As filed with the U.S. Securities and Exchange Commission on August 6, 2021

March 8, 2024

File No. 333- 258176

333-_________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

FIRSTSUN CAPITAL BANCORP

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 6021 (Primary Standard Industrial Classification Code Number) | 81-4552413 (IRS Employer |

1400 16thStreet, Suite 250

Denver, Colorado 80202

(303) 831-6704

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Neal E. Arnold 1400 16th Street, Suite 250 Denver, Colorado 80202 |

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| J. Brennan Ryan | ||

| Chief Executive Officer and President | ||

| Nelson Mullins Riley & Scarborough LLP | FirstSun Capital Bancorp | |

| Atlantic Station | 1400 16th Street, Suite 250 |

(212) 558-4000 |

201 17th Street NW, Suite 1700 Atlanta, Georgia 30363 | Denver, Colorado 80202 (303) 831-6704 | |

| (404) 322-6000 | ||

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon completion of the merger described in the enclosed proxy statement/prospectus.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | ||

| Non-accelerated filer | Smaller reporting company Emerging Growth Company | o x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Information contained herein is subject to completion or amendment. A registration statement relating to the shares of FirstSun Capital Bancorp common stock to be issued in the mergermergers has beenfiled with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.This document shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in whichsuch offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION—DATED AUGUST 6, 2021MARCH 8, 2024

|  |

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

To the Shareholders of Pioneer Bancshares,HomeStreet, Inc.:

On May 11, 2021,behalf of the board of directors of HomeStreet, Inc., which we refer to as “HomeStreet,” we are pleased to enclose the accompanying proxy statement/prospectus relating to, among other matters, the proposed combination of FirstSun Capital Bancorp, which we refer to as “FirstSun,” and Pioneer Bancshares,HomeStreet. We are requesting that you take certain actions as a holder of HomeStreet common stock.

On January 16, 2024, FirstSun, HomeStreet, and Dynamis Subsidiary, Inc., which we refer to as “Pioneer,”a Washington corporation and wholly-owned subsidiary of FirstSun organized for the purposes of carrying out the merger, entered into an Agreement and Plan of Merger, as it may be amended, modified or supplemented from time to time in accordance with its terms, which we refer to as the “merger agreement,” that provides for the combination of FirstSun and Pioneer.HomeStreet. The transaction will create a premier bank in the Southwest and West Coast with approximately $17 billion in assets. Under the merger agreement, a wholly-owned subsidiary of FirstSunDynamis Subsidiary, Inc. will merge with and into Pioneer,HomeStreet, with PioneerHomeStreet remaining as the surviving entity and becoming a wholly-owned subsidiary of FirstSun, in a transaction we refer to as the “merger.” This surviving entity, as soon as reasonably practicableimmediately following the merger and as part of a single integrated transaction, will merge with and into FirstSun, with FirstSun continuing as the surviving corporation, in a transaction we refer to as the “second step merger,” and together with the merger, as the “mergers.” Immediately following the completion of the second step merger, or at such later time as the parties may mutually agree, Pioneer’sHomeStreet’s wholly-owned subsidiary, PioneerHomeStreet Bank, SSB, a Texas state savingsWashington state-chartered bank, will merge with and into FirstSun’s wholly-owned subsidiary, Sunflower Bank, National Association, a national banking association, with Sunflower Bank as the surviving bank, in a transaction we refer to as the “bank merger.”

If the merger ismergers are completed, each outstanding share of PioneerHomeStreet common stock will be converted into the right to receive 1.04430.4345 shares of FirstSun common stock, plus cash in lieu of fractional shares, except for (i) treasury stock orand (ii) shares owned by PioneerHomeStreet or FirstSun, in each case, other than those held in certain accounts or in a fiduciary or agency capacity, shares held by HomeStreet or as a resultFirstSun in respect of debts previously contracted, which will be cancelled, and shares held by shareholders who properly exercise dissenters’ rights. Although HomeStreet shareholders will receive a fixed number of shares of FirstSun common stock, the market value of the merger consideration will fluctuate with the market price of FirstSun common stock and will not be known at the time HomeStreet shareholders vote on the merger agreement.

FirstSun common stock is not tradedcurrently quoted on any exchange or interdealer market, nor is it contemplated that FirstSun common stock will be traded on any exchange or interdealer market at the consummationOTCQX® Best Market operated by the OTC Markets under the symbol “FSUN”, and as a closing condition to the mergers and undertakings in securities purchase agreements entered into in connection with the execution of the merger and, therefore, there are currently no publicly available market quotationsagreement, FirstSun will uplist its common stock to The Nasdaq Stock Market (“Nasdaq”) regardless of the value of FirstSun common stock.mergers being consummated. The last known salesclosing price for a share of FirstSun common stock on the OTCQX® Best Market on January 12, 2024, the last day that there were trades in FirstSun common stock before the public announcement of the mergers, was $24.50 in February 2020, when$33.75 per share. The closing price of FirstSun completed its repurchasecommon stock on the OTCQX® Best Market on [·], 2024, the last practicable trading day before the printing date of 63,844 shares.this proxy statement/prospectus, was $[·] per share. The shares of FirstSun common stock that will be issued to PioneerHomeStreet shareholders in the mergermergers will be freely transferable.

PioneerHomeStreet common stock is quotedtraded on the OTC Markets Groups, Inc.’s Pink Open MarketNasdaq under the symbol “PONB.“HMST.” The closing price of PioneerHomeStreet common stock on the Pink Open MarketNasdaq on May 7, 2021,January 12, 2024, the last day that there were trades in PioneerHomeStreet common stock before the public announcement of the merger,mergers, was $33.00$10.77 per share. Pink Open Market quotations reflect inter-dealer prices, without retail mark-up, mark-downThe closing price of HomeStreet common stock on the Nasdaq on [·], 2024, the last practicable trading day before the printing date of this proxy statement/prospectus, was $[·] per share. The implied value of the merger consideration payable for each share of HomeStreet common stock on January 12, 2024 and [·], 2024 is $14.66 and $[·], respectively. The value of the FirstSun common stock at the time of completion of the mergers could be greater than, less than or commission and may not necessarily represent actual transactions.the same as the value of FirstSun common stock on the date of the accompanying proxy statement/prospectus or the date of the HomeStreet shareholder meeting. We urge you to obtain current market quotations for PioneerHomeStreet and FirstSun common stock.

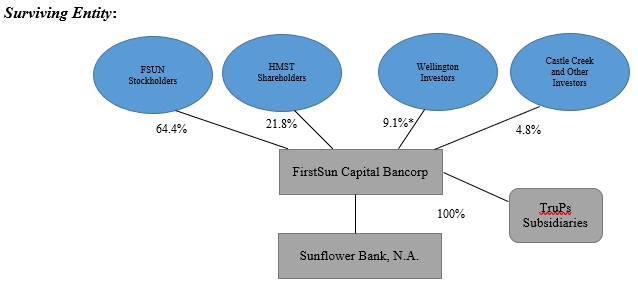

Immediately following the completion of the mergers, FirstSun stockholders will continue to own shares of FirstSun common stock held by the FirstSun stockholders immediately prior to the completion of the mergers.

