| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-191331-02 |

| | | |

January 15, 2014

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,113,635,129

(Approximate Mortgage Pool Balance)

$968,862,000

(Offered Certificates)

GS Mortgage Securities Trust 2014-GC18

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2014-GC18

Goldman Sachs Mortgage Company

Citigroup Global Markets Realty Corp.

Starwood Mortgage Funding I LLC

Cantor Commercial Real Estate Lending, L.P.

As Sponsors

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman, Sachs & Co. | Citigroup |

Co-Lead Managers and Joint Bookrunners |

Drexel Hamilton |

| Co-Manager |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the prospectus included as part of our registration statement (SEC File No. 333-191331) (the “Base Prospectus”) and a separate free writing prospectus, each anticipated to be dated January 15, 2014 (the “Free Writing Prospectus”). The Base Prospectus and the Free Writing Prospectus contain material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus). The Base Prospectus and the Free Writing Prospectus are available upon request from Goldman, Sachs & Co., Citigroup Global Markets Inc. or Drexel Hamilton, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Free Writing Prospectus or, if not defined in the Free Writing Prospectus, in the Base Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Base Prospectus and the Free Writing Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman, Sachs & Co., Citigroup Global Markets Inc., or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED WITH THE STATE OF NEW HAMPSHIRE UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES (“RSA 421-B”), NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE, AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT ANY EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | Expected Ratings (Moody’s / Fitch / KBRA)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | Approximate Initial Credit Support | | Initial Pass-Through

Rate(3) | | Pass-

Through

Rate Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected Principal Window(4) |

| Class A-1 | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 56,812,000 | | | 30.000%(5) | | [ ]% | | (6) | | 2.72 | | 02/14 – 11/18 |

| Class A-2 | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 116,213,000 | | | 30.000%(5) | | [ ]% | | (6) | | 4.87 | | 11/18 – 01/19 |

| Class A-3 | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 216,747,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.80 | | 10/23 – 12/23 |

| Class A-4 | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 301,979,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.87 | | 12/23 – 01/24 |

| Class A-AB | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 87,793,000 | | | 30.000%(5) | | [ ]% | | (6) | | 7.40 | | 01/19 – 10/23 |

| Class X-A | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 847,754,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

Class A-S(9) | | Aaa(sf) / AAAsf / AAA(sf) | | $ | 68,210,000 | (10) | | 23.875% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

Class B(9) | | Aa3(sf) / AA-sf / AA(sf) | | $ | 76,563,000 | (10) | | 17.000% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

Class PEZ(9) | | A1(sf) / A-sf / A-(sf) | | $ | 189,318,000 | | | 13.000%(11) | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

Class C(9) | | A3(sf) / A-sf / A-(sf) | | $ | 44,545,000 | (10) | | 13.000%(11) | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

| | | | | | | | | | | | | | | | | |

NON-OFFERED CERTIFICATES | | | | | | | | | | | |

| Non-Offered Class | | Expected Ratings (Moody’s / Fitch / KBRA)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | Approximate Initial Credit Support | | Initial Pass-Through

Rate(3) | | Pass-

Through Rate Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected Principal Window(4) |

| Class X-B | | NR / BBsf / BB+(sf) | | $ | 22,273,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class X-C | | NR / NR / NR | | $ | 66,818,128 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class D | | NR / BBB-sf / BBB-(sf) | | $ | 55,682,000 | | | 8.000% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

| Class E | | NR / BBsf / BB+(sf) | | $ | 22,273,000 | | | 6.000% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

| Class F | | NR / Bsf / B+(sf) | | $ | 12,528,000 | | | 4.875% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

| Class G | | NR / NR / NR | | $ | 54,290,128 | | | 0.000% | | [ ]% | | (6) | | 9.94 | | 01/24 – 01/24 |

Class R(12) | | NR / NR / NR | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A |

(1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, Inc. (“KBRA”). Subject to the discussion under “Ratings” in the Free Writing Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Free Writing Prospectus. Moody’s, Fitch and KBRA have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximate per annum rate as of the closing date. |

| (4) | Assuming no prepayments prior to the maturity date for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Free Writing Prospectus. |

| (5) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (6) | For any distribution date, the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G certificates will each be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a specified pass-through rate and the rate specified in clause (ii), or (iv) the rate specified in clause (ii) less a specified percentage. The Class PEZ certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, Class B and Class C trust components represented by the Class PEZ certificates. The pass-through rates on the Class A-S, Class B and Class C trust components will at all times be the same as the pass-through rates of the Class A-S, Class B and Class C certificates, respectively. |

| (7) | The Class X-A, Class X-B and Class X-C certificates (the “Class X Certificates”) will not have certificate principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-C certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate certificate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component. The notional amount of the Class X-B certificates will be equal to the certificate principal amount of the Class E certificates. The notional amount of the Class X-C certificates will be equal to the aggregate certificate principal amounts of the Class F and Class G certificates. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| CERTIFICATE SUMMARY (continued) |

| (8) | The pass-through rate of the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component, as described in the Free Writing Prospectus. The pass-through rate of the Class X-B certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class E certificates, as described in the Free Writing Prospectus. The pass through rate of the Class X-C certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class F and Class G certificates, as described in the Free Writing Prospectus. |

| (9) | The Class A-S, Class B and Class C certificates may be exchanged for Class PEZ certificates, and Class PEZ certificates may be exchanged for the Class A-S, Class B and Class C certificates. The Class A-S, Class B, Class PEZ and Class C certificates are collectively referred to as the “Exchangeable Certificates”. |

| (10) | On the closing date, the issuing entity will issue the Class A-S, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $68,210,000, $76,563,000 and $44,545,000, respectively. The Class A-S, Class B, Class PEZ and Class C certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class A-S, Class B and Class C certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A-S, Class B and Class C trust components, respectively. The Class PEZ certificates will, at all times, represent a beneficial interest in the remaining percentages of each of the outstanding principal balances of the Class A-S, Class B and Class C trust components. Following any exchange of Class A-S, Class B and Class C certificates for Class PEZ certificates or any exchange of Class PEZ certificates for Class A-S, Class B and Class C certificates, the percentage interest of the outstanding principal balances of the Class A-S, Class B and Class C trust components that is represented by the Class A-S, Class B, Class PEZ and Class C certificates will be increased or decreased accordingly. The initial certificate principal amount of each of the Class A-S, Class B and Class C certificates shown in the table above represents the maximum certificate principal amount of such class without giving effect to any issuance of Class PEZ certificates. The initial certificate principal amount of the Class PEZ certificates shown in the table above is equal to the aggregate of the maximum initial certificate principal amounts of the Class A-S, Class B and Class C certificates, representing the maximum certificate principal amount of the Class PEZ certificates that could be issued in an exchange. The actual certificate principal amount of any class of the Class A-S, Class B, Class PEZ and Class C certificates issued on the closing date may be less than the maximum certificate principal amount of that class and may be zero. The certificate principal amounts of the Class A-S, Class B and Class C certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal amount of the Class PEZ certificates issued on the closing date. |

| (11) | The initial subordination levels for the Class C and Class PEZ certificates are equal to the subordination level of the underlying Class C trust component, which will have an initial outstanding balance on the closing date of $44,545,000. |

| (12) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interest in each of two separate REMICs, as further described in the Free Writing Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| MORTGAGE POOL CHARACTERISTICS |

Mortgage Pool Characteristics(1) |

| Initial Pool Balance | $1,113,635,129 |

| Number of Mortgage Loans | 74 |

| Number of Mortgaged Properties | 141 |

| Average Cut-off Date Mortgage Loan Balance | $15,049,123 |

| Weighted Average Mortgage Interest Rate | 4.9732% |

| Weighted Average Remaining Term to Maturity (months) | 113 |

Weighted Average Remaining Amortization Term (months)(2) | 352 |

Weighted Average Cut-off Date LTV Ratio(3) | 67.2% |

Weighted Average Maturity Date LTV Ratio(4) | 57.1% |

Weighted Average Underwritten Debt Service Coverage Ratio(5) | 1.58x |

Weighted Average Debt Yield on Underwritten NOI(6) | 10.6% |

| % of Mortgage Loans with Additional Mezzanine Debt | 9.7% |

| % of Mortgaged Properties with Single Tenants | 3.5% |

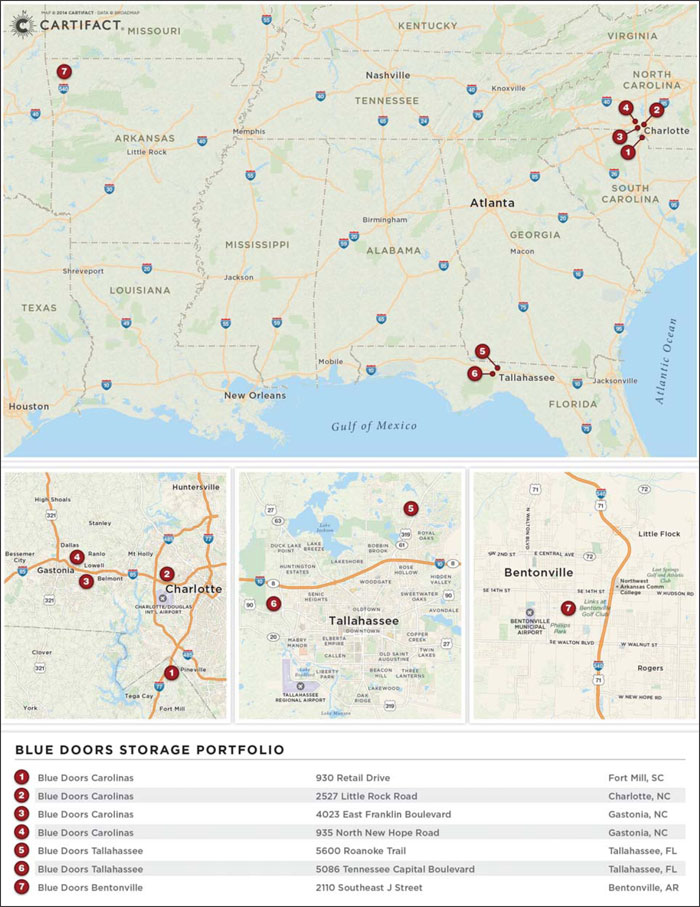

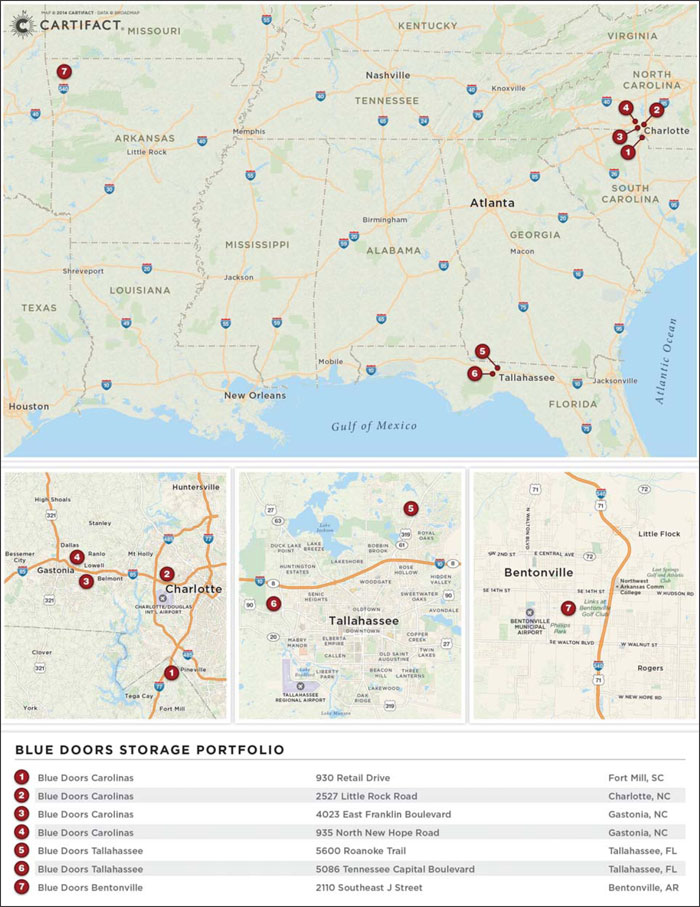

| (1) | Each of the CityScape - East Office/Retail mortgage loan and the 1500 Spring Garden mortgage loan has one related pari passu companion loan, and the loan-to-value ratio, debt service coverage ratio and debt yield calculations presented in this Term Sheet include the related pari passu companion loan unless otherwise indicated. Additionally, with respect to the Blue Doors Carolinas, Blue Doors Tallahassee and Blue Doors Bentonville mortgage loans (collectively, the “Blue Doors Storage Portfolio”), which are cross-collateralized and cross-defaulted with each other, the loan-to-value ratio, debt service coverage ratio and debt yield of those mortgage loans are presented in the aggregate unless otherwise indicated. Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Excludes mortgage loans that are interest only for the entire term. |

| (3) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value. |

| (4) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to 14 mortgage loans representing approximately 25.4% of the initial pool balance, the respective Maturity Date LTV Ratios were each calculated using the related aggregate “as stabilized” appraised value. See “Description of the Mortgage Pool—–Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Maturity Date LTV Ratio. |

| (5) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio is calculated by taking the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties and dividing by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (6) | Unless otherwise indicated, the Debt Yield on Underwritten NOI is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of the mortgage loan, and the Debt Yield on Underwritten NCF is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of the mortgage loan. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| KEY FEATURES OF THE CERTIFICATES |

