Russell Shepherd

Lead Director &

Associate General Counsel

(212) 314-3944

Fax (212) 314-3955

June 26, 2015

Deborah Skeens, Esquire

Division of Investment Management

Mail Stop 8629

Washington, DC 20549-8629

| | |

| Re: | | AXA Equitable Life Insurance Company |

| | Correspondence filing related to Post Effective Amendments to the |

| | Registration Statement on Form N-4 |

| | File Nos. 333-05593; 333-64749; 333-31131; 333-60730 and 811-07659 |

| | CIK # 0001015570 |

Dear Ms. Skeens:

The purpose of this letter is to provide a response to the Staff’s comments on the N-4 Amendment filed by AXA Equitable Life Insurance Company (the “Company”) on May 7, 2015, as provided by telephone on June 12, 2015.

The Registrant is Separate Account No. 49 of AXA Equitable Life Insurance Company. We intend to file a post-effective amendments to the above-referenced Registration Statement to incorporate these changes and to include the consent of our independent registered public accounting firm.

For your convenience, I have restated those comments below and followed each comment with the Company’s response.

General Comments:

| 1. | Please provide the required Tandy Representation for all four filings prior to the effective date of the 485(a) Prospectus Supplements, if you have not already done so. |

Response: The Company hereby acknowledges that the Staff of the Commission has not passed upon the accuracy or adequacy of the Prospectus Supplements for the above-referenced Registration Statements. We acknowledge that the review of the filing by the Staff of the Commission does not relieve the Registrant of its full responsibility for the adequacy and accuracy of the disclosure of this filing nor does it foreclose the Commission from taking any action with respect to this filing. Further, we acknowledge

that the Registrant may not assert as a defense in any proceeding initiated by the Commission or any person under federal securities law that the Staff of the Commission reviewed the filing and provided comments to the Registrant or that the filing became automatically effective thereafter.

| 2. | How many contract owners are subject to the offer? |

Response: As of December 31, 2014, there were approximately 19,000 contracts eligible for the offer.

| 3. | What is the average contract value and benefit base of those subject to the offer? |

Response: As of December 31, 2014, the average contract value was $144,500 and the average Guaranteed minimum death benefit base was $193,000.

| 4. | What is the average percent increase in contract value if the offer is accepted? |

Response: As of December 31, 2014, the average percent increase in contract value would be approximately 11% if an offer is accepted.

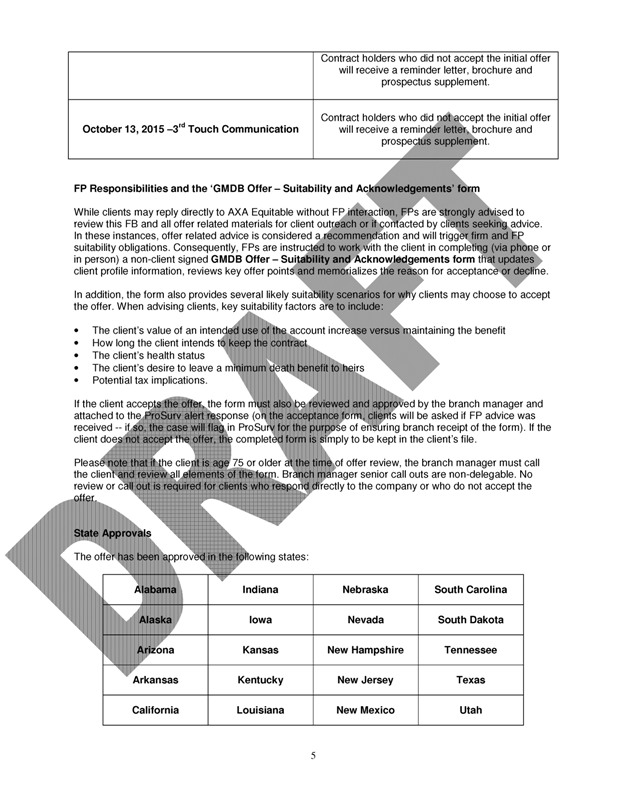

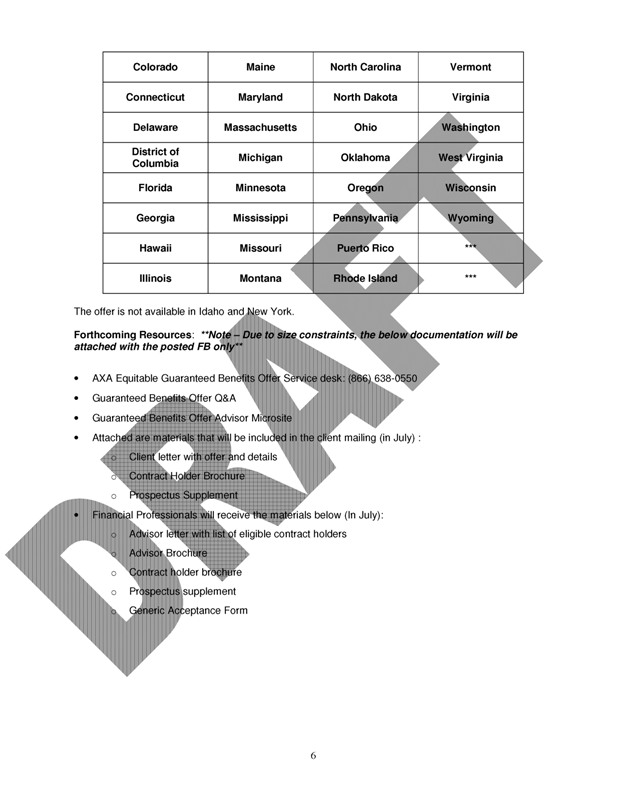

| 5. | Please provide the Staff a copy of the Offer Letter and Acceptance Letter, as well as any other materials that may be sent to contract owners in connection with this offer. |

Response: We have enclosed copies of the Offer Letter(s) and the Acceptance Form(s) and other materials that are being mailed along with them. Please note that the Acceptance Form is a typed section within the Offer Letter, which can be detached and returned by mail in an envelope that will be provided.

| 6. | Please clarify supplementally whether a copy of the Prospectus Supplement and the Accumulator® Series Prospectus will accompany the Offer Letter? |

Response: Only the Prospectus Supplement will accompany the Offer Letter.

| 7. | Please also state supplementally what, if any, other documents will accompany the Offer Letter. If so, please provide copies. |

Response: A client brochure and the Prospectus Supplement will be mailed to contract owners in connection with this offer. Copies of these documents are enclosed in response to comment number 5 above.

| 8. | Will any written notice be sent to financial intermediaries in connection with this offer? If so, please provide the Staff with copies of such written notices together with a list of any materials that may accompany the written notices, if any. |

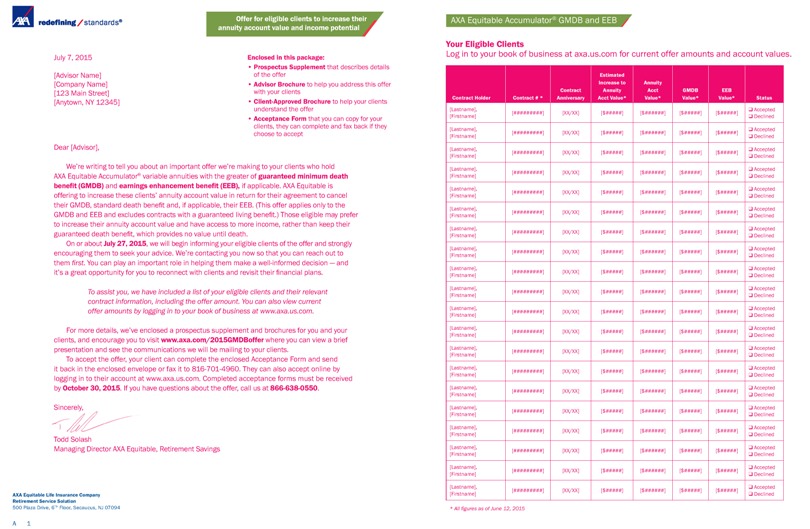

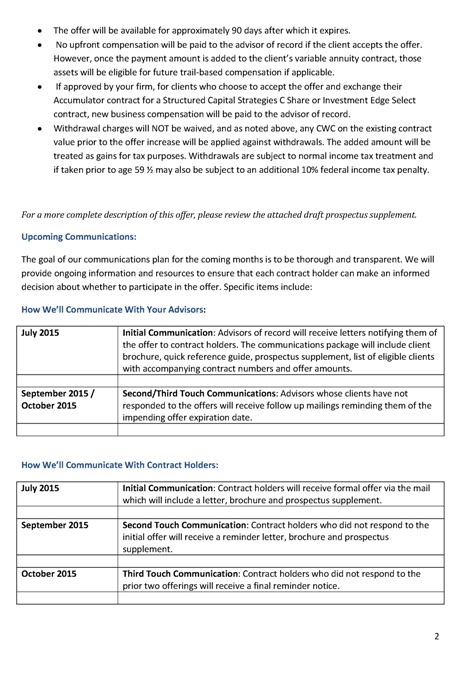

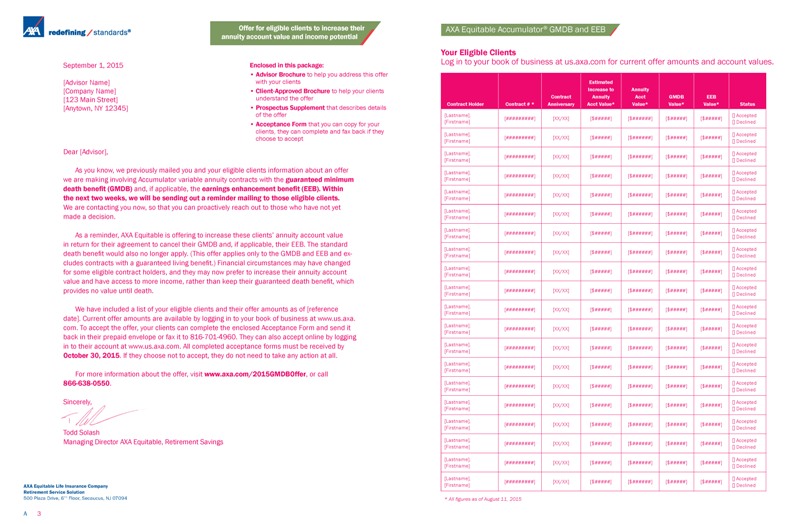

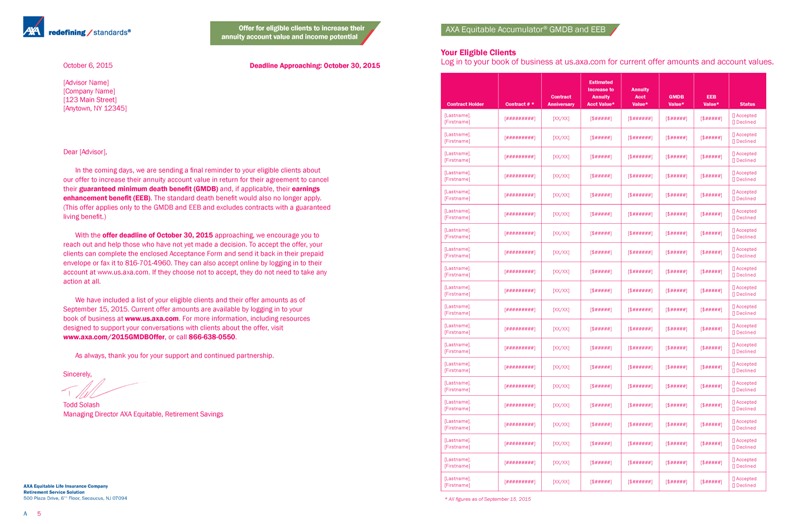

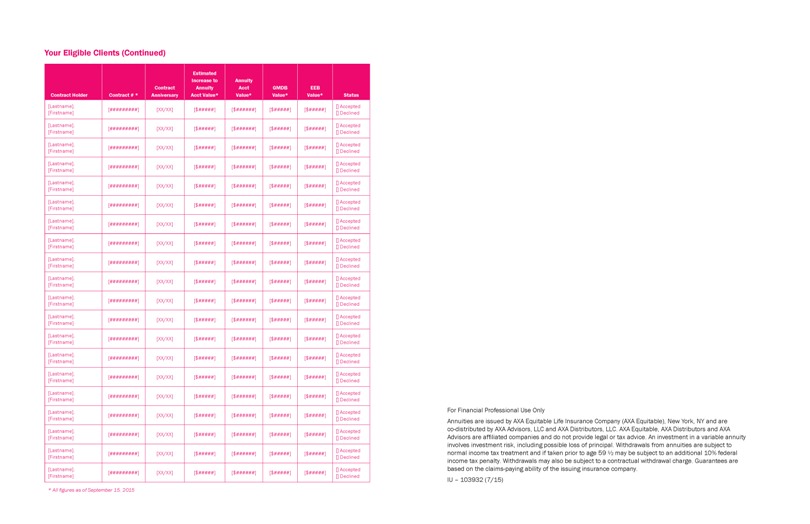

Response: Written notices will be sent to financial intermediaries in connection with the offer. We have enclosed copies of those written notices and provided a list of the documents that will accompany those written notices on Schedule A, which is attached hereto.

| 9. | If you are sending a written notice to financial intermediaries, please state when the written notice will be sent to such financial intermediaries? |

Response: The dates or proposed scheduled dates when written notices will be sent are listed in Schedule A, which is attached hereto.

| 10. | If you are not sending a written notice to financial intermediaries, please explain why you are not sending the notice or not doing so. |

Response: As noted in our response to number 9 above, the Company will be issuing written notices to financial intermediaries.

Comments to the Prospectus Supplement:

| 11. | On page 5 of the Supplement, in the last sentence of the first paragraph under the heading “How does AXA Equitable determine the offer amount? How much would be added to my contract’s account value?”, please consider bolding the phrase following the semi-colon: “if your contract account value equals or exceeds your benefit base, you will very likely (though not necessarily) receive the minimum offer amount described below.” |

Response: The Company has made the requested change.

| 12. | On page 5 of the Supplement, under the heading “How does AXA Equitable determine the offer amount? How much would be added to my contract’s account value?”, please clarify that if a contract owner owns both the GMDB and EEB that their minimum amount is the sum of the GMDB minimum offer and the EEB minimum offer. |

Response: The Company has made the requested change.

| 13. | On page 6 of the Supplement, please add another example in which the contract owner would only receive the minimum offer amount for either the GMDB or EEB buyout offer. |

Response: The Company has added the example.

| 14. | In the heading of the Appendix II chart, please define what is the term “SCS”. |

Response: The Company has made the requested change.

| 15. | Please consider revising Appendix II to convey other material features of the Existing Contracts and the New Contracts and add any other material features that may be missing in comparing the Existing Contracts and New Contracts as part of the exchange offer. For example, the Investment EdgeSM Select contract is designed principally to provide for tax efficient withdrawals and this does not come across in the Appendix II chart. |

Response: The Company has revised Appendix II.

| 16. | Please represent supplementally that in the next update filing of the Accumulator® Series Prospectus, you will revise the section in the Accumulator® Series Prospectus where it discusses the standard death benefit to clarify that for certain contract owners the standard death benefit may only equal their contract value. |

Response: The Company confirms that it will add the disclosure in the next normal filing update for the Accumulator® Series Prospectuses.

I trust that the responses provided in this letter address your comments adequately. If you have any questions regarding these responses, please contact the undersigned at (212) 314-3944. Thank you very much for your assistance with this filing.

|

| Very truly yours, |

|

| /s/ Russell Shepherd |

| Russell Shepherd |

| | |

| cc: | | Dodie Kent, Esq. |

| | Sutherland Asbill & Brennan LLP |

Schedule A

| | | | | | |

I.Response to Comment 5: |

| | |

| | A. | | Description of documents being sent with the Offer Letter(s) and Acceptance Form(s) scheduled to be mailed on or about July 27, 2015: |

| | | |

| | | | 1. | | Sample Contract Holder Letter – GMDB |

| | | | 2. | | Sample Contract Holder Letter – GMDB/EEB |

| | | | 3. | | Prospectus Supplement |

| | | | 4. | | Contract Holder Brochure |

|

II. Responses to Comments 8 and 9: |

| | |

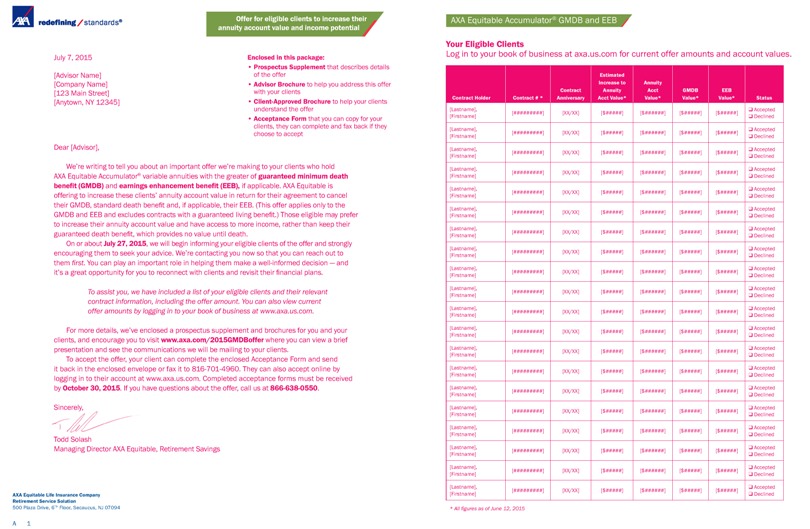

| | A. | | GMDB Advisor Letter – Scheduled to be mailed on or about July 7, 2015 to advisors who have eligible contract owners. |

| | |

| | | | List of documents sent or to be sent: |

| | | |

| | | | 1. | | Prospectus Supplement |

| | | | 2. | | Link via micro-site for a sample of the Contract Holder Letter – GMDB and Contract Holder Letter GMDB/EEB |

| | | | 3. | | Contract Holder Brochure |

| | | | 4. | | GMDB Advisor Brochure |

| | | | 5. | | Stand-alone GMDB Acceptance Form |

| | | | 6. | | Accumulator® Variable Annuity – Greater of Roll Up or Annual Ratchet GMDB Buyout Offers – 2015 (FAQ) |

| | |

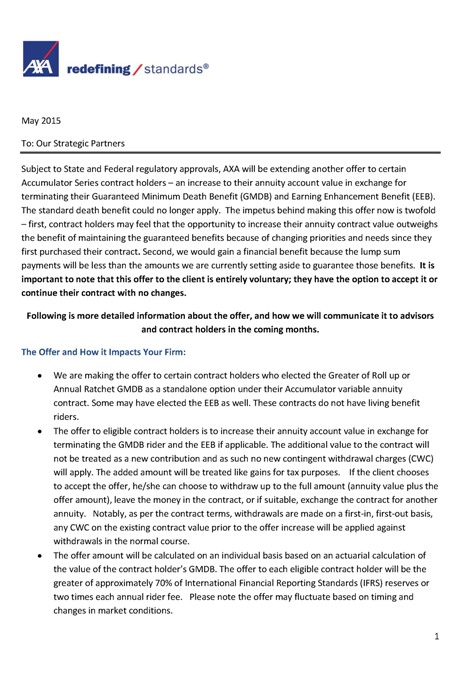

| | B. | | Strategic Partners Letter – Mailed on May 8, 2015 to third party broker-dealers. |

| | |

| | | | List of documents sent or to be sent: |

| | | |

| | | | 1. | | Prospectus supplement (copy of initial 485(a) Supplement filing) |

| | | | 2. | | Sample Contract Holder Letter – GMD |

| | | | 3 | | Sample Contract Holder Letter – GMDB/EEB |

| | | | 4. | | Contract Holder Brochure |

| | | | 5. | | GMDB Advisor Brochure |

| | | | 6. | | Stand-alone GMDB Acceptance Form |

| | | | 7. | | AXA Distributors, LLC (“ADL”) Amended Selling Agreement |

| | | | 8. | | Accumulator® Variable Annuity – Greater of Roll Up or Annual Ratchet GMDB Buyout Offers – 2015 (FAQ) |

| | | | | | |

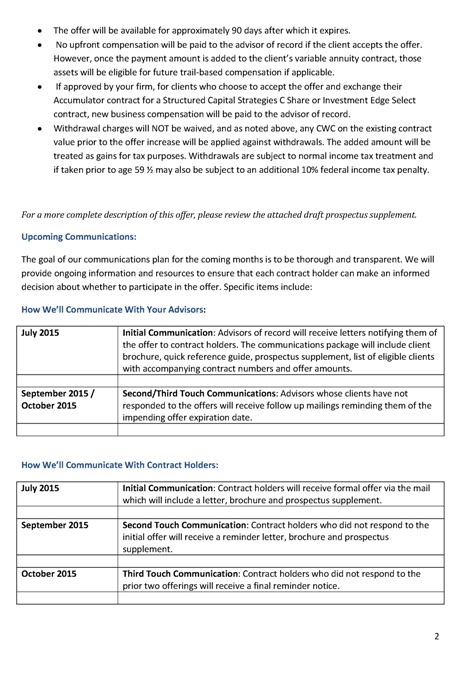

| | C. | | Draft Field Bulletin – Scheduled to be posted for web access on or about July 7, 2015 for AXA Advisors who have eligible contract owners. |

| | |

| | | | Documents linked to posting: |

| | | |

| | | | 1. | | Sample GMDB Advisor Letter with list of eligible contract holders |

