HARMONY GOLD MINING COMPANY LIMITED

Technical Report Summary of the

Mineral Resources and Mineral Reserves

for

Tshepong South

Free State Province, South Africa

Effective Date: June 30, 2024

Final Report Date: October 31, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

| | |

IMPORTANT NOTICE

This Technical Report Summary has been prepared for Harmony Gold Mining Company Limited in support of disclosure and filing requirements with the United States Securities and Exchange Commission’s (SEC) under Subpart 1300 of Regulation S-K 1300 and Section 229.601(b)(96) of Regulation S-K. The quality of information, estimates, and conclusions contained in this Technical Report Summary apply as of the effective date of this report. Subsequent events that may have occurred since that date may have resulted in material changes to such information, estimates and conclusions in this summary. |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

QP Consent and Sign-off

I have read and understood the requirements of:

•the South African Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (the “SAMREC Code, 2016 edition”)

•the Harmony Guidelines on the Reporting of Exploration Results, Mineral Resources and Mineral Reserves

•Subpart 1300 (17 CFR 229.1300) of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (“Regulation S-K 1300”)

I am a Competent Person as defined by the SAMREC Code, 2016 edition and the Qualified Person (“QP”) under Regulation S-K 1300, having more than five years` experience that is relevant to the style of mineralization and type of deposit described in the Report, and to the all activities for which I am accepting responsibility and have been appointed as QP for Tshepong South Mineral Resources and Mineral Reserves.

I am a Member of SACNASP and my registration is as follow:

Mineral Resource

Mr C. Pienaar

SACNASP (South African Council for Natural Scientific Professions)

Nr 135676

Years’ Experience: 15

I have reviewed the tables and graphs included for the Tshepong South Mineral Resource and Mineral Reserve which will be used in the 2024 Harmony Gold Mineral Resource and Mineral Reserve Report to which this Consent Statement applies.

I acknowledge responsibility for all the sections of the TRS report and as the QP and author I relied on information provided by various subject experts.

At the effective date of the Report, to the best of my knowledge, information and belief, the Report contains all scientific and technical information that is required to be disclosed to make the Report not misleading.

/s/ Conrad Pienaar

___________________________________

Mr C. Pienaar

B.Sc Hons (Geology)

SACNASP (135676)

HOD Geology

Tshepong South

Harmony Gold Mining Company Limited

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

List of Contents

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

List of Figures

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

List of Tables

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Units of Measure and Abbreviations

| | | | | |

| Unit / Abbreviation | Description or Definition |

| °C | degrees Celsius |

| µm | Micrometers |

| 2D | Two-dimensional |

| 3D | Three-dimensional |

| AE | Abnormal expenditure |

| Ag | Silver |

| AngloGold Ashanti | AngloGold Ashanti Limited |

| ARM | African Rainbow Minerals Limited |

| ARMGold | ARM Gold Division |

| Au | Gold |

| AuBIS | Harmony electronic database |

| Ave. | Average |

| BLR | Black Reef |

| BMD | Below mine datum |

| Bn | Billion |

| c. | Approximately |

| CIP | Carbon-In-Pulp |

| CLR | Carbon Leader Reef |

| cm | Centimeter |

| cmg/t | Centimeter-grams per tonne |

| CODM | Chief Operating Decision-Maker |

| Company | Harmony Gold Mining Company Limited |

| COP | Code of Practice |

| CRG | Central Rand Group |

| CRM | Certified Reference Material |

| CV | Coefficient of Variation |

| DBH | Dewatering borehole |

| DMRE | Department of Mineral Resources and Energy |

| DWAFEC | Department of Water Affairs, Forestry and Environmental Conservation |

| DWS | Department of Water and Sanitation |

| EIA | Environmental Impact Assessment |

| EMPR | Environmental Management Program |

| EMS | Environmental Management System |

| EMTS | Electric Monorail Transport System |

| ESG | Environmental Social and Governance |

| ETF | Exchange traded fund |

| FAG | Fully autogenous |

| FX | Foreign Exchange rate |

| g | Gram |

| g/t | Grams per metric tonne |

| GBH | Groundwater boreholes |

| GDARD | Gauteng Department of Agriculture and Rural Development |

| GHG | Greenhouse gas |

| GISTM | Global Industry Standard on Tailings Management |

| ha | Hectare |

| Harmony | Harmony Gold Mining Company Limited |

| HLS | Heavy liquid separation |

| HPE | Hydro-powered |

| kg | Kilogram |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

| | | | | |

| Unit / Abbreviation | Description or Definition |

| km | Kilometer |

km2 | Square kilometer |

| kWh | Kilowatt-hour |

| LBMA | London Bullion Market Association |

| LIB | Long Inclined Borehole |

| LOM | Life of Mine |

| LOI | Loss on ignition |

| Ltd | Limited |

| m | Meter |

| M | Million |

m3/hr | Cubic meters per hour |

| MCC | Mining Charter Compliance |

| MCF | Mine Call Factor |

| Moz | Million troy ounces |

| MPRDA | Mineral and Petroleum Resources Development Act, 28 of 2002 |

| Mt | Million tonnes |

| Mtpa | Million tonnes per annum |

| Mtpm | Million tonnes per month |

| NEMA | National Environmental Management Act, 107 of 1998 |

| No. | Number |

| NPV | Net present value |

| OK | Ordinary Kriging |

| oz | Troy ounce |

| OTC | Over the counter |

| Tshepong South | Tshepong South Mine |

| Pty | Proprietary |

| QA/QC | Quality Assurance/Quality Control |

| QEMSCAN | Scanning electron microscope |

| QP | Qualified Person |

| RAW’s | Return Airways |

| ROM | Run-of-Mine |

| SACNASP | South African Council for Natural Scientific Professions |

| SAMREC | The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| SD | Standard Deviation |

