UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

Closure Medical Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 11, 2003

To Our Stockholders:

Notice is hereby given that the 2003 Annual Meeting of Stockholders (the “Annual Meeting”) ofCLOSURE MEDICAL CORPORATION (the “Company”) will be held on June 11, 2003 at 9:00 a.m., local time, at the Sheraton Capital Center, Raleigh, North Carolina, for the following purposes:

| 1. | | To elect two Class I directors to the Board of Directors, each to serve a three-year term or until the election and qualification of his successor; |

| 2. | | To ratify the selection by the Board of Directors of PricewaterhouseCoopers LLP as the Company’s independent accountants for the fiscal year ending December 31, 2003; and |

| 3. | | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only stockholders of record as of the close of business on April 21, 2003 will be entitled to vote at the Annual Meeting and any adjournments or postponements thereof. A list of stockholders of the Company as of the close of business on April 21, 2003 will be available for inspection during normal business hours for ten days prior to the Annual Meeting at the Company’s executive offices at 5250 Greens Dairy Road, Raleigh, North Carolina.

| | | By Order of the Board of Directors, |

|

| | | /s/ Benny Ward

|

| | | Benny Ward Secretary |

April 24, 2003

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING,

PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN

THE ENVELOPE PROVIDED, WHICH REQUIRES NO POSTAGE IF MAILED

IN THE UNITED STATES.

CLOSURE MEDICAL CORPORATION

5250 Greens Dairy Road

Raleigh, NC 27616

PROXY STATEMENT

FOR

2003 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 11, 2003

This Proxy Statement is being furnished to the stockholders of Closure Medical Corporation (the “Company”) in connection with the Annual Meeting of Stockholders of the Company to be held on June 11, 2003 and any adjournments or postponements thereof (the “Annual Meeting”). This Proxy Statement and the enclosed Proxy Card are being mailed to stockholders on or about May 5, 2003.

The enclosed proxy is being solicited by and on behalf of the Board of Directors of the Company for the purposes set forth in the foregoing notice of meeting. The costs incidental to the solicitation and obtaining of proxies, including the cost of reimbursing banks and brokers for forwarding proxy materials to their principals, will be borne by the Company. Proxies may be solicited, without extra compensation, by officers and employees of the Company by mail, telephone, telefax, personal interviews and other methods of communication.

The Annual Report to Stockholders for the fiscal year ended December 31, 2002, including financial statements and other information with respect to the Company, is being mailed to stockholders with this Proxy Statement but does not constitute a part of this Proxy Statement.

VOTING AT THE MEETING

Record Date; Vote Required; Proxies

Only stockholders of record at the close of business on April 21, 2003 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting and any adjournments or postponements thereof. As of that date, the Company had outstanding 13,636,086 shares of Common Stock, par value $.01 per share (“Common Stock”). The holders of a majority of the outstanding shares of Common Stock, represented in person or by proxy, shall constitute a quorum at the Annual Meeting. A quorum is necessary before business may be transacted at the Annual Meeting except that, even if a quorum is not present, the stockholders present in person or by proxy shall have the power to adjourn the meeting from time to time until a quorum is present. Each stockholder entitled to vote shall have the right to one vote for each share of Common Stock outstanding in such stockholder’s name.

1

The shares of Common Stock represented by each properly executed Proxy Card will be voted at the Annual Meeting in the manner directed therein by the stockholder signing such Proxy Card. The Proxy Card provides spaces for a stockholder to vote in favor of or withhold authority to vote for each nominee for the Board of Directors and to vote for or against the ratification of PricewaterhouseCoopers LLP as independent accountants.

Except for the election of directors, for which a plurality of the votes cast is required, and except as otherwise required by law or provided in the Company’s Restated Certificate of Incorporation, as amended, and By-Laws, the affirmative vote of a majority of the shares represented in person or by proxy at the Annual Meeting and entitled to vote is required to ratify PricewaterhouseCoopers LLP as independent accountants or to take action with respect to any other matter that may properly be brought before the Annual Meeting.

With regard to the election of directors, votes may be cast in favor of or withheld from any or all nominees. Votes that are withheld will be excluded entirely from the vote and will have no effect, other than for purposes of determining the presence of a quorum. Abstentions may be specified on the proposal to ratify PricewaterhouseCoopers LLP as independent accountants (but not for the election of directors). An abstention will be considered present and entitled to vote at the Annual Meeting, but will not be counted as a vote cast in the affirmative. An abstention on the proposal to ratify PricewaterhouseCoopers LLP will have the effect of a negative vote because this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote to be approved by the stockholders.

Brokers who hold shares in street name for customers have the authority under the rules of the various stock exchanges to vote on certain items when they have not received instructions from beneficial owners. The Company believes that brokers that do not receive instructions are entitled to vote those shares with respect to the election of directors and the ratification of the independent accountants. A failure by brokers to vote these shares will have no effect on the outcome of the election of directors.

If a signed Proxy Card is returned and the stockholder has given no direction with respect to a voting matter, the shares will be voted with respect to that matter by the proxy agents as recommended by the Board of Directors. Execution and return of the enclosed Proxy Card will not affect a stockholder’s right to attend the Annual Meeting and vote in person. Any stockholder giving a proxy has the right to revoke it by giving notice of revocation to the Secretary of the Company at any time before the proxy is voted.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of Common Stock as of April 11, 2003 by (i) each person known by the Company to own beneficially more than 5% of the Company’s Common Stock, (ii) each of the executive officers named in the Summary Compensation Table, (iii) each of the Company’s directors (including the nominees) and (iv) all directors and executive officers of the Company as a group.

| | | Shares

Beneficially Owned (1)

|

Name of Beneficial Owner

| | Number

| | Percent

|

Robert V. Toni (2) | | 1,054,600 | | 7.5 |

Constitution Research & Management, Inc. (3) | | 717,800 | | 5.3 |

F. William Schmidt (4)(6) | | 3,228,275 | | 23.5 |

Rolf D. Schmidt (5)(6) | | 3,176,375 | | 23.1 |

Jeffrey G. Clark (6)(7) | | 486,654 | | 3.6 |

Ronald A. Ahrens (6)(8) | | 227,397 | | 1.7 |

Richard W. Miller (6) | | 114,512 | | * |

William M. Cotter (6) | | 114,490 | | * |

Dennis C. Carey (6)(9) | | 110,564 | | * |

Randy H. Thurman (6) | | 103,044 | | * |

Debra L. Pawl (6) | | 97,459 | | * |

Benny Ward (6) | | 86,447 | | * |

James E. Niedel (6) | | 45,000 | | * |

Daniel A. Pelak (6) | | 5,000 | | * |

All directors and executive officers as a group (14 persons) (10) | | 7,597,799 | | 51.1 |

* Less than 1%.

| (1) | | Nature of ownership consists of sole voting and investment power unless otherwise indicated. Includes shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 11, 2003. |

| (2) | | Mr. Toni retired as the Company’s Chief Executive Officer in September 2002 and is no longer a director of the Company. Mr. Toni’s address is 3061 69th Avenue SE, Mercer Island, WA 98040. Includes (a) 495,000 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 11, 2003 and (b) 20,000 shares held by Mr. Toni’s spouse for which he disclaims beneficial ownership. |

| (3) | | The address of the stockholder is 175 Federal St., 12th Floor, Boston, MA 02110. The number of shares beneficially owned is as reported on the stockholder’s Form 13F as filed with the Securities Exchange Commission for the quarter ended March 31, 2003. |

3

| (4) | | The address of the stockholder is 534 Ridge Avenue, Ephrata, PA 17522. Includes (a) 2,236,945 shares held by Triangle Partners, L.P., a limited partnership of which F. William Schmidt is the sole general partner, for which shares he is deemed to have sole voting and investment power; (b) 539,912 shares held by OMI Partners, L.P., a limited partnership of which F. William Schmidt and Rolf D. Schmidt are the sole general partners, for which shares they are deemed to share voting and investment power; and (c) 50,000 shares held by F. William Schmidt’s spouse, for which shares he is deemed to share voting and investment power. |

| (5) | | The address of the stockholder is 205 Sweitzer Road, Sinking Spring, PA 19608. Includes (a) 2,225,445 shares held by Cacoosing Partners, L.P., a limited partnership of which Rolf D. Schmidt is the sole general partner, for which shares he is deemed to have sole voting and investment power; (b) 539,912 shares held by OMI Partners, L.P., a limited partnership of which Rolf D. Schmidt and F. William Schmidt are the sole general partners, for which shares they are deemed to share voting and investment power; and (c) 140,000 shares owned jointly by Rolf D. Schmidt and his spouse, for which shares he is deemed to share voting and investment power. |

| (6) | | Except as otherwise noted in footnote (2), (3) (4) or footnote (5), the address of the stockholder is c/o Closure Medical Corporation, 5250 Greens Dairy Road, Raleigh, NC 27616. Includes the following shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 11, 2003: F. William Schmidt—91,044; Rolf D. Schmidt—91,044; Jeffrey G. Clark—85,100; Ronald A. Ahrens—177,397; Randy H. Thurman—112,044; Richard W. Miller—107,512; Dennis C. Carey—101,044; James E. Niedel—45,000; William M. Cotter—109,200; Debra L. Pawl—96,866; Benny Ward—79,490 and Daniel A. Pelak—0. |

| (7) | | Includes 69,000 shares owned by Mr. Clark’s spouse, for which shares he disclaims beneficial ownership. |

| (8) | | Includes 800 shares held by Mr. Ahrens’ spouse, for which shares he disclaims beneficial ownership. |

| (9) | | Includes 1,500 shares owned jointly by Mr. Carey and his spouse, for which shares he is deemed to share voting and investment power. |

| (10) | | See footnotes (4)—(9) above. Includes 1,229,331 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 11, 2003. |

MATTERS CONCERNING DIRECTORS

Election of Directors

The Company’s Board of Directors is divided into three classes. Members of one class are elected each year to serve a three-year term until their successors have been elected and qualified or until their earlier resignation or removal.

The Board of Directors has nominated James E. Niedel and F. William Schmidt for election as Class I directors. The nominees are presently directors of the Company whose terms expire at the Annual Meeting.

The nominees have consented to be named and to serve if elected. Unless otherwise instructed by the stockholders, the persons named in the proxies will vote the shares represented thereby for the election of such nominees. The Board of Directors believes each nominee will be able to serve as a director; if this should not be the case, however, the proxies may be voted for one or more substitute nominees to be designated by the Board of Directors, or the Board of Directors may decide to reduce the number of directors.The Board of Directors unanimously recommends a vote FOR each of the nominees.

Set forth below is certain information with respect to each nominee for director and each other person currently serving as a director of the Company whose term of office will continue after the Annual Meeting, including the class and term of office of each such person. This information has been provided by each director at the request of the Company.

Class I—Nominees for Terms Continuing until 2006

James E. Niedel, M.D., PhD., age 59, has served as a director of the Company since October 2001. He has recently joined the Sprout Group as a venture partner. Prior to that appointment, he was Chief Science and Technology Officer of GlaxoSmithKline plc. From 1988 to 2000, Dr. Niedel served as Vice President of Research

4

and Senior Vice President for Research and Development at Glaxo Inc., and as a member of the Board of Directors of Glaxo Wellcome plc with responsibility for worldwide Research and Development, Information Systems and Product Strategy. Before joining the pharmaceutical industry he was Professor of Medicine and Chief of Clinical Pharmacology at Duke University Medical School. Dr. Niedel holds a bachelor’s degree in psychology from the University of Wisconsin and doctorates of medicine and biochemistry from the University of Miami. He is a Fellow of the Royal College of Physicians (London) and a member of the Board of Directors of CRF Box and TolerRx Inc.

F. William Schmidt, age 63, a co-founder of the Company in 1990, has served as a director of the Company since February 1996. Mr. Schmidt co-founded Sharpoint, Inc. with his brother, Rolf D. Schmidt, and completed the design work on production and manufacturing equipment that led to product development within that company. In 1986, a significant portion of the business of Sharpoint, Inc. was sold to its primary distributor, Alcon Laboratories, Inc. In 1991, the remainder of such business was sold to a management group. Since 1990, Mr. Schmidt has primarily invested in and devoted substantial time and attention to healthcare-related entities, including the Company.

Class III—Directors with Terms Continuing until 2005

Daniel A. Pelak, 51, has served as President and Chief Executive Officer of Closure since September 2002. Prior to joining Closure Medical, Mr. Pelak spent 26 years with Medtronic, Inc. During his career, he has held positions in sales, sales management, marketing, and general management. Immediately prior to joining Closure, he was the Vice President and General Manager of Medtronic’s Perfusion Systems Division. From March 2000 until January 2002, he was the Vice President and General Manager of Medtronic’s Cardiac Surgery Technologies Division. From 1992 to 2000, Mr. Pelak managed progressively larger sales and marketing operations within the cardiovascular areas of Medtronic, including Vice President Cardiovascular Marketing and Vice President U.S. Cardiac Surgery Business. Prior to 1992, he held the position of Vice President and General Manager of Medtronic’s Nortech Division. Mr. Pelak holds a B.S. degree from Pennsylvania State University. Mr. Pelak serves on the Board of Directors of Reliant Technologies, Inc.

Randy H. Thurman, age 53, has served as a director of the Company since May 1996. On April 16, 2001, Mr. Thurman became Chairman and Chief Executive Officer of Viasys Healthcare Inc., a global healthcare technology company focusing on respiratory and neuro science products. Mr. Thurman previously was Chief Executive Officer of Strategic Reserves, LLC™, a healthcare technology consulting and investment company. From 1993 to 1996, Mr. Thurman was Chairman and CEO of Corning Life Sciences, a wholly-owned subsidiary of Corning Inc. which specialized in pharmaceutical testing, clinical diagnostics and disease state management. From 1984 to 1993, Mr. Thurman was an executive with Rhône-Poulenc Rorer, most recently as President and a director. Mr. Thurman holds a M.A. degree from Webster University and a B.A. degree from Virginia Polytechnic Institute. Mr. Thurman serves on the Board of Directors of ICN Pharmaceuticals, Inc.

Class II—Directors with Terms Continuing until 2004

Ronald A. Ahrens, age 63, has served as a director of the Company since January 1, 1999 and has served as Chairman of the Board since December 1999. Mr. Ahrens has been an advisor to Merck & Company, Inc. since 1995, when he retired as President of Merck Consumer Healthcare Group Worldwide. He previously served as Executive Vice President of Merck Consumer Healthcare Group International. From 1985 to 1990, Mr. Ahrens was Consumer Group President, North America of Bristol-Myers Squibb and previously was President of Bristol Myers Products Division. Prior to 1985, he held senior management and sales and marketing positions with Richardson Vicks, Bristol-Myers Squibb and Procter and Gamble. Mr. Ahrens holds a B.A. degree and a M.A. degree from Concordia College. Mr. Ahrens serves on the Board of Directors of Viasys Healthcare Inc.

Richard W. Miller, age 62, has served as a director of the Company since August 1997. From 1993 to 1997, he served as Senior Executive Vice President and Chief Financial Officer of AT&T. Previously, he was Chief Executive Officer of Wang Laboratories from 1989 to 1993, and prior to that, he held executive positions at General Electric Company and RCA. Currently, Mr. Miller advises companies and serves on the Board of Directors of SBA Communications Inc. Mr. Miller holds a M.B.A. from Harvard Business School and a B.B.A. degree in Economics from Case Western Reserve University.

5

Rolf D. Schmidt, age 70, a co-founder of the Company in 1990, served as Chairman of the Board of Directors of the Company from February 1996 to December 1999, and has been a director of the Company since then. Mr. Schmidt has served as Chief Executive Officer and Chairman of Performance Sports Apparel, Inc. since 1995. In 1986, a significant portion of the business of Sharpoint, Inc., a developer and manufacturer of surgical needles and sutures co-founded by Mr. Schmidt and his brother, F. William Schmidt, was sold to its primary distributor, Alcon Laboratories, Inc. In 1991, the remainder of such business was sold to a management group. Since 1990, Mr. Schmidt has invested primarily in and devoted substantial time and attention to healthcare-related entities, including the Company.

General Information Concerning the Board of Directors and its Committees

The Board of Directors has standing Executive, Audit and Compensation Committees. During 2002, the Board of Directors held 10 meetings, the Audit Committee held 6 meetings and the Compensation Committee held 2 meetings. There were no meetings held by the Executive Committee during 2002. Each director attended at least 75% of the aggregate of the meetings of the Board of Directors held during the period for which he was a director and the meetings of the committee or committees on which he served during such period.

The Executive Committee, to the extent permitted under Delaware law, may exercise, with certain exceptions, all of the power and authority of the Board of Directors in the management of the business and affairs of the Company. The Executive Committee is intended to serve in the event action must be taken by the board at a time when convening the entire board is not feasible. The Audit Committee is responsible for recommending to the Board of Directors the engagement of the independent auditors of the Company, for reviewing with the independent auditors the scope and results of the audits, and for reviewing the accounting controls, operating, capital and research and development budgets and other financial matters of the Company. The Compensation Committee is responsible for reviewing and approving compensation arrangements for the officers of the Company and other compensation matters generally, for recommending to the Board of Directors the compensation of the Company’s chief executive officer and non-employee directors, for establishing incentive compensation or bonus plans and for evaluating board performance and recommending nominees for election as directors. The Stock Option Subcommittee of the Compensation Committee determines grants under and administers the Equity Compensation Plan, subject, in certain instances, to approval by the Board of Directors.

