Exhibit 99.1

Analyst Conference

April 2005

Legal Disclaimer

This presentation may contain statements about future events and Energy Transfer Partners, L.P.’s (“Energy Transfer”, the “Partnership” or “ETP”) outlook and expectations, which are forward-looking statements. Any statement in this presentation that is not a historical fact may be deemed to be a forward-looking statement. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside Energy Transfer’s control, and which could cause Energy Transfer’s actual results, performance or achievements to be materially different. While Energy Transfer believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business.

These risks and uncertainties are discussed in more detail in Energy Transfer’s filings with the Securities and Exchange Commission, copies of which are available to the public. Energy Transfer expressly disclaims any intention or obligation to revise or update any forward- looking statements whether as a result of new information, future events, or otherwise.

2

Agenda

Recent Developments/ Asset Update Texas Natural Gas Supply/ Demand Internal Growth Financial Review

3

Recent Developments/Asset Update

Houston Pipeline Acquisition

4,200 miles of intrastate natural gas gathering and transmission pipeline 2.4 Bcf/d capacity 170 MMcf/d treating facilities Processing and compression by third parties Storage

One of the largest reservoir storage facilities in Texas 130 Bcf capacity

64.5 Bcf working gas

5

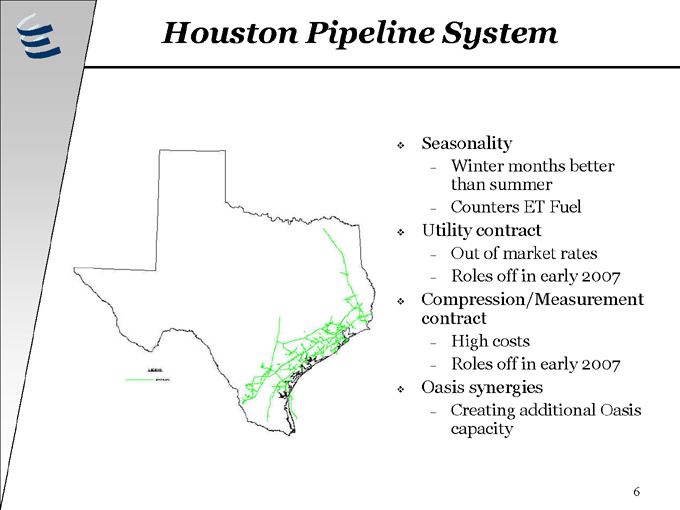

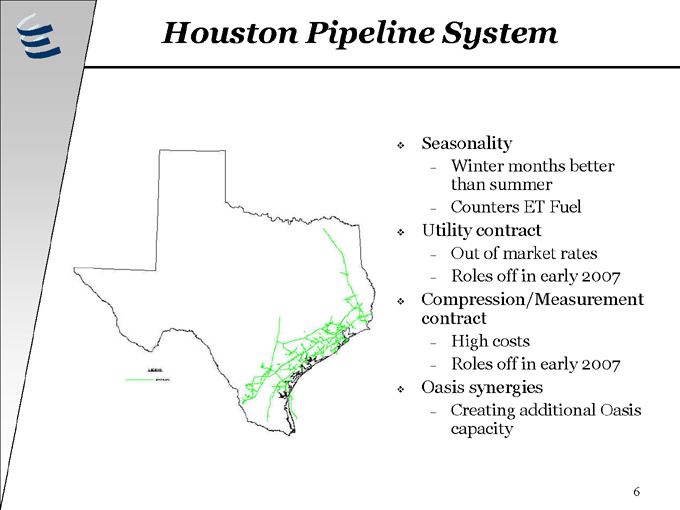

Houston Pipeline System

Seasonality

Winter months better than summer

Counters ET Fuel

Utility contract

Out of market rates

Roles off in early 2007

Compression/Measurement contract

High costs

Roles off in early 2007

Oasis synergies

Creating additional Oasis capacity

6

Elk City Sale

Purchase Price - $190 million – 100% Cash > 10x LTM EBITDA

Use of Proceeds – Debt Pay down from HPL Acquisition Increased Focus on Core Assets Increases overall fee-based cash flow

Most volatile ETP business segment

Effective Alternative to Equity Issuance Closing upon regulatory approval

HSR filed March 15, 2005

7

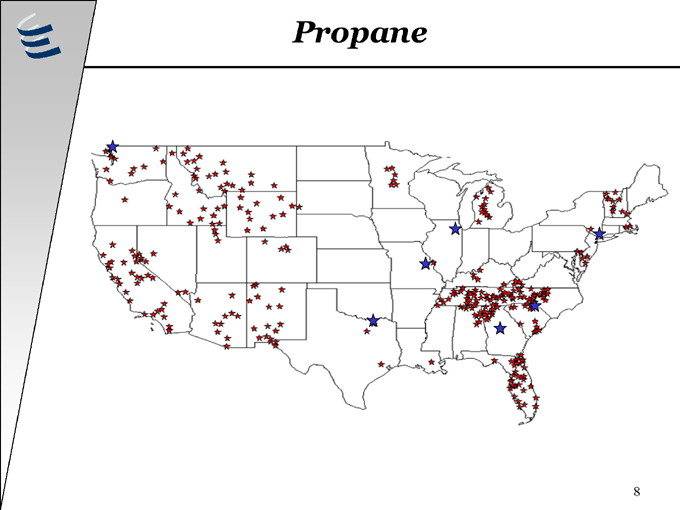

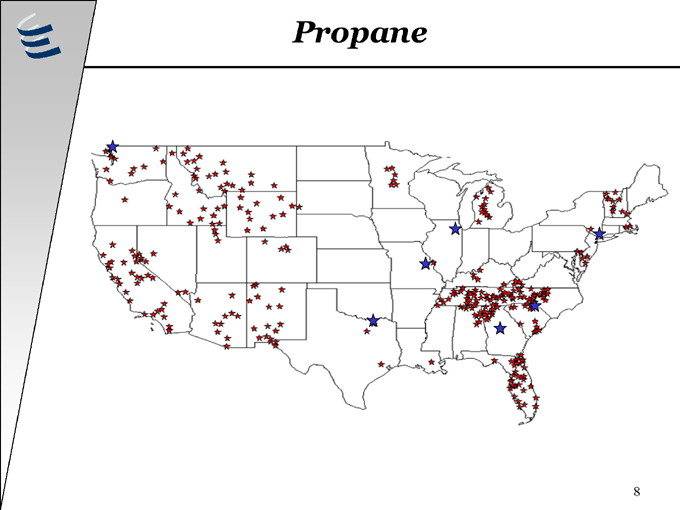

Propane

8

Propane

Trends

Warm weather

Increased gross margins

Increased cost of tanks, vehicles and propane

Acquisitions

Bifurcated purchase multiples

Fiscal 2006 (full 12 months activity for purchases in FY 2005) Gallons = 10.6 million EBITDA projection = $2 million Purchase multiple = 5.3X EBITDA

