HARMONY GOLD MINING COMPANY LIMITED

Technical Report Summary of the

Mineral Resources and Mineral Reserves

for

Kalgold Mine

North West Province, South Africa

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

| | |

IMPORTANT NOTICE

This Technical Report Summary has been prepared for Harmony Gold Mining Company Limited in support of disclosure and filing requirements with the United States Securities and Exchange Commission’s (SEC) under Subpart 1300 of Regulation S-K 1300 and Section 229.601(b)(96) of Regulation S-K. The quality of information, estimates, and conclusions contained in this Technical Report Summary apply as of the effective date of this report. Subsequent events that may have occurred since that date may have resulted in material changes to such information, estimates and conclusions in this summary. |

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

ii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

QP Consent and Sign-off

I have read and understood the requirements of:

•the South African Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (the “SAMREC Code, 2016 edition”)

•the Harmony Guidelines on the Reporting of Exploration Results, Mineral Resources and Mineral Reserves

•Subpart 1300 (17 CFR 229.1300) of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (“Regulation S-K 1300”)

I am a Competent Person as defined by the SAMREC Code, 2016 edition and the Qualified Person (“QP”) under Regulation S-K 1300, having more than five years` experience that is relevant to the style of mineralization and type of deposit described in the Report, and to the all activities for which I am accepting responsibility and have been appointed as QP for Kalgold Mineral Resources and Mineral Reserves.

I am a Member of SACNASP and my registration is as follow:

Mineral Resource

Rebaone Francis Gaelejwe

SACNASP (South African Council for Natural Scientific Professions)

Nr 400207/14

Years’ Experience: 23

I have reviewed the tables and graphs included for the Kalgold Mineral Resource and Mineral Reserve which will be used in the 2024 Harmony Gold Mineral Resource and Mineral Reserve Report to which this Consent Statement applies.

I acknowledge responsibility for all the Sections of the TRS report and as the QP and author I relied on information provided by various subject experts.

At the effective date of the Report, to the best of my knowledge, information and belief, the Report contains all scientific and technical information that is required to be disclosed to make the Report not misleading.

/s/ Rebaone Francis Gaelejwe

____________________________________

Mr Rebaone Francis Gaelejwe

BSc. Hons (Geol), PgDip, EMBA

SACNASP (No. 400207/14)

Ore Reserve Manager

Harmony Gold Mining Company Limited

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

iii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

List of Contents

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

iv

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

v

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

vi

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

vii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

List of Figures

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

viii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

List of Tables

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

ix

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Units of Measure and Abbreviations

| | | | | |

| Unit / Abbreviation | Description or Definition |

| °C | degrees Celsius |

| µm | Micrometres |

| 3D | Three-dimensional |

| ADT | Articulated dump truck |

| AE | Abnormal expenditure |

| Andru Mining | Andru Mining (Pty) Limited |

| amsl | Above mean sea level |

| Avg. | Average |

| BIF | Banded iron formation |

| c. | Approximately |

| CIL | Carbon-in-Leach |

| cm | Centimetre |

| cmg/t | Centimetre-grams per tonne |

| CODM | Chief Operating Decision-Maker |

| Company | Harmony Gold Mining Company Limited |

| COP | Code of Practice |

| CRM | Certified Reference Material |

| COV | Coefficient of Variation |

| DD | Diamond Drilling |

| DMRE | Department of Mineral Resources and Energy |

| DWS | Department of Water and Sanitation |

| EIA | Environmental Impact Assessment |

| EMPR | Environmental Management Programme |

| EMS | Environmental Management System |

| EMTS | Electric Monorail Transport System |

| ESG | Environmental Social and Governance |

| ETF | Exchange traded fund |

| g | Gram |

| FEL | Front end loader |

| GHG | Greenhouse gas |

| g/t | Grams per metric tonne |

| GISTM | Global Industry Standard on Tailings Management |

| HG | High grade |

| kg | Kilogram |

| Kalgold | Kalahari Goldridge Mining Company Limited |

| KGB | Kalahari Greenstone Belt |

| km | Kilometre |

| Kpa | Kilo Pascals |

| ktpm | Kilo tonnes per month |

| Leapfrog | Leapfrog Geo 4.5 software |

| LBMA | London Bullion Market Association |

| LG | Low grade |

| Ltd | Limited |

| m | Metre |

| M | Million |

| Ma | Million years |

| masl | Metres above sea level |

| MCC | Mining Charter Compliance |

| MCF | Mine Call Factor |

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

x

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

| | | | | |

| Unit / Abbreviation | Description or Definition |

| NEMA | National Environmental Management Act, 107 of 1998 |

| MPRDA | Mineral and Petroleum Resources Development Act, 28 of 2002 |

| MRMR | Modified Rock Mass Ratings |

| Moz | Million troy ounces |

| Mpa | Mega Pascals |

| Mt | Million tonnes |

| Mtpa | Million tonnes per annum |

| Mtpm | Million tonnes per month |

| No. | Number |

| NPV | Net present value |

| OTC | Over the counter |

| oz | Troy ounce |

| PERC | Percussion drilling |

| Pty | Proprietary |

| QAQC | Quality Assurance and Quality Control |

| QP | Qualified Person |

| RC | Reverse Circulation drilling |

| RCDD | Reverse Circulation Diamond Drilling |

| RMR | Rock Mass Ratings |

| SACNASP | South African Council for Natural Scientific Professions |

| SAMREC | South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| SANAS | South African National Accreditation System |

| SD | Standard Deviation |

| SEC | Securities and Exchange Commission |

| SGS | SGS South Africa (Pty) Limited |

| Shamrock | Shamrock Mining and Prospecting Company |

| Shell | Shell Limited |

| SLP | Social Labour Plan |

| SP | Stockpile |

| t | Metric tonne |

| t/m3 | tonne per cubic metre |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| UCS | Uniaxial compressive strength (MPa) |

| USD | United States Dollars |

| USD/oz | United States Dollar per troy ounce |

| WRCM | West Rand Consolidated Mines |

| WUL(s) | Water Use Licence(s) |

| y-o-y | Year on year |

| Yr | Year |

| ZAR | South African Rand |

| ZAR/kg | South African Rand per kilogram |

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

xi

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Glossary of Terms

| | | | | |

| Term | Definition |

| Co-kriging | A method that is used to predict the value of the point at unobserved locations by sample points that are known to be spatially interconnected by adding other variables that have a correlation with the main variable or can also be used to predict 2 or more variables simultaneously. |

| Cut-off grade | Cut-off grade is the grade (i.e., the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio. |

| Dilution | Unmineralized rock that is by necessity, removed along with ore during the mining process that effectively lowers the overall grade of the ore. |

| Head grade | The average grade of ore fed into the mill. |

| Economically viable | Economically viable, when used in the context of Mineral Reserve determination, means that the qualified person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. |

| Harmony | Harmony Gold Mining Company Limited |

| Indicated Mineral Resource | Indicated Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

| Inferred Mineral Resource | Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the Modifying Factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project and may not be converted to a Mineral Reserve. |

| Kriging | A method of interpolation based on Gaussian process governed by prior covariances. It uses a limited set of sampled data points to estimate the value of a variable over a continuous spatial field. |

| LOM | The Life of Mine (LOM) is a technically achievable and economically viable period, which is formed from the basis of the determined Mineral Reserves, during which the Proven and Probable Mineral Reserves of the operation are planned to be extracted |

| Mine Call Factor | The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. |

| Measured Mineral Resource | Measured Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a qualified person to apply Modifying Factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| Mineral Reserve | Mineral Reserve is an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Mineral Resource | Mineral Resource is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralisation, taking into account relevant factors such as cut-off grade, likely mining dimensions, location, or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralisation drilled or sampled. |

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

xii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

| | | | | |

| Term | Definition |

| Modifying Factors | Modifying Factors are the factors that a qualified person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate Modifying Factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include but are not restricted to mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the Modifying Factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| Pre-Feasibility Study | A pre-feasibility study (or preliminary feasibility study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. (1) A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. (2) A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment. |

|

|

| Probable Mineral Reserve | Probable Mineral Reserve is the economically mineable part of an Indicated and, in some cases, a Measured Mineral Resource. |

| Proven Mineral Reserve | Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource. |

| Qualified Person | A qualified person is: (1) A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and (2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: (i) Be either: A) An organization recognized within the mining industry as a reputable professional association; or (B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field; (ii) Admit eligible members primarily on the basis of their academic qualifications and experience; (iii) Establish and require compliance with professional standards of competence and ethics; (iv) Require or encourage continuing professional development; (v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and (vi) Provide a public list of members in good standing. |

|

|

|

|

|

|

|

|

|

|

| Tailings | Finely ground rock of low residual value from which valuable minerals have been extracted is discarded and stored in a designed dam facility. |

| Tailings Freeboard | The vertical height between the beached tailings against the embankment crest and the crest itself. |

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

xiii

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

1Executive Summary

Section 229.601(b)(96)(iii)(B)(1)

The QP of Harmony Gold Mining Company Limited (“Harmony” or the “Company”) has prepared this Technical Report Summary (“TRS”) to disclose the Mineral Resource and Mineral Reserve estimates for the Company’s Kalahari Goldridge Mining Company Limited (“Kalgold” or “Kalgold Mine”). The TRS has been prepared in accordance with the U.S. Securities and Exchange Commission’s (“SEC”) Regulation S-K 1300, with an effective date as at June 30, 2024. No material changes have occurred between the effective date and the date of signature of this TRS.

This TRS updates the TRS filed by Harmony on Kalgold on October 31, 2023, named Exhibit 96.6 Technical Report Summary of the Mineral Resources and Mineral Reserves for Kalgold Mine, North West Province, South Africa, which was effective on 30 June 2023. This TRS is prepared to satisfy the requirement of Item 1302(e)(6) of regulation S-K. An economic assessment was included, using a detailed discounted cashflow analysis for the Mineral Reserves, excluding all scheduled Inferred Mineral Resource which is not reported under Mineral Reserve.

Property Description

Kalgold is a modular open gold pit mine, extracting ore from a series of satellite orebodies. The mine is in the North West Province of South Africa, 55km southwest of the town of Mahikeng. The Kalgold Mine is serviced by well-maintained sealed roads with good access to all nearby towns and cities. The mine is surrounded by farmland and the closest community is at Kraaipan, approximately 15km to the south of the mine. The Kalgold Mine has been in operation since 1995 and is the only significant mining operation in the region.

The mining rights related to Kalgold was successfully acquired as the Kalahari Goldridge Mining Company Limited in July 1999. Through a successful legislative Section 11 process undertaken in terms of the Mineral and Petroleum Resources Development Act, 2008 (“MPRDA”), Harmony is now the holder of the following mining rights:

•NW30/5/1/2/2/77MR valid from 28 August 2008 to 27 August 2038; and

•NW30/5/1/1/2/863 and 1469PR lapsed. New PR application NW30/5/1/1/2/14264 PR has be lodged on the 31st January 2024. The area is currently reserved, and the Department of Mineral Resources and Energy (“DMRE”) may not accept any other applications for the area.

There is no material litigation (including violations or fines) against the Company which threatens its mineral rights, tenure, or operations.

Ownership

Kalgold is 100% owned by Harmony, including the associated mineral rights. Harmony acquired the mine as part of a transaction concluded by the company in July 1999.

Geology and Mineralisation

The Kalgold lode deposit is located within the geological terrane known as the Archaean Kraaipan Greenstone Belt ("KGB"). The KGB forms part of the Kaapvaal Craton of South Africa and comprises a linear belt of weakly metamorphosed mafic volcanic rocks with interbedded metasedimentary rocks and Banded Iron Formation (“BIF”). The belt extends in a roughly north/south direction over 250km from South Africa into southern Botswana.

The belt is intruded by several granitoid suites which range from tonalitic and trondhjemitic gneisses through to granodiorite-monzonite suites. There is a general paucity of outcrop owing to the variably developed weathering profile and to the Tertiary-to-Recent cover, including transported Kalahari sands. Due to the younger cover rocks and lack of surface exposure, the mineralisation potential of the belt was poorly understood for many years.

The Kalgold lode deposit is accessed through five discrete mining areas, namely the D Zone, A Zone and A Zone south extension (Henrys), Bridge Zone, Watertank, and Windmill pits. The geology of the D Zone Pit is used as a benchmark for the other pits. The geology consists of mafic schist, which forms the immediate footwall, a BIF horizon as the main mineralised zone and a succession of clastic sediments consisting of shale,

Effective Date: June 30, 2024

1

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

greywacke, and volcanic conglomerates as the hanging wall. Mining is currently taking place at the A Zone, Watertank, Henrys and Windmill pits.

Mineralisation at Kalgold is essentially strata bound to the BIF packages, resulting from intense silica, carbonate, sulphide, potassium alteration and metasomatic replacement of the BIF lenses. The mineralisation is manifested primarily as quartz veined and sulphidised BIF, with sulphides dominated by pyrrhotite and pyrite. Gold predominantly occurs as small grains of native gold, in association with pyrrhotite and trace chalcopyrite and sphalerite.

Status of Exploration, Development and Operation

Kalgold is an established, existing mining operation that has been in production for over 25 years. It currently mines at rates of c.3Mtpa of ore. An average of c.1,300kg of gold is produced annually, with ore sources originating from mining and stockpile handling operations.

In the period 2017 - 2019, definition and exploration drilling were undertaken over the Kalgold line of lode deposit. This exploration was aimed at validating and expanding the Mineral Resource estimate at that time. The drilling yielded significant extensions to the Mineral Resource area, expanding on the understanding of the deposit. The drilling results were analysed and incorporated into the geological model to upgrade the Mineral Resource estimates, and in-fill the areas between the A Zone and Watertank mining pits, known as the Bridge Zone.

Further exploration drilling took place during 2021 -2023. The results from this exploration drilling extended and in-filled the mineralised area beyond the current resource limits. The exploration drilling and the subsequent definition of the Mineral Resources are ongoing, and the intention is that the Mineral Resource estimate will be continuously updated as the data becomes available and incorporated into the model.

Exploratory work planned to the south of the D zone will commence as soon as the pending prospecting right application approval is received. This drilling is aimed at expanding Mineral Resource and Reserve beyond the current limits.

Overall, the current Kalgold Mine site is well established and operates uninterrupted at a steady state capacity throughout the year.

