QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2005

Commission File Number:1-14118

2005 SECOND QUARTER RESULTS

QUEBECOR WORLD INC.

(Translation of Registrant's Name into English)

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Fork 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

- Press Release dated August 2, 2005; Financial Highlights

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Financial Statements

- Certifications of Interim Filings

- Code of Business

August 2, 2005 07/05

For immediate release Page 1 of 6

QUEBECOR WORLD ANNOUNCES 2005 SECOND QUARTER RESULTS

Montréal, Canada - Quebecor World Inc. (NYSE:IQW, TSX:IQW.SV) announces that for the second quarter 2005 the Company reported net income of $10 million from continuing operations compared to $16 million in the second quarter of last year. The continuing operations do not include a previously identified non-core group of assets slated for sale and the second quarter results for 2004 have been restated to reflect this fact. On the same basis, earnings per share in the quarter were nil compared to $0.05 in the second quarter of 2004. Operating income was $53.4 million compared to $55.1 million during the same period last year. Before impairment of assets, restructuring and other charges, earnings per share were $0.22 compared to $0.30 in the second quarter of 2004. Consolidated revenues for the quarter were $1.49 billion compared to $1.47 billion last year.

For the first six months of 2005 net income was $26.7 million or $0.05 per share compared to $48.4 million or $0.23 per share last year. Before the impairment of assets, restructuring and other charges, earnings per share for the first half of 2005 were $0.50 compared to $0.51 last year. Consolidated revenue for the first six months of 2005 was $3.05 billion compared to $2.95 billion in 2004.

"These results are in line with what we communicated in our first quarter press release. As we indicated at that time, they reflect the loss of an important customer in the UK, the underperfomance of our French operations and our U.S. magazine platform as well as continuing global price pressures. We are implementing our plan to address these issues by investing in new, more efficient technologies, aggressively seeking additional volume and reducing costs," said Pierre Karl Péladeau, President and CEO, Quebecor World Inc. "While we still face a challenging market environment we have registered some important customer wins and renewals in our U.S. retail and directory business and in our Canadian and Latin American platforms. We continue to generate significant free cash flow. In the second quarter free cash flow was $117 million, an increase of $46 million from the same period last year."

1

For immediate release Page 2 of 6

In the quarter the Company recorded impairment of assets, restructuring and other charges of $31.8 million. The cash portion of this charge is $15.8 million and is related to workforce reductions in the UK, Sweden and North America. The second quarter restructuring initiatives will affect 886 employee positions however it is estimated that 63 new jobs will be created at other facilities. Impairment of long-lived assets of $16 million were recorded in the quarter, mostly in the Company's French operations.

In the second quarter 2005, selling, general and administrative expenses were $99 million compared to $103 million in the second quarter of 2004, a decrease of 4%. For the first six months of 2005, SG&A expenses were $200 million compared to $211 in the same period last year. Excluding the negative impact of currency translation SG&A expenses were lower by $17 million in the first six months of 2005. The decrease is mainly due to workforce reductions and cost containment initiatives.

North America

In North America revenues were $1.15 billion compared to $1.12 billion in the second quarter last year. For the first six months of 2005 revenues were $2.31 billion compared to $2.24 billion in the first six months of last year. Operating income in the second quarter before impairment of assets restructuring and other charges was $84.9 million compared to $92.7 million and operating margin on the same basis was 7.4% compared to 8.3%. The Magazine and Direct group continued to experience negative price pressures, and an unfavourable product mix resulting in lower operating income and margins. Volume for the quarter declined 3% in the Magazine group. This was partially offset by lower labor costs resulting from workforce reductions. In the Retail group revenues and volume increased. This is attributable to the addition of new customers and increased volume form existing customers. In the Book and Directory group despite a challenging price environment operating income and margins were relati vely flat in the second quarter due to cost containment and increased efficiencies. In Catalogs revenue decreased on flat volume as a result of lower prices. In Canada excluding the favourable impact of currency translation revenues decreased by 3% in the quarter but operating income and margins increased due to savings from cost containment initiatives and operational efficiencies. Volume was flat in the second quarter and increased 2% in the first six months of 2005 compared to last year.

2

For immediate release Page 3 of 6

Europe

In Europe revenues in the second quarter were $284 million compared to $310 million in the second quarter of 2004. Excluding the positive impact of currency translation revenues for the quarter were down 12%. Volume in Europe decreased 13% in the second quarter and is largely due to the catalog and magazine segments in France and the loss of a significant customer in the UK. Price erosion also had a significant impact on results. Operating margin in France was negative in the quarter and for the first six months of 2005. The challenging market environment was exacerbated by work stoppages in the first quarter that resulted in additional inefficiencies that affected results in the second quarter. In European operations outside of France operating income and margins were lower compared to the second quarter last year. This is mostly attributable to the Company's UK facility which has been able to replace some of the lost volume but at lower margins.

Latin America

In Latin America revenues were $66 million up 49% compared to the second quarter last year. Volume for the quarter increased 17% compared to the same period last year. Much of this increase is attributable to the positioning of the Company's Latin American book and directory facilities as a low-cost alternative to publishers who were having their work produced in China. This has resulted in increased cross-selling from North America and Europe. The positive impact of currency translation and increased paper sales also contributed to increased revenue. Operating income and margin increased in the quarter and for the first six months compared to the same periods last year.

Discontinued Operations

Quebecor World's core printing activities involve the printing of magazines, catalogs, retail inserts, books, directories and direct mail for the world's largest publishers and retailers. As the Company has grown by acquisition certain facilities were included in those transactions that do not relate to these core businesses. Approximately a dozen facilities in North America are involved in the printing of short-run contractual work such as marketing materials, annual reports, travel and fashion brochures. These activities are different from Quebecor World's core businesses and do not benefit from the advantages and synergies of the Company's global platform. The Company has announced its intention to sell this non-core group. Consequently the operating results related to these activities have been presented separately in the Company's consolidated financial results as discontinued operations and comparative figures have been restated to conform to the presentation adopted during the quart er ended June 30, 2005.

3

For immediate release Page 4 of 6

Dividend

The Board of Directors declared a dividend of $0.14 per share on Multiple Voting Shares and Subordinate Voting Shares. The Board also declared a dividend of CDN$0.3845 per share on Series 3 Preferred Shares, CDN$0.421875 per share on Series 4 Preferred Shares and CDN$0.43125 on Series 5 Preferred Shares. The dividends are payable on September 1st, 2005 to shareholders of record at the close of business August 16th, 2005.

Management Discussion and Analysis

Please refer to the MD&A for the reconciliation to Canadian generally accepted accounting principles of certain figures used to explain these results. The MD&A can be found on the Company's website atwww.quebecorworld.com and through the SEDAR and SEC filings.

Financial statements are available on the Company's website and through the SEDAR and SEC filings.

Sedar web address:www.sedar.com

SEC web address:www.sec.gov

Quebecor World To Webcast Investor Conference Call on August 2, 2005

Quebecor World Inc. will broadcast its Second Quarter conference call live over the Internet on August 2, 2005 at 4:00 PM (Eastern Time).

The conference call, which will last approximately one hour, will be webcast live and can be accessed on the Quebecor World web site:

http://www.quebecorworld.com/en/investors/webcasts/Q205

Prior to the call please ensure that you have the appropriate software. The Quebecor World web address listed above has instructions and a direct link to download the necessary software, free of charge.

Anyone unable to attend this conference call may listen to the replay tape by phoning (877) 293-8133 or (403) 266-2079 &150 passcode 287589#, available from August 2, 2005 to September 3, 2005.

4

For immediate release Page 5 of 6

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customers' demand for the Company's products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by the Company's competitors, and general changes in economic conditions.

Quebecor World Inc. (NYSE:IQW; TSX:IQW.SV) is one of the largest commercial printers in the world. It is a market leader in most of its major product categories which include magazines, inserts and circulars, books, catalogs, direct mail, directories, digital pre-media, logistics, mail list technologies and other value added services. The Company has approximately 35,000 employees working in more than 160 printing and related facilities in the United States, Canada, Brazil, France, the United Kingdom, Belgium, Spain, Austria, Sweden, Switzerland, Finland, Chile, Argentina, Peru, Colombia, Mexico and India.

