a number of factors (primarily regulatory approvals), many of which are beyond the control of Glacier and FNB.AB. The merger is conditioned upon and will occur after the approval of the merger agreement by the affirmative vote of holders of at least a majority of the outstanding AB common shares of FNB common stock,entitled to vote on the matter at the AB special meeting, after the merger has received regulatory approvals, and following the satisfaction or waiver of the other conditions to the merger described in the merger agreement and summarized under “The Merger” below.

The merger agreement provides that in the event the closing has not occurred by November 30, 2021, the first date on which the closing may occur is January 31, 2022.

If the merger does not occur by September 30, 2019,February 28, 2022, either Glacier or FNBAB may unilaterally terminate the merger agreement. However, if as of September 30, 2019, the condition to closing thatFebruary 28, 2022, all required governmental regulatory approvals have been obtained has not been satisfied,obtained, then the deadline for closingconsummation of the merger will be extended to on or before NovemberApril 30, 2019,2022, if either Glacier or AB notifies FNBthe other party in writing on or prior to September 30, 2019February 28, 2022, of its election to extend such closing deadline.date.

When and where will the special meeting take place?

FNBAB will hold a special meeting of its shareholders on April 18, 2019,[___], 2021, at 10:[___] Mountain Time. The special meeting will be held in virtual meeting format only. In order to attend the special meeting, AB shareholders must register at www.proxydocs.com/ALTA by 5:00 a.m.p.m. Mountain Time at the Davis Conference Center located at 1651 North 700 West, Layton, Utah 84041.on [__], 2021.

Who may vote at the special meeting?

The FNBAB Board has set March 6, 2019[___], 2021 as the record date for the special meeting. If you were the owner of FNBAB common stockshares at the close of business on March 6, 2019,[___], 2021, you may vote at the special meeting. Each holder of AB common shares is entitled to one vote for each AB common share owned as of the record date.

What constitutes a quorum for the special meeting?

The quorum requirement for the special meeting is the presence at the meeting or by proxy of a majority of the total number of outstanding AB common shares entitled to vote.

What vote is required to approve the merger agreement?

Approval of the merger agreement requires the affirmative vote of the holders of at least a majority of the outstanding shares of FNB’s outstandingAB’s common stock.stock entitled to vote on the matter. As described in this proxy statement, FNB’sstatement/prospectus, AB’s directors and executive officers and certain significant shareholders have agreed to vote the shares they are entitled to vote in favor of the merger agreement. As of the record date, hereof, such persons arewere entitled to vote 1,357,605[_________] AB common shares, of FNB common stock, representing approximately 42.95%[___]% of all outstanding shares of FNBAB common stock.shares. See “FNB“AB Special Shareholders’ Meeting” and “The Merger – Voting Agreement.Agreements.”

What vote is required to approve the merger-related named executive compensation proposal?

The proposal to approve merger-related named executive compensation will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal, assuming a quorum is present.

What vote is required to approve the adjournment of the special meeting, if necessary or appropriate?

If less than a quorum is represented at the special meeting, a majority of the shares so represented may adjourn the special meeting without further notice. The proposal to adjourn the special meeting, if necessary or appropriate, including adjournments to solicit additional proxies, will be approved if the votes cast in favor of the proposal exceed the votes cast againstopposing the proposal, assumingwhether or not a quorum is present. If less than a quorum is represented atEach of the Voting Agreements entered into by AB’s directors and executive officers and certain significant shareholders provides that such persons have agreed to vote the shares subject to such agreement in favor of any proposal to adjourn the special meeting a majority ofif there are not sufficient votes to approve the shares so represented may adjourn the meeting without further notice.merger agreement.

How do I vote?

If you were a shareholder of record on March 6, 2019,[___], 2021, you may vote on the proposals presented at the special meeting in personat the meeting or by proxy. We urge you to vote promptly by submitting a proxy to vote through the Internet, by telephone, or by completing the enclosed proxy card. Even if you plan to attend the special meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the virtual special meeting.

You may cast your vote by submitting a proxy through the Internet or by telephone by following the instructions included on the enclosed proxy card or by mail by completing, signing and dating the enclosed proxy card and returning it to us promptly in the enclosed envelope. ReturningSubmitting a proxy through the Internet or by telephone or returning the proxy card will not affect your right to attend the special meeting by virtual means and vote.

If you choose to vote your shares at the virtual special meeting, you should follow the instructions available on the shareholder meeting website.

If your shares are registered in person“street name” in the name of a broker or other nominee and you wish to vote at the special meeting, please bringyou will need to obtain a legal proxy from your bank or brokerage firm. Please consult the enclosedvoting form sent to you by your bank or broker to determine how to obtain a legal proxy in order to vote at the meeting.

What if I fail to submit a proxy or to instruct my broker, bank or other nominee?

If you fail to properly submit a proxy or to instruct your broker, bank or other nominee to vote your AB common shares, and you do not attend the special meeting and vote your shares, your shares will not be voted. This will have the same effect as a vote “AGAINST” approval of the merger agreement, but will have no impact on the outcome of the other proposals.

Can I attend the special meeting and vote my shares at the meeting?

Yes. Although the AB Board requests that you submit a proxy through the Internet, by telephone or by returning the proxy card and proofaccompanying this proxy statement/prospectus, all shareholders are invited to attend the shareholder meeting. Shareholders of identification.record on [__________], 2021 can vote at the special meeting by following the instructions available on the meeting website.