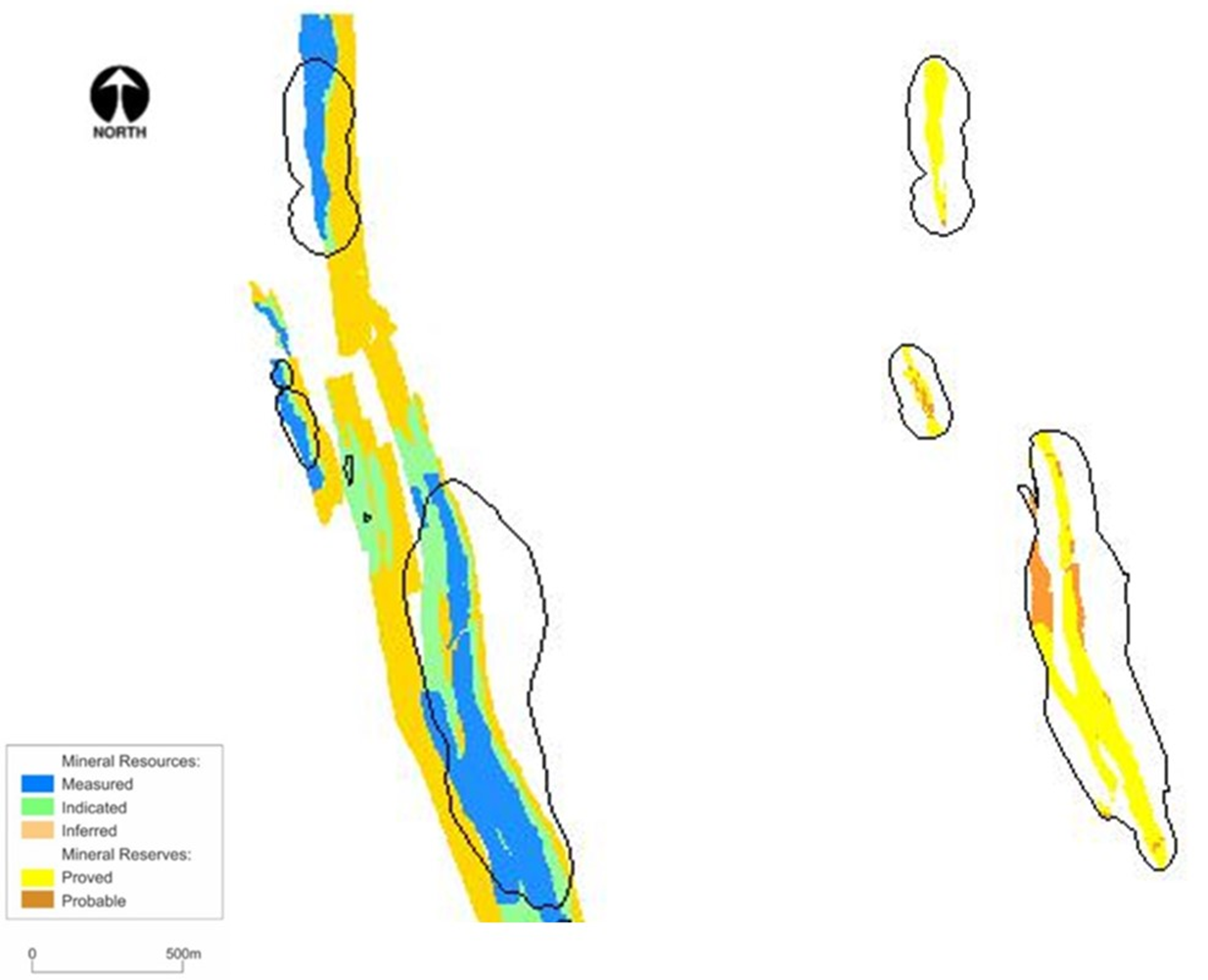

Mineral Resource Estimate

The declared Mineral Resource estimate for Kalgold is based on the January 2024 Mineral Resource model. The model was completed by the QP using Leapfrog Geo 4.5 modelling software. The QP created wireframes and block models using the Datamine RMTM modelling software. The data used for the modelling in Datamine RM was based on a validated DatamineTM (“Datamine”) Fusion database containing exploration drill hole data, obtained until December 2023. The gold grade was estimated using the Ordinary Kriging interpolation method.

For the purposes of this TRS, the Mineral Resources are classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K), which is similar to the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves.

The QP compiling the Mineral Resource estimates is Mr RF Gaelejwe, who is Ore Reserve Manager at Kalgold, and an employee of Harmony.

The Mineral Resource estimate, as at June 30, 2024, exclusive of the reported Mineral Reserves is summarised in Table 1-1. These Mineral Resources account for mining depletions recorded until June 30, 2024 (19 January 2024 actuals plus five months forecast). They incorporate the A Zone, Watertank, Henry's and the Windmill Zone.

Effective Date: June 30, 2024

2

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Table 1-1: Summary of the Kalgold Mineral Resources as at June 30, 2024 (Exclusive of Mineral Reserves) 1-8

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 8.928 | 1.15 | 10 223 |

| Indicated | 14.715 | 1.33 | 19 538 |

| Total / Ave. Measured + Indicated | 23.643 | 1.26 | 29 762 |

| Inferred | 31.688 | 0.60 | 18 855 |

| IMPERIAL |

| Mineral Resource Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 9.841 | 0.033 | 0.329 |

| Indicated | 16.221 | 0.039 | 0.628 |

| Total / Ave. Measured + Indicated | 26.062 | 0.037 | 0.957 |

| Inferred | 34.930 | 0.017 | 0.606 |

Notes:

1. Mineral Resources reported with an effective date of June 30, 2024 were originally classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr RF Gaelejwe, who is Ore Reserve Manager at Kalgold, and a Harmony employee.

2. The Mineral Resource tonnes are reported as in-situ with reasonable prospects for economic extraction.

3. No modifying factors or dilution sources have been included to in-situ Reserve which was subtracted from the SAMREC Resource in order to obtain the S-K 1300 Resource.

4. The Mineral Resources are reported using a cut-off value of 0.55g/t and a gold price of USD1,878/oz

5. Tonnes are reported as rounded to three decimal places. Gold values are rounded to zero decimal places.

6. Mineral Resources are exclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not necessarily demonstrate economic viability.

7. Rounding as required by reporting guidelines may result in apparent summation differences.

8. The inferred portion of the Mineral Resource includes the historical Surface tailings of 6 263Kg (0,201Moz)

9. The Mineral Resource estimate is for Harmony’s 100% interest.

Mineral Reserve Estimate

The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K).

Mineral Reserves are derived from the Mineral Resources, a detailed business plan and the operational mine planning processes. Mine planning utilises and takes into consideration historical technical parameters achieved. In addition, Mineral Resource conversion to Mineral Reserves considers Modifying Factors, dilution, ore losses, minimum mining widths and planned mine call factor. The Mineral Reserves are 0.645Moz as at June 30, 2024 (Table 1-2).

The Mineral Reserves comprise 51% Proved Reserves and 49% are Probable Reserves. In the opinion of the QP, given that Kalgold is an established operation, the Modifying Factors informing the Mineral Reserve estimates would at minimum, satisfy the confidence levels of a Pre-Feasibility Study.

The declared Mineral Reserve is depleted to generate the Kalgold cash flows. The economic analysis of the cash flows displays positive 9% discounted NPV result of ZAR1 150 million. Declared Mineral Reserves are deemed both technically and economically achievable. It is important to note that the Mineral Reserves are declared as delivered to the mills.

Effective Date: June 30, 2024

3

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Table 1-2: Summary of the Kalgold Mineral Reserves as at June 30, 2024 1-5

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Milled Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proved | 10.342 | 0.99 | 10 207 |

| Probable | 8.369 | 1.18 | 9 854 |

| Total (Proved + Probable) | 18.711 | 1.07 | 20 061 |

| | | | | | | | | | | |

| IMPERIAL |

| Mineral Reserve Category | Milled Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proved | 11.400 | 0.029 | 0.328 |

| Probable | 9.225 | 0.034 | 0.317 |

| Total (Proved + Probable) | 20.625 | 0.031 | 0.645 |

Notes:

1. The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr RF Gaelejwe, who is the Kalgold Ore Reserve Manager, and a Harmony employee.

2. Tonnes, grade, and gold content are declared as net delivered to the mills.

3. Figures are fully inclusive of all mining dilutions, gold losses and are reported as mill delivered tonnes and head grades. Metallurgical recovery factors have not been applied to the reserve figures.

4. Gold content is delivered gold content after taking into consideration the modifying factors.

5. Mineral Reserves are reported using a cut-off grade of 0.58g/t determined using a gold price of USD1,772/oz gold.

6. Rounding as required by reporting guidelines may result in apparent summation differences.

Capital and Operating Cost Estimates

The capital and operating cost estimates for Kalgold are based on actual historical data, as well as budget forecasts. Therefore, the forecast costs are reliable, and at minimum meet the confidence levels of a Feasibility Study.

The capital cost estimates for Kalgold are determined using the business plan as a basis. The capital cost elements can be mostly attributed to vehicle replacements, pumping and water control mechanisms, and slope stability monitoring. The capital and operating costs are reported in ZAR terms and on a real basis.

The capital cost estimates are shown in Table 1-3.

The operating cost estimates for Kalgold are categorised into direct and total costs. A summary of the Kalgold operating cost estimate is shown in the Table 1-4. All inclusive unit operating costs starts at R890/t year one and gradually decreases in the last years of life of mine to R393/t in financial year 2036, inline with mining completion and low grade stockpile feeding at the end of life.

The above operating unit costs are as per approved business plan submitted to the board for financial year 2024.

Permitting Requirements

Kalgold has the following valid permits and does not require any additional permits to continue with their mining operations. Environmental Management Programme (Amendment) authorisation was granted by DMRE on March 8, 2022, allowing the expansion of the current mining footprint within the approved Mining Right area.

Kalgold’s valid environmental permits are summarised in Table 1-5.

At the effective date, Harmony was still awaiting the approval of the new Prospecting right application lodged on January 31, 2024. to secure the area where the section 102 application was refused by DMRE in 2021. The Prospecting Rights will be an extension to the current Mining Right which will be converted to a mining right as soon as the resource has been confirmed.

Effective Date: June 30, 2024

4

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Conclusions

Kalgold Mine, a 100% owned Harmony asset, is well-established and has been operating successfully for over 25 years. The mine is accessible within national and provincial roads, with secure infrastructure. Management has a good handle on aspects pertaining to legal and environmental matters with respect to operating within the South African mining law, as regulated by the MPRDA, and supporting legislation.

Kalgold hosts a distinct gold bearing Mineral Resource. The interpretation of the regional geological setting, mineralisation and orebody deposit is well understood and provides valuable insight to the gold mining operations. The mining methods of the Mineral Reserves is of sound design and has evolved over the history of the operations. The current preferred, modular open pit mining method based on the satellite orebodies, has progressively improved, with a significant focus on increased safety, grade control and pit slope stability monitoring. The gold recovery is well monitored through continuous benchmarking initiatives against the mineral processing plants’ historical data.

Harmony is in possession of robust contracts, with the gold price showing upside potential. The economics for Kalgold Mine display positive discounted NPV result of ZAR1 150 million, based on detailed operating and capital costs. The valuation of the asset is proven to be most sensitive to the gold price. The assumptions and conclusions in this TRS contain the views of the QP and does not contain any known material risks at the time of compilation.

Kalgold did not incur any fines or penalties for non-compliance during the year ended June 30, 2024 and no significant encumbrances exist.

Recommendations

The current geological model is well understood. The Mineral Resource model in use, as updated in January 2024, is drilled to a standard suitable for robust estimation. However, a significant amount of additional definition drilling would be required to increase more Mineral Resources to a Measured category, as the small high grade ore lenses that fit inside the current drill spacing, would be better defined. To this end, further exploration drilling is required to expand on the current Mineral Resource and Mineral Reserve base.

Table 1-3: Summary of the Mineral Reserve Capital Cost Estimate for Kalgold

| | | | | |

| Capital Cost Element (ZAR'000s) | Total Mineral Reserve (FY2025- FY2036) |

| Shaft | 73 488 |

| MCC | 37 336 |

| Total | 110 824 |

Table 1-4: Summary of Operating Cost Estimates for Kalgold

| | | | | |

| Operating Cost Element (ZAR'000) | Total Mineral Reserve

(FY2025- FY2036) |

| Wages - payroll 1 | 529 708 |

| Wages - payroll 2 | 44 653 |

| Stores and materials | 1 785 063 |

| Electric power and water | 24 604 |

| Outside contractors | 5 643 911 |

| Other | 447 854 |

| Direct Costs | 8 475 793 |

| Refining charge | 105 031 |

| Assay cost | 57 302 |

| Plant treatment cost | 6 120 199 |

| Re-allocated costs | 6 282 532 |

| Mine overheads re-allocated | (260 591) |

| Total | 14 738 367 |

Effective Date: June 30, 2024

5

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Table 1-5: Status of Environmental Permits and Licences

| | | | | | | | | | | | | | |

| Permit / Licence | Reference No. | Issued By | Date Granted | Validity |

| Environmental Management Programme (Amendment) | NW30/5/1/2/2/77MR | DMR | March 8, 2022 | LOM |

| Environmental Authorisation | (NW) 30/5/1/2/3/2/1/77 EM | DMR | October 4, 2022 | LOM |

| Water Use Licence | 07/D41B/ABCGIJ/4754 | DWS | February 22, 2021 | 15 Years |

| Certificate of Registration Inflammable Liquids and Substances | FS/FLM 01/06/02/2023 | Ngaka Modiri Molema District Municipality | June 6, 2024 | 12 Months |

| Protected Trees Permit | 01-12-2020/24NW | DFFE | December 2, 2020 | December 2, 2025 |

| Atmospheric Emission Licence | NWPG/KALGOLDAEL 4.1,4.13 & 4.17/OCT2023 | DEDECT | October 4, 2023 | September 1, 2024 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Notes: DMRE - Department of Mineral Resources and Energy, DEDECT - Development of Economic Development, Environment, Conservation and Tourism, DWS -Department of Water and Sanitation

Effective Date: June 30, 2024

6

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

2Introduction

Section 229.601(b)(96)(iii)(B)(2) (i-v)

This TRS on Kalgold has been prepared for the registrant, Harmony. The TRS has been prepared in accordance with Regulation S-K 1300. It has been prepared to meet the requirements of Section 229.601(b)96 - Technical Report Summary. The purpose of this TRS is to provide open and transparent disclosure of all material, exploration activities, geological model, mine planning inputs, Mineral Resource and Mineral Reserve information to enable the investor to understand the Kalgold Mine, which forms part of Harmony’s activities.

The TRS was prepared with inputs from Technical Specialists employed by Kalgold or Harmony at Corporate Office. Those based at corporate office, visit the operation on ad hoc basis and they participate in the business planning process reviews.

The TRS was prepared by a QP employed on a full-time basis by the registrant. The QP’s qualifications, areas of responsibility / contribution and personal inspections of the property are summarised in Table 2 1.

Table 2-1: List of Responsible and Contributing Authors

| | | | | | | | | | | | | | |

| Qualified Person | Prof. Assoc. | Qualifications | TRS Section Responsibility | Personal Insp. |

| Mr RF Gaelejwe | SACNASP (400207/14) | BSc. Hons (Geol), PgDip, EMBA | All | Full time |

| | | | |

The QP states that this TRS updates the TRS filed by Harmony on Kalgold on October 31, 2023, named Exhibit 96.6 Technical Report Summary of the Mineral Resources and Mineral Reserves for Kalgold Mine, North West Province, South Africa, which was effective on June 30, 2023. This updated TRS has an effective date of June 30, 2024, and no material changes occurred between the effective date and the final date of this report.

