SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number:1-14118

REPORT TO SHAREHOLDERS

SECOND QUARTER 2004

QUEBECOR WORLD INC.

(Translation of Registrant's Name into English)

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Fork 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

REPORT TO SHAREHOLDERS

SECOND QUARTER2004

QUEBECOR WORLD INC.

FINANCIAL HIGHLIGHTS

Periods ended June 30

(In millions of US dollars, except per share data)

(Unaudited)

| | Three months

| | Six months

| |

|---|

| | 2004

| | 2003

| | 2004

| | 2003

| |

|---|

| Consolidated Results | | | | | | | | | | | | | |

| Revenues | | $ | 1,541.4 | | $ | 1,513.5 | | $ | 3,094.4 | | $ | 3,053.1 | |

| Operating income before depreciation and amortization and before IAROC | | | 199.3 | | | 129.5 | | | 386.5 | | | 291.2 | |

| Operating income before IAROC | | | 108.0 | | | 38.7 | | | 206.0 | | | 113.0 | |

| IAROC | | | 51.7 | | | 81.8 | | | 56.0 | | | 81.8 | |

| Operating income (loss) | | | 56.3 | | | (43.1 | ) | | 150.0 | | | 31.2 | |

| Net income (loss) | | | 15.3 | | | (61.7 | ) | | 51.1 | | | (37.2 | ) |

| Cash provided by operating activities | | | 112.3 | | | 177.8 | | | 65.5 | | | 5.7 | |

| Free cash flow (outflow) from operations* | | | 71.3 | | | 72.3 | | | (18.2 | ) | | (177.8 | ) |

| Operating margin before depreciation and amortization and before IAROC** | | | 12.9 | % | | 8.6 | % | | 12.5 | % | | 9.5 | % |

| Operating margin before IAROC** | | | 7.0 | % | | 2.6 | % | | 6.7 | % | | 3.7 | % |

| Operating margin** | | | 3.7 | % | | (2.8 | )% | | 4.8 | % | | 1.0 | % |

| | |

| |

| |

| |

| |

| Segmented Information | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | |

| | North America | | $ | 1,188.1 | | $ | 1,195.2 | | $ | 2,380.5 | | $ | 2,425.6 | |

| | Europe | | | 309.7 | | | 274.3 | | | 625.1 | | | 537.9 | |

| | Latin America | | | 44.4 | | | 43.7 | | | 91.2 | | | 88.8 | |

Operating income (loss) before IAROC |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 95.5 | | $ | 43.3 | | $ | 182.5 | | $ | 124.6 | |

| | Europe | | | 12.4 | | | 1.9 | | | 24.3 | | | — | |

| | Latin America | | | 1.8 | | | (3.5 | ) | | 2.0 | | | (5.4 | ) |

Operating margins before IAROC** |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | | 8.0 | % | | 3.6 | % | | 7.7 | % | | 5.1 | % |

| | Europe | | | 4.0 | % | | 0.7 | % | | 3.9 | % | | — | % |

| | Latin America | | | 4.0 | % | | (8.0 | )% | | 2.1 | % | | (6.1 | )% |

| | |

| |

| |

| |

| |

| Financial Position | | | | | | | | | | | | | |

| Working capital | | | | | | | | $ | 9.0 | | $ | (73.3 | ) |

| Total assets | | | | | | | | $ | 6,076.7 | | $ | 6,193.2 | |

| Long-term debt (including convertible notes) | | | | | | | | $ | 2,077.5 | | $ | 2,253.5 | |

| Shareholders' equity | | | | | | | | $ | 2,492.8 | | $ | 2,512.3 | |

| Debt-to-capitalization | | | | | | | | | 45:55 | | | 47:53 | |

| | | | | | | | |

| |

| |

| Per Share Data | | | | | | | | | | | | | |

| Earnings (loss) | | | | | | | | | | | | | |

| | Diluted | | $ | 0.05 | | $ | (0.51 | ) | $ | 0.25 | | $ | (0.39 | ) |

| | Diluted before IAROC | | $ | 0.31 | | $ | (0.07 | ) | $ | 0.54 | | $ | 0.04 | |

| Dividends on equity shares | | $ | 0.13 | | $ | 0.13 | | $ | 0.26 | | $ | 0.26 | |

| Book value | | | | | | | | $ | 15.39 | | $ | 15.62 | |

| | |

| |

| |

| |

| |

IAROC: Impairment of assets, restructuring and other charges.

- *

- Cash provided by operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

- **

- Margins calculated on revenues.

Message to Shareholders

In the second quarter 2004, Quebecor World delivered improved results as it benefited from cost containment and cost reduction initiatives as well as improved efficiencies across it global platform. On July 28 the Company announced a major three-year strategic investment plan that will significantly strengthen its U.S. platform by delivering even greater efficiencies and further enhancing customer service.

FINANCIAL RESULTS

For the second quarter 2004, Quebecor World reported net income of $50 million or $0.31 per share before the impairment of assets, restructuring and other charges. On the same basis this compares to a loss of $1 million or $0.07 per share in the second quarter of 2003. For the first six months of 2004 net income on the same basis was $89 million or $0.54 per share compared to net income of $23 million of $0.04 per share for the first two quarters of 2003. Operating income was $108 million, before the impairment of assets, restructuring and other charges compared to $39 million in the second quarter of 2003. Operating margin increased to 7% before impairment of assets, restructuring and other charges compared to 2.6% last year. Consolidated revenues for the quarter were $1.54 billion and year to date revenues increased $41 million to $3.09 billion. Excluding the favourable impact of currency, revenues were flat for the quarter and down 2% year to date. Reported net income for the second qua rter of 2004 was $15 million compared to a net loss of $62 million in the second quarter of 2003 and net income for the six-month period of 2004 was $51 million compared to a net loss of $37 million for the same period last year. These results are a significant improvement over last year but management is determined to do even better.

During the quarter Quebecor World took additional measures to further reduce its cost base and to reorganize its U.S. magazine and book platforms. The Company announced it will be closing its Effingham, Illinois magazine facility and downsizing its Kingsport, Tennessee book facility. Primarily as a result of these decisions, Quebecor World recorded a restructuring charge in the second quarter of $52 million or $0.26 per share. The cash component of the charge is $11 million. These announcements involve the decommissioning or idling of older equipment, the relocation of other equipment to facilities where it can be deployed more efficiently and combined with an investment in new technologies. These second quarter restructuring initiatives will affect 1,363 employees but should also create 457 new jobs in other facilities resulting in a net workforce reduction of 906 employee positions. The Company estimates these initiatives will provide $27 million of EBITDA annually, of which approximatel y $9 million will be realized in 2004.

Quebecor World's rigorous approach to cost containment further lowered selling, general and administrative expenses in the second quarter 2004 compared to the same period in 2003. Excluding specific charges of $3 million this year and $15 million in 2003 and currency translation of $2 million, SG&A expenses in the quarter were reduced by $18 million or 14% compared to the second quarter last year. Year to date SG&A expense is down $45 million to $232 million and down $39 million, excluding specific charges and the impact of currency translation. Financial expenses for the quarter were reduced by $10 million compared to the same period last year largely reflecting the refinancing of a portion of the Company's long-term debt, lower interest rates and the positive effects of currency translation. Free cash flow from operations for the quarter was $71 million which was similar to the second quarter last year, but year to date free cash flow from operations has improved by $160 million.

Operating income and margins improved in all our geographies compared to the second quarter of 2003, before the impairment of assets, restructuring and others charges. While the situation varies from country to country and product to product, there continues to be a challenging price environment in the print industry. This is why Quebecor World has taken an aggressive approach to cost containment and cost reduction in all the regions in which it operates.

STRATEGIC INVESTMENT

While cost-containment efforts are ongoing and an important element in producing improved results, the Company believes it is at the stage where it can confidently invest in its platform to provide maximum benefit to its customers and to its shareholders. Recently Quebecor World announced a major three-year strategic investment that involves the purchase of 22 new presses for its U.S. manufacturing platform. The new wide-web offset 48, 64, 96 and 128 page presses will firmly establish Quebecor World as the technological leader in the North American printing industry enabling it to renew and expand its customer base. The investment is focussed on Quebecor World's magazine, catalog, retail and book platforms.