Can I change my vote after I have mailedsubmitted my signed proxy card?proxy?

Yes. YouIf you do not hold your shares in “street name,” there are three ways you may change your vote at any time after you have submitted your proxy and before your proxy is voted at the special meeting. If your shares of FNB common stock are held in your own name, you may change your vote as follows:meeting:

Byby sending a written notice bearing a date later than the date of your proxy card to theAltabancorp, 1 East Main Street, American Fork, Utah 84003, ATTN: Corporate Secretary, of FNB at 12 South Main, Layton Utah 84041, ATTN: Secretary, Shelly Holt, stating that you would like to revoke your proxy and provide new instructions on how to vote;proxy;

Byby granting a new, valid proxy bearing a later date (by telephone, through the Internet or by completing and submitting a later-dated proxy card;card); or

Byby attending the meeting and voting, in person.although attendance at the special meeting will not, by itself, revoke a proxy.

If you choose either the first or second method above, you must submit youra written notice of revocation, or your new proxy card to FNB’sit must be received by AB’s Secretary prior to the vote at the special meeting. If you grant a new proxy by telephone or Internet, your revised instructions must be received by 11:59 p.m., Mountain Time, one day before the meeting date.

If you have instructed a bank, broker or other nominee to vote your shares, you must follow the directions you receive from your bank, broker or other nominee to change your voting instructions.

What happens if I return my proxy but do not indicate how to vote my shares?

If you sign and return your proxy card but do not provide instructions on how to vote your shares of FNBAB common stockshares at the special meeting of shareholders, your shares of FNBAB common stockshares will be voted “FOR” approval ofthe proposal to approve the merger agreement, “FOR” the merger-related named executive compensation proposal and “FOR” approval of one or more adjournments of the special meeting.

If my shares are held in “street name” by my broker, bank or other nominee, will my broker, bank or other nominee automatically vote my shares for me?

No. Your broker, bank or other nominee will not vote your shares unless you provide instructions to your broker, bank or other nominee on how to vote. You should instruct your broker, bank or other nominee to vote your shares by following the instructions provided by the broker, bank or nominee with this proxy statement/prospectus.

How does the FNBAB Board recommend that I vote?

The FNBAB Board unanimously recommends that FNBAB shareholders vote “FOR” the proposals described in this proxy statement/prospectus, including in favor of approval of the merger agreement.agreement and the merger-related named executive compensation proposal.

What do I need to do now?

We encourage you to read this proxy statement/prospectus and related information in its entirety. Important information is presented in greater detail elsewhere in this document, and documents governing the merger are attached as appendices to this proxy statement/prospectus. In addition, much of the business and financial information about Glacier that may be important to you is incorporated by reference into this document from documents separately filed by Glacier with the Securities and Exchange Commission (“SEC”). This means that important disclosure obligations to you are satisfied by referring you to one or more documents separately filed with the SEC.

Following review of this proxy statement/prospectus,please complete, sign,submit a proxy through the Internet, by telephone or by completing, signing, and datedating the enclosed proxy card and return it in the enclosed envelopeas soon as possible so that your shares of FNBAB common stockshares can be voted at FNB’sAB’s special meeting of shareholders.

What happens if I sell my shares after the record date but before the special meeting?

The record date of the special meeting is earlier than the date of the special meeting and the date that the merger is expected to be completed. If you sell or otherwise transfer your shares after the record date, but before the date of the special meeting, you will retain your right to vote at the special meeting, but you will not have the right to receive the merger consideration to be received by shareholders in the merger. In order to receive the merger consideration, a shareholder must hold his or her shares through completion of the merger.

What do I do if I receive more than one proxy statement/prospectus or set of voting instructions?

If you hold shares directly as a record holder and also in “street name” or otherwise through a nominee, you may receive more than one proxy statement/prospectus and/or set of voting instructions relating to the special meeting. These should each be voted and/or returned separately in order to ensure that all of your shares are voted.

Should I send in my common stock certificates now?

No.Please do not send your FNBAB common stockshare certificates with your proxy card. You will receive written instructions from Glacier’s exchange agent promptly following the closing of the merger on how to exchange your FNBAB common stockshare certificates for the merger consideration.

What risks should I consider?consider in deciding whether to vote for approval of the merger agreement?

You should review carefully our discussion under “Risk Factors.” You should also review the factors considered by the FNBAB Board in approving the merger agreement. See “Background of and Reasons for the Merger.”

What are the material United States federal income tax consequences of the merger to FNBAB shareholders?

Glacier and FNB expect to reportAB intend for the merger of FNB with and into Glacierto qualify as atax-free reorganization for U.S. federal income tax purposes under “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). It is a condition to the closing ofIf the merger that Miller Nash Graham & Dunn LLP, tax counsel to Glacier, deliver an opinion addressed to Glacier and FNB that the merger will qualifyqualifies as a reorganization underwithin the meaning of Section 368(a).