3Property Description

Section 229.601(b)(96)(iii)(B)(3) (i-vii)

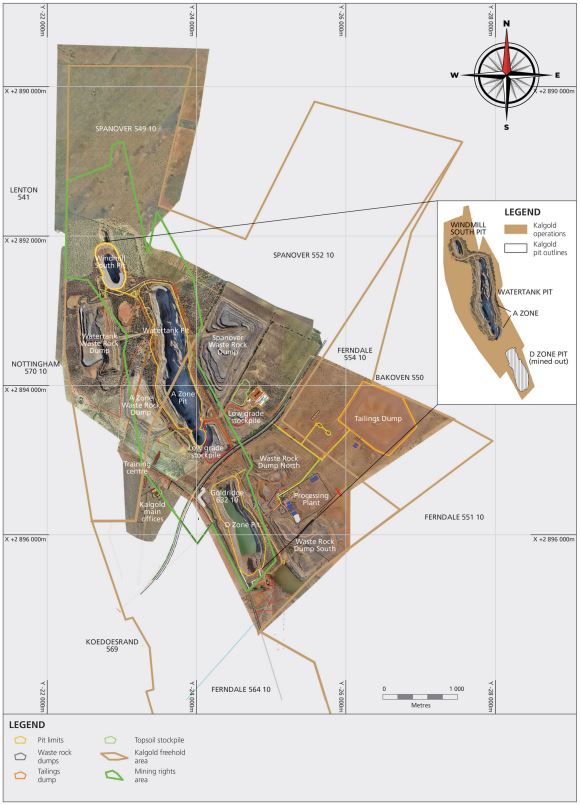

Kalgold is located at latitude 26°10.0’S and longitude 25°14.5’E, 55km southwest of Mahikeng, between Mahikeng and Stella, along the Mahikeng-Vryburg road (N18) in North West Province, South Africa (Figure 3-1). The Kalgold Mine is serviced by well-maintained sealed roads with good access to all nearby towns and cities. The mine is surrounded by farmland and the closest community is at Kraaipan, approximately 15km to the south of the mine. The Kalgold Mine has been in operation since 1997 and is the only significant mining operation in the region.

3.1Mineral Tenure

South African Mining Law is regulated by the MPRDA which is the predominant piece of legislation dealing with acquisitions or rights to conduct reconnaissance, prospecting, and mining. There are several other pieces of legislation which deal with such ancillary issues such as royalties (MPRDA), title registration (Mining Titles Registration Act, 1967), and health and safety (Mine Health and Safety Act, 1996).

The Kalgold Mining Right, which encompassed 615ha, was successfully converted, executed, and registered as a New Order Mining Right on 24 February 2015 as MR12/2015 under Mining Right Protocol 574/2008. A Section 102, in terms of the MPRDA, to include portions of the farms Goldridge 632 IO and Ferndale 544 IO was executed on 9 November 2010 under Mining Right Protocol 774/2010.

The Mining Right now encompasses 988.23ha (Figure 3-2, Table 3-1). The mining right was issued for a period of 30 years, expiring on 27 August 2038, and Kalgold has the exclusive right to renew the right for a further 30 years. The Kalgold mineral rights are held by Harmony (Table 3-1, Figure 3-2). Under the MPRDA, Harmony is entitled to apply to renew the mining right on its expiry. At the effective date, Harmony was still awaiting the approval of the new Prospecting right application lodged on January 31, 2024 to secure the area where the section 102 application was refused by DMRE in 2021. The Prospecting Rights will be an extension to the current Mining Right which will be converted to a mining right as soon as the resource has been confirmed.

Figure 3-1 depicts the prospecting right boundaries of the renewed application refused by DMRE in 2021.

Table 3-1: Summary of Mineral Rights for Kalgold

Effective Date: June 30, 2024

7

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

| | | | | | | | | | | | | | | | | |

| Licence Holder | Licence Type | Reference No. | Effective Date | Expiry Date | Area (ha) |

| Kalahari Goldridge Mining Company Ltd | MR | NW30/5/1/2/2/77 MR | 26-Aug-08 | 27-Aug-38 | 988.23 |

| PR | NW30/5/1/1/2/14264 PR | PR application lodged 31 January 2024 | 16 254.10 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Notes: MR - Mining Right, PR - Prospecting Right

There is no material litigation (including violations or fines) against the Company which threatens its mineral rights, tenure, or operations.

3.2Property Permitting Requirements

Kalgold is located on a site that has been operational for over 40 years. The surface rights in the Kalgold area were previously held by Shamrock Mining and Prospecting Company (“Shamrock”), a wholly owned exploration and development subsidiary of Shell Limited (“Shell”). Harmony has access to all the properties it requires to conduct its current mining activities. The surface lease and surface right areas are sufficient in size and nature to accommodate the required surface infrastructure to facilitate current and planned mining and processing operations. There are no land claims or other legal proceedings that may have an influence on the rights to mine the minerals.

Harmony monitors complaints and litigation against the Company as part of its risk management systems, policies, and procedures. There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its property permitting. The QP is also not aware of any land claims pending on the property.

Figure 3-1: Location of Kalgold

Effective Date: June 30, 2024

8

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 3-2: Mineral Tenure of Kalgold

Effective Date: June 30, 2024

9

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

4Accessibility, Climate, Local Resources, Infrastructure and Physiography

Section 229.601(b)(96)(iii)(B)(4) (i-iv)

4.1Accessibility

Kalgold is located adjacent to the N18 National Road and can be reached via the local R49 road between Mahikeng and Vryburg (Figure 3-1). The mine is surrounded by farmland. The closest community is at Kraaipan, approximately 15km to the south of the mine. Access to the mine is restricted by security fencing, security guards, booms, and lockable gates at the main entrance. In addition, a communication system and access control system monitors personnel entering and leaving the mine property.

4.2Physiology and Climate

Kalgold is situated approximately 1,250 metres above sea level (“masl”) on the south eastern edge of the Kalahari Desert. The topography around the area is generally flat to low undulating country with outcrops rare and commonly confined to low ridges and hillocks. Much of the mine area is covered in bright orange-red Kalahari sands which progressively get deeper to the north and south of the operation. A significant paleo-channel cuts the mine site to the south and another to the north of the operation.

The area comprising farmlands are devoted to cereal production and cattle farming. However, there are belts of natural vegetation present which are considered part of the Savannah Biome and forms part of the Semi-arid Bushveld. The vegetation comprises Kalahari Thornveld and shrub Bushveld which is dominated by grasses and open forest comprising trees from the genus Acacia.

The climate is in a region that is considered as sub-tropical steppe climate, synonymous to a sub-tropical desert which is hot and dry. The winters are characterised as cool to mild, experiencing a daily mean temperature of approximately 16°C and the summers are characterised as hot and humid, experiencing a daily mean temperature of approximately 31°C. The average annual rainfall for the area is approximately 100mm - 550mm, the majority of which falls during the months of November to February. The months of May through to September rarely sees rain. The average annual precipitation for the area is approximately 37mm. The wettest month experienced is February (~80mm). Rain occurs during only 17.2% of the year, while no rainfall is received for 82.8% of the year. However, the Kraaipan area can experience rare occurrences of heavy rainfall which can result in a brief stoppage of the open pit mining activities. There are no other specific climatic risks which affect the property.

4.3Local Resources and Infrastructure

Infrastructure in the region is well established. Kalgold Mine is serviced locally by well-maintained sealed roads with good access to all nearby towns and cities. Regional infrastructure also includes power transmission and distribution and communication networks. Schools, clinics and hospitals are readily available in the surrounding areas. The mine personnel are typically sourced from local communities e.g., Ratlou local municipality, in which they reside.

Operations are powered by electricity from Eskom Holdings State Owned Company (“SOC”) Limited.

Ore and waste material are transported separately, with ore being trucked from the pit to the plant ROM pad, and waste rock going to the mines waste dumps. Marginal and low-grade ore is transported by truck and stockpiled for future processing. Kalgold has its own processing plant situated adjacent to the mine.

Mining consumables, such as processing reagents, diesel, etc, are sourced from neighbouring provinces through the procurement system managed from Corporate Office located in Randfontein, Gauteng province.

Effective Date: June 30, 2024

10

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

5History

Section 229.601(b)(96)(iii)(B)(5) (i-ii)

5.1Historical Ownership and Development

Kalgold was previously known as Shamrock, formed in 1982 as a wholly owned exploration and development subsidiary of Shell.

Exploration of the Kraaipan Greenstone belt by Shell, began in the 1980s. In 1994, West Rand Consolidated Mines (“WRCM”) acquired Shamrock. The company changed its name to Kalgold in May 1996 and was listed on the Johannesburg Stock Exchange on 14 October 1996, via an issue of 18.4% of the shares of the company, as a dividend in specie, to shareholders of WRCM.

Harmony acquired 100% of Kalgold in July 1999. The historical ownership and associated activities related to Kalgold are summarised in Table 5-1.

Table 5-1: Summary of Historical Ownership Changes and Activities of Kalgold

| | | | | |

| Year | Asset History Highlights |

| 1982 | Formed by Shamrock, a wholly owned exploration and development subsidiary of Shell. |

| 1987 - 1994 | Shell conducted extensive exploration work in the Kraaipan region. In 1991, the D Zone one area was discovered on the Goldridge farm. |

| 1994 | Shamrock was acquired by West Rand Consolidated Exploration Limited, a subsidiary of WRCM. |

| 1994 - 1996 | WRCM intensified exploration work. Mining commences in the D-Zone, in December 1995. |

| Jan-96 | Construction of the crushing plant and phase 1 of the metallurgical extraction plant, consisting of the heap leach and gold recovery section, began. |

| May-96 | WRCM changed its name to Kalahari Goldridge Mining Company Limited (“Kalgold”). |

| Jul-96 | Planned mine infrastructure activities are completed and the first gold is produced. |

| Oct-96 | Kalgold listed on the Johannesburg Stock Exchange (JSE), via an issue of 18.4% of the shares of the company as a dividend in specie to shareholders of WRCM. |

| Dec-96 | The D-Zone open pit was exposed to a maximum depth of 25m below surface. The plant ore processing capabilities averaged at approximately 70ktpm. 174kg of gold was produced from approximately 345kt of low-grade and near-surface heap leach ore. |

| Mar-97 | Mills are installed and the plant ore processing capabilities was increased to an average of approximately 90ktpm. |

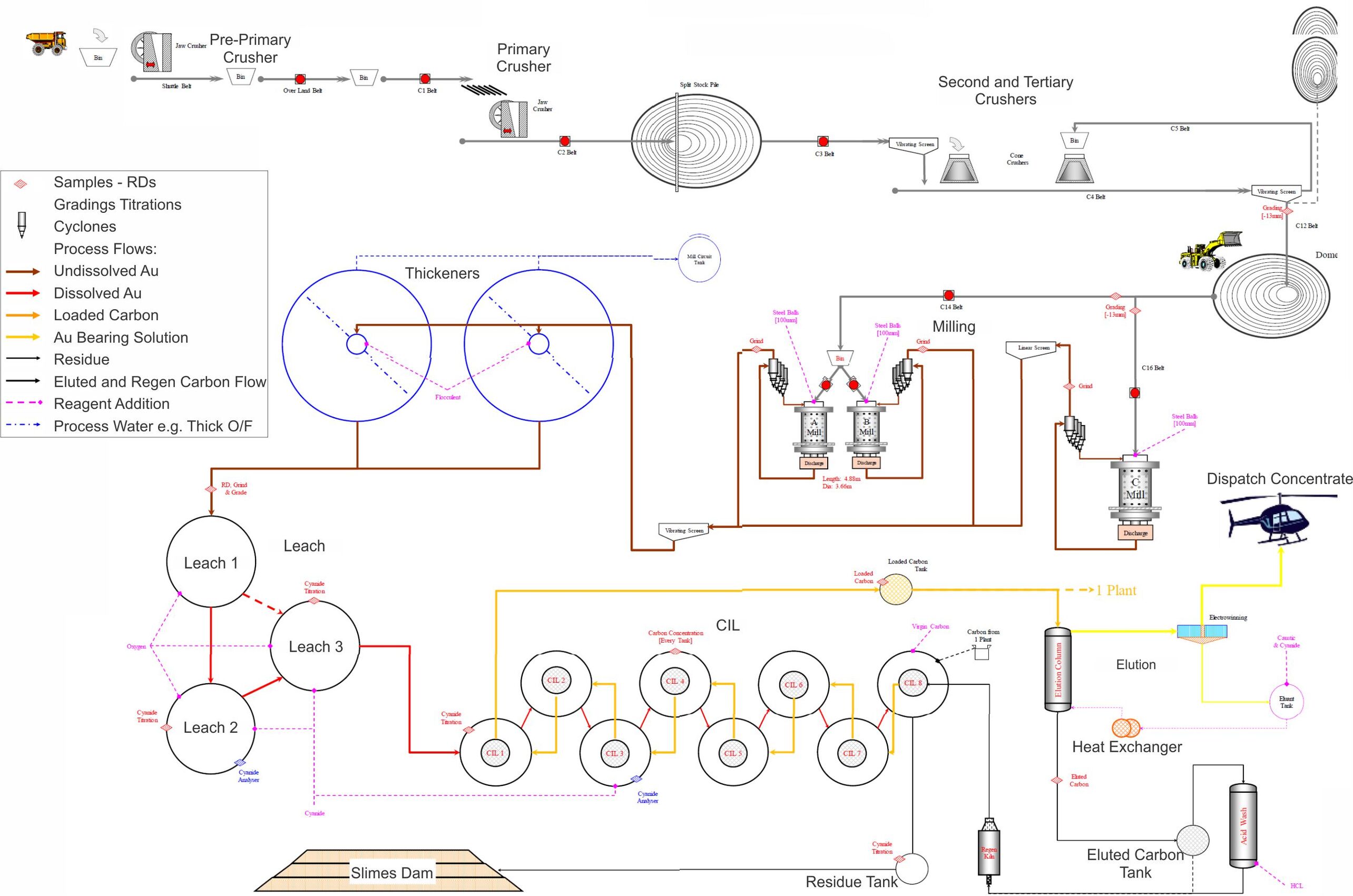

| May-97 | Construction commenced on the second phase of the processing facility which included an 80ktpm carbon-in-leach (“CIL”) plant and associated Tailings Storage Facility (“TSF”). |

| Jan-98 | The second phase of the construction was fully commissioned. The throughput in the heap leach facility was reduced. |

| Jul-99 | Harmony acquires Kalgold. |

| 2003 | A third mill was added to increase treatment capacity. |

| 2012 | A Mineral Resource model was constructed by ExplorMine Consultants. |

| 2017 - 2019 | Exploration drilling supported improvements in significantly expanding the understanding of the deposit, upgraded the Windmill and A Zone south extension (Henry) pit Mineral Resources, and provided insightful data to the areas between the A-Zone and Watertank Zone (current mining), known as the Bridge Zone. |

| 2018 | A new Mineral Resource model was generated by the Harmony South East Asia team. The model included the updated drilling database based on the exploration drilling, and an updated geological and oxide model based on new drilling information. |

| 2019 | The Mineral Resource model was updated by the Harmony South East Asia team. The model included the updated drilling database based on additional exploration drilling and updated implicitly geological and oxide models. |

| 2022 - 2024 | Harmony team updated the Mineral Resource model yearly using Datamine. The model included the updated drilling database based on additional exploration drilling and geological limb models. |

Effective Date: June 30, 2024

11

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

5.2Historical Exploration

Historical technical investigations which led to the discovery of the Kalgold deposit include detailed geological mapping, soils sampling, geotechnical sampling and geophysical surveys, followed by drilling and metallurgical testwork. A total of 212,395m of exploration and evaluation drilling was completed within the area and on surrounding properties in the periods 1987 to 2023. Historical drilling completed by previous owners is summarised in Table 5-2 and includes air core (“AC”), percussion, reverse circulation (“RC”) and diamond core (“DD”) drilling. Much of the deeper historic drilling has been focused on the D Zone Pit which has been mined out.