Quebecor World is placing a firm order for 12 new presses with an option for 10 others. This represents an investment of approximately $330 million dollars. The first 12 presses will be commissioned in 2005 and 2006 and the additional 10 in 2006 and 2007. This investment is being made after an assessment of the market and the current and future needs of our customers. The presses will be fitted with the latest robotic and automated systems, as well as closed-loop color and ribbon control systems, to maximize efficiency and quality. The new equipment will significantly improve efficiency and through-put while delivering improved customers service. The installation of the new presses will be combined with the decommissioning and idling of older less efficient assets thereby allowing Quebecor World to improve its operating performance without increasing capacity.

In the second quarter Quebecor World announced the appointment of Antonio Fernandez as Chief Operating Officer, Quebecor World Europe. He will assume responsibility for all of Quebecor World's European Operations outside of France. Mr. Fernandez has extensive experience in the printing industry. He joined Quebecor World in 1996 and will continue to be based at Quebecor World's office in Madrid, Spain.

Mr. Charles Baillie, a Director of Quebecor World since 2003, informed the Company of his decision to resign from the Board of Directors, owing to the pressure of other commitments. We thank him for his service and wise counsel and wish him well in all his future endeavours

DIVIDEND

The Board of Directors declared a dividend of $0.13 per share on Multiple Voting Shares and Subordinate Voting Shares. The Board also declared a dividend of CDN$0.3845 per share on Series 3 Preferred Shares, CDN$0.421875 per share on Series 4 Preferred Shares and CDN$0.43125 per share on Series 5 Preferred Shares. The dividends are payable on September 1st, 2004 to shareholders of record at the close of business August 13, 2004.

/s/ Brian Mulroney

The Right Honourable

Brian Mulroney

Chairman of the Board | | /s/ Pierre Karl Péladeau

Pierre Karl Péladeau

President and Chief

Executive Officer | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Quebecor World Inc. is one of the largest commercial print media services companies in the world. Quebecor World is the market leader in most of its product categories and geographies. This market-leading position has been built through a combination of integrating acquisitions, investing in key strategic technologies and a commitment to building long-term partnerships with the world's leading print media customers.

Quebecor World has facilities in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

The Company offers its customers a broad range of printed products and related communication services, such as magazines, retail inserts, catalogs, specialty printing and direct mail, books, directories, pre-media, logistics and other value-added services.

The Company operates in the commercial print media segment of the printing industry and its business groups are located in three geographical regions: North America, which historically represents approximately 80% of the Company's revenues, Europe and Latin America. This industry has experienced difficult economic conditions in the last three years. Weaker demand and overcapacity have given rise to increased competition and a significant erosion in prices.

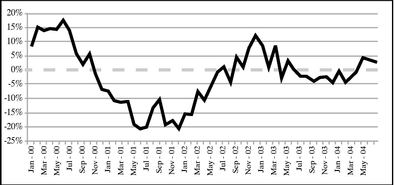

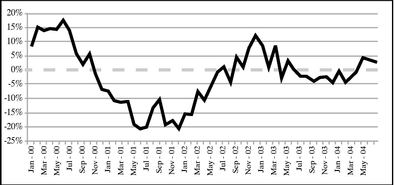

The primary drivers affecting the Company are consumer confidence and economic growth rates. These key drivers of demand for commercial print media affect the level of advertising and merchandising activity. The Company uses magazine advertising pages as a key indicator of demand for printing products and services. This indicator, as measured in the United States by the Publishers Information Bureau, showed some positive signs in this second quarter of 2004, but it may be too soon to conclude that a sustainable recovery is in place. Historically, magazine advertising pages tend to recover more slowly after a recession than other sectors of the economy.

U.S. Magazine Advertising Pages 2000-2004 (Monthly)

Percentage Year-Over-Year Change

Source: Publishers Information Bureau (PIB)

Figure 1

The Company has obtained improved overall results for the second quarter of 2004 with operating income, margins and earnings per share significantly higher than last year, a clear indication that the cost containment efforts undertaken during the last 12 to 18 months were justified and are paying off. The cost containment efforts were adopted by the Company to counter the difficult print market. Since 2002, global printing overcapacity has created an environment of reduced prices and margins in all of the Company's markets. However, markets seemed to be slowly recovering in the first half of 2004, as reflected by the U.S. magazine advertising pages indicator.

The Company's cost reduction initiatives involved workforce reductions, closure or downsizing of facilities, decommissioning of under-performing assets, cutting overhead expenses, consolidating corporate functions and relocating sales and administrative offices into plants. This uncompromising focus on cost containment has reduced the long-term cost structure and improved efficiency and will be maintained throughout the Company.

During the second quarter, the Company completed a long-term strategic plan which brought forth additional restructuring measures. The Company recorded impairment of assets and restructuring charges for the closing of a facility and the downsizing of another plant in North America and a workforce reduction. The completion of the second quarter initiatives will affect 1,363 employees in total, however the Company estimates that 457 new jobs will be created in other facilities.

With the proper global platform in place, the Company believes it is now the appropriate time to start investing in new equipment and technology to reach the next productivity level and to further improve efficiencies and customer service. Targeted investments will be made in specific markets where the potential for growth has been identified.

Financial data has been prepared in conformity with Canadian Generally Accepted Accounting Principles ("GAAP"). However, certain measures used in this discussion and analysis do not have any standardized meaning under Canadian GAAP. When used, these measures are defined in such terms to allow the reconciliation to the closest GAAP measure. Numerical reconciliations are provided in figure 6. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Company's functional currency is the Canadian dollar and its reporting currency is the U.S. dollar.

REVIEW OF SECOND QUARTER AND YEAR-TO-DATE

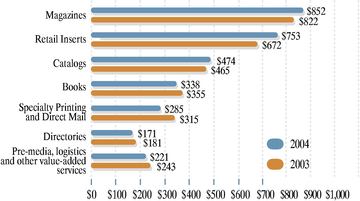

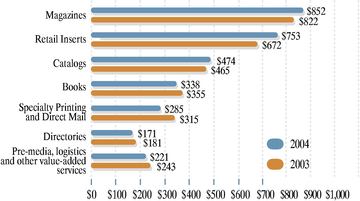

The Company's consolidated revenues for the quarter were $1,541 million, a 2% increase when compared to $1,513 million for the same period in 2003. On a year-to-date basis, revenues were $3,094 million, up 1% from $3,053 million in 2003. Excluding the favorable impact of currency translation (see figure 3), revenues were flat for the quarter and down 2% year-to-date due to continued pressure on prices. However, the overall volume for the quarter and year-to-date was up compared to last year. Revenue by product is shown in figure 2.

Revenue by Product — Worldwide($ millions)

Six-month periods ended June 30

Figure 2

The Company assesses performance based on operating income before impairment of assets, restructuring and other charges. The following operating analyses are before impairment of assets, restructuring and other charges.

In 2004, the Company recorded specific charges of $7 million in the second quarter and $4 million year-to-date for various items including provisions for leases, depreciation of assets and favorable legal claim settlements, mainly in North America. In 2003, the Company incurred specific charges that reduced operating income, totalling $49 million for the second quarter and $54 million for the first six months. This included a $15 million adjustment related to rapid growth and system issues in the North American Logistics business and a $15 million provision for doubtful accounts. The remaining balance was for write-downs of other assets, inventories and other items.

For the second quarter of 2004, operating income, before impairment of assets, restructuring and other charges, increased significantly to $108 million, from $39 million in 2003. On a year-to-date basis, operating income, before impairment of assets, restructuring and other charges was $206 million, up 82% from $113 million in 2003. On the same basis, operating margin for the quarter improved to 7.0% from 2.6% in 2003. On a year-to-date basis, operating margin improved to 6.7% in 2004 from 3.7% in 2003.

