Exhibit 99.4

Direct - to - Consumer Opportunity Cathy Doherty SVP, Clinical Franchises & Marketing

SAFE HARBOR DISCLOSURE The statements in the following presentations which are not historical facts may be forward - looking statements . Readers are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date that they are made and which reflect management’s current estimates, projections, expectations or beliefs and which involve risks and uncertainties that could cause actual results and outcomes to be materially different . Risks and uncertainties that may affect the future results of the company include, but are not limited to, impacts of the COVID - 19 pandemic and measures taken in response, adverse results from pending or future government investigations, lawsuits or private actions, the competitive environment, the complexity of billing, reimbursement and revenue recognition for clinical laboratory testing, changes in government regulations, changing relationships with customers, payers, suppliers or strategic partners and other factors discussed in the company's most recently filed Annual Report on Form 10 - K and in any of the company's subsequently filed Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, including those discussed in the “Business,” “Risk Factors,” “Cautionary Factors that May Affect Future Results” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of those reports . The Company continues to believe that the impact of the COVID - 19 pandemic on future operating results, cash flows and/or its financial condition will be primarily driven by : the pandemic’s severity and duration ; healthcare insurer, government and client payer reimbursement rates for COVID - 19 molecular tests ; the pandemic’s impact on the U . S . healthcare system and the U . S . economy ; and the timing, scope and effectiveness of federal, state and local governmental responses to the pandemic which are drivers beyond the Company’s knowledge and control .

What you’ll hear today Consumers are increasingly engaged in their health, including diagnostics Consumer - initiated testing market is positioned for breakout growth Targeted marketing and enhanced digital experience will drive performance QuestDirect is a robust dynamic offering that can capture this opportunity

Leading the way in personal diagnostics OUR CONSUMER VISION

Consumers are increasingly informed and engaged Digital Transformation Consumers bring the same expectations around digital brand engagement to healthcare Delivery Channels (Retail & Home) Consumers desire more convenient and accessible channels and locations Consumer Engagement Consumers have increased decision - making power and economic motivation

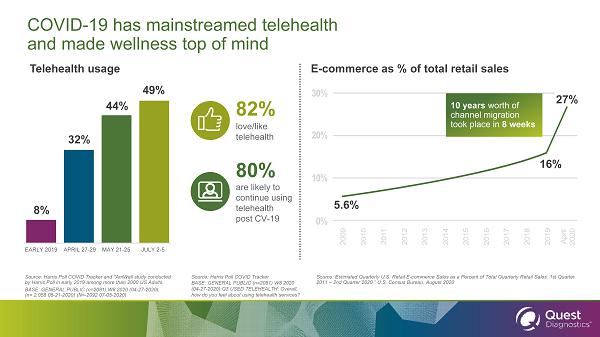

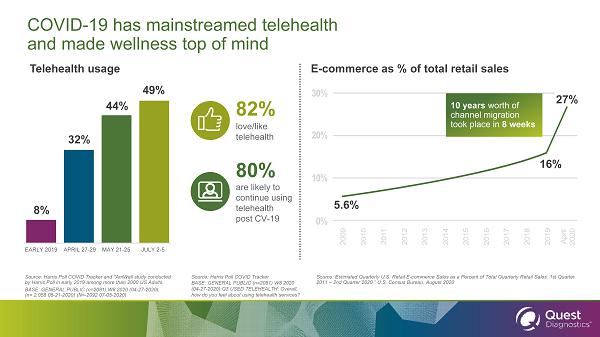

16% COVID - 19 has mainstreamed telehealth and made wellness top of mind Telehealth usage E - commerce as % of total retail sales Source: Harris Poll COVID Tracker and * AmWell study conducted by Harris Poll in early 2019 among more than 2000 US Adults. BASE: GENERAL PUBLIC (n=2081) W8 2020 (04 - 27 - 2020), (n= 2,058 05 - 21 - 2020) (N= - 2092 07 - 05 - 2020) EARLY 2019 APRIL 27 - 29 MAY 21 - 25 JULY 2 - 5 8% 32% 44% 49% 5.6% 27% 10 years worth of channel migration took place in 8 weeks Source: Estimated Quarterly U.S. Retail E - commerce Sales as a Percent of Total Quarterly Retail Sales: 1st Quarter 2011 – 2nd Quarter 2020,” U.S. Census Bureau, August 2020 82% love/like telehealth 80% are likely to continue using telehealth post CV - 19 Source: Harris Poll COVID Tracker BASE: GENERAL PUBLIC (n=2081) W8 2020 (04 - 27 - 2020) Q3 USED TELEHEALTH: Overall, how do you feel about using telehealth services?

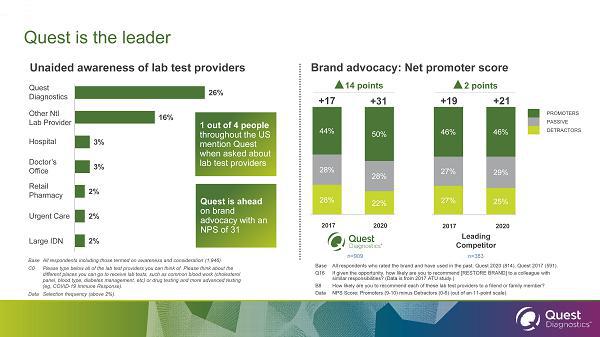

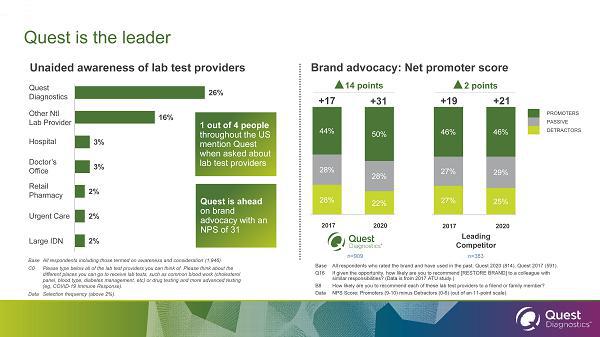

Quest is ahead on brand advocacy with an NPS of 31 1 out of 4 people throughout the US mention Quest when asked about lab test providers Quest is the leader Unaided awareness of lab test providers Brand advocacy: Net promoter score 26% 16% 3% 3% 2% 2% 2% Quest Diagnostics Other Ntl Lab Provider Hospital Doctor's Office Retail Pharmacy Urgent Care Large IDN Base All respondents including those termed on awareness and consideration (1,946). C0 Please type below all of the lab test providers you can think of. Please think about the different places you can go to receive lab tests, such as common blood work (cholesterol panel, blood type, diabetes management, etc ) or drug testing and more advanced testing ( eg , COVID - 19 Immune Response). Data Selection frequency (above 2%). 28% 22% 28% 28% 44% 50% 46% 46% 27% 29% 27% 25% 14 points 2020 2017 2020 2017 n=383 n=909 2 points Base All respondents who rated the brand and have used in the past: Quest 2020 (814), Quest 2017 (591). Q16 If given the opportunity, how likely are you to recommend [RESTORE BRAND] to a colleague with similar responsibilities? (Data is from 2017 ATU study.) B8 How likely are you to recommend each of these lab test providers to a friend or family member? Data NPS Score: Promoters (9 - 10) minus Detractors (0 - 6) (out of an 11 - point scale). Leading Competitor +17 +31 +19 +21 PROMOTERS PASSIVE DETRACTORS Quest Diagnostics Other Ntl Lab Provider Hospital Doctor’s Office Retail Pharmacy Urgent Care Large IDN BSC1

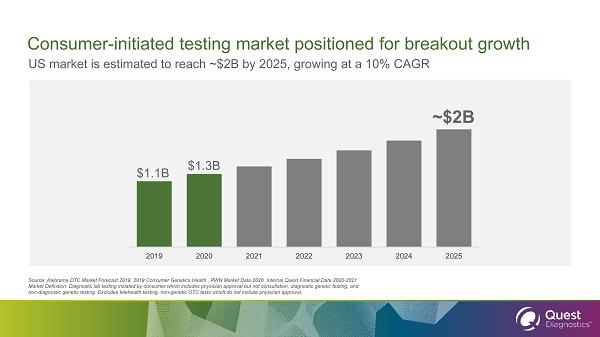

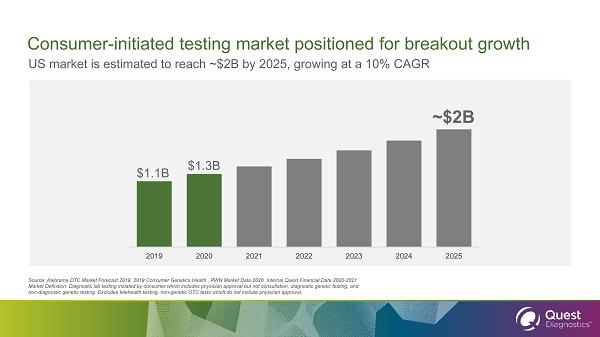

2019 2020 2021 2022 2023 2024 2025 US market is estimated to reach ~$2B by 2025, growing at a 10% CAGR Consumer - initiated testing market positioned for breakout growth Source: Kalorama DTC Market Forecast 2019, 2019 Consumer Genetics Health , PWN Market Data 2020, Internal Quest Financial Dat a 2 020 - 2021 Market Definition: Diagnostic lab testing initiated by consumer which includes physician approval but not consultation, diagn ost ic genetic testing, and non - diagnostic genetic testing. Excludes telehealth testing, non - genetic OTC tests which do not include physician approval. ~$2B $1.1B $1.3B

We’ve built a compelling product offering to appeal to the market

And we’ve invested in a consumer omnichannel marketing strategy to capture the market AUDIO - STREAMING VIDEO - TRADITIONAL AUDIO - PODCAST VIDEO DIGITAL

QuestDirect Success To Date 15 M MYQUEST USERS 2 X NON - COVID 2019 REV >8 X TOTAL 2019 REV 30 K KITS ORDERED SINCE SEPT 280 K ANTIBODY TESTS SINCE APRIL 1000 KITS/DAY VIA INSURANCE (Dec) ONE OF 1 ST TO MAKE ANTIBODY TEST AVAILABLE FOR PURCHASE !

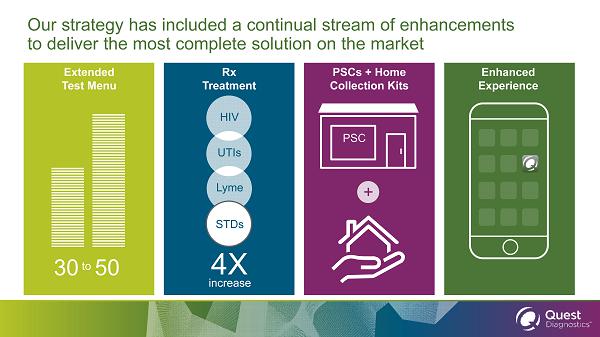

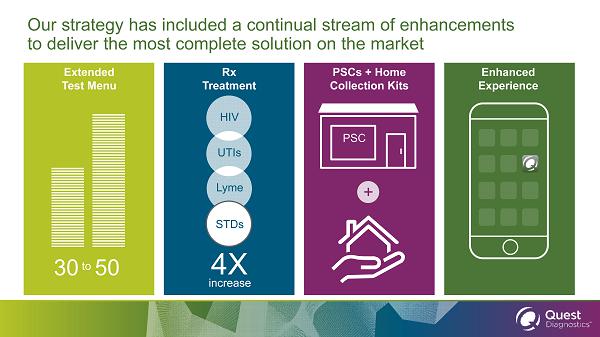

Our strategy has included a continual stream of enhancements to deliver the most complete solution on the market Extended Test Menu 30 50 to Rx Treatment 4X increase HIV UTIs Lyme STDs PSCs + Home Collection Kits + PSC Enhanced Experience

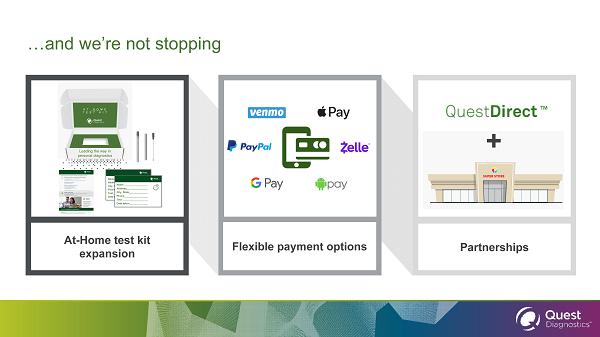

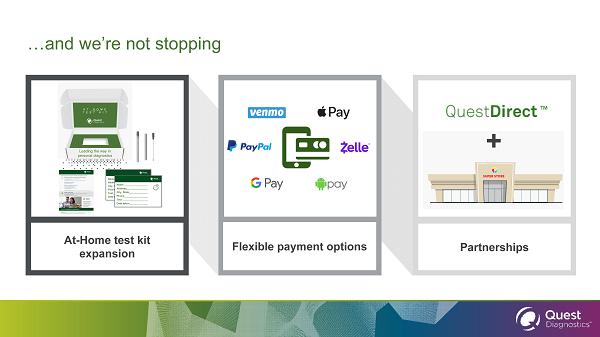

…and we’re not stopping Partnerships At - Home test kit expansion Flexible payment options AT HOME TEST KIT Leading the way in personal diagnostics Name _____________________________ Address ___________________________ City, State _________________________ Phone ______________________________ Test _______________________________ Date taken __________________________ Name ___________________ Address_________________ City, State_______________ Phone___________________ Test ___________________ Date taken ______________________ +

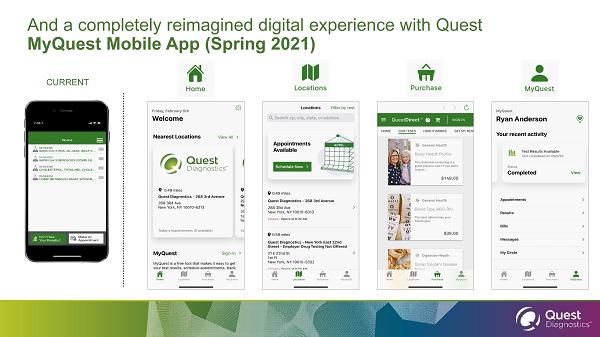

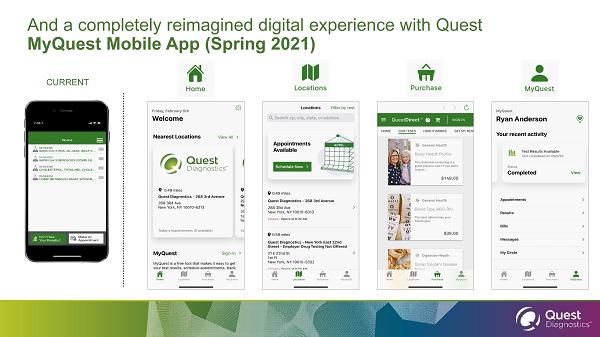

CURRENT And a completely reimagined digital experience with Quest MyQuest Mobile App (Spring 2021)

Quest is well positioned to lead the way in personal diagnostics Reliable & Innovative Experienced & Trustworthy Convenient & Saves Time Reputable Helpful. Affordable.

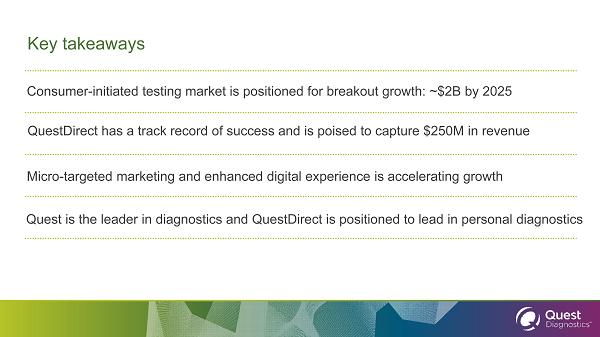

Key takeaways Consumer - initiated testing market is positioned for breakout growth: ~$2B by 2025 Micro - targeted marketing and enhanced digital experience is accelerating growth Quest is the leader in diagnostics and QuestDirect is positioned to lead in personal diagnostics QuestDirect has a track record of success and is poised to capture $250M in revenue