EXHIBIT 16(c)(1)

Presentation to:

South Street Financial Corp.

William J. Wagner, CPA, Managing Director

HOWE BARNES INVESTMENTS, INC.

4000 WestChase Boulevard, Suite 110 Raleigh, NC 27607 Phone: 800-638-4250 Fax: 919-573-1879 bwagner@howebarnes.com

July 14, 2005

Table of Contents

Contents

3 | | Shareholder List Analysis |

1. Going Private Overview

Introduction

In many cases, a bank may be deriving little benefit from being a registered company

Despite being listed on a national exchange, the bank’s stock suffers from a low valuation and / or a limited trading volume

In some cases, the bank’s stock may not even be listed on an exchange, but is subject to registration with the SEC

Going private allows the bank to de-register with the SEC

The goal of going private is to reduce the number of registered shareholders below 300 and eliminate all future SEC filings

Once de-registered, the bank cannot be listed on the NASDAQ National and Small Cap Markets

Shares can trade on the OTC Bulletin Board or the Pink Sheets

The bank can remain private as long as registered shareholders do not exceed 300 (500 in certain circumstances)

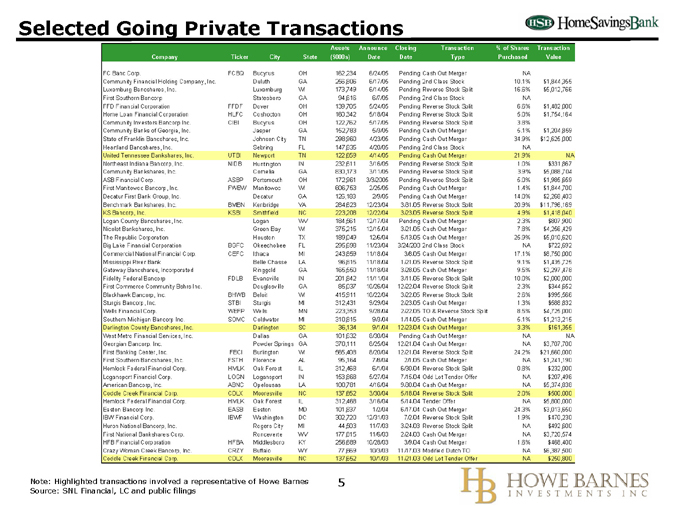

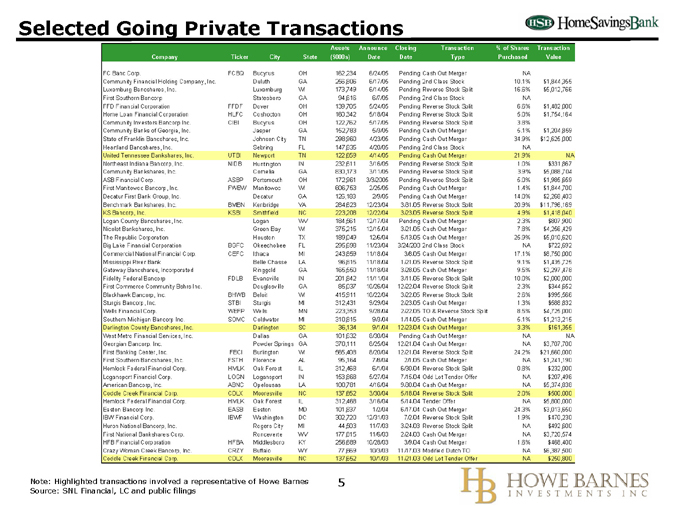

Selected Going Private Transactions

Company Ticker City State Assets ($000s) Announce Date Closing Date Transaction Type % of Shares Purchased Transaction Value

FC Banc Corp. FCBQ Bucyrus OH 162,234 6/24/05 Pending Cash Out Merger NA

Community Financial Holding Company, Inc. Duluth GA 256,806 6/17/05 Pending 2nd Class Stock 10.1% $1,844,355

Luxemburg Bancshares, Inc. Luxemburg WI 173,749 6/14/05 Pending Reverse Stock Split 16.6% $5,012,766

First Southern Bancorp Statesboro GA 94,616 6/7/05 Pending 2nd Class Stock NA

FFD Financial Corporation FFDF Dover OH 139,705 5/24/05 Pending Reverse Stock Split 6.6% $1,482,000

Home Loan Financial Corporation HLFC Coshocton OH 160,342 5/18/04 Pending Reverse Stock Split 5.0% $1,754,164

Community Investors Bancorp Inc. CIBI Bucyrus OH 122,762 5/17/05 Pending Reverse Stock Split 3.8%

Community Banks of Georgia, Inc. Jasper GA 152,783 5/3/05 Pending Cash Out Merger 5.1% $1,204,859

State of Franklin Bancshares, Inc. Johnson City TN 298,960 4/23/05 Pending Cash Out Merger 34.9% $12,625,000

Heartland Bancshares, Inc. Sebring FL 147,835 4/20/05 Pending 2nd Class Stock NA

United Tennessee Bankshares, Inc. UTBI Newport TN 122,659 4/14/05 Pending Cash Out Merger 21.9% NA

Northeast Indiana Bancorp, Inc. NIDB Huntington IN 232,611 3/16/05 Pending Reverse Stock Split 1.0% $331,867

Community Bankshares, Inc. Cornelia GA 830,173 3/11/05 Pending Reverse Stock Split 3.9% $5,088,704

ASB Financial Corp. ASBP Portsmouth OH 172,961 3/3/2005 Pending Reverse Stock Split 5.0% $1,985,659

First Manitowoc Bancorp, Inc. FWBW Manitowoc WI 606,753 2/25/05 Pending Cash Out Merger 1.4% $1,844,700

Decatur First Bank Group, Inc. Decatur GA 126,183 2/9/05 Pending Cash Out Merger 14.0% $2,268,403

Benchmark Bankshares, Inc. BMBN Kenbridge VA 284,623 12/23/04 3/31/05 Reverse Stock Split 20.9% $11,796,169

KS Bancorp, Inc. KSBI Smithfield NC 223,208 12/22/04 3/23/05 Reverse Stock Split 4.9% $1,418,040

Logan County Bancshares, Inc. Logan WV 184,561 12/17/04 Pending Cash Out Merger 2.3% $807,900

Nicolet Bankshares, Inc. Green Bay WI 375,215 12/15/04 3/21/05 Cash Out Merger 7.8% $4,256,429

The Republic Corporation Houston TX 189,049 12/6/04 5/13/05 Cash Out Merger 25.9% $5,010,620

Big Lake Financial Corporation BGFC Okeechobee FL 295,698 11/23/04 3/24/200 2nd Class Stock NA $722,692

Commercial National Financial Corp. CEFC Ithaca MI 243,859 11/18/04 3/8/05 Cash Out Merger 17.1% $8,750,000

Mississippi River Bank Belle Chasse LA 96,815 11/18/04 1/21/05 Reverse Stock Split 9.1% $1,435,725

Gateway Bancshares, Incorporated Ringgold GA 165,550 11/18/04 3/28/05 Cash Out Merger 9.5% $2,297,478

Fidelity Federal Bancorp FDLB Evansville IN 201,842 11/11/04 3/11/05 Reverse Stock Split 10.0% $2,000,000

First Commerce Community Bshrs Inc. Douglasville GA 85,037 10/26/04 12/22/04 Reverse Stock Split 2.3% $344,652

Blackhawk Bancorp, Inc. BHWB Beloit WI 415,911 10/22/04 3/22/05 Reverse Stock Split 2.6% $995,566

Sturgis Bancorp, Inc. STBI Sturgis MI 312,431 9/29/04 2/23/05 Cash Out Merger 1.3% $588,832

Wells Financial Corp. WEFP Wells MN 223,353 9/28/04 2/22/05 TO & Reverse Stock Split 8.5% $4,725,000

Southern Michigan Bancorp Inc. SOMC Coldwater MI 310,815 9/3/04 1/14/05 Cash Out Merger 5.1% $1,213,215

Darlington County Bancshares, Inc. Darlington SC 36,134 9/1/04 12/23/04 Cash Out Merger 3.3% $161,355

West Metro Financial Services, Inc. Dallas GA 101,632 8/30/04 Pending Cash Out Merger NA NA

Georgian Bancorp. Inc. Powder Springs GA 370,111 8/25/04 12/21/04 Cash Out Merger NA $3,707,700

First Banking Center, Inc. FBCI Burlington WI 565,408 8/20/04 12/21/04 Reverse Stock Split 24.2% $21,660,000