Concurrently with the execution of the merger agreement, FirstSun entered into an Upfront Securities Purchase Agreement (the “Upfront Securities Purchase Agreement”), dated January 16, 2024, with certain funds managed by Wellington Management (“Wellington”), pursuant to which, on the terms and subject to the conditions set forth therein, FirstSun sold, and Wellington purchased, for $32.50 per share and an aggregate purchase price of $80 million, approximately 2.46 million shares of FirstSun common stock. This transaction closed on January 17, 2024. Under the terms of the Upfront Securities Purchase Agreement, FirstSun is obligated to issue to Wellington, upon consummation of the mergers, warrants to purchase approximately 1.15 million shares of FirstSun common stock with such warrants having an initial exercise price of $32.50 per share (the “warrants”). The warrants will carry a term of three years, and may be settled on a “net share” basis by applying shares otherwise issuable under the warrants in satisfaction of the exercise price. In the event the mergers are not consummated, no warrants will be issued. Additionally, and concurrently with execution of the merger agreement, FirstSun entered into an Acquisition Finance Securities Purchase Agreement (the “Acquisition Finance Securities Purchase Agreement,” and together with the Upfront Securities Purchase Agreement, the “Investment Agreements”), dated January 16, 2024, with Wellington, Castle Creek Capital Partners VIII, L.P. (“Castle Creek”), and certain other institutional accredited investors. Pursuant to the Acquisition Finance Securities Purchase Agreement, on the terms and subject to the conditions set forth therein, substantially concurrently with the closing of the mergers, the investors will invest an aggregate of $95 million in exchange for the sale and issuance, at a purchase price of $32.50 per share, of approximately 2.92 million shares of FirstSun common stock.

The mergers, taken together, will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, HomeStreet shareholders generally will not recognize any gain or loss for U.S. federal income tax purposes on the exchange of shares of HomeStreet common stock for FirstSun common stock in the mergers, except with respect to any cash received by HomeStreet shareholders in lieu of fractional shares of FirstSun common stock or from the exercise of dissenters’ rights.

Based on the number of shares of PioneerHomeStreet common stock outstanding as of August 5 March 4, 2024 and underlying outstanding HomeStreet equity awards as of March 4, 2024 that, at the effective time of the mergers, will be cancelled and entitle the holder to receive a number of shares of FirstSun common stock (for more information, see the section entitled “The Merger— Interests of HomeStreet’s Directors and Executive Officers in the Mergers”), 2021, the total number of shares of FirstSun common stock expected to be issued in connection with the mergermergers is approximately 6,522,7758,437,632 shares. In addition, based on (i) the number of outstanding shares of FirstSun common stock and PioneerHomeStreet common stock as of August 5 , 2021, and based onJanuary 12, 2024, (ii) the exchange ratio of 1.0443,0.4345, and (iii) upon completion of the FirstSun capital raise transaction and the consummation of the mergers, it is expected that FirstSun stockholders will hold approximately 73.75% and Pioneer shareholders will hold approximately 26.25%78% of the issued and outstanding shares of FirstSun common stock immediately following the closingand HomeStreet shareholders will hold approximately 22% of the merger.issued and outstanding shares of FirstSun common stock.

PioneerEffective January 15, 2024, the holders of a majority of the voting power of FirstSun common stock executed a written consent approving the issuance of common stock to be issued by FirstSun in connection with the mergers. The written consent was signed by the holders of 12,945,632 shares of FirstSun common stock. Accordingly, the holders of approximately 51.9% of the voting power of FirstSun common stock signed the written consent approving such share issuance.

HomeStreet will hold a special meeting of its shareholders in connection with the merger. Pioneerto ask shareholders will be asked to vote to adopt and approve the merger agreement and other related matters as described in this proxy statement/prospectus. PioneerIn addition to the proposal to approve the merger agreement, HomeStreet will ask shareholders will also be asked to approve a proposal to adjourn the specialHomeStreet shareholder meeting if necessary or appropriate, to solicit additional proxies in favor of the proposal to adopt and approve the merger agreement, aselect directors and vote on the other proposals described in the notice that follows this letter.

Your vote is important. HomeStreet and FirstSun cannot complete the mergers unless HomeStreet shareholders approve the merger agreement and the transactions contemplated thereby. The failure of any shareholder to vote will have the same effect as a vote against approving the merger agreement. Accordingly, whether or not you plan to virtually attend the HomeStreet shareholder meeting, you are requested to promptly vote your shares by proxy statement/prospectus. electronically via the Internet, by telephone or by sending in the appropriate paper proxy card as instructed in these materials.

Certain PioneerHomeStreet shareholders have entered into voting and support agreements with FirstSun pursuant to which they have agreed to vote “FOR” the approval of the merger agreement, subject to the terms of the voting and support agreements.

The special meeting of PioneerHomeStreet shareholders will be held virtually on September 16 [·], 20212024 at 11:30 a.m. local time,[·], Pacific Time at the Omni Austin Downtown in the Longhorn Room, 700 San Jacinto at 8th Street, Austin, Texas 78701 .website www.virtualshareholdermeeting.com/HMST2024SM.

The PioneerHomeStreet board of directors has unanimously determined that the merger agreement, the merger,mergers, and the transactions contemplated by the merger agreement are advisable and in the best interests of PioneerHomeStreet and its shareholders and unanimously authorized, adopted and approved the merger agreement, the mergermergers and the transactions contemplated by the merger agreement, and unanimously recommends that PioneerHomeStreet shareholders vote “FOR” the proposal to adopt and approve the merger agreement, “FOR” the proposal to approve, on an advisory (non-binding) basis, the merger-related compensation payments that will or may be paid to named executive officers of HomeStreet in connections with the transactions contemplated by the merger agreement and “FOR” the proposal to adjourn the Pioneer specialHomeStreet shareholder meeting, if necessary or appropriate, to solicit additional proxies in favor of the proposal to adopt and approve the merger agreement. The members of the HomeStreet board of directors have, as shareholders of HomeStreet, agreed to vote their shares of HomeStreet common stock to approve the merger proposal.

This document, which serves as a proxy statement for the specialHomeStreet shareholder meeting of Pioneer shareholders and as a prospectus for the shares of FirstSun common stock to be issued in the mergermergers to PioneerHomeStreet shareholders, describes the special meeting of PioneerHomeStreet shareholders, the merger,mergers, the documents related to the merger,mergers and other related matters.matters, and the other proposals to be considered by HomeStreet shareholders. Please carefully read this entire proxy statement/prospectus. In particular, you should carefully read the information under the section entitled “Risk Factors” beginning on page 27.24. You can also obtain information about FirstSun and HomeStreet from documents that have been filed with the U.S. Securities and Exchange Commission that are either incorporated by reference into or attached to the accompanying proxy statement/prospectus.

On behalf of HomeStreet, thank you for your prompt attention to this important matter.

Sincerely,

Mark K. Mason

Chairman, Chief Executive Officer and President

HomeStreet, Inc.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the mergermergers or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

The securities to be issued in the mergermergers are not savings or deposit accounts or other obligations of any bank or non-bank subsidiary of either FirstSun or Pioneer,HomeStreet, and they are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

The date of this proxy statement/prospectus is [ ], 2021,·], 2024, and it is first being mailed or otherwise delivered to PioneerHomeStreet shareholders on or about [ ], 2021.·], 2024.

