1 QUEST DIAGNOSTICS INCORPORATED POLICY ON SECURITIES TRADING (Amended as of December 31, 2024) The federal securities laws impose civil and criminal penalties on a company, its directors, officers and other employees or those receiving information from a company, its directors, officers and other employees who transact in that company’s securities while in possession of “material non-public information” (as discussed below). In the course of serving in their roles with Quest Diagnostics, members of the board of directors of Quest Diagnostics (“directors”), officers and other employees may from time to time obtain confidential and/or highly sensitive information concerning Quest Diagnostics, its customers, suppliers or others with which Quest Diagnostics has contractual or other relationships or may be negotiating transactions. This policy applies with equal force to information relating to any other company, including Quest Diagnostics’ customers, suppliers, competitors, acquisition targets or other companies with which it has business dealings, obtained in the course of your role at Quest Diagnostics. For example, if you have information that Quest Diagnostics is engaged in the confidential negotiation of a contract with another company that may impact a third company with which Quest Diagnostics is not in negotiations, you may not trade in the securities of Quest Diagnostics, the company with whom Quest Diagnostics is in negotiations or any company that may be impacted by the contract, or suggest to anyone else that they do so. This information could affect the market price of securities issued by Quest Diagnostics and/or the other companies involved. In addition to civil and criminal penalties, there could be reputational harm to Quest Diagnostics if it became public that a director, officer or other employee of Quest Diagnostics used material non-public information to purchase or sell securities or shared such information with someone else who acted in such manner. Therefore, it is imperative for