Exhibit 99.2

INTERIM REPORT JANUARY – SEPTEMBER 2011

TABLE OF CONTENTS

| | | | |

INTRODUCTORY NOTES | | | 3 | |

QUARTERLY FINANCIAL STATEMENTS (CONDENSED AND UNAUDITED) | | | | |

Interim Management Report | | | 4 | |

Consolidated Interim Financial Statements – IFRS | | | 22 | |

ADDITIONAL FINANCIAL INFORMATION (UNAUDITED) | | | | |

IFRS and Non-IFRS-Financial Data | | | 43 | |

Multi-Quarter Summary | | | 47 | |

ADDITIONAL INFORMATION | | | | |

Financial Calendar, Investor Services, Addresses, and Imprint | | | 48 | |

3

Introductory Notes

This interim group report meets the requirements of German Accounting Standard No. 16 “Zwischenberichterstattung” (DRS 16). We prepared the financial data in the “Quarterly Financial Statements (Condensed and Unaudited)” section for SAP AG and its subsidiaries in accordance with International Financial Reporting Standards (IFRSs) of the International Accounting Standards Board (IASB) and the respective interpretations by the International Financial Reporting Interpretations Committee (IFRIC) endorsed by the European Union (EU) up to September 30, 2011. For additional IFRS and non-IFRS information, see the “Additional Financial Information (Unaudited)” section.

All of the information in this interim group report is unaudited. This means the information has been subject neither to any audit nor to any review by an independent auditor.

4 INTERIM REPORT JANUARY–SEPTEMBER 2011

INTERIM MANAGEMENT REPORT

FORWARD-LOOKING STATEMENTS

This interim financial report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information currently available to them. Any statements contained in this interim financial report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks, many of which are beyond our control. If one or more of these uncertainties or risks materializes, or if management‘s underlying assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

We describe these risks and uncertainties in the “Risk and Opportunity Management” section, respectively in the there mentioned sources.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “development,”“is confident,” “estimate,” “expect,” “forecast,””future trends,” “guidance,” “intend,” “may,” “outlook,” “plan,” “project,” “predict,” “seek,” “should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made in the “Operating Results” section, the “Risk and Opportunity Management” section, our “Forecast for SAP”, and other forward-looking information appearing in other parts of this interim financial report. To fully consider the factors that could affect our future financial results both our Annual Report for December 31, 2010, and Annual Report on Form 20-F for December 31, 2010, should be considered, as well as all of our other filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or the date of this report. Except where legally required, we undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report, future events, or otherwise unless we are required to do so by law.

All of the information in this report relates to the situation on September 30, 2011, or the quarter ended on that date unless otherwise stated.

NON-IFRS FINANCIAL INFORMATION

We present and discuss the reconciliation of non-IFRS measures to IFRS measures in the “Additional Financial Information (Unaudited)” section. For more information about non-IFRS measures, see www.sap.com/corporate-en/investors/reports.

INTERIM MANAGEMENT REPORT 5

ECONOMIC CONDITIONS

Global Economic Trends

The global economy continued to expand in the third quarter of 2011, although at a slower pace. The slowdown was far more significant in the advanced economies than in the emerging and developing economies. That is the conclusion reached by organizations such as the European Central Bank (ECB), the Organization for Economic Co-operation and Development (OECD), and the International Monetary Fund (IMF). They ascribe this trend to continuing high levels of indebtedness and unemployment in the leading industrial nations, the worldwide effects of the natural and nuclear disasters in Japan, and the dampening impact of high commodity prices.

The situation in the Europe, Middle East, and Africa (EMEA) region was characterized by the weakening economy of the euro area caused by continuous pressure on the European securities markets. In particular, talk of the Greek government’s defaulting on its debt and the possibility that Greece might withdraw from the euro area depressed the markets. In the Middle East and North Africa, political unrest also held back economic progress.

In the Americas region, economic growth was slower in the third quarter than it had been at the beginning of 2011. But, the recovery in the United States continued slower as expected, Factors holding back the recovery included rising commodity prices, a decline in consumer spending, and export shipments canceled because of the earthquake in Japan. U.S. public-sector budgetary concerns led to mark down the rating of U.S. government bonds in the beginning of August, a factor that also held back recovery.

With little to hold them back, emerging economies in the Asia Pacific Japan (APJ) region continued to expand during the quarter. The Japanese economy proved more resilient than the markets expected after the terrible earthquake in March. Nonetheless, growth slowed in the third consecutive quarter.

The IT Market

Despite the difficult business climate in some regions, global investment in all IT segments has continued to show strong growth so far in 2011, albeit not quite at the level seen last year. This is the view of International Data Corporation (IDC), a market research organization based in the United States, in its latest sector report. However, regional analysis shows noticeable differences.

In the EMEA region, the deteriorating economic situation in Europe has had a growing impact on the IT market over the course of 2011, IDC reports. Consumers and businesses have less confidence in the stability of the economy and their plans for the future, so increasingly they were holding back investments in IT. The German IT market was an exception in the first three quarters, producing growth slightly above the EMEA region average and so leading Western Europe alongside France.

By contrast, according to IDC unhelpful economic conditions have had little impact on the IT market in the Americas region so far in 2011. The software segment in particular has proved resilient. Within the region, the market for IT has expanded more slowly in the United States than in the Latin American countries.

The IT market in the APJ region was divided in the first three quarters of 2011: The front runners were the Asian emerging economies, above all China and India, where the IT market produced almost unbridled growth. Japan, by contrast, suffered a severe setback with the environmental disasters in March 2011, from which the Japanese IT market was unable to recover by the end of the third quarter.

MISSION AND STRATEGY

In the first nine months of 2011, we had no changes in our mission or our strategy. For a detailed description of our mission and strategy, see page 68 and the subsequent pages in our 2010 Annual Report and item 4 in our 2010 Annual Report on Form 20-F.

6 INTERIM REPORT JANUARY–SEPTEMBER 2011

PORTFOLIO OF SOFTWARE AND SERVICES

In the first nine months of 2011, we made the following enhancements to our portfolio of software and services. For a detailed description of our portfolio of software and services, see page 72 and the subsequent pages in our 2010 Annual Report and item 4 in our 2010 Annual Report on Form 20-F.

On Premise

Development in the third quarter

At SAP TechEd Las Vegas in September, we announced two new solutions built on the SAP HANA platform: SAP Smart Meter Analytics software powered by SAP HANA and SAP CO-PA Accelerator. Utility companies today face an exponential increase in data volume generated by smart meters. SAP Smart Meter Analytics, powered by SAP HANA, aims to help utility companies to instantly turn this “big data” into powerful insights that they can use to develop more tailored customer offerings and support our customers to design their use of energy more sustainable. SAP CO-PA Accelerator software aims to improve the speed and depth of working with large volumes of financial data. For example, the software will enable corporate finance departments to perform real-time profitability reporting on large-scale data volumes and run cost allocations at significantly faster processing time.

In September we also announced the global general availability of solutions from the SAP Business Objects portfolio, including the 4.0 releases of business intelligence (BI) and enterprise information management (EIM) solutions. They are designed to provide companies with the best possible tools for analyzing large volumes of data from within and outside of their businesses to come to informed decisions.

In the same month we also announced the general availability of the 10.0 release of SAP Business Objects governance, risk, and compliance (GRC) solutions. We presented this new release in the first quarter. It can be used by companies to manage, monitor, and analyze their risks in a single, unified environment. The new release integrates GRC capabilities into everyday business processes, making risk management, regulatory compliance, and safe, productive operations a standard and a consistent practice.

In July we announced our collaboration with Google to help customers manage large data volumes in intuitive, visual displays and facilitate faster, more-informed decisions. SAP will enhance its business

analytics software with location-based data capabilities, allowing people to interact with real-time information via Google Maps.

Development in the previous quarters

In June, we announced the general availability of SAP HANA, originally presented in spring 2010, heralding a new generation of analytics, business applications, and IT simplification with SAP in-memory computing technology.

At SAPPHIRE NOW in May, we announced general availability of “Innovations 2010” enhancement packages across all core SAP Business Suite 7 applications, which enable customers to switch on new software features for unique industry and line-of-business processes, without disrupting operations to undergo system upgrades. We also announced the 10.0 release of enterprise performance management (EPM) solutions – software that helps companies ensure decisions and actions are aligned with business aims.

Also in the first quarter, we announced the SAP Social Services Management for Public Sector package, a new solution to help improve disbursement processes for monetary social benefits. The software is designed for government agencies at the federal, state, and local level that are tasked with administering and approving monetary benefits as they relate to social services.

