Management’s discussion and analysis

The following Management’s Discussion and Analysis (MD&A) of the financial condition and results of our operations should be read in conjunction with our consolidated financial statements and notes relating the reto that are included elsewhere in this report. Our financial statements have been prepared in accordance with Canadian generally accepted accounting principles (GAAP). This discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements.

In our MD&A we use certain terms, which are specific to the oil and gas industry, including "netback" and "cash flow". These are non-GAAP terms with cash flow defined as cash generated from operating activities before changes in non-cash working capital and netback is defined within our MD&A.

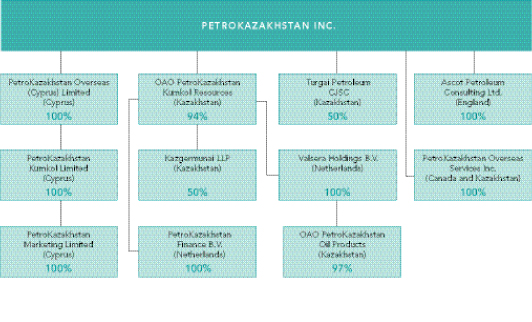

Except as otherwise required by the context, reference in this MD&A to "our", "we" or "us" refer to the combined business of PetroKazakhstan Inc. and all of its subsidiaries and joint ventures.

All numbers are in U.S.$’s unless otherwise indicated.

OVERVIEW AND STRATEGY

PetroKazakhstan Inc. is an integrated oil company that owns and operates oil and gas production and a refinery in Kazakhstan. We use the term “Upstream” to refer to the exploration for and production of oil and gas from our licenses in the South Turgai Basin, Kazakhstan. We use the term "Downstream" to refer to the operations of our refinery located in Shymkent, Kazakhstan, and the marketing of refined products and the management of the marketing of crude oil for Upstream.

In 2003, we almost doubled our net income and cash flow as compared to 2002. Production increased by 11.4% and we completed and brought into service our Kyzylkiya, Aryskum and Maibulak (KAM) pipeline, which significantly reduced our per unit transportation costs in the last quarter of 2003. Our gas utilization project (GUP), which will enable us to extract liquids and produce electricity for our oil fields was being commissioned at year end, as was our vacuum distillation unit (VDU) at our refinery, which will help improve our refining yields. We have made significant progress in opening new export routes for our crude oil and in addressing our transportation costs.

STRATEGY

PetroKazakhstan strives to be the leading integrated oil and gas company in Central Asia and an exemplary corporate citizen. Our goal is to create superior value for our shareholders and the Republic of Kazakhstan while protecting the health and safety of our people and the environment. The primary elements of our strategy are to:

| • | Open new transportation routes to international markets and reduce our transportation costs. |

| • | Increase our production and reserves through exploration and development of our existing fields and through selective acquisitions in Kazakhstan. |

| • | Improve the operational performance of our refinery. |

| • | Control and reduce our overhead and operating costs. |

| • | Manage our environmental and social responsibilities to ensure that we earn support from all stakeholders for PetroKazakhstan’s growth and operating plans. |

HIGHLIGHTS

Years Ended December 31 | | | 2003 | | | 2002 | | | 2001 | | | 2003 vs 2002 | | | 2002 vs 2001 | |

|

Net income( $000' s) | | | 317,488 | | | 162,568 | | | 169,340 | | | 95.3 | % | | (4.0 | %) |

Cash flow( $000 's)1 | | | 399,931 | | | 216,794 | | | 200,349 | | | 84.5 | % | | 8.2 | % |

| | | | | | | | | | | | | | | | | |

Basic net income per share | | | 4.06 | | | 2.01 | | | 2.12 | | | 102.0 | % | | (5.2 | %) |

Basic cash flow per share | | | 5.12 | | | 2.68 | | | 2.51 | | | 91.0 | % | | 6.8 | % |

| | | | | | | | | | | | | | | | | |

bopd2 | | | 151,349 | | | 135,842 | | | 100,877 | | | 11.4 | % | | 34.7 | % |

Capital expenditures | | | 203,213 | | | 140,102 | | | 110,207 | | | 45.1 | % | | 27.1 | % |

|

| 1 | Cash flow: We evaluate our operations based upon our net income and cash flow. Cash flow is a non-GAAP measure that re p resents cash flow from operations before changes in working capital. We consider this to be a key measure as we use this measure to evaluate our ability to generate cash to fund our growth through capital expenditures and our ability to repay debt. The comparable GAAP measure is cash flow from operating activities. The following table reconciles our non-GAAP measure cash flow to the comparable GAAP measure "Cash flow from operating activities". |

Years ended December 31( $ '000 s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Cash flow | | | 399,931 | | | 216,794 | | | 200,349 | |

Changes in non-cash operating working capital items | | | (60,581 | ) | | (37,816 | ) | | (48,396 | ) |

Cash flow from operating activities | | | 339,350 | | | 178,978 | | | 151,953 | |

|

| 2 | We report production before royalties as we measure our Upstream operations on this basis, which is consistent with industry practice in Canada. |

Analysis of net income and cash flow

Net income in 2003 improved primarily as a result of increases in the prices we received for crude oil and refined products and our higher production levels, partially offset by increases in our per unit transportation expenses, royalties and other taxes, depletion and depreciation and income tax expense. Despite positive improvements in production, sales volumes and crude oil prices, net income in 2002 decreased from 2001 due to higher income tax charges and a sharp decline in refined product prices. Cash flow was affected by the same factors that led to the increase in net income in 2003. Depreciation, which increased by $36.9 million in 2003 and $10.8 million in 2002, reduced net income but had no impact on cash flow, as it is a non-cash item.

NET RETURN PER BARREL

Set forth below are the details of the average net return achieved for export sales and sales derived from the refining of our own crude. These tables show averages across all types of sales contracts, and illustrate the relationship between exports of crude oil versus refining our own crude oil and marketing refined crude oil products.

| | | Crude Oil | | | Own Crude Oil | |

| | | Exports | | | Refined and Sold | |

|

| | | | | | | | |

Year ended December 31, 2003($/bbl) | | | | | | | |

Net sales price achieved | | | 21.32 | | | 17.20 * | |

Transportation costs | | | (7.21 | ) | | (1.09 | ) |

Selling costs | | | (0.19 | ) | | (0.71 | ) |

Crude utilized in refining | | | – | | | (1.04 | ) |

Refining cost | | | – | | | (0.51 | ) |

Royalties and taxes – Downstream | | | – | | | (0.40 | ) |

General and administrative costs – Downstream | | | – | | | (0.66 | ) |

|

Netback at Kumkol** | | | 13.92 | | | 12.79 | |

Production cost | | | (1.19 | ) | | (1.19 | ) |

Royalties and taxes – Upstream | | | (1.27 | ) | | (1.27 | ) |

General and administrative costs – Upstream | | | (0.59 | ) | | (0.59 | ) |

|

| | | | | | | | |

Net return per barrel | | | 10.87 | | | 9.74 | |

|

| | | | | | | | |

Year ended December 31, 2002($/bbl) | | | | | | | |

Net sales price achieved | | | 17.20 | | | 13.81 * | |

Transportation costs | | | (5.04 | ) | | (0.94 | ) |

Selling costs | | | (0.23 | ) | | (0.67 | ) |

Crude utilized in refining | | | – | | | (0.98 | ) |

Refining cost | | | – | | | (0.80 | ) |

Royalties and taxes – Downstream | | | – | | | (0.41 | ) |

General and administrative costs – Downstream | | | – | | | (0.64 | ) |

|

Netback at Kumkol** | | | 11.93 | | | 9.37 | |

Production cost | | | (1.22 | ) | | (1.22 | ) |

Royalties and taxes – Upstream | | | (1.16 | ) | | (1.16 | ) |

General and administrative costs – Upstream | | | (0.75 | ) | | (0.75 | ) |

|

| | | | | | | | |

Net return per barrel | | | 8.80 | | | 6.24 | |

|

| | | | | | | | |

Year ended December 31, 2001($/bbl) | | | | | | | |

Net sales price achieved | | | 12.34 | | | 16.52 * | |

Transportation costs | | | (1.87 | ) | | (0.84 | ) |

Selling costs | | | (0.15 | ) | | (0.86 | ) |

Crude utilized in refining | | | – | | | (0.88 | ) |

Refining cost | | | – | | | (0.78 | ) |

Royalties and taxes – Downstream | | | – | | | – | |

General and administrative costs – Downstream | | | – | | | (0.68 | ) |

|

Netback at Kumkol** | | | 10.32 | | | 12.48 | |

Production cost | | | (1.12 | ) | | (1.12 | ) |

Royalties and taxes – Upstream | | | (0.96 | ) | | (0.96 | ) |

General and administrative costs – Upstream | | | (0.76 | ) | | (0.76 | ) |

|

| | | | | | | | |

Net return per barrel | | | 7.48 | | | 9.64 | |

|

| * | Net sales price achieved shown in these tables do not include the price received for purchased refined products resold. |

| | |

| * * | Average Platts Brent or a similar index for each respective year does not reflect our average realized Brent price because of the timing of recognition of sales for financial statement purposes. Financial statement sales revenue is the basis used to determine the net sales price achieved in these tables. Therefore, a comparison of average Platts Brent or similar index to our netback at Kumkol cannot be used to determine our differential. |

During 2003, the netback at Kumkol for crude oil exports increased by $1.99 per barrel ($/bbl) compared to 2002 due to an increase in market prices (average Platts Brent was $28.83/bbl compared to $25.02/bbl in 2002) and the transportation cost reductions after the start up of the KAM pipeline. These were partially offset by an increase in pipeline and railway tariffs. The increase in non–free carrier (non–FCA) agreement sales of 90.0%, to 19.40 mmbbls in 2003 versus 10.21 mmbbls in 2002, increased both net sales price achieved and our transportation costs, as our sales point for crude oil, where title is transferred, was closer to the final destination.