The current members of the Executive Committee are Messrs. Ahrens, Miller, Pelak and Rolf D. Schmidt (Chair); of the Audit Committee, Messrs. Miller (Chair), Niedel and Thurman; and of the Compensation Committee, Messrs. Ahrens, Carey, F. William Schmidt and Thurman (Chair). Messrs. Ahrens, Carey and Thurman (Chair) comprise the Stock Option Subcommittee of the Compensation Committee.

Director Compensation

Directors who are employees of the Company receive no compensation for serving on the Board of Directors. Each non-employee director receives $1,500 per day for each meeting of the Board of Directors attended either in person or participated in telephonically. Non-employee directors of the Company do not receive annual compensation, except in the case of the Chairman, Mr. Ahrens, who receives a cash retainer of $5,000 per quarter. Further, each non-employee director receives a one-time grant of options to purchase 60,000 shares of Common Stock upon initial election or appointment to the Board of Directors, with 50% of the options vesting immediately and 25% vesting on each of the next two anniversaries of the grant date. Any director may receive additional options as determined by the Compensation Committee and subject to the approval of the Board. If a director retires from the Board or in the event of death or disability, in general, unvested options held by the director at the time of the director’s departure from the Board will become fully vested. In addition, in such event, each director will generally have up to three years to exercise vested options.

During 2003, options to purchase 60,000 shares will be granted to each director to cover the subsequent three year period, with 50% of the options vesting immediately and 25% vesting on each of the next two anniversaries of the grant date. Mr. Ahrens will also receive options to purchase an additional 30,000 shares and Mr. Miller and Mr. Thurman, as the Audit and Compensation Committee Chairs, respectively, will each receive options

6

to purchase an additional 10,000 shares. These options will be restricted from exercise until three years after the grant date without the express approval of the Board of Directors.

Compensation Committee Interlocks and Insider Participation

F. William Schmidt, a member of the Compensation Committee, was a party to a transaction with the Company in 1998. See “Certain Transactions.” Mr. Schmidt is not a member of the Stock Option Subcommittee of the Compensation Committee.

Share Ownership Guideline

In 2003, the Board of Directors adopted the following guideline for Company stock ownership by non-employee directors: each non-employee director should own shares of Common Stock of the Company with a value, at any time within two years after such director joins the Board of Directors and at the greater of cost or market value, equal to $50,000.

Requirements for Advance Notification of Nominations

Article Two of the Company’s By-Laws provides that no person may be nominated for election as a director by a stockholder at an annual or special meeting unless written notice of such stockholder’s intent to make such nomination has been delivered to the Secretary of the Company at the principal executive offices of the Company (i) with respect to an election to be held at an annual meeting of stockholders, which meeting is to be held no earlier than 30 days before and no later than 60 days after the first anniversary date of the previous year’s annual meeting, not earlier than 90 days and not later than 60 days in advance of the first anniversary date of the previous year’s annual meeting; (ii) with respect to an election to be held at an annual meeting of stockholders, which meeting is to be held more than 30 days before or more than 60 days after the first anniversary date of the previous year’s annual meeting, not earlier than 90 days prior to such meeting and not later than the later of 60 days in advance of such meeting or 10 days following the date of the first public announcement of the date of such meeting; (iii) with respect to an election to be held at an annual meeting at which a director will be elected to fill an increase in the number of directors to be elected to the Board of Directors, which increase has not been publicly announced more than 70 days prior to the first anniversary date of the previous year’s annual meeting, not later than the close of business on the tenth day after the first public announcement of such increase; and (iv) with respect to an election to be held at a special meeting of stockholders for the election of directors, not earlier than 90 days prior to such meeting and not later than the later of 60 days prior to such meeting or the tenth day following the date on which public announcement of the date of such meeting and of the nominees for the Board of Directors is first made. The By-Laws define a “public announcement” as a press release reported by the Dow Jones News Service, the Associated Press or a comparable national news service or disclosure in a document publicly filed by the Company with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13, 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

A notice from a stockholder shall set forth: (a) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made, the name and address of the stockholder as they appear on the Company’s books, and of such beneficial owner; (b) the number of shares of the Company which are owned of record and beneficially by such stockholder and such beneficial owner; (c) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC in an election contest or would otherwise be required pursuant to the Exchange Act and Rule 14a-11 thereunder; and (d) the consent of each nominee to serve as a director of the Company if so elected. The chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

7

RATIFICATION OF INDEPENDENT ACCOUNTANTS

The Board of Directors of the Company has approved the recommendation of the Audit Committee for the appointment of PricewaterhouseCoopers LLP, Raleigh, North Carolina, as independent public accountants to audit the financial statements of the Company for the year 2003. PricewaterhouseCoopers LLP has audited the Company’s financial statements since 1992. There have been no disagreements between the Company and PricewaterhouseCoopers LLP concerning the Company’s financial statements. It is intended that, unless otherwise specified by the stockholders, votes will be cast pursuant to the proxy hereby solicited in favor of the appointment of PricewaterhouseCoopers LLP.

Audit fees are approved by the Company’s Audit Committee and all professional services to be rendered by PricewaterhouseCoopers LLP are approved by the Board of Directors. The Board considers the possible effect on auditors’ independence of providing nonaudit services prior to the service being rendered, but the Board does not anticipate significant non-audit services will be rendered during 2003 other than tax advisory services.

Fees for audit services include the examination of financial statements, assistance with the preparation of the Annual Report to Stockholders and the Annual Report on Form 10-K to the Securities and Exchange Commission, review of the financial statements and related data as reported in the Quarterly Report on Form 10-Q, tax computation assistance, and consultation in connection with various accounting and tax related matters.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. Therefore, such representatives will have an opportunity to make a statement or be available to respond to any questions from stockholders.

Adoption of this proposal requires the affirmative vote of a majority of the votes cast by all stockholders entitled to vote at the Annual Meeting.The Board of Directors unanimously recommends a vote FOR this proposal.

It is understood that even if the selection of PricewaterhouseCoopers LLP is ratified, the Board, at its discretion, may direct the appointment of a new independent auditing firm at any time during the year if the Board determines that such a change would be in the best interests of the Company and its stockholders.

8

EXECUTIVE COMPENSATION

The following table provides information concerning the annual and long-term compensation of the Company’s Chief Executive Officer and the four most highly compensated executive officers other than the Chief Executive Officer who were executive officers as of December 31, 2002 (the “Named Officers”).

Summary Compensation Table

| | | Annual Compensation

| | Long-Term Compensation

| | |

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)(1)

| | Other Annual Compensation ($)(2)

| | Number of Securities Underlying Options Awarded (#)(1)

| | All Other Compensation ($)(3)

|

Daniel A. Pelak (4) President and Chief Executive

Officer | | 2002 2001 2000 | | 110,385 — — | | — — — | | 15,727 — — | | 400,000 — — | | 5,862 — — |

|

William M. Cotter Vice President of Manufacturing and

Operations | | 2002 2001 2000 | | 207,235 195,927 184,754 | | 95,550 80,000 — | | — — — | | 30,000 — 30,000 | | 17,508 13,298 14,657 |

|

Jeffrey G. Clark Vice President of Research and

Development | | 2002 2001 2000 | | 194,654 179,802 164,840 | | 87,750 72,000 — | | — — — | | 40,000 — 30,000 | | 14,312 13,991 14,393 |

|

Debra L. Pawl Vice President and General Counsel | | 2002 2001 2000 | | 187,212 174,897 164,917 | | 85,313 72,000 — | | — — — | | 40,000 — 25,000 | | 9,957 9,225 8,727 |

|

Benny Ward Vice President of Finance and

Chief Financial Officer | | 2002 2001 2000 | | 184,423 159,862 144,174 | | 78,000 66,000 — | | — — — | | 40,000 — 75,000 | | 11,314 8,660 6,243 |

| (1) | | Cash bonuses and stock option awards are reflected in the year of payment or grant. |

| (2) | | Represents moving and relocation expenses in accordance with the individual’s employment agreement. |

| (3) | | Represents Company-paid insurance premiums (life, disability and medical) and 401(k) retirement plan matching contributions. |

| (4) | | Appointed as Chief Executive Officer in September 2002 with an annual base salary of $350,000. |

9

STOCK OPTION INFORMATION

The following table sets forth information concerning stock option exercises during 2002 as well as options outstanding as of December 31, 2002.

Aggregated Option Exercises in 2002 and 2002 Year-End Option Values

| | | Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($) (1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| | | (#) | | ($) | | | | | | | | |

Daniel A. Pelak | | — | | — | | — | | 400,000 | | — | | — |

William M. Cotter | | — | | — | | 104,600 | | 61,400 | | — | | — |

Jeffrey G. Clark | | — | | — | | 78,100 | | 62,000 | | 219,748 | | — |

Debra L. Pawl | | — | | — | | 81,266 | | 74,734 | | — | | — |

Benny Ward | | — | | — | | 64,045 | | 84,433 | | 84,200 | | — |

| (1) | | Calculated on the basis of the closing price of $10.48 per share of Common Stock on December 31, 2002 as quoted on the Nasdaq National Market. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information regarding our compensation plans under which our equity securities are authorized for issuance. The information provided is as of December 31, 2002.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options (a)

| | Weighted average exercise price of outstanding options and rights compensation plans (b)

| | Number of securities remaining available for future issuance under equity (c)

| |

Equity compensation plans approved by security holders | | 3,958,579 | | $ | 19.78 | | 3,179,968 | * |

Equity compensation plans not approved by security holders | | — | | | — | | — | |

|

* This number includes 1,428,181 shares reserved for issuance under the Company’s 1999 Employee Stock Purchase Plan. |

10

Employment Agreements

Daniel A. Pelak, Jeffrey G. Clark, William M. Cotter, Debra L. Pawl and Benny Ward entered into employment agreements with the Company commencing in August 2002, May 1996, June 1997, March 1998 and May 2000, respectively. Messrs. Pelak’s and Clark’s employment agreements have a three-year term beginning on their commencement. Messrs. Cotter’s and Ward’s and Ms. Pawl’s employment agreements have a two-year term beginning on their commencement. Each of the employment agreements provides for automatic one-year extensions unless 60 days’ prior notice is given by either party, except for Mr. Pelak’s agreement, which requires 180 days’ prior notice. The agreements provide for annual base salaries for Pelak, Clark, Cotter, Pawl and Ward of not less than $350,000, $127,200, $150,000, $150,000 and $150,000, respectively, which salaries may be increased as determined by the Compensation Committee or the Board of Directors. Each agreement also provides for an annual bonus ranging from 20% to 60% of base salary to be awarded based on performance milestones to be established for each calendar year by the Compensation Committee based on the recommendation of the Chief Executive Officer, except for Mr. Pelak who may receive up to 75% of base salary.

Upon entering into his employment agreement with the Company, Mr. Pelak was granted options to purchase 400,000 shares of Common Stock under the Equity Compensation Plan at an exercise price of $14.86. Further, Mr. Pelak’s employment agreement provided that he would be entitled to receive options to purchase an additional 200,000 shares upon the satisfaction of certain conditions. Those conditions have been satisfied and Mr. Pelak was granted the additional options in April 2003 at an exercise price of $13.67. Both option grants have a term of ten years and, provided employment has not been terminated for “cause” (as defined in his employment agreement), vest in four equal annual installments, commencing on the first anniversary of the date of grant. In connection with his employment agreement, the Company granted to Mr. Clark options to purchase 40,100 shares of Common Stock under the Equity Compensation Plan at an exercise price of $5.00 per share. Such options have a term of ten years and, provided employment has not been terminated for “cause” (as defined in his employment agreement), vested in five equal annual installments, commencing as of the date of grant. Mr. Cotter, in connection with his employment agreement, was granted options to purchase 40,000 shares each of Common Stock under the Equity Compensation Plan at an exercise price of $18.25 per share. Ms. Pawl and Mr. Ward were each granted 50,000 shares of Common Stock under the Equity Compensation Plan at an exercise price of $21.88 and $16.63, respectively. Messrs. Cotter’s, Ward’s and Ms. Pawl’s options have a term of ten years and, provided employment has not been terminated for “cause” (as defined in their respective employment agreements), vest in five equal annual installments, commencing on the first anniversary of the date of grant.

If, following a “change in control” (as defined in his employment agreement), Mr. Pelak is terminated other than for “cause,” “disability,” or death or terminates his employment for “good reason” (all as defined in his employment agreement), he will be entitled to receive all accrued base salary and incentive compensation earned up to the date of his termination, benefits for a specified period of time and a lump sum cash payment equal to three times the sum of his then current base salary plus his target bonus for the year in which the change occurs. If, following a “change in control” (as defined in their respective employment agreements), Messrs. Clark or Cotter, is terminated other than for “cause” (as defined in their respective employment agreements) or terminates his employment for “good reason” (as defined in each agreement), he will be entitled to receive all accrued and any pro rata incentive compensation to the date of termination and a continuation of his then current annual salary, incentive compensation and benefits for three years after such termination. If, following a “change in control” (as defined in their respective employment agreements), Ms. Pawl or Mr. Ward is terminated other than for “cause” (as defined in their respective employment agreements) or terminates his employment for “good reason” (as defined in each agreement), she/he will be entitled to receive all accrued and any pro rata incentive compensation to the date of termination and a continuation of the then current annual salary, incentive compensation and benefits for one year after such termination. In the event of termination for “cause,” each of Messrs. Clark, Cotter and Ward and Ms. Pawl is entitled to a continuation of base salary, incentive compensation and benefits for a period of one year. Pursuant to each of these employment agreements, the Company has agreed to indemnify such executive officers to the maximum extent permitted by applicable law against all costs, charges and expenses incurred by each in connection with any action, suit or proceeding to which he may be a party or in which he may be a witness by reason of his being an officer, director or employee of the Company or any subsidiary or affiliate of the Company. Each of the foregoing executive officers has agreed not to compete with the Company for two years after termination of his/her employment with the Company.

11

CERTAIN TRANSACTIONS

On January 1, 1998, the Company entered into a Representative and Manufacturing Facility Agreement with Innocoll GmbH of Saal-Donau, Germany (“Innocoll”). Rolf D. Schmidt and F. William Schmidt, directors of the Company, own a majority of the outstanding equity interests in Innocoll. Pursuant to the agreement, Innocoll acted as the Company’s representative in Europe to assist the Company in complying with various regulatory approvals and clearances required in connection with the Company’s products. Additionally, under the agreement, Innocoll provided the Company with up to 20,000 square feet of space at its facility in Germany for use as an alternative manufacturing facility, including quality control services, as needed for the Company’s products. Pursuant to the terms of the agreement, the Company paid Innocoll $120,000 per year for acting as the Company’s representative in Europe and $60,000 per year for the manufacturing space. The agreement had a five-year term and expired on December 31, 2002.

12

THE MATERIAL IN THE FOLLOWING REPORTOFTHE COMPENSATION COMMITTEEANDTHE PERFORMANCE GRAPHONPAGE 17ISNOTSOLICITINGMATERIAL,ISNOTDEEMEDFILEDWITHTHE SECUNDERTHE SECURITIES ACTOF 1933,ASAMENDED,ORUNDERTHE EXCHANGE ACT,ANDISNOTINCORPORATEDBYREFERENCEBYANYGENERALSTATEMENTINCORPORATINGBYREFERENCETHISPROXYSTATEMENTINTOANYFILINGOFTHE COMPANYUNDERSUCH ACTSWHETHERMADEBEFOREORAFTERTHEDATEOFTHISPROXYSTATEMENT. |

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors consists of four outside, non-employee directors. It is responsible for executive compensation, including the review and approval of salaries and other compensation of management employees, as well as the approval of all policies and plans under which compensation is paid or awarded to management employees. The Compensation committee is also responsible for recommending to the Board of Directors the compensation of the non-employee directors, evaluating the board performance and recommending nominees for election as directors. A subcommittee of the Compensation Committee, the Stock Option Subcommittee, administers the Equity Compensation Plan and is responsible for grants of incentive compensation under the Equity Compensation Plan. See “Matters Concerning Directors—General Information Concerning the Board of Directors and its Committees.”

General Compensation Philosophy

The Company’s basic compensation policy is that total cash compensation should vary depending upon the Company’s success in achieving specific financial and non-financial goals and that long-term incentive compensation should be tied to the creation of stockholder value. The Committee has considered the interrelationship of the three elements of its compensation—salary, bonus and incentive—to determine how they can be used to accomplish the Company’s goals.

The Compensation Committee recognizes that, in the short-term, the market value of the Company will be affected by many factors, some of which are beyond the control of the Company’s executives. In order to attract and retain qualified executives, the Compensation Committee attempts to create a balanced compensation package by combining components based upon the achievement of long-term value to stockholders with components based upon the achievement of annual performance milestones. These milestones are approved each year by the Compensation Committee after recommendation by and discussion with the Chief Executive Officer. They reflect financial and other specific goals to be achieved in the coming year. The milestones for the Chief Executive Officer are set by the Compensation Committee after discussion with the Chief Executive Officer, and include additional goals. The Compensation Committee expects that the achievement of these shorter-term goals will contribute to the long-term success of the Company.

The Company competes with both medical device companies and pharmaceutical companies in the hiring and retention of qualified personnel. The Company uses long-term compensation, principally the grant of stock options, to offset the advantages such companies may offer, such as less risk, higher cash compensation and better retirement benefits.

The Company’s compensation program for executive officers comprises base salary, performance bonuses, longer-term incentive compensation in the form of stock options, and benefits available generally to all of the Company’s employees. In 1998, the Company adopted an Employee Stock Purchase Plan to permit investment in Company stock. The Compensation Committee believes that such a plan will enhance stockholder value.

Compensation Components

Base Salary. Base salary levels for the Company’s management employees are reviewed on an annual basis by the Compensation Committee. In conducting this review, the Compensation Committee considers competitive

13

factors and industry trends, as well as performance within the Company and changes in job responsibility. The Committee considers the Company’s guidelines for pay increases based on level of performance. The Committee also reviews certain compensation information publicly available and gathered informally, and considers salary history at the Company. In setting the base salaries for 2002, the Committee reviewed and considered an executive compensation analysis prepared by an independent compensation consulting firm for the Company, and compared the current base salaries of the Company’s management employees with a competitive market reference in the report. For 2003 service, Mr. Pelak’s annual base salary is $350,000.

Performance Bonus Compensation. All management employees of the Company participate in a bonus plan based on performance milestones adopted annually by the Committee in order to provide a direct financial incentive to achieve predefined objectives. The five individuals listed in the Summary Compensation Table, excluding Mr. Pelak, and other officers of the Company may receive as bonuses a minimum of 20% of base salary and a maximum of 60% of base salary based on the Committee’s evaluation of the achievement of the performance milestones. Mr. Pelak may receive up to 75% of base salary. The various milestones are weighted and the achievement of one or more milestones may be a condition to the payment of any bonus. The payment of any bonus will be conditioned upon the achievement of budgeted earnings per share. In addition, 50% of an officer’s bonus will be based on performance milestones tied to the achievement of corporate goals and 50% will be based on the officer’s departmental goals. The granting of other bonuses is discretionary.

In determining the bonuses to the Company’s executive officers for 2002, the Compensation Committee reviewed the percentage of completion of each of the 2002 performance milestones and multiplied such percentage by the weight assigned to each of the milestones, which included specific operating and regulatory goals.

Stock Option Grants. The Equity Compensation Plan is the Company’s long-term equity incentive plan for employees. The objective of the Equity Compensation Plan is to align the long-term financial interests of the option holder with the financial interests of the Company’s stockholders. Annual stock option grants for management employees are an important element of competitive compensation. Based on the recommendation of management, the Stock Option Subcommittee may approve stock option grants to all employees based on employee grade level and approve additional grants for special performance recognition.

Application of Section 162(m)

Payments during 2002 to the Company’s executives under the various programs discussed above were made with regard to the provisions of Section 162(m) of the Internal Revenue Code. Section 162(m) limits the deduction that may be claimed by a “public company” for compensation paid to certain individuals to $1 million except to the extent that any excess compensation is “performance-based compensation.” It is intended that, in accordance with current regulations, the amounts received upon the exercise of stock options under the Equity Compensation Plan qualify as “performance-based compensation.”

COMPENSATION COMMITTEE

Ronald A. Ahrens

Dennis C. Carey, Ph.D.

F. William Schmidt

Randy H. Thurman (Chair)

April 24, 2003

14

REPORT OF THE AUDIT COMMITTEE

The Company’s Audit Committee (the “Committee”) consists of three non-employee directors that are considered independent according to the guidelines set forth by the National Association of Securities Dealers. The Board of Directors has adopted an amended and restated written charter for the Audit Committee.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. In addition, the Committee recommends to the Board, subject to stockholder ratification, the selection of the Company’s independent public accountants.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent public accountants are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee’s responsibility is to monitor and oversee these processes.

In this context, the Committee has met and held discussions with management and the independent public accountants. Management represented to the Committee that the Company’s audited financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the financial statements with management and the independent public accountants. The Committee discussed with the independent public accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

In addition, the Committee has discussed with the independent public accountants the auditor’s independence from the Company and its management, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

The Committee discussed with the Company’s independent public accountants the overall scope and plans for their audits. The Committee meets with the independent public accountants, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

Based upon the Committee’s discussions with management and the independent public accountants and the Committee’s review of the representations of management and the report of the independent public accountants to the Committee, the Committee recommended that the Board include the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the SEC.

THE AUDIT COMMITTEE

Richard W. Miller (Chair)

James E. Niedel, M.D., Ph.D.

Randy H. Thurman

April 24, 2003

15

PricewaterhouseCoopers LLP Fees Related to Fiscal 2002

Audit Fees:

The aggregate audit fees billed, or to be billed, by the Company’s independent auditors for professional services in connection with the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2002 and the reviews conducted by the independent auditors of the financial statements included in the Company’s quarterly reports on Form 10-Q required to be filed by the Company during fiscal 2002 totaled $81,325 which has been billed through April 11, 2003.

Financial Information Systems Design and Implementation Fees:

The Company did not engage PricewaterhouseCoopers LLP to provide advice to the Company regarding financial information systems design and implementation during the fiscal year ended December 31, 2002.

All Other Fees:

The aggregate of all other fees by PricewaterhouseCoopers LLP for the Company’s 2002 fiscal year for all other non-audit services rendered to the Company, primarily for tax related services, is approximately $26,500, of which $20,200 has been billed.

The Audit Committee has considered whether the provision of non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining the independence of PricewaterhouseCoopers LLP.

