| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-190246-13 | ||

Dated March 23, 2015 | JPMBB 2015-C28 |

Free Writing Prospectus Structural and Collateral Term Sheet | ||

| JPMBB 2015-C28 | ||

$1,142,791,698 (Approximate Mortgage Pool Balance) | ||

$1,002,907,000 (Approximate Offered Certificates) | ||

J.P. Morgan Chase Commercial Mortgage Securities Corp. Depositor | ||

COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2015-C28 | ||

JPMorgan Chase Bank, National Association Barclays Bank PLC KeyBank National Association Starwood Mortgage Funding II LLC MC-Five Mile Commercial Mortgage Finance LLC Redwood Commercial Mortgage Corporation Mortgage Loan Sellers | ||

J.P. Morgan Co-Lead Manager and Joint Bookrunner | Barclays Co-Lead Manager and Joint Bookrunner | |

KeyBanc Capital Markets Co-Manager | Drexel Hamilton Co-Manager | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Dated March 23, 2015 | JPMBB 2015-C28 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Barclays Capital Inc. (“Barclays”), KeyBanc Capital Markets Inc. (“KeyBanc”) or Drexel Hamilton, LLC (“Drexel”) (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) is soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-190246) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1 (866) 400-7834 or by emailing cmbs-prospectus@jpmorgan.com.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000 as amended or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the issuer undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the issuer’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS. PROSPECTIVE INVESTORS SHOULD UNDERSTAND THAT, WHEN CONSIDERING THE PURCHASE OF THESE CERTIFICATES, A CONTRACT OF SALE WILL COME INTO BEING NO SOONER THAN THE DATE ON WHICH THE RELEVANT CLASS OF CERTIFICATES HAS BEEN PRICED AND THE UNDERWRITERS HAVE CONFIRMED THE ALLOCATION OF CERTIFICATES TO BE MADE TO INVESTORS; ANY “INDICATIONS OF INTEREST” EXPRESSED BY ANY PROSPECTIVE INVESTOR, AND ANY “SOFT CIRCLES” GENERATED BY THE UNDERWRITERS, WILL NOT CREATE BINDING CONTRACTUAL OBLIGATIONS FOR SUCH PROSPECTIVE INVESTORS, ON THE ONE HAND, OR THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE OTHER HAND.

AS A RESULT OF THE FOREGOING, A PROSPECTIVE INVESTOR MAY COMMIT TO PURCHASE CERTIFICATES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND EACH PROSPECTIVE INVESTOR IS ADVISED THAT ALL OR A PORTION OF THE CERTIFICATES REFERRED TO IN THESE MATERIALS MAY BE ISSUED WITHOUT ALL OR CERTAIN OF THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. EACH UNDERWRITER’S OBLIGATION TO SELL CERTIFICATES TO ANY PROSPECTIVE INVESTOR IS CONDITIONED ON THE CERTIFICATES AND THE TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. IF THE UNDERWRITERS DETERMINE THAT A CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, SUCH PROSPECTIVE INVESTOR WILL BE NOTIFIED, AND NEITHER THE DEPOSITOR NOR THE UNDERWRITERS WILL HAVE ANY OBLIGATION TO SUCH PROSPECTIVE INVESTOR TO DELIVER ANY PORTION OF THE CERTIFICATES THAT SUCH PROSPECTIVE INVESTOR HAS COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY OR OBLIGATION BETWEEN THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE ONE HAND, AND SUCH PROSPECTIVE INVESTOR, ON THE OTHER HAND, AS A CONSEQUENCE OF THE NON-DELIVERY.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 1 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

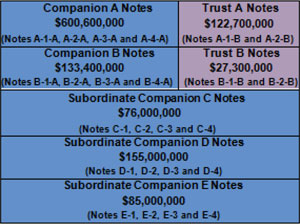

| Indicative Capital Structure | ||

Publicly Offered Certificates

| Class | Expected Ratings (Moody’s / KBRA / Morningstar) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||||

| A-1 | Aaa(sf) / AAA(sf) / AAA | $35,258,000 | 30.000% | 2.79 | 5/15-1/20 | 44.2% | 14.1% | |||||||

| A-2 | Aaa(sf) / AAA(sf) / AAA | $163,954,000 | 30.000% | 4.84 | 1/20-4/20 | 44.2% | 14.1% | |||||||

| A-3 | Aaa(sf) / AAA(sf) / AAA | $150,000,000 | 30.000% | 9.63 | 11/24-1/25 | 44.2% | 14.1% | |||||||

| A-4 | Aaa(sf) / AAA(sf) / AAA | $379,976,000 | 30.000% | 9.83 | 1/25-3/25 | 44.2% | 14.1% | |||||||

| A-SB | Aaa(sf) / AAA(sf) / AAA | $70,766,000 | 30.000% | 7.26 | 1/20-11/24 | 44.2% | 14.1% | |||||||

| X-A | Aa1(sf) / AAA(sf) / AAA | $878,521,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| X-B | NR / AAA(sf) / AAA | $70,218,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

A-S(7)(8) | Aa1(sf) / AAA(sf) / AAA | $78,567,000 | 23.125% | 9.89 | 3/25-3/25 | 48.6% | 12.9% | |||||||

B(7)(8) | NR / AA-(sf) / AA- | $70,218,000 | 16.981% | 9.89 | 3/25-3/25 | 52.5% | 11.9% | |||||||

C(7)(8) | NR / A-(sf) / A- | $54,168,000 | 12.241% | 9.89 | 3/25-3/25 | 55.5% | 11.3% | |||||||

EC(7)(8)(9) | NR / A-(sf) / A- | $202,953,000 | 12.241% | 9.89 | 3/25-3/25 | 55.5% | 11.3% | |||||||

Privately Offered Certificates(10)

| Class | Expected Ratings (Moody’s / KBRA / Morningstar) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||||

| X-C | NR / AAA(sf) / AAA | $54,168,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| X-D | NR / BBB-(sf) / AAA | $54,005,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| X-E | NR / BB-(sf) / AAA | $27,149,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| X-F | NR / B(sf) / AAA | $14,639,000(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| X-NR | NR / NR / AAA | $44,091,697(6) | N/A | N/A | N/A | N/A | N/A | |||||||

| D | NR / BBB-(sf) / BBB- | $54,005,000 | 7.515% | 9.94 | 3/25-4/25 | 58.5% | 10.7% | |||||||

| E | NR / BB-(sf) / BB- | $27,149,000 | 5.139% | 9.98 | 4/25-4/25 | 60.0% | 10.4% | |||||||

| F | NR / B(sf) / B | $14,639,000 | 3.858% | 9.98 | 4/25-4/25 | 60.8% | 10.3% | |||||||

| NR | NR / NR / NR | $44,091,697 | 0.000% | 9.98 | 4/25-4/25 | 63.2% | 9.9% | |||||||

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. |

| (2) | The credit support percentages set forth for Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates in the aggregate. |

| (3) | Assumes 0% CPR / 0% CDR and a April 23, 2015 closing date. Based on modeling assumptions as described in the Free Writing Prospectus dated March 23, 2015 (the “Free Writing Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Notional Amounts are defined in the Free Writing Prospectus. |

| (7) | A holder of Class A-S, Class B and Class C Certificates (the “Exchangeable Certificates”) may exchange such Classes of Certificates (on an aggregate basis) for a related amount of Class EC Certificates, and Class EC Certificates may be exchanged for a ratable portion of each class of Exchangeable Certificates. |

| (8) | The initial Certificate Balance of a Class of Exchangeable Certificates represents the principal balance of such Class without giving effect to any exchange. The initial Certificate Balance of the Class EC Certificates is equal to the aggregate of the initial Certificate Balances of the Exchangeable Certificates and represents the maximum principal balance of such Class that could be issued in an exchange. See “Exchangeable Certificates and the Class EC Certificates” below. |

| (9) | Although the Class EC Certificates are listed below the Class C Certificates in the chart, the Class EC Certificates’ payment entitlements and subordination priority will be a result of the payment entitlements and subordination priority at each level of the related component classes of Class A-S, Class B and Class C Certificates. For purposes of determining the Approximate Initial Credit Support, Certificate Principal to Value Ratio and Underwritten NOI Debt Yield for Class EC Certificates, the calculation is based on the aggregate initial Certificate Balance of Class A-S, Class B and Class C Certificates as if they were a single class. |

| (10) | The Class X-C, Class X-D, Class X-E, Class X-F, Class X-NR, Class D, Class E, Class F, Class NR, Class Z and Class R Certificates are not being offered by the Free Writing Prospectus and this Term Sheet. The Class Z and Class R Certificates are not shown above. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Summary of Transaction Terms | ||

| Securities Offered: | $1,002,907,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC and Barclays Capital Inc. |

| Co-Managers: | KeyBanc Capital Markets Inc. and Drexel Hamilton, LLC |

| Mortgage Loan Sellers: | Barclays Bank PLC (“Barclays”) (25.1%), JPMorgan Chase Bank, National Association (“JPMCB”) (24.5%), KeyBank National Association (“KeyBank”) (16.9%), JPMCB/Barclays (13.1%), Starwood Mortgage Funding II LLC (“SMF II”) (11.1%), MC-Five Mile Commercial Mortgage Finance LLC (“MC-Five Mile”) (6.6%) and Redwood Commercial Mortgage Corporation (“RCMC”) (2.7%). |

| Master Servicer: | Wells Fargo Bank, National Association (“Wells Fargo”). |

| Special Servicer: | Torchlight Loan Services, LLC (“Torchlight”). |

| Directing Certificateholder: | Torchlight Investors, LLC. |

| Trustee: | Wilmington Trust, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Senior Trust Advisor: | Pentalpha Surveillance LLC. |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Kroll Bond Rating Agency, Inc. (“KBRA”) and Morningstar Credit Ratings, LLC (“Morningstar”). |

| Pricing Date: | On or about March 31, 2015. |

| Closing Date: | On or about April 23, 2015. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in April 2015, or with respect to any mortgage loan that has its first due date in May 2015, the date that would otherwise have been the related due date in April 2015. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in May 2015. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in May 2015. |

| Assumed Final Distribution Date: | The Distribution Date in April 2025, which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in October 2048. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC regular interests for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class A-S, Class B, Class C and Class EC Certificates will be offered publicly (the “Publicly Offered Certificates”). The Class X-C, Class X-D, Class X-E, Class X-F, Class X-NR, Class D, Class E, Class F, Class NR, Class Z and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | 1.0% clean-up call. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management Inc., Interactive Data Corporation and Markit. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

| Loan Pool | ||

Initial Pool Balance (“IPB”): | $1,142,791,698 | |

| Number of Mortgage Loans: | 67 | |

| Number of Mortgaged Properties: | 122 | |

| Average Cut-off Date Balance per Mortgage Loan: | $17,056,593 | |

| Weighted Average Current Mortgage Rate: | 4.25783% | |

| 10 Largest Mortgage Loans as % of IPB: | 51.5% | |

Weighted Average Remaining Term to Maturity(1): | 109 months | |

| Weighted Average Seasoning: | 2 months | |

| Credit Statistics | ||

Weighted Average UW NCF DSCR(2): | 1.88x | |

Weighted Average UW NOI Debt Yield(2): | 9.9% | |

Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(3): | 63.2% | |

Weighted Average Maturity Date LTV(1)(2)(3): | 56.9% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 37.5% | |

| % of Mortgaged Properties with Single Tenants: | 13.6% | |

| Amortization | ||

Weighted Average Original Amortization Term(4): | 353 months | |

Weighted Average Remaining Amortization Term(4): | 353 months | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 39.9% | |

| % of Mortgage Loans with Interest-Only: | 24.0% | |

| % of Mortgage Loans with Amortizing Balloon: | 23.4% | |

| % of Mortgage Loans with Interest-Only followed by ARD-Structure: | 12.2% | |

% of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon followed by ARD-Structure(5): | 0.5% | |