In January, we launched the SAP Billing for Telecommunications package, an integrated solution designed to cover the widespread demands and service portfolios of communications service providers (CSPs) globally. Building on the acquisitions of software companies Highdeal and Sybase, the solution marks a new step in enabling CSPs to launch and monetize next-generation service offerings.

On Demand

Development in the third quarter

In August we announced the general availability of the second release of the SAP Business ByDesign solution in 2011, including extended availability for Australia and Mexico, and language support for Spanish.

In July we announced general availability of the SAP Sales OnDemand solution in Austria, Canada, Germany, Ireland, Switzerland, the United Kingdom and the United States. The solution is designed from the ground up with the input of customers’ sales professionals in order to specifically support the way they work and help them sell more effectively.

INTERIM MANAGEMENT REPORT 7

Development in the previous quarters

In April, SAP marked a milestone in its product road map for on-demand applications that quickly and easily add on to customers’ on-premise software installations. A cloud-based e-commerce solution from SAP partners for companies running SAP Business All-in-One sets up SMEs with an e-commerce site that is hosted in the cloud. Web orders are processed alongside traditional sales channels in the SAP back end.

At CeBIT in the first quarter, we announced a new class of on-demand software solutions that include packaged integration into SAP Business Suite. They apply mobile and social networking technologies to give better support for the way people work today anytime, anywhere. As the linchpin of SAP’s cloud strategy, the SAP Business ByDesign solution is the platform on which this new line of applications is built.

In February, we announced feature pack 2.6 for SAP Business ByDesign, a major update in our portfolio of on-demand solutions. The new release serves as an open platform on which a broad ecosystem of partners can further customize the software, and on which SAP will develop new on-demand offerings for various lines of business.

On Device

Development in the third quarter

In September we announced the general availability of the SAP EAM Work Order mobile app, on which online and offline functionalities let technicians manage work orders on their devices even without network connectivity. Companies can extend the value of existing enterprise applications.

Also in September, at SAP TechEd, SAP and Sybase premiered interface support for Apple’s App Store Volume Purchase Program (VPP) for Business with Afaria, the industry-leading mobile device and application management solution from Sybase. Afaria helps enterprises by providing a single administrative console from which to centrally manage and secure mobile data, applications, and devices. Afaria helps extend App Store VPP for Business, which provides businesses a way to purchase custom business-to-business apps built by third-party developers.

Also in September, at SAP TechEd 2011 Las Vegas, SAP and Sybase announced the forthcoming Sybase Unwired Platform 2.1. The new version will enrich the mobile application development experience through significant enhancements to its software development kit and new developer

resources for the more than 2 million members of SAP Community Network.

Development in the previous quarters

In May, at SAPPHIRE NOW in Orlando, SAP and Sybase announced Sybase Unwired Platform 2.0 and the unveiling of an enhanced version of their software development kit (SDK). The releases help businesses of all sizes better respond to real-time business dynamics through simplified deployment and development of native and Web-based mobile applications on a wide array of device types.

Also at SAPPHIRE NOW in May, SAP and Sybase announced a series of new mobile apps aimed at mobilizing business processes and business information across key industries including manufacturing, consumer products, utilities, high tech, oil and gas, and retail.

In the first quarter, we announced the launch of the SAP Collaborative E-Care Management application, which connects patients, their families and care providers through medical monitoring software and mobile devices. The aim is to improve the management of health with individualized treatment plans and educational content. With the SAP technology, patients will be able to use mobile devices to track their health status, interact with care providers, and monitor how they are progressing on an individualized care plan developed with their care provider.

Orchestration

Development in the third quarter

In September we announced the general availability of the 7.1 release of the SAP Solution Manager, the first major update in more than four years. The latest release is a one-stop shop for total application life-cycle management and offers control mechanisms for both SAP and non-SAP environments.

Development in the previous quarters

In June, SAP announced the general availability of the 7.3 release of SAP NetWeaver. The latest release helps customers adapt business processes more quickly and easily without increasing costs.

At SAPPHIRE NOW in Orlando, we announced the launch of SAP NetWeaver Gateway, a forthcoming open, standards-based framework for extending the reach of our business software to an exponentially larger number of users, developers and environments.

8 INTERIM REPORT JANUARY–SEPTEMBER 2011

Rapid-Deployment Solutions

Development in the third quarter

Rapid-deployment solutions are pre-packaged solutions based on SAP software that enable quick time-to-value at a fixed cost. We regularly expand our portfolio of rapid-deployment solutions in quarterly innovation cycles. In the third quarter alone, we delivered 50 more rapid-deployment solutions and SAP Business All-in-One enhancement packages, focusing on core SAP Business Suite solutions and forward-looking lines such as mobile applications and SAP HANA.

We shipped our first two in-memory rapid-deployment solutions to enable our customers to quickly and inexpensively add powerful SAP HANA reporting and profitability analytics to their SAP ERP solutions. In the mobility space, a rapid-deployment solution for mobile apps and infrastructure fast-tracks customers to a wealth of applications on the Sybase mobile infrastructure. Two other rapid-deployment solutions we delivered were for our strategic innovations in transportation management. We are now also delivering a spectrum of solutions based on SAP Business Suite, such as an extended version of the SAP CRM rapid-deployment solution, as well as an enhanced version of the Sybase mobile sales software, a new CRM analytics package, and rapid-deployment solutions for planning applications such as SAP SCM Demand Planning. Also in the third quarter, we shipped rapid-deployment solutions for industry software, such as for loans management in banking.

To optimize the channels for our new solutions, we grew our partner ecosystem and worked hard to upskill our partners in the third quarter.

Services

Recent developments

In October we announced the accelerated delivery of business innovations for SAP Business Suite. SAP introduced the software enhancements without disruption on a quarterly schedule in areas where customers can benefit most, including mobility, in-memory computing technology and cloud computing. As a consequence, SAP will extend mainstream maintenance for the core SAP Business Suite 7 applications by five years, from December 2015 through December 2020, giving SAP customers long-term predictability and removing the burden of upgrades across the enterprise for several years. The longer maintenance also applies to SAP NetWeaver and all current SAP enhancement packages for SAP Business Suite.

Development in the third quarter

In August we announced the expansion of SAP MaxAttention services to specifically address the needs of large companies operating in the Chinese market. The premium, on-site support services, custom-tailored for business in China, offer customers there deeper, closer and long-term support.

Solutions Delivered Jointly With Partners

Development in the third quarter

In September we announced that Capgemini is cooperating with Sybase to manage the deployment of enterprise mobility solutions, and will enter into an agreement with SAP to build differentiated mobility solutions.

In September we introduced a “Build and Sell” program that enables SAP channel partners to build, market, and sell analytic applications based on technology from the SAP BusinessObjects portfolio. The program offers partners the means to more easily extend their reach by marketing and selling their intellectual property to others with similar needs throughout the SAP ecosystem.

In July, less than one year following our acquisition of Sybase, we announced that SAP value-added resellers (VARs) currently authorized to sell SAP BusinessObjects solutions and SAP Business All-in-One solutions get the opportunity to sell selected Sybase-branded enterprise mobility apps and solutions for application development, device management, and security, and more.

Development in the previous quarters

At SAPPHIRE NOW in May, SAP and Amazon Web Services announced that a variety of SAP solutions are available on demand via Amazon Web Services. Also at SAPPHIRE NOW, SAP and Dell announced the availability of SAP applications for deployment via Dell’s VIS Next Generation Datacenter Platform, opening up new ways for customers to increase IT responsiveness and business efficiency. Dell’s PowerEdge R910 is among the hardware platforms certified by SAP for running SAP in-memory computing technology.

In the first quarter, SAP and Verizon announced that we would jointly deliver the SAP Customer Relationship Management (SAP CRM) rapid-deployment solution to enterprise workers through Verizon’s flagship cloud offering, Computing as a Service. Workers will be able to access SAP CRM from their desktops or their mobile devices.

In February, HSBC, SAP, and SWIFT announced that we have teamed together to create the next

INTERIM MANAGEMENT REPORT 9

generation of HSBC Connect to SAP, HSBC’s corporate-to-bank integration and treasury solution catering to HSBC’s corporate customers that use enterprise resource planning (ERP) software from SAP.

At the Duet Enterprise Virtual Launch Summit in February, SAP and Microsoft released and announced general availability of Duet Enterprise software, our joint product that connects Microsoft SharePoint 2010 and SAP solutions, providing users easier access to business processes and data. In addition, the companies launched the new Unite Partner Connection program, which will help partners of both companies increase their business opportunities more effectively through a better understanding of Microsoft and SAP joint solutions and product road maps.

Analyst Endorsements

Development in the third quarter

SAP announced in August its top position by IDC in the “Worldwide Financial Accounting Applications 2010 Vendor Share” report. SAP was recognized as a market leader for both “2008-2010 worldwide revenue” and “2010 growth and market share” for financial accounting applications.

In July, we announced our positioning by Gartner in the leaders quadrant of two reports: “Magic Quadrant for Utilities Customer Information Systems (CIS)” and “Magic Quadrant for Enterprise Governance, Risk and Compliance (EGRC) Platforms.”

Development in the previous quarters

In June, IDC named SAP leader in the worldwide BI tools market based on software license and maintenance revenue. IDC also reported that SAP has grown faster than the worldwide market for financial performance and strategy management applications for the fifth consecutive year.

SAP was the overall leader in BI worldwide, according to an April 2011 report issued by Gartner Inc. SAP ranked first with a 23% share of the worldwide BI segment based on 2010 revenue, reflecting our 16.8% revenue growth since 2009.

In May we announced that we had been named a leading vendor by two independent analyst firms serving the financial services sector, Ovum and Forrester Research, Inc. SAP Transactional Banking received the top ranking of “shortlist” from Ovum and is the highest ranked vendor for functionality, while SAP software received a “strong” rating in a Forrester report that examined CRM offerings from

24 vendors with respect to their ability to meet the specific requirements for financial services firms.

In the first quarter, SAP achieved a position in the leaders’ quadrant of the Magic Quadrant for Corporate Performance Management (CPM) Suites report. SAP was recognized by Gartner as a market leader for both its “ability to execute” and its “completeness of vision.”

In January, Ventana Research, a leading benchmark research and advisory services firm, ranked SAP as a top software vendor in its 2011 Value Index for Product Information Management and its 2010 Value Index for Financial Performance Management. SAP earned high marks for its solutions that help organizations establish a single source of product information across the enterprise supply chain.

In January, Gartner positioned SAP in the leaders’ quadrant of the Magic Quadrant for ERP for Product-Centric Midmarket Companies report. SAP was recognized as a market leader for both its “ability to execute” and its “completeness of vision.”

10 INTERIM REPORT JANUARY–SEPTEMBER 2011

CUSTOMERS

In the third quarter of 2011, SAP closed major contracts in key regions.

EMEA

TOTAL SA, Unilever PLC, AOK, DekaBank Deutsche Girozentrale, Givaudan Suisse SA, Royal Bank of Scotland Group Plc

Americas

Automercados S.A. de C. V, Johnson Controls, Inc., American Railcar Industries, Inc, Waters Corporation, Bristol-Myers Squibb Company, Pacific Coast Building Products

Asia Pacific/Japan

Assam Power Distribution Company Ltd., Beijing Toread Outdoor Products Co., Union Steel Mfg. Co., Ltd., Maharashtra State Electricity, Transfield Services Limited, Far East Organization

SAP Business ByDesign

SOUPLETUBE, Markwins International Corp, INFORA GmbH, AbsolutData Research & Analytics, Wireless Advanced Communications, SolarBridge Technologies, Marsulex Environmental Technologies Corp, BIOBASE GmbH

RESEARCH AND DEVELOPMENT

Our total research and development expense rose by 13% to€1,402 million in the first nine months of 2011 compared to€1,243 million in the corresponding period in 2010.

The amounts for 2011 include R&D expense for Sybase, but the comparative amounts for 2010 include Sybase numbers since the acquisition date July 26, 2010.

On our IFRS numbers, the portion of total revenue we spent on research and development in the third quarter of 2011 was 12.8%, which is 2.3 percentage points less than the 15.1% recorded for the third quarter of 2010. This is chiefly because our third-quarter total revenue was 14% greater in 2011 than in 2010 and because we spent less on share-based compensation for our R&D staff in the third quarter of 2011 than in the comparator prior-year period. On the non-IFRS numbers, the portion of total revenue we spent on R&D in the third quarter of 2011 was 12.9%, a 1.6 percentage point increase in comparison with the portion in the third quarter of the previous year, which was 14.5%.

On our IFRS numbers, the portion of total revenue we spent on research and development in the first nine months of 2011 was 14.4%, which is 0.4 percentage points less than the 14.8% recorded for the first nine months in 2010. This because while total revenue for the first nine months was 17% greater, R&D spending for the same period increased less steeply, at 13%. Those numbers include the greater acquisition-related expenses arising out of Sybase acquisition in 2010. On the non-IFRS numbers, the portion of our total revenue we spent on R&D in the first nine months of 2011 was 14.0%, a 0.5 percentage point decrease in comparison with the portion in the first nine months of the previous year, which was 14.5%.

We had 15,807 full-time equivalent (FTE) employees working in research and development teams on September 30, 2011, which is relatively constant compared with the corresponding period in 2010 (September 30, 2010: 15,775; December 31, 2010: 15,884).

In February, we announced that we would build an innovation center in Potsdam, Germany, where we will develop new software solutions in cooperation with customers. The building at the new location will have space for 150 staff. The center will eventually have over 100 permanent employees, and be used by up to 200 students and doctorate students. With the innovation center, SAP will continue to drive momentum for innovative and customer-oriented solutions. SAP plans to invest€15.8 million in the new location.

ACQUISITIONS

Third quarter

In September 2011 SAP acquired Right Hemisphere, a leading provider of visual enterprise solutions based in San Ramon, California, and Auckland, New Zealand. The 3-D model-based visualization and communications technologies from Right Hemisphere will enhance SAP software solutions and enable visual navigation and interrogation of an entire product or asset and all its associated data in one, unified environment.

In September 2011, SAP announced its intention to acquire Crossgate, a company that provides hosted business-to-business integration services. We expect that the antitrust authorities will give their clearance to the acquisition in the final quarter of 2011. Crossgate’s integration services enable companies to connect with their trading partners, customers, and suppliers, allowing them to exchange data securely regardless of their technical

INTERIM MANAGEMENT REPORT 11

capabilities. Headquartered in Munich, Germany, Crossgate helps more than 40,000 business partners across multiple industries to securely exchange important documents and data. Through this acquisition, SAP can enable networking at the enterprise level, providing an easy way for customers to collaborate and share data with their trading partners.

Previous quarters

In February 2011, SAP acquired security, identity and access management software, as well as assets including development and consulting resources from SECUDE, a leading vendor of application security solutions in Switzerland. SAP will include Secure Login and Enterprise Single Sign-On in its product portfolio to provide its customers with secure client-server communications for their SAP systems.

EMPLOYEES

At the end of the third quarter of 2011, our employee headcount in full-time equivalents was 54.589 (September 30, 2010: 52.921; December 31, 2010: 53,513). Thereof 15.811 were based in Germany (September 30, 2010: 15.464; December 31, 2010: 15,633) and 10.340 in the United States (September 30, 2010: 10.098; December 31, 2010: 10,194).

ORGANIZATION AND CHANGES IN MANAGEMENT

In July, Angelika Dammann, a member of the Executive Board, left SAP for personal reasons. On a provisionary basis, SAP CFO Werner Brandt assumes the duties of Dammann’s global HR leadership and labor relations role.

12 INTERIM REPORT JANUARY–SEPTEMBER 2011

OPERATING RESULTS, FINANCES, AND ASSETS

In the sections that follow, our operating results, finances and assets are discussed in detail. It must be borne in mind that the 2011 amounts include expenses and software revenue for Sybase, but the comparative amounts for 2010 do only partially. We acquired Sybase on July 26, 2010. Therefore, the Sybase numbers in 2010 are included since the acquisition date.

Performance against our Outlook for 2011 (Non-IFRS)

In this section, all discussion of the first nine months’ contribution to target achievement is based exclusively on non-IFRS measures. However, in the following section the discussion of results refers to IFRS figures only, so those figures are therefore not expressly identified as IFRS figures.

We present, discuss, and explain the reconciliation from IFRS measures to non-IFRS measures in the “Additional Financial Information (Unaudited)” section and online at www.sap.com/corporate-en/investors/reports.

Our outlook for operating profit and the thereof resulting operating margin in 2011 and their 2010 comparative amounts are based on amended non-IFRS definitions that exclude expenses for share-based payments and restructuring compared to 2010. Our prior year figures have been adjusted accordingly.

Operational Targets for 2011 (Non-IFRS)

For our outlook based on non-IFRS numbers, we refer to the passage “Forecast for SAP” in this interim management report.

Key Figures – SAP Group 7/1/-9/30/2011 (Non-IFRS)

Non-IFRS

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | 7/1/-9/30/

2011 | | | 7/1/-9/30/

2010 | | | Change in % | | | Change in %

(constant

currency) | |

Software revenue | | | 841 | | | | 656 | | | | 28 | | | | 32 | |

Support revenue | | | 1,758 | | | | 1,595 | | | | 10 | | | | 13 | |

Software and software-related service revenue | | | 2,692 | | | | 2,352 | | | | 14 | | | | 18 | |

Total revenue | | | 3,410 | | | | 3,039 | | | | 12 | | | | 15 | |

Operating expense | | – | 2,279 | | | – | 2,124 | | | | 7 | | | | 10 | |

Operating profit | | | 1,131 | | | | 915 | | | | 24 | | | | 27 | |

Operating margin in % | | | 33.2 | | | | 30.1 | | | | 3.1pp | | | | 3.0pp | |

Profit after tax | | | 860 | | | | 629 | | | | 37 | | | | n.a. | |

Effective tax rate in % | | | 23.3 | | | | 28.5 | | | | –5.2pp | | | | n.a. | |

Earnings per share – basic in€ | | | 0.72 | | | | 0.53 | | | | 36 | | | | n.a. | |

Actual Performance in the Third Quarter of 2011 (Non-IFRS)

In the third quarter of 2011, software and software-related service revenue (non-IFRS) increased by 14% over the same period in the previous year to€2,692 million (Q3 2010:€2,352 million). On a constant currency basis, the increase was 18%.

Non-IFRS total revenue in the same period was€3,410 million (Q3 2010:€3,039 million), an increase of12%. On a constant currency basis, the increase was 15%.

Non-IFRS operating profit was€1,131 million (Q3 2010:€915 million), an increase of 24% (27% at constant currencies).

The operating margin (non-IFRS) widened in the third quarter of 2011 by 3.1 percentage points to 33.2% compared to the prior year’s third quarter (Q3 2010: 30.1%). At constant currencies, the operating margin (non-IFRS) increased by 3.0 percentage points to 33.1%.

In the third quarter of 2011 non-IFRS profit after tax was€860 million (Q3 2010:€629 million), an increase of 37%. Non-IFRS basic earnings per share was€0.72 (Q3 2010:€0.53), an increase of 36%.

The non-IFRS effective tax rate in the third quarter of 2011 was 23.3% (Q3 2010: 28.5%). The year over year decrease in the effective tax rate mainly results from tax effects relating to intercompany financing.

INTERIM MANAGEMENT REPORT 13

Key Figures – SAP Group 1/1/-9/30/2011 (Non-IFRS)

Non-IFRS

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | 1/1/-9/30/

2011 | | | 1/1/-9/30/

2010 | | | Change in % | | | Change in %

(constant

currency) | |

Software revenue | | | 2,226 | | | | 1,757 | | | | 27 | | | | 31 | |

Support revenue | | | 5,119 | | | | 4,515 | | | | 13 | | | | 15 | |

Software and software-related service revenue | | | 7,623 | | | | 6,557 | | | | 16 | | | | 18 | |

Total revenue | | | 9,759 | | | | 8,442 | | | | 16 | | | | 18 | |

Operating expense | | – | 6,830 | | | – | 6,057 | | | | 13 | | | | 15 | |

Operating profit | | | 2,929 | | | | 2,386 | | | | 23 | | | | 25 | |

Operating margin in % | | | 30.0 | | | | 28.3 | | | | 1.7pp | | | | 1.7pp | |

Profit after tax | | | 2,091 | | | | 1,629 | | | | 28 | | | | n.a. | |

Effective tax rate in % | | | 26.7 | | | | 27.1 | | | | –0.4pp | | | | n.a. | |

Earnings per share – basic in€ | | | 1.76 | | | | 1.37 | | | | 28 | | | | n.a. | |

Actual Performance in the First Nine Months of 2011 (Non-IFRS)

In the first nine months of 2011, software and software-related service revenue (non-IFRS) increased by 16% over the same period in the previous year to€7,623 million (first nine months of 2010:€6,557 million). On a constant currency basis, the increase was 18%.

Non-IFRS total revenue in the same period was€9,759 million (first nine months of 2010:€8,442 million), an increase of 16%. On a constant currency basis, the increase was 18%.

Non-IFRS operating profit was€2,929 million (first nine months of 2010:€2,386 million), an increase of 23% (25% at constant currencies).

The operating margin (non-IFRS) widened in the first nine months of 2011 by 1.7 percentage point to 30.0% compared to the prior year’s first nine months (first nine months of 2010: 28.3%). At constant currencies, the operating margin widened by 1.7 percentage points to 30.0%.

In the first nine months of 2011, non-IFRS profit after tax was€2,091 million (first nine months of 2010:€1,629 million), an increase of 28%. Non-IFRS basic earnings per share was€1.76 (first nine months of 2010:€1.37), an increase of 28%. The non-IFRS effective tax rate in the first nine months of 2011 was 26.7% (first nine months of 2010: 27.1%).

14 INTERIM REPORT JANUARY–SEPTEMBER 2011

Key Figures SAP Group in the Third Quarter of 2011

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | 7/1/-9/30/

2011 | | | 7/1/-9/30/

2010 | | | Change | | | Change in % | |

Software revenue | | | 841 | | | | 656 | | | | 185 | | | | 28 | |

Support revenue | | | 1,757 | | | | 1,559 | | | | 198 | | | | 13 | |

Software and software-related service revenue | | | 2,691 | | | | 2,316 | | | | 375 | | | | 16 | |

Total revenue | | | 3,409 | | | | 3,003 | | | | 406 | | | | 14 | |

Operating expense | | | –1,650 | | | | –2,287 | | | | 637 | | | | –28 | |

Operating profit | | | 1,759 | | | | 716 | | | | 1,043 | | | | 146 | |

Operating margin in % | | | 51.6 | | | | 23.8 | | | | 27.8pp | | | | n.a. | |

Profit after tax | | | 1,251 | | | | 501 | | | | 750 | | | | 150 | |

Effective tax rate in % | | | 28.7 | | | | 27.3 | | | | 1.4pp | | | | n.a. | |

Headcount in full-time equivalents (September 30) | | | 54,589 | | | | 52,921 | | | | 1,668 | | | | 3 | |

Days sales outstanding in days (September 30) | | | 62 | | | | 70 | | | | –8 | | | | –11 | |

Earnings per share – basic in€ | | | 1.05 | | | | 0.42 | | | | 0.63 | | | | 150 | |

OPERATING RESULTS IN THE THIRD QUARTER (IFRS)

Orders

The total number of new software deals we closed grew 13% in the third quarter of 2011 to 14,379 (Q3 2010: 12,728). The average value of software orders we received showed a substantial increase of 25% compared with the previous year.

Revenue

In the third quarter of 2011, software revenue was€841 million (Q3 2010:€656 million), an increase of 28% compared to the same period in 2010. Software revenues in the third quarter of 2011 included an amount of€34 million from HANA (Q3 2010:€0).

Our software and software-related service revenue was€2,691 million (Q3 2010:€2,316 million), an increase of 16% compared to the same period in 2010.

Total revenue was€3,409 million (Q3 2010:€3,003 million), an increase of 14% compared to the same period in 2010.

Operating Expenses

In the third quarter of 2011, our operating expenses decreased 28% to€1,650 million (Q3 2010:€2,287 million), Because the Court in the TomorrowNow litigation reduced the damages awarded against us from US$1.3 billion to US$272 million, we were able to release€723 million from the related provision that we recorded in the final quarter of 2010. This contributed to reduction in operating expenses. For more information about the TomorrowNow litigation, see the Notes to the Consolidated Interim Financial Statements section, Note (13).

Operating Profit and Margin

In the third quarter of 2011, operating profit increased by 146% over the same period in the previous year to€1,759 million (Q3 2010:€716 million).

Our operating margin increased 27.8 percentage points to 51.6% (Q3 2010: 23.8%). In the third quarter of 2011, effects from our discontinued TomorrowNow operation had a 21.2 percentage point positive influence on operating margin (Q3 2010: -1.5 percentage points).

Profit after Tax and Earnings per Share

In the third quarter of 2011 profit after tax was€1,251 million (Q3 2010:€501 million), an increase of 150%. The increase was due largely to the release of part of the provision we had recorded for the TomorrowNow litigation. Basic earnings per share was€1.05 (Q3 2010:€0.42), an increase of 150%.

The effective tax rate in the third quarter of 2011 was 28.7% (Q3 2010: 27.3%). The year over year increase in the effective tax rate mainly results from a decrease in the provision recorded for the TomorrowNow litigation which was partly compensated by effects relating to intercompany financing.

INTERIM MANAGEMENT REPORT 15

Key Figures SAP Group in the First Nine Months of 2011

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | 1/1/-9/30/

2011 | | | 1/1/-9/30/

2010 | | | Change | | | Change in % | |

Software revenue | | | 2,226 | | | | 1,757 | | | | 469 | | | | 27 | |

Support revenue | | | 5,093 | | | | 4,479 | | | | 614 | | | | 14 | |

Software and software-related service revenue | | | 7,597 | | | | 6,521 | | | | 1,076 | | | | 17 | |

Total revenue | | | 9,733 | | | | 8,406 | | | | 1,327 | | | | 16 | |

Operating expense | | | –6,520 | | | | –6,359 | | | | –161 | | | | 3 | |

Operating profit | | | 3,213 | | | | 2,047 | | | | 1,166 | | | | 57 | |

Operating margin in % | | | 33.0 | | | | 24.4 | | | | 8.6pp | | | | n.a. | |

Profit after tax | | | 2,242 | | | | 1,379 | | | | 863 | | | | 63 | |

Effective tax rate in % | | | 28.7 | | | | 26.9 | | | | 1.8pp | | | | n.a. | |

Earnings per share – basic in€ | | | 1.88 | | | | 1.16 | | | | 0.73 | | | | 62 | |

OPERATING RESULTS IN THE FIRST NINE MONTHS (IFRS)

Orders

The total number of new software deals we closed grew 26% in the first nine months of 2011 to 41,275 (first nine months of 2010: 32,785). The average value of software orders we received showed an increase of 16% compared with the previous year.

Revenue

In the first nine months of 2011, software revenue was€2,226 million (first nine months of 2010:€1,757 million), an increase of 27% compared to the same period in 2010. Software revenues in the first nine months of 2011 included an amount of€61 million from HANA.

Our software and software-related service revenue was€7,597 million (first nine months of 2010:€6,521 million), an increase of 17% compared to the same period in 2010.

Total revenue was€9,733 million (first nine months of 2010:€8,406 million), an increase of 16% compared to the same period in 2010.

Operating Expenses

In the first nine months of 2011, our operating expenses increased 3% to€6,520 million (first nine months of 2010:€6,359 million). The increase in operating expenses is on the one hand due to expenses in connection with the acquisition of Sybase that were only included since the acquisition date July 26, 2010 in the comparator period of the prior year, as well as an increase in personnel costs, acquisition-related charges and an increase in expenses relating directly to the gain in total revenue for the first nine months, such as sales expense. Also, operating expenses were positively influenced by the release of part of the

provision we had recorded for the TomorrowNow litigation. For more information about the TomorrowNow litigation, see the Notes to the Consolidated Interim Financial Statements section, Note (13).

The chief cause of the rise in personnel expense was the increase in headcount.

Operating Profit and Margin

Our nine-month operating profit increased 57% to€3,213 million year over year (first nine months of 2010:€2,047 million).

Our operating margin widened 8.6 percentage points to 33.0% (first nine months of 2010: 24.4%). Thereof 7.3 percentage points result from effects of our discontinued TomorrowNow operation (first nine months of 2010: -0.5 percentage points).

Profit after Tax and Earnings per Share

In the first nine months of 2011 profit after tax was€2,242 million (first nine months of 2010:€1,379 million), an increase of 63%. Basic earnings per share was€1.88 (first nine months of 2010:€1.16), an increase of 62%.

The effective tax rate in the first nine months of 2011 was 28.7% (first nine months of 2010: 26.9%). The year over year increase in the effective tax rate mainly results from a decrease in the provision recorded for the TomorrowNow litigation which was partly compensated by effects relating to intercompany financing.

16 INTERIM REPORT JANUARY–SEPTEMBER 2011

FINANCES (IFRS)

Cash Flow and Liquidity

Operating cash flow for the first nine months of 2011 was€2,966 million (September 30, 2010:€2,052 million), our highest nine months figure ever. The increase in operating cash flow was due mainly to strong growth in revenue in the previous quarters. Improvements in our working capital management also reduced our average collection period.

Our cash flow increased substantially in comparison with the corresponding period last year because, among other things, last year we invoiced support fees later. Having introduced a two-tier support model, we decided in early 2010 not to invoice customers until they had told us which of the options they were choosing. In consequence, first nine months’ operating cash flow was lower than usual in 2010.

Group liquidity stood at€4,929 million on September 30, 2011 (December 31, 2010:€3,528 million). Group liquidity comprised cash and cash equivalents totaling€3,911 million (December 31, 2010:€3,518 million) and short-term investments totaling€1,018 million (December 31, 2010:€10 million). The significant increase in short-term investments was mainly due to investments in fixed-term deposits and German government bonds.

Group Liquidity of SAP Group

| | | | | | | | | | | | |

€ millions | | Septem-

ber 30,

2011 | | | Decem-

ber 31,

2010 | | | Change | |

Cash and cash equivalents | | | 3,911 | | | | 3,518 | | | | 393 | |

| | | |

Short-term investments | | | 1,018 | | | | 10 | | | | 1,008 | |

| | | |

Group Liquidity - gross | | | 4,929 | | | | 3,528 | | | | 1,401 | |

| | | |

Current bank loans | | | 1 | | | | 1 | | | | 0 | |

| | | |

Net liquidity 1 | | | 4,928 | | | | 3,527 | | | | 1,401 | |

| | | |

Non-current bank loans | | | 101 | | | | 1,106 | | | | –1,005 | |

| | | |

Private placement transactions | | | 1,623 | | | | 1,071 | | | | 552 | |

Bond | | | 2,200 | | | | 2,200 | | | | 0 | |

Net liquidity 2 | | | 1,004 | | | | –850 | | | | 1,854 | |

Net liquidity 1 is total group liquidity minus current bank loans. Current bank loans comprise overdrafts only.

Net liquidity 2, defined as group liquidity minus bank loans, private placement transactions, and bonds, was€1,004 million (December 31, 2010: -€850 million). Our strong operating cash flow in the

first nine months of 2011 was the main reason for the improvement in net liquidity 2 since December 31, 2010. The increase in private placement liabilities in the first nine months of 2011 compared with December 31, 2010, results from a US$750 million private placement transaction concluded in the United States on June 1, 2011. The transaction enhances the Group’s financial flexibility by broadening its investor base and extending its maturity profile. Proceeds of the issue were used to repay existing Group financial debt incurred to finance the Sybase acquisition. A group of 16 institutional investors participated in the two tranches: a US$600 million tranche with a five-year term, and a US$150 million tranche with a seven-year term. The coupon was less than 3.5% on both tranches.

Free Cash Flow and Days’ Sales Outstanding

Our free cash flow and our days’ sales outstanding (DSO) on September 30, 2011 were as follows:

Free Cash Flow

| | | | | | | | | | | | |

€ millions | | Septem-

ber 30,

2011 | | | Septem-

ber 30,

2010 | | | Change in

% | |

Free cash flow | | | 2,637 | | | | 1,852 | | | | 42 | |

We calculate free cash flow as net cash from operating activities minus purchases of intangible assets and property, plant, and equipment.

Days‘ Sales Outstanding

| | | | | | | | | | | | |

| | | Septem-

ber 30,

2011 | | | Decem-

ber 31,

2010 | | | Change in

days | |

Days sales outstanding (DSO) in days | | | 62 | | | | 65 | | | | –3 | |

DSO measures the length of time it takes to collect receivables. SAP calculates DSO by dividing the average invoiced accounts receivables balance of the last 12 months by the average monthly sales of the last 12 months.

ASSETS (IFRS)

Analysis of Consolidated Statements of Financial Position

The total assets of the Group were€21,239 million on September 30, 2011, and were thus practically constant compared with€20,839 million on December 31, 2010.

The equity ratio was 53% on September 30, 2011, which was a improvement compared to the 47% on

INTERIM MANAGEMENT REPORT 17

December 31, 2010. The reason for this are the good results in the first nine months of the current fiscal year.

Investments

Our capital expenditures for property, plant, and equipment and intangible assets increased to€329 million for the first nine months of 2011 (December 31, 2010:€287 million). This increase can mainly be traced back to an increase in spending on IT hardware, software, and cars.

Off-Balance-Sheet Financial Instruments

There are no off-balance-sheet financial instruments, such as sale-and-lease-back transactions, asset-backed securities, and liabilities related to special-purpose entities, that are not disclosed in our interim Consolidated Financial Statements. Any factoring contracts are not material in volume.

Competitive Intangibles

The assets that are the basis for our current and future success do not appear on the Consolidated Statements of Financial Position. This is apparent from a comparison of the market capitalization of SAP AG, which was€47.0 billion, with the equity of the SAP Group on the Consolidated Statements of Financial Position, which was€11.3 billion at the end of the third quarter of 2011 (December 31, 2010:€9.8 billion). This means that the market capitalization of our equity is 416% higher than the book value.

As per the 2011 Interbrand annual survey of the Best Global Brands, SAP’s brand value has increased 14% to US $14.5 billion, adding US $1.8 billion to our brand value in the past year. Furthermore, SAP is ranked the 24th most valued brand in the world, up from 26th place in 2010 and our highest rank to date. This puts SAP among the best, placing us ahead of Nike, Amazon.com, and just behind Pepsi and American Express.

Customer capital, our employees and their knowledge and skills, our ecosystem of partners, the SAP brand, and our past investments in research and development are some of the most important competitive intangibles that influence our market value.

SUSTAINABILITY

Building on our commitment to sustainability, we released our unaudited quarterly sustainability update for the third quarter of 2011 in October.

Our greenhouse gas (GHG) emissions for the quarter ended September 30, 2011, totaled 112 kilotonnes (not including Sybase), a 2% increase compared to the third quarter of 2010. While our employee base increased in size, our emissions per employee (in full-time equivalents) decreased by 2% since the third quarter of 2010 and 3% since the second quarter of 2011.

While air travel continues to contribute heavily to our overall GHG emissions, the number of business flights decreased by 6% compared to the second quarter of 2011. Our company cars are another example of efficiency: year over year the number of cars increased by 10% but emissions only went up by 5%.

From the start of 2008 to today, SAP has realized approximately€195 million in cost avoidance, in comparison with a “business as usual” extrapolation.

We are still on track to meet our year-end emissions target of 460 kilotons — in line with our long-term target of reducing GHG emissions to year-2000 levels by 2020.

This quarter, we have become one of the first companies in the world to start adhering to the corporate value chain emissions standard (Scope 3), which was recently launched by the Greenhouse Gas Protocol. It was developed in a multi-stakeholder process by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD).

It is our goal to have women in 25% of our leadership positions by 2017. For the third quarter of 2011, 18.6% of those in leadership positions were women, up from 18.2% at the end of the second quarter of 2011. In the third quarter of 2011, we held our SAP Global Diversity Days, which brought together 8,000 employees across 30 offices in 20 countries to drive diversity awareness and education.

18 INTERIM REPORT JANUARY–SEPTEMBER 2011

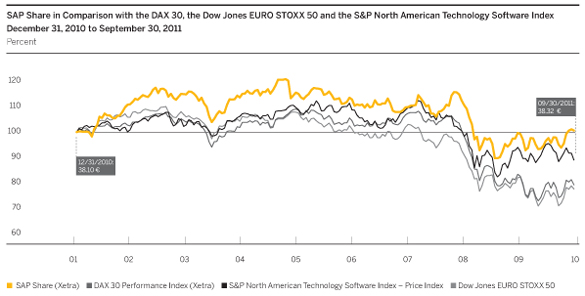

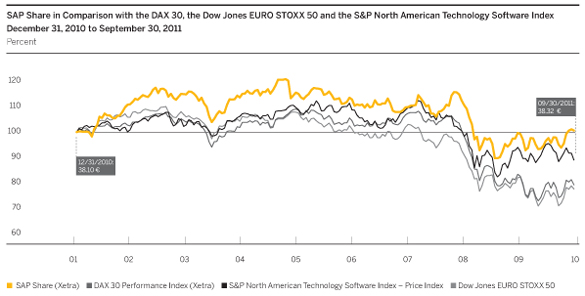

SAP STOCK

SAP AG common stock is listed on the Frankfurt Stock Exchange as well as a number of other German exchanges. On the New York Stock Exchange (NYSE), SAP American depositary receipts (ADRs), each representing one common share, trade under the symbol SAP. SAP is a component of the DAX, the index of 30 German blue chip companies, the Dow Jones EURO STOXX 50, the S&P North American Technology Software Index, and the TechPGI.

SAP stock started the third quarter at closing price of€41.75 (Xetra) on June 30, and thanks to impressive second-quarter results, reached its peak of€44.02 on July 27 for the three month period. At

the beginning of August, however, fears about sovereign debt in the euro area coupled with concerns about the development of the global economy, especially in the U.S. marketplace, increased dramatically, which led to a massive drop in share prices worldwide. SAP stock subsequently fell to€34.26 on August 19, its lowest price of the quarter.

Fears of recession continued to negatively affect the markets for the rest of the reporting period. Positive news from companies in the IT sector bolstered SAP stock creating a positive climate in the software market, and as a result, SAP stock ended the quarter at€38.32.

When comparing the DAX 30 and EURO STOXX 50 benchmark indexes, we see just how stable SAP stock was in the first nine months of fiscal year 2011. The two comparator indexes posted losses of 20.4% and 22% respectively, while SAP stock rose 0.6% during the same period.

Additional information about SAP common stock is available on Bloomberg under the symbol SAP GR, on Reuters under SAPG.F, on Quotron under SAGR.EU, and on the SAP Web site at www.sap.com/investor.

INTERIM MANAGEMENT REPORT 19

RISK AND OPPORTUNITY MANAGEMENT

We have comprehensive risk management structures in place, which are intended to enable us to recognize and analyze risks early and to take the appropriate action.

Economic instability in the euro area and civil and political unrest in the Middle East and North Africa have so far had only minor negative impact on our business. However, it is very difficult to judge how the situation will develop and we cannot make any reliable judgments at this stage about the possible effects of events on our business. We cannot exclude the possibility that they may negatively impact our financial position, cash flows, profit, or stock price.

We believe that risks in relation to earthquakes in Japan and subsequent events have slightly decreased. The economic consequences of such events cannot be foreseen with complete accuracy.

For changes in our legal liability risks since our last annual report, see note (13) in the Notes to the Interim Financial Statements. The other risk factors remain largely unchanged since 2010, and are discussed more fully in our 2010 Annual Report and our Annual Report on Form 20-F for 2010. We do not believe the risks we have identified jeopardize our ability to continue as a going concern.

OUTLOOK

Future Trends in the Global Economy

The global economy is now expected to grow only a little in 2011 – and less than was forecast earlier in the year – according to organizations such as the European Central Bank (ECB), the Organization for Economic Co-operation and Development (OECD), and the International Monetary Fund (IMF). This mostly follows a change of mood on the international financial markets in the third quarter.

Those organizations have revised their predictions for growth in the EMEA region. For example, they now expect the economy of the euro area to grow only by a percentage in the low single digits in 2011. Their explanation is that volatility on the financial markets and the sovereign debt crises in Greece and some other countries that use the euro are undermining the entire European economy. In the Middle East and North Africa, continuing political unrest is expected to hold back economic progress.

Economic recovery is also expected to slow in the coming months in the Americas region. Unhelpful

financial market conditions are restraining U.S. economic growth in particular. Currently, consumer demand cannot compensate for the demand of government stimulus packages, which are drying up. On the brighter side, shipments to Japan are expected gradually to return to normal as the disruption caused by the earthquake comes to an end. This is expected to afford more economic stability.

Divergent economic trends are expected to continue into the future within the APJ region. Whereas the emerging economies in Asia are expected to continue to growing vigorously – if not quite so vigorously as earlier in the year – the Japanese economy is not expected to grow at all year over year. Gradually, Japan is recovering from the earthquake in March. Reconstruction work is strengthening the economy; supply bottlenecks are being cleared.

How the global economy as a whole performs will depend very much on how quickly the financial sector recovers and how quickly the advanced economies regain control of sovereign debt.

The IT Market

The market for information technology will grow twice as fast as the global economy over 2011, according to IDC’s latest projections for the industry. As three months ago, IDC still expects worldwide IT sales growth in the higher single-digit percentages for the full year. It foresees growth in the middle of the single-digit range in the software and services segments, and double-digit growth in the hardware segment.

IDC has now dampened expectations for 2011 EMEA region growth in the IT market to a medium single-digit percentage. This is because of the sluggish growth in European IT markets reflecting equally listless economic recovery in Europe. IDC believes the market will remain healthier in Germany than elsewhere in Western Europe.

From the Americas region, IDC reports that U.S. companies are keeping a sharp eye on the world economy. Should the situation worsen, they would revise plans to invest in IT in the fourth quarter of 2011, it says. In contrast, in Latin America IDC sees a positive outlook for IT sales.

A divergent IT market in the Asia Pacific Japan (APJ) region will continue to move in two directions at once for the rest of this year, IDC predicts. Although Japan is recovering from the March earthquake and reconstruction work is benefiting the economy, IDC does not expect anything more

20 INTERIM REPORT JANUARY–SEPTEMBER 2011

encouraging than low single-digit IT market growth there for the year. On the other hand, it expects IT sales to increase by double-digit percentages in the emerging Asian economies.

In the months to come, the debt crisis, high levels of unemployment, and inflation could hamper growth in global IT markets. However, it is also possible that global recovery will encourage the market for IT to drive forward, IDC says.

Forecast for SAP

Operational Targets for 2011 (Non-IFRS)

Business Outlook

SAP’s pipeline continues to remain very strong and companies continue to invest in IT, in particular in innovative software solutions. During the last few months, uncertainty has risen from a macroeconomic pespektive. The primary reasons for this are the lingering negotiations to find a solution for the crisis in Greece and the increasing discussions about the financial situation of other European countries, such as Italy, Spain and Portugal. Furthermore, there are fears about the possible implications of sovereign insolvency on the world wide banking system and the increasing pessimism from various economic research institutes. The high national debt of the United States and Japan are also causing some problems. Due to the ongoing uncertain macroeconomic environment, the Company’s outlook for the full year 2011 remains unchanged from its previous guidance reported on July 26th, 2011 (except for the IFRS effective tax rate).

The Company expects full-year 2011 non-IFRS software and software-related service revenue to increase in a range of 10% – 14% at constant currencies (2010:€9.87 billion), but expects to reach the high end of the range.

The Company expects full-year 2011 non-IFRS operating profit to be in a range of€4.45 billion –€4.65 billion at constant currencies (2010:€4.01 billion), but expects to reach the high end of the range, resulting in 2011 non-IFRS operating margin increasing in a range of 0.5 – 1.0 percentage points at constant currencies (2010: 32.0%).

The Company projects a full-year 2011 IFRS effective tax rate of 28.5% – 29.5% (2010: 22.5%) and a non-IFRS effective tax rate of 27.5% – 28.5% (2010: 27.3%).

Differences Between IFRS and Non-IFRS Measures

As noted above, our guidance is based on Non-IFRS measures at constant currencies. The following provides additional insight into the impact of the constant currency notion and the items by which our IFRS measures and non-IFRS measures differ:

The following table shows the differences between IFRS and Non-IFRS measures in our operating profit:

| | | | | | | | |

Non-IFRS Measures (in€ million) | | Actual

Amounts

from 2010 | | | Estimated

amounts for

20111) | |

Deferred support revenue write-down | | | 74 | | |

| between 20

and 30 |

|

| | |

Discontinued activities2) | | | 983 | | | | -700 | |

| | |

Stock-based compensation expenses3),4) | | | 58 | | |

| between 80

and 120 |

|

| | |

Acquisition-related charges5) | | | 300 | | |

| between 430

and 460 |

|

| | |

Restructuring | | | 3 | | | | less than 10 | |

1) All adjusting items are partly incurred in currencies other than the euro. Consequently, the amounts are subject to currency volatility. All estimates for 2011 provided in the table are at actual currency and are calculated based on certain assumptions regarding the developments of the different currency exchange rates. Depending on the future development of these exchange rates the total amounts for 2011 may differ significantly from the estimates provided in the table above. Please remember that SAP’s financial market outlook is based on constant currency.

2) We will consider all new information that emerges from further developments of the TomorrowNow lawsuit to determine if the provision should be adjusted in the future furthermore, which could result in a change to the estimate provided in the table above.

3) Our share-based payment expenses are subject, among other factors, to share price volatility, volatility in SAP’s performance against the Tech PGI index and fluctuations in SAP’s workforce. The estimates in the table above are based on certain assumptions regarding these factors. Depending on the future development of these factors the total expense for 2011 may differ significantly from these estimates.

4) The estimates provided above for share-based payment expenses are based on the share-based payment plans in place on the day of this document and grants under these plans in 2011 as currently planned by management. New share-based payment plans or changes to the existing plans may make the total amounts for 2011 differ significantly from these estimates.

5) The estimates provided above for acquisition-related charges/restructuring are based on the acquisitions performed by SAP until the day of this document. Further acquisitions may make the total amounts for 2011 differ significantly from these estimates.

Historically, every 1% impact on total revenue resulting from foreign currency movements has

INTERIM MANAGEMENT REPORT 21

resulted in a 10-15 basis point movement in the operating margin.

If exchange rates remained unchanged at the September 2011 level for the remainder of the year, our 2011 total year Non-IFRS SSRS revenues at actual currencies as well as our Non-IFRS total revenues at actual currencies would both be approximately 1% lower than the respective constant currency numbers, and our Non-IFRS operating margin at actual currencies would be on the same level than the respective constant currency margin.

Goals for Liquidity, Finance, Investments and Dividends

Our goals for liquidity, finance, investments and dividends as discussed in our Annual Report 2010 are unchanged:

We have been in positive net liquidity since the end of the first quarter of 2011 and we seek to remain in that position at the end of the year. We will reduce our current financial debt level according to the given maturity profile. We will consider issuing new debt, such as bonds or U.S. private placements, only if market conditions are advantageous. Given SAP’s strong free cash flow generation over the first nine months of 2011, the Company plans to further evaluate buying back shares in the future.

Excepting acquisitions, our planned capital expenditures for 2011 will be covered in full by operating cash flow.

We have not changed our objective of returning about 30% of our net income to our shareholders through dividend payments.

Premises on Which our Outlook is Based

In preparing our outlook guidance, we have taken into account all events known to us at the time we prepared these interim financial statements that could influence SAP’s business going forward.

Among the premises on which this outlook is based are those presented concerning economic development and our expectation there will not be any effects in 2011 from a major acquisition.

Medium-Term Prospects

Our medium-term prospects as discussed in our 2010 Annual Report and our 2010 annual report on Form 20 F did not change in the first nine months of 2011. We still aim to increase our annual total revenue to at least€20 billion by the middle of the present decade. Over the same period, we aim to widen our non-IFRS operating margin to 35% by average annual increments of up to 100 basis points. To achieve these objectives, we are planning to realign our organizational structure to further drive growth, innovation, and simplicity.

22 INTERIM REPORT JANUARY–SEPTEMBER 2011

CONSOLIDATED INTERIM FINANCIAL STATEMENTS - IFRS (Unaudited)

| | | | |

Consolidated Income Statements of SAP Group – Quarter | | | 23 | |

Consolidated Statements of Comprehensive Income of SAP Group – Quarter | | | 24 | |

Consolidated Income Statements of SAP Group – First Nine Months | | | 25 | |

Consolidated Statements of Comprehensive Income of SAP Group – First Nine Months | | | 26 | |

Consolidated Statements of Financial Position of SAP Group | | | 27 | |

Consolidated Statements of Changes in Equity of SAP Group | | | 29 | |

Consolidated Statements of Cash Flows of SAP Group | | | 30 | |

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

| | | | |

(1) General Information about the Consolidated Financial Statements | | | 31 | |

(2) Scope of Consolidation | | | 31 | |

(3) Summary of Significant Accounting Policies | | | 31 | |

(4) Business Combinations | | | 32 | |

(5) Employee Benefits Expense and Headcount | | | 33 | |

(6) Income Tax | | | 34 | |

(7) Earnings per Share | | | 34 | |

(8) Other Financial Assets | | | 35 | |

(9) Trade and Other Receivables | | | 35 | |

(10) Financial Liabilities | | | 36 | |

(11) Total Equity | | | 36 | |

(12) Contingent Liabilities | | | 36 | |

(13) Litigation and Claims | | | 36 | |

(14) Share-Based Payment Plans | | | 38 | |

(15) Other Financial Instruments | | | 39 | |

(16) Segment and Geographic Information | | | 39 | |

(17) Related Party Transactions | | | 42 | |

CONSOLIDATED INTERIM FINANCIAL STATEMENTS – IFRS 23

CONSOLIDATED INCOME STATEMENTS

for the three months ended September 30

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | Note | | | 2011 | | | 2010 | | | Change

in % | |

Software revenue | | | | | | | 841 | | | | 656 | | | | 28 | |

Support revenue | | | | | | | 1,757 | | | | 1,559 | | | | 13 | |

Subscription and other software-related service revenue | | | | | | | 93 | | | | 101 | | | | –8 | |

Software and software-related service revenue | | | | | | | 2,691 | | | | 2,316 | | | | 16 | |

Consulting revenue | | | | | | | 578 | | | | 565 | | | | 2 | |

Other service revenue | | | | | | | 140 | | | | 122 | | | | 15 | |

Professional services and other service revenue | | | | | | | 718 | | | | 687 | | | | 5 | |

Total revenue | | | | | | | 3,409 | | | | 3,003 | | | | 14 | |

| | | | |

Cost of software and software-related services | | | | | | | –513 | | | | –469 | | | | 9 | |

Cost of professional services and other services | | | | | | | –537 | | | | –530 | | | | 1 | |