9

Other Assets

ET Fuel (TUFCO)

FW Basin expansions Measurement improvements

SETPS

Increasing volumes

Bossier/ East Texas

Bullish producer estimates/ activity require expansions Approaching current capacity

Additional compression to be installed

Lower Bossier trend

Recently installed treating facility (150 MMcf/d capacity)

10

Texas Natural Gas Supply/Demand

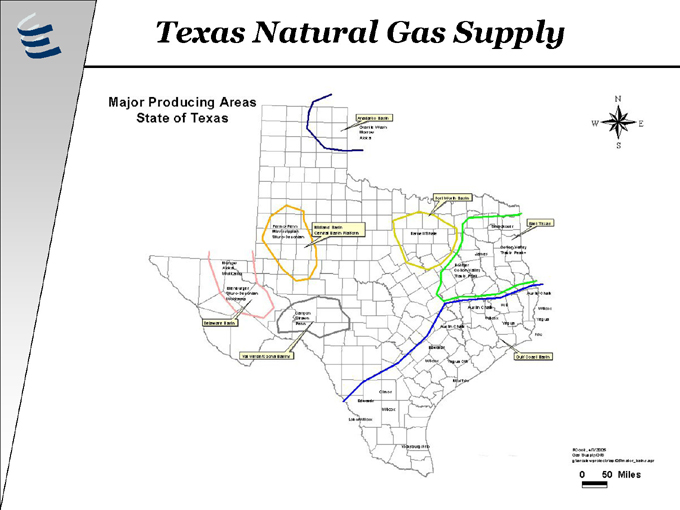

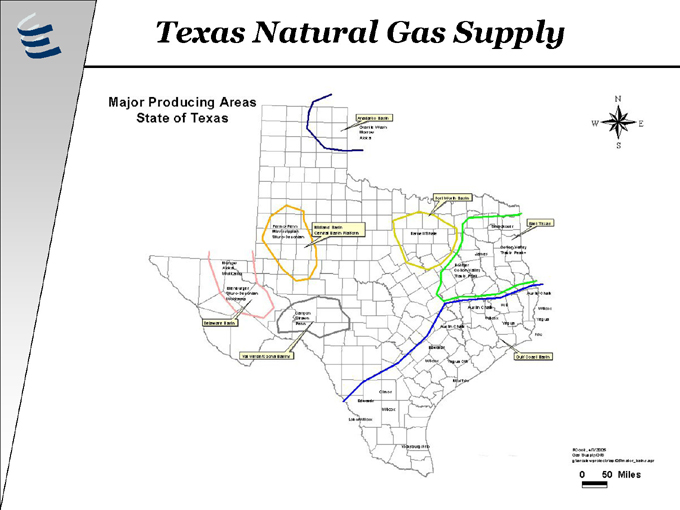

Texas Natural Gas Supply

Major Producing Areas State of Texas

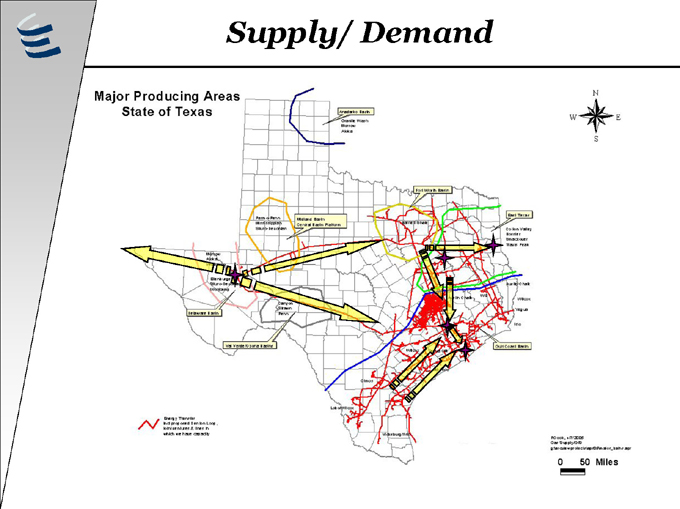

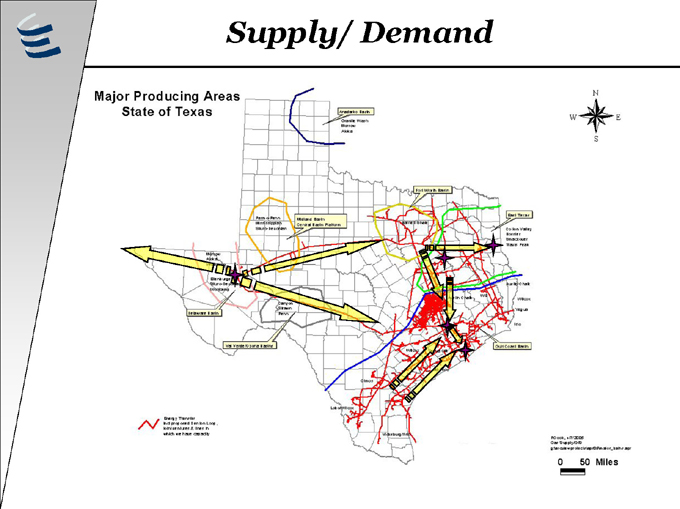

Supply/ Demand

Major Producing Areas State of Texas

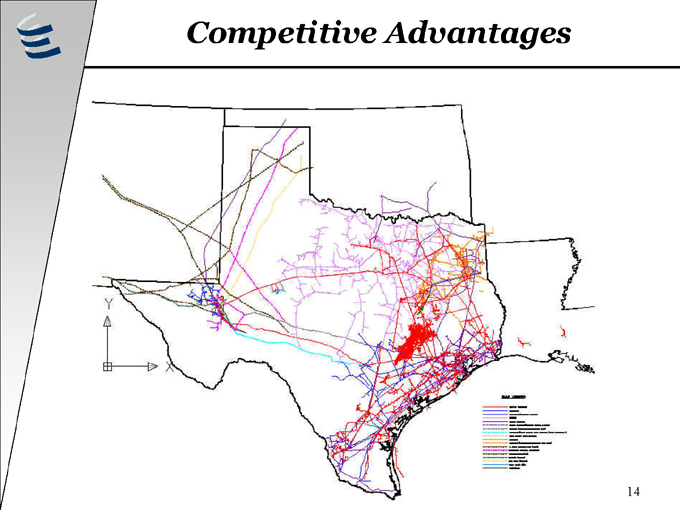

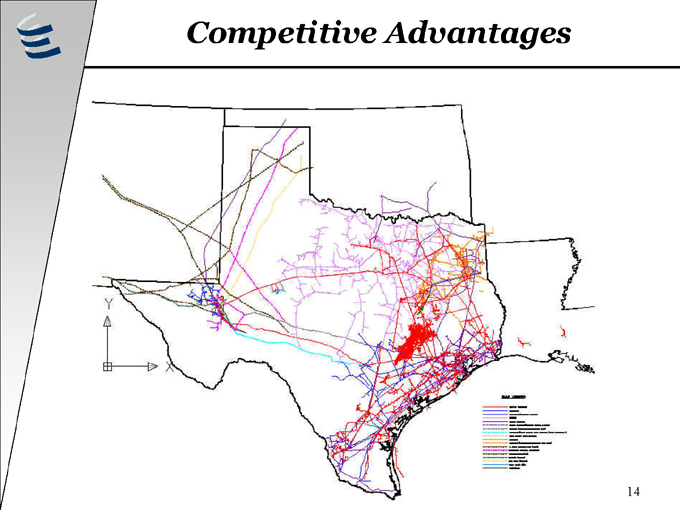

Competitive Advantages

14

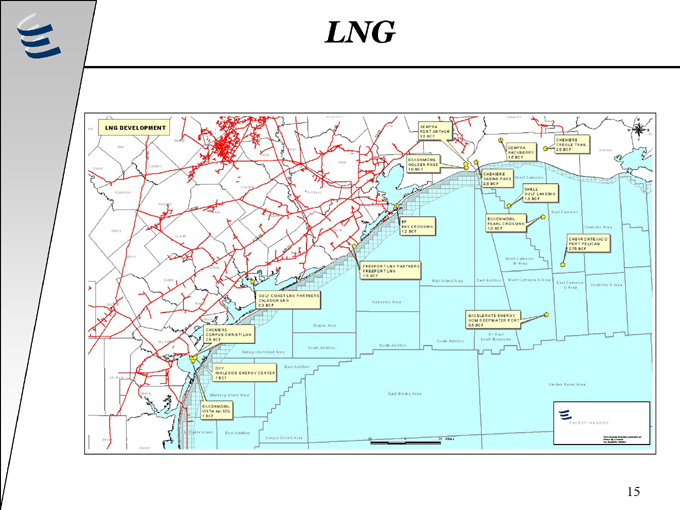

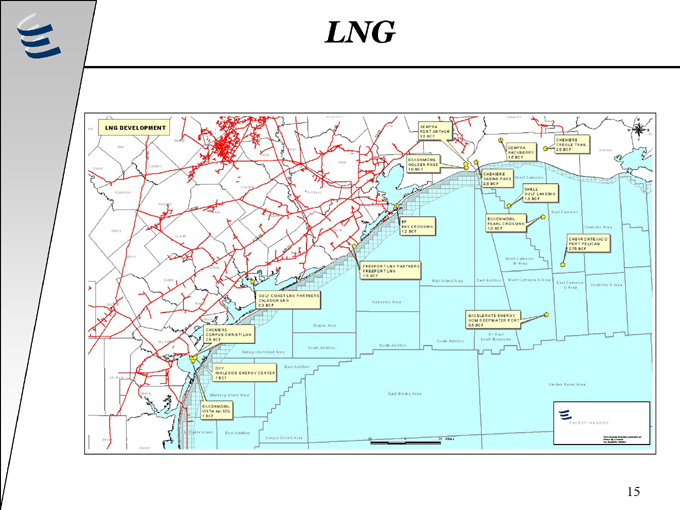

LNG

15

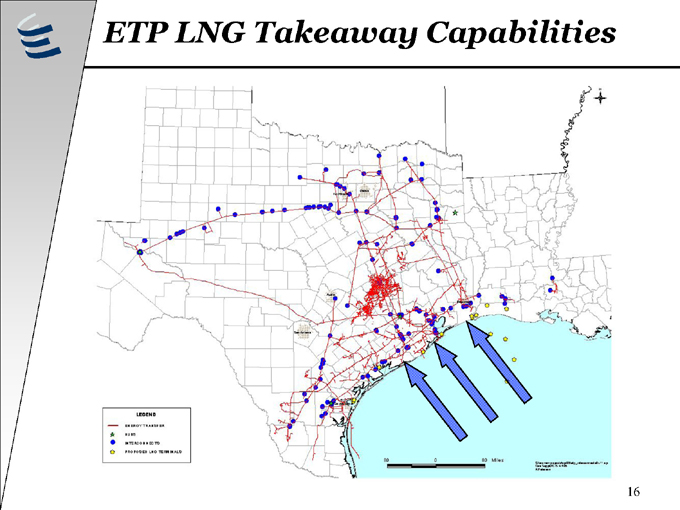

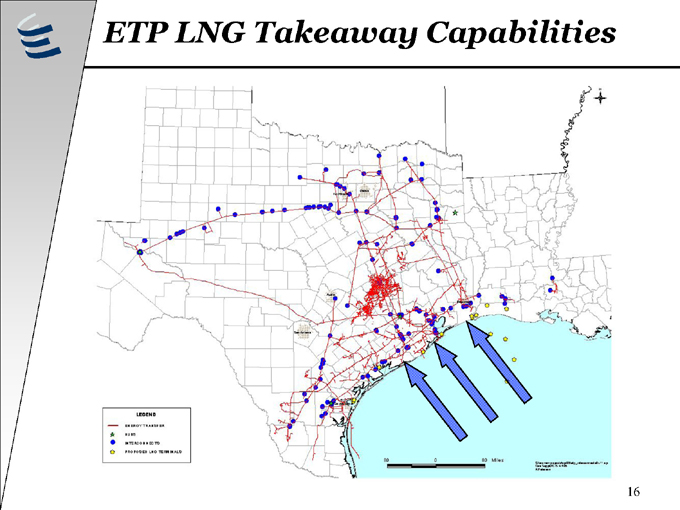

ETP LNG Takeaway Capabilities

16

Internal Growth

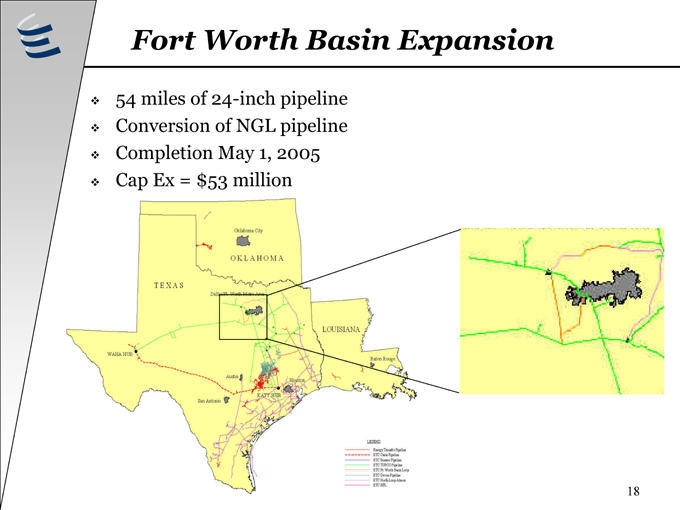

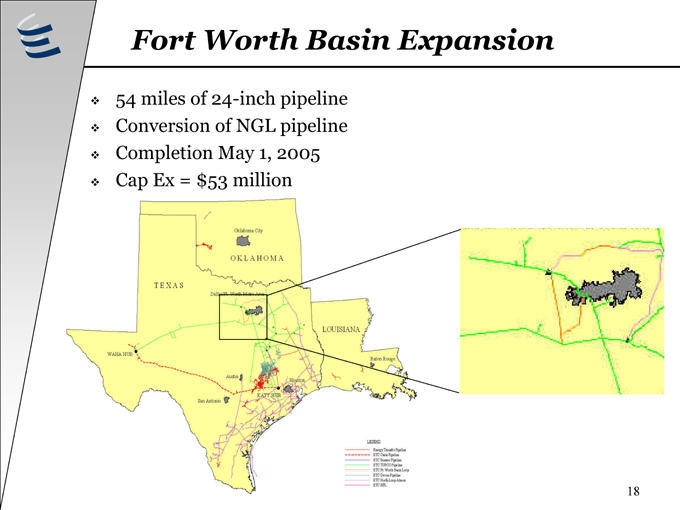

Fort Worth Basin Expansion

54 miles of 24-inch pipeline Conversion of NGL pipeline Completion May 1, 2005 Cap Ex = $53 million

18

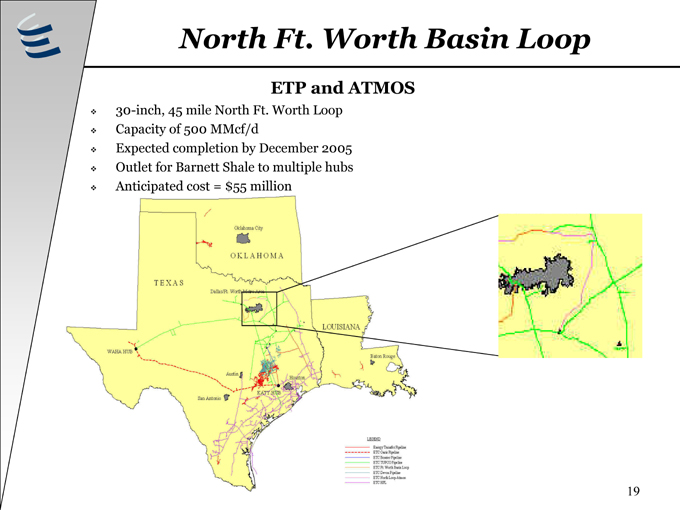