Cash Management(6) | ||

| % of Mortgage Loans with In-Place, CMA Lockboxes: | 47.5% | |

| % of Mortgage Loans with In-Place, Hard Lockboxes: | 36.0% | |

| % of Mortgage Loans with Springing Lockboxes: | 12.3% | |

| % of Mortgage Loans with No Lockbox: | 2.2% | |

| % of Mortgage Loans with In-Place, Soft Lockboxes: | 1.9% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 69.0% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 38.3% | |

% of Mortgage Loans Requiring Monthly CapEx Reserves(7): | 74.9% | |

% of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 52.8% | |

| (1) | In the case of Loan Nos. 3, 9, 10 and 45 each with an anticipated repayment date, as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (3) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (4) | Excludes eight mortgage loans that are interest-only for the entire term or until the anticipated repayment date, as applicable. |

| (5) | In the case of Loan No. 45, the mortgage loan has an ARD feature with an anticipated repayment date of February 1, 2025, with an increase in the interest rate equal to the greater of (i) 6.60000% per annum or (ii) the 10 year treasury rate plus 250 basis points, until the final maturity date of October 1, 2035. Upon the anticipated repayment date, if the mortgage loan is not paid off in full, the monthly debt service payment will be a fully amortizing monthly payment of principal and interest calculated based on (i) a loan amount equal to the then outstanding principal balance as of the anticipated repayment date, (ii) an applicable interest rate and (iii) a loan term commencing on the anticipated repayment date and ending on the maturity date. |

| (6) | For a detailed description of Cash Management, refer to “Description of the Mortgage Pool – Lockbox Accounts” in the Free Writing Prospectus. |

| (7) | CapEx Reserves include FF&E reserves for hotel properties. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, industrial, office and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of IPB | ||||

| Barclays | 19 | 38 | $286,465,440 | 25.1% | ||||

| JPMCB | 10 | 13 | 280,019,592 | 24.5 | ||||

| KeyBank | 17 | 37 | 193,430,106 | 16.9 | ||||

JPMCB / Barclays(1) | 1 | 1 | 150,000,000 | 13.1 | ||||

| SMF II | 7 | 10 | 127,138,497 | 11.1 | ||||

| MC-Five Mile | 9 | 17 | 75,437,351 | 6.6 | ||||

| RCMC | 4 | 6 | 30,300,712 | 2.7 | ||||

| Total: | 67 | 122 | $1,142,791,698 | 100.0% |

| (1) | JPMorgan Chase Bank, National Association and Barclays Bank PLC, along with two other lenders each co-originated 25% of one mortgage loan in the combined principal amount of $1,200,000,000, identified as “Houston Galleria” on Annex A-1 to the Free Writing Prospectus, and all references to “Houston Galleria” refer to the total mortgage loan sold to the trust by both of these mortgage loan sellers. The principal balance of the portion of the mortgage loan included in this trust is $150,000,000, representing approximately 13.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, and is evidenced by two components of debt, each comprised of two pari passu notes sold to the trust by each of JPMorgan Chase Bank, National Association and Barclays Bank PLC. |

| Ten Largest Mortgage Loans |

| No. | Loan Name | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | SF/ Rooms | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2) | ||||||||||

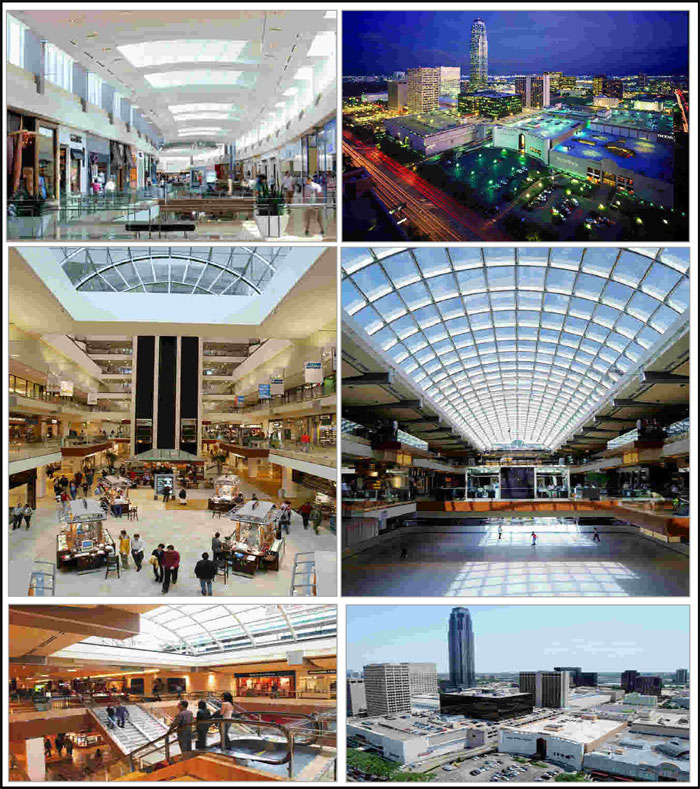

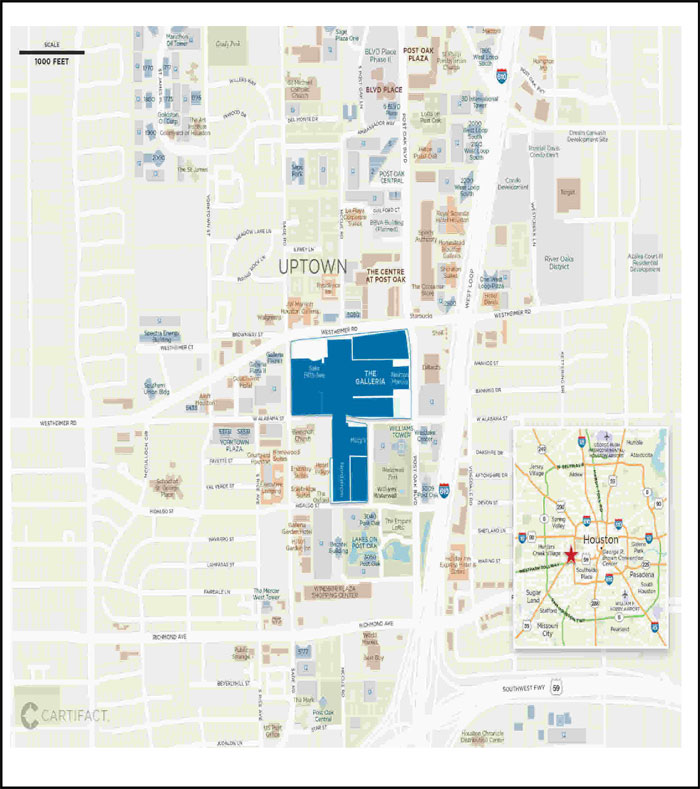

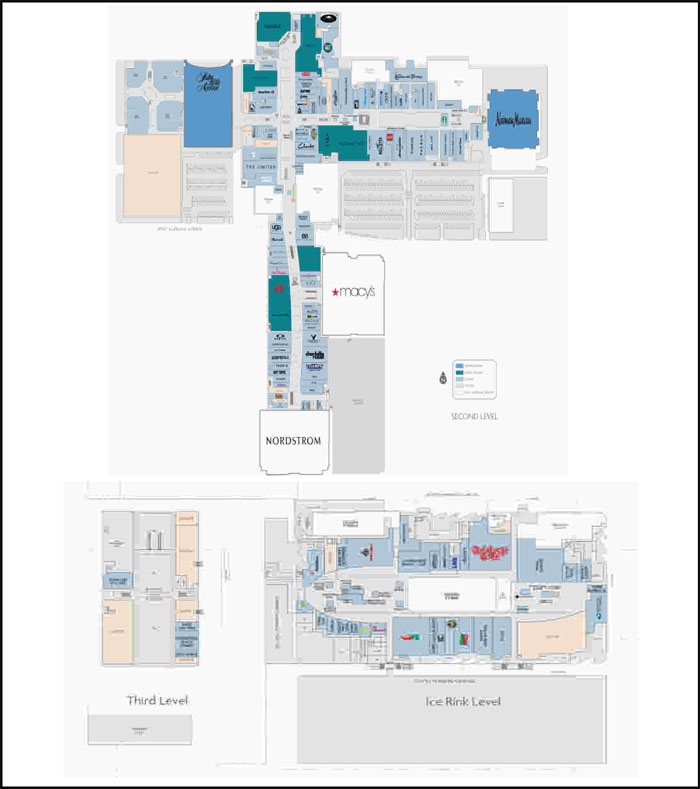

| 1 | Houston Galleria | JPMCB / Barclays | 1 | $150,000,000 | 13.1% | 1,212,006 | Retail | 3.38x | 11.6% | 35.1% | 35.1% | ||||||||||

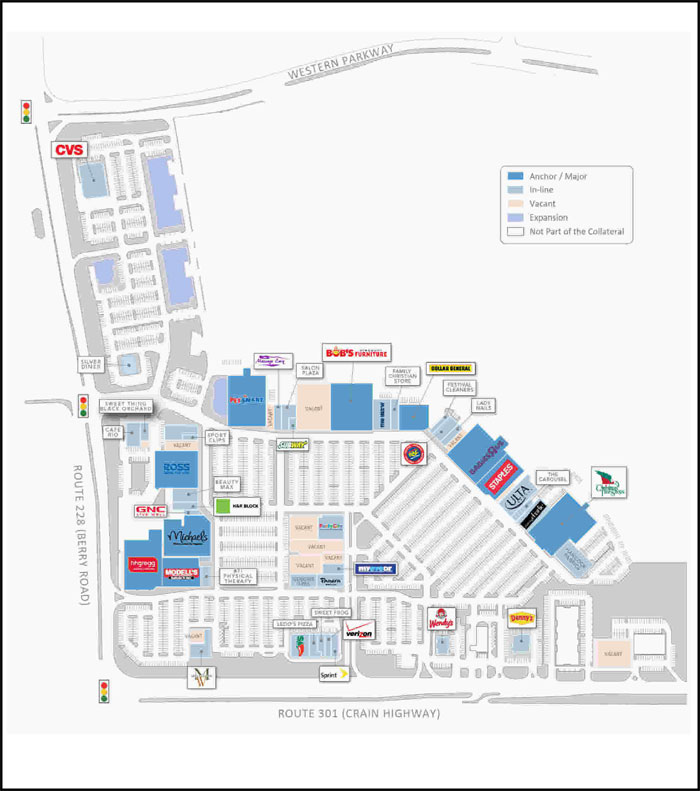

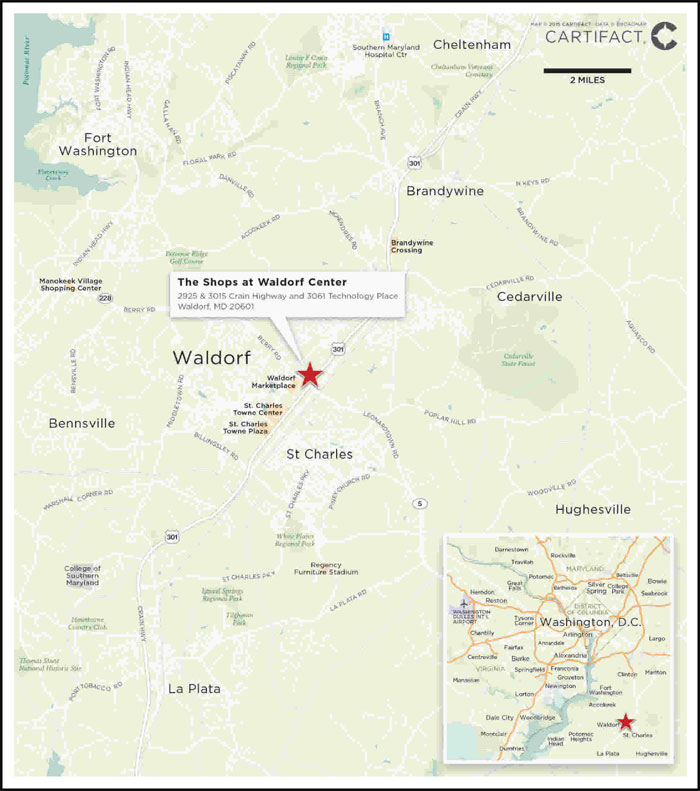

| 2 | The Shops at Waldorf Center | JPMCB | 1 | $78,000,000 | 6.8% | 497,529 | Retail | 1.35x | 8.4% | 69.0% | 62.8% | ||||||||||