Impact of Foreign Currency($ millions)

| | Three months ended June 30, 2004

| | Six months ended June 30, 2004

|

|---|

| Foreign currency favorable impact on revenues | | $ | 26.6 | | $ | 100.7 |

| Foreign currency favorable impact on operating income | | $ | 1.3 | | $ | 2.6 |

Figure 3

Cost of sales for the quarter and on a year-to-date basis remained essentially flat compared to last year despite increased volume. Gross profit margin increased to 19.9% in the second quarter of 2004 from 17.5% in 2003. On a year-to-date basis, gross profit margin increased to 19.6% in 2004 from 18.2% in 2003. The 2004 and 2003 cost of sales included specific charges of $2 million and $34 million for the second quarter, respectively and $(3) million and $34 million year-to-date. Excluding these specific items, gross profit margin for the quarter improved to 20.0% from 19.8% last year. On the same basis, year-to-date gross profit margin also increased to 19.5% from 19.3% last year. Higher paper price on sales of waste disposal and gain on other materials contributed to reduce cost of material by approximately $18 million in the second quarter of 2004 and $26 million year-to-date. Despite an overall increase in volume across the platform, labor decreased by $8 million for the quarter and $20 million year-to-date, reflecting the impact of restructuring. Excluding the negative impact of currency translation, these items contributed to improve the gross profit margin for both the second quarter and the six-month period of 2004.

Selling, general and administrative expenses for the second quarter of 2004 were $113 million compared to $141 million in 2003, a decrease of $28 million. On a year-to-date basis, selling, general and administrative expenses were $232 million in 2004, compared to $277 million in 2003. Excluding specific charges of $3 million in 2004 and $15 million in 2003, as well as the unfavorable impact of currency translation of $2 million, selling, general and administrative expenses were lower by $18 million for the second quarter compared to last year. On a year-to-date basis, excluding specific charges of $5 million in 2004 and $20 million in 2003, as well as the impact of currency translation of $8 million, selling, general and administrative expenses improved by $39 million. The savings were mostly explained by the workforce reduction: decreases in salaries and benefits and travel and entertainment expenses explained approximately 80% of the drop from 2003.

Depreciation and amortization were $85 million in the second quarter of 2004, same as 2003. On a year-to-date basis, depreciation and amortization were $168 million in 2004, compared to $167 million in 2003. Excluding the impact of currency movement, depreciation and amortization decreased by 2% for both the second quarter and the year-to-date of 2004 compared to last year.

During the second quarter, the Company undertook additional restructuring initiatives and recorded a net impairment of assets and restructuring charges of $52 million, which reflected the closing of a facility and the downsizing of another plant in North America and a workforce reduction in North America, Europe and Latin America. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $32 million in the second quarter of 2004, compared to $42 million in 2003. On a year-to-date basis, financial expenses were $70 million in 2004, compared to $84 million in 2003. Excluding a $2 million charge on extinguishment of long-term debt recorded in the first quarter of 2004, financial expenses decreased by $16 million on a year-to-date basis compared to last year. The lower expenses were mainly due to the favorable impact of the 2003 fourth quarter refinancing of long-term debt, combined with lower average interest rates and reduced foreign exchange losses compared to the previous year. The volume of debt was also lower in the second quarter of 2004 versus last year. During the first quarter of 2004, the Company reclassified its trade receivables securitization fees from financial expenses to selling, general and administrative expenses. The purpose of this reclassification was to harmonize with the practice normally used by companies in the United States for the sale of accounts receivable. For comparative purposes, prior years' figures have been restated.

For the second quarter of 2004, income taxes were $6 million compared to $(24) million in 2003. On a year-to-date basis, income taxes were $25 million in 2004, compared to $(16) million in 2003. Before impairment of assets, restructuring and other charges, income taxes were $23 million for the second quarter of 2004 compared to $(2) million for the same period last year. On the same basis, the year-to-date income taxes were $43 million in 2004 for an effective tax rate of 31.9% and $5 million in 2003 for an effective tax rate of 18.1%. The increase in income taxes was due to an increase in profits before taxes in countries with a higher overall tax rate and the impact of the debt refinancing and the higher tax rate in the United States, both of which occurred in the fourth quarter of 2003.

Net income for the second quarter rose to $15 million from a net loss of $62 million in 2003. For the six-month period, net income was $51 million, a significant increase from a net loss of $37 million for the same period last year.

For the second quarter ended June 30, 2004, the Company reported diluted earnings per share of $0.05 compared to loss per share of $0.51 in 2003. These results incorporated impairment of assets, restructuring and other charges of $52 million ($35 million net of taxes) or $ 0.26 per share compared with $82 million ($61 million net of taxes) or $0.44 per share in 2003. Excluding the effect of impairment of assets, restructuring and other charges, the second quarter of 2004 resulted in diluted earnings per share of $0.31 compared with a loss per share of $0.07 in the same period of 2003. The specific charges of $7 million ($4 million net of taxes) in 2004 and $49 million ($33 million net of taxes) in 2003 also negatively impacted earnings per share by $0.03 and $0.24, respectively.

For the first six months of 2004, the Company reported a diluted earnings per share of $0.25 compared to a loss per share of $0.39 in 2003. These results incorporated impairment of assets, restructuring and other charges of $56 million ($38 million net of taxes) or $0.29 per share compared with $82 million ($61 million net of taxes) or $0.43 per share in 2003. Excluding the effect of impairment of assets, restructuring and other charges, 2004 resulted in diluted earnings per share of $0.54 compared with $0.04 in 2003. The specific charges of $4 million ($3 million net of taxes) in 2004 and $54 million ($37 million net of taxes) in 2003 also negatively impacted earnings per share by $0.02 and $0.27, respectively.

SEGMENT REVIEW

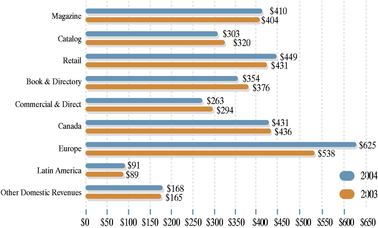

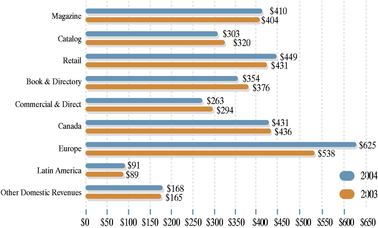

The following review of operating activity by business group (figure 4) is before impairment of assets, restructuring and other charges.

Revenue by Business Group($ millions)

Six-month periods ended June 30

Figure 4

North America

North American revenues for the second quarter of 2004 were $1,188 million, down 1% from $1,195 million in 2003. On a year-to-date basis, revenues were $2,380 million in 2004, down 2% from $2,426 million in 2003. Excluding the effect of currency translation, revenues decreased by 1% in the second quarter and 3% year-to-date. The following is a review of the North American activities by business group. The North American segment is made up of the following business groups: Magazine, Catalog, Retail, Book & Directory, Commercial & Direct, Canada and Other Domestic Revenues.

Segmented Results of Operations($ millions)

Selected Performance Indicators

| | North America

| | Europe

| | Latin America

| | Inter-Segment and Others

| | Total

| |

|---|

| | 2004

| | 2003

| | 2004

| | 2003

| | 2004

| | 2003

| | 2004

| | 2003

| | 2004

| | 2003

| |

|---|

| Three months ended June 30, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 1,188.1 | | $ | 1,195.2 | | $ | 309.7 | | $ | 274.3 | | $ | 44.4 | | $ | 43.7 | | $ | (0.8 | ) | $ | 0.3 | | $ | 1,541.4 | | $ | 1,513.5 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 166.9 | | | 114.6 | | | 29.2 | | | 18.0 | | | 4.6 | | | (0.7 | ) | | (1.4 | ) | | (2.4 | ) | | 199.3 | | | 129.5 | |

| Operating income (loss) before IAROC | | | 95.5 | | | 43.3 | | | 12.4 | | | 1.9 | | | 1.8 | | | (3.5 | ) | | (1.7 | ) | | (3.0 | ) | | 108.0 | | | 38.7 | |

| IAROC | | | 48.9 | | | 58.1 | | | 2.3 | | | 13.2 | | | 0.4 | | | 9.6 | | | 0.1 | | | 0.9 | | | 51.7 | | | 81.8 | |

| Operating income (loss) | | | 46.6 | | | (14.8 | ) | | 10.1 | | | (11.3 | ) | | 1.4 | | | (13.1 | ) | | (1.8 | ) | | (3.9 | ) | | 56.3 | | | (43.1 | ) |

| Operating margin before depreciation and amortization and before IAROC | | | 14.0 | % | | 9.6 | % | | 9.4 | % | | 6.6 | % | | 10.2 | % | | (1.7 | )% | | | | | | | | 12.9 | % | | 8.6 | % |

| Operating margin before IAROC | | | 8.0 | % | | 3.6 | % | | 4.0 | % | | 0.7 | % | | 4.0 | % | | (8.0 | )% | | | | | | | | 7.0 | % | | 2.6 | % |

| Operating margin | | | 3.9 | % | | (1.2 | )% | | 3.3 | % | | (4.1 | )% | | 3.0 | % | | (29.8 | )% | | | | | | | | 3.7 | % | | (2.8 | )% |