Quest Diagnostics and all of its directors, officers and other employees, including at its subsidiaries and affiliates, to adhere to this policy. In addition, all external contractors, consultants and advisors are expected to abide by this policy. Exceptions to this policy may only be made by the General Counsel of Quest Diagnostics. Exhibit 19.1

2 Part I. Background Discussion The federal securities laws prohibit the purchase or disposition of a security at a time when you possess “material non-public information” concerning the company that issued the security, or the market for the security, which has not yet become a matter of general public knowledge and which has been obtained or is being used in breach of a duty to maintain the information in confidence. Communication of non-public information to a third party under circumstances where improper trading can be anticipated (“tipping”) is also prohibited by law. Material non-public information includes information that is not available to the public and that could affect the market price of the security. It is information that a reasonable investor would attach importance to in deciding whether to buy, dispose of, or hold the security or how to exercise a right to vote related to such security. Common examples of information frequently regarded as material are: unpublished financial results or projections by a corporation’s officers of future earnings or losses; news of a significant pending or proposed merger or acquisition, or a tender offer or exchange offer; news of a significant sale of assets or the disposition of a subsidiary; changes in dividend policies or the declaration of a stock split or the offering of additional securities; changes in management or the board of directors; significant new products or discoveries; significant regulatory or litigation developments; impending bankruptcy or financial liquidity problems; the gain or loss of a substantial customer or supplier; change in credit ratings; or a significant cybersecurity breach or