NOTICE OF THE SPECIALHOMESTREET SHAREHOLDER MEETING OF SHAREHOLDERS TO BE HELD ONSEPTEMBER 16

To be held on [·], 20212024, [·] a.m. (Pacific Time)

Virtual Meeting Only – No Physical Meeting Location

To the Shareholders of Pioneer Bancshares,HomeStreet, Inc.:

We are pleased to invite you to virtually attend the speciala meeting of shareholders, which we refer to as the Pioneer specialHomeStreet shareholder meeting, of Pioneer Bancshares,HomeStreet, Inc. (which we refer to as “Pioneer”)“HomeStreet” and references to “we,” “us,” and “our” for purposes of this notice refer to HomeStreet), to be held via webcast at www.virtualshareholdermeeting/HMST2024SM on September 16 [·], 20212024 at 11:30 a.m. local[·] Pacific time, at the Omni Austin Downtown in the Longhorn Room, 700 San Jacinto at 8th Street, Austin, Texas 78701 , for the following purposes:

| 1. | To consider and vote on |

| 2. | To consider and vote on a proposal to approve, on an advisory (non-binding) basis, the merger-related compensation payments that will or may be paid to the named executive officers of HomeStreet in connection with the transactions contemplated by the merger agreement, which we refer to as the “merger-related compensation proposal”; |

| 3. | To consider and vote on a proposal to adjourn the |

| 4. | To consider and vote on a proposal to elect eight directors of HomeStreet to serve until the next annual meeting of shareholders of HomeStreet, or until their successors are elected or appointed or until earlier death, resignation or removal, which we refer to as the “director election proposal”; |

| 5. | To consider and vote on a proposal to approve, on an advisory (non-binding) basis, the executive compensation of HomeStreet’s named executive officers for 2023, which we refer to as the “compensation (non-merger) proposal”; |

| 6. | To consider and vote on a proposal to approve, on an advisory (non-binding) basis, the frequency of future advisory (non-binding) votes on executive compensation, which we refer to as the “frequency of compensation vote proposal”; and |

| 7. | To consider and vote on a proposal to ratify, on an advisory (non-binding) basis, HomeStreet’s independent registered public accounting firm for the fiscal year ending December 31, 2024, which we refer to as the “auditor ratification proposal”. |

The PioneerHomeStreet board of directors has set August 2 [·], 20212024 as the record date for the Pioneer specialHomeStreet shareholder meeting. Only holders of record of PioneerHomeStreet common stock at the close of business on August 2 [·], 20212024 will be entitled to notice of and to vote at the Pioneer specialHomeStreet shareholder meeting and any adjournments or postponements thereof. Any shareholder entitled to attend and vote at the Pioneer special meeting is entitled to appoint a proxy to attend and vote on such shareholder’s behalf. Such proxy need not be a holder of Pioneer common stock.

The affirmative vote of two-thirdsa majority of the outstanding shares of PioneerHomeStreet common stock entitled to vote thereon is required to approve the merger proposal. Assuming a quorum is present, approval of each of the merger-related compensation proposal, adjournment proposal, director election proposal (for a non-contested election), compensation (non-merger) proposal and auditor ratification proposal requires the affirmative vote of a majority ofthat the votes cast in favor of such proposal exceed the votes cast against such proposal. For the frequency of compensation vote proposal, the frequency (one year, two years or three years) receiving the highest number of votes from shareholders present virtually or by proxy at the holders of Pioneer common stockHomeStreet shareholder meeting and entitled to vote. Pioneervote thereon will be considered the frequency preferred by shareholders. HomeStreet will transact no other business at the specialshareholder meeting, except for business properly brought before the Pioneer specialHomeStreet shareholder meeting or any adjournment or postponement thereof. Certain PioneerHomeStreet shareholders have entered into voting and support agreements with FirstSun pursuant to which they have agreed to vote “FOR” the approval of the merger agreement, subject to the terms of the voting and support agreements.

PioneerHomeStreet shareholders must approve the merger proposal in order for the mergermergers to occur. If PioneerHomeStreet shareholders fail to approve the merger proposal, the mergermergers will not occur. The proxy statement/prospectus accompanying this notice explains the merger agreement and the transactions contemplated thereby, as well as the proposals to be considered at the Pioneer specialHomeStreet shareholder meeting. Please carefully review the proxy statement/prospectus and its annexes carefully and in their entirety.

PioneerHomeStreet shareholders who do not vote in favor of the proposal to adopt and approve the merger agreement and who object in writing todeliver a demand for payment before the vote is taken on the merger prior to the special meetingproposal and comply with all of the requirements of the lawsChapter 23B.13 (“Chapter 23B.13”) of the State of Texas,Washington Business Corporation Act (“WBCA”), which are summarized in the accompanying proxy statement/prospectus, and reproduced in their entirety in Annex C will have the right to the accompanying proxy statement/prospectus, will be entitled to dissenters’ rightsseek appraisal of appraisal to obtain the fair value of their shares of PioneerHomeStreet common stock.stock, in accordance with Chapter 23B.13 of the WBCA. Pursuant to Chapter 23B.13, when a proposed merger is to be submitted to a vote at a meeting of shareholders, the meeting notice must state that shareholders are or may be entitled to assert dissenters’ rights and must be accompanied by a copy of Chapter 23B.13. Accordingly, this notice of the HomeStreet shareholder meeting constitutes notice to the shareholders of HomeStreet common stock of their dissenters’ rights, and a copy of Chapter 23B.13 is attached to the accompanying proxy statement/prospectus as Annex C.

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES OF PIONEERHOMESTREET COMMON STOCK YOU OWN. Whether or not you plan to virtually attend the Pioneer specialHomeStreet shareholder meeting, pleasecomplete, sign, date and return the enclosed proxy card in the postage-paid envelope provided at yourearliest convenience. You may also submit a proxy by telephone or via the Internet by following theinstructions in the enclosed proxy statement/prospectus and on your proxy card. If you hold yourshares in “street name” through a broker, bank or other nominee, you should direct the vote of yourshares in accordance with the voting instruction form received from your broker, bank or other nominee.

The PioneerHomeStreet board of directors has unanimously determined that the merger agreement, the merger,mergers, and the transactions contemplated by the merger agreement are advisable and in the best interests of PioneerHomeStreet and its shareholders and unanimously authorized, adopted and approved the merger agreement, the mergermergers and the transactions contemplated by the merger agreement, and unanimously recommends that PioneerHomeStreet shareholders vote “FOR” the merger proposal, “FOR” the merger-related compensation proposal, “FOR” the adjournment proposal, “FOR” the director election proposal, “FOR” the compensation (non-merger) proposal, “FOR” one year as the frequency of future votes to adopt and approve the merger agreementexecutive compensation and “FOR” the proposalauditor ratification proposal.

HomeStreet has adopted a virtual format for the HomeStreet shareholder meeting to adjournprovide a safe, consistent and convenient experience to all shareholders regardless of location. You will be able to virtually attend the Pioneer special meeting, if necessarysubmit your questions and comments during the meeting, and vote your shares at the meeting by visiting www.virtualshareholdermeeting.com/HMST2024SM and entering your control number found on your proxy card or appropriate, to solicit additional proxies in favor of the merger proposal.broker instruction letter.

If you have any questions or need assistance with voting, please contact Pioneer’s proxy solicitor, D.F. King & Co., Inc., by calling toll-free at (877) 871-1741.contact:

If you plan to attendOKAPI PARTNERS LLC

1212 Avenue of the Pioneer special meeting in person, please bring valid photo identification. Pioneer shareholders that hold their shares of Pioneer common stock in “street name” are required to bring valid photo identification and proof of stock ownership in order to attend the Pioneer special meeting, and a legal proxy, executed in such shareholder’s favor, from the record holder of such shareholder’s shares, such as a broker, bank or other nominee.Americas

New York, NY 10036

Toll-Free: (877) 566-1922

Email: pmchugh@okapipartners.com

BY ORDER OF THE BOARD OF DIRECTORS,

Executive Vice President, General Counsel, and |

[ ], 2021 ·], 2024

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a Registration Statement on Form S-4 filed with the SECU.S. Securities and Exchange Commission (the “SEC”) by FirstSun, constitutes a prospectus of FirstSun under Section 5 of the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” with respect to the shares of FirstSun common stock to be offered to PioneerHomeStreet shareholders in connection with the merger.mergers. This proxy statement/prospectus also constitutes a notice of meeting and proxy statement being used by the PioneerHomeStreet board of directors to solicit proxies of PioneerHomeStreet shareholders in connection with approval of the mergermergers and related matters.