In atax-free reorganization, a shareholder who exchanges his, her or its shares of common stock in an acquired company for shares of common stock in an acquiring company must generally recognize gain (but not loss) on the exchange in an amount equal to the lesser of (1) the amount of gain realized (i.e., the excess of the sumInternal Revenue Code, then for U.S. federal income tax purposes a U.S. holder of the fair market value of theAB common shares of the acquiring company(as defined below) generally will not recognize any gain or loss upon surrendering its AB common stock (including any fractional shares) andshares, except with respect to any cash received pursuant toor treated as received in the merger (excludingand any cash received in lieu of fractional shares) over the shareholder’s adjusted tax basisshares. A U.S. holder of AB common shares receiving cash in his, her or its shareslieu of acquired companya fractional share of Glacier common stock surrendered pursuantwill generally recognize gain or loss equal to the merger), or (2)difference between the amount of any cash (excluding any cash received instead of a fractional share and the basis in lieuits fractional share of fractional shares) received pursuantGlacier common stock. The U.S. federal income tax consequences described above may not apply to all holders of AB common shares. Your tax consequences will depend on your individual situation. Accordingly, we strongly urge you to consult an independent tax advisor for a full understanding of the merger.

particular tax consequences of the merger to you. For a detailed discussion of the material U.S. federal income tax consequences of the merger, see “The Merger – Material U.S. Federal Income Tax Consequences of the Merger.”

We urge youMerger to consult your tax advisor to fully understand the tax consequences to you of the merger. Tax matters are very complicated and in many cases the tax consequences of the merger will depend upon your particular facts and circumstances.AB Shareholders.”

Do I have appraisal or dissenters’ rights?

Yes. If youNo. Under Utah law, AB shareholders are an FNB shareholder and you do not agreeentitled to exercise appraisal rights in connection with the merger, do not vote in favor of the merger agreement, and take certain other actions required by Utah law, you will have dissenters’ rights under the Utah Revised Business Corporations Act, Sections 1301 through 1331.Exercise of these rights will result in the purchase of your shares of FNB common stock at “fair value,” as determined in accordance with Utah law. If you elect to exercise this right, we encourage you to consult with your financial and legal advisors.merger. Please read the section entitled “The Merger – Dissenters’ Rights”for additional information.

Who can help answer my questions?

If you have questions about the merger, the special shareholders meeting, or your proxy, or if you need additional copies of this document or a proxy card, you should contact:

FNB BancorpAltabancorp

12 South1 East Main Street

Layton,American Fork, Utah 8404184003

ATTN: Shelly Holt,Attention: Corporate Secretary

Tel. No.Telephone: (801)831-1600642-3998

This summary, together with the preceding section entitled “Questions and Answers about this Document and the Merger,” highlights selected information about this proxy statement/prospectus. It may not contain all of the information that is important to you. We urge you to read carefully the entire proxy statement/prospectus and any other documents to which we refer to fully understand the merger. The merger agreement is attached asAppendix A to this proxy statement/prospectus.

Information about Glacier and FNBAB

Glacier Bancorp, Inc.

49 Commons Loop

Kalispell, Montana 59901

(406) 756-4200

General

Glacier, headquartered in Kalispell, Montana, is a Montana corporation, initially incorporated in Delaware in 1990, and subsequently incorporated under Montana law in 2004. Glacier is a publicly traded company and its common stock trades on the NASDAQThe Nasdaq Global Select Market under the symbol “GBCI.” Glacier is a registered bank holding company under the Bank Holding Company Act of 1956, as amended (“BHC Act”), and is a regional bank holding company providing a full range of commercial banking services from 150172 branch locations in Montana, Idaho, Utah, Washington, Wyoming, Colorado, Utah, WashingtonArizona and Arizona,Nevada, operating through 1416 separately branded divisions of its wholly owned bank subsidiary, Glacier Bank. Glacier Bank is a Montana state-chartered bank regulated primarily by the Montana Division of Banking and Financial Institutions and the Federal Deposit Insurance Corporation. Glacier offers a wide range of banking products and services, including transaction and savings deposits, real estate, commercial, agriculture and consumer loans, mortgage origination services, and retail brokerage services. Glacier serves individuals, small tomedium-sized businesses, community organizations and public entities.

As of DecemberMarch 31, 2018,2021, Glacier had total assets of approximately $12.115$19.771 billion, total net loans receivable of approximately $8.156$11.113 billion, total deposits of approximately $9.494$16.104 billion and approximately $1.516$2.295 billion in shareholders’ equity.

Financial and other information regarding Glacier, including risks associated with Glacier’s business, is set forth in Glacier’s annual report on Form10-K for the year ended December 31, 2018.2020. Information regarding Glacier’s executive officers and directors, as well as additional information, including executive compensation and certain relationships and related transactions, is set forth or incorporated by reference in Glacier’s annual report on Form10-K for the year ended December 31, 20182020 and Glacier’s proxy statement for its 20182021 annual meeting of shareholders, and the Forms8-K filed by Glacier that are incorporated by reference into this proxy statement/prospectus. See “Where You Can Find More Information.”