other incident. The above list is only illustrative and other types of information may be considered material, depending on the circumstances. Both positive and adverse information may be material, and partial knowledge may also be material (for example, if you learn that a significant acquisition or sales contract is being planned, you may possess material information even if you do not know the identity of the parties involved). Information is considered to be available to the public only when it has been widely disseminated to the public through appropriate channels and enough time has elapsed to permit the investment market to absorb and evaluate the information. Information generally would be considered widely disseminated to the public if it has been disclosed through major newswire services, national news services and financial news services or through public filings with the SEC. Information will normally be regarded as absorbed and evaluated within one business day after it is publicly released. Persons who trade on material non-public information may be liable for civil fines assessed as a multiple of the profit gained or loss avoided, criminal fines and jail sentences of up to twenty years. Persons who wrongfully provide material non-public information to third parties can be liable for similar fines, based on the trading profits of the tippee. Persons who fail to comply with the policy are subject to sanctions imposed by Quest Diagnostics, including disgorging profits and dismissal for cause, whether or not the person’s failure to comply results in a violation of the law. Part II. All Directors, Officers and Other Employees A. Comply with the Law. All directors, officers and other employees must fully comply with the federal securities laws prohibiting the purchase or disposition of any securities (including

3 common stock, debt, hybrid and derivative securities) of Quest Diagnostics or any other company while in possession of material non-public information. Dispositions include sales, broker-assisted cashless exercise of stock options or any other market sale of securities for the purpose of generating funds necessary to pay the exercise price of a stock option, sale of shares received under the Employee Stock Purchase Plan or in connection with the settlement of restricted share units or other equity awards, reallocation of 401(k) or Supplemental Deferred Compensation Plan account balances that result in a sale or purchase in the Quest Stock Fund or through the relevant plan’s brokerage window, changes in the level of contributions to the Employee Stock Purchase Plan, as well as charitable contributions and gifts. Material non-public information relating to Quest Diagnostics or other companies may not be passed to others except on a need-to-know basis related solely to Quest Diagnostics’ business needs. Each individual who is subject to this policy is responsible for making sure that he or she is in compliance with the policy, and that any Restricted Immediate Family Member or Controlled Entity whose transactions are subject to this policy, as discussed below, also comply with the policy. B. Specified Prohibited Activities. In addition to the general prohibition contained in Part II.A. above, all directors, officers and other employees must not engage in any of the following specific activities. 1. Purchase or dispose of Quest Diagnostics securities on a short-term basis. Any security purchased must be held for a minimum of three (3) months before being sold (except for common stock obtained by an employee exercising an employee stock option). A sale (or purchase) of any stock acquired through the Employee Stock Purchase Plan, the Quest Stock Fund or in the Supplemental Deferred Compensation Plan is covered by this policy. 2. Enter into any transaction or series of transactions or purchase a financial instrument that is expected to hedge or offset, or designed to hedge or offset, a decline in Quest Diagnostics’ common stock, including but not limited to the use of financial derivatives (including, for example, prepaid forward contracts, equity swaps, collars, puts and calls or exchange funds) or entering into transactions (including, for example, short sales) that establish downside price protection for Quest Diagnostics common stock. 