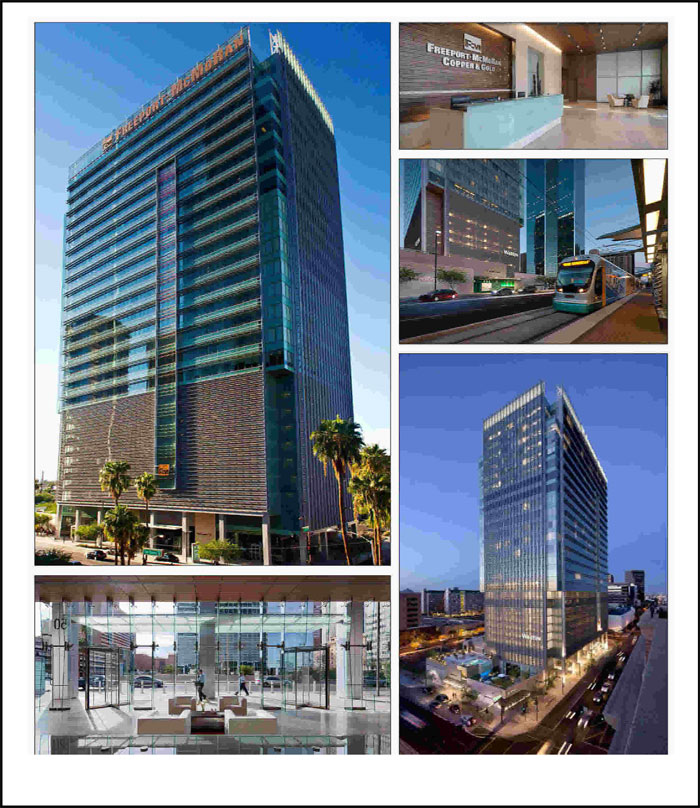

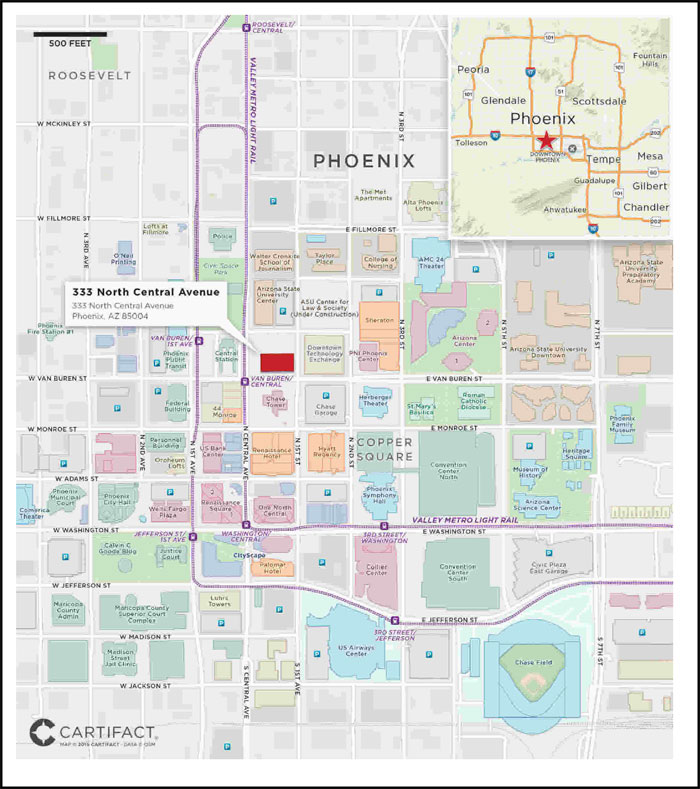

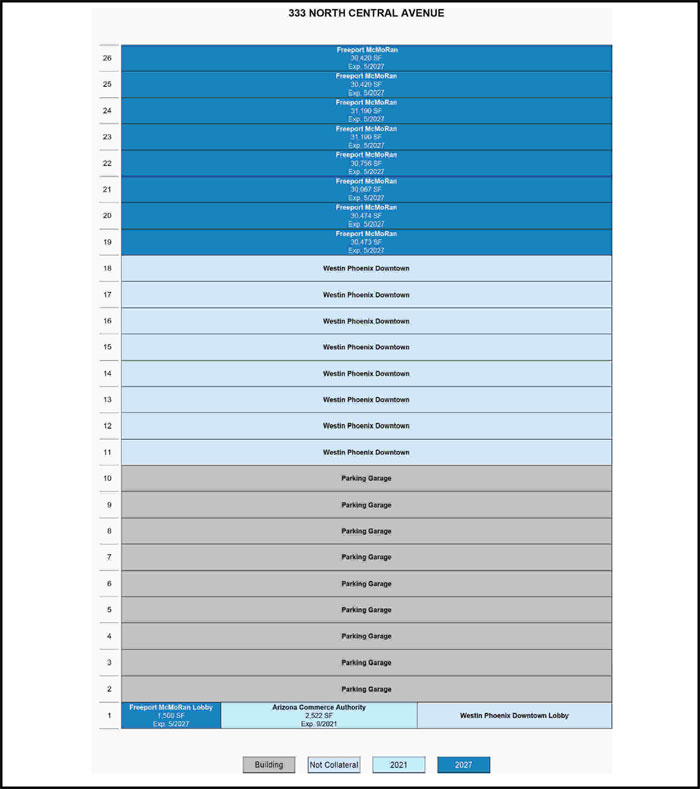

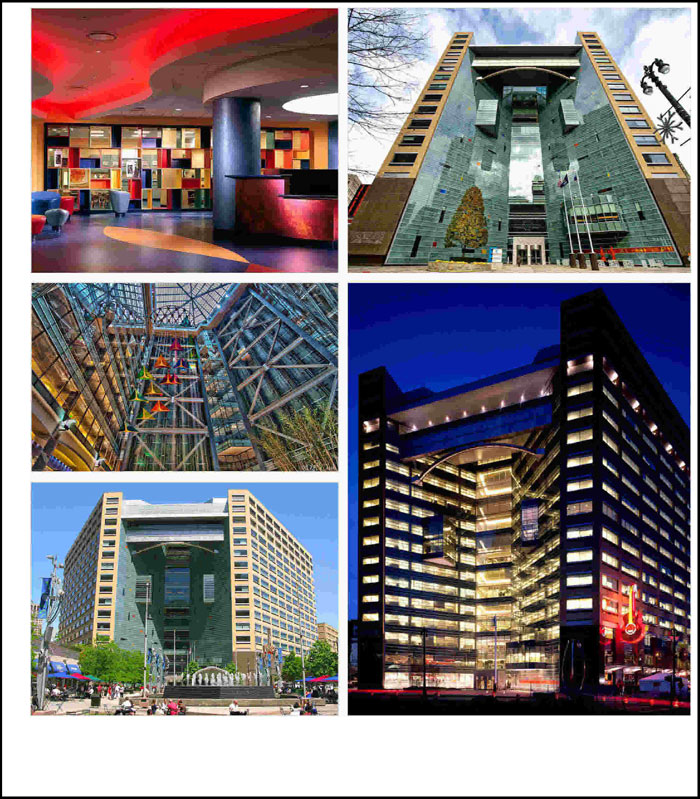

| 3 | 333 North Central Avenue | Barclays | 1 | $71,500,000 | 6.3% | 249,012 | Office | 1.92x | 10.0% | 65.0% | 65.0% | ||||||||||

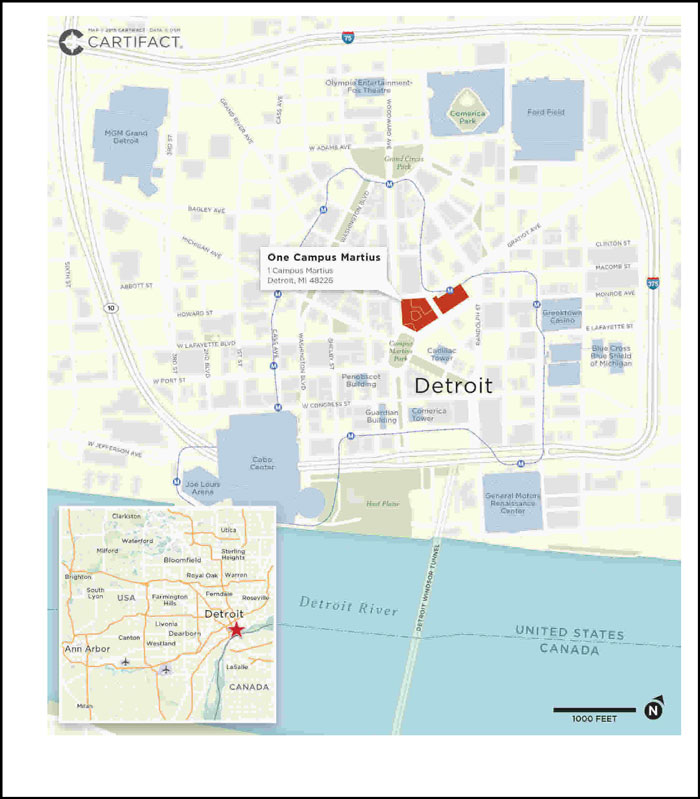

| 4 | One Campus Martius | SMF II | 1 | $50,000,000 | 4.4% | 965,078 | Office | 2.54x | 12.1% | 66.5% | 66.5% | ||||||||||