Table 5-2: Summary of Historical Drilling at Kalgold

| | | | | | | | | | | | | | | | | | | | | | | |

| Year | Company | No. Drill Holes | Drill Hole ID | Diamond Drill Hole (m) | Percussion Drill Hole (m) | AC or RC (m) | Assay Lab |

| N/A | Various | 2 805 | ARC Series, CRC series, GDP Series, DD series, ADD Series, SDD Series, SPD Series, WDD | 18 167 | 71 820 | 21 240 | N/A |

| 1990 | Shell | 11 | GDP1-GDP11 | — | 300 | 352 | N/A |

| 1991 | Shell | 43 | GDP12-GDP76 DD1-DD5 | 933 | 1 514 | 845 | N/A |

| 1992 | Shell | 6 | GDP253-GDP259 | — | 150 | — | N/A |

| 1993 | Shell | 3 | GDP331-GDP333 | — | — | 183 | - |

| 1995 | WRCM | 18 | GDP377-GDP404 DD18-DD21 | 487 | 101 | 175 | N/A |

| 1996 | Kalgold | 1 | GDP415 | — | — | 77 | N/A |

| 1997 | Kalgold | 63 | GDP440-GD600 | — | 1 783 | 5 870 | N/A |

| 1998 | Kalgold | 1 | GDP589 | — | — | 528 | N/A |

| 1999 | Harmony | 46 | GDP602-GD647 | 588 | 879 | 5 132 | N/A |

| 2000 | Harmony | 1 | WB98 | — | — | 150 | N/A |

| 2001 | Harmony | 17 | GDP648-GDP664 | — | — | 1 853 | N/A |

| 2002 | Harmony | 37 | GDP668-GDP707 | 8 200 | — | 234 | N/A |

| 2003 | Harmony | 6 | GDP710-GDP716 | 1 150 | — | 295 | N/A |

| 2017 | Harmony | 34 | KG001-KG037 | 4 935 | 3 934 | — | SGS |

| 2018 | Harmony | 97 | KG029 - KG126 | 25 194 | 4 952 | — | SGS |

| 2019 | Harmony | 81 | KG127 KG204 | 3 173 | 7 370 | — | SGS |

| 2022 | Harmony | 142 | KG205-KG344 | 101 | 16 135 | — | SGS |

| 2023 | Harmony | 35 | KG345-KG380 | — | 3 595 | — | SGS |

| Total | 3 447 | | 62 928 | 112 533 | 36 934 | |

Notes: Lab - Laboratory

5.3Previous Mineral Resource and Mineral Reserve Estimates

The previous Mineral Resource estimate for Kalgold was reported by Harmony on June 30, 2023 in accordance with Regulation S-K 1300; 229.601(b)(96). The Mineral Resource estimates are updated annually by Harmony, incorporating the latest exploration drilling information. The previous Mineral Resource estimate exclusive of Mineral Reserves is presented in Table 5-3. The inferred portion of the Mineral Resource includes the historical Surface tailings of 6 263Kg (0,201Moz).

Effective Date: June 30, 2024

12

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Table 5-3: Summary of the Previous Kalgold Mineral Resources as at June 30, 2023 (exclusive of Mineral Reserves)

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 3.474 | 1.05 | 3 634 |

| Indicated | 31.832 | 1.20 | 38 187 |

| Total / Ave. Measured + Indicated | 35.306 | 1.18 | 41 821 |

| Inferred | 25.448 | 0.34 | 8 648 |

| IMPERIAL |

| Mineral Resource Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 3.830 | 0.031 | 0.117 |

| Indicated | 35.089 | 0.035 | 1.228 |

| Total / Ave. Measured + Indicated | 38.918 | 0.035 | 1.345 |

| Inferred | 28.052 | 0.010 | 0.278 |

The previous Mineral Reserve estimate for Kalgold was declared by Harmony on June 30, 2023 in accordance with the SAMREC Code. Modifying Factors were considered and applied to the Mineral Resource to arrive at the Mineral Reserve estimate. These factors included the cut-off grade, the mine call factor (“MCF”), dilution, and the plant recovery factor. The previous Mineral Reserve estimate is summarised in Table 5-4 and has been superseded by the current estimate prepared by Harmony as detailed in Section 11 of this TRS.

Table 5-4: Summary of the Previous Kalgold Mineral Reserves as at June 30, 2023

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proved | 5.384 | 0.93 | 4 991 |

| Probable | 8.529 | 0.85 | 7 217 |

| Total / Ave. Proven + Probable | 13.913 | 0.88 | 12 208 |

| IMPERIAL |

| Mineral Reserve Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proved | 5.935 | 0.027 | 0.160 |

| Probable | 9.401 | 0.025 | 0.232 |

| Total / Ave. Proven + Probable | 15.336 | 0.026 | 0.392 |

5.4Past Production

The opening up of the D Zone pit commenced in December 1995. By December 1996, ~2.1Mt of overburden waste material had been moved, to gain access to the D-Zone orebody and approximately 345kt of low-grade and near-surface heap leach ore was treated. Plant construction activities started at the Kalgold site in January 1996, with the crushing plant and Phase 1 of the metallurgical extraction plant. By 30 July 1996, when the first gold was poured, the mine infrastructure was complete.

Ore was treated by heap leaching until the installation of the first two mills in 1997. The mill rate built up to more than 90ktpm by the end of the first quarter of 1997. In May 1997 construction work commenced on the second phase of the processing facility which included an 80ktpm CIL plant and associated tailings disposal facility. In 1998, when the mill and CIL plant were fully commissioned, throughput in the heap leach facility was reduced to 50ktpm. In 2003, a third mill was added to increase treatment capacity. The D Zone pit was mined out in 2009.

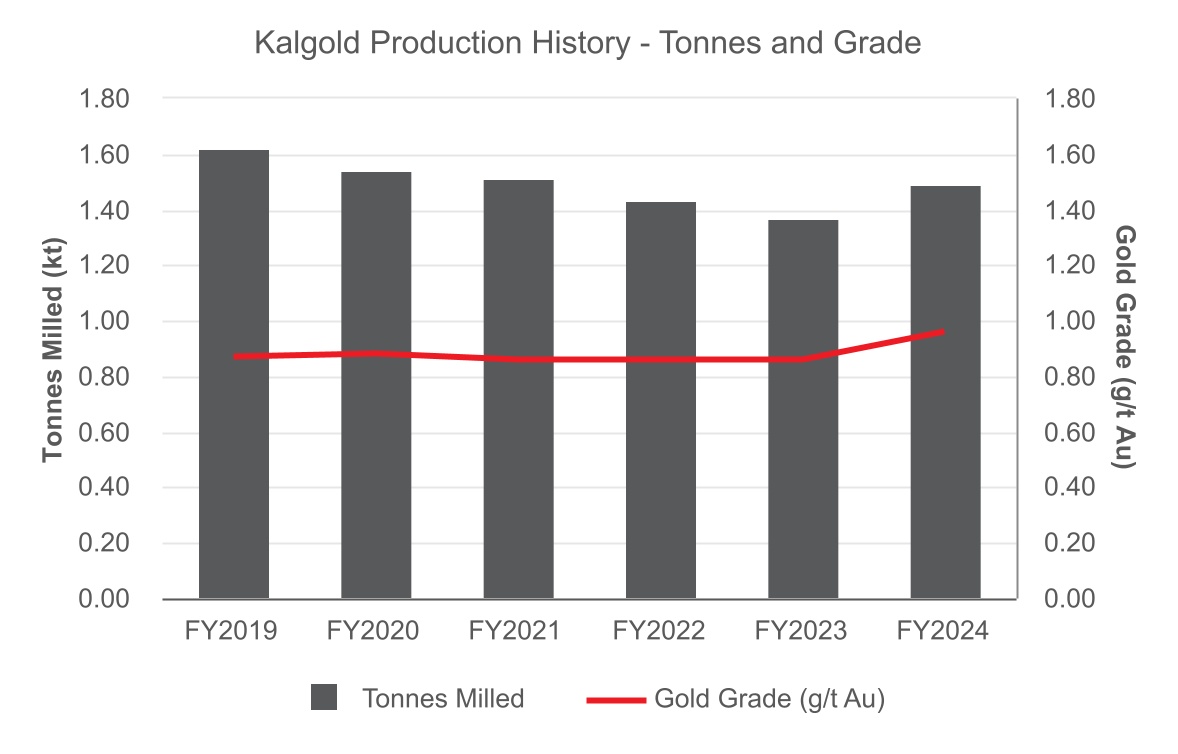

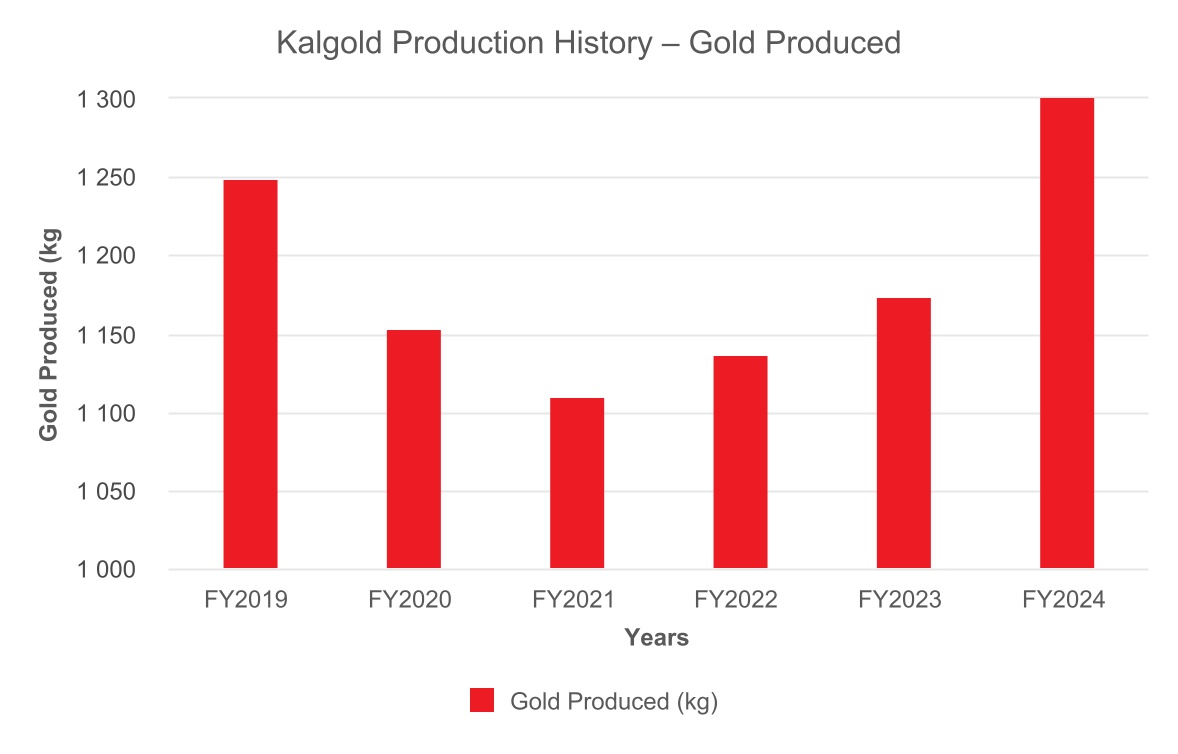

Past production for Kalgold is presented in Figure 5-1 and Figure 5-2. The production numbers are reported on a 12 month Harmony Financial year calendar starting July ending June.

Effective Date: June 30, 2024

13

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 5-1: Graph of Kalgold Production History – Tonnes and Grade

Figure 5-2: Graph of Kalgold Production History – Gold Produced

Effective Date: June 30, 2024

14

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

6Geological Setting, Mineralisation and Deposit

Section 229.601(b)(96)(iii)(B)(6) (i-iii)

6.1Regional Geology

The Kaapvaal Craton of southern Africa hosts many of the region's economic mineral deposits. The craton has been subdivided into four sectors, namely the Eastern, Central, Northern and Western Terranes. The Western Terrane hosts the KGB, Amalia, and Madibe greenstone belts, and their southerly extensions. It is also host to the Gaborone Granite Complex to the north, which intrudes the Archaean granite-greenstone basement in south-eastern Botswana (Poujol et. al, 2002).

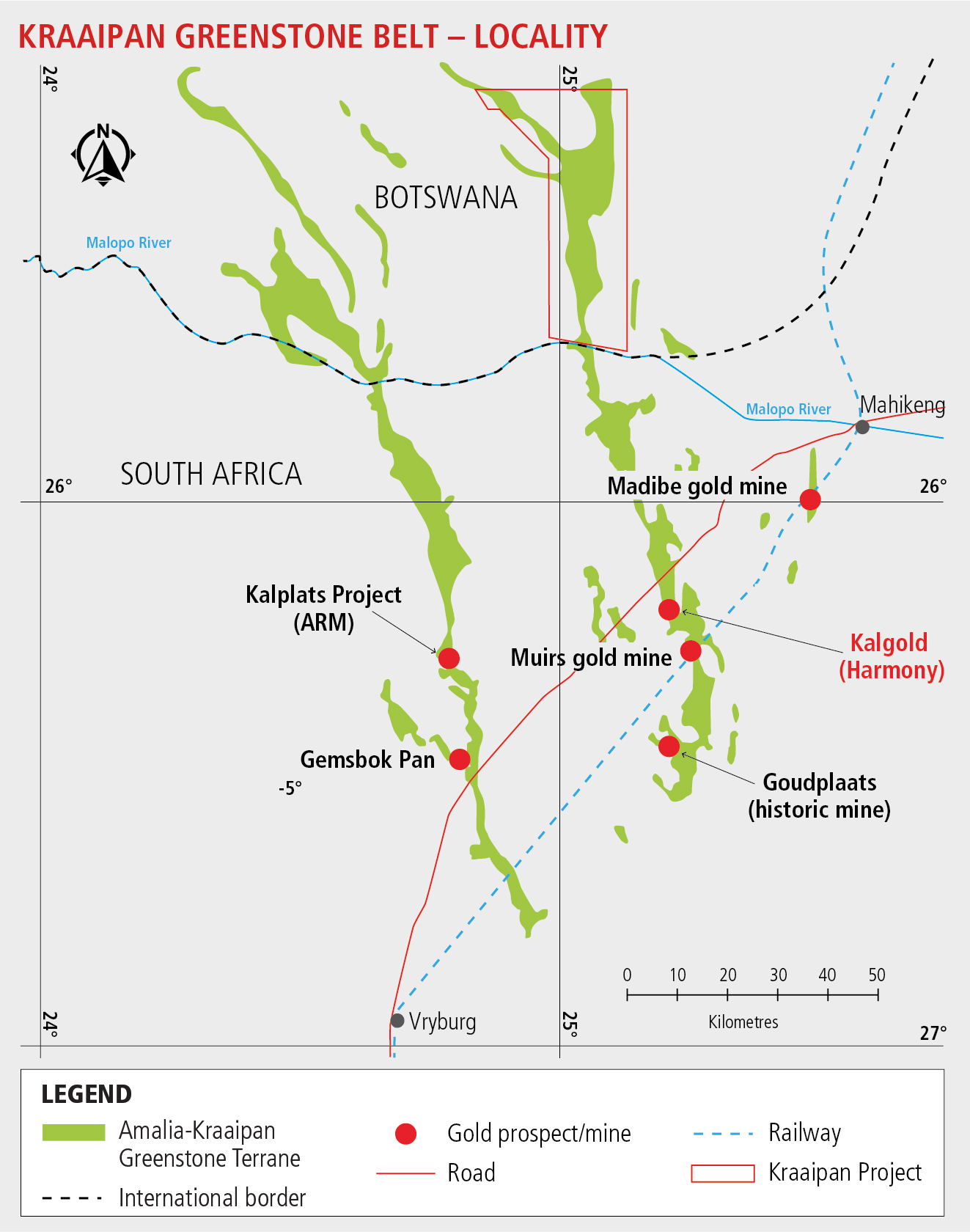

The Kalgold deposit is located within the KGB. The KGB has received significantly less geological attention when compared to the Murchison and Barberton greenstone belts, situated in the Northern and Eastern Terranes, respectively (Hammond and Moore, 2006). Investigations conducted in the region indicated that the KGB extends approximately 250km, in a north-south direction, from southern Botswana into South Africa (Hammond and Moore, 2006) (Figure 6-1). In the north, the KGB is subdivided into three narrow, sub-parallel north-to northwest-trending belts, spaced at 30km - 40km intervals, namely the western (Stella), central (Kraaipan) and eastern (Madibeng) belts.

