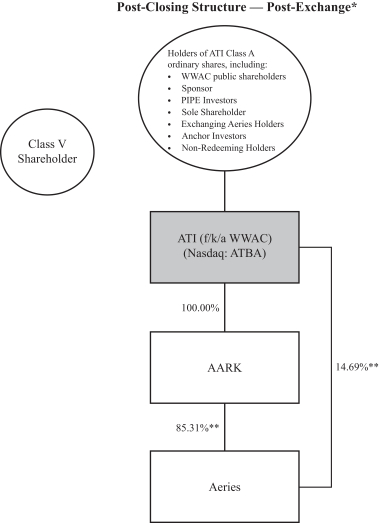

| • | | WWAC will issue to NewGen Advisors and Consultants DWC-LLC, a company incorporated in Dubai, United Arab Emirates with limited liability under registration No. 8754 (the “Class V Shareholder”), one Class V ordinary share of WWAC (the “ATI Class V ordinary share”), whichClass V Shareholder. The ATI Class V ordinary share will have multiple votes per share, and this ownership will limit or preclude your ability to influence corporate matters, including the election of directors, amendments of our organizational documents, and any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transactions requiring shareholder approval, and that may adversely affect the trading price of our Class A ordinary shares.

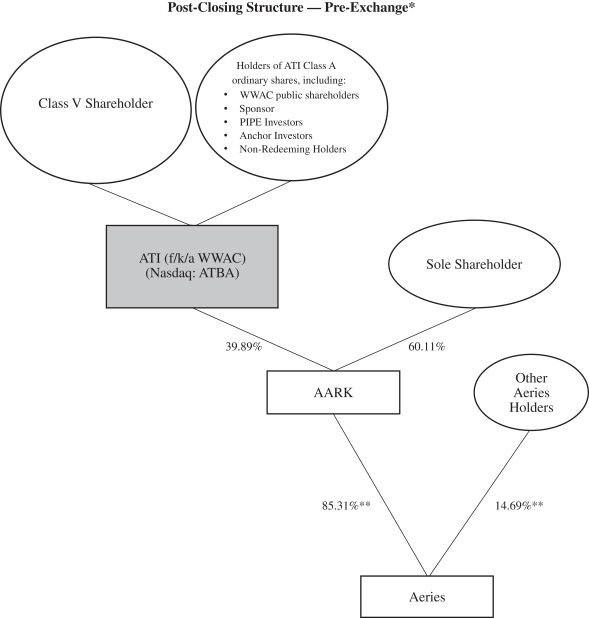

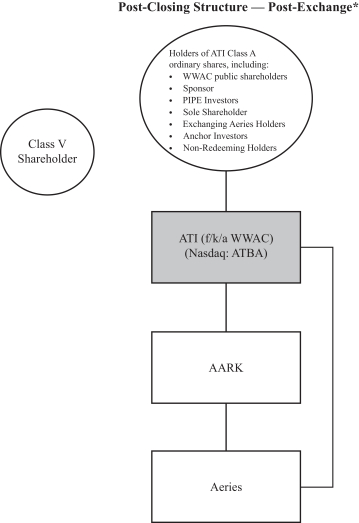

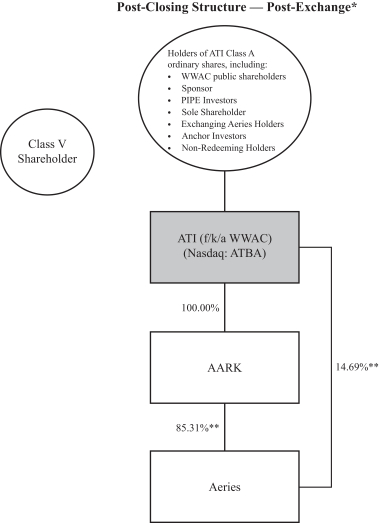

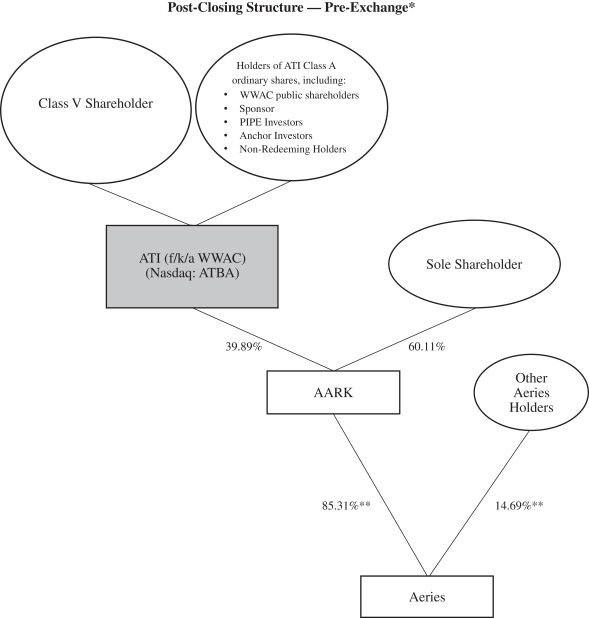

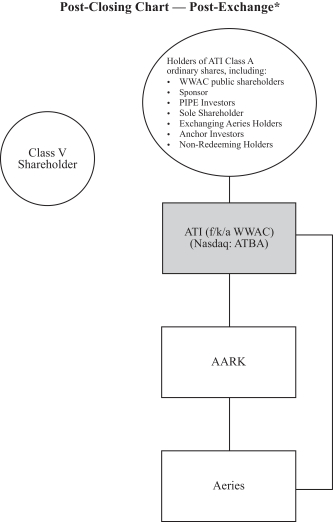

The Combined Company will have a dual class ordinary share structure and the Class V Shareholder, at Closing, will hold the ATI Class V ordinary share. Such ATI Class V ordinary share will have no economic rights, but will have voting rights equal to (1) 26.0% of the total issued and outstanding Class A ordinary shares and ATI Class V ordinary share voting together as a single class (subject to a proportionate reduction in voting power in connection with the exchange by the Sole Shareholder of AARK ordinary shares for ATI Class A ordinary shares pursuant to the AARK Exchange Agreement); provided, however, that such proportionate reduction will not affect the voting rights of the ATI Class V ordinary share in the event of (i) a threatened or actual Hostile Change of Control (as defined in the Business Combination Agreement) and/or (ii) the appointment and removal of a director on the Company Board) and (2) in certain circumstances, including the threat of a hostile change of control of ATI, 51% of the total issued and outstanding ATI Class A ordinary shares and ATI Class V ordinary share voting together as a class. This concentrated control may limit or preclude your ability to influence corporate matters for the foreseeable future, including the election of directors, amendments of our organizational documents and any merger, consolidation, sale of all or substantially all of our assets or other major corporate transactions requiring shareholder approval. In addition, this concentrated control may prevent or discourage unsolicited acquisition proposals or offers for our capital stock that you may feel are in your best interest as one of our shareholders. As a result, such concentrated control may adversely affect the market price of our Class A ordinary shares. A substantial number of WWAC public shareholders redeemed their Class A ordinary shares in connection with the shareholder vote on the Extension Amendment, and additional WWAC public shareholders may redeem their Class A ordinary shares in connection with the Business Combination. Due to our Up-C-like structure and the fact that the Exchanging Aeries Holders and Sole Shareholder may not exchange their Aeries Shares and AARK ordinary shares for ATI Class A ordinary shares until April 1, 2024, the public float and trading volume of ATI Class A ordinary shares may initially be very small. As a result, the trading price of ATI Class A ordinary shares may be volatile. A substantial number of WWAC public shareholders have already redeemed their Class A ordinary shares in connection with the shareholder vote on the Extension Amendment, which has caused the WWAC public float and trading volume to decline significantly. Additionally, WWAC public shareholders will be provided with an opportunity to redeem their Class A ordinary shares in connection with the Business Combination, which may further reduce the WWAC public float and trading volume. Given our Up-C-like structure, we will not be immediately issuing ATI Class A ordinary shares as consideration in the Business Combination. Pursuant to the Exchange Agreements, the Exchanging Aeries Holders and Sole Shareholder may not exchange their Aeries Shares and AARK ordinary shares for ATI Class A ordinary shares until April 1, 2024. As a result, the public float and trading volume of ATI Class A ordinary shares may be very small, thus causing the share price to be volatile. 86

