HARMONY GOLD MINING COMPANY LIMITED

Technical Report Summary of the

Mineral Resources and Mineral Reserves

for

Moab Khotsong Operations

Free State Province, South Africa

Effective Date: June 30, 2024

Final Report Date: June 30, 2024

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

| | |

IMPORTANT NOTICE

This Technical Report Summary has been prepared for Harmony Gold Mining Company Limited in support of disclosure and filing requirements with the United States Securities and Exchange Commission’s (SEC) under Subpart 1300 of Regulation S-K 1300 and; Section 229.601(b)(96) of Regulation S-K. The quality of information, estimates, and conclusions contained in this Technical Report Summary apply as of the effective date of this report. Subsequent events that may have occurred since that date may have resulted in material changes to such information, estimates and conclusions in this summary. |

Effective Date: June 30, 2024

ii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

QP Consent and Sign-off

I have read and understood the requirements of:

•the South African Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (the “SAMREC Code, 2016 edition”)

•the Harmony Guidelines on the Reporting of Exploration Results, Mineral Resources and Mineral Reserves

•Subpart 1300 (17 CFR 229.1300) of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (“Regulation S-K 1300”)

I am a Competent Person as defined by the SAMREC Code, 2016 edition and the Qualified Person (“QP”) under Regulation S-K 1300, having more than five years` experience that is relevant to the style of mineralization and type of deposit described in the Report, and to all activities for which I am accepting responsibility and have been appointed as QP for Moab Khotsong Mineral Resources and Mineral Reserves.

I am a Member of SACNASP and my registration is as follow:

Mineral Resource

Van Heerden Esterhuizen

SACNASP (South African Council for Natural Scientific Professions)

Nr 124879

Years’ Experience: 13

I have reviewed the tables and graphs included for the Moab Khotsong Mineral Resource and Mineral Reserve which will be used in the 2024 Harmony Gold Mineral Resource and Mineral Reserve Report to which this Consent Statement applies.

I acknowledge responsibility for all the Sections of the TRS report and as the QP and author I relied on information provided by various subject experts.

At the effective date of the Report, to the best of my knowledge, information and belief, the Report contains all scientific and technical information that is required to be disclosed to make the Report not misleading.

/s/ Van Heerden Esterhuizen

___________________________________

Mr Van Heerden Esterhuizen

B.Sc. (Hons) Geology

SACNASP (124879)

Acting Ore Reserve Manager, Moab Khotsong Operations

Harmony Gold Mining Company Limited

Effective Date: June 30, 2024

iii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Effective Date: June 30, 2024

iv

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

List of Contents

Effective Date: June 30, 2024

v

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Effective Date: June 30, 2024

vi

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Effective Date: June 30, 2024

vii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Effective Date: June 30, 2024

viii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

List of Figures

Effective Date: June 30, 2024

ix

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

List of Tables

Effective Date: June 30, 2024

x

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Units of Measure and Abbreviations | | | | | |

| Unit / Abbreviation | Description or Definition |

| °C | degrees Celsius |

| µm | Micrometers |

| 2D | Two-dimensional |

| 3D | Three-dimensional |

| AE | Abnormal expenditure |

| Ag | Silver |

| AngloGold | AngloGold Limited |

| Au | Gold |

| Ave. | Average |

| BMD | Below mine datum |

| Bn | Billion |

| c. | Approximately |

| CIP | Carbon-In-Pulp |

| cm | Centimeter |

| cmg/t | Centimeter-grams per tonne |

| CODM | Chief Operating Decision-Maker |

| Company | Harmony Gold Mining Company Limited |

| COP | Code of Practice |

| CRG | Central Rand Group |

| CRM | Certified Reference Material |

| CV | Coefficient of Variation |

| DMRE | Department of Mineral Resources and Energy |

| DWS | Department of Water and Sanitation |

| EIA | Environmental Impact Assessment |

| EMPR | Environmental Management Program |

| EMS | Environmental Management System |

| ESG | Environmental Social and Governance |

| ETF’s | Exchange Traded Funds |

| EW-SX | Electro-wining solvent extraction |

| FX | Foreign Exchange rate |

| g | Gram |

| g/t | Grams per metric tonne |

| GHG | Greenhouse gas |

| GISTM | Global Industry Standard on Tailings Management |

| Harmony | Harmony Gold Mining Company Limited |

| HPE | Hydro-powered |

| kg | Kilogram |

| km | Kilometer |

km2 | Square kilometer |

| kWh | Kilowatt-hour |

| LDL | Lower detection limit |

| LIB | Long Inclined Borehole |

| LOM | Life of Mine |

| Ltd | Limited |

| m | Meter |

| M | Million |

m3/hr | Cubic meters per hour |

| masl | Meters above sea level |

| MCC | Mining Charter Compliance |

Effective Date: June 30, 2024

xi

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

| | | | | |

| Unit / Abbreviation | Description or Definition |

| MCF | Mine Call Factor |

| Mintek | South Africa's national mineral research organization |

| Moz | Million troy ounces |

| MPRDA | Mineral and Petroleum Resources Development Act, 28 of 2002 |

| Mt | Million tonnes |

| Mtpa | Million tonnes per annum |

| Mtpm | Million tonnes per month |

| NEMA | National Environmental Management Act, 107 of 1998 |

| No. | Number |

| NPV | Net present value |

| oz | Troy ounce |

| PSD | Particle Size Distribution |

| Pty | Proprietary |

| QA/QC | Quality Assurance/Quality Control |

| QP | Qualified Person |

| ROM | Run-of-Mine |

| SACNASP | South African Council for Natural Scientific Professions |

| SAMREC | The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| SEC | Securities and Exchange Commission |

| SGM | Sequential Grid Mining |

| SLP | Social Labour Plan |

| STD | Standard Deviation |

| t | Metric tonne |

t/m3 | Tonne per cubic meter |

| TMM | Trackless mobile machinery |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| USD | United States Dollars |

| USD/oz | United States Dollar per troy ounce |

| WRG | West Rand Group |

| WUL(s) | Water Use License(s) |

| ZAR | South African Rand |

| ZAR/kg | South African Rand per kilogram |

Effective Date: June 30, 2024

xii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

Glossary of Terms

| | | | | |

| Term | Definition |

| Co-kriging | A method that is used to predict the value of the point at unobserved locations by sample points that are known to be spatially interconnected by adding other variables that have a correlation with the main variable or can also be used to predict 2 or more variables simultaneously. |

| Cut-off grade | Cut-off grade is the grade (i.e. the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio. |

| Dilution | Unmineralized rock that is by necessity, removed along with ore during the mining process that effectively lowers the overall grade of the ore. |

| Head grade | The average grade of ore fed into the mill. |

| Economically viable | Economically viable, when used in the context of Mineral Reserve determination, means that the qualified person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. |

| Indicated Mineral Resource | Indicated Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

| Inferred Mineral Resource | Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a Mineral Reserve. |

| Kriging | A method of interpolation based on Gaussian process governed by prior covariances. It uses a limited set of sampled data points to estimate the value of a variable over a continuous spatial field |

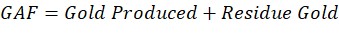

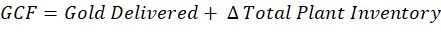

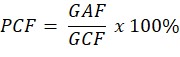

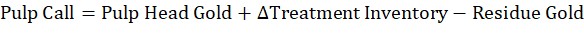

| Mine Call Factor | The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. |

| Measured Mineral Resource | Measured Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| Mineral Reserve | Mineral Reserve is an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Mineral Resource | Mineral Resource is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

Effective Date: June 30, 2024

xiii

Technical Report Summary for

Moab Khotsong Operations, Free State, South Africa

| | | | | |

| Term | Definition |

| Modifying Factors | Modifying factors are the factors that a qualified person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include but are not restricted to; mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| Pre-Feasibility Study | A pre-feasibility study (or preliminary feasibility study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. (1) A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. (2) A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment. |

|

|

| Probable Mineral Reserve | Probable Mineral Reserve is the economically mineable part of an Indicated and, in some cases, a Measured Mineral Resource. |

| Proven Mineral Reserve | Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource. |

| Qualified Person | A qualified person is: (1) A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and (2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: (i) Be either: (A) An organization recognized within the mining industry as a reputable professional association; or (B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field; (ii) Admit eligible members primarily on the basis of their academic qualifications and experience; (iii) Establish and require compliance with professional standards of competence and ethics; (iv) Require or encourage continuing professional development; (v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and (vi) Provide a public list of members in good standing. |

|

|

|

|

|

|

|

|

|

|

| Tailings | Finely ground rock of low residual value from which valuable minerals have been extracted is discarded and stored in a designed dam facility. |

| Tailings Freeboard | The vertical height between the beached tailings against the embankment crest and the crest itself. |

Effective Date: June 30, 2024

xiv

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

1Executive Summary

Section 229.601(b)(96) (iii)(B)(1)

The Qualified Person(s) (“QP”) of Harmony Gold Mining Company Limited (“Harmony” or the “Company”) has prepared this Technical Report Summary (“TRS”) to disclose the Mineral Resource and Mineral Reserve estimates for the Company’s Moab Khotsong Operations (“Moab Khotsong”). The TRS has been prepared in accordance with the U.S. Securities and Exchange Commission’s (“SEC”) Regulation S-K 1300, with an effective date as at June 30, 2024. No material changes have occurred between the effective date and the date of signature of this TRS.

This TRS updates the TRS filed by Harmony on Moab Khotsong on October 31, 2022, named Exhibit 96.5 Technical Report Summary of the Mineral Resources and Mineral Reserves for Moab Khotsong Operations, Free State Province, South Africa, which was effective on June 30, 2022. This TRS is being prepared to satisfy the requirement of Item 1302(e)(6) of regulation S-K. An economic assessment was included, using a detailed discounted cashflow analysis for the Mineral Reserves, excluding all scheduled Inferred Mineral Resource which is not reported under Mineral Reserve.

Property Description

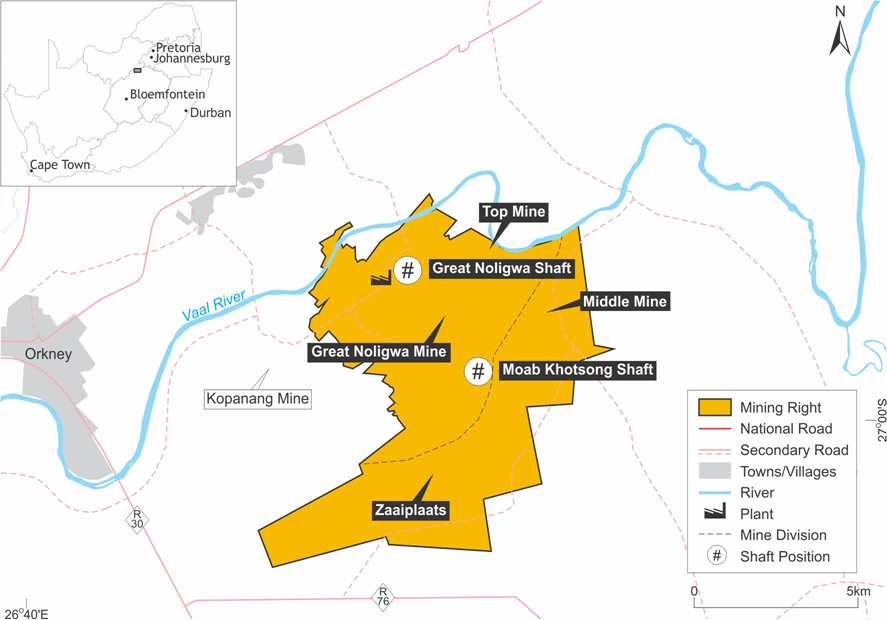

Moab Khotsong comprises the underground and surface assets associated with two mines, namely Moab Khotsong Mine and Great Noligwa Mine, which Harmony acquired from AngloGold Ashanti Limited (“AngloGold”) in 2018. Both are deep level gold mines, operating at depths of between 2km and 3km. They are situated directly south of the Vaal River approximately 10km east of the town of Orkney, in the Free State Province of South Africa. The primary reef mined is the Vaal Reef, with additional production being sourced from the C Reef.

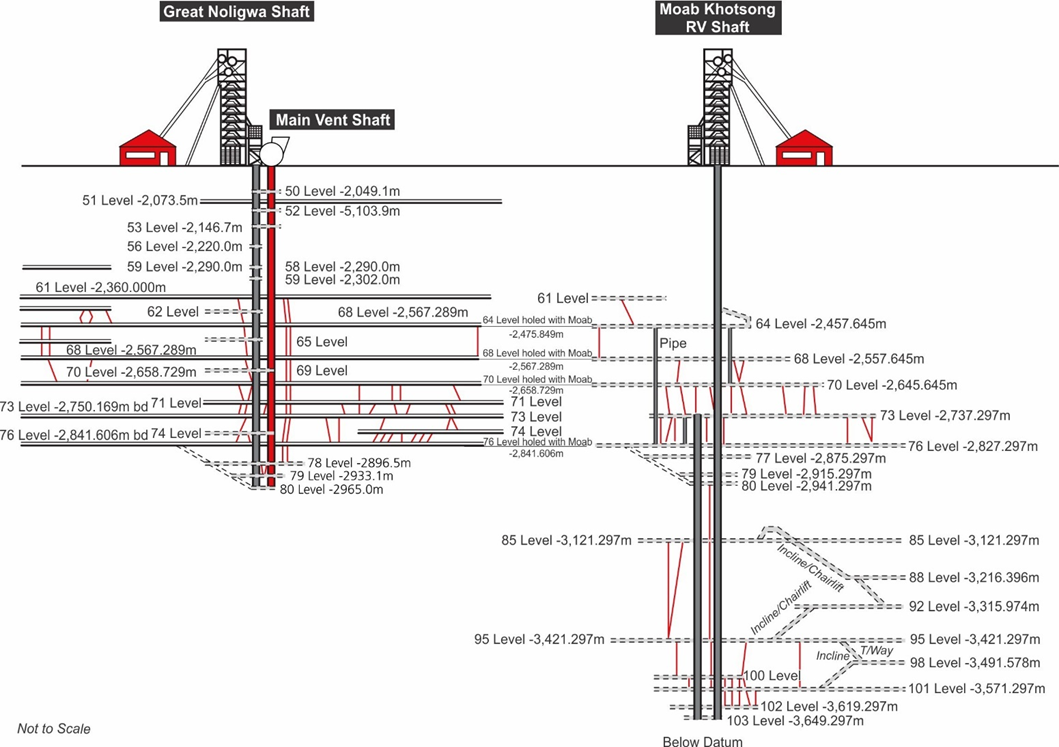

Moab Khotsong is sub-divided by major faults into three distinct geographical mining areas. These are referred to as Top Mine, accessed through Great Noligwa shaft and Moab Khotsong shaft, Middle Mine, accessed through Moab Khotsong shaft, and Zaaiplaats designed to be accessed through a decline system off the base of the Moab Khotsong shaft. Men, material and ore is conveyed vertically through a shaft hoisting system. Underground horizontal travelling is by rail and foot. Inter levels are connected by a series of incline systems equipped with chairlifts.

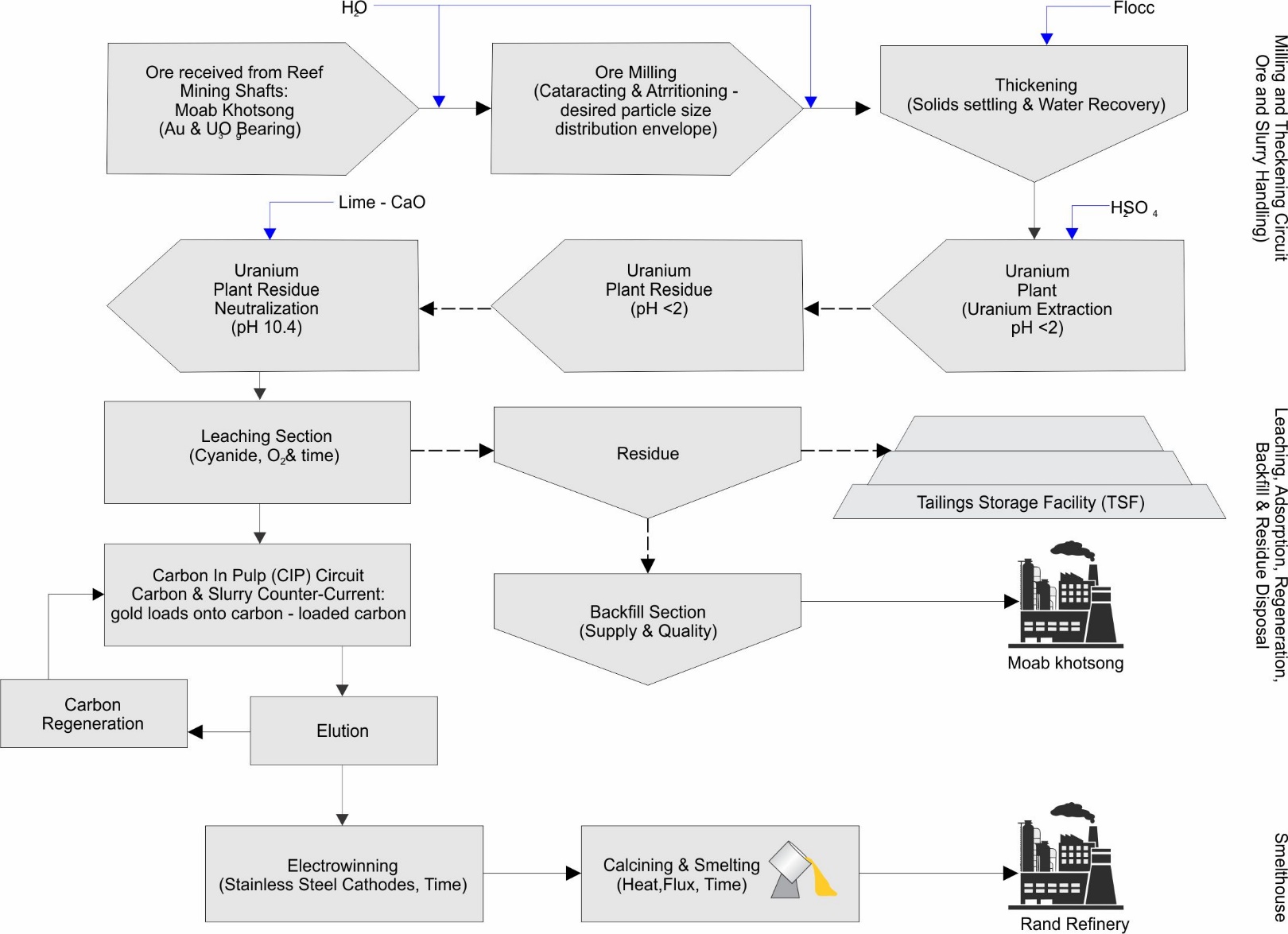

Ore processing takes place at the Noligwa gold and uranium processing facility located approximately 7km from the Moab Khotsong shaft. Ore is transported by rail to the facility after being hoisted to surface. The milled ore follows a reverse gold leach method using an acid uranium leach, gold cyanide leach, CIP and electro winning process in order to extract the gold bullion.

Harmony’s Moab Khotsong mineral tenure comprises two mining rights covering approximately 10,991 hectares (“ha”), namely:

•NW30/5/1/2/2/15 MR valid from September 12, 2007 to September 12, 2037; and

•NW30/5/1/1/2/16 MR valid from August 20, 2008 to August 19, 2038.

The two mining rights have been successfully converted, executed and registered as new order mining rights at the Mineral and Petroleum Resources Titles Office. These rights include the extraction of gold, silver, nickel and uranium. Both mining rights are valid and remain effective unless cancelled or suspended. Under the Mineral and Petroleum Resources Development Act, 28 of 2002 (“MPRDA”), Harmony is entitled to apply to renew the mining right on its expiry. There are no known legal proceedings that may influence the right to mine.

Ownership

Moab Khotsong is wholly owned by Harmony, including the associated mineral rights. Harmony acquired Moab Khotsong from AngloGold in March 2018.

Geology and Mineralization

Moab Khotsong is situated within the Klerksdorp Goldfield on the western margin of the Witwatersrand Basin of South Africa, one of the most prominent gold provinces in the world. The major gold bearing conglomerate reefs are mostly confined to the Central Rand Group (“CRG”) of the Witwatersrand Supergroup.

Effective Date: June 30, 2024

1

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

The CRG is up to 2,100m thick in the Vaal River area and the general orientation of the Witwatersrand Supergroup succession in this goldfield is interpreted as southwest-trending and southeast dipping. A series of northeast-trending faults including the Buffelsdoorn, the Kromdraai, the Buffels East and the Jersey Faults, is a key feature of the Klerksdorp Goldfield and the key structural features at Moab Khotsong are related to this series of faults.

Moab Khotsong exploits gold mineralization occurring in the Vaal Reef. This reef is stratigraphically located near the top of the Johannesburg Sub-group, within the CRG. The Vaal Reef ranges in depth at Moab Khotsong from 1,500m below mine datum (“BMD”) to 3,400m BMD. Gold mineralization also occurs in the stratigraphically higher C Reef, which lies approximately 225m above the Vaal Reef. However, the C Reef typically contributes less than 5% to the mining production.

The Vaal Reef consists of a thin basal conglomerate and a thicker upper sequence of conglomerates, which are separated by barren orthoquartzite. The thickness of Vaal Reef reaches up to 280cm with an average channel width of approximately 90cm. The C Reef is an approximately 10cm thick conglomerate, which commonly has a 5mm to 20mm thick carbon seam at the base.

The gold mineralization at Moab Khotsong succeeded a period of deep burial, fracturing, and alteration. The gold and other elements are believed to have been precipitated through the reaction of hydrothermal fluids at high temperatures along the reef horizons.

Current Status of Exploration, Development and Operation

Great Noligwa Mine was originally developed by the Anglo American Corporation Limited (“AAC”) and known as Vaal River No.8 Shaft. Work on Great Noligwa was initiated in 1968, and the mine produced its first gold in 1972. Great Noligwa Mine reached its peak of mining production in the late 1990s, producing up to 1,000koz of gold per annum. Production has reduced over time and the operation is nearing the end of its life, with current operations concentrated on the mining of the shaft pillar.

The Moab Khotsong Mine was developed by AngloGold and is the youngest of South Africa’s deep-level gold mines. The Middle Mine at Moab Khotsong came into production in 2003, and as such, the Moab Khotsong Mine can be considered a well-established operation producing at steady state.

Zaaiplaats project received Board approval in October 2021. Development has already started, and Mineral Reserves were stated as from June 2021.

The Vaal and C reefs at Moab Khotsong have been extensively explored. Harmony continues to conduct underground production and exploration drilling and channel (chip) sampling. Sampling of underground drill hole intersections, as well as sampling of established stopes on the reef horizon, enable the geological model to be updated monthly as new data is generated. Harmony has budgeted ZAR48.4M for infill exploration drilling, which will be used to improve the level of confidence in the structural model.

Mineral Resource Estimate

The Mineral Resources for both the Vaal Reef and C Reef at Moab Khotsong were estimated by the Harmony QP in Datamine™ Studio RM software. The Qualified Person (QP) created block models based on a verified electronic database containing surface drill hole data, as well as underground drilling, mapping, and chip sampling data obtained until November 2023. Gold values were estimated using ordinary and simple macro kriging interpolation methods. Uranium is extracted as a by-product of gold production.

The Mineral Resources were originally prepared, classified and reported according to the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves, 2016 edition (“SAMREC, 2016”). For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K) which is similar to the SAMREC 2016 classification scheme. The Mineral Resource estimate, as at June 30, 2024, exclusive of the reported Mineral Reserves is summarized in Table 1-1.

The QP compiling the Mineral Resource estimates is Mr V Esterhuizen, who is the Acting Ore Reserve Manager, and who is a Harmony employee.

Effective Date: June 30, 2024

2

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Table 1-1: Summary of the Moab Khotsong Mineral Resources as at June 30, 2024 (Exclusive of Mineral Reserves)1-8

| | | | | | | | | | | | | | | | | | | | |

| METRIC | Gold | Uranium |

| Mineral Resource Category | Tonnes (Mt) | Grade (g/t) | Content (kg) | Tonnes(Mt) | Grade (Kg/t) | Content (Kg) |

| Measured | 2.938 | 17.32 | 50,895 | — | — | — |

| Indicated | 2.888 | 15.38 | 44,417 | 5.826 | 1.17 | 6,817,224 |

| Total / Ave. Measured + Indicated | 5.826 | | 16.36 | | 95,312 | | 5.826 | | 1.17 | | 6,817,224 | |

| Inferred | 2.703 | 18.16 | 49,098 | 2.703 | 0.71 | 1,925,445 |

| | | | | | |

| IMPERIAL | Gold | Uranium |

| Mineral Resource Category | Tons (Mt) | Grade (oz/t) | Content (Moz) | Tons(Mt) | Grade (lb/t) | Content (Mlb) |

| Measured | 3.239 | 0.505 | 1.636 | — | — | — |

| Indicated | 3.183 | 0.449 | 1.428 | 6.423 | 2.340 | 15.029 |

| Total / Ave. Measured + Indicated | 6.423 | | 0.477 | | 3.064 | | 6.423 | | 2.340 | | 15.029 | |

| Inferred | 2.980 | 0.530 | 1.579 | 2.980 | 1.424 | 4.245 |

Notes:

1. The Mineral Resources were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is V. Esterhuizen, who is the Acting Ore Reserve Manager, and who is a Harmony employee.

2. The Mineral Resource tonnes are reported as in-situ with reasonable prospects for economic extraction.

3. No modifying factors or dilution sources have been included to in-situ Reserve which was subtracted from the SAMREC Resource in order to obtain the S-K 1300 Resource.

4. The Mineral Resources are reported using a cut-off value per area of 500cmg/t, 1000cm.g/t and 1350cm.g/t determined at a gold price of USD1,878/oz.

5. Tonnes are reported as rounded to three decimal places. Gold values are rounded to zero decimal places.

6. Mineral Resources are exclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not necessarily demonstrate economic viability.

7. Rounding as required by reporting guidelines may result in apparent summation differences.

8. The Mineral Resource estimate is for Harmony’s 100% interest.

9. The Mineral Resource estimate for Uranium is reported under Indicated and Inferred Resource category as a gold production by-product.

Mineral Reserve Estimate

The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The same criteria is used in both the SAMREC 2016 and S-K reporting.

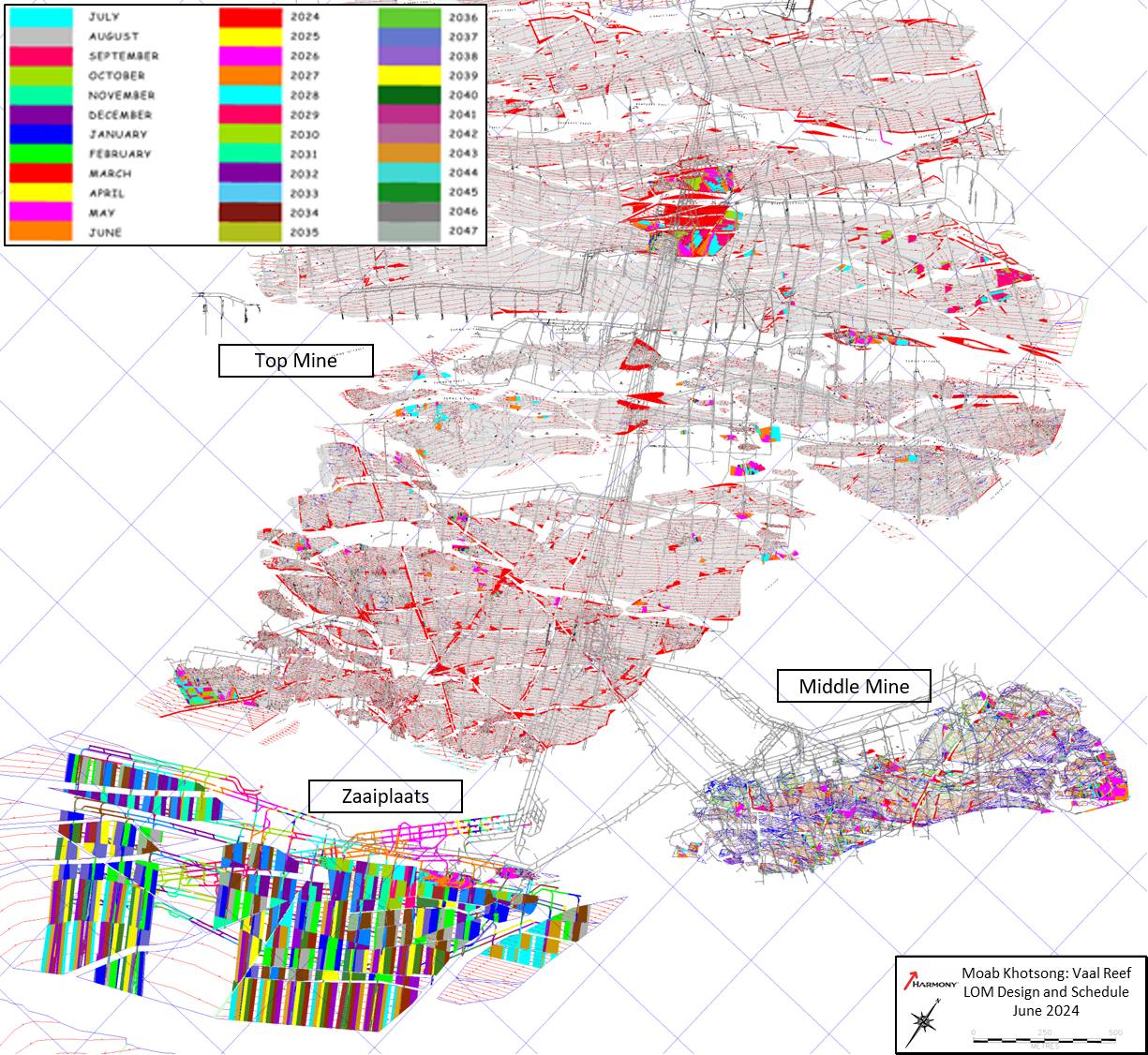

Mineral Reserves are derived from the Mineral Resources, a detailed business plan and the operational mine planning processes for Middle Mine, Top Mine and Zaaiplaats. Mine planning utilises and takes into consideration historical technical parameters achieved. In addition, Mineral Resource conversion to Mineral Reserves considers Modifying Factors, dilution, ore losses, minimum mining widths and planned mine call factors. In the opinion of the QP, given that Moab Khotsong is an established operation, the Modifying Factors informing the Mineral Reserve estimates would at minimum, satisfy the confidence levels of a Feasibility Study. Zaaiplaats is in the execution phase of the project.

The declared Mineral Reserves are depleted to generate the Moab Khotsong cash flows. The economic analysis of the cash flows displays positive NPV of ZAR1,545 million profit after OCD and Capital and are deemed both technically and economically achievable. Uranium is extracted as a by-product of gold production.

The reported Mineral Reserve estimate as at June 30, 2024 for Gold and Uranium is summarized in Table 1-2.

The QP compiling the Mineral Reserve estimates is Mr V Esterhuizen, who is the Acting Ore Reserve Manager, and who is a Harmony employee.

Effective Date: June 30, 2024

3

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Table 1-2: Summary of the Moab Khotsong Mineral Reserves as at June 30, 20241-7

| | | | | | | | | | | | | | | | | | | | |

| METRIC | Gold | Uranium |

| Mineral Reserve Category | Tonnes (Mt) | Grade (g/t) | Content (kg) | Tonnes(Mt) | Grade (Kg/t) | Content (Kg) |

| Proved | 3.360 | 7.69 | 25,848 | — | — | — |

| Probable | 10.277 | 8.14 | 83,671 | 13.637 | 0.35 | 4,762,876 |

| Total (Proved + Probable) | 13.637 | 8.03 | 109,519 | 13.637 | 0.35 | 4,762,876 |

| | | | | | |

| IMPERIAL | Gold | Uranium |

| Mineral Reserve Category | Tons (Mt) | Grade (oz/t) | Content (Moz) | Milled Tons (Mt) | Grade (lb/t) | Content (Mlb) |

| Proved | 3.704 | 0.224 | 0.831 | — | — | — |

| Probable | 11.329 | 0.237 | 2.690 | 15.032 | 0.699 | 10.500 |

| Total (Proved + Probable) | 15.032 | 0.234 | 3.521 | 15.032 | 0.699 | 10.500 |

Notes:

1. The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is V. Esterhuizen, who is the Acting Ore Reserve Manager, and who is a Harmony employee.

2. Tonnes, grade, and gold content (oz) are declared as net delivered to the mills.

3. Figures are fully inclusive of all mining dilutions, gold losses and are reported as mill delivered tonnes and head grades. Metallurgical recovery factors have not been applied to the Mineral Reserve figures.

4. Gold content is recovered gold content after taking into consideration the modifying factors.

5. Mineral Reserves are reported using a cut-off grades per mining area of 1,200cm.g/t, 1,300cm.g/t and 1,800 cm.g/t determined using a gold price of USD1,772/oz gold.