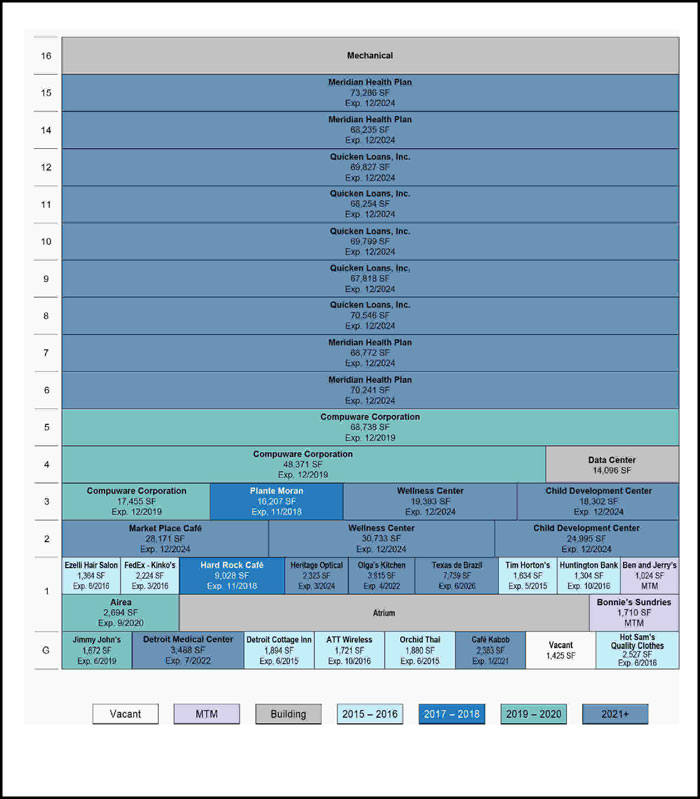

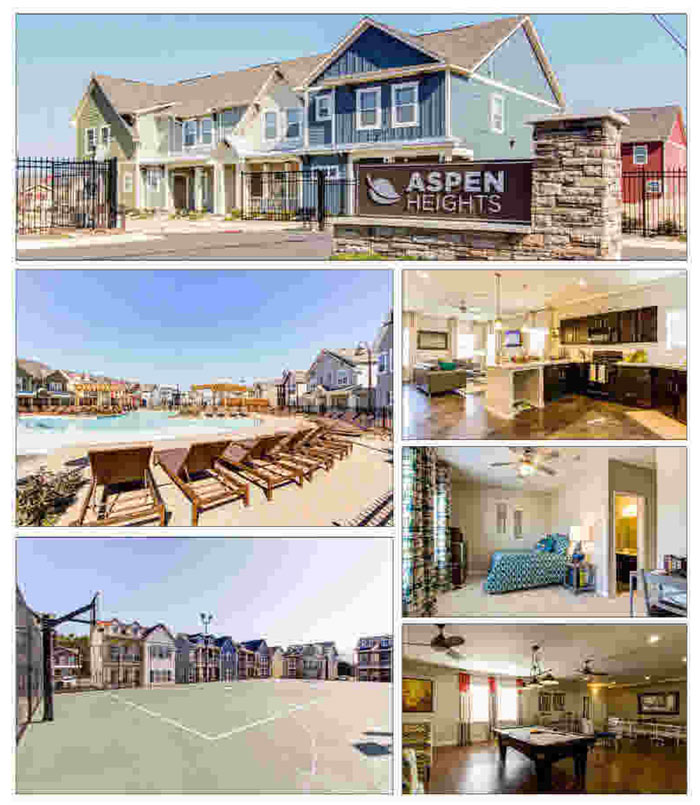

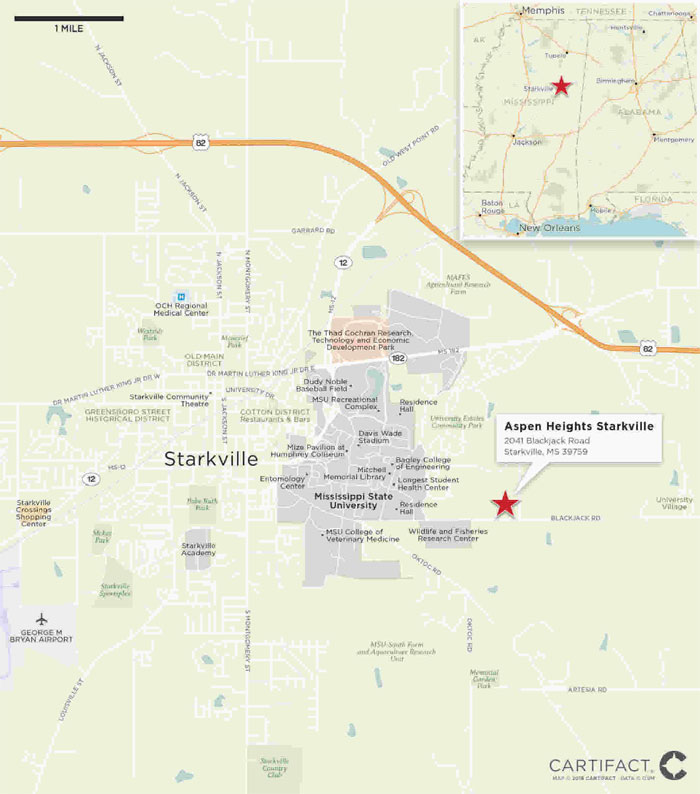

| 5 | Aspen Heights Starkville | KeyBank | 1 | $46,000,000 | 4.0% | 958 | Multifamily | 1.33x | 8.2% | 74.0% | 64.5% | ||||||||||

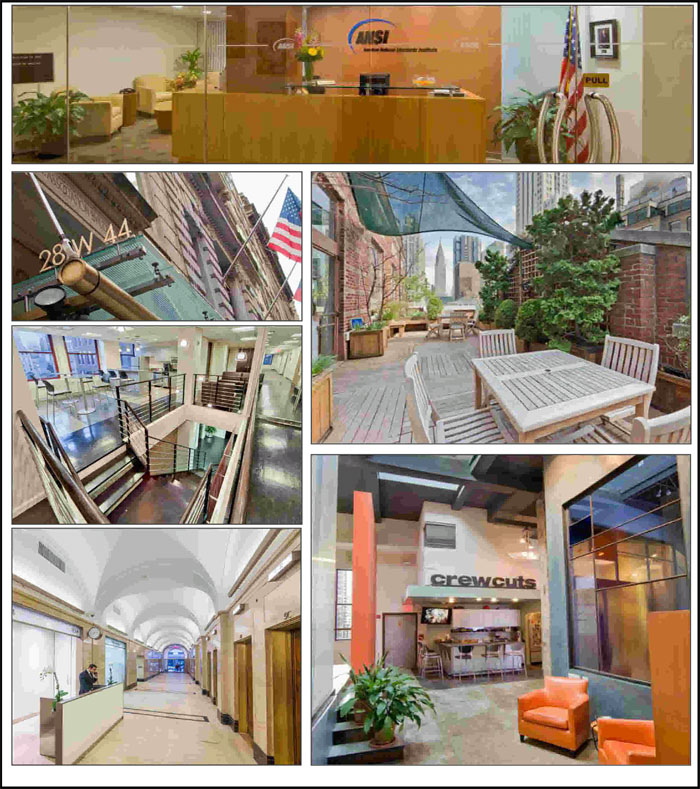

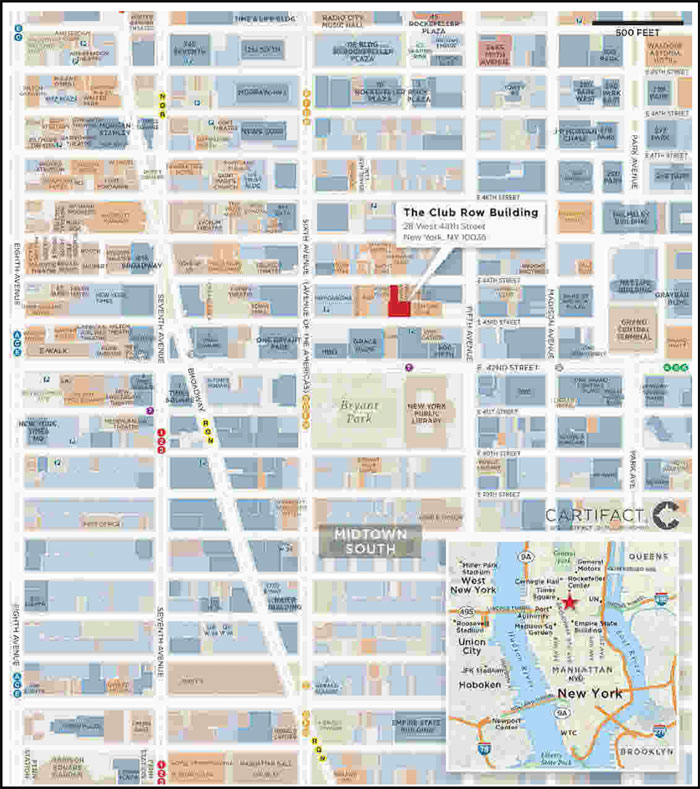

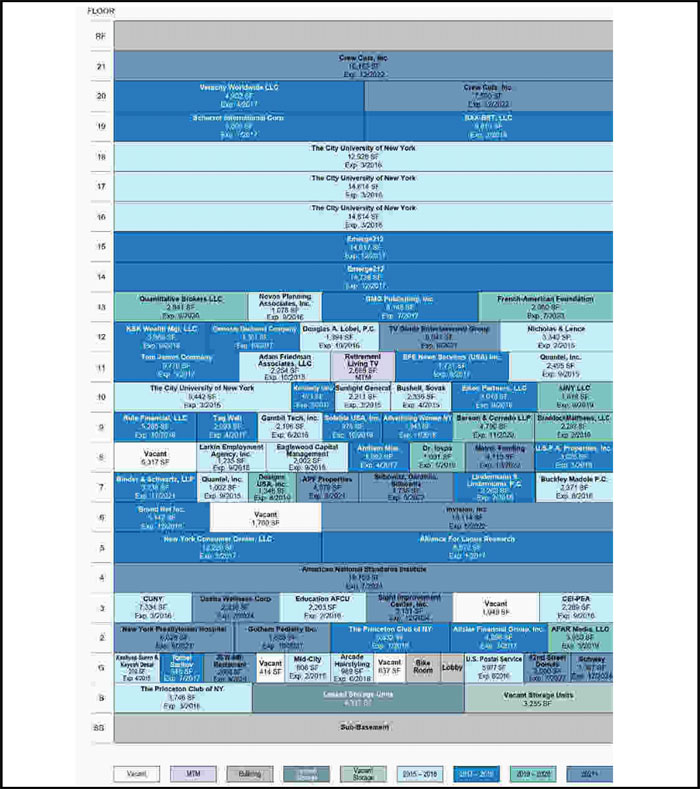

| 6 | The Club Row Building | JPMCB | 1 | $45,000,000 | 3.9% | 365,819 | Office | 1.58x | 7.7% | 62.0% | 62.0% | ||||||||||

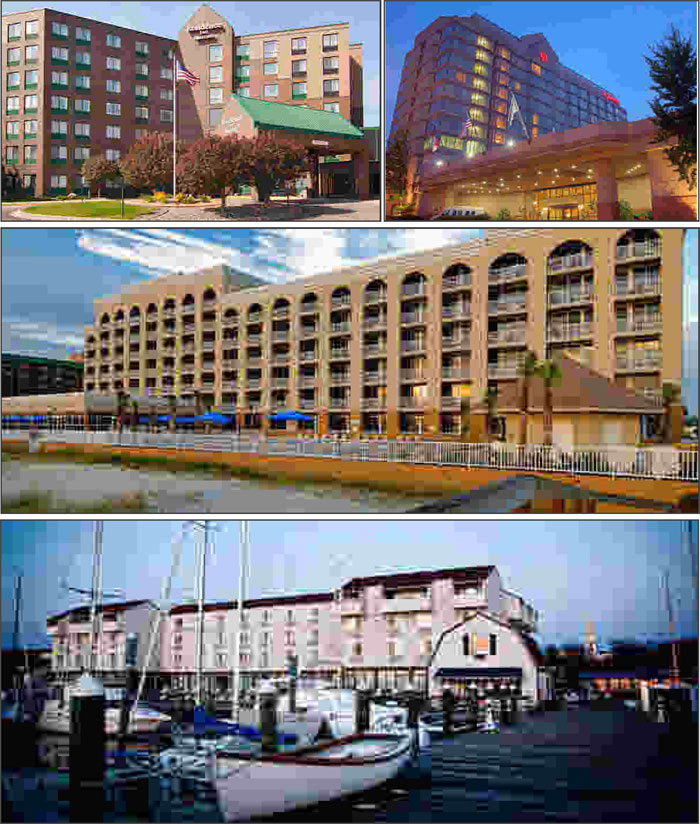

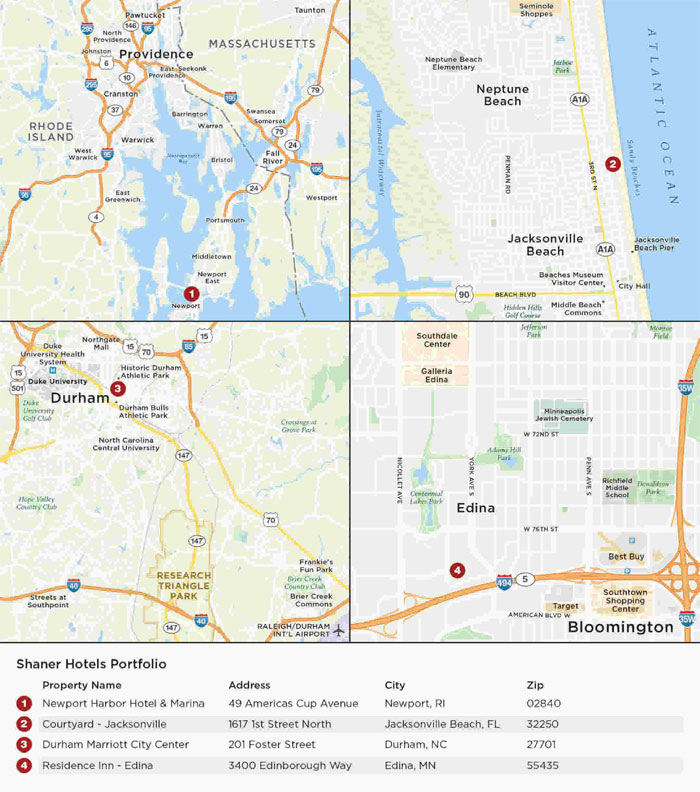

| 7 | Shaner Hotels Portfolio | JPMCB | 4 | $42,090,000 | 3.7% | 605 | Hotel | 1.83x | 11.1% | 68.8% | 58.8% | ||||||||||

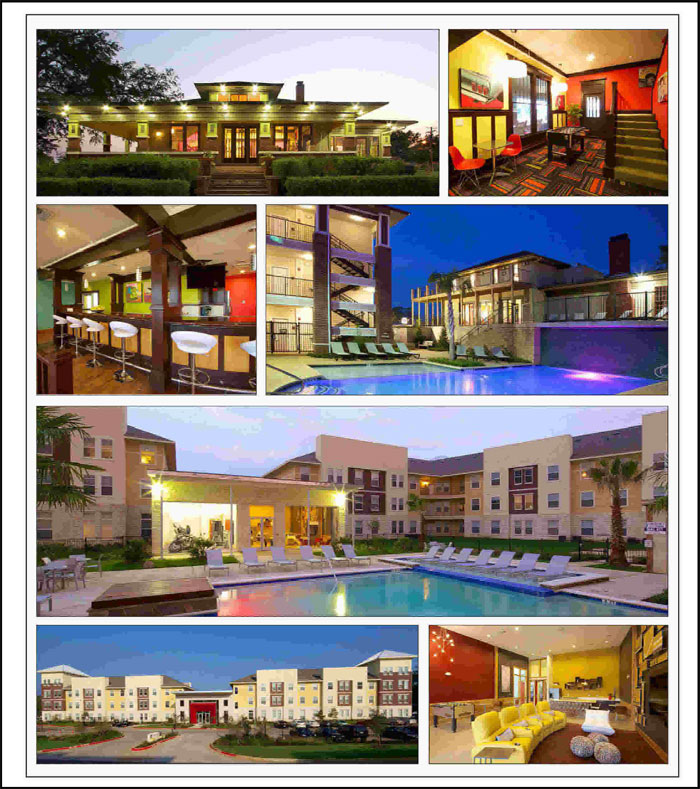

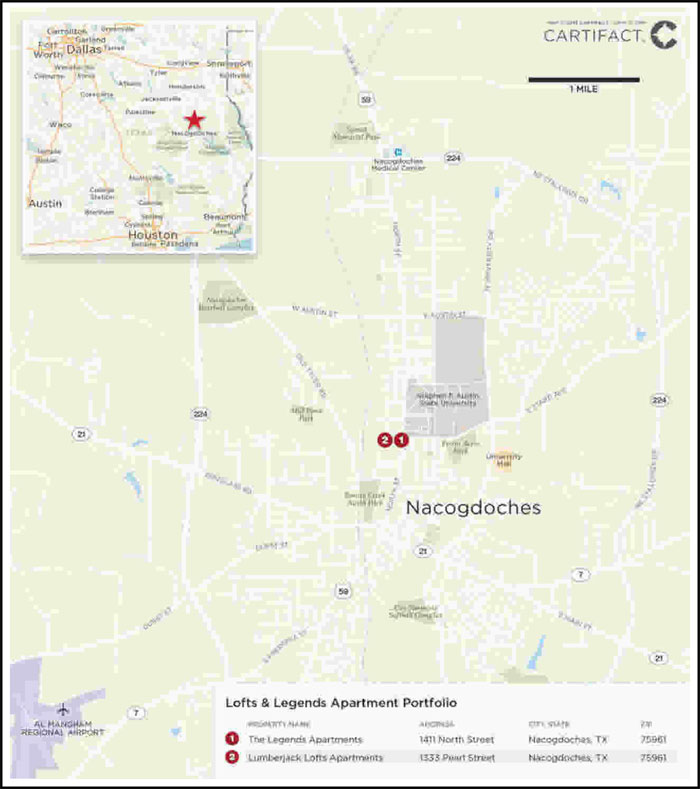

| 8 | Lofts & Legends Apartment Portfolio | Barclays | 2 | $37,975,000 | 3.3% | 859 | Multifamily | 1.32x | 8.0% | 77.5% | 70.6% | ||||||||||

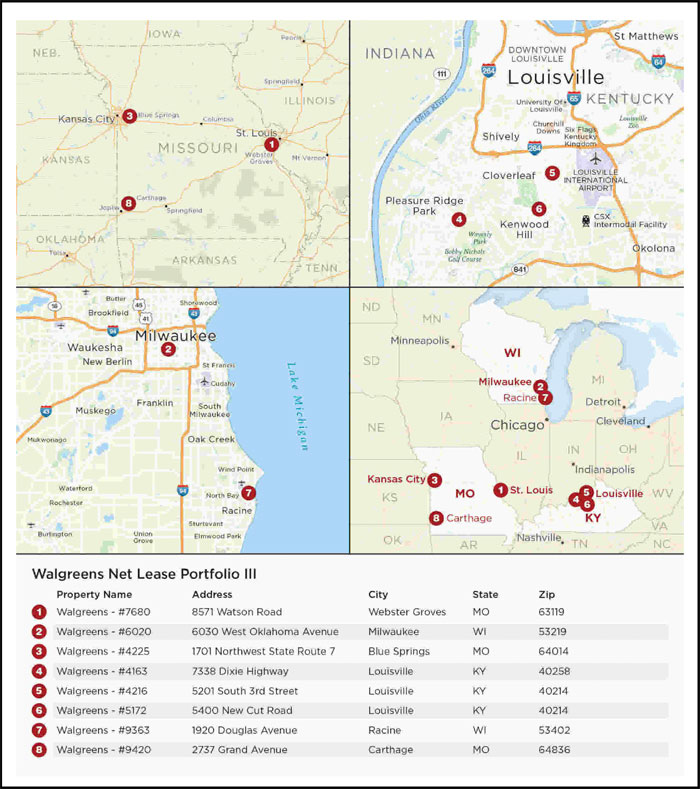

| 9 | Walgreens Net Lease Portfolio III | KeyBank | 8 | $34,287,252 | 3.0% | 117,645 | Retail | 1.81x | 7.8% | 69.9% | 69.9% | ||||||||||

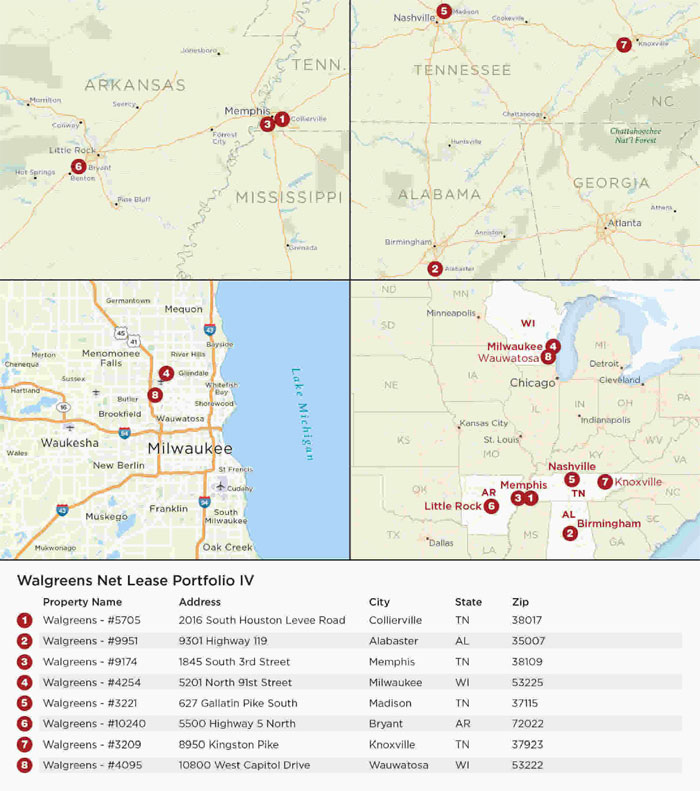

| 10 | Walgreens Net Lease Portfolio IV | KeyBank | 8 | $33,247,566 | 2.9% | 115,123 | Retail | 1.81x | 7.8% | 69.3% | 69.3% | ||||||||||

| Top 3 Total/Weighted Average | 3 | $299,500,000 | 26.2% | 2.50x | 10.4% | 51.1% | 49.5% | ||||||||||||||

| Top 5 Total/Weighted Average | 5 | $395,500,000 | 34.6% | 2.37x | 10.3% | 55.7% | 53.4% | ||||||||||||||

| Top 10 Total/Weighted Average | 28 | $588,099,818 | 51.5% | 2.14x | 9.8% | 60.1% | 57.4% | ||||||||||||||

| (1) | In the case of Loan Nos. 1, 4, 6, and 7, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loans. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. The UW NCF DSCR for the senior tranche of the Houston Galleria Mortgage Loan, including the related Houston Galleria pari passu Companion Loan, is 4.15x. |

| (2) | In the case of Loan No. 2, the Cut-off Date LTV and Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” in the Free Writing Prospectus for additional information. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

| Pari Passu Note Loan Summary | |||||||||||||||

No. | Loan Name | Trust Cut- off Date Balance | Pari Passu Loan Cut-off Date Balance | Total Mortgage Loan Cut- off Date Balance | Controlling Pooling & Servicing Agreement | Master Servicer | Special Servicer | Voting Rights | |||||||

| 1 | Houston Galleria(1) | $150,000,000 | $734,000,000 | $884,000,000 | Houston Galleria Mall Trust 2015-HGLR | KeyBank | Pacific Life Insurance Co. | Houston Galleria Mall Trust 2015-HGLR | |||||||

| 4 | One Campus Martius | $50,000,000 | $75,000,000 | $125,000,000 | JPMBB 2015-C27 | Midland | LNR Partners | JPMBB 2015-C27 | |||||||

| 6 | The Club Row Building | $45,000,000 | $110,000,000 | $155,000,000 | JPMBB 2015-C27 | Midland | LNR Partners | JPMBB 2015-C27 | |||||||

| 7 | Shaner Hotels Portfolio | $42,090,000 | $35,000,000 | $77,090,000 | JPMBB 2015-C27 | Midland | LNR Partners | JPMBB 2015-C27 | |||||||

| 12 | Horizon Outlet Shoppes Portfolio | $28,000,000 | $26,675,000 | $54,675,000 | JPMBB 2015-C28 | Wells Fargo | Torchlight | JPMBB 2015-C28 | |||||||

| 15 | Renaissance New Orleans Portfolio | $23,837,918 | $19,503,751 | $43,341,670 | JPMBB 2015-C28 | Wells Fargo | Torchlight | JPMBB 2015-C28 | |||||||

| (1) | In the case of Loan No. 1, the Pari Passu Loan Cut-off Date Balance is the approximate aggregate outstanding principal balance of two companion loans, each of which is pari passu with respect to one tranche of the Houston Galleria Mortgage Loan (each such companion loan being comprised of four pari passu notes). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

| Collateral Characteristics | ||

Additional Debt Summary(1) |

No. | Loan Name | Trust Cut-off Date Balance | Subordinate Debt Cut-off Date Balance | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan Cut-off Date LTV(2)(3) | Total Debt Cut-off Date LTV(3) | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield | |

| 1 | Houston Galleria | $150,000,000 | $316,000,000 | $1,200,000,000 | 3.38x | 2.32x | 35.1% | 47.7% | 11.6% | 8.5% | |

| 2 | The Shops at Waldorf Center | $78,000,000 | $10,000,000 | $88,000,000 | 1.35x | 1.08x | 69.0% | 77.8% | 8.4% | 7.4% | |

| 6 | The Club Row Building | $45,000,000 | $25,000,000 | $180,000,000 | 1.58x | 1.27x | 62.0% | 72.0% | 7.7% | 6.6% | |

| 7 | Shaner Hotels Portfolio | $42,090,000 | $12,510,000 | $89,600,000 | 1.83x | 1.44x | 68.8% | 80.0% | 11.1% | 9.6% | |

| 9 | Walgreens Net Lease Portfolio III | $34,287,252 | $9,786,720 | $44,073,972 | 1.81x | 1.54x | 69.9% | 89.8% | 7.8% | 6.1% | |

| 10 | Walgreens Net Lease Portfolio IV | $33,247,566 | $9,489,959 | $42,737,525 | 1.81x | 1.55x | 69.3% | 89.1% | 7.8% | 6.1% | |

| 14 | Marriott - Chattanooga | $24,100,000 | $3,900,000 | $28,000,000 | 1.80x | 1.42x | 68.9% | 80.0% | 11.0% | 9.4% | |

| 17 | The Legacy at Traditions | $21,750,000 | $2,900,000 | $24,650,000 | 1.37x | 1.11x | 74.7% | 84.7% | 8.1% | 7.1% |

| (1) | In the case of Loan Nos. 2, 7, 9, 10, 14 and 17, subordinate debt represents mezzanine loans. In the case of Loan No. 6, subordinate debt represents a B-Note. In the case of Loan No. 1, the loan is comprised of (i) a mortgage loan (evidenced by two tranches of debt, each comprised of two pari passu notes with an aggregate original principal balance of $150.0 million), (ii) two pari passu companion loans (each comprised of four pari passu notes with an aggregate original principal balance of $734.0 million and (iii) three subordinate companion loans (each comprised of four pari passu notes with an aggregate original principal balance of $316.0 million). |

| (2) | In the case of Loan Nos. 1, 6 and 7, Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI Debt Yield and Mortgage Loan Cut-off Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI Debt Yield and Mortgage Loan Cut-off Date LTV calculations exclude the Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. The UW NCF DSCR for the senior tranche of the Houston Galleria Mortgage Loan, including the related Houston Galleria pari passu Companion Loan, is 4.15x. |

| (3) | In the case of Loan No. 2, the Cut-off Date LTV is calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Competition” in the Free Writing Prospectus for additional information. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

| Collateral Characteristics | ||

Mortgaged Properties by Type(1) |

| Weighted Average | |||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(2)(3)(4) |

| Retail | Super Regional Mall | 1 | $150,000,000 | 13.1% | 98.3% | 3.38x | 11.6% | 35.1% | 35.1% |

| Freestanding | 48 | 132,752,354 | 11.6 | 100.0% | 1.74x | 8.8% | 66.4% | 61.6% | |

| Anchored | 6 | 114,815,257 | 10.0 | 91.4% | 1.41x | 9.0% | 68.8% | 61.2% | |

| Regional Mall | 1 | 31,850,000 | 2.8 | 97.8% | 1.76x | 11.0% | 63.7% | 55.4% | |

| Outlet Center | 3 | 28,000,000 | 2.5 | 86.7% | 1.42x | 9.6% | 62.6% | 53.4% | |

| Shadow Anchored | 4 | 23,603,261 | 2.1 | 100.0% | 1.46x | 9.2% | 72.9% | 59.9% | |

| Single Tenant | 4 | 13,890,110 | 1.2 | 100.0% | 1.97x | 9.6% | 60.9% | 58.2% | |

| Subtotal: | 67 | $494,910,983 | 43.3% | 96.6% | 2.14x | 9.9% | 57.2% | 52.4% | |

| Multifamily | Garden | 11 | $106,910,479 | 9.4% | 95.7% | 1.44x | 9.2% | 71.1% | 62.0% |

| Student | 3 | 83,975,000 | 7.3 | 96.5% | 1.33x | 8.1% | 75.6% | 67.3% | |

| Subtotal: | 14 | $190,885,479 | 16.7% | 96.0% | 1.39x | 8.7% | 73.0% | 64.3% | |

| Hotel | Full Service | 7 | $96,670,363 | 8.5% | 72.7% | 1.68x | 10.7% | 64.9% | 55.8% |

| Extended Stay | 4 | 47,966,420 | 4.2 | 81.1% | 1.86x | 11.4% | 66.3% | 54.1% | |

| Limited Service | 4 | 32,894,990 | 2.9 | 76.4% | 1.90x | 11.8% | 66.0% | 54.1% | |

| Subtotal: | 15 | $177,531,772 | 15.5% | 75.7% | 1.77x | 11.1% | 65.5% | 55.0% | |

| Office | CBD | 3 | $166,500,000 | 14.6% | 98.9% | 2.01x | 10.0% | 64.6% | 64.6% |

| Medical | 2 | 6,640,000 | 0.6 | 96.6% | 1.81x | 10.3% | 65.0% | 60.2% | |

| Subtotal: | 5 | $173,140,000 | 15.2% | 98.8% | 2.01x | 10.0% | 64.7% | 64.5% | |

| Self Storage | Self Storage | 13 | $47,268,854 | 4.1% | 89.1% | 1.79x | 10.9% | 64.1% | 53.7% |

| Mixed Use | Office/Retail/Parking | 1 | $24,221,581 | 2.1% | 77.6% | 1.33x | 9.4% | 70.2% | 57.0% |

| Industrial/Retail/Office | 1 | 7,989,589 | 0.7 | 91.3% | 1.35x | 10.2% | 69.5% | 55.5% | |

| Retail/Office | 1 | 5,493,117 | 0.5 | 81.8% | 1.36x | 8.7% | 67.8% | 54.5% | |

| Subtotal: | 3 | $37,704,286 | 3.3% | 81.1% | 1.34x | 9.5% | 69.7% | 56.3% | |

| Industrial | Flex | 2 | $11,594,369 | 1.0% | 94.1% | 1.45x | 9.4% | 69.7% | 55.8% |

| Warehouse/Distribution | 1 | 4,162,500 | 0.4 | 100.0% | 1.41x | 9.3% | 75.0% | 61.9% | |

| Warehouse | 1 | 3,196,189 | 0.3 | 100.0% | 1.83x | 11.5% | 64.9% | 52.6% | |

| Subtotal: | 4 | $18,953,057 | 1.7% | 96.4% | 1.51x | 9.8% | 70.1% | 56.6% | |

| Manufactured Housing | Manufactured Housing | 1 | $2,397,266 | 0.2% | 91.1% | 1.90x | 12.2% | 57.4% | 46.7% |

| Total / Weighted Average: | 122 | $1,142,791,698 | 100.0% | 92.8% | 1.88x | 9.9% | 63.2% | 56.9% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (3) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (4) | In the case of Loan Nos. 3, 9, 10 and 45, each of which has an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

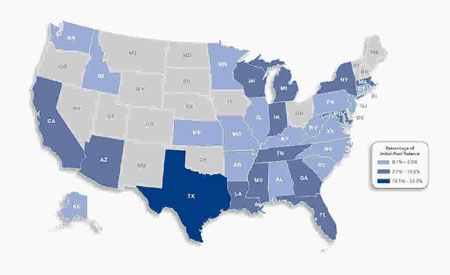

Mortgaged Properties by Location(1) | |||||||||

Weighted Average | |||||||||

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(2)(3)(4) | |

| Texas | 11 | $266,722,787 | 23.3% | 97.3% | 2.52x | 10.4% | 51.3% | 47.8% | |

| California | 15 | 109,883,745 | 9.6 | 93.2% | 1.70x | 10.6% | 64.1% | 54.8% | |

| Maryland | 1 | 78,000,000 | 6.8 | 89.5% | 1.35x | 8.4% | 69.0% | 62.8% | |

| New York | 12 | 77,899,588 | 6.8 | 96.9% | 1.50x | 8.7% | 64.0% | 58.4% | |

| Mississippi | 3 | 74,222,433 | 6.5 | 89.7% | 1.34x | 8.7% | 72.8% | 61.8% | |

| Arizona | 1 | 71,500,000 | 6.3 | 100.0% | 1.92x | 10.0% | 65.0% | 65.0% | |

| Michigan | 3 | 52,245,686 | 4.6 | 99.9% | 2.49x | 12.0% | 66.5% | 65.7% | |

| Tennessee | 5 | 41,066,212 | 3.6 | 83.7% | 1.80x | 9.7% | 69.1% | 63.1% | |

| Wisconsin | 5 | 32,501,563 | 2.8 | 95.2% | 1.62x | 8.7% | 66.1% | 61.5% | |

| Indiana | 5 | 28,675,415 | 2.5 | 82.0% | 1.84x | 10.8% | 63.2% | 53.3% | |

| Louisiana | 5 | 26,687,918 | 2.3 | 80.7% | 1.63x | 9.9% | 60.6% | 56.6% | |

| Massachusetts | 2 | 24,975,000 | 2.2 | 87.5% | 1.69x | 10.2% | 68.9% | 58.9% | |

| Florida | 6 | 24,563,610 | 2.1 | 89.2% | 1.69x | 10.3% | 69.6% | 59.6% | |

| Georgia | 4 | 24,561,020 | 2.1 | 85.4% | 2.00x | 12.8% | 67.4% | 52.8% | |

| Missouri | 5 | 21,894,598 | 1.9 | 93.3% | 1.80x | 9.5% | 66.0% | 60.3% | |

| Illinois | 4 | 21,848,028 | 1.9 | 100.0% | 1.66x | 9.2% | 65.3% | 59.8% | |

| Virginia | 3 | 20,000,000 | 1.8 | 90.8% | 1.83x | 10.9% | 60.1% | 51.8% | |

| North Carolina | 3 | 19,840,676 | 1.7 | 87.7% | 1.69x | 10.3% | 71.1% | 61.3% | |

| Connecticut | 4 | 13,835,486 | 1.2 | 92.8% | 1.72x | 9.5% | 64.4% | 55.0% | |

| Rhode Island | 1 | 13,529,514 | 1.2 | 62.3% | 1.83x | 11.1% | 68.8% | 58.8% | |

| Washington | 2 | 12,861,143 | 1.1 | 88.2% | 1.43x | 9.3% | 66.1% | 54.8% | |

| Kentucky | 3 | 12,765,916 | 1.1 | 100.0% | 1.81x | 7.8% | 69.9% | 69.9% | |

| Alabama | 4 | 12,227,475 | 1.1 | 91.4% | 1.71x | 9.3% | 67.2% | 61.2% | |

| Minnesota | 2 | 12,057,446 | 1.1 | 87.2% | 1.69x | 10.5% | 70.9% | 59.9% | |

| Alaska | 1 | 9,500,000 | 0.8 | 56.7% | 1.45x | 11.8% | 69.3% | 44.2% | |

| Pennsylvania | 4 | 8,860,000 | 0.8 | 100.0% | 1.95x | 10.3% | 62.1% | 54.7% | |

| West Virginia | 1 | 8,500,000 | 0.7 | 89.7% | 1.35x | 9.2% | 74.6% | 68.1% | |

| New Jersey | 1 | 7,100,000 | 0.6 | 90.3% | 1.36x | 9.1% | 73.2% | 58.4% | |

| South Carolina | 3 | 5,875,017 | 0.5 | 100.0% | 1.42x | 9.6% | 70.2% | 55.3% | |

| Arkansas | 1 | 3,891,426 | 0.3 | 100.0% | 1.81x | 7.8% | 69.3% | 69.3% | |

| Idaho | 1 | 3,639,659 | 0.3 | 93.0% | 1.37x | 8.4% | 74.3% | 59.9% | |

| Kansas | 1 | 1,060,338 | 0.1 | 100.0% | 1.30x | 9.3% | 65.1% | 47.5% | |

| Total / Weighted Average: | 122 | $1,142,791,698 | 100.0% | 92.8% | 1.88x | 9.9% | 63.2% | 56.9% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (3) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (4) | In the case of Loan Nos. 3, 9, 10 and 45, each of which has an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | |||||||||||

| Range of Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| $1,598,028 | - | $9,999,999 | 39 | $213,444,768 | 18.7% | 4.35605% | 116 | 1.59x | 10.2% | 67.3% | 55.8% |

| $10,000,000 | - | $19,999,999 | 9 | 122,288,816 | 10.7 | 4.45072% | 110 | 1.64x | 10.5% | 65.9% | 54.3% |

| $20,000,000 | - | $24,999,999 | 7 | 159,108,296 | 13.9 | 4.43849% | 108 | 1.64x | 9.7% | 67.0% | 59.3% |

| $25,000,000 | - | $49,999,999 | 8 | 298,449,818 | 26.1 | 4.33454% | 117 | 1.60x | 8.8% | 68.7% | 63.2% |

| $50,000,000 | - | $150,000,000 | 4 | 349,500,000 | 30.6 | 3.98260% | 98 | 2.51x | 10.6% | 53.3% | 51.9% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

| Mortgage Interest Rates |

Weighted Average | |||||||||||

Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 3.30699% | - | 4.40000% | 48 | $743,362,725 | 65.0% | 4.04257% | 118 | 1.94x | 9.6% | 61.9% | 56.1% |

| 4.40001% | - | 4.60000% | 11 | 252,287,088 | 22.1 | 4.53380% | 101 | 1.81x | 10.6% | 66.5% | 58.6% |

| 4.60001% | - | 4.80000% | 3 | 80,889,285 | 7.1 | 4.75799% | 67 | 1.90x | 10.1% | 65.2% | 63.8% |

| 4.80001% | - | 5.00000% | 3 | 36,952,600 | 3.2 | 4.95083% | 75 | 1.59x | 10.5% | 60.7% | 54.1% |

| 5.00001% | - | 5.25000% | 2 | 29,300,000 | 2.6 | 5.08782% | 120 | 1.43x | 11.0% | 66.5% | 47.2% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

Original Term to Maturity/ARD in Months(1) |

Weighted Average | |||||||||

Original Term to Maturity/ARD in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 60 | 5 | $168,035,990 | 14.7% | 4.70765% | 58 | 2.00x | 10.6% | 64.4% | 62.9% |

| 84 | 2 | 5,098,028 | 0.4 | 4.69327% | 84 | 1.32x | 9.4% | 65.6% | 55.6% |

| 120 | 60 | 969,657,679 | 84.8 | 4.17758% | 118 | 1.87x | 9.8% | 63.0% | 55.8% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% |

Remaining Term to Maturity/ARD in Months(1) | |||||||||

Weighted Average | |||||||||||

| Remaining Term to Maturity/ARD in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 57 | - | 60 | 5 | $168,035,990 | 14.7% | 4.70765% | 58 | 2.00x | 10.6% | 64.4% | 62.9% |

| 61 | - | 120 | 62 | 974,755,708 | 85.3 | 4.18028% | 118 | 1.86x | 9.8% | 63.0% | 55.8% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

| (1) | In the case of Loan Nos. 3, 9, 10 and 45, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (3) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

| Original Amortization Term in Months |

Weighted Average | |||||||||

Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Interest Only | 8 | $412,784,818 | 36.1% | 4.03383% | 101 | 2.50x | 10.2% | 54.3% | 54.3% |

| 240 | 2 | 14,766,817 | 1.3 | 4.93257% | 98 | 1.37x | 11.2% | 71.3% | 50.6% |

| 300 | 7 | 50,251,950 | 4.4 | 4.57973% | 117 | 1.64x | 11.4% | 64.8% | 48.2% |

| 360 | 50 | 664,988,113 | 58.2 | 4.35756% | 114 | 1.53x | 9.6% | 68.4% | 59.3% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% |

| Remaining Amortization Term in Months |

Weighted Average | |||||||||||

Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| Interest Only | 8 | $412,784,818 | 36.1% | 4.03383% | 101 | 2.50x | 10.2% | 54.3% | 54.3% | ||

| 239 | - | 240 | 2 | 14,766,817 | 1.3 | 4.93257% | 98 | 1.37x | 11.2% | 71.3% | 50.6% |

| 241 | - | 299 | 5 | 26,951,950 | 2.4 | 4.22853% | 118 | 1.84x | 12.2% | 64.8% | 47.2% |

| 300 | 360 | 52 | 688,288,113 | 60.2 | 4.37883% | 114 | 1.53x | 9.7% | 68.3% | 58.9% | |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

| Amortization Types |

Weighted Average | |||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| IO-Balloon | 25 | $456,525,499 | 39.9% | 4.29486% | 118 | 1.51x | 9.3% | 69.8% | 61.5% |

| Interest Only | 5 | 273,750,000 | 24.0 | 3.79667% | 107 | 2.82x | 10.9% | 47.8% | 47.8% |

| Balloon | 33 | 267,781,381 | 23.4 | 4.54333% | 107 | 1.59x | 10.6% | 65.6% | 52.9% |

| ARD-Interest Only | 3 | 139,034,818 | 12.2 | 4.50079% | 88 | 1.87x | 8.9% | 67.2% | 67.2% |

ARD-IO-Balloon(4) | 1 | 5,700,000 | 0.5 | 4.10000% | 118 | 1.41x | 8.2% | 62.8% | 57.1% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% |

Underwritten Net Cash Flow Debt Service Coverage Ratios(2) |

Weighted Average | |||||||||||

| Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 1.22x | - | 1.35x | 14 | $249,807,839 | 21.9% | 4.30594% | 117 | 1.32x | 8.5% | 71.4% | 63.0% |

| 1.36x | - | 1.45x | 12 | 119,193,786 | 10.4 | 4.47204% | 119 | 1.40x | 9.4% | 68.4% | 56.1% |

| 1.46x | - | 1.55x | 12 | 104,314,407 | 9.1 | 4.42582% | 105 | 1.51x | 9.6% | 69.3% | 59.6% |

| 1.56x | - | 1.65x | 6 | 80,058,991 | 7.0 | 4.33568% | 118 | 1.60x | 8.8% | 63.4% | 58.7% |

| 1.66x | - | 1.80x | 6 | 102,598,273 | 9.0 | 4.39062% | 107 | 1.75x | 10.7% | 65.3% | 56.8% |

| 1.81x | - | 2.00x | 10 | 229,475,906 | 20.1 | 4.51042% | 99 | 1.86x | 10.0% | 66.6% | 62.2% |

| 2.01x | - | 3.38x | 7 | 257,342,496 | 22.5 | 3.74140% | 107 | 2.97x | 11.8% | 46.4% | 45.0% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

| (1) | In the case of Loan Nos. 3, 9, 10 and 45, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (3) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (4) | In the case of Loan No. 45, the mortgage loan has an ARD feature with an anticipated repayment date of February 1, 2025, with an increase in the interest rate equal to the greater of (i) 6.60000% per annum or (ii) the 10 year treasury rate plus 250 basis points, until the final maturity date of October 1, 2035. Upon the anticipated repayment date, if the mortgage loan is not paid off in full, the monthly debt service payment will be a fully amortizing monthly payment of principal and interest calculated based on (i) a loan amount equal to the then outstanding principal balance as of the anticipated repayment date, (ii) an applicable interest rate and (iii) a loan term commencing on the anticipated repayment date and ending on the maturity date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

LTV Ratios as of the Cut-off Date(1)(2) |

Weighted Average | |||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(3) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 35.1% | - | 59.9% | 9 | $220,760,165 | 19.3% | 3.63123% | 114 | 2.95x | 11.4% | 42.0% | 40.7% |

| 60.0% | - | 64.9% | 13 | 193,337,165 | 16.9 | 4.45083% | 110 | 1.64x | 9.9% | 62.7% | 55.7% |

| 65.0% | - | 69.9% | 25 | 500,641,969 | 43.8 | 4.44674% | 103 | 1.74x | 9.8% | 67.7% | 61.1% |

| 70.0% | - | 77.5% | 20 | 228,052,399 | 20.0 | 4.28603% | 117 | 1.38x | 8.8% | 74.2% | 64.3% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