| SEC | Securities and Exchange Commission |

| SGM | Sequential Grid Mining |

| SLP | Social Labour Plan |

| SMK | Simple Macro Kriging |

| t | Metric tonne |

t/m3 | Tonne per cubic meter |

| Target | Target Mine |

| TCFD | Task Force on Climate-Related Financial Disclosure |

| TMS | Trace mineral search |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| Tshepong | Tshepong Mine |

| USD | United States Dollars |

| USD/oz | United States Dollar per troy ounce |

| WRG | West Rand Group |

| WUL(s) | Water Use License(s) |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

| | | | | |

| Unit / Abbreviation | Description or Definition |

| X/C’s | Cross-cuts |

| XRD | X-ray diffraction |

| ZAR | South African Rand |

| ZAR/kg | South African Rand per kilogram |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Glossary of Terms

| | | | | |

| Term | Definition |

| Co-kriging | A method that is used to predict the value of the point at unobserved locations by sample points that are known to be spatially interconnected by adding other variables that have a correlation with the main variable or can also be used to predict 2 or more variables simultaneously. |

| Cut-off grade | Cut-off grade is the grade (i.e., the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio. |

| Dilution | Unmineralized rock that is by necessity, removed along with ore during the mining process that effectively lowers the overall grade of the ore. |

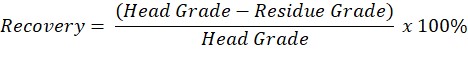

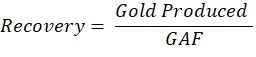

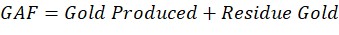

| Head grade | The average grade of ore fed into the mill. |

| Economically viable | Economically viable, when used in the context of Mineral Reserve determination, means that the qualified person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. |

| Indicated Mineral Resource | Indicated Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

| Inferred Mineral Resource | Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project and may not be converted to a Mineral Reserve. |

| Kriging | A method of interpolation based on Gaussian process governed by prior covariances. It uses a limited set of sampled data points to estimate the value of a variable over a continuous spatial field |

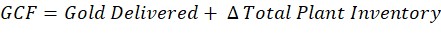

| Mine Call Factor | The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. |

| Measured Mineral Resource | Measured Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| Mineral Reserve | Mineral Reserve is an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Mineral Resource | Mineral Resource is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralisation drilled or sampled. |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

| | | | | |

| Term | Definition |

| Modifying Factors | Modifying factors are the factors that a qualified person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include but are not restricted to; mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| Pre-Feasibility Study | A pre-feasibility study (or preliminary feasibility study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. (1) A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. (2) A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment. |

|

|

| Probable Mineral Reserve | Probable Mineral Reserve is the economically mineable part of an Indicated and, in some cases, a Measured Mineral Resource. |

| Proven Mineral Reserve | Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource. |

| Qualified Person | A qualified person is: (1) A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and (2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: (i) Be either: (A) An organization recognized within the mining industry as a reputable professional association; or (B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field; (ii) Admit eligible members primarily on the basis of their academic qualifications and experience; (iii) Establish and require compliance with professional standards of competence and ethics; (iv) Require or encourage continuing professional development; (v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and (vi) Provide a public list of members in good standing. |

|

|

|

|

|

|

|

|

|

|

| Tailings | Finely ground rock of low residual value from which valuable minerals have been extracted is discarded and stored in a designed dam facility. |

Effective Date: June 30, 2024

Technical Report Summary for

Tshepong South, Free State Province, South Africa

1Executive Summary

Section 229.601(b)(96)(iii)(B)(1)

The QP of Harmony Gold Mining Company Limited (“Harmony” or the “Company”) has prepared this Technical Report Summary (“TRS”) to disclose the Mineral Resource and Mineral Reserve estimates for the Company’s Tshepong South Mine (“Tshepong South”). The TRS has been prepared in accordance with the U.S. Securities and Exchange Commission’s (“SEC”) Regulation S-K 1300, with an effective date as at June 30, 2024. No material changes have occurred between the effective date and the date of signature of this TRS.

This TRS updates the TRS filed by Harmony on Tshepong South on October 31, 2023, named Exhibit 96.13 Technical Report Summary of the Mineral Resources and Mineral Reserves for Tshepong South, Free State Province, South Africa, which was effective on June 30, 2023. This TRS is being filed to satisfy the requirement of Item 1302(e)(6) of regulation S-K. An economic assessment was included, using a detailed discounted cashflow analysis for the Mineral Reserves, excluding all scheduled Inferred Mineral Resources which is not reported under Mineral Reserves.

Property Description

Tshepong South comprise the underground and surface assets associated with one mine, namely Tshepong South (“Tshepong South”,“Tshepong South Mine” or “Phakisa”), situated between the towns of Welkom and Odendaalsrus in the Free State Province of South Africa. The mine is a moderate to deep-level gold mine, operating at depths of between 1.6km and 2.4km below mine datum (“BMD”). The primary reef mined is the Basal Reef, with additional gold mineralization being found in the B-Reef and A-Reef.

Mining at Tshepong South is carried out under the following mining right, covering both Tshepong North and Tshepong South:

•FS30/5/1/284MR, which is valid from December 11, 2007 to December 10, 2029 and covers an area of 10,798.74 hectares (“ha”).

The mining right was originally held in a joint venture between African Rainbow Minerals Limited (“ARM”) Gold Division (“ARMGold”) and Harmony until ARMGold was incorporated into Harmony.

