HARMONY GOLD MINING COMPANY LIMITED

| | | | | | |

| Randfontein Office Park | | P O Box 2, Randfontein, 1760 | | T +27 11 411 2000 | | NYSE trading symbol HMY |

| Cnr Main Reef Road and Ward | | Johannesburg, South Africa | | F +27 11 692 3879 | | JSE trading symbol HAR |

| Avenue, Randfontein, 1759 | | | | Wwww.harmony.co.za | | |

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

DIVISION OF CORPORATION FINANCE

100 F STREET, NE

WASHINGTON, D.C.

20549

| | |

| FOR ATTENTION: | | TIA L. JENKINS |

| | SENIOR ASSISTANT CHIEF ACCOUNTANT |

| |

| CC: | | SUYING LI |

| | BRIAN BHANDARI |

| |

| RE: | | Harmony Gold Mining Company Limited Form 20-F for Fiscal Year Ended June 30, 2012 Filed October 29, 2012 Comment Letter dated July 3, 2013 |

July 31, 2013

Dear Sirs,

Reference is made to the Staff’s comment letter dated July 3, 2013 in respect of the Harmony Gold Mining Company Limited (the “Company”) Form 20-F for the year ended June 30, 2012 and the Company’s response letter dated May 17, 2013. Set forth below in detail is the response to the Staff’s comment, which follows the text of the comment in the Staff letter:

Form 20-F for Fiscal Year Ended June 30, 2012

Item 5. Operating and Financial Review and Prospects

Critical Accounting Policies and Estimates, page 83

| 1. | Please revise your future filings to provide a critical accounting policy that addresses your method of depreciating mining-related assets. Please address the following items: |

| | • | | Define your accounting policy, define each of proven and probable reserves, measured and indicated resources and inferred resources. |

| | |

| Directors: | | PT Motsepe* (Chairman), JM Motloba* (Deputy Chairman), GP Briggs (Chief Executive), F Abbott (Financial Director), HE Mashego (Executive Director), JA Chissano*#, FFT De Buck*, KV Dicks*, Dr DSS Lushaba*, CE Markus*, M Msimang*, JL Wetton*, AJ Wilkens*, KT Nondumo*, VP Pillay* *Non-Executive;#Mozambican |

| |

| Secretary: | | Riana Bisschoff |

| |

| Registration Number: | | 1950/038232/06 |

| | • | | Describe the circumstance under which each type of “resource” is included in the calculation of depreciation, describe management’s assumptions concerning these resources (i.e., circumstances under which the resources may be economically mined, additional timing and work to convert the resources to reserves, gold pricing concerns, etc.), and describe management’s track record regarding the conversion of resources to reserves. |

| | • | | Disclose the nature and amount of resources that are included in the depreciation calculation for each year for which an income statement is presented. |

| | • | | Describe how you risk-weighted the resources included in the depreciation calculation; if you do not risk-weight those quantities, explain why. |

| | • | | Disclose whether additional development costs are also included in the calculation of depreciation and how those costs are determined. If so, disclose the amount of additional development costs that were included in the depreciation calculation for each year for which and income statement is presented. |

| | • | | Provide all the requested disclosures on an overall basis and on a mine-by-mine basis as necessary. Discuss the uncertainties surrounding management’s estimates and also how changes in the estimates would affect the depreciation expense. |

Please provide us with a draft of proposed disclosures to be included in your future filings.

Response: The Company has addressed the separate points below.

| | • | | The Company will include a section on the accounting policy for depreciation of mining-related assets (proposed disclosure included below). The definition of the various categories of resources will be added to the glossary, which already includes the definition of proved and probable reserves. The proposed definitions are as follows: |

| | a) | Measured mineral resource - Part of a mineral resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a high level of confidence. It is based on detailed and reliable exploration, sampling and testing information using appropriate techniques from outcrops, trenches, pits, workings and drill holes. The locations are spaced closely enough to confirm geological and grade continuity. |

| | b) | Indicated mineral resource - Part of a mineral resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a reasonable level of confidence. It is based on exploration, sampling and testing information using appropriate techniques from outcrops, trenches, pits, workings and drill holes. The locations are too widely or inappropriately spaced to confirm geological and/or grade continuity but close enough for continuity to be assumed. |

| | c) | Inferred mineral resource - Part of a mineral resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and assumed but not verified geological and/or grade continuity. It is based on information gathered through appropriate techniques from outcrops, trenches, pits, workings and drill holes that may be limited or of uncertain quality and reliability. |

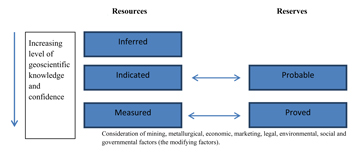

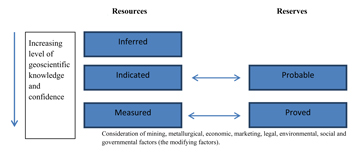

The Company has also included a flow chart of the categories of resources and the manner in which these categories relate to the reserve sub-sets to better illustrate the relationships.

| | • | | The Company will address the circumstances and assumptions regarding each category of resource included in the depreciation calculation in the accounting policy. |

| | • | | The nature and amounts of the resources will be discussed in the accounting policy. |

| | • | Management has considered the Staff’s comment on risk-weighting of resources and has included a discussion as to how resources are included in the depreciation calculation in the accounting policy. The discussion focuses on the fact that management uses the resources that have been included in the life-of-mine plan and therefore no reference has been made to risk-weighting. This is due to the fact that management does not rely on estimates of the projected rates of classifying resources as reserves. The mineral deposits that are included in the life of mine plan include only those measured and indicated resources that can be economically extracted (that is, proved and probable reserves) as well as certain of the inferred resources that management has sufficient confidence in, and which can also be economically extracted. |

| | • | Future capital expenditure needed to access the inferred resources, for example costs necessary to complete a decline or level, has been included in the depreciation calculation. This expenditure has been extracted from the life of mine plan. The inclusion and determination of the additional development costs will be included in the discussion. |

| | • | The Company has drafted the proposed disclosure for inclusion in future filings and provided here below. |

Depreciation of mining assets

Depreciation of mining assets is computed principally by the units of production method over the life-of-mine based on estimated quantities of economically recoverable proved and probable reserves, which can be recovered in future from known mineral deposits.

The preparation of consolidated financial statements in compliance with International Financial Reporting Standards as issued by the International Accounting Standards Board requires management to assess the useful life of each of its operations separately based on the characteristics of each deposit and select the reserve/resource base that best reflects the useful life of the operation. In most instances, management considers the use of proved and probable reserves for the calculation of depreciation and amortisation expense to be the best estimate of the life of the respective mining operation. Therefore, for most of the Company’s operations, we use proved and probable reserves only, excluding all inferred resources as well as any indicated and measured resources that have not yet been deemed economically recoverable.

However, in some instances, proved and probable reserves alone may not provide a realistic indication of the useful life of mine and related assets. In these instances, management may be confident that certain inferred resources will eventually be classified as measured and indicated resources, and if economically recoverable, they will be included in proved and probable reserves. Management are approaching economic decisions affecting the mine on this basis, but has not yet done the necessary development and geological drill work to improve the confidence to the required levels to designate them formally as reserves. In these cases, management, in addition to proved and probable reserves, may also include certain, but not all, of the inferred resources associated with these properties as the best estimate of the pattern in which the asset’s future economic benefits are expected to be consumed by the entity.

Management only includes the proved and probable reserves and the inferred resources that have been included in the life-of-mine plan. To be included in the life-of-mine plan, resources need to be above the cut-off grade set by management, which means that the resource can be economically mined and is therefore commercially viable. This consistent systematic method for inclusion in the life-of-mine plan takes management’s view of the gold price, exchange rates as well as cost inflation into account. The Board of Directors and management approach economic decisions affecting these operations based on the life-of-mine plans that include such resources. In declaring the resource, management would have had to obtain a specified level of confidence of the existence of the resource through drilling as required by SAMREC or JORC. For further discussion on mineral reserves, see—“Gold mineral reserves” in this section.

During the periods presented, the Company added the inferred resources that were included in the life-of-mine plans at Doornkop and Masimong to the proved and probable reserves in order to calculate the depreciation expense. The depreciation calculation for all other operations was done using only the proved and probable reserves. At these two operations, there has been a steady conversion of the inferred resources included in the life-of-mine plan into measured and indicated resources that are then classified as reserves if economically viable. In addition, there have been no instances during the periods presented where subsequent drilling or underground development indicated instances of inappropriate inclusion of inferred resources in such life-of-mine plans. As such, management is confident that the inclusion of the inferred resources included in the life-of-mine plan in calculating the depreciation charge is a better reflection of the pattern of consumption of the future economic benefits of these assets than would be achieved by excluding them.

Management’s confidence in the economical recovery of these inferred resources is based on historical experience and available geological information. The surface drilling spread (surface boreholes) and underground advance drilling at Doornkop South Reef and Masimong have indicated that the portion of the inferred resources included in the life-of-mine plan exist and can be economically mined with a high level of confidence in the orebodies. The surface boreholes have been used to determine the existence of the orebodies as well as the location of major geological structures and the mineralogy of the orebodies. However, since further drilling and underground development necessary to classify the inferred resources as measured and/or indicated resources and then as reserves, if economically recoverable, has not been done yet, they remain in the inferred resource category. Geological drilling can only be done as and when the underground infrastructure is advanced.

Additional confidence in existence and commercial viability is obtained from the fact that the orebodies surrounding these two operations have already been mined over many years in the past. We mine continuations of the same reefs that these mined-out operations exploited. At Masimong and Doornkop South Reef, the geological setting of the orebodies are such that there is an even distribution of the mineralized content, and reliance can be placed on the comparable results of the surrounding mines. As these results are already known, simulations and extrapolations of the expected formations can be done with a reasonable degree of accuracy. Although this information will not allow the classification of inferred resources to measured and indicated resources and then as a reserve if economically viable, it does provide management with valuable information and increases the level of confidence in existence and grade expectation.

Future capital expenditure necessary to access these inferred resources, such as costs to complete a decline or a level, has also been included in the cash flow projections for the life-of-mine plan and have been taken into account when determining the pattern of depreciation charge for these operations.

Due to the fact that the economic assumptions used to estimate the proved and probable reserves and resources change from year to year, and because additional geological data is generated during the course of operations, estimates of the resources and proved and probable reserves may change from year to year. Changes in the proved and probable reserves and the inferred resource base used in the Life of Mine plan may affect the calculation of depreciation and amortization. The change is recognised prospectively.

The relevant statistics for the two operations have been included below.

Doornkop South Reef

| | | | | | | | | | | | | | |

| | | | | Applicable to the financial year ended June 30, | |

| | | | | 20131 | | | 2012 | | | 2011 | |

| A | | Years (life-of-mine plan) | | | X | | | | 14 | | | | 16 | |

| B | | Reserves (Tons million) | | | X | | | | 3.5 | | | | 2.3 | |

| C | | Resources (Tons million) | | | X | | | | 25.5 | | | | 25.2 | |

| D | | • Total inferred resources (Tons million) | | | X | | | | 21.2 | | | | 22.0 | |

| E | | • Inferred resources included in life-of-mine plan (Tons million) | | | X | | | | 14.5 | | | | 15.1 | |

| F | | Future development costs | | | | | | | | | | | | |

| | • Rand million | | | X | | | | 227.0 | | | | 205.0 | |

| | • US$ million | | | X | | | | 33.5 | | | | 26.9 | |

| G | | Depreciation expense for the financial year ended June 30, | | | | | | | | | | | | |

| | • As reported (US$ million) | | | X | | | | 13.4 | | | | 4.9 | |

| | • Excluding inferred resources (US$ million) | | | X | | | | 35.7 | | | | 12.2 | |

Masimong

| | | | | | | | | | | | | | |

| | | | | Applicable to the financial year ended June 30, | |

| | | | | 2013 1 | | | 2012 | | | 2011 | |

| A | | Years (life-of-mine plan) | | | X | | | | 12 | | | | 13 | |

| B | | Reserves (Tons million) | | | X | | | | 7.3 | | | | 8.1 | |

| C | | Resources (Tons million) | | | X | | | | 99.2 | | | | 106.7 | |

| D | | • Total inferred resources (Tons million) | | | X | | | | 81.8 | | | | 87.9 | |

| E | | • Inferred resources included in life-of-mine plan (Tons million) | | | X | | | | 5.1 | | | | 4.9 | |

| F | | Future development costs | | | | | | | | | | | | |

| | • Rand million | | | X | | | | 85.0 | | | | 21.1 | |

| | • US$ million | | | X | | | | 12.5 | | | | 2.8 | |

| G | | Depreciation expense | | | | | | | | | | | | |

| | • As reported (US$ million) | | | X | | | | 12.5 | | | | 8.9 | |

| | • Excluding inferred resources (US$ million) | | | X | | | | 13.9 | | | | 10.0 | |

| 1 | The amounts for fiscal 2013 have not been included in the proposed disclosure as the results for the Group for the year ended June 30, 2013 have not been released at the time of writing this response. |

