Exhibit 19.1

BJ’s Restaurants, Inc. Securities Trading by Company Personnel

(as amended as of June 15, 2023)

The purchase or sale of securities while aware of material nonpublic information, or the disclosure of material nonpublic information to others who then trade in BJ’s Restaurants, Inc.’s (“BJRI” or “the Company”) securities, is prohibited by the federal securities laws. Insider trading violations are pursued vigorously by the SEC and the U.S. Attorneys and are punished severely. While the regulatory authorities concentrate their efforts on the individuals who trade, or who tip inside information to others who trade, the federal securities laws also impose potential liability on companies and other “controlling persons” if they fail to take reasonable steps to prevent insider trading by company personnel.

The Company’s Board of Directors has adopted this Policy both to satisfy the Company’s obligation to prevent insider trading and to help Company personnel avoid the severe consequences associated with violations of the insider trading laws. The Policy Statement also is intended to prevent even the appearance of improper conduct on the part of anyone employed by or associated with the Company (not just so-called insiders). We have all worked hard over the years to establish a reputation for integrity and ethical conduct, and we cannot afford to have that reputation damaged.

Consequences of an Insider Trading Violation

The consequences of an insider trading violation can be serious:

Traders and Tippers. Individuals who trade on inside information (or tip inside information to others) are subject to, among other things, the following penalties:

•A civil penalty of up to $1,000,000 or, if greater, up to three times the profit gained or loss avoided;

•A criminal fine of up to $5,000,000 (no matter how small the profit); and

•A jail term of up to twenty years.

In addition, violators can be barred from serving as officers and directors of public companies. In addition, convicted insider traders and the companies and persons with whom they are affiliated suffer enormous and irreparable damage to their personal and business reputation.

A team member who tips information to a person who then trades is subject to the same penalties as the tippee, even if the team member did not trade and did not profit from the tippee’s trading.

Controlling Persons. The Company and its supervisory personnel, if they fail to take appropriate steps to prevent illegal insider trading, are subject to the following penalties:

•A civil penalty of up to $1,000,000 or, if greater, three times the profit gained or loss avoided as a result of the violation; and

•A criminal penalty of up to $25,000,000 (for entities only)

Separate penalties could be imposed on each “controlling person” who failed to take appropriate steps to prevent a violation. If you are a director or a corporate officer, you could be found to be a “controlling person.”

A company or other “controlling person” may also be subject to private lawsuits by contemporaneous traders for damages suffered as a result of illegal inside trading or tipping by persons under the company’s control.

Company Imposed Sanctions. A director, officer or team member who violates the Company’s insider trading policy will be subject to sanctions imposed by the Company, which may include dismissal for cause. A violation of the Company’s policy is not necessarily the same as a violation of law. The Company reserves the right to determine, in its own discretion and on the basis of the information available to it, whether its policy has been violated. The Company may determine that specific conduct violates its policy whether or not the conduct also violates the law. It is not necessary for the Company to await the filing or conclusion of a civil or criminal action against the alleged violator before taking disciplinary action.

The Company’s Policy.

General. It is the policy of the Company that a director, officer or other team member of the Company who is aware of material nonpublic information relating to the Company may not, directly or through family members or other persons or entities:

•Buy or sell securities, including options, of the Company (other than pursuant to a trading plan that complies with this policy and with SEC Rule 10b5-1) or engage in any other action to take personal advantage of that information; or

•pass that information on to others outside the Company, including family and friends, even if the director, officer or team member does not derive any personal benefit from doing so.

In addition, it is the policy of the Company that no director, officer or other team member of the Company who, in the course of service to the Company, learns of material nonpublic information about a company with which the Company does business, including a customer or supplier of the Company, may trade in that company’s securities until the information becomes public or is no longer material.

It does not matter if there is an independent, justifiable reason for a purchase or sale (such as the need to raise money for emergency expenditures) -- if the team member, officer or director has material, nonpublic information, the prohibition still applies. The securities laws do not recognize such mitigating circumstances, and, in any event, even the appearance of an improper transaction must be avoided to preserve the Company’s reputation for adhering to the highest standards of conduct.