The netback at Kumkol for own crude oil refined and sold increased substantially by $3.42/bbl compared to 2002 due to an improvement in yields and higher sales prices. This more than offset the loss in netback of $3.11/bbl between 2002 and 2001 when we suffered from low refined product prices.

We see a very similar pattern in the net return per barrel figures, since Upstream costs and taxes are applied equally to both measures.

KEY PERFORMANCE INDICATORS

We measure the performance of our Upstream and Downstream operations using the following key performance indicators.

Year ended December 31 | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

bopd | | | 151,349 | | | 135,842 | | | 100,877 | |

Differential* ($/bbl) | | | 14.11 | | | 13.97 | | | 13.47 | |

Average refined products price ($/bbl) | | | 17.18 | | | 13.59 | | | 16.64 | |

Production expense ($/bbl) | | | 1.19 | | | 1.22 | | | 1.12 | |

Refining cost ($/bbl) | | | 0.51 | | | 0.80 | | | 0.78 | |

General and administrative ($/bbl) | | | 1.25 | | | 1.39 | | | 1.44 | |

Effective income tax rate | | | 32.7 | % | | 37.9 | % | | 28.5 | % |

|

| * | Our differential is calculated as the difference between the average Brent price for crude oil export sales received by PetroKazakhstan Kumkol Resources (PKKR) and Turgai Petroleum (Turgai), and our netback at Kumkol. It is the sum of the costs and discounts incurred in order to transport and sell our crude oil to international markets. The sales revenue used in this measure differs from sales revenue in the statement of net income and the net return table for the following reasons. |

| • | The differential does not include Kazgermunai sales over which we have limited control. Kazgermunai is excluded because the differential is used to measure the performance of our internal marketing group. |

| | |

| • | The differential is calculated using finalized sales transactions. Our financial statements include estimates that may or may not reflect the finalized transactions. |

Barrels of oil per day (bopd).See Production and Processing for a discussion of our production.

Differentials.The graph below shows the evolution of our differential over the last three years. Of particular note are the movements between the last quarter of 2002 and the end of 2003.

There was an increase in the differential of $0.91/bbl between the fourth quarter of 2002 and the first quarter of 2003. Although this can be partially explained by an increase in the Kumkol-Tekesu pipeline tariff and rail tariff increases at the beginning of the year, the most significant factor was weather problems preventing us from using the port of Aktau during the first quarter of 2003, leading us to use less attractive routes, particularly the Atyrau-Samara pipeline to Odessa and direct rail to Novorossiisk. These sales increased the average differential for the first quarter of 2003.

In the second quarter of 2003, shipments via less attractive routes had virtually stopped, although a number of sales on these routes were completed in the quarter and affected the average.

During the third quarter of 2003, we began to use and benefit from the KAM pipeline, but very few sales of crude oil for oil transported through the pipeline were completed and included in the quarter. Most of the improvement in this quarter was due to our sales via Aktau and to Uzbekistan.

During the fourth quarter of 2003, our differential dropped to its lowest level for three years, as we began to see a significant contribution from sales through the KAM pipeline, as well as the benefit of sales to China via the Atasu terminal.

Bringing the KAM pipeline into service led to a reduction of approximately 1,300 kilometres (km) in our transportation distance to our western export markets, reducing our costs for those routes by about $2.00/bbl. The KAM pipeline project included a new rail-loading terminal at Dzhusaly in western Kazakhstan and we also commenced using a rail terminal at Atasu to ship oil to China. The addition of these rail terminals increases our export options, reduces our costs and breaks our historic dependency on one export route. All of these actions have led to decreases in our overall crude oil transportation costs. We expect this trend to continue in the future.

Offsetting these items, we have encountered significant increases in rail tariffs in Kazakhstan through rail tariff increases and the fact that rail tariffs in Kazakhstan are linked to the Swiss franc-U.S.$ exchange rate. Also in the fourth quarter of 2003 we incurred substantial demurrage charges and increased crude oil tanker rates of approximately $1.00/bbl for crude oil shipped via the Black Sea, as the Bosphorous Strait connecting the Black Sea to the Mediterranean became congested, because the Turkish government implemented new rules restricting tanker traffic at night. Rising crude oil production in Kazakhstan and Russia has led to increased competition for leased railcars cars, which in turn, has led to higher rental costs. To address this issue, Turgai purchased 600 railcars in November and December of 2003 and we plan to purchase up to 1,000 railcars in 2004. Tr ansportation costs will remain our primary focus in 2004.

Our differential is our single largest expenditure and the management of this cost is our primary objective. To achieve this we have formed a dedicated logistics team, taken control of our export routes by moving away from Free Carrier (FCA) sales, constructed and brought into service our KAM pipeline and have opened up a number of new routes to our export markets and expanded or opened new export markets including China, Iran and Uzbekistan. These initiatives have greatly enhanced our understanding of the dynamics of transportation of crude oil in the region and the underlying costs. In our view, rail tariffs in Kazakhstan are clearly not based on a cost plus system as is common with monopolies regulated by governments and the tariffs for the transportation of crude oil to export markets are used to subsidize the entire rail system in Kazakhstan. We are there f o re acti vely engaging the government in discussions, hosting conferences and educational seminars to improve all stakeholders' understanding of the issues involved and making representations to the government agencies responsible for setting transportation tariffs.

Average refined products price.Our average refined product prices received in 2003 recovered to $0.54 higher than 2001 prices after the disappointing prices we received in 2002. This was due to improvements in our yield such that we now obtain greater volumes of higher value products for each barrel of crude oil refined. In addition, international crude oil prices influence refined product prices albeit with a time lag, as does economic growth within Kazakhstan. The price of refined products in Russia has a significant impact on the market price in Kazakhstan as products from Russia can move across the border with relative ease and if refined product prices rise above Russian prices, the Kazakhstan market is subject to high levels of imports of refined products from Russia. This factor explains the decline in refined product price in 2002. We have also implemented a strategy whereby we sell directly to the end users of our products rather than through traders. Refined product prices will remain one of our primary areas of focus in 2004.

Production expenses.Production costs per barrel were lower in 2003 compared to 2002. This was mainly due to the benefit of higher production levels with a substantial amount of fixed costs. The increase in 2002 over 2001 was due to increased costs of handling formation water and higher insurance costs.

Refining cost. Refining costs in 2003 were significantly reduced on a per barrel of processed crude basis. This was partly due to the benefit of higher throughput, but was also due to the substantial refinery process improvements that have reduced energy requirements. We have also reduced the per unit cost of purchased steam. 2002 refining costs were a little higher than 2001, primarily due to higher repair and maintenance costs in 2002.

General and administrative expenses. Overall general and administrative expenses on an absolute basis are virtually unchanged in 2003 compared to 2002. On a per unit basis, we have experienced a substantial reduction in general and administrative expenses due to higher volumes produced and refined during 2003. These costs also decreased on a per unit basis between 2002 and 2001, as the higher production and refining rate in 2002 more than offset a rise in the absolute level of cost.

Effective income tax rate. The statutory tax rate in Kazakhstan, where all of our operations are located, is 30%. Our effective tax rate differs due to certain expenses, which cannot be deducted for statutory tax purposes. Our tax rate as a percentage of net income before tax of 32.7% in 2003 decreased from 37.9% in 2002, mainly because we refinanced our debt, increasing the deductibility of our interest expense. The effective income tax rate for 2001 was 28.5% due to the recognition of a deferred tax asset, which arose when we revalued our Upstream tax pools, as provided for in Kazakhstan tax legislation.

Sensitivities

The following table sets forth our estimate of the impact on annual net income and cash flow after tax to changes in our key performance indicators.

| | | | | | Net income and cash flow | |

| | | Change | | | after tax($ million | ) |

|

Crude oil | | | $1/bbl in dated Brent | | | 37.5 | |

Differential | | | $1/bbl change | | | 26.6 | |

Refined products price | | | $1/bbl in overall average | | | 17.6 | |

Production volume | | | 5% | | | 9.9 | |

Production cost | | | 10% | | | 5.6 | |

General and administrative expenses | | | 10% | | | 3.8 | |

Refining cost | | | 10% | | | 1.4 | |

|

The variable with the most significant impact on our business is the international Brent oil price. This directly impacts the value of our exports, and has a significant influence on refined product prices.

The differential has an equivalent per barrel impact as Brent on our exports of crude oil, while average refined product prices impact the value obtained for refined products sales.

Production volumes impact our results as we have more or less crude oil to sell or refine.

Changes in our production, general and administrative and refining costs are less significant because these costs represent a relatively low percentage of our total net income.

PRODUCTION AND PROCESSING

Production

Production levels in 2003 were affected by a number of factors unrelated to the technical performance of our fields. These included adverse weather conditions in the Caspian and Black Seas, which reduced producers' ability to export crude oil, restrictions in the transportation system and temporary suspension of production at the Aryskum field in mid-year. The fourth quarter also saw a temporary reduction of production in order to harmonize the operation of certain wells at the border of Kumkol South and Kumkol North fields. Future operating practices have been agreed at the technical level and full production should resume early in 2004.

The following table sets forth our barrels of oil produced per day by field and on a consolidated basis.

Field(bopd) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Kumkol South | | | 58,718 | | | 66,726 | | | 59,585 | |

Kumkol North | | | 29,746 | | | 22,810 | | | 15,876 | |

South Kumkol | | | 29,846 | | | 22,728 | | | 12,968 | |

Kyzylkiya | | | 7,925 | | | 6,941 | | | 2,973 | |

Aryskum | | | 7,000 | | | 4,330 | | | 58 | |

Maibulak | | | 1,051 | | | 824 | | | 750 | |

East Kumkol | | | – | | | 634 | | | – | |

North Nurali | | | 464 | | | – | | | – | |

Kazgermunai Fields | | | 16,599 | | | 10,849 | | | 8,667 | |

|

| | | | | | | | | | | |

Total | | | 151,349 | | | 135,842 | | | 100,877 | |

|

The following table sets forth the movements in inventory for our Upstream operations for the years ended December 31.

(mmbbls) | | | 2003 | | | 2002 | | | 2001 | |

| |

| | | | | | | | | | | |

Opening inventory of crude oil | | | 2.72 | | | 0.70 | | | 0.39 | |

Production | | | 55.24 | | | 49.58 | | | 36.82 | |

Crude oil purchased from third parties | | | 0.03 | | | 0.68 | | | – | |

Crude oil purchased from joint ventures (50%) | | | 0.25 | | | 2.92 | | | – | |

Sales or transfers | | | (54.53 | ) | | (51.08 | ) | | (36.47 | ) |

Transportation losses | | | (0.19 | ) | | (0.08 | ) | | (0.04 | ) |

Return of purchased crude | | | (0.65 | ) | | – | | | – | |

Closing inventory of crude oil | | | 2.87 | | | 2.72 | | | 0.70 | |

|

In 2002, our Upstream operations purchased 2.9 mmbbls of crude oil from Turgai. In 2003, almost all crude oil acquired from Turgai was purchased by our Downstream operations.

Under the terms of an agreement with the company assigned by the government to market royalty-in-kind volumes for 2002 we purchased 0.65 mmbbls of crude oil, which was in our inventory at December 31, 2002. This oil was returned in the first quarter of 2003.

The following table sets out our total crude oil sales and transfers from Upstream operations for the years ended December 31.

| | | 2003 | 2002 | 2001 |

| | | mmbbls | | | % | | | mmbbls | | | % | | | mmbbls | | | % | |

|

| | | | | | | | | | | | | | | | | | | | |

Crude oil exports | | | 27.99 | | | 51.3 | | | 25.89 | | | 50.7 | | | 18.15 | | | 49.8 | |

Crude oil transferred to Downstream | | | 18.85 | | | 34.6 | | | 16.82 | | | 32.9 | | | 10.83 | | | 29.7 | |

Crude oil transferred to | | | | | | | | | | | | | | | | | | | |

Downstream and exported | | | – | | | – | | | – | | | – | | | 0.15 | | | 0.4 | |

Crude oil transferred to Downstream | | | | | | | | | | | | | | | | | | | |

by joint ventures (50%) | | | 5.31 | | | 9.7 | | | 4.39 | | | 8.6 | | | 4.83 | | | 13.2 | |

Crude oil tolled by joint ventures (50%) | | | 0.35 | | | 0.7 | | | – | | | – | | | – | | | – | |

Royalty payments | | | 2.03 | | | 3.7 | | | 3.48 | | | 6.8 | | | 1.69 | | | 4.7 | |

Crude oil domestic sales | | | – | | | – | | | 0.50 | | | 1.0 | | | 0.82 | | | 2.2 | |

|

| | | | | | | | | | | | | | | | | | | | |

Total crude oil sales or transfers | | | 54.53 | | | 100.0 | | | 51.08 | | | 100.0 | | | 36.47 | | | 100.0 | |

|

REFINING

The refinery at Shymkent has a total operating capacity of 6.6 million tonnes per year or about 51.1 mmbbls per year. Crude oil feedstock for our refinery is primarily acquired from our Upstream operations, but purchases a re also made from third parties. Feedstock is refined into a number of products, which are generally sold domestically. The refinery also refines crude oil on behalf of third parties for a processing fee. Due to the relatively limited current size of the available market for sales of refined products in Kazakhstan, the refinery operated at 60% capacity or 30.6 mmbbls in 2003, 53% capacity or 27.1 mmbbls in 2002 and 51.5% capacity or 26.3 mmbbls in 2001.

Our total processed volumes were as follows:

(mmbbls) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Feedstock refined into product | | | 30.01 | | | 25.77 | | | 20.86 | |

Tolled volumes | | | 0.58 | | | 1.33 | | | 5.46 | |

|

| | | | | | | | | | | |

Total processed volumes* | | | 30.59 | | | 27.10 | | | 26.32 | |

|

* The total processed volumes are used for our per barrel calculations.

The refinery continues to focus on the improvement of yields while minimizing the production of heavier end and lower value products. The production of mazut (heavy fuel oil), a low value product, has been further reduced year-over-year. Mazut yield in 2003 averaged 32.5% versus 35.9% in 2002. This improvement year-over-year was attributable to the refinery’s continued focus on the optimization of refinery processes in its main operating units. When our VDU is brought on stream in early 2004, we expect to see further improvements in our yields in higher value products.

Sources of feedstock supplies for our refinery were as follows:

(mmbbls) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Acquired from PKKR | | | 18.85 | | | 16.82 | | | 10.98 | |

Purchased from joint ventures (100%) | | | 10.62 | | | 8.78 | | | 9.66 | |

Tolled by joint ventures (50%)* | | | 0.35 | | | – | | | – | |

Purchased from third parties | | | 0.08 | | | – | | | 0.59 | |

|

| | | | | | | | | | | |

Total feedstock acquired | | | 29.90 | | | 25.60 | | | 21.23 | |

|

| • | 50% of volumes tolled by our joint ventures are attributable to our joint venture partners and are not included in our inventory movements and ending inventory. |

The movements in our feedstock inventory at our refinery were as follows:

(mmbbls) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Opening inventory of crude oil feedstock | | | 0.20 | | | 0.34 | | | 0.08 | |

Purchase and acquisition of feedstock | | | 29.90 | | | 25.60 | | | 21.23 | |

Recoverable feedstock from traps | | | (0.06 | ) | | 0.03 | | | 0.04 | |

Feedstock sold for export | | | – | | | – | | | (0.15 | ) |

Feedstock refined into product | | | (30.01 | ) | | (25.77 | ) | | (20.86 | ) |

|

| | | | | | | | | | | |

Closing inventory of feedstock | | | 0.03 | | | 0.20 | | | 0.34 | |

|

The movement in inventory of refined products was as follows:

(mmtonnes) * | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Opening inventory of refined product | | | 0.22 | | | 0.20 | | | 0.13 | |

Refined product from feedstock | | | 3.64 | | | 3.09 | | | 2.55 | |

Refined product purchased | | | 0.02 | | | 0.09 | | | 0.09 | |

Refined product sold | | | (3.62 | ) | | (3.16 | ) | | (2.55 | ) |

Refined product internal use and yield losses | | | – | | | – | | | (0.02 | ) |

|

| | | | | | | | | | | |

Closing inventory of refined product | | | 0.26 | | | 0.22 | | | 0.20 | |

|

| • | The inventory of products represents a mix of products for which no unique conversion from barrels to tonnes exists. The standard conversion used by us for crude oil is 7.746 barrels to the tonne. |

RESULTS OF OPERATIONS

REVENUE

We derive our revenues principally from the sale of crude oil and refined products. To a much lesser extent, we also derive revenue from refining crude oil on behalf of third parties for which we receive processing fees, and production and ancillary support services provided to our joint venture Turgai on a fee basis. Our results are dependent on the levels of our oil production and on prevailing world prices for crude oil and Kazakhstan prices for refined products. Prices for oil and refined products are subject to large fluctuations in response to a variety of factors beyond our control .