WWAC is not in compliance with the Nasdaq Capital Market’s minimum public holders requirement and if WWAC fails to regain compliance with Nasdaq’s continued listing requirements, WWAC Class A ordinary shares could be delisted, which could adversely affect the liquidity of WWAC Class A ordinary shares and WWAC’s ability to raise additional capital or complete the Business Combination. On May 12, 2023, WWAC received adeficiency letter (the “Notice”) from the Listing Qualifications Department of Nasdaq notifying it that it no longer complies with Nasdaq Listing Rule 5550(a)(3) due to WWAC’s failure to maintain a minimum of 300 public holders for continued listing on The Nasdaq Capital Market. On June 26, 2023, WWAC submitted its plan of compliance to Nasdaq. This plan of compliance detailed WWAC’s intention to close the Business Combination and the PIPE Financing as means to satisfy Nasdaq Listing Rule 5550(a)(3). Based on the review of the materials submitted by WWAC, on July 5, 2023 Nasdaq determined to grant WWAC an extension until November 8, 2023 to regain compliance with the Minimum Public Holder Rule. In accordance with Nasdaq’s acceptance of the plan of compliance on July 5, 2023, on or before November 8, 2023, WWAC must file with Nasdaq documentation from its transfer agent, or independent source, that demonstrates that its securities have a minimum of 300 public holders. In the event WWAC does not satisfy the terms, Nasdaq will provide written notification that its securities will be delisted. At that time, WWAC may appeal Nasdaq’s determination to a Listing Qualifications Panel. If WWAC’s appeal is not accepted, WWAC Class A ordinary shares will be delisted from the Nasdaq Capital Market which could adversely affect the liquidity of the WWAC Class A ordinary shares and WWAC’s ability to raise additional capital or complete the Business Combination. If, after WWAC distributes the proceeds in the trust account to the public shareholders, WWAC files a bankruptcy petition or an involuntary bankruptcy petition is filed against WWAC that is not dismissed, a bankruptcy court may seek to recover such proceeds, and WWAC and the WWAC Board may be exposed to claims of punitive damages. If, after WWAC distributes the proceeds in the trust account to its public shareholders, WWAC files a bankruptcy or winding up petition or an involuntary bankruptcy or winding up petition is filed against WWAC that is not dismissed, any distributions received by shareholders could be viewed under applicable debtor/creditor and/or bankruptcy laws as either a “preferential transfer” or a “fraudulent conveyance, preference or disposition.” As a result, a bankruptcy court could seek to recover all amounts received by WWAC’s shareholders. In addition, the WWAC Board may be viewed as having breached its fiduciary duty to WWAC’s creditors and/or having acted in bad faith, thereby exposing itself and WWAC to claims of punitive damages, by paying public shareholders from the trust account prior to addressing the claims of creditors. The U.S. Internal Revenue Service (the “IRS”) or the Income Tax Department, Department of Revenue, Ministry of Finance, Government of India, including without limitation, any court, tribunal or other authority, in each case that is competent to impose or adjudicate tax in the Republic of India (the “Indian Taxation Authority”) may disagree regarding the tax treatment of the Business Combination and the other transactions that will be undertaken in connection with the Business Combination, which could have a material adverse effect on our business and the market price of our Class A ordinary shares. None of WWAC, AARK or Aeries intends to or has sought any rulings from the IRS or the Indian Tax Authority regarding the tax consequences of the Business Combination and the other transactions that will be undertaken in connection with the Business Combination. Accordingly, no assurance can be given that the IRS or Indian Tax Authority will not assert, or that a court of competent jurisdiction will not sustain, a position contrary to the intended tax treatment.Any such determination could subject you to adverse tax consequences that would be different from those described herein and have a material adverse effect on our business and the market price of our Class A ordinary shares. 87

BofA Securities, Inc. (“BofA”) and J.P. Morgan Securities LLC (“J.P. Morgan”), the underwriters in WWAC’s IPO, were to be compensated, in part, on a deferred basis for already-rendered underwriting services in connection with WWAC’s IPO, yet they waived such compensation without any consideration from WWAC and, effective as of November 3, 2022, resigned and withdrew from their roles in the Business Combination. As a result, BofA and J.P. Morgan disclaim any responsibility for this proxy statement/prospectus and will not be associated with the disclosure or underlying business analysis related to the Business Combination, which could result in an increased number of WWAC shareholders voting against the Business Combination or seeking to redeem their shares for cash. As underwriters in WWAC’s IPO, BofA and J.P. Morgan received an underwriting discount of $0.20 per unit, or $4.6 million in the aggregate, paid upon the closing of the IPO and exercise in full of the over-allotment option. Subject to certain limitations, $8,050,000 in the aggregate was agreed to be paid to BofA and J.P. Morgan as deferred underwriting fees at the consummation of the Business Combination. On November 3, 2022, BofA and J.P. Morgan each formally notified WWAC in writing that it had resigned and withdrew from its role in the Business Combination and thereby waived its entitlement to the deferred underwriting fees. Investors should be aware that a fee waiver for services already rendered is unusual and some investors may find the Business Combination less attractive as a result. This may make it more difficult for WWAC to consummate the Business Combination. As a result of such resignations, BofA and J.P. Morgan claim no role in the Business Combination, disclaim any responsibility for this proxy statement/prospectus and will not be associated with the disclosure or underlying business analysis related to the Business Combination. Neither BofA nor J.P. Morgan had a role in the identification or evaluation of business combination targets, and neither BofA nor J.P. Morgan were involved in the preparation of any disclosure included in this proxy statement/prospectus or any analysis underlying disclosure included in this proxy statement/prospectus. Further, neither BofA nor J.P. Morgan assisted in the preparation or review of any materials for WWAC in connection with the Business Combination and did not participate in any other aspect of the Business Combination. You should not put any reliance on the fact that BofA or J.P. Morgan were previously involved in WWAC’s IPO. It is possible that such resignations may adversely affect market perception of the Business Combination generally. If market perception of the Business Combination is negatively impacted, an increased number of WWAC shareholders may vote against the Business Combination or seek to redeem their shares for cash. The scope of due diligence that WWAC has conducted in conjunction with the Business Combination may be different than would typically be conducted in the event Aeries pursued an underwritten public offering, and you may be less protected as an investor from any material issues with respect to Aeries’ business, including any material omissions or misstatements contained in the registration statement or this proxy statement/prospectus, than an investor in a public offering. The scope of due diligence WWAC has conducted in conjunction with the Business Combination may be different than would typically be conducted in the event Aeries pursued an underwritten public offering. In a traditional underwritten public offering, an issuer initially sells its securities to the public market via one or more underwriters, who purchase such securities on a firm commitment basis and distribute or resell them to the public. Investors in such an offering benefit from the role played by underwriters. Underwriters have liability under the U.S. securities laws for material misstatements or omissions in a registration statement pursuant to which an issuer sells securities in an underwritten offering. Because the underwriters have a “due diligence” defense to such liability by, among other things, conducting a reasonable investigation, the underwriters and their counsel conduct a due diligence investigation of the issuer as part of the underwriting process. Due diligence entails engaging legal, financial and other experts to perform an investigation as to the accuracy of an issuer’s disclosure regarding, among other things, its business and financial results. Auditors of the issuer will also deliver a “comfort” letter to the underwriters with respect to the financial information contained in the registration statement. In making their investment decision, investors in an underwritten public offering have the benefit of such diligence. While sponsors, private investors and management in a business combination involving a special purpose acquisition company like WWAC conduct due diligence on the target company, it is not necessarily the same 88