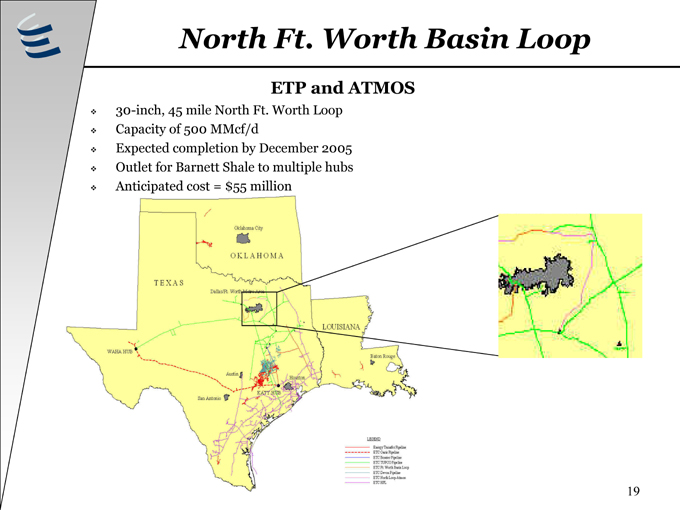

North Ft. Worth Basin Loop

ETP and ATMOS

30-inch, 45 mile North Ft. Worth Loop Capacity of 500 MMcf/d Expected completion by December 2005 Outlet for Barnett Shale to multiple hubs Anticipated cost = $55 million

19

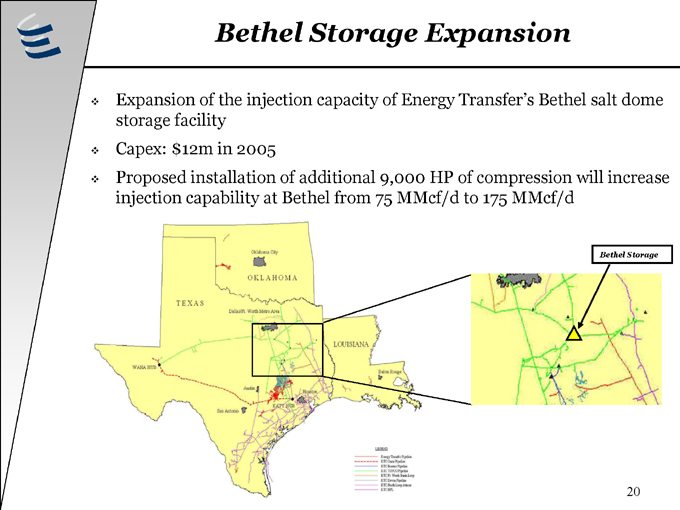

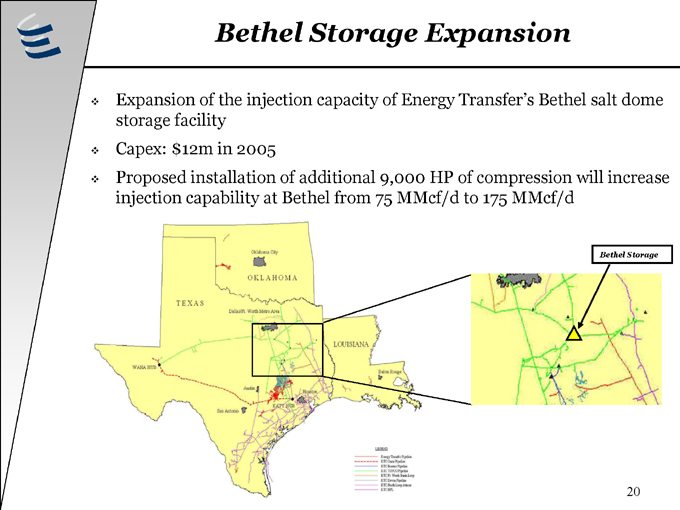

Bethel Storage Expansion

Expansion of the injection capacity of Energy Transfer’s Bethel salt dome storage facility Capex: $12m in 2005 Proposed installation of additional 9,000 HP of compression will increase injection capability at Bethel from 75 MMcf/d to 175 MMcf/d