| | | | 2. | | Sample Contract Holder Letter |

| | | | 3. | | Contract Holder Letter – GMDB/EEB |

| | | | 4. | | Contract Holder Brochure |

| | |

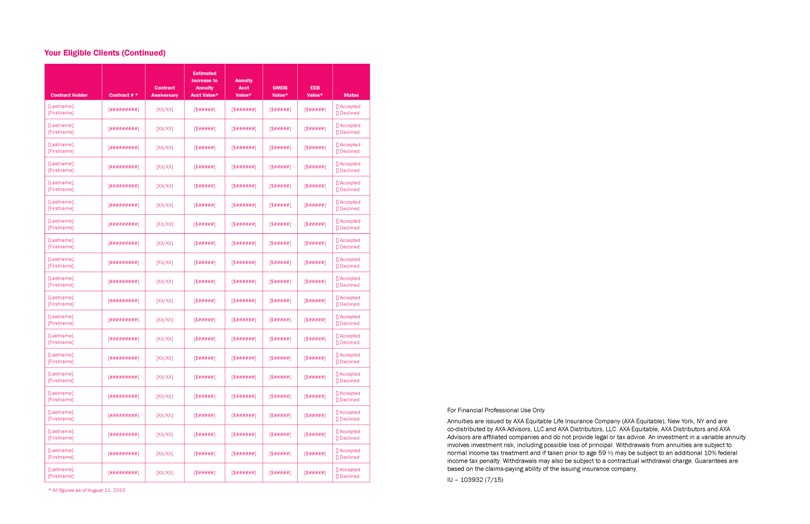

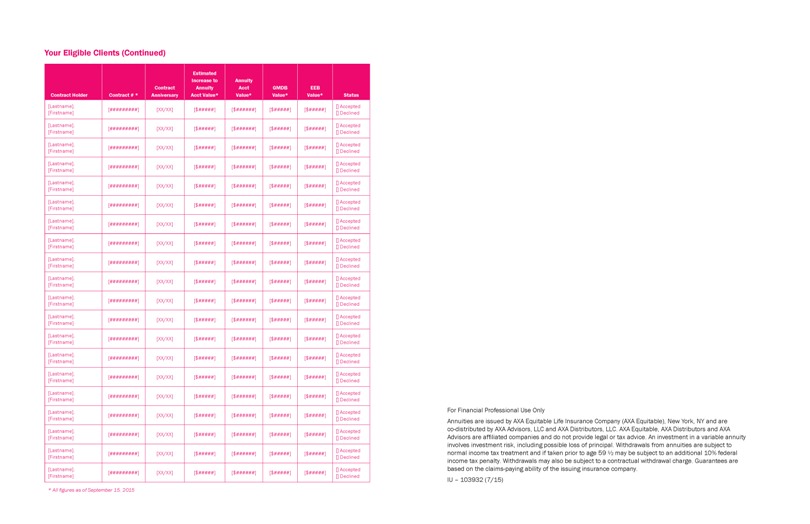

| | D. | | Sample Reminder Letters – Scheduled to be mailed on or about September 1, 2015 and October 6, 2015 to advisors who have eligible contract owners who have not responded to the Offer Letter. |

| | |

| | E. | | Sample Reminder Letters – Scheduled to be mailed on or about September 8, 2015 and October 13, 2015 to contract owners who did not respond to the Offer Letter. |

| | |

| | | | Documents attached: |

| | | |

| | | | 1. | | Prospectus Supplement |

| | | | 2. | | Contract Holder Brochure |

Summary Prospectus Supplement and Prospectus Supplement

Guaranteed Minimum Death Benefit and Earnings Enhancement Benefit Offer

This supplement describes an offer we are making to you in connection with your Accumulator® variable annuity contract guaranteed benefits. If you accept this offer and you do not want to remain invested in your Accumulator® variable annuity contract, we also offer you the opportunity to exchange your contract for another annuity contract issued by us.

This supplement contains important information that you should know before accepting this offer or taking any other action under your contract.You are not required to accept this offer or take any action under your contract. If you do not accept this offer, your contract and the guaranteed benefits you previously elected will continue unchanged.

You should carefully read the summary in conjunction with the supplement that follows before making your decision regarding this offer. This offer asks you to give up valuable guaranteed benefits in return for additional cash in your contract. Reading the summary alone is no substitute for reading the entire document.

AXA Equitable Life Insurance Company

Supplement dated July 7, 2015 to the current Prospectuses for:

This Supplement modifies certain information in the above-referenced prospectuses, supplements to prospectuses and statements of additional information (together the “Prospectuses”) offered by AXA Equitable Life Insurance Company (“AXA Equitable”). You should read this Supplement in conjunction with your Prospectus and retain it for future reference. This Supplement incorporates each Prospectus by reference. Unless otherwise indicated, all other information included in your Prospectus remains unchanged. The terms we use in this Supplement have the same meaning as in your Prospectus. We will send you another copy of any prospectus or supplement without charge upon request. Please contact the customer service center referenced in your Prospectus.

2

Summary Prospectus Supplement

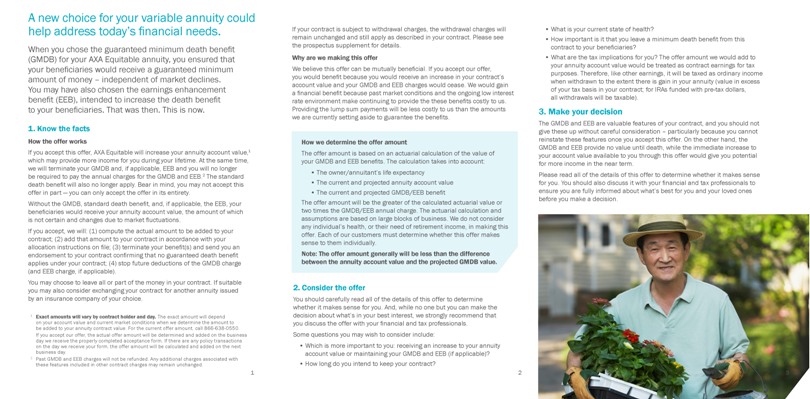

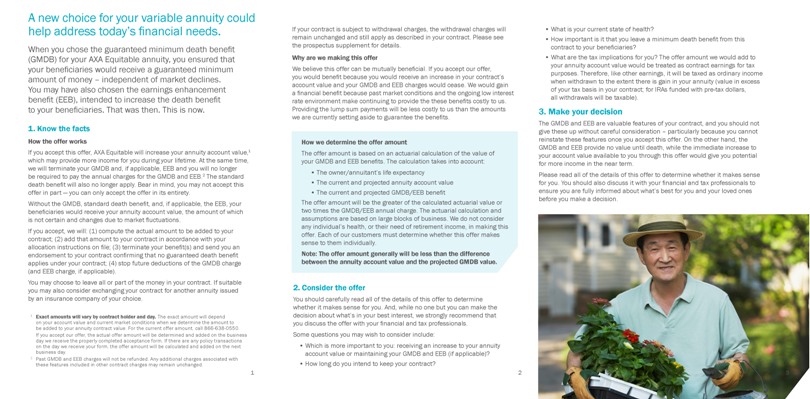

You are receiving this offer because, at the time you purchased your contract, you elected a guaranteed minimum death benefit (“GMDB”) to be paid to your beneficiaries. For a limited time, we are offering to increase your contract’s account value in return for terminating your GMDB, standard death benefit, and earnings enhancement benefit or Protection PlusSM (together referred to as “EEB”), if you elected that as well.

When you purchased your contract you made a determination that the GMDB (and EEB, if applicable) were important to you, based on your personal circumstances at that time. When considering this offer, you should consider whether you no longer need or want the GMDB and standard death benefit (and EEB, if applicable), given your personal circumstances today and your expected future needs. These benefits provide no annuity account value until your death, while the immediate increase to your account value available through this offer would give you potential for more income while you are alive.

The offer and acceptance letter included with this supplement indicates the amount of our offer to you as of the date specified in the letter. The offer amount will change each business day because of the factors that we use to determine our reserve for these types of benefits change. In other words, should you accept the offer; the amount we pay you will likely be either more or less than the offer amount in your letter. For your current offer amount, call 1-866-638-0550.

If you accept the offer, the following conditions apply:

| | • | | Offer amount: The amount we add to your contract’s account value will be determined and added on the business day we receive your acceptance in good order. The amount will be allocated according to your current investment allocation instructions on file with us. |

You can obtain a current offer amount by calling 1-866-638-0550 or by logging in to your account at www.us.axa.com.

| | • | | Benefit changes: Your GMDB, (and EEB, if applicable), and the availability of the standard death benefit will terminate, and your contract’s account value will be increased. The termination of the availability of the standard death benefit — which provides a minimum death benefit (at no additional charge) that is equal to your total contributions adjusted for any withdrawals you make, including applicable taxes and withdrawal charges — means that, should you die while the contract is still in force, the amount payable to your beneficiaries will be equal to your contract’s account value, which could be less than your net contributions. |

| | • | | Charges eliminated: Upon termination of your GMDB (and EEB, if applicable), you will no longer pay the annual charges for those guaranteed benefits. |

| | • | | Deadline: We must receive your acceptance of this offer no later than the date specified in your offer letter (see “How to accept this offer” below). |

| | • | | No reinstatement: Once you accept this offer, the GMDB and standard death benefit (and EEB, if applicable) cannot be reinstated. In considering the factors above, and any other factors you believe relevant, you may wish to consult with your beneficiaries and your financial professional or other advisor. |

| | • | | Additional contract options: If you accept the offer, you may choose to remain invested in your current contract, or if you do not want to remain invested in your contract without the GMDB and standard death benefit (and EEB, if applicable), you may: |

| | (i) | terminate your contract and receive the account value plus the amount we add to your contract; |

| | (ii) | transfer all or part of your contract’s account value to another investment product; |

| | (iii) | exchange your contract for another annuity contract issued by an insurance company of your choice; or |

| | (iv) | if a withdrawal charge does not apply to your existing contract, exchange your contract for a New Contract to a: (i) Structured Capital Strategies® Series C or Series ADV contract; (ii) Investment Edge® 15.0 Investment Edge® Select or Investment Edge® ADV contract; or (iii) Investment Edge® Investment Edge® Select or Investment Edge® ADV contract, as detailed in Appendix II of this supplement. Please note that a New Contract may not be available in all states. Please speak with your financial professional or our customer service representative for further information. |

The offer to exchange your contract (iii and iv above) is distinct from our offer to increase your contract account value in return for terminating your GMDB and EEB, as applicable. You can accept our offer to increase your account value and reject our offer to exchange your contract. However, our offer to exchange your contract is not available unless you accept our offer to increase your account value in return for terminating your benefits.

| | • | | Financial professional compensation: Your financial professional will not be directly compensated in connection with your decision to accept or reject our offer. You should know, however, that your financial professional may receive payments that may provide an incentive in recommending whether or not you should accept this offer. For example, if you accept our offer and you choose to remain invested in your contract, the total dollar amount of any ongoing annual compensation to your financial professional and his or her firm may increase due to the increase in your account value. |

In addition, should you accept the offer and decide to surrender your contract in exchange for another contract, your financial professional and his or her firm may be compensated in connection with the sale of the new contract.

3

How to accept this offer

You may accept this offer either online or by sending us the enclosed acceptance form; note that we must receive your reply no later than the date specified in your offer letter.

| | • | | Online: Login to your account at www.us.axa.com and click “Guaranteed Benefit Offer Acceptance.” |

| | • | | On paper: Complete, sign and date the acceptance form included in the mailing. Fax the acceptance form to us at 1-816-701-4960 or return it to us at the following address: |

AXA Equitable Life Insurance Company

Retirement Services Solution

500 Plaza Drive, 6th Floor

Secaucus, NJ 07094

Additional information

If you have any questions about this offer or would like a copy of the current Prospectus for your contract, contact your financial professional or call us directly at1-866-638-0550. As noted earlier,in considering whether to accept or reject this offer, you may wish to consult with your beneficiaries and your financial professional or other advisor.

4

Prospectus Supplement

Guaranteed Minimum Death Benefit and Earnings Enhancement Benefit Offer

This supplement describes an offer we are making to you in connection with your Accumulator® variable annuity contract death benefits. If you accept this offer and your existing contract is not subject to any withdrawal charge, we also offer you the opportunity to exchange your contract for another annuity contract issued by us if you do not want to remain invested in your Accumulator® variable annuity contract.

This supplement contains important information that you should know before accepting this offer or taking any other action under your contract.You are not required to accept this offer or take any action under your contract. If you do not accept this offer, your contract and the death benefit options you previously elected will continue unchanged.You should carefully read this supplement in conjunction with your Prospectus before making your decision regarding this offer. For a current offer amount, you can login to Online Account Access (“OAA”) by visitingwww.us.axa.com. If you have any questions about this offer, contact your financial professional or call us directlyat 1-866-638-0550.

Why am I receiving this offer?

You are receiving this offer because, at the time you purchased your contract, you elected a guaranteed minimum death benefit (“GMDB”). In addition, at the time you purchased your contract, you also may have elected the earnings enhancement benefit (“EEB”), also referred to as “Protection PlusSM”.

What is this offer? How does this offer work?

For a limited time, we are offering to increase your contract’s account value in return for terminating both your GMDB (and EEB, if applicable) and the availability of the standard death benefit. Upon termination of your GMDB (and EEB, if applicable) you would no longer pay the annual charges for the GMDB and EEB. In addition, the availability of the standard death benefit, which is equal to your total contributions to the contract adjusted for any withdrawals you make (including any applicable withdrawal charges), and any taxes that apply, would be terminated and the amount payable to your beneficiaries, should you die while the contract is still in force, would be equal to your contract’s account value, which could be less than your net contributions. For additional information about the GMDB, EEB, and standard death benefit see Appendix I to this supplement.

While the charges for the GMDB and EEB would cease, you should be aware that the annual percentage rate we charge for separate account expenses would remain the same if you accept this offer. There is no additional charge for the standard death benefit. This means that you would continue to pay the same annual percentage rate for separate account expenses as contract owners that have the standard death benefit, even though the standard death benefit would not be available to you.

An offer letter is included with this supplement. You have a limited time period to accept this offer. The offer letter indicates the deadline by which you can accept this offer. You can only accept this offer in its entirety. If we do not receive your acceptance before the offer expires, we will consider you to have rejected this offer.

Why is AXA Equitable making this offer?

We believe this offer can be mutually beneficial to both us and contract owners who no longer want or anticipate needing the GMDB (and EEB, if applicable). If you accept this offer, you would benefit because you would receive an increase in your contract’s account value and your GMDB and EEB charges would cease. We would gain a financial benefit because past market conditions and the ongoing low interest rate environment make continuing to provide these benefits costly to us. Providing the lump sum payments will be less costly to us than the amounts we are currently setting aside to guarantee the benefits.

You should carefully read this supplement before making your decision regarding this offer. This offer asks you to give up valuable benefits in return for additional cash in your contract.

How does AXA Equitable determine the offer amount? How much would be added to my contract’s account value?

We determine the offer amount using standard actuarial calculations for determining contract reserves. In general, the contract reserve for these types of benefits is the difference between the present value of expected benefit claims less the present value of expected benefit charges. We calculate the actuarial value of your GMDB and EEB separately. The amount of the offer is approximately 70% of this combined actuarial valuation. Both of the benefit calculations are subject to a minimum offer. We calculate the total offer amount as the sum of the two benefit calculations, after applying the minimum to each. The larger your contract account value is relative to your benefit base, the smaller your offer amount will be;if your contract account value equals or exceeds your benefit base, you will very likely (though not necessarily) receive the minimum offer amount described below.

The minimum offer amount for the GMDB is equal to the annual percentage rate of the GMDB charge multiplied by the GMDB benefit base as of the close of the business day immediately prior to the business day we process your acceptance of this offer, multiplied by two. The minimum offer amount for the EEB (if you have the EEB) is equal to the annual percentage rate of the EEB charge multiplied by the contract account value as of the close of the business day immediately prior to the business day we process your acceptance of this offer, multiplied by two. If the calculated actuarial value is less than the minimum offer amount, you will receive the minimum offer amount. If you own both the GMDB and EEB your minimum offer amount would be the sum of the GMDB minimum offer amount and EEB minimum offer amount. The actuarial value takes into account:

| | • | | The owner/annuitant’s life expectancy (based on gender and age); |

5

| | • | | The current and projected contract account value; and |

| | • | | The current and projected GMDB/EEB benefit. |

The offer letter included with this supplement indicates the amount of our offer to you as of the date specified in the letter.The offer amount will change each business day because the factors that we use to determine our reserve for these types of benefits change. For example, in determining your current and projected GMDB/EEB benefit, we consider a number of factors including your contract’s current account value, your current allocation of contract assets among the investment options, and interest rates. As these factors change, the amount of our offer changes. Therefore, the exact amount you receive may be more or less than the offer amount quoted to you in our offer letter and will depend on current market conditions and any changes in our estimate of your current and projected contract account value and GMDB/EEB benefit when we determine the amount to be added to your contract’s account value. In general, as your contract account value increases, the amount of the offer decreases. Similarly, as your contract account value decreases, the amount of the offer increases. For a current offer amount, you can login to OAA atwww.us.axa.com or call us at 1-866-638-0550.

Example 1:

Assume the contract owner is a 74-year old male. Further assume the GMDB benefit base is $97,000 and the contract account value is $66,000. The amount of the initial offer as stated in the contract owner’s offer letter is $17,246. Assume the contract owner accepts the offer 30 days later at which time the contract account value has decreased to $61,000. Further assume there are no changes to any other factors that affect the calculation of the offer amount. The amount of the offer would increase to $18,423.

Example 2:

Assume the contract owner is a 74-year old male. Further assume the GMDB benefit base is $97,000 and the contract account value is $66,000. The amount of the initial offer as stated in the contract owner’s offer letter is $17,246. Assume the contract owner accepts the offer 30 days later at which time the contract account value has increased to $71,000. Further assume there are no changes to any other factors that affect the calculation of the offer amount. The amount of the offer would decrease to $16,144.

Example 3:

Assume the contract owner is an 82-year old male. Further assume the GMDB benefit base is $119,000 and the contract account value is $120,000. Further assume that the contract reserve is negative and that the GMDB fee is 0.65%. The amount of the initial offer as stated in the contract owner’s offer letter would be based on the minimum offer amount of annual percentage rate of the GMDB charge multiplied by the GMDB benefit base multiplied by two. Assume the contract owner accepts the offer immediately. The amount of the offer would be $1,547.

How can I evaluate this offer?

You must decide between keeping your GMDB or terminating your GMDB (and EEB, if applicable) and accepting an increase in your contract’s account value. Your GMDB is equal to the greater of your Roll-up benefit base or your Annual Ratchet to Age 85 benefit base and is generally equal to the greater of:

| | a) | your contributions to this contract accumulated at the roll-up rate specified in your contract (to age 85), adjusted for withdrawals (including any applicable withdrawal charges); and |

| | b) | if you have not taken a withdrawal, the Annual Ratchet to age 85 benefit base which is equal to the greater of: (i) your contributions to this contract; or (ii) your highest account value on any contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday (plus any contributions made since the most recent Annual Ratchet). If you have taken a withdrawal, the Annual Ratchet to age 85 benefit base is reduced from the amount described above and is equal to the greater of either: (i) your GMDB benefit base immediately following the most recent withdrawal (plus any additional contributions made after the date of such withdrawal); or (ii) your highest account value on any contract date anniversary after the most recent withdrawal, up to the contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday (plus any contributions made since the most recent Annual Ratchet after the date of such withdrawal). |

AXA Equitable guarantees that the GMDB will not be less than the GMDB benefit base. If your contract’s account value is less than the GMDB benefit base at the time a death claim is paid, the GMDB payable will be equal to the GMDB benefit base. For additional information about the GMDB, see Appendix I.

If you accept this offer, your EEB will also terminate. The EEB provides an additional death benefit which is generally equal to a specified percentage of: the greater of: (i) your contract account value, or (ii) any applicable death benefit; and decreased by your total net contributions. For certain contracts issued from April 2002 – September 2003, in calculating the death benefit, contributions are decreased for withdrawals on a pro rata basis. Depending on the terms of your contract, the specified percentage payable is either 40% or 25%. For additional information about the EEB, see the Appendix I.

If you accept this offer, you should also consider the fact that the standard death benefit will not be available to you even though it is available to other contract owners at no additional charge. The standard death benefit is equal to your total contributions to the contract adjusted for any withdrawals you make (including any applicable withdrawal charges) and any taxes that apply. For additional information about the standard death benefit, see the Appendix I.

6

If you do not accept our offer, no amount would be added to your contract’s account value and the GMDB (and EEB, if applicable) would continue to apply. If you accept this offer, your GMDB (and EEB, if applicable) and the availability of the standard death benefit would terminate, and your contract’s account value would be increased. In the future, should you die while the contract is still in force, the amount payable to your beneficiaries would be equal to your contract’s account value, which could be less than your net contributions.

When you purchased your contract you made a determination that the GMDB (and EEB, if applicable) was important to you under your personal circumstances at that time. When considering this offer, you should consider whether you no longer want or anticipate needing the GMDB (and EEB, if applicable) given your personal circumstances today. You should also consider your specific contract account values (with and without the offer), your GMDB benefit base and the following factors:

| | • | | Whether the increased contract account value available through the offer is more important to you than the current value of the GMDB provided by the current GMDB benefit base; |

| | • | | Whether you believe that your contract account value, with the addition provided by the offer, may increase (through market gains) relative to how the GMDB benefit base may increase such that the GMDB may become less valuable to you over time; |

| | • | | Whether you believe that your contract account value, with the addition provided by the offer, may decline (through market losses), stay the same, or increase slowly relative to how the GMDB benefit base would have increased such that the value of having the GMDB may become more valuable to your beneficiaries over time; and |

| | • | | Whether your need for income (or withdrawals) from this contract is more important to you than your need to leave a death benefit to your beneficiaries. |

You should assess your own situation to decide whether to accept the offer. In considering the factors above, and any other factors you believe relevant, you may wish to consult with your beneficiaries, and your financial professional or other advisors. We cannot provide investment advice to you, including how to weigh any relevant factors for your particular situation. We cannot provide any advice regarding future contract account value, including whether investment options under your contract will experience market gains or losses.