The policy also applies to transactions by each team member’s, officer’s or director’s family members and other persons living in the team member’s, officer’s or director’s household. Team members, officers and directors are responsible for ensuring compliance by their family and personal household. Additionally, the Company’s policy is that directors, officers and designated team members adhere to appropriate trading periods as defined later in this document.

Disclosure of Information to Others. Directors, officers and team members must not pass on to others inside information about the Company or recommend the purchase or sale of the Company’s securities while in the possession of material nonpublic information (even if that information itself is not disclosed). This policy applies whether or not the director, officer or team member who gives the tip derives any personal benefit from doing so.

The Company is required under Regulation FD of the federal securities laws to avoid the selective disclosure of material nonpublic information. The Company has established procedures for releasing material information in a manner that is designed to achieve broad public dissemination of the information immediately upon its release. You may not, therefore, disclose material nonpublic information to anyone outside the Company, including family members and friends, other than in accordance with those procedures. You also may not discuss, post or otherwise disclose the Company’s or its business material nonpublic information in an internet “chat room” or similar internet-based forum (such as Twitter, Snapchat, Instagram or Facebook). Please consult with the Company’s Disclosure Policy for a more detailed description of the Company’s policies in this regard.

What Constitutes “Material Information.” Material information is any information that a reasonable investor would consider important in making a decision to buy, hold, or sell securities. Any information that could be expected to affect the Company’s stock price, whether it is positive or negative, should be considered material. Some examples of information that ordinarily would be regarded as material are:

•Projections of future revenues, earnings or losses, or other financial guidance;

•Historical financial information that has not been publicly disclosed, including (but not limited to) restaurant sales and operating profit trends;

•Information regarding mergers, acquisitions, tender offers, strategic investments, joint ventures, agreements with current or prospective suppliers or divestitures of assets;

•A pending or proposed acquisition or disposition of a significant asset;

•A change in dividend policy, the declaration of a stock split, or an offering of additional securities;

•Material changes in actual or expected trading under any Company share repurchase plan;

•Information regarding changes in management or a change in control;

•Development plans or projections, including prospective new restaurant locations and opening dates;

•Impending bankruptcy or the existence of severe liquidity problems;

•Information regarding restaurant performance, the gain or loss of customers or suppliers, or other developments regarding the Company’s customers or suppliers;

•Information regarding major threatened or actual litigation.

Financial information, such as the results of the Company’s operations for even a portion of a current fiscal quarter, is particularly sensitive since it might be material in helping others predict the Company’s results of operations for the quarter.

Twenty-Twenty Hindsight. Remember, anyone scrutinizing your transactions will be doing so after the fact, with the benefit of hindsight. As a practical matter, before engaging in any transaction, you should carefully consider how enforcement authorities and others might view the transaction in hindsight.

When Information is “Public.” If you are aware of material nonpublic information, you may not trade until the information has been disclosed broadly to the marketplace (such as by press release or an SEC filing) and the investing public has had time to absorb and evaluate the information fully. To avoid the appearance of impropriety, you should refrain from trading until:

•One full business day has elapsed since a formal press release containing such information has been distributed and carried on a financial wire service, or published in one or more major metropolitan newspapers of general circulation;

•One business day has elapsed since a public filing has been made containing such information with the Securities Exchange Commission or the Nasdaq Stock Market or any other national exchange on which the Company’s stock is listed.

If, for example, the Company were to make an announcement that is distributed and carried on a national business wire on a Monday, you should not trade in the Company’s securities until Wednesday. If an announcement were made on a Friday, the following Tuesday generally would be the first eligible trading day.

Transactions by Family Members. The insider trading policy also applies to your family members who reside with you, anyone else who lives in your household, and any family members who do not live in your household but whose transactions in company securities are directed by you or are subject to your influence or control (such as parents or children who consult with you before they trade in company securities). You are responsible for the transactions of these other persons and therefore should make them aware of the need to confer with you before they trade in the Company’s securities.