Recent Acquisitions

Glacier’s strategy is to profitably grow its business through internal growth and selective acquisitions. Glacier continues to look for profitable expansion opportunities, primarily in existing and new markets in the Rocky Mountain states. The table below provides information regarding Glacier’s most recent completed acquisitions. InformationExcept as noted, information with respect to acquisitions reflects fair value adjustments following completion of the acquisitions.

| Total Assets | Gross Loans | Total Deposits | Closing Date | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

Inter-Mountain Bancorp, Inc. and subsidiary First Security Bank | 1,109,684 | 627,767 | 877,586 | 2/28/2018 | ||||||||||||

Columbine Capital Corp. and subsidiary Collegiate Peaks Bank | 551,198 | 354,252 | 437,171 | 1/31/2018 | ||||||||||||

TFB Bancorp and subsidiary The Foothills Bank | 385,839 | 292,529 | 296,760 | 4/30/2017 | ||||||||||||

FNB Bancorp

12 South

| Total Assets | Gross Loans | Total Deposits | Closing Date | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

State Bank Corp. and subsidiary State Bank of Arizona | $ | 745,420 | $ | 451,702 | $ | 603,289 | 2/29/2020 | |||||||||

Heritage Bancorp and subsidiary Heritage Bank of Nevada | 977,944 | 615,279 | 722,220 | 7/31/2019 | ||||||||||||

FNB Bancorp and subsidiary The First National Bank of Layton (in Utah) | 379,155 | 245,485 | 274,646 | 4/30/2019 | ||||||||||||

Inter-Mountain Bancorp, Inc. and subsidiary First Security Bank of Bozeman (in Montana) | 1,109,684 | 627,767 | 877,586 | 2/28/2018 | ||||||||||||

Columbine Capital Corp. and subsidiary Collegiate Peaks Bank (in Colorado) | 551,198 | 354,252 | 437,171 | 1/31/2018 | ||||||||||||

For additional information, see “Information Concerning Glacier” below

Altabancorp.

1 East Main Street

Layton,American Fork, Utah 8404184003

(801)813-1600642-3998

FNB,AB, headquartered in Layton,American Fork, Utah, is a Utah corporation formedand a registered bank holding company under the BHC Act. AB was organized in 1999 for1998 under the purposename People’s Utah Bancorp and is the bank holding company of acquiring the stock of The First National Bank of Layton (the “Bank”) and becoming the holding companyfor the Bank. FNBAB has no substantial operations separate or apart from the Bank. The Bank is a national banking associationUtah state-chartered bank, formerly known as People’s Intermountain Bank, which commenced operationswas organized in 1905.1913 and is regulated primarily by the Utah Department of Financial Institutions and the Federal Deposit Insurance Corporation. The Bank’s principal office is located in Layton,American Fork, Utah and the Bank maintains branch offices in Layton (two branches), Bountiful, ClearfieldPreston County, Idaho and Draper, allthe following counties in Utah.the Utah: Box Elder County, Cache County, Davis County, Salt Lake County, Utah County, and Washington County.

As of DecemberMarch 31, 2018, FNB2021, AB had total assets of approximately $334.7 million,$3.522 billion, total gross loans receivable of approximately $246.7 million,$1.804 billion, total deposits of approximately $285.8 million$3.159 billion and approximately $40.1$349.9 million in shareholders’ equity.

For additional information, see“Information Concerning FNB”Altabancorp” below.

The MergerSpecial Meeting of Shareholders of AB

Date, Time and Place of the Special Meeting

AB will hold its special meeting of shareholders on [___], 2021, at [___] Mountain Time. The special meeting will be held in virtual meeting format only. In order to attend the special meeting, AB shareholders must register at www.proxydocs.com/ALTA by 5:00 p.m. Mountain Time on [__], 2021.

Purpose of the Special Meeting

At the special meeting, you will be asked to vote on proposals to:

| 1. | approve the merger agreement; |

| 2. | approve merger-related compensation to named executive officers on an advisory basis; and |

| 3. | approve one or more adjournments of the special meeting, if necessary or appropriate. |

Recommendation of the AB Board

The AB Board unanimously recommends that you vote “FOR” the proposal to approve the merger agreement, provides“FOR” the merger-related named executive compensation proposal, and “FOR” approval of the proposal to adjourn the special meeting.

Record Date; Outstanding Shares; Shares Entitled to Vote

Only holders of record of AB common shares at the close of business on the record date of [___], 2021 are entitled to notice of and to vote at the special meeting. As of the record date, there were [___] AB common shares issued and outstanding held of record by approximately [___] shareholders.

Quorum; Vote Required

A quorum of AB shareholders is necessary to hold a valid meeting. The quorum requirement for the mergerspecial meeting is the presence at the meeting or by proxy of FNB witha majority of the total number of outstanding AB common shares entitled to vote. AB will include proxies marked as abstentions and into Glacier, and immediately thereafter,broker non-votes in determining the presence of a quorum at the special meeting.

The affirmative vote of the holders of at least a majority of the outstanding AB common shares entitled to vote at the special meeting is required to approve the merger agreement. Abstentions and broker non-votes with respect to this proposal will have the same effect as votes against such proposal. The merger-related named executive officer compensation proposal will be approved if the votes cast in favor of the Bank withproposal exceed the votes cast opposing the proposal. Abstentions and into Glacier Bank. Inbroker non-votes are not considered votes cast and, therefore, will not affect the outcome of this proposal. The proposal to adjourn the special meeting will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal, whether or not a quorum is present. Abstentions and broker non-votes are not considered votes cast and, therefore, will not affect the outcome of this proposal.

