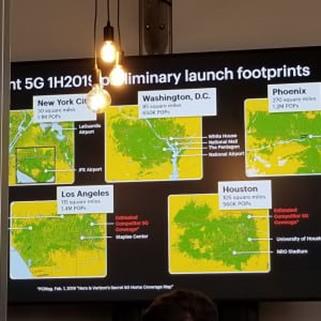

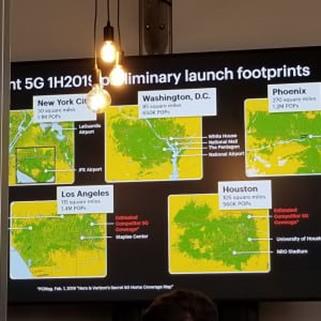

Sprint’s first markets include Atlanta, Georgia; Chicago, Illinois; Dallas and Houston, Texas; Kansas City; Los Angeles, California; New York City; Phoenix, Arizona and Washington, D.C. Of those, Chicago, Atlanta, Dallas and Kansas City are slated to launch in May, with the others going live later in the first half. Saw gave fairly detailed specifics of its initial coverage footprint, including the number of potential customers covered and maps — information which AT&T and Verizon have kept quiet. Sprint’s initial 5G footprint for its launch in the first half includes:

-20 square miles of Chicago coverage, with 300,000 POPs covered

-30 square miles of 5G coverage in New York City, covering 1.1 million POPs

-270 square miles covered in the Phoenix, Arizona area, covering 1.2 million POPs

-115 square miles of coverage in Los Angeles, California, covering 1.4 million POPs

-85 square miles covered in the Washington, D.C. metropolitan area, covering 650,000 people

-105 square miles of 5G coverage around Houston, covering 560,000 people

Those footprints typically cover the local airport and/or large local sports venues, according to Sprint’s slides, and the carrier said that it “plans to offer coverage in the downtown area of these cities for its highly mobile,on-the-go customers.” Sprint is deploying Samsung equipment in Chicago, and it is working with Nokia in Los Angeles and Ericsson in Atlanta.

Saw also couldn’t resist a dig at how some competitors are marketing 5G, saying that over the past year, Sprint has learned that “there’s more than one way to build a 5G network. We also learned that some 5G networks are built by a marketing department.”

Saw also shared a video highlighting Sprint’s drive-testing and deployment in Chicago:

In terms of monetizing 5G, Sprint CMO Roger Solé said that there were three areas that the carrier was targeting to make a short-term impact: augmented and virtual reality; a better video experience than is available via LTE; and mobile gaming. Solé cited numbers that nearly 180 million Americans use their mobile phones to play games, including 60% of men and 58% of