We market and sell our crude oil for export under a variety of contracts. Crude production can be sold to third parties within Kazakhstan, normally at rail terminals in Kazakhstan. Under these contracts, called FCA agreements, sales title to the crude oil passes to the buyer at the point of loading the crude into railcars. The price achieved for these export sales is shown net of a differential to the prevailing Brent price at the time of the sale. The differential reflects a number of factors, the most significant of which relates to rail transportation costs. In the following tables included in our MD&A, these sales are shown as "Crude sales sold FCA".

Alternatively, we can sell crude at points closer to a final delivery point. Under this type of sale, where b y contracts are concluded on various alternative bases, including delivery at frontier (DAF), delivered duty unpaid (DDU), cost, insurance and freight (CIF), carriage paid to (CPT) and free on board (FOB), we arrange and assume all of the costs and obligations of transportation. The sales price reflects the Brent price less a differential. As with FCA sales, this differential reflects a number of factors, the most significant being remaining transportation costs to the final delivery point. With this type of sale, title to the crude oil does not pass to the buyer until the crude is loaded into an oil tanker at a port or the railcars pass the borders of Kazakhstan or reach a specific destination point. We do not record the associated revenue until title to the crud e oil passes to the buyer. This leads to significant volumes in transit, recorded as inventory. These sales a re shown in the tables as "crude sales sold non-FCA".

We recorded a significant increase in non-FCA sales in 2003 as compared to 2002 (19.40 mmbbls in 2003 versus 10.21 mmbbls in 2002). As at December 31, 2003, approximately 1.9 mmbbls of non-FCA sales were incomplete and hence, included in inventory. The effect of this was to cause an estimated $15.6 million of net income to be deferred into the first quarter of 2004. At the end of 2002 approximately 1.6 mmbbls of non-FCA sales were incomplete and included in inventory. Net income realized in 2003 from these sales was $14.1 million.

Revenue

Year ended December 31 | | | 2003 | | | 2002 | | | 2003 vs 2002 | | | % | |

|

| | | | | | | | | | | | | | |

Crude oil | | | 621,126 | | | 481,114 | | | 140,012 | | | 29.1 | |

Refined products | | | 481,326 | | | 332,639 | | | 148,687 | | | 44.7 | |

Service fees | | | 11,532 | | | 9,646 | | | 1,886 | | | 19.6 | |

Interest income | | | 3,340 | | | 1,951 | | | 1,389 | | | 71.2 | |

|

| | | | | | | | | | | | | | |

Total revenue | | | 1,117,324 | | | 825,350 | | | 291,974 | | | 35.4 | |

|

| | | | | | | | | | | | | | |

Year ended December 31 | | | 2002 | | | 2001 | | | 2002 vs 2001 | | | % | |

|

| | | | | | | | | | | | | | |

Crude oil | | | 481,114 | | | 252,981 | | | 228,133 | | | 90.2 | |

Refined products | | | 332,639 | | | 328,958 | | | 3,681 | | | 1.12 | |

Service fees | | | 9,646 | | | 18,631 | | | (8,985 | ) | | (48.2 | ) |

Interest income | | | 1,951 | | | 2,486 | | | (535 | ) | | (21.5 | ) |

|

| | | | | | | | | | | | | | |

Total revenue | | | 825,350 | | | 603,056 | | | 222,294 | | | 36.9 | |

|

Crude oil

The table below sets forth the crude oil revenue, volumes sold and net realized prices:

| | | Quantity | | | Net Realized | | | | |

| | | Sold | | | Price | | | Revenue | |

|

| | | (mmbbls) | | | ($/bbl | ) | | ($000’s | ) |

| | | | | | | | | | | |

2003 | | | | | | | | | | |

Crude sales sold FCA | | | 2.89 | | | 15.50 | | | 44,781 | |

Crude sales sold non-FCA | | | 19.40 | | | 23.22 | | | 450,542 | |

Kazgermunai export sales | | | 5.70 | | | 17.78 | | | 101,350 | |

Royalty payments | | | 2.03 | | | 12.05 | | | 24,453 | |

|

| | | | | | | | | | | |

Total | | | 30.02 | | | 20.69 | | | 621,126 | |

|

| | | | | | | | | | | |

2002 | | | | | | | | | | |

Crude sales sold FCA | | | 12.74 | | | 13.48 | | | 171,711 | |

Crude sales sold non-FCA | | | 10.21 | | | 22.70 | | | 231,766 | |

Kazgermunai export sales | | | 2.94 | | | 14.22 | | | 41,813 | |

Royalty payments | | | 3.48 | | | 9.27 | | | 32,247 | |

Crude oil domestic sales | | | 0.50 | | | 7.15 | | | 3,577 | |

|

| | | | | | | | | | | |

Total | | | 29.87 | | | 16.11 | | | 481,114 | |

|

| | | | | | | | | | | |

2001 | | | | | | | | | | |

Crude sales sold FCA | | | 15.58 | | | 11.34 | | | 176,720 | |

Crude sales sold non-FCA | | | 0.39 | | | 17.72 | | | 6,910 | |

Kazgermunai export sales | | | 2.33 | | | 18.16 | | | 42,307 | |

Royalty payments | | | 1.69 | | | 11.38 | | | 19,232 | |

Crude oil domestic sales | | | 0.82 | | | 9.53 | | | 7,812 | |

|

| | | | | | | | | | | |

Total | | | 20.81 | | | 12.16 | | | 252,981 | |

|

Our increase of $140.0 million in crude oil revenue for 2003 compared to 2002 was due to the increase in the average price we receive for our exported crude oil. Our total volumes of crude oil sold were virtually unchanged as our increase in production was processed through our refinery.

We increased our net realized price by $4.58/bbl. We achieved this increase mainly because the average Brent price for the year was $3.81/bbl higher than in to 2002. Additionally, we increased our non-FCA volumes, which obtain a higher price, as the sale is made closer to the final destination of the crude oil by 9.19 mmbbls. Kazgermunai also contributed to the increase because the joint venture increased its crude oil revenue by $59.6 million due to an almost doubling of export volumes and a $3.56 increase in the price received per barrel.

Our increase in crude oil revenue of $228.1 million in 2002 was due to an increase in volumes sold of 9.1 mmbbls or 43.7% and an increase in the price received of $3.95/bbl. The additional 9.1 mmbbls accounted for $146.0 million of the increase and the increase in price accounted for the remaining $82.1 million.

Our increased volumes were mainly due to our increased production. The increase in prices was mainly due to our increase in non-FCA sales as average Brent for the year was relatively unchanged at $25.02/bbl in 2002 versus $24.44/bbl in 2001.

We have significantly increased the percentage of our oil export sales sold through non-FCA contracts in 2003, which were 69.3% in 2003 (39.4% in 2002). By the end of 2003 there were no crude oil sales sold on an FCA basis.

Royalty payment volumes are physical deliveries made quarterly in arrears for all fields with the exception of North Kumkol. The royalty obligation for the fourth quarter of 2002 and first quarter of 2003 was settled in cash, and physical deliveries in 2003 were made for the second and third quarter royalty obligations for 2003. Royalty obligations in 2002, which cover the fourth quarter of 2001 and first nine months of 2002, were made in kind.

Refined products

The table below sets forth the products and related volumes sold for 2003, 2002 and 2001, and the average price obtained and revenue received by product line.

| | | Tonnes Sold | | | Average Price | | | Revenue | |

|

| | | | | | ($/tonne) | | | ($000’s) | |

| | | | | | | | | | | |

2003 | | | | | | | | | | |

Gasoline | | | 854,392 | | | 205.28 | | | 175,386 | |

Diesel | | | 1,239,182 | | | 152.48 | | | 188,949 | |

Mazut | | | 1,152,042 | | | 44.49 | | | 51,253 | |

LPG | | | 143,914 | | | 109.84 | | | 15,808 | |

Jet fuel | | | 216,449 | | | 226.20 | | | 48,960 | |

|

| | | | | | | | | | | |

Total self refined | | | 3,605,979 | | | 133.21 | | | 480,356 | |

Resale of purchased refined products | | | 11,106 | | | 87.34 | | | 970 | |

|

| | | | | | | | | | | |

Total refined product sales | | | 3,617,085 | | | 133.07 | | | 481,326 | |

|

| | | | | | | | | | | |

2002 | | | | | | | | | | |

Gasoline | | | 785,846 | | | 157.78 | | | 123,994 * | |

Diesel | | | 898,003 | | | 122.56 | | | 110,057 * | |

Mazut | | | 1,087,564 | | | 42.37 | | | 46,078 | |

Liquified petroleum gas | | | 108,931 | | | 79.35 | | | 8,644 | |

Jet fuel | | | 178,695 | | | 214.82 | | | 38,388 | |

|

| | | | | | | | | | | |

Total self refined | | | 3,059,039 | | | 106.95 | | | 327,161 * | |

Resale of purchased refined products | | | 101,023 | | | 54.23 | | | 5,478 | |

|

| | | | | | | | | | | |

Total refined product sales | | | 3,160,062 | | | 105.26 | | | 332,639 | |

|

| | | Tonnes Sold | | | Average Price | | | Revenue | |

|

| | | | | | ($/tonne) | | | ($000’s) | |

| | | | | | | | | | | |

2001 | | | | | | | | | | |

Gasoline | | | 548,503 | | | 207.54 | | | 113,838 | |

Diesel | | | 710,029 | | | 178.30 | | | 126,600 | |

Mazut | | | 1,045,682 | | | 50.00 | | | 52,284 | |

LPG | | | 107,079 | | | 92.71 | | | 9,927 | |

Jet fuel | | | 57,829 | | | 231.84 | | | 13,407 | |

|

| | | | | | | | | | | |

Total self refined | | | 2,469,122 | | | 128.00 | | | 316,056 | |

Resale of purchased refined products | | | 83,695 | | | 154.15 | | | 12,902 | |

|

| | | | | | | | | | | |

Total refined product sales | | | 2,552,817 | | | 128.86 | | | 328,958 | |

|

| • | We have classified excise taxes on gasoline and diesel for our tolled volumes as royalties and taxes, whereas we previously reduced our sales revenue. |