All relevant underground mining and surface right permits, and any other permit related to the work conducted on the property have been obtained and are valid. There are no known legal proceedings (including violations or fines) against Harmony, which threaten its mineral rights, tenure, or operations.

Ownership

Tshepong South is wholly owned by Harmony, including the associated mineral rights. Harmony commenced acquiring the assets through the acquisition of AngloGold Ashanti Limited (“AngloGold Ashanti”) Free State operations in 2001, together with ARMGold. ARMGold was subsequently incorporated into Harmony in 2003, giving Harmony 100% ownership and control of the Tshepong South.

Geology and Mineralization

Tshepong South is situated in the Free State Goldfield, on the southwestern margin of the Witwatersrand Basin of South Africa, one of the most prominent gold provinces in the world. The major gold bearing conglomerate reefs are mostly confined to the Central Rand Group (“CRG”) of the Witwatersrand Supergroup.

The general orientation of the Witwatersrand Supergroup succession in this goldfield is interpreted as north-trending, within a syncline that is plunging to the north. The syncline has been divided by faults into the Odendaalsrus, Central Horst and Virginia sections. The Tshepong South mining right area is also affected by the Ophir and Dagbreek faults.

Tshepong South exploited primarily the Basal Reef, which occurs within the Harmony Formation of the Johannesburg Subgroup of the CRG.

Effective Date: June 30, 2024

1

Technical Report Summary for

Tshepong South, Free State Province, South Africa

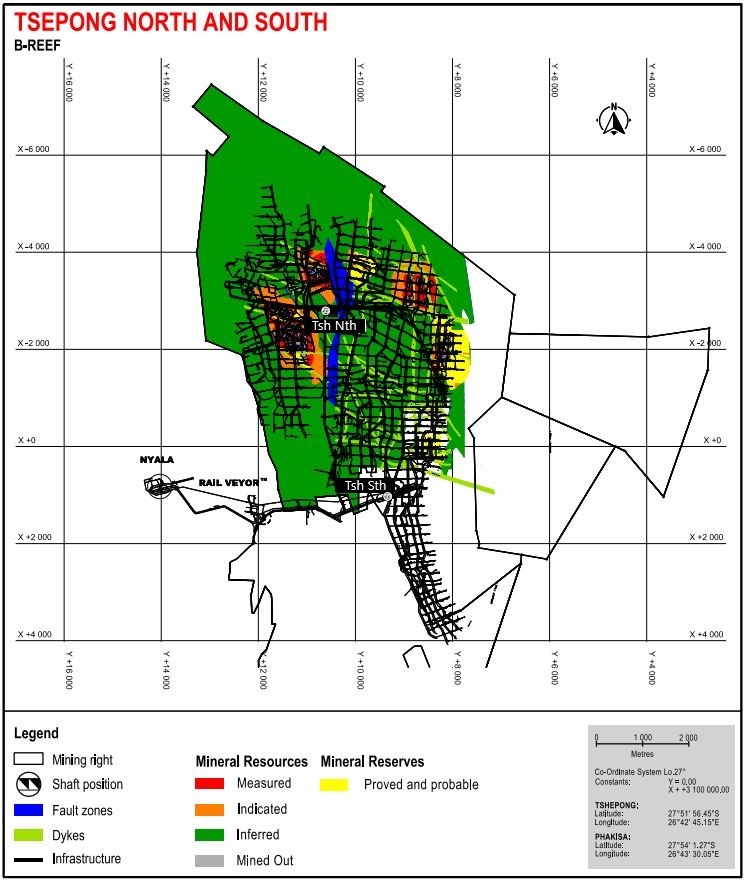

Mineralization also occurs within the stratigraphically higher A- and B-Reefs of the Kimberley (formerly Aandenk) Formation, within the Turffontein subgroup of the CRG. However, only the B-Reef can be economically extracted.

Mineralization is associated with the presence of medium to coarse, clast-supported oligomictic pebble horizons. The presence of allogenic pyrite and detrital carbon is also common.

Status of Exploration, Development and Operation

The Basal Reef at Tshepong South has been extensively explored from historic borehole data collected during initial Shaft Sinking stage beginning of 1994 and vigorous data collection (Borehole and Chip sample) in the early 2007 when development from the Station commenced. Recent exploration has mainly focused on improving confidence in the geological model, as well as adding and upgrading Mineral Resources to replace the mining depletion. Geological data has been obtained through underground channel sampling, mapping and exploration drilling. Initial exploration included a historical geophysical seismic survey and surface diamond core drilling comprising of nine mother holes. This was followed up with closer spaced underground data gathering exercises.