How do I accept this offer?

To accept this offer, you may login to your account atwww.us.axa.com. You may also accept this offer by completing the acceptance form included with this supplement. Please complete, sign and date the acceptance form and return it to us at the following address:

AXA Equitable Life Insurance Company

Retirement Services Solution

500 Plaza Drive, 6th Floor

Secaucus, NJ 07094

Or you may fax the acceptance form to us at 1-816-701-4960.

REMEMBER:If you accept this offer, the amount we pay you will likely be either more or less than the offer amount in your letter, as the amount we add to your contract’s account value will be determined and added on the business day we receive your acceptance in good order. The amount will be allocated according to your current investment allocation instructions on file with us. If there are any policy transactions on the day we receive your acceptance form, the amount we add to your contract’s account value will be determined and added on the next business day.Note: For most contract owners, the offer amount will be less than the difference between the projected GMDB benefit base and the contract’s account value.However, if the actuarial calculation of the offer amount is less than the minimum offer amount (i.e. two times the GMDB fee rate multiplied by the respective benefit base and the EEB fee rate (if applicable) multiplied by the account value), the offer amount may be greater than the difference between the projected GMDB benefit base and the contract’s account value. This is more likely to occur if the difference between the GMDB benefit base and the contract account value is small relative to the fees paid for the GMDB.

What are my options after I accept this offer?

If you accept this offer you may choose to remain invested in your contract, or if you do not want to remain invested in your contract without the GMDB (and EEB, if applicable) or the standard death benefit, you have the following options: (i) you may terminate your contract and receive the cash value which includes the amount we add to your contract; (ii) you may transfer all or part of your contract’s cash value to another investment product; (iii) you may exchange your contract for another annuity contract issued by an insurance company of your choice; or (iv) if a withdrawal charge does not apply to your existing contract, you may exchange your contract for a New Contract. (See Appendix II to this supplement for a comparison of some of the important features of your existing contract and the New Contracts.) If you are considering exchanging your existing contract for a New Contract and would like a copy of a prospectus, contact your financial professional. Before making a decision to purchase a New Contract, you should read the prospectus and carefully consider the investment objectives, risks, and charges and expenses. We cannot recommend a course of action for you. Your financial professional will be able to explain the features of the New Contract, and provide you with the proper forms and application necessary to complete the transaction. New Contracts can only be purchased through a broker-dealer and are not available in all states or through all broker-dealer firms.

The offer to exchange your contract is distinct from our offer to increase your contract account value in return for terminating your GMDB (and EEB, if applicable) and the availability of the standard death benefit. You can accept our offer to increase your account value and reject our offer to exchange your contract. However, our offer to exchange your contract is not available unless you accept our offer to increase your account value in return for terminating your benefits.

7

If I accept this offer and stay invested in the contract, would my automatic payment plans be impacted?

If you are enrolled in the dollar-for-dollar withdrawal service, your enrollment would terminate if you accept this offer. Systematic withdrawals and payments under the automatic required minimum distribution service would not be affected if you accept this offer. If you wish to enroll in automated withdrawal services, call us at 1-800-789-7771.

More information about this offer

If you accept this offer, you will receive an endorsement to your contract that terminates your GMDB, and EEB, if applicable. The death benefit under your contract will be a return of account value.

You will not incur any fees or charges as a result of accepting this offer. All expenses we incur in connection with this offer, including legal, accounting and other fees and expenses, will be paid by us and have no effect on your contract regardless of whether or not you accept this offer.

You will not be subject to any current tax consequences if you accept this offer. The amount added to your contract will be treated like earnings for income tax purposes. The tax rules for withdrawals from and surrenders of the contract continue to apply. For additional information, see “Tax information” in your Prospectus.

The amount we add to your contract’s account value is not subject to any credits that may apply if you have an Accumulator® PlusSM contract. Therefore, you will not receive any credit in connection with this offer.

A withdrawal charge will not apply to the amount we add to your contract’s account value. However, for contracts other than Accumulator® SelectSM, withdrawal charges will continue to apply to your contributions depending on how long each contribution has been invested in your contract. A withdrawal charge may apply if: (i) you make one or more withdrawals during the contract year that, in total, exceed the free withdrawal amount (10% or 15% of your contract’s account value at the beginning of the year depending on the terms of your contract); or (ii) you surrender your contract to receive its cash value or apply your cash value to a non-life contingent payout option. For additional information, see “Withdrawal charge” in “Charges and expenses” in your Prospectus.

Although we do not directly compensate your financial professional based on your acceptance of this offer, your financial professional may receive payments that may provide an incentive in recommending whether or not you should accept this offer. For example, if your account value increases and you choose to remain invested in your contract, the total dollar amount of any ongoing annual compensation to your financial professional and his or her firm may increase. Or, if you exchange this contract for another variable annuity or other investment product, your financial professional may receive compensation upon completion of that purchase. You should contact your financial professional for information about the compensation he or she receives. For additional information about compensation paid to your financial professional, see “Distribution of the contracts” in “More information” in your Prospectus.

This offer may not be available in all states. We may suspend or terminate this offer at any time. In the future, we may make additional offers in connection with these benefits on different and/or more or less favorable terms. In other words, we may make an offer to a group of contract owners based on an offer amount, and, in the future, make another offer based on a higher or lower offer amount to the remaining contract owners in the same group. If you accept the offer and terminate your GMDB (and EEB, if applicable) and the availability of the standard death benefit, you will not be eligible for any future offers related to that type of guaranteed benefit even if such future offer would have included a greater offer amount or different payment or incentive. You may currently be receiving this offer as part of a group of remaining contract owners who did not accept a prior offer.

8

Appendix I

Guaranteed Minimum Death Benefit, Earnings Enhancement Benefit, and Standard Death Benefit Information

Guaranteed minimum death benefit base

The Guaranteed minimum death benefit base (hereinafter, in this section called your “benefit base”) is used to calculate the Guaranteed minimum death benefit, as described in this section. Your benefit base is not an account value or a cash value. See also, “Guaranteed minimum death benefit” below.

Standard death benefit.Your benefit base is equal to:

| • | | your initial contribution and any additional contributions to the contract; less a deduction that reflects any withdrawals you make (including any applicable withdrawal charges). The amount of this deduction is described under “Accessing your money” in your Prospectus. The amount of any withdrawal charge is described under “Withdrawal charge” in “Charges and expenses” in your Prospectus. Please note that withdrawal charges do not apply to Accumulator® SelectSM contracts. |

6 1/2% (6%, or 5%, if applicable) Roll-Up to age 85 (used for the Greater of 6 1/2% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit, the Greater of 6% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit, AND for the Greater of 5% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit). Your benefit base is equal to:

| • | | your initial contribution and any additional contributions to the contract; plus |

| • | | a deduction that reflects any withdrawals you make (including any applicable withdrawal charges). The amount of this deduction is described under “Accessing your money” and the section entitled “Charges and expenses” in your Prospectus. The amount of any withdrawal charge is described under “Withdrawal charge” in “Charges and expenses” in your Prospectus. Please note that withdrawal charges do not apply to Accumulator® SelectSM contracts. |

The effective annual roll-up rate credited to this benefit base is:

| • | | 6 1/2% (6%, or 5%, if applicable) with respect to the variable investment options (including amounts allocated to the account for special money market dollar cost averaging under Accumulator® PlusSM and Accumulator® SelectSM contracts but excluding all other amounts allocated to the EQ/Money Market variable investment option), and the account for special dollar cost averaging (under Accumulator® and Accumulator® EliteSM contracts only). Certain versions of the contracts also exclude amounts allocated to the EQ/Intermediate Government Bond variable investment option; the effective annual rate may be 4% in some states. Please see “State contract availability and/or variations of certain features and benefits” in your Prospectus to see what applies in your state; and |

| • | | 3% with respect to the EQ/Money Market variable investment option (certain versions of the contracts also include the EQ/Intermediate Government Bond variable investment option), the fixed maturity options, the guaranteed interest option and the loan reserve account under Rollover TSA (if applicable). |

The benefit base stops rolling up on the contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday.

Please see “Our administrative procedures for calculating your Roll-Up benefit base following a transfer” in your Prospectus for more information about how we calculate your Roll-Up benefit base when you transfer account values between investment options with a higher Roll-Up rate (4-6.5%) and investment options with a lower Roll-Up rate (3%).

Annual Ratchet to age 85 (used for the Annual Ratchet to age 85 enhanced death benefit, the Greater of 6 1/2% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit, the Greater of 6% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit, the Greater of 5% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit, AND for the Greater of 3% Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit ). If you have not taken a withdrawal from your contract, your benefit base is equal to the greater of either:

| • | | your initial contribution to the contract (plus any additional contributions), |

-or-

| • | | your highest account value on any contract date anniversary up to the contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday (plus any contributions made since the most recent Annual Ratchet). |

If you have taken a withdrawal from your contract, your benefit base will be reduced from the amount described above. See “Accessing your money” in your Prospectus. The amount of any withdrawal charge is described under “Withdrawal charge” in “Charges and expenses” in your Prospectus. Please note that withdrawal charges do not apply to Accumulator® SelectSM contracts. At any time after a withdrawal, your benefit base is equal to the greater of either:

| • | | your benefit base immediately following the most recent withdrawal (plus any additional contributions made after the date of such withdrawal), |

-or-

| • | | your highest account value on any contract date anniversary after the date of the most recent withdrawal, up to the contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday (plus any contributions made since the most recent Annual Ratchet after the date of such withdrawal). |

Greater of 6 1/2% (6%, or 5%, if applicable) Roll-Up to age 85 or Annual Ratchet to age 85 enhanced death benefit. Your benefit base is equal to the greater of the benefit base computed for the 6 1/2% (6%, or 5%, if applicable) Roll-Up to age 85 or the benefit base computed for the Annual Ratchet to age 85, as described immediately above, on each contract date anniversary.

3% Roll-Up to age 85 (used for the Greater of 3% Roll-Up to age 85 or the Annual Ratchet to age 85 enhanced death benefit).Your benefit base is equal to:

| • | | your initial contribution and any additional contributions to the contract; plus |

| • | | a deduction that reflects any withdrawals you make (including any applicable withdrawal charges). The amount of this deduction is described under “Accessing your money” and the section entitled “Charges and expenses” in your Prospectus. The amount of any withdrawal charge is described under “Withdrawal charge” in “Charges and expenses” in your Prospectus. Please note that withdrawal charges do not apply to Accumulator® SelectSM contracts. |

The effective annual roll-up rate credited to the benefit base is 3%.

The benefit base stops rolling up on the contract date anniversary following the owner’s (or older joint owner’s, if applicable) 85th birthday.

Greater of 3% Roll-Up to age 85 or the Annual Ratchet to age 85 enhanced death benefit.Your benefit base is equal to the greater of the benefit base computed for the 3% Roll-Up to age 85 or the benefit base computed for the Annual Ratchet to age 85, as described immediately above, on each contract date anniversary.

Guaranteed minimum death benefit

Your contract provides a standard death benefit. The standard death benefit is equal to your total contributions, adjusted for any withdrawals (and any associated withdrawal charges, if applicable under your Accumulator® Series contract). Once your contract is issued, you may not change or voluntarily terminate your death benefit, unless we make an offer to you to do so.

You may also elect one of the enhanced death benefits , which provides a death benefit that is equal to your account value (without adjustment for any otherwise applicable negative market value adjustment) as of the date we receive satisfactory proof of the owner’s (or older joint owner’s, if applicable) death, any required instructions for the method of payment, information and forms necessary to effect payment, or your elected enhanced death benefit on the date of the owner’s (or older joint owner’s, if applicable) death, adjusted for any subsequent withdrawals (and associated withdrawal charges, if applicable under your Accumulator® Series contract), whichever provides the higher amount. See “Payment of death benefit” in your Prospectus for more information.

If you elect one of the enhanced death benefits and change ownership of the contract, generally the benefit will automatically terminate, except under certain circumstances. If this occurs, any enhanced death benefit elected will be replaced with the standard death benefit. See “Transfers of ownership, collateral assignments, loans and borrowing” in “More information” in your Prospectus for more information.

Earnings enhancement benefit (or Protection PlusSM)

The Earnings enhancement benefit provides an additional death benefit as described below. Once you purchase the Earnings enhancement benefit you may not voluntarily terminate this feature.

If you elect the Earnings enhancement benefit described below and change ownership of the contract, generally this benefit will automatically terminate, except under certain circumstances. See “Transfers of ownership, collateral assignments, loans and borrowing” in “More information,” in your Prospectus for more information.

If the owner (or older joint owner, if applicable) is 70 or younger when we issue your contract (or if the spouse beneficiary or younger spouse joint owner is 70 or younger when he or she becomes the successor owner and the Earnings enhancement benefit had been elected at issue), the additional death benefit will be 40% of:

the greater of:

| | (ii) | any applicable death benefit decreased by; |

| | (iii) | total net contributions. |

For certain contracts issued from April 2002 – September 2003, in calculating the death benefit, contributions are decreased for withdrawals on a pro rata basis.

For purposes of calculating your Earnings enhancement benefit, the following applies: (i) “Net contributions” are the total contributions made (or if applicable, the total amount that would otherwise have been paid as a death benefit had the spouse beneficiary or younger spouse joint owner not continued the contract plus any subsequent contributions) adjusted for each withdrawal that exceeds your Earnings enhancement benefit earnings. “Net contributions” are reduced by the amount of that excess. Earnings enhancement benefit earnings are equal to (a) minus (b) where (a) is the greater of the account value and the death benefit immediately prior to the withdrawal, and (b) is the net contributions as adjusted by any prior withdrawals (for Accumulator® PlusSM contracts, credit amounts are not included in “net contributions”); and (ii) “Death benefit” is equal to the greater of the account value as of the date we receive satisfactory proof of death or any applicable Guaranteed minimum death benefit as of the date of death.

For Accumulator® PlusSM contracts, for purposes of calculating your Earnings enhancement benefit, if any contributions are made in the one-year period prior to death of the owner (or older joint owner, if applicable), the account value will not include any credits applied in the one-year period prior to death.

If the owner (or older joint owner, if applicable) is age 71 through 75 when we issue your contract (or if the spouse beneficiary or younger spouse joint owner is between the ages of 71 and 75 when he or she becomes the successor owner and the Earnings enhancement benefit had been elected at issue), the additional death benefit will be 25% of:

the greater of:

| | (ii) | any applicable death benefit decreased by; |

| | (iii) | total net contributions. |

For certain contracts issued from April 2002 – September 2003, in calculating the death benefit, contributions are decreased for withdrawals on a pro rata basis.

The value of the Earnings enhancement benefit is frozen on the first contract date anniversary after the owner (or older joint owner, if applicable) turns age 80, except that the benefit will be reduced for withdrawals on a pro rata basis. Reduction on a pro rata basis means that we calculate the percentage of the current account value that is being withdrawn and we reduce the benefit by that percentage. For example, if the account value is $30,000 and you withdraw $12,000, you have withdrawn 40% of your account value. If the benefit is $40,000 before the withdrawal, it would be reduced by $16,000 ($40,000 × .40) and the benefit after the withdrawal would be $24,000 ($40,000 – $16,000).

For contracts continued under Spousal continuation, upon the death of the spouse (or older spouse, in the case of jointly owned contracts), the account value will be increased by the value of the Earnings enhancement benefit as of the date we receive due proof of death. The benefit will then be based on the age of the surviving spouse as of the date of the deceased spouse’s death for the remainder of the contract. If the surviving spouse is age 76 or older, the benefit will terminate and the charge will no longer be in effect. The spouse may also take the death benefit (increased by the Earnings enhancement benefit) in a lump sum. See “Spousal continuation” in “Payment of death benefit” in your Prospectus for more information.

Appendix II

Exchange Offer Program

If you are considering purchasing a New Contract you should contact your financial professional, who will be able to explain the features of the New Contract, and provide you with the proper forms and application necessary to complete the transaction. New Contracts can only be purchased through a broker-dealer and are not available in all states or through all broker-dealer firms.

AXA Equitable will permit owners of the contracts included in this Guaranteed minimum death benefit and Earnings enhancement benefit offer to exchange their existing contract at net asset value for a New Contract. This exchange offer program is available if: (i) your existing contract is not subject to any withdrawal charge; and (ii) you accept our Guaranteed minimum death benefit and Earnings enhancement offer. If you are considering exchanging your existing contract for a New Contract and would like a copy of the prospectus for the New Contract, contact your financial professional.

Under this exchange offer program, your existing contract must not be subject to a withdrawal charge. The account value attributable to your existing contract would not be subject to any withdrawal charge under the New Contract (but would be subject to all other charges and fees under the New Contract). You should carefully consider whether an exchange is appropriate for you by comparing the features and benefits provided by your existing contract to the benefits and features provided by the New Contracts and other investment products. You should also compare the fees and charges of your existing contract to the fees and charges of the New Contract, which may be higher than the fees and charges under your existing contract and other investment products available to you.

The chart set out on the next page provides a summary comparison of some of the important features of your existing contract and the New Contracts. You should not rely solely on this chart in examining the differences between your existing contract and the New Contracts. There may be other differences important for you to consider prior to purchasing a New Contract. You should read your Prospectus and other information related to your existing contract prior to requesting an exchange to a New Contract. Please note, this chart does not create or modify any existing rights or benefits, all of which are only established by your existing contract.

Comparison of your existing contract and the New Contracts

| | | | | | | | | | | | | | | | |

| | | Existing Contracts | | New Contracts* | | | | |

| | | Existing Contracts prior to

accepting offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Existing Contracts after

accepting this offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Structured Capital

Strategies® Series C

Contract2 | | Structured Capital

Strategies® Series

ADV Contract2 | | Investment Edge®

15.0 Investment

Edge® Select

Contract3 | | Investment Edge®

15.0 Investment

Edge® ADV

Contract3 | | Investment Edge®

Investment Edge®

Select Contract3 | | Investment Edge®

Investment Edge®

ADV Contract3 |

Annual Administrative Charge | | $0 – $304 | | $0 – $304 | | None | | None | | $505 | | None | | $506 | | $506 |

Total Separate Account Annual Expenses | | 1.25% – 1.70% | | 1.25% – 1.70% | | 1.65% | | 0.65% | | 1.25% | | 0.30% | | 1.25% | | 0.30% |

Maximum Withdrawal Charge | | 0% – 8% | | 0% – 8% | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

| Standard Death Benefit | | The greater of: (i) your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment; and (ii) your total contributions, adjusted for withdrawals (and any associated withdrawal charges, if applicable). | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. | | Your account value as of the date we receive satisfactory proof of death, any required instructions for the method of payment, and all information and forms necessary to effect payment. |

Guaranteed Minimum Death Benefit charge | | 0% – 1.15% | | N/A | | N/A | | N/A | | 0.6% – 40%7 | | 0.6% – 40%7 | | N/A | | N/A |

Protection PlusSM Benefit Charge | | 0.35% (Only applicable to Accumulator® Series ‘02/’04 contracts) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Earning Enhancement Benefit Charge | | 0.35% (Only applicable to Accumulator® Series ‘06/’06.5 and ‘07/’07.5 contracts) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | | | | |

| | | Existing Contracts | | New Contracts* | | | | |

| | | Existing Contracts prior to

accepting offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Existing Contracts after

accepting this offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Structured Capital

Strategies® Series C

Contract2 | | Structured Capital

Strategies® Series

ADV Contract2 | | Investment Edge®

15.0 Investment

Edge® Select

Contract3 | | Investment Edge®

15.0 Investment

Edge® ADV

Contract3 | | Investment Edge®

Investment Edge®

Select Contract3 | | Investment Edge®

Investment Edge®

ADV Contract3 |

Principal Guarantee Benefits Charge8 | | 0.50% – 0.75% | | 0.50% – 0.75% | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Guaranteed Minimum Income Benefit Charge8 | | 0.65% – 1.10% | | 0.65% – 1.10% | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Principal ProtectorSM Benefit Charge8 | | 0.35% – 0.80% (Only applicable to Accumulator® Series ‘02/’04 contracts) | | 0.35% – 0.80% (Only applicable to

Accumulator® Series ‘02/’04 contracts) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Guaranteed Withdrawal Benefit For Life Benefit Charge8 | | 0.60% – 0.95% (Only applicable to Accumulator® Series ‘06/’06.5 and ‘07/’07.5 contracts) | | 0.60% – 0.95% (Only applicable to Accumulator® Series ‘06/’06.5 and ‘07/’07.5 contracts) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

Choice Cost9 | | N/A | | N/A | | 3% or 5% | | 3% or 5% | | N/A | | N/A | | N/A | | N/A |

Loan Features (if your employer’s plan permits | | Yes | | Yes | | No | | No | | No | | No | | No | | No |

Variable Investment Options10 | | 37 Class B and IB | | 37 Class B and IB | | 3 Class IB | | 3 Class IB | | 134 Various classes | | 134 Various classes | | 134 Various classes | | 134 Various classes |

Structured Investment Options11 | | N/A | | N/A | | 21 | | 21 | | N/A | | N/A | | N/A | | N/A |

Lifetime minimum guaranteed interest rate in the guaranteed interest option | | 1% – 3% | | 1% – 3% | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | | | | |

| | | Existing Contracts | | New Contracts* | | | | |

| | | Existing Contracts prior to

accepting offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Existing Contracts after

accepting this offer for:

Accumulator® (Series

‘02/’04 through ‘07/’07.5)

Accumulator®,

Accumulator® PlusSM,

Accumulator® EliteSM, and

Accumulator® SelectSM

Series1 | | Structured Capital

Strategies® Series C

Contract2 | | Structured Capital

Strategies® Series

ADV Contract2 | | Investment Edge®

15.0 Investment

Edge® Select

Contract3 | | Investment Edge®

15.0 Investment

Edge® ADV

Contract3 | | Investment Edge®

Investment Edge®

Select Contract3 | | Investment Edge®

Investment Edge®

ADV Contract3 |

Fixed Maturity Options12 | | Yes | | Yes | | No | | No | | No | | No | | No | | No |

| * | A New Contract may not be available in all states. Please speak with your financial professional or our customer service representative for further information. |

| 1 | The Accumulator® Series Prospectus offers a variable deferred annuity contract to accumulate value on a tax deferred basis by investing in one or more investment options, including variable and fixed investment options. It also provides certain income and death benefit protections. For more information, please refer to the Accumulator® Series Prospectus. |

| 2 | The Structured Capital Strategies® Prospectus offers a variable and indexed-deferred annuity contract to accumulate value on a tax deferred basis by investing in variable investments options and/or structured investment options. Structured investment options provide performance tied to the performance of a securities or commodities indexed for a set period of time. Please note that if you exchange into a Structured Capital Strategies® Series ADV contract there are fees and expenses of a fee-based program that are separate from and in addition to the fees and expenses of the contract, including other conditions related to brokerage services. For more information, please refer to the Structured Capital Strategies® Prospectus. |

| 3 | The Investment Edge® and Investment Edge® 15.0 Prospectuses offer variable deferred annuity contracts to accumulate value on a tax deferred basis by investing in one or more variable investment options and provide a number of payout options. The Investment Edge® 15.0 Prospectus also provides a death benefit protection option. Please note that if you exchange into either Investment Edge® ADV contract there are fees and expenses of a fee-based program that are separate from and in addition to the fees and expenses of the contract, including other conditions related to brokerage services. For more information, please refer to the Investment Edge® and/or Investment Edge® 15.0 Prospectus. |

| 4 | The charge, if applicable, is $30 for each contract year. If the contract is surrendered or annuitized, or a death benefit is surrendered or annuitized, or a death benefit is paid on any date other than a contract anniversary, we will deduct a pro rata portion of the annual administrative charge for that year. |

| 5 | Beginning with your first contract date anniversary, we will deduct a charge of $50 on any contract date anniversary on which your account value is less than $50,000. If the contract is surrendered or annuitized or a death benefit is paid on any date other than the contract date anniversary, we will deduct a pro rata portion of the charge for that year. Otherwise, we will deduct the full charge. This charge will no longer apply to NQ contracts following election of an Income Edge payment program, even if your account value falls below $50,000. |

| 6 | For Investment Edge® contracts, we will deduct this charge on any contract date anniversary following the first contract date anniversary (or, for NQ contracts where an Income Edge payment program has been elected, the first Income Edge Anniversary Date) if you were not enrolled in electronic delivery for the entirety of the preceding contract year (or, for NQ contracts where an Income Edge payment program has been elected, the preceding Annual Payout Period). If the contract is surrendered or annuitized or a death benefit is paid on any date other than the contract date anniversary, we will deduct a pro rata portion of the charge for that year. Otherwise, we will deduct the full charge. |

| 7 | The charge, if applicable, is calculated daily as a percentage of your net amount at risk and deducted annually on each contract date anniversary for which the benefit is in effect. If on any date other than the contract date anniversary your contract is surrendered or annuitized, Income Edge® is elected and becomes effective, a death benefit is paid, or the death benefit is terminated, we will deduct the cumulative accrued charge for that year from your account value. |

| 8 | Not all guaranteed benefits may be currently available to you since certain guaranteed benefits had to be elected at issue of the contract and/or are not available in combination with other elected guaranteed benefits. Please refer to your Accumulator® Series Prospectus for more information. |

| 9 | Choice cost is a charge which is only applicable if a contract owner elects to invest in Choice Segments under the Structured Capital Strategies® contract. Subject to certain conditions, Choice cost is equal to 3% or 5% for a Choice Segment to the corresponding 3-year or 5-year segment duration that you elect. For more information on Choice costs, please refer to the Structured Capital Strategies® Prospectus. |

| 10 | The number of investment options available under a particular contract is subject to change. Please refer to your Prospectus for more information on investment options available under your contract. |

| 11 | The Structured Investment Option permits you to invest in one or more Segments, each of which provides performance tied to the performance of an index such as the S&P 500 Price Return Index (the “Index”), for a set period of time. The Structured Investment Option does not involve an investment in any underlying portfolio. Instead, it is an obligation of AXA Equitable. Unlike an index fund, the Structured Investment Option provides a return at maturity designed to provide protection against certain decreases in the Index in exchange for a limitation on participation in certain increases in the Index. The extent of the downside protection at maturity ranges from the first 10%, 20%, or 30% of loss. This means that you could lose up to 70% of your principal with a -30% Segment Buffer, up to 80% of your principal with a -20% Segment Buffer and up to 90% of your principal with a -10% Segment Buffer. See the Structured Capital Strategies® Prospectus for more information. |

| 12 | Fixed Maturity Options offer a fixed rate of interest if held to maturity. Fixed Maturity Options generally have maturity dates that range from one to ten years. Withdrawals or transfers from a Fixed Maturity Option prior to maturity may be subject to a market value adjustment, which may increase or decrease the account value. See “fixed maturity options” in your Prospectus for more information. This feature is not available in all contracts or in all states. |

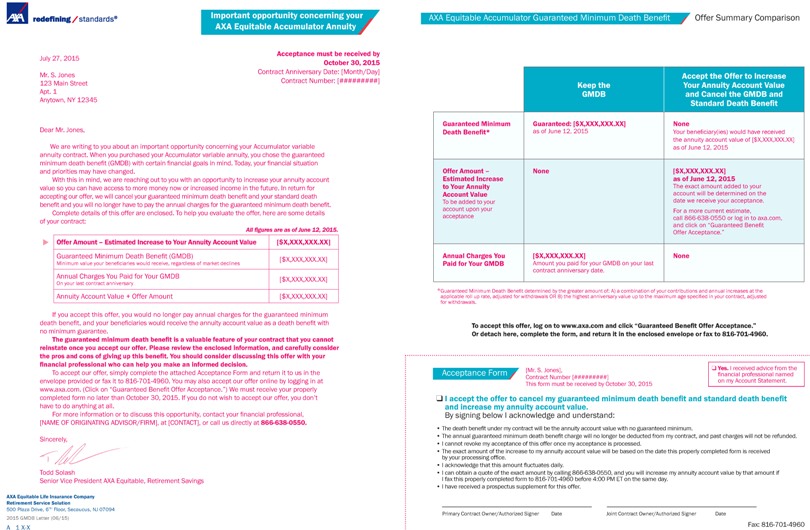

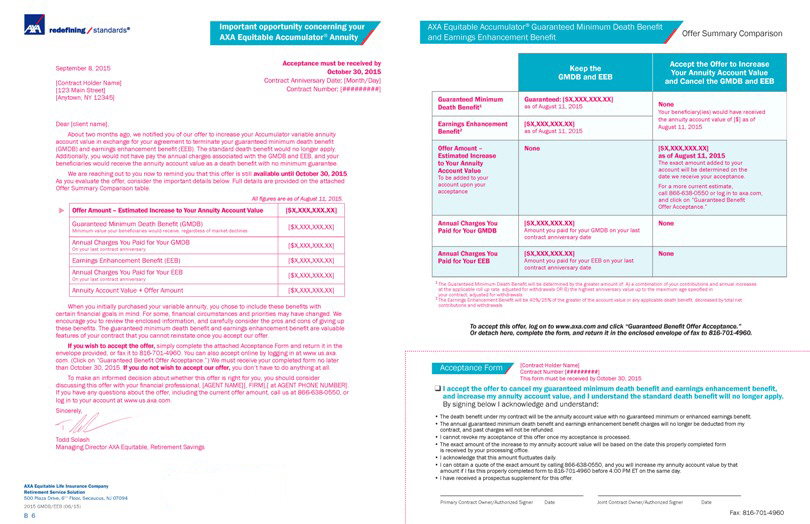

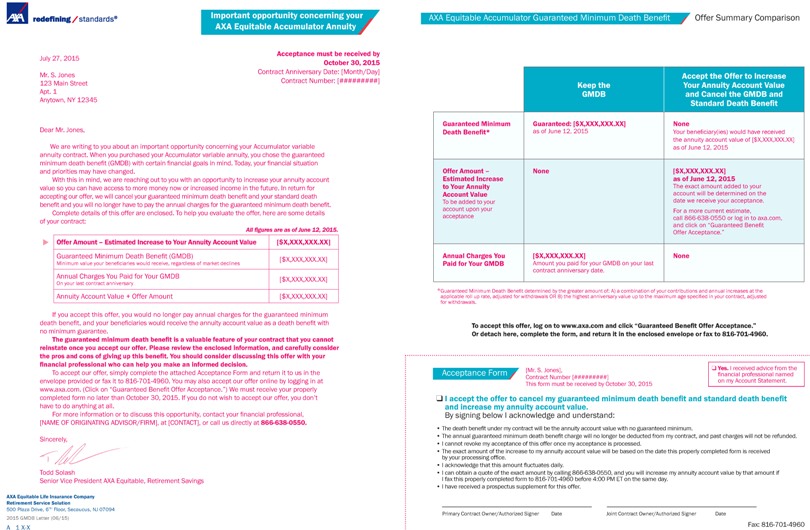

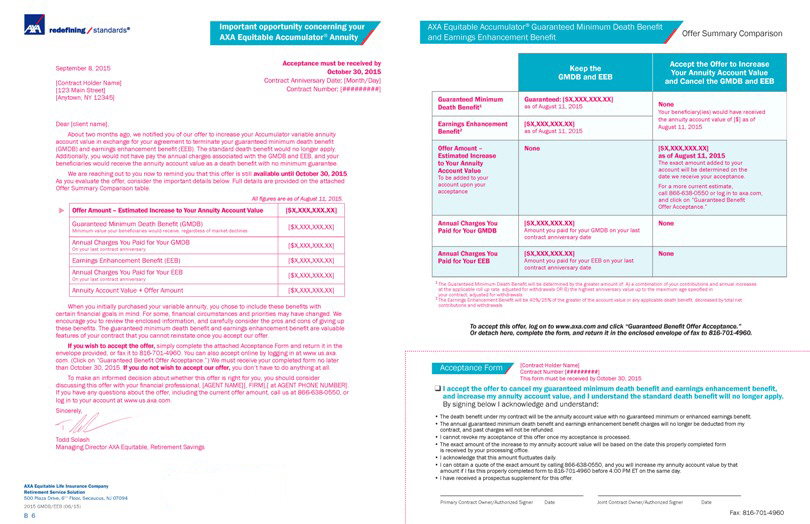

Important opportunity concerning your AXA Equitable Accumulator Annuity .

Acceptance must be received by

July 27, 2015

October 30, 2015

Mr. S. Jones Contract Anniversary Date: [Month/Day] 123 Main Street Contract Number: [#########]

Apt. 1

Anytown, NY 12345

Dear Mr. Jones,

We are writing to you about an important opportunity concerning your Accumulator variable annuity contract. When you purchased your Accumulator variable annuity, you chose the guaranteed minimum death benefit (GMDB) with certain financial goals in mind. Today, your financial situation and priorities may have changed.

With this in mind, we are reaching out to you with an opportunity to increase your annuity account value so you can have access to more money now or increased income in the future. In return for accepting our offer, we will cancel your guaranteed minimum death benefit and your standard death benefit and you will no longer have to pay the annual charges for the guaranteed minimum death benefit.

Complete details of this offer are enclosed. To help you evaluate the offer, here are some details of your contract:

All figures are as of June 12, 2015.

Offer Amount – Estimated Increase to Your Annuity Account Value [$X,XXX,XXX.XX]

Guaranteed Minimum Death Benefit (GMDB) [$X,XXX,XXX.XX]

Minimum value your beneficiaries would receive, regardless of market declines

Annual Charges You Paid for Your GMDB [$X,XXX,XXX.XX]

On your last contract anniversary

Annuity Account Value + Offer Amount [$X,XXX,XXX.XX]

If you accept this offer, you would no longer pay annual charges for the guaranteed minimum death benefit, and your beneficiaries would receive the annuity account value as a death benefit with no minimum guarantee.

The guaranteed minimum death benefit is a valuable feature of your contract that you cannot reinstate once you accept our offer. Please review the enclosed information, and carefully consider the pros and cons of giving up this benefit. You should consider discussing this offer with your financial professional who can help you make an informed decision.

To accept our offer, simply complete the attached Acceptance Form and return it to us in the envelope provided or fax it to 816-701-4960. You may also accept our offer online by logging in at www.axa.com. (Click on “Guaranteed Benefit Offer Acceptance.”) We must receive your properly completed form no later than October 30, 2015. If you do not wish to accept our offer, you don’t have to do anything at all.

For more information or to discuss this opportunity, contact your financial professional,

[NAME OF ORIGINATING ADVISOR/FIRM], at [CONTACT], or call us directly at 866-638-0550.

Todd Solash

Senior Vice President AXA Equitable, Retirement Savings

AXA Equitable Life Insurance Company Retirement Service Solution

500 Plaza Drive, 6TH Floor, Secaucus, NJ 07094 2015 GMDB Letter (06/15)

A 1 X-X

AXA Equitable Accumulator Guaranteed Minimum Death Benefit Offer Summary Comparison

Accept the Offer to Increase Keep the Your Annuity Account Value GMDB and Cancel the GMDB and

Standard Death Benefit

Guaranteed Minimum Guaranteed: [$X,XXX,XXX.XX] None

Death Benefit* as of June 12, 2015 Your beneficiary(ies) would have received the annuity account value of [$X,XXX,XXX.XX] as of June 12, 2015

Offer Amount – None [$X,XXX,XXX.XX] Estimated Increase as of June 12, 2015 to Your Annuity The exact amount added to your Account Value account will be determined on the

To be added to your date we receive your acceptance. account upon your For a more current estimate, acceptance call 866-638-0550 or log in to axa.com, and click on “Guaranteed Benefit Offer Acceptance.”

Annual Charges You [$X,XXX,XXX.XX] None

Paid for Your GMDB Amount you paid for your GMDB on your last contract anniversary date.

*Guaranteed applicable roll Minimum up rate, Death adjusted Benefit for withdrawals determined OR by B) the the greater highest amount anniversary of: A) a value combination up to the of maximum your contributions age specified and in annual your contract, increases adjusted at the for withdrawals.

To accept this offer, log on to www.axa.com and click “Guaranteed Benefit Offer Acceptance.”

Or detach here, complete the form, and return it in the enclosed envelope or fax to 816-701-4960.

Acceptance Form [Mr. S. Jones], qfinancial Yes. I received professional advice from named the Contract Number [#########] on my Account Statement.

This form must be received by October 30, 2015

q I accept the offer to cancel my guaranteed minimum death benefit and standard death benefit and increase my annuity account value.

By signing below I acknowledge and understand:

• The death benefit under my contract will be the annuity account value with no guaranteed minimum.

• The annual guaranteed minimum death benefit charge will no longer be deducted from my contract, and past charges will not be refunded.

• I cannot revoke my acceptance of this offer once my acceptance is processed.

• The by your exact processing amount of office the .increase to my annuity account value will be based on the date this properly completed form is received

• I acknowledge that this amount fluctuates daily.

• II can fax this obtain properly a quote completed of the exact form amount to 816- 701 by calling -4960 866 before -638 4:00 -0550, PM and ET on you the will same increase day. my annuity account value by that amount if

• I have received a prospectus supplement for this offer.

Primary Contract Owner/Authorized Signer Date

Joint Contract Owner/Authorized Signer Date

Fax: 816-701-4960

Annuities are issued by AXA Equitable Life Insurance Company (AXA Equitable), New York, NY and are co-distributed by AXA Advisors, LLC and AXA Distributors, LLC. AXA Equitable, AXA Distributors and AXA Advisors are affiliated companies and do not provide legal or tax advice. An investment in a variable annuity involves investment risk, including possible loss of principal. Withdrawals from annuities are subject to normal income tax treatment and if taken prior to age 59 ½ may be subject to an additional 10% federal income tax penalty. Withdrawals may also be subject to a contractual withdrawal charge. Guarantees are based on the claims-paying ability of the issuing insurance company.

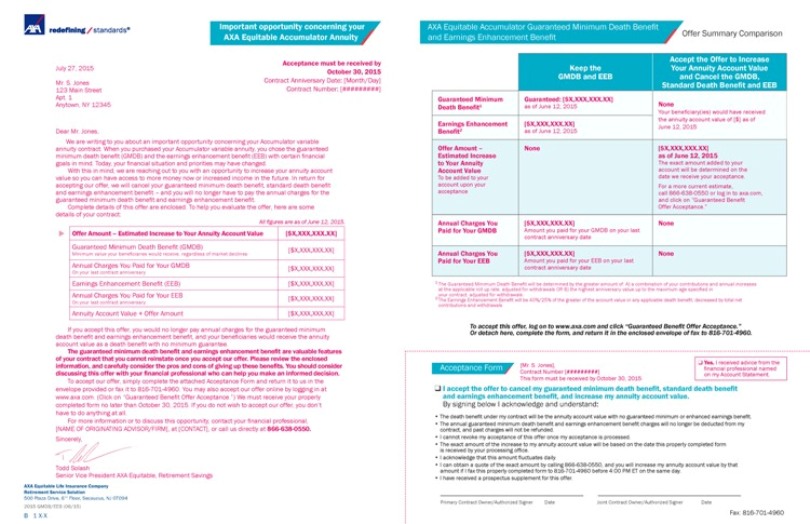

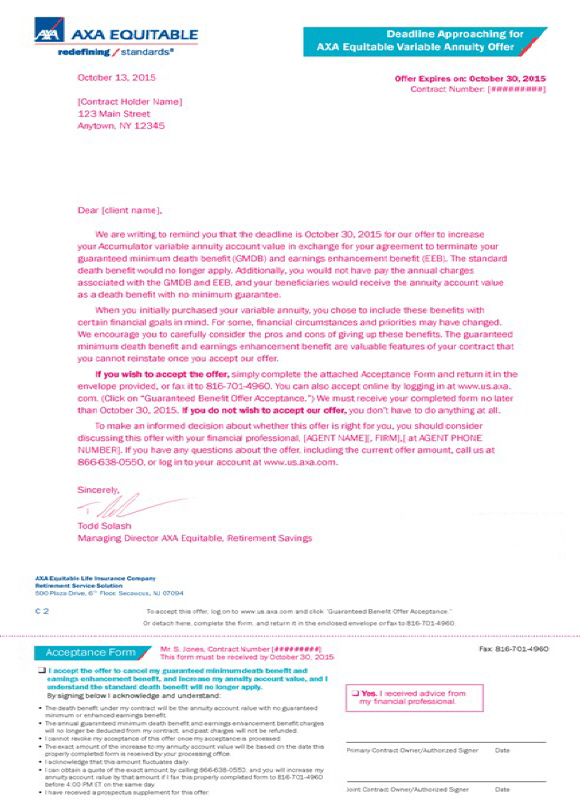

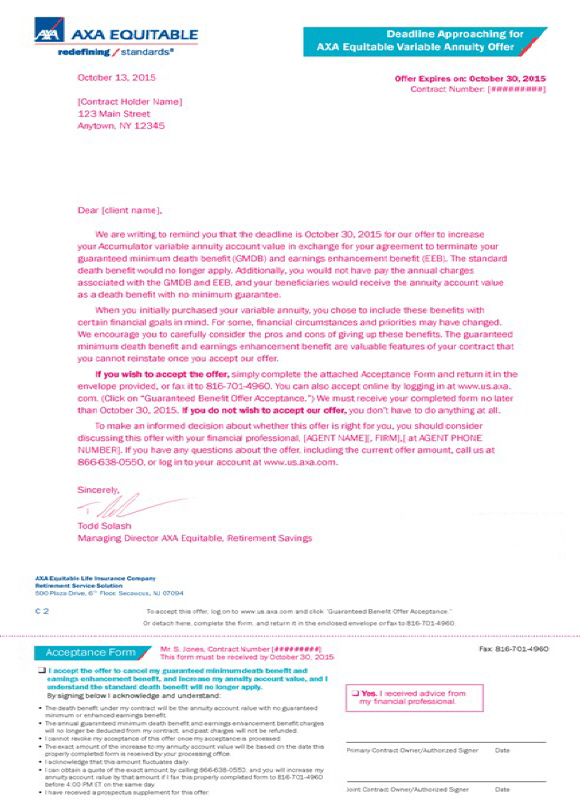

Important opportunity concerning your AXA Equitable Accumulator Annuity .

Acceptance must be received by July 27, 2015 October 30, 2015 Mr. S. Jones Contract Anniversary Date: [Month/Day] 123 Main Street Contract Number: [#########] Apt. 1 Anytown, NY 12345 Dear Mr. Jones, We are writing to you about an important opportunity concerning your Accumulator variable annuity contract. When you purchased your Accumulator variable annuity, you chose the guaranteed minimum death benefit (GMDB) and the earnings enhancement benefit (EEB) with certain financial goals in mind. Today, your financial situation and priorities may have changed. With this in mind, we are reaching out to you with an opportunity to increase your annuity account value so you can have access to more money now or increased income in the future. In return for accepting our offer, we will cancel your guaranteed minimum death benefit, standard death benefit and earnings enhancement benefit – and you will no longer have to pay the annual charges for the guaranteed minimum death benefit and earnings enhancement benefit.