6. Rounding as required by reporting guidelines may result in apparent summation differences.

7. Mineral Reserves for Uranium is reported under the Probable category as a by-product of gold extraction.

Capital and Operating Cost Estimates

The capital cost estimates for the Reserve plans for Great Noligwa Mine and Moab Khotsong Mine are determined at a corporate level, using the business plan as the basis. The capital cost estimate for Zaaiplaats has been developed as part of the Feasibility Study and is considered to be of industry-standard Feasibility Study level of confidence. The capital costs are those associated with major equipment outside the main operating sections which is termed abnormal expenditure (“AE”), infrastructure development, ongoing capital development (“OCD”) and Mining Charter Compliance (“MCC”). A summary of the capital cost estimates for Moab Khotsong, including Zaaiplaats, are shown in Table 1-3. This includes ongoing, stay in business and project capital. Capital cost estimates are completed at Feasibility Study level of accuracy for the remaining mines excluding Zaaiplaats.

The operating cost estimates for Moab Khotsong and Zaaiplaats are categorised into direct and total costs. A summary of the operating cost estimates for Moab Khotsong, including Zaaiplaats, are shown in Table 1-4, which are completed to Feasibility Study level of accuracy. The unit costs (Total cost including capital and royalty) over the Reserve plan is ZAR927 303/kg. The cashflow with unit costs are included further on in the document.

The capital and operating costs are reported in ZAR terms and on a real basis. The economic analysis, including the capital and operating costs are reported for the period comprising financial year (“FY”) July - June. Both the capital and operating estimates are accounted for in the economic analysis of Moab Khotsong, and the results of the economic analysis for Zaaiplaats demonstrate a positive discounted NPV.

Table 1-3: Summary of the Mineral Reserve Plan Capital Cost Estimate for Moab Khotsong

| | | | | |

| Capital Cost Element (ZAR'000s) | Total Reserve Plan

(FY2025 - FY2044) |

| OCD | 4,842,375 |

| AE | 1,100,617 |

| Shaft Projects | 525,490 |

| Major Projects | 7,703,930 |

| MCC | 526,017 |

| Total | 14,698,429 |

Notes: Rounding of figures may result in minor computational discrepancies.

Effective Date: June 30, 2024

4

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Table 1-4: Summary of Operating Cost Estimates for Moab Khotsong

| | | | | |

| Operating Cost Element (ZAR'000) | Total Reserve Plan

(FY2025 - FY2044) |

| Wages - Payroll 1 | 10,493,967 |

| Wages - Payroll 2 | 15,497,016 |

| Stores and Materials | 9,274,723 |

| Electric Power and Water | 18,776,465 |

| Outside Contractors | 3,483,914 |

| Other | 7,923,905 |

| Direct Costs | 65,449,990 | |

| Pumping Allocation | 2,242,867 |

| Refining Charge | 232,968 |

| Uranium Allocation | (2,766,022) |

| Hostel Cost | (173,039) |

| Backfill Cost | 560,843 |

| Plant Treatment Cost | 8,056,681 |

| Working Cost Transfer to Capital | (507,780) |

| Workshops allocations | 380,651 |

| Care and Maintenance | 1,385,604 |

| Re-allocated costs | 9,412,773 |

| Mine Overheads Re-allocated | 4,863,126 |

| Total | 79,725,889 |

Permitting Requirements

All relevant mining, and environmental permits and licenses are in place and are valid and are shown in Table 1-5. All permits are audited regularly for compliance and no material risks to the operations have been identified.

Based on the environmental studies undertaken to date, there are no sensitive areas or any other environmental factors, including interested and affected parties and/or studies that could have a material effect on the likelihood of eventual economic extraction. Harmony is committed to maintaining good relationships with regulatory authorities, industries, communities, business partners and surrounding stakeholders.

Table 1-5: Status of Environmental Permits and Licenses

| | | | | | | | | | | | | | | | | |

| Permit Holder | Permit / License | Reference No. | Issued By | Date Granted | Validity |

| Harmony | EMPR | NW30/5/1/2/2/15&16MR | DMRE | 21-Oct-2022 | LOM |

| Harmony | Atmospheric Emission Licence | AEL/FS/MKO- HGM/14/10/2019F | DFFE | 29-Jan-2021 | 30-Jan-26 |

| Harmony | Waste Management Licence | NWP/WM/DK2/ 2018/04/01/02 | DARD | 13-Mar-2019 | LOM |

| Harmony | Water Use Licence | 08/C24B/AGJ/9799 | DWS | 12-Nov-2020 | 12-Nov-40 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Conclusions

The QP’s opinion is that the mine plan is achievable under the set of assumptions and parameters used in this TRS and that Moab Khotsong Mine, including Zaaiplaats, show positive NPV which supports the Mineral Resource and Mineral Reserve estimates.

Moab Khotsong did not incur any fines or penalties for non-compliance during the year ended June 30, 2024 and no significant encumbrances exist.

Effective Date: June 30, 2024

5

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Recommendations

Exploration drilling has been recommended. The program has been designed for Mineral Resource replacement to fill the production gap between the current mine and the production build up at the future Zaaiplaats project, and also to refine the geological model for the Zaaiplaats block. Drill targets have been identified and the exploration plan is focusing on improving the geological confidence within the northeastern corner of Lower Mine. Above 101 Level drilling is targeting the area A Vaal Reef blocks adjacent to the Jersey fault and potential ‘blue sky’ Vaal Reef blocks caught up within the Jersey fault zone. Below 101 Level drilling will upgrade structural confidence of the larger Lower Mine block. Some of the drill holes budgeted for will also be utilized for geotechnical analysis.

Zaaiplaats design and scheduling will be adjusted as new orebody information becomes available through continuous exploration.

Resource growth opportunities have been identified below 76 level. Brown fields exploration is required to confirm Vaal Reef blocks that are situated below 76 Level that can potentially be accessed.

Opportunities in blocks that have been moved into inventory continues to be investigated, especially adjacent areas to current mining with synergies.

Effective Date: June 30, 2024

6

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

2Introduction

Section 229.601(b)(96) (iii)(B) (2) (i-v)

This TRS on Moab Khotsong has been prepared for the registrant, Harmony. The TRS has been prepared in accordance with Regulation S-K 1300. It has been prepared to meet the requirements of Section 229.601(b)96 - Technical Report Summary. The purpose of this TRS is to provide open and transparent disclosure of all material, exploration activities, Mineral Resource and Mineral Reserve information to enable the investor to understand Moab Khotsong which forms part of Harmony’s activities.

This TRS has been prepared from the following sources of information:

•Competent Persons Report (Ore Reserve Statement for period ended June 30, 2024, Technical Report for Moab Khotsong Operations) (prepared by Mr V Esterhuizen) dated June 30, 2024;

•Base geological and mine planning data;

•various technical reports;

•the 2024 and 2025 Harmony Corporate Business Plan; and

•published Harmony 2024 Mineral Resources and Mineral Reserves Report as at June 30, 2024 (“HAR-RR24”).

The TRS was prepared by a QP employed on a full-time basis by the registrant. The QP’s qualifications, areas of responsibility and personal inspection of the property are summarized in Table 2-1.

Table 2-1: QP Qualification, Section responsibilities and Personal Inspections

| | | | | | | | | | | | | | |

| Qualified Person | Professional Organization | Qualification | TRS Section Responsibility | Personal Insp. |

| Mr V. Esterhuizen | SACNASP, GSSA | BSc Hons (Geol) | All sections | Full time employed on the property |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

The QP states that this TRS updates the TRS filed by Harmony on Moab Khotsong on October 31, 2022, named Exhibit 96.5 Technical Report Summary of the Mineral Resources and Mineral Reserves for Moab Khotsong Operations, Free State Province, South Africa, which was effective on June 30, 2022. This updated TRS has an effective date as at June 30, 2024 and no material changes have occurred between the effective date and the date of signature.

Effective Date: June 30, 2024

7

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

3Property Description and Location

Section 229.601(b)(96) (iii)(B) (3) (i-vii)

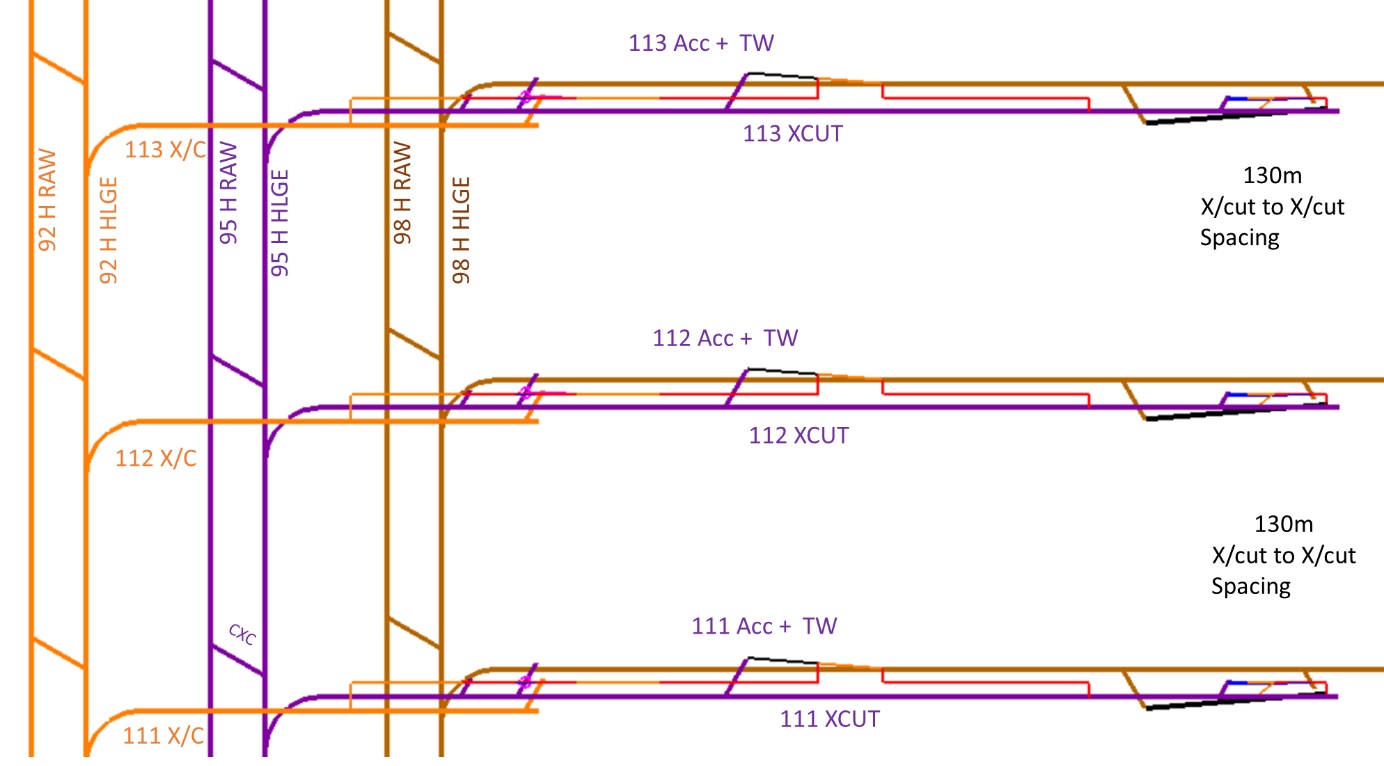

Moab Khotsong comprises two operating underground deep level gold mines, namely the Moab Khotsong Mine and the Great Noligwa Mine. Moab Khotsong is sub-divided by major faults into three distinct geographical mining areas. These are referred to as Top Mine, accessed through Great Noligwa shaft and Moab Khotsong shaft, Middle Mine, accessed through Moab Khotsong shaft, and Zaaiplaats designed to be accessed through a decline system off the base of the Moab Khotsong shaft. Men, material and ore is conveyed vertically through a shaft hoisting system. Underground horizontal travelling is by rail and foot. Inter levels are connected by a series of incline systems equipped with chairlifts.

Ore processing takes place at the Noligwa gold and uranium processing facility located approximately 7km from the Moab Khotsong shaft. Ore is transported by rail to the facility after being hoisted to surface. The milled ore follows a reverse gold leach method using an acid uranium leach, gold cyanide leach, CIP and electro winning process in order to extract the gold bullion.

Production at Great Noligwa commenced in 1972, whilst Middle Mine came into production in 2003. Zaaiplaats, located to the southwest of Middle Mine, received Board approval in October 2021. Development has already started, and Mineral reserves were issued as from June 2021.

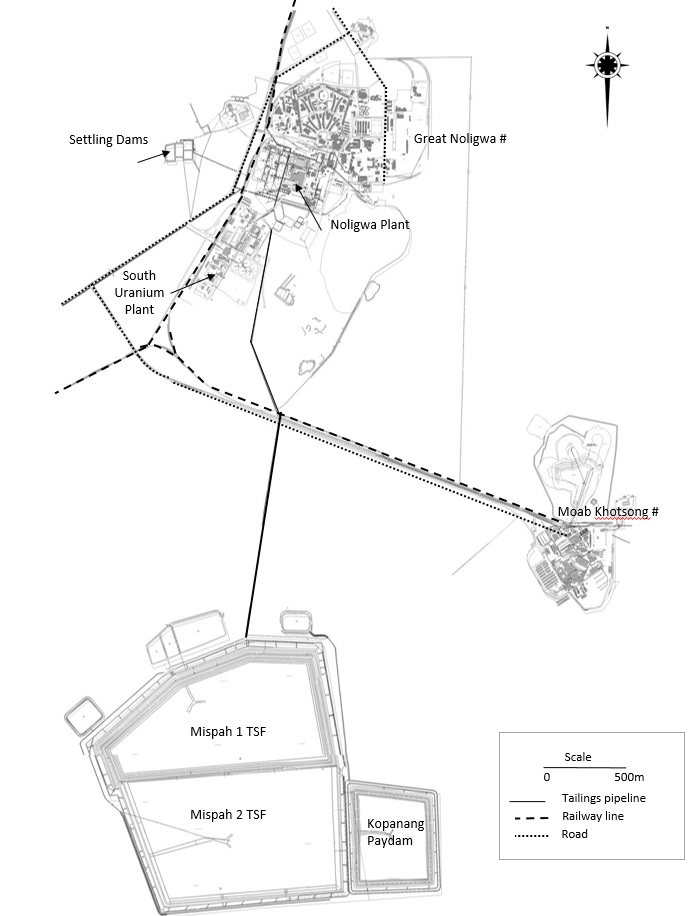

At longitude 26°48'03.3"E and latitude 26°59'12.7"S, Moab Khotsong is approximately 180km from Johannesburg. The mine is located approximately 10km east of Orkney and directly south of the Vaal River, which forms the border between the North West and Free State provinces. The location of Moab Khotsong and the associated mines are shown in Figure 3-1.

3.1Mineral Tenure

South African Mining Law is regulated by the MPRDA which is the predominant piece of legislation dealing with acquisitions or rights to conduct reconnaissance, prospecting and mining. There are several other pieces of legislation which deal with such ancillary issues such as royalties (the Mineral and Petroleum Resources Royalty Act, 2008), title registration (the Mining Titles Registration Act, 1967), and health and safety (the Mine Health and Safety Act, 1996).

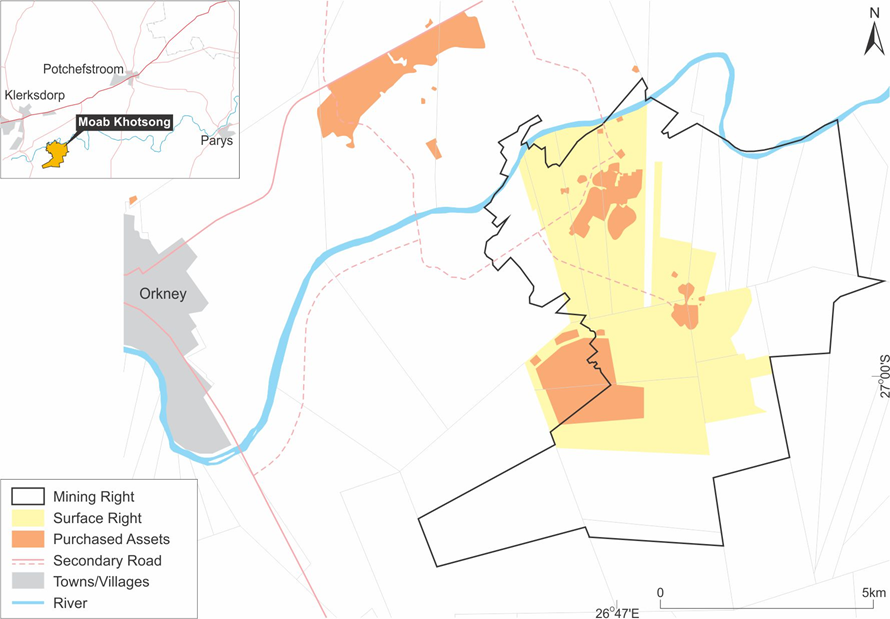

Harmony holds two mining rights, which have been successfully converted, executed and registered as new order mining rights at the Mineral and Petroleum Resources Titles Office. These rights cover a total combined area of 10,991.13ha for the mining of gold, silver, nickel and uranium. Both mining rights are valid and remain effective unless cancelled or suspended. Under the MPRDA, Harmony is entitled to apply to renew the mining right on its expiry. Harmony’s mining rights pertaining to Moab Khotsong are presented in Table 3-1 and their location is shown in Figure 3-2.

Table 3-1: Summary of Mining Rights for Moab Khotsong

| | | | | | | | | | | | | | | | | |

| License Holder | License Type | Reference No. | Effective Date | Expiry Date | Area (ha) |

| Harmony | MR | NW(15) MR | September 12, 2007 | 11-Sep-2037 | 1,372.47 |

| Harmony | MR | NW(16) MR | August 20, 2008 | 19-Aug-2038 | 9,618.66 |

| Total | 10,991.13 |

There are no known legal proceedings (incl. violations or fines) against the Company which threatens its mineral rights, tenure, or operations. Taxes and royalties payments are up to date in line with South African government requirements.

3.2Property Permitting Requirements

All relevant underground mining and surface right permits, and any other permit related to the work conducted on the property have been obtained and are valid.

Harmony has access to all the properties it requires to conduct its current mining activities. The surface right areas are sufficient in size and nature to accommodate the required surface infrastructure to facilitate current and planned mining and processing operations.

Effective Date: June 30, 2024

8

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Harmony monitors complaints and litigation against the Company as part of its risk management systems, policies, and procedures. There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its property permitting. The Company is also not aware any land claims or other legal proceedings that may have an influence on the rights to mine the minerals.

Figure 3-1: Location of Moab Khotsong

Figure 3-2: Legal Tenure of Moab Khotsong

Effective Date: June 30, 2024

9

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

4Accessibility, Climate, Local Resources, Infrastructure and Physiography

Section 229.601(b)(96) (iii)(B) (4) (i-iv)

4.1Accessibility

Moab Khotsong is located approximately 30km from the town of Klerksdorp, which is on the N12 national road. The mine is located approximately 10km southeast of the town of Orkney. The mine can be reached via tarred roads from all main access points in South Africa. Access to the mines are restricted by security fencing, security guards, booms and lockable gates at the main entrance. In addition, a communication system and access control system monitors personnel entering and leaving the mine properties.

4.2Physiography and Climate

Moab Khotsong is situated approximately 1,310 meters above sea level (“masl”) within the Highveld region of South Africa. The surrounding area is characterized by undulating plains interspersed by rocky peaks. The operations are situated immediately south of the Vaal River. No significant topographical disturbances are expected from mining operations. However, the topography is affected by tailings dams, waste rock dumps and solid waste disposal sites.

Klerksdorp has a semi-arid climate, with warm to hot summers and cool, dry winters. The average annual precipitation is 482mm. Heavy thunderstorms between November and February, during which much of the rainfall occurs.

The seasonal fluctuations in mean temperatures between the warmest and the coldest months vary between a minimum 5°C in winter to a maximum of 29°C in summer. The month of July is generally the coldest month with the hottest month typically being February.

The local climate does not pose any risk to the production at Moab Khotsong, and the operations continue throughout the year.

4.3Local Resources and Infrastructure

Infrastructure in the region is well established supporting the numerous operational gold mines in the area. The regional infrastructure includes national and provincial paved road networks, power transmission and distribution networks, water supply networks and communication infrastructure.

The Moab Khotsong operation is powered by electricity from Eskom Holdings State Owned Company (“SOC”) Limited (“Eskom”), and has the necessary water and power infrastructure to support the Life of Mine up to 2044 and beyond. Supplies and labour force are readily available through well established supply and human resources management systems and teams across the company.

Moab Khotsong Mine has a single vertical shaft. Great Noligwa Mine has a twin vertical shaft and a dedicated ore processing plant. Moab Khotsong is sub-divided by major faults into three distinct geographical mining areas. These are referred to as Top Mine, accessed through Great Noligwa shaft and Moab Khotsong shaft, Middle Mine, accessed through Moab Khotsong shaft, and Zaaiplaats designed to be accessed through a decline system off the base of the Moab Khotsong shaft. Men, material and ore is conveyed vertically through a shaft hoisting system. Underground horizontal travelling is by rail and foot. Inter levels are connected by a series of incline systems equipped with chairlifts.

Ore processing takes place at the Noligwa gold and uranium processing facility located approximately 7km from the Moab Khotsong shaft. Ore is transported by rail to the facility after being hoisted to surface. The milled ore follows a reverse gold leach method using an acid uranium leach, gold cyanide leach, CIP and electro winning process in order to extract the gold bullion.

Effective Date: June 30, 2024

10

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

5History

Section 229.601(b)(96) (iii)(B) (5) (i-ii)

5.1Historical Ownership and Development

Great Noligwa Mine was developed by AAC and was originally known as Vaal River No. 8 Shaft. Work on Great Noligwa was initiated in 1968, and the mine produced its first gold in 1972. Great Noligwa reached its production peak of around 1,000koz per annum in the late 1990s and at present, mining activity at Great Noligwa Mine is concentrated on the extraction of pillars. The Great Noligwa Shaft Pillar Extraction project was approved by the technical and investment committees for implementation in 2020. The chosen option is based on the partial extraction of reef blocks with a central stabilizing pillar to maintain the integrity of both shaft barrels. In addition to this smaller remnants left during historic mining has been re-evaluated and included into the Reserve plan based on consideration of modifying factors such as and not limited to costs, gold price, content and accessibility.

The Moab Khotsong Mine was developed by AngloGold and is the youngest of South Africa’s deep-level gold mines. It came into production in 2003 and has been continuously economically exploited since then. Great Noligwa was merged with Moab Khotsong Mine in 2014, and since the merger of the two mines, annual production has been in the order of 250koz of gold.

Harmony assumed ownership of Moab Khotsong in March 2018 and has since added the Zaaiplaats area to the Mineral Resources and Mineral Reserves. The inclusion of Zaaiplaats in the Reserve plan has extended the life of Moab Khotsong for 22 years up to 2044 and the overall production is expected to be in the order of 200koz of gold per annum.

The historical ownership and associated activities related to Moab Khotsong are summarized in Table 5-1.

Table 5-1: Summary of Historical Ownership Changes and Activities at Moab Khotsong

| | | | | |

| Year | Asset History Highlights |

| 1968 | The Vaal River No. 8 Shaft system and the gold plant comes into production. |

| 1972 | Vertical sub-shaft commissioned. |

| 1991 | Anglo American initiates the development of Vaal River No.11 Shaft. |

| 1998 | AngloGold Ashanti was formed through the merger of the gold interests of Anglo American and its associated companies. |

| 1999 | Vaal River No. 8 Shaft renamed to Great Noligwa and No. 11 Shaft renamed to Moab Khotsong |

| 2003 | Moab Khotsong mine comes into production. |

| 2014 | Great Noligwa mine merged into Moab Khotsong. |

| 2017 | Great Noligwa production footprint reduced. |

| 2018 | Harmony takes ownership and control of Moab Khotsong from AngloGold Ashanti. |

| 2020 | Great Noligwa Shaft Pillar extraction starts. |

| 2021 | Zaaiplaats Board approval and start of project. |

| |

| |

| |

| |

| |

| |

5.2Historical Exploration

Exploration work in the area surrounding Great Noligwa was undertaken in the 1950s and 1960s. The work was initially limited to surface drilling. An extensive surface exploration program was conducted across the Vaal River area by AAC.

After the establishment of Great Noligwa Mine, brownfield exploration continued from surface and underground access points to extend the known Mineral Resources at Great Noligwa. During the 1980s and 1990s, this exploration extended into the areas which were to become known as Moab Khotsong. The exploration efforts in the 1990s included further surface drilling, as well as a 3-dimensional (“3D”) seismic survey, which assisted in delineating the major fault blocks at depth.

Following the establishment of the Moab Khotsong Mine, exploration between 2005 and 2015 included another 3-dimensional (“3D”) seismic survey in 2011, additional surface drilling and long, inclined boreholes (“LIBs”). The latter which enabled the identification and quantification of the Zaaiplaats block. Brownfields exploration continues at Moab Khotsong at present, to identify additional Mineral Resources, and to upgrade the confidence in existing Mineral Resources.

Effective Date: June 30, 2024

11

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

5.3Previous Mineral Resource and Mineral Reserve Estimates

The previous Mineral Resource estimate for Moab Khotsong was declared as at June 30, 2023 under regulation SK-1300. The previous Mineral Resource estimate, summarized in Table 5-2, is exclusive of Mineral Reserves and has been superseded by the current estimate prepared by the QP in Section 11 of this TRS.

Table 5-2: Summary of Previous Moab Khotsong Mineral Resources as at June 30, 2023 (Exclusive of Mineral Reserves)

| | | | | | | | | | | | | | | | | | | | |

| METRIC | Gold | Uranium |

| Mineral Resource Category | Tonnes (Mt) | Grade (g/t) | Content (kg) | Tonnes(Mt) | Grade (Kg/t) | Content (Kg) |

| Measured | 2.881 | 18.34 | 52,822 | — | — | — |

| Indicated | 3.122 | 13.57 | 42,361 | 6.002 | 0.68 | 4,105,900 |

| Total / Ave. Measured + Indicated | 6.002 | 15.86 | 95,183 | 6.002 | 0.68 | 4,105,900 |

| Inferred | 2.549 | 19.09 | 48,663 | 2.549 | 0.73 | 1,866,432 |

| IMPERIAL | Gold | Uranium |

| Mineral Resource Category | Tons (Mt) | Grade (oz/t) | Content (Moz) | Tons(Mt) | Grade (lb/t) | Content (Mlb) |

| Measured | 3.175 | 0.535 | 1.698 | — | — | — |

| Indicated | 3.441 | 0.396 | 1.362 | 6.617 | 1.368 | 9.052 |

| Total / Ave. Measured + Indicated | 6.617 | 0.463 | 3.060 | 6.617 | 1.368 | 9.052 |

| Inferred | 2.810 | 0.557 | 1.565 | 2.810 | 1.464 | 4.115 |

The previous Mineral Reserve estimate for Moab Khotsong was also declared as at June 30, 2023, in accordance with the SAMREC Code. Modifying Factors were applied to the Mineral Resource to arrive at the Mineral Reserve estimate. These factors included a dilution to accommodate the difference between milling width and stoping width, as well as the Mine Call Factor (“MCF”). The previous Mineral Reserve estimate, summarized in Table 5-3, has been superseded by the current estimate prepared by Harmony as detailed in Section 12.3 of this TRS.

Table 5-3: Summary of the Previous Moab Khotsong Mineral Reserves as at June 30, 2023

| | | | | | | | | | | | | | | | | | | | |

| METRIC | Gold | Uranium |

| Mineral Reserve Category | Tonnes (Mt) | Grade (g/t) | Content (kg) | Tonnes(Mt) | Grade (Kg/t) | Content (Kg) |

| Proved | 3.897 | 7.80 | 30,396 | — | — | — |

| Probable | 9.447 | 8.90 | 84,106 | 13.345 | 0.32 | 4,260,181 |

| Total (Proved + Probable) | 13.345 | 8.58 | 114,502 | 13.345 | 0.32 | 4,260,181 |

| IMPERIAL | Gold | Uranium |

| Mineral Reserve Category | Tonnes (Mt) | Grade (g/t) | Content (kg) | Tonnes(Mt) | Grade (Kg/t) | Content (Mlb) |

| Proved | 4.296 | 0.227 | 0.977 | — | — | — |

| Probable | 10.414 | 0.260 | 2.704 | 14.710 | 0.638 | 9.392 |

| Total (Proved + Probable) | 14.710 | 0.250 | 3.681 | 14.710 | 0.638 | 9.392 |

5.4Past Production

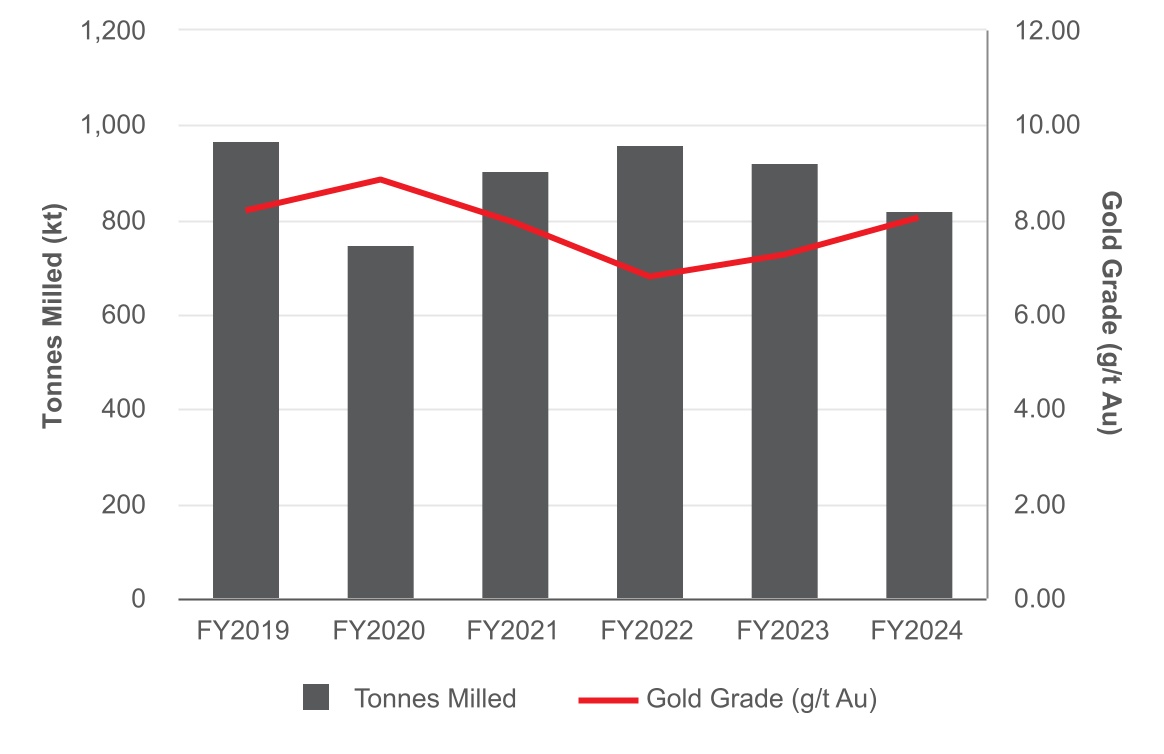

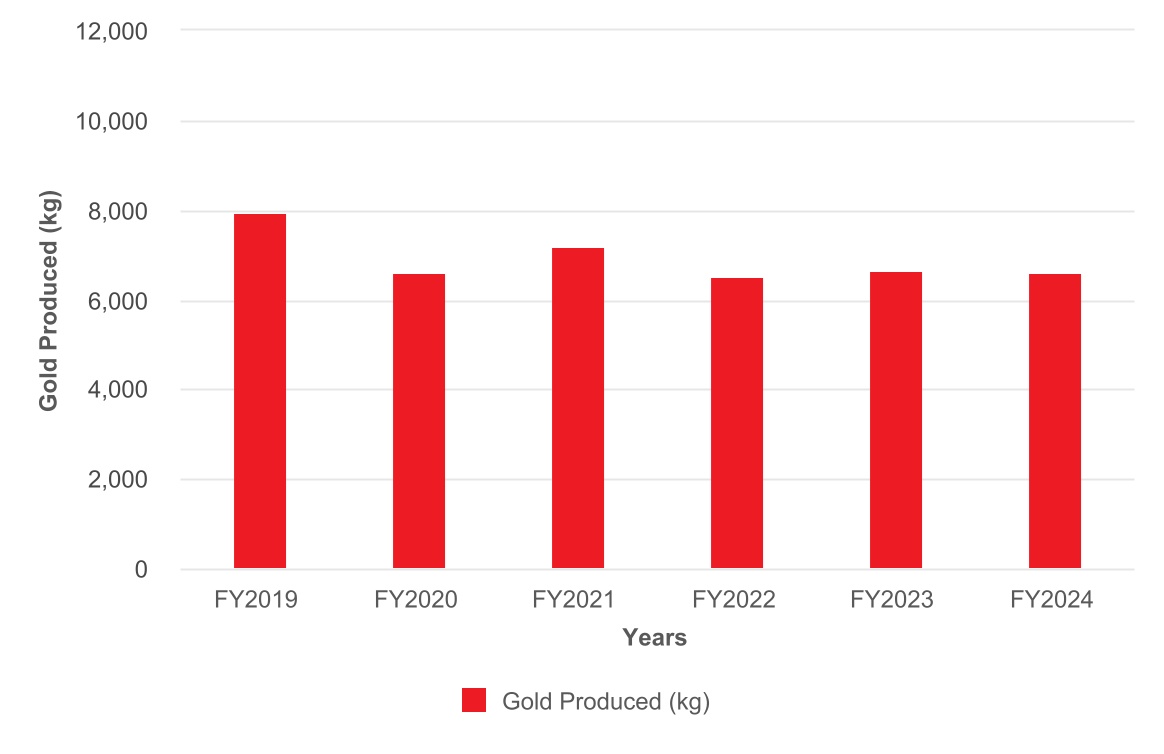

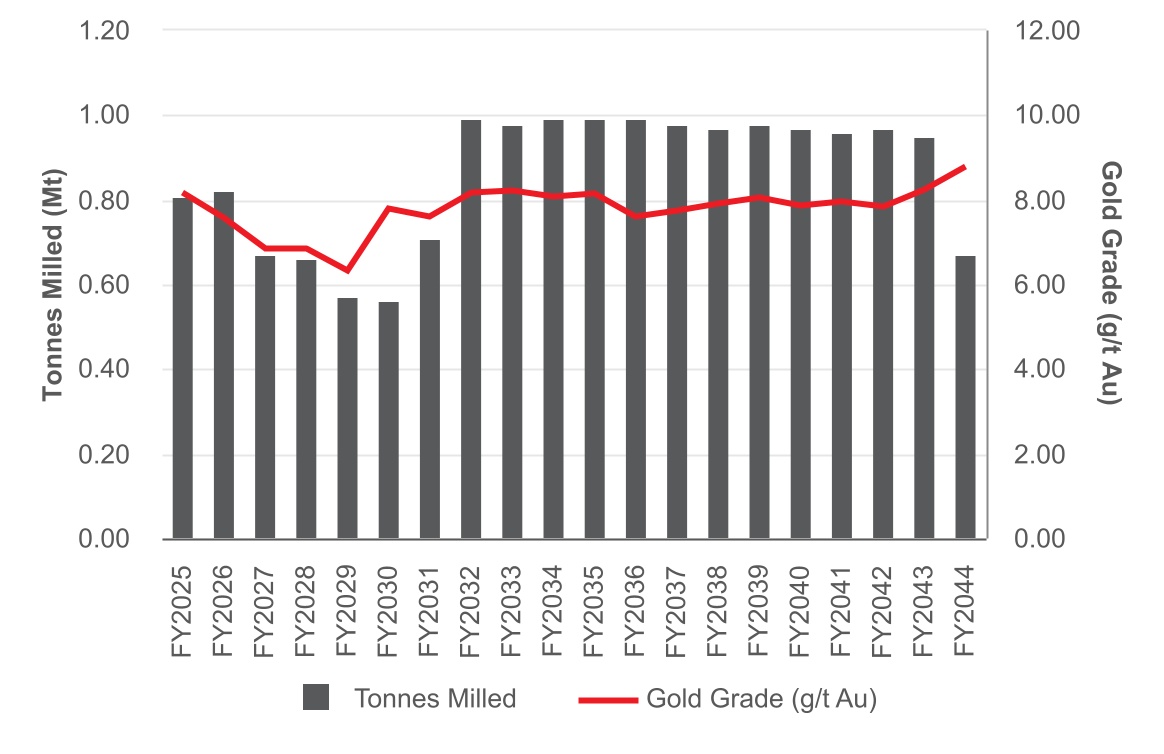

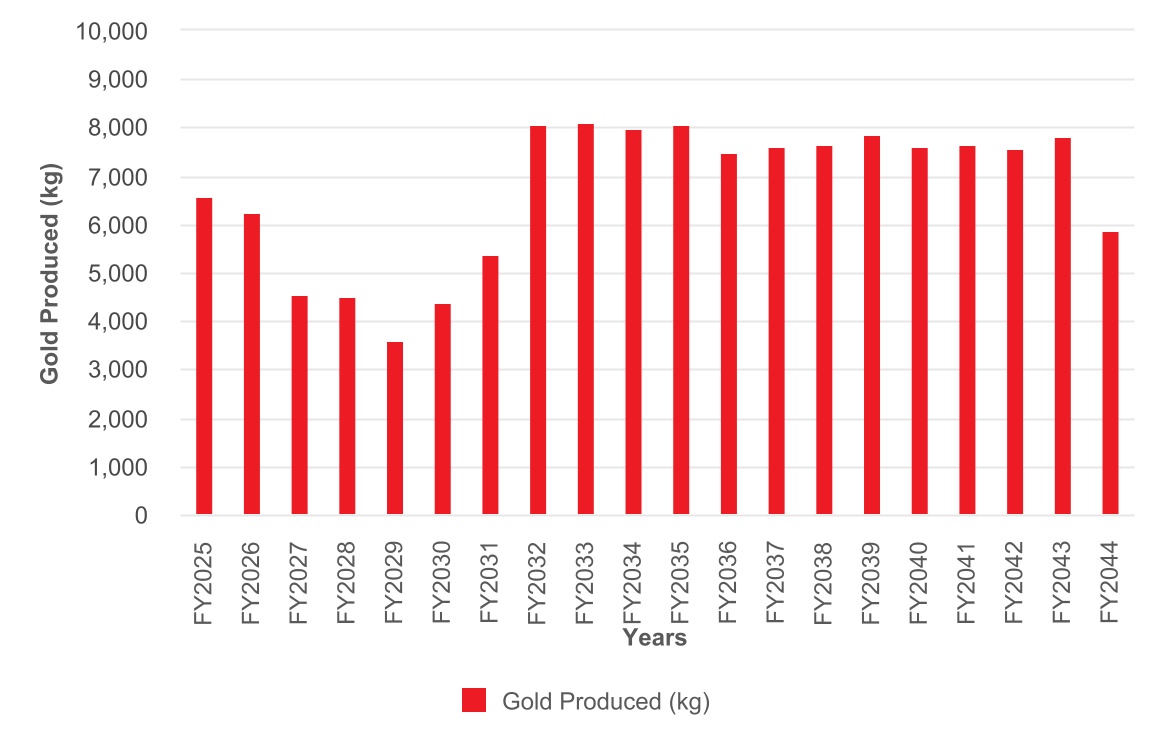

Since the commencement of mining in 1972, an average annual production rate of 465koz was achieved. The highest product rates at Moab Khotsong were achieved in 1998 of 1,077koz. The average production rate has decreased to an average of 221.8koz over the last six years. The average annual production over the past six years is presented in Figure 5-1 and Figure 5-2. The years refer to financial years from July to June.

The average annual production rate over the last 6 years is at 6,910kg since Harmony acquired Moab Khotsong in 2018. The 2019 production rate was 14% higher than the average production rate over the 6 year period, whilst the average production rate decreased by 3% since 2020 to 6706kg. Gold production outlook for 2025 is at 6569kg and is in line with 2024. The average production rate will decrease from 2026 to 2031 during the build-up phase of project Zaaiplaats and the project will reach steady state production from 2032.

Effective Date: June 30, 2024

12

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 5-1: Graph of Past Production – Tonnes and Gold Grade

Figure 5-2: Graph of Past Metal Production

Effective Date: June 30, 2024

13

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

6Geological Setting, Mineralization and Deposit

Section 229.601(b)(96) (iii)(B) (6) (i-iii)

6.1Regional Geology

The Klerksdorp Goldfield is located on the western margin of the Archean Witwatersrand Basin, one of the most prominent gold provinces in the world. The Witwatersrand Basin is an approximately 7,000m thick terrigenous sequence comprising mainly arenaceous and argillaceous, together with minor rudaceous, lithologies deposited in a fluvio-deltaic environment in the center of the Archaean Kaapvaal Craton of South Africa (Robb and Meyer, 1995). The regional geology of the Witwatersrand Basin is shown in Figure 6-1.

The Witwatersrand Basin hosts the Witwatersrand Supergroup, which either conformably or unconformably overlies the metamorphosed volcanic and minor clastic sediments of the Dominion Group (Tucker et al., 2016). The Dominion Group overlies the older granite-greenstone basement.

The majority of the Witwatersrand Supergroup is capped by the volcano-sedimentary sequence of the Ventersdorp Supergroup through an angular unconformity. The Ventersdorp Supergroup is in turn overlain by the dolomitic and quarzitic sequence of the Transvaal Supergroup, and sediments of the Karoo Supergroup (Tucker et al., 2016). Several suites of dykes and sills cut across the Archaean basement and the Witwatersrand, Ventersdorp, Transvaal and Karoo supergroups, and form important geological features.

The Witwatersrand Supergroup is subdivided into the basal West Rand Group (“WRG”) and overlying CRG (Robb and Robb, 1998). The WRG extends over an area of 43,000km2 and is up to 5,150m thick. It is sub-divided in three subgroups, namely, from bottom upwards, the Hospital Hill Subgroup; Government Subgroup and Jeppestown Subgroup. The stratigraphic succession of the WRG mainly consists of shale sediments, with occasional units of banded iron formation and conglomerate. The CRG is up to 2,880m thick and covers an area of up to 9,750km2, with a basal extent of approximately 290km x 150km. It is sub-divided into the lower Johannesburg Subgroup and upper Turffontein Subgroup as shown in Figure 6-2. These subgroups are separated by the Booysens Shale Formation.

The major gold bearing conglomerates are mostly confined to the CRG, and these conglomerate horizons are known as reefs. The most important reefs within the CRG are at six stratigraphic positions, three within the Johannesburg Sub-group and three within the Turffontein Sub-group. The reefs are mined in seven major goldfields, and a few smaller occurrences, which extend for over 400km in what has been called “The Golden Arc”. This arc is centered on the prominent Vredefort Dome, as shown in Figure 6-1, which is thought to be a major meteorite impact site in the center of the Witwatersrand Basin (Therriault et al., 1997). The goldfields, as shown in Figure 6-1, include: East Rand, South Rand, Central Rand, West Rand, West Wits, Klerksdorp, Free State (Welkom), and Evander.

6.2Local Geology

Moab Khotsong is located within the Klerksdorp Goldfield as shown in Figure 6-1. The general orientation of the Witwatersrand Supergroup succession in this goldfield is interpreted as southwest-trending and southeast dipping (Dankert and Hein, 2010).

The CRG is up to 2,100m thick in the Vaal River area. Moab Khotsong mainly exploits the Vaal Reef, which is located near the top of the Johannesburg Sub-group, within the CRG (Figure 6-2 and Figure 6-3). The Vaal Reef ranges in depth at Moab Khotsong from 1,500m - 3,400m BMD.

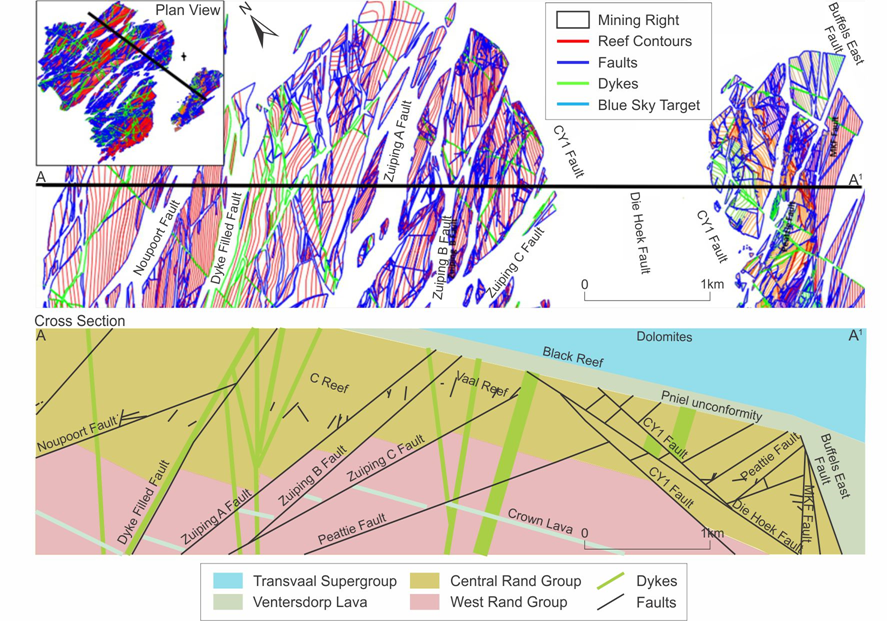

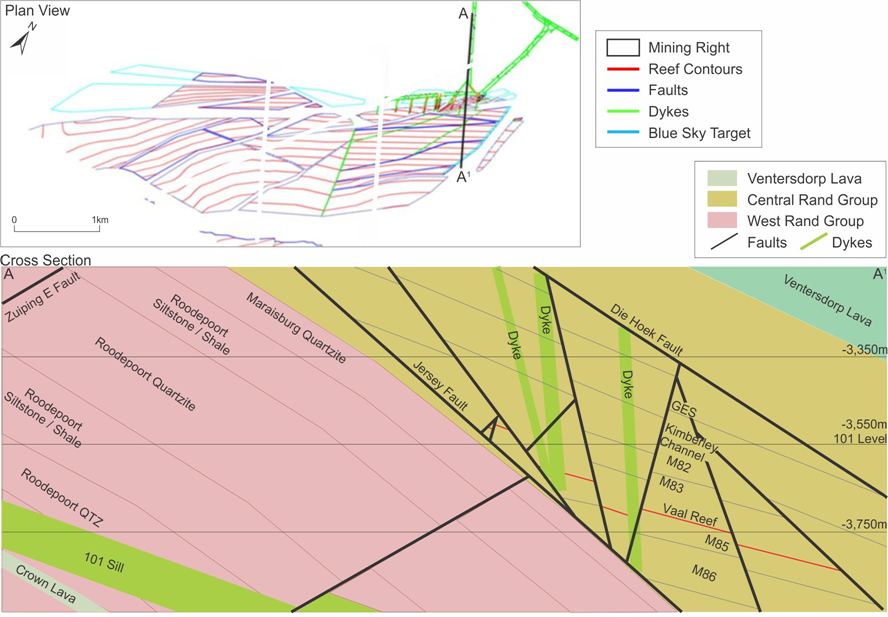

A series of northeast-trending faults including the Buffelsdoorn, Kromdraai, Buffels East and Jersey Faults, are a key feature of the Klerksdorp Goldfield. These major faults are south-dipping and have north-dipping “Zuiping” faults wedged between them. Moab Khotsong’s Vaal Reef structure plan is presented in Figure 6-4.

Effective Date: June 30, 2024

14

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 5-2: Graph of Past Metal Production

Effective Date: June 30, 2024

15

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 6-2: Stratigraphy of the CRG in the Witwatersrand Supergroup

Source: Modified after Tucker et al. (2016)

Effective Date: June 30, 2024

16

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 6-3: Stratigraphic Column of the Klerksdorp Goldfield

Effective Date: June 30, 2024

17

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 6-4: Structure Plan for Moab Khotsong

Effective Date: June 30, 2024

18

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

6.3Property Geology

The principal reef, both in terms of current production and Mineral Resources and Mineral Reserves, is the Vaal Reef. A second reef, lying approximately 225m stratigraphically above the Vaal Reef, is the C-Reef. This reef contributes less than 5% to the mining production. These reefs are continuously developed across the Great Noligwa Mine and Moab Khotsong mining right areas, with the exception of some fault-loss areas. The reefs dip at approximately 22° towards the southeast.

6.3.1Vaal Reef Lithology

The Vaal Reef consists of a thin basal conglomerate, termed the C-Facies, and a thicker upper sequence of conglomerates, termed the A-Facies. The A-Facies and the C-Facies are separated by the B-Facies, which is a barren orthoquartzite. The A-Facies is the primary economic horizon at Moab Khotsong; however, remnants of the C-Facies are sporadically mined where it is preserved below the A-Facies.

The Vaal Reef mining unit can reach thicknesses of up to 280cm, while the average channel width is approximately 90cm.

6.3.2C Reef Lithology

The C Reef is an approximately 10cm thick conglomerate, which has a 5mm - 20mm thick carbon seam commonly occurring at the base. To the north of the mine, the C Reef sub-crops against the Gold Estates Conglomerate Formation, and in the extreme south of the mine, the C Reef has been eliminated by a deep Kimberley erosion channel and the Jersey fault.

The C Reef is mined on a limited scale in the central part of Top Mine, where a high-grade, north-south trending sedimentary channel containing two economic horizons has been exposed. To the east and the west of this channel, the C Reef is poorly developed with limited areas containing economic concentrations of gold and uranium.

6.3.3Structure

The structure at Moab Khotsong has been interpreted from seismic data with confirmatory information sourced from surface drilling and LIBs. Moab Khotsong is structurally complex (Figure 6-4) with large fault-loss areas between Top Mine, Middle Mine and Zaaiplaats. The structural setting is one of crustal extension, dominated by major south dipping fault systems. The north dipping Zuiping faults are wedged between these major faults. The De Hoek and Buffels East faults bound the reef blocks of the Middle Mine to the northwest and southeast respectively, while the northern boundary of the Middle Mine is the north dipping Zuiping fault.

A northwest/southeast cross section from Top Mine to Middle Mine is presented in Figure 6-5, which demonstrates the structural complexity associated with the area. Similarly, a northwest/southeast cross section through Zaaiplaats is presented in Figure 6-6, again illustrating the complexity of area.

6.4Mineralization

The gold mineralization in the Witwatersrand deposits is believed to have followed an episode of deep burial, fracturing and alteration. The mineralization model is that Archean gold bearing hydrothermal fluid was introduced into the conglomerates and circulated throughout in hydrothermal cells. The fluids precipitated gold and other elements through reactions that took place at elevated temperatures along the reef horizons, which was the more favorable fluid conduit.

Effective Date: June 30, 2024

19

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 6-5: Top Mine and Middle Mine Cross Section and Plan

Figure 6-6: Zaaiplaats Cross Section and Plan

Effective Date: June 30, 2024

20

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

6.4.1Vaal Reef Mineralization

The Vaal Reef A-facies is dominated by silicate phases including quartz (~84 %), chlorite (~5 %), muscovite (~4 %) and zircon (~0.22 %), as well as sulphide phases of pyrite (~5 %). The remainder of the conglomerate consists of an array of accessory mineral phases which include uraninite, coffinite, brannerite, as well as various minor sulphide and oxide phases. The matrix of the conglomerate is made up of muscovite, chlorite, re-crystalized quartz and pyrite.

High gold values in the Vaal Reef are often located at the base of this unit and are associated with high uranium values as well as with the presence of carbon. It is interpreted that carbon was preferentially precipitated in bedding–parallel fractures that most commonly followed the base of the Vaal Reef package and that gold was precipitated very soon after the carbon, giving the critical gold-carbon association that characterizes many of the high-grade Vaal Reef localities. Uranium is an important by-product which is also recovered from the Vaal Reef.

6.4.2C Reef Mineralization

The Crystalkop formation attains a maximum thickness of about 9m, and contains a lower greenish, fuchsite-rich, tinged orthoquartzite overlain by a coarser grained protoquartzite that can be confused with Kimberley Channel deposits. The C Reef is present at the base of the Crystalkop formation and is typically a thin (<5cm ) oligomictic conglomerate with a well-developed carbon seam at the base. Although grades can be similar to that of the Vaal Reef the C Reef is only preserved in a small portion of the mine as it is truncated in the north by the Gold Estates Conglomerate and in the south by a large Kimberley channel (Watts, M, 2010).

The C Reef comprises of the following minerals: quartz (74.34 to 80.32 weight %), muscovite (7.69 to 10.54 weight %), pyrophyllite (2.89 to 8.35 weight %) and pyrite (5.21 to 7.73 weight %). A wide variety of accessory minerals includes zircon, chlorite, gersdorffite, sphalerite, cobaltite, galena, rutile, chromite, magnetite, ilmenite, calcite, siderite and florencite. Uranium bearing minerals such as uraninite, coffinite and brannerite occur in relevant amounts (Pienaar, D, 2016).

Gold is present predominantly in the form of pure gold, containing ~ 11 to ~ 18 weight % silver (Harris, 1990; Petruk, 2000; Zhou and Cabri, 2004; Zhou et al., 2004; Zhou and Gu, 2008).

6.4.3Alteration

Alteration is evident in the Vaal Reef and C Reefs at Moab Khotsong and is a result of the hydrothermal fluids that infiltrated the reef and have overprinted on the original mineral assemblage. The reefs contain authigenic sulphides such as pyrite, and other minerals associated with alteration such as chlorite. Gold associations with these mineral assemblages indicate a strong correlation of gold mobilization and redistribution at the time of the hydrothermal fluid influx.

While alteration is an important part of the mineralization at Moab Khotsong, alteration is not used for the identification, modelling or mining of the reefs.

6.5Deposit Type

The Moab Khotsong deposit is classed a meta-sedimentary gold deposit. Folding and basin edge faulting have been important controls for sediment deposition and gold distribution patterns within the Witwatersrand Basin and fold trends have been employed in the economic evaluation of various reef horizons.

6.6Commentary on Geological Setting, Mineralization and Deposit

The regional geological setting, local and property geology, mineralization and deposit-type for Moab Khotsong is well established, through many decades of exploration and mining. Reliable geological models, maps and cross sections are available that support the interpretations and inform the Mineral Resource estimates.

Effective Date: June 30, 2024

21

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

7Exploration

Section 229.601(b)(96) (iii)(B) (7) (i-vi)

Exploration at Moab Khotsong has focused on improving confidence in the geological model, as well as adding and upgrading additional Mineral Resources to the mine. Geological data has been obtained from an initial geophysical seismic survey and later through surface drilling, underground channel (chip) sampling, underground mapping and underground drilling.

7.1Geophysical Seismic Survey

A 3D seismic reflection survey was conducted by AngloGold in 1995 over the previously termed Vaal River region. The objective of the survey was to delineate the major sub-surface formations above and below the Vaal Reef, at depths ranging from 2.0km to 3.5km.

The data obtained from the survey was processed and interpreted, successfully delineating the stratigraphy from the Ventersdorp Supergroup to the base of the Witwatersrand Basin, including the Vaal Reef. This enabled AngloGold to better understand the structural characteristics of the Vaal River at depth. A high resolution 3D survey was done in 2012 over the Zaaiplaats area by CGGVeritas, which was the first high resolution patch done in the Witwatersrand basin . This survey was a patch within the more extensive 1996 Moab and 11 Shaft 3D surveys. The receiver points design was over 2.7km by 3.2km, while the source points design was over 5.0km by 6km to maintain a regular coverage of 25m by 25m bin. The total vibration points consisted out of 12,440 with a total of 1,064 receiver points. A recording time of 3 seconds was applied at a frequency range of 3.5Hz to 160Hz. The seismic interpretation continues to guide the delineation of the major fault blocks in the vicinity of Moab Khotsong, and guide surface and underground drilling efforts.

7.2Topographic Surveys

As Moab Khotsong is an underground operation, topographic surveys are not material to the Mineral Resource estimates.

7.3Underground Mapping

Extensive face and reef development mapping is undertaken by the Geosciences Department at Moab Khotsong. This mapping is typically undertaken at the same time and at the same frequency as channel sampling, although denser mapping coverage is set up in structurally complex areas.

During mapping, face tapes are setup along gullies and the stope face and secured with the latest survey pegs installed in the workplaces. Reef position and other lithological and stratigraphic information is collected and measured relative to the reference tapes. The information is captured in a notebook.

Once at surface, the geologists transfer the information from the notebook into the system where a mapping report is produced for each mapped workplace. The mapping reports depict the geological information graphically relative to the survey measurement points. Data from the mapping is also incorporated into the geological models.

7.4Channel Sampling Methods and Sample Quality

Channel sampling of underground panels blasted on monthly basis is conducted perpendicular to the channel contact across the exposed channels. The section lines demarcating the width of the sample are drawn parallel to the reef waste contact while those demarcating the length of the sample are drawn at right angles to the reef waste contact and are marked 10cm apart. Samples of a consistent depth are chipped out between these section lines, along with 2cm of waste material from above and below the reef. A detailed description of the sampling process is provided in Section 8.1.1

Sampling of the channels is undertaken at the advancing face on a grid spacing of 5m x 5m. On average 2,360 chip samples are collected per month The sampling process is audited monthly and annually by the Geoscience Manager.

Sampling is done to a standard set by Harmony. Only a qualified person will conduct and oversee any chip sampling procedures. Official task observations by the supervisors are carried out on a regular basis and signed off with the sampler. Each sample receives a unique sample number by which the sample is identified. A chain of custody is set up whereby the samples are transported from underground and is stored in a locked

Effective Date: June 30, 2024

22

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

container ready for dispatch to the Laboratory. Sample numbers are scanned at the Laboratory and assay results are reported electronically. The electronic assay results are imported using Datamine FusionTM.