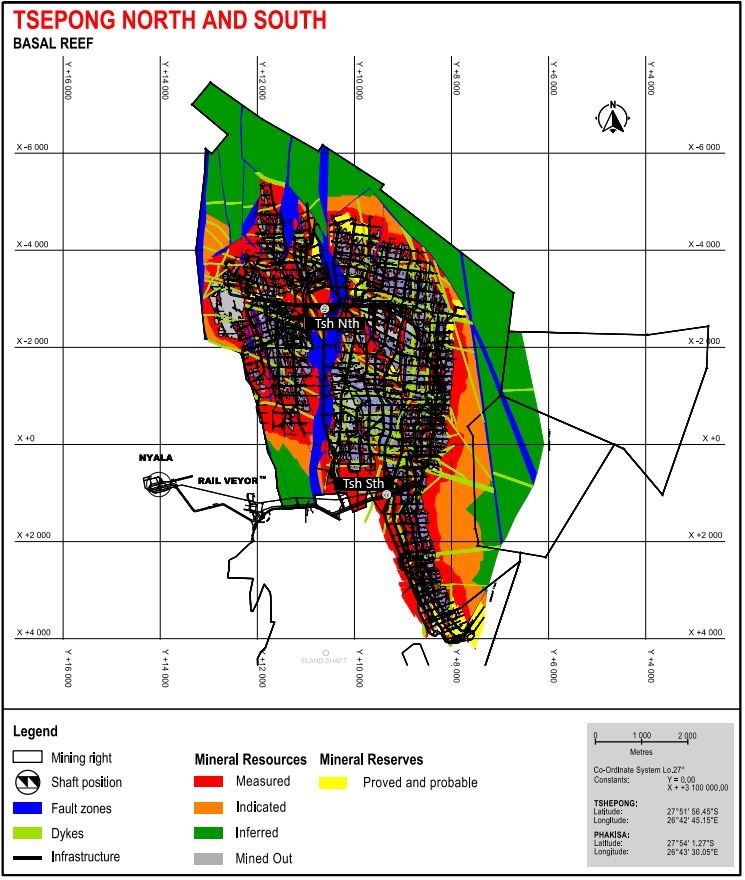

Mineral Resource Estimate

The Mineral Resources for the Basal Reef and B-Reef were estimated by the Harmony QP in Datamine™ Studio software. The QP created block models based on a verified electronic database containing surface drill hole data, as well as underground drilling, mapping, and sampling data obtained up until December 2023. Gold values were estimated using ordinary and simple macro kriging interpolation methods.

The Mineral Resources for Tshepong South were correspondingly originally prepared, classified and reported in accordance with the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (“SAMREC, 2016”). For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K).

The QP compiling the Mineral Resource estimate for Tshepong South is Mr Conrad Pienaar, Geology HOD at Tshepong South and an employee of Harmony.

The Mineral Resource estimate for Tshepong South, as at June 30, 2024, exclusive of the reported Mineral Reserves is summarized in Table 1-1.

Table 1-1: Summary of Tshepong South Mineral Resources as at June 30, 2024 (Exclusive of Mineral Reserves) 1-8

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 6.155 | 12.80 | 78 768 |

| Indicated | 8.687 | 11.10 | 96 434 |

| Total / Ave. Measured + Indicated | 14.843 | 11.80 | 175 202 |

| Inferred | 22.799 | 11.03 | 251 447 |

| IMPERIAL |

| Mineral Resource Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 6.785 | 0.373 | 2.532 |

| Indicated | 9.576 | 0.324 | 3.100 |

| Total / Ave. Measured + Indicated | 16.361 | 0.344 | 5.633 |

| Inferred | 25.131 | 0.322 | 8.084 |

Notes:

1. Mineral Resources are reported with an effective date of June 30, 2024 were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr Conrad Pienaar, who is Geology HOD at Tshepong South, and a Harmony employee.

2. The Mineral Resource tonnes are reported as in-situ with reasonable prospects for economic extraction.

3. No modifying factors or dilution sources have been included to in-situ Reserve which was subtracted from the SAMREC Resource in order to obtain the S-K 1300 Resource.

4. The Mineral Resources are reported using a cut-off value of 780cmg/t determined at a gold price of USD1,878/oz.

5. Tonnes are reported as rounded to three decimal places. Gold values are rounded to zero decimal places.

6. Mineral Resources are exclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not necessarily demonstrate economic viability.