LTV Ratios as of the Maturity Date(1)(2)(3) |

Weighted Average | |||||||||||

Range of Maturity Date/ARD LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 35.1% | - | 44.9% | 4 | $168,072,056 | 14.7% | 3.45095% | 119 | 3.21x | 11.7% | 37.4% | 35.7% |

| 45.0% | - | 49.9% | 9 | 70,658,389 | 6.2 | 4.57801% | 119 | 1.79x | 12.0% | 62.9% | 48.2% |

| 50.0% | - | 54.9% | 11 | 115,753,002 | 10.1 | 4.46559% | 108 | 1.58x | 10.2% | 63.7% | 53.0% |

| 55.0% | - | 59.9% | 17 | 248,244,274 | 21.7 | 4.40619% | 112 | 1.71x | 10.3% | 66.1% | 57.5% |

| 60.0% | - | 64.9% | 17 | 268,929,159 | 23.5 | 4.29517% | 117 | 1.41x | 8.5% | 69.8% | 62.7% |

| 65.0% | - | 70.6% | 9 | 271,134,818 | 23.7 | 4.41298% | 91 | 1.84x | 9.4% | 69.8% | 67.6% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% | ||

| Prepayment Protection |

Weighted Average | |||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Defeasance | 54 | $805,229,844 | 70.5% | 4.18132% | 114 | 2.03x | 10.4% | 61.7% | 54.8% |

| Yield Maintenance | 12 | 313,723,936 | 27.5 | 4.40008% | 102 | 1.54x | 8.9% | 67.3% | 62.4% |

| None | 1 | 23,837,918 | 2.1 | 4.97000% | 57 | 1.54x | 9.9% | 60.7% | 56.2% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% |

| Loan Purpose |

Weighted Average | |||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Refinance | 51 | $783,694,155 | 68.6% | 4.20142% | 115 | 1.89x | 10.1% | 61.7% | 53.6% |

| Acquisition | 15 | 354,935,043 | 31.1 | 4.38269% | 98 | 1.89x | 9.6% | 66.4% | 64.1% |

| Recapitalization | 1 | 4,162,500 | 0.4 | 4.23000% | 119 | 1.41x | 9.3% | 75.0% | 61.9% |

| Total / Weighted Average: | 67 | $1,142,791,698 | 100.0% | 4.25783% | 109 | 1.88x | 9.9% | 63.2% | 56.9% |

| (1) | In the case of Loan Nos. 1, 4, 6, 7, 12 and 15, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan. In the case of Loan Nos. 1 and 6, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan No. 1, the UW NCF DSCR reflects the aggregate debt service payment of both tranches of debt comprising the Houston Galleria Mortgage Loan and both related Houston Galleria pari passu Companion Loans. |

| (2) | In the case of Loan Nos. 2, 36 and 61, the Cut-off Date LTV and the Maturity Date LTV are calculated using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool – Assessments of Property Value and Condition” in the Free Writing Prospectus for additional details. |

| (3) | In the case of Loan Nos. 3, 9, 10 and 45, each of which has an anticipated repayment date, Remaining Loan Term, Original Term To Maturity/ARD, Remaining Term to Maturity/ARD and Maturity Date LTV are as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Collateral Characteristics | ||

Previous Securitization History(1) |

| No. | Loan Name | Location | Property Type | Previous Securitization |

| 1 | Houston Galleria | Houston, TX | Retail | JPMCC 2005-LDP5, JPMCC 2006-CIBC14 |

| 7 | Shaner Hotels Portfolio | Various, Various | Hotel | GSMS 2006-GG6 |

| 12 | Horizon Outlet Shoppes Portfolio | Various, Various | Retail | WBCMT 2006-C23 |

| 16 | Diede Self Storage Portfolio(2) | Various, CA | Self Storage | MLCFC 2006-3 |

| 19.03 | Tractor Supply – West Hanover, PA | West Hanover, PA | Retail | BSCMS 2006-T24 |

| 21 | Toll House Hotel | Los Gatos, CA | Hotel | MLFT 2006-1 |

| 23.01 | Teaberry Greene Townhomes(3) | Fishersville, VA | Multifamily | BSCMS 2006-PW13, MSC 2007-T25, BSCMS 2007-PW17 |

| 25 | Sunkist Shopping Center | La Puente, CA | Retail | LBUBS 2005-C2 |

| 28 | Advenir at Casa Bella | Charlotte, NC | Multifamily | FNA 2013-M12 |

| 33 | Dunbar Village Plaza | Dunbar, WV | Retail | UBSC 2011-C1 |

| 34.01 | La Porte Self Storage | La Porte, TX | Self Storage | MSC 2006-HQ8 |

| 38 | 6 Industrial Way | Eatontown, NJ | Industrial | JPMCC 2005-LDP3 |

| 42 | Village at Thrashers | Bothell, WA | Retail | BACM 2005-2 |

| 43 | Compass Self Storage Portfolio | Various, GA | Self Storage | MSC 2005-HQ6 |

| 44 | Bank of America – Avenue U | Brooklyn, NY | Retail | BACM 2006-2 |

| 54 | Timbercreek Apartments | Spartanburg, SC | Multifamily | MLCFC 2007-8 |

| 59 | StaxUp Self Storage – Menifee | Menifee, CA | Self Storage | COMM 2005-LP5 |

| 61 | 8915 Rosedale Highway | Bakersfield, CA | Retail | JPMCC 2007-LDPX |

| 65 | Shady Grove MHC | Huntsville, AL | Manufactured Housing | JPMCC 2005-LDP3 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

| (2) | In the case of Loan No. 16, Diede Self Storage Portfolio, one Industrial property, Loan No. 16.03 Armor Struxx, was not included in the MLCFC 2006-3 securitization. |

| (3) | The mortgaged loan identified on Annex A-1 as “Teaberry Greene Townhomes and Creative Wonders” is secured by a portfolio of two mortgaged properties. The mortgaged property identified as “Teaberry Greene Townhomes” was previously securitized in three transactions: BSCMS 2006-PWR13, MSC 2007-T25 and BSCMS 2007-PW17, and such mortgaged property was referred to in such securitizations as “Teaberry Greene Townhomes”, “Trillium Townhomes” and “Trillium Townhomes Phase II”, respectively. The mortgaged property in the portfolio identified on Annex A-1 as “Creative Wonders” has not previously been securitized. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 | |

Class A-2(1) |

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity/ARD Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV Ratio | Maturity Date/ARD LTV Ratio | |

| 3 | 333 North Central Avenue | Phoenix, AZ | $71,500,000 | 6.3% | $71,500,000 | 43.6 | % | 60 | 60 | 1.92x | 10.0% | 65.0% | 65.0% |

| 4 | One Campus Martius | Detroit, MI | 50,000,000 | 4.4 | 50,000,000 | 30.5 | 60 | 57 | 2.54x | 12.1% | 66.5% | 66.5% | |

| 15 | Renaissance New Orleans Portfolio | New Orleans, LA | 23,837,918 | 2.1 | 22,053,864 | 13.5 | 60 | 57 | 1.54x | 9.9% | 60.7% | 56.2% | |

| 21 | Toll House Hotel | Los Gatos, CA | 17,431,255 | 1.5 | 16,026,773 | 9.8 | 60 | 57 | 1.66x | 10.2% | 58.1% | 53.4% | |

| 48 | Kings Road Apartments | Freeport, TX | 5,266,817 | 0.5 | 4,373,176 | 2.7 | 60 | 59 | 1.22x | 10.1% | 74.8% | 62.1% | |

| Total / Weighted Average: | $168,035,990 | 14.8% | $163,953,813 | 100.0 | % | 60 | 58 | 2.00x | 10.6% | 64.4% | 62.9% | ||

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date or anticipated repayment date, as applicable. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Maturity/ARD Balance divided by the initial Class A-2 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 |

| Structural Overview | |

| ■ | Accrual: | Each Class of Certificates (other than the Class R and Class Z Certificates) will accrue interest on a 30/360 basis. The Class R Certificates will not accrue interest. On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date during the related due period will be distributed to the holders of the Class Z Certificates. | |

| ■ | Distribution of Interest: | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class R and Class Z Certificates) at the applicable pass-through rate will be distributed in the following order of priority to the extent of available funds: first, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Certificates, on a pro rata basis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full. | |

The pass-through rate applicable to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR certificates on each Distribution Date will be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed pass-through rate and the rate described in clause (ii) above or (iv) the rate described in clause (ii) above less a specified percentage. | |||

| The pass-through rate for the Class X-A Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S Certificates, weighted on the basis of their respective Certificate Balances immediately prior to that Distribution Date and calculated without giving effect to any exchange and conversion of any Class A-S Certificates for Class EC Certificates. | |||

| The pass-through rate for the Class X-B Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class B Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-C Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class C Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-D Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class D Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-E Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class E Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-F Certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 |

| Structural Overview | |

| twelve 30-day months), over (b) the pass-through rate on the Class F Certificates for that Distribution Date. | |||

| The pass-through rate for the Class X-NR certificates for any Distribution Date will equal the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class NR certificates for that Distribution Date. | |||

| The Class EC Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest otherwise distributable on the portion of Exchangeable Certificates that have been converted in an exchange for such Class EC Certificates. | |||

| On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date during the related due period will be distributed to the holders of the Class Z Certificates. | |||

See “Description of the Certificates—Distributions” in the Free Writing Prospectus. | |||

| ■ | Distribution of Principal: | On any Distribution Date prior to the Cross-Over Date, payments in respect of principal of the Certificates will be distributed first, to the Class A-SB Certificates until the Certificate Balance of the Class A-SB Certificates is reduced to the planned principal balance for the related Distribution Date set forth in Annex E to the Free Writing Prospectus, second, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero, third, to the Class A-2 Certificates, until the Certificate Balance of such Class is reduced to zero, fourth, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero, fifth, to the Class A-4 Certificates, until the Certificate Balance of such Class is reduced to zero, sixth, to the Class A-SB Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. | |

On any Distribution Date on or after the Cross-Over Date, payments in respect of principal of the Certificates will be distributed first, to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates, on a pro rata basis, based on the Certificate Balance of each such Class until the Certificate Balance of each such Class is reduced to zero and then, to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. | |||

The “Cross-Over Date” means the Distribution Date on which the aggregate Certificate Balances of the Class A-S, Class B, Class C, Class D, Class E, Class F and Class NR Certificates (without giving effect to any exchange of the Exchangeable Certificates for Class EC Certificates) have been reduced to zero (after taking into account any allocation of realized losses on the mortgage loans (exclusive of any related companion loan) to such Classes on or prior to such date). If Exchangeable Certificates are converted in an exchange for Class EC Certificates, all principal that would otherwise be distributable to such converted Exchangeable Certificates will be distributed to such Class EC Certificates. | |||

The Class X-A, Class X-B, Class X-C, Class X-D, Class X-E, Class X-F and Class X-NR Certificates (the “Class X Certificates”) will not be entitled to receive distributions of principal; however, the notional amount of the Class X-A Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to Certificates that are components of the Class X-A Certificates’ notional amount (the Certificate Balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S Certificates (determined without giving effect to any exchange and conversion of any Class A-S Certificates for Class EC Certificates)), the notional amount of the Class X-B Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to Certificates that are components of the Class X-B Certificates’ notional amount (the Certificate Balance of the Class B Certificates (determined without giving effect to any exchange and conversion of any Class B |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 of 134 |  |

| Structural and Collateral Term Sheet | JPMBB 2015-C28 |

| Structural Overview | |

| Certificates for Class EC Certificates)), the notional amount of the Class X-C Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to Certificates that are components of the Class X-C Certificates’ notional amount (the Certificate Balance of the Class C Certificates (determined without giving effect to any exchange and conversion of any Class C Certificates for Class EC Certificates)), the notional amount of the Class X-D Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to the Certificates that are components of the Class X-D Certificates’ notional amount (the Certificate Balance of the Class D Certificates), the notional amount of the Class X-E Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to the Certificates that are components of the Class X-E Certificates’ notional amount (the Certificate Balance of the Class E Certificates), the notional amount of the Class X-F Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses allocated to the Certificates that are components of the Class X-F Certificates’ notional amount (the Certificate Balance of the Class F Certificates) and the notional amount of the Class X-NR Certificates will be reduced by the aggregate amount of principal distribution, realized losses and trust fund expenses allocated to the Certificates that are components of the Class X-NR Certificates’ notional amount (the Certificate Balance of the Class NR Certificates). | |||