Co-Lead Managers and Joint Bookrunners: | Goldman, Sachs & Co. Citigroup Global Markets Inc. |

| Co-Manager: | Drexel Hamilton, LLC |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $1,113,635,129 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | LNR Partners, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Deutsche Bank Trust Company Americas |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Pricing: | Week of January 20, 2014 |

| Closing Date: | February 3, 2014 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in January 2014 (or, in the case of any mortgage loan that has its first due date in February 2014, the date that would have been its due date in January 2014 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 6th day of each month or next business day |

| Distribution Date: | The 4th business day after the Determination Date, commencing in February 2014 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | January 2047 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to Class X-A: $1,000,000 minimum); $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | | | | |

| | ■ | $1,113,635,128 (Approximate) New-Issue Multi-Borrower CMBS: |

| | | |

| | | — | Overview: The mortgage pool consists of 74 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,113,635,129 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $15,049,123 and are secured by 141 mortgaged properties located throughout 27 states |

| | | | |

| | | — | LTV: 67.2% weighted average Cut-off Date LTV Ratio |

| | | | |

| | | — | DSCR: 1.58x weighted average Underwritten Debt Service Coverage Ratio |

| | | | |

| | | — | Debt Yield: 10.6% weighted average Debt Yield on Underwritten NOI |

| | | | |

| | | — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

| | | | | |

| | ■ | Loan Structural Features: |

| | | | |

| | | — | Amortization: 88.3% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| | | | | |

| | | | – | 44.1% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| | | | | |

| | | | – | 44.2% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| | | | |

| | | — | Hard Lockboxes: 54.9% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| | | | |

| | | — | Cash Traps: 93.7% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.00x coverage, that fund an excess cash flow reserve |

| | | | |

| | | — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| | | | |

| | | | – | Real Estate Taxes: 70 mortgage loans representing 80.1% of the Initial Pool Balance |

| | | | | |

| | | | – | Insurance: 59 mortgage loans representing 54.1% of the Initial Pool Balance |

| | | | | |

| | | | – | Replacement Reserves (Including FF&E Reserves): 71 mortgage loans representing 88.5% of Initial Pool Balance |

| | | | | |

| | | | – | Tenant Improvements / Leasing Commissions: 37 mortgage loans representing 82.1% of the allocated Initial Pool Balance of office, retail, industrial and mixed use properties only |

| | | | | |

| | | — | Predominantly Defeasance: 79.0% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

| | | |

| | ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| | | | | |

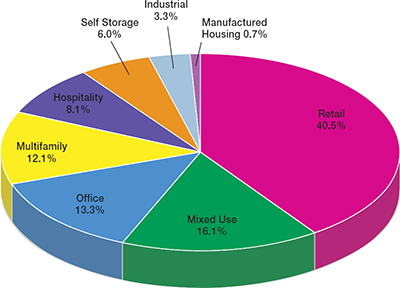

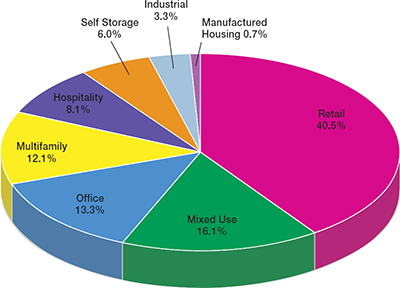

| | | — | Retail: 40.5% of the mortgaged properties by allocated Initial Pool Balance are retail properties (18.9% are regional mall properties, 7.0% are super regional mall properties and 6.1% are anchored retail properties) |

| | | | |

| | | — | Mixed Use: 16.1% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| | | | |

| | | — | Office: 13.3% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| | | | |

| | | — | Multifamily: 12.1% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| | | | |

| | | — | Hospitality: 8.1% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| | | | |

| | | — | Self Storage: 6.0% of the mortgaged properties by allocated Initial Pool Balance are self storage properties |

| | | | |

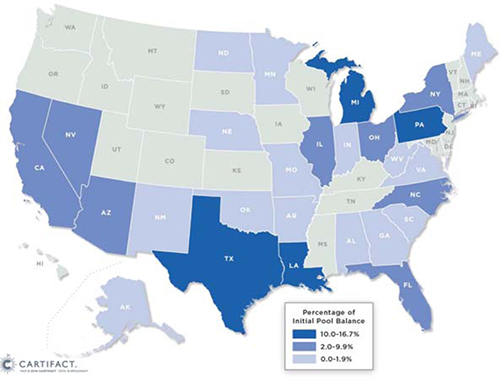

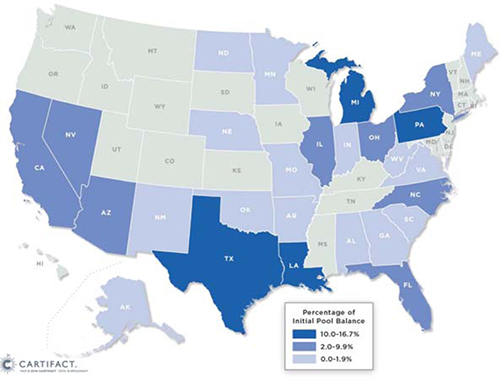

| | ■ | Geographic Diversity: The 141 mortgaged properties are located throughout 27 states, with four states having greater than or equal to 10.0% of the allocated Initial Pool Balance: Pennsylvania (16.7%), Michigan (12.9%), Louisiana (11.7%) and Texas (10.0%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| Mortgage Loans by Loan Seller |

| | | | | | Aggregate Cut-off

Date Balance | | |

| Goldman Sachs Mortgage Company | �� | 27 | | | 32 | | | $460,016,686 | | | 41.3 | % |

| Citigroup Global Markets Realty Corp. | | 18 | | | 70 | | | 332,283,643 | | | 29.8 | |

| Starwood Mortgage Funding I LLC | | 23 | | | 32 | | | 199,354,800 | | | 17.9 | |

| Cantor Commercial Real Estate Lending, L.P. | | 6 | | | 7 | | | 121,980,000 | | | 11.0 | |