The increase in 2003 of $148.7 million was due to our higher average realized price of $133.07/tonne (compared to $105.26/tonne in 2002) and our higher sales volumes of 3.6 mm tonnes (compared to 3.2 mm tonnes in 2002). We were able to obtain higher prices and volumes for 2003 as compared to 2002, as demand in Kazakhstan increased. We also implemented a strategy of selling direct to end users and the prices in Kazakhstan were lower than in Russia, the alternative supplier.

We increased our refinery throughput in 2003, as we were experiencing interruptions in our ability to export crude oil at the beginning of the year. This led to a 457,000 tonne, or 14.5%, increase in refined product sales. Our average price increase of $27.81/tonne was mainly due to increases in prices received for gasoline and diesel. The price of mazut, which accounted for about 32% of our volume of refined products sold, had a very minor price increase of $2.12/tonne.

Refined product sales volumes in 2002 increased by 607,245 tonnes compared to 2001 because of our increased crude oil production and demand for refined products in Kazakhstan. This increase in volumes was offset by a decline in the average price received (from $128.86/tonne in 2001 to $105.26/tonne in 2002). This decline occurred mainly during the first quarter of 2002 due to pressure on prices from increased Russian imports, and from mazut pricing, as there was an oversupply during the export ban in the heating season from early fall of 2001 to late winter of 2002.

PRODUCTION EXPENSES

Production expenses relate to the cost of producing crude oil in our Upstream operations. Based on the number of barrels of oil produced, these costs were $1.19/bbl in 2003, $1.22/bbl for 2002 and $1.12/bbl barrel for 2001. Production expenses increased by $4.9 million in 2003. The main reason was the 11.4% increase in production volumes, which led to an increase of $3.8 million. The remaining $1.1 million was due to increased costs because of the increasing production of formation water.

The absolute increase between 2002 and 2001 of $19.4 million and the per barrel increase of $0.10 was the result of the increase in production volumes of 12.7 mmbbls or 35% in 2002 and additional maintenance work required due to increasing production of formation water.

ROYALTIES AND TAXES

The following table sets forth the components of royalties and taxes.

($000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Royalties and production bonus | | | 56,234 | | | 47,892 | | | 35,504 | |

Tax assessments | | | 5,426 | | | 5,121 | | | 573 | |

Other taxes | | | 20,635 | | | 15,701 * | | | 4,946 | |

|

| | | | | | | | | | | |

Royalties and taxes | | | 82,295 | | | 68,714 * | | | 41,023 | |

|

| • | We have classified excise taxes on gasoline and diesel for our tolled volumes as royalties and taxes, whereas we previously reduced our sales revenue. |

Royalties and production bonus

Royalties are levied at differing rates for each of our oil fields. The table below sets forth the parameters for each field. Royalty terms remain the same throughout the term of the license.

| | | | | | | Annual production | | | | | | | | | | |

| | | | | | | at which | | | Effective | | | Effective | | | Effective | |

| | | | | | | maximum royalty | | | average royalty | | | average royalty | | | average royalty | |

| Field | | | Range | | | is charged | | | rate for 2003 | | | rate for 2002 | | | rate for 2001 | |

|

| Kumkol South | | | 3.0 – 15.0% | | | 11.62 mmbbls | | | 10.3% | | | 10.9% | | | 10.4% | |

| Kumkol North | | | 9% | | | Flat | | | 9.0% | | | 9.0% | | | 9.0% | |

| South Kumkol | | | 10% | | | Flat | | | 10.0% | | | 10.0% | | | 10.0% | |

| Kyzylkiya | | | 1.5 – 2.5% | | | 24.8 mmbbls* | | | 1.5% | | | 1.5% | | | 1.5% | |

| Aryskum | | | 1.5 – 2.5% | | | 52.7 mmbbls* | | | 1.5% | | | 1.5% | | | 1.5% | |

| Maibulak | | | 3.0 – 6.0% | | | 3.9 mmbbls | | | 3.0% | | | 3.0% | | | 3.0% | |

| Kazgermunai Fields | | | 3.0 – 15.0% | | | 11.62 mmbbls | | | 6.12% | | | 4.5% | | | 4.2% | |

|

• Royalty rate is based upon cumulative life of field production.

Royalties and production bonus for 2003 were $56.2 million, which re p resented an effective overall royalty rate of 8.6% excluding production bonuses of $1.4 million. Royalties and production bonus for 2002 were $47.9 million, an overall royalty rate of 9.0%, after excluding the production bonuses of $4.0 million. The reason for the lower overall royalty rate was that a higher proportion of production came from fields with lower royalty rates.

Royalties and production bonus for 2001 were $35.5 million, which re p resented an effective overall percentage of 9.24%. Our effective overall royalty percentage decreased in 2002 and 2003 as we brought new fields with lower royalty rates on production. The absolute increase in royalties of 35% compared to 2001 was due to the increase in our production volumes.

Our production bonus expense was $1.4 million in 2003, $4.0 million in 2002 and $3.3 million in 2001. These a re production bonuses related to our Kumkol South, South Kumkol and North Kumkol fields. The bonus decreased by $2.4 million in 2003, because we accrue for the bonus as we produce our crude oil, and we paid the final amount for our Kumkol South field in February of 2003 and on our South Kumkol field in October of 2003. We have to pay a further $1.0 million (our 50% share) for North Kumkol when the cumulative production reaches 15,000,000 tonnes (116.2 mmbbls), which we expect to occur in 2005.

Tax assessments

Tax assessments of $5.4 million for 2003 and $5.1 million for 2002 re p resent tax assessments received. See Note 20 to our consolidated financial statements.

Other taxes

The increase in other taxes for 2003 compared to 2002 of $4.9 million included $4.1 million of expensed value added tax (VAT) and various other taxes. Tax legislation amendments introduced at the beginning of 2003 required the expensing of VAT for crude oil purchases made by the refinery. The absolute increase of $10.8 million in other taxes in 2002 included $10.6 million of excise tax on refined products and $0.2 million of various taxes. Excise tax on refined products was recovered through the sales prices for refined products.

TRANSPORTATION

Transportation costs are the costs of shipping crude oil from our Central Processing Facility (CPF) located at South Kumkol to our Shymkent refinery, our rail terminals at Tekesu (adjacent to our refinery), Dzhusaly and the terminal at Atasu for oil destined for China, the costs of trucking crude oil from the KAM fields to the CPF, railway transportation and pipeline costs under non-FCA crude sales contracts and on export of refined products. Transportation costs also include transportation of crude produced by our Kazgermunai joint venture to its export customers.

The pipeline tariff from the CPF to Shymkent depends on the ultimate destination of the crude oil. Effective January 1, 2003, an increase in pipeline tariffs charged for the Kumkol – Shymkent pipeline for crude oil destined for export was authorized by Kazakhstan’s Agency for Regulation of Natural Monopolies and Protection of Competition (ARNM). The official 2003 forecasted tenge-U.S.$ exchange rate is now being used to determine the tariff, as opposed to the previous practice of using actual exchange rates. This led to a 7.8% increase in the pipeline tariffs for crude oil exported through our rail loading terminal at Tekesu.

In 2003, the tariff was $1.52/bbl ($1.41/bbl in 2002 and 2001), while the tariff for crude oil processed at the refinery was $0.82/bbl in 2003 ($0.81/bbl in 2002 and $0.84/bbl in 2001).

The table below sets forth the components of transportation costs.

