Capital Plan: Delivering and Returning Value Mark Guinan Senior Vice President and Chief Financial Officer November 5th, 2014

| 2 Safe Harbor Disclosure The statements in this presentation which are not historical facts may be forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date that they are made and which reflect management’s current estimates, projections, expectations or beliefs and which involve risks and uncertainties that could cause actual results and outcomes to be materially different. Risks and uncertainties that may affect the future results of the Company include, but are not limited to, adverse results from pending or future government investigations, lawsuits or private actions, the competitive environment, changes in government regulations, changing relationships with customers, payers, suppliers or strategic partners and other factors discussed in the Company's most recently filed Annual Report on Form 10-K and in any of the Company's subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including those discussed in the “Business,” “Risk Factors,” “Cautionary Factors that May Affect Future Results” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of those reports.

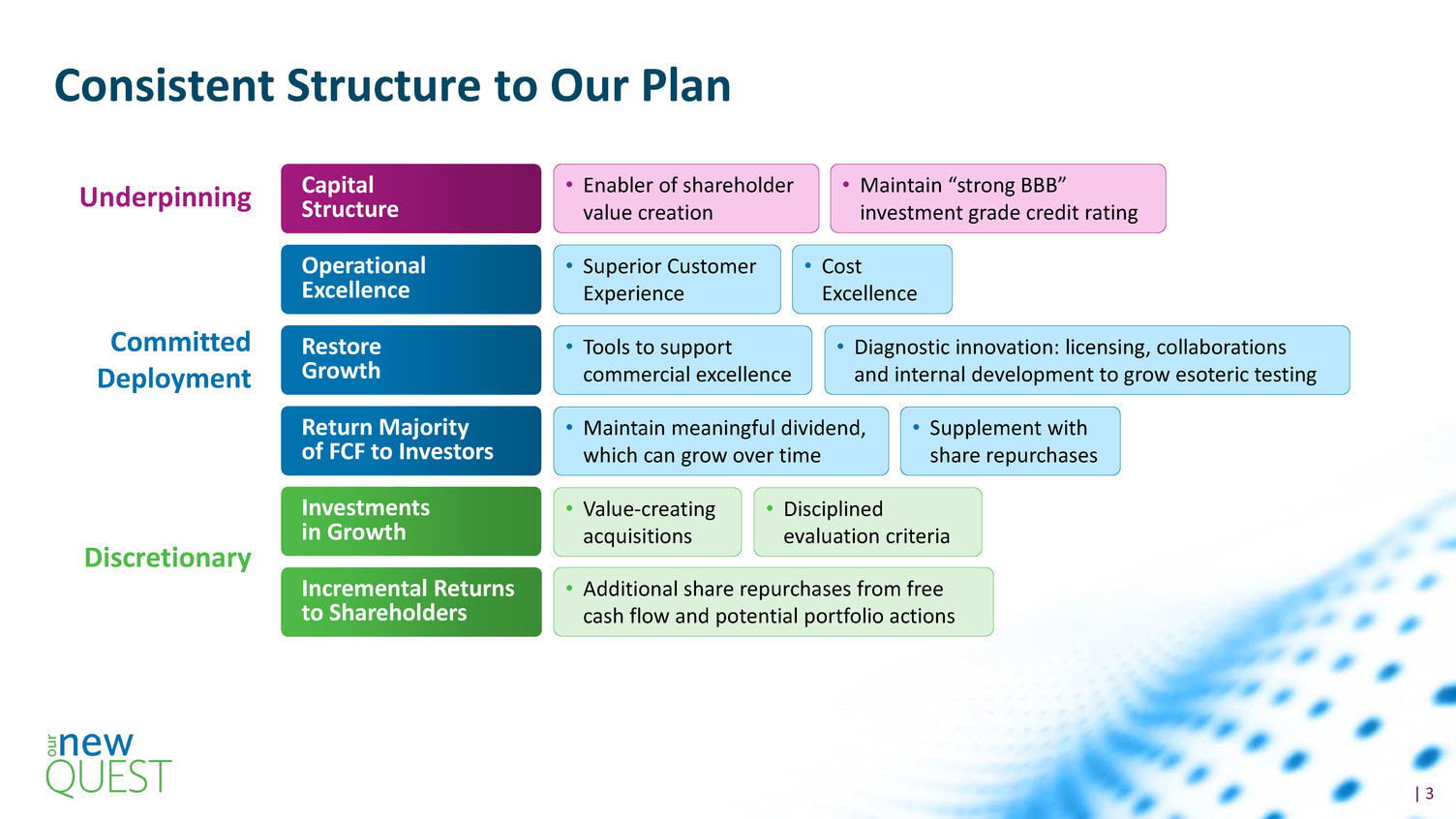

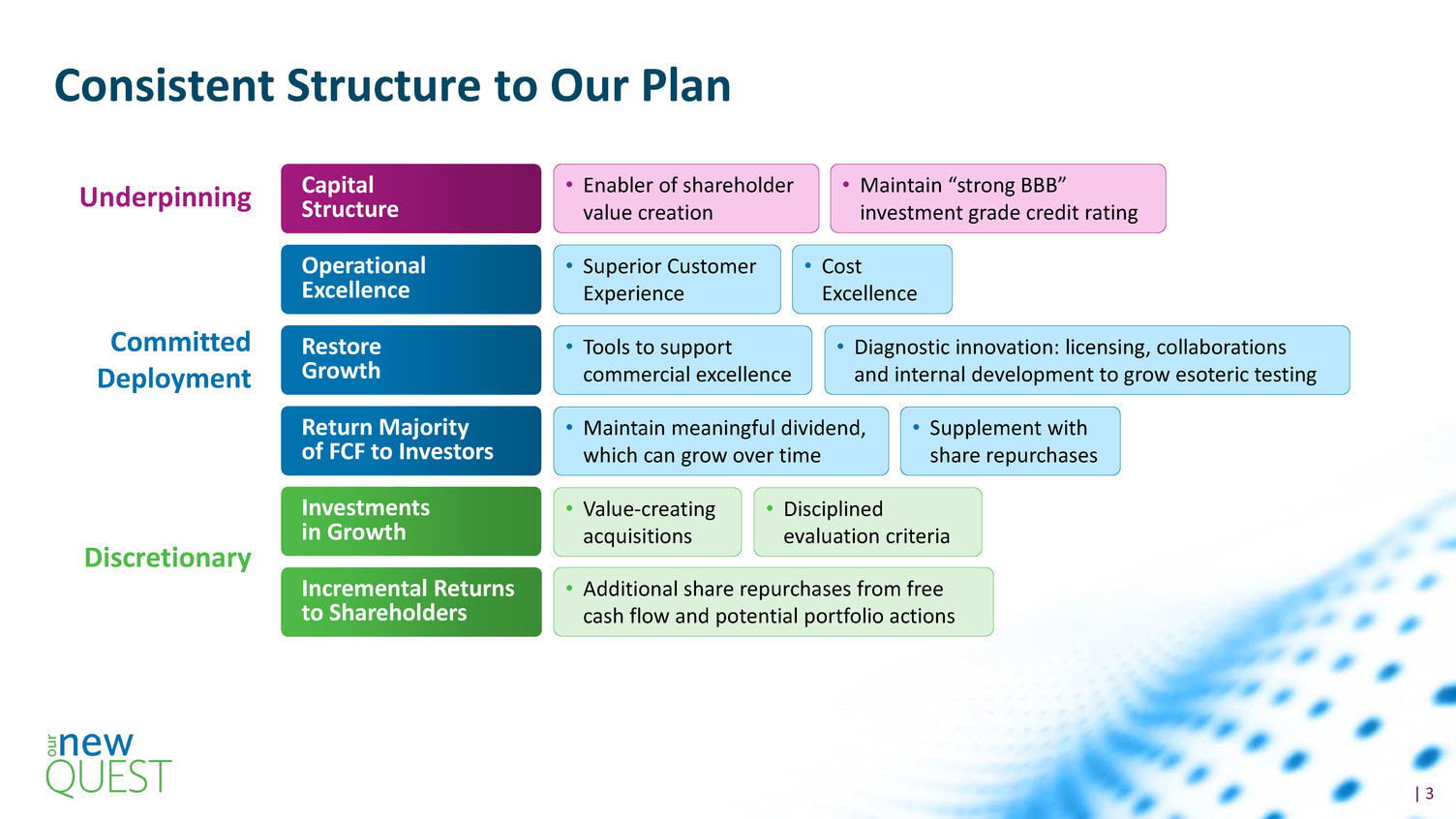

| 3 Consistent Structure to Our Plan Underpinning Capital Structure Return Majority of FCF to Investors Incremental Returns to Shareholders Operational Excellence Restore Growth Investments in Growth Committed Deployment Discretionary • Enabler of shareholder value creation • Maintain “strong BBB” investment grade credit rating • Superior Customer Experience • Cost Excellence • Tools to support commercial excellence • Diagnostic innovation: licensing, collaborations and internal development to grow esoteric testing • Maintain meaningful dividend, which can grow over time • Supplement with share repurchases • Value-creating acquisitions • Disciplined evaluation criteria • Additional share repurchases from free cash flow and potential portfolio actions