3. Purchase or dispose of securities issued by any other commercial clinical laboratory or anatomic pathology provider or the parent company of such laboratory or provider, public or private. The scope of this restriction is understandably broad, so directors, officers and other employees should consult with the General Counsel or Corporate Secretary of Quest Diagnostics prior to entering into any transaction in the securities of a company involved in the commercial clinical laboratory or anatomic pathology industry. Directors, officers and other employees are not required to dispose of such securities acquired before they became a Quest Diagnostics director, officer or employee. 4. Disclose material non-public information relating to Quest Diagnostics or any other entity or recommend the purchase or disposition of securities of Quest

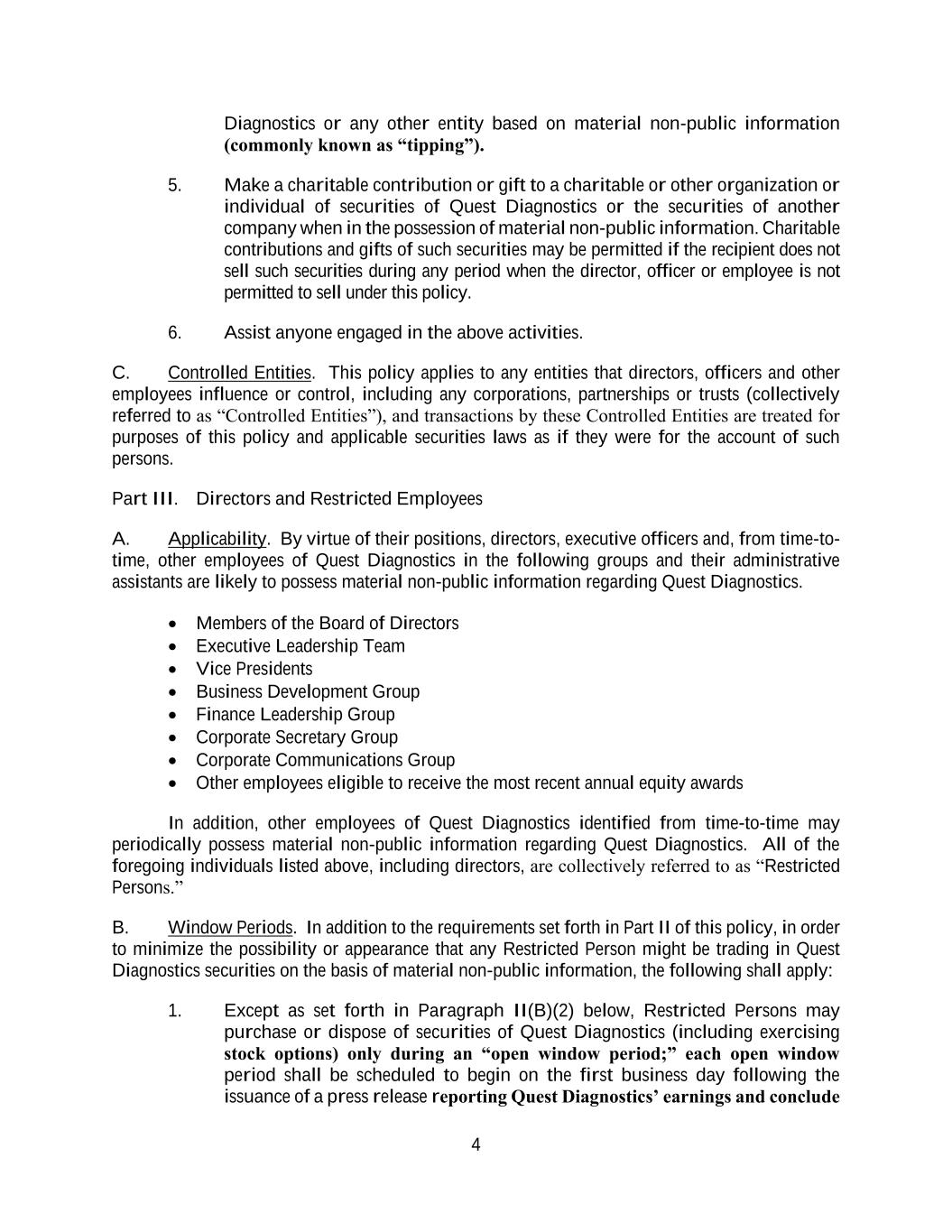

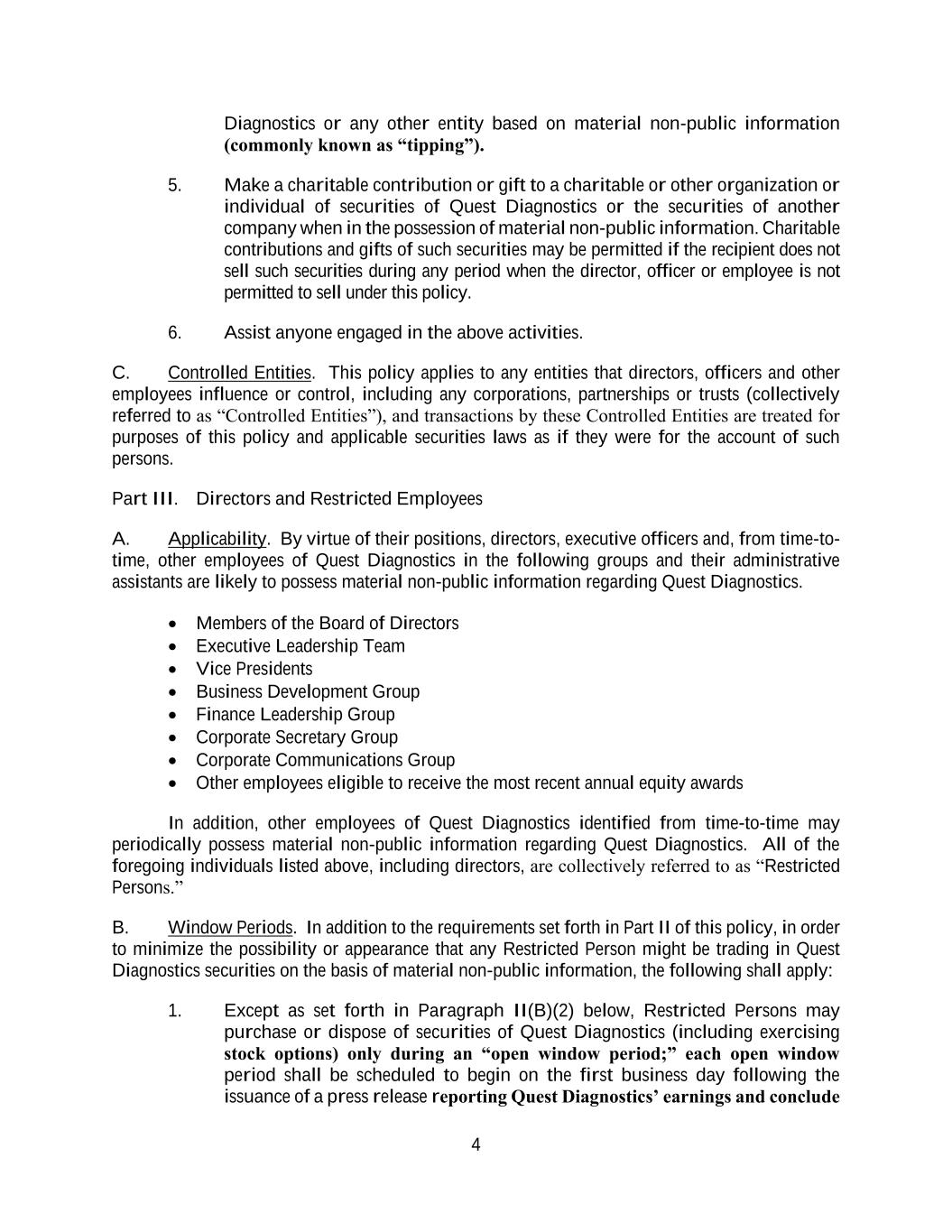

4 Diagnostics or any other entity based on material non-public information (commonly known as “tipping”). 5. Make a charitable contribution or gift to a charitable or other organization or individual of securities of Quest Diagnostics or the securities of another company when in the possession of material non-public information. Charitable contributions and gifts of such securities may be permitted if the recipient does not sell such securities during any period when the director, officer or employee is not permitted to sell under this policy. 