Bethel Storage

20

Bossier to Bethel Pipeline Expansion

Will connect Bethel Salt Dome Storage Facility (part of TUFCO system) with the recently constructed Bossier Pipeline 39 miles Adds direct access to Katy hub from Bethel

Increases the value of the Bethel storage capacity

21

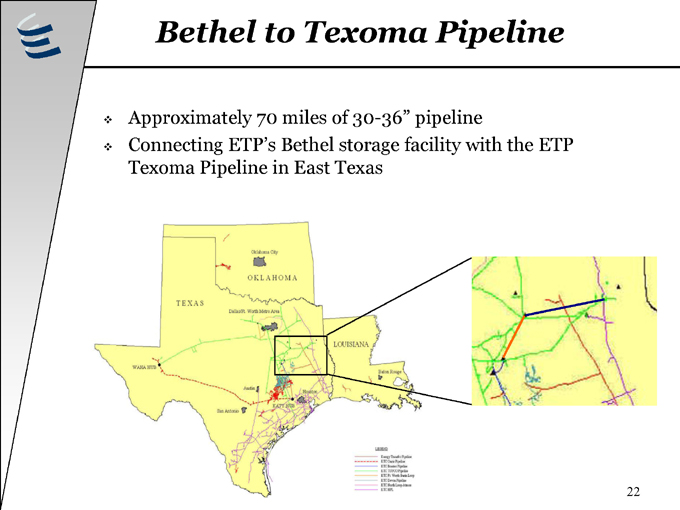

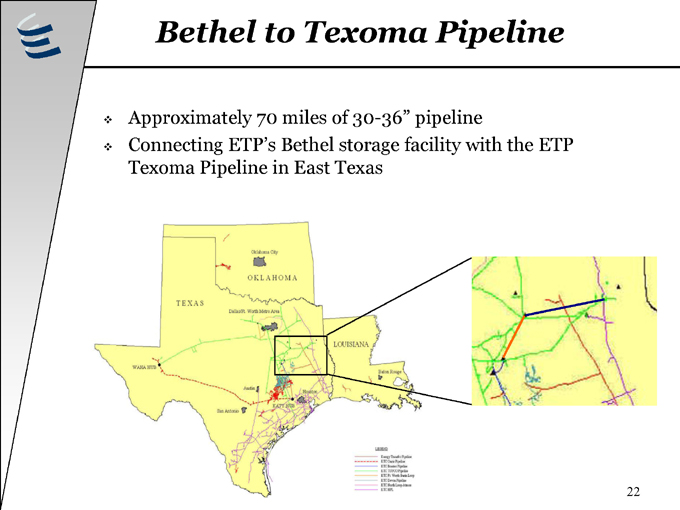

Bethel to Texoma Pipeline

Approximately 70 miles of 30-36” pipeline

Connecting ETP’s Bethel storage facility with the ETP Texoma Pipeline in East Texas

22

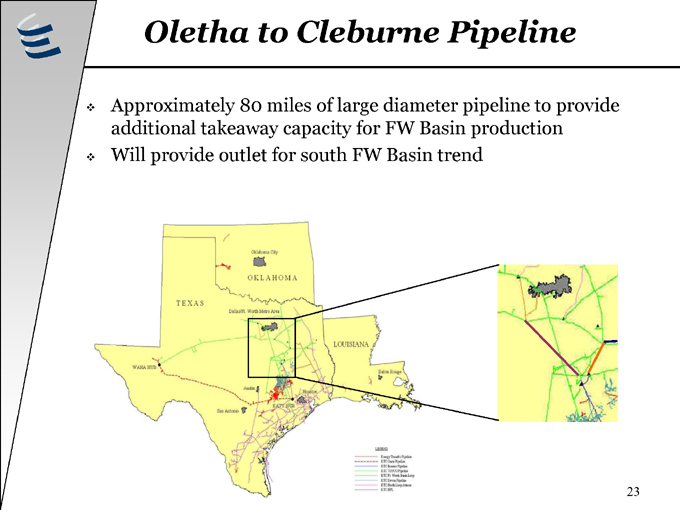

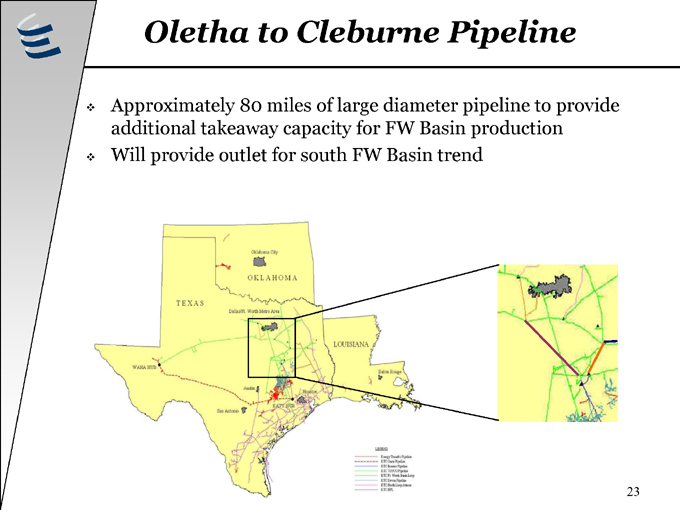

Oletha to Cleburne Pipeline

Approximately 80 miles of large diameter pipeline to provide additional takeaway capacity for FW Basin production Will provide outlet for south FW Basin trend