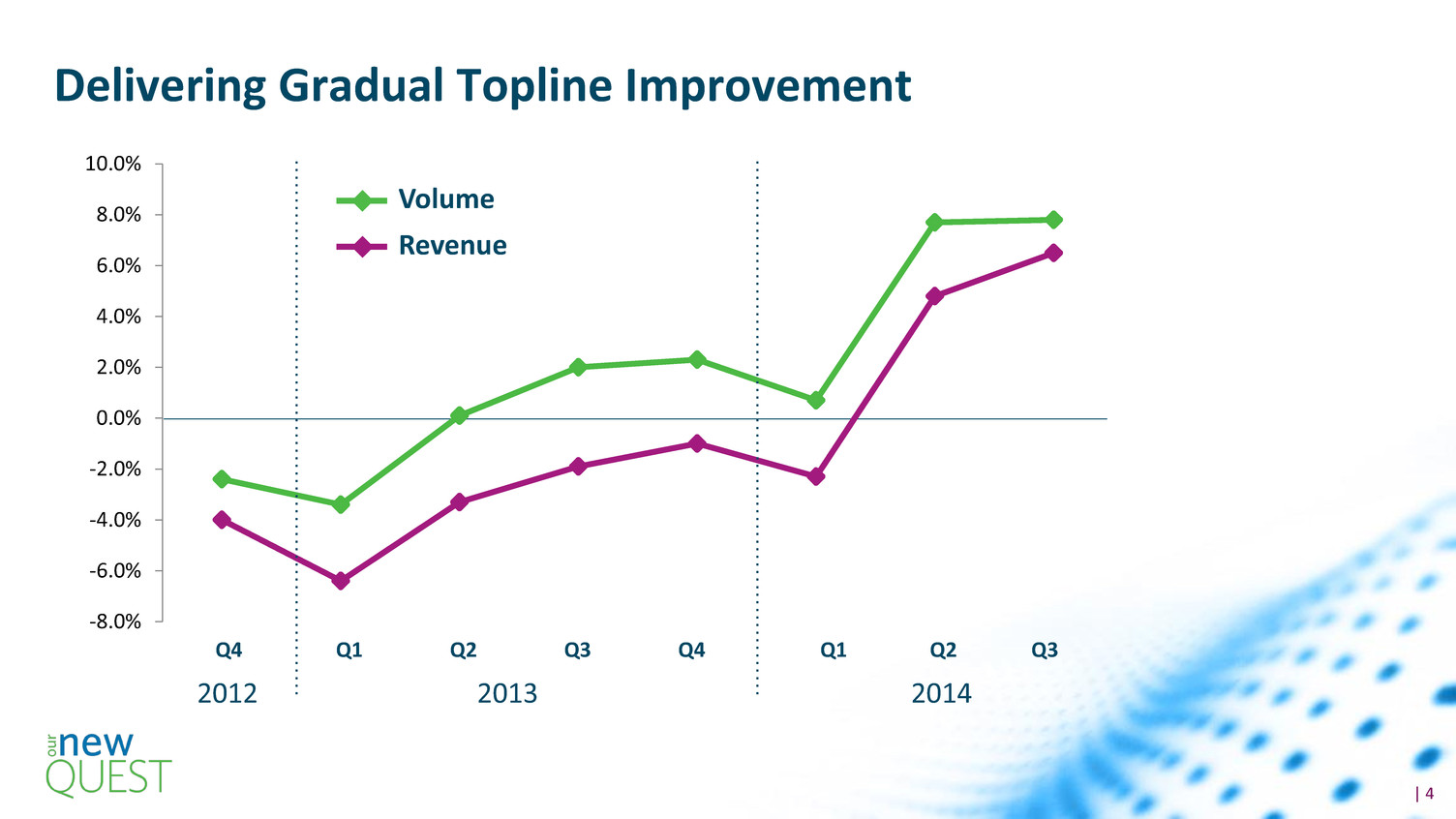

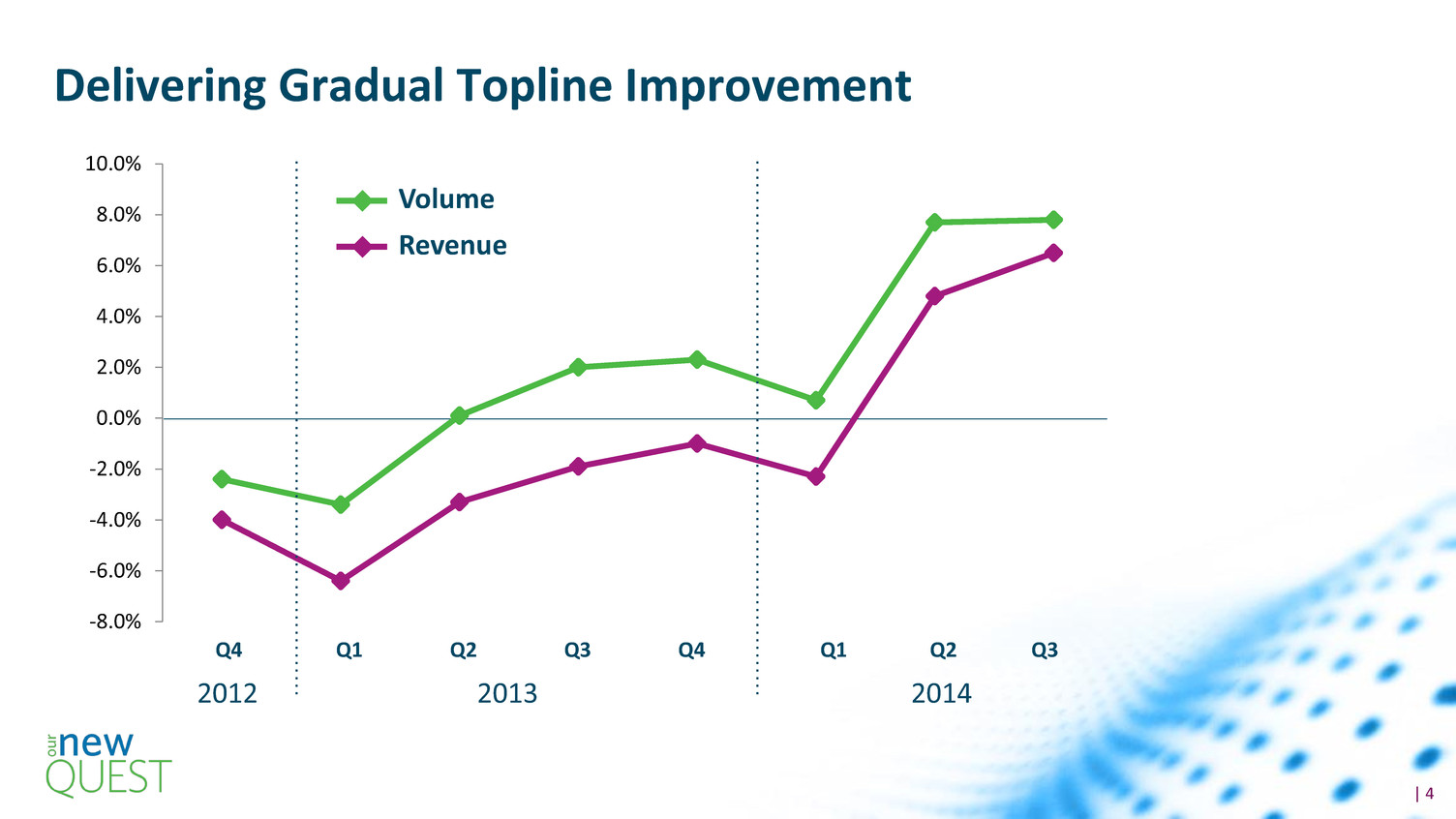

| 4 -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Delivering Gradual Topline Improvement 2013 2012 2014 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Revenue Volume