Financial Statements

Notes to the Consolidated Financial Statements

2. Accounting policies

2.5 (vi) Depreciation and amortization of mining assets, page F-12

| 2. | Please expand this note in your future filings to address the following items: |

| | • | | Describe the specific nature of the resources that are included in the depreciation calculation. |

| | • | | Describe the nature of the historical experience and available geological information that permit management to conclude with a high degree of confidence that the resources are economically recoverable. |

| | • | | Discuss the nature and amount of development costs that are include in the depreciation calculation. Describe how these costs are determined. |

| | • | | Disclose the amount of depreciation and amortization expense of mining assets for each period presented with and without the inclusion of resources in the denominator and future development costs in the numerator. |

| | Please provide us with a draft of proposed disclosures to be included in your future filings. |

Response:The Company has considered the Staff’s comments above and proposes the amended accounting policy below, with changes from the current policy shown inunderlined italics or with adouble strike-through. The Company will disclose the sensitivity of the depreciation calculation to the inclusion of the inferred resources in its critical estimates and judgements note in the financial statements.

Depreciation of mining assets

Depreciation of mining assets is computed principally by the units of production method over the life-of-mine based on estimated quantities of economically recoverable proved and probable reserves, which can be recovered in future from known mineral deposits.

In most instances, proved and probable reserves provide the best indication of the useful life of the group’s mines (and related assets). However, in some instances, proved and probable reserves may not provide a realistic indication of the useful life of mine (and related assets). This may be the case, for example, where management is confident that further inferred resources will be converted into measured and indicated resources and if they are economically recoverable, they can also be classified as proved and probable reserves. Management are approaching economic decisions affecting the mine on this basis, but has chosen to delay the work required to designate them formally as reserves.In assessing which resources to include so as to best reflect the useful life of the mine, management considers resources that have been included in the life-of-mine plan. To be included in the life-of-mine plan, resources need to be above the cut-off grade set by management, which means that the resource can be economically mined and is therefore commercially viable. This consistent systematic method for inclusion in the life-of-mine plan takes management’s view of the gold price, exchange rates as well as cost inflation into account. In declaring the resource, management would have had to obtain a specified level of confidence of the existence of the resource through drilling as required by the South African Code for Reporting Exploration Results, Mineral Resources and Mineral Reserves (“SAMREC”).

Management’s Additionalconfidence in theexistence, commercial viability andeconomical recovery of such resources may be based on historical experience and available geological information,such as geological information obtained from other operations that are contiguous to the group’s as well as where the group mines continuations of these other operations’ orebodies and reefs. This is in addition to the drilling results obtained by the Group and management’s knowledge of the geological setting of the surrounding areas, which would enable simulations and extrapolations to be done with a reasonable degree of accuracy.

In instances where management is able to demonstrate the economic recovery of such resources with a high level of confidence, such additional resources,which may also include certain, but not all, of the inferred resources, as well as the associated future development costs of accessing those resources, are included in the calculation of depreciation.The future development costs are those costs that need to be incurred to access these inferred resources, for example the costs to complete a decline or level, which may include infrastructure and equipping costs. These amounts have been extracted from the cash flow projections for the life-of-mine plans.

Critical accounting estimates and judgements

3.11 Gold mineral reserves and resources

As discussed in note 2.5 (iv), the Group includes certain inferred resources in the denominator and future development costs in the numerator when performing the depreciation calculation for certain of its operations, where proved and probable reserves alone do not provide a realistic indication of the useful life of mine (and related assets). During the periods presented, this related to the Doornkop South Reef and Masimong shafts. Had the Group only used proved and probable reserves in its calculations, depreciation for 2013 would have amounted to US$XX million (2012: US$273 million; 2011: US$239 million), compared with the reported totals of US$XX million (2012: US$247 million; 2011: US$230 million).

The Company acknowledges that it is responsible for the adequacy and accuracy of the disclosure in the filings it makes with the Commission. It understands that staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing and that the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

| Yours faithfully |

|

| /s/ F Abbott |

| F Abbott |

|

| Financial Director |