Share Ownership of Management; Voting Agreements

As of the record date, the directors and executive officers of AB and their affiliates collectively owned [___] AB common shares, or approximately [___]% of AB’s outstanding common shares.

Each of AB’s directors and executive officers and certain significant shareholders have signed agreements to vote their shares in favor of the merger youragreement. As of the record date, such persons were entitled to vote [___] shares representing approximately [___]% of FNBall outstanding AB common stock, if you do not dissent, will be exchanged for the right to receive shares of Glacier common stock.shares.

The Merger

In the merger, Glacier will issue shares of its common stock in exchange for all shares of FNBAB common stockshares outstanding as of the date of the closing of the merger, except properly dissenting shares.merger. Each outstanding share of FNBAB (including each share to be issued upon settlement of each unvested RSU) will be exchanged for 0.64740.7971 Glacier shares (the “per share stock consideration”), subject to possible adjustment as follows: If the average closing price of Glacier common stock subject to adjustment as described below.

Assuming the exchange of all outstanding FNB common stock for stockcalculated in accordance with the merger agreement FNB shareholders will own approximately 2.36%exceeds $74.15, Glacier may elect to terminate the merger agreement, unless AB elects to accept a decrease in the number of Glacier’s outstandingshares to be issued on a per-share basis, in order to avoid termination of the merger agreement; conversely, if the average closing price of Glacier stock is less than $49.43, AB may terminate the merger agreement, unless Glacier elects to increase on a per-share basis the number of shares of Glacier common stock following the merger. Afterin order to avoid termination of the merger youagreement. The per share stock consideration is subject to further adjustment if AB’s closing capital, after being further adjusted in

accordance with the terms of the merger agreement, is less than the minimum required, which is $342,937,000 (subject to specified adjustments). In such event, the per share stock consideration will no longer ownbe reduced on a per share basis in accordance with the formula set forth in the merger agreement.

On [___], 2021, the closing price of Glacier common stock was $[___] per share.

Potential adjustments to the per share stock consideration are described under “The Merger – Termination of the Merger Agreement” below.

Glacier will not issue fractional shares and will instead pay cash in lieu of such fractional shares calculated as follows: each holder of AB common shares who is otherwise entitled to receive a fractional share of Glacier stock after adding together all shares of FNB. Glacier common stock received by the shareholder in the merger will receive an amount of cash equal to the product of such fractional share multiplied by the average closing price of Glacier common stock calculated in accordance with the merger agreement. Any such fractional share interests will not include the right to vote or receive dividends or any interest on dividends.

If the AB Closing Capital, as determined in accordance with the merger agreement, is in excess of $342,937,000, subject to adjustment, AB may, prior to the merger, declare and pay a special dividend to its shareholders in the aggregate amount of such excess. The amount of the AB Closing Capital may be reduced if AB’s transaction-related expenses are above a specified amount.

For additional information, including the manner in which the AB Closing Capital is determined, see the discussion under the heading “The Merger” below.

The merger agreement is attached asAppendix A to this proxy statement/prospectus. We encourage you to read the merger agreement in its entirety.

If the average closing priceTreatment of GlacierAB Equity Incentive Awards

As incentive awards, AB has awarded stock calculated in accordanceoptions and RSUs as additional compensation to various directors, executive officers, and other officers. In connection with the merger, agreement exceeds $46.63, Glacier may elect to terminate the merger agreement unless FNB elects to accept a decrease on aper-share basis in the number of Glacier shares tooutstanding incentive awards will be issued in order to avoid terminationtreated as follows:

| • | Outstanding RSUs. Immediately prior to the closing of the merger, each outstanding or payable RSU will vest and convert to AB common shares and will be entitled to receive the per share stock consideration and cash in lieu of fractional shares described under the heading “Summary – Merger Consideration” above. |

| • | Outstanding Options. All options that remain outstanding and unexercised at the closing of the merger shall be canceled, and in lieu thereof, the holders of such options shall be paid in cash pursuant to the formula set forth in the merger agreement. If the exercise price of any such option exceeds the formula ratio, the option will be cancelled without any cash payment. For additional information, including the formula for calculating any cash payments related to outstanding options, see “The Merger – Treatment of AB Equity Awards.” |

Recommendation of the merger agreement.

Conversely, if the average closing price of Glacier stock calculated in accordance with the merger agreement is (i) less than $34.47 and the price of Glacier common stock has underperformed the KBW Regional Banking Index by more than 10% or (ii) less than $32.44, FNB may terminate the merger agreement, unless Glacier elects to increase on aper-share basis the number of shares of Glacier common stock to be issued in the merger, or in Glacier’s discretion, Glacier pays cash, or a combination of cash and additional Glacier shares, so that the value of the consideration equals an amount specified in the merger agreement.

Glacier will not issue fractional shares and will instead pay cash in lieu of such fractional shares, as described under “The Merger – Fractional Shares” below.

If the FNB Closing Capital exceeds $39,285,000, subject to certain adjustments, FNB may, upon written notice to Glacier and effective immediately prior to the closing of the merger, declare and pay a special dividend to its shareholders in the amount of such excess.

If the FNB Closing Capital is less than $39,285,000, the total Glacier stock consideration will be reduced by a number of shares equal in value to the amount of the shortfall.