Pre-Clearance Procedures

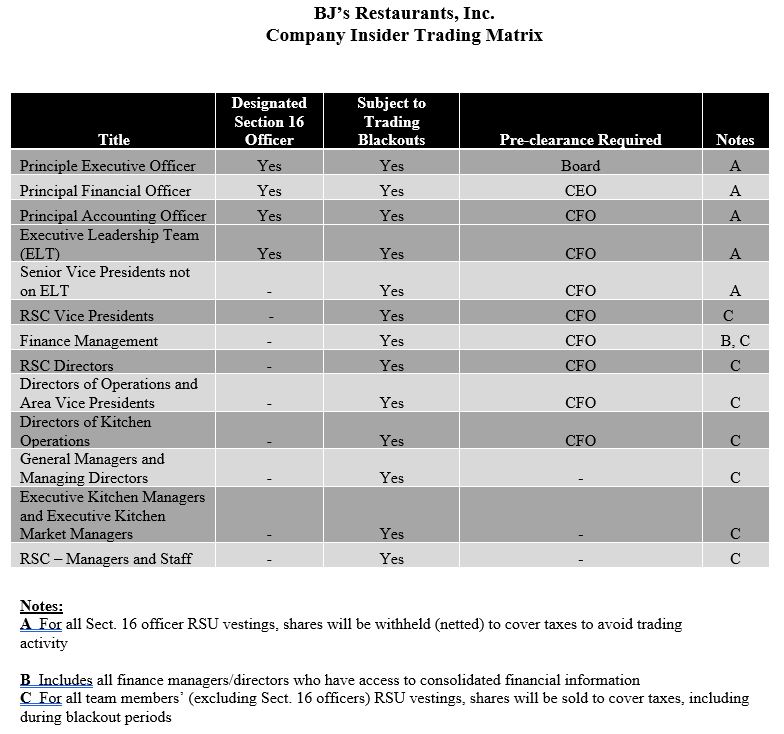

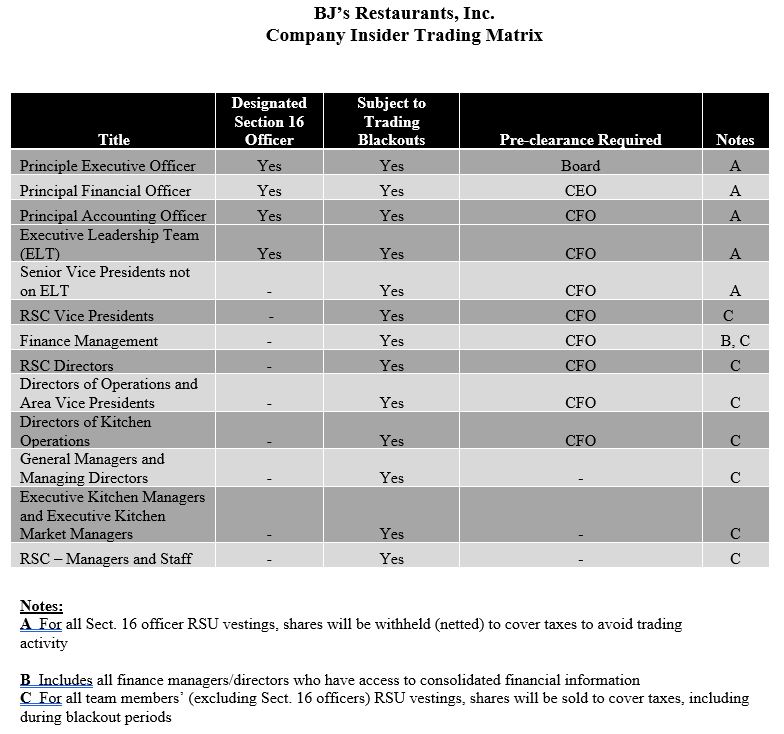

Generally. To help prevent inadvertent violations of the federal securities laws and to avoid even the appearance of trading on inside information, directors and officers of the Company and any other persons designated by the Chief Executive Officer, President or Chief Financial Officer as being subject to the Company’s pre-clearance procedures, together with their family members, may not engage in any transaction in the Company’s securities (including a gift, contribution to a trust, or similar transfer) without first notifying and obtaining pre-clearance of the transaction from the Company’s Chief Executive Officer, President or Chief Financial Officer as set forth in the Insider Trading Matrix included herewith. A request for pre-clearance should be submitted to the Chief Financial Officer, President or Chief Executive Officer at least three days in advance of the proposed transaction. The Company is under no obligation to approve a trade submitted for pre-clearance and may determine not to permit the trade.

Pre-Arranged Trading Plans. Any person subject to the pre-clearance requirements who wishes to implement a trading plan under SEC Rule 10b5-1 must first pre-clear the plan with the Company’s President or Chief Financial Officer. As required by Rule 10b5-1, you may enter into a trading plan only when you are not in possession of material nonpublic information, and trading under any such plan may not begin until the later of (i) 90 days after adoption or modification of the plan, or (ii) two business days following the filing of the Company’s 10-Q (or 10-K) for the period during which the plan was adopted or modified. In addition, it is the Company’s policy that you may

not enter into a trading plan during a blackout period. Transactions effected pursuant to a pre-cleared trading plan will not require further pre-clearance at the time of the transaction if the plan specifies the dates, prices and amounts of the contemplated trades, or establishes a formula for determining the dates, prices and amounts. The Company may, in its discretion, impose additional restrictions on such trading plans to the extent it deems necessary to protect against possible violations of applicable securities laws or to avoid the appearance of any impropriety or improper trading by persons.

Blackout Periods

Quarterly Blackout Periods. The Company’s announcement of its quarterly financial results almost always has the potential to have a material effect on the market for the Company’s securities. Therefore, in order to avoid even the appearance of trading while aware of material nonpublic information, persons who are or may be expected to be aware of the Company’s quarterly financial results may not trade in the Company’s securities during the following periods:

•Three weeks prior to the last day of the Company's first fiscal quarter through the end of the first business day following the Company’s public announcement of its financial results for the first fiscal quarter;

•Three weeks prior to the last day of the Company's second fiscal quarter through the end of the first business day following the Company’s public announcement of its financial results for the second fiscal quarter;

•Three weeks prior to the last day of the Company's third fiscal quarter through the end of the first business day following the Company’s announcement of its financial results for the third fiscal quarter; and

•Three weeks prior to the last day of the Company's fourth fiscal quarter through the end of the first business day following the Company’s announcement of its financial results for the fourth fiscal quarter.

In addition to these “blackout periods” the Company may on occasion issue interim earnings guidance or other potentially material information by means of a press release, SEC filing on Form 8-K or other means designed to achieve widespread dissemination of the information. You should anticipate that trades are unlikely to be pre-cleared while the Company is in the process of assembling the information to be released and until the information has been released and fully absorbed by the market.

Event-Specific Blackout Periods. From time to time, an event may occur that is material to the Company and is known by only a few directors or executives. So long as the event remains material and nonpublic, directors, executive officers, and such other persons as are designated by the Chief Executive Officer, President or Chief Financial Officer may not trade in the Company’s securities. The existence of an event-specific blackout will not be announced, other than to those who are aware of the event giving rise to the blackout. If, however, a person whose trades are subject to pre-clearance requests permission to trade in the Company’s securities during an event-specific blackout, the Chief Financial Officer, President or Chief Executive Officer will inform the requester of the existence of a blackout period, without disclosing the reason for the blackout. Any person made aware of the existence of an event-specific blackout should not disclose the existence of the blackout to any other person. The failure of the Company to designate a person as being subject to an event-specific blackout will not relieve that person of the obligation not to trade while aware of material nonpublic information.