7. Rounding as required by reporting guidelines may result in apparent summation differences.

8. The Mineral Resource estimate is for Harmony’s 100% interest.

Effective Date: June 30, 2024

2

Technical Report Summary for

Tshepong South, Free State Province, South Africa

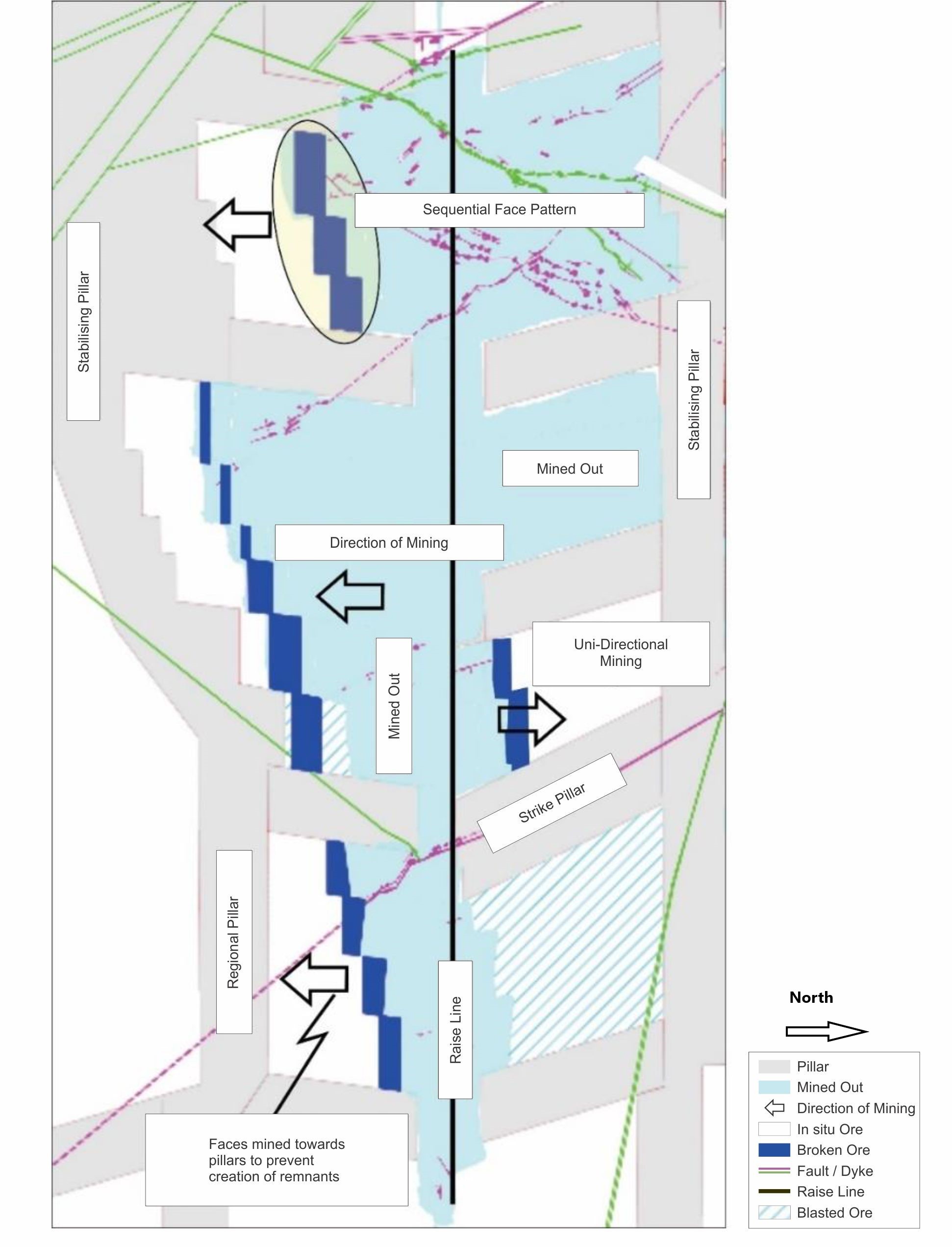

Mineral Reserve Estimate

Mineral Reserves are derived from the Mineral Resources, a detailed business plan and the operational mine planning processes. Mine planning utilises and takes into consideration historical technical parameters achieved. In addition, Mineral Resource conversion to Mineral Reserves considers Modifying Factors, dilution, ore losses and minimum mining widths.

The Mineral Reserves for Tshepong South were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Mineral Reserve estimate for Tshepong South, as at June 30, 2024, is summarized in Table 1-2.

The QP compiling the Mineral Resource estimate for Tshepong South is Mr Conrad Pienaar, Geology HOD at Tshepong South and employee of Harmony.

Table 1-2: Summary of Tshepong South Mineral Reserves as at June 30, 2024 1-5

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proved | 2.355 | 8.02 | 18 900 |

| Probable | 0.229 | 7.08 | 1 621 |

| Total (Proved + Probable) | 2.584 | 7.94 | 20 521 |

| | | | | | | | | | | |

| IMPERIAL |

| Mineral Reserve Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proved | 2.596 | 0.234 | 0.608 |

| Probable | 0.252 | 0.207 | 0.052 |

| Total (Proved + Probable) | 2.849 | 0.232 | 0.660 |

Notes:

1. The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr Conrad, who is Geology HOD at Tshepong South, and a Harmony employee.

2. Tonnes, grade, and gold content are declared as net delivered to the mills.

3. Figures are fully inclusive of all mining dilutions, gold losses and are reported as mill delivered tonnes and head grades. Metallurgical recovery factors have not been applied to the reserve figures.

4. Gold content has not taken metallurgical recovery factors into account.

5. Mineral Reserves are reported using a cut-off grade of 790cmg/t determined using a gold price of USD1,772/oz gold.

6. Rounding as required by reporting guidelines may result in apparent summation differences.

Capital and Operating Cost Estimates

The capital cost estimates for Tshepong South are determined at a corporate level, using the business plan as the basis. The capital costs are associated with major equipment outside the main operating sections which is termed abnormal expenditure (“AE”), infrastructure development, as well as ongoing capital development (“OCD”). Costs associated with the Mining Charter Compliance (“MCC”), as per South Africa’s Social Labour Plan (“SLP”) requirements are also included in the capital estimates.

The capital costs are presented in Table 1-5. The accuracy level of the capital cost is to the accuracy level of Feasibility level.

The operating cost estimates for Tshepong South are categorised into direct and total costs. The operating cost estimates are shown in Table 1-6.

The capital and operating costs are reported in ZAR terms and on a real basis. The economic analysis, including the capital and operating costs are reported for the period comprising the financial year (“FY25”) July – June. Both the capital and operating estimates are accounted for in the economic analysis of Tshepong South. The results of the economic analysis demonstrate a positive NPV at a discounted cash flow of 9% for the Mineral Reserve.

Effective Date: June 30, 2024

3

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Table 1-3: Summary of capital cost estimate for Tshepong South

| | | | | |

| Capital Cost Element (ZAR'000s) | Total Reserve plan

(FY2025-FY2028) |

| OCD | 1 154 928 | |

| AE | 195 940 | |

| Shaft Projects | 150 720 | |

| Major Projects | 67 101 | |

| MCC | 89 523 | |

| Total | 1 658 212 | |

Table 1-4: Summary of operating cost estimate for Tshepong South

| | | | | |

| Operating Cost Element (ZAR'000) | Total Reserve Plan

(FY2025-FY2028) |

| Mining | 6 393 267 | |

| Services | 1 667 146 | |

| Medical Hub / Station | 400 487 | |

| Engineering | 7 111 649 | |

| Workshops | — | |

| Plant | — | |

| Total Direct Costs | 15 572 549 | |

| Mine Overheads | 937 052 | |

| Total Cost | 16 509 601 | |

Permitting Requirements

The permits held by Tshepong South are presented in Table 1-5.

Tshepong South has the necessary valid permits, administered and managed by various departments, and do not require any additional permits to continue with their mining operations, except for the application which has been submitted to amend the Water Use Applications.

An application to renew and amend the Water Use License Applications (WULA) was submitted to the respective regulator in November 2023. The approval for this permit is still pending at the effective date of this TRS. Based on current industry norms, a realistic timeframe to obtain relevant authorizations is estimated between 12 and 18 months.

There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its mineral rights, tenure, or operations.

Conclusions

In the QP’s opinion, Tshepong South, a 100% owned Harmony asset, is located in a well-established mining district and has been operating successfully for the past 30 years. The mine is accessible within national and provincial roads, with well-established infrastructure. Management has a good handle on aspects pertaining to legal and environmental matters with respect to operating within the South African mining law, as regulated by the MPRDA, and supporting legislation.

Tshepong South hosts a prominent gold bearing Mineral Resource. The interpretation of the regional geological setting, mineralization and ore body deposit is well understood and provides valuable insight to the gold mining operations. The mining methods of the Mineral Reserves is of sound design and has evolved over the history of the operations.

The economics for Tshepong South display positive discounted cashflows, based on detailed operating and capital costs. The valuation of the asset is proven to be most sensitive to the gold price. The assumptions and conclusions in this TRS contain the views of QPs and does not contain any known material risks at the time of compilation.

Tshepong South did not incur any fines or penalties for non-compliance during the year ended June 30, 2024 and no significant encumbrances exist.

Effective Date: June 30, 2024

4

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Recommendations

In the QP’s opinion, the gold output from Tshepong South can be optimized through improvement of quality of mining and this will result in achieving the planned shaft call factor. This impact will be realized through our currently implemented Business Improvement Initiative program that will look at driving the quality of mining through measures such as in-stope water controls and better fragmentation during blasting to contain the gold.

Table 1-5: Status of environmental permits and licenses

| | | | | | | | | | | | | | |

| Permit / License | Reference No. | Issued By | Date Granted | Validity |

| Environmental Management Programme | FS 30/5/1/2/3/2/1(84)EM | DMRE | April 6, 1910 | LOM |

| Environmental Management Updated | FS 30/5/1/2/2/84MR | DWAFEC | Pending Approval Submitted in 2020 | LOM |

| Water Permit 936B. Harmony. Free State Geduld Mines. Discharge of untreated effluents | B33/2/340/31 | DWAFEC | April 2, 1981 | LOM |

| Water Permit 870B. Harmony. Discharge of untreated effluents. | B33/2/340/25 | DWAFEC | May 27, 1991 | LOM |

| Water Permit 1214N. Free State Consolidated Gold Mine. Tshepong, Freddie’s and Phakisa shafts. | B33/2/340/12 | DWAFEC | Not indicated. | LOM |

Notes: DWAFEC - Department of Water Affairs, Forestry and Environmental Conservation, DWA - Department of Water Affairs.

Effective Date: June 30, 2024

5

Technical Report Summary for

Tshepong South, Free State Province, South Africa

2Introduction

Section 229.601(b)(96)(iii)(B)(2) (i-v)

This TRS on Tshepong South has been prepared for the registrant, Harmony. The TRS has been prepared in accordance with Regulation S-K 1300. It has been prepared to meet the requirements of Section 229.601(b)96 - Technical Report Summary. The purpose of this TRS is to provide open and transparent disclosure of all material, exploration activities, Mineral Resource and Mineral Reserve information to enable the investor to understand Tshepong South, which forms part of Harmony’s activities. No material change has occurred since the previous TRS report.

This TRS has been prepared from the following sources of information:

•File 18 (Competent Persons Report) Tshepong South Mineral Resource and Reserve Statement FY25;

•Tshepong South Gold Mine 2024 SAMREC Table 1

•The 2024 and 2025 Corporate Business Plan

•Base Geological and Mine Planning data; and

•Integrated Internal Technical Report FY25.

The TRS was prepared by a QP employed on a full-time basis by the registrant. The QP’s qualifications, areas of responsibility and personal inspection of the property are summarized in Table 2-1.

Table 2-1: QP qualification, section responsibilities and personal inspections

| | | | | | | | | | | | | | |

| Qualified Person | Professional Organization | Qualification | TRS Section Responsibility | Personal Insp. |

| | | | |

| Mr C. Pienaar | SACNASP Reg nr 135676 | B.Sc Hons (Geology) | All Sections (Phakisa) | Full Time |

This TRS updates the TRS filed by Harmony on Tshepong South on October 31, 2023, named Exhibit 96.13 Technical Report Summary of the Mineral Resources and Mineral Reserves for Tshepong South, Free State Province, South Africa, which was effective on June 30, 2023. This updated TRS has an effective date as at June 30, 2024. No material changes have occurred between the effective date and the date of signature.

Effective Date: June 30, 2024

6

Technical Report Summary for

Tshepong South, Free State Province, South Africa

3Property Description and Location

Section 229.601(b)(96)(iii)(B)(3) (i-vii)