Capital expenditures |

|

$ |

29.6 |

|

$ |

89.5 |

|

$ |

2.6 |

|

$ |

4.9 |

|

$ |

0.7 |

|

$ |

1.4 |

|

$ |

— |

|

$ |

0.1 |

|

$ |

32.9 |

|

$ |

95.9 |

|

| Changes in non-cash balances related to operations, cash flow (outflow) |

|

| (20.3 |

) |

| 107.6 |

|

| 1.4 |

|

| 9.1 |

|

| 7.1 |

|

| 3.3 |

|

| (14.8 |

) |

|

9.6 |

|

| (26.6 |

) |

| 129.6 |

|

Six months ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | $ | 2,380.5 | | $ | 2,425.6 | | $ | 625.1 | | $ | 537.9 | | $ | 91.2 | | $ | 88.8 | | $ | (2.4 | ) | $ | 0.8 | | $ | 3,094.4 | | $ | 3,053.1 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 322.9 | | | 265.5 | | | 58.3 | | | 31.0 | | | 7.5 | | | — | | | (2.2 | ) | | (5.3 | ) | | 386.5 | | | 291.2 | |

| Operating income (loss) before IAROC | | | 182.5 | | | 124.6 | | | 24.3 | | | — | | | 2.0 | | | (5.4 | ) | | (2.8 | ) | | (6.2 | ) | | 206.0 | | | 113.0 | |

| IAROC | | | 52.2 | | | 58.1 | | | 2.9 | | | 13.2 | | | 0.6 | | | 9.6 | | | 0.3 | | | 0.9 | | | 56.0 | | | 81.8 | |

| Operating income (loss) | | | 130.3 | | | 66.5 | | | 21.4 | | | (13.2 | ) | | 1.4 | | | (15.0 | ) | | (3.1 | ) | | (7.1 | ) | | 150.0 | | | 31.2 | |

| Operating margin before depreciation and amortization and before IAROC | | | 13.6 | % | | 10.9 | % | | 9.3 | % | | 5.8 | % | | 8.2 | % | | — | % | | | | | | | | 12.5 | % | | 9.5 | % |

| Operating margin before IAROC | | | 7.7 | % | | 5.1 | % | | 3.9 | % | | — | % | | 2.1 | % | | (6.1 | )% | | | | | | | | 6.7 | % | | 3.7 | % |

| Operating margin | | | 5.5 | % | | 2.7 | % | | 3.4 | % | | (2.5 | )% | | 1.5 | % | | (16.8 | )% | | | | | | | | 4.8 | % | | 1.0 | % |

Capital expenditures |

|

$ |

55.7 |

|

$ |

131.1 |

|

$ |

6.1 |

|

$ |

33.4 |

|

$ |

3.1 |

|

$ |

5.1 |

|

$ |

— |

|

$ |

0.4 |

|

$ |

64.9 |

|

$ |

170.0 |

|

| Changes in non-cash balances related to operations, cash flow (outflow) | | | (193.6 | ) |

| (162.0 |

) |

| (27.7 |

) |

| 0.1 |

|

| 5.7 |

|

| (3.7 |

) |

| 2.1 |

|

| 4.7 |

|

| (213.5 |

) |

| (160.9 | ) |

IAROC: Impairment of assets, restructuring and other charges.

Figure 5

Magazine

Magazine revenues for the second quarter of 2004 were $203 million, up 6% from $193 million in 2003. On a year-to-date basis, revenues were $410 million in 2004 up 1% from $404 million in 2003. Revenues increased due to volume increases of 4% in the second quarter and 5% year-to-date. Volume increase is in line with the Magazine advertising pages indicator (see figure 1). Prices were down for both the second quarter and the year-to-date due to the continued price erosion. Selling, general and administrative expenses decreased in the first six months of 2004 compared to 2003, due to savings from cost containment initiatives and headcount reductions. During the second quarter of 2004, the Company announced restructuring initiatives that included the closing of the Effingham, Illinois facility, which will result in a net reduction of approximately 430 employee positions. Year-over-year headcount for the group was reduced by 458 employees or approximately 7%.

Catalog

Catalog revenues for the second quarter of 2004 were $144 million, down 4% from $151 million in 2003. On a year-to-date basis, revenues were $303 million in 2004 down 5% from $320 million in 2003. Volume was flat for the quarter and down 4% year-to-date. Prices were relatively stable in this segment compared to last year. The decrease in revenues for the second quarter was due to an increase in customer-furnished paper. Operating margin for both the second quarter and the year-to-date decreased due to operational inefficiencies in certain facilities. These issues are currently being addressed. Year-over-year headcount was reduced by 123 employees, or approximately 3%.

Retail

Retail revenues for the second quarter of 2004 were $231 million, up 3% from $225 million in 2003. On a year-to-date basis, revenues were $449 million in 2004, up 4% from $431 million in 2003.The increase in revenues was driven by an increase in volume of 3% for the quarter and 5% year-to-date, partly offset by the negative impact of lower price work and price pressures. Operating income and margin improved compared to last year as a result of savings from cost control initiatives and operational efficiency gains. Year-over-year headcount decreased by 179 employees, or approximately 5%.

Book & Directory

Book & Directory revenues for the second quarter of 2004 were $181 million, down 3% from $187 million in 2003. On a year-to-date basis, revenues were $354 million in 2004, down 6% from $376 million in 2003.The decrease for the second quarter and year-to-date was directly related to negative price pressures and a change to the overall product mix. Volume for the Book group was down 4% for the second quarter of 2004 and 2% for the year-to-date compared to last year. For the Directory group, volume was up 13% for the quarter and 17% for the year-to-date. The price erosion in Directory is explained by more volume from independent directory publishers replacing one major contract terminated in 2003. For the Book group, prices decreased due to a heavier mix of one and two color work and a loss of higher value hardcover work. Operating income and margin increased in the second quarter of 2004 and for the year-to-date compared to 2003 due to productivity gains, headcount reductions and other cost containment initiatives from 2003. During the second quarter of 2004, the Company announced restructuring initiatives which included the downsizing of the Kingsport, Tennessee facility in the Book group. This will result in a net reduction of approximately 180 employee positions. Year-over-year headcount for the group was reduced by 541 employees, or approximately 10%.

Commercial & Direct

Commercial & Direct revenues for the second quarter of 2004 were $125 million, down 9% from $137 million in 2003. On a year-to-date basis, revenues were $263 million in 2004, down 11% from $294 million in 2003.The decrease in revenues was mainly due to a drop in volume and prices in the Commercial group in both the second quarter and year-to-date, due to intense competition. In the Direct group, volume slightly decreased while prices remained stable for the quarter and year-to-date compared to last year. Selling, general and administrative expenses for the second quarter and year-to-date were down from last year, due to volume decline and to the favorable impact of cost containment efforts. During the second quarter of 2004, the Company announced restructuring initiatives that will include workforce reductions in the Commercial group for 76 employee positions. Year-over-year headcount reductions were 267 employees, or approximately 9% for this group.

Canada

Canadian revenues for the second quarter of 2004 were $216 million, down 3% compared to $221 million in 2003. On a year-to-date basis, revenues were $431 million in 2004, down 1% from $436 million in 2003. Excluding the favorable impact of currency translation, revenues decreased by 6% for the quarter and 9% year-to-date compared to the same periods last year. Overall volume increased by 3% for both the quarter and year-to-date, compared to last year, mainly due to volume growth in Retail and Directory. Despite a volume increase, revenues were down for both the quarter and year-to-date due to price pressure and an increase in customer-furnished paper. Year-over-year headcount was reduced by 236 employees, or approximately 4%, and this improvement was reflected in selling, general and administrative costs.

Other Revenues

Other sources of revenues in North America include Quebecor World Premedia and Logistics. Premedia revenues for the second quarter of 2004 were $17 million, down 12% from $19 million last year. On a year-to-date basis, revenues were $35 million in 2004, down 8% from $38 million in 2003. Although volume increased by 26% in the second quarter for 2004 and 15% for the year-to-date, the economic environment encouraged customers to continue looking for ways to reduce their costs by putting pressure on reduced prices, re-using previously captured images and taking more of the prepress production in-house.