The KGB, consisting of metamorphosed mafic volcanic rocks and interlayered metasediments (mainly gold-hosting BIFs, jaspilite’s and ferruginous chert), are exposed as discontinuous outcrops of steeply dipping units beneath cover sequences comprising mainly late Archean volcanic rocks of the Ventersdorp Supergroup and a blanket of Tertiary-to-Recent Kalahari sands. A variety of granitoid rocks (ranging from tonalitic and trondhjemitic gneisses through to granodiorite – monzonite) intruded the KGB. This age relationship was based upon whole-rock lead dating of the BIFs which yielded an age of 3,410Ma (±61Ma – 64Ma).

The lack of exposure has made mapping of the KGB difficult. However, subdivisions of the Kraaipan Group have been proposed for the region on the basis BIFs and chert exposures (SAC, 1980). The Kraaipan Group consists of three formations, namely the Khunwana, Ferndale and Gold Ridge formations. The Gold Ridge Formation is the oldest of the three and contains gold hosting BIFs (Anon, 2017).

6.2Local Geology

The Kalgold deposit occurs within the central (Kraaipan) belt (Figure 6-1), which comprises steeply dipping gold-hosting BIFs interbedded with magnetite quartzite, chert, greywacke, shale, and schist (Figure 6-2). BIFs are rhythmically banded chemical sediments comprising alternating light and dark laminae, which vary from 10mm - 50mm in thickness (Hilliard, 1996). The assemblage is surrounded by intrusive granites and gneisses. These rocks have a complex history of deformation, which includes folding, thrusting, faulting, and shearing. Several large dykes with a predominant east-west trend have intruded the rocks.

6.3Property Geology

The geology of the Mining Right area and its immediate vicinity is characterized by ferruginous chemical and clastic sediments interbedded with meta-lavas and non-ferruginous metasedimentary rocks. Outcrops in the area are sparse and generally restricted to the ferruginous rock types which are more resistant to erosion. The Kalahari Sand cover ranges from 2m - 12m thick. Magnetite quartzite and clastic sediments form a low ridge to the west of the lease area. Eastwards of this unit the iron-rich rocks generally comprise chemical sediments represented by magnetite-rich BIF, cherty BIF, and banded chert. These units are interbedded with mafic schist, greywacke, and sparse black shale (Mathe and Hilliard, 1998).

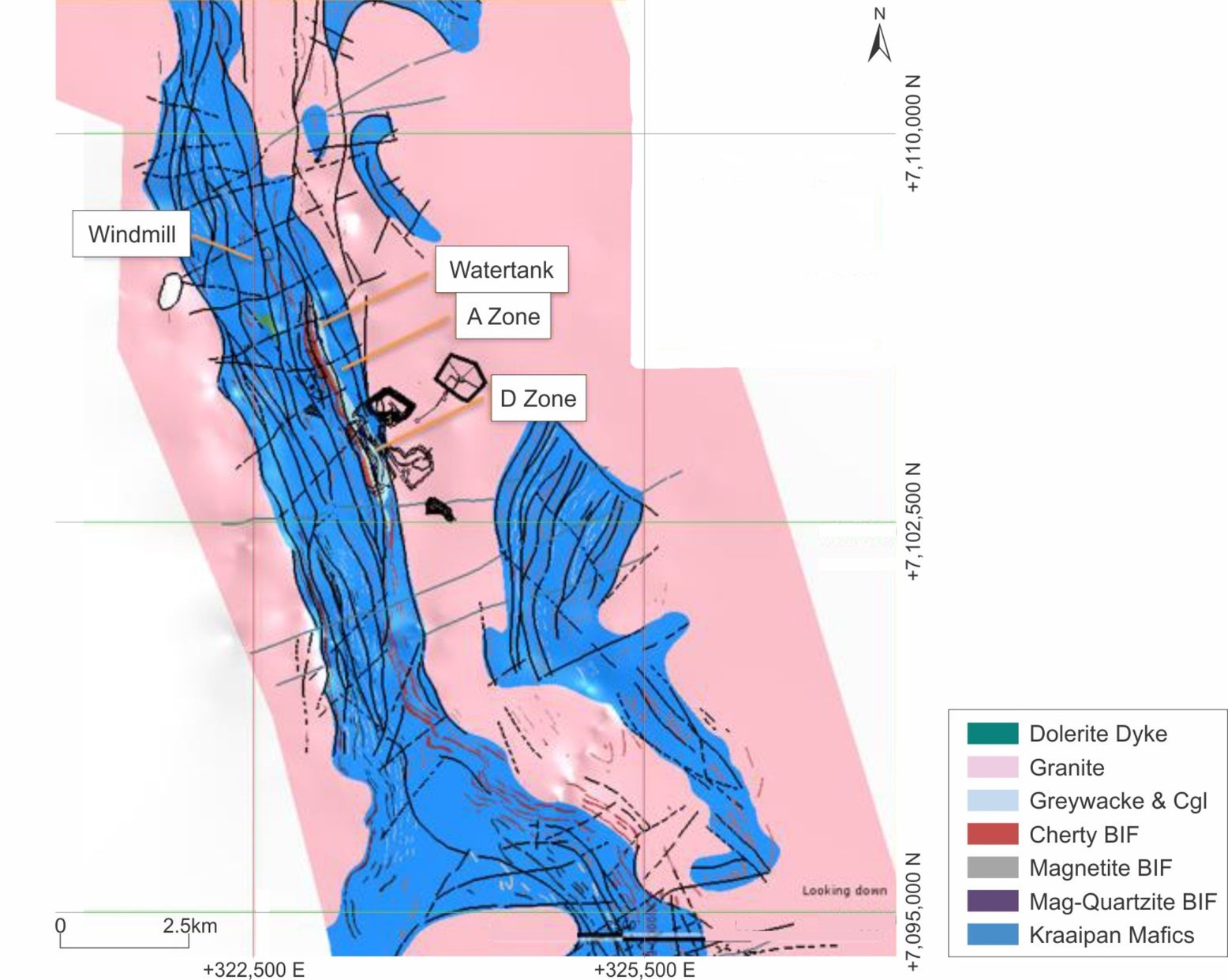

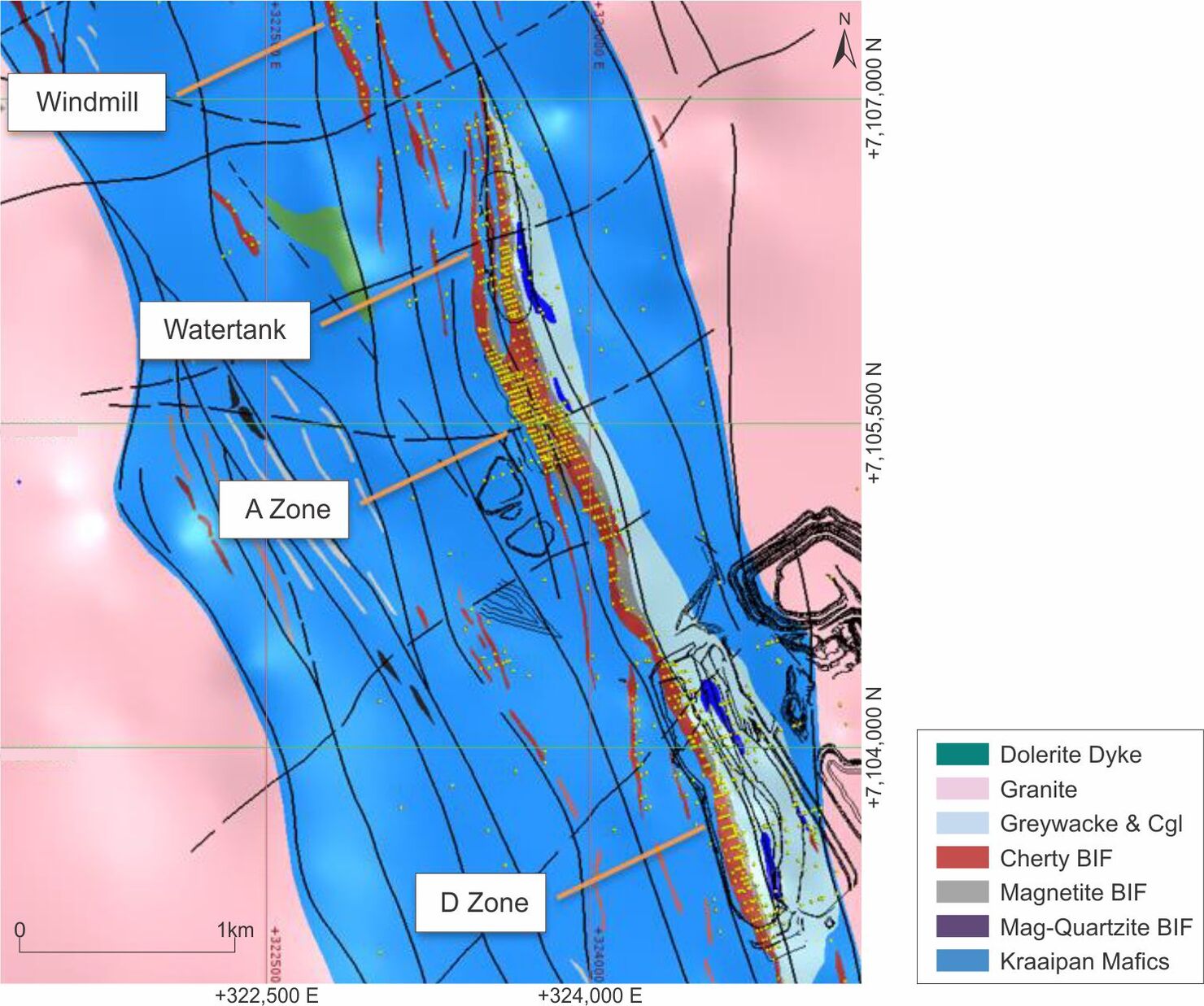

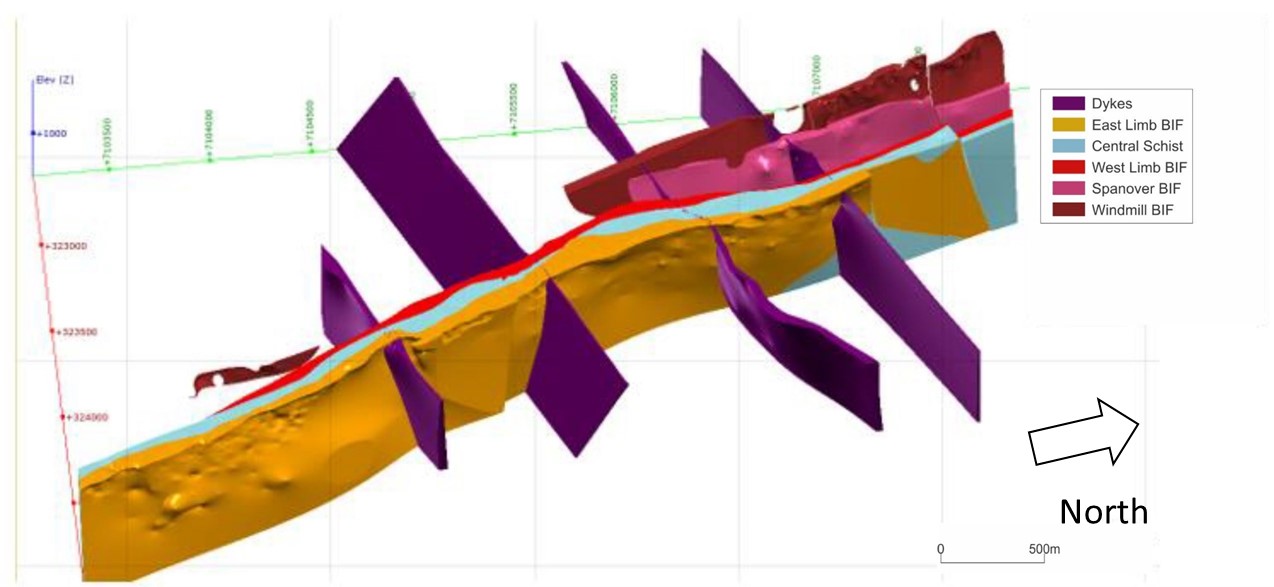

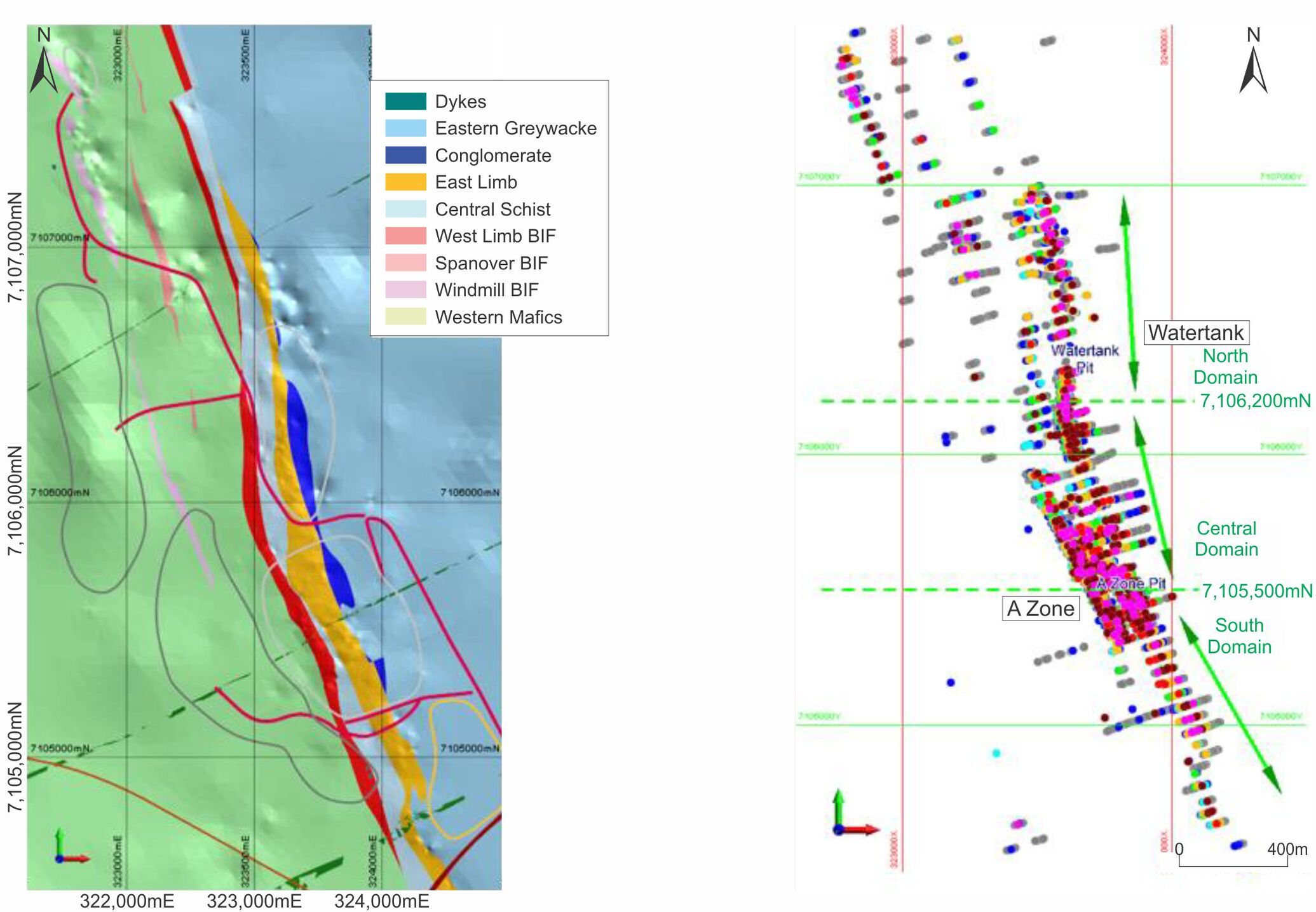

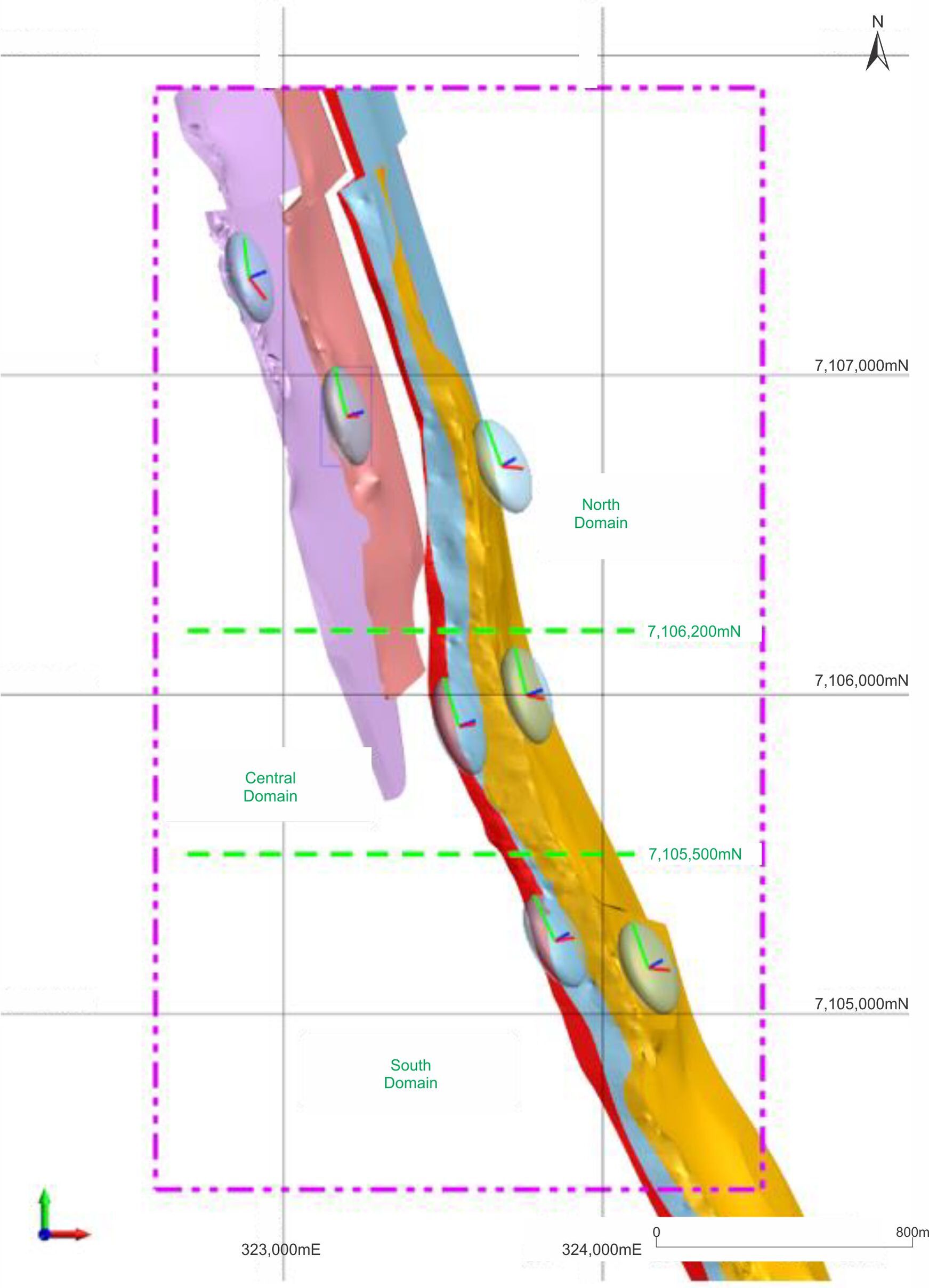

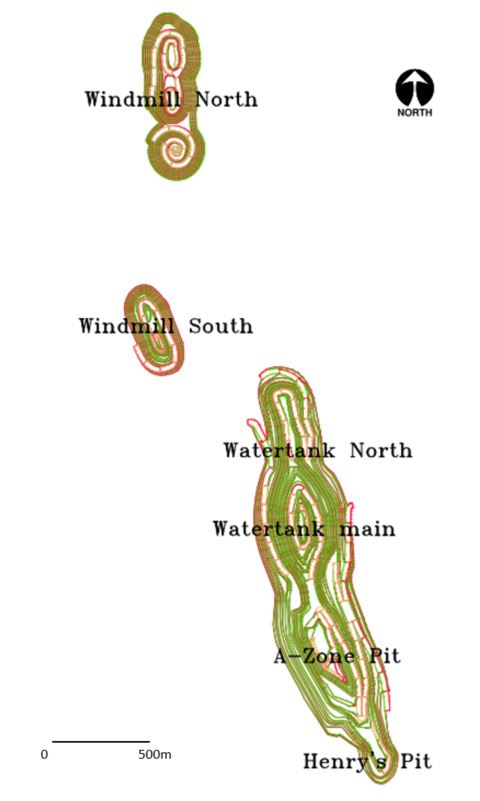

Kalgold comprises five discrete mineralised zones, namely D Zone, A Zone, Watertank, Windmill and A Zone south extension (Henry) (Figure 6-3), which are all hosted in BIF. Watertank pit can be split into Watertank Main and North. Watertank North refers to the Northern extension of the pit. The Spanover Zone occurs closer to the Windmill zones. The geology of the D Zone is used as a benchmark at Kalgold. The previous mining activities have provided extensive geological information of the deposit. Pits are now well established in the A Zone and Watertank areas. However, the geology does not vary significantly from that found at D Zone. Deposit thickness ranges up to 45m, and the main line of lode containing the D Zone, A Zone and Watertank Zone extends over 4.5km of strike.

Effective Date: June 30, 2024

15

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 6-1: Regional Geology of the Kraaipan Greenstone Belt

Effective Date: June 30, 2024

16

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 6-2: Local Geology of Kalgold

Figure 6-3: Property Geology of Kalgold

Effective Date: June 30, 2024

17

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

The D Zone is hosted by a sheared, cherty-BIF with associated silicification and carbonate alteration. The gold mineralisation occurs within blebs, veins, and disseminations of pyrite and pyrrhotite, which are oxidized, to goethite near the surface. This zone dips 70° east, and has a strike length of 1,500m, varying in width between 15m-45m. The footwall rocks predominantly comprise chloritic schist with subordinate BIF and carbonaceous shale. Carbonaceous shale and greywacke are exposed in the hanging wall.

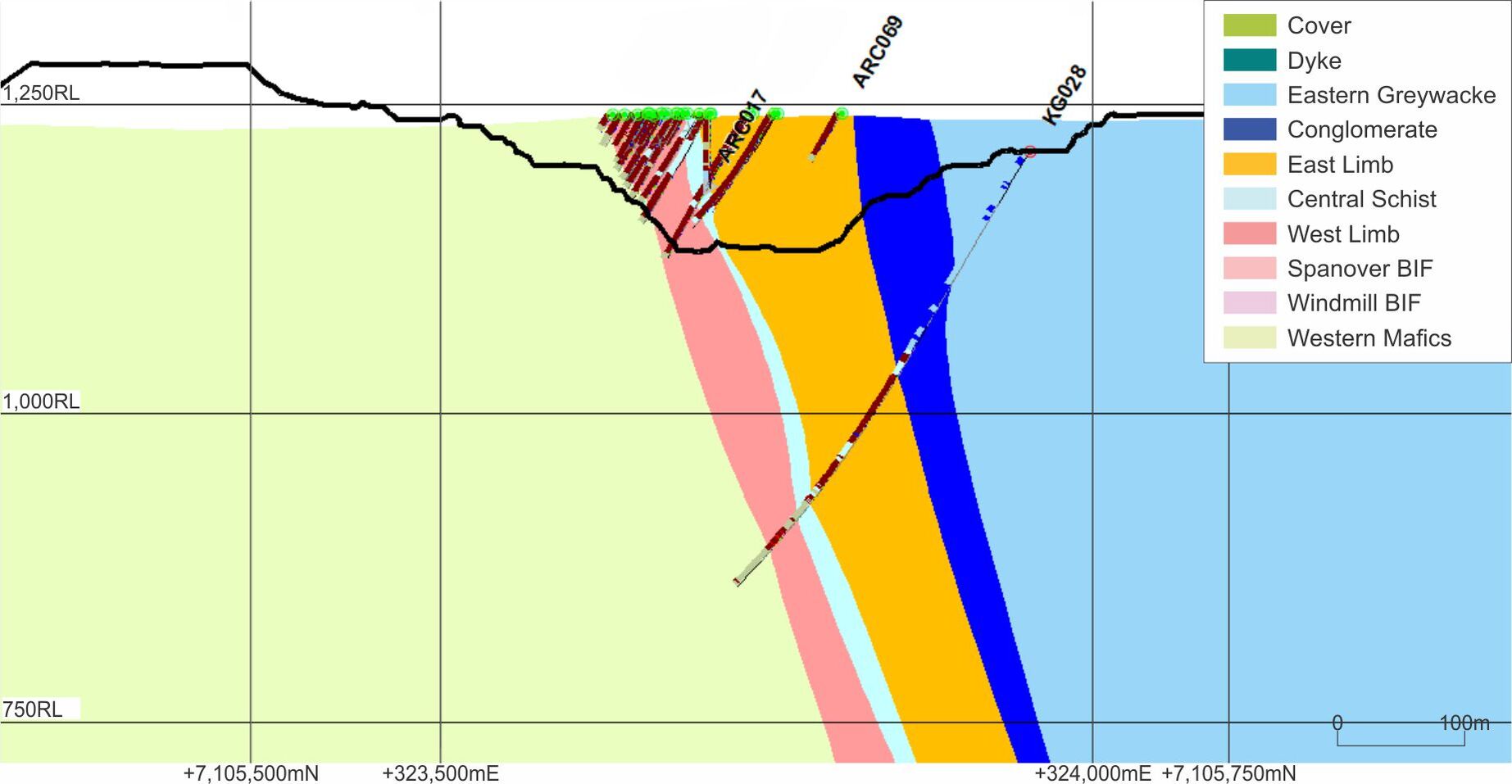

The A Zone occurs to the north of the D Zone at a similar stratigraphic position. It is a composite, consisting of several mineralised cherty BIF units that are interbedded with schist and shale and is referred to as the east limb in Figure 6-4. Due to shearing in the pillow basalts between the two BIF lenses, the central schist unit thins out and both west and east limbs are very close to each other in the A Zone pit. The A Zone has an overall strike length of 850m and comprises individual zones of mineralisation which are steeply dipping and have strike length that ranges from 200m - 500m. The width of these mineralised zones or mineralised limbs range between 15m - 70m.

A section through the A Zone from the June 2019 geological model (Figure 6-4) shows the east and west limbs. The east limb and west limb are separated by a zone of sericite-chlorite schist with intercalated shale and phyllite that pinches out to the north. The A Zone west limb is situated in the footwall of the A Zone, and is separated by a chloritic schist unit that pinches out to the north. The A Zone west limb has an overall strike length of 750m and width of 20m thinning to the north.

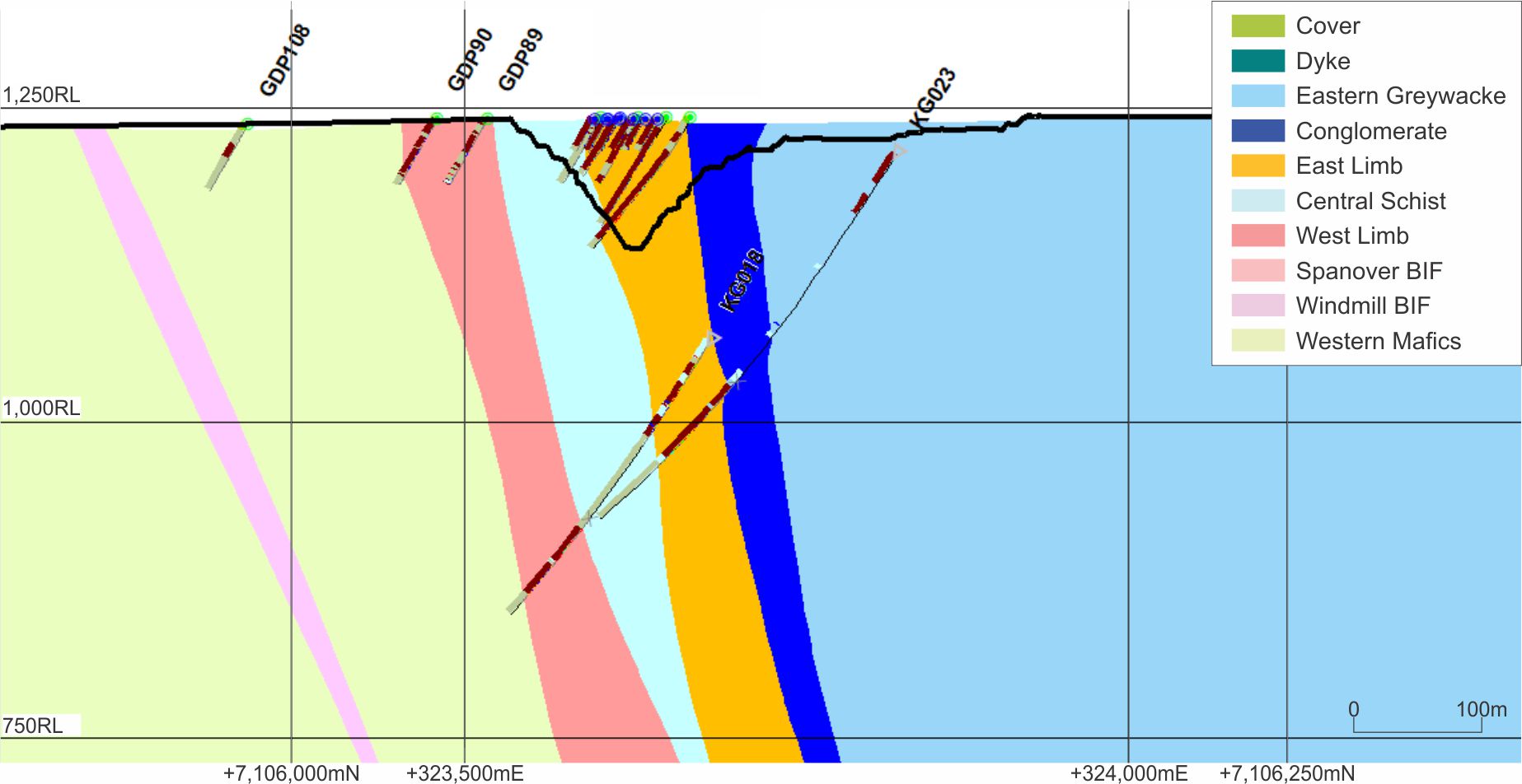

The geology associated to the Watertank pit is a long narrow more northerly striking, hoisted by cherty BIF and is in the northern extension to the A Zone east limb mineralised BIF. The host rock BIF is steeply dipping and has a strike length of 1,200m and an average width of 45m. The mineralised zones within this unit ranges from 2m - 12m in width. Recent drilling has shown an extension of this BIF to the north, where it has intersected significant intervals of mineralised BIF. This area has been termed the Watertank North. A section through the Watertank Zone from the 2019 geological model is presented in Figure 6-5.

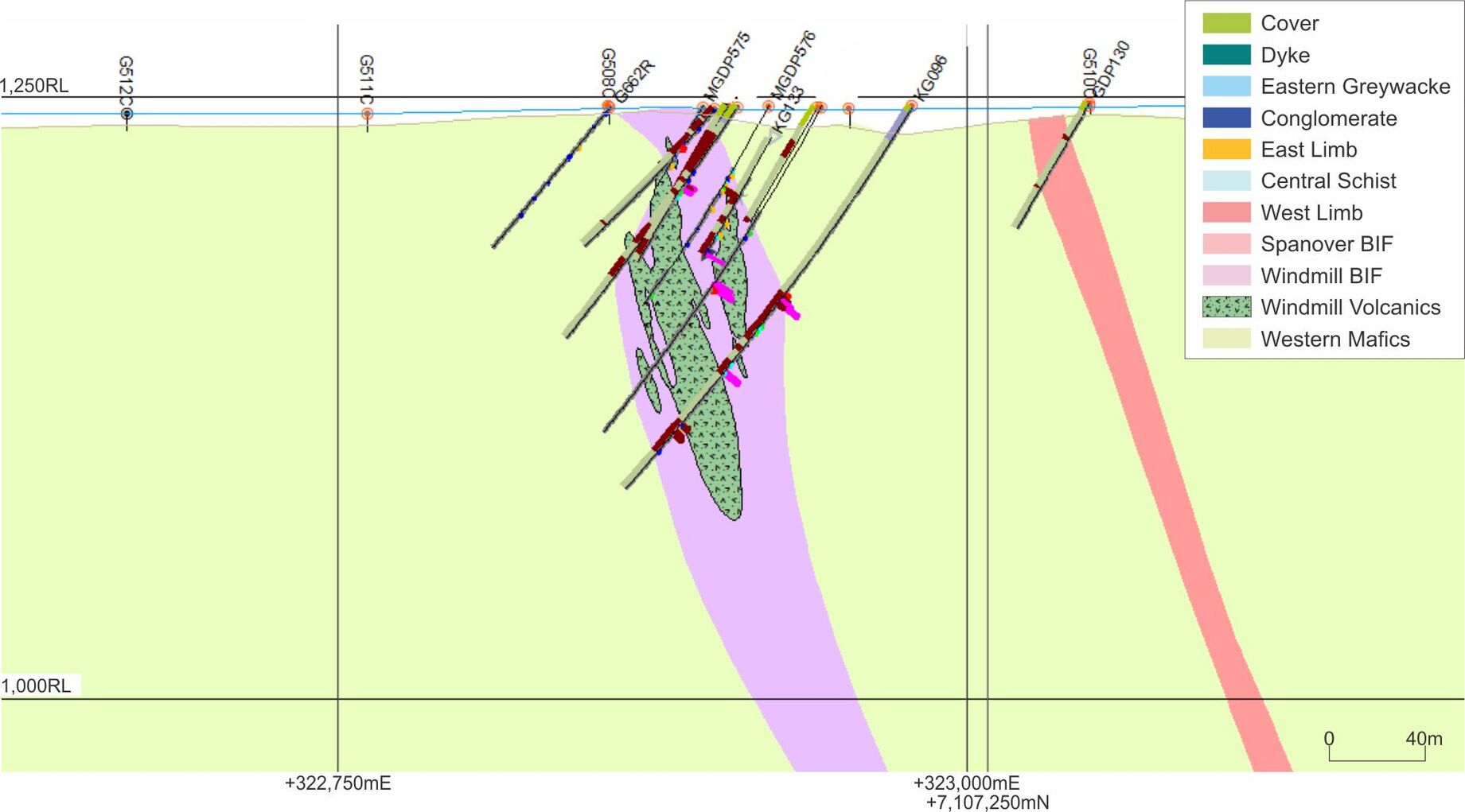

The Windmill Zone represented in Figure 6-6, is the smallest of the Kalgold zones but contains generally higher gold grades. It sits stratigraphically below the other three mineral zones and is hoisted by a magnetite-rich BIF unit with interbedded schist units. The host rock BIF has a strike length of 950m and thins to the north and south with a maximum width of 25m in the centre. Mineralisation within this zone occurs over a length of 800m with widths ranging from 2m - 17m and is structurally complex with displacements by faulting and dips varying from 75° - 90° east.

6.3.1Lithology

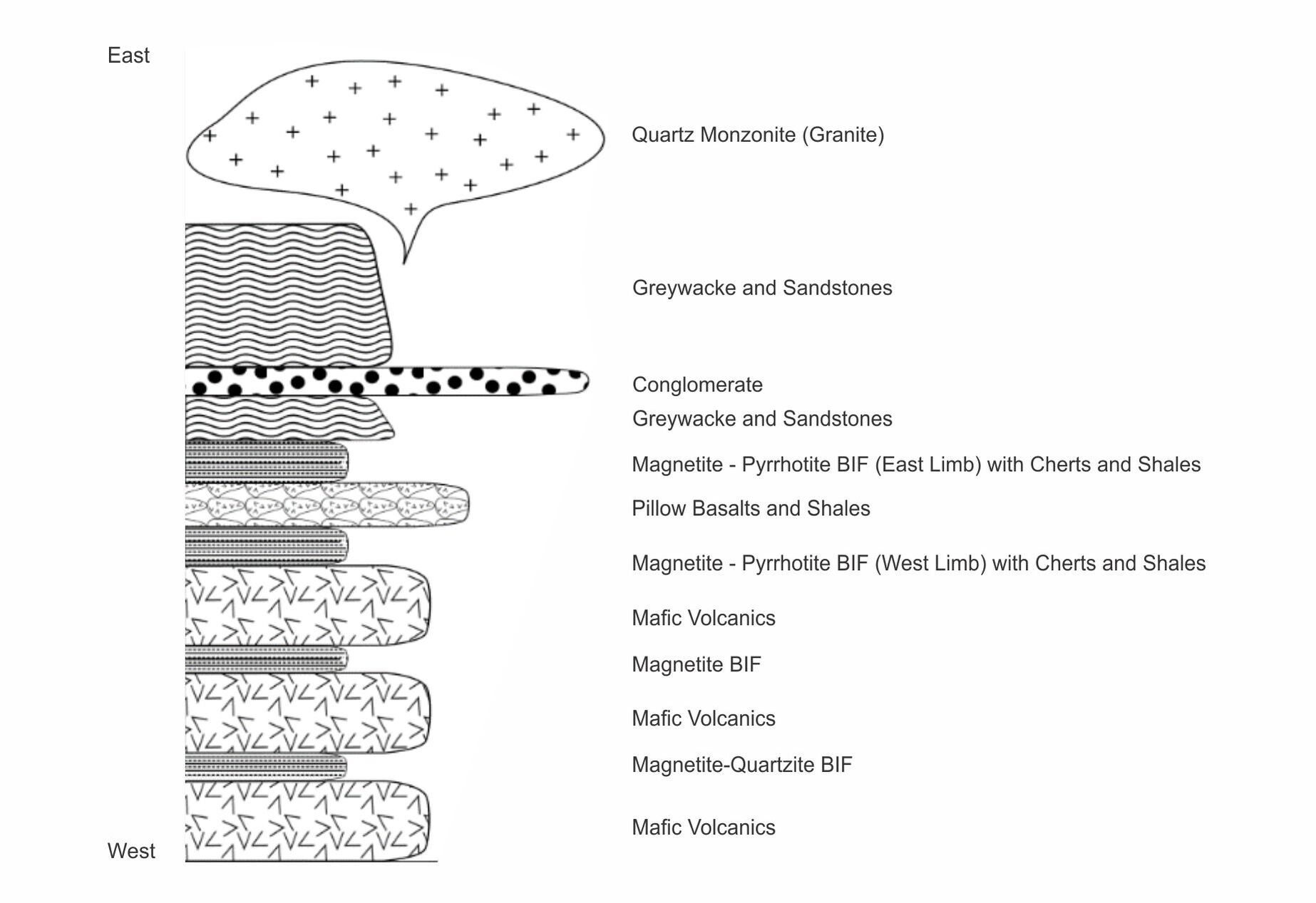

The lithological sequence at the Kalgold Mine area is grouped as follows:

•footwall mafic, including metabasaltic rocks and chlorite schist;

•package of interbedded shale and BIF; and

•hanging wall metasediments comprising a succession of metamorphosed chert, conglomerate, and greywacke.

A schematic stratigraphic column of the immediate Kalgold Mine is presented in Figure 6-7 showing the thin BIF units spaced between a significant package of mafic volcanics, capped by the deep water greywacke units. The mafic volcanics show significant evidence of pillow basalts indicating these are possibly deep water volcanics, the BIFs being chemical sediments, all capped by nearer shore sedimentary package.

6.3.2Structure

The KGB within the Kalgold Mine region is strongly deformed with consistent uniform regional fabric striking ~340° and dipping 65° - 70° east (Hilliard, 1996; Wilson, 1996; Moore, 1999; Hammond and Moore, 2016). The earliest tectonic fabric developed in the area, is a bedding parallel foliation defined, aligned with phyllosilicate and carbonate grains (Hilliard, 1996; Hammond and Moore, 2006). This foliation is best developed in the footwall schists and phyllites but is also evident in the BIF units as a strong slaty cleavage.

Mineral lineations are defined by elongate quartz and sulphide grains, strained clasts in the conglomerates and rods in the BIF. They have an average plunge of 67° towards 108° (Hilliard, 1996; Hammond and Moore, 2006).

Effective Date: June 30, 2024

18

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 6-4: Cross Section Through A Zone Pit

Figure 6-5: Cross Section Through Watertank Pit

Effective Date: June 30, 2024

19

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Figure 6-6: Cross Section Through the Windmill Pit

Figure 6-7: Schematic Kalgold Stratigraphy

Effective Date: June 30, 2024

20

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

Small scale isoclinal folds are common in the schist and BIF, and have axial planes dipping 61° - 64°, subparallel to the foliation. The axes of the isoclinal folds are subparallel to the mineral lineations (Hammond and Moore, 2006). Large open folds extend along the entire length in the north-south direction, with subvertical axial planes and fold axes plunging steeply to the east (Hilliard, 1996; Hammond and Moore, 2006). These open folds appear to have a significant impact on the contacts of the BIFs.

Late northeast to east-northeast trending faults are present cutting across the stratigraphy with visible fault offsets of 10s - 100s of metres (Wilson, 1996). Many of the late northeast to east-northeast striking dolerite dykes follow these structures (Wilson, 1996). In many areas, the dykes show evidence of minor shearing and foliation development that indicate and pre-date the last ductile deformation event. The BIF displays centimetre-scale boudins in some mineralised sections that are defined by orthogonal fracturing of Fe-rich and siliceous bands commonly filled with quartz and carbonates (Hammond and Moore, 2006).

6.4Mineralisation

Gold mineralisation at Kalgold is BIF-hosted. The BIFs are oxidized to a depth of approximately 40m below surface. Near the surface the material is red and porous, composed of quartz, hematite, and goethite with minor magnetite. At depth the unaltered BIF consists of quartz, siderite, pyrite, pyrrhotite and magnetite with minor chlorite, calcite and stilpnomelane. In general, gold mineralisation has an erratic and localized distribution. Individual gold grains are on average less than 10µm in diameter and occur in clusters. Gold is generally associated with goethite in the weathered rocks and with pyrite and pyrrhotite in the fresh material.

Hammond (2002) established that the gold mineralisation is associated with two generations of sub horizontal quartz-carbon veins oriented approximately 20° - 40° west. The first generation consists of ladder vein sets preferentially developed in iron-rich mesobands, whilst the second generation consists of large quartz-carbon veins, which cut across the entire deposit, extending into the footwall, and hanging wall in places. Hammond (2002) indicated that major structures that control the mineralisation are related to meso-scale isoclinal folds with fold axes sub-parallel to mineral elongation lineation. Gold is closely associated with sulphides, mainly pyrite and pyrrhotite and to a lesser extent, bismuth telluride and carbonate gangue. The ore fluid responsible for gold deposition is a carbon-oxygen-hydrogen system with increased methane content attributed to localized hydrolysis reactions between interbedded carbonaceous sediments and ore fluid (Hammond, 2002; Hammond and Moore, 2006).

The mineralisation at Windmill South is strongly associated with sulphide replacement within the magnetite-rich BIF unit. These zones of sulphide replacement appear to be more structurally controlled compared to the mineralisation in the eastern and western limbs at Watertank and A zone pits, respectively. Mineralised veins and thin open fractures formed through crystallisation of hydrothermal fluids in a brittle structural environment. Alteration and mineralisation of the Kalgold deposit has been described by several previous workers and the paragenesis and associated mineral assemblages are described in detail by Hammond 2002, amongst other scholars.

6.5Deposit Type

The Kalgold deposit is a BIF hosted lode gold deposit of a type typical throughout Archean greenstone belts across the world. Gold is precipitated through the sulphidation of iron rich BIF host rock due to late movement of retrograde fluids during the later stages of deformation.

6.6Commentary on Geological Setting, Mineralisation and Deposit

The Kalgold geological model is not complicated, being based on the stratigraphy as determined through the mining and drilling.

The geological model has been well tested through years of mining and exploration drilling.

New drilling does not result in significant changes to the geological model, which has remained relatively unchanged for many years. Drilling undertaken on the Kalgold deposit to the current effective date of June 30, 2024, has confirmed this model. Continuous mining activities have also resulted in a relatively high level of confidence in the nature of the Kalgold mineralisation and its association with the cherty BIF horizons.

Effective Date: June 30, 2024

21

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

7Exploration

Section 229.601(b)(96)(iii)(B)(7) (i-vi)

Extensive Surface exploration drilling commenced in 2017 to present, in order to both infill the current Mineral Resource areas, and to identify additional potential mining targets. Recent Infill drilling targeted the Windmill North, and the Spanover ore limb next to Windmill South . The Spanover is on the footwall of the Watertank Zone. The results of this drilling have been incorporated in the latest resource model used for FY25 business planning process.

Most of the deeper pre 2017 historical drilling was centred on the D-Zone deposit which has been mined-out. Historical drilling in the current mining areas is predominantly shallow drilling and mining already beyond this drilling

7.1Aeromagnetic Survey

The Mining Right area is covered by a high resolution aeromagnetic and radiometric survey completed by Xcalibur Airborne Geophysics in September 2012. The survey comprised 7,680 line-km over a 47km x 8km area of the KGB at a line spacing of 50m and nominal flying height above ground of 30m. The aeromagnetic data provided detail of the magnetite bearing horizons, structural offsets to stratigraphy and intrusive bodies at a local scale. However, it was not able to differentiate mineralised from non-mineralised BIF units.

7.2Geological and Topographical Mapping

Several geological maps of the Kalgold Mine exist but they are relatively simple and sparse as much of the area is covered in Kalahari sands with very little outcrop. Therefore, reliance was largely placed on geophysical interpretation rather than ground mapping. The topography has been generated from surveyed pickups and traditional air photo mapping methods. New DTMs have recently been generated from shuttle radar topography mission data. Some detailed mapping results for the Windmill Zone has also been incorporated into the geological mapping.

Drone and GPS surveys are used for day to day data management and volume movements calculation.

7.3Surface Drilling Campaigns, Procedures, Sampling, Recoveries and Results

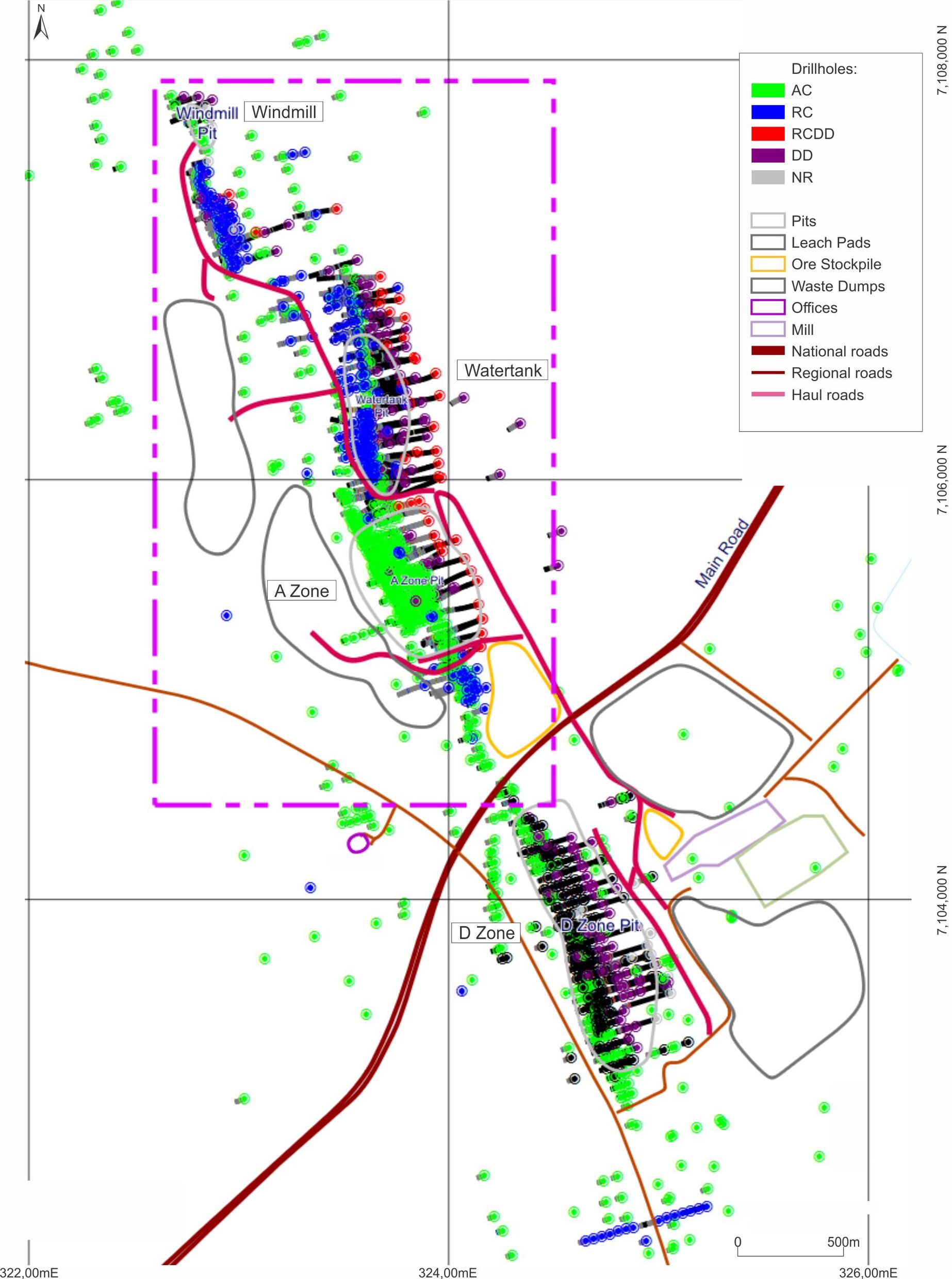

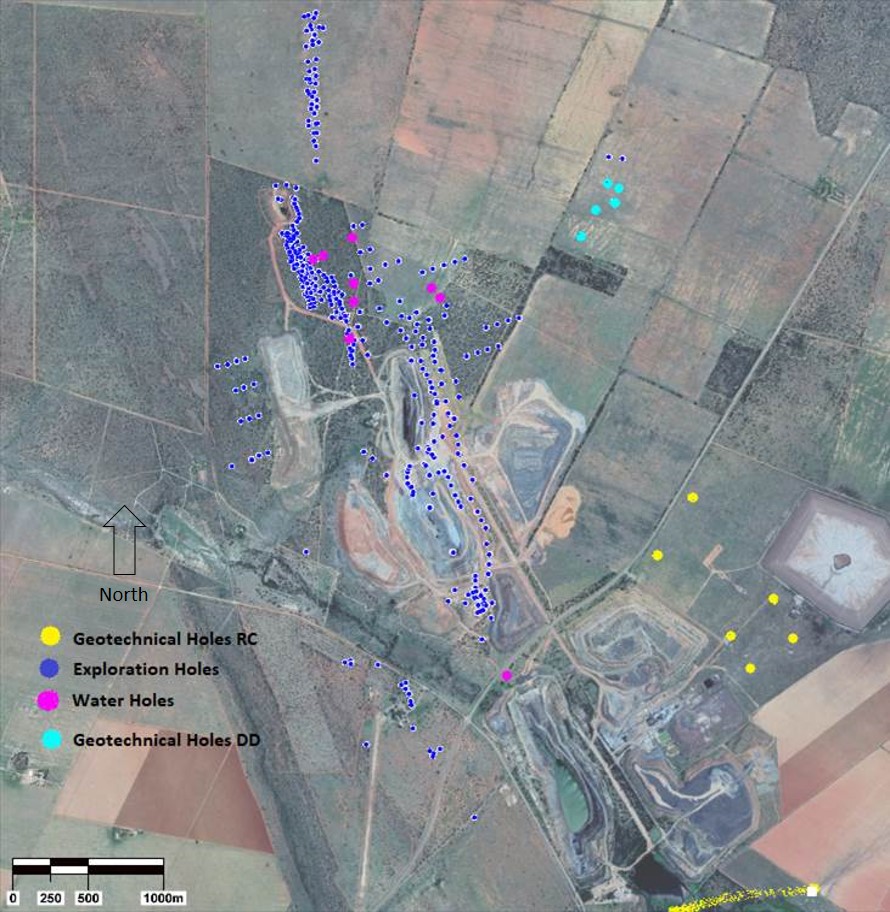

The location of the drilling from 2017 to 2019 is indicated in Figure 7-1. Location of drilling from 2020 to 2023 is depicted in Figure 7-2.

Drill holes flagged as Not Recorded (“NR”) are generally assumed to be either AC, as in the case of shallow drill holes, or RC for the deeper drill holes. Surface drilling at Kalgold has:

•indicated significant extensions to the Mineral Resource area;

•expanded significantly on an understanding of the Kalgold deposit;

•upgraded the Windmill and A Zone south extension (Henry) pit Mineral Resources; and

•infilled the areas between the A Zone and Watertank Zone (current mining), known as the Bridge Zone.

A combination of RC only and RC pre-collars with DD tails (“RCDD”) was completed during the exploration drilling programme. The depth of the RC drill holes and pre-collars varied depending on the target depth, the depth and amount of groundwater, and the penetration rate. If penetration rates of the RC drilling decreased materially, or if groundwater inflows prevented the collection of a dry sample, then the drill hole would be continued with a DD tail. In some cases, in the hanging wall units where mineralisation was not intersected, the RC pre-collars were continued through zones of groundwater and associated wet samples to achieve the planned pre-collar depth prior to commencing the DD tail.

7.3.1AC and Percussion Drilling

Part of the historic drilling at Kalgold comprised very shallow, regional AC or percussion drill holes.

AC drilling uses blades and compressed air to obtain a sample of the top unconsolidated or semi-consolidated cover and regolith. AC drilling technique was previously used to identify presence of BIF under cover and guide exploration activities.

Percussion drilling uses hammer and compressed air to deliver samples to surface. Since the sample travels between the rods and the walls of the hole it becomes contaminated with the rocks overlying the sampled horizon. This drilling technique has not been used at Kalgold with the exception of pre-collars being drilled

Effective Date: June 30, 2024

22

Technical Report Summary for

Kalgold Mine, North West Province, South Africa

through the overburden for the diamond boreholes. No AC or percussion data has been used in the evaluation of the deposits.

Figure 7-1: Location of Kalgold Targeted Exploratory Drilling in Relation to the Mining Pits (2017 - 2019)

7.3.2RC Drilling

Effective Date: June 30, 2024

23

Technical Report Summary for

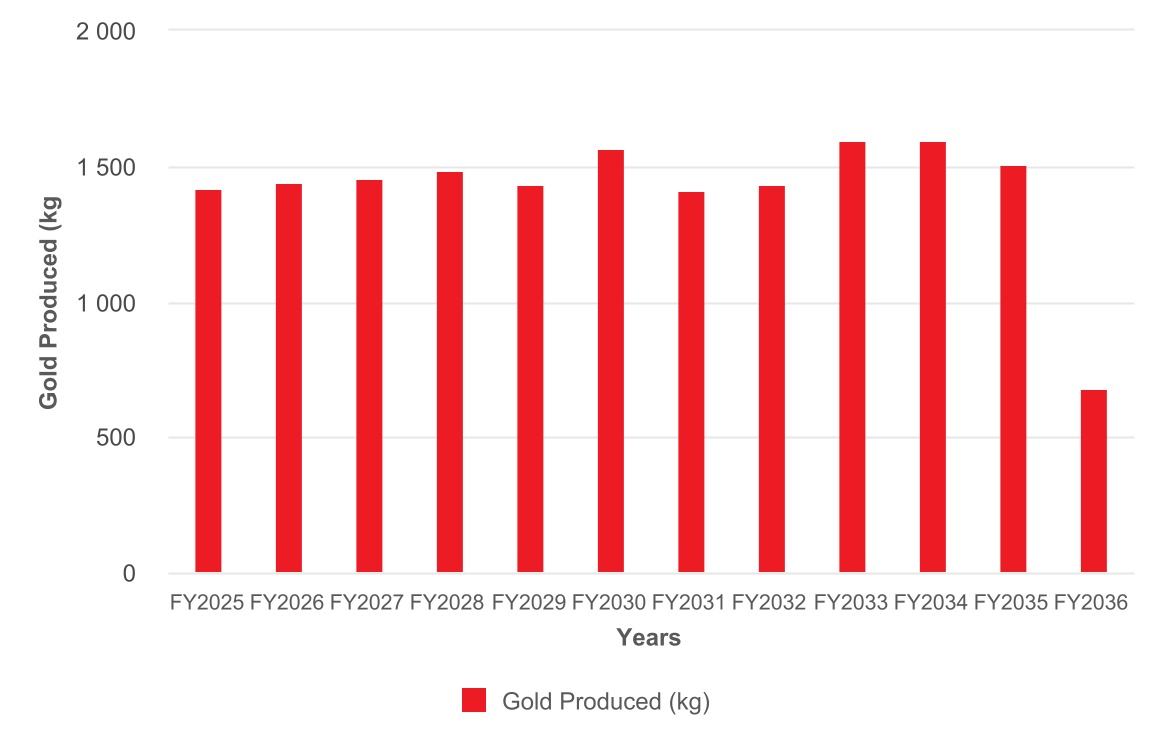

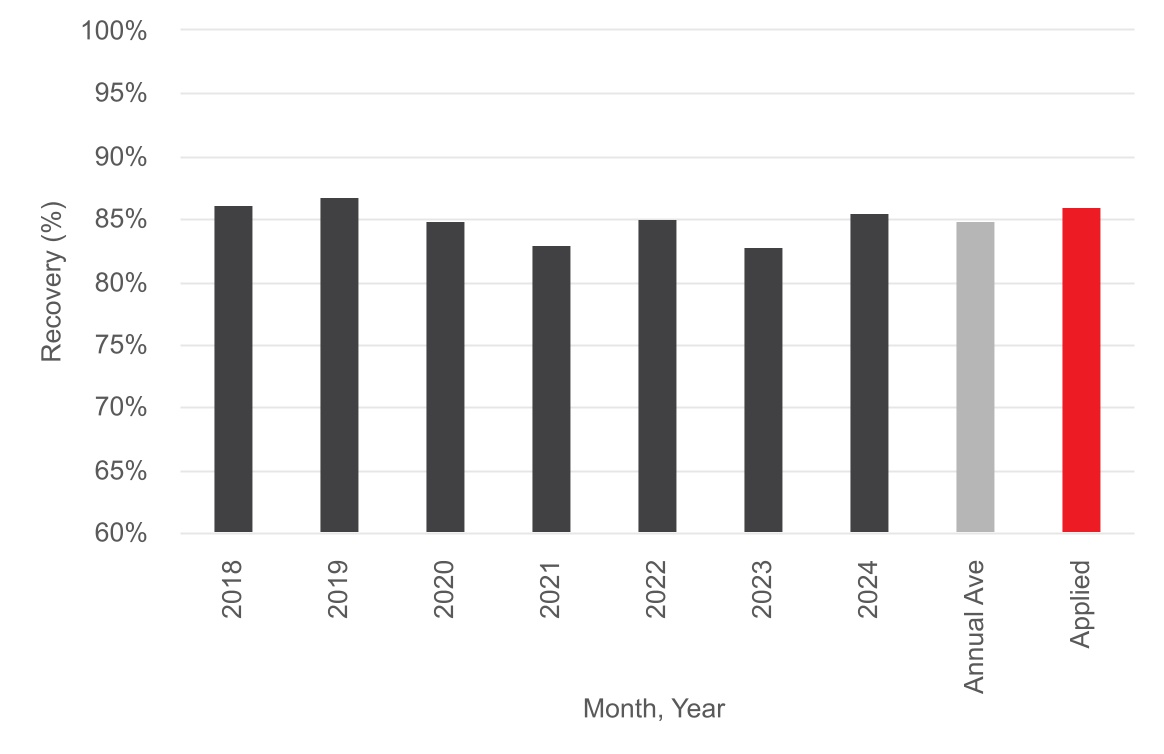

Kalgold Mine, North West Province, South Africa