level of due diligence undertaken by an underwriter in a public securities offering and, therefore, although WWAC has conducted due diligence on Aeries, WWAC cannot assure you that this diligence revealed all material issues that may be present in Aeries’ business, that it would be possible to uncover all material issues through a customary amount of due diligence, or that factors outside of each company’s control will not later arise. There could be a heightened risk of an incorrect valuation of Aeries’ business or material misstatements or omissions in this proxy statement/prospectus. Such risks include that Aeries may be forced to later write down or write off assets, restructure its operations, or incur impairment or other charges that could result in losses. Even if the due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with WWAC’s preliminary risk analysis. Even though these charges may be non-cash items and not have an immediate impact on Aeries’ liquidity, the fact that the company reports charges of this nature could contribute to negative market perceptions about Aeries or ATI’s securities. Accordingly, any WWAC shareholders who chooses to remain a shareholder following the Closing could suffer a reduction in the value of their shares. Such WWAC shareholders are unlikely to have a remedy for such reduction in value unless they are able to successfully claim that the reduction was due to the breach by WWAC’s officers or directors of a duty of care or other fiduciary duty owed to them, or if they are able to successfully bring a private claim under securities laws that the proxy solicitation relating to the Business Combination contained an actionable material misstatement or material omission. In addition, because there are no underwriters engaged in connection with the Business Combination, prior to the opening of trading on the Nasdaq on the trading day immediately following the Closing, there will be no traditional “roadshow” or book building process, and no price at which underwriters initially sold shares to the public to help inform efficient and sufficient price discovery with respect to the initial post-closing trades. Therefore, buy and sell orders submitted prior to and at the opening of initial post-closing trading of the ATI Class A ordinary shares and warrants will not have the benefit of being informed by a published price range or a price at which the underwriters initially sold shares to the public, as would be the case in an underwritten initial public offering. There will be no underwriters assuming risk in connection with an initial resale of ATI’s securities or helping to stabilize, maintain or affect the public price of ATI’s securities following the Closing. Moreover, neither WWAC nor Aeries will engage in, and has not and will not, directly or indirectly, request financial advisors to engage in, any special selling efforts or stabilization or price support activities in connection with ATI’s securities that will be outstanding immediately following the Closing. In addition, since Aeries will become public through a merger with a special purpose acquisition company, securities analysts of major brokerage firms may not provide coverage of ATI since there is no incentive to brokerage firms to recommend the purchase of ATI’s securities. No assurance can be given that brokerage firms will, in the future, want to conduct any offerings on behalf of ATI. All of these differences from an underwritten public offering of ATI’s securities could result in a more volatile price for such securities. Further, since there will be no traditional “roadshow,” there can be no guarantee that any information made available in this proxy statement/prospectus or otherwise disclosed or filed with the SEC will have the same impact on investor education as a traditional “roadshow” conducted in connection with an underwritten initial public offering. As a result, there may not be efficient or sufficient price discovery with respect to the ATI Class A ordinary shares or warrants or sufficient demand among potential investors immediately after the Closing, which could result in a more volatile price for such securities. 89

ANNUAL GENERAL MEETING OF WWAC General WWAC is furnishing this proxy statement/prospectus to WWAC’s shareholders as part of the solicitation of proxies by the WWAC Board for use at the annual general meeting of WWAC to be held on , 2023, and at any adjournment thereof. This proxy statement/prospectus is first being furnished to WWAC’s shareholders on or about , 2023 in connection with the vote on the proposals described in this proxy statement/prospectus. This proxy statement/prospectus provides WWAC’s shareholders with information they need to know to be able to vote or instruct their vote to be cast at the annual general meeting. Date, Time and Place The annual general meeting will be held at a.m., Mountain Time, on , 2023 at the offices of Kirkland & Ellis LLP located at 95 South State Street, Salt Lake City, Utah 84111, and virtually via a live webcast at , or at such other time, on such other date and at such other place to which the meeting may be adjourned. Purpose of the WWAC Annual General Meeting At the annual general meeting, WWAC is asking holders of ordinary shares to consider and vote upon: a proposal to approve by ordinary resolution and adopt the Business Combination Agreement and the transactions contemplated thereby, including the Amalgamation; a proposal to approve by special resolution the Proposed Memorandum and Articles of Association; | • | | a proposal to approve, on a non-binding advisory basis, each of the Governing Documents Proposals and thereby (i) authorize a change to our authorized capital stock, (ii) authorize a dual class ordinary share structure in which holders of Class A ordinary shares will be entitled to one vote per share and the Class V Shareholder will be entitled to a number of votes equal to (1) 26.0% of all votes attached to the total issued and outstanding Class A ordinary shares and the ATI Class V ordinary share (subject to a proportionate reduction in voting power in connection with the exchange by the Sole Shareholder of AARK ordinary shares for ATI Class A ordinary shares pursuant to the AARK Exchange Agreement); provided, however, that such proportionate reduction will not affect the voting rights of the ATI Class V ordinary share in the event of (i)(a) a threatened or actual Hostile Change of Control (as defined in the Business Combination Agreement) and/or (ii)(b) the appointment and removal of a director on the Company Board), and (2) in certain circumstances, including the threatinstances 51.0% of a hostile change of control of WWAC, 51% ofall votes attached to the total issued and outstanding ATI Class A ordinary shares and ATI Class V ordinary share voting together as a class. Upon the exchange of any AARK ordinary shares for Class A ordinary shares pursuant to the Exchange Agreement (collectively, the “Converted Shares”), the voting power of the ATI Class V ordinary share willand (iii) approve other changes to be reduced in proportion to the AARK ordinary shares exchanged to that of the AARK ordinary shares held by the Sole Shareholder on Closing. The Sole Shareholder does not control the Class V Shareholder, and the Class V Shareholder will not receive any compensationmade in connection with its ownershipthe adoption of Governing Documents. A copy of the ATI Class V ordinary share.Proposed Memorandum and Articles of Association is attached to this proxy statement/prospectus as Annex E; |

Conditions

a proposal to Closingapprove by ordinary resolution the issuance of the Business Combination The obligations of the Parties to consummate the Business Combination are subject to certain closing conditions, including, but not limited to: (1) the approval of WWAC’s shareholders; (2) the approval of Aeries shareholders; (3) WWAC’sATI Class A ordinary shares to be issuedand the ATI Class V ordinary share in connection with the Business Combination shall have been approvedand the PIPE Financing in compliance with Nasdaq listing requirements;

a proposal to approve and adopt by ordinary resolution the Equity Incentive Plan; a proposal for listing on the Nasdaq Global Marketholders of the Class B ordinary shares to consider and vote upon a proposal under the Cayman Islands Companies Act to elect Sudhir Appukuttan Panikassery, Daniel S. Webb, Venu Raman Kumar, Alok Kochhar, Biswajit Dasgupta, Nina B. Shapiro and Ramesh Venkataraman, in each case, to serve as directors until their respective successors are duly elected and qualified, or until their earlier death, resignation or removal; and a proposal to approve by ordinary resolution the Nasdaq Capital Market, subjectadjournment of the annual general meeting to official noticea later date or dates, if necessary, to, among other things, permit further solicitation and vote of issuance; (4) no governmental authority has enacted, issued, promulgated, enforcedproxies in the event that there are insufficient votes for the approval of one or entered any law (that has not been rescinded) or governmental order which could makemore proposals at the transactions illegal or which otherwise prevents or prohibits consummationannual general meeting. 90