23

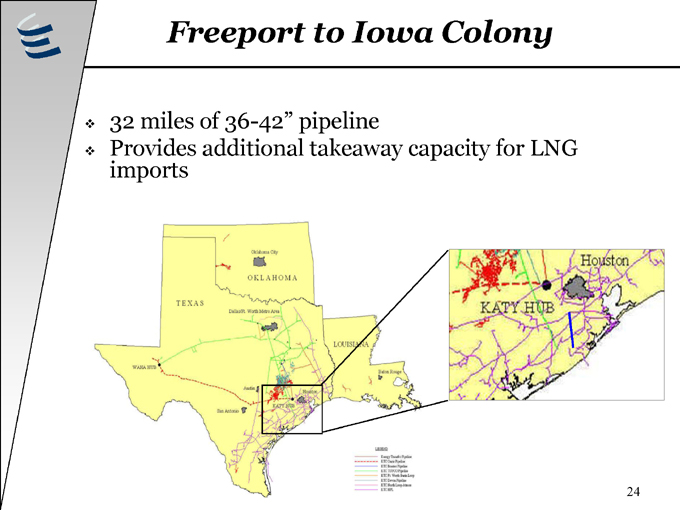

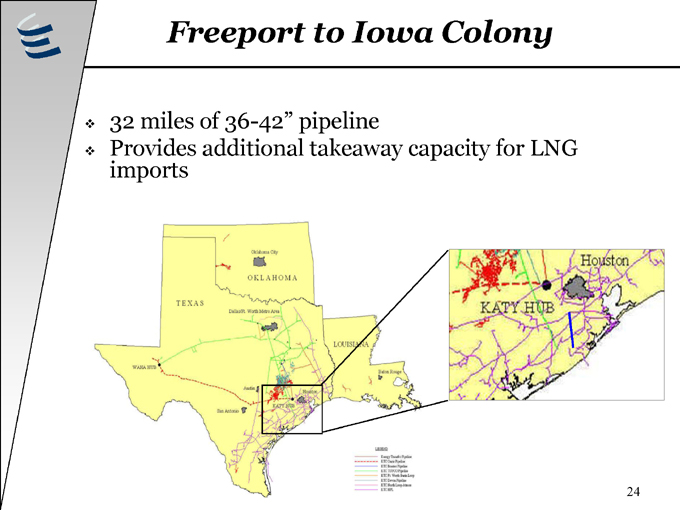

Freeport to Iowa Colony

32 miles of 36-42” pipeline

Provides additional takeaway capacity for LNG imports

24

Financial Review

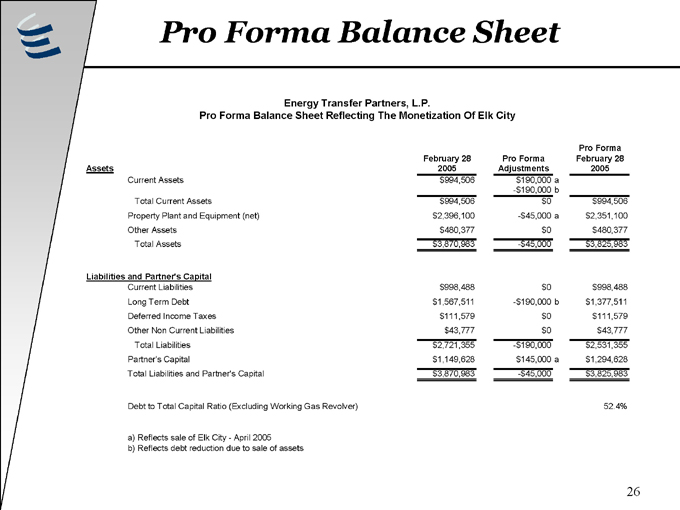

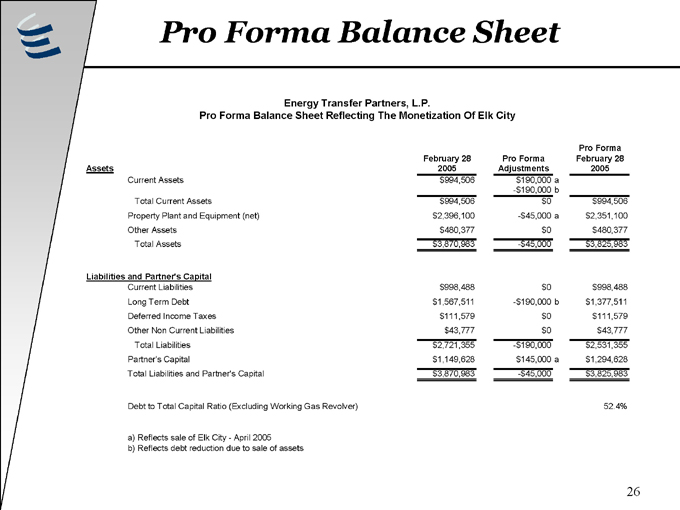

Pro Forma Balance Sheet

Energy Transfer Partners, L.P.

Pro Forma Balance Sheet Reflecting The Monetization Of Elk City

Pro Forma

February 28 2005 Pro Forma Adjustments February 28 2005

Assets

Current Assets $994,506 $190,000 a

-$190,000 b

Total Current Assets $994,506 $0 $994,506

Property Plant and Equipment (net) $2,396,100 - $45,000 a $2,351,100

Other Assets $480,377 $0 $480,377

Total Assets $3,870,983 - $45,000 $3,825,983

Liabilities and Partner’s Capital

Current Liabilities $998,488 $0 $998,488

Long Term Debt $1,567,511 - -$190,000 b $1,377,511

Deferred Income Taxes $111,579 $0 $111,579

Other Non Current Liabilities $43,777 $0 $43,777

Total Liabilities $2,721,355 -$190,000 $2,531,355

Partner’s Capital $1,149,628 $145,000 a $1,294,628

Total Liabilities and Partner’s Capital $3,870,983 - $45,000 $3,825,983

Debt to Total Capital Ratio (Excluding Working Gas Revolver) 52.4%

a) Reflects sale of Elk City—April 2005 b) Reflects debt reduction due to sale of assets

26

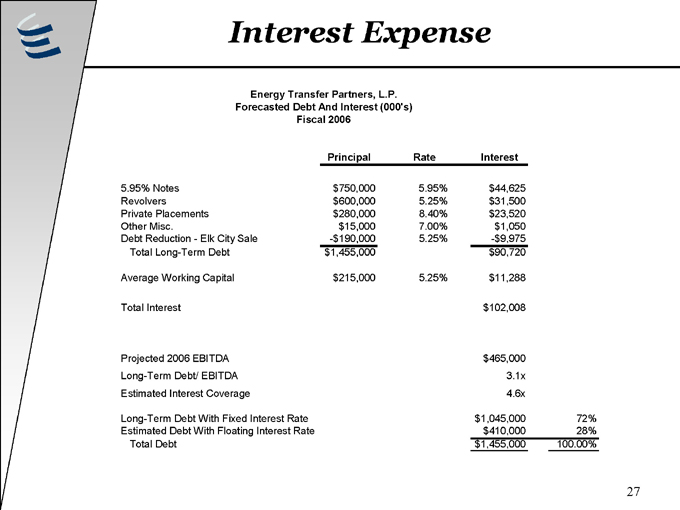

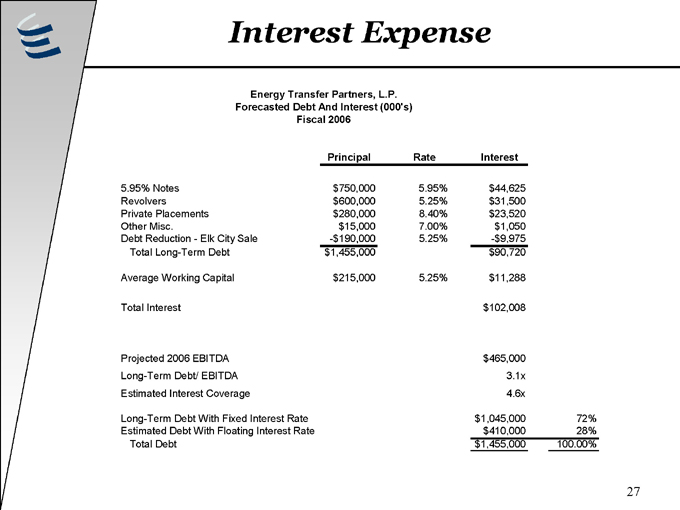

Interest Expense

Energy Transfer Partners, L.P. Forecasted Debt And Interest (000’s) Fiscal 2006

Principal Rate Interest

5.95% Notes $750,000 5.95% $44,625

Revolvers $600,000 5.25% $31,500

Private Placements $280,000 8.40% $23,520

Other Misc. $15,000 7.00% $1,050

Debt Reduction - Elk City Sale - $190,000 5.25% - $9,975

Total Long-Term Debt $1,455,000 $90,720

Average Working Capital $215,000 5.25% $11,288

Total Interest $102,008

Projected 2006 EBITDA $465,000

Long-Term Debt/ EBITDA 3.1x

Estimated Interest Coverage 4.6x

Long-Term Debt With Fixed Interest Rate $1,045,000 72%

Estimated Debt With Floating Interest Rate $410,000 28%

Total Debt $1,455,000 100.00%

27

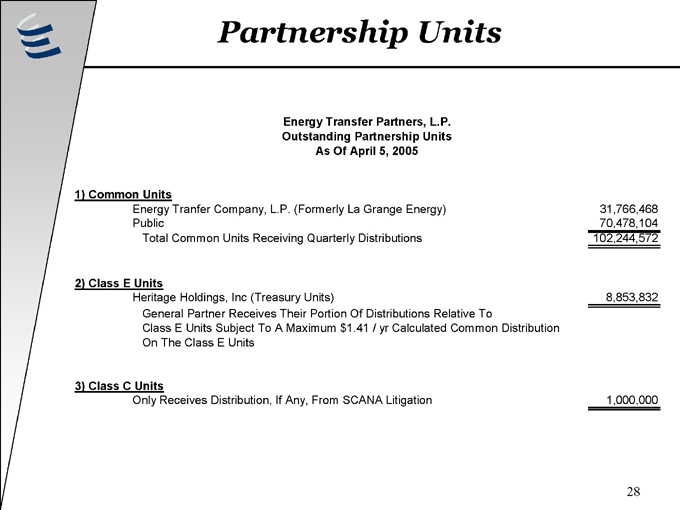

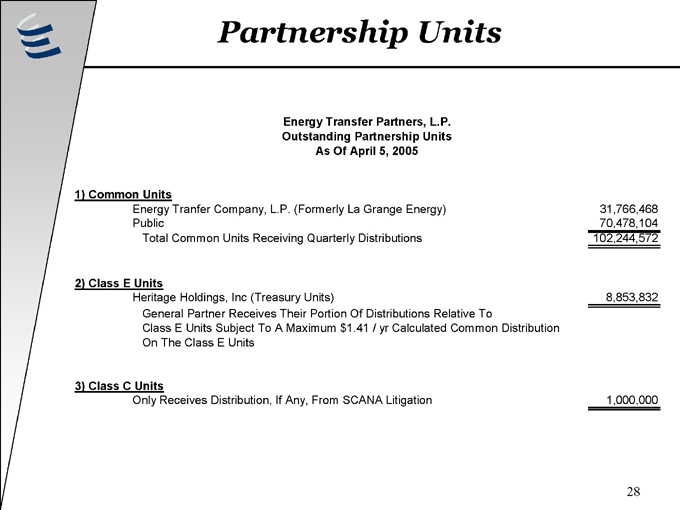

Partnership Units

Energy Transfer Partners, L.P. Outstanding Partnership Units As Of April 5, 2005

1) Common Units

Energy Tranfer Company, L.P. (Formerly La Grange Energy) 31,766,468

Public 70,478,104

Total Common Units Receiving Quarterly Distributions 102,244,572

2) Class E Units

Heritage Holdings, Inc (Treasury Units) 8,853,832

General Partner Receives Their Portion Of Distributions Relative To

Class E Units Subject To A Maximum $1.41 / yr Calculated Common Distribution

On The Class E Units

3) Class C Units

Only Receives Distribution, If Any, From SCANA Litigation 1,000,000

28

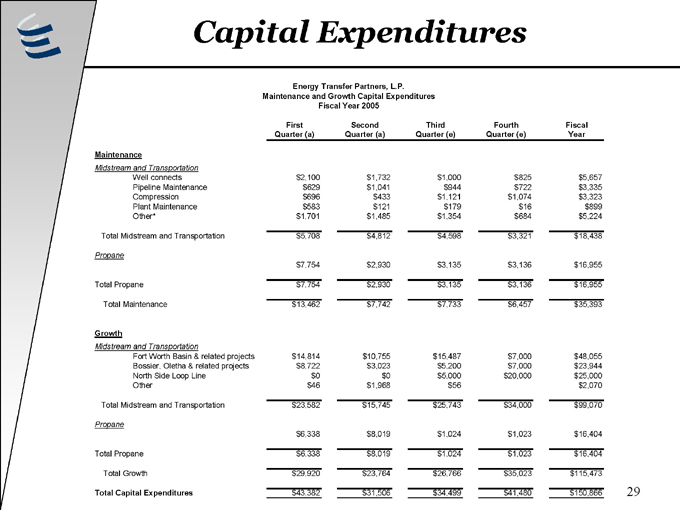

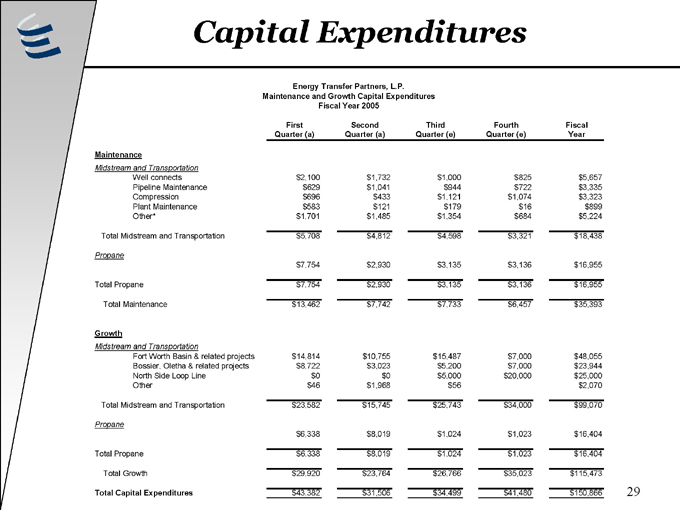

Capital Expenditures

Energy Transfer Partners, L.P. Maintenance and Growth Capital Expenditures Fiscal Year 2005

First Second Third Fourth Fiscal

Quarter (a) Quarter (a) Quarter (e) Quarter (e) Year

Maintenance

Midstream and Transportation

Well connects $2,100 $1,732 $1,000 $825 $5,657

Pipeline Maintenance $629 $1,041 $944 $722 $3,335

Compression $696 $433 $1,121 $1,074 $3,323

Plant Maintenance $583 $121 $179 $16 $899

Other* $1,701 $1,485 $1,354 $684 $5,224

Total Midstream and Transportation $5,708 $4,812 $4,598 $3,321 $18,438

Propane

$7,754 $2,930 $3,135 $3,136 $16,955

Total Propane $7,754 $2,930 $3,135 $3,136 $16,955

Total Maintenance $13,462 $7,742 $7,733 $6,457 $35,393

Growth

Midstream and Transportation

Fort Worth Basin & related projects $14,814 $10,755 $15,487 $7,000 $48,055

Bossier, Oletha & related projects $8,722 $3,023 $5,200 $7,000 $23,944

North Side Loop Line $0 $0 $5,000 $20,000 $25,000

Other $46 $1,968 $56 $2,070

Total Midstream and Transportation $23,582 $15,745 $25,743 $34,000 $99,070

Propane

$6,338 $8,019 $1,024 $1,023 $16,404

Total Propane $6,338 $8,019 $1,024 $1,023 $16,404

Total Growth $29,920 $23,764 $26,766 $35,023 $115,473

Total Capital Expenditures $43,382 $31,506 $34,499 $41,480 $150,866

29

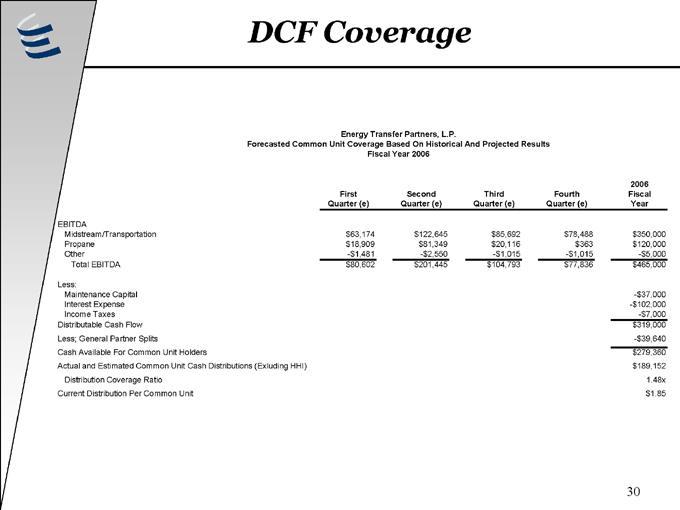

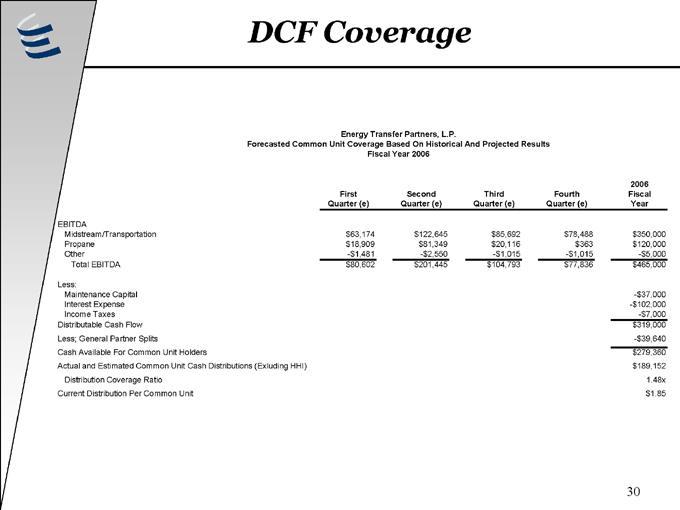

DCF Coverage

Energy Transfer Partners, L.P.

Forecasted Common Unit Coverage Based On Historical And Projected Results Fiscal Year 2006

First Quarter (e) Second Quarter (e) Third Quarter (e) Fourth Quarter (e) 2006 Fiscal Year

EBITDA

Midstream/Transportation $ 63,174 $ 122,645 $ 85,692 $ 78,488 $ 350,000

Propane $ 18,909 $ 81,349 $ 20,116 $ 363 $ 120,000

Other -$ 1,481 -$ 2,550 -$ 1,015 - $ 1,015 - $ 5,000

Total EBITDA $ 80,602 $ 201,445 $ 104,793 $ 77,836 $ 465,000

Less:

Maintenance Capital - $ 37,000

Interest Expense -$ 102,000

Income Taxes - $ 7,000

Distributable Cash Flow $ 319,000

Less; General Partner Splits - $ 39,640

Cash Available For Common Unit Holders $ 279,360

Actual and Estimated Common Unit Cash Distributions (Exluding HHI) $ 189,152

Distribution Coverage Ratio 1.48x

Current Distribution Per Common Unit $1.85

30

Investment Highlights

Successful acquisition track record

Significant internal growth projects at attractive multiples Healthy common unit coverage Strong balance sheet positioned for internal growth and acquisitions Management philosophy to minimize common unit dilution by reinvesting distributable cash flow Strong entrepreneurial management with low cost structure Significant LP ownership by management

31