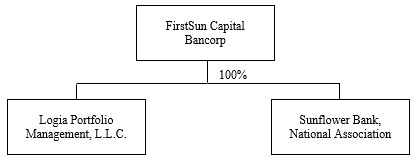

All references in this proxy statement/prospectus to “FirstSun” refer to FirstSun Capital Bancorp, a Delaware corporation, all references to “Sunflower Bank” refer to Sunflower Bank, National Association, a national banking association, and all references to “Merger Sub” refer to FSCB MergerDynamis Subsidiary, Inc.

All references in this proxy statement/prospectus to “Pioneer”“HomeStreet” refer to Pioneer Bancshares,HomeStreet, Inc., a TexasWashington corporation, and all references to “Pioneer“HomeStreet Bank” refer to PioneerHomeStreet Bank, SSB, a Texas state savingsWashington state-chartered bank.

All references in this proxy statement/prospectus to the “combined company” refer to FirstSun immediately following completion of the second step merger.

All references in this proxy statement/prospectus to “FirstSun common stock” refer to the common stock of FirstSun, par value $0.0001 per share, and all references in this proxy statement/prospectus to “Pioneer“HomeStreet common stock” refer to the common stock of Pioneer,HomeStreet, no par value $1.00 per share.value.

All references in this proxy statement/prospectus to the “merger agreement” refer to the Agreement and Plan of Merger dated May 11, 2021,January 16, 2024, by and between FirstSun, HomeStreet, and Pioneer, as amended by the First Amendment to Agreement and Plan of Merger dated May 18, 2021.Sub.

All references in this proxy statement/prospectus to “we,” “our” and “us” refer to FirstSun and PioneerHomeStreet collectively, unless otherwise indicated or as the context requires.

WHERE YOU CAN FIND MORE INFORMATION

NoYou should rely only on the information regarding FirstSuncontained in, attached to or Pioneer has been incorporated by reference into thisthe accompanying proxy statement/prospectus.

FirstSun

FirstSun does not currently have a class of securities registered under Section 12 of the Securities Exchange Act of 1934, which we refer to as the “Exchange Act,” is not currently subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act, and accordingly does not currently file documents and reports with the SEC pursuant to such sections.

FirstSun has filed a Registration Statement on Form S-4 to register with the SEC the shares of FirstSun common stock to be issued pursuant to the merger. This proxy statement/prospectus is a part of that Registration Statement on Form S-4. As permitted by SEC rules, this proxy statement/prospectus does not contain all of the information included in the Registration Statement on Form S-4 or in the exhibits or schedules to the Registration Statement on Form S-4. The Registration Statement on Form S-4, including any amendments, schedules and exhibits, is available, free of charge, by accessing the SEC’s website at http://www.sec.gov, or by requesting them from FirstSun in writing or by telephone at the address below:

FirstSun Capital Bancorp

1400 16th Street, Suite 250

Denver, Colorado 802020

Attention: Stockholder Relations

(303) 831-6704

You will not be charged for any of these documents that you request. To obtain timely delivery of these documents, you must request them no later than September 9 , 2021 in order to receive them before the Pioneer special meeting.

Pioneer

Pioneer does not have a class of securities registered under Section 12 of the Exchange Act, is not subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act, and accordingly does not file documents and reports with the SEC.

If you have any questions concerning the merger or this proxy statement/prospectus, would like additional copies of this proxy statement/prospectus or need help voting your shares of Pioneer common stock, please contact either Pioneer or D.F. King & Co., Inc., Pioneer's proxy solicitor, at:

|

|

You will not be charged for any of these documents that you request. To obtain timely delivery of these documents, you must request them no later than September 9 , 2021 in order to receive them before the Pioneer special meeting.

No person has been authorized to give any information or make any representation about the mergers or FirstSun or PioneerHomeStreet that differs from, or adds to, the information in this proxy statement/prospectus or in documents that are publicly filed with the SEC. We take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than the date of this proxy statement/prospectus, and neither the mailing of this proxy statement/prospectus to PioneerHomeStreet shareholders nor the issuance of FirstSun common stock in the mergermergers or investment agreements will create any implication to the contrary.

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer tobuy, any securities, or the solicitation of a proxy, in any jurisdiction in which or from any person to whomit is unlawful to make any such offer or solicitation in such jurisdiction.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE HOMESTREET SHAREHOLDER MEETING TO BE HELD ON [●], 2024:

The proxy materials, including the proxy statement/prospectus and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available free of charge at [●].

WHERE YOU CAN FIND MORE INFORMATION

Both FirstSun and HomeStreet file annual, quarterly and special or current reports, proxy statements and other business and financial information with the SEC. In addition, FirstSun and HomeStreet file reports and other business and financial information with the SEC electronically, and the SEC maintains a website located at www.sec.gov containing this information. You will also be able to obtain these documents, free of charge, from FirstSun at https://ir.firstsuncb.com/investor-relations/default.aspx under the section “Financials and Filings” and then click the tab “View Filings”, or from HomeStreet at https://ir.homestreet.com/corporate-profile/default.aspx under the tab “SEC Filings.”

FirstSun has filed a registration statement on Form S-4 of which this proxy statement/prospectus forms a part. As permitted by SEC rules, this proxy statement/prospectus does not contain all of the information included in the registration statement or in the exhibits or schedules to the registration statement. You may obtain a free copy of the registration statement, including any amendments, schedules and exhibits at the addresses set forth below. Statements contained in this proxy statement/prospectus as to the contents of any contract or other documents referred to in this proxy statement/prospectus are not necessarily complete. In each case, you should refer to the copy of the applicable contract or other document filed as an exhibit to the registration statement. This proxy statement/prospectus incorporates by reference documents that FirstSun and HomeStreet have previously filed with the SEC. These documents contain important information about the companies and their financial condition. See “Incorporation of Certain Documents by Reference” beginning on page 162. These documents are available without charge to you upon written or oral request to the applicable company’s principal executive offices. The respective addresses and telephone numbers of such principal executive offices are listed below.

| FirstSun Capital Bancorp | HomeStreet, Inc. |

| 1400 16th Street, Suite 250 | 601 Union Street, Suite 2000 |

| Denver, Colorado 80202 | Seattle, WA 98101 |

| Attention: Investor Relations | Attention: Investor Relations |

| (303) 962-0150 | (206) 515-2291 |

If you have any questions regarding the accompanying proxy statement/prospectus, you may contact FirstSun, by calling (303) 962-0150, or HomeStreet, by calling (206) 515-2291.

To obtain timely delivery of these documents, you must request them no later than five business days before the date of the HomeStreet shareholder meeting. This means that to obtain timely delivery of these documents, you must request the information no later than [·], 2024 in order to receive them before the HomeStreet shareholder meeting.

This proxy statement/prospectus includes government, industry and trade association data, forecasts and information that FirstSun and PioneerHomeStreet have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information available to us, which information may be specific to particular markets or geographic locations. Statements as to market position are based on market data currently available to FirstSun and Pioneer.HomeStreet. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although FirstSun and PioneerHomeStreet believe these sources are reliable, FirstSun and PioneerHomeStreet have not independently verified the information. Some data is also based on FirstSun’s and Pioneer’sHomeStreet’s good faith estimates, which are derived from management’s knowledge of the industry and independent sources. FirstSun and PioneerHomeStreet believe their internal research is reliable, even though such research has not been verified by any independent sources. While FirstSun and PioneerHomeStreet are not aware of any misstatements regarding industry data presented herein, FirstSun’s and Pioneer’sHomeStreet’s estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this proxy statement/prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this proxy statement/prospectus.

| ii |

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.07$1.235 billion in total annual gross revenue during its last fiscal year, FirstSun qualifies as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| · | FirstSun is |

| · | FirstSun will be permitted an extended transition period for complying with new or revised accounting standards affecting public companies and such new or revised accounting standards will not be applicable to FirstSun until such time as they are applicable to private companies; |

| · | FirstSun is permitted to provide reduced disclosure regarding its executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means FirstSun does not have to include a compensation discussion and analysis and certain other disclosures regarding its executive compensation arrangements; and |

| · | FirstSun is not required to hold non-binding stockholder advisory votes on executive compensation or golden parachute arrangements. |

FirstSun may take advantage of some or all of these provisions for up to five yearsthrough 2026, or such earlier time as FirstSun ceases to qualify as an emerging growth company, which will occur if FirstSun has more than $1.07$1.235 billion in total annual gross revenue, if FirstSun issues more than $1.0 billion of non-convertible debt in a three-year period, or if FirstSun is deemed to be a large accelerated filer, which means the market value of its common stock that is held by non-affiliates exceeds $700.0 million as of any June 30, in which case FirstSun would no longer be an emerging growth company as of the following December 31.

FirstSun has taken advantage of certain reduced reporting obligations in this proxy statement/prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold securities. In addition, FirstSun expects to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports it files and will file with the SEC.SEC and proxy statements that it uses to solicit proxies from its stockholders. As a result, the information that FirstSun provides to its stockholders may be different than what you might receive from other public reporting companies from which you hold equity interests. In addition, the JOBS Act permits FirstSun to take advantage of an extended transition period for complying with new or revised accounting standards affecting public companies. FirstSun has elected to use this extended transition period, which means that the financial information included in this prospectus, as well as any financial statements that it files in the future, may not be subject to all new or revised accounting standards generally applicable to public companies for the transition period as long as it remains an emerging growth company or until it affirmatively and irrevocably opts out of the extended transition period under the JOBS Act. As a result, FirstSun’ financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards on a non-delayed basis.

TABLE OF CONTENTS

The following are brief answers to certain questions that you may have regarding the mergers between FirstSun Capital Bancorp (“FirstSun”) and HomeStreet, Inc. (“HomeStreet”) and the Pioneer specialmeeting of the shareholders of HomeStreet and the other matters being proposed for the HomeStreet shareholder meeting. We urge you to read this section carefully, as well as the remainderentirety of this proxy statement/prospectus, including all annexes and exhibits, because theinformation in this section may not provide all the information that might be important to you in determininghow to vote.vote regarding the mergers and the other matters being proposed for the HomeStreet shareholder meeting. Additional important information is also contained in the annexes to, and the documents incorporated by reference in, this proxy statement/prospectus. See “Where You Can Find More Information” on page ii.

| Q: | What are the mergers? |

| A: | FirstSun, |

| At the effective time of the mergers (the “effective time”), each holder of HomeStreet common stock issued and outstanding immediately prior to the effective time, except for (i) treasury stock and (ii) shares owned by HomeStreet or FirstSun, in each case, other than those held in certain accounts or in a fiduciary or agency capacity that are beneficially owned by third parties, shares held by HomeStreet or FirstSun in respect of debts previously contracted, which will be cancelled, and shares held by shareholders who properly exercise dissenters’ rights, will be entitled to receive 0.4345 of a share (the “exchange ratio”) of FirstSun common stock, and cash in lieu of fractional shares of FirstSun common stock, subject to certain exceptions (the “merger consideration”). |

A copy of the merger agreement is attached to this proxy statement/prospectus as Annex A. We urge you to read carefully this proxy statement/prospectus and the merger agreement in their entirety.

| Immediately following the effective time, (i) HomeStreet will no longer be a public company, (ii) HomeStreet common stock will be delisted from The Nasdaq Stock Market (“Nasdaq”) and will cease to be publicly traded and (iii) HomeStreet common stock will be deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Immediately following the second step merger, FirstSun stockholders will continue to own their existing shares of FirstSun common stock and the separate corporate existence of HomeStreet will cease. |

| The |

A copy of the merger agreement is attached to this proxy statement/prospectus as Annex A. Additionally, see the information provided in the section entitled “The Merger Agreement—Structure of the Mergers” beginning on page 70. We urge you to read carefully this proxy statement/prospectus and all annexes and exhibits hereto, including the merger agreement, in its entirety. |

| Q: | Why am I receiving this proxy statement/prospectus? |

| A: |

| 1 |

| In order to complete the mergers, among other things, HomeStreet shareholders must approve the merger agreement. HomeStreet shareholders will also be asked to approve a proposal to approve, by a non-binding advisory vote, the merger-related compensation payments that will or may be paid to the named executive officers of HomeStreet in connection with the transactions contemplated by the merger agreement and to adjourn the meeting of the HomeStreet shareholders, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the HomeStreet shareholder meeting to approve the merger agreement. The approval of neither the merger-related compensation proposal nor the adjournment proposal is a condition to the obligations of HomeStreet or FirstSun to complete the merger. |

To approve the merger agreement and related matters, Pioneeras well as the other matters described in this proxy statement/prospectus, HomeStreet has called a special meeting of its shareholders. This document serves as the proxy statement for the Pioneer specialHomeStreet shareholder meeting because HomeStreet’s board of directors is soliciting proxies from its shareholders and the document describes the proposals to be presented at the Pioneer specialHomeStreet shareholder meeting.

Finally, thisThis document is also a prospectus that is being delivered to PioneerHomeStreet shareholders because, in connection withpursuant to the merger agreement, FirstSun will be issuing to Pioneer shareholdersis offering shares of FirstSun common stock to HomeStreet shareholders in exchange for HomeStreet common stock as merger consideration.

This proxy statement/prospectus contains important information about the mergers and the other proposals beingdescribed in this proxy statement/prospectus that will be voted on at the Pioneer specialHomeStreet shareholder meeting and important information on the investment agreements and information to consider in connection with an investment in FirstSun common stock. You should read it carefullythe proxy statement/prospectus and all annexes and exhibits hereto in its entirety.their entirety, carefully. The enclosed materials allow you to have your shares of PioneerHomeStreet common stock voted by proxy without attending the Pioneer specialHomeStreet shareholder meeting. Your vote is important and we encourage you to submit your proxy as soon as possible whether or not you plan to virtually attend the Pioneer specialHomeStreet shareholder meeting.

| Q: | What will |

| A: | If the |

properly exercise dissenters’ rights. FirstSun will not issue any fractional shares of FirstSun common stock in the |

For example, if you own 100 shares

| It is currently expected that the shareholders of |

| Q: | Will the value of the |

| A: | Yes. Although the number of shares of FirstSun common stock |

| Q: | How will the |

| A: |

| 2 |

At the effective time, the merger agreement provides that each outstanding HomeStreet restricted stock unit granted after December 31, 2023 (a “2024 HomeStreet RSU”) will automatically be converted into a FirstSun restricted stock unit award in respect of a number of shares of FirstSun common stock equal to (x) the number of shares of HomeStreet common stock subject to the 2024 HomeStreet RSU immediately prior to the effective time multiplied by (y) the exchange ratio (the “Converted RSU Awards”). Each Converted RSU Award will be subject to the same terms and conditions, including payment of accrued dividends upon vesting, as applied to the corresponding 2024 HomeStreet RSU immediately prior to the effective time, provided that time-based vesting conditions will accelerate upon the earlier of (i) a termination of employment of the applicable holder of such Converted RSU Award without Cause or for Good Reason (each as defined in the 2014 Plan and 2024 HomeStreet RSU), (ii) the date on which the system conversion of the banking operations of FirstSun and HomeStreet is completed (or up to 30 days thereafter, at FirstSun’s discretion), (iii) six months from the closing date or (iv) any earlier vesting date or event required by the 2024 HomeStreet RSU prior to the effective time.

| Q: | How will the merger affect |

| A: |

| Q: | What will happen in the mergers with respect to the agreements FirstSun entered into with certain third parties when the merger agreement was executed to provide financing for the transactions contemplated by the merger agreement? |

| A: | Concurrently with the execution of the merger |

In addition, if requested by FirstSun before the effective time, Pioneer will cooperateAdditionally, and concurrently with FirstSun and use its reasonable best efforts to obtain the written consent from each holder of Pioneer stock options to cancel and convert such options immediately before the effective time into the right to receive a cash payment from Pioneer in an amount equal to (i) the excess, if any,execution of the productmerger agreement, FirstSun entered into an Acquisition Finance Securities Purchase Agreement (the “Acquisition Finance Securities Purchase Agreement,” and together with the Upfront Securities Purchase Agreement, the “Investment Agreements”) with Wellington, Castle Creek and certain other institutional accredited investors. Pursuant to the Acquisition Finance Securities Purchase Agreement, on the terms and subject to the conditions set forth therein, substantially concurrently with the closing of $33.499 multiplied by the mergers, such investors will invest an aggregate of $95 million in exchange ratio of 1.0443 overfor the exercisesale and issuance, at a purchase price of each such Pioneer stock option, multiplied by (ii) the number$32.50 per share, of approximately 2.92 million shares of PioneerFirstSun common stockstock.

| 3 |

The Acquisition Finance Securities Purchase Agreement investment is contingent upon the merger closing in accordance with the terms of the merger agreement and are subject to such stock option. FirstSun is still evaluating whether it will seek written consents to cash out Pioneer stock options.

the satisfaction or waiver of certain other closing conditions. See the information provided in the section entitled “The Mergers—Investment Agreements” beginning on page 66.

| Q: | What are the material U.S. federal income tax consequences of the |

| A: | The mergers, taken together, |

| Q: | If I am a |

| A: | No. Please do not send in your |

| Q: | When and where is the |

| A: | The |

| Even if you plan to virtually attend the |

| Q: | What are |

| A: |

| · | Proposal No. 1 – a proposal to |

| · | Proposal No. 2 – a proposal to approve, on an advisory (non-binding) basis the merger-related compensation payments that will or may be paid to the named executive officers of HomeStreet in connection with the transactions contemplated by the merger agreement, which HomeStreet refers to as the “merger-related compensation proposal”; and |

| · | Proposal No. 3 – a proposal to adjourn the |

In order to complete the mergers, among other things, HomeStreet shareholders must approve the HomeStreet merger proposal. The approval of neither the merger-related compensation proposal nor the adjournment proposal is a condition to the obligations of HomeStreet or FirstSun to complete the mergers.

| 4 |

In addition to the merger-related proposals, HomeStreet shareholders will be asked to consider and vote on the following four proposals:

| · | Proposal No. 4 – a proposal to elect eight directors of HomeStreet to serve until the next annual the meeting of shareholders of HomeStreet, or until their successors are elected or appointed or until death, resignation or removal, whichever is earlier, which HomeStreet refers to as the “director election proposal” (provided that if Proposal No. 1 is approved and the mergers are completed, the separate corporate existence of HomeStreet will cease and the term of the directors will end in accordance with the merger agreement); |

| · | Proposal No. 5 – a proposal to approve, on an advisory (non-binding) basis, the executive compensation of HomeStreet’s named executive officers for 2023, which HomeStreet refers to as the “compensation (non-merger) proposal”; |

| · | Proposal No. 6 – a proposal to approve, on an advisory (non-binding) basis, the frequency of future advisory (non-binding) votes on executive compensation, which HomeStreet refers to as the “frequency of compensation vote proposal” (provided that if mergers are completed, no such future advisory votes will occur); and |

| · | Proposal No. 7 – a proposal to ratify, on an advisory (non-binding) basis, HomeStreet’s independent registered public accounting firm for the fiscal year ending December 31, 2024, which HomeStreet refers to as the “auditor ratification proposal.” |

| Q | Why am I being asked to consider and vote on the merger-related compensation proposal? |

| A: | Under the U.S. Securities and Exchange Commission (the “SEC”) rules, HomeStreet is required to seek an advisory non-binding vote with respect to the compensation that will or may be paid to HomeStreet’s named executive officers in connection with the consummation of the transactions contemplated by the merger agreement, or “golden parachute” compensation. |

| Q | What happens if holders of HomeStreet common stock do not approve, by advisory, non-binding vote, the merger-related compensation proposal? |

| A: | The vote on the merger-related compensation proposal is separate and apart from the votes to approve the other proposals being presented at the HomeStreet shareholder meeting. Because the vote on the merger-related compensation proposal is advisory in nature only, it will not be binding on HomeStreet, FirstSun or the combined company in the mergers. Accordingly, the merger-related compensation will be paid to HomeStreet’s named executive officers to the extent payable in accordance with the terms of their compensation agreements and arrangements even if the holders of HomeStreet common stock do not approve the merger-related compensation proposal. |

| Q: | What constitutes a quorum for the |

| A: | The presence at the |

| Q: | Who is entitled to vote? |

| A: | All shareholders of record of HomeStreet’s common stock at the close of business on [·], 2024 (the “record date”) are entitled to notice of, and to vote at, the HomeStreet shareholder meeting. |

| 5 |

| Q: | How many shares are entitled to vote at the meeting? |

| A: | As of the record date, [·] shares of HomeStreet common stock were issued, outstanding and entitled to vote at the HomeStreet shareholder meeting. |

| Q: | How many votes do I have? |

| A: | Each share of HomeStreet common stock you owned on the record date is entitled to one vote for each director candidate. You may NOT cumulate votes relating to the election of directors. For the other matters presented at this meeting, you are entitled to one vote for each share of common stock you owned on the record date. |

| Q: | What is the vote required to approve each proposal at the |

| A: | Merger proposal |

Standard: Approval of the merger proposal requires the affirmative vote of at least a majority of the outstanding shares of HomeStreet common stock. HomeStreet shareholders must approve the merger proposal in order for the mergers to occur. If HomeStreet shareholders fail to approve the HomeStreet merger proposal, the mergers will not occur and HomeStreet shareholders will not receive the merger consideration.

Effect of abstentions and broker non-votes: If you fail to vote, mark “ABSTAIN” on your proxy card or fail to instruct your bank or broker how to vote with respect to the merger proposal, it will have the same effect as a vote “AGAINST” the proposal.

| B. | Merger-relatedcompensation proposal, compensation (non-merger) proposal, adjournment proposal, and auditor ratification proposal |

Standard: Approval of the merger-related compensation proposal, compensation (non-merger) proposal, adjournment proposal, and auditor ratification proposal requires the votes cast by shareholders of HomeStreet in favor of the proposal to exceed the votes cast by shareholders of HomeStreet against the proposal at the HomeStreet shareholder meeting.

Effect of abstentions and broker non-votes: If you fail to vote, mark “ABSTAIN” on your proxy card or fail to instruct your bank or broker how to vote with respect to any of these proposals, you will be deemed not to have cast a vote with respect to the proposal for which you failed to vote, marked “ABSTAIN” or failed to instruct your bank or broker, and it will have no effect on the proposal.

| C. | Director election proposal |

Standard: Assuming a quorum is present, and in accordance with HomeStreet’s Amended and Restated Bylaws, dated July 25, 2019, in an uncontested election, the number of votes cast for a director nominee must exceed the votes cast against the director nominee for the director to be elected.