Each of the Business Combination; (5)Combination Proposal, the Charter Proposal and the Nasdaq Proposal, is conditioned on the approval and adoption of each of the other Condition Precedent Proposals. None of the Governing Documents Proposals, which will be voted upon on a non-binding advisory basis, or the Adjournment Proposal, the Equity Incentive Plan Proposal or the Director Election Proposal is conditioned upon the approval of any other proposal. Recommendation of the WWAC Board The WWAC Board believes that the Business Combination Proposal and the other proposals to be presented at the annual general meeting are in the best interest of WWAC and its shareholders and unanimously recommends that its shareholders vote “FOR” the Business Combination Proposal, “FOR” the Charter Proposal, “FOR” each of the separate Governing Documents Proposals, “FOR” the Nasdaq Proposal, “FOR” the Equity Incentive Plan Proposal, “FOR” the Director Election Proposal and “FOR” the Adjournment Proposal, in each case, if presented to the annual general meeting. The existence of financial and personal interests of one or more of WWAC’s directors may result in a conflict of interest on the part of such director(s) between what he, she or they may believe is in the best interests of WWAC and its shareholders and what he, she or they may believe is best for himself, herself or themselves in determining to recommend that shareholders vote for the proposals. In addition, WWAC’s officers have interests in the Business Combination that may conflict with your interests as a shareholder. See the section entitled “Proposal No. 1—Business Combination Proposal—Interests of WWAC’s Directors and Executive Officers in the Business Combination” for a further discussion of these considerations. Record Date; Who is Entitled to Vote WWAC shareholders holding shares in “street name” will be entitled to vote or direct votes to be cast at the annual general meeting if they owned ordinary shares at the close of business on , 2023, which is the “record date” for the annual general meeting. Shareholders will have one vote for each ordinary share owned at the close of business on the record date. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. Our warrants do not have voting rights. As of the close of business on the record date, there were 10,468,054 ordinary shares issued and outstanding, of which 4,718,054 were issued and outstanding public shares. Quorum A quorum of WWAC shareholders is necessary to hold a valid meeting. A quorum will be present at the annual general meeting if one or more shareholders who together hold not less than a majority of the issued and outstanding ordinary shares entitled to vote at the annual general meeting are represented in person or by proxy at the annual general meeting. As of the record date for the annual general meeting, 5,234,028 ordinary shares would be required to achieve a quorum. Abstentions and Broker Non-Votes Abstentions will be considered present for the purposes of establishing a quorum but, as a matter of Cayman Islands law, will not constitute a vote cast at the annual general meeting and therefore will have no action initiatedeffect on the approval of any of the proposals voted upon at the annual general meeting. Broker non-votes will not be counted in connection with the determination of whether a valid quorum is established and will have no effect on any of the proposals at the annual general meeting. Vote Required for Approval The approval of each of the Business Combination Proposal, the Nasdaq Proposal, the Equity Incentive Plan Proposal, the Director Election Proposal and the Adjournment Proposal requires an ordinary resolution under 91

Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. The approval of the Charter Proposal requires a governmental authority shallspecial resolution under Cayman Islands law, being the affirmative vote of at least two-thirds (2/3) of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. Each of the Business Combination Proposal, the Charter Proposal and the Nasdaq Proposal is conditioned on the approval and adoption of each of the other Condition Precedent Proposals. None of the Governing Documents Proposals, which will be pendingvoted upon on a non-binding advisory basis, or the Adjournment Proposal, the Equity Incentive Plan Proposal or the Director Election Proposal is conditioned upon the approval of any other proposal. Voting Your Shares Each ordinary share that could enjoinyou own in your name entitles you to one vote. Your annual general meeting proxy card shows the number of ordinary shares that you own. If your shares are held in “street name” or prohibitare in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. There are two ways to vote your ordinary shares at the annual general meeting: | • | | You can vote by signing and returning the enclosed annual general meeting proxy card. If you vote by proxy card, your “proxy,” whose name is listed on the annual general meeting proxy card, will vote your shares as you instruct on the annual general meeting proxy card. If you sign and return the annual general meeting proxy card but do not give instructions on how to vote your shares, your shares will be voted as recommended by the WWAC Board “FOR” the Business Combination Proposal, “FOR” the Charter Proposal, “FOR” each of the separate Governing Documents Proposals, “FOR” the Nasdaq Proposal, “FOR” the Equity Incentive Plan Proposal, “FOR” the Director Election Proposal and “FOR” the Adjournment Proposal, in each case, if presented to the annual general meeting. Votes received after a matter has been voted upon at the annual general meeting will not be counted. |

| • | | You can attend the annual general meeting and vote virtually. You will receive a ballot when you virtually join the meeting. However, if your shares are held in the name of your broker, bank or another nominee, you must get a valid legal proxy from the broker, bank or other nominee. That is the only way WWAC can be sure that the broker, bank or nominee has not already voted your shares. |

Revoking Your Proxy If you are a WWAC shareholder and you give a proxy, you may revoke it at any time before it is exercised by doing any one of the following: you may send another annual general meeting proxy card with a later date; you may notify WWAC in writing before the annual general meeting that you have revoked your proxy; or you may attend the annual general meeting, revoke your proxy, and vote virtually, as indicated above. Who Can Answer Your Questions About Voting Your Shares If you are a shareholder and have any questions about how to vote or direct a vote in respect of your ordinary shares, you may call Morrow Sodali LLC, our proxy solicitor, by calling (800) 662-5200 (toll free), or banks and brokers can call collect at (203) 658-9400, or by emailing WWAC.info@investor.morrowsodali.com. 92

Redemption Rights In connection with the proposed Business Combination, pursuant to the Existing Memorandum and Articles of Association, a public shareholder may request that WWAC redeem all or a portion of its public shares for cash if the Business Combination is consummated. As a holder of public shares, you will be entitled to receive cash for any public shares to be redeemed only if you: | (i) | (a) hold public shares, or (b) if you hold public shares through units, you elect to separate your units into the underlying public shares and warrants prior to exercising your redemption rights with respect to the public shares; |

| (ii) | submit a written request to Continental in which you (i) request that WWAC redeem all or a portion of your public shares for cash, and (ii) identify yourself as the beneficial holder of the public shares and provide your legal name, phone number and address; and |

| (iii) | deliver your public shares to Continental physically or electronically through DTC. |

Holders must complete the procedures for electing to redeem their public shares in the manner described above prior to 5:00 p.m., Eastern Time, on , 2023 (two (2) business days before the annual general meeting) in order for their shares to be redeemed. Public shareholders may elect to redeem all or a portion of the public shares held by them regardless of if or how they vote in respect of the Business Combination Proposal. If the Business Combination is not consummated, the public shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated, and if a public shareholder properly exercises its right to redeem all or a portion of the public shares that it holds and timely delivers its shares to Continental, WWAC will redeem such public shares for a per-share price, payable in cash, equal to the pro rata portion of the trust account, calculated as of two (2) business days prior to the consummation of the Business Combination;Combination. For illustrative purposes, as of , 2023, this would have amounted to approximately $ per issued and (6)outstanding public share. If a public shareholder exercises its redemption rights in full, then it will be electing to exchange its public shares for cash and will no longer own public shares. If you hold the receiptshares in “street name,” you will have to coordinate with your broker to have your shares certificated or delivered electronically. Class A ordinary shares that have not been tendered (either physically or electronically) in accordance with these procedures will not be redeemed for cash. There is a nominal cost associated with this tendering process and the act of certificating the shares or delivering them through DTC’s DWAC system. The transfer agent will typically charge the tendering broker $80 and it would be up to the broker whether or not to pass this cost on to the redeeming shareholder. In the event the proposed Business Combination is not consummated this may result in an additional cost to shareholders for the return of their shares. Any request for redemption, once made by AARK and Aeriesa holder of a tax opinion and accompanying reliance letter from a global accounting firm relatedpublic shares, may be withdrawn at any time up to the time the vote is taken with respect to the Business Combination.Combination Proposal at the annual general meeting. If you deliver your shares for redemption to Continental and later decide prior to the annual general meeting not to elect redemption, you may request that Continental return the shares (physically or electronically) to you. You may make such request by contacting Continental at the phone number or address listed at the end of the section entitled “Questions and Answers for Shareholder of WWAC.” The obligationsAny corrected or changed written exercise of AARKredemption rights must be received by Continental prior to consummatethe vote taken on the Business Combination is also subjectProposal at the annual general meeting. No request for redemption will be honored unless the holder’s public shares have been delivered (either physically or electronically) to Continental at least two (2) business days prior to the fulfillment (or waiver)vote at the annual general meeting.