First Southern Bancshares, Inc. FSTH Florence AL 95,164 7/8/04 2/1/05 Cash Out Merger NA $1,241,190

Hemlock Federal Financial Corp. HMLK Oak Forest IL 312,468 6/1/04 6/30/04 Reverse Stock Split 0.8% $232,000

Logansport Financial Corp. LOGN Logansport IN 153,868 5/27/04 7/15/04 Odd Lot Tender Offer NA $207,496

American Bancorp, Inc. ABNC Opelousas LA 100,781 4/16/04 9/30/04 Cash Out Merger NA $5,374,838

Coddle Creek Financial Corp. CDLX Mooresville NC 137,652 3/30/04 5/18/04 Reverse Stock Split 2.0% $500,000

Hemlock Federal Financial Corp. HMLK Oak Forest IL 312,468 3/16/04 5/14/04 Tender Offer NA $5,800,000

Easton Bancorp Inc. EASB Easton MD 101,837 1/2/04 6/17/04 Cash Out Merger 24.3% $3,013,650

IBW Financial Corp. IBWF Washington DC 302,720 12/31/03 7/2/04 Reverse Stock Split 1.9% $470,230

Huron National Bancorp, Inc. Rogers City MI 44,503 11/7/03 3/24/03 Reverse Stock Split NA $492,600

First National Bankshares Corp. Ronceverte WV 177,815 11/6/03 2/24/03 Cash Out Merger NA $3,720,574

HFB Financial Corporation HFBA Middlesboro KY 256,689 10/28/03 3/9/04 Cash Out Merger 1.6% $468,400

Crazy Woman Creek Bancorp, Inc. CRZY Buffalo WY 77,669 10/3/03 11/17/03 Modified Dutch TO NA $6,387,500

Coddle Creek Financial Corp. CDLX Mooresville NC 137,652 10/1/03 11/21/03 Odd Lot Tender Offer NA $250,800

Note: Highlighted transactions involved a representative of Howe Barnes Source: SNL Financial, LC and public filings

Going Private Strategic Considerations

What is the Company’s strategic plan?

Future capital needs

Acquisition strategy

Increase visibility of the company

Image

General Considerations to Going Private

Reaction of local community

How will the community react to the transaction?

Are many small shareholders customers?

Would a voluntary method of going private be better received?

Reaction of institutional investors

Will / can they continue to hold shares?

Reaction from other banks

Will going private encourage acquisition offers from other banks?

How many shareholders must be eliminated?

How many shares do they own?

General Considerations to Going Private

Financial impact on the Company

Cost of purchasing shares plus transaction costs Pro-forma capital ratios Impact on future growth Financing alternatives

Impact on the trading market

Volume

Listing

Ability to obtain favorable shareholder vote

Insider ownership Past history of difficulty Shareholder sentiment

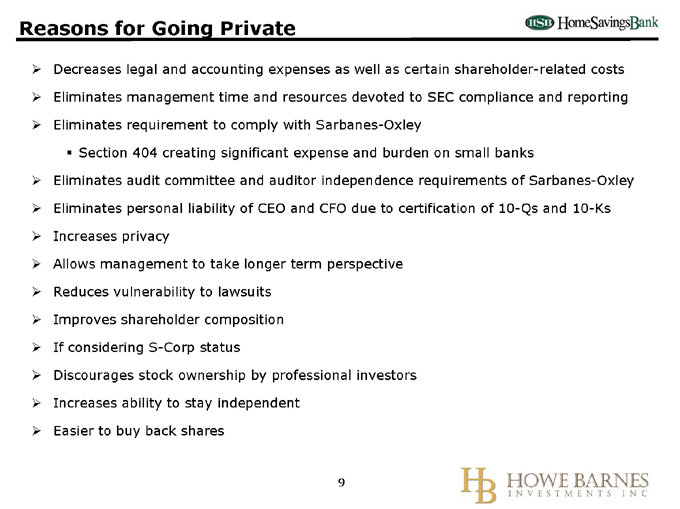

Reasons for Going Private

Decreases legal and accounting expenses as well as certain shareholder-related costs Eliminates management time and resources devoted to SEC compliance and reporting Eliminates requirement to comply with Sarbanes-Oxley

Section 404 creating significant expense and burden on small banks

Eliminates audit committee and auditor independence requirements of Sarbanes-Oxley Eliminates personal liability of CEO and CFO due to certification of 10-Qs and 10-Ks Increases privacy Allows management to take longer term perspective Reduces vulnerability to lawsuits Improves shareholder composition If considering S-Corp status Discourages stock ownership by professional investors Increases ability to stay independent Easier to buy back shares

9

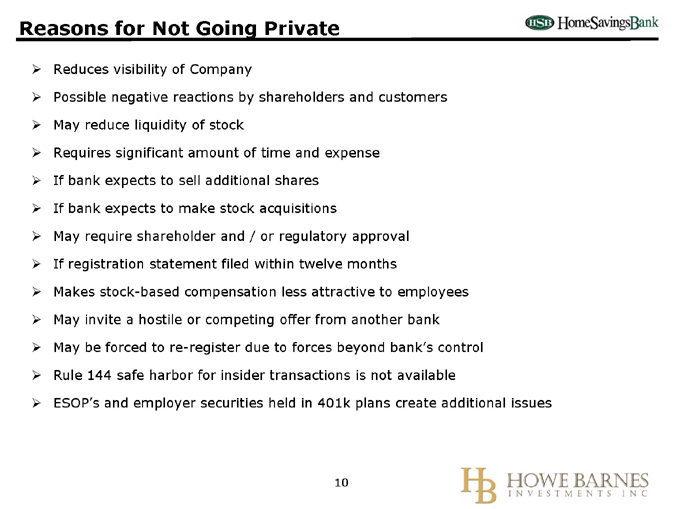

Reasons for Not Going Private

Reduces visibility of Company

Possible negative reactions by shareholders and customers May reduce liquidity of stock Requires significant amount of time and expense If bank expects to sell additional shares If bank expects to make stock acquisitions May require shareholder and / or regulatory approval If registration statement filed within twelve months Makes stock-based compensation less attractive to employees May invite a hostile or competing offer from another bank May be forced to re-register due to forces beyond bank’s control Rule 144 safe harbor for insider transactions is not available

ESOP’s and employer securities held in 401k plans create additional issues

10

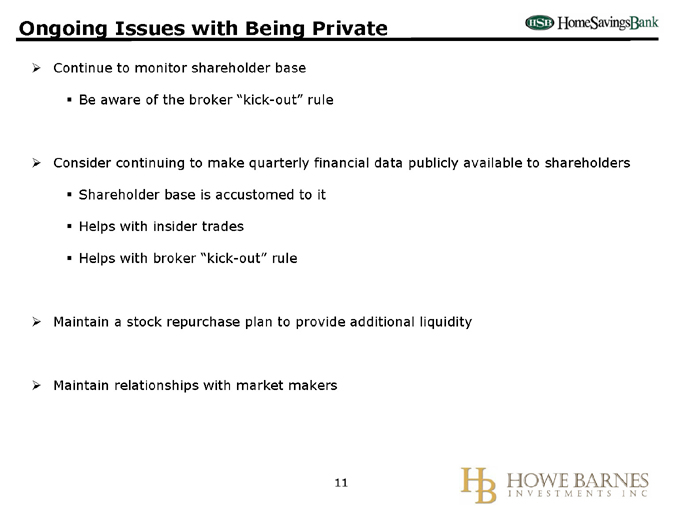

Ongoing Issues with Being Private

Continue to monitor shareholder base

Be aware of the broker “kick-out” rule

Consider continuing to make quarterly financial data publicly available to shareholders

Shareholder base is accustomed to it Helps with insider trades Helps with broker “kick-out” rule

Maintain a stock repurchase plan to provide additional liquidity

Maintain relationships with market makers

11

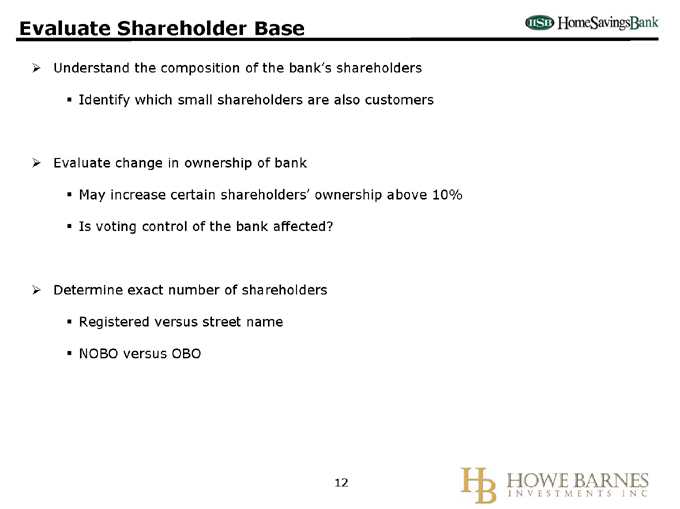

Evaluate Shareholder Base

Understand the composition of the bank’s shareholders

Identify which small shareholders are also customers

Evaluate change in ownership of bank

May increase certain shareholders’ ownership above 10%

Is voting control of the bank affected?

Determine exact number of shareholders

Registered versus street name

NOBO versus OBO

12

2. Going Private Methods

13

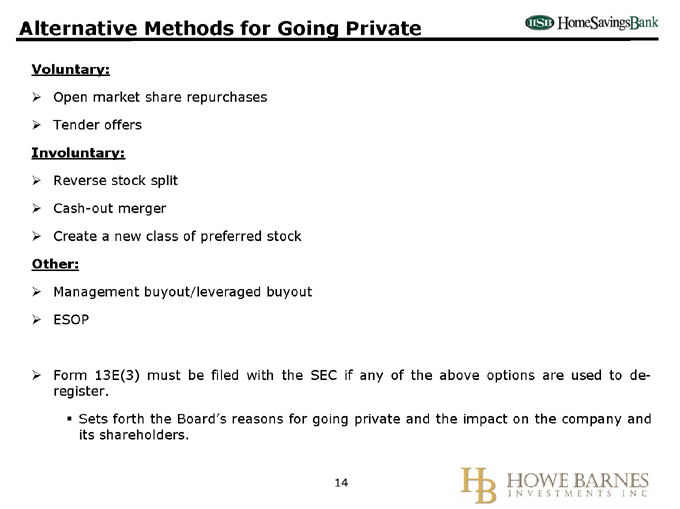

Alternative Methods for Going Private

Voluntary:

Open market share repurchases Tender offers

Involuntary:

Reverse stock split Cash-out merger

Create a new class of preferred stock

Other:

Management buyout/leveraged buyout ESOP

Form 13E(3) must be filed with the SEC if any of the above options are used to deregister.

Sets forth the Board’s reasons for going private and the impact on the company and its shareholders.

14

Voluntary Methods

15

Open Market Share Repurchase Program

Board authorizes repurchase plan

Typically less than 10% of outstanding shares

Company makes press release

Company follows rules set forth by SEC Rule 10b-18

No guarantee that enough shareholders will sell shares to go private

No guarantee that a shareholder will sell all of their shares

New block purchase rules have made it more difficult to buy large blocks of stock in a short period of time

Difficult to predict how long it will take

16

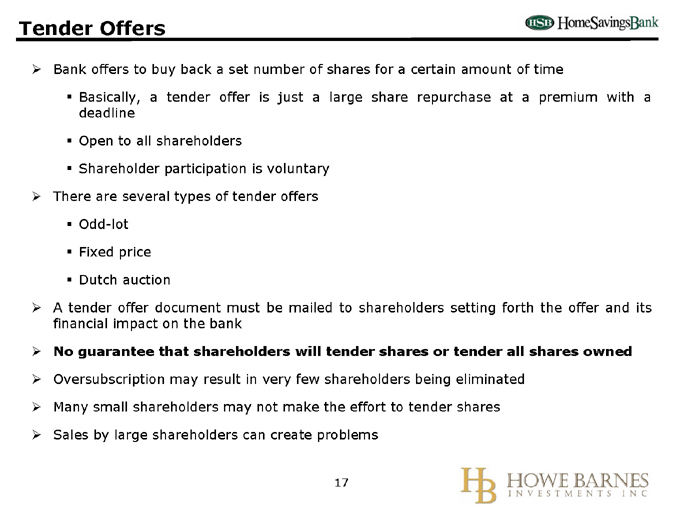

Tender Offers

Bank offers to buy back a set number of shares for a certain amount of time

Basically, a tender offer is just a large share repurchase at a premium with a deadline Open to all shareholders Shareholder participation is voluntary

There are several types of tender offers

Odd-lot Fixed price Dutch auction

A tender offer document must be mailed to shareholders setting forth the offer and its financial impact on the bank

No guarantee that shareholders will tender shares or tender all shares owned

Oversubscription may result in very few shareholders being eliminated Many small shareholders may not make the effort to tender shares Sales by large shareholders can create problems

17

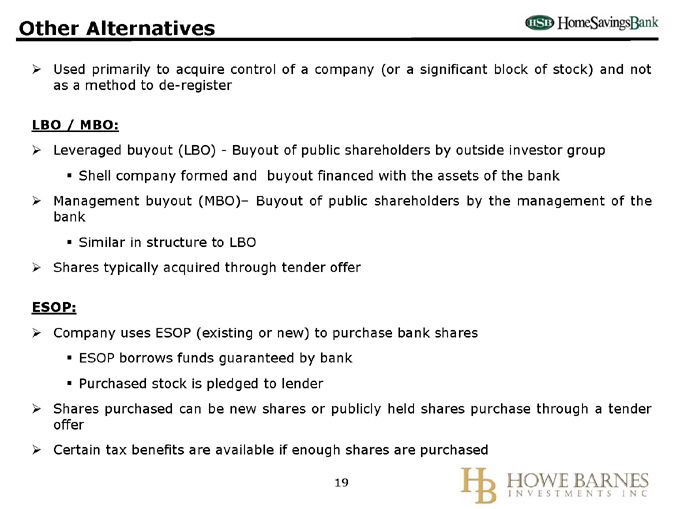

Other Alternatives

18

Used primarily to acquire control of a company (or a significant block of stock) and not as a method to de-register

LBO / MBO:

Leveraged buyout (LBO)—Buyout of public shareholders by outside investor group

Shell company formed and buyout financed with the assets of the bank

Management buyout (MBO)– Buyout of public shareholders by the management of the bank

Similar in structure to LBO

Shares typically acquired through tender offer

ESOP:

Company uses ESOP (existing or new) to purchase bank shares

ESOP borrows funds guaranteed by bank Purchased stock is pledged to lender

Shares purchased can be new shares or publicly held shares purchase through a tender offer Certain tax benefits are available if enough shares are purchased

19

Involuntary Methods

20

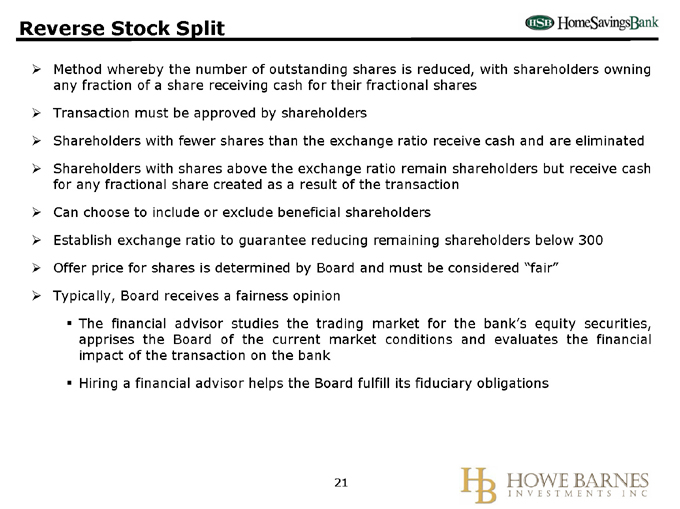

Reverse Stock Split

Method whereby the number of outstanding shares is reduced, with shareholders owning any fraction of a share receiving cash for their fractional shares Transaction must be approved by shareholders Shareholders with fewer shares than the exchange ratio receive cash and are eliminated Shareholders with shares above the exchange ratio remain shareholders but receive cash for any fractional share created as a result of the transaction Can choose to include or exclude beneficial shareholders Establish exchange ratio to guarantee reducing remaining shareholders below 300 Offer price for shares is determined by Board and must be considered “fair” Typically, Board receives a fairness opinion

The financial advisor studies the trading market for the bank’s equity securities, apprises the Board of the current market conditions and evaluates the financial impact of the transaction on the bank Hiring a financial advisor helps the Board fulfill its fiduciary obligations

21

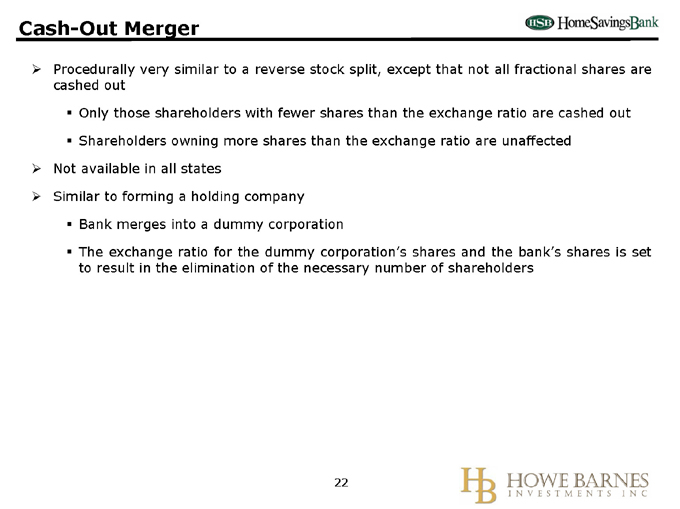

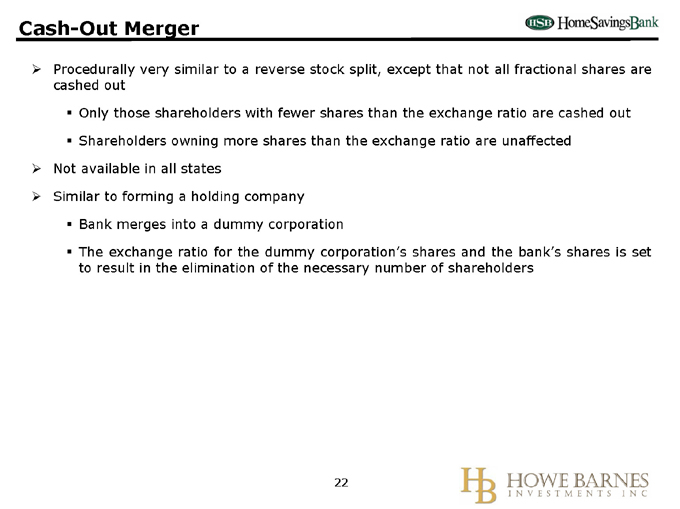

Cash-Out Merger

Procedurally very similar to a reverse stock split, except that not all fractional shares are cashed out

Only those shareholders with fewer shares than the exchange ratio are cashed out Shareholders owning more shares than the exchange ratio are unaffected

Not available in all states

Similar to forming a holding company

Bank merges into a dummy corporation

The exchange ratio for the dummy corporation’s shares and the bank’s shares is set to result in the elimination of the necessary number of shareholders

22

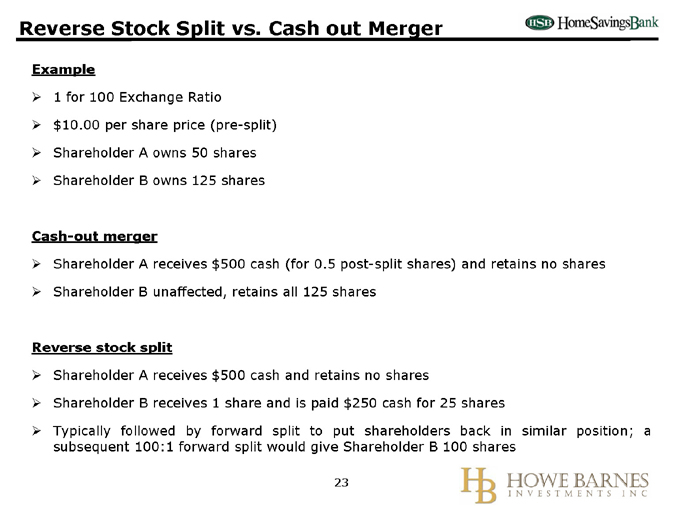

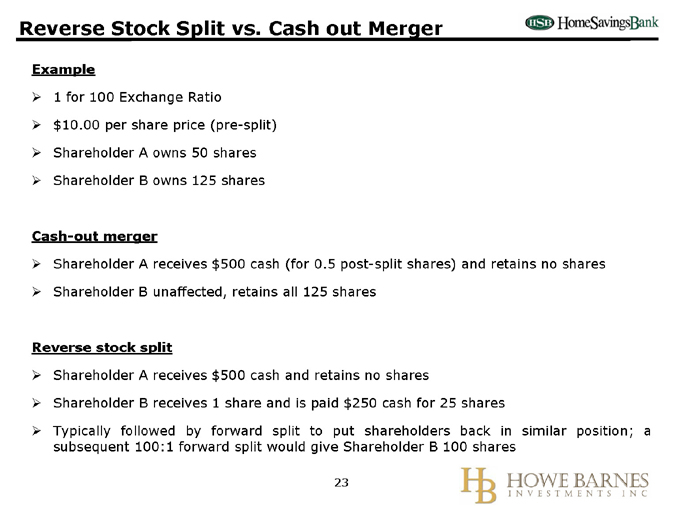

Reverse Stock Split vs. Cash out Merger

Example

1 | | for 100 Exchange Ratio $10.00 per share price (pre-split) Shareholder A owns 50 shares Shareholder B owns 125 shares |

Cash-out merger

Shareholder A receives $500 cash (for 0.5 post-split shares) and retains no shares Shareholder B unaffected, retains all 125 shares

Reverse stock split

Shareholder A receives $500 cash and retains no shares

Shareholder B receives 1 share and is paid $250 cash for 25 shares

Typically followed by forward split to put shareholders back in similar position; a subsequent 100:1 forward split would give Shareholder B 100 shares

23

Additional Transaction Features

Going Private transactions have been structured with the following additional features:

Shareholders Affected – The transaction can be structured to include or exclude beneficially owned (street name) shares. By effecting the transaction only at the registered shareholder level, shareholders holding their shares in street name are not impacted by the transaction.

Restrictions on Trading – Future transfers of shares can be restricted to maintain a minimum number of shares traded in each block. This mechanism can be used to prevent an increase in small shareholders.

24

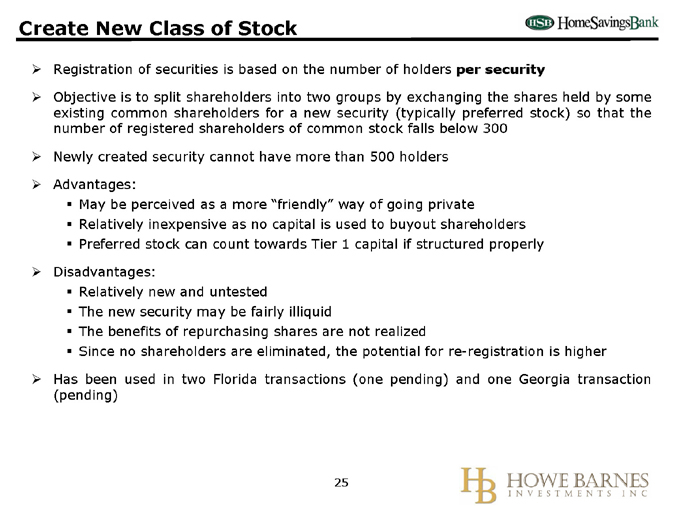

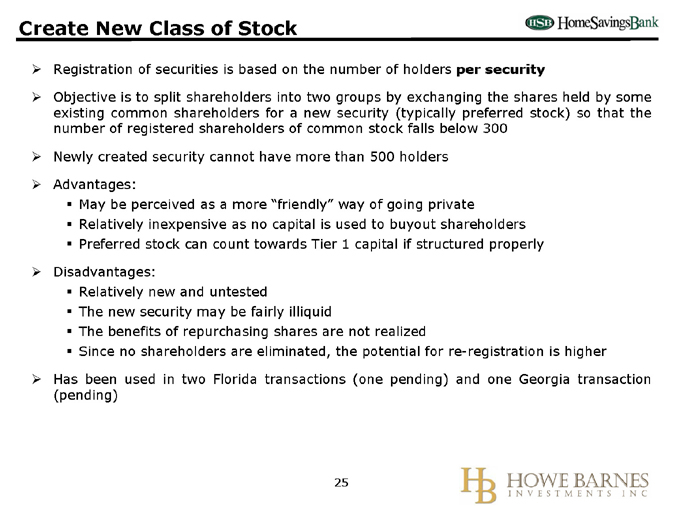

Create New Class of Stock

Registration of securities is based on the number of holders per security

Objective is to split shareholders into two groups by exchanging the shares held by some existing common shareholders for a new security (typically preferred stock) so that the number of registered shareholders of common stock falls below 300 Newly created security cannot have more than 500 holders Advantages:

May be perceived as a more “friendly” way of going private Relatively inexpensive as no capital is used to buyout shareholders Preferred stock can count towards Tier 1 capital if structured properly

Disadvantages:

Relatively new and untested

The new security may be fairly illiquid

The benefits of repurchasing shares are not realized

Since no shareholders are eliminated, the potential for re-registration is higher

Has been used in two Florida transactions (one pending) and one Georgia transaction (pending)

25

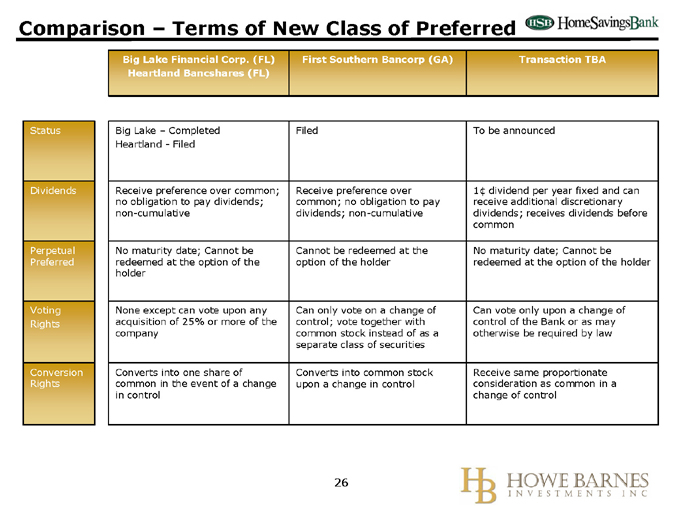

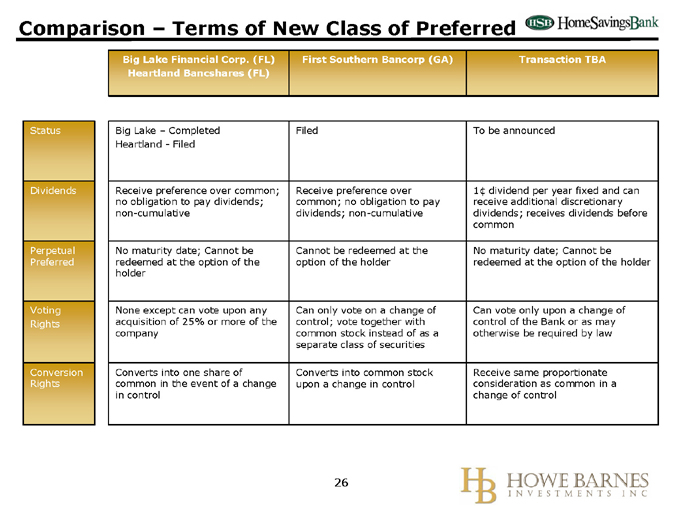

Comparison – Terms of New Class of Preferred

Big Lake Financial Corp. (FL) Heartland Bancshares (FL) First Southern Bancorp (GA) Transaction TBA

Status Big Lake – Completed Heartland—Filed Filed To be announced

Dividends Receive preference over common; no obligation to pay dividends; non-cumulative Receive preference over common; no obligation to pay dividends; non-cumulative 1¢ dividend per year fixed and can receive additional discretionary dividends; receives dividends before common

Perpetual Preferred No maturity date; Cannot be redeemed at the option of the holder Cannot be redeemed at the option of the holder No maturity date; Cannot be redeemed at the option of the holder

Voting Rights None except can vote upon any acquisition of 25% or more of the company Can only vote on a change of control; vote together with common stock instead of as a separate class of securities Can vote only upon a change of control of the Bank or as may otherwise be required by law

Conversion Rights Converts into one share of common in the event of a change in control Converts into common stock upon a change in control Receive same proportionate consideration as common in a change of control

26

Comparison – Terms of New Class of Preferred

Big Lake Financial Corp. (FL) Heartland Bancshares (FL) First Southern Bancorp (GA) Transaction TBA

Liquidation Rights Preference in distribution of assets in liquidation equal to the book value of common stock at the time of the conversion to preferred Preference in liquidation equal to the greater of $10.00, the book value of the preferred, or the amount paid to common shareholders Preference in distribution of assets in liquidation equal to the book value of common stock at time of the conversion to preferred

Preemptive Rights Do not have any preemptive rights to purchase any class of the issuer’s common stock None Do not have any preemptive rights to purchase any class of the issuer’s common stock

Redemption Rights The issuer cannot force the holder to redeem the shares; the holder cannot force the issuer to redeem the shares Holders have no right to require that the company redeem their shares The issuer cannot force the holder to redeem the shares; the holder cannot force the issuer to redeem the shares

Call Rights None Company can call at a price equal to the greater of book value of the preferred, market value of the preferred or the market value of the common None

Dissenters Rights May exercise appraisal rights subject to certain limitations of Florida law May exercise dissenter’s rights under Georgia law No appraisal rights under North Carolina law

27

3. Shareholder List Analysis

28

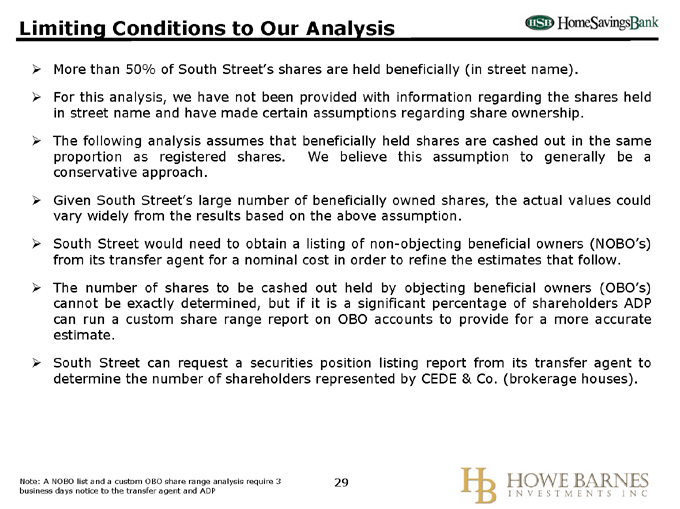

Limiting Conditions to Our Analysis

More than 50% of South Street’s shares are held beneficially (in street name).

For this analysis, we have not been provided with information regarding the shares held in street name and have made certain assumptions regarding share ownership.

The following analysis assumes that beneficially held shares are cashed out in the same proportion as registered shares. We believe this assumption to generally be a conservative approach.

Given South Street’s large number of beneficially owned shares, the actual values could vary widely from the results based on the above assumption.

South Street would need to obtain a listing of non-objecting beneficial owners (NOBO’s) from its transfer agent for a nominal cost in order to refine the estimates that follow. The number of shares to be cashed out held by objecting beneficial owners (OBO’s) cannot be exactly determined, but if it is a significant percentage of shareholders ADP can run a custom share range report on OBO accounts to provide for a more accurate estimate.

South Street can request a securities position listing report from its transfer agent to determine the number of shareholders represented by CEDE & Co. (brokerage houses).

Note: A NOBO list and a custom OBO share range analysis require 3 business days notice to the transfer agent and ADP

29

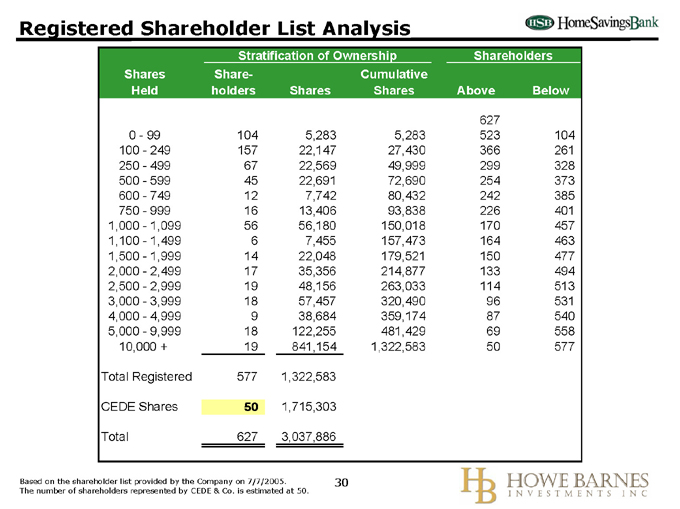

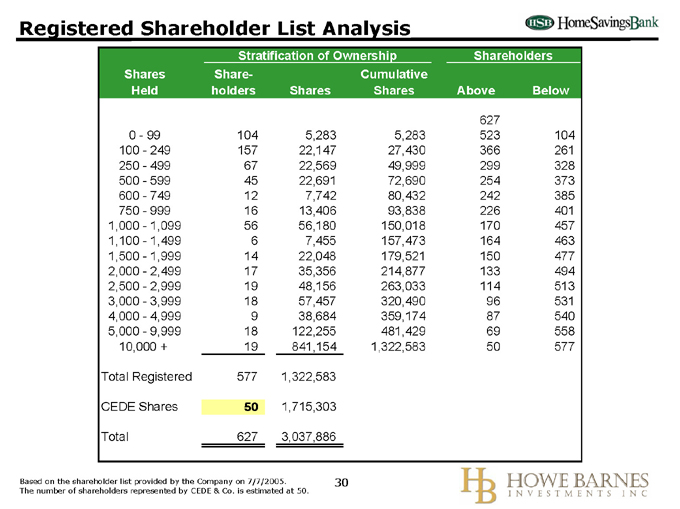

Registered Shareholder List Analysis

Stratification of Ownership Shareholders

Shares Held Shareholders Shares Cumulative Shares Above Below

627

0—99 104 5,283 5,283 523 104

100—249 157 22,147 27,430 366 261

250—499 67 22,569 49,999 299 328

500—599 45 22,691 72,690 254 373

600—749 12 7,742 80,432 242 385

750—999 16 13,406 93,838 226 401

1,000—1,099 56 56,180 150,018 170 457

1,100—1,499 6 7,455 157,473 164 463

1,500—1,999 14 22,048 179,521 150 477

2,000—2,499 17 35,356 214,877 133 494

2,500—2,999 19 48,156 263,033 114 513

3,000—3,999 18 57,457 320,490 96 531

4,000—4,999 9 38,684 359,174 87 540

5,000—9,999 18 122,255 481,429 69 558

10,000 + 19 841,154 1,322,583 50 577

Total Registered 577 1,322,583

CEDE Shares 50 1,715,303

Total 627 3,037,886

Based on the shareholder list provided by the Company on 7/7/2005. The number of shareholders represented by CEDE & Co. is estimated at 50.

30

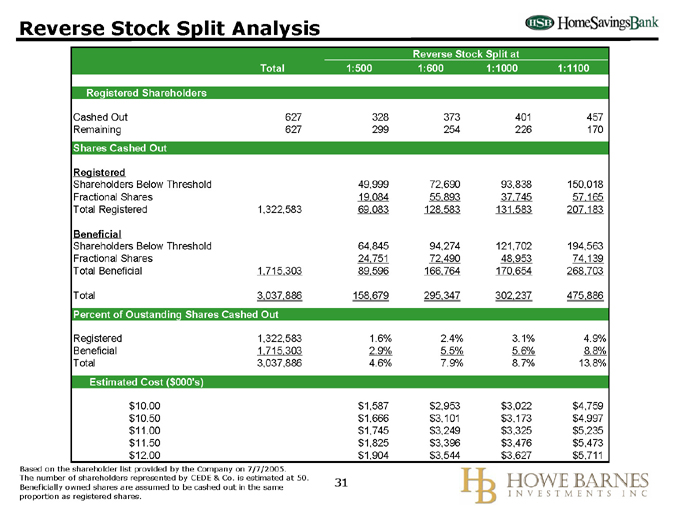

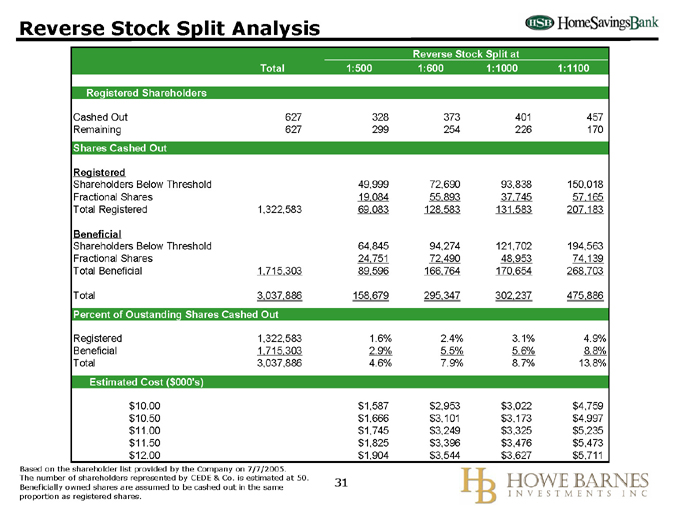

Reverse Stock Split Analysis

Reverse Stock Split at

Total 1:500 1:600 1:1000 1:1100

Registered Shareholders

Cashed Out 627 328 373 401 457

Remaining 627 299 254 226 170

Shares Cashed Out

Registered

Shareholders Below Threshold 49,999 72,690 93,838 150,018

Fractional Shares 19,084 55,893 37,745 57,165

Total Registered 1,322,583 69,083 128,583 131,583 207,183

Beneficial

Shareholders Below Threshold 64,845 94,274 121,702 194,563

Fractional Shares 24,751 72,490 48,953 74,139

Total Beneficial 1,715,303 89,596 166,764 170,654 268,703

Total 3,037,886 158,679 295,347 302,237 475,886

Percent of Oustanding Shares Cashed Out

Registered 1,322,583 1.6% 2.4% 3.1% 4.9%

Beneficial 1,715,303 2.9% 5.5% 5.6% 8.8%

Total 3,037,886 4.6% 7.9% 8.7% 13.8%

Estimated Cost ($000’s)

$10.00 $1,587 $2,953 $3,022 $4,759

$10.50 $1,666 $3,101 $3,173 $4,997

$11.00 $1,745 $3,249 $3,325 $5,235

$11.50 $1,825 $3,396 $3,476 $5,473

$12.00 $1,904 $3,544 $3,627 $5,711

Based on the shareholder list provided by the Company on 7/7/2005. The number of shareholders represented by CEDE & Co. is estimated at 50. Beneficially owned shares are assumed to be cashed out in the same proportion as registered shares.

31

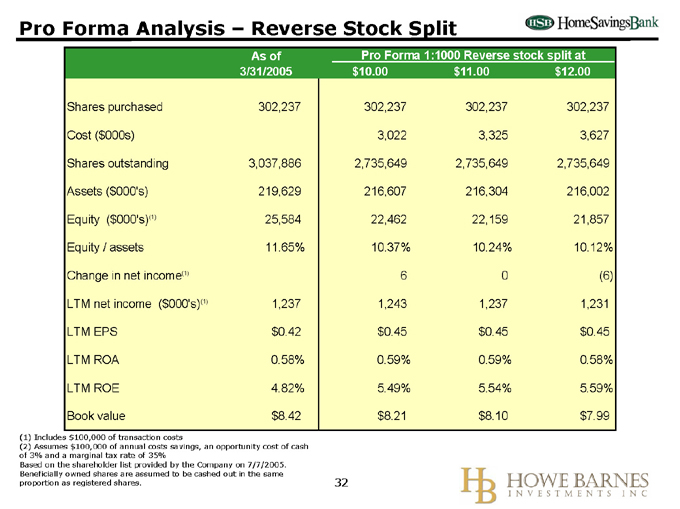

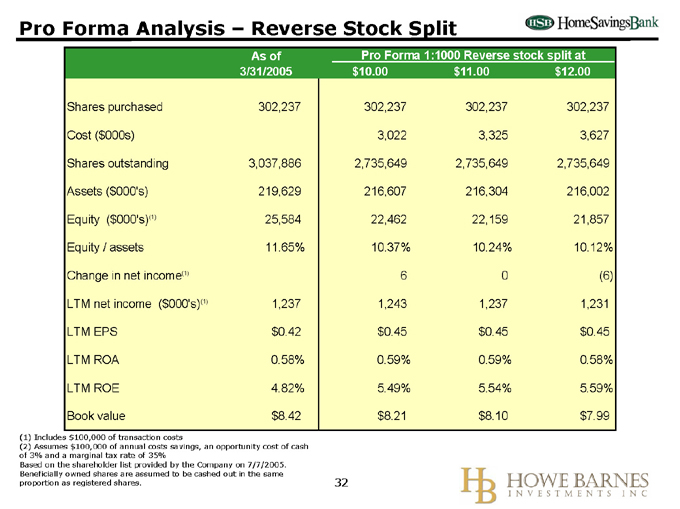

Pro Forma Analysis – Reverse Stock Split

Pro Forma 1:1000 Reverse stock split at

As of 3/31/2005 $10.00 $11.00 $12.00

Shares purchased 302,237 302,237 302,237 302,237

Cost ($000s) 3,022 3,325 3,627

Shares outstanding 3,037,886 2,735,649 2,735,649 2,735,649

Assets ( $000’s) 219,629 216,607 216,304 216,002

Equity ($000’s)(1) 25,584 22,462 22,159 21,857

Equity / assets 11.65% 10.37% 10.24% 10.12%

Change in net income(1) 6 0 (6)

LTM net income ($000’s)(1) 1,237 1,243 1,237 1,231

LTM EPS $0.42 $0.45 $0.45 $0.45

LTM ROA 0.58% 0.59% 0.59% 0.58%

LTM ROE 4.82% 5.49% 5.54% 5.59%

Book value $8.42 $8.21 $8.10 $7.99

(1) | | Includes $100,000 of transaction costs |

(2) Assumes $100,000 of annual costs savings, an opportunity cost of cash of 3% and a marginal tax rate of 35% Based on the shareholder list provided by the Company on 7/7/2005. Beneficially owned shares are assumed to be cashed out in the same proportion as registered shares.

32

4. Trading Analysis

33

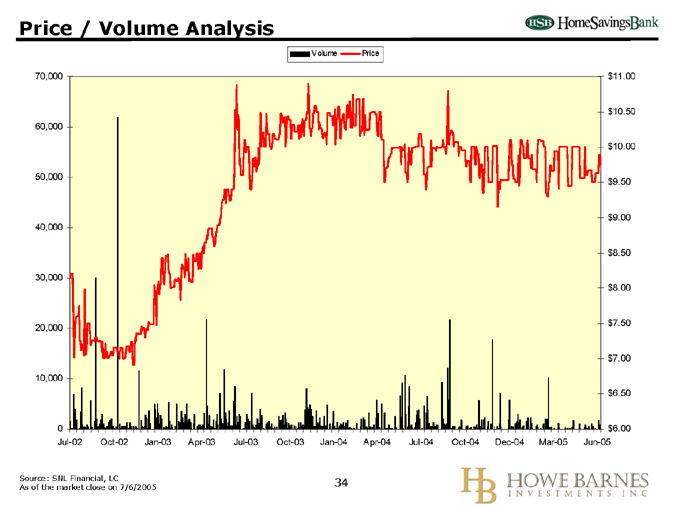

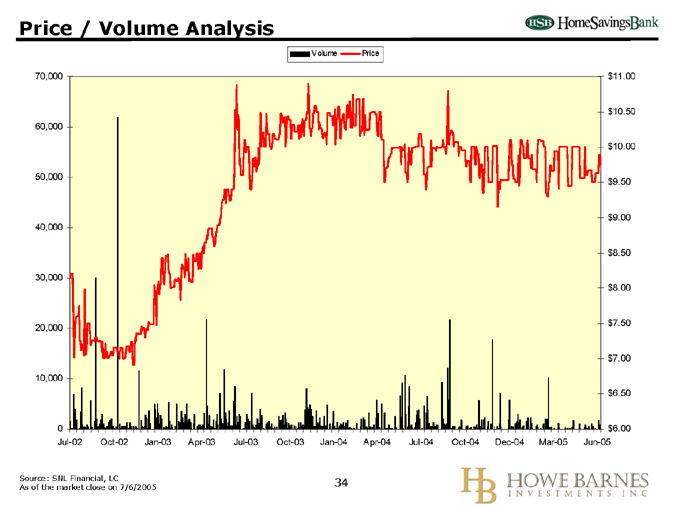

Price / Volume Analysis

Volume Price

70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 $11.00 $10.50 $10.00 $9.50 $9.00 $8.50 $8.00 $7.50 $7.00 $6.50 $6.00

Jul-02 Oct-02 Jan-03 Apr-03 Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 Oct-04 Dec-04 Mar-05 Jun-05

Source: SNL Financial, LC

As of the market close on 7/6/2005

34

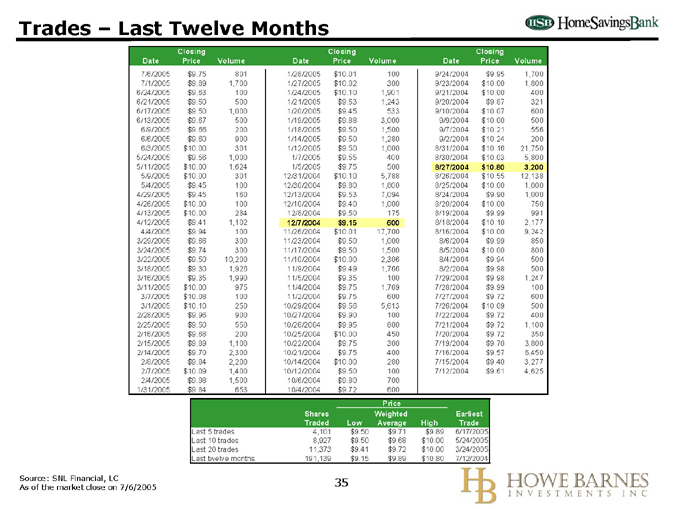

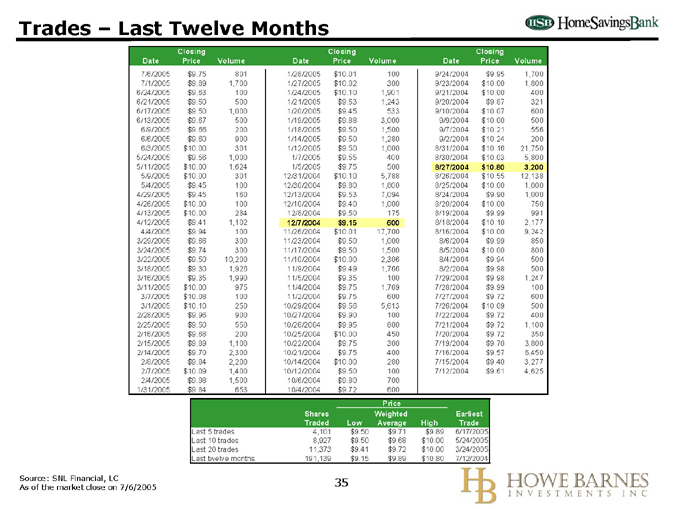

Trades – Last Twelve Months

Date Closing Price Volume Date Closing Price Volume Date Closing Price Volume

7/6/2005 $9.75 801 1/28/2005 $10.01 100 9/24/2004 $9.95 1,700

7/1/2005 $9.89 1,700 1/27/2005 $10.02 300 9/23/2004 $10.00 1,800

6/24/2005 $9.63 100 1/24/2005 $10.10 1,901 9/21/2004 $10.00 400

6/21/2005 $9.50 500 1/21/2005 $9.53 1,243 9/20/2004 $9.87 321

6/17/2005 $9.50 1,000 1/20/2005 $9.45 533 9/10/2004 $10.07 600

6/13/2005 $9.67 500 1/19/2005 $9.88 3,000 9/9/2004 $10.00 500

6/9/2005 $9.66 200 1/18/2005 $9.50 1,500 9/7/2004 $10.21 556

6/6/2005 $9.60 900 1/14/2005 $9.50 1,280 9/2/2004 $10.24 200

6/3/2005 $10.00 301 1/12/2005 $9.50 1,000 8/31/2004 $10.16 21,750

5/24/2005 $9.56 1,000 1/7/2005 $9.55 400 8/30/2004 $10.03 5,800

5/11/2005 $10.00 1,624 1/5/2005 $9.75 500 8/27/2004 $10.80 3,200

5/9/2005 $10.00 301 12/31/2004 $10.10 5,788 8/26/2004 $10.55 12,138

5/4/2005 $9.45 100 12/30/2004 $9.80 1,800 8/25/2004 $10.00 1,000

4/29/2005 $9.45 160 12/13/2004 $9.53 7,094 8/24/2004 $9.90 1,000

4/26/2005 $10.00 100 12/10/2004 $9.40 1,000 8/20/2004 $10.00 750

4/13/2005 $10.00 284 12/8/2004 $9.50 175 8/19/2004 $9.99 991

4/12/2005 $9.41 1,102 12/7/2004 $9.15 600 8/18/2004 $10.10 2,177

4/4/2005 $9.94 100 11/26/2004 $10.01 17,700 8/16/2004 $10.00 9,242

3/29/2005 $9.66 300 11/23/2004 $9.50 1,000 8/6/2004 $9.99 850

3/24/2005 $9.74 300 11/17/2004 $9.50 1,500 8/5/2004 $10.00 800

3/22/2005 $9.50 10,200 11/10/2004 $10.00 2,306 8/4/2004 $9.94 500

3/18/2005 $9.30 1,926 11/9/2004 $9.49 1,766 8/2/2004 $9.98 500

3/16/2005 $9.35 1,990 11/5/2004 $9.35 100 7/29/2004 $9.98 1,247

3/11/2005 $10.00 975 11/4/2004 $9.75 1,769 7/28/2004 $9.99 100

3/7/2005 $10.08 100 11/2/2004 $9.75 600 7/27/2004 $9.72 600

3/1/2005 $10.10 250 10/29/2004 $9.56 5,613 7/26/2004 $10.09 500

2/28/2005 $9.96 900 10/27/2004 $9.90 100 7/22/2004 $9.72 400

2/25/2005 $9.50 550 10/26/2004 $9.95 800 7/21/2004 $9.72 1,100

2/16/2005 $9.68 200 10/25/2004 $10.00 450 7/20/2004 $9.72 350

2/15/2005 $9.89 1,100 10/22/2004 $9.75 300 7/19/2004 $9.70 3,800

2/14/2005 $9.70 2,300 10/21/2004 $9.75 400 7/16/2004 $9.57 6,450

2/8/2005 $9.84 2,200 10/14/2004 $10.00 280 7/15/2004 $9.40 3,277

2/7/2005 $10.09 1,400 10/12/2004 $9.50 100 7/12/2004 $9.61 4,625

2/4/2005 $9.98 1,500 10/6/2004 $9.80 700

1/31/2005 $9.84 653 10/4/2004 $9.72 600

Shares Traded Low Price Weighted Average High Earliest Trade

Last 5 trades 4,101 $9.50 $9.71 $9.89 6/17/2005

Last 10 trades 8,927 $9.50 $9.68 $10.00 5/24/2005

Last 20 trades 11,373 $9.41 $9.72 $10.00 3/24/2005

Last twelve months 191,139 $9.15 $9.89 $10.80 7/12/2004

Source: SNL Financial, LC

As of the market close on 7/6/2005

35

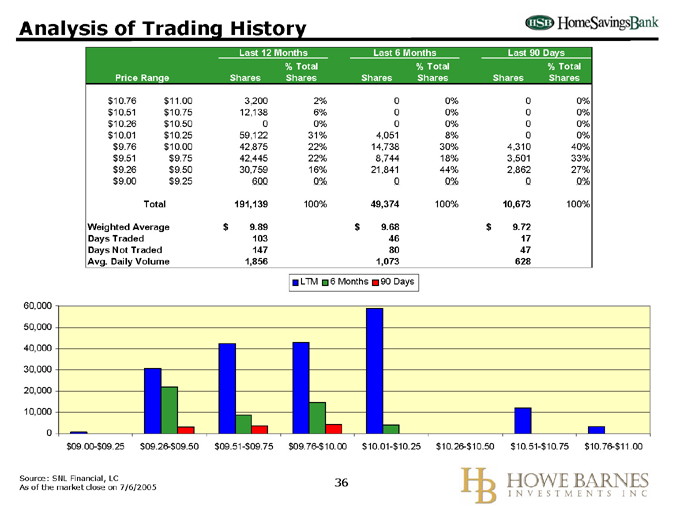

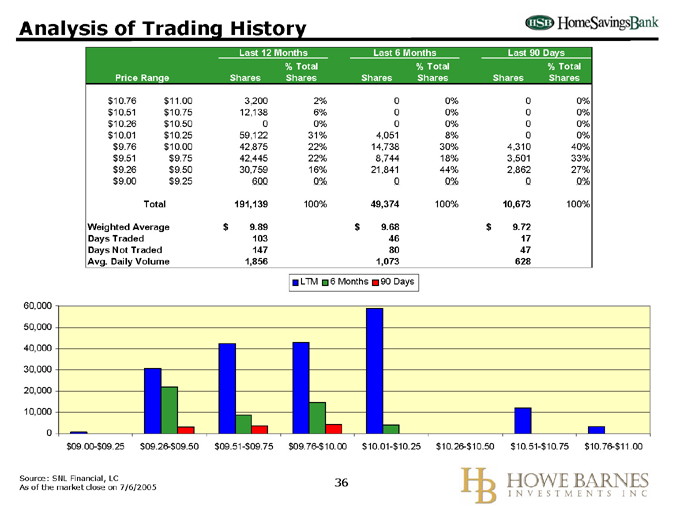

Analysis of Trading History

Last 12 Months Last 6 Months Last 90 Days

Price Range Shares % Total Shares Shares % Total Shares Shares % Total Shares

$10.76 $11.00 3,200 2% 0 0% 0 0%

$10.51 $10.75 12,138 6% 0 0% 0 0%

$10.26 $10.50 0 0% 0 0% 0 0%

$10.01 $10.25 59,122 31% 4,051 8% 0 0%

$9.76 $10.00 42,875 22% 14,738 30% 4,310 40%

$9.51 $9.75 42,445 22% 8,744 18% 3,501 33%

$9.26 $9.50 30,759 16% 21,841 44% 2,862 27%

$9.00 $9.25 600 0% 0 0% 0 0%

Total 191,139 100% 49,374 100% 10,673 100%

Weighted Average $9.89 $9.68 $9.72

Days Traded 103 46 17

Days Not Traded 147 80 47

Avg. Daily Volume 1,856 1,073 628

LTM 6 Months 90 Days

60,000 50,000 40,000 30,000 20,000 10,000 0 $09.00-$09.25 $09.26-$09.50 $09.51-$09.75 $09.76-$10.00 $10.01-$10.25 $10.26-$10.50 $10.51-$10.75 $10.76-$11.00

Source: SNL Financial, LC

As of the market close on 7/6/2005

36

5. Other Topics

37

Share Repurchases From Large Unfriendly Shareholders

In certain circumstances, it may be advantageous to purchase the shares of a large hostile shareholder

Hostile shareholders can distract from management’s ability to operate the company Further, in many illiquid companies, it is difficult to find shares to repurchase

In these situations, it makes sense for the company to repurchase these shares

Eliminates the shareholder

Allows the company to benefit from repurchasing shares (increased ROE, EPS, dividend paying capacity) Can be financed with trust preferred securities

Typically, the purchase price is negotiated, and the hostile shareholder is required to sign a stand-still agreement as a condition for the Company to purchase the shares

The purchase price can be at a premium to the market

The standstill agreement is designed to prevent the hostile shareholder from buying shares of the company for a designated period of time (3-5years) after the repurchase

38

Option Plan – Current Situation

Currently, South Street’s outstanding options are “underwater” and have been so for several years

The options are scheduled to expire in slightly over two years

South Street does not have any additional options authorized

South Street would like to have options to grant to new employees and provide existing option-holders new options that have some upside potential

South Street does not want to issue additional options on top of the existing options; South Street would like to explore the idea of replacing existing options with new options

Unfortunately, new accounting rules require that a compensation expense be recorded for all new options granted for the years beginning after 12/15/2005

39

Option Plan – Alternatives

There are several ways that the existing options can be cancelled, although they require the consent of each individual employee

Option-holders can be offered a cash payment in exchange for cancellation of their existing options. They can then be granted new options at the current market price with a new 10 year holding period, or Option-holders can be asked to cancel their existing options in exchange for new options at the current market price with a new 10 year holding period

As an alternative to issuing new options, since options must new be expensed, South Street should consider granting shares of restricted stock instead of options

Both options and restricted stock create a non-cash expense

Option expense can be replaced with the cost of vesting restricted shares

Employees would receive fewer restricted shares than options, but would not have to wait for the share price to increase to receive value and the cost of exercising option would be eliminated Restricted stock creates a tax liability to the recipient as the shares vest while options to not

40

These materials are for discussion purposes only. They should not be construed as an offer or solicitation with respect to the purchase or sale of any security or to enter into any particular transaction and may not be relied on in evaluating the merits of investing in any security or entering into any transaction.

The information contained herein and any supplemental information or other documents provided in connection herewith are submitted to you on a strictly confidential basis, should be kept confidential and should not be used other than in connection with your evaluation of a proposed structure or transaction. By accepting a copy of this presentation, the recipient agrees that neither it nor any of its employees or advisors shall use the information for any purpose other than evaluating a proposed structure or transaction or divulge the information to any other party. The information contained herein shall not be photocopied, reproduced or distributed to others, in whole or in part, without the prior written consent of Howe Barnes Investments, Inc.