| Total | | 74 | | | 141 | | | $1,113,635,129 | | | 100.0 | % |

| Ten Largest Mortgage Loans or Crossed Group | |

| | | | | | | | | | Cut-off Date Balance Per

SF / Room | | | | | | | |

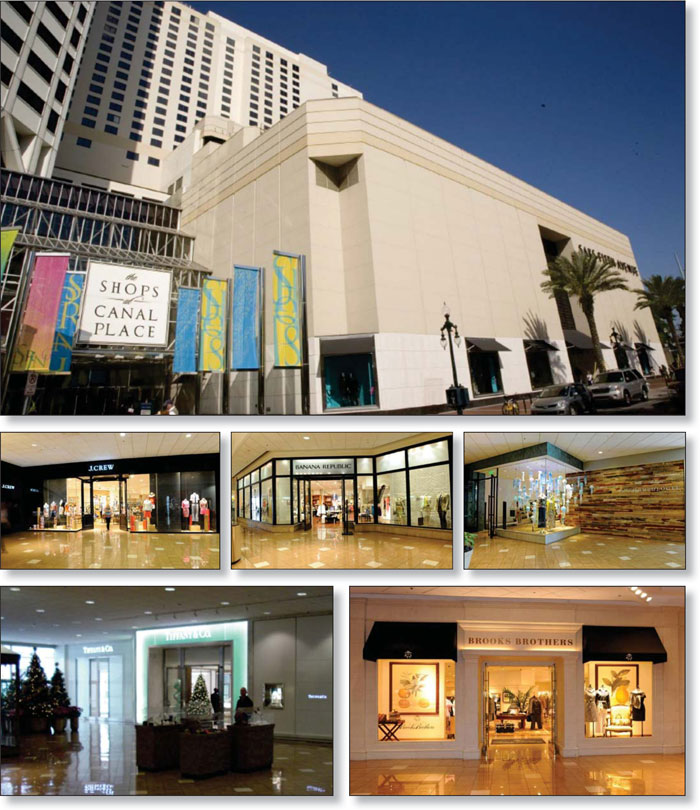

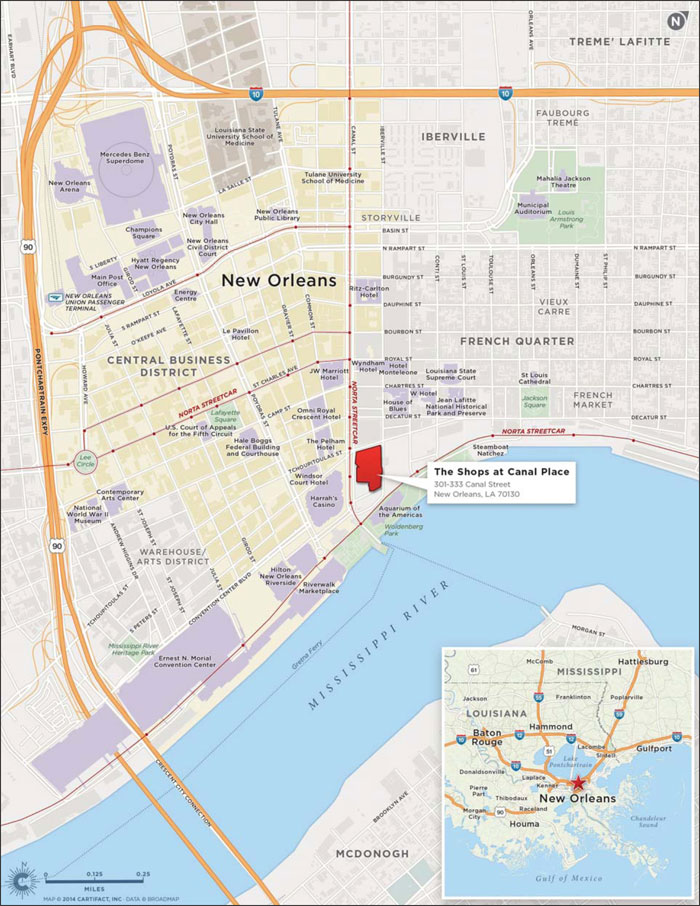

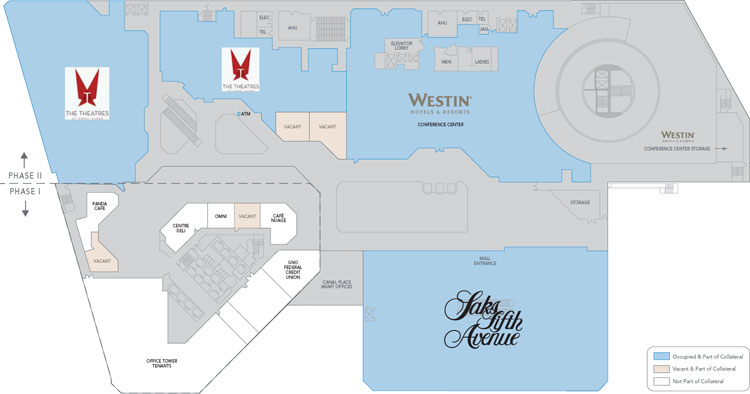

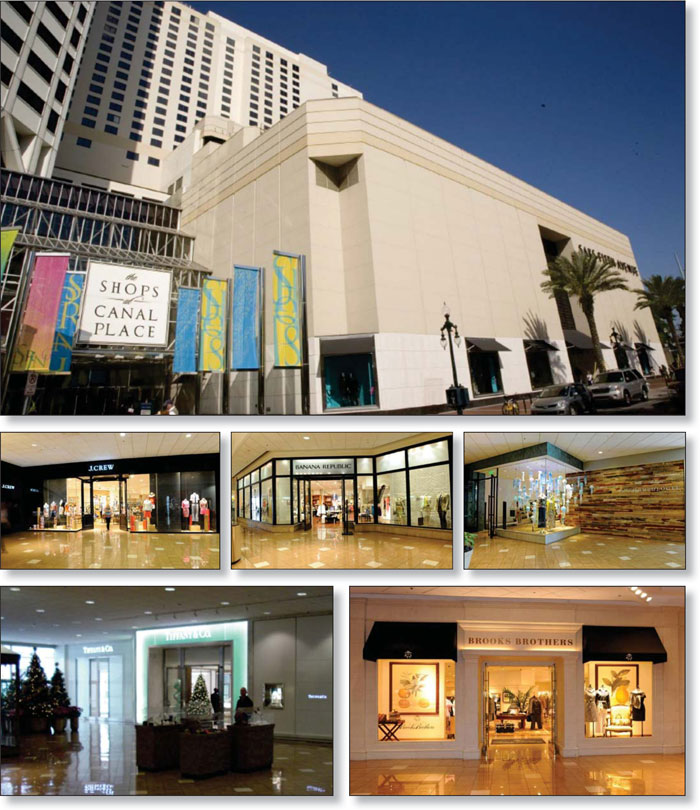

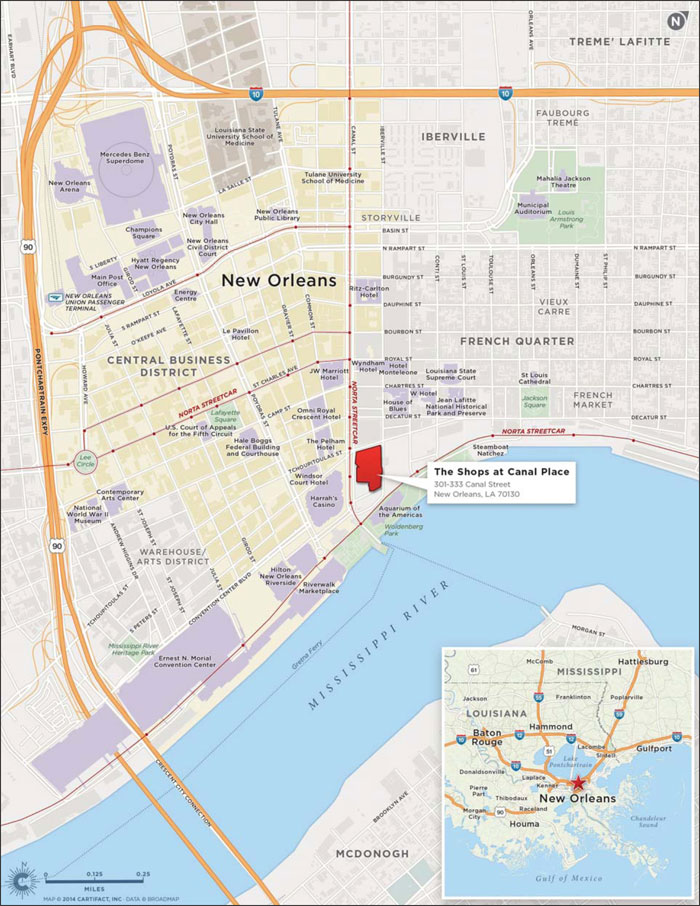

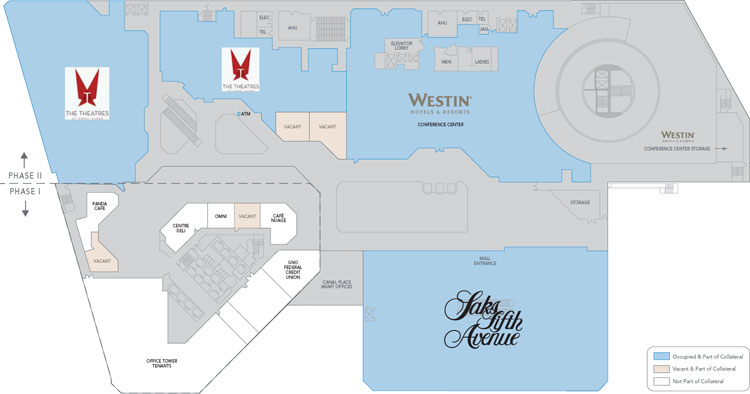

| The Shops at Canal Place | | $111,000,000 | | | 9.97 | % | | Retail | | 216,938 | | | $512 | | | 1.23x | | | 8.1% | | | 65.1% | | |

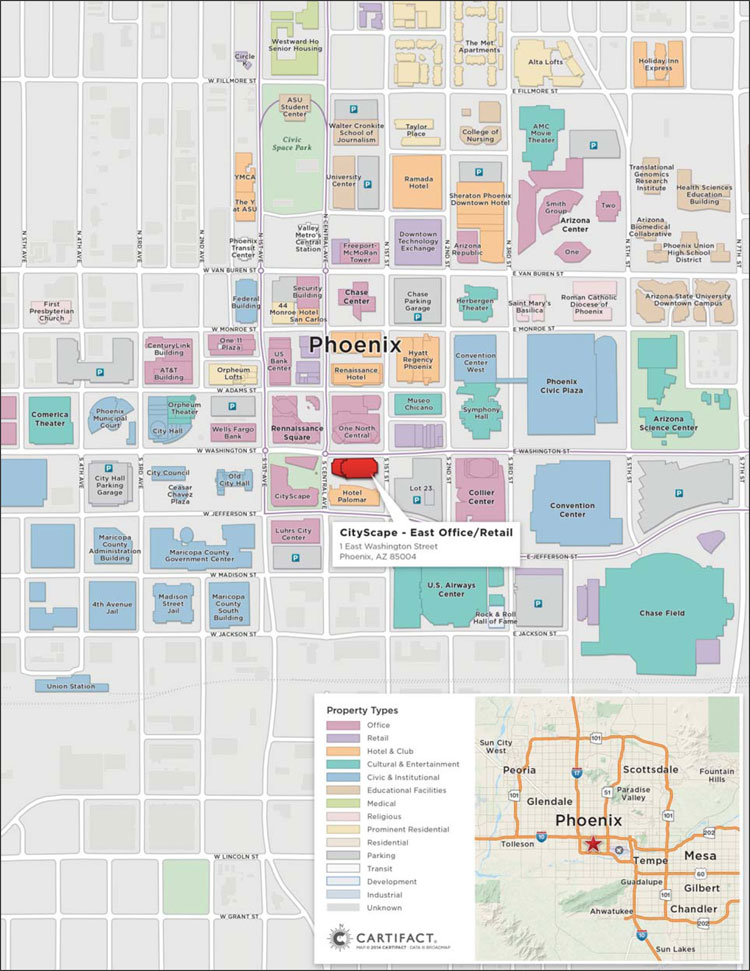

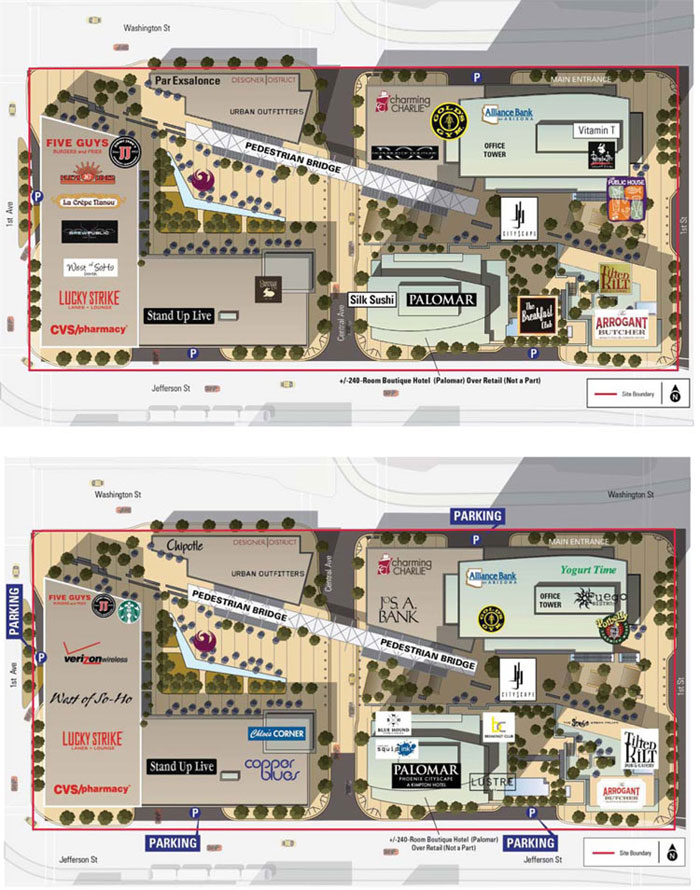

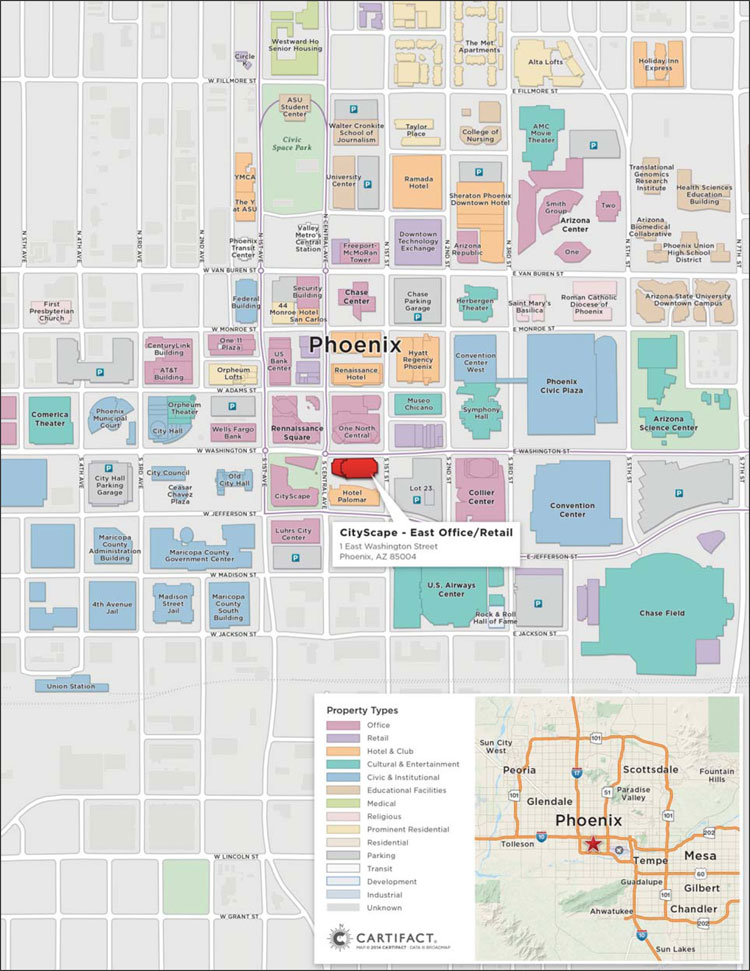

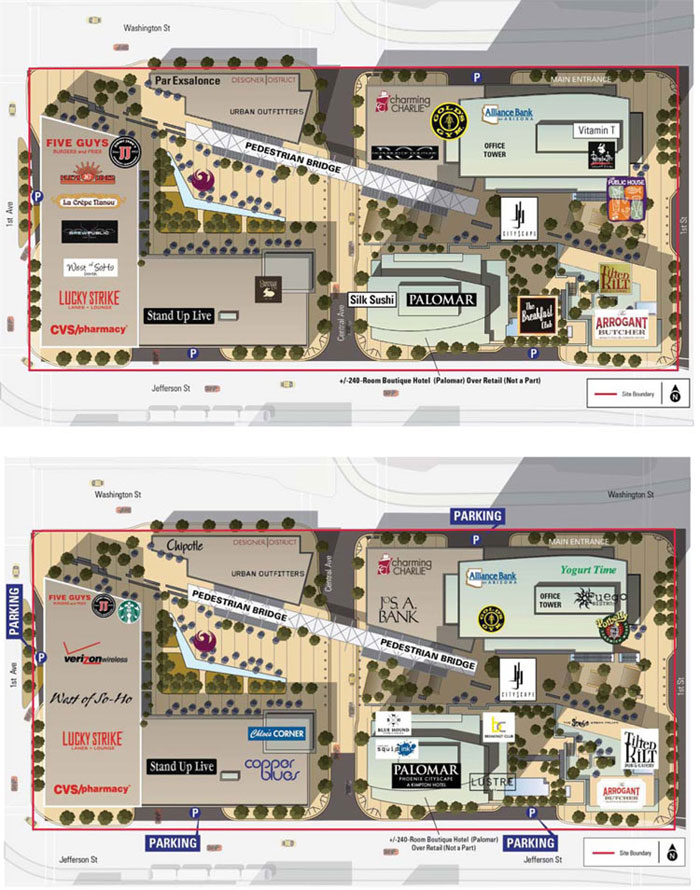

| CityScape - East Office/Retail | | 100,000,000 | | | 9.0 | | | Mixed Use | | 641,935 | | | $288 | | | 1.34x | | | 9.3% | | | 67.5% | | |