Notwithstanding the foregoing, a public shareholder, together with any affiliate of such public shareholder or any other closing conditions, including, but not limited to, (1) the representations and warranties of WWAC and Amalgamation Sub being true and correct to the standards applicable toperson with whom such representations and warranties, (2) eachpublic shareholder is acting in concert or as a “group” (as defined in 93

Section 13(d)(3) of the covenantsExchange Act), will be restricted from redeeming its public shares with respect to more than an aggregate of WWAC and Amalgamation Sub under15% of the public shares. Accordingly, if a public shareholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the public shares, then any such shares in excess of that 15% limit would not be redeemed for cash. Pursuant to the Business Combination Agreement, holders of Class A ordinary shares who elect not to redeem those shares in connection with the vote to approve the Business Combination Agreement will be issued an aggregate of up to 3,750,000 Bonus Shares, provided, however, that if aggregate redemptions (including the 18,281,946 Class A ordinary shares redeemed in connection with the vote to approve the First Extension Amendment) exceed 89.15%, then the number of Bonus Shares will be (A) 3,750,000 less the Extension Shares, the PIPE Incentive Shares and the other transaction documentsEmployee Merger Consideration Shares multiplied by (B) the quotient, obtained by dividing (i) the number equal to the difference between (a) 100 and each of(b) the covenants of redemption percentage multiplied by 100 by (ii) 10.85. Sponsor underhas, pursuant to the Sponsor Support Agreement, shall have been performedagreed to, among other things, vote all of its Class B ordinary shares in all material respectsfavor of the proposals being presented at the annual general meeting and (3) delivery of certain ancillary agreements requiredwaive its redemption rights with respect to be executed and deliveredsuch ordinary shares in connection with the consummation of the Business Combination (which waiver was provided in connection with WWAC’s IPO and without any separate consideration paid in connection with providing such waiver). Such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. As of the date of this proxy statement/prospectus, Sponsor owns approximately 43.0% of the issued and outstanding ordinary shares. See “Proposal No. 1—Business Combination Proposal—Related Agreements—The Sponsor Support Agreement” in the accompanying proxy statement for more information related to the Sponsor Support Agreement. Ten Anchor Investors have entered into investment agreements with the Sponsor and WWAC, pursuant to which the Anchor Investors have agreed to, among other things, vote all of their Class B ordinary shares in favor of the Business Combination. Such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. As of the date of the accompanying proxy statement/prospectus, the Anchor Investors own approximately 12% of the issued and outstanding ordinary shares. Holders of the warrants will not have redemption rights with respect to the warrants. The closing price of public shares on , 2023 was $ . For illustrative purposes, as of , 2023, funds in the trust account plus accrued interest thereon totaled approximately $ or $ per issued and outstanding public share. Prior to exercising redemption rights, public shareholders should verify the market price of the public shares as they may receive higher proceeds from the sale of their public shares in the public market than from exercising their redemption rights if the market price per share is higher than the redemption price. WWAC cannot assure its shareholders that they will be able to sell their public shares in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities when its shareholders wish to sell their shares. Future Purchases by our Affiliates At any time at or prior to the Business Combination, during a period when they are not then aware of any material nonpublic information regarding us or our securities, Sponsor, Aeries and/or their directors, officers, advisors or respective affiliates may purchase public shares from institutional and other investors who vote, or indicate an intention to vote, against any of the Condition Precedent Proposals, or execute agreements to purchase such shares from such investors in the future, or they may enter into transactions with such investors and others to provide them with incentives to acquire public shares or vote their public shares in favor of the Condition Precedent Proposals. Such a purchase may include a contractual acknowledgement that such 94

In addition,shareholder, although still the obligationsrecord or beneficial holder of WWACour shares, is no longer the beneficial owner thereof and Amalgamation Subtherefore agrees not to consummateexercise its redemption rights. If Sponsor, Aeries and/or their directors, officers, advisors or respective affiliates engage in such transactions prior to the completion of the Business Combination, are also subjectthe purchase will be at a price no higher than the price offered through the redemption process. Any such securities purchased by Sponsor, Aeries and/or their directors, officers, advisors or respective affiliates, or any other third party that would vote at the direction of Sponsor, Aeries and/or their directors, officers, advisors or respective affiliates will not be voted in favor of approving the Business Combination. Sponsor, pursuant to the fulfillment (or waiver) ofSponsor Support Agreement, agreed to, among other closing conditions, including, but not limited to, (1) the representations and warranties of AARK, Aeries and their subsidiaries (the “Aeries Group Companies”) being true and correct to the standards applicablethings, waive its redemption rights with respect to such representations and warranties, (2) each of the covenants of the Aeries Group Companies under the Business Combination Agreement and the other transaction documents and each of the covenants of the Exchanging Aeries Holders under the AARK and Aeries Equity Holder Support Agreement shall have been performed in all material respects, (3) delivery of certain ancillary agreements required to be executed and deliveredordinary shares in connection with the Business Combination, (4) delivery of evidence of consummation of the Pre-Closing Restructuring (as defined in the Business Combination Agreement), and (5) evidenceCombination. In the event that WWAC has at least $5,000,001 net tangible assets (after deducting any amounts paidSponsor, Aeries and/or their directors, officers, advisors or respective affiliates purchase shares in privately negotiated transactions from public shareholders who have already elected to the WWAC shareholders that exercise their redemption rights, in connection withsuch selling shareholders would be required to revoke their prior elections to redeem their shares. The purpose of such share purchases and other transactions would be to increase the Business Combination).

Representations and Warranties; Covenants

The Business Combination Agreement contains representations, warranties and covenantslikelihood of eachsatisfaction of the Parties theretorequirements that are customary for transactions of this type, including, among others, covenants providing for (1) certain limitations on the operation of the Parties’ respective businesses prior to consummation of(i) the Business Combination (2)Proposal, the Parties’ efforts to satisfy conditions to consummation ofNasdaq Proposal, the Business Combination, including by obtaining necessary approvals from governmental agencies, (3) prohibitions on the Parties soliciting alternative transactions, (4) WWAC preparing and filing a proxy statement with the SEC and taking certain other actions to obtain the requisite approval of WWAC’s shareholders to vote in favor of certain matters, including the adoption of the Business Combination Agreement and approval of the Business Combination, at a special meeting to be called for the approval of such matters, (5) WWAC preparing and filing a proxy statement with the SEC related to the extension of the time by which WWAC must complete a business combination (the “Extension”) (which proxy statement has already been prepared and filed) and (6) the protection of, and access to, confidential information of the Parties.

In addition, WWAC has agreed to adopt an Equity Incentive Plan as described inProposal, the Business Combination Agreement.

Governance

The Parties have agreed to take actions such that, effective immediately afterDirector Election Proposal and the ClosingAdjournment Proposal are approved by the affirmative vote of at least a majority of the Business Combination: (1)votes cast by the WWAC Board will consist of seven directors and will be divided into three classes, designated Class I, II and III, with Class I consisting of three directors, Class II consisting of two directors and Class III consisting of two directors; and (2) the membersholders of the board will include Daniel Webb, current Chief Executive Officerissued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter (ii) the Charter Proposal is approved by the affirmative vote of WWAC, Venu Raman Kumar, Sudhir Appukuttan Panikassery and four other individuals designated by AARK, whom will meet the standards of independence for companies subject to the rules and regulations of Nasdaq Stock Market. Additionally, currently serving officers of Aeries will become the officersat least two-thirds (2/3) of the Company.

Termination

The Business Combination Agreement may be terminated under certain customary and limited circumstances prior tovotes cast by the Closingholders of the Business Combination, including, but not limited to: (1)issued ordinary shares present in person or represented by written consentproxy at the annual general meeting and entitled to vote on such matter, (iii) otherwise limit the number of AARKpublic shares electing to redeem and WWAC; (2) by either AARK or WWAC(iv) ATI’s net tangible assets (as determined in accordance with written noticeRule 3a51-1(g)(1) of the Exchange Act) being at least $5,000,001 after giving effect to the other Party, if any governmental authority shall have enacted any permanent law or final, non-appealable governmental order which has the effect of making the transactions contemplated by the Business Combination Agreement, illegal or which otherwise prevents consummationthe PIPE Financing and all of the WWAC shareholder redemptions.