Hardship Exceptions. A person who is subject to a quarterly earnings blackout period and who has an unexpected and urgent need to sell Company stock in order to generate cash may, in appropriate circumstances, be permitted to sell Company stock even during the blackout period. Such circumstances will be very rare and infrequent. Hardship exceptions may be granted only by the Chief Executive Officer, President or Chief Financial Officer and must be requested at least three days in advance of the proposed trade. A hardship exception may be granted only if the Chief Executive Officer, President or Chief Financial Officer or, with respect to executive officers or directors, the Board of Directors or the Audit Committee or other committee designated by the Board of Directors, concludes that the Company’s earnings information for the applicable quarter does not constitute material nonpublic information. Under no circumstance will a hardship exception be granted during an event-specific blackout period.

Gifts During Blackout Periods. Bona fide gifts and charitable contributions are not transactions subject to this policy or the related blackout periods so long as such gifts or contributions are pre-cleared in accordance with the procedures described above.

Post-Termination Transactions

If you are aware of material nonpublic information when you terminate service as a director, officer or other team member of the Company, you may not trade in the Company securities until that information has become public or is no longer material. In all other respects, the procedures set forth in this memorandum will cease to apply to your transactions in Company securities upon the expiration of any “blackout period” that is applicable to your transactions at the time of your termination of service.

Other Prohibited Transactions

The Company considers it improper and inappropriate for any director, officer or other team member of the Company to engage in short-term or speculative transactions in the Company’s securities. It therefore is the Company’s policy that directors, officers and other team members may not engage in any of the following transactions:

Short Sales. Short sales of the Company’s securities evidence an expectation on the part of the seller that the securities will decline in value, and therefore signal to the market that the seller has no confidence in the Company or its short-term prospects. In addition, short sales may reduce the seller’s incentive to improve the Company’s performance. For these reasons, short sales of the Company’s securities are prohibited by this Policy. In addition, Section 16(c) of the Exchange Act prohibits officers and directors from engaging in short sales.

Margin Accounts and Pledges. Securities held in a margin account may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Similarly, securities pledged (or hypothecated) as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when the pledgor is aware of material nonpublic information or otherwise is not permitted to trade in Company securities, directors, officers and other team members are prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan. An exception to this prohibition may be granted where a person wishes to pledge Company securities as collateral for a loan (not including margin debt) and clearly demonstrates the financial capacity to repay the loan without resort to the pledged securities. Any person who wishes to pledge Company securities as collateral for a loan must submit a request for approval to the Company’s Chief Executive Officer, President or Chief Financial Officer at least two weeks prior to the proposed execution of documents evidencing the proposed pledge.

Publicly Traded Options. A transaction in options is, in effect, a bet on the short-term movement of the Company’s stock and therefore creates the appearance that the director, officer or team member is trading based on inside information. Transactions in options also may focus the director’s, officer’s or team member’s attention on short-term performance at the expense of the Company’s long-term objectives. Accordingly, transactions in puts, calls or other derivative securities, on an exchange or in any other organized market, are prohibited by this Policy. (Option positions arising from certain types of hedging transactions are governed by the section below captioned “Hedging Transactions”).

Hedging Transactions. Certain forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts, allow a team member, officer or director to lock in much of the value of his or her stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock. These transactions allow the director, officer or team member to continue to own the covered securities, but without the full risks and rewards of ownership. When that occurs, the director, officer or team member may no longer have the same objectives as the Company’s other shareholders. As a result, the Company prohibits you from engaging in such transactions.

Short-term Trading. A team member’s, officer’s or director’s short-term trading of the Company’s securities may be distracting to such person and may unduly focus such person on the Company’s short-term stock market performance instead of the Company’s long-term business objectives. Officers and directors of the Company are subject to a prohibition on such short-term trading by virtue of the provisions of Section 16(b) of the Securities Exchange Act of 1934. However, all team members of the Company who purchase Company securities in the open market are strongly discouraged from selling any company securities of the same class during the six months following

the purchase. Such suggestion applies only to purchases in the open market and is not intended to apply to stock option exercises or other team member benefit plan acquisitions.