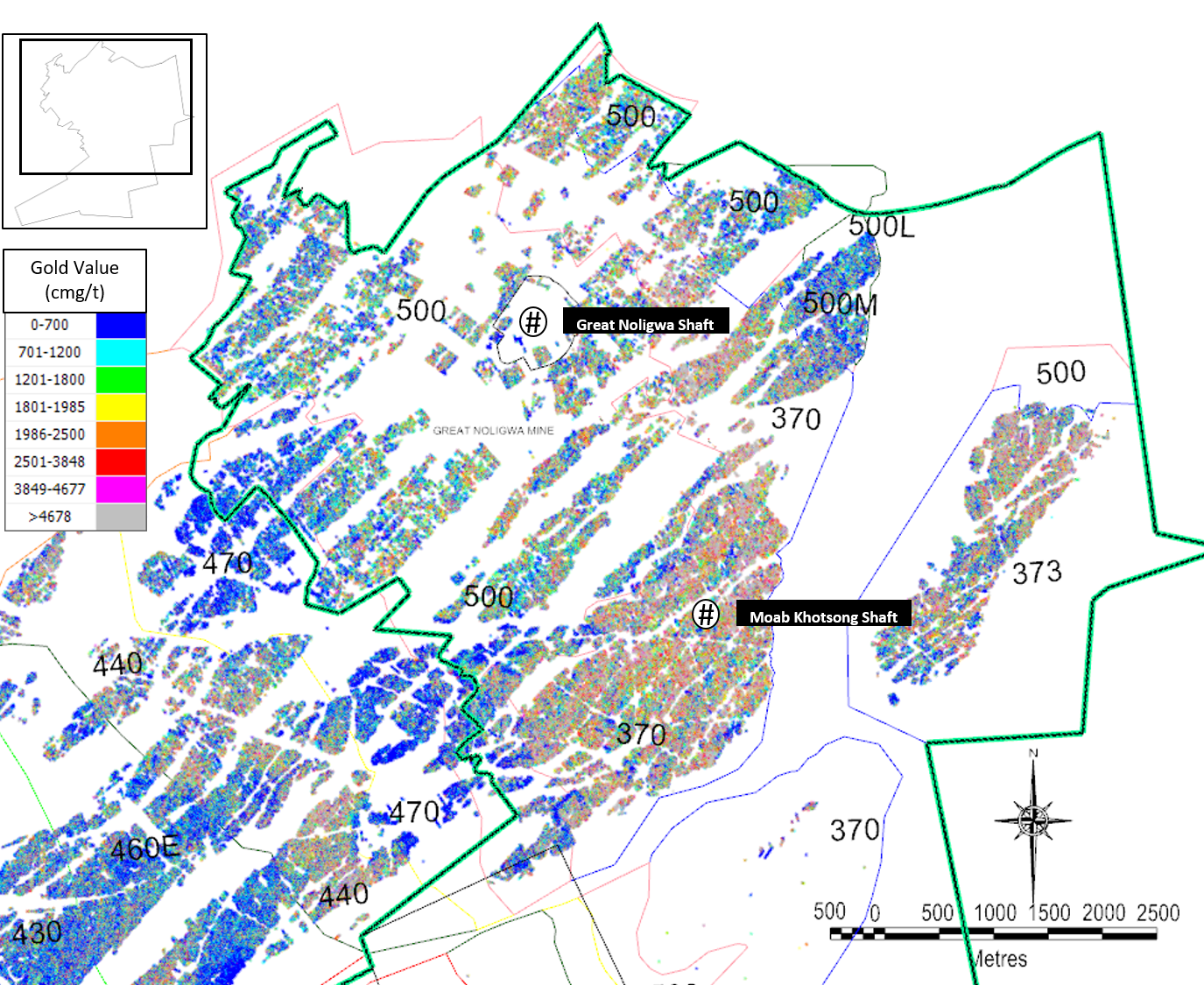

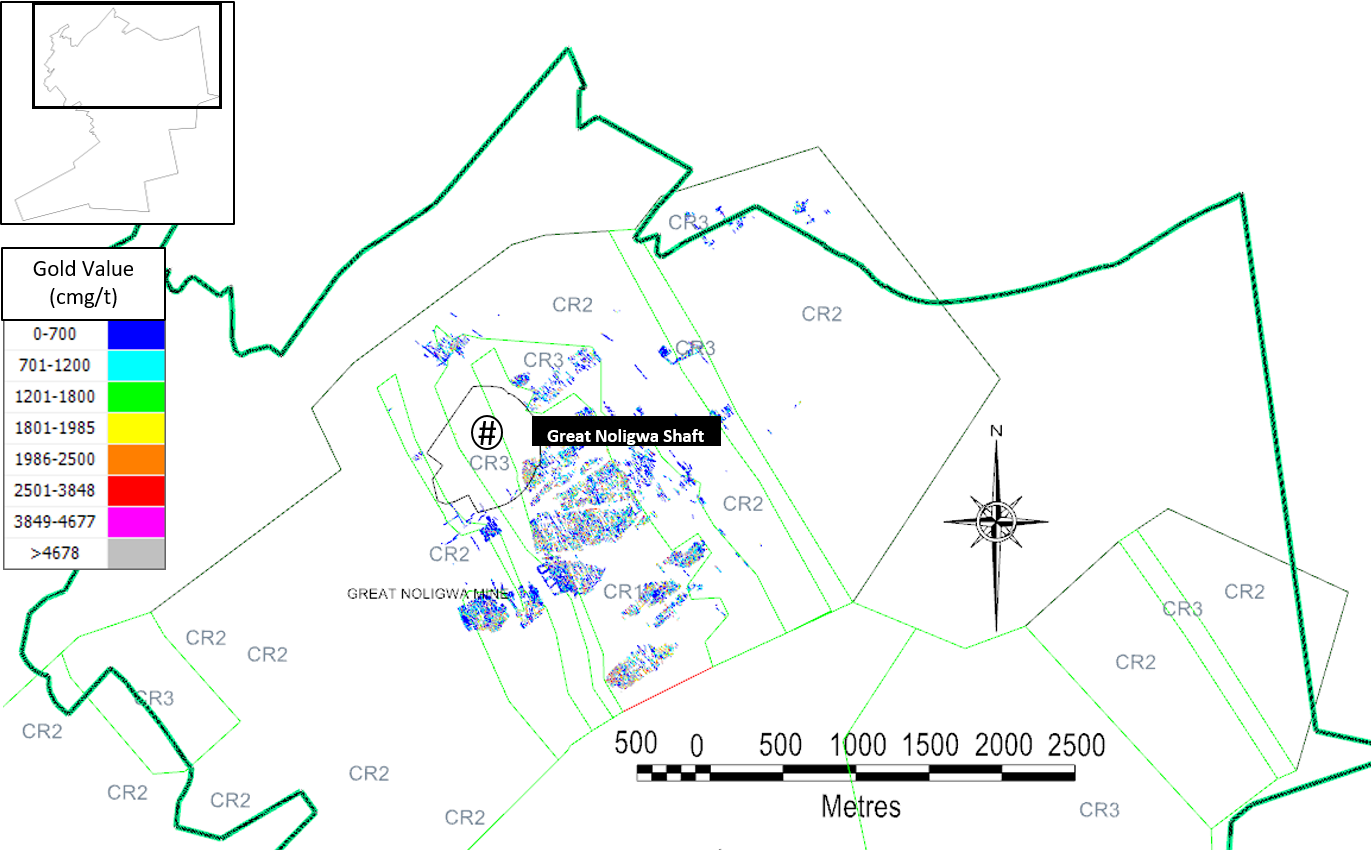

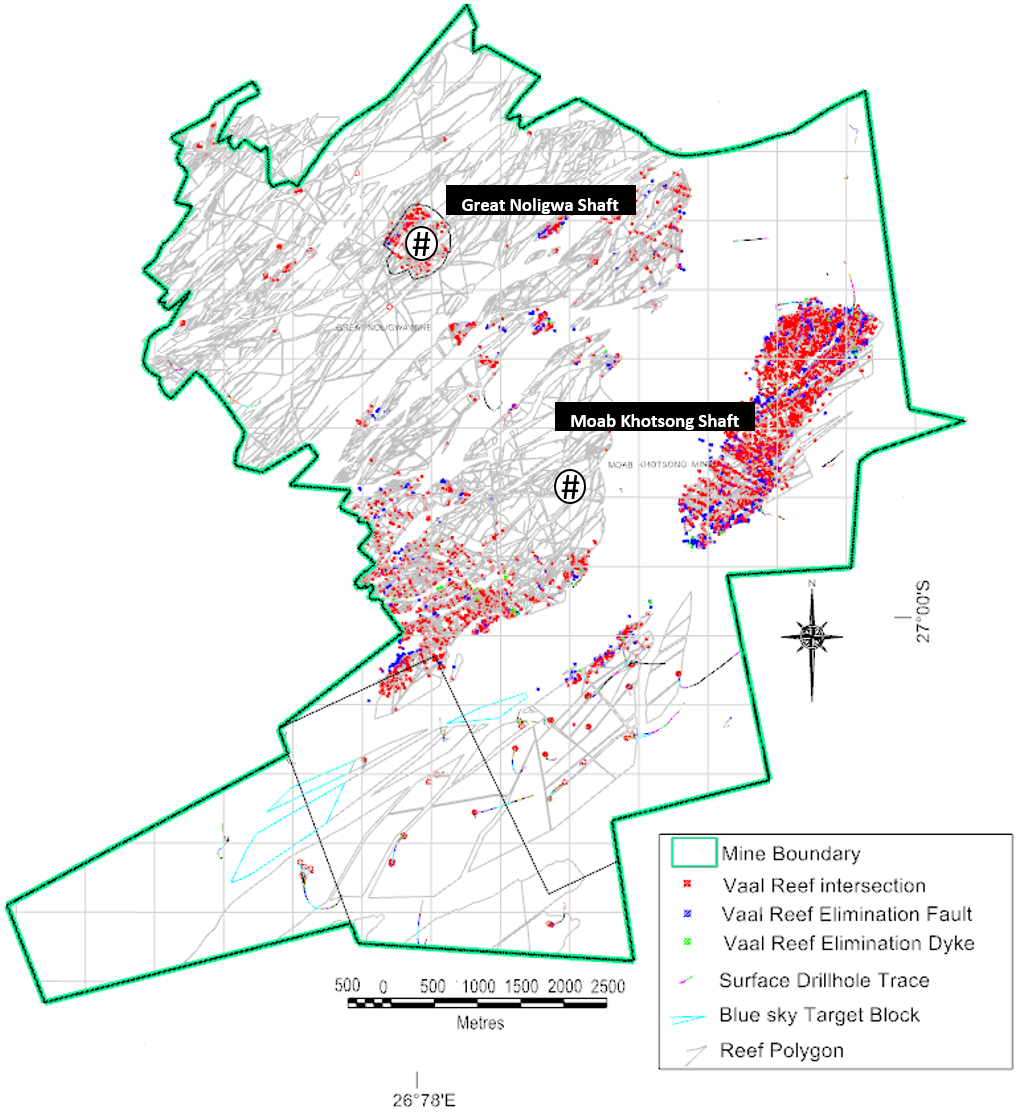

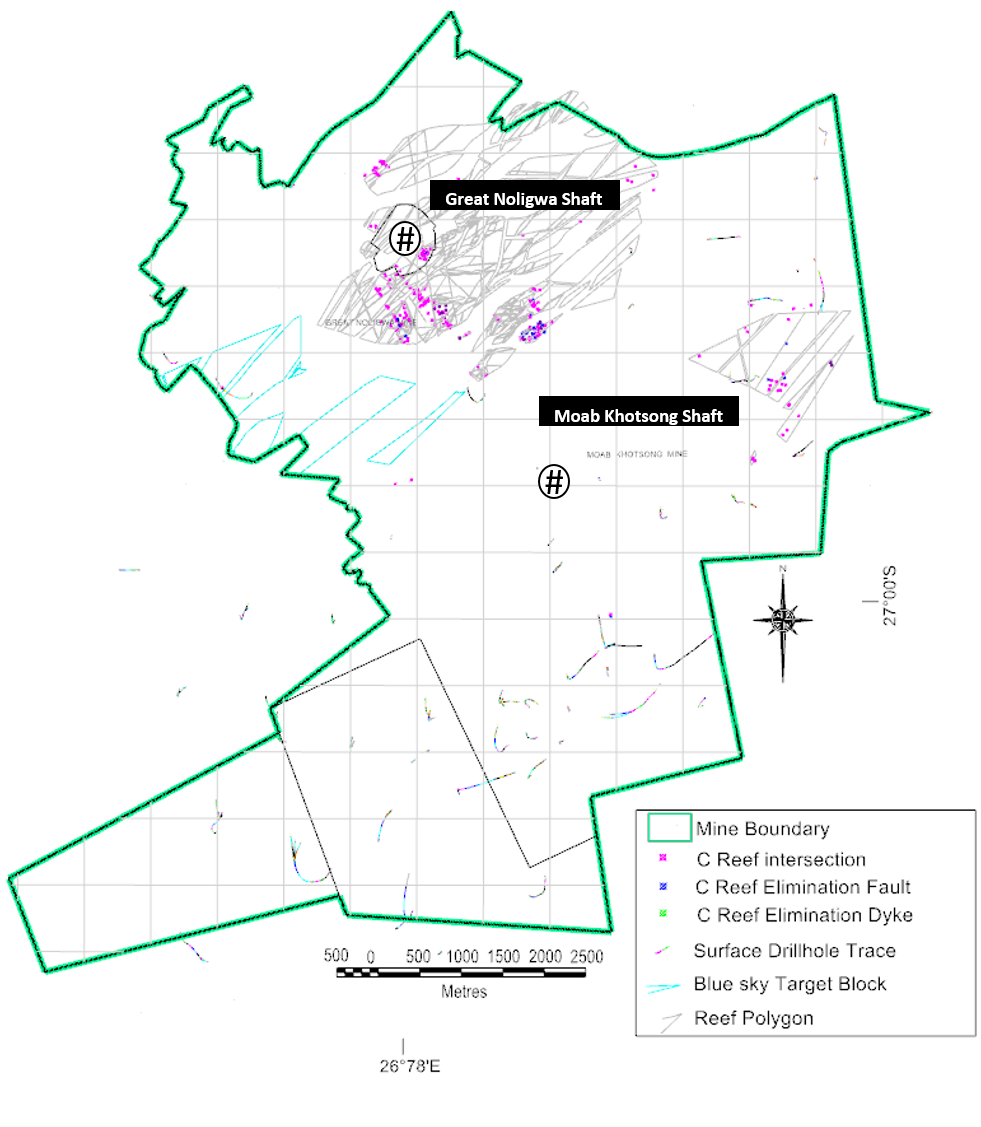

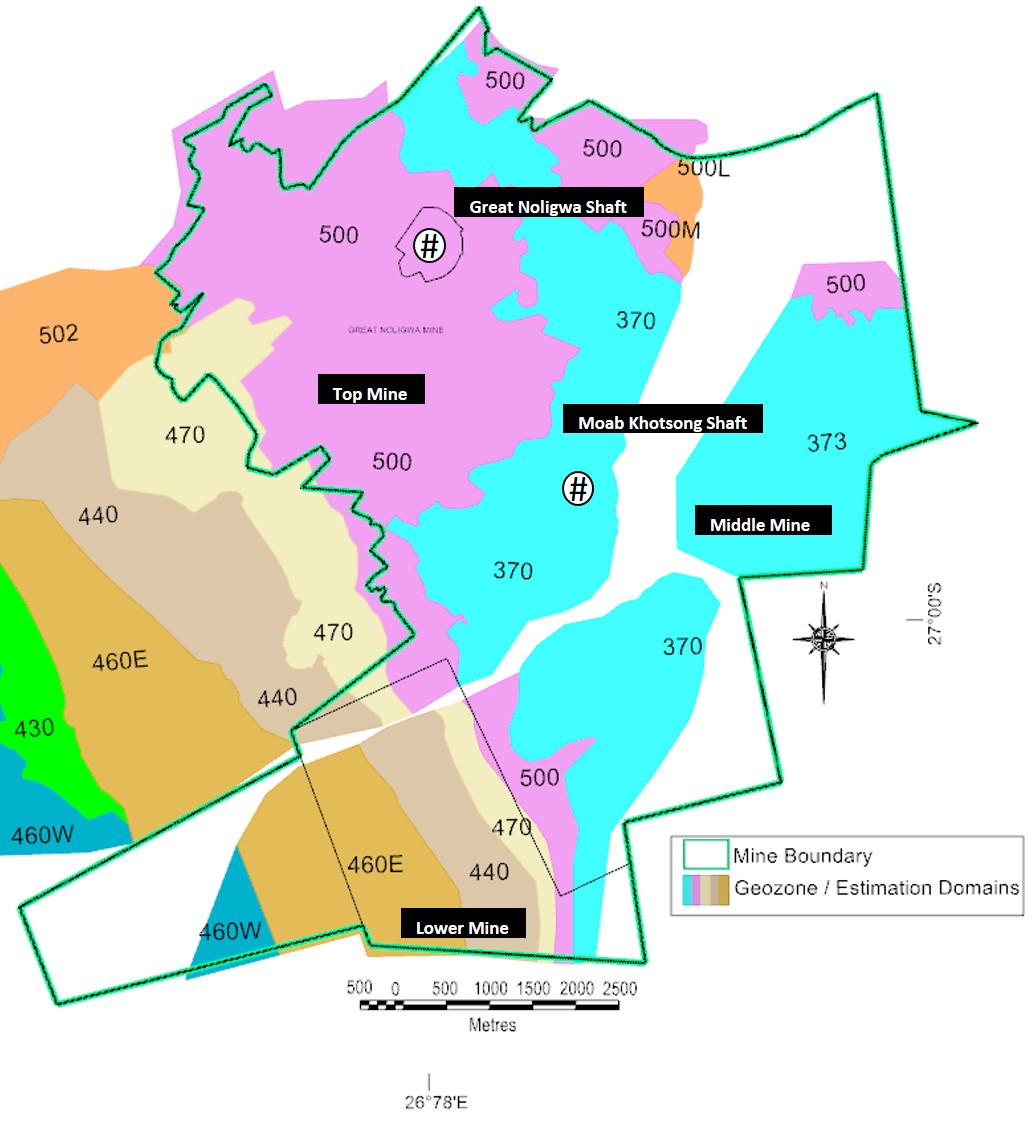

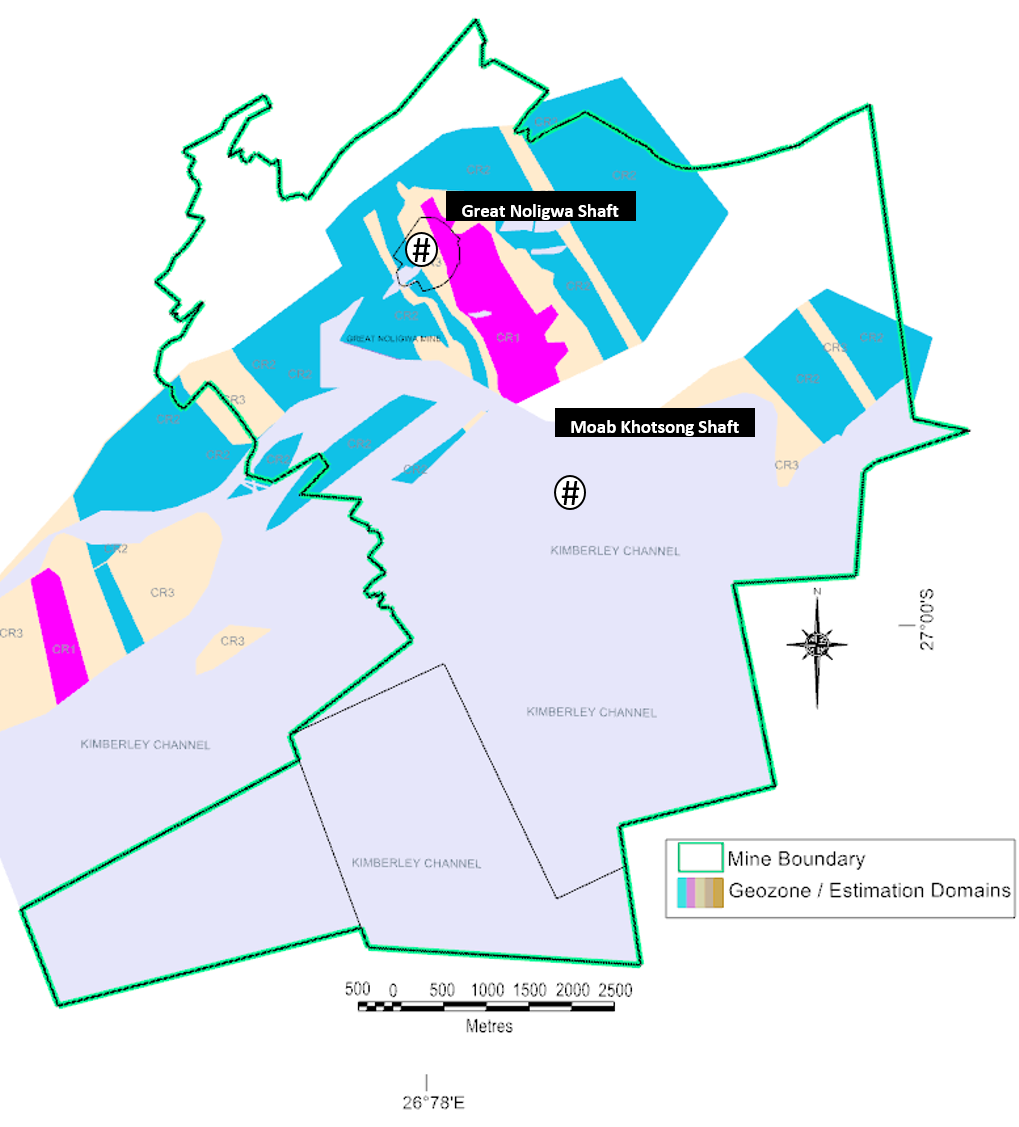

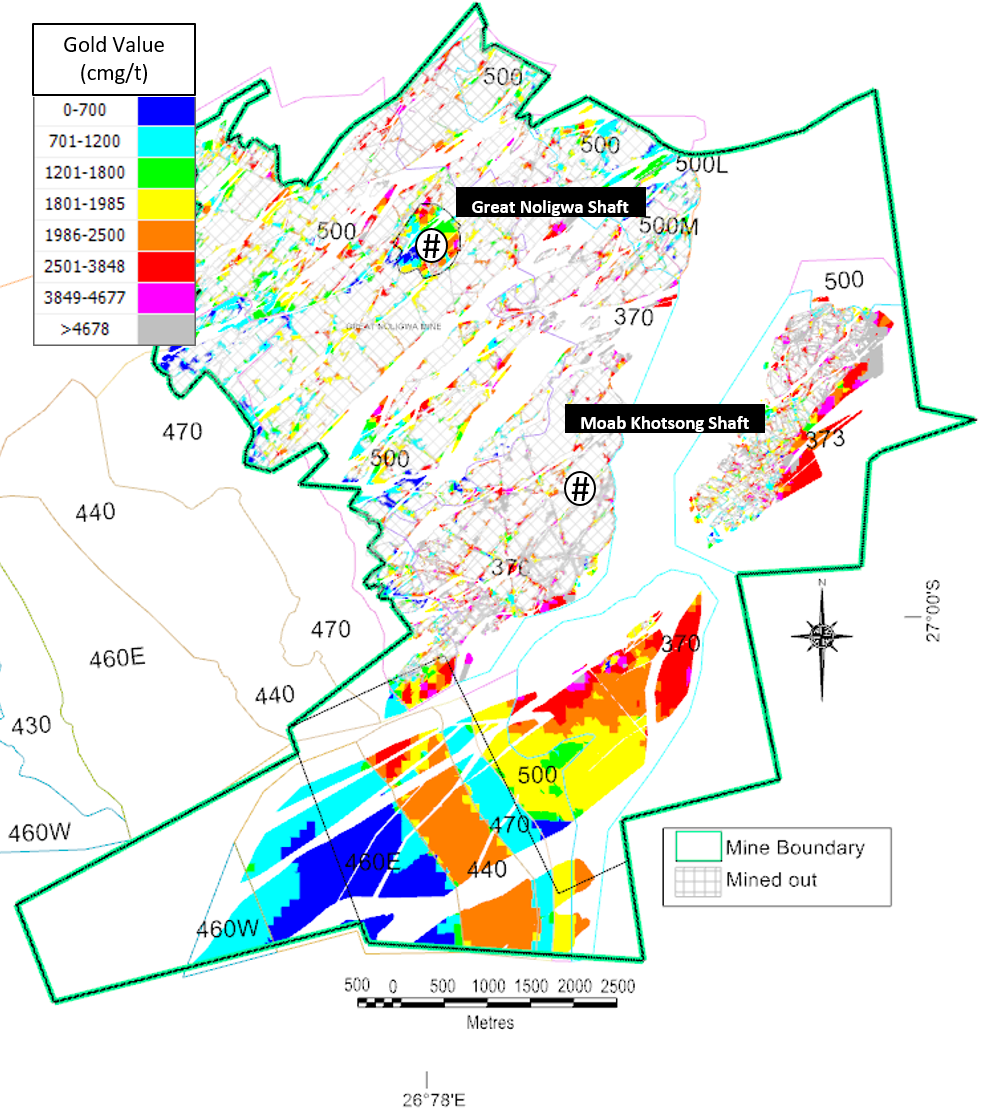

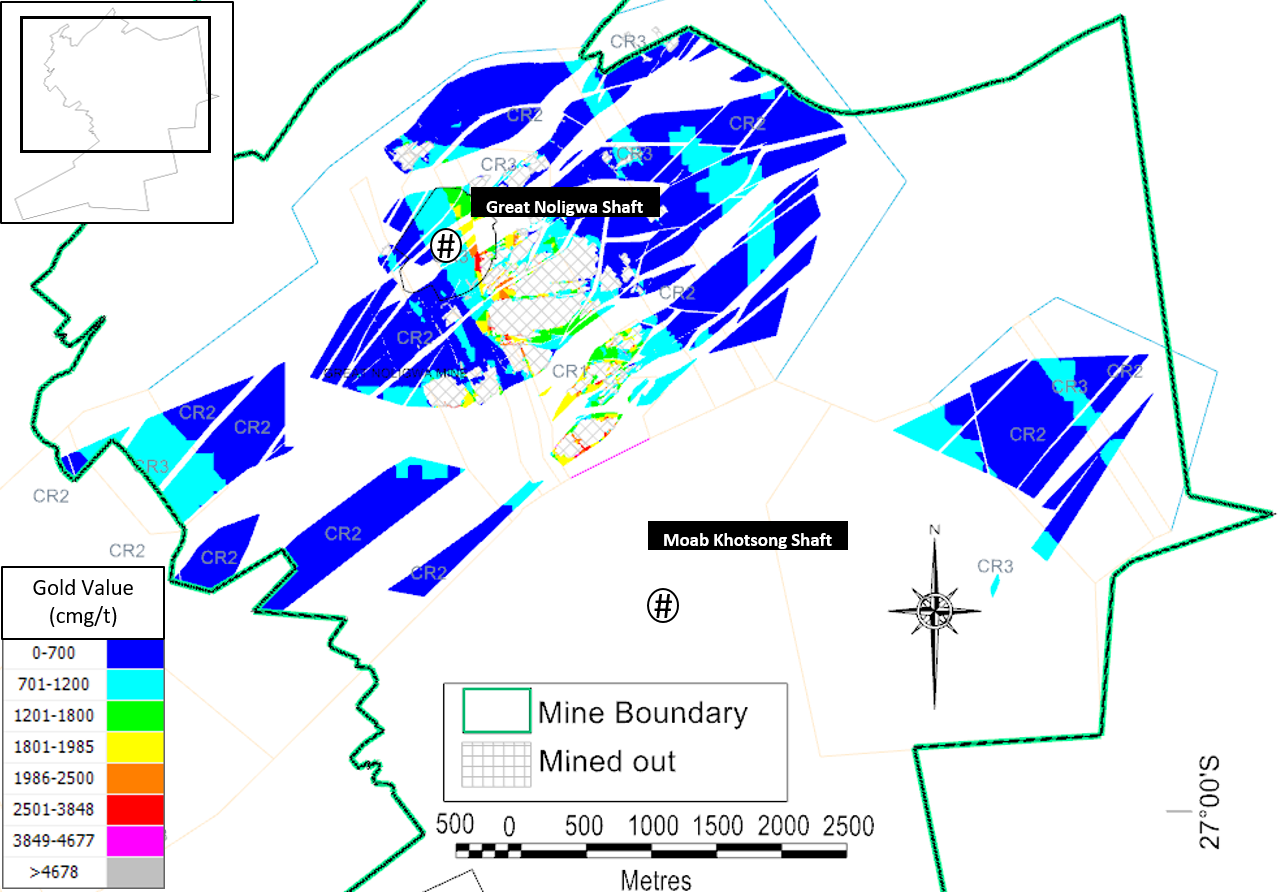

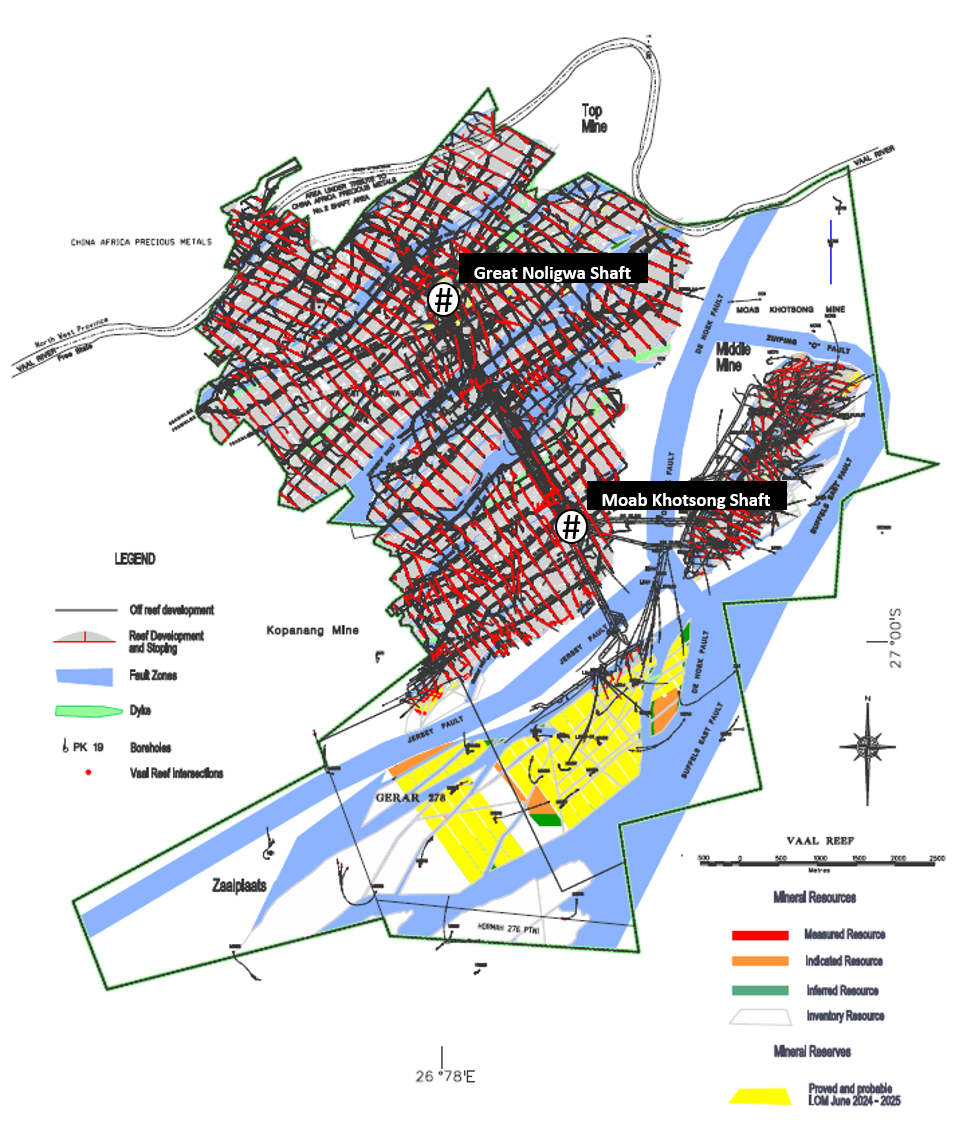

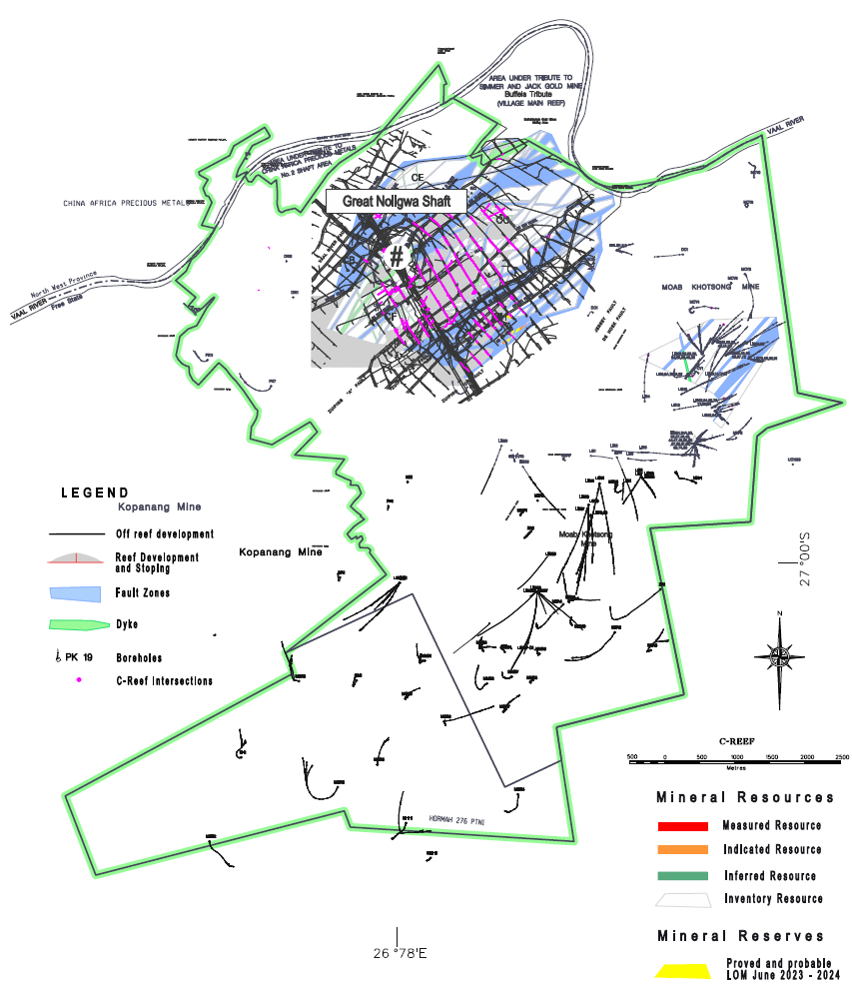

The location of samples collected from the Vaal Reef to date is shown in Figure 7-1, while that the C Reef is presented in Figure 7-2.

Effective Date: June 30, 2024

23

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

Figure 7-1: Location of Channel Samples Collected from the Vaal Reef to Date

Figure 7-2: Location of Channel Samples Collected from the C Reef to Date

7.5Surface Drilling Campaigns, Procedures, Sampling, Recoveries and Results

The surface drill holes used in the estimation of the current Mineral Resources were drilled by AAC and AngloGold before Harmony acquired Moab Khotsong.

Effective Date: June 30, 2024

24

Technical Report Summary for

Moab Khotsong Operations, Free State Province, South Africa

7.5.1Drilling Methods

The surface drill holes were completed using Boart Longyear DR27 drill rigs. This diamond core drilling was undertaken using a thin-walled TNW size core barrel that delivers NQ (47.6mm) core for better sample recovery. A single mother hole is drilled with multiple deflection holes drilled from the mother hole.

The drill grid spacing of the surface drill hole intersections is up to 1,000m, and is often required to be complimented by underground drill hole intersections. The accuracy of the surface drilling intersection positions from drill holes that are from 2,000m to 3,000m in depth is the major limiting factor of actually achieving any sort of planned grid. Long surface drill holes often deflect and the controlling direction over that depth has always been challenging in the South African gold mining context.