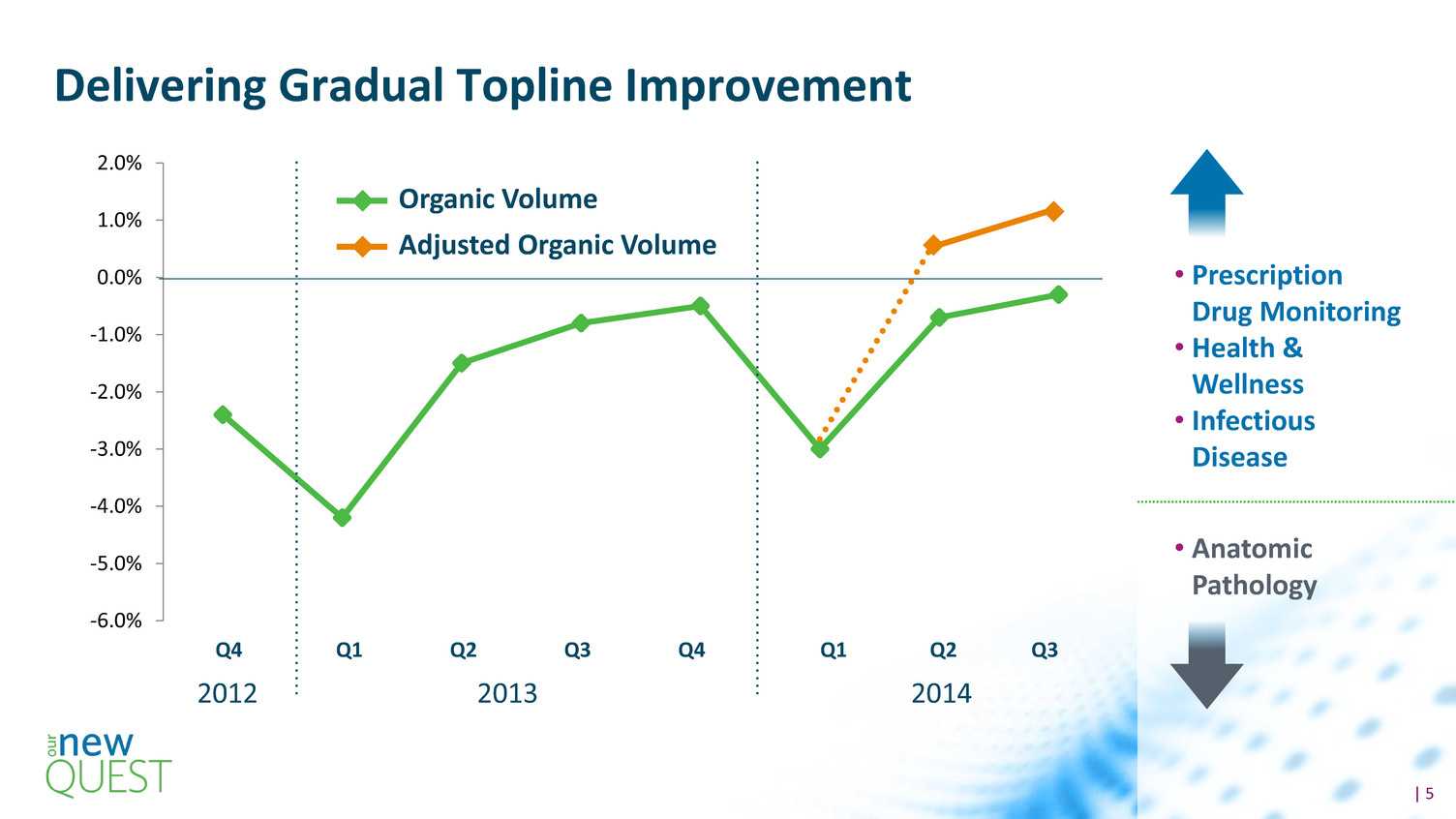

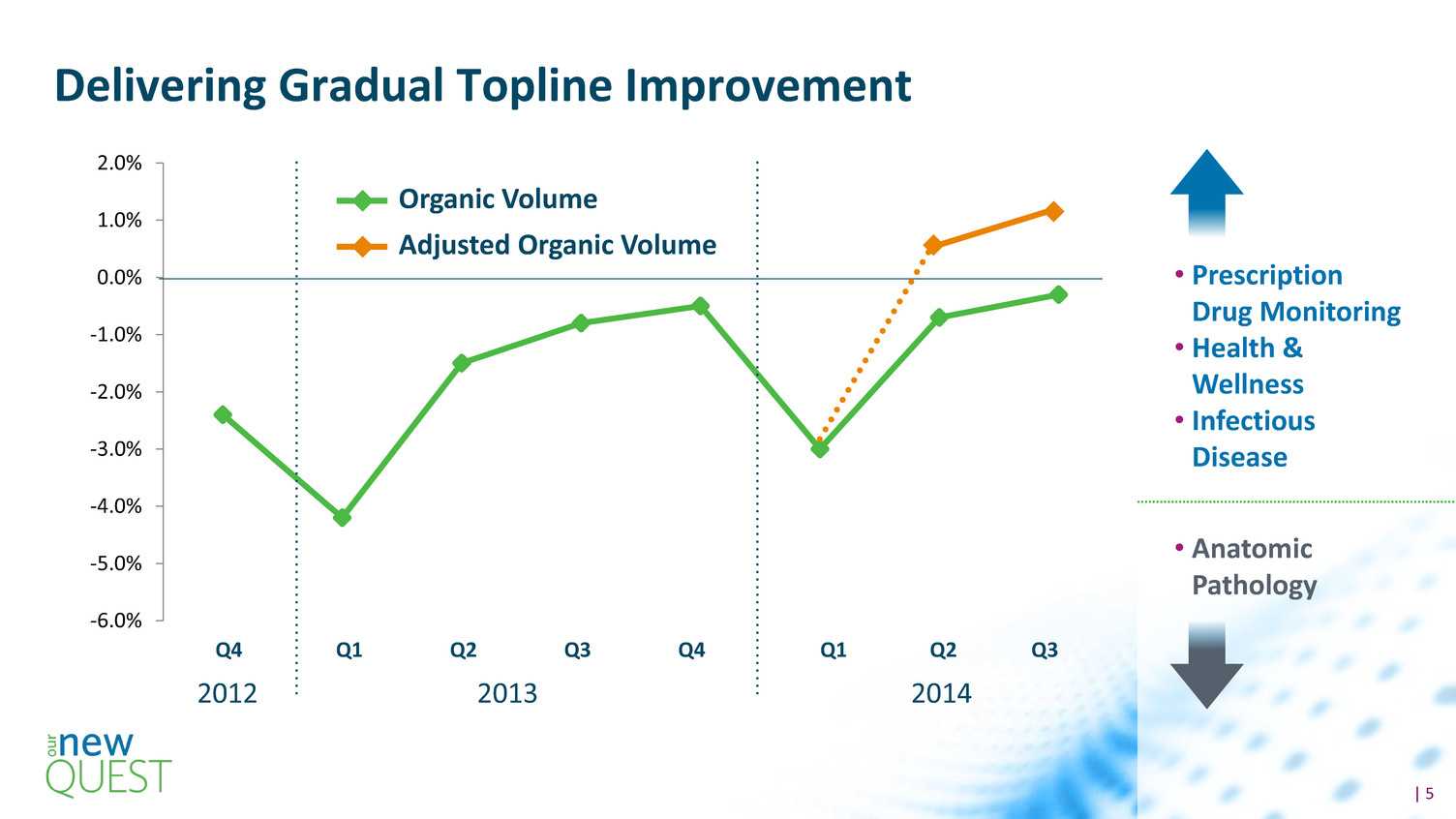

| 5 -6.0% -5.0% -4.0% -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% Delivering Gradual Topline Improvement Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2013 2012 2014 • Prescription Drug Monitoring • Health & Wellness • Infectious Disease • Anatomic Pathology Adjusted Organic Volume Organic Volume