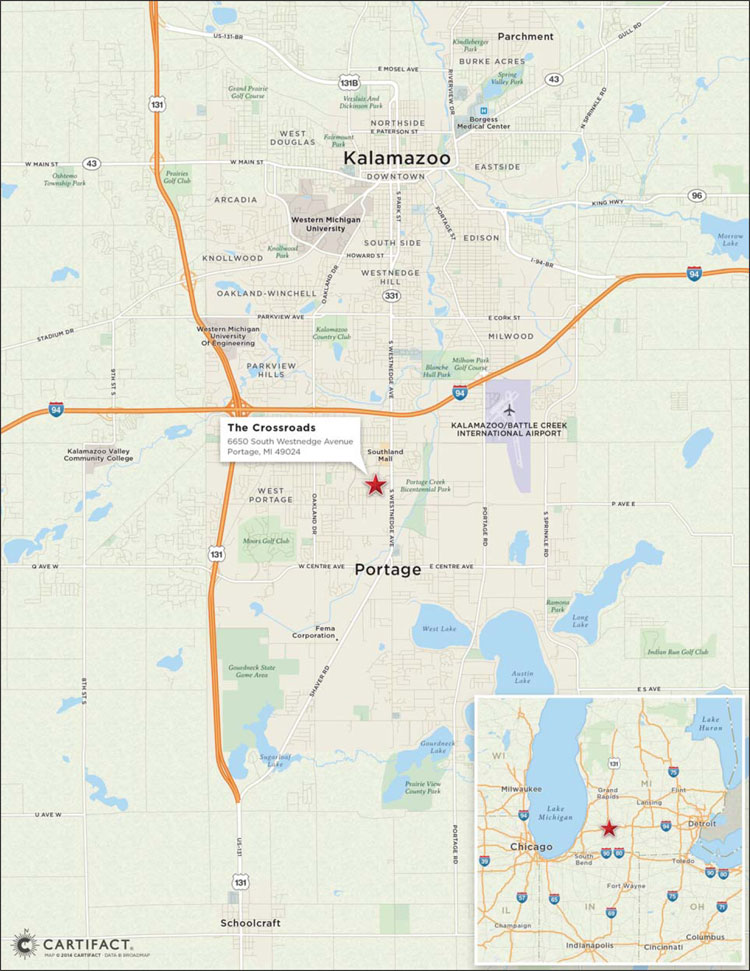

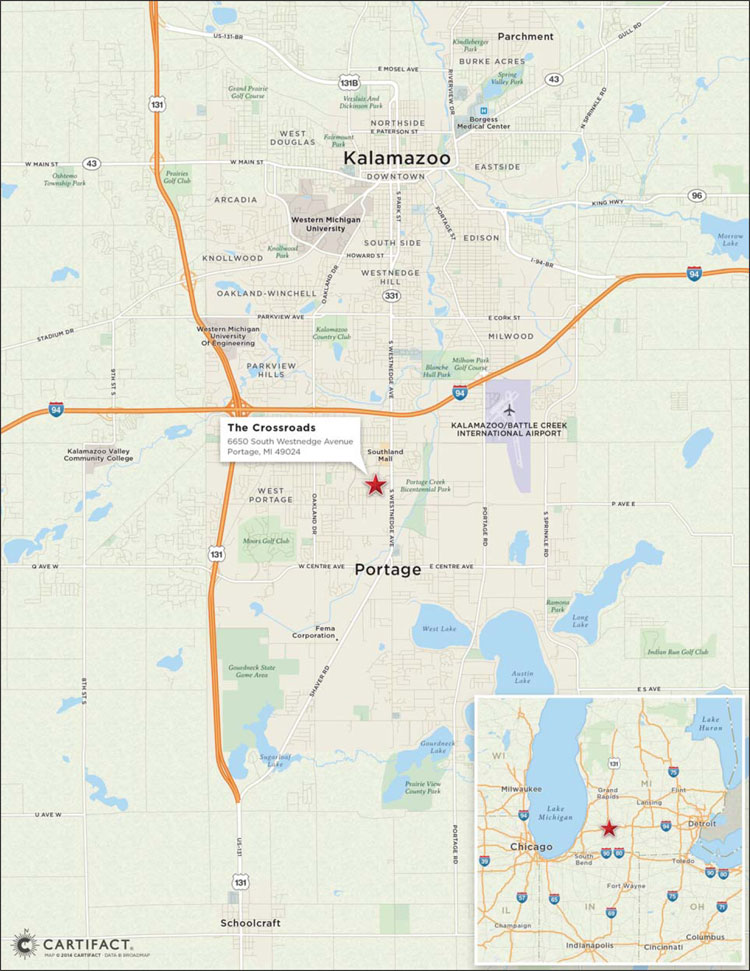

| The Crossroads | | 99,878,765 | | | 9.0 | | | Retail | | 348,810 | | | $286 | | | 1.73x | | | 10.8% | | | 65.7% | | |

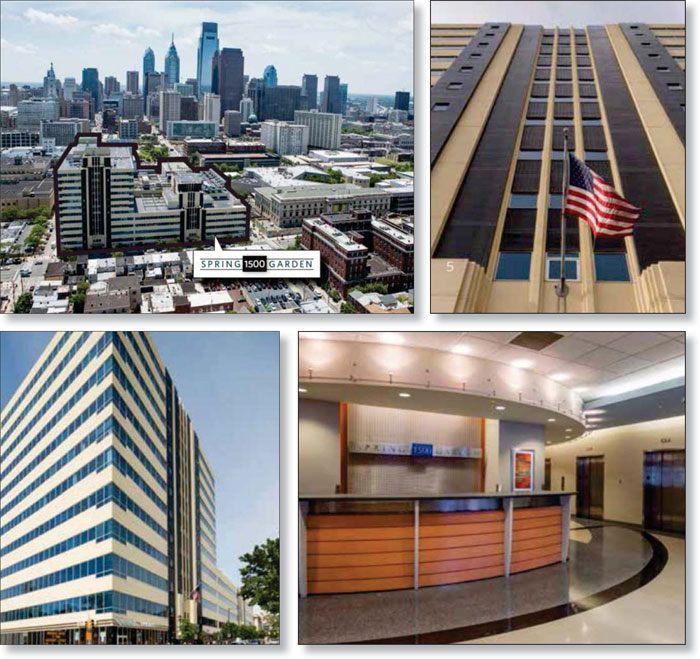

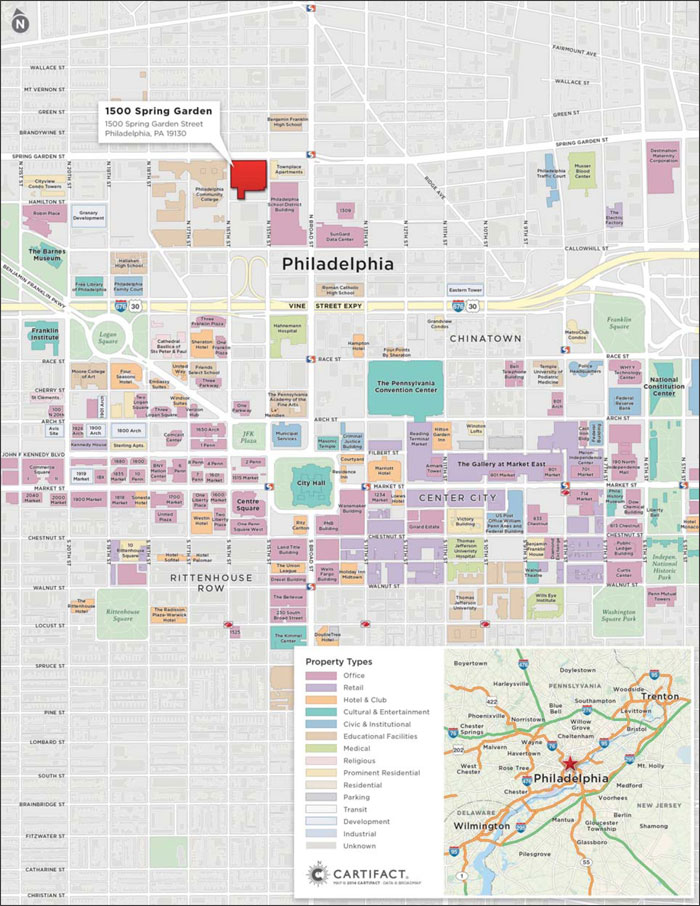

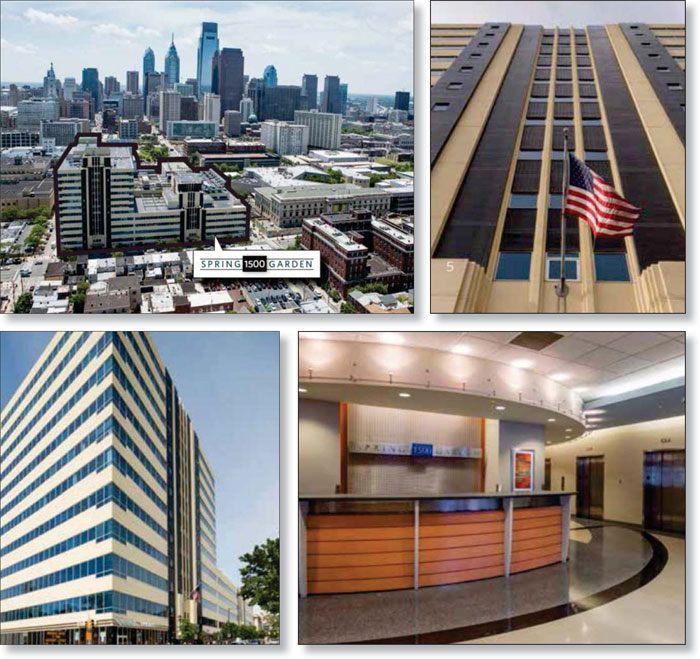

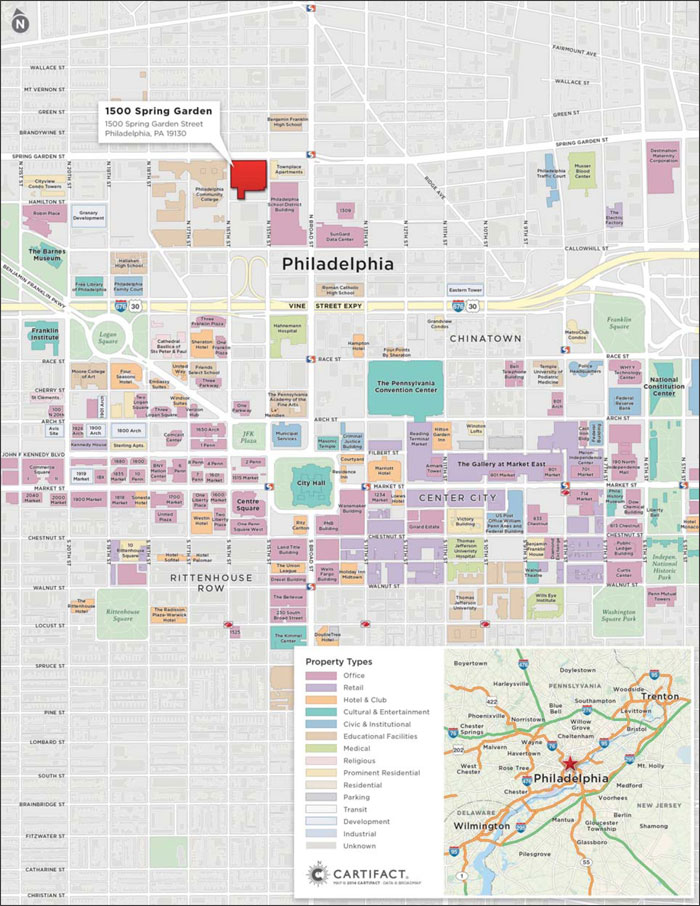

| 1500 Spring Garden | | 80,000,000 | | | 7.2 | | | Office | | 1,068,125 | | | $140 | | | 2.11x | | | 9.8% | | | 75.8% | | |