6. Assist anyone engaged in the above activities. C. Controlled Entities. This policy applies to any entities that directors, officers and other employees influence or control, including any corporations, partnerships or trusts (collectively referred to as “Controlled Entities”), and transactions by these Controlled Entities are treated for purposes of this policy and applicable securities laws as if they were for the account of such persons. Part III. Directors and Restricted Employees A. Applicability. By virtue of their positions, directors, executive officers and, from time-to- time, other employees of Quest Diagnostics in the following groups and their administrative assistants are likely to possess material non-public information regarding Quest Diagnostics. • Members of the Board of Directors • Executive Leadership Team • Vice Presidents • Business Development Group • Finance Leadership Group • Corporate Secretary Group • Corporate Communications Group • Other employees eligible to receive the most recent annual equity awards In addition, other employees of Quest Diagnostics identified from time-to-time may periodically possess material non-public information regarding Quest Diagnostics. All of the foregoing individuals listed above, including directors, are collectively referred to as “Restricted Persons.” B. Window Periods. In addition to the requirements set forth in Part II of this policy, in order to minimize the possibility or appearance that any Restricted Person might be trading in Quest Diagnostics securities on the basis of material non-public information, the following shall apply: 1. Except as set forth in Paragraph II(B)(2) below, Restricted Persons may purchase or dispose of securities of Quest Diagnostics (including exercising stock options) only during an “open window period;” each open window period shall be scheduled to begin on the first business day following the issuance of a press release reporting Quest Diagnostics’ earnings and conclude

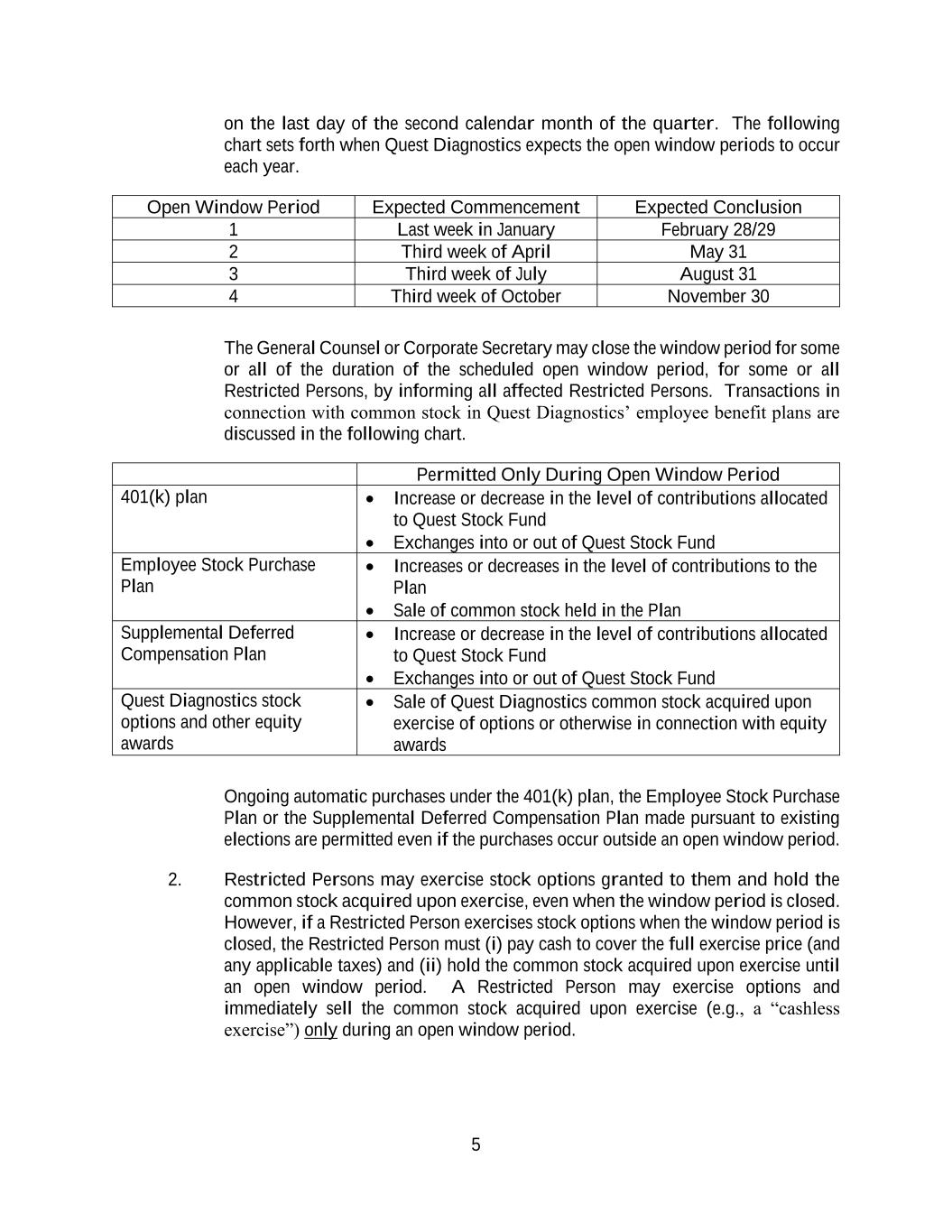

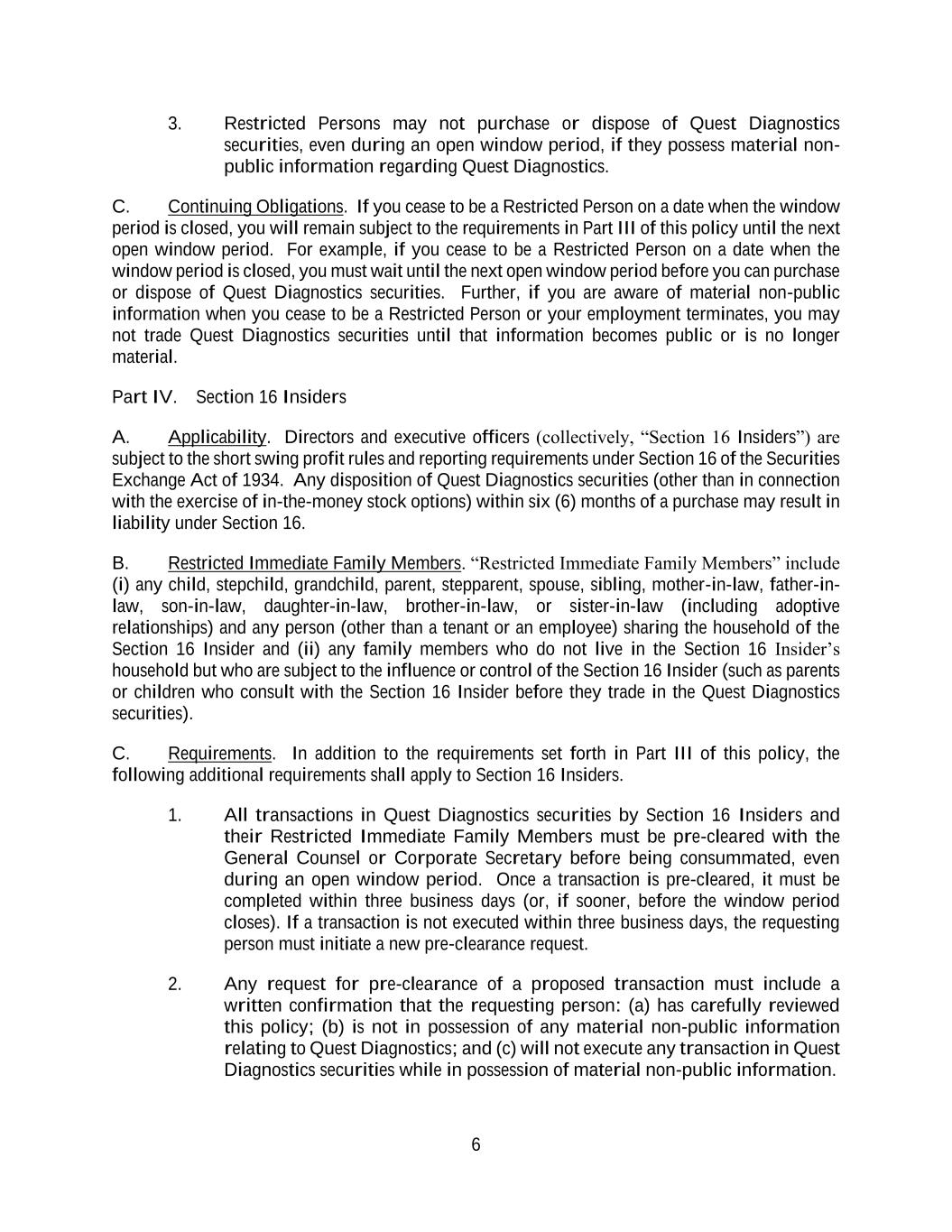

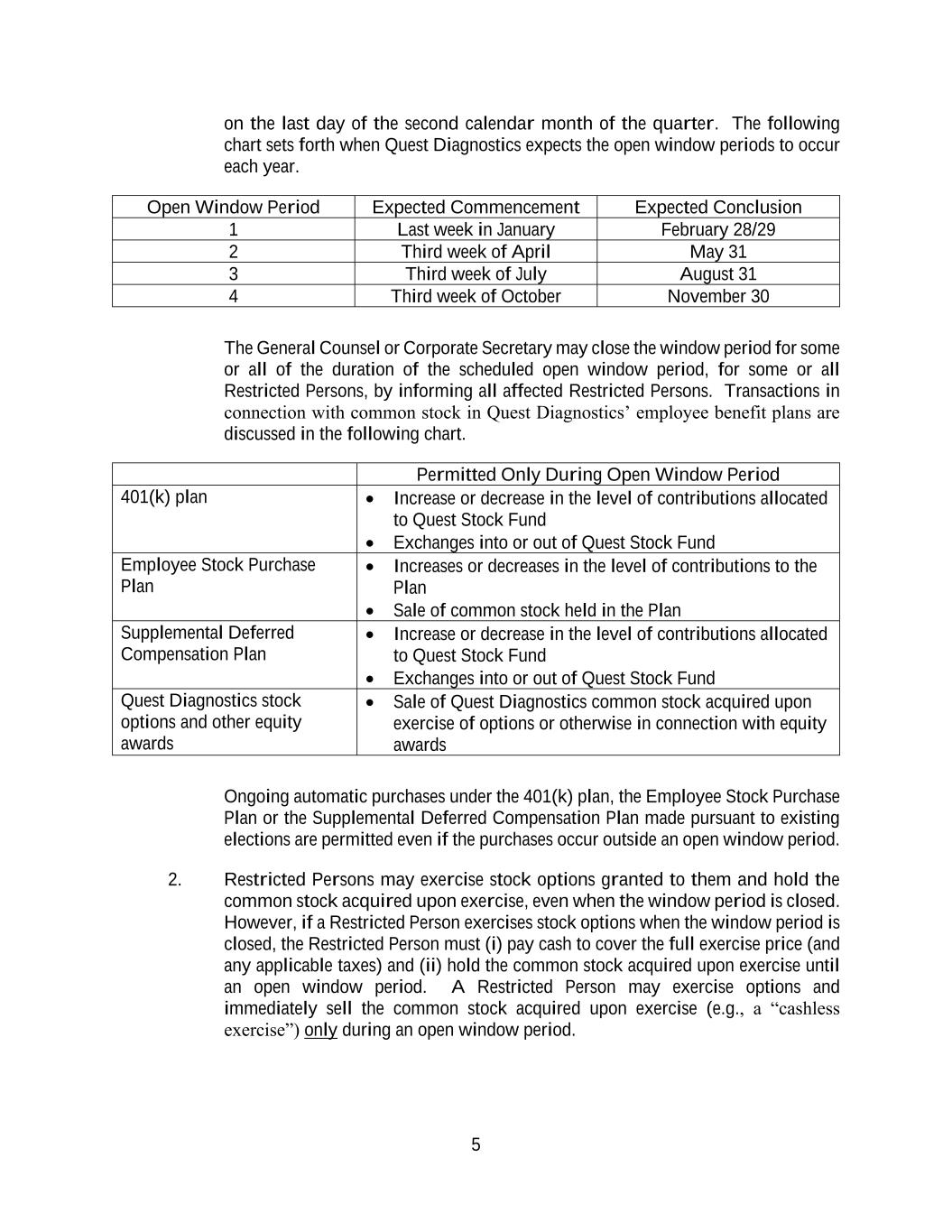

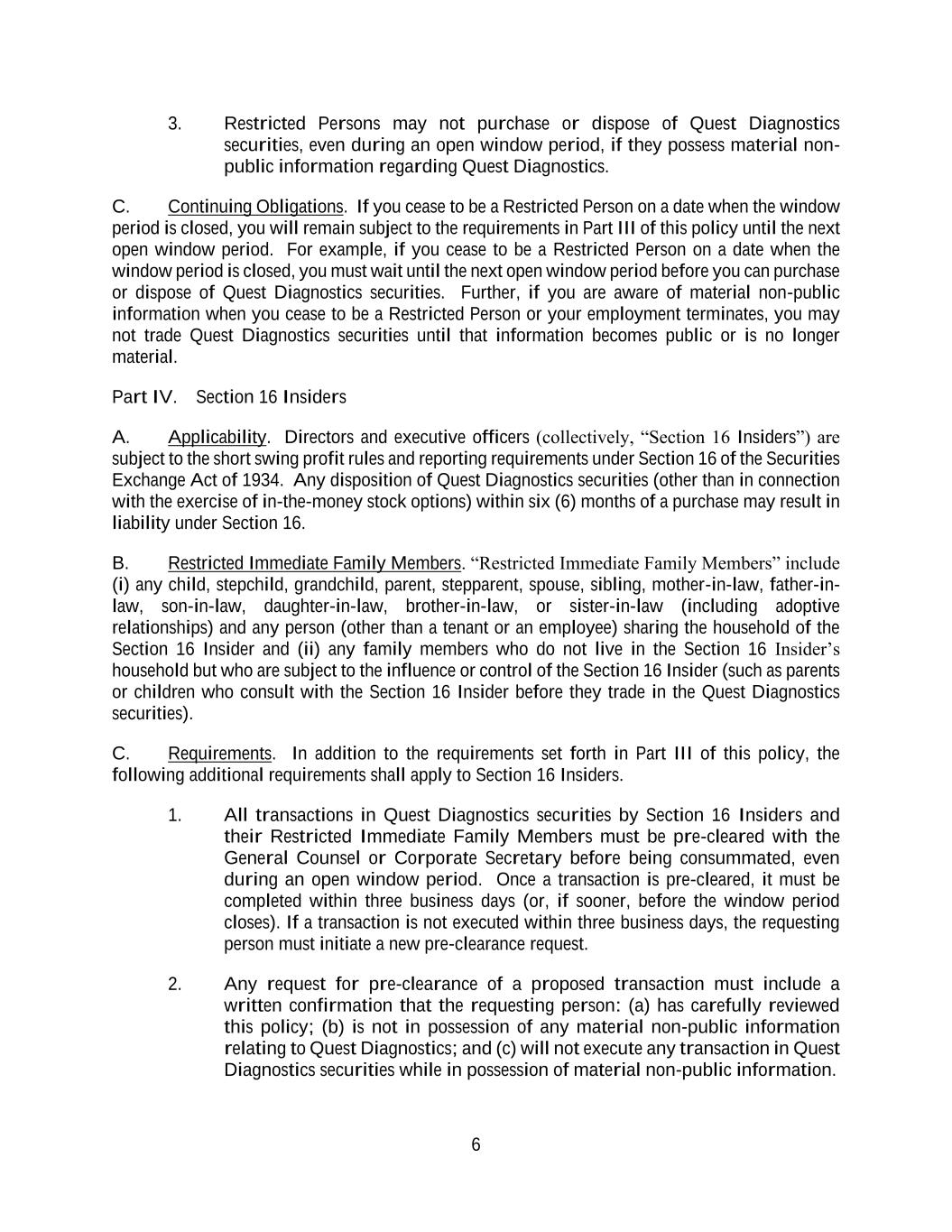