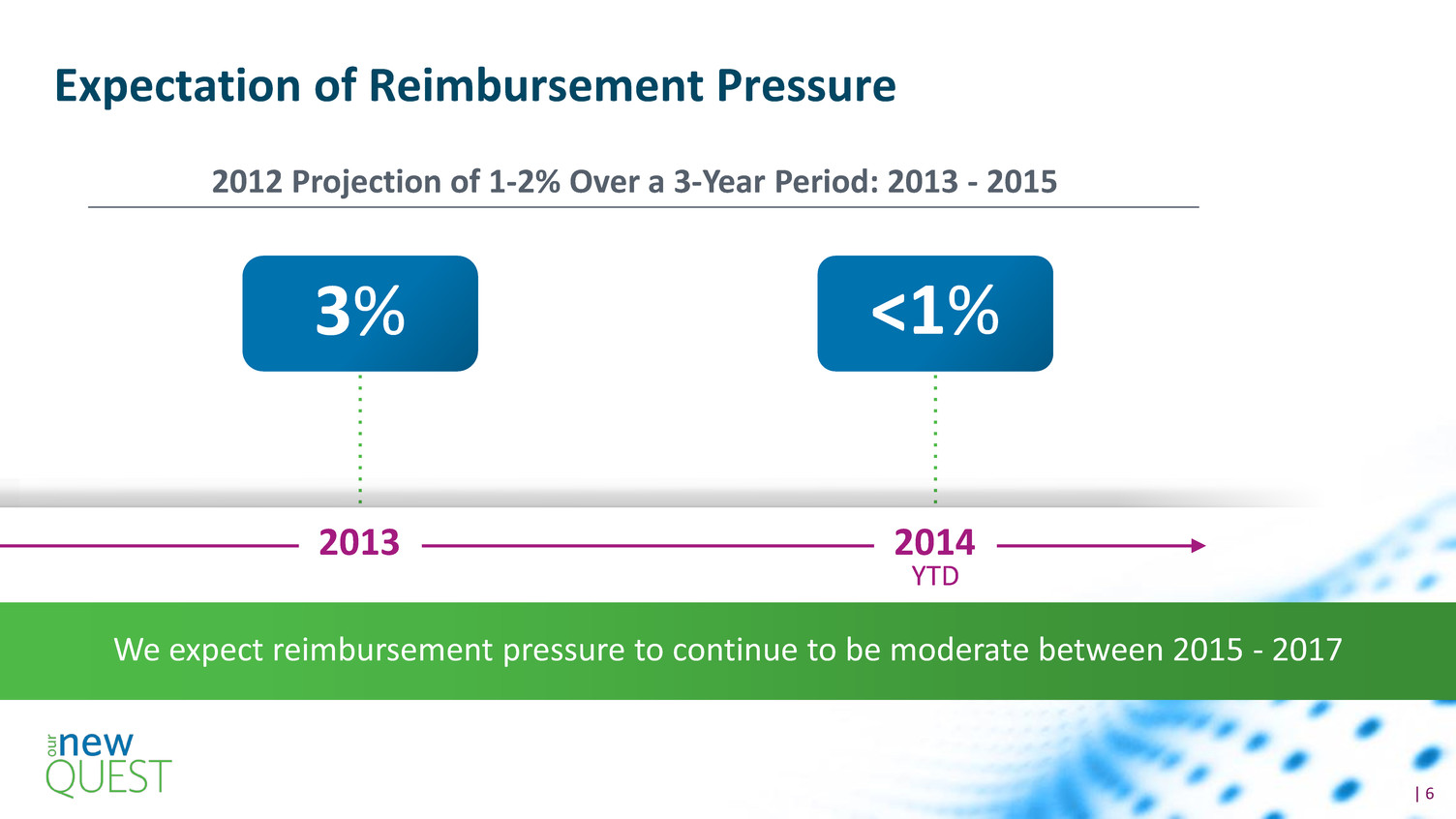

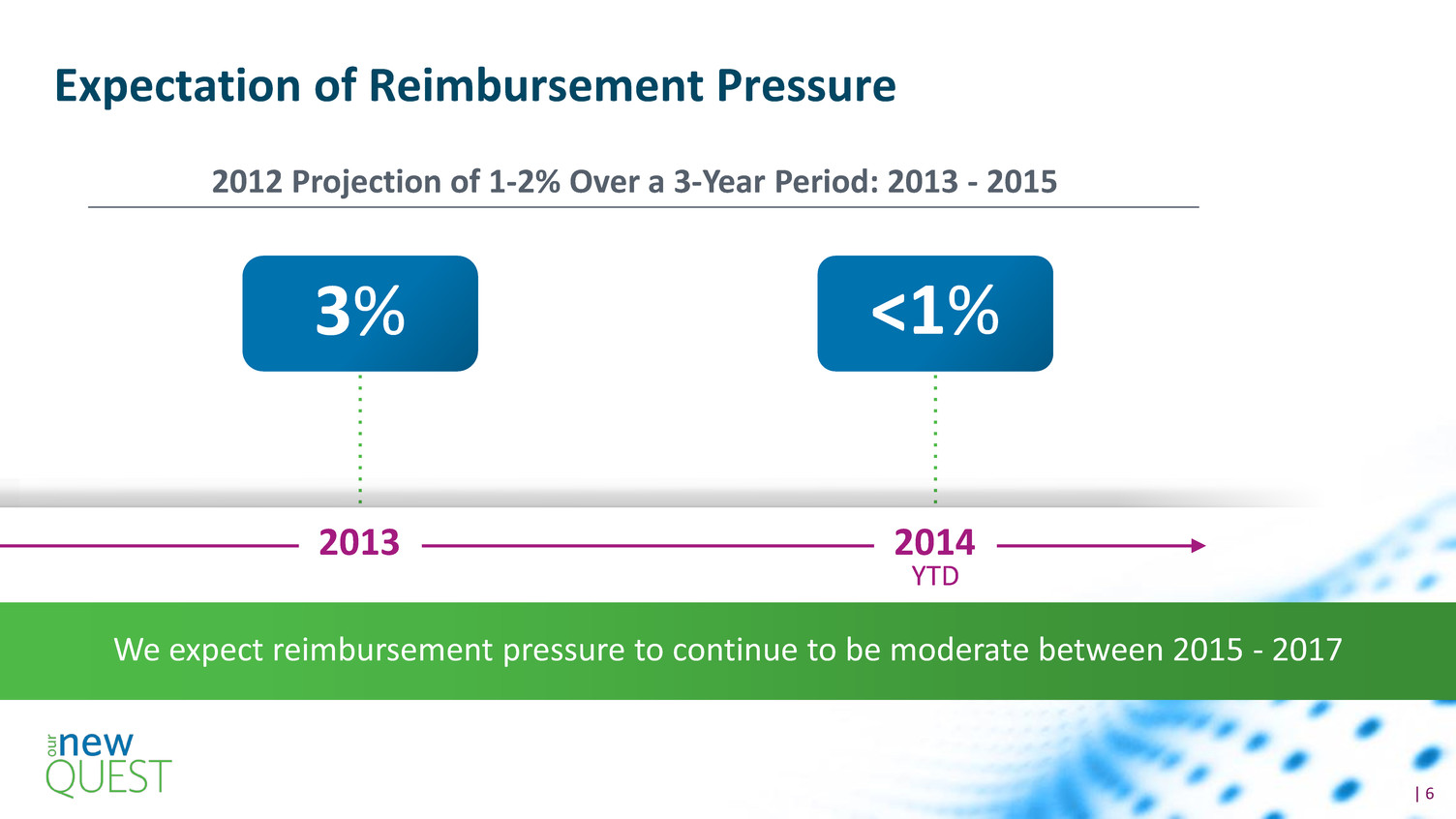

| 6 Expectation of Reimbursement Pressure 3% 2013 <1% 2014 2012 Projection of 1-2% Over a 3-Year Period: 2013 - 2015 We expect reimbursement pressure to continue to be moderate between 2015 - 2017 YTD

| 7 Investing in Growth: $1B on 7 acquisitions Guidelines for Assessing Acquisitions Regional Independent Labs Specialty, Boutique Labs Hospital Outreach Converge Solstas ATN (Toxicology) Summit (Wellness) UMass Dignity Steward 2013 - 2014 Acquisitions Strategic Fit NPV ROIC EPS