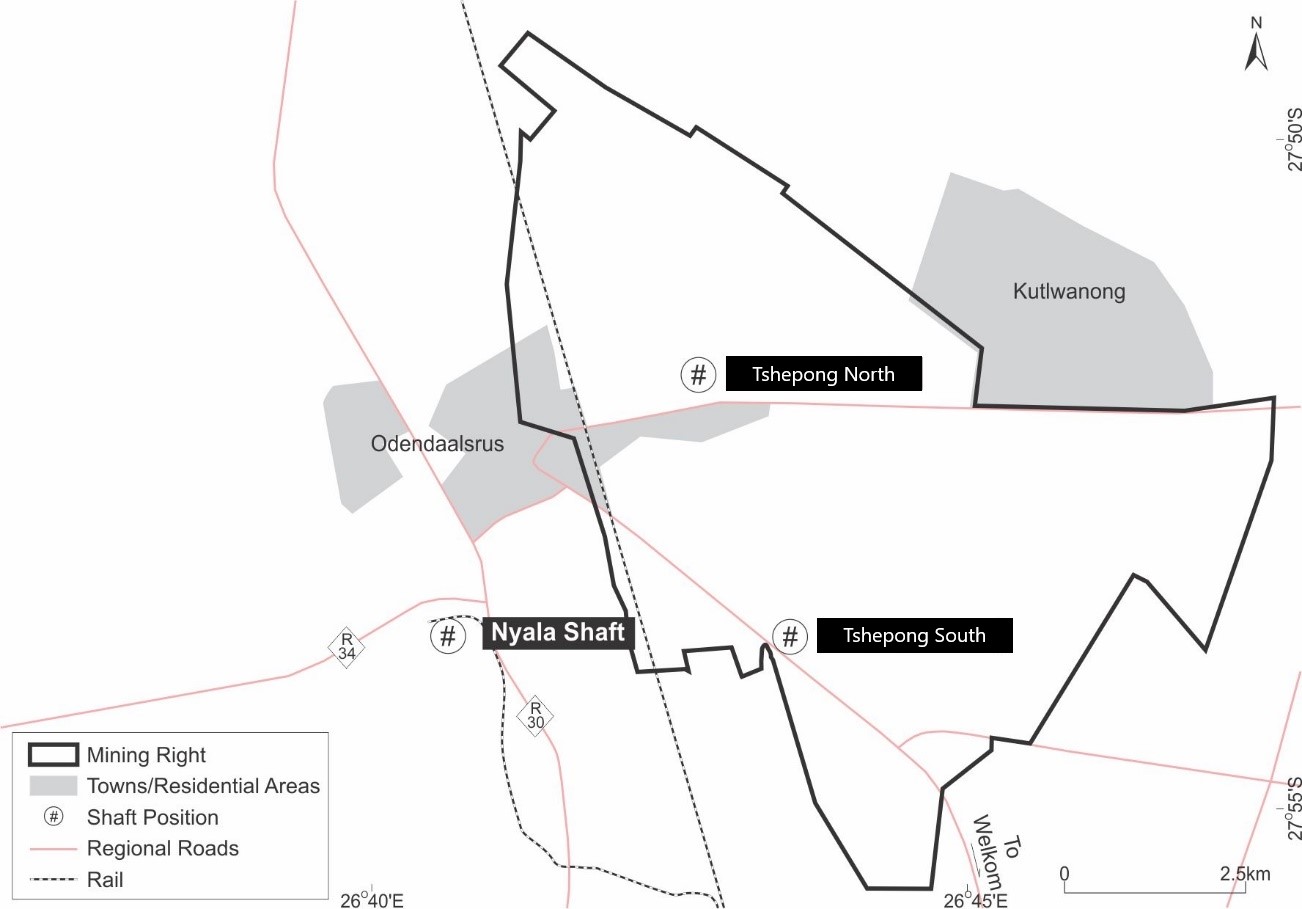

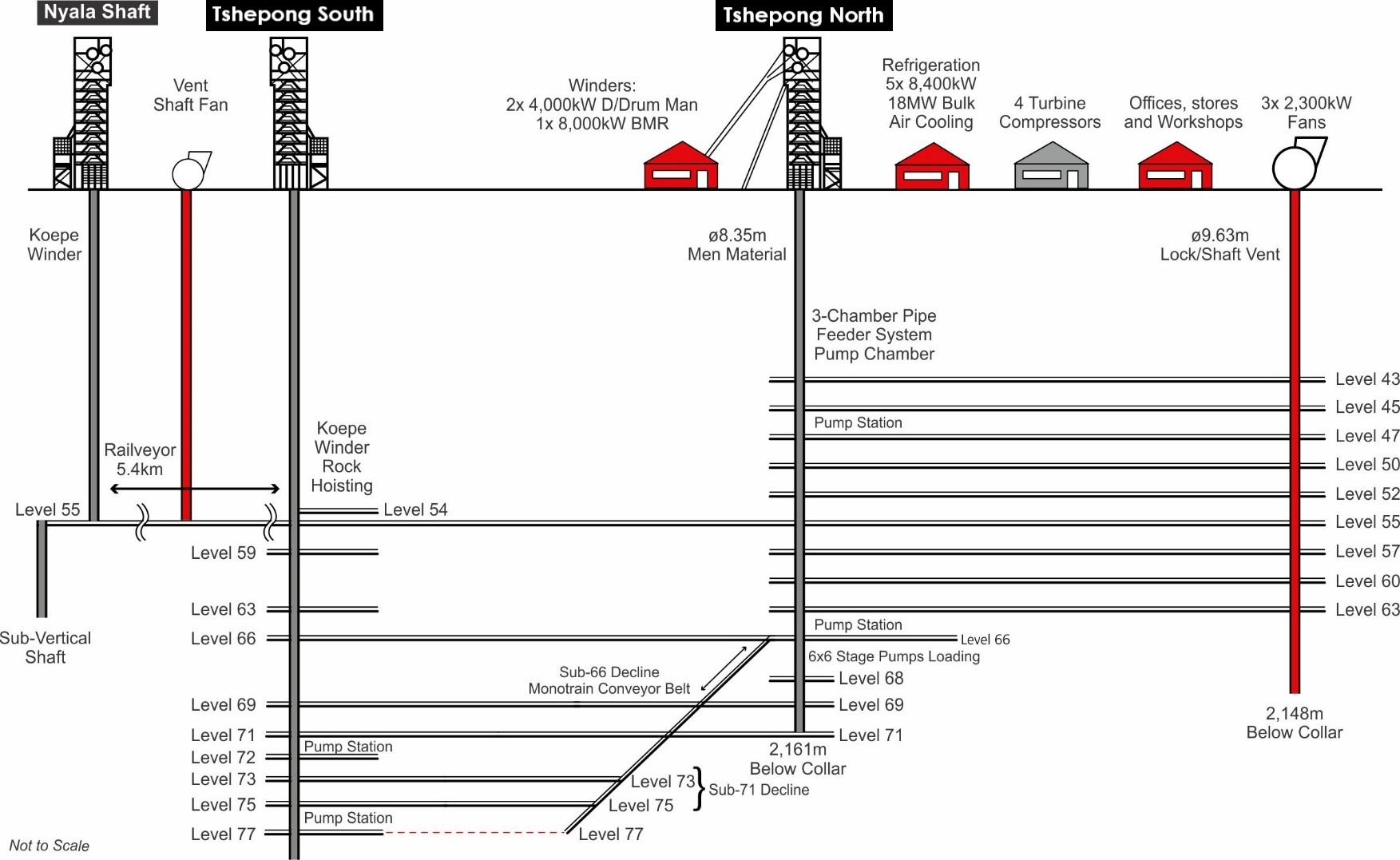

Tshepong South comprises one operating underground gold mine namely “Tshepong South”. Tshepong South is a mature, moderate to deep-level underground operation using conventional underground mining methods to depths of 2,427m BMD. The mine utilises the Tshepong North