“FNB Closing Capital” is defined in the merger agreement and is equal to an amount, estimated as of the closing date of the merger, equal to FNB’s capital stock, surplus and retained earnings, determined in accordance with generally accepted accounting principles (“GAAP”) on a consolidated basis, net of goodwill and other intangible assets, after giving effect to adjustments, calculated in accordance with GAAP, for accumulated other comprehensive income or loss as reported in FNB’s or the Bank’s balance sheet. FNB’s Closing Capital is subject to downward adjustment if transaction-related expenses exceed certain thresholds set forth in the merger agreement.

Recommendation of FNBAB Board

The FNBAB Board unanimously recommends that holders of FNBAB common stockshares vote “FOR” the proposal to approve the merger agreement.agreement and “FOR” the merger-related named executive compensation proposal.

For further discussion of FNB’sAB’s reasons for the merger and the recommendations of the FNBAB Board, see “Background of and Reasons for the Merger – Reasons for the Merger – FNB.AB.”

Opinion of FNB’sAB’s Financial Advisor

In connection with the merger, FNB’sAB’s financial advisor, Sandler O’NeillKeefe, Bruyette & Partners, L.P.Woods, Inc. (“KBW”), delivered a written opinion, dated January 15, 2019,May 17, 2021, to the FNBAB Board as to the fairness, from a financial point of view and as of the date of the opinion, to the holders of FNBAB common stockshares of the merger considerationexchange ratio of 0.7971 in the proposed merger. The full text of the opinion, which describes the procedures followed, assumptions made, matters considered, and qualifications and limitations on the review undertaken by Sandler O’NeillKBW in preparing the opinion, is attached asAppendix CB to this document.The opinion was for the information of, and was directed to, the FNBAB Board (in its capacity as such) in

connection with its consideration of the financial terms of the merger. The opinion did not address the underlying business decision of FNBAB to engage in the merger or enter into the merger agreement or constitute a recommendation to the FNBAB Board in connection with the merger, and it does not constitute a recommendation to any holder of FNBAB common stockshares or any shareholder of any other entity as to how to vote or act in connection with the merger or any other matter.

For further information, see “Background of and Reasons for the Merger – Opinion of FNB’sAB’s Financial Advisor.”

Interests of FNBAB’s Directors and Executive Officers in the Merger

When you consider the unanimous recommendation of the FNBAB Board that FNB’sAB’s shareholders approve the merger agreement, you should be aware that certain members of FNB’sAB’s and/or the Bank’s Board of Directors and executive management have interests in the merger that are different from, or in addition to, their interests as FNBAB shareholders. These interests arise out of, among other things, voting andnon-competition agreements entered into by the directors and executive officers of FNB,AB and the Bank, the acceleration of vesting of RSUs, employment agreements entered into with Glacier by certain FNBAB and Bank executive officers, Glacier’s agreementpayments to appoint several FNB directorsbe made to an advisory boardcertain executive officers pursuant to existing employment agreements or change in control agreements with AB and/or the Bank, and provisions in the merger agreement relating to indemnification of FNBAB directors and officers. For a description of the interests of FNB’sAB’s directors and executive officers in the merger, see “The Merger – Interests of FNBAB Directors and Executive Officers in the Merger.”

The FNBAB Board was aware of these interests and took them into account in its decision to approve the merger agreement.agreement and recommend that it be approved by AB’s shareholders.

FNBAB Shareholders Dissenters’ Rights

Under Utah law, FNBAB shareholders have the rightwill not be entitled to dissent from the merger and receive cash for the “fair value”of their shares of FNB common stock. The procedures required under Utah law are described laterexercise any appraisal or dissenters’ rights in this document, and a copyconnection with any of the relevant statutory provisions is attached asAppendix B.proposals being presented to them. For more information, on dissenters’ rights, see “The Merger – Dissenters’ Rights.”

Regulatory Matters

Each of Glacier and FNBAB has agreed to use its commercially reasonable efforts to obtain all regulatory approvals, waivers or non-objectionsrequired by the merger agreement and the transactions contemplated by the merger agreement. These approvals include approvalApplications or a waiver from the Federal Reserve, the Federal Deposit Insurance Corporation, and the Commissioner of the Montana Division of Banking and Financial Institutions, Applicationsrequests have been filed with thesesuch regulatory bodies seeking such approvals.approvals or waivers. We expect to obtain all such regulatory approvals, waivers or non-objections, although we cannot be certain if or when we will obtain them. See “The Merger – Regulatory Requirements.”

Conditions to Completion of the Merger

Currently, Glacier and FNBAB expect to complete the merger during the secondfourth quarter of 2019.2021. As more fully described in this proxy statementstatement/prospectus and in the merger agreement, the completion of the merger depends

on a number of conditions being satisfied or, where legally permissible, waived. Neither Glacier nor FNBAB can provide assurance as to when or if all of the conditions to the merger can or will be satisfied or waived. See “The Merger – Conditions to the Merger.”

Termination of the Merger Agreement

The merger agreement provides that either Glacier or FNBAB may terminate the merger agreement either before or after the FNBAB special shareholders meeting, under certain circumstances. See “The Merger – Termination of the Merger Agreement.”