($000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Pipeline | | | 57,344 | | | 56,230 | | | 33,396 | |

Kazgermunai transportation | | | 18,675 | | | 8,462 | | | 8,829 | |

Railway | | | 141,131 | | | 93,305 | | | 6,255 | |

Other | | | 7,837 | | | 5,804 | | | 1,757 | |

|

| | | | | | | | | | | |

Total | | | 224,987 | | | 163,801 | | | 50,237 | |

|

Pipeline

The increase in pipeline costs of $1.1 million for 2003 compared to 2002 was due to a $2.7 million increase attributable to higher volumes supplied to Downstream for processing (24.51 mmbbls in 2003 compared to 21.21 mmbbls in 2002), $2.5 million due to the increased export tariff to Shymkent ($1.52/bbl in 2003 versus $1.41/bbl in 2002) and a $1.6 million increase in non-FCA pipeline costs ($10.5 million for 2003 compared to $8.9 million for 2002) because of our use of the Atyrau-Samara pipeline for the first six months of 2003. These increases were partially offset by $5.7 million in savings from using our KAM pipeline, when compared to exports of crude oil through our Tekesu rail terminal located in Shymkent.

The absolute increase in pipeline costs in 2002 was due to the increased volumes of crude oil exported in 2002 versus 2001, which attracted a higher tariff. In 2002, export volumes were 25.9 million barrels or 41% higher than for 2001.

Railway

Railway transportation increased by $47.8 million or 51.3% for 2003 compared to 2002 due to our increase in non-FCA sales. Non-FCA sales increased by 90.0% in 2003 compared to 2002 (19.40 mmbbls versus 10.21 mmbbls). Also, the ARNM approved a 6% increase in rail tariffs effective January 1, 2003. Railway transportation increased in 2002 as compared to 2001 due to our increase in non-FCA sales.

Other

Other transportation costs are mainly trucking costs incurred to transport crude oil from the KAM fields to the CPF located at Kumkol. Trucking costs have increased in 2003 to $7.8 million from $5.8 million in 2002 due to the increase in production from our KAM fields (5.8 mmbbls in 2003 compared to 4.4 mmbbls 2002). The Aryskum pumping station, which connects the KAM fields to the KAM pipeline, became operational in November 2003. This will significantly reduce our crude oil trucking costs. The increase other transportation costs in 2002 was in proportion to the increase in production from our KAM fields.

REFINING

Refining costs represent the direct costs related to processing all crude oil including tollers’ volumes at the refinery.

Refining costs for 2003 were $15.5 million ($0.51/bbl) compared to $21.7 million ($0.80/bbl) in 2002. The main reason for the $6.2 million decrease in refining costs was that purchased steam costs were lower as a result of process improvements and equipment upgrades combined with a lower price per unit. With no major t u r n a round in 2003, the refinery’s repairs, maintenance and other expenses were also $1.0 million lower, and $1.0 million of insurance costs were reclassified from refining to general and administrative expenses.

Total refining costs in 2002 increased by $1.1 million from $20.6 million ($0.78/bbl) in 2001. The increase was mainly due to increased repair and maintenance at the refinery in 2002 as part of our ongoing maintenance program. In August of 2002, six refinery workshops, including the transportation, construction and repair workshops each of which has a direct impact on refining costs, became independent from the refinery. Costs of separating these workshops were included in refining costs for 2002.

CRUDE OIL AND REFINED PRODUCT PURCHASES

Crude oil and refined product purchases re p resent the expensed portion of crude oil purchased for the refinery from third parties, as well as refined products purchased for resale. Purchases and sales between our Upstream and Downstream business units are eliminated on consolidation.

Our purchases of crude oil and refined products were as follows:

($000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Crude oil | | | 55,886 | | | 69,410 | | | 64,373 | |

Refined products | | | 574 | | | 3,917 | | | 14,415 | |

|

| | | | | | | | | | | |

Total | | | 56,460 | | | 73,327 | | | 78,788 | |

|

The purchases of crude oil were mainly made from our joint venture .

SELLING

Selling expenses for crude oil are comprised of customs, quality inspection and costs related to the export of crude oil. Selling expenses for refined products are comprised of the costs of operating the distribution centres for our Downstream operations.

($000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Crude oil | | | 10,494 | | | 3,471 | | | 5,622 | |

Refined products | | | 16,046 | | | 19,782 | | | 13,655 | |

|

| | | | | | | | | | | |

Total | | | 26,540 | | | 23,253 | | | 19,277 | |

|

The increase in crude oil selling expenses during 2003 compared to 2002 was the direct result of increased export sales volumes related to non-FCA routes, for which all selling costs are borne by us, as well as the increase in Kazgermunai sales and a reclassification of certain crude oil marketing costs to selling from general and administrative expenses.

The decrease in selling expenses on refined products during 2003 was due to the fact that in 2002 Downstream refunded $1.1 million of transportation discounts it had received, as it had not met the throughput obligations under a transportation contract. This contract is no longer in effect. An additional $1.0 million in 2002 was due to one time charges in 2002 including settlement payments and storage charges.

The increase in refined products revenue in 2002 compared to 2001 was attributable to the increase in volumes sold.

GENERAL AND ADMINISTRATIVE

The table below analyzes total general and administrative costs for Upstream, Downstream and Corporate In the case of Upstream and Downstream the general and administrative costs are also reflected on a per barrel basis.

| | | General and | | | Per Barrel of Oil | |

| | | Administrative | | | Produced or Processed * | |

|

| | | ($000’s) | | | ($/bbl | ) |

| | | | | | | | |

2003 | | | | | | | |

Upstream | | | 32,721 | | | 0.59 | |

Downstream | | | 20,285 | | | 0.66 | |

Corporate | | | 5,483 | | | | |

|

| | | | | | | | |

Total | | | 58,489 | | | | |

|

| | | | | | | | |

2002 | | | | | | | |

Upstream | | | 37,093 | | | 0.75 | |

Downstream | | | 17,216 | | | 0.64 | |

Corporate | | | 4,570 | | | | |

|

| | | | | | | | |

Total | | | 58,879 | | | | |

|

| | | | | | | | |

2001 | | | | | | | |

Upstream | | | 28,024 | | | 0.76 | |

Downstream | | | 17,906 | | | 0.68 | |

Corporate | | | 5,564 | | | | |

|

| | | | | | | | |

Total | | | 51,494 | | | | |

|

* Including tollers’ volumes

Upstream expenses decreased by $4.4 million in 2003 due to the reclassification of certain costs relating to crude oil marketing. Downstream general and administrative expenses increased by $3.1 million mainly due to a reclassification of insurance costs of $1.0 million from refining costs, severance payments to employees for the divested business units of $0.9 million and service fees of $1.2 million, paid to the divested business units.

The increase in total general and administrative expenses in 2002 of $7.4 million compared to 2001 was due to increased activity in Upstream operations, including increases in staff, insurance, legal and consulting costs. There was also a change in 2002 in the method of allocating centrally incurred general and administrative costs whereby a higher percentage of costs are allocated to Upstream.

Our Upstream field office is in Kyzylorda, the majority of our Upstream staff is located there, and all related costs are classified as general and administrative as opposed to production expenses.

INTEREST AND FINANCING

The following table sets forth our interest and financing costs and any related amortization of debt issue costs or discounts upon issuance of the debt instrument.

($000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Short-term debt | | | 754 | | | 1,470 | | | 1,855 | |

Term facility | | | 9,858 | | | 4,106 | | | – | |

9.625% Notes | | | 11,860 | | | – | | | – | |

12% Notes | | | 8,718 | | | 24,936 | | | 8,881 | |

Kazgermunai debt | | | 1,657 | | | 3,447 | | | 5,960 | |

Term loans | | | 594 | | | 332 | | | – | |

PKOP bonds | | | 2,576 | | | 1,514 | | | 1,029 | |

Canadian and U.S. Notes | | | – | | | – | | | 1,805 | |

|

| | | | | | | | | | | |

Less portion capitalized | | | (438 | ) | | (332 | ) | | – | |

|

| | | | | | | | | | | |

Total | | | 35,579 | | | 35,473 | | | 19,530 | |

|

| • | Our short-term debt interest expense decreased by $0.7 million due to the repayment of all working capital facilities by the end of 2003. |

| | |

| • | Our term facility interest expense increased by $5.8 million due to the repayment of the previous $60.0 million facility and entering a new $225.0 million facility. |

| | |

| • | Our 9.625% Notes interest expense arose only in 2003 as these notes were issued in February 2003. |

| | |

| • | Our 12% Notes interest expense in 2003 is $8.7 million including $6.6 million of issue costs that were expensed when we redeemed these notes, whereas 2002 includes interest for the entire year. |

| | |

| • | Interest on our Kazgermunai debt decreased by $1.8 million due to an $18.3 million (50%) repayment of a portion of the debt. |

| | |

| • | Interest on our PetroKazakhstan Oil Products (PKOP) bonds increased by $1.1 million due to the issuance of the remaining 115,200 bonds in February 2003. |

DEPRECIATION AND DEPLETION

| | | Depreciation | | | Depreciation | |

| | | & Depletion | | | & Depletion | |

|

| | | ($000’s) | | | ($/bbl | ) |

2003 | | | | | | | |

Upstream | | | 62,954 | | | 1.14 | |

Downstream | | | 18,849 | | | 0.62 | |

Corporate | | | 182 | | | | |

|

| | | | | | | | |

Total | | | 81,985 | | | | |

|

| | | | | | | | |

2002 | | | | | | | |

Upstream | | | 31,647 | | | 0.64 | |

Downstream | | | 13,347 | | | 0.49 | |

Corporate | | | 94 | | | | |

|

| | | | | | | | |

Total | | | 45,088 | | | | |

|

| | | | | | | | |

2001 | | | | | | | |

Upstream | | | 24,116 | | | 0.65 | |

Downstream | | | 9,764 | | | 0.37 | |

Corporate | | | 374 | | | | |

|

| | | | | | | | |

Total | | | 34,254 | | | | |

|

• Downstream includes tollers’ volumes

Upstream depreciation and depletion increased by $31.3 million during 2003 compared to 2002. This increase was mainly due to an increase in the amounts subject to depletion or depreciation as a result of capital expenditures. Our 11.4% increase in production and 10.4% decline in proved producing reserves also increased our depletion charge. Downstream depreciation increased by $5.5 million in 2003 compared to 2002 mainly due to additional depreciation for assets, which were under construction in 2002.