and Nyala shafts. Tshepong South’s success is greatly dependent on the services rendered via Nyala. Four main compressors and Tshepong South’s ore is transported 5.2km’s via the railveyor system that runs underground on 55 level to Nyala where it is then hoisted and transported via Rail system to the plant.

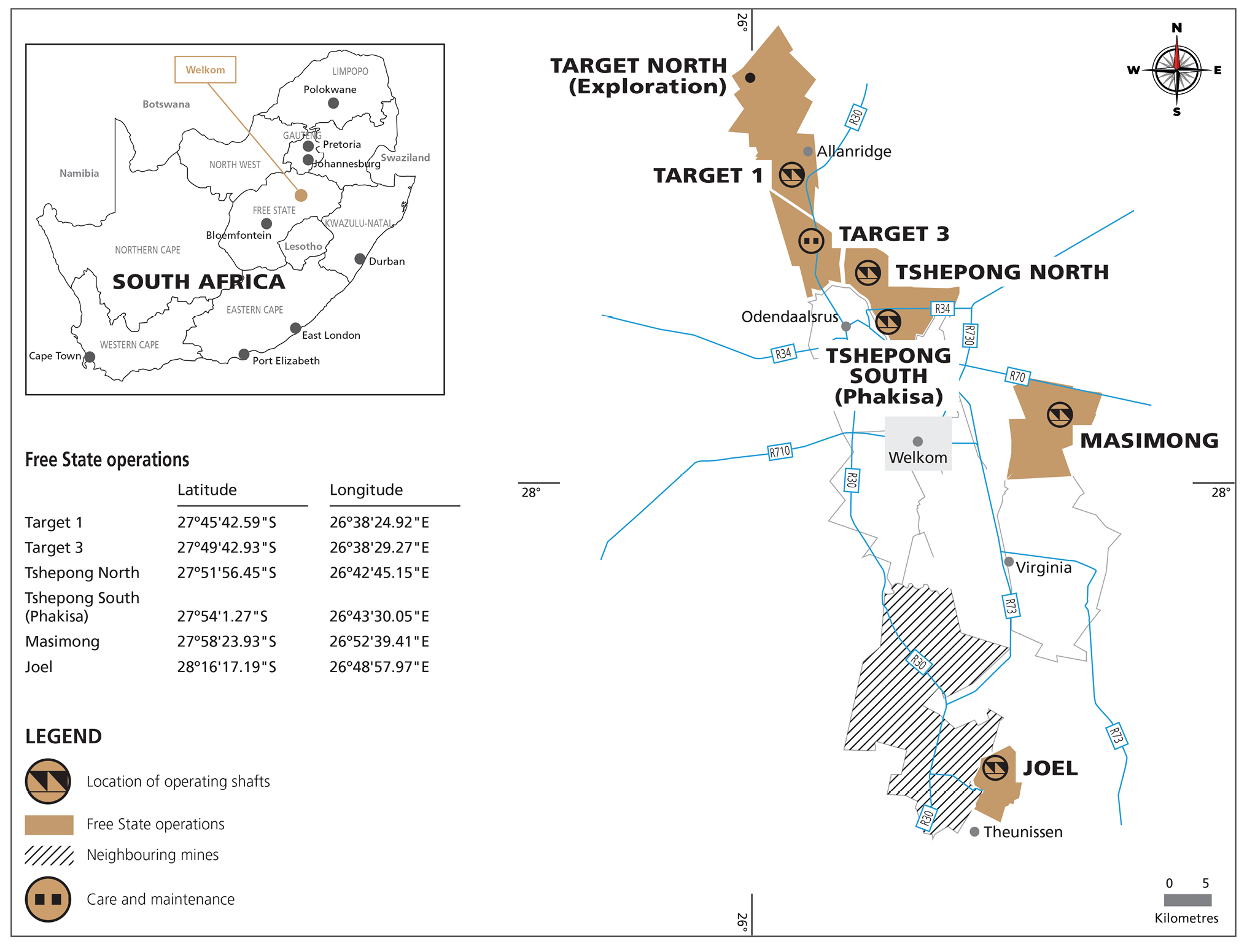