Break-Up Fee

The merger agreement provides that FNBAB must pay Glacier abreak-up fee of $3,200,000$35,000,000 if the merger agreement is terminated(i) by Glacier if the FNBAB Board fails to recommend approval of the merger agreement by FNB’sAB’s shareholders or modifies, withdraws or adversely changes its recommendation, or(ii) by the FNBAB Board due to its determination that an acquisition proposal received by FNBAB constitutes a “Superior Proposal” (as defined in the merger agreement), which is acted upon by FNB,AB, or(iii) by Glacier because an “Acquisition Event” (as defined in the merger agreement) with respect to FNBAB has occurred. In addition, abreak-up fee of $3,200,000$35,000,000 will be due to Glacier if the merger agreement is terminated(1) by Glacier or FNBAB due to a failure of FNB’sAB’s shareholders to approve the merger agreement, (2)or (2) by Glacier for FNB’sAB’s breach of certain covenants set forth in the merger agreement, or(3) by Glacier because a third party has made a proposal to FNB or its shareholders to engage in, or enter into an agreement with respect to, an Acquisition Event and the merger agreement and the merger are not approved by FNB’s shareholdersand within 18 months after any such termination described in clauses(1) through(3) and (2) above, FNBAB or the Bank enters into an agreement for, or publicly announces its intention to engage in, an Acquisition Event or within 18 months after any such termination described in clauses(1) through(3) and (2) above, an Acquisition Event will have occurred.occurs.

FNBAB agreed to pay thebreak-up fee under the circumstances described above in order to induce Glacier to enter into the merger agreement. This arrangement could have the effect of discouraging other companies from trying to acquire FNB.AB. See “The Merger –Break-upBreak-Up Fee.”

FNBAB Shareholders’ Rights After the Merger

The rights of FNBAB shareholders are governed by Utah law, as well as by FNB’sAB’s amended and restated articles of incorporation (“FNB’sAB’s articles”) and amended and restated bylaws (“FNB’sAB’s bylaws”). After completion of the merger, the rights of the former FNBAB shareholders receiving Glacier common stock in the merger will be governed by Montana law, and will be governed by Glacier’s amended and restated articles of incorporation (“Glacier’s articles”) and amended and restated bylaws (“Glacier’s bylaws”). Although Glacier’s articles and Glacier’s bylaws are similar in many ways to FNB’sAB’s articles and FNB’sAB’s bylaws, there are some substantive and procedural differences that will affect the rights of FNBAB shareholders. See “Comparison of Certain Rights of Holders of Glacier and FNBAB Common Stock.Shares.”

Material U.S. Federal Income Tax Consequences of the Merger to AB Shareholders

Glacier and AB intend for the merger to qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code. It is a condition to the respective obligations of Glacier and AB to complete the merger that Glacier and AB each receive a legal opinion from Miller Nash LLP and Jones Day, respectively, or in certain circumstances other counsel reasonably acceptable to each of Glacier and AB, to the effect that the merger will qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code. Neither Glacier nor AB currently intends to waive these conditions to the consummation of the merger. In the event that Glacier and AB waive the condition to receive such tax opinion and the tax consequences of the merger materially change, then AB will recirculate appropriate soliciting materials and seek new approval of the

merger from AB’s shareholders. If the merger qualifies as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code, then for U.S. federal income tax purposes a U.S. holder of AB common shares generally will not recognize any gain or loss upon surrendering its AB common shares, except with respect to any cash received or treated as received in the merger and any cash received in lieu of fractional shares. A U.S. holder of AB common shares receiving cash in lieu of a fractional share of Glacier common stock will generally recognize gain or loss equal to the difference between the amount of cash received instead of a fractional share and the basis in its fractional share of Glacier common stock.

The U.S. federal income tax consequences described above may not apply to all holders of AB common shares. Your tax consequences will depend on your individual situation. Accordingly, we strongly urge you to consult an independent tax advisor for a full understanding of the particular tax consequences of the merger to you. For a more detailed discussion of the material U.S. federal income tax consequences of the merger, see “The Merger – Material U.S. Federal Income Tax Consequences of the Merger to AB Shareholders.”

Accounting Treatment of the Merger

The acquisition of AB will be accounted for as an acquisition by Glacier using the acquisition method of accounting in accordance with accounting principles generally accepted in the United States of America. Accordingly, the assets (including identifiable intangible assets) and liabilities (including executory contracts and other commitments) of AB as of the date of acquisition will be recorded at their respective fair values. Any excess of the total consideration paid in connection with the merger over the net fair values is recorded as goodwill. Consolidated financial statements of Glacier issued after the date of acquisition would reflect these fair values and would not be restated retroactively to reflect the historical financial position or results of operations of AB.

In addition to the other information contained in or incorporated by reference into this document, including the matters addressed under the caption “Cautionary Note Regarding Forward-Looking Statements,” you should consider the matters described below carefully in determining whether or not to approve the merger agreement and the transactions contemplated by the merger agreement.

Risks Associated with the Proposed Merger

Because you are receiving a fixed number of shares (subject to adjustment) and the market price of the Glacier common stock may fluctuate, you cannot be sure of the value of the shares of Glacier common stock that you will receive.

At the time of the FNBAB special shareholder meeting, and prior to the closing of the merger, you will not be able to determine the value of the Glacier common stock that you will receive upon completion of the merger. Any change in the market price of Glacier common stock prior to completion of the merger will affect the value of the consideration that FNBAB shareholders will receive in the merger. Common stock price changes may result from a variety of factors, including but not limited to general market and economic conditions, changes in Glacier’s business, operations and prospects, and regulatory considerations. Many of these factors are beyond the control of Glacier or FNB. On March 11, 2019, the closing price of Glacier common stock was $41.06.AB. You should obtain current market prices for Glacier common stock.