Web address:www.quebecorworld.com

- 30 -

For further Information contact:

Tony Ross

Director, Communications

Quebecor World Inc.

(514) 877-5317

(800) 567-7070 | Philippe Cloutier

Director, Finance and

Investor Relations

Quebecor World Inc.

(514) 877-5147

(800) 567-7070 | | |

5

QUEBECOR WORLD INC.

FINANCIAL HIGHLIGHTS

Periods ended June 30

(In millions of US dollars, except per share data)

(Unaudited)

| | Three months

| | Six months

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Consolidated Results from Continuing Operations | | | | | | | | | | | | | |

| Revenues | | $ | 1,494.2 | | $ | 1,473.8 | | $ | 3,047.1 | | $ | 2,950.5 | |

| Operating income before depreciation and amortization and before IAROC | | | 168.3 | | | 194.0 | | | 344.2 | | | 373.8 | |

| Operating income before IAROC | | | 85.2 | | | 105.2 | | | 175.0 | | | 198.3 | |

| IAROC | | | 31.8 | | | 50.1 | | | 65.1 | | | 54.3 | |

| Operating income | | | 53.4 | | | 55.1 | | | 109.9 | | | 144.0 | |

| Net income from continuing operations | | | 10.1 | | | 15.6 | | | 26.7 | | | 48.4 | |

| Operating margin before depreciation and amortization and before IAROC** | | | 11.3 | % | | 13.2 | % | | 11.3 | % | | 12.7 | % |

| Operating margin before IAROC** | | | 5.7 | % | | 7.1 | % | | 5.7 | % | | 6.7 | % |

| Operating margin ** | | | 3.6 | % | | 3.7 | % | | 3.6 | % | | 4.9 | % |

Segmented Information from Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | | | | | | | | | | | | |

| | North America | | $ | 1,145.6 | | $ | 1,121.9 | | $ | 2,311.3 | | $ | 2,238.9 | |

| | Europe | | | 283.9 | | | 309.7 | | | 615.5 | | | 625.1 | |

| | Latin America | | | 66.2 | | | 44.4 | | | 122.8 | | | 91.2 | |

Operating income (loss) before IAROC |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 84.9 | | $ | 92.7 | | $ | 166.3 | | $ | 174.8 | |

| | Europe | | | (2.3 | ) | | 12.4 | | | 4.0 | | | 24.3 | |

| | Latin America | | | 3.5 | | | 1.8 | | | 6.5 | | | 2.0 | |

Operating margins before IAROC** |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | | 7.4 | % | | 8.3 | % | | 7.2 | % | | 7.8 | % |

| | Europe | | | (0.8 | )% | | 4.0 | % | | 0.6 | % | | 3.9 | % |

| | Latin America | | | 5.3 | % | | 4.0 | % | | 5.3 | % | | 2.1 | % |

Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities | | $ | 201.2 | | $ | 112.3 | | $ | 184.7 | | $ | 65.5 | |

| Free cash flow from operations* | | $ | 116.8 | | $ | 71.3 | | $ | 36.9 | | $ | (18.2 | ) |

| Working capital | | | | | | | | $ | 44.9 | | $ | 9.0 | |

| Total assets | | | | | | | | $ | 5,978.6 | | $ | 6,076.7 | |

| Long-term debt (including convertible notes) | | | | | | | | $ | 1,897.4 | | $ | 2,077.5 | |

| Shareholders' equity | | | | | | | | $ | 2,499.6 | | $ | 2,492.8 | |

| Debt-to-capitalization | | | | | | | | | 43:57 | | | 45:55 | |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations | | | | | | | | | | | | | |

| | Diluted | | $ | — | | $ | 0.05 | | $ | 0.05 | | $ | 0.23 | |

| | Diluted before IAROC | | $ | 0.22 | | $ | 0.30 | | $ | 0.50 | | $ | 0.51 | |

| Dividends on equity shares | | $ | 0.14 | | $ | 0.13 | | $ | 0.28 | | $ | 0.26 | |

| Book value | | | | | | | | $ | 15.62 | | $ | 15.39 | |

IAROC: Impairment of assets, restructuring and other charges.

- *

- Cash provided by operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

- **

- Margins calculated on revenues.

6

MANAGEMENT'S DISCUSSION AND ANALYSIS

The following is a discussion of the consolidated financial condition and results of operations of Quebecor World Inc. for the three-month and six-month periods ended June 30, 2005 and 2004, and should be read together with the Company's interim consolidated financial statements and the annual "Management's Discussion and Analysis" included in the 2004 Annual Report. The interim consolidated financial statements and Management's Discussion and Analysis have been reviewed by the Company's Audit Committee and approved by its Board of Directors. This discussion contains forward-looking information that is qualified by reference to, and should be read together with, the discussion regarding forward-looking statements that is part of this document. Management determines whether or not information is "material" based on whether it believes a reasonable investor's decision to buy, sell or hold securities in the Company would likely be influenced or changed if the information were omitted or misstated.

Financial data has been prepared in conformity with Canadian Generally Accepted Accounting Principles ("GAAP"). However, certain measures used in this discussion and analysis do not have any standardized meaning under Canadian GAAP. When used, these measures are defined in such terms as to allow the reconciliation to the closest GAAP measure. Numerical reconciliations are provided in figure 6. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Company's functional currency is the Canadian dollar and its reporting currency is the U.S. dollar.

FORWARD-LOOKING STATEMENTS

Except for historical information contained herein, the statements in this document are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customer demand for products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by competitors and general changes in economic conditions.

OVERVIEW

Quebecor World Inc. is one of the largest commercial print media services companies in the world. Quebecor World is a market leader in the product categories and geographies it serves. This market-leading position has been built through a combination of integrating acquisitions, investing in key strategic technologies and a commitment to building long-term partnerships with the world's leading print media customers.

Quebecor World has facilities in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

The Company offers its customers a broad range of printed products and related communication services, such as magazines, retail inserts, catalogs, direct mail, books, directories, pre-media, logistics and other value-added services.

The Company operates in the commercial print media segment of the printing industry and its business groups are located in three geographical regions: North America, which historically represents approximately 80% of the Company's revenues, Europe and Latin America.

Operations in this segment of the print industry are seasonal with a greater part of volume being realized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions. The interim results of operations analyzed hereafter are not necessarily indicative of full year results.

Consolidation of the printing industry is ongoing because of global overcapacity which has led to negative price pressures. As smaller plants disappear, larger plants continue to grow and deploy more efficient equipment. Consequently global overcapacity will remain an issue and will likely impact prices in certain segments.

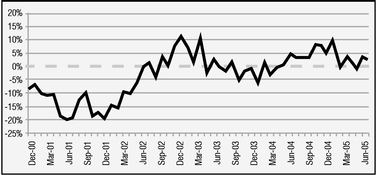

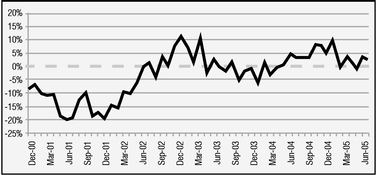

The primary drivers affecting the Company are consumer confidence and economic growth rates. These are key drivers of demand for commercial print media because they affect the level of advertising and merchandising activity. The Company uses magazine advertising pages as an important indicator of demand for printing products and services. This indicator, as measured in the United States by the Publishers Information Bureau, showed some positive signs throughout 2004, but was volatile in the first half of 2005. (Figure 1)

U.S. Magazine Advertising Pages 2001-2005 (Monthly)

Percentage Year-Over-Year Change

Source: Publishers Information Bureau (PIB)

Figure 1

The Company also emphasizes two additional key success factors — administrative and manufacturing efficiency — and addresses them on a continual basis. In recent years, the Company has undertaken restructuring initiatives that resulted in downsizing across the platform and several plant closures. These measures are ongoing and are expected to continue through the rest of 2005. In the current challenging environment, the positive effects of the 2004 restructuring initiatives were not evident in operating income because of the continuing price reductions.

Furthermore, technology will continue to play an important role in improving Quebecor World's manufacturing efficiency. The Company is focussed on improving speeds, reducing manning, lowering downtime and paper waste as well as shorter make-ready times. As part of these efforts the Company approved a three year investment plan in 2004 that calls for over $300 million in investments in newer, more efficient presses across the platform. The Company's strategy is to reduce its fixed cost base and increase its efficiency by consolidating smaller facilities into larger groups of operations, grouping similar types of assets into larger facilities using available space and optimizing all aspects of pressroom efficiencies. In addition, the Company divested itself of certain smaller operations in France and North America.

7

At the annual shareholders meeting held on May 10, 2005, management announced that the Company's results for the second quarter of 2005 would be lower than those of the first quarter of 2005. The actual results for the quarter are, as anticipated, below those of the first quarter and the first six months of 2005 have been particularly difficult for the Company. They reflect the loss of an important customer in the UK, the underperformance of French operations, the U.S. magazine platform and non-core operations in North America. The French operations suffered in the first quarter from labor strikes that led to various inefficiencies coupled with continued price pressure. These elements continued to affect the French operations in the second quarter and its financial results continued to suffer. The Company is presently assessing the situation in France in order to determine what actions are necessary to help bring results back on track. Britain's results for the second quarter reflect the volume lost because an important contract was not renewed and was terminated. Management is developing a strategic plan to help the British operations replace lost volume. Magazine operations are suffering in North America as volumes are down in general and particularly due to the loss of certain important contracts. The Company will retool this platform, along with the majority of North American operations, to render them more competitive and help replace lost volumes. Finally, the non-core printing activities continued to perform below par in the second quarter of 2005. In order to address this situation, the Company is actively negotiating the disposal of these activities as explained in the "Discontinued operations" section hereafter.

The current charge for impairment of assets, restructuring and other charges reflects both smaller initiatives undertaken in the first half and definite plans to eliminate inefficient and idle equipment. As such, a detailed review of activities took place at the facility in Corby, England. This resulted in the implementation of a workforce reduction plan and an impairment of long-lived assets. The Company anticipates additional restructuring charges in the upcoming quarters related to the restructuring of this facility, as discussed in the "Impairment of Assets and Restructuring Initiatives" section.

DISCONTINUED OPERATIONS

Over the years, Quebecor World has strived to build a global printing platform that allows publishers and retailers to print in multiple plants, in various countries, reducing lead-time and distribution costs. The Company's core printing activities, mainly the printing of magazines, catalogs, retail inserts, books and directories benefit from this platform. However, as the Company grew by acquisitions, certain facilities were included in these transactions that do not concentrate on Quebecor World's core printing activities. As a result, there are approximately a dozen facilities in North America whose primary activities are non-core general commercial printing. These activities consist primarily of short-run, non-contractual work such as annual reports, marketing materials, travel, fashion and automobile brochures and packaging. This market is highly competitive and fragmented with many small local and regional players. Different from Quebecor World's previously described core business, these activities do not benefit from the advantages and synergies of the Company's global platform. As a result, on May 10, 2005, the Company announced a plan to sell its group of non-core printing facilities in North America (the "non-core Group").

At the end of the second quarter, the Company had completed the sale of a facility in Los Angeles, California and was in the process of concluding the disposal of the remaining facilities included in the non-core Group. Consequently, the operating results related to these activities have been presented separately in the Company's consolidated financial statements as discontinued operations and comparative figures have been restated to conform to the presentation adopted during the quarter ended June 30, 2005. The assets related to the Los Angeles facility have been excluded from the Company's consolidated balance sheet and the assets and liabilities related to the remaining plants are presented as held for sale in Note 5 to the consolidated financial statements as at June 30, 2005.

The results of the non-core Group have been significantly impacted by the loss on disposal of the Los Angeles facility as well as specific charges related to this facility. Also, this facility incurred decreased revenues and operating income. The Company is continuing to negotiate the disposal of other facilities in this non-core Group.

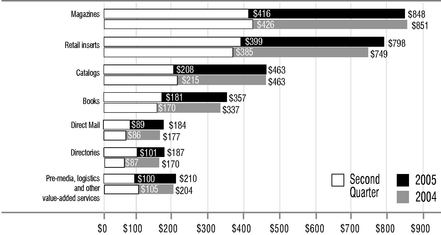

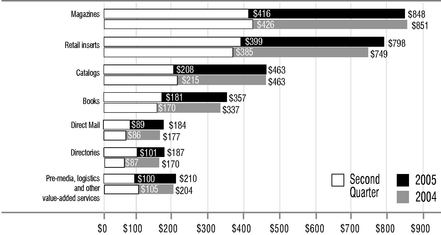

Revenue by Product-Worldwide($ millions)

For the quarter and the six-month periods ended June 30

(Continuing Operations)

Figure 2

REVIEW OF SECOND QUARTER AND YEAR-TO-DATE

The Company assesses performance based on operating income before impairment of assets, restructuring and other charges. The following operating analyses are before impairment of assets, restructuring and other charges. The review focussed only on continuing operations.

The Company's consolidated revenues for the quarter were $1,494 million, a 1% increase when compared to $1,474 million for the same period in 2004. On a year-to-date basis, revenues were $3,047 million, up 3% from $2,951 million in 2004. Excluding the favorable impact of currency translation (see figure 3), revenues were $1,460 for the quarter, down 1% compared to 2004 and $2,980 for the first six months of 2005, up 1% compared to 2004. This situation is mainly due to continued pressure on prices, and an overall volume decrease for the quarter and year-to-date. Revenue by product is shown in figure 2.

Impact of Foreign Currency($ millions)

(Continuing Operations)

| | Three months ended

June 30, 2005

| | Six months ended

June 30, 2005

|

|---|

| Foreign currency favorable impact on revenues | | $ | 33.9 | | $ | 66.7 |

| Foreign currency favorable impact on operating income | | $ | 0.8 | | $ | 1.6 |

Figure 3

8

For the second quarter of 2005, operating income decreased 19% to $85 million, from $105 million in 2004. On a year-to-date basis, operating income was $175 million, down 12% from $198 million in 2004. Operating margin for the quarter was 5.7% compared to 7.1% for the same period in 2004. For the year 2005 to date, operating margin was 5.7% down from 6.7% in 2004.

Paper sales, excluding the effect of currency translation, increased by 8% in the second quarter of 2005 compared to the same period in 2004. On the same basis, for the first six months of 2005, paper sales increased by 9% compared to the same period in 2004. The increase for both the quarter and year-to-date was mainly due to the increase in paper sales to customers and the increase in paper prices compared to 2004. Although the increase in paper sales has a positive impact on revenues, it has little or no impact on operating income because the cost is generally passed on to the customer and, as a result, it contributes to the lower operating margin. Most of the Company's long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper.

In the second quarter of 2005 and 2004, operating income was affected by recording specific charges of $7 million mainly for provisions for leases in North America. For the first six months of 2005, the Company recorded specific charges of $10 million compared to $3 million in 2004. The 2005 charges related mainly to provisions for leases in North America, whereas the 2004 charges related to various items including provisions for leases, depreciation of assets and favorable legal claim settlements in North America.

Cost of sales for the second quarter 2005 increased 4% at $1,228 million compared to $1,180 million last year. For the year 2005 to date, cost of sales was $2,505 million, a 6% increase compared to $2,372 million for the same period in 2004. Gross profit margin was 17.8% in the second quarter of 2005, down from 19.9% in 2004. On a year-to-date basis, gross profit margin was 17.8% compared to 19.6% in 2004. The cost of sales for the second quarter included specific charges of $5 million and $8 million for the first six months of 2005 mainly due to lease provisions. In the second quarter of 2004, the cost of sales included specific charges of $2 million for the second quarter and net recovery of $4 million on a year-to-date basis. Excluding these specific items as well as the unfavorable impact of currency translation, gross profit margin for the quarter was 19.3%, down from 20.0% for the same quarter last year. On a year-to-date basis in 2005, gross profit margin, excluding specific items as well as the unfavorable impact of currency translation, was 17.4% compared to 19.5% for 2004. The decrease compared to 2004 is explained by continued pressure on prices, an increase in freight costs due to higher fuel prices and a higher level of paper sales. These were partly offset by a $30 million decrease in labor costs compared to the same period in 2004. This reflects the effect of the ongoing restructuring initiatives undertaken by the Company and described in the "Impairment of Assets and Restructuring Initiatives" section hereafter.

Segmented Results of Continuing Operations($ millions)

Selected Performance Indicators

| | North America

| | Europe

| | Latin America

| | Inter-Segment and Others

| | Total

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Three months ended June 30, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 1,145.6 | | $ | 1,121.9 | | $ | 283.9 | | $ | 309.7 | | $ | 66.2 | | $ | 44.4 | | $ | (1.5 | ) | $ | (2.2 | ) | $ | 1,494.2 | | $ | 1,473.8 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 150.6 | | | 161.7 | | | 12.2 | | | 29.2 | | | 6.2 | | | 4.6 | | | (0.7 | ) | | (1.5 | ) | | 168.3 | | | 194.0 | |

| Operating income (loss) before IAROC | | | 84.9 | | | 92.7 | | | (2.3 | ) | | 12.4 | | | 3.5 | | | 1.8 | | | (0.9 | ) | | (1.7 | ) | | 85.2 | | | 105.2 | |

| IAROC | | | 8.3 | | | 47.3 | | | 23.1 | | | 2.3 | | | 0.4 | | | 0.4 | | | — | | | 0.1 | | | 31.8 | | | 50.1 | |

| Operating income (loss) | | | 76.6 | | | 45.4 | | | (25.4 | ) | | 10.1 | | | 3.1 | | | 1.4 | | | (0.9 | ) | | (1.8 | ) | | 53.4 | | | 55.1 | |

| Operating margin before depreciation and amortization and before IAROC | | | 13.2 | % | | 14.4 | % | | 4.3 | % | | 9.4 | % | | 9.4 | % | | 10.2 | % | | | | | | | | 11.3 | % | | 13.2 | % |

| Operating margin before IAROC | | | 7.4 | % | | 8.3 | % | | (0.8) | % | | 4.0 | % | | 5.3 | % | | 4.0 | % | | | | | | | | 5.7 | % | | 7.1 | % |

| Operating margin | | | 6.7 | % | | 4.1 | % | | (9.0) | % | | 3.3 | % | | 4.7 | % | | 3.0 | % | | | | | | | | 3.6 | % | | 3.7 | % |

| Capital expenditures(1) | | $ | 64.2 | | $ | 29.6 | | $ | 8.7 | | $ | 2.6 | | $ | 0.8 | | $ | 0.7 | | $ | — | | $ | — | | $ | 73.7 | | $ | 32.9 | |

| Changes in non-cash balances related to operations, cash flow (outflow)(1) | | | 88.8 | | | (20.3 | ) | | 12.5 | | | 1.4 | | | 1.3 | | | 7.1 | | | (10.8 | ) | | (14.8 | ) | | 91.8 | | | (26.6 | ) |

Six months ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | $ | 2,311.3 | | $ | 2,238.9 | | $ | 615.5 | | $ | 625.1 | | $ | 122.8 | | $ | 91.2 | | $ | (2.5 | ) | $ | (4.7 | ) | $ | 3,047.1 | | $ | 2,950.5 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 299.0 | | | 310.3 | | | 34.7 | | | 58.3 | | | 11.8 | | | 7.5 | | | (1.3 | ) | | (2.3 | ) | | 344.2 | | | 373.8 | |

| Operating income (loss) before IAROC | | | 166.3 | | | 174.8 | | | 4.0 | | | 24.3 | | | 6.5 | | | 2.0 | | | (1.8 | ) | | (2.8 | ) | | 175.0 | | | 198.3 | |

| IAROC | | | 16.4 | | | 50.5 | | | 48.2 | | | 2.9 | | | 0.5 | | | 0.6 | | | — | | | 0.3 | | | 65.1 | | | 54.3 | |

| Operating income (loss) | | | 149.9 | | | 124.3 | | | (44.2 | ) | | 21.4 | | | 6.0 | | | 1.4 | | | (1.8 | ) | | (3.1 | ) | | 109.9 | | | 144.0 | |

| Operating margin before depreciation and amortization and before IAROC | | | 12.9 | % | | 13.9 | % | | 5.6 | % | | 9.3 | % | | 9.6 | % | | 8.2 | % | | | | | | | | 11.3 | % | | 12.7 | % |

| Operating margin before IAROC | | | 7.2 | % | | 7.8 | % | | 0.6 | % | | 3.9 | % | | 5.3 | % | | 2.1 | % | | | | | | | | 5.7 | % | | 6.7 | % |

| Operating margin | | | 6.5 | % | | 5.6 | % | | (7.2) | % | | 3.4 | % | | 4.9 | % | | 1.5 | % | | | | | | | | 3.6 | % | | 4.9 | % |

| Capital expenditures(1) | | $ | 110.6 | | $ | 55.7 | | $ | 16.7 | | $ | 6.1 | | $ | 1.1 | | $ | 3.1 | | $ | — | | $ | — | | $ | 128.4 | | $ | 64.9 | |

| Changes in non-cash balances related to operations, cash flow (outflow)(1) | | | 2.5 | | | (193.6 | ) | | (31.5 | ) | | (27.7 | ) | | (4.9 | ) | | 5.7 | | | (22.7 | ) | | 2.1 | | | (56.6 | ) | | (213.5 | ) |

IAROC: Impairment of assets, restructuring and other charges.

- (1)

- Including both continued and discontinued operations

Figure 4

9

Selling, general and administrative expenses for the second quarter of 2005 were $99 million compared to $103 million in 2004, a decrease of 4%. On a year-to-date basis, selling, general and administrative expenses were $200 million in 2005, compared to $211 million in 2004 or a decrease of 5%. Excluding the unfavorable impact of currency translation of $3 million, selling, general and administrative expenses were lower by $7 million for the second quarter compared to last year. On a year-to-date basis, excluding the negative impact of currency translation of $6 million, selling, general and administrative expenses improved by $17 million. The savings were mostly explained by cost-containment initiatives and headcount reductions.

Depreciation and amortization were $77 million in the second quarter of 2005 compared to $83 million in the same period of 2004. On a year-to-date basis, depreciation and amortization were $157 million in 2005, compared to $163 million in 2004. Excluding the impact of currency movement, depreciation and amortization decreased by 9% for the second quarter and 6% year-to-date in 2005 compared to last year. The decrease is mostly due to impairment charges taken during the last twelve months.

Securitization fees totalled $6 million for the second quarter of 2005 ($3 million for the second quarter of 2004) and $10 million for the first six months of 2005 ($6 million for the same period in 2004). The increase for the first six months of 2005 was mainly due to higher market interest rates underlying the program fees. Servicing revenues and expenses did not have a significant impact on the Company's results.

During the first half of 2005, the Company continued its restructuring initiatives and recorded a net impairment of assets and restructuring charges of $65 million, which reflected further workforce reductions across the Company. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $31 million in the second quarter of 2005, compared to $32 million in 2004. On a year-to-date basis, financial expenses were $60 million in 2005, compared to $70 million in 2004. The lower expenses were mainly due to a lower average volume of debt in 2005 and a $2 million non-recurring charge on extinguishment of long-term debt in 2004.

In the second quarter of 2005, income taxes were $12 million compared to $5 million for the same period in 2004 or an effective tax rate of 54.9% compared to 20.6% in 2004. On a year-to-date basis, income taxes were $23 million in 2005, compared to $21 million in 2004, or an effective tax rate of 46.7% compared to 29.0% in 2004. The rates were significantly higher in 2005 due to valuation allowances recorded on tax benefit related to the impairment of long-lived assets, restructuring and other charges. Before impairment of assets, restructuring and other charges, income taxes were $15 million for the second quarter of 2005 compared to $22 million for the same period last year or an effective tax rate of 28.4% for 2005 compared to 29.1% in 2004. On the same basis, the year-to-date income taxes were $29 million compared to $39 million in 2004, or an effective tax rate of 25.5% compared to 30.6% for 2004. The decrease in income tax rate was mainly due to a decrease in profits before taxes in jurisdictions with higher tax rates.

