EXECUTION VERSION Quest Amendment No. 9 to 6th A&R CSA AMENDMENT NO. 9 TO SIXTH AMENDED AND RESTATED CREDIT AND SECURITY AGREEMENT This Amendment No. 9 to Sixth Amended and Restated Credit and Security Agreement (this “Amendment”) is entered into as of August 8, 2024 (the “Effective Date”), by and among: (1) QUEST DIAGNOSTICS RECEIVABLES INC., a Delaware corporation (together with its successors and permitted assigns, the “Borrower”), (2) QUEST DIAGNOSTICS INCORPORATED, a Delaware corporation, as initial servicer (in such capacity, together with any successor servicer or sub-servicer, the “Servicer”), (3) PNC BANK, NATIONAL ASSOCIATION, in its individual capacity as a Lender (together with its successors, “PNC” or the “PNC Group”) and as issuer of the Letters of Credit, (4) GOTHAM FUNDING CORPORATION, a Delaware corporation (together with its successors, “Gotham”), and MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO- MITSUBISHI UFJ, LTD.), in its capacity as a Liquidity Bank to Gotham (together with its successors, “MUFG” and, together with Gotham, the “Gotham Group”), (5) ATLANTIC ASSET SECURITIZATION LLC, a Delaware limited liability company (together with its successors, “Atlantic”), and CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK, in its capacity as a Liquidity Bank to Atlantic (together with its successors, “CACIB” and, together with Atlantic, the “Atlantic Group”), (6) PNC BANK, NATIONAL ASSOCIATION, in its capacity as agent for the PNC Group (together with its successors in such capacity, a “Co-Agent”), CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK, in its capacity as agent for the Atlantic Group (together with its successors in such capacity, a “Co-Agent”), and MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.), in its capacity as agent for the Gotham Group (together with its successors in such capacity, a “Co-Agent”), (7) PNC BANK, NATIONAL ASSOCIATION, in its capacity as Letter of Credit issuer (together with its successors in such capacity, the “LC Issuer”), and (8) MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.), as administrative agent for the Atlantic Group, the PNC Group, the Gotham Group and the Co-Agents (in such capacity, together with any successors thereto in such capacity, the “Administrative Agent” and together with each of the Co-Agents, the “Agents”). RECITALS: A. The Borrower, the Servicer, the PNC Group, the Gotham Group, the Atlantic Group and the Agents are parties to that certain Sixth Amended and Restated Credit and Security Agreement, dated as of October 27, 2017 (as amended, restated or otherwise modified from time to time, the “Credit and Security Agreement”; capitalized terms used and not otherwise defined herein are used with the meanings attributed thereto in the Credit and Security Agreement). Exhibit 99.13

