| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-191331-01 |

| | | |

THIS SUPPLEMENT TO FREE WRITING PROSPECTUS, DATED NOVEMBER 12, 2013

MAY BE AMENDED OR SUPPLEMENTED PRIOR TO TIME OF SALE

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., any other underwriter, or any dealer participating in this offering will arrange to send to you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

Supplement to Free Writing Prospectus supplementing the Prospectus dated October 31, 2013

$956,172,000 (Approximate)

GS Mortgage Securities Trust 2013-GCJ16

as Issuing Entity

GS Mortgage Securities Corporation II

as Depositor

Jefferies LoanCore LLC

Rialto Mortgage Finance, LLC

Goldman Sachs Mortgage Company

MC-Five Mile Commercial Mortgage Finance LLC

Citigroup Global Markets Realty Corp.

as Sponsors

Commercial Mortgage Pass-Through Certificates, Series 2013-GCJ16

This Supplement to Free Writing Prospectus supplements and modifies (i) the free writing prospectus, dated October 31, 2013 (the “Free Writing Prospectus”) and (ii) the term sheet dated October 29, 2013 (the “Term Sheet”), as supplemented by the additional collateral information, dated November 7, 2013, relating to the Mortgage Loan secured by the Mortgaged Property identified on Annex A to the Free Writing Prospectus as Gibson & Heritage MHCs (collectively, the “Offering Documents”). Capitalized terms used in this communication have the meanings given to them in the Free Writing Prospectus.

****************

The purpose of this supplement is to inform you that the Mortgage Loan secured by the portfolio of Mortgaged Properties identified on Annex A to the Free Writing Prospectus as “Perkins Retail Portfolio” (the “Perkins Loan”) is being removed from the Mortgage Pool due to a potential dispute between the sponsor of the borrower under the Perkins Loan and a securitization trust, J.P. Morgan Chase Commercial Mortgage Securities Trust 2006-CIBC15, that previously owned a mortgage loan secured by the related Mortgaged Properties and a separate shopping mall property.

All information contained in the Offering Documents should be considered in light of the removal of the Perkins Loan. Attached as Exhibit A to this supplement are the updated tables reflecting the removal of the Perkins Loan from the Mortgage Pool, which supersede in their entirety the tables set forth on pages 43 to 45 of the Preliminary Offering Circular. Attached as Exhibit B to this supplement are updated pages B-1 through B-13 of Annex B to the Free Writing Prospectus reflecting the removal of the Perkins Loan from the Mortgage Pool, which supersede pages B-1 through B-13 of Annex B to, and any other contrary information in, the Free Writing Prospectus in its entirety. Attached as Exhibit C to this supplement is an updated Annex F to the Free Writing Prospectus reflecting the removal of the Perkins Loan from the Mortgage Pool, which supersedes Annex F to the Free Writing Prospectus in its entirety. Attached as Exhibit D to this supplement is additional disclosure regarding Mortgaged Properties in Texas, which now represent approximately 10% of the Initial Pool Balance. Attached as Exhibit E to this supplement is an updated Annex A to the Free Writing Prospectus reflecting the removal of the Perkins Loan from the Mortgage Pool, which supersedes Annex A to, and any other contrary information in, the Free Writing Prospectus in its entirety. In all other respects, except for changes resulting from the removal of the Perkins Loan from the Mortgage Pool, the Offering Documents remain unmodified.

| Goldman, Sachs & Co. | Jefferies |

| | Citigroup |

| Co-Lead Managers and Joint Bookrunners | |

| Drexel Hamilton | RBS |

| Co-Managers | |

EXHIBIT A

Percentages of the Initial Certificate Principal Amount of

the Class A-1 Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 85% | | 85% | | 85% | | 85% | | 85% |

| November 10, 2015 | | 67% | | 67% | | 67% | | 67% | | 67% |

| November 10, 2016 | | 44% | | 44% | | 44% | | 44% | | 44% |

| November 10, 2017 | | 18% | | 18% | | 18% | | 18% | | 18% |

| November 10, 2018 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 2.63 | | 2.63 | | 2.63 | | 2.63 | | 2.63 |

| First Principal Payment Date | | Dec 13 | | Dec 13 | | Dec 13 | | Dec 13 | | Dec 13 |

| Last Principal Payment Date | | Aug 18 | | Jun 18 | | Jun 18 | | Jun 18 | | Jun 18 |

Percentages of the Initial Certificate Principal Amount of

the Class A-2 Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 4.85 | | 4.83 | | 4.82 | | 4.80 | | 4.61 |

| First Principal Payment Date | | Aug 18 | | Jun 18 | | Jun 18 | | Jun 18 | | Jun 18 |

| Last Principal Payment Date | | Nov 18 | | Nov 18 | | Nov 18 | | Nov 18 | | Nov 18 |

Percentages of the Initial Certificate Principal Amount of

the Class A-3 Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 99% | | 98% | | 93% |

| November 10, 2021 | | 100% | | 100% | | 99% | | 98% | | 93% |

| November 10, 2022 | | 100% | | 100% | | 99% | | 98% | | 93% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.81 | | 9.73 | | 9.63 | | 9.54 | | 9.28 |

| First Principal Payment Date | | Sep 23 | | Jul 20 | | Jul 20 | | Jul 20 | | Jul 20 |

| Last Principal Payment Date | | Sep 23 | | Sep 23 | | Sep 23 | | Aug 23 | | Jun 23 |

Percentages of the Initial Certificate Principal Amount of

the Class A-4 Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2021 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2022 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.85 | | 9.84 | | 9.83 | | 9.79 | | 9.57 |

| First Principal Payment Date | | Sep 23 | | Sep 23 | | Sep 23 | | Aug 23 | | Jun 23 |

| Last Principal Payment Date | | Oct 23 | | Oct 23 | | Oct 23 | | Oct 23 | | Jul 23 |

Percentages of the Initial Certificate Principal Amount of

the Class A-AB Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 83% | | 83% | | 83% | | 83% | | 83% |

| November 10, 2020 | | 55% | | 56% | | 57% | | 58% | | 64% |

| November 10, 2021 | | 36% | | 37% | | 37% | | 39% | | 45% |

| November 10, 2022 | | 16% | | 17% | | 17% | | 18% | | 25% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 7.43 | | 7.45 | | 7.46 | | 7.49 | | 7.65 |

| First Principal Payment Date | | Nov 18 | | Nov 18 | | Nov 18 | | Nov 18 | | Nov 18 |

| Last Principal Payment Date | | Sep 23 | | Sep 23 | | Sep 23 | | Sep 23 | | Jul 23 |

Percentages of the Initial Certificate Principal Amount of

the Class A-S Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2021 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2022 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.89 | | 9.89 | | 9.89 | | 9.89 | | 9.64 |

| First Principal Payment Date | | Oct 23 | | Oct 23 | | Oct 23 | | Oct 23 | | Jul 23 |

| Last Principal Payment Date | | Nov 23 | | Oct 23 | | Oct 23 | | Oct 23 | | Jul 23 |

Percentages of the Initial Certificate Principal Amount of

the Class B Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2021 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2022 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.97 | | 9.96 | | 9.93 | | 9.89 | | 9.71 |

| First Principal Payment Date | | Nov 23 | | Oct 23 | | Oct 23 | | Oct 23 | | Jul 23 |

| Last Principal Payment Date | | Nov 23 | | Nov 23 | | Nov 23 | | Nov 23 | | Aug 23 |

Percentages of the Initial Certificate Principal Amount of

the Class PEZ Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2021 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2022 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.94 | | 9.93 | | 9.92 | | 9.91 | | 9.68 |

| First Principal Payment Date | | Oct 23 | | Oct 23 | | Oct 23 | | Oct 23 | | Jul 23 |

| Last Principal Payment Date | | Nov 23 | | Nov 23 | | Nov 23 | | Nov 23 | | Aug 23 |

Percentages of the Initial Certificate Principal Amount of

the Class C Certificates at the Specified CPRs

0% CPR during lockout, defeasance and/or yield maintenance or fixed prepayment premiums—

otherwise at indicated CPR

| | | Prepayment Assumption (CPR) |

| | | | | | | | | | |

| Closing Date�� | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2014 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2015 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2016 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2017 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2018 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2019 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2020 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2021 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2022 | | 100% | | 100% | | 100% | | 100% | | 100% |

| November 10, 2023 | | 0% | | 0% | | 0% | | 0% | | 0% |

| Weighted Average Life (in years) | | 9.97 | | 9.97 | | 9.97 | | 9.97 | | 9.72 |

| First Principal Payment Date | | Nov 23 | | Nov 23 | | Nov 23 | | Nov 23 | | Aug 23 |

| Last Principal Payment Date | | Nov 23 | | Nov 23 | | Nov 23 | | Nov 23 | | Aug 23 |

EXHIBIT B

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,086,559,119

(Approximate Mortgage Pool Balance)

$956,172,000

(Offered Certificates)

GS Mortgage Securities Trust 2013-GCJ16

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2013-GCJ16

Jefferies LoanCore LLC

Rialto Mortgage Finance, LLC

Goldman Sachs Mortgage Company

MC-Five Mile Commercial Mortgage Finance LLC

Citigroup Global Markets Realty Corp.

As Sponsors

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman, Sachs & Co. | Jefferies Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| Drexel Hamilton | RBS |

| Co-Managers |

| OFFERED CERTIFICATES |

| | Expected Ratings (Moody’s / DBRS / KBRA)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | Approximate

Initial Credit

Support | | Initial Pass-

Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected

Principal

Window(4) |

| Class A-1 | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 51,939,000 | | | 30.000%(5) | | [ ]% | | (6) | | 2.63 | | 12/13 – 08/18 |

| Class A-2 | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 231,514,000 | | | 30.000%(5) | | [ ]% | | (6) | | 4.85 | | 08/18 – 11/18 |

| Class A-3 | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 98,000,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.81 | | 09/23 – 09/23 |

| Class A-4 | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 304,943,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.85 | | 09/23 – 10/23 |

| Class A-AB | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 74,195,000 | | | 30.000%(5) | | [ ]% | | (6) | | 7.43 | | 11/18 – 09/23 |

| Class X-A | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 848,874,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class X-B | | A2(sf) / AAA(sf) / AAA(sf) | | $ 69,268,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

Class A-S(9) | | Aaa(sf) / AAA(sf) / AAA(sf) | | $ 88,283,000 | (10) | | 21.875% | | [ ]% | | (6) | | 9.89 | | 10/23 – 11/23 |

Class B(9) | | Aa3(sf) / AA(low)(sf) / AA-(sf) | | $ 69,268,000 | (10) | | 15.500% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

Class PEZ(9) | | A1(sf) / A(low)(sf) / A-(sf) | | $ 195,581,000 | (10) | | 12.000%(11) | | [ ]% | | (6) | | 9.94 | | 10/23 – 11/23 |

Class C(9) | | A3(sf) / A(low)(sf) / A-(sf) | | $ 38,030,000 | (10) | | 12.000%(11) | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

| |

| NON-OFFERED CERTIFICATES |

| | Expected Ratings (Moody’s / DBRS / KBRA)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | | Approximate