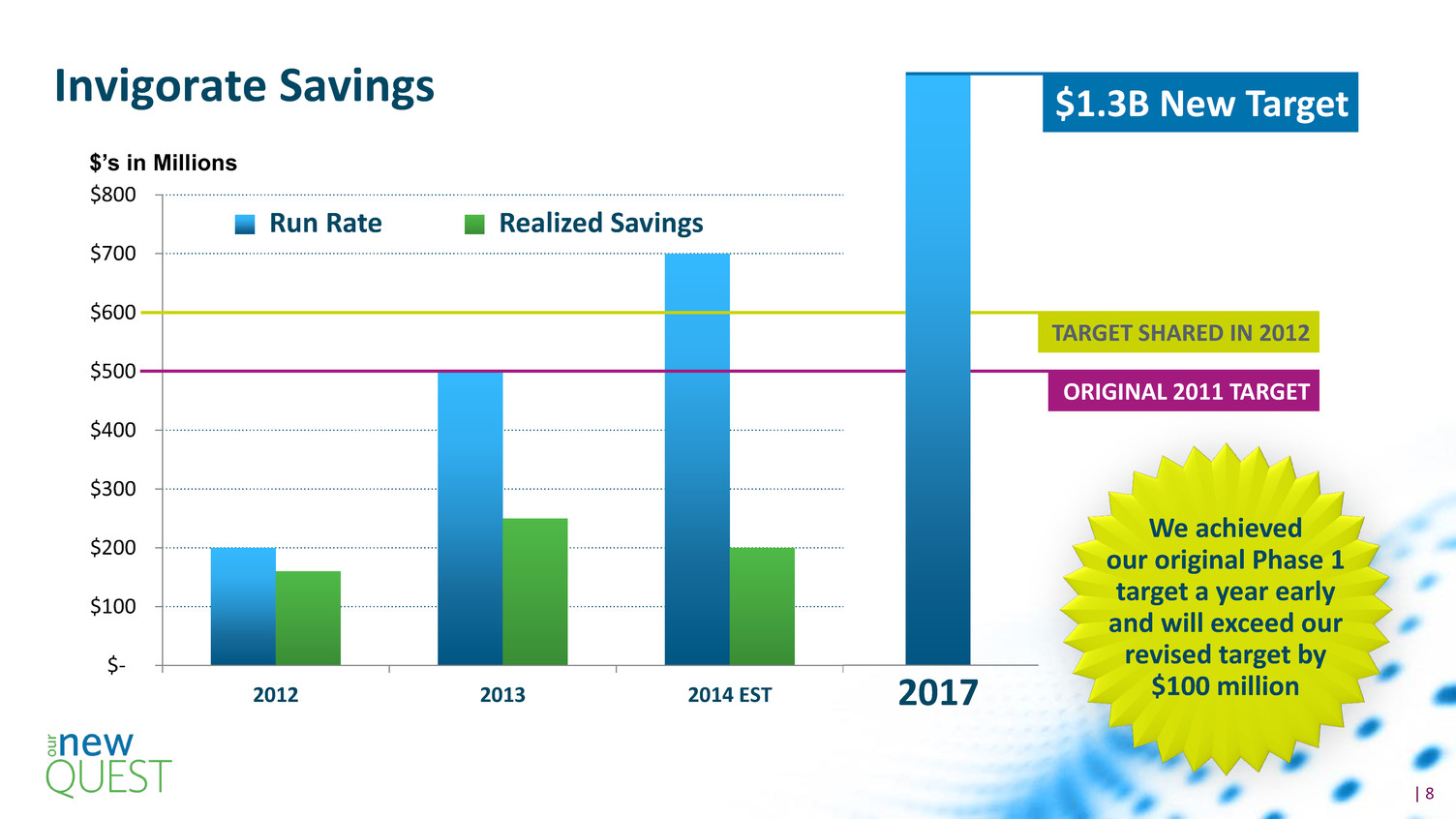

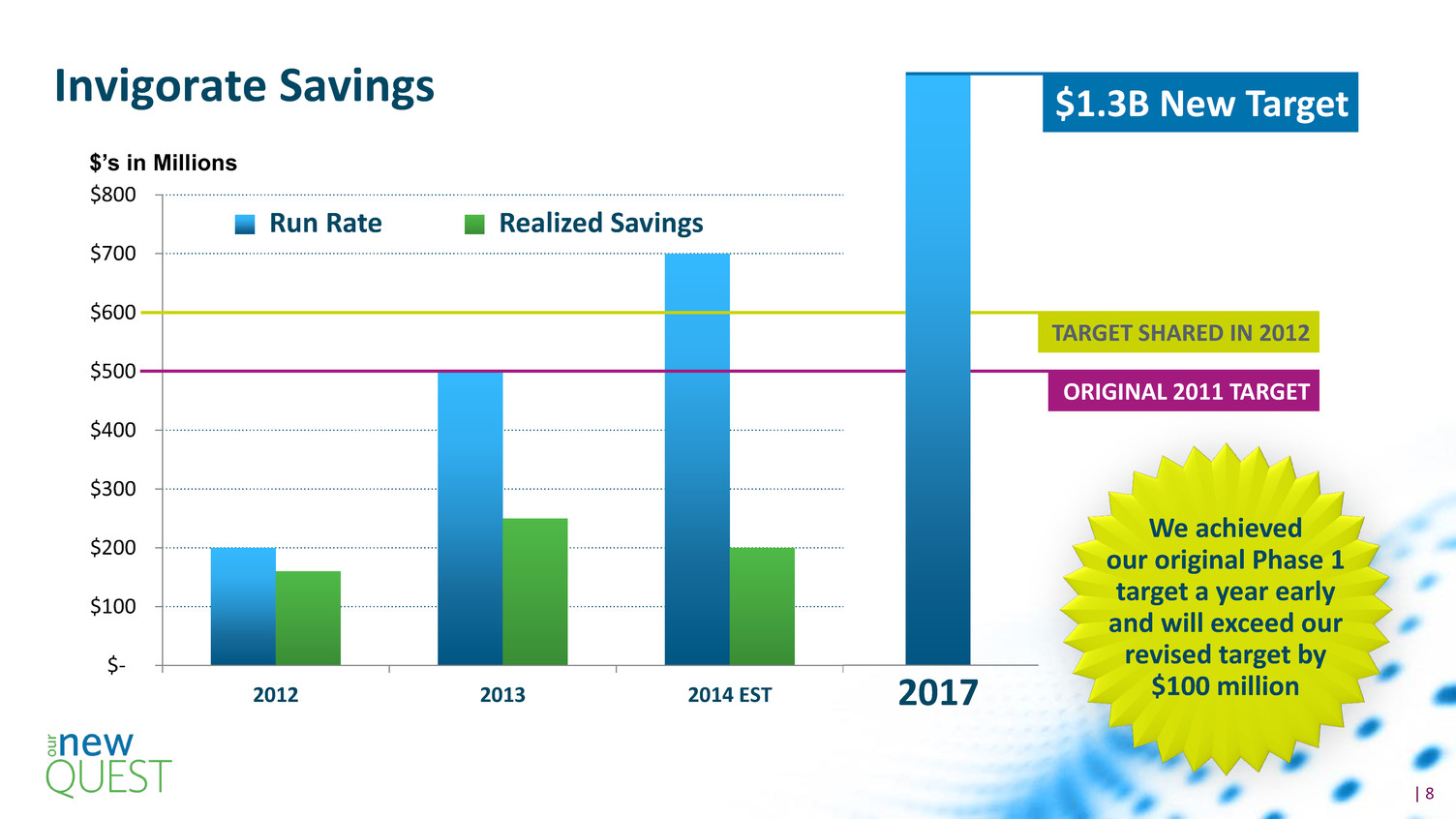

| 8 Invigorate Savings $- $100 $200 $300 $400 $500 $600 $700 $800 2012 2013 2014 EST ORIGINAL 2011 TARGET TARGET SHARED IN 2012 We achieved our original Phase 1 target a year early and will exceed our revised target by $100 million Run Rate Realized Savings 2017 $1.3B New Target $’s in Millions