Logistics revenues for the second quarter were $69 million, up 10% from $63 million in 2003. On a year-to-date basis, revenues were $140 million in 2004, up 10% from $127 million in 2003. The revenue increase was due mainly to higher retail commodity shipments. However, margins decreased slightly due to a larger proportion of truck shipments compared to air freight for time-sensitive products. Higher margin air freight in the United States continued to grow slowly with pricing pressure from fuel surcharge and security fees.

Europe

European revenues for the second quarter of 2004 were $310 million, up 13% from $274 million in 2003. On a year-to-date basis, revenues were $625 million in 2004 up 16% from $538 million in 2003. Excluding the positive impact of currency translation, revenues were $290 million for the second quarter and $561 million year-to-date, still up compared to last year. Overall volume increased by 6% for the second quarter, with strong performances in the Retail and Catalog market. On a year-to-date basis, the volume increase was also 6% explained by the Retail and Catalog as well as the Magazine markets, in part due to additional capacity provided by two new presses in Spain and Sweden. However, price erosion continued to have a negative impact in virtually all countries. Magazine revenues represented more than 50% of total European revenues and the balance was mainly composed of Retail, Catalog and Book. France's operating income and margin for the second quarter and year-to-date were still negative, but showed a significant improvement from last year, an indication of the positive impact of the 2003 restructuring initiatives. The new sales compensation plan in France also contributed to improve margins. Excluding France, Europe also increased significantly its operating income and margin, for the second quarter of 2004 and year-to-date, compared to last year. During the second quarter of 2004, the Company was informed that an important printing contract expiring in 2005 would not be renewed. As a result, management is currently evaluating and developing a sales strategy to replace the expected lost volume. Year-over-year headcount in Europe was reduced by 131 employees, or approximately 2%.

Reconciliation of non GAAP measures

($ millions)

| | Three months ended June 30,

| | Six months ended

June 30,

| |

|---|

| | 2004

| | 2003

| | 2004

| | 2003

| |

|---|

| Operating Income | | | | | | | | | | | | | |

| | Operating income (loss) | | $ | 56.3 | | $ | (43.1 | ) | $ | 150.0 | | $ | 31.2 | |

| | Impairment of assets, restructuring and other charges (IAROC) | | | 51.7 | | | 81.8 | | | 56.0 | | | 81.8 | |

| | |

| |

| |

| |

| |

| | Operating income before IAROC | | $ | 108.0 | | $ | 38.7 | | $ | 206.0 | | $ | 113.0 | |

| | |

| |

| |

| |

| |

| | Operating income (loss) | | $ | 56.3 | | $ | (43.1 | ) | $ | 150.0 | | $ | 31.2 | |

| | Depreciation of property, plant and equipment | | | 84.8 | | | 84.8 | | | 167.7 | | | 165.8 | |

| | Amortization of deferred charges | | | 6.5 | | | 6.0 | | | 12.8 | | | 12.4 | |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization | | $ | 147.6 | | $ | 47.7 | | $ | 330.5 | | $ | 209.4 | |

| | IAROC | | | 51.7 | | | 81.8 | | | 56.0 | | | 81.8 | |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization and before IAROC | | $ | 199.3 | | $ | 129.5 | | $ | 386.5 | | $ | 291.2 | |

| | |

| |

| |

| |

| |

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Net income (loss) | | $ | 15.3 | | $ | (61.7 | ) | $ | 51.1 | | $ | (37.2 | ) |

| | IAROC (net of income taxes of $17 million for the second quarter of 2004 ($18 million year-to-date) and $21 million for the second quarter of 2003 ($21 million year-to-date)) | | | 34.5 | | | 60.5 | | | 37.6 | | | 60.5 | |

| | |

| |

| |

| |

| |

| | Net income (loss) before IAROC | | $ | 49.8 | | $ | (1.2 | ) | $ | 88.7 | | $ | 23.3 | |

| | Net income available to holders of preferred shares | | | 8.8 | | | 8.8 | | | 17.9 | | | 17.0 | |

| | |

| |

| |

| |

| |

| | Net income (loss) available to holders of equity shares before IAROC | | $ | 41.0 | | $ | (10.0 | ) | $ | 70.8 | | $ | 6.3 | |

| |

Diluted average number of equity shares outstanding (in millions) |

|

|

132.4 |

|

|

139.0 |

|

|

132.3 |

|

|

140.2 |

|

| |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Diluted | | $ | 0.05 | | $ | (0.51 | ) | $ | 0.25 | | $ | (0.39 | ) |

| | Diluted before IAROC | | $ | 0.31 | | $ | (0.07 | ) | $ | 0.54 | | $ | 0.04 | |

| | |

| |

| |

| |

| |

| | | | | | | | | | | | | | |

| Free Cash Flow | | | | | | | | | | | | | |

| | Cash provided by operating activities | | $ | 112.3 | | $ | 177.8 | | $ | 65.5 | | $ | 5.7 | |

| | Dividends on preferred shares | | | (8.5 | ) | | (10.2 | ) | | (20.2 | ) | | (14.8 | ) |

| | Additions to property, plant and equipment | | | (32.9 | ) | | (95.9 | ) | | (64.9 | ) | | (170.0 | ) |

| | Net proceeds from disposal of assets | | | 0.4 | | | 0.6 | | | 1.4 | | | 1.3 | |

| | |

| |

| |

| |

| |

| | Free cash flow (outflow) from operations | | $ | 71.3 | | $ | 72.3 | | $ | (18.2 | ) | $ | (177.8 | ) |

| | |

| |

| |

| |

| |

| | | | | | | | | | | | | | |

| Debt-to-capitalization as at June 30, | | | | | | | | | | | | | |

| | Bank indebtedness | | | | | | | | $ | 0.9 | | $ | 1.1 | |

| | Current portion of long-term debt and convertible notes | | | | | | | | | 12.8 | | | 17.5 | |

| | Long-term debt | | | | | | | | | 1,953.0 | | | 2,120.2 | |

| | Convertible notes | | | | | | | | | 111.7 | | | 115.8 | |

| | | | | | | | |

| |

| |

| | Total debt | | | | | | | | $ | 2,078.4 | | $ | 2,254.6 | |

| |

Minority interest |

|

|

|

|

|

|

|

|

26.9 |

|

|

21.0 |

|

| | Shareholders' equity | | | | | | | | | 2,492.8 | | | 2,512.3 | |

| | | | | | | | |

| |

| |

| | Capitalization | | | | | | | | $ | 4,598.1 | | $ | 4,787.9 | |

| | | | | | | | |

| |

| |

| | Debt-to-capitalization | | | | | | | | | 45:55 | | | 47:53 | |

| | | | | | | | |

| |

| |

| | | | | | | | | | | | | | |

| Book value per share as at June 30, | | | | | | | | | | | | | |

| | Shareholders' equity | | | | | | | | $ | 2,492.8 | | $ | 2,512.3 | |

| | Preferred shares | | | | | | | | | (456.6 | ) | | (456.6 | ) |

| | | | | | | | |

| |

| |

| | | | | | | | | $ | 2,036.2 | | $ | 2,055.7 | |

| | Ending number of equity shares (in millions) | | | | | | | | | 132.3 | | | 131.6 | |

| | | | | | | | |

| |

| |

| | Book value per share | | | | | | | | $ | 15.39 | | $ | 15.62 | |

| | | | | | | | |

| |

| |

Figure 6

Latin America

Latin America's revenues for the second quarter of 2004 were $44 million, flat compared to 2003, essentially explained by the positive impact of currency movement. On a year-to-date basis, revenues were $91 million in 2004, up 3% from $89 million in 2003. In general, prices were down for the second quarter and year-to-date in Latin America as compared to last year. Overall volume increased by 4% for the second quarter and 2% year-to-date from last year. Volume increased for Commercial and Directory in Peru and for Book in Argentina and was offset by a shortfall of Book in Brazil, Colombia and Mexico. Book revenues represented approximately 40% of total revenues in Latin America and the balance was composed mainly of Directory, Retail, Catalog and Commercial & Direct. Strong results were obtained in Argentina in the second quarter of 2004 due to book orders received from the Ministry of Education.Also in the second quarter of 2004, Colombia successfully entered the flyer market by securing a new six-month contract for a weekly production of flyers. Overall, selling, general and administrative expenses were below last year's amounts, as the positive impact of the cost containment initiatives continued to bear fruit. Year-over-year headcount was reduced by 218 employees, or approximately 9%.