Entering into any such arrangements may have a depressive effect on the ordinary shares. For example, as a result of these arrangements, an investor or holder may have the ability to effectively purchase shares at a price lower than market and may therefore be more likely to sell the shares he or she owns, either at or prior to the Business Combination. If such transactions contemplated byare effected, the consequence could be to cause the Business Combination Agreement; (3)to be consummated in circumstances where such consummation could not otherwise occur. Purchases of shares by either AARK the persons described above would allow them to exert more influence over the approval of the proposals to be presented at the annual general meeting and would likely increase the chances that such proposals would be approved. To the extent that Sponsor, Aeries and/or WWAC with written noticetheir directors, officers, advisors or respective affiliates enter into any such private purchase, prior to the other Party,annual general meeting, we will file a current report on Form 8-K to disclose (1) the amount of securities purchased in any such purchases, along with the purchase price; (2) the purpose of any such purchases; (3) the impact, if shareholder approval to extendany, of any such purchases on the time for WWAC to consummatelikelihood that the Business Combination waswill be approved; (4) the identities or the nature of the security holders (e.g., 5% security holders) who sold their securities in any such purchases (if not obtained; (4)purchased in the open market); and (5) the number of securities for which we have received redemption requests pursuant to our public shareholders’ redemption rights in connection with the Business Combination. We will file or submit a Current Report on Form 8-K to disclose any material arrangements entered into or significant purchases made by WWAC with written noticeany of the aforementioned persons that would affect the vote on the proposals to AARK, if there is any breachbe put to the annual general meeting or the redemption threshold. Any such report will include descriptions of any representation, warranty, covenantarrangements entered into or agreement onsignificant purchases by any of the part of AARK or any other Aeries Group Company such thataforementioned persons. Appraisal Rights Our shareholders have no appraisal rights in connection with the conditions to WWAC’s obligation to close would not be satisfied atBusiness Combination under the Cayman Islands Companies Act. 95

Proxy Solicitation Costs WWAC is soliciting proxies on behalf of its board of directors. This solicitation is being made by mail but also may be made by telephone or in person. WWAC and its directors, officers and employees may also solicit proxies in person, by telephone or by other electronic means. WWAC will bear the Effective Time, subjectcost of the solicitation. WWAC has hired Morrow Sodali LLC to assist in the proxy solicitation process. WWAC will pay that firm a cure period; (5) by AARKfee of $20,000 plus disbursements. Such fee will be paid with written noticenon-trust account funds. WWAC will ask banks, brokers and other institutions, nominees and fiduciaries to forward the proxy materials to their principals and to obtain their authority to execute proxies and voting instructions. WWAC if there is any breach of any representation, warranty, covenant or agreement on the part of WWAC or Amalgamation Sub set forth inwill reimburse them for their reasonable expenses. 96

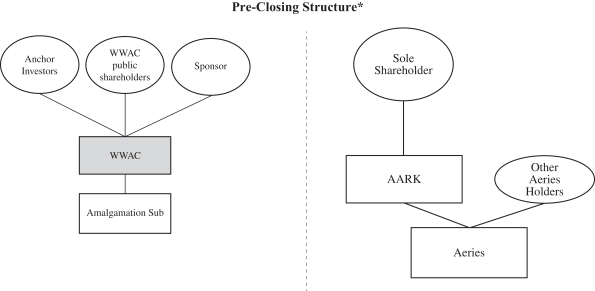

PROPOSAL NO. 1—BUSINESS COMBINATION PROPOSAL Overview We are asking our shareholders to adopt and approve the Business Combination Agreement, such thatcertain related agreements and the conditions to AARK’s obligation to close would not be satisfied attransactions contemplated thereby (including the Effective Time, subject to a cure period; (6) byAmalgamation). WWAC with written notice to AARK, if (i) Aeries did not timely deliver the written consent of the Aeries shareholders approving and adoptingshould read carefully this proxy statement/prospectus in its entirety for more detailed information concerning the Business Combination Agreement, which is attached as Annex A, Annex A-1and approvingAnnex A-2 to this proxy statement/prospectus, and the transactions contemplated thereby. Please see “—Business Combination Agreement” below for additional information and a summary of certain terms of the Business Combination and (ii)Agreement. You are urged to read carefully the Sole Shareholder does not timely deliver the approval by the Sole ShareholderBusiness Combination Agreement in its entirety before voting on this proposal. The descriptions of the Business Combination Agreement and the related agreements and the transactions contemplated thereby are qualified in their entirety by reference to the full text of the Business Combination (bothAgreement and the related agreements that are filed with this proxy statement/prospectus. Because we are holding a shareholder vote on the Business Combination, we may consummate the Business Combination only if it is approved by the affirmative vote of which approvals have been delivered); (7)at least a majority of the votes cast by either WWACthe holders of the issued of ordinary shares present in person or AARK with written noticerepresented by proxy at the annual general meeting and entitled to vote on such matter. Business Combination Agreement This subsection of the proxy statement/prospectus describes the material provisions of the Business Combination Agreement but does not purport to describe all of the terms of the Business Combination Agreement. The following summary is qualified in its entirety by reference to the complete text of the Business Combination Agreement, which is attached as Annex A, Annex A-1 and Annex A-2 to this proxy statement/prospectus. You are urged to read the Business Combination Agreement in its entirety because it is the primary legal document that governs the Business Combination. On March 11, 2023, WWAC entered into the Business Combination Agreement with Amalgamation Sub and AARK. Aeries is a subsidiary of AARK, and AARK is wholly owned by the Sole Shareholder. The Business Combination Agreement provides that, among other Party, ifthings, at the Effective Time has not occurred on or priorClosing, in accordance with Section 215A of the Singapore Companies Act, Amalgamation Sub and AARK will amalgamate and continue as one company (the “Amalgamation”), with AARK being the surviving entity and partially owned and controlled by ATI (by virtue of ATI’s right to appoint two of ATI’s independent directors to the laterthree-member AARK board) and partially owned by the Sole Shareholder. The Sole Shareholder, if presiding over a meeting of (i) September 30, 2023, or (ii) the date toboard of Directors of the Combined Company, will abstain from voting on the appointment of either of the two directors of AARK who will be selected only from the four independent directors of ATI. As the AARK board works by majority vote, even in the case that the Sole Shareholder, the remaining member of the three-member AARK board, votes against the other two members, ATI will still control AARK via its two independent directors sitting on the AARK board, and there are no circumstances in which WWAC’s period to consummatethe Sole Shareholder can override the vote of the AARK Board and substitute his decision for the AARK board’s decision. Since Aeries is a subsidiary of AARK, upon the Closing of the Business Combination is extended; or (8)it will be an indirect subsidiary of the Company. In connection with the Business Combination, the Company will change its name to “Aeries Technology, Inc.” The Business Combination Agreement and the transactions contemplated thereby were approved by the boards of directors of each of WWAC, Amalgamation Sub and AARK, with written noticeand by the sole shareholders of each of Amalgamation Sub and AARK. In this section, WWAC, Amalgamation Sub and AARK are sometimes collectively referred to WWAC, if Aggregate Cash is less than $30,000,000.as the “Parties” and individually as a “Party”. 97