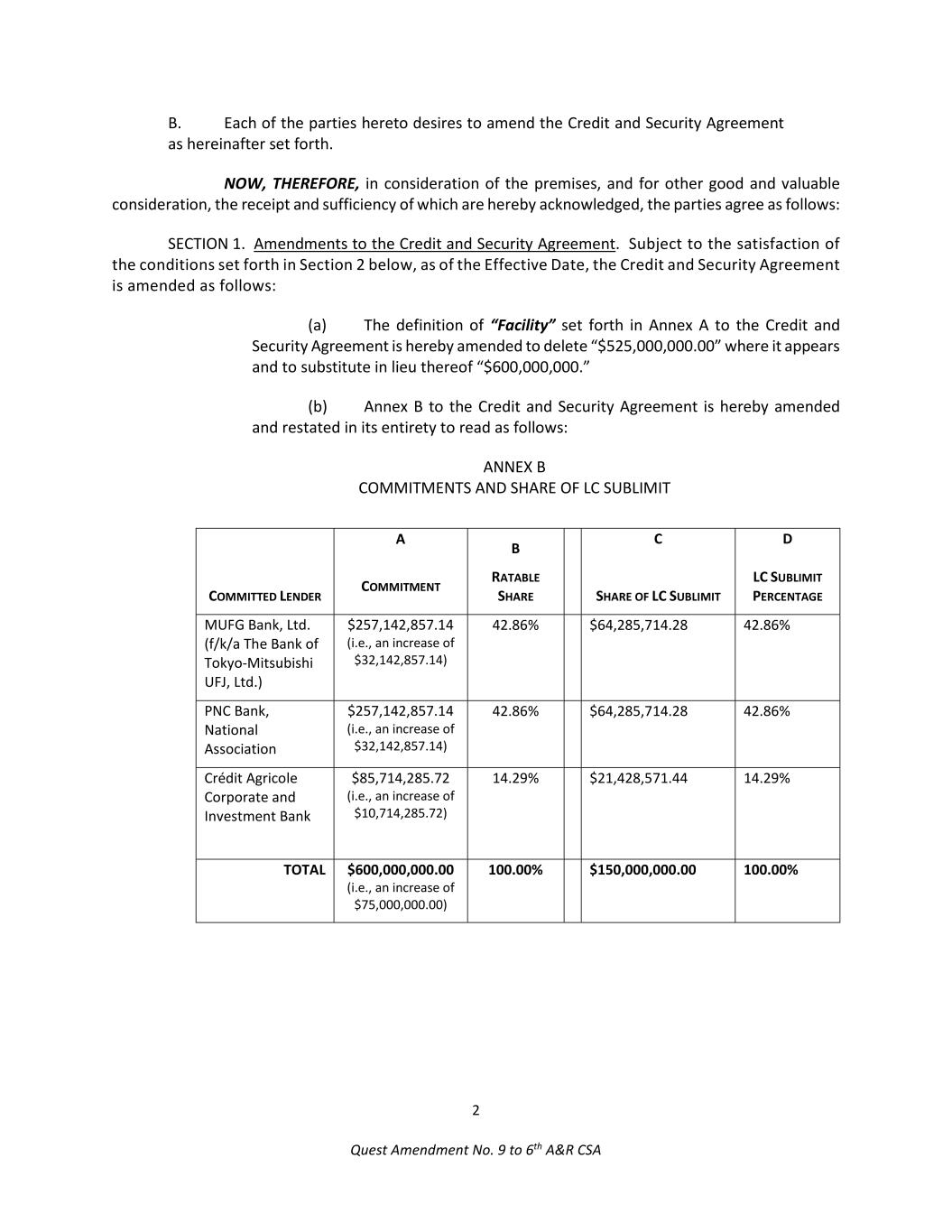

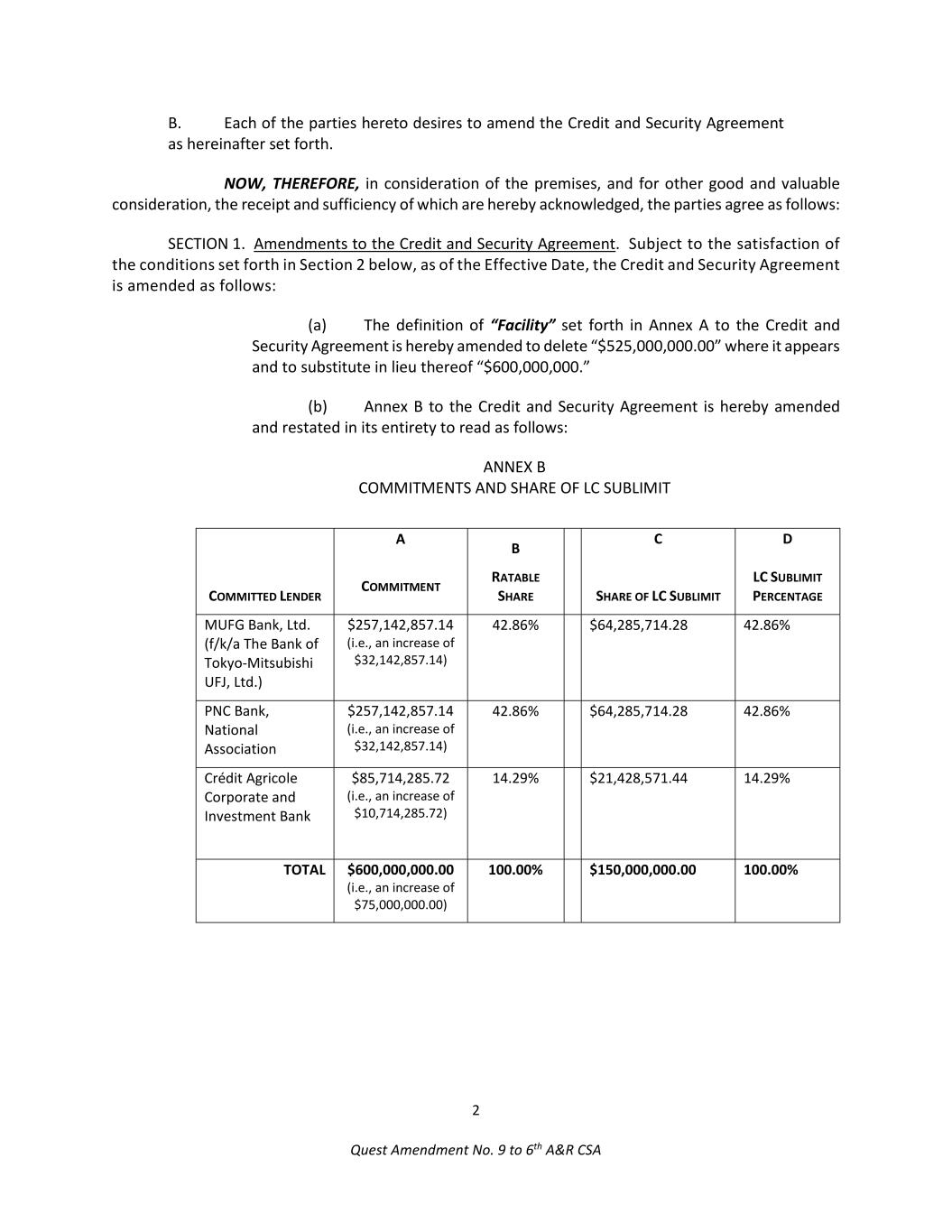

2 Quest Amendment No. 9 to 6th A&R CSA B. Each of the parties hereto desires to amend the Credit and Security Agreement as hereinafter set forth. NOW, THEREFORE, in consideration of the premises, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows: SECTION 1. Amendments to the Credit and Security Agreement. Subject to the satisfaction of the conditions set forth in Section 2 below, as of the Effective Date, the Credit and Security Agreement is amended as follows: (a) The definition of “Facility” set forth in Annex A to the Credit and Security Agreement is hereby amended to delete “$525,000,000.00” where it appears and to substitute in lieu thereof “$600,000,000.” (b) Annex B to the Credit and Security Agreement is hereby amended and restated in its entirety to read as follows: ANNEX B COMMITMENTS AND SHARE OF LC SUBLIMIT COMMITTED LENDER A COMMITMENT B RATABLE SHARE C SHARE OF LC SUBLIMIT D LC SUBLIMIT PERCENTAGE MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, Ltd.) $257,142,857.14 (i.e., an increase of $32,142,857.14) 42.86% $64,285,714.28 42.86% PNC Bank, National Association $257,142,857.14 (i.e., an increase of $32,142,857.14) 42.86% $64,285,714.28 42.86% Crédit Agricole Corporate and Investment Bank $85,714,285.72 (i.e., an increase of $10,714,285.72) 14.29% $21,428,571.44 14.29% TOTAL $600,000,000.00 (i.e., an increase of $75,000,000.00) 100.00% $150,000,000.00 100.00%