SELECTED ANNUAL INFORMATION

The following table (figure 7) provides selected annual information as derived from the Company's consolidated financial statements, for each of the three most recently completed fiscal years, in accordance with the requirements of Item 1.3 of Form 51-102F1 of the Canadian Securities Administrators' («CSA»)National Instrument 51-102 Continuous Disclosure Obligations.

Selected Annual Information($ millions, except per share data)

| | Years ended December 31,

|

|---|

| | 2003

| | 2002

| | 2001

|

|---|

| Consolidated Results(1) | | | | | | | | | |

| Revenues(2) | | $ | 6,391.5 | | $ | 6,271.7 | | $ | 6,442.7 |

| Operating income before depreciation and amortization and before IAROC | | | 675.3 | | | 882.7 | | | 926.7 |

| Operating income before IAROC(3) | | | 315.9 | | | 547.2 | | | 588.9 |

| IAROC(4) | | | 98.3 | | | 19.6 | | | 270.0 |

| Operating income | | | 217.6 | | | 527.6 | | | 318.9 |

| Net income (loss) | | | (31.4 | ) | | 279.3 | | | 22.4 |

Financial Position(1) |

|

|

|

|

|

|

|

|

|

| Total assets | | | 6,256.9 | | | 6,207.4 | | | 6,186.5 |

| Total long-term debt and convertible notes(5) | | | 2,009.0 | | | 1,822.1 | | | 2,132.2 |

Per Share Data |

|

|

|

|

|

|

|

|

|

| Earnings (loss) | | | | | | | | | |

| | Basic | | | (0.50 | ) | | 1.78 | | | — |

| | Diluted | | | (0.50 | ) | | 1.76 | | | — |

| | Diluted before IAROC | | | 0.03 | | | 1.92 | | | 1.58 |

| Dividends on preferred shares | | | 1.17 | | | 0.96 | | | 0.68 |

| Dividends on equity shares | | | 0.52 | | | 0.49 | | | 0.46 |

IAROC: Impairment of assets, restructuring and other charges.

- (1)

- Certain reclassifications have been made to prior years' amounts to conform with the basis of presentation adopted in the current period.

- (2)

- Revenues have been consistently declining over the last three years due to weak advertising spending and global overcapacity in the industry resulting in significant price erosions. In 2003, although volume increased, pressures on prices continued to push revenues down. However, the favorable impact of currency translation more than offset the decrease, pushing overall revenues up.

- (3)

- Operating income before IAROC has decreased over the years due to reduced capacity utilization and pricing pressures. In addition, significant increases in pension, utilities and medical expenses are also negatively impacting operating income. In 2003, the Company incurred specific charges that further reduced the operating income by $79 million, mainly due to system issues in the North American logistics business, provisions for doubtful accounts, lease provisions and various other items.

- (4)

- In 2001, in response to the significant drop in volume, the Company announced a restructuring plan to shut down under-performing business units, redeploy assets and reduce the workforce. Most of the 2001 restructuring plan was completed in 2002. In 2003, although overall volume had increased, pricing continued to drop. To mitigate eroding prices, the Company's new management team performed a detailed review and additional restructuring intiatives were adopted. These intiatives involved a general workforce reduction across the platform, the closure of four smaller facilities in North America, the decommissioning of under-performing assets, the consolidation of corporate functions and the relocation of certain sales offices into plants.

- (5)

- Long-term debt and convertible notes decreased in 2002 from 2001 due mainly to a decrease in capital expenditures and business acquisitions in 2002. Long-term debt and convertible notes increased in 2003 compared to 2002 due to the repurchase for cancellation of 10,000,000 Subordinate Voting Shares and an increase in capital expenditures in 2003.

Figure 7

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with Canadian GAAP requires the Company to make estimates and assumptions which affect the reported amounts of assets and liabilities, the disclosure on contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. The Ontario Securities Commission defines critical accounting estimates as those requiring assumptions made about matters that are highly uncertain at the time the estimate is made, and when the use of different reasonable estimates or changes to the accounting estimates would have a material impact on a company's financial condition or results of operations.

Based on this definition, the Company has identified the following critical accounting estimates:

Revenue Recognition

The Company recognizes revenue either when the production process is completed or when services are performed, or on the basis of production and service activity at the pro rata billing value of the work completed. When progress needs to be measured, the method used always reflects the output achieved. For example, one method is based on the number of units produced for each of the significant production processes, where each of these units is attributed a certain profit based on the stage of the production. Other methods may be based on the hours of labor recorded or the costs incurred, but this is only allowed when it reflects the true output of the project. The underlying work in process is valued at the pro rata billing value of the work completed. Usually, the time lag is short between revenue recognition and the billing process.

Goodwill

Goodwill is not amortized but tested for impairment annually, or more frequently if events or changes in circumstances indicate a possible impairment. The Company compares the reporting unit's carrying value to its market value determined through a discounted cash flows analysis. In preparing discounted cash flows, the Company uses its judgment in estimating future profitability, growth, capital spending and discount rate. As an additional overall check on the reasonableness of the fair value attributed to reporting units, the Company performs a market comparable companies analysis, which takes into consideration 1) valuation multiples of comparable public companies to which a control premium is applied and 2) publicly-known acquisition multiples of recent transactions in the industry. If the carrying value of the reporting unit exceeds the market value, the Company would then evaluate the impairment loss by comparing the fair value of the goodwill to its carrying amount.

Based on the results of the latest impairment test performed, the Company concluded that no impairment existed. However, if the assumptions and estimates used by the Company were inaccurate, an impairment could be necessary in the future.

Impairment of Long-Lived Assets

The Company tests the recoverability of long-lived assets periodically or more frequently, when events or changes in circumstances indicate that their carrying amounts may not be recoverable. Examples of such events and changes include: a significant decrease in the market price of an asset, the decommissioning of an asset, assets rendered idle after plant shutdown, costs that significantly exceed the amount initially estimated for the acquisition or construction of an asset, and operating or cashflow losses constantly associated with the use of an asset. Long-lived assets tested include property, machinery and equipment and other long-term assets.

An impairment loss is recognized when the carrying amount of a long-lived asset is not recoverable and exceeds its fair value. A long-lived asset, or group of assets is considered unrecoverable when its carrying value exceeds the estimated undiscounted future cash flows directly associated to it. The Company estimates future cash flows based on historical and budgeted performance as well as assumptions on future economic environment, pricing and volume. The fair value measurement is determined based on quoted market prices when available, or on the expected present value of future cash flows approach.

During the second quarter of 2004, the Company approved a long-term strategic plan, which involved the closing and downsizing of certain facilities and the decommissioning of presses in North America. As a result, a recoverability test was performed for equipment to be transferred and for equipment rendered idle that are to be disposed of or that are to remain in the plant affected by the downsizing. An impairment loss of $32 million was recorded.

With the exception of the above mentioned item, the Company believes that no other impairment loss should be taken on its long-lived assets. If the assumptions and estimates should prove to be inappropriate, an additional impairment loss would have to be charged to future results.

Pension and Postretirement Benefits

The Company maintains defined benefit plans and postretirement benefits for its employees and ensures that contributions are sustained at a level sufficient to cover benefits. Actuarial valuations of the Company's various pension plans were performed during the last three years. Plan assets are measured at fair value and consist of equity securities and corporate and government fixed income securities. Pension and other postretirement costs and obligations are based on various economic and demographic assumptions determined with the help of actuaries and are reviewed each year. Key assumptions include the discount rate, the expected long-term rate of return on plan assets, the rate of compensation increase and the health care cost trend rate.

The discount rate assumption used to calculate the present value of the plans' projected benefit payments was determined using a measurement date of September 30, 2003 and based on yields of long-term high-quality fixed income investments.

The expected long-term rate of return on pension plan assets was obtained by calculating a weighted average rate based on targeted asset allocations of the plans. The expected returns of each asset class are based on a combination of rigorous historical performance analyses and forward looking views of the financial markets. The targeted asset allocation of the plans is generally 65% for equity and 35% for fixed income securities.