Effect of abstentions and broker non-votes: If you fail to vote, mark “ABSTAIN” on your proxy card or fail to instruct your bank or broker how to vote with respect to the director election proposal, you will be deemed not to have cast a vote, marked “ABSTAIN” or failed to instruct your bank or broker, with respect to the proposal and it will have no effect on the proposal.

| D. | Frequency of compensation vote proposal |

Standard: Assuming a quorum is present, the frequency (one year, two years or three years) receiving the highest number of votes from shareholders present virtually or by proxy at the HomeStreet shareholder meeting and entitled to vote thereon will be considered the frequency preferred by the shareholders.

Effect of abstentions and broker non-votes: If you fail to vote, mark “ABSTAIN” on your proxy card or fail to instruct your bank or broker how to vote with respect to the frequency of compensation vote proposal, you will be deemed not to have cast a vote, marked “ABSTAIN” or failed to instruct your bank or broker, with respect to the proposal and it will have no effect on the proposal.

| 6 |

| Q: | Are there any voting agreements with existing shareholders? |

| A: | Yes. In connection with entering into the merger agreement, each member of the HomeStreet board of directors has entered into a voting agreement with FirstSun in which such HomeStreet director has agreed to vote all HomeStreet common stock owned by such director in favor of the mergers, and against alternative transactions or other proposals that could prevent or materially delay the mergers, grant a corresponding proxy with respect to their shares of HomeStreet common stock under certain circumstances and not, directly or indirectly, assign, sell, transfer or otherwise dispose of their shares of HomeStreet common stock, subject to certain exceptions. The voting agreements relate only to the merger-related proposals. As of the record date, shares constituting [·]% of HomeStreet common stock entitled to vote at the HomeStreet shareholder meeting are subject to the voting agreements. |

| Q: | Are there any risks I should consider in deciding whether to vote for the approval of the merger proposal or the other proposals to be considered at the HomeStreet shareholder meeting? |

| A: | Yes. You should read and carefully consider the risk factors set forth in the section entitled “Risk Factors” beginning on page 24. You also should read and carefully consider the risk factors of FirstSun and HomeStreet contained in the documents that are incorporated by reference into or attached as an annex to this proxy statement/prospectus, and we also urge you to read carefully this proxy statement/prospectus and all annexes and exhibits hereto in its entirety. |

| What are the conditions to complete the mergers? |

Adjournment proposal

For information regarding the voting and support agreements between FirstSun and certain holders of shares of Pioneer common stock, see “Pioneer Special Meeting of Shareholders—Shares Subject to Voting and Support Agreements.”

| Q: | How does the |

| A: | The |

| · | “FOR” the merger proposal, |

| · | “FOR” the merger-related compensation proposal, |

| · | “FOR” the adjournment proposal, |

| · | “FOR” the director election proposal, |

| 7 |

| · | “FOR” the compensation (non-merger) proposal, |

| · | “FOR” one year for the frequency of future advisory (non-binding) votes on executive compensation, and |

| · | “FOR” the auditor ratification proposal. |

| In considering the recommendations of the HomeStreet board of directors, HomeStreet shareholders should be aware that HomeStreet directors and executive officers may have interests in the mergers that are different from, or in addition to, the interests of the HomeStreet shareholders generally. For a more complete description of these interests, see the information provided in the section entitled “The Mergers—Interests of HomeStreet’s Directors and Executive Officers in the Mergers” beginning on page 57. |

| Q: | What do I need to do now? |

| A: | After carefully reading and considering the information contained in this proxy statement/prospectus, including all annexes, exhibits and documents incorporated by reference in this document in its |

| Q: | How do I vote my shares? |

| A: | If you are a shareholder of record of |

| · | via the Internet, by accessing the website [·] and following the instructions on the website; |

| · | by mail, by completing, signing, dating and returning the enclosed proxy card to HomeStreet using the enclosed postage-paid envelope; |

| · |

If you intend to submit your proxy by telephone or via the Internet, you must do so by 11:59 p.m. Eastern Time on the day before the Pioneer specialHomeStreet shareholder meeting. If you intend to submit your proxy by mail, your completed proxy card must be received before the Pioneer specialHomeStreet shareholder meeting.

If you are a PioneerHomeStreet shareholder as of the Pioneer record date,Record Date, and you virtually attend the HomeStreet shareholder meeting through the website provided using the control number from your proxy card or voting instruction materials, you may also cast your vote in person at the Pioneer special meeting. If you plan to attend the Pioneer special meeting, you must hold your shares in your own name or have a letter fromassociated with that control number online during the record holder of your shares confirming your ownership. In addition, you must bring a form of personal photo identification with you in order to be admitted to theHomeStreet shareholder meeting. Pioneer reserves the right to refuse admittance to anyone without proper proof of stock ownership or without proper photo identification. Whether or not you intend to be virtually present at the Pioneer specialHomeStreet shareholder meeting, you are urged to complete, sign, date and return the enclosed proxy card to PioneerHomeStreet in the enclosed postage-paid envelope or submit a proxy by telephone or via the Internet as described on the enclosed instructions as soon as possible. If you are then presentvirtually attend and wish to vote your shares in person,during the meeting, your original proxy may be revoked by virtually attending and voting at the Pioneer specialHomeStreet shareholder meeting.

If you hold your shares in “street name” through a broker, bank or other nominee, your broker, bank or other nominee will send you separate instructions describing the procedure for voting your shares. If your shares are held in “street name,” you must obtain a legal proxy, executed in your favor, from the record holder of your shares, such as a broker, bank or other nominee, to vote your shares in person at the Pioneer specialHomeStreet shareholder meeting. Please contact your bank, broker or other nominee if you want to obtain a legal proxy to vote your shares.

| 8 |

| Q: | How do I virtually attend and participate in the HomeStreet shareholder meeting? |

| A: | The meeting webcast on [·], 2024 will begin promptly at [·] a.m. Pacific Time. You are encouraged to access the meeting prior to the start time. Online check-in will begin at [·] a.m. Pacific Time, and you should allow ample time for the check-in procedures. |

Only HomeStreet shareholders or their duly authorized and constituted proxies may virtually attend the HomeStreet shareholder meeting. The control number printed on your proxy card or voting instruction materials is required to virtually attend the meeting through the website at www.virtualshareholdermeeting.com/HMST2024SM regardless of whether you are a registered shareholder or a beneficial shareholder. HomeStreet has been advised that Google Chrome and Microsoft Edge browsers will give the best user experience for participation in the virtual meeting.

HomeStreet’s Chairman of the Board and Chief Executive Officer is expected to lead the meeting, and members of the HomeStreet board of directors are expected to be present and available during the HomeStreet shareholder meeting. During the HomeStreet shareholder meeting, you will be able to hear the business of the meeting as it is conducted, vote your shares if you have not already done so, access information that would normally be available at an in-person meeting, including the list of shareholders entitled to vote at the meeting, and submit questions to be answered by HomeStreet’s Chairman of the Board. Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

The virtual HomeStreet shareholder meeting has been designed to provide substantially the same rights to participate as you would have at an in-person meeting. Shareholders participating in the virtual meeting will be in a listen-only mode and will not be able to speak during the webcast. However, in order to maintain the interactive nature of the virtual meeting, virtual attendees are able to submit questions before and during the meeting through the virtual meeting portal. To submit a question, log into the virtual meeting platform at www.virtualshareholdermeeting.com/HMST2024SM, type your question into the “Ask a Question” field, and click “Submit.” Questions and answers may be grouped by topic and substantially similar questions may be grouped and answered once. In order to promote fairness and efficient use of time, HomeStreet will respond to up to two questions from a single shareholder and may not be able to respond to all questions. FirstSun and certain advisors are expected guests.