5 on the last day of the second calendar month of the quarter. The following chart sets forth when Quest Diagnostics expects the open window periods to occur each year. Open Window Period Expected Commencement Expected Conclusion 1 Last week in January February 28/29 2 Third week of April May 31 3 Third week of July August 31 4 Third week of October November 30 The General Counsel or Corporate Secretary may close the window period for some or all of the duration of the scheduled open window period, for some or all Restricted Persons, by informing all affected Restricted Persons. Transactions in connection with common stock in Quest Diagnostics’ employee benefit plans are discussed in the following chart. Permitted Only During Open Window Period 401(k) plan • Increase or decrease in the level of contributions allocated to Quest Stock Fund • Exchanges into or out of Quest Stock Fund Employee Stock Purchase Plan • Increases or decreases in the level of contributions to the Plan • Sale of common stock held in the Plan Supplemental Deferred Compensation Plan • Increase or decrease in the level of contributions allocated to Quest Stock Fund • Exchanges into or out of Quest Stock Fund Quest Diagnostics stock options and other equity awards • Sale of Quest Diagnostics common stock acquired upon exercise of options or otherwise in connection with equity awards Ongoing automatic purchases under the 401(k) plan, the Employee Stock Purchase Plan or the Supplemental Deferred Compensation Plan made pursuant to existing elections are permitted even if the purchases occur outside an open window period. 2. Restricted Persons may exercise stock options granted to them and hold the common stock acquired upon exercise, even when the window period is closed. However, if a Restricted Person exercises stock options when the window period is closed, the Restricted Person must (i) pay cash to cover the full exercise price (and any applicable taxes) and (ii) hold the common stock acquired upon exercise until an open window period. A Restricted Person may exercise options and immediately sell the common stock acquired upon exercise (e.g., a “cashless exercise”) only during an open window period.