16

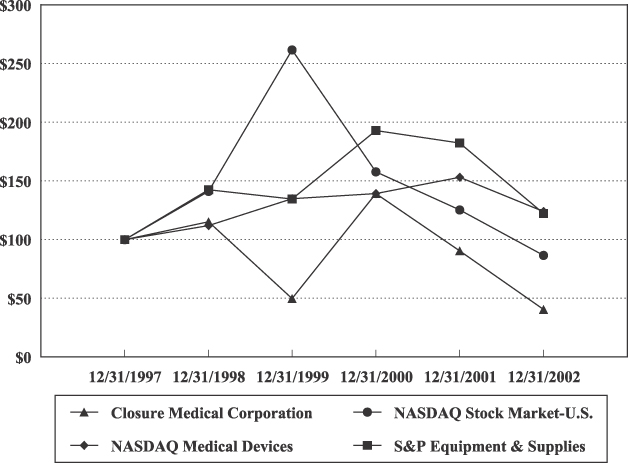

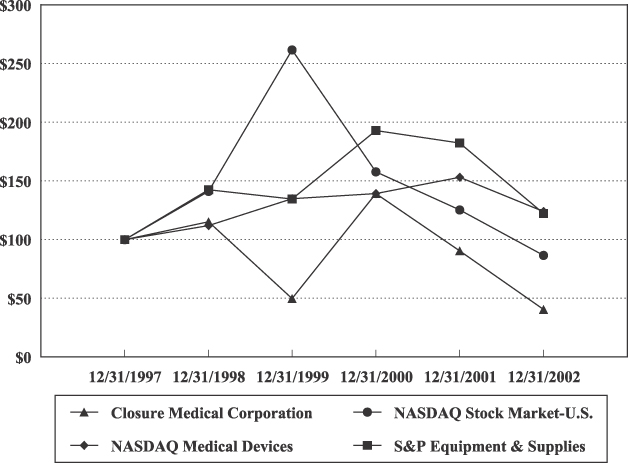

PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return on the Company’s Common Stock with the cumulative total stockholder return of (i) the Nasdaq Stock Market—US Index (“Nasdaq Stock Market- US”), (ii) the Nasdaq Stock Market—Medical Devices, Instruments and Supplies Index (“Nasdaq Medical Devices”), and (iii) the S&P Health Care Equipment and Supplies Index (“S&P Equipment and Supplies”), assuming an investment of $100 on December 31, 1997 in each of the Common Stock of the Company, the stocks comprising the Nasdaq Stock Market- US, the stocks comprising the Nasdaq Medical Devices and the stocks comprising the S&P Equipment and Supplies, and further assuming reinvestment of dividends.

17

INDEPENDENT ACCOUNTANTS

Price Waterhouse LLP served as the Company’s independent accountants since 1992 and upon its merger with Coopers & Lybrand LLP in 1998, the Company retained PricewaterhouseCoopers LLP as its independent accountants. PricewaterhouseCoopers LLP has been selected to continue in such capacity for the current year. The Company has requested that a representative of PricewaterhouseCoopers LLP attend the Annual Meeting. Such representative will have an opportunity to make a statement, if he or she desires, and will be available to respond to appropriate questions of stockholders.

OTHER MATTERS

The Board of Directors is not aware of any matters not set forth herein that may come before the Annual Meeting. If, however, further business properly comes before the Annual Meeting, the persons named in the proxies will vote the shares represented thereby in accordance with their judgment.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors, officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Directors, officers and greater-than-ten-percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such reports received by the Company, the Company believes that during the year ended December 31, 2002 all filing requirements applicable to its directors, officers and greater-than-ten-percent stockholders were satisfied, with the following exceptions: Joe B. Barefoot, Jeffrey G. Clark, William M. Cotter and Benny Ward each filed two late Form 4’s, and Anthony Sherbondy (former Vice President of New Business Generation) failed to file two Form 4’s, each with respect to two transactions related to an incentive stock option grant. Mr. Pelak filed his Form 3 late as well as one late Form 4 with respect to one transaction.

STOCKHOLDER PROPOSALS FOR THE 2004 ANNUAL MEETING

Stockholders may submit proposals on matters appropriate for stockholder action at annual meetings in accordance with regulations adopted by the SEC. To be considered for inclusion in the proxy statement and form of proxy relating to the 2004 annual meeting, such proposals must be received by the Company no later than December 31, 2003. Proposals should be directed to the attention of the Secretary of the Company.

| | | By Order of the Board of Directors, |

|

| | | /s/ Benny Ward

|

| | | Benny Ward Secretary |

April 24, 2003

18

PROXY

CLOSURE MEDICAL CORPORATION

5250 Greens Dairy Road

Raleigh, North Carolina 27616

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Daniel A. Pelak and Benny Ward, or

either of them acting singly in the absence of the other, each with the power to

appoint his substitute, the Proxy Agents of the undersigned to attend the Annual

Meeting of Stockholders of Closure Medical Corporation (the "Company") to be

held June 11, 2003 and any adjournments or postponements thereof, and with all

powers the undersigned would possess if personally present, to vote upon the

following matters as indicated on the reverse.

(Continued and to be signed on reverse side.)

SEE REVERSE

SIDE

Please date, sign and mail your

proxy card back as soon as possible.

Annual Meeting of Stockholders

CLOSURE MEDICAL CORPORATION

June 11, 2003

(arrow) Please Detach and Mail in the Envelope Provided (arrow)

- --------------------------------------------------------------------------------

A [X] Please mark your

votes as in this

example.

FOR WITHHELD

1. Election of [ ] [ ] Nominees: James E. Niedel

Directors F. William Schmidt

Class I

FOR, except vote withheld from the following nominees:

- ---------------------------------------------------------

FOR AGAINST ABSTAIN

2. Ratification of the selection by the Board of

Directors of PricewaterhouseCoopers LLP as the [ ] [ ] [ ]

Company's independent accountants for the fiscal

year ending December 31, 2003.

3. In their discretion, the Proxy Agents are authorized to vote upon such other

business as may properly come before the meeting and any adjournments or

postponements thereof.

This proxy when properly executed will be voted in the manner directed herein by

the undersigned stockholder. If no direction is made, this proxy will be voted

FOR all nominees for election as the Class I directors and FOR Proposal Number

2. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting

of Stockholders and the related Proxy Statement.

PLEASE MARK, SIGN AND DATE THIS PROXY CARD PROMPTLY AND RETURN IT USING THE

ENCLOSED ENVELOPE.

Signature(s)__________________________________Date:__________________ , 2003

Note: Please sign exactly as name appears hereon. When shares are held by joint

tenants, both should sign. When signing as attorney, executor,

administrator, trustee or guardian, please give full title as such. If a

corporation, please sign in full corporate name by the President or other

authorized officer. If a partnership, please sign in the partnership name

by an authorized person.

- --------------------------------------------------------------------------------