The rate of compensation increase is used to project current plan earnings in order to estimate pension benefits at future dates. This assumption was determined based on historical pay increases, forecast of salary budgets, collective bargaining influence and competitive factors.

For postretirement benefits, the assumptions related to the health care cost trend rate is based on increases experienced by plan participants in recent years and national average cost increases.

The Company believes that the assumptions are reasonable based on information currently available, but changes to these assumptions could impact pension and postretirement benefit expenses and obligations recognized in future periods.

Health Care Costs

The Company provides health care benefits to employees in North America and covers approximately 75% of the costs under these employee health care plans. The Company actively manages its health care spendings with its vendors to maximize discounts in an attempt to limit the cost escalation experienced over the past years. Health care costs and liabilities are estimated with the help of actuaries. For the first half of 2004, health care costs increased by over 10% from the same period in 2003.Trend assumption is the most important factor in estimating future costs. The Company uses the most recent twelve months of claims trended forward to estimate the next year's liability.

Allowance for Doubtful Accounts

The Company maintains an allowance for doubtful accounts for expected losses from customers who are unable to pay their debts. The allowance is reviewed periodically and is based on an analysis of specific significant accounts outstanding, the age of the receivable, customer creditworthiness, and historical collection experience. In addition, the Company maintains an allowance to cover a fixed percentage of all accounts for customers under Chapter 11 and other critical accounts. These accounts may take several years before a settlement is reached. However, the allowance is periodically reassessed based on new developments.

Income Taxes

The Company uses its best judgment in determining its effective tax rate. There are many factors in the normal course of business that affect the effective tax rate since the ultimate tax outcome of some transactions and calculations is uncertain until assessed by the taxation authorities.

Future income tax assets are recognized and a corresponding provision is recorded if such assets are unlikely to be realized. The provision is based on management's estimates of taxable income for each jurisdiction in which the Company operates, and the period over which the future tax assets are expected to be recoverable. In the event that the tax outcome differs from management's estimates, the provision may be adjusted.

The Company is at all times under audit by various tax authorities in each of the jurisdictions in which it operates. A number of years may elapse before a particular matter for which management has established a reserve, is audited and resolved. The number of years with open tax audits varies depending on the tax jurisdiction.

Management believes that its estimates are reasonable and reflect the probable outcome of known tax contingencies, although the final outcome and its timing are difficult to predict. In addition, the Company has not recognized a future tax liability for the undistributed earnings of its subsidiaries in the current and prior years because the Company does not expect those unremitted earnings to reverse and become taxable in the foreseeable future.

Insurance

The Company is exposed in the normal course of business to a variety of operational risks, some of which are transferred to third parties by way of insurance agreements. The Company has a policy of self-insurance when the foreseeable losses from self-insurance are low relative to the cost of purchasing third-party insurance.

U.S. workers' compensation claims tend to be relatively low in value on a case-by-case basis, and the Company self-insures against the majority of such claims. The Company maintains third-party insurance coverage against workers' compensation claims which are unusually large in nature. In addition, the third-party insurance provides a cap on total exposure to workers' compensation claims.

With respect to the workers' compensation self-insurance, the Company maintains a provision to cover liabilities for all open claims related to both current and past policies and relies on claims experience and the advice of its actuaries and plan administrators in determining an adequate liability for all open claims. The workers' compensation liability is estimated based on reserves for claims that are established by an independent administrator and the reserves are increased to reflect the estimated future development of the claims based on Company specific factors provided by its actuaries. The liability for workers' compensation claims is the estimated total cost of the claims on a fully-developed basis. Certain claims may take several years to be settled. Each year, the status of open claims is reviewed and the liability is reassessed. The difference is recorded to income or expense.

While the Company believes that the assumptions used are appropriate, significant changes in any of the assumptions could materially affect the workers' compensation costs.

The Company maintains insurance for exposure related to property and casualty losses. It has also chosen to retain a portion of such losses in the form of a deductible, in order to reduce the cost of protecting its assets. The Company manages the self-insured portion of its property insurance program through its captive insurance subsidiary.

As at June 30, 2004, the Company's potential exposure under its self-insured property program was capped at $5 million, subject to ongoing deductibles and other factors related to the nature of each specific claim.

The Company believes that it has in place a combination of third-party insurance and self-insurance that provides adequate protection against unexpected losses while minimizing cost.

LIQUIDITY AND FINANCIAL POSITION

The Company measures its liquidity performance using the calculation of free cash flow as described in figure 6. Free cash flow reflects liquidity available for business acquisitions, equity dividends and repayments of long-term debt.

Free cash flow for the second quarter of 2004 amounted to $71 million, compared to $72 million for the same quarter last year. On a year-to-date basis, free cash flow for 2004 amounted to an outflow of $18 million, compared to an outflow of $178 million for the same period of 2003. The Company typically generates most of its free cash flow in the second half of the year. Working capital was $9 million as at June 30, 2004, compared to a deficiency in working capital of $73 million as at June 30, 2003. This increase in working capital of $82 million was largely due to higher levels of cash and cash equivalents, as the Company is required to maintain a minimum level of funds in its captive insurance subsidiary, and a decrease of future income tax assets. The Company manages its trade payables in order to take advantage of prompt payment discounts. Also, the Company maximizes the use of its accounts receivable securitization program, since the cost of these programs is relatively low compared to that of the credit facility. The amount of trade receivables under securitization varies from month to month, based on the previous month's volume (June securitization is based on outstanding receivables at the end of May).

As at June 30, 2004, the debt level was at $2,078 million, a $176 million decrease compared to the end of June 2003.The debt-to-capitalization ratio was 45:55 compared to 47:53 in June 2003 (see non-GAAP measures at figure 6). The same ratio was 44:56 as at December 31, 2003. Including accounts receivable securitization, total debt would be $2,730 million, $138 million lower than last year. The debt-to-capitalization ratio, including accounts receivable securitization, was 52:48 as at June 30, 2004, compared to 53:47 in June 2003 (see figure 8).

Total Debt and Accounts Receivable Securitization($ millions)

| | June 30, 2004

| | June 30, 2003

|

|---|

| Bank indebtedness | | $ | 0.9 | | $ | 1.1 |

| Current portion of long-term debt and convertible notes | | | 12.8 | | | 17.5 |

| Long-term debt | | | 1,953.0 | | | 2,120.2 |

| Convertible notes | | | 111.7 | | | 115.8 |

| | |

| |

|

| Total debt | | $ | 2,078.4 | | $ | 2,254.6 |

| Accounts receivable securitization | | | 652.0 | | | 613.6 |

| | |

| |

|

| Total debt and accounts receivable securitization | | $ | 2,730.4 | | $ | 2,868.2 |

Minority interest |

|

|

26.9 |

|

|

21.0 |

| Shareholders' equity | | | 2,492.8 | | | 2,512.3 |

| | |

| |

|

| Capitalization, including securitization | | $ | 5,250.1 | | $ | 5,401.5 |

| | |

| |

|

| Debt-to-Capitalization, including securitization | | | 52:48 | | | 53:47 |

| | |

| |

|

These ratios are non-GAAP measures.

Figure 8

The Company is subject to certain financial covenants in some of its major financing agreements. The key financial ratios are the earnings before interest, tax and depreciation and amortization (EBITDA) coverage ratio and the debt-to-capitalization ratio. As at June 30, 2004, the Company is in compliance with all significant debt covenants.

The Company signed a binding agreement to purchase, in September 2004, the remaining 50% of Helio Charleroi in Belgium, a subsidiary of European Graphic Group, SA. The transaction should amount to the highest of 25 million Euros ($30 million) or a calculation based on financial performance achieved during the last three fiscal years.

The 6.50% senior debentures due 2027 are redeemable at the option of the holders at par value on August 1, 2004. Out of a total principal amount of $150 million, $147 million senior debentures have been tendered. The Company will repay the senior debentures by using its long-term revolving bank facility.

The Company maintains a $1 billion revolving bank facility for general corporate purposes. The first tranche of $250 million is available to both, the Company and its US subsidiary and matures in November 2004.The second tranche of $250 million, available to the US subsidiary only, and the third tranche of $500 million, available to both, the Company and the US subsidiary, mature in November 2006. All tranches are cross-guaranteed by the Company and the US subsidiary and can be extended annually.