Net income for the second quarter was $10 million compared to $16 million in 2004. For the six-month period, net income was $27 million, compared to $48 million for the same period last year. Diluted earnings per share were nil for the second quarter of 2005 down from $0.05 compared to 2004. These results incorporated impairment of assets, restructuring and other charges of $32 million ($29 million net of taxes) or $0.22 per share compared with $50 million ($34 million net of taxes) or $0.25 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges, the second quarter of 2005 resulted in diluted earnings per share of $0.22 compared with $0.30 in the same period of 2004. Diluted earnings per share were $0.05 for the first six months of 2005 compared to $0.23 for the same period in 2004. These results incorporated impairment of assets, restructuring and other charges of $65 million ($59 million net of taxes) or $0.45 per share compared with $54 million ($37 million net of taxes) or $0.28 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges, the first half of 2005 resulted in diluted earnings per share of $0.50 compared with $0.51 in the same period of 2004.

SEGMENT REVIEW

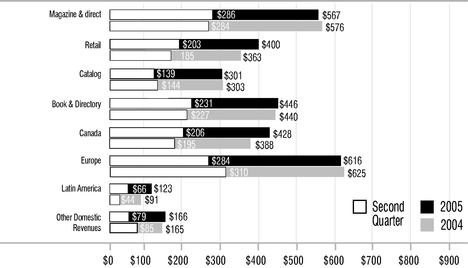

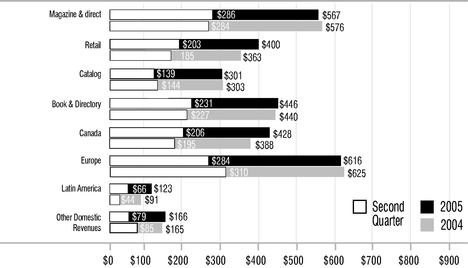

The following review of operating activities by business group (figure 5) is before impairment of assets, restructuring and other charges. Also, the review focusses only on continuing operations.

Revenue by Business Group($ millions)

For the quarter and the six-month periods ended June 30

(Continuing Operations)

Figure 5

North America

North American revenues for the second quarter of 2005 were $1,146 million, up 2% from $1,122 million in 2004. On a year-to-date basis, revenues were $2,311 in 2005 up 3% from $2,239 in 2004. Excluding the effect of currency translation and the favorable impact of paper sales, revenues decreased by 2% in the second quarter and 1% on a year-to-date basis mainly due to shortfalls in volume and price erosion. Selling, general and administrative expenses decreased across the North American platform in the second quarter and on a year-to-date basis in 2005 compared to 2004, due to savings from facility closures, cost-containment initiatives and corporate headcount reductions, mostly in 2004. Year-over-year headcount was reduced in North America by 1,314 employees, or approximately 5%.

The following is a review of the North American activities by business group. The North American segment is made up of the following business groups: Magazine & Direct, Retail, Catalog, Book & Directory, Canada and Other Revenues.

10

Reconciliation of non GAAP measures

($ millions)

| | Three months ended June 30,

| | Six months ended June 30,

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Operating Income from Continuing Operations | | | | | | | | | | | | | |

| | Operating income | | $ | 53.4 | | $ | 55.1 | | $ | 109.9 | | $ | 144.0 | |

| | IAROC | | | 31.8 | | | 50.1 | | | 65.1 | | | 54.3 | |

| | |

| |

| |

| |

| |

| | Operating income before IAROC | | $ | 85.2 | | | 105.2 | | $ | 175.0 | | $ | 198.3 | |

| | |

| |

| |

| |

| |

| | Operating income | | $ | 53.4 | | $ | 55.1 | | $ | 109.9 | | $ | 144.0 | |

| | Depreciation of property, plant and equipment(1) | | | 78.2 | | | 84.8 | | | 160.6 | | | 167.7 | |

| | Amortization of deferred charges(1) | | | 6.6 | | | 6.5 | | | 12.7 | | | 12.8 | |

| | Less depreciation and amortization from discontinued operations(2) | | | (1.7 | ) | | (2.5 | ) | | (4.1 | ) | | (5.0 | ) |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization | | $ | 136.5 | | $ | 143.9 | | $ | 279.1 | | $ | 319.5 | |

| | IAROC | | | 31.8 | | | 50.1 | | | 65.1 | | | 54.3 | |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization and before IAROC | | $ | 168.3 | | $ | 194.0 | | $ | 344.2 | | $ | 373.8 | |

| | |

| |

| |

| |

| |

Earnings per share from Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Net income from Continuing Operations | | $ | 10.1 | | $ | 15.6 | | $ | 26.7 | | $ | 48.4 | |

| | IAROC (net of income taxes of $3 million for the second quarter of 2005 ($6 million year-to-date) and $17 million for the second quarter of 2004 ($18 million year-to-date)) | | | 28.8 | | | 33.6 | | | 59.1 | | | 36.6 | |

| | |

| |

| |

| |

| |

| | Net income before IAROC | | $ | 38.9 | | | 49.2 | | $ | 85.8 | | $ | 85.0 | |

| | Net income available to holders of preferred shares | | | 9.8 | | | 8.7 | | | 19.7 | | | 17.8 | |

| | |

| |

| |

| |

| |

| | Net income available to holders of equity shares before IAROC | | $ | 29.1 | | $ | 40.5 | | $ | 66.1 | | $ | 67.2 | |

| | Diluted average number of equity shares outstanding (in millions) | | | 132.5 | | | 132.4 | | | 132.7 | | | 132.3 | |

| | Earnings per share | | | | | | | | | | | | | |

| | | Diluted | | $ | — | | $ | 0.05 | | $ | 0.05 | | $ | 0.23 | |

| | | Diluted before IAROC | | $ | 0.22 | | $ | 0.30 | | $ | 0.50 | | $ | 0.51 | |

| | |

| |

| |

| |

| |

Free Cash Flow (outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Cash provided by operating activities | | $ | 201.2 | | $ | 112.3 | | $ | 184.7 | | $ | 65.5 | |

| | Dividends on preferred shares | | | (12.2 | ) | | (8.5 | ) | | (24.6 | ) | | (20.2 | ) |

| | Additions to property, plant and equipment | | | (73.7 | ) | | (32.9 | ) | | (128.4 | ) | | (64.9 | ) |

| | Net proceeds from disposal of assets | | | 1.5 | | | 0.4 | | | 5.2 | | | 1.4 | |

| | |

| |

| |

| |

| |

| | Free cash flow (outflow) from operations | | $ | 116.8 | | $ | 71.3 | | $ | 36.9 | | $ | (18.2 | ) |

| | |

| |

| |

| |

| |

Debt-to-capitalization |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Bank indebtedness | | | | | | | | $ | 0.2 | | $ | 0.9 | |

| | Current portion of long-term debt | | | | | | | | | 9.3 | | | 12.8 | |

| | Long-term debt | | | | | | | | | 1,774.4 | | | 1,953.0 | |

| | Convertible notes | | | | | | | | | 113.7 | | | 111.7 | |

| | | | | | | | |

| |

| |

| | Total debt | | | | | | | | $ | 1,897.6 | | $ | 2,078.4 | |

| | Minority interest | | | | | | | | | 1.1 | | | 26.9 | |

| | Shareholders' equity | | | | | | | | | 2,499.6 | | | 2,492.8 | |

| | | | | | | | |

| |

| |

| | Capitalization | | | | | | | | $ | 4,398.3 | | $ | 4,598.1 | |

| | | | | | | | |

| |

| |

| | Debt-to-capitalization | | | | | | | | | 43:57 | | | 45:55 | |

| | | | | | | | |

| |

| |

Book value per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Shareholders' equity | | | | | | | | $ | 2,499.6 | | $ | 2,492.8 | |

| | Preferred shares | | | | | | | | | (456.6 | ) | | (456.6 | ) |

| | | | | | | | |

| |

| |

| | | | | | | | | $ | 2,043.0 | | $ | 2,036.2 | |

| | Ending number of equity shares (in millions) | | | | | | | | | 130.8 | | | 132.3 | |

| | | | | | | | |

| |

| |

| | Book value per share | | | | | | | | $ | 15.62 | | $ | 15.39 | |

| | | | | | | | |

| |

| |

IAROC: Impairment of assets, restructuring and other charges.

- (1)

- As reported in the Consolidated Statements of cash flows

- (2)

- As reported in Note 5 "Discontinued Operations"

Figure 6

11

Magazine & Direct

Magazine & Direct revenues for the second quarter of 2005 were $286 million, up 1% from $284 million in 2004. On a year-to-date basis, revenues were $567 million in 2005, down 2% from $576 million in 2004. Revenue increased in the second quarter due mainly to increased paper sales in both groups offset by a 3% volume shortfall in the Magazine group and continued price erosion in both groups. Revenue decreased on a year-to-date basis due to the volume shortfalls of 5% in Magazine and 3% in Direct and continued price erosion in both groups. Volume in the magazine group was negatively impacted due to the non-renewal of certain important contracts. Operating income and margin decreased in the second quarter and on a year-to-date basis due mainly to the volume decreases and price erosion, but was partly offset by a decrease in labor costs from head-count reduction.

Retail

Retail revenues for the second quarter of 2005 were $203 million, up 10% from $185 million in 2004. On a year-to-date basis, revenues were $400 million in 2005, up 10% from $363 million in 2004. Excluding the favorable impact of paper sales, revenues increased by 2% and 3% in the second quarter and year-to-date, respectively, compared to 2004. The increase in revenue was due mainly to an 8% increase in volume in both the second quarter and year-to-date partly offset by the negative impact of lower priced work. The volume increase is explained by both new gains as well as additional volume from existing customers. Operating income was flat in the second quarter of 2005 compared to the same period in 2004, but on a year-to-date basis, operating income increased due mainly to the savings from restructuring initiatives and operational efficiency gains.

Catalog

Catalog revenues for the second quarter of 2005 were $139 million, down 4% from $144 million in 2004. On a year-to-date basis, revenues were $301 million in 2005, down 1% from $303 million in 2004. The decrease in revenue for the second quarter and year-to-date basis was due mainly to the negative impact of lower priced work while volume remained relatively flat. The price erosion was a result of the overall competitive catalog market. Operating income and margin decreased in the second quarter and year-to-date basis due mainly to the negative impact of lower pricing that was partly offset by cost containment initiatives and headcount reduction.

Book & Directory

Book & Directory revenues for the second quarter of 2005 were $231 million, up 2% from $227 million in 2004. On a year-to-date basis, revenues were $446 million in 2005, up 1% from $440 million in 2004. Excluding the favorable impact of paper sales, revenues were flat in the second quarter and decreased 2% year-to-date compared to the same periods in 2004. The decrease in revenue was due mainly to the negative impact of price with volume remaining relatively flat on a year-to-date basis. Operating income and margin were flat in the second quarter and year-to-date basis compared to 2004. The Book and Directory group has continued to enhance its position by maintaining competitive efficiencies and by adding a significant ten-year contract with Dex Media.

Canada

The Canadian business group operates mainly in the Retail, Magazine, Direct, Catalog, and Directory markets. Canadian revenues for the second quarter of 2005 were $206 million, up 6% from $195 million in 2004. On a year-to-date basis, revenues were $428 million in 2005, up 10% from $388 million in 2004. Excluding the favorable impact of currency translation, revenues decreased by 3% for the quarter and increased 2% year-to-date compared to the same periods in 2004. Volume was relatively flat in the second quarter of 2005 but increased 2% year-to-date compared to the same periods last year, mainly due to volume growth in the Directory and Retail markets. Despite a volume increase, market conditions remained extremely competitive as reflected in the pricing. However, operating income and margin increased in both the second quarter and year-to-date compared to the same periods last year mainly due to savings from cost control initiatives and operational efficiency gains.

In April 2005, the Company announced a plan to reorganize a portion of its East Group printing operations to better position itself to compete in a challenging market environment. The plan included the consolidation of prepress and sales operations at its Laval facility with other plants in Quebec and the cessation of printing operations in Laval. Approximately 50 employees were transferred to other facilities and approximately 140 positions were eliminated as a result of this reorganization.

Other Revenues

Other sources of revenues in North America include Quebecor World Premedia and Logistics.

The Quebecor World Premedia revenues for the second quarter of 2005 were $14 million, down 15% from $16 million in 2004. On a year-to-date basis, revenues were $28 million in 2005, down 17% from $33 million in 2004. The decrease in revenue for the second quarter compared to 2004 was due to a 17% decrease in volume offset by a slight increase in price, essentially due to product mix. On a year-to-date basis, volume was relatively flat year over year, but changes in the type of prepress work and the continued price erosion caused a negative impact on revenue. The economic environment has led customers to continue looking for ways to reduce their costs by putting pressure on reducing prices, re-using previously captured images and taking more of the prepress production in-house. Operating income and margin for the second quarter and year-to-date 2005 compared to the same periods last year decreased due mainly to price reductions and the loss of the higher margin services.

Logistics revenues for the second quarter of 2005 and 2004 were $69 million. On a year-to-date basis, revenues were $144 million in 2005, up 3% from $140 million in 2004. The revenue increase for the six-month period was due mainly to higher retail commodity shipments. However, margins decreased in both the second quarter and year-to-date due to more truck shipments for time-sensitive products. Higher margin airfreight in the United States continued to grow slowly with pricing pressure from fuel surcharge and security fees. Operating income and margin decreased in both the second quarter and year-to-date of 2005 compared to the same periods last year due mainly to the continuing rise in fuel charges and a shift in the sales mix to increased retail freight with lower margins.

Europe

The European business group operates mainly in the Magazine, Retail, Catalog and Book markets. European revenues for the second quarter of 2005 were $284 million, down 8% from $310 million in 2004. On a year-to-date basis, revenues were $616 million in 2005 down 2% from $625 million in 2004. Excluding the positive impact of currency translation, revenues were down 12% for the second quarter and down 6% year-to-date compared to the same periods last year. Overall volume decreased by 13% in the second quarter and 6% year-to-date mainly explained by the Catalog and Magazine markets in France and the wind down of an important contract not renewed at the Corby (England) facility. Price erosion continued to have a negative impact on the European results.

The operating income and margin for the European segment decreased significantly in the second quarter and year-to-date compared to the same periods in 2004. France's operating margin was negative for both the second quarter and six-months of 2005 compared to the same periods last year. The decrease in volume combined with labor troubles that led to various inefficiencies and the continued price pressure negatively affected the French results in the first half of 2005. Management is currently assessing the situation in order to implement a comprehensive investment program that will provide this platform with the right mix of technology to perform in this market. In the first quarter of 2005, the Company completed divestitures of two under-performing facilities in France. Outside France, operating income and margin decreased in the second quarter and year-to-date of 2005 compared to the same periods in 2004. This is mostly attributable to the Corby (England) facility. In 2004, the Company was informed that an important printing contract at this facility would not be renewed. Volumes related to this contract began to decrease in the first half of 2005 and the contract was terminated at June 30, 2005. The facility has been able to replace some of the lost volume, but at a lower margin.

12

Selling, general and administrative expenses decreased in the second quarter and six-months of 2005 compared to the same periods in 2004 as a result of savings from cost containment initiatives and head-count reductions. Year-over-year headcount decreased by 763 employees or approximately 13%.

Latin America

Latin America operates mainly in the Book, Directory, Magazine, and Retail markets. Latin America's revenues for the second quarter of 2005 were $66 million, up 49% from $44 million in 2004. On a year-to-date basis, revenues were $123 million in 2005, up 35% from $91 million in 2004. Overall volume increased by 17% for the quarter and 16% year-to-date compared to the same periods as last year, mainly in the Book and the Directory markets in Peru, Recife, Brazil and Mexico, as well as in the Book market in Argentina. The increase was mainly due to the positive impact of currency translation along with an increase in paper sales and the volume increase of cross selling with the North American and European groups. During the third quarter of 2004, the Company had embarked on an initiative to link more closely the Latin American Book and Directory facilities with its North American counterparts to expand the capacity and capabilities to its overall customer base. This initiative has continued through the second quarter of 2005. Prices were lower in the second quarter and year-to-date 2005 compared to the same periods last year due to the continued competitive market conditions. Operating income and margin have increased in both the second quarter and six-months of 2005 compared to the same periods last year mainly due to the increased volume and the efficiency cost saving initiatives.

Selling, general and administrative expenses for the second quarter and year-to-date 2005, when excluding the effect of currency translation, decreased from last year due mainly to savings from cost containment initiatives and headcount reductions. Year-over-year headcount was reduced by 310 employees, or approximately 14%.

CRITICAL ACCOUNTING ESTIMATES

The Company's critical accounting estimates are discussed in the Company's annual "Management's Discussion and Analysis" included in the 2004 Annual Report. The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management has not made any significant changes to the estimates and assumptions on the quarter ended June 30, 2005. Actual results could differ from those estimates.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

The Company measures its liquidity performance using the calculation of free cash flow as described in figure 6. Free cash flow reflects liquidity available for business acquisitions, equity dividends and repayments of long-term debt. Free cash flow for the second quarter of 2005 amounted to $117 million, compared to $71 million for the same quarter last year. On a year-to-date basis, free cash flow for 2005 amounted to $37 million, compared to an outflow of $18 million for the same period of 2004. The Company typically generates most of its free cash flow in the second half of the year.

Operating Activities

Working capital was $45 million as at June 30, 2005, compared to $9 million as at June 30, 2004. This increase in working capital of $36 million was largely due to higher levels of cash and cash equivalents, as the Company is required to maintain a minimum level of funds in its captive insurance subsidiary, and a decrease of future income tax assets. The Company manages its trade payables in order to take advantage of prompt payment discounts. Also, the Company maximizes the use of its accounts receivable securitization program, since the cost of these programs is relatively low compared to that of the credit facility. The amount of trade receivables under securitization varies from month to month, based on the previous month's volume (June securitization is based on outstanding receivables at the end of May).

Financing Activities

As at June 30, 2005, the debt level was at $1,898 million, a $181 million decrease compared to the end of June 2004. The debt-to-capitalization ratio was 43:57 compared to 45:55 in June 2004 (see figure 6). The same ratio was 44:56 as at December 31, 2004. Including accounts receivable securitization, total debt would be $2,514 million, $216 million lower than last year. The debt-to-capitalization ratio, including accounts receivable securitization, was 50:50 as at June 30, 2005, compared to 52:48 in June 2004 (see figure 7).

Total Debt and Accounts Receivable Securitization($ millions)

| | June 30, 2005

| | June 30, 2004

|

|---|

| Bank indebtedness | | $ | 0.2 | | $ | 0.9 |

| Current portion of long-term debt | | | 9.3 | | | 12.8 |

| Long-term debt | | | 1,774.4 | | | 1,953.0 |

| Convertible notes | | | 113.7 | | | 111.7 |

| | |

| |

|

| Total debt | | $ | 1,897.6 | | $ | 2,078.4 |

| Accounts receivable securitization | | | 616.6 | | | 652.0 |

| | |

| |

|

| Total debt and accounts receivable securitization | | $ | 2,514.2 | | $ | 2,730.4 |

| Minority interest | | | 1.1 | | | 26.9 |

| Shareholders' equity | | | 2,499.6 | | | 2,492.8 |

| | |

| |

|

| Capitalization, including securitization | | $ | 5,014.9 | | $ | 5,250.1 |

| | |

| |

|

| Debt-to-Capitalization, including securitization | | | 50:50 | | | 52:48 |

| | |

| |

|

These ratios are non-GAAP measures.

Figure 7

The Company is subject to certain financial covenants in some of its major financing agreements. The key financial ratios are the earnings before interest, tax and depreciation and amortization (EBITDA) coverage ratio and the debt-to-capitalization ratio. As at June 30, 2005, the Company was in compliance with all significant debt covenants.

The 7.20% Senior Notes for a principal amount of $250 million will mature in March 2006. The Company intends to repay the Senior Notes by using its long-term revolving bank facility and, as such, these Notes have not been included in the current portion of long-term debt.

On May 10, 2005, the Company announced that the Board of Directors had approved a normal course issuer bid for a maximum of 7,300,000 Subordinate Voting Shares, which represented approximately 10% of the public float for the Subordinate Voting Shares at the time of the announcement. The purchases will be made at prevailing market prices, on the open market through the facilities of the Toronto Stock Exchange during a twelve month period from May 13, 2005 to May 12, 2006. In the second quarter of 2005, the Company repurchased 2,332,500 shares at an average price of Cdn$23.85 for a net cash consideration of Cdn$56 million ($44 million). The excess of the price paid over the book value of the shares repurchased amounting to $9 million was charged to retained earnings. The issuer bid is funded using the Company's revolving bank facility. As at June 30, 2005, the unused portion of the bank facility was $670 million.

13

Contractual Cash Obligations($ millions)

(Continuing Operations)

| | Remainder of 2005

| | 2006

| | 2007

| | 2008

| | 2009

| | 2010 and thereafter

|

|---|

| Long-term debt and convertible notes | | $ | — | | $ | 250 | | $ | 637 | | $ | 202 | | $ | — | | $ | 772 |

| Capital lease | | | 5 | | | 8 | | | 4 | | | 3 | | | 8 | | | 9 |

| Operating lease | | | 58 | | | 77 | | | 58 | | | 36 | | | 27 | | | 100 |

| Capital asset purchase commitments | | | 67 | | | 68 | | | 6 | | | — | | | — | | | — |

| | |

| |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 130 | | $ | 403 | | $ | 705 | | $ | 241 | | $ | 35 | | $ | 881 |

| | |

| |

| |

| |

| |

| |

|

Figure 8

The minimum legal requirement for pension contributions is $50 million in 2005 of which $11 million has been paid as of June 30, 2005 (total annual contribution in 2004 was $77 million).

As at June 30, 2005, the following investment grade ratings applied to the long-term unsecured debt of the Company:

Rating Agency

| | Rating

|

|---|

| Moody's Investors Service | | Baa3 |

| Standard & Poor's | | BBB– |

| Dominion Bond Rating Service Limited | | BBB (low) |

The Company believes that its liquidity, capital resources and cash flow from operations are sufficient to fund planned capital expenditures, working capital requirements, interest and principal payments for the foreseeable future.

Investing Activities

In the second quarter of 2005, the Company invested $74 million in capital projects compared to $33 million in 2004. On a year-to-date basis, $128 million has been invested in capital projects in 2005 compared to $65 million in 2004. Of that amount, 90% (80% in 2004) was for organic growth, including expenditures for new capacity requirements and productivity improvement, and 10% (20% in 2004) was for the maintenance of the Company's structure.

Key expenditures for the second quarter of 2005 included the replacement of a bindery line in Islington (Canada), an efficiency improvement program in Cayfosa (Spain) and relocation of equipment from Interprint (Sweden) to Helprint (Finland) and Hélio-Charleroi (Belgium). As part of the strategic plan announced in 2004, the Company placed 3 additional orders for new presses in the quarter ended June 30, 2005. The Company has now placed a total of 18 firm orders for new presses representing a total cost of approximately $200 million.

For the remainder of 2005, the Company projects capital expenditures of $175 million of which a portion is related to the strategic plan and a significant lease buyout. Expected sources of funds to meet these expenditures are cash flows from operations and drawings on the Company's revolving bank facility.

Furthermore, in April 2005, the Company purchased assets of a web offset printing facility in Pittsburg, California for $9 million. This facility will complement and strengthen the Company's retail insert platform and add capacity for customers in the West coast market.

During the first six months of 2005, the Company acquired minority interests in its North American operations for a cash consideration of $6 million. The Company also sold investments in facilities in France for a total cash consideration of $0.3 million. The Company realized no gain or loss on these transactions.

In June 2005, the Company disposed of its facility in Los Angeles, California for a total cash consideration of $0.5 million resulting in a loss on disposal of $5.9 million ($3.7 million net of income tax recovery).

IMPAIRMENT OF ASSETS AND RESTRUCTURING INITIATIVES

The following analysis takes into account impairments and measures pertaining to continuing operations.

During the second quarter of 2005, the Company recorded impairments of assets and restructuring charges of $31.8 million, which were composed of cash items amounting to $15.8 million and non-cash items of $16.0 million. The cash items included $3.7 million for the implementation of initiatives from the second quarter of 2005 and $8.5 million for initiatives from the first quarter of 2005. For the six-month period ended June 30, 2005, the Company recorded impairments of assets and restructuring charges of $65.1 million, composed of non-cash items of $41.0 million and cash items of $24.1 million.

During the first two quarters of 2005, the Company performed a review of its assets following impairment tests on specific units. For the second quarter, the Company concluded that some assets, mainly in France, were impaired. Accordingly, impairments of long-lived-assets assets of $16.0 million were recorded for the quarter then ended. Furthermore, in the first quarter, the Company modified its plan of action for the facility in Corby, England and engaged in restructuring activities. The Company had concluded at December 31, 2004 that no impairment was required. However, based on the revised plan of action, the Company re-evaluated the situation at Corby and recorded an impairment of assets. Furthermore, the announcement, in April 2005, of the closing of a facility in Canada and other events triggered an impairment test on other groups of assets. Accordingly, for the first quarter of 2005, the Company recorded an impairment of long-lived assets of $24.6 million. The impairments have been calculated as the excess of the carrying amount of the asset or group of assets over its fair value, based on quoted market prices when available, or using a discounted cash flow method.

In the first half of 2005, the Company continued its restructuring initiatives. In the second quarter of 2005, the Company approved further downsizing operations in Corby, the closure of a Canadian facility and other workforce reductions across the Company. The cash costs of these initiatives were estimated at $18.2 million, of which $12.3 million were recorded during the second quarter. In the first quarter of 2005, the Company had approved the first phase of the downsizing of operations in Corby and other workforce reductions across the Company. The cash costs of these initiatives, estimated at $3.8 million, were recorded in the first quarter. The non-cash cost of these initiatives included $0.4 million for the curtailment of one of the Company's Canadian pension plans. The 2005 restructuring initiatives affected 886 employees in total with 800 jobs that had been eliminated at June 30, 2005 and 86 still to come in 2005. However, the Company estimated that 63 new jobs would be created in other facilities.

During the second quarter of 2005, the Company recorded $3.7 million resulting from the continuation of the 2004 initiatives. The Company also recorded a net reversal of $0.2 million resulting from the execution of the prior year initiatives. During the first quarter of 2005, the Company recorded $4.7 million resulting from the continuation of the 2004 initiatives and $2.2 million for the pension obligation related to the Effingham multiemployer benefit plan. The Company has also recorded a net reversal of $2.4 million resulting from the execution of the prior year initiatives. In summary, 289 jobs were eliminated in the first half of 2005 as a result of the execution of prior years initiatives and 77 are still to come in 2005.

14

For the remaining quarters of 2005 and the year 2006, the Company estimates it will incur additional restructuring charges of $14.7 million for initiatives related to continuing operations which were announced and approved prior to June 30, 2005.

As at January 1, 2005, the balance of the restructuring reserve was $35.2 million. This amount related mostly to the workforce reduction across the platform and lease and facility carrying costs. The Company utilized $30.8 million of the current and prior years' restructuring and other charges reserves during the six-month period ended June 30, 2005 such that the balance of the reserve, including new initiatives in 2005, was $31.2 million at period-end.

FINANCIAL INSTRUMENTS

The Company uses a number of financial instruments for which a complete description of these instruments is contained in the Company's annual "Management's Discussion and Analysis" included in the 2004 Annual Report. The following is an analysis of the Company's financial instruments as at June 30, 2005.

- •

- Interest rate swap agreements outstanding at quarter-end had a notional value of $233 million. The total adjustment recorded to interest expense was nil for the first six months of 2005 and a revenue of $0.7 million for the same period in 2004.

- •

- The Company enters into foreign exchange forward contracts to hedge foreign denominated sales and related receivables, raw materials and equipment purchases. The contracts outstanding as at June 30, 2005 had a notional value of $306 million and expire between 2005 and 2007. The foreign exchange translation gains and losses and the deferred premiums and discounts are recognized as an adjustment to the corresponding revenues and exchange gain or losses when the transaction is recorded. The total amounts recorded in these accounts for the first six months of 2005 for these contracts were revenues of $10.5 million, and a gain of $0.4 million (revenues of $6.9 million, and a loss of $0.6 million for the same period in 2004).

- •

- In February 2005, the Company sold foreign exchange forward contracts that were used to hedge its net investment in a foreign subsidiary for a cash consideration of $69 million. These foreign exchange forward contracts were already recorded at the fair market value and all resulting gains were previously recorded in cumulative translation adjustment.

- •

- Foreign exchange forward contracts and cross currency swaps outstanding at quarter-end, used to hedge foreign denominated asset exposures, had a notional value of $247 million and $100 million respectively, and expire between 2005 and 2006. The total adjustment recorded in foreign exchange gain or loss related to these contracts was a gain of $42 million for the first six months of 2005 (a gain of $10 million for 2004) which compensated the foreign exchange gains and losses on the translation of foreign denominated assets.

- •

- Natural gas swap contracts outstanding at quarter-end had a notional quantity of 223,000 gigajoules in Canada and 1,938,000 MMBTU in the U.S. and expire between July and December 2005. The total adjustment to gas cost for the first six months of 2005 was a gain of $0.3 million ($1.8 million in 2004).

- •

- The total amount deferred as a liability in relation to terminated derivative instruments or those that have ceased to be effective as at June 30, 2005 was $7.8 million ($12.6 million for the same period in 2004) and the total amount recognized in income was $1.1 million ($2.1 million for the same period of 2004).

Fair Value of Derivative Financial Instruments($ millions)

(Continuing Operations)

| | June 30, 2005

| | December 31, 2004

| |

|---|

| | Book Value

| | Fair Value

| | Book Value

| | Fair Value

| |

|---|

| Derivative financial instruments | | | | | | | | | | | | | |

| | Interest rate swap agreements | | $ | — | | $ | (6.6 | ) | $ | — | | $ | (5.1 | ) |

| | Foreign exchange forward contracts | | | 7.5 | | | 25.0 | | | 72.8 | | | 109.8 | |

| | Cross currency interest rate swaps | | | 5.2 | | | 5.2 | | | (16.7 | ) | | (16.7 | ) |

| | Commodity swaps | | | 0.2 | | | 1.7 | | | (0.1 | ) | | (1.0 | ) |

Figure 9

OFF-BALANCE SHEET ARRANGEMENTS

The Company is party to various off-balance sheet arrangements. For a complete description of these arrangements, please refer to the Company's annual "Management's Discussion and Analysis" included in the 2004 Annual Report.

As at June 30, 2005, the amounts outstanding under the Canadian, US and European securitization programs were Cdn$89 million, $400 million and 119 million Euros, respectively. (Cdn$108 million, $405 million and 138 million Euros as at June 30, 2004). The Company had a retained interest in the trade receivables sold of $129 million, which is recorded in the Company's trade receivables. As at June 30, 2005, an aggregate amount of $746 million ($772 million as at June 30, 2004) of accounts receivable has been sold under the three programs. The Company is in compliance with all its covenants under the agreements governing its securitization programs.

RELATED PARTY TRANSACTIONS

The Company entered into transactions with the parent company and its other subsidiaries, which were accounted for at prices and conditions prevailing in the market, except as otherwise specified for transactions that occurred outside the normal course of operations. Intercompany revenues from the parent company's media subsidiaries involved mostly printing of magazines.

Related Party Transactions($ millions)

| | 2005

| | 2004

|

|---|

| Three-month periods ended June 30, | | | | | | |

| Revenues | | $ | 13.5 | | $ | 12.1 |

| Purchases | | | 1.1 | | | 1.0 |

| Management fees billed by Quebecor Inc. | | | 1.1 | | | 1.1 |

| IT services billed by VTL (net of incurred expenses billed to VTL of $0.8) | | | 2.9 | | | — |

Six-month periods ended June 30, |

|

|

|

|

|

|

| Revenues | | $ | 27.8 | | $ | 23.3 |

| Purchases | | | 2.2 | | | 1.5 |

| Management fees billed by Quebecor Inc. | | | 2.2 | | | 2.1 |

| IT services billed by VTL (net of incurred expenses billed to VTL of $1.8) | | | 5.4 | | | — |

Figure 10