Related Agreements This section describes certain additional agreements entered into or to be entered into pursuant toin connection with the Business Combination Agreement, but does not purport to describe all of the terms thereof. The following summary is qualified in its entirety by reference to the complete text of each of the agreements. The AARK and Aeries Equity Holder Support Agreement, ExchangeAgreement. For additional information, see “Proposal No. 1—Business Combination Proposal—Related Agreements Sponsor Support Agreement and form of Subscription Agreement are attached hereto as Annex B, Annex C, Annex D and Annex I, respectively. You are urged to read such agreements in their entirety prior to voting on the proposals presented at the annual general meeting..” Subscription Agreements Following the execution of the Business Combination Agreement, WWAC entered into subscription agreements (the “Subscription Agreements”) with the PIPE Investors, pursuant to which the PIPE Investors have agreed to subscribe for and purchase, and WWAC has agreed to issue and sell to the PIPE Investors, on the Closing Date, an aggregate of 1,033,058 ATI Class A ordinary shares at a price of $4.84 per share, for aggregate gross proceeds of $5 million.million (the “PIPE Financing”). The ATI Class A ordinary shares to be issued pursuant to the Subscription Agreements have not been registered under the Securities Act, in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act. WWAC will grant the PIPE Investors certain registration rights in connection with the PIPE Financing. The PIPE Financing is contingent upon, among other things, the substantially concurrent closing of the Business Combination. For additional information, see “Proposal No. 1—Business Combination Proposal—Related Agreements—PIPE Financing.” The Sponsor Support Agreement Concurrently with the execution of the Business Combination Agreement, WWAC, Sponsor and AARK entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”), pursuant to which Sponsor has 43

agreed to, among other things, vote at any meeting of the shareholders of WWAC all of its Class A ordinary shares held of record or thereafter acquired in favor of the proposals relating to the Business Combination. Sponsor also agreed that up to 1,500,000 WWAC Class B ordinary shares held by Sponsor will be surrendered to WWAC for no consideration and cancelled by WWAC effective as of the Effective Time (such cancelled shares, the “Cancelled Shares”); provided that if Sponsor transfers up to 1,000,000 Class B ordinary shares to third parties in connection with seeking approval of an extension proposal (the “Extension Shares”), then such Extension Shares so transferred will reduce (one for one) the number of Cancelled Shares. Pursuant to non-redemption agreements, Sponsor agreed to forfeit 987,000 Class B ordinary shares and WWAC agreed to issue an aggregate of 987,000 Class A ordinary shares to the non-redeeming holders party thereto prior to the closing of the Business Combination. Therefore, the number of Extension Shares is 987,000 and the number of and the number of Canceled Shares pursuant to the Sponsor Support Agreement will be 513,000. Furthermore, if (a) WWAC Available Cash at Closing is less than $50 million, Sponsor will forfeit an additional 1,500,000 Class B ordinary shares or (b) WWAC Available Cash at Closing is $50 million or more, subject 1,500,000 ATI Class A ordinary shares to an earn-out based on the trading price of the ATI Class A ordinary shares over the five-year period post-Closing. For additional information, see “Proposal No. 1—Business Combination Proposal—Related Agreements—The Sponsor Support Agreement.” On October 9, 2023, WWAC and AARK entered into Amendment No. 1 to the Sponsor Support Agreement to modify the definition of Extension Transfer Shares (as defined in the Sponsor Support Agreement) from up to 1,000,000 Class B ordinary shares to 1,314,250 Class B ordinary shares. AARK and Aeries Equity Holder Support Agreement Concurrently with the execution of the Business Combination Agreement, WWAC, AARK, the Exchanging Aeries Holders and the Sole Shareholder entered into the AARK and Aeries Equity Holder Support Agreement (the “AARK and Aeries Equity Holder Support Agreement”), pursuant to which each such holder agrees to vote, at any meeting of the Aeries Shareholders, and in any action by written consent of the Aeries Shareholders, all Aeries Shares held by such shareholder (1) in favor of the approval and adoption of the Business Combination Agreement and the other transaction documents to which AARK is a party and (2) against any action, agreement, transaction or proposal that would result in a material breach of any covenant, representation or warranty or any other obligation or agreement of AARK under the Business Combination Agreement. For additional information, see “Proposal No. 1—Business Combination Proposal—Related Agreements— AARK and Aeries Equity Holder Support Agreement.” Exchange Agreements Concurrently with the Closing of the Business Combination the holders of Aeries shares other than AARK and the Sole Shareholder will each enter into an Exchange Agreement with WWAC, Aeries and AARK (with such exchange agreements collectively, the “Exchange Agreements”). Pursuant to the Exchange Agreements, from and after April 1, 2024, and subject to the satisfaction of the exercise conditions specified therein: | • | | ATI will have the right to purchase from any shareholder the Aeries Shares or AARK ordinary shares held by such shareholder (the “Exchanged Shares”) in exchange for the delivery of a number of Class A ordinary shares (the “Stock Exchange Payment”) equal to the product of the number of Exchanged Shares multiplied by the applicable number of Class A ordinary shares for which an Exchanged Share is entitled to be exchanged at such time (the “Exchange Rate”) or, at the election of ATI, an amount of cash equal to the number of Class A ordinary shares included in a Stock Exchange Payment multiplied by the 5-day volume weighted average price of the Class A ordinary shares (the “Cash Exchange Payment”). The Exchange Rate will be 14.40 in the case of Aeries Shares and 2,246 in the case of AARK ordinary shares, in each case, subject to adjustment (the “ATI Call Exchange”); and |

| • | | each shareholder will be entitled to deliver Exchanged Shares in exchange for the delivery of the Stock Exchange Payment or, at the election of the shareholder, the Cash Exchange Payment (the “ATI Put Exchange”); |

44

in each case, the Cash Exchange Payment may only be elected by ATI in connection with an ATI Call Exchange or by the shareholder in connection with an ATI Put Exchange, as applicable, in the event approval from the Reserve Bank of India is not obtained for a Stock Exchange Payment and provided ATI has reasonable cash flow to pay the Cash Exchange Payment and such Cash Exchange Payment would not be prohibited by any then outstanding debt agreements or arrangements of ATI or any of its subsidiaries. For additional information, see “Proposal No. 1—Business Combination Proposal—Related Agreements—Exchange Agreements.” Date, Time and Place of the Annual General Meeting of WWAC’s Shareholders The annual general meeting of WWAC will be held at a.m., Mountain Time, on , 2023, at the offices of Kirkland & Ellis LLP located at 95 South State Street, Salt Lake City, Utah 84111, and virtually via a live webcast at , or at such other time, on such other date and at such other place to which the meeting may be adjourned, to consider and vote upon the proposals to be put to the annual general meeting, including if necessary, the Adjournment Proposal, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the annual general meeting, each of the Condition Precedent Proposals have not been approved. Voting Power; Record Date for the Annual General Meeting WWAC shareholders will be entitled to vote or direct votes to be cast at the annual general meeting if they owned ordinary shares at the close of business on , 2023, which is the “record date” for the annual general meeting. Shareholders will have one vote for each ordinary share owned at the close of business on the record date. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. Our warrants do not have voting rights. As of the close of business on the record date, there were 10,468,054 ordinary shares issued and outstanding, of which 4,718,054 were issued and outstanding public shares. Quorum and Required Vote for Proposals for the Annual General Meeting A quorum of WWAC shareholders is necessary to hold a valid meeting. A quorum will be present at the annual general meeting if one or more shareholders who together hold not less than a majority of the issued and outstanding ordinary shares entitled to vote at the annual general meeting are represented in person or by proxy at the annual general meeting. As of the record date for the annual general meeting, 5,234,028 ordinary shares would be required to achieve a quorum. Sponsor has, pursuant to the Sponsor Support Agreement, agreed to, among other things, vote all of its Class B ordinary shares in favor of the proposals being presented at the annual general meeting. As of the date of this proxy statement/prospectus, Sponsor owns approximately 43.0% of the issued and outstanding ordinary shares. See “Proposal No. 1—Business Combination Proposal—Related Agreements—The Sponsor Support Agreement” in the accompanying proxy statement for more information related to the Sponsor Support Agreement. Ten Anchor Investors have entered into investment agreements with the Sponsor and WWAC (the “Investment Agreements”), pursuant to which the Anchor Investors have agreed to, among other things, vote all of their Class B ordinary shares in favor of the Business Combination. Such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. As of the date of the accompanying proxy statement/prospectus, the Anchor Investors own approximately 12% of the issued and outstanding ordinary shares. 45

The proposals presented at the annual general meeting require the following votes: | (i) | Business Combination Proposal: The approval of the Business Combination Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. |

| (ii) | Charter Proposal: The approval of the Charter Proposal requires a special resolution under Cayman Islands law, being the affirmative vote of at least two-thirds (2/3) of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. |

| (iii) | Governing Documents Proposals: Approval of each of the Governing Documents Proposals requires an ordinary resolution under Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. Each of the Governing Documents Proposals will be voted upon on a non-binding advisory basis only. |

| (iv) | The Nasdaq Proposal: The approval of the Nasdaq Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. |

| (vi) | Equity Incentive Plan Proposal: The approval of the Equity Incentive Plan Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of a majority of the ordinary shares represented in person or by proxy and entitled to vote thereon and who vote at the annual general meeting. |

| (vii) | Director Election Proposal: The approval of the Director Election Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of a majority of the ordinary shares represented in person or by proxy and entitled to vote thereon and who vote at the annual general meeting. |

| (viii) | Adjournment Proposal: The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being the affirmative vote of at least a majority of the votes cast by the holders of the issued ordinary shares present in person or represented by proxy at the annual general meeting and entitled to vote on such matter. |