In February 2004, the Company redeemed all of the 7.75% senior notes callable on or after February 15, 2004 that were not tendered in November 2003, for a total cash consideration of $33 million. During the first quarter, the Company discontinued its Canadian Commercial paper program. At December 31, 2003, Cdn $0.4 million ($0.3 million) was outstanding under the program.

Contractual Cash Obligations($ millions)

| | Remainder of 2004

| | 2005

| | 2006

| | 2007

| | 2008

| | 2009 and thereafter

|

|---|

| Long-term debt and convertible notes | | $ | 1 | | $ | — | | $ | 793 | | $ | 262 | | $ | 202 | | $ | 770 |

| Capital lease | | | 8 | | | 10 | | | 8 | | | 4 | | | 3 | | | 17 |

| Operating lease | | | 50 | | | 83 | | | 67 | | | 51 | | | 36 | | | 107 |

| Capital asset purchase commitments | | | 10 | | | — | | | — | | | — | | | — | | | — |

| Minority interest acquisition | | | 30 | | | — | | | — | | | — | | | — | | | — |

| | |

| |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 99 | | $ | 93 | | $ | 868 | | $ | 317 | | $ | 241 | | $ | 894 |

| | |

| |

| |

| |

| |

| |

|

Figure 9

The Company has no major operating leases expiring in 2004. For major leases terminating in 2005, the terminal value that the Company would pay to acquire the equipment under leases (mainly presses and binders) is approximately $60 million, of which $36 million is guaranteed by the Company. Historically, the Company has acquired most of the equipment under leases when it is used for production. The total terminal value of these leases expiring after 2005 is approximately $120 million, of which $52 million is guaranteed.

The minimum legal requirement for pension contributions is $55 million in 2004 of which $32 million has been paid as of June 30, 2004 (total annual contribution in 2003 was $68 million).

As of June 30, 2004, the following investment grade ratings applied to the long-term unsecured debt of the Company:

Rating Agency

| | Rating

|

|---|

| Moody's Investors Service | | Baa3 |

| Standard & Poor's | | BBB- |

| Dominion Bond Rating Service Limited | | BBB (low) |

The Company believes that its liquidity, capital resources and cash flow from operations are sufficient to fund planned capital expenditures, working capital requirements, interest and principal payments for the foreseeable future.

CAPITAL RESOURCES

The Company invested $33 million in capital projects during the second quarter of 2004 compared to $96 million for the same period last year. On a year-to-date basis, $65 million has been invested in capital projects in 2004 compared to $170 million in 2003, when the Company purchased 19 presses that were previously under an operating lease in North America. In 2004, approximately 80% of investments were for organic growth, including expenditures for new capacity requirements and productivity improvement, and 20% was for maintenance of the Company's structure. Key expenditures for customer-driven requirements during the quarter included the continuation of two major projects announced in 2003: phase 2 of the educational book market expansion in the Dubuque, Iowa facility and the purchase of new gravure presses in the Augusta, Georgia and Franklin, Kentucky facilities to service L.L. Bean and other retail customers.

For the remainder of the year 2004, the Company projects $135 million of capital expenditures. Expected sources of funds to meet these expenditures are cash flow from operations and drawings under the Company's revolving bank facility.

IMPAIRMENT OF ASSETS AND RESTRUCTURING INITIATIVES

During the second quarter of 2004, the Company recorded an impairment of assets, restructuring and other charges of $51.7 million. Non-cash items amounted to $40.9 million and cash items to $10.8 million. The cash portion was made up of an $11.2 million charge related to new initiatives and a $0.4 million net reversal of prior years' initiatives. For the six-month period ended June 30, 2004, the Company recorded an impairment of assets, restructuring and other charges of $56.0 million, composed of non-cash items of $40.9 million and cash items of $15.1 million.

During the second quarter of 2004, the Company approved other restructuring initiatives to improve asset utilization and enhance efficiency. The restructuring initiatives included the closure of the Effingham, Illinois facility in the Magazine platform, an important downsizing at the Kingsport, Tennessee facility in the Book platform and other workforce reductions across the Company. The total cost of these initiatives was estimated at $59.2 million, of which $52.1 million was recorded in the second quarter and $7.1 million remains to be booked over the remainder of fiscal year 2004 and fiscal year 2005, when the liability related to the initiatives will have been contracted (see figure 10). These costs exclude a pension obligation related to the Effingham multiemployer benefit plan that could not be reasonably estimated at this time. Further information should become available over the next few months, which will allow the Company to measure and recognize this pension obligation. Of the $52.1 million booked in the second quarter of 2004, $40.9 million was for non-cash items and $11.2 million was for cash items. The $40.9 million non-cash portion, essentially in North America, included $31.9 million for impairment of long-lived assets, $8.0 million related to pension obligations and $1.0 million of impairment of other assets. The impairment of long-lived assets has been calculated as the excess of the carrying amount of an asset over its fair value, based on quoted market prices when available, or on the expected present value of future cash flows approach. The $11.2 million cash portion, mostly related to workforce reduction, included $10.2 million for North America, $0.5 million for Europe and $0.5 million for Latin America. The second quarter restructuring initiatives affected 1,363 employees in total, however the Company estimated that 457 new jobs will be created in other facilities. In summary, 258 employee positions have been eliminated and 1,105 will be eliminated before December 31, 2004.

In addition, the Company entered into negotiations with its employees' representatives at its facility in Stockholm, Sweden with regards to the facility's future. This facility has struggled financially during the last several years and there is a strong possibility that the current negotiations will lead to a reorganization of the Nordic gravure platform that could involve the closing of the Stockholm plant. Should the Company decide to close the Stockholm plant, the restructuring costs are estimated at $13 million and the net reduction of employee positions would be approximately 150.

During the second quarter, the execution of the prior year's initiatives resulted in a net reversal of $0.4 million comprised of a cash overspending of $2.6 million and a $3.0 million reversal of prior year restructuring and other charges. The net reversal of $0.4 million was essentially explained by the cancellation of the termination of 8 employee positions. In the first quarter, the net reversal of $0.7 million was mainly related to the cancellation of the termination of 48 employee positions and was made up of a cash overspending of $1.3 million and a $2.0 million reversal of prior years' restructuring charges. Since 2001, 6,163 employee positions have been eliminated under these initiatives as at June 30, 2004, and 37 will be eliminated during the second half of 2004, including 26 terminations in Europe to be completed when all the legal procedures and requirements are met.

In the first quarter of 2004, the Company initiated restructuring initiatives and recorded cash restructuring and other charges of $4.3 million. This was made up of a $0.7 million net reversal of prior years' initiatives and $5.0 million for workforce reduction, of which $3.9 million was for North America, $0.6 million for Europe and $0.3 million for Latin America. Under these initiatives, 356 employee positions have been eliminated and 3 still remain to come.

As at January 1, 2004, the balance of the restructuring reserve was $45.8 million. Before usage, the reserve had been increased by net cash items of $15.1 million as explained above. The reserve related mostly to future cash disbursements for workforce reductions across the platform and lease and facility carrying costs. The Company utilized $24.7 million of the current and prior years' restructuring and other charges reserves during the six-month period ended June 30, 2004.

Restructuring charges related to the initiatives undertaken in June 2004 that are expected to be incurred in the following periods are as follows:

Expected restructuring charges($ millions)

| | Q3 2004

| | Q4 2004

| | 2005

| | Total

|

|---|

| Workforce reduction costs | | $ | 1.1 | | $ | 0.6 | | $ | — | | $ | 1.7 |

| Leases, closed facilities carrying costs and other | | | 1.5 | | | 2.7 | | | 1.2 | | | 5.4 |

| | |

| |

| |

| |

|

| | | $ | 2.6 | | $ | 3.3 | | $ | 1.2 | | $ | 7.1 |

| | |

| |

| |

| |

|

Figure 10

FINANCIAL INSTRUMENTS

The Company uses a number of financial instruments: cash and cash equivalents, trade receivables, receivables from related parties, bank indebtedness, trade payables, accrued liabilities, payables to related parties, long-term debt and convertible notes. The carrying amounts of these financial instruments, except for long-term debt and convertible notes, approximate their fair values due to their short-term nature. The fair values of long-term debt and convertible notes are estimated based on discounted cash flows using period-end market yields of similar instruments with the same maturity.