6 3. Restricted Persons may not purchase or dispose of Quest Diagnostics securities, even during an open window period, if they possess material non- public information regarding Quest Diagnostics. C. Continuing Obligations. If you cease to be a Restricted Person on a date when the window period is closed, you will remain subject to the requirements in Part III of this policy until the next open window period. For example, if you cease to be a Restricted Person on a date when the window period is closed, you must wait until the next open window period before you can purchase or dispose of Quest Diagnostics securities. Further, if you are aware of material non-public information when you cease to be a Restricted Person or your employment terminates, you may not trade Quest Diagnostics securities until that information becomes public or is no longer material. Part IV. Section 16 Insiders A. Applicability. Directors and executive officers (collectively, “Section 16 Insiders”) are subject to the short swing profit rules and reporting requirements under Section 16 of the Securities Exchange Act of 1934. Any disposition of Quest Diagnostics securities (other than in connection with the exercise of in-the-money stock options) within six (6) months of a purchase may result in liability under Section 16. B. Restricted Immediate Family Members. “Restricted Immediate Family Members” include (i) any child, stepchild, grandchild, parent, stepparent, spouse, sibling, mother-in-law, father-in- law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law (including adoptive relationships) and any person (other than a tenant or an employee) sharing the household of the Section 16 Insider and (ii) any family members who do not live in the Section 16 Insider’s household but who are subject to the influence or control of the Section 16 Insider (such as parents or children who consult with the Section 16 Insider before they trade in the Quest Diagnostics securities). C. Requirements. In addition to the requirements set forth in Part III of this policy, the following additional requirements shall apply to Section 16 Insiders. 1. All transactions in Quest Diagnostics securities by Section 16 Insiders and their Restricted Immediate Family Members must be pre-cleared with the General Counsel or Corporate Secretary before being consummated, even during an open window period. Once a transaction is pre-cleared, it must be completed within three business days (or, if sooner, before the window period closes). If a transaction is not executed within three business days, the requesting person must initiate a new pre-clearance request. 2. Any request for pre-clearance of a proposed transaction must include a written confirmation that the requesting person: (a) has carefully reviewed this policy; (b) is not in possession of any material non-public information relating to Quest Diagnostics; and (c) will not execute any transaction in Quest Diagnostics securities while in possession of material non-public information.

7 3. If a pre-clearance request is denied, the requesting person may not be informed of the reason of such denial, must refrain from initiating any transaction in Quest Diagnostics securities and must not inform any other person of the denied request to transact in the Quest Diagnostics securities. It is therefore important that you pre-clear any proposed transaction before discussing it with your broker. 4. Section 16 Insiders must advise the Corporate Secretary immediately after the transaction is completed so that required reports can be timely filed with the SEC. 5. Margin Accounts; Pledges. Section 16 Insiders and their Restricted Immediate Family Members may not hold Quest Diagnostics common stock in a margin account and may not pledge their Quest Diagnostics common stock as collateral for a loan. 6. Managed Accounts. If a managed account is maintained for the benefit of a Section 16 Insider or his or her Restricted Immediate Family Members, securities of Quest Diagnostics and/or the securities of a commercial clinical laboratory or anatomic pathology provider or the parent company of such laboratory or provider may not be purchased or disposed of in such accounts.1 The Section 16 Insider or Restricted Immediate Family Member must instruct the account manager of the managed account regarding this limitation. This policy does not prohibit purchases and dispositions of mutual funds and unit investment trusts. 7. 10b5-1 Plans. Trades in Quest Diagnostics securities that are executed pursuant to an approved 10b5-1 plan are not subject to the prohibition on trading on the basis of material non-public information contained in this policy. All trading plans or arrangements that delegate the purchase or sale of Quest Diagnostics securities to a broker or other third party must be approved in writing in advance by the Corporate Secretary’s office and must comply with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, including, but not limited to, “cooling-off” periods delaying first trades after a 10b5-1 plan is adopted and limitations on the number of such plans. A 10b5-1 plan generally may not be adopted, modified or terminated during a closed window period. A 10b5-1 plan may only be adopted, modified or terminated when the person adopting the plan is not aware of material non-public information. By adopting a 10b5-1 plan, you consent to Quest Diagnostics publicly disclosing that you adopted the plan, the key terms of the plan, and the details of transactions executed under the plan. You also consent to Quest Diagnostics publicly disclosing any modification or cancellation of the plan. 1 A “managed account” is an account as to which you have designated an account manager to manage your funds and you have no control over the purchase or sale of investments in the account. Decisions regarding transactions in the account are made at the sole discretion of your account manager.

8 Authorization from a Quest Diagnostics representative for you to transact in securities is not personal legal, tax or financial advice to you, and does not create a legal safe harbor from an insider trading violation. In all cases, you are personally responsible for determining whether you are aware of material non-public information and, if so, for refraining from trading in securities to which that material non-public information relates. Quest Diagnostics’ attorneys represent Quest Diagnostics and its subsidiaries, not you or other individuals employed by Quest Diagnostics. Part V. Company Transactions Quest Diagnostics will comply with the requirements of the securities laws, including those related to transacting in its securities while in possession of material non-public information, in connection with its purchase or sale of its securities. Part VI. Inquiries If you have a question concerning this policy, a proposed securities transaction, or whether information is material non-public information, please contact the General Counsel or Corporate Secretary.