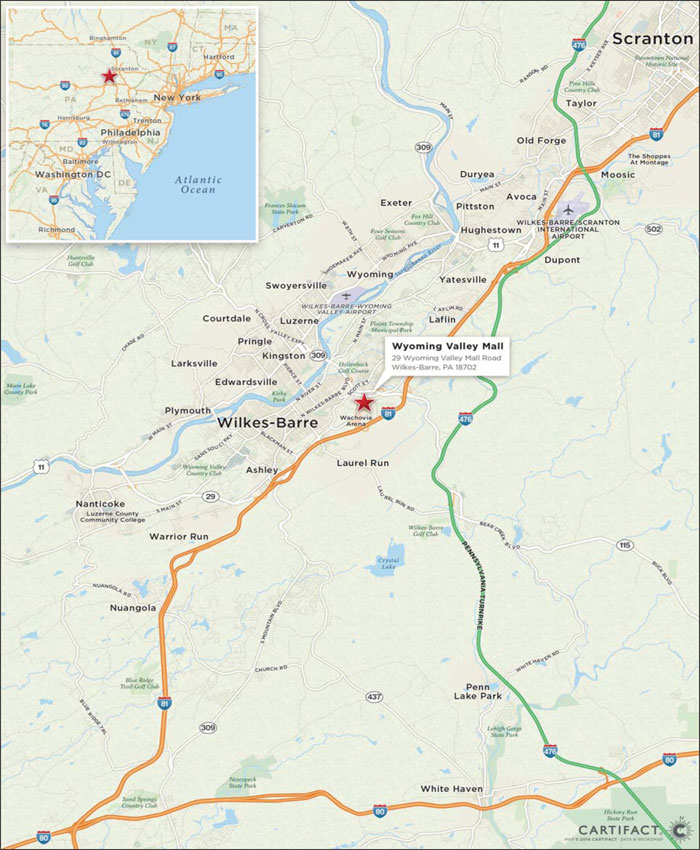

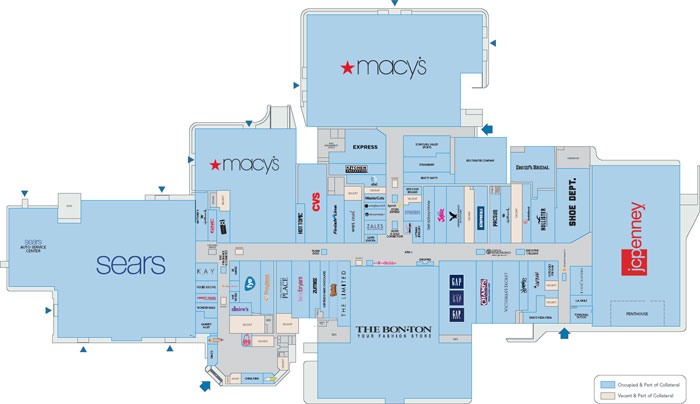

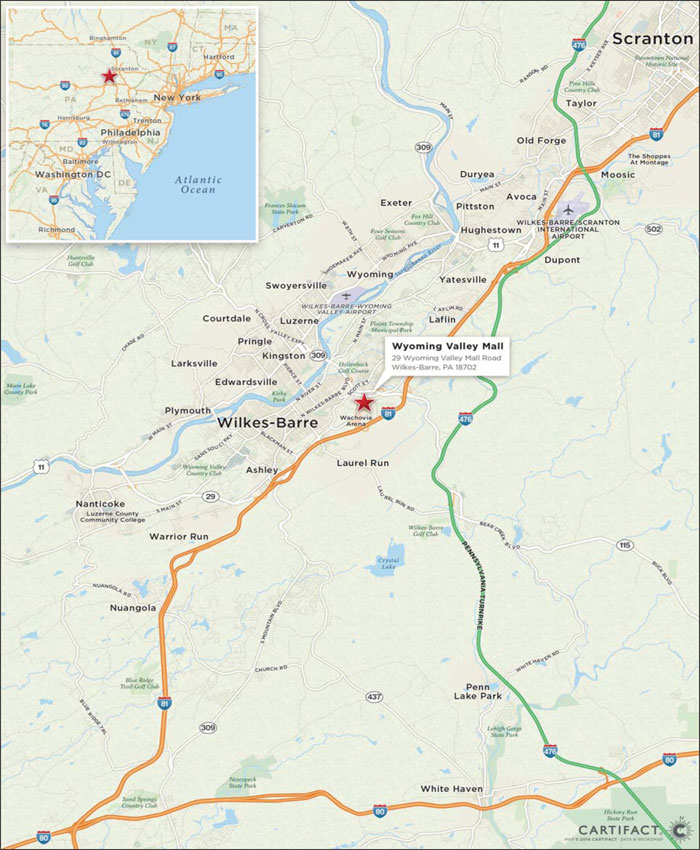

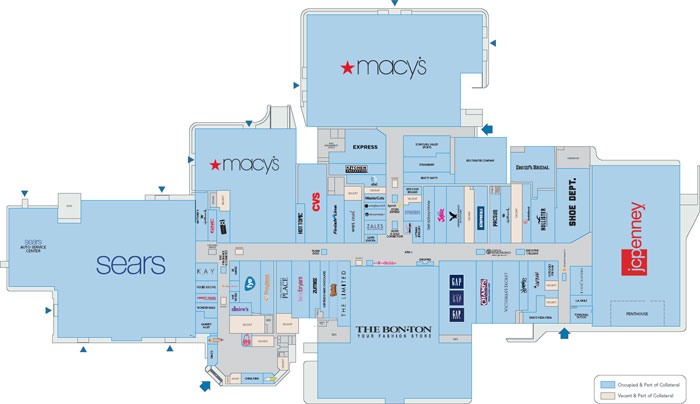

| Wyoming Valley Mall | | 78,000,000 | | | 7.0 | | | Retail | | 909,757 | | | $86 | | | 1.39x | | | 10.6% | | | 63.9% | | |

| Blue Doors Storage Portfolio | | 25,790,000 | | | 2.3 | | | Self Storage | | 482,071 | | | $53 | | | 1.43x | | | 9.5% | | | 66.7% | | |

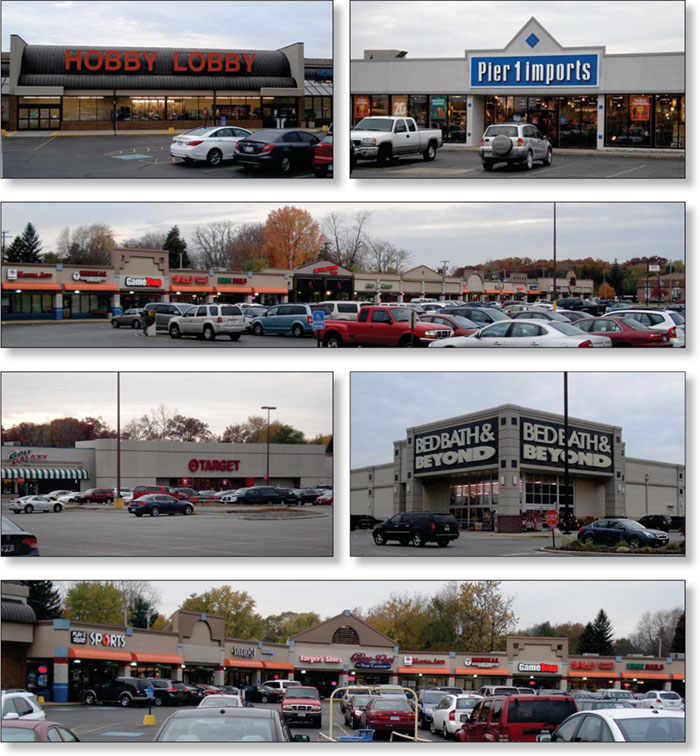

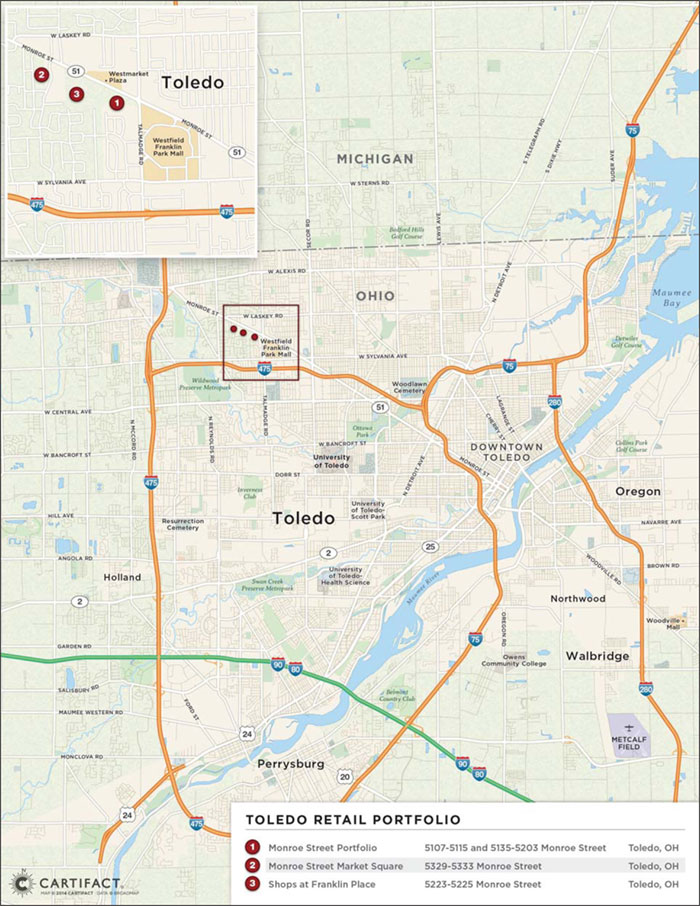

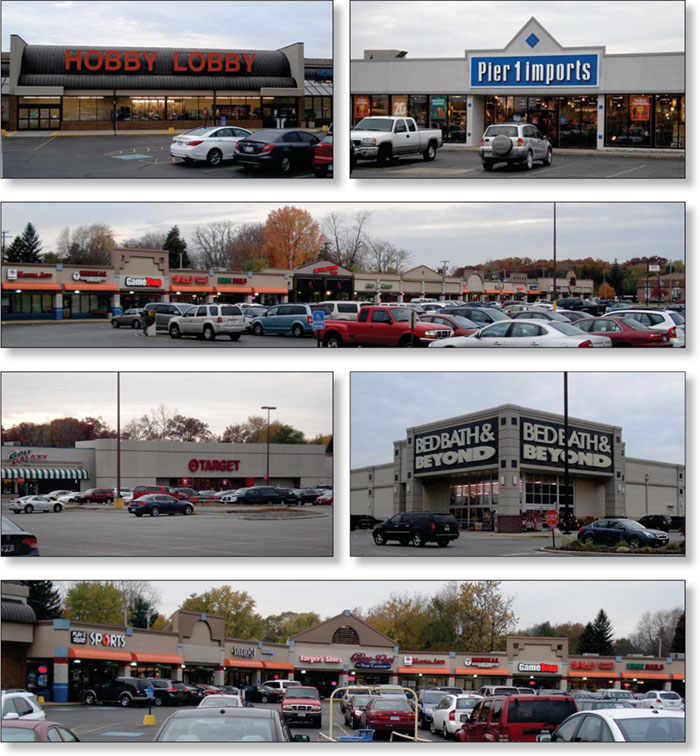

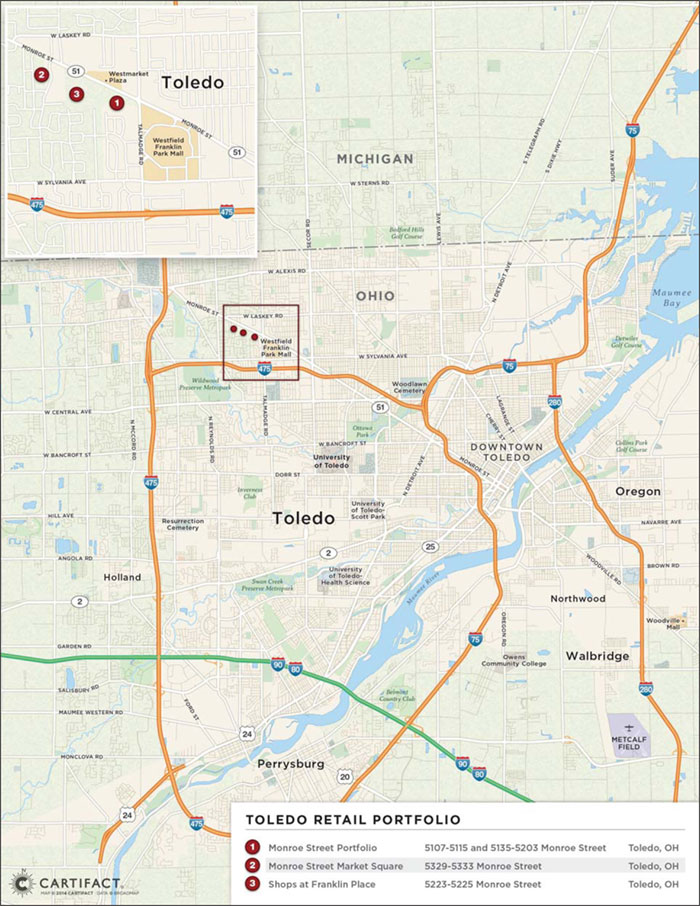

| Toledo Retail Portfolio | | 24,087,500 | | | 2.2 | | | Retail | | 403,616 | | | $60 | | | 1.47x | | | 10.7% | | | 72.9% | | |

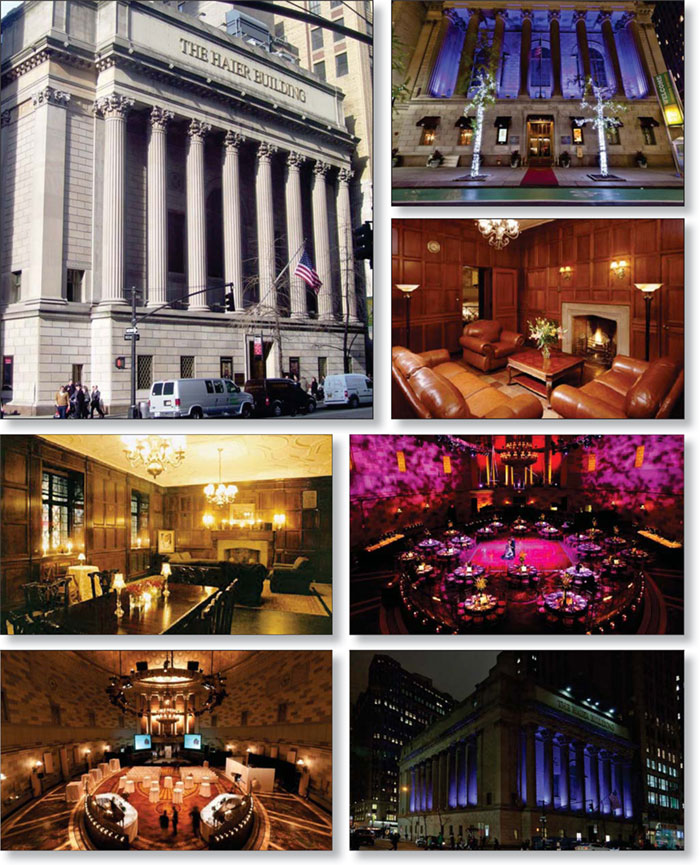

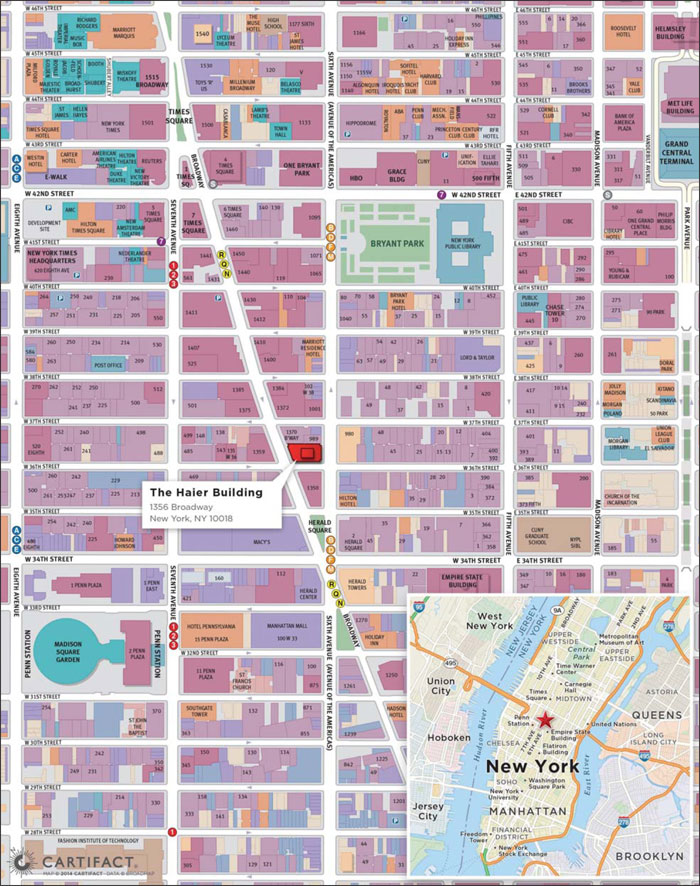

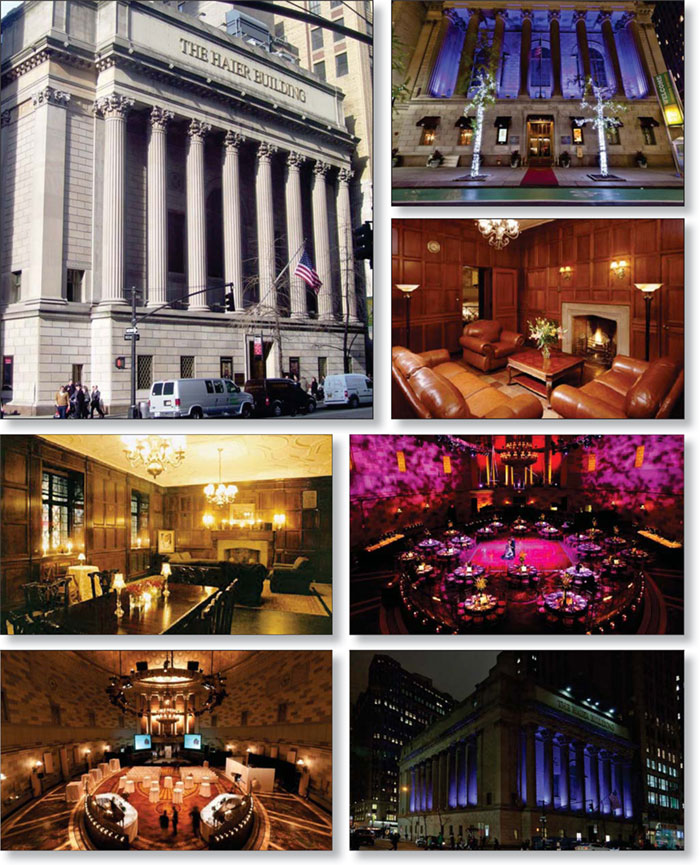

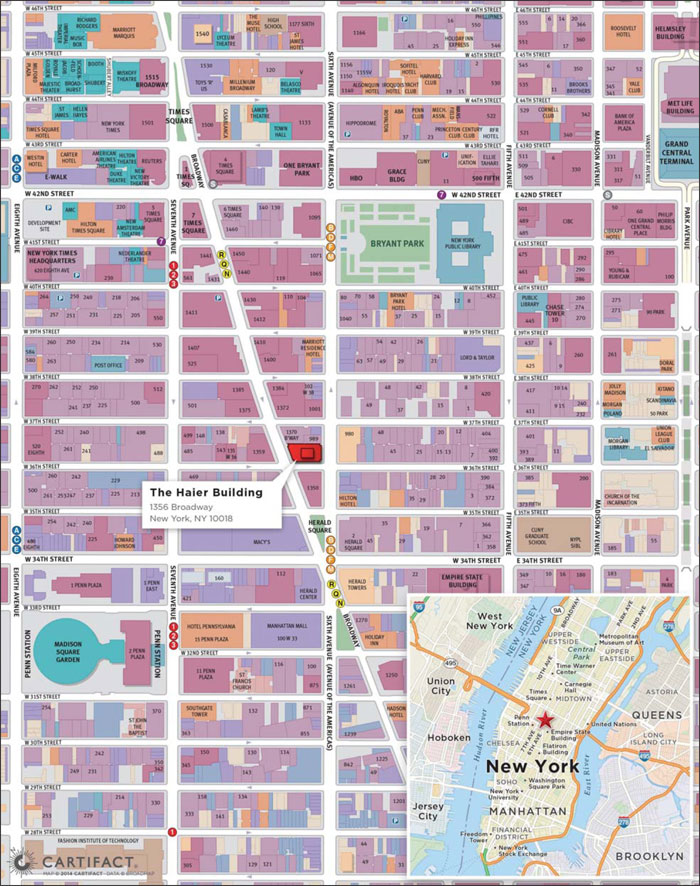

| The Haier Building | | 23,000,000 | | | 2.1 | | | Mixed Use | | 63,500 | | | $362 | | | 2.37x | | | 12.4% | | | 40.4% | | |

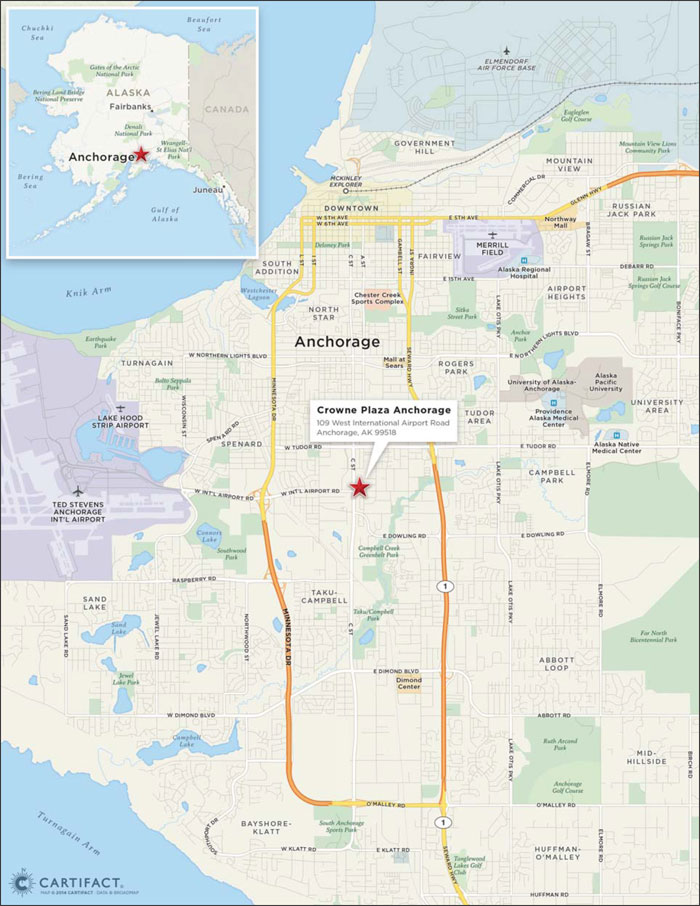

| Crowne Plaza Anchorage | | 18,750,000 | | | 1.7 | | | Hospitality | | 165 | | | $113,636 | | | 1.53x | | | 12.1% | | | 69.7% | | |

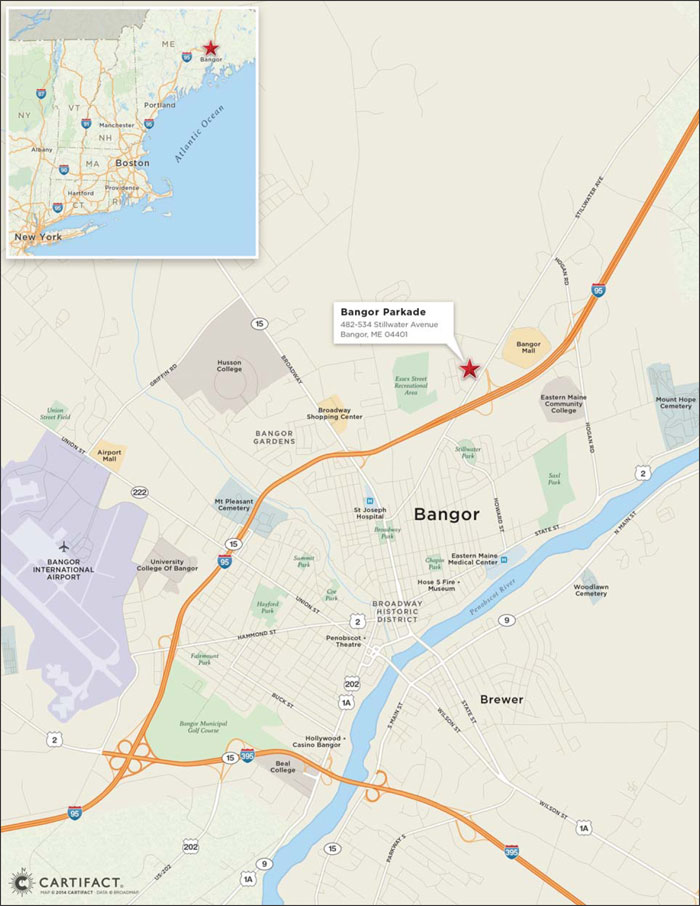

| Bangor Parkade | | | | | | | | Retail | | 232,381 | | | $80 | | | | | | | | | | | |

| Top 10 Total / Wtd. Avg. | | $579,006,265 | | | 52.0 | % | | | | | | | | | | 1.56x | | | 9.9% | | | 66.6% | | |

| Remaining Total / Wtd. Avg. | | | | | | | | | | | | | | | | | | | | | | | | |

| Total / Wtd. Avg. | | $1,113,635,129 | | | 100.0 | % | | | | | | | | | | 1.58x | | | 10.6% | | | 67.2% | | |

| Pari Passu Companion Loan Summary |

| | Mortgage

Loan Cut-off

Date Balance | | | | Pari Passu

Companion

Loan Cut-off

Date Balance | | Whole Loan Cut-

off Date Balance | | Controlling Pooling &

Servicing Agreement | | | | |

| CityScape - East Office/Retail | | $100,000,000 | | 9.0% | | $85,000,000 | | $185,000,000 | | GSMS 2014-GC18 | | Wells Fargo | | LNR |

| 1500 Spring Garden | | $80,000,000 | | 7.2% | | $69,500,000 | | $149,500,000 | | GSMS 2014-GC18 | | Wells Fargo | | LNR |

| Mortgage Loans with Existing Mezzanine or Other Financing | |

| | Mortgage Loan

Cut-off Date

Balance | | Mezzanine

Debt Cut-off

Date

Balance | | Cut-off Date

Total Debt

Balance | | Cut-off Date

Wtd. Avg.

Total Debt

Interest Rate | | Cut-off

Date

Mortgage

Loan LTV | | | | Cut-off

Date

Mortgage

Loan

DSCR | | Cut-off

Date Total

Debt DSCR | |

CityScape - East Office/Retail(1) | | $100,000,000 | | $25,000,000 | | $210,000,000(2) | | 5.69452%(3) | | 67.5% | | 76.6% | | 1.34x | | 1.07x | |

Gateway Commerce Center(4) | | $7,500,000 | | $3,605,998 | | $11,105,998 | | 5.26391%(5) | | 72.8% | | 107.8% | | 1.66x | | 1.66x | |

(1) | The related mezzanine loan is currently held by GV CityScape Mezz Lender, LLC, or its affiliate, and is secured by the mezzanine borrower’s interest in the related mortgage borrower. |

| (2) | Cut-off Date Total Debt Balance includes the related pari passu companion loan with a principal balance as of the Cut-off Date of $85,000,000. |

| (3) | The CityScape – East Office/Retail mezzanine loan has a fixed interest rate of 11.50000% from the origination date to December 31, 2018 and has a fixed interest rate of 13.50000% from January 1, 2019 to the related maturity date. |

| (4) | The related mezzanine loan is initially held by York Investments LP, an affiliate of the mortgage borrower, and is secured by the mezzanine borrower’s interest in the related mortgage borrower. |

| (5) | The Gateway Commerce Center mezzanine loan has a fixed interest rate of 6.00000% until the related maturity date. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1) | |

| | | | | | | | | | Cut-off Date

Balance /

Allocated Cut-off

Date Balance | | | | | |

| The Shops at Canal Place | | GSMC | | New Orleans | | LA | | Retail | | $111,000,000 | | | 9.97% | | JPMCC 2005-LDP2 | |

| The Haier Building | | CGMRC | | New York | | NY | | Mixed Use | | $23,000,000 | | | 2.1% | | MLCFC 2006-3 | |

| Bangor Parkade | | CCRE | | Bangor | | ME | | Retail | | $18,500,000 | | | 1.7% | | BSCMS 2006-T22 | |

| Smith Brothers Hardware Building | | GSMC | | Columbus | | OH | | Office | | $16,981,416 | | | 1.5% | | GMACC 2004-C1 | |

| Highland Plantation Apartments | | SMF I | | Baton Rouge | | LA | | Multifamily | | $16,500,000 | | | 1.5% | | BACM 2005-1 | |

| Gessner Estates Apartments | | CGMRC | | Houston | | TX | | Multifamily | | $15,000,000 | | | 1.3% | | CSFB 2005-C2 | |

| 246 Fifth Avenue | | SMF I | | New York | | NY | | Mixed Use | | $15,000,000 | | | 1.3% | | WBCMT 2007-C33 | |

| Quorum II Plaza | | CGMRC | | Dallas | | TX | | Retail | | $11,000,000 | | | 1.0% | | GMACC 1998-C1 | |

| 7500 Bellaire Boulevard | | GSMC | | Houston | | TX | | Office | | $10,375,859 | | | 0.9% | | DBUBS 2011-LC3 | |

121 Hillpointe & 130 Technology(2) | | GSMC | | Canonsburg | | PA | | Office | | $8,606,427 | | | 0.8% | | MSC 2003-IQ6 | |

Brittany Knoll Apartments(3) | | SMF I | | Stuarts Draft | | VA | | Multifamily | | $7,706,420 | | | 0.7% | | GMACC 2003-C3 | |

| Gateway Commerce Center | | SMF I | | Gainesville | | VA | | Retail | | $7,500,000 | | | 0.7% | | BACM 2007-4 | |

| Lovejoy Station | | SMF I | | Hampton | | GA | | Retail | | $7,350,000 | | | 0.7% | | WBCMT 2004-C10 | |

| Oliver Creek Shopping Center | | SMF I | | Montgomery | | AL | | Retail | | $7,243,307 | | | 0.7% | | WBCMT 2004-C11 | |

| Stonesthrow Apartments | | GSMC | | Durham | | NC | | Multifamily | | $6,493,254 | | | 0.6% | | CMAT 1999-C1 | |

| Southport Industrial Complex | | GSMC | | West Sacramento | | CA | | Industrial | | $6,417,865 | | | 0.6% | | BACM 2004-2 | |

| Mansfield Crossing | | GSMC | | Mansfield | | TX | | Retail | | $5,786,141 | | | 0.5% | | JPMCC 2004-C1 | |

| Hillcrest Medical Park | | SMF I | | Frisco | | TX | | Office | | $3,995,834 | | | 0.4% | | GECMC 2004-C2 | |

5086 Tennessee Capital Boulevard(4) | | SMF I | | Tallahassee | | FL | | Self Storage | | $3,240,000 | | | 0.3% | | BACM 2006-6 | |

Town Center & Druid Hills Self Storage(5) | | SMF I | | Various | | GA | | Self Storage | | $3,196,703 | | | 0.3% | | LBUBS 2004-C7 | |

| Blue Doors Bentonville | | SMF I | | Bentonville | | AR | | Self Storage | | $2,830,000 | | | 0.3% | | MLMT 2006-C2 | |

(1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | A mortgage loan secured by the 121 Hillpointe Drive building was included in MSC 2003-IQ6. The 130 Technology Drive building was not included in any previous securitization. |

| (3) | A mortgage loan secured by the Brittany Knoll Apartments (which is part of the collateral securing the Brittany Knoll Apartments and Abbey Rose Townhomes mortgage loan) was included in GMACC 2003-C3. The table above does not include any mortgage loans secured by the other mortgaged property that secures the Brittany Knoll Apartments and Abbey Rose Townhomes mortgage loan. |

| (4) | A mortgage loan secured by 5086 Tennessee Capital Boulevard (which is part of the collateral securing the Blue Doors Tallahassee mortgage loan) was included in BACM 2006-C6. The table above does not include any mortgage loans secured by the other mortgaged property that secures the Blue Doors Tallahassee mortgage loan. |

| (5) | Both of the Town Center & Druid Hills Self Storage mortgaged properties secured a mortgage loan that was included in the LBUBS 2004-C7 transaction. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Property Types

| | Number of Mortgaged Properties | | Aggregate Cut-off Date

Balance(1) | | | | Wtd. Avg. Underwritten

NCF DSCR(2) | | Wtd. Avg.

Cut-off

Date LTV

Ratio(2) | | Wtd. Avg. Debt Yield on

Underwritten NOI(2) |

| Retail | | 71 | | | $451,258,514 | | | 40.5 | % | | 1.49x | | | 66.2% | | | 10.2% | |

| Regional Mall | | 2 | | | 210,878,765 | | | 18.9 | | | 1.47x | | | 65.4% | | | 9.4% | |

| Super Regional Mall | | 1 | | | 78,000,000 | | | 7.0 | | | 1.39x | | | 63.9% | | | 10.6% | |

| Anchored | | 8 | | | 68,125,724 | | | 6.1 | | | 1.49x | | | 70.0% | | | 10.6% | |

| Shadow Anchored | | 10 | | | 49,751,156 | | | 4.5 | | | 1.59x | | | 72.4% | | | 11.3% | |

| Unanchored | | 5 | | | 24,883,707 | | | 2.2 | | | 1.81x | | | 63.7% | | | 11.1% | |

| Single Tenant Retail | | 45 | | | 19,619,162 | | | 1.8 | | | 1.45x | | | 59.3% | | | 12.5% | |

| Mixed Use | | 8 | | | $179,723,316 | | | 16.1 | % | | 1.50x | | | 64.6% | | | 9.9% | |

| Office/Retail | | 7 | | | 175,230,049 | | | 15.7 | | | 1.50x | | | 65.0% | | | 9.9% | |

| Multifamily/Retail | | 1 | | | 4,493,267 | | | 0.4 | | | 1.34x | | | 46.6% | | | 9.7% | |

| Office | | 9 | | | $148,192,045 | | | 13.3 | % | | 1.91x | | | 72.0% | | | 10.7% | |

| CBD | | 2 | | | 96,981,416 | | | 8.7 | | | 2.05x | | | 73.9% | | | 10.3% | |

| General Suburban | | 5 | | | 38,608,368 | | | 3.5 | | | 1.64x | | | 67.8% | | | 11.6% | |

| Flex | | 1 | | | 8,606,427 | | | 0.8 | | | 1.54x | | | 74.8% | | | 11.1% | |

| Medical | | 1 | | | 3,995,834 | | | 0.4 | | | 1.72x | | | 60.5% | | | 11.9% | |

| Multifamily | | 16 | | | $134,290,477 | | | 12.1 | % | | 1.48x | | | 69.7% | | | 10.6% | |

| Garden | | 13 | | | 107,290,477 | | | 9.6 | | | 1.50x | | | 69.1% | | | 10.6% | |

| Student Housing | | 3 | | | 27,000,000 | | | 2.4 | | | 1.40x | | | 71.8% | | | 10.4% | |

| Hospitality | | 8 | | | $89,718,638 | | | 8.1 | % | | 1.67x | | | 67.7% | | | 13.1% | |

| Limited Service | | 6 | | | 60,668,638 | | | 5.4 | | | 1.77x | | | 66.7% | | | 13.6% | |

| Full Service | | 2 | | | 29,050,000 | | | 2.6 | | | 1.48x | | | 69.7% | | | 12.0% | |

| Self Storage | | 19 | | | $66,697,785 | | | 6.0 | % | | 1.71x | | | 62.5% | | | 10.2% | |

| Industrial | | 5 | | | $36,401,347 | | | 3.3 | % | | 1.59x | | | 70.3% | | | 11.9% | |

| Warehouse/Distribution | | 2 | | | 16,167,865 | | | 1.5 | | | 1.67x | | | 71.7% | | | 12.1% | |

| Flex | | 2 | | | 15,444,137 | | | 1.4 | | | 1.36x | | | 72.2% | | | 10.7% | |

| Warehouse/Office | | 1 | | | 4,789,344 | | | 0.4 | | | 2.03x | | | 59.9% | | | 15.2% | |

| Manufactured Housing | | | | | | | | | % | | | | | | | | | |

| Total / Wtd. Avg. | | 141 | | | $1,113,635,129 | | | 100.0 | % | | 1.58x | | | 67.2% | | | 10.6% | |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

| | Number of Mortgaged Properties | | Aggregate Cut-off

Date Balance(1) | | % of Initial

Pool Balance | | Aggregate

Appraised

Value(2) | | % of Total Appraised

Value | | | | % of Total

Underwritten

NOI |

| Pennsylvania | | 8 | | | $185,513,274 | | | | 16.7% | | $357,910,000 | | | | 18.9% | | $26,183,142 | | | | 19.7% |

| Michigan | | 10 | | | 143,839,117 | | | | 12.9 | | 217,190,000 | | | | 11.5 | | 16,123,854 | | | | 12.2 |

| Louisiana | | 8 | | | 130,068,245 | | | | 11.7 | | 197,320,000 | | | | 10.4 | | 10,977,705 | | | | 8.3 |

| Texas | | 29 | | | 111,129,150 | | | | 10.0 | | 163,320,000 | | | | 8.6 | | 13,188,126 | | | | 9.9 |

| Arizona | | 5 | | | 108,902,564 | | | | 9.8 | | 287,140,000 | | | | 15.2 | | 18,224,921 | | | | 13.7 |

| Ohio | | 16 | | | 63,048,150 | | | | 5.7 | | 90,765,000 | | | | 4.8 | | 7,196,417 | | | | 5.4 |

| New York | | 9 | | | 60,608,527 | | | | 5.4 | | 120,970,000 | | | | 6.4 | | 6,792,404 | | | | 5.1 |

| North Carolina | | 8 | | | 57,516,829 | | | | 5.2 | | 81,465,000 | | | | 4.3 | | 5,535,911 | | | | 4.2 |

| Nevada | | 5 | | | 25,895,935 | | | | 2.3 | | 37,970,000 | | | | 2.0 | | 3,006,687 | | | | 2.3 |

| Florida | | 4 | | | 25,164,918 | | | | 2.3 | | 37,580,000 | | | | 2.0 | | 2,792,690 | | | | 2.1 |

| Illinois | | 7 | | | 24,925,169 | | | | 2.2 | | 37,270,000 | | | | 2.0 | | 2,978,867 | | | | 2.2 |

| California | | 4 | | | 23,420,832 | | | | 2.1 | | 37,230,000 | | | | 2.0 | | 2,452,721 | | | | 1.8 |

| Alaska | | 1 | | | 18,750,000 | | | | 1.7 | | 26,900,000 | | | | 1.4 | | 2,272,976 | | | | 1.7 |

| Maine | | 1 | | | 18,500,000 | | | | 1.7 | | 27,350,000 | | | | 1.4 | | 1,948,954 | | | | 1.5 |

| Missouri | | 1 | | | 16,800,000 | | | | 1.5 | | 22,690,000 | | | | 1.2 | | 1,612,716 | | | | 1.2 |

| Minnesota | | 4 | | | 16,750,000 | | | | 1.5 | | 32,305,000 | | | | 1.7 | | 1,958,223 | | | | 1.5 |

| Georgia | | 4 | | | 16,546,703 | | | | 1.5 | | 23,820,000 | | | | 1.3 | | 1,637,326 | | | | 1.2 |

| Virginia | | 3 | | | 16,490,823 | | | | 1.5 | | 24,300,000 | | | | 1.3 | | 1,863,728 | | | | 1.4 |

| South Carolina | | 2 | | | 15,565,000 | | | | 1.4 | | 22,310,000 | | | | 1.2 | | 1,669,386 | | | | 1.3 |

| Indiana | | 2 | | | 7,483,066 | | | | 0.7 | | 10,800,000 | | | | 0.6 | | 889,631 | | | | 0.7 |

| Alabama | | 1 | | | 7,243,307 | | | | 0.7 | | 10,000,000 | | | | 0.5 | | 823,310 | | | | 0.6 |

| Oklahoma | | 4 | | | 6,837,004 | | | | 0.6 | | 10,050,000 | | | | 0.5 | | 786,002 | | | | 0.6 |

| New Mexico | | 1 | | | 5,313,002 | | | | 0.5 | | 7,600,000 | | | | 0.4 | | 769,372 | | | | 0.6 |

| North Dakota | | 1 | | | 3,830,000 | | | | 0.3 | | 5,350,000 | | | | 0.3 | | 554,744 | | | | 0.4 |

| Arkansas | | 1 | | | 2,830,000 | | | | 0.3 | | 4,500,000 | | | | 0.2 | | 333,683 | | | | 0.3 |

| West Virginia | | 1 | | | 465,956 | | | | 0.04 | | 700,000 | | | | 0.04 | | 57,057 | | | | 0.04 |

| Nebraska | | | | | | | | | | | | | | | | | | | | | 0.02 |

| Total | | 141 | | | $1,113,635,129 | | | | 100.0% | | $1,895,055,000 | | | | 100.0% | | $132,656,641 | | | | 100.0% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI values are calculated based on the inclusion of the pari passu companion loans. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Distribution of Cut-off Date Balances | | | Distribution of Cut-off Date LTV Ratios(1) |

| | | | | | | | | | % of | | | | | | | | | | | | % of | |

| | | | Number of | | | | | Initial | | | | | | Number of | | | | | Initial | |

| | Range of Cut-off Date | | Mortgage | | Cut-off Date | | Pool | | | | Range of Cut-off | | Mortgage | | | | | Pool | |

| | Balances ($) | | Loans | | Balance | | Balance | | | | Date LTV (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | 1,297,123 - 3,000,000 | | 4 | | | $9,449,054 | | | 0.8 | % | | | | 37.1 - 50.0 | | 3 | | | $28,790,390 | | | 2.6 | % | |

| | 3,000,001 - 5,000,000 | | 13 | | | 53,690,226 | | | 4.8 | | | | | 50.1 - 55.0 | | 2 | | | 27,750,000 | | | 2.5 | | |

| | 5,000,001 - 10,000,000 | | 29 | | | 228,959,532 | | | 20.6 | | | | | 55.1 - 60.0 | | 4 | | | 47,927,929 | | | 4.3 | | |

| | 10,000,001 - 15,000,000 | | 11 | | | 131,629,328 | | | 11.8 | | | | | 60.1 - 65.0 | | 9 | | | 144,438,012 | | | 13.0 | | |

| | 15,000,001 - 20,000,000 | | 10 | | | 173,940,725 | | | 15.6 | | | | | 65.1 - 70.0 | | 26 | | | 516,474,235 | | | 46.4 | | |

| | 20,000,001 - 30,000,000 | | 2 | | | 47,087,500 | | | 4.2 | | | | | 70.1 - 75.8 | | 30 | | | 348,254,562 | | | 31.3 | | |

| | 30,000,001 - 80,000,000 | | 2 | | | 158,000,000 | | | 14.2 | | | | | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | |

| | 80,000,001 - 100,000,000 | | 2 | | | 199,878,765 | | | 17.9 | | | | | (1) See footnotes (1) and (3) to the table entitled “Mortgage Pool |

| | 100,000,001 - 111,000,000 | | 1 | | | 111,000,000 | | | 10.0 | | | | | Characteristics” above. |

| | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Distribution of Maturity Date LTV Ratios(1) |

| | Distribution of Underwritten DSCRs(1) | | | | | | | | | | | % of | |

| | | | | | | | | | % of | | | | | | Number of | | | | | Initial | |

| | | | Number of | | | | | Initial | | | | Range of Maturity | | Mortgage | | | | | Pool | |

| | | | Mortgage | | Cut-off Date | | Pool | | | | Date LTV (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | Range of UW DSCR (x) | | Loans | | Balance | | Balance | | | | 30.7 - 40.0 | | 4 | | | $27,779,699 | | | 2.5 | % | |

| | 1.23 - 1.30 | | 3 | | | $129,250,000 | | | 11.6 | % | | | | 40.1 - 45.0 | | 3 | | | 43,486,135 | | | 3.9 | | |

| | 1.31 - 1.40 | | 13 | | | 285,986,521 | | | 25.7 | | | | | 45.1 - 50.0 | | 5 | | | 37,403,055 | | | 3.4 | | |

| | 1.41 - 1.50 | | 21 | | | 196,101,263 | | | 17.6 | | | | | 50.1 - 55.0 | | 17 | | | 312,577,091 | | | 28.1 | | |

| | 1.51 - 1.60 | | 10 | | | 104,761,258 | | | 9.4 | | | | | 55.1 - 60.0 | | 22 | | | 369,133,104 | | | 33.1 | | |

| | 1.61 - 1.70 | | 8 | | | 55,413,331 | | | 5.0 | | | | | 60.1 - 65.0 | | 20 | | | 211,456,046 | | | 19.0 | | |

| | 1.71 - 1.80 | | 7 | | | 162,394,876 | | | 14.6 | | | | | 65.1 - 70.0 | | 2 | | | 31,800,000 | | | 2.9 | | |

| | 1.81 - 1.90 | | 3 | | | 19,378,002 | | | 1.7 | | | | | 70.1 - 73.6 | | 1 | | | 80,000,000 | | | 7.2 | | |

| | 1.91 - 2.00 | | 1 | | | 6,143,909 | | | 0.6 | | | | | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | |

| | 2.01 - 2.10 | | 2 | | | 14,258,845 | | | 1.3 | | | | | (1) See footnotes (1) and (4) to the table entitled “Mortgage Pool |

| | 2.11 - 2.20 | | 1 | | | 80,000,000 | | | 7.2 | | | | | Characteristics” above. |

| | 2.21 - 2.70 | | 5 | | | 59,947,123 | | | 5.4 | | | | | | | | | | | | | | | |

| | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | | | | Distribution of Loan Purpose |

| | (1) See footnotes (1) and (5) to the table entitled “Mortgage Pool | | | | | | | | | | | % of | |

| | Characteristics” above. | | | | | Number of | | | | | Initial | |

| | | | | | | | | | | | | | | | | Mortgage | | | | | Pool | |

| | Distribution of Amortization Types(1) | | | Loan Purpose | | Loans | | Cut-off Date Balance | | Balance | |

| | | | | | | | | | % of | | | | Refinance | | 46 | | | $667,698,570 | | | 60.0 | % | |

| | | | Number of | | | | | Initial | | | | Acquisition | | 25 | | | 328,522,391 | | | 29.5 | | |

| | | | Mortgage | | Cut-off Date | | Pool | | | | Recapitalization | | 2 | | | 111,128,765 | | | 10.0 | | |

| | Amortization Type | | Loans | | Balance | | Balance | | | | Refinance/Acquisition | | 1 | | | 6,285,403 | | | 0.6 | | |

| | Interest Only, Then | | | | | | | | | | | | | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | |

| | Amortizing(2) | | 20 | | | $492,027,500 | | | 44.2 | % | | | | | | | | | | | | | | |

| | Amortizing (30 Years) | | 37 | | | 395,458,409 | | | 35.5 | | | | | Distribution of Mortgage Interest Rates |

| | Amortizing (25 Years) | | 9 | | | 48,609,911 | | | 4.4 | | | | | | | | | | | | | % of | |

| | Amortizing (20 Years) | | 2 | | | 26,959,308 | | | 2.4 | | | | | Range of | | Number of | | | | | Initial | |

| | Amortizing (27 Years) | | 1 | | | 16,000,000 | | | 1.4 | | | | | Mortgage Interest | | Mortgage | | | | | Pool | |

| | Amortizing (15 Years) | | 1 | | | 3,830,000 | | | 0.3 | | | | | Rates (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | Interest Only | | 4 | | | 130,750,000 | | | 11.7 | | | | | 4.330 - 4.500 | | 3 | | | $187,304,670 | | | 16.8 | % | |

| | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | | | | 4.501 - 4.750 | | 4 | | | 51,036,141 | | | 4.6 | | |

| | (1) All of the mortgage loans will have balloon payments at maturity. | | | 4.751 - 5.000 | | 15 | | | 261,219,127 | | | 23.5 | | |

| | (2) Original partial interest only periods range from 12 to 60 months. | | | 5.001 - 5.250 | | 34 | | | 452,050,515 | | | 40.6 | | |

| | | | | | | | | | | | | | | 5.251 - 5.500 | | 9 | | | 78,655,045 | | | 7.1 | | |

| | Distribution of Lockboxes | | | | | | | 5.501 - 5.750 | | 8 | | | 78,056,629 | | | 7.0 | | |

| | | | | | | | | | % of | | | | 5.751 - 5.845 | | 1 | | | 5,313,002 | | | 0.5 | | |

| | | | | | | | | Initial | | | | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | |

| | | | Number of | | Cut-off Date | | Pool | | | | | | | | | | | | | | |

| | Lockbox Type | | Mortgage Loans | | Balance | | Balance | | | | | | | | | | | | | | |

| | Hard | | 19 | | | $610,901,587 | | | 54.9 | % | | | | | | | | | | | | | | |

| | Springing | | 32 | | | 312,061,183 | | | 28.0 | | | | | | | | | | | | | | | |

| | None | | 12 | | | 104,060,794 | | | 9.3 | | | | | | | | | | | | | | | |

| | Soft Springing | | 7 | | | 51,270,743 | | | 4.6 | | | | | | | | | | | | | | | |

| | Soft | | 4 | | | 35,340,823 | | | 3.2 | | | | | | | | | | | | | | | |

| | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | | | | | | | | | | | | | | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that a condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Distribution of Debt Yield on Underwritten NOI(1) | | | Distribution of Remaining Terms to Maturity |

| | | | | | | | | | % of | | | | Range of | | | | | | | | % of | |

| | Range of | | Number of | | | | Initial | | | | Remaining Terms | | Number of | | | | | Initial | |

| | Debt Yields on | | Mortgage | | | | Pool | | | | to Maturity | | Mortgage | | | | | Pool | |

| | Underwritten NOI (%) | | Loans | | Cut-off Date Balance | | Balance | | | | (months) | | Loans | | Cut-off Date Balance | | Balance | |

| | 8.1 - 9.0 | | 2 | | | $126,000,000 | | | 11.3 | % | | | | 58 - 60 | | 4 | | | $115,225,905 | | | 10.3 | % | |

| | 9.1 - 10.0 | | 20 | | | 340,687,883 | | | 30.6 | | | | | 61 - 120 | | 70 | | | 998,409,223 | | | 89.7 | | |

| | 10.1 - 11.0 | | 15 | | | 296,107,906 | | | 26.6 | | | | | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | |

| | 11.1 - 12.0 | | 18 | | | 166,941,598 | | | 15.0 | | | | | | | | | | | | | | | |

| | 12.1 - 13.0 | | 9 | | | 125,776,860 | | | 11.3 | | | | | Distribution of Original Amortization Terms(1) |

| | 13.1 - 14.0 | | 2 | | | 15,123,186 | | | 1.4 | | | | | | | | | | | | | % of | |

| | 14.1 - 15.0 | | 4 | | | 19,541,727 | | | 1.8 | | | | | Range of Original | | Number of | | | | | Initial | |

| | 15.1 - 16.0 | | 2 | | | 14,258,845 | | | 1.3 | | | | | Amortization | | Mortgage | | | | | Pool | |

| | 16.1 - 20.5 | | 2 | | | 9,197,123 | | | 0.8 | | | | | Terms (months) | | Loans | | Cut-off Date Balance | | Balance | |

| | Total | | 74 | | | $1,113,635,129 | | | 100.0 | % | | | | Interest Only | | 4 | | | $130,750,000 | | | 11.7 | % | |

| | (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” | | | 180 - 300 | | 12 | | | 79,399,220 | | | 7.1 | | |