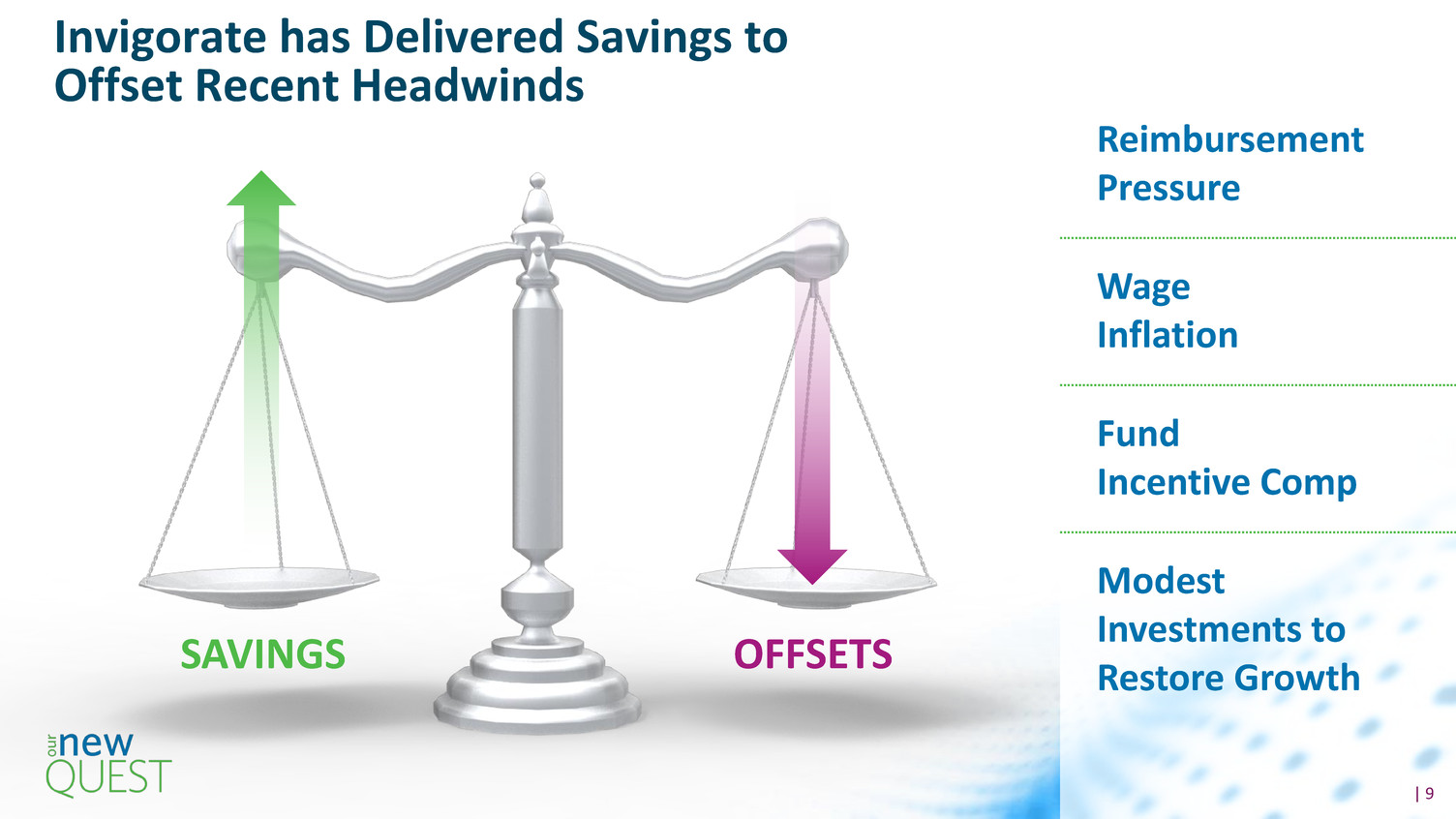

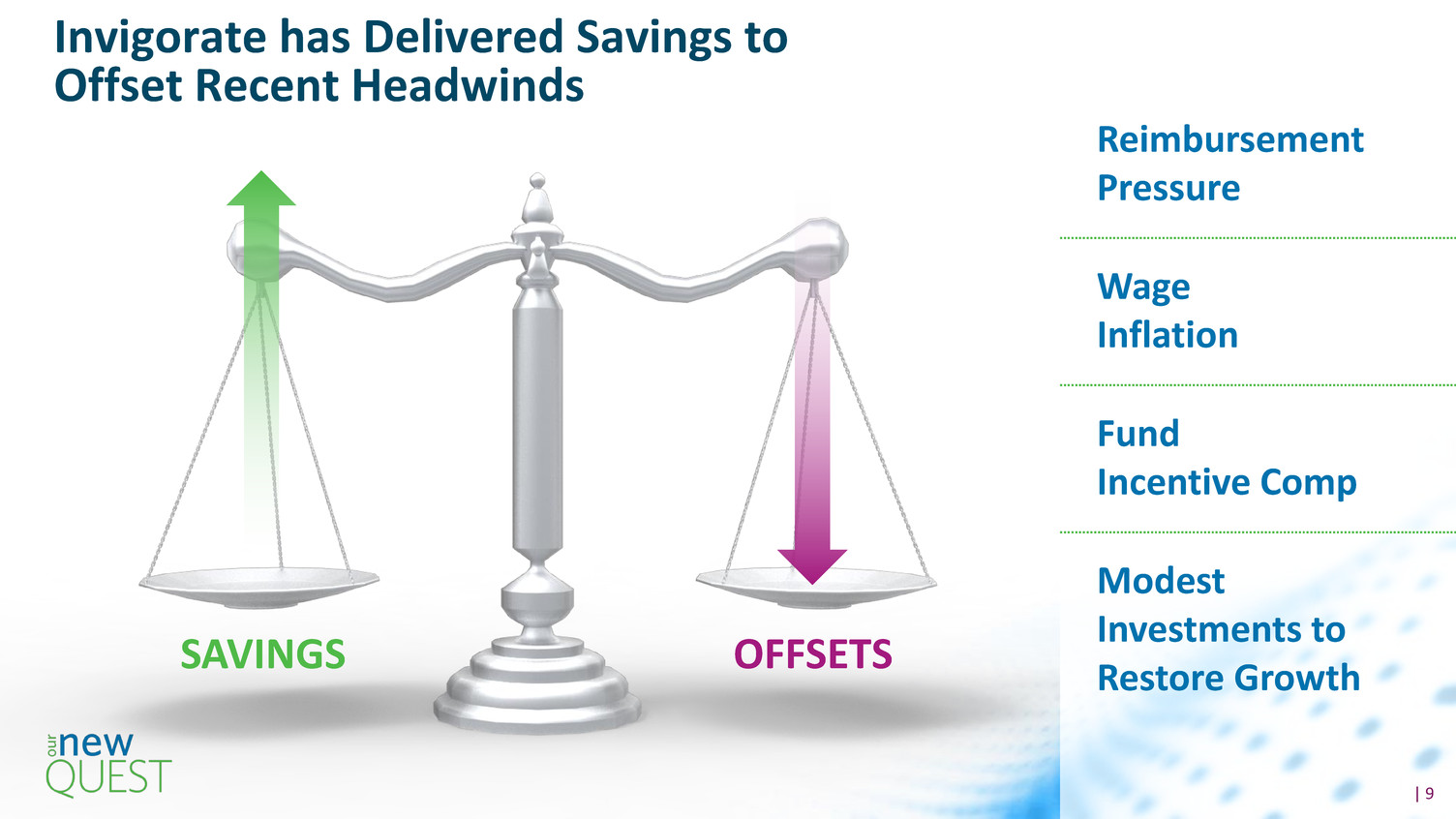

| 9 Invigorate has Delivered Savings to Offset Recent Headwinds SAVINGS OFFSETS Reimbursement Pressure Wage Inflation Fund Incentive Comp Modest Investments to Restore Growth