Underground borehole core is brought up from underground by the drilling contractor and stored in the core yard for inspection by the geologists. Core is brought to surface in enclosed core trays. The core is measured by the drilling foreman and stored in durable display trays for logging. The actual core meters at the end of the month is checked and signed off by the responsible geologist and drilling Supervisor. The geologists review core measurement and overall quality of the core collected to ensure optimal information collection from underground and as a quality control.

7.5.2Collar and Downhole Surveys

Drill holes are surveyed to confirm both collar position and trajectory. Drill hole collar and downhole surveys are conducted on all surface drill holes at Moab Khotsong. Surface drill hole collars are surveyed by internal Land Survey Department

Downhole surveying is conducted using Electronic Multishot System and non-magnetic north seeking Gyro tools as supplied by a certified and specialized downhole survey company. Additional surveys are conducted on all LIB or long vertical borehole (“LVB”) drill holes for verification purposes, and the results are submitted together with the primary survey data used to determine the drill hole trajectories. Regular roll tests are conducted on the in-hole survey tools by the downhole survey company to assure survey accuracy.

7.5.3Logging Procedure

The drill core was transported from the field to the core yard, where it was logged by the geologist according to the AAC or AngloGold standard logging procedures. Drill core logging is quantitative and qualitative. The following information is recorded:

•lithology;

•packing density;

•roundness;

•sorting;

•contact type, grain/pebble size;

•sediment maturity; and

•mineralization; and

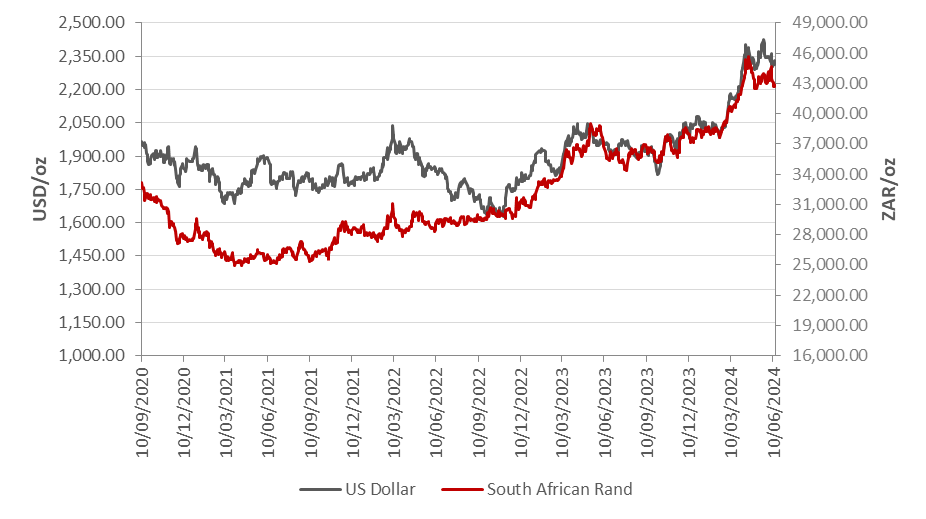

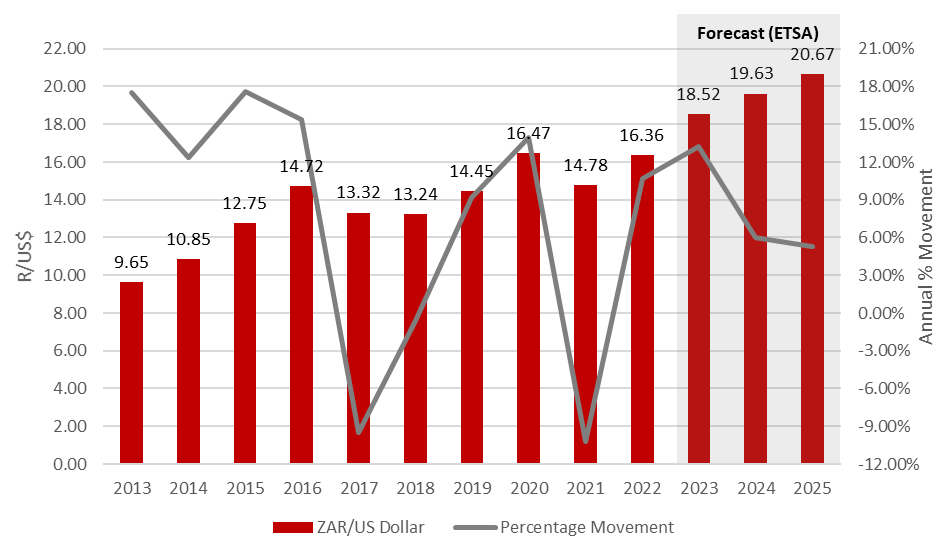

•alteration.