Initial Credit

Support | | Initial Pass-

Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected

Principal

Window(4) |

| Class X-C | | NR / AAA(sf) / NR | | $ 85,567,119 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class D | | Baa3(sf) / BBB(low)(sf) / BBB(sf) | | $ 42,104,000 | | | 8.125% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

| Class E | | Ba1(sf) / NR / BB+(sf) | | $ 2,716,000 | | | 7.875% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

| Class F | | Ba3(sf) / BB(low)(sf) / BB(sf) | | $ 25,806,000 | | | 5.500% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

| Class G | | B3(sf) / B(low)(sf) / B(sf) | | $ 24,447,000 | | | 3.250% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

| Class H | | NR / NR / NR | | $ 35,314,119 | | | 0.000% | | [ ]% | | (6) | | 9.97 | | 11/23 – 11/23 |

Class S(12) | | NR / NR / NR | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Class R(13) | | NR / NR / NR | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), DBRS, Inc. (“DBRS”), and Kroll Bond Rating Agency (“KBRA”). Subject to the discussion under “Ratings” in the Free Writing Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Free Writing Prospectus. Moody’s, DBRS and KBRA have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximate per annum rate as of the closing date. |

| (4) | Assuming no prepayments prior to the maturity date or anticipated repayment date, for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Free Writing Prospectus. |

| (5) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (6) | For any distribution date, the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H certificates will each be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a specified pass-through rate and the rate specified in clause (ii), or (iv) the rate specified in clause (ii) less a specified percentage. The Class PEZ certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, Class B and Class C trust components represented by the Class PEZ certificates. The pass-through rates on the Class A-S, Class B and Class C trust components will at all times be the same as the pass-through rates of the Class A-S, Class B and Class C certificates, respectively. |

| (7) | The Class X-A, Class X-B and Class X-C certificates (the “Class X Certificates”) will not have certificate principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-C certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate certificate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component. The notional amount of the Class X-B certificates will be equal to the aggregate certificate principal amounts of the Class B trust component. The notional amount of the Class X-C certificates will be equal to the aggregate certificate principal amounts of the Class F, Class G and Class H certificates. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| CERTIFICATE SUMMARY (continued) |

| (8) | The pass-through rate of the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component, as described in the Free Writing Prospectus. The pass-through rate of the Class X-B certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class B trust component, as described in the Free Writing Prospectus. The pass through rate of the Class X-C certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class F, Class G and Class H certificates, as described in the Free Writing Prospectus. |

| (9) | The Class A-S, Class B and Class C certificates may be exchanged for Class PEZ certificates, and Class PEZ certificates may be exchanged for the Class A-S, Class B and Class C certificates. The Class A-S, Class B, Class PEZ and Class C certificates are collectively referred to as the “Exchangeable Certificates”. |

| (10) | On the closing date, the issuing entity will issue the Class A-S, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $88,283,000, $69,268,000 and $38,030,000, respectively. The Class A-S, Class B, Class PEZ and Class C certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class A-S, Class B and Class C certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A-S, Class B and Class C trust components, respectively. The Class PEZ certificates will, at all times, represent a beneficial interest in the remaining percentages of each of the outstanding principal balances of the Class A-S, Class B and Class C trust components. Following any exchange of Class A-S, Class B and Class C certificates for Class PEZ certificates or any exchange of Class PEZ certificates for Class A-S, Class B and Class C certificates, the percentage interest of the outstanding principal balances of the Class A-S, Class B and Class C trust components that is represented by the Class A-S, Class B, Class PEZ and Class C certificates will be increased or decreased accordingly. The initial certificate principal amount of each of the Class A-S, Class B and Class C certificates shown in the table above represents the maximum certificate principal amount of such class without giving effect to any issuance of Class PEZ certificates. The initial certificate principal amount of the Class PEZ certificates shown in the table above is equal to the aggregate of the maximum initial certificate principal amounts of the Class A-S, Class B and Class C certificates, representing the maximum certificate principal amount of the Class PEZ certificates that could be issued in an exchange. The certificate principal amounts of the Class A-S, Class B and Class C certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal amount of the Class PEZ certificates issued on the closing date. |

| (11) | The initial subordination levels for the Class C and Class PEZ certificates are equal to the subordination level of the underlying Class C trust component, which will have an initial outstanding balance on the closing date of $38,030,000. |

| (12) | The Class S certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class S certificates will only be entitled to distribution of excess interest accrued on the mortgage loan with an anticipated repayment date. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loan” in the Free Writing Prospectus. |

| (13) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interest in each of two separate REMICs, as further described in the Free Writing Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| MORTGAGE POOL CHARACTERISTICS |

Mortgage Pool Characteristics(1) |

| Initial Pool Balance | $1,086,559,119 |

| Number of Mortgage Loans | 77 |

| Number of Mortgaged Properties | 124 |

| Average Cut-off Date Mortgage Loan Balance | $14,111,157 |

| Weighted Average Mortgage Interest Rate | 5.3641% |

Weighted Average Remaining Term to Maturity/ARD (months)(2) | 105 |

Weighted Average Remaining Amortization Term (months)(3) | 353 |

Weighted Average Cut-off Date LTV Ratio(4) | 67.2% |

Weighted Average Maturity Date/ARD LTV Ratio(2)(5) | 58.9% |

Weighted Average Underwritten Debt Service Coverage Ratio(6)(7) | 1.52x |

Weighted Average Debt Yield on Underwritten NOI(8) | 10.9% |

| % of Mortgage Loans with Additional Debt | 21.0% |

| % of Mortgaged Properties with Single Tenants | 4.9% |

| (1) | Each of the Miracle Mile Shops mortgage loan, the Matrix MHC Portfolio mortgage loan, the Walpole Shopping Mall mortgage loan and the Related Home Depot mortgage loan has one or more related pari passu companion loans, and the loan-to-value ratio, debt service coverage ratio and debt yield calculations presented in this Term Sheet include the related pari passu companion loan(s) unless otherwise indicated. Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Unless otherwise indicated, the mortgage loan with an anticipated repayment date is considered as if it matures on the anticipated repayment date. |

| (3) | Excludes mortgage loans that are interest only for the entire term. |

| (4) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to the Walnut Creek Marriott mortgage loan, the Cut-off Date LTV Ratio is based on the “as-is” appraised value of $41,300,000 plus a stated $6,800,000 “capital deduction” (for which $8,200,000 was reserved in connection with the origination of the mortgage loan) related to capital improvements. The Cut-off Date LTV Ratio of the mortgage pool without adding the $6,800,000 “capital deduction” is 67.5%. See “Description of the Mortgage Pool—–Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Cut-off Date LTV Ratio. |

| (5) | Unless otherwise indicated, the Maturity Date/ARD LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to 12 mortgage loans representing approximately 23.8% of the initial pool balance, the respective Maturity Date/ARD LTV Ratios were each calculated using the related aggregate “as stabilized” appraised value. See “Description of the Mortgage Pool—–Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Maturity Date/ARD LTV Ratio. |

| (6) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio is calculated by taking the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties and dividing by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (7) | With respect to the Matrix MHC Portfolio mortgage loan, the Walnut Creek Marriott mortgage loan and the Mariner’s Landing and 2401 Bert mortgage loan, the Underwritten Debt Service Coverage Ratio is calculated using such mortgage loan’s non-standard amortization schedule as set forth in Annex G-1, Annex G-2 and Annex G-3, respectively, in the Free Writing Prospectus and adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. |

| (8) | Unless otherwise indicated, the Debt Yield on Underwritten NOI is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of the mortgage loan, and the Debt Yield on Underwritten NCF is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of the mortgage loan. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| KEY FEATURES OF THE CERTIFICATES |

Co-Lead Managers and Joint Bookrunners: | Goldman, Sachs & Co. Jefferies LLC Citigroup Global Markets Inc. |

| Co-Managers: | Drexel Hamilton, LLC RBS Securities Inc. |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $1,086,559,119 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | U.S. Bank National Association |

| Trustee: | U.S. Bank National Association |

| Operating Advisor: | Situs Holdings, LLC |

| Pricing: | Week of November 4, 2013 |

| Closing Date: | November 20, 2013 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in November 2013 (or, in the case of any mortgage loan that has its first due date in December 2013, the date that would have been its due date in November 2013 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 6th day of each month or next business day |

| Distribution Date: | The 4th business day after the Determination Date, commencing in December 2013 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | November 2046 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to Class X-A and Class X-B: $1,000,000 minimum); $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

■ | $1,086,559,119 (Approximate) New-Issue Multi-Borrower CMBS: |

| | — | Overview: The mortgage pool consists of 77 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,086,559,119 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $14,111,157 and are secured by 124 mortgaged properties located throughout 26 states |

| | — | LTV: 67.2% weighted average Cut-off Date LTV Ratio |

| | — | DSCR: 1.52x weighted average Underwritten Debt Service Coverage Ratio |

| | — | Debt Yield: 10.9% weighted average Debt Yield on Underwritten NOI |

| | — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

■ | Loan Structural Features: |

| | — | Amortization: 93.3% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| | – | 47.6% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| | – | 45.8% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| | — | Hard Lockboxes: 52.8% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| | — | Cash Traps: 96.5% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.00x coverage, that fund an excess cash flow reserve |

| | — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| | – | Real Estate Taxes: 75 mortgage loans representing 96.7% of the Initial Pool Balance |

| | – | Insurance: 65 mortgage loans representing 72.6% of the Initial Pool Balance |

| | – | Replacement Reserves (Including FF&E Reserves): 76 mortgage loans representing 98.8% of Initial Pool Balance |

| | – | Tenant Improvements / Leasing Commissions: 33 mortgage loans representing 82.9% of the allocated Initial Pool Balance of office, retail, industrial and mixed use properties only |

| | — | Predominantly Defeasance: 89.6% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

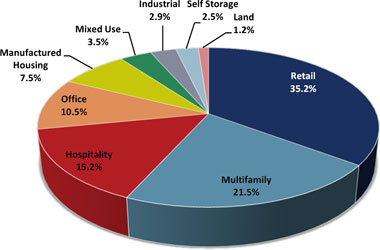

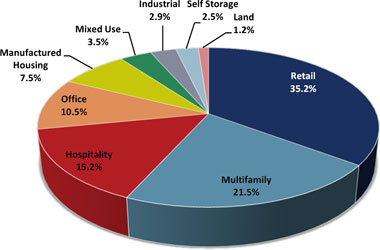

■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| | — | Retail: 35.2% of the mortgaged properties by allocated Initial Pool Balance are retail properties (19.3% are retail anchored properties, 6.4% are super regional mall properties) |

| | — | Multifamily: 21.5% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| | — | Hospitality: 15.2% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| | — | Office: 10.5% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| | — | Manufactured Housing: 7.5% of the mortgaged properties by allocated Initial Pool Balance are manufactured housing properties |

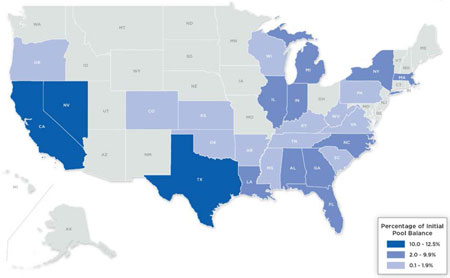

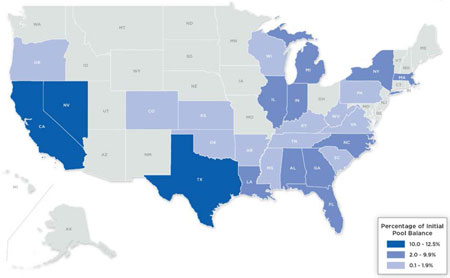

■ | Geographic Diversity: The 124 mortgaged properties are located throughout 26 states, with only three states having greater than 10.0% of the allocated Initial Pool Balance: Nevada (12.5%), California (12.0%) and Texas (10.0%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| Mortgage Loans by Loan Seller |

| | | | | | Aggregate Cut-off

Date Balance | | |

| Jefferies LoanCore LLC | | 23 | | 34 | | $367,190,538 | | | 33.8% |

| Rialto Mortgage Finance, LLC | | 14 | | 18 | | 230,337,561 | | | 21.2 |

| Goldman Sachs Mortgage Company | | 12 | | 21 | | 195,843,830 | | | 18.0 |

| MC-Five Mile Commercial Mortgage Finance LLC | | 22 | | 42 | | 190,559,019 | | | 17.5 |

| Citigroup Global Markets Realty Corp. | | | | | | | | | |

| Total | | 77 | | 124 | | $1,086,559,119 | | | 100.0% |

| Ten Largest Mortgage Loans |

| | | | | | | | Property Size

SF / Rooms /

Pads | | Cut-off Date

Balance Per

SF / Room /

Pad | | | | | | |

| Windsor Court New Orleans | | $72,928,787 | | | 6.7 | % | | Hospitality | | 316 | | | $230,787 | | | 1.68x | | 13.1 | % | | 68.8% |

| Miracle Mile Shops | | 70,000,000 | | | 6.4 | | | Retail | | 448,835 | | | $1,292 | | | 1.24x | | 8.4 | % | | 62.7% |

| Matrix MHC Portfolio | | 69,500,000 | | | 6.4 | | | Manufactured Housing | | 5,347 | | | $25,248 | | | 1.47x | | 11.1 | % | | 69.4% |

| The Gates at Manhasset | | 60,000,000 | | | 5.5 | | | Retail | | 106,442 | | | $564 | | | 2.05x | | 12.6 | % | | 43.5% |

| Walpole Shopping Mall | | 47,000,000 | | | 4.3 | | | Retail | | 397,971 | | | $162 | | | 1.33x | | 9.2 | % | | 75.0% |

| Regency Portfolio | | 43,800,000 | | | 4.0 | | | Retail | | 1,362,551 | | | $32 | | | 1.52x | | 11.9 | % | | 74.2% |

| Shadow Mountain Marketplace | | 38,000,000 | | | 3.5 | | | Retail | | 201,044 | | | $189 | | | 1.39x | | 10.1 | % | | 70.4% |

| 1245 16th Street | | 37,000,000 | | | 3.4 | | | Office | | 57,457 | | | $644 | | | 1.98x | | 10.3 | % | | 60.1% |

| Walnut Creek Marriott | | 31,280,000 | | | 2.9 | | | Hospitality | | 338 | | | $92,544 | | | 1.45x | | 11.6 | % | | 65.0% |

| University Tower | | | | | | | | Office | | 184,969 | | | $146 | | | | | | % | | |

| Top 10 Total / Wtd. Avg. | | $496,479,416 | | | 45.7 | % | | | | | | | | | | 1.56x | | 10.9 | % | | 65.6% |

| Remaining Total / Wtd. Avg. | | | | | | | | | | | | | | | | | | | % | | |

| Total / Wtd. Avg. | | $1,086,559,119 | | | 100.0 | % | | | | | | | | | | 1.52x | | 10.9 | % | | 67.2% |

| Pari Passu Companion Loan Summary |

| | Mortgage Loan

Cut-off Date

Balance | | | | Pari Passu

Companion

Loan Cut-off

Date Balance | | Whole Loan Cut-off

Date Balance | | Controlling Pooling &

Servicing Agreement | | | | |

| Miracle Mile Shops | | $70,000,000 | | 6.4% | | $510,000,000 | | $580,000,000 | | | COMM 2013-CCRE12(1) | | Wells Fargo | | LNR Partners |

| Matrix MHC Portfolio | | $69,500,000 | | 6.4% | | $65,500,000 | | $135,000,000 | | | GSMS 2013-GCJ16 | | Wells Fargo | | Rialto |

Walpole Shopping Mall(2) | | $47,000,000 | | 4.3% | | $17,500,000 | | $64,500,000 | | | CGCMT 2013-GC15 | | Wells Fargo | | Midland |

| Related Home Depot | | $12,600,000 | | 1.2% | | $14,400,000 | | $27,000,000 | | | WFRBS 2013-C17(3) | | Wells Fargo | | Rialto |

| | (1) | The Miracle Mile Shops mortgage loan will be serviced under the COMM 2013-CCRE12 pooling and servicing agreement pursuant to which Wells Fargo Bank, National Association is the master servicer and LNR Partners, LLC is the special servicer. However, Midland Loan Services, a division of PNC Bank, National Association will be the primary servicer of the whole loan pursuant to a primary servicing agreement between Wells Fargo Bank, National Association and Midland Loan Services, a division of PNC Bank, National Association. |

| | (2) | The Walpole Shopping Mall mortgage loan will be serviced under the CGCMT 2013-GC15 pooling and servicing agreement, but the controlling class under GSMS 2013-GCJ16 transaction will exercise those control rights. |

| | (3) | Anticipated to close on or about November 20, 2013. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

| Mortgage Loans with Existing Mezzanine or Other Financing |

| | Mortgage Loan Cut-off Date Balance | | Mezzanine Debt Cut-off

Date

Balance | | Other Debt

Cut-off Date

Balance | | Cut-off Date

Total Debt

Balance | | | | Cut-off

Date

Mortgage

Loan LTV | | | | | | |

Matrix MHC Portfolio(1) | | $69,500,000 | | $15,000,000 | | $65,500,000 | | $150,000,000 | | 6.9070% | | 69.4% | | 77.1% | | 1.47x | | 1.24x |

Walpole Shopping Mall(2) | | $47,000,000 | | $10,000,000 | | $17,500,000 | | $74,500,000 | | 5.9309% | | 75.0% | | 86.6% | | 1.33x | | 1.08x |

Walnut Creek Marriott(3) | | $31,280,000 | | $8,000,000 | | NA | | $39,280,000 | | 6.6648% | | 65.0% | | 81.7% | | 1.45x | | 0.93x |

8670 Wilshire(3) | | $22,500,000 | | $2,500,000 | | NA | | $25,000,000 | | 6.0890% | | 67.2% | | 74.6% | | 1.27x | | 1.14x |

Mariner’s Landing and 2401 Bert(3) | | $22,260,866 | | $1,493,864 | | NA | | $23,754,730 | | 6.1850% | | 74.7% | | 79.7% | | 1.30x | | 1.15x |

Sanctuary at Winterlakes Apartments(3) | | $12,000,000 | | $800,000 | | NA | | $12,800,000 | | 6.1070% | | 75.0% | | 80.0% | | 1.27x | | 1.19x |

5607-5625 Baum Boulevard(3) | | $11,700,000 | | $1,300,000 | | NA | | $13,000,000 | | 6.2050% | | 75.0% | | 83.3% | | 1.27x | | 1.14x |

Ball State Portfolio(4) | | $11,520,000 | | $2,700,000 | | NA | | $14,220,000 | | 6.8835% | | 68.7% | | 84.8% | | 1.46x | | 1.00x |

| | (1) | The related mezzanine loan is currently held by Terra Secured Income Fund 4, LLC, or its affiliate, and is secured by the mezzanine borrower’s interest in the related mortgage borrower. There also exists a related pari passu companion loan with a scheduled principal balance as of the Cut-off Date of $65,500,000. While the Total Debt Interest Rate remains constant, the monthly interest rate for the mezzanine loan declines as the mortgage whole loan amortizes and is derived from a schedule attached to the mezzanine loan agreement. |

| | (2) | The related mezzanine loan is currently held by Annaly CRE Holdings LLC and is secured by a pledge of 100% of the mezzanine borrower’s interest in the related borrower. There also exists a related pari passu companion loan with a scheduled principal balance as of the Cut-off Date of $17,500,000. |

| | (3) | The related mezzanine loan is initially held by Jefferies LoanCore LLC, or its affiliate, and is secured by the mezzanine borrower’s interest in the related mortgage borrower. |

| | (4) | The related mezzanine loan is currently held by Terra Secured Income Fund 4, LLC, or its affiliate, and is secured by the mezzanine borrower’s interest in the related mortgage borrower. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1) | | | | | | | |

| | | | | | | | | | Cut-off Date

Balance /

Allocated

Cut-off Date

Balance | | | | |

| 1245 16th Street | | GSMC | | Santa Monica | | CA | | Office | | $37,000,000 | | | 3.4% | | GSMS 2005-GG4 |

| 8670 Wilshire | | JLC | | Beverly Hills | | CA | | Office | | $22,500,000 | | | 2.1% | | GCCFC 2003-C2 |

| McAllister Plaza | | CGMRC | | San Antonio | | TX | | Office | | $18,000,000 | | | 1.7% | | MSDWC 2001-TOP1 |

| Parkway and Parkgreen on Bellaire | | RMF | | Houston | | TX | | Multifamily | | $16,750,000 | | | 1.5% | | BSCMS 2004-PWR3 |

| Villages on the River | | RMF | | Jonesboro | | GA | | Multifamily | | $14,350,000 | | | 1.3% | | COMM 2004-LB4A |

| The Brittany | | RMF | | Indialantic | | FL | | Multifamily | | $14,100,000 | | | 1.3% | | CSFB 2004-C2 |

| Candlewood | | RMF | | Corpus Christi | | TX | | Multifamily | | $12,815,000 | | | 1.2% | | CSFB 2004-C1 |

| The Camp | | JLC | | Costa Mesa | | CA | | Retail | | $12,000,000 | | | 1.1% | | GSMS 2004-GG2 |

| Sheraton Four Points Hotel O’Hare | | MC-Five Mile | | Schiller Park | | IL | | Hospitality | | $11,500,000 | | | 1.1% | | BSCMS 2006-T24 |

| Northlake Square SC | | JLC | | Tucker | | GA | | Retail | | $10,491,689 | | | 1.0% | | CSFB 2003-C5 |

Avon on the Lake(2) | | JLC | | Rochester Hills | | MI | | Manufactured Housing | | $8,710,667 | | | 0.8% | | JPMCC 2003-CB7 |

| Randolph Park | | RMF | | Charlotte | | NC | | Multifamily | | $7,990,000 | | | 0.7% | | LBCMT 1995-C2 |

Green Park South(2) | | JLC | | Pelham | | AL | | Manufactured Housing | | $7,181,667 | | | 0.7% | | FNA 2013-M1 |

Jackson Park(3) | | MC-Five Mile | | Seymour | | IN | | Retail | | $5,933,950 | | | 0.5% | | JPMCC 2007-LDPX |

Fairchild Lake(2) | | JLC | | Chesterfield | | MI | | Manufactured Housing | | $5,652,667 | | | 0.5% | | MLMT 2003-KEY1 |