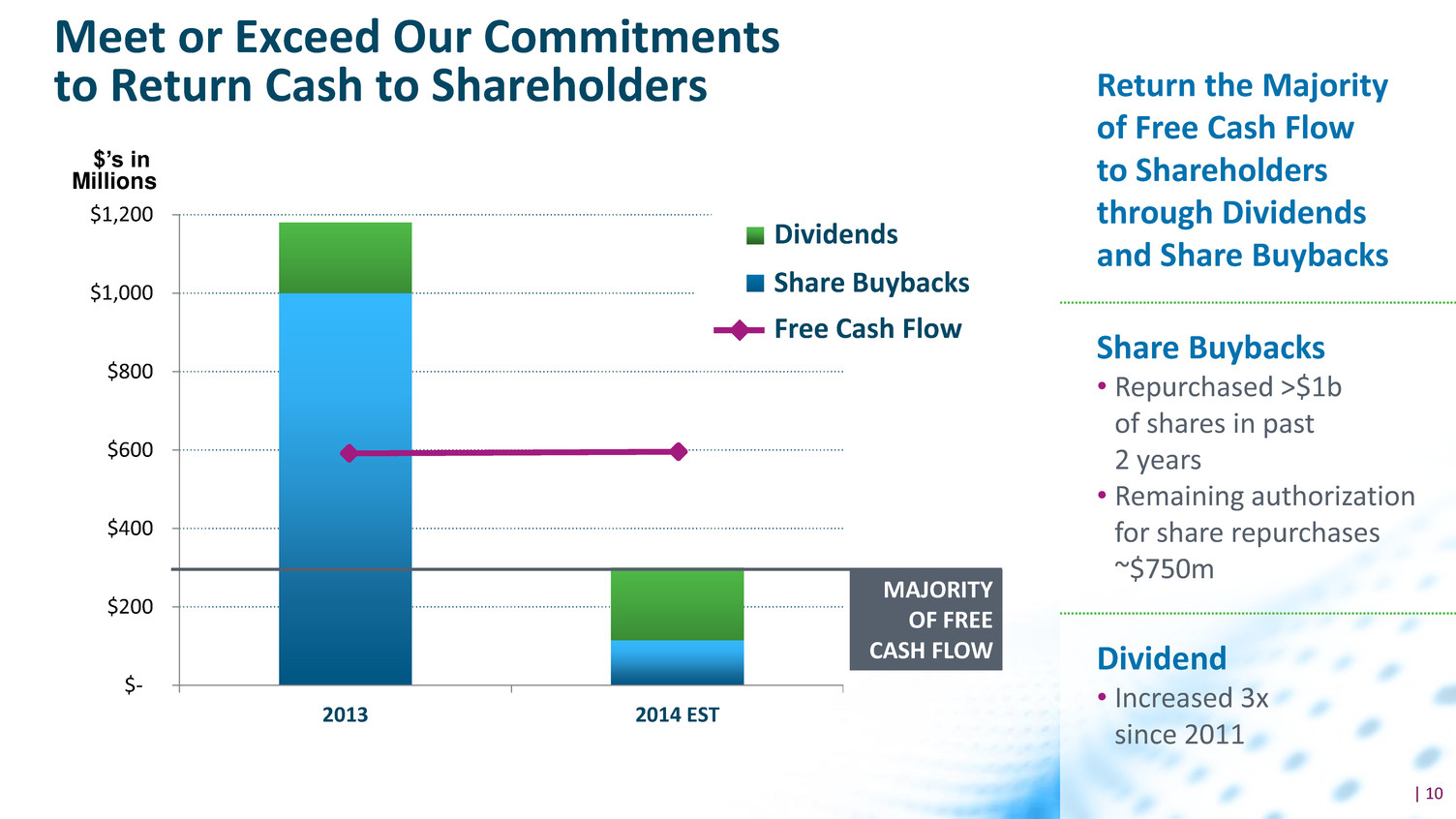

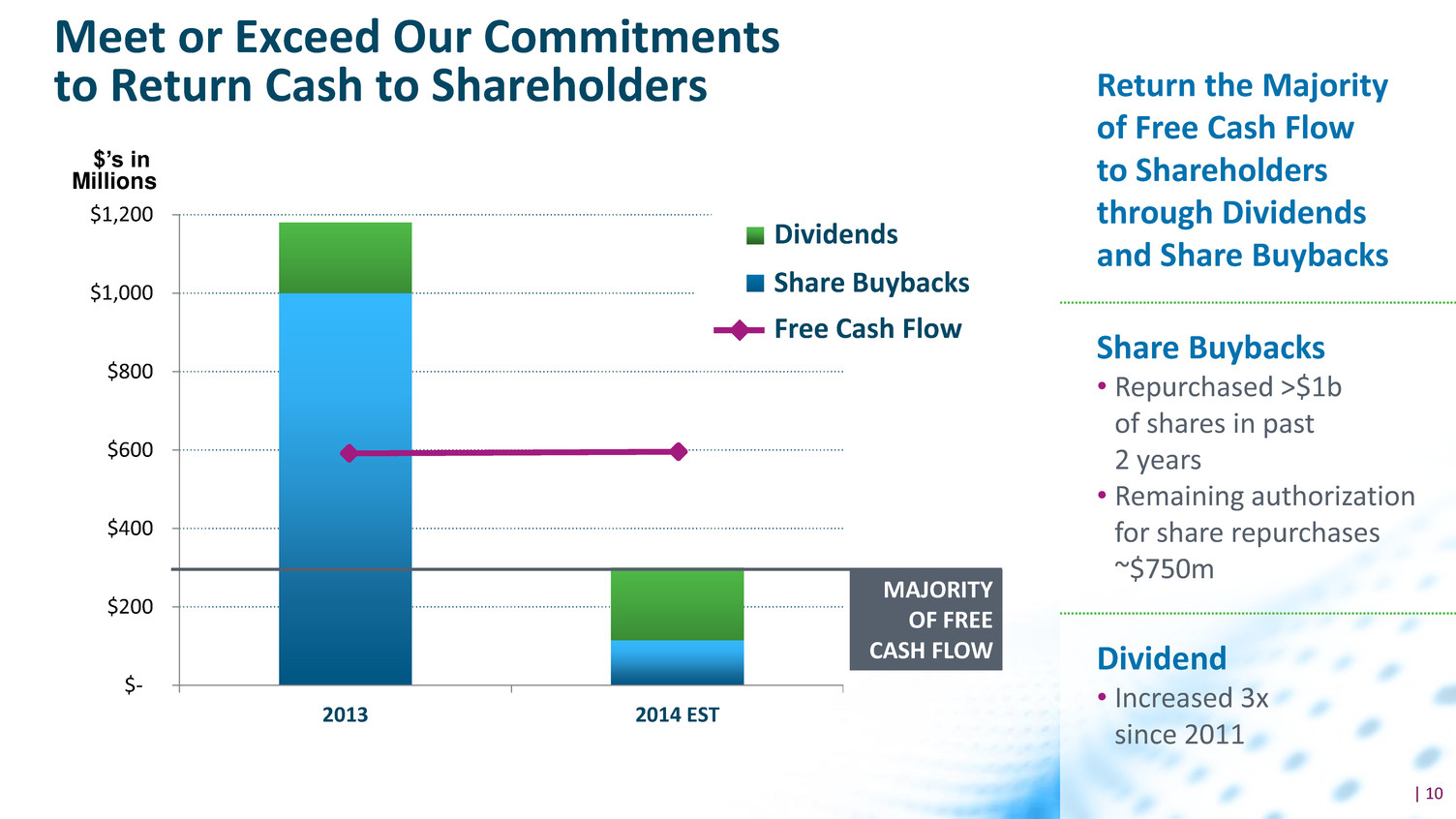

| 10 $- $200 $400 $600 $800 $1,000 $1,200 2013 2014 EST Meet or Exceed Our Commitments to Return Cash to Shareholders MAJORITY OF FREE CASH FLOW Return the Majority of Free Cash Flow to Shareholders through Dividends and Share Buybacks Share Buybacks • Repurchased >$1b of shares in past 2 years • Remaining authorization for share repurchases ~$750m Dividend • Increased 3x since 2011 Dividends Share Buybacks Free Cash Flow $’s in Millions

| 11 Report & Guide on “Cash EPS” in 2015 • Cash EPS = Adjusted Diluted EPS excluding amortization • Consistent with other healthcare companies and largest competitor • Continued investment community interest • Aid assessment of our M&A strategy • Amortization estimated to be ~$0.40 per diluted share for full year 2014 $0.09 Q1 $0.11 Q2 $0.10 Q3

| 12 MODERATE PRESSURE IMPROVING FEWER HEADWINDS REIMBURSEMENT UTILIZATION INVIGORATE Making Progress in an Improving Environment

| 13 Outlook 2014 FY Guidance 3-Year CAGR Revenue Increase of ~3.5% 2% to 5% • Includes M&A • Organic growth to accelerate to market levels through period Adjusted Diluted EPS $4.03 - $4.07 8-10% • Excludes share repurchases Adjusted Diluted EPS, Excluding Amortization Coming in 2015 8-10% • Excludes share repurchases Cash from Operations ~$900 million High single digit growth

| 14 Key Takeaways Consistent capital structure Invigorate savings continue to be key source of value creation Organic volume and revenue performance continue to improve Commitment remains to return a majority of FCF through dividends & share buybacks

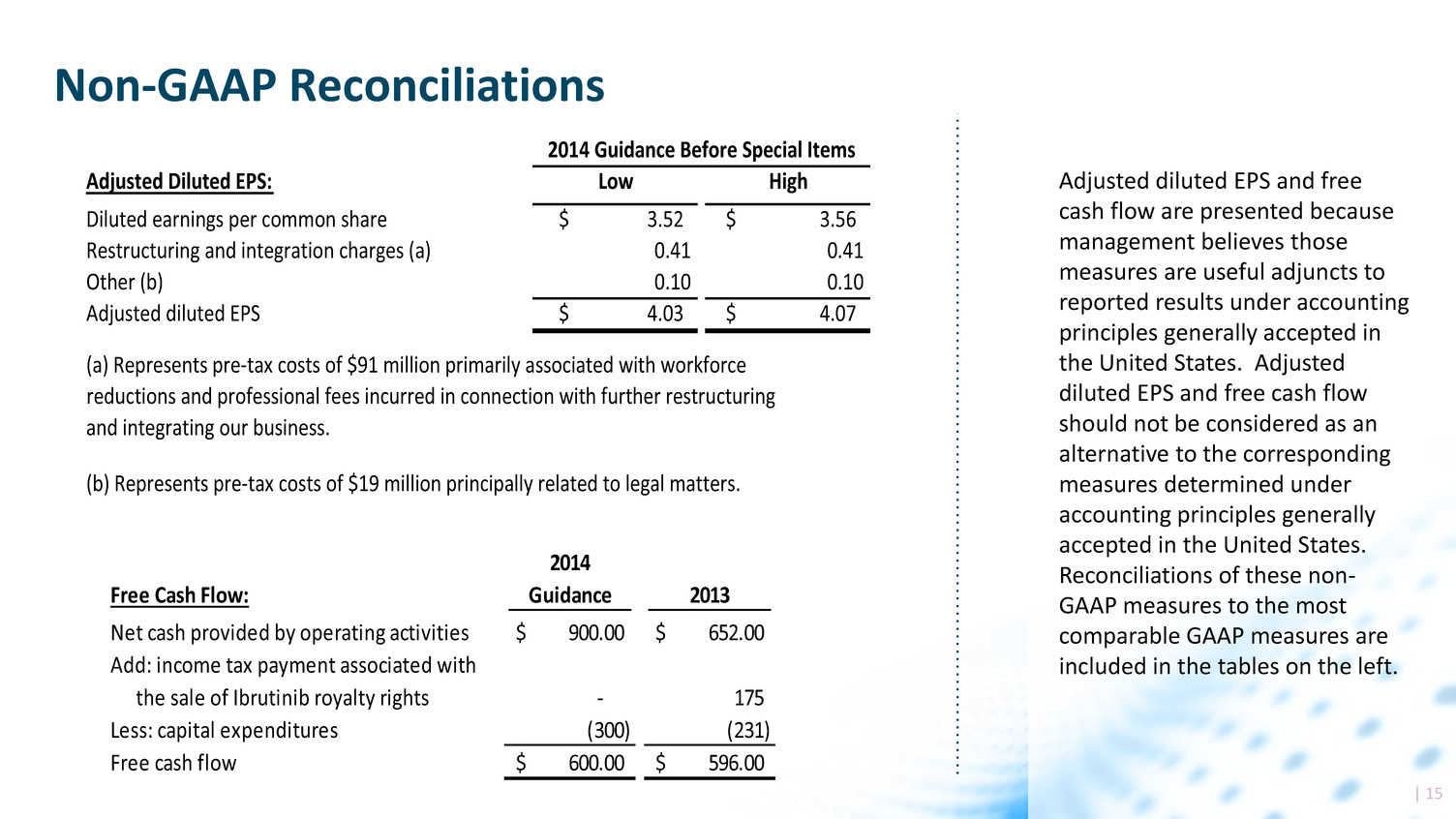

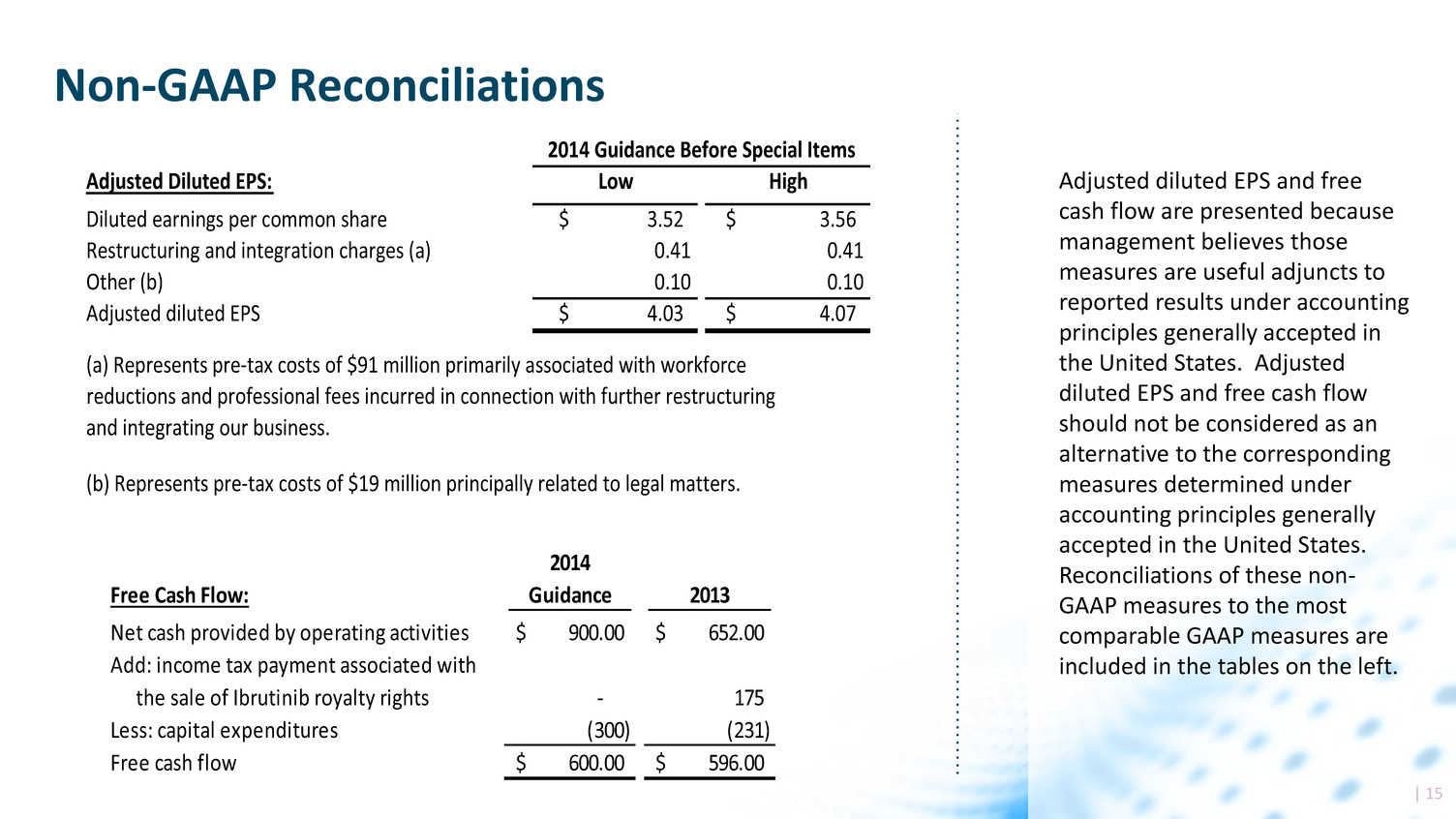

| 15 Non-GAAP Reconciliations Adjusted Diluted EPS: Low High Diluted earnings per common share 3.52$ 3.56$ Restructuring and integration charges (a) 0.41 0.41 Other (b) 0.10 0.10 Adjusted diluted EPS 4.03$ 4.07$ (b) Represents pre-tax costs of $19 million principally related to legal matters. (a) Represents pre-tax costs of $91 million primarily associated with workforce reductions and professional fees incurred in connection with further restructuring and integrating our business. 2014 Guidance Before Special Items 2014 Free Cash Flow: Guidance 2013 Net cash provided by operating activities 900.00$ 652.00$ Add: income tax payment associated with the sale of Ibrutinib royalty rights - 175 Less: capital expenditures (300) (231) Free cash flow 600.00$ 596.00$ Adjusted diluted EPS and free cash flow are presented because management believes those measures are useful adjuncts to reported results under accounting principles generally accepted in the United States. Adjusted diluted EPS and free cash flow should not be considered as an alternative to the corresponding measures determined under accounting principles generally accepted in the United States. Reconciliations of these non- GAAP measures to the most comparable GAAP measures are included in the tables on the left.