Redemption Rights Pursuant to the Existing Memorandum and Articles of Association, a public shareholder may request that WWAC redeem all or a portion of its public shares for cash if the Business Combination is consummated. As a holder of public shares, you will be entitled to receive cash for any public shares to be redeemed only if you: | (i) | (a) hold public shares, or (b) if you hold public shares through units, you elect to separate your units into the underlying public shares and warrants prior to exercising your redemption rights with respect to the public shares; |

| (ii) | submit a written request to Continental in which you (i) request that WWAC redeem all or a portion of your public shares for cash, and (ii) identify yourself as the beneficial holder of the public shares and provide your legal name, phone number and address; and |

| (iii) | deliver your public shares to Continental physically or electronically through DTC. |

46

Holders must complete the procedures for electing to redeem their public shares in the manner described above prior to 5:00 p.m., Eastern Time, on , 2023 (two (2) business days before the annual general meeting) in order for their shares to be redeemed. Public shareholders may elect to redeem all or a portion of the public shares held by them regardless of if or how they vote in respect of the Business Combination Proposal. If the Business Combination is not consummated, the public shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated, and if a public shareholder properly exercises its right to redeem all or a portion of the public shares that it holds and timely delivers its shares to Continental, WWAC will redeem such public shares for a per-share price, payable in cash, equal to the pro rata portion of the trust account, calculated as of two (2) business days prior to the consummation of the Business Combination. For illustrative purposes, as of , 2023, this would have amounted to approximately $ per issued and outstanding public share. If a public shareholder exercises its redemption rights in full, then it will be electing to exchange its public shares for cash and will no longer own public shares. See “Annual General Meeting of WWAC—Redemption Rights” in this proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to redeem your public shares for cash. Notwithstanding the foregoing, a public shareholder, together with any affiliate of such public shareholder or any other person with whom such public shareholder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Exchange Act), will be restricted from redeeming its public shares with respect to more than an aggregate of 15% of the public shares. Accordingly, if a public shareholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the public shares, then any such shares in excess of that 15% limit would not be redeemed for cash. Pursuant to the Business Combination Agreement, holders of Class A ordinary shares who elect not to redeem those shares in connection with the vote to approve the Business Combination Agreement will be issued a number of Bonus Shares as described herein. See “Selected Definitions—Bonus Shares.” Sponsor has, pursuant to the Sponsor Support Agreement, agreed to, among other things, vote all of its Class B ordinary shares in favor of the proposals being presented at the annual general meeting and waive its anti-dilution rights with respect to its Class B ordinary shares in connection with the consummation of the Business Combination. Such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. As of the date of this proxy statement/prospectus, Sponsor owns approximately 43.0% of the issued and outstanding ordinary shares. See “Proposal No. 1—Business Combination Proposal—Related Agreements—The Sponsor Support Agreement” in the accompanying proxy statement for more information related to the Sponsor Support Agreement. Ten Anchor Investors have entered into investment agreements with the Sponsor and WWAC, pursuant to which the Anchor Investors have agreed to, among other things, vote all of their Class B ordinary shares in favor of the Business Combination. Such shares will be excluded from the pro rata calculation used to determine the per-share redemption price. As of the date of the accompanying proxy statement/prospectus, the Anchor Investors own approximately 12% of the issued and outstanding ordinary shares. Holders of the warrants will not have redemption rights with respect to the warrants. Appraisal Rights WWAC shareholders have no appraisal rights in connection with the Business Combination under the Cayman Islands Companies Act. 47

Proxy Solicitation Proxies may be solicited by mail, telephone or in person. WWAC has engaged Morrow Sodali LLC to assist in the solicitation of proxies. If a shareholder grants a proxy, it may still vote its shares virtually if it revokes its proxy before the annual general meeting. A shareholder also may change its vote by submitting a later-dated proxy as described in the section entitled “Annual General Meeting of WWAC—Revoking Your Proxy.” Interests of WWAC’s Directors and Executive Officers in the Business Combination The Sponsor and WWAC’s directors and executive officers have collectively invested an aggregate of $9,370,500 in WWAC and could potentially lose this entire amount if an initial business combination is not consummated by October 22, 2023, and they may therefore be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to shareholders rather than liquidate. When you consider the recommendation of the WWAC Board in favor of approval of the Business Combination Proposal, you should keep in mind that Sponsor and WWAC’s directors and executive officers have interests in such proposal that are different from, or in addition to, those of WWAC shareholders generally. These interests include, among other things, the interests listed below: the fact that Sponsor has agreed not to redeem any Class B ordinary shares held by it in connection with a shareholder vote to approve a proposed initial business combination; the fact that Sponsor paid an aggregate of $18,750 for the 4,500,000 Class B ordinary shares currently owned by Sponsor and such securities will have a significantly higher value at the time of the Business Combination, and the Sponsor may therefore experience a positive rate of return on its investment, even if the other WWAC shareholders experience a negative rate of return on their investment. Such shares had an estimated aggregate market value of $ based upon the closing price of $ per share on Nasdaq on the record date; the fact that Sponsor paid an aggregate purchase price of $8,900,000 (or $1.00 per warrant) for its 8,900,000 private placement warrants to purchase Class A ordinary shares and such private placement warrants will expire worthless if an initial business combination is not consummated by October 22, 2023. A portion of the proceeds from such private placement were placed in the trust account. Such warrants had an estimated aggregate value of $194,910 based on the closing price of $0.0219 per public warrant on Nasdaq on June 30, 2023; | • | | the fact that Sponsor and WWAC’s directors and executive officers have agreed to waive their rights to liquidating distributions from the trust account with respect to any ordinary shares held by them if WWAC fails to complete an initial business combination by October 22, 2023. In such event, the Class B ordinary shares held by Sponsor, which were acquired for an aggregate purchase price of $18,750 prior to WWAC’s initial public offering, would be worthless because the holders thereof are not entitled to participate in any redemption or distribution with respect to such shares. For more information, see “Information about WWAC—Effecting WWAC’s Business Combination—Redemption of Public Shares and Liquidation if No Business Combination”; |

| • | | the continued indemnification of WWAC’s directors and executive officers and the continuation of WWAC’s directors’ and officers’ liability insurance after the Business Combination (i.e., a “tail policy”); |

| • | | the fact that Sponsor and WWAC’s directors and executive officers will lose their entire investment in WWAC and will not be reimbursed for any loans extended, fees due or out-of-pocket expenses incurred in connection with activities on our behalf, such as identifying potential target businesses and performing due diligence on suitable business combinations unless an initial business combination is consummated by October 22, 2023, although no such amounts require reimbursement as of the date of this proxy statement/prospectus; |

48

the fact that if the trust account is liquidated, including in the event WWAC is unable to complete an initial business combination by October 22, 2023, Sponsor has agreed to indemnify WWAC to ensure that the proceeds in the trust account are not reduced below $10.10 per public share, or such lesser per public share amount as is in the trust account on the liquidation date, by the claims of prospective target businesses with which WWAC has entered into an acquisition agreement or claims of any third party for services rendered or products sold to WWAC, but only if such a vendor or target business has not executed a waiver of any and all rights to seek access to the trust account. As of , 2023, funds in the trust account totaled approximately $ and were held in U.S. treasury securities; and | • | | pursuant to the Registration Rights Agreement, dated October 21, 2021, between WWAC and Sponsor and certain of WWAC’s directors and executive officers will have customary registration rights, including demand and piggy-back rights, subject to cooperation and cut-back provisions with respect to the ATI Class A ordinary shares and ATI warrants held by such parties. |