The merger agreement provides that the number of shares of Glacier common stock to be issued for each share of FNBAB common stockshare in the merger may be decreased or increased, as the case may be, if the average closing price of Glacier common stock, determined pursuant to the merger agreement, is greater than or less than specified prices. If Glacier’s average closing price determined in accordance with the merger agreement is greater than $46.63$74.15 and Glacier elects to terminate the merger agreement, the FNBAB Board wouldcould determine, without resoliciting the vote of FNBAB shareholders, whether or not to accept a decrease on aper-share basis in the number of shares of Glacier common stock to be issued in the merger to avoid such termination. See “The Merger – Termination of the Merger Agreement.”

The results of operations of Glacier after the merger may be affected by factors different from those currently affecting the results of operations of AB.

The businesses of Glacier and AB differ in certain respects and, accordingly, the results of operations of the combined company and the market price of the combined company’s common shares may be affected by factors different from those currently affecting the independent results of operations of AB and Glacier. For a discussion of the business of Glacier and certain factors to be considered in connection with Glacier’s business, see “Information Concerning Glacier” and the documents incorporated by reference in this document and referred to under “Where You Can Find More Information.” For a discussion of the business of AB and certain factors to be considered in connection with AB’s business, see “Information Concerning Altabancorp” and the documents incorporated by reference in this document and referred to under “Where You Can Find More Information.”

The merger agreement limits FNB’sAB’s ability to pursue other transactions and provides for the payment of abreak-up fee if FNBAB does so.

While the merger agreement is in effect, subject to very narrow exceptions, FNBAB and its directors, officers, employees, agents and representatives are prohibited from initiating or encouraging inquiries with respect to alternative acquisition proposals. The prohibition limits FNB’sAB’s ability to seek offers from other potential acquirers that may be superior from a financial point of view to the proposed transaction. If FNBAB receives an unsolicited proposal from a third party that is superior from a financial point of view to that made by Glacier and the merger agreement is terminated, FNBAB will be required to pay a $3,200,000$35,000,000 break-up fee. This fee makes it less likely that a third party will make an alternative acquisition proposal. See “The Merger –Break-Up Fee.”

Combining ourthe two companies may be more challenging, costly or time-consuming than we expect.expected.

Glacier and FNBAB have operated and, until the completion of the merger, will continue to operate, independently. Although Glacier has successfully completed numerous mergers in the recent past, this is a larger transaction than others and regardless it is possible that the integration of the Bank into Glacier Bank could result in the loss of key employees, the disruption of the ongoing business of the Bank or inconsistencies in standards, controls, procedures and policies that adversely affect ourthe Bank’s ability to maintain relationships with customers and employees or to achieve the anticipated benefits of the merger. As with any merger of banking institutions, there also may be disruptions that cause usthe Bank to lose customers or cause customers to take their deposits out of the Bank.

Unanticipated costs relating to the merger could reduce Glacier’s future earnings per share.

Glacier believes that it has reasonably and conservatively estimated the likely costs of integrating the operations of the Bank into Glacier Bank, and the incremental costs of operating as a combined financial institution. However, it is possible that unexpected transaction costs or future operating expenses, as well as other types of unanticipated adverse developments, could have a material adverse effect on the results of operations and financial condition of Glacier after the merger. If the merger is completed and unexpected costs are incurred, the merger could have a dilutive effect on Glacier’s earnings per share, meaning earnings per share could be less than they would be if the merger had not been completed.

The merger agreement may be terminated in accordance with its terms and the merger may not be completed, which could have a negative impact on AB.

The merger agreement with Glacier is subject to a number of conditions that must be fulfilled in order to close. Those conditions include: approval by the shareholders of AB, regulatory approval, the continued accuracy of certain representations and warranties by both parties (subject to the materiality standards set forth in the merger agreement), and the performance by both parties of certain covenants and agreements. In addition, certain circumstances exist in which AB may terminate the merger, including by accepting a superior proposal or by electing to terminate if Glacier’s stock price declines below a specified level. There can be no assurance that the conditions to closing the merger will be fulfilled or that the merger will be completed.

If the merger agreement is terminated, there may be various consequences to AB, including:

AB’s business may have been adversely impacted by the failure to pursue other beneficial opportunities due to the focus of management on the merger, without realizing any of the anticipated benefits of completing the merger; and

AB may have incurred substantial expenses in connection with the merger, without realizing any of the anticipated benefits of completing the merger.

If the merger agreement is terminated and the AB Board approves another merger or business combination, under certain circumstances AB may be required to pay Glacier a $35,000,000 termination fee. AB’s shareholders cannot be certain that AB will be able to find a party willing to pay an equivalent or more attractive price than the price Glacier has provisionsagreed to pay in its articlesthe merger.

The opinion of incorporation that could impedeAB’s financial advisor delivered to the AB Board before the execution of the merger agreement does not reflect any changes in circumstances subsequent to the date of the opinion.

The opinion of KBW regarding the fairness, from a takeoverfinancial point of Glacier.