Depreciation and depletion increased by $10.8 million in 2002 compared to 2001. This increase was due to the increase in production as compared to 2001 and capital additions in 2002. The effect of these increases was partly offset by an increase in proved producing reserves.

In accordance with Canadian and United States accounting standards, and to provide comfort that anticipated future revenues are sufficient to cover the capitalized costs of properties, we perform a quarterly "ceiling test". The ceiling test for 2003 demonstrated that future net revenues exceed the carrying value of the Upstream properties under the full cost method of accounting.

UNUSUAL ITEMS

There were no unusual items during the year ended December 2003.

We were named as defendants in a claim filed by a company alleging it was retained under a consulting contract. The arbitration decision was received in 2002 and we accrued and paid $7.1 million for full settlement of the claim. In 2001, we incurred $5.5 million in costs defending against a potential takeover bid.

INCOME TAXES

| | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Upstream | | | 82,450 | | | 72,237 | | | 52,713 | |

Downstream | | | 68,632 | | | 18,413 | | | 9,891 | |

Corporate | | | 4,359 | | | 9,845 | | | 5,790 | |

|

| | | | | | | | | | | |

Total | | | 155,441 | | | 100,495 | | | 68,394 | |

|

The increase in income taxes of $54.9 million in 2003 was mainly the result of the increase in sales volumes and in the price of crude oil and refined products, which led to an increase in income before income taxes of $210.1 million.

The increase in income taxes of $32.1 million in 2002 was a result of the following items:

| • | Upstream tax charges had increased due to an increase in sales volumes and in the price of crude oil. |

| • | $11.3 million due to the recognition of a deferred tax asset in 2001, which reduced 2001 taxes by a corresponding amount. |

| • | $7.5 million due to the non-deductibility for tax purposes of interest paid on the 12% Notes. |

| • | $4.5 million due to court decision with respect to the tax rate for South Kumkol. |

Kazakhstani income taxes are based upon stabilized tax regimes under the terms of our hydro carbon contracts. The majority of the differences are temporary differences where an expense item is recorded for Canadian generally accepted accounting principles (GAAP) purposes in a diff e rent period than allowed under the terms of our hydrocarbon contracts. The income tax rate is 30%.

The foundation agreement for Kazgermunai provides for a tax on the profits of Kazgermunai with respect to its operations in the Akshabulak, Nurali and Aksai fields. The foundation agreement provides for taxes of:

Range($ millions) | | | Income tax rate | |

|

| | | | | |

| Up $20.0 | | | 25 | % |

| $20.0 – $30.0 | | | 30 | % |

| $30.0 – $40.0 | | | 35 | % |

| Over $40.0 | | | 40 | % |

|

Corporate tax expenses are taxes paid by PetroKazakhstan Overseas Services, the company that provides services to the operating subsidiaries in Kazakhstan, and includes the tax impact of non-deductible interest. See Note 17 of the Consolidated Financial Statements for further information pertaining to income taxes.

Excess profits tax has been negotiated with the Kazakhstani government in each hydrocarbon contract with the exception of the Kazgermunai licenses. With respect to the Kumkol South, South Kumkol and KAM fields, we are subject to excess profit tax at rates that vary from 0% to 30% based on the cumulative internal rate of return. With respect to Kumkol North, we are subject to excess profit tax at rates that vary from 0% to 50% based on the cumulative internal rate of return. We have not incurred any excess profit tax with respect to production from any of our fields. We expect to incur excess profit tax in 2004 within our Turgai joint venture .

CAPITAL EXPENDITURES AND COMMITMENTS

The table below sets forth a breakdown of our capital expenditures in 2003, 2002 and 2001.

(000’s) | | | 2003 | | | 2002 | | | 2001 | |

|

| | | | | | | | | | | |

Upstream | | | | | | | | | | |

Development wells | | | 56,767 | | | 40,489 | | | 10,650 | |

Facilities and equipment | | | 92,002 | | | 67,884 | | | 79,330 | |

Exploration | | | 34,365 | | | 23,502 | | | 10,279 | |

Downstream | | | | | | | | | | |

Refinery HS&E | | | 704 | | | 773 | | | 796 | |

Refinery sustaining | | | 2,571 | | | 4,019 | | | 5,046 | |

Refinery return projects | | | 15,024 | | | 3,364 | | | 3,013 | |

Marketing & other | | | 771 | | | 71 | | | 477 | |

Corporate | | | 1,009 | | | – | | | 616 | |

|

| | | | | | | | | | | |

Total capital expenditure | | | 203,213 | | | 140,102 | | | 110,207 | |

|

| | | | | | | | | | | |

Less accrued amounts | | | (6,743 | ) | | (3,250 | ) | | (7,475 | ) |

|

| | | | | | | | | | | |

Total cash capital expenditure | | | 196,470 | | | 136,852 | | | 102,732 | |

|

For 2003, facilities and equipment included $35.4 million for KAM pipeline costs (2002 – $27.1 million), $18.4 million GUP costs (2002 – $10.6 million) and $11.2 million purchased for railcars.

In 2004, capital expenditures will be incurred for:

Upstream

• full development of the Kyzylkiya and Aryskum fields.

• completion of the development of Kumkol North.

• initial development of the North Nurali, Nurali and Aksai fields.

• exploration and appraisal, to include the drilling of seven wells and seismic acquisition.

• installation of additional production facilities for the Akshabulak field.

• construction of a gas plant at Akshabulak.

• commencement of a pilot study for enhanced oil recovery.

Downstream

• studies and installation of metering equipment for process optimization and safety equipment.

Marketing and transportation

• the acquisition of 1,000 railcars for transporting of crude oil and refined products.

• infrastructure upgrades at various storage facilities and transport terminals.

Our 2004 capital budget is $175.4 million, which has been allocated as follows (in $ millions):

Upstream, including joint ventures | | | 110.1 | |

Downstream | | | 16.0 | |

Marketing and transportation | | | 48.7 | |

Corporate | | | 0.6 | |

|

| | | | | |

Total | | | 175.4 | |

|

Our capital budget for 2004 includes commitments of $6.0 million and $4.0 million respectively, for our new exploration blocks acquired through our Orient farm-in and license #952 acquisition. We have a commitment for construction of a gas plant at Kazgermunai; our 50% share is $11.5 million. These commitments are included in our capital budget. The remainder of our capital budget can be modified, if necessary, to meet changing circumstances. See Note 13 to our consolidated financial statements for a schedule of our required debt repayments for the next five years.

We have operating leases for our premises in Calgary, Alberta and Windsor, England, the impact of which is insignificant.

Capital investments are judged against our internal investment criteria that require that:

| • | investments generate a real return of 15%, and additionally. |

| • | that the present value discounted at 15% of the return from the investment is sufficient to repay the investment plus a 50% premium. |

| • | the long term real Brent oil price used is $19.00/bbl. |

LIQUIDITY

The levels of cash, current assets and current liabilities as at December 31, 2003 and December 31, 2002 a reset forth below.

($000’s) | | | 2003 | | | 2002 | |

|

| | | | | | | | |

Cash and cash equivalents | | | 184,660 | | | 74,796 | |

Cash flow(for the year ended) | | | 399,931 | | | 216,794 | |

Working capital* | | | 151,737 | | | 92,541 | |

Net debt** | | | 135,220 | | | 233,308 | |

Ratio of cash flow to net debt | | | 3.0 | | | 1.0 | |

Ratio of cash flow to fixed charges*** | | | 11.2 | | | 6.1 | |

Ratio of earnings to fixed charges**** | | | 14.3 | | | 8.5 | |

|

| * | Working capital is net of cash and short-term debt |

| ** | Net debt includes short-term and long-term debt less cash |

| *** | Fixed charges includes interest expense and preferred dividends before tax |

| **** | Earnings is income before income taxes plus fixed charges |

At December 31, 2003, we had $220.1 million of cash including $35.5 million in restricted cash. Our restricted cash includes $25.0 million on deposit in a margin account to support our hedging of crude oil prices for 2005 (as set out in Note 17 to our consolidated financial statements) and $10.5 million in a debt service reserve account re p resenting three months principal and interest on our term facility. The required amount for the debt service reserve account diminishes as the facility is repaid.

We have retained these cash balances as we have been pursuing possible acquisitions for some time and while no agreements have been reached, serious conversations are progressing and are at a sufficiently advanced stage that our view is that cash should be retained for this purpose.

Our net working capital has increased mainly because our accounts receivable have increased. We do not anticipate substantial increases in net working capital. Virtually all crude oil sales are now on a non-FCA basis and this had led to a $17.0 million increase in accounts receivable. We had a $13.1 million increase in VAT recoverable due to the timing expenditures and the recognition of revenue subject to VAT. We had taxes recoverable of $7.6 million relating to a penalty assessed for non-payment of road fund taxes. See Note 20 to our consolidated financial statements. These amounts will be recovered through reducing our cash tax payments in 2004. The increase in the receivable from Turgai is from amounts owed to us for our KAM pipeline and GUP.

In 2004, we plan to fund our capital budget of $175.4 million and required debt repayments of $62.2 million from cash flow. It would require Brent prices of less than $19.00/bbl or an increase in our differential of $6.00/bbl or a combination of factors leading to the same reduction in cash flow, before we would require additional funds to finance our budgeted capital expenditures and required debt repayments.

In Kazakhstan, we have lines of credit available of $72.0 million. We entered into a $225.0 million pre-export term facility on January 2, 2003 and issued $125 million of 9.625% notes. Our debt covenants, as described in Note 13 to our consolidated financial statements will not, in our view, restrict or limit our plans. Our aim is to structure our balance sheet to help weather the periods of volatility our industry experiences. In the current economic climate, opportunities to restructure our debt or lower our effective interest rate may arise. We will evaluate these possibilities in 2004.

RISK ANALYSIS

We operate in a highly competitive industry, the oil and gas industry. We face competition for new licences, qualified staff, markets for our crude oil exports and our refined products.

Key performance indicators

Please refer to the section entitled Key Performance Indicators of our MD&A for a discussion of these indicators and their impact on our business.

Reserves and production

The addition of oil and gas reserves and our ability to develop these reserves is one of the key factors to our success. New exploration acreage must be acquired through acquisitions or obtaining additional licenses. We have been successful over the last year with the addition of license #952 and our agreement to farm-in for a 75% working interest in license #951-D. We are actively pursuing acquisitions while adhering to our investment criteria. We believe we are well positioned to continue to succeed as we have a demonstrated track re c o rd in discovering and developing reserves, continual involvement with the industry in Kazakhstan and with the Government of Kazakhstan and we have the financial capacity to execute transactions. This is a highly competitive process.

Our ability to discover new reserves and develop our reserves is another key to our success. We have introduced and continue to utilize western technology in exploring for and developing reserves. We have the financial capacity to acquire and implement this technology but we compete for the staff and intellectual capacity necessary to fully utilize this technology. We have successfully addressed this through offering competitive compensation and recruiting on a worldwide basis. The recruitment of staff is a highly competitive process.

Evaluation of oil and gas reserves

The process of estimating our oil and gas reserves is complex and requires significant assumptions and decisions in the evaluation of engineering, geological, geophysical and financial information. On an annual basis McDaniel & Associates Consultants Ltd. of Calgary, Alberta, perform an independent evaluation of our reserves. This reserve evaluation may change substantively from year to year as a result of numerous factors, including and not limited to the development and economic conditions, under which we operate our business. As a result, despite all reasonable efforts involved in the process of evaluation, the estimation of our reserves may materially change from period to period.

Taxes

We have been engaged in litigation with respect to tax assessments received for the years 1998 to 2001. We participated in a high level Working Group formed by the Minister of Finance to resolve our disputable issues arising from this litigation and for issues yet to be litigated. We have successfully resolved these issues. See Note 20 to our consolidated financial statements.

We expect to have tax audits for 2002 and 2003 during the second quarter of 2004. The tax assessments could be significant as we experience inconsistent application and interpretation of the tax legislation applicable to each of our hydrocarbon contracts. The tax legislation applicable to each of our hydro carbon contracts is stabilized at the legislation in effect on the date of signing the contract, all of which were signed from 1996 through 1998. As the legislation applicable to our contracts is from five to eight years old, the expertise pertaining to this legislation is diminishing within the tax inspectorate.

Kazakhstan environment and legislation

We have received assessments from the ARNM relating to the sale of refined products in Kazakhstan. The impact of these assessments will be significant, if we do not prevail in our opinion with respect to these assessments.

See Note 20 to our consolidated financial statements.

Financial risks

See Note 20 to our consolidated financial statements.

CRITICAL ACCOUNTING ESTIMATES

Property, plant and equipment

We follow the full cost method of accounting for oil and gas operations whereby all acquisition, exploration and development expenditures are capitalized. This may lead to the capitalization of costs for which no direct future benefit will be obtained. We perform a ceiling test or cost recovery test on a quarterly basis to assess impairment of the carrying cost of our reserves. The ceiling test is based on a number of estimates. We use our independent reservoir engineer’s estimate of our production from our proved reserves and our year-end prices received, actual costs incurred to produce our reserves and run our operations and our estimated future development costs to develop our proved reserves. All of these estimates are subject to uncertainty.

We use the unit-of-production method for calculating depletion of our oil and gas assets. Our reserve estimates and production volumes have a significant impact on our depletion expense.

Site restoration costs

We provide for our estimated future site restoration, facility disassembling and other abandonment costs using the unit-of-production method. These estimated costs are depleted over the estimated useful life of the related assets and recorded as part of depreciation and depletion expense. These costs are based on the engineering estimates using current rates, existing legislation and industry practices, and therefore, can be impacted by changes in laws, reserve estimate, production rates, number of wells drilled, well depth and geographical conditions. Our site restoration estimate is regularly reviewed and changes in our estimate of site restoration costs could have a material impact.

ADOPTION OF CERTAIN ACCOUNTING STANDARDS

See Note 2 Changes in Accounting Standards and Note 21 Reconciliation of Results from Canadian GAAP to U.S. GAAP to our consolidated financial statements.

QUARTERLY INFORMATION

The table below sets forth selected quarterly information for 2003, 2002 and 2001.

| | | | | | | | Net Income ($/share) |

($000’s) | | | Total Revenue | | | Net Income | | | Basic | | | Diluted | |

|

2003, Quarter Ended | | | | | | | | | | | | | |

March 31 | | | 248,923 | | | 68,224 | | | 0.86 | | | 0.83 | |

June 30 | | | 254,601 | | | 68,211 | | | 0.87 | | | 0.84 | |

September 30 | | | 303,152 | | | 90,733 | | | 1.17 | | | 1.12 | |

December 31 | | | 310,648 | | | 90,320 | | | 1.16 | | | 1.11 | |

|

2002, Quarter Ended | | | | | | | | | | | | | |

March 31 | | | 143,331 | | | 23,109 | | | 0.29 | | | 0.28 | |

June 30 | | | 177,398 | | | 33,808 | | | 0.42 | | | 0.40 | |

September 30 | | | 247,962 | | | 60,513 | | | 0.74 | | | 0.71 | |

December 31 | | | 256,659 | | | 45,138 | | | 0.56 | | | 0.54 | |

|

2001, Quarter Ended | | | | | | | | | | | | | |

March 31 | | | 139,243 | | | 55,372 | | | 0.69 | | | 0.67 | |

June 30 | | | 174,849 | | | 44,435 | | | 0.56 | | | 0.54 | |

September 30 | | | 160,743 | | | 46,490 | | | 0.58 | | | 0.55 | |

December 31 | | | 128,221 | | | 23,043 | | | 0.29 | | | 0.27 | |

|

Statement of corporate governance practices

The Board of Directors and senior management of the Corporation consider good corporate governance to be central to the effective and efficient operation of the Corporation and its business. The Board of Directors and management are committed not only to satisfying legal and regulatory requirements, but also to developing and maintaining corporate governance practices that reflect evolving best practices standards as appropriate to the Corporation and its business.

The Board of Directors and management have been following developments in corporate governance requirements and best practices standards in both Canada and the United States closely. The Corporation is listed on the New York Stock Exchange (NYSE). Although it is not required to comply with many of the corporate governance listing requirements imposed by the NYSE for domestic listed issuers, the Corporation has aligned its governance practices with those requirements. The Board of Directors and management have reviewed the corporate governance policy (Multilateral Instrument 58-201) released by certain of the Canadian securities regulators for comment in January 2004. To the extent necessary, the Corporation intends to adapt its governance practices to the best practices set out in the final form of that policy.

The 14 corporate governance guidelines set out in the TSX Corporate Governance Policy and a brief discussion of the Corporation’s corporate governance practices with reference to each guideline is set out below.