Cranberry Lake(2) | | JLC | | White Lake | | MI | | Manufactured Housing | | $5,606,333 | | | 0.5% | | JPMCC 2004-C2 |

| Westridge Business Center | | MC-Five Mile | | New Berlin | | WI | | Industrial | | $5,154,433 | | | 0.5% | | JPMCC 2002-CIB4 |

| Shops at Memorial Heights | | MC-Five Mile | | Houston | | TX | | Retail | | $5,127,488 | | | 0.5% | | LBUBS 2004-C1 |

| Park 2000 Mini Storage | | JLC | | Las Vegas | | NV | | Self Storage | | $4,993,262 | | | 0.5% | | GCCFC 2003-C2 |

Village Center(3) | | MC-Five Mile | | Seymour | | IN | | Retail | | $4,969,690 | | | 0.5% | | JPMCC 2007-LDPX |

| Broadway Festival Shopping Center | | MC-Five Mile | | Chicago | | IL | | Retail | | $4,081,200 | | | 0.4% | | BACM 2006-2 |

| 257 West 17th Street | | JLC | | New York | | NY | | Retail | | $4,000,000 | | | 0.4% | | PSSF 1999-C2 |

| Gibson & Heritage MHCs | | MC-Five Mile | | Williamsburg | | VA | | Manufactured Housing | | $3,800,000 | | | 0.3% | | CD 2007-CD4 |

| Timbers of Keegans Bayou | | MC-Five Mile | | Houston | | TX | | Multifamily | | $3,750,000 | | | 0.3% | | CSFB 2004-C1, Mezz 2004-C1 |

| Gappie Plaza | | CGMRC | | Chicago | | IL | | Retail | | $3,646,346 | | | 0.3% | | CGCMT 2004-C1 |

| Joyner Crossing | | MC-Five Mile | | Rocky Mount | | NC | | Retail | | $3,500,000 | | | 0.3% | | CSFB 2003-C5 |

| Archer Plaza | | MC-Five Mile | | Chicago | | IL | | Retail | | $3,296,969 | | | 0.3% | | BACM 2006-2 |

Royal Estates(2) | | JLC | | Kalamazoo | | MI | | Manufactured Housing | | $2,270,333 | | | 0.2% | | JPMCC 2004-C1 |

Old Orchard(2) | | JLC | | Davison | | MI | | Manufactured Housing | | $2,224,000 | | | 0.2% | | JPMCC 2004-C2 |

| | (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| | (2) | Avon on the Lake, Green Park South, Fairchild Lake, Cranberry Lake, Royal Estates and Old Orchard are part of the Matrix MHC Portfolio. The other mortgaged properties that are part of the Matrix MHC Portfolio that are not listed were not part of the criteria for this chart. |

| | (3) | Jackson Park and Village Center are part of the Regency Portfolio. The other mortgaged properties that are part of the Regency Portfolio that are not listed were not part of the criteria for this chart. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

| Property Types |

| | Number of

Mortgaged

Properties | | Aggregate Cut-off Date

Balance(1) | | | | Wtd. Avg.

Underwritten

NCF DSCR(2) | | Wtd. Avg.

Cut-off Date

LTV Ratio(2) | | Wtd. Avg.

Debt Yield on

Underwritten

NOI(2) |

| Retail | | 49 | | | $382,867,198 | | | 35.2 | % | | 1.53x | | 65.5% | | 10.4% |

| Anchored | | 21 | | | 209,636,945 | | | 19.3 | | | 1.60x | | 64.4% | | 11.1% |

| Super Regional Mall | | 1 | | | 70,000,000 | | | 6.4 | | | 1.24x | | 62.7% | | 8.4% |

| Shadow Anchored | | 15 | | | 48,406,988 | | | 4.5 | | | 1.72x | | 72.0% | | 12.0% |

| Unanchored | | 6 | | | 28,093,265 | | | 2.6 | | | 1.42x | | 65.7% | | 8.1% |

| Single Tenant Retail | | 6 | | | 26,730,000 | | | 2.5 | | | 1.50x | | 69.5% | | 10.3% |

| Multifamily | | 30 | | | $233,231,311 | | | 21.5 | % | | 1.38x | | 71.0% | | 10.1% |

| Garden | | 27 | | | 204,627,857 | | | 18.8 | | | 1.36x | | 71.7% | | 10.0% |

| Student Housing | | 1 | | | 11,520,000 | | | 1.1 | | | 1.46x | | 68.7% | | 11.1% |

| Senior Living | | 1 | | | 10,689,762 | | | 1.0 | | | 1.86x | | 62.7% | | 12.9% |

| Conventional | | 1 | | | 6,393,692 | | | 0.6 | | | 1.27x | | 67.3% | | 8.7% |

| Hospitality | | 8 | | | $164,897,636 | | | 15.2 | % | | 1.68x | | 65.3% | | 13.5% |

| Full Service | | 5 | | | 145,073,368 | | | 13.4 | | | 1.70x | | 65.1% | | 13.6% |

| Limited Service | | 3 | | | 19,824,268 | | | 1.8 | | | 1.54x | | 67.0% | | 12.6% |

| Office | | 6 | | | $114,360,486 | | | 10.5 | % | | 1.58x | | 66.9% | | 10.4% |

| Medical | | 2 | | | 59,500,000 | | | 5.5 | | | 1.71x | | 62.8% | | 10.0% |

| General Suburban | | 2 | | | 44,970,629 | | | 4.1 | | | 1.46x | | 71.3% | | 10.8% |

| CBD | | 2 | | | 9,889,857 | | | 0.9 | | | 1.35x | | 71.2% | | 10.7% |

| Manufactured Housing | | 16 | | | $82,000,000 | | | 7.5 | % | | 1.47x | | 69.3% | | 11.0% |

| Mixed Use | | 4 | | | $38,305,154 | | | 3.5 | % | | 1.36x | | 71.4% | | 10.7% |

| Office/Retail | | 2 | | | 18,586,931 | | | 1.7 | | | 1.33x | | 75.0% | | 10.4% |