Research and development | | | | | | | –436 | | | | –453 | | | | –4 | |

Sales and marketing | | | | | | | –721 | | | | –642 | | | | 12 | |

General and administration | | | | | | | –168 | | | | –157 | | | | 7 | |

Restructuring | | | (6 | ) | | | –1 | | | | 2 | | | | –150 | |

TomorrowNow litigation | | | | | | | 723 | | | | –45 | | | | –1,707 | |

Other operating income/expense, net | | | | | | | 3 | | | | 7 | | | | –57 | |

Total operating expenses | | | | | | | –1,650 | | | | –2,287 | | | | –28 | |

| | | | |

Operating profit | | | | | | | 1,759 | | | | 716 | | | | 146 | |

| | | | |

Other non-operating income/expense, net | | | | | | | 0 | | | | –13 | | | | –100 | |

Finance income | | | | | | | 29 | | | | 24 | | | | 19 | |

Finance costs TomorrowNow litigation | | | | | | | 7 | | | | 0 | | | | N/A | |

Other finance costs | | | | | | | –38 | | | | –38 | | | | 0 | |

Finance costs | | | | | | | –31 | | | | –38 | | | | –20 | |

Financial income, net | | | | | | | –2 | | | | –14 | | | | –86 | |

Profit before tax | | | | | | | 1,757 | | | | 689 | | | | 155 | |

Income tax TomorrowNow litigation | | | | | | | –276 | | | | 17 | | | | –1,724 | |

Other income tax expense | | | | | | | –229 | | | | –205 | | | | 12 | |

Income tax expense | | | (6 | ) | | | –505 | | | | –188 | | | | 169 | |

Profit after tax | | | | | | | 1,251 | | | | 501 | | | | 150 | |

Profit attributable to non-controlling interests | | | | | | | 0 | | | | 1 | | | | –100 | |

Profit attributable to owners of parent | | | | | | | 1,251 | | | | 500 | | | | 150 | |

| | | | | | | | | | | | | | | | | |

| | | | |

Basic earnings per share, in€* | | | (7 | ) | | | 1.05 | | | | 0.42 | | | | 150 | |

Diluted earnings per share, in€* | | | (7 | ) | | | 1.05 | | | | 0.42 | | | | 150 | |

| * | For the three months ended September 30, 2011 and 2010 the weighted average number of shares were 1,191 million (Diluted: 1,191 million) and 1,188 million (Diluted: 1,188 million), respectively (treasury stock excluded). |

24 INTERIM REPORT JANUARY–SEPTEMBER 2011

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

for the three months ended September 30

| | | | | | | | |

€ millions | | 2011 | | | 2010 | |

Profit after tax | | | 1,251 | | | | 501 | |

Gains (losses) on exchange differences on translation, before tax | | | 97 | | | | –270 | |

Reclassification adjustments on exchange differences on translation, before tax | | | 0 | | | | 11 | |

Exchange differences on translation | | | 97 | | | | –259 | |

Gains (losses) on remeasuring available-for-sale financial assets, before tax | | | –8 | | | | 6 | |

Reclassification adjustments on available-for-sale financial assets, before tax | | | 0 | | | | 0 | |

Available-for-sale financial assets | | | –8 | | | | 6 | |

Gains (losses) on cash flow hedges, before tax | | | –18 | | | | 6 | |

Reclassification adjustments on cash flow hedges, before tax | | | 5 | | | | 31 | |

Cash flow hedges | | | –13 | | | | 37 | |

Actuarial gains (losses) on defined benefit plans, before tax | | | –6 | | | | 7 | |

Other comprehensive income before tax | | | 70 | | | | –209 | |

Income tax relating to components of other comprehensive income | | | 19 | | | | –13 | |

Other comprehensive income after tax | | | 89 | | | | –222 | |

Total comprehensive income | | | 1,340 | | | | 279 | |

– attributable to non-controlling interests | | | 0 | | | | 1 | |

– attributable to owners of parent | | | 1,340 | | | | 278 | |

CONSOLIDATED INTERIM FINANCIAL STATEMENTS - IFRS 25

CONSOLIDATED INCOME STATEMENTS

for the nine months ended September 30

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | Note | | | 2011 | | | 2010 | | | Change

in % | |

Software revenue | | | | | | | 2,226 | | | | 1,757 | | | | 27 | |

Support revenue | | | | | | | 5,093 | | | | 4,479 | | | | 14 | |

Subscription and other software-related service revenue | | | | | | | 278 | | | | 285 | | | | –2 | |

Software and software-related service revenue | | | | | | | 7,597 | | | | 6,521 | | | | 17 | |

Consulting revenue | | | | | | | 1,726 | | | | 1,572 | | | | 10 | |

Other service revenue | | | | | | | 410 | | | | 313 | | | | 31 | |

Professional services and other service revenue | | | | | | | 2,136 | | | | 1,885 | | | | 13 | |

Total revenue | | | | | | | 9,733 | | | | 8,406 | | | | 16 | |

| | | | |

Cost of software and software-related services | | | | | | | –1,503 | | | | –1,281 | | | | 17 | |

Cost of professional services and other services | | | | | | | –1,672 | | | | –1,478 | | | | 13 | |

Research and development | | | | | | | –1,402 | | | | –1,243 | | | | 13 | |

Sales and marketing | | | | | | | –2,140 | | | | –1,858 | | | | 15 | |

General and administration | | | | | | | –515 | | | | –461 | | | | 12 | |

Restructuring | | | (6 | ) | | | –2 | | | | 1 | | | | –300 | |

TomorrowNow litigation | | | | | | | 711 | | | | –46 | | | | –1,646 | |

Other operating income/expense, net | | | | | | | 3 | | | | 7 | | | | –57 | |

Total operating expenses | | | | | | | –6,520 | | | | –6,359 | | | | 3 | |

| | | | |

Operating profit | | | | | | | 3,213 | | | | 2,047 | | | | 57 | |

| | | | |

Other non-operating income/expense, net | | | | | | | –34 | | | | –136 | | | | –75 | |

Finance income | | | | | | | 78 | | | | 52 | | | | 50 | |

Finance costs TomorrowNow litigation | | | | | | | 7 | | | | 0 | | | | N/A | |

Other finance costs | | | | | | | –119 | | | | –77 | | | | 55 | |

Finance costs | | | | | | | –112 | | | | –77 | | | | 45 | |

Financial income, net | | | | | | | –34 | | | | –25 | | | | 36 | |

Profit before tax | | | | | | | 3,145 | | | | 1,886 | | | | 67 | |

| | | | |

Income tax TomorrowNow litigation | | | | | | | –276 | | | | 18 | | | | –1,633 | |

Other income tax expense | | | | | | | –626 | | | | –525 | | | | 19 | |

Income tax expense | | | (6 | ) | | | –902 | | | | –507 | | | | 78 | |

Profit after tax | | | | | | | 2,242 | | | | 1,379 | | | | 63 | |

Profit attributable to non-controlling interests | | | | | | | 1 | | | | 2 | | | | –50 | |

Profit attributable to owners of parent | | | | | | | 2,241 | | | | 1,377 | | | | 63 | |

| | | | |

| | | | | | | | | | | | | | | | | |

Basic earnings per share, in€* | | | (7 | ) | | | 1.88 | | | | 1.16 | | | | 62 | |

Diluted earnings per share, in€* | | | (7 | ) | | | 1.88 | | | | 1.16 | | | | 62 | |

| * | For the nine months ended September 30, 2011 and 2010 the weighted average number of shares were 1,189 million (Diluted: 1,190million) and 1,188 million (Diluted: 1,189 million), respectively (treasury stock excluded). |

26 INTERIM REPORT JANUARY–SEPTEMBER 2011

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

for the nine months ended September 30

| | | | | | | | |

€ millions | | 2011 | | | 2010 | |

Profit after tax | | | 2,242 | | | | 1,379 | |

Gains (losses) on exchange differences on translation, before tax | | | –71 | | | | 2 | |

Reclassification adjustments on exchange differences on translation, before tax | | | 0 | | | | –6 | |

Exchange differences on translation | | | –71 | | | | –4 | |

Gains (losses) on remeasuring available-for-sale financial assets, before tax | | | 3 | | | | 5 | |

Reclassification adjustments on available-for-sale financial assets, before tax | | | 0 | | | | 0 | |

Available-for-sale financial assets | | | 3 | | | | 5 | |

Gains (losses) on cash flow hedges, before tax | | | 1 | | | | –66 | |

Reclassification adjustments on cash flow hedges, before tax | | | 14 | | | | 47 | |

Cash flow hedges | | | 15 | | | | –19 | |

Actuarial gains (losses) on defined benefit plans, before tax | | | 1 | | | | –3 | |

Other comprehensive income before tax | | | –52 | | | | –21 | |