Standing and Limit Orders. Standing and limit orders (except standing and limit orders under approved pre-arranged trading plans under Rule 10b5-1, as described above) create heightened risks for insider trading violations similar to the use of margin accounts. There is no control over the timing of purchases or sales that result from standing instructions to a broker, and as a result the broker could execute a transaction when a director, officer or other team member is in possession of material nonpublic information. The Company therefore discourages placing standing or limit orders on Company Securities. If a person subject to this Policy determines that they must use a standing order or limit order, the order should be limited to short duration (no more than 48 hours) and should otherwise comply with the restrictions and procedures outlined herein.

Transactions Under Company Plans

Stock Option Exercises; Vesting of Restricted Stock. The Company’s insider trading policy does not apply to the exercise of a team member stock option or the vesting of restricted stock awards. The policy does apply, however, to any sale of stock as part of a broker-assisted cashless exercise of an option, or any other market sale for the purpose of generating the cash needed to pay the exercise price of an option. The policy also applies to sales by officers of the Company who are designated as Section 16 officers for the purpose of generating cash necessary to pay withholding or other taxes on exercise of options or vesting of restricted stock awards. In the event tax withholding is required upon exercise of options or vesting of restricted stock awards for Section 16 officers, the Company may withhold shares having a fair market value equal to the required tax withholding.

Team Member Stock Purchase Plan. If the Company adopts a team member stock purchase plan in the future, the Company’s insider trading policy would not apply to purchases of Company stock in the team member stock purchase plan resulting from your periodic contribution of money to the plan pursuant to the election you made at the time of your enrollment in the plan. The policy also would not apply to purchases of Company stock resulting from lump sum contributions to the plan, provided that you elected to participate by lump-sum payment at the beginning of the applicable enrollment period. The policy would apply to your election to participate in the plan for any enrollment period and to your sales of Company stock purchased pursuant to the plan.

Changes in Policy and Other Matters.

Compliance with this policy is a condition of your continued employment or service with the Company The Company may change these procedures or adopt such other procedures in the future as the Company considers appropriate in order to carry out the purposes of its insider trading policy.

This policy addresses insider trading under SEC Rule 10b-5 and related provisions of the securities laws. It does not address issues concerning compliance with officer and director short-swing trading under Section 16(b), trading of private or control securities under Rule 144 or reporting obligations of officers and directors.

This policy is not intended to create any rights in third parties with respect to any violation of its terms and is also not intended to create any legal liability for the Company or any team member beyond those for which they are already responsible under applicable securities laws.

Further Assistance

Any person who has a question regarding the Company’s insider trading policy or its application may obtain additional information and guidance from counsel to the Company. Before you engage in any transactions in the Company’s securities or if you have any questions regarding the policy, you should contact the Company’s Chief Executive Officer, President or Chief Financial Officer.

Ultimately, however, the responsibility for adhering to this Policy and avoiding unlawful transactions rests with the individual team member, officer or director.

Compliance Certificate.

All directors, officers and team members must certify their understanding of and intent to comply with this Policy. A copy of the certification that all team members, officers, and directors must sign is set forth below.

CERTIFICATIONS

I hereby certify that:

1.I have read and understand the Company’s Securities Trading by Company Personnel Policy (“the Policy”);

2.I have complied with the Policy since its effective date and will continue to comply with such Policy for so long as I am subject to the policy;

3.I understand and agree that compliance with the Policy is a condition to my continued employment by or service to the Company;

4.I hereby consent to the Company’s imposition of sanctions for violation of the policy as well as the issuance of any necessary stop-transfer orders to the Company’s transfer agent to enforce compliance with this policy. Such sanctions may include demotion or other disciplinary actions up to and including termination of employment where the Company has a reasonable basis to conclude that its insider trading policy has been violated; and

5.The Company may require directors, officers and team members to recertify compliance with the policy on a periodic basis.

____________________________________

Signature

____________________________________

Name

____________________________________

Date