The virtual HomeStreet shareholder meeting website will be hosted by Broadridge. In the event you have any technical difficulties logging into the meeting, support from Broadridge will be available. For more information, please go to the virtual meeting website, where you will be able to find additional information on technical support matters.

| Q: | If my shares are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee automatically vote my shares for me? |

| A: | No. Under the rules of the NYSE, brokers who hold shares in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion only on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not permitted to exercise their voting discretion with respect to the approval of matters that the NYSE determines to be “non-routine” without specific instructions from the beneficial owner. Under the NYSE rules, all of the proposals to be voted on at the |

on at the Pioneer special meeting are “routine” matters for which brokers may have discretionary authority to vote, Pioneer does not expect any broker non-votes at the Pioneer special meeting. As a result, if you hold your shares of Pioneer common stock in “street name,” your shares will not be represented and will not be voted on any matter unless you affirmatively instruct your bank, broker or other nominee how to vote your shares in one of the ways indicated by your bank, broker or other nominee. It is therefore critical that you cast your vote by instructing your bank, broker or other nominee on how to vote.

Please follow the voting instructions provided by your broker, bank or other nominee. Please note that you may not vote shares held in “street name” by returning a proxy card directly to PioneerHomeStreet or by voting in person at the Pioneer specialHomeStreet shareholder meeting, unless you provide a legal proxy, executed in your favor, from the broker, bank or other nominee that is the record holder of your shares. In addition to such legal proxy, if you plan to attend the Pioneer specialHomeStreet shareholder meeting virtually, but you are not a shareholder of record because you hold your shares in “street name,” please bring evidence ofyou will receive voting instructions from your beneficial ownership of your shares (e.g.,broker, bank or other nominee, which will include a copy of a recent brokerage statement showingcontrol number that you can use to virtually attend the shares) and valid photo identification with you to the Pioneer specialHomeStreet shareholder meeting.

| 9 |

| Q: | Can I change my vote? |

| A: | Yes. If you are the record holder of |

| · | timely delivering a signed written notice of revocation to the Corporate Secretary of |

| · | timely delivering a new, valid proxy bearing a later date; or |

| · | virtually attending the |

If you hold your shares in “street name” through a bank, broker, or other holder of record, you should contact your record holder to change your vote.

| Q: | Why is my vote important? |

| A: | If you do not vote, it will be more difficult for |

| Q: | What will happen if I return my proxy card without indicating how to vote? |

| A: | If you sign and return your proxy card without indicating how to vote on any particular proposal, the shares of |

| Q: | What should I do if I receive more than one set of voting materials? |

| A: |

| Q: | Will |

| A: | Yes. Unless the merger agreement is terminated before the |

The steps you must follow to perfect your right of dissent are described in greater detail under the section of this proxy statement/prospectus entitled “Dissenters’ Rights in the Merger” beginning on page 115, and this discussion is qualified by that description and by the text of the provisions of the Texas Business Organizations Code, which we refer to as the “TBOC,” relating to rights of dissent attached as Annex C to this proxy statement/prospectus. The fair value, as determined under the statute, could be more than the merger consideration but could also be less. The appraised value of your shares of Pioneer common stock may be more or less that the value of the merger consideration. In addition, it is a closing condition of the merger that Pioneer does not receive timely notice from Pioneer shareholders of their intent to dissent from the merger with respect to shares of Pioneer common stock that would have, in the aggregate, been converted into the right to receive more than 5% of the outstanding shares of FirstSun common stock at the effective time of the merger.

| Q: |

| A: |

| 10 |

| Q: | What happens if I sell my shares of HomeStreet common stock before the completion of the mergers? |

| A: | If you transfer your shares of HomeStreet common stock, you will have transferred your right to receive the merger consideration in the mergers or to exercise dissenters’ rights in connection with the mergers. In order to receive the merger consideration or to exercise dissenters’ rights in connection with the mergers, you must hold your shares of HomeStreet common stock through the effective time of the mergers. The record date for shareholders entitled to vote at the HomeStreet shareholder meeting is earlier than the date the mergers is anticipated to be consummated. Accordingly, if you sell or transfer your shares of HomeStreet common stock after the record date but before the HomeStreet shareholder meeting, unless special arrangements (such as provision of a proxy) are made between you and the person to whom you sell or otherwise transfer your shares, and each of you (the transferor and the transferee) notifies HomeStreet in writing of such special arrangements, you will transfer the right to receive the merger consideration, if the mergers are consummated, to the person to whom you sell or transfer your shares of HomeStreet common stock, but you will have retained your right to vote these shares at the shareholder meeting. Even if you sell or otherwise transfer your shares of HomeStreet common stock after the record date, we encourage you to complete, date, sign, and return the enclosed proxy card or vote via the Internet or by telephone. |

| Q: | When do you expect to complete the mergers? |

| A: | FirstSun and HomeStreet expect to complete the mergers in the middle of 2024. FirstSun and HomeStreet must obtain the approval of the merger agreement by the HomeStreet shareholders at the HomeStreet shareholder meeting, and also must obtain necessary regulatory approvals in addition to satisfying certain other closing conditions prior to the completion of the mergers. However, neither FirstSun nor HomeStreet can assure you of when or if the mergers will be completed, because completion is subject to conditions and factors outside the control of both companies. |

| Q: | What happens if the mergers are not completed? |

| A: | If the mergers are not completed, HomeStreet shareholders will not receive any consideration for their shares of HomeStreet common stock in connection with the mergers. Instead, HomeStreet will remain an independent company and its stock is expected to remain listed on Nasdaq. In addition, if the merger agreement is terminated in certain circumstances, a termination fee of $10.0 million may be required to be paid by either HomeStreet or FirstSun to the other party, as applicable. See “The Merger Agreement—Termination Fee” beginning on page 86 for a complete discussion of the circumstances under which any such termination fee will be required to be paid. |

| Q: | Who will count the votes? |

| A: | Broadridge Financial Solutions, Inc. will serve as the independent inspector of election and, in such capacity, will count and tabulate the votes. |

| Q: | Where can I find the results of the HomeStreet shareholder meeting? |

| A: | HomeStreet intends to announce preliminary voting results at the HomeStreet shareholder meeting and intends to publish final results in a Current Report on Form 8-K, which HomeStreet will file with the SEC within four business days after the HomeStreet shareholder meeting. |

| Q: | If I have any questions regarding the meeting or voting my shares, whom may I contact? |

| A. | If you have any questions or need any assistance in voting your shares, please contact |

OKAPI PARTNERS LLC

1212 Avenue of the Americas

New York, NY 10036

Toll-Free: (877) 566-1922

Email: pmchugh@okapipartners.com

This summary highlights selected information included in this proxy statement/prospectus and does not contain all of the information that may be important to you. You should read this entire document and its annexes. Each item in this summary includes a page reference directing you to a more complete description of that item.

The Mergers (page 62)35)

FirstSun and PioneerHomeStreet have entered into the merger agreement that provides for the combination of FirstSun and Pioneer.HomeStreet. Under the merger agreement, a wholly-owned subsidiary of FirstSun will merge with and into Pioneer,HomeStreet, with PioneerHomeStreet remaining as the surviving entity and becoming a wholly-owned subsidiary of FirstSun. This surviving entity, as soon as reasonably practicableimmediately following the merger and as part of a single integrated transaction, will merge with and into FirstSun, with FirstSun as the surviving entity. The terms and conditions of the mergers are contained in the merger agreement, which is attached as Annex A to this proxy statement/prospectus. We encourage you to read the merger agreement carefully, as it is the legal document that governs the mergers. Immediately following the completion of the second step merger, or at such later time as the parties may mutually agree, PioneerHomeStreet Bank will merge with and into Sunflower Bank, with Sunflower Bank as the surviving bank.