| Industrial/Office/Retail | | 1 | | | 12,527,976 | | | 1.2 | | | 1.30x | | 74.7% | | 9.9% |

| Warehouse/Office/Self Storage | | 1 | | | 7,190,247 | | | 0.7 | | | 1.52x | | 56.4% | | 12.6% |

| Industrial | | 4 | | | $31,223,806 | | | 2.9 | % | | 1.53x | | 63.9% | | 12.4% |

| Flex | | 2 | | | 17,145,003 | | | 1.6 | | | 1.67x | | 55.0% | | 14.0% |

| Warehouse | | 2 | | | 14,078,803 | | | 1.3 | | | 1.36x | | 74.7% | | 10.5% |

| Self Storage | | 6 | | | $27,073,528 | | | 2.5 | % | | 1.50x | | 66.9% | | 10.6% |

| Land | | | | | | | | | % | | | | | | |

| Total / Wtd. Avg. | | 124 | | | $1,086,559,119 | | | 100.0 | % | | 1.52x | | 67.2% | | 10.9% |

| | (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| | (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Jefferies LLC, Drexel Hamilton, LLC, RBS Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

| | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance(1) | | | | Aggregate

Appraised

Value(2) | | | | | | % of Total

Underwritten

NOI |

| Nevada | | 5 | | | $135,783,509 | | | 12.5 | % | | $1,022,960,000 | | | 39.2 | % | | $55,247,274 | | 32.3 | % |

| California | | 7 | | | 130,036,122 | | | 12.0 | | | 200,450,000 | | | 7.7 | | | 13,467,113 | | 7.9 | |

| Texas | | 16 | | | 108,557,245 | | | 10.0 | | | 156,560,000 | | | 6.0 | | | 11,882,010 | | 6.9 | |

| New York | | 5 | | | 85,859,286 | | | 7.9 | | | 206,030,000 | | | 7.9 | | | 11,045,536 | | 6.4 | |

| Michigan | | 16 | | | 85,731,934 | | | 7.9 | | | 211,830,000 | | | 8.1 | | | 16,528,062 | | 9.7 | |

| Florida | | 12 | | | 80,862,060 | | | 7.4 | | | 109,125,000 | | | 4.2 | | | 7,412,552 | | 4.3 | |

| Georgia | | 11 | | | 77,720,346 | | | 7.2 | | | 109,125,000 | | | 4.2 | | | 8,017,644 | | 4.7 | |

| Louisiana | | 1 | | | 72,928,787 | | | 6.7 | | | 106,000,000 | | | 4.1 | | | 9,576,399 | | 5.6 | |

| Indiana | | 9 | | | 60,630,444 | | | 5.6 | | | 91,770,000 | | | 3.5 | | | 7,175,813 | | 4.2 | |

| Massachusetts | | 1 | | | 47,000,000 | | | 4.3 | | | 86,000,000 | | | 3.3 | | | 5,942,553 | | 3.5 | |

| North Carolina | | 4 | | | 41,910,629 | | | 3.9 | | | 58,500,000 | | | 2.2 | | | 4,183,100 | | 2.4 | |

| Illinois | | 8 | | | 35,443,172 | | | 3.3 | | | 51,405,000 | | | 2.0 | | | 4,293,262 | | 2.5 | |

| Alabama | | 5 | | | 21,970,722 | | | 2.0 | | | 39,600,000 | | | 1.5 | | | 3,147,933 | | 1.8 | |

| Virginia | | 4 | | | 20,534,720 | | | 1.9 | | | 30,085,000 | | | 1.2 | | | 2,421,298 | | 1.4 | |

| Oregon | | 1 | | | 15,964,581 | | | 1.5 | | | 36,400,000 | | | 1.4 | | | 2,780,200 | | 1.6 | |

| South Carolina | | 2 | | | 14,975,000 | | | 1.4 | | | 21,600,000 | | | 0.8 | | | 2,367,595 | | 1.4 | |

| Pennsylvania | | 1 | | | 11,700,000 | | | 1.1 | | | 15,600,000 | | | 0.6 | | | 1,178,435 | | 0.7 | |

| Kentucky | | 2 | | | 9,899,730 | | | 0.9 | | | 13,550,000 | | | 0.5 | | | 1,164,917 | | 0.7 | |

| Kansas | | 4 | | | 8,700,000 | | | 0.8 | | | 12,350,000 | | | 0.5 | | | 935,817 | | 0.5 | |

| Wisconsin | | 1 | | | 5,154,433 | | | 0.5 | | | 7,860,000 | | | 0.3 | | | 566,960 | | 0.3 | |

| Oklahoma | | 2 | | | 4,171,600 | | | 0.4 | | | 5,650,000 | | | 0.2 | | | 504,671 | | 0.3 | |

| Mississippi | | 3 | | | 3,504,740 | | | 0.3 | | | 4,725,000 | | | 0.2 | | | 484,657 | | 0.3 | |

| Arkansas | | 1 | | | 2,362,600 | | | 0.2 | | | 3,200,000 | | | 0.1 | | | 268,856 | | 0.2 | |

| Tennessee | | 1 | | | 1,850,000 | | | 0.2 | | | 2,650,000 | | | 0.1 | | | 212,056 | | 0.1 | |

| Colorado | | 1 | | | 1,749,800 | | | 0.2 | | | 2,370,000 | | | 0.1 | | | 228,792 | | 0.1 | |

| West Virginia | | | | | | | | | | | | | | | | | | | | |

| Total | | 124 | | | $1,086,559,119 | | | 100.0 | % | | $2,607,495,000 | | | 100.0 | % | | $171,267,949 | | 100.0 | % |

| | (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| | (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values with respect to pari passu companion loans. |