3 Quest Amendment No. 9 to 6th A&R CSA SECTION 2. Conditions to Effectiveness. This Amendment shall become effective as of the Effective Date provided that each of the following conditions precedent is satisfied: (a) The Administrative Agent shall have received counterparts of this Amendment (whether by electronic mail or otherwise) duly executed by each of the parties hereto; (b) (i) The amendment fee letter dated of even date herewith by and among the Borrower and the Co-Agents shall have been duly executed by all parties thereto, and (ii) on or before the date hereof, the Borrower shall have paid to the Co- Agents in immediately available funds, the fully-earned and non-refundable amendment structuring fees specified therein. (c) Each of the representations and warranties set forth in Section 3 of this Amendment is true and correct as of the Effective Date. SECTION 3. Representations and Warranties. The Borrower hereby represents and warrants to the Agents and the Lenders as of the Effective Date as follows: (a) Representations and Warranties. The representations and warranties contained in Article VI of the Credit and Security Agreement are true and correct as of the date hereof (unless stated to relate solely to an earlier date, in which case such representations or warranties were true and correct as of such earlier date). (b) Enforceability. The execution and delivery by each of the Borrower and the Servicer of this Amendment, and the performance of each of its obligations under this Amendment and the Credit and Security Agreement, as amended hereby, are within each of its organizational powers and have been duly authorized by all necessary action on each of its parts. This Amendment and the Credit and Security Agreement, as amended hereby, are each of the Borrower’s and the Servicer’s valid and legally binding obligations, enforceable in accordance with its terms. (c) No Default. Immediately after giving effect to this Amendment and the transactions contemplated hereby, no Event of Default or Unmatured Default exists or shall exist. SECTION 4. Legal Fees and Disbursements. The Borrower hereby acknowledges and agrees that this Amendment constitutes a Transaction Document and that the provisions of Section 14.5(a) of the Credit and Security Agreement apply hereto. SECTION 5. Governing Law. This Amendment shall be governed by, and construed in accordance with, the internal laws of the State of New York without regard to any otherwise applicable conflicts of law principles (other than Sections 5-1401 and 5-1402 of the New York General Obligations Law which shall apply hereto). SECTION 6. Effect of Amendment; Ratification. Except as specifically amended hereby, the Credit and Security Agreement is hereby ratified and confirmed in all respects, and all of its provisions shall

4 Quest Amendment No. 9 to 6th A&R CSA remain in full force and effect. After this Amendment becomes effective, all references in the Credit and Security Agreement (or in any other Transaction Document) to “the Credit and Security Agreement,” “this Agreement,” “hereof,” “herein,” or words of similar effect, in each case referring to the Credit and Security Agreement, shall be deemed to be references to the Credit and Security Agreement as amended hereby. This Amendment shall not be deemed to expressly or impliedly waive, amend, or supplement any provision of the Credit and Security Agreement other than as specifically set forth herein. The Borrower, the Servicer, the PNC Group, the Gotham Group, the Atlantic Group and the Agents shall treat this Amendment as not resulting in a significant modification of the Loans for U.S. federal, state and local income tax purposes. SECTION 7. Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, and each counterpart shall be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument. To the fullest extent permitted by applicable law, delivery of an executed counterpart of a signature page of this Amendment by telefacsimile or electronic image scan transmission (such as a “pdf” file) will be effective to the same extent as delivery of a manually executed original counterpart of this Amendment. SECTION 8. Section Headings. The various headings of this Amendment are inserted for convenience only and shall not affect the meaning or interpretation of this Amendment or the Credit and Security Agreement or any provision hereof or thereof. SECTION 9. Successors and Assigns. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns. SECTION 10. Severability. If any one or more of the provisions or terms of this Amendment shall for any reason whatsoever be held invalid or unenforceable, then such agreements, provisions or terms shall be deemed severable from the remaining agreements, provisions and terms of this Amendment and shall in no way affect the validity or enforceability of the provisions of this Amendment or the Credit and Security Agreement. <Balance of page intentionally left blank>

6 Quest Amendment No. 9 to 6th A&R CSA ATLANTIC ASSET SECURITIZATION LLC, as a Conduit BY: CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK, AS ATTORNEY-IN-FACT By: Name: Title: By: ___________________________________________ Name: Title: Docusign Envelope ID: DF9C9095-E2F1-4BBB-AEDA-157690509423 David R NÚÑEZ Director Managing Director Michael Regan

7 Quest Amendment No. 9 to 6th A&R CSA CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK, individually as a Liquidity Bank for Atlantic and as Atlantic Group Agent By: Name: Title: By: Name: Title: Docusign Envelope ID: DF9C9095-E2F1-4BBB-AEDA-157690509423 David R NÚÑEZ Director Managing Director Michael Regan

9 Quest Amendment No. 9 to 6th A&R CSA GOTHAM FUNDING CORPORATION, as a Conduit By: ___________________________________________ Name: Title:

10 Quest Amendment No. 9 to 6th A&R CSA MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.), individually as a Liquidity Bank for Gotham By: _____________________________________________ Name: Title: MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.), as Gotham Agent By: _____________________________________________ Name: Title: MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.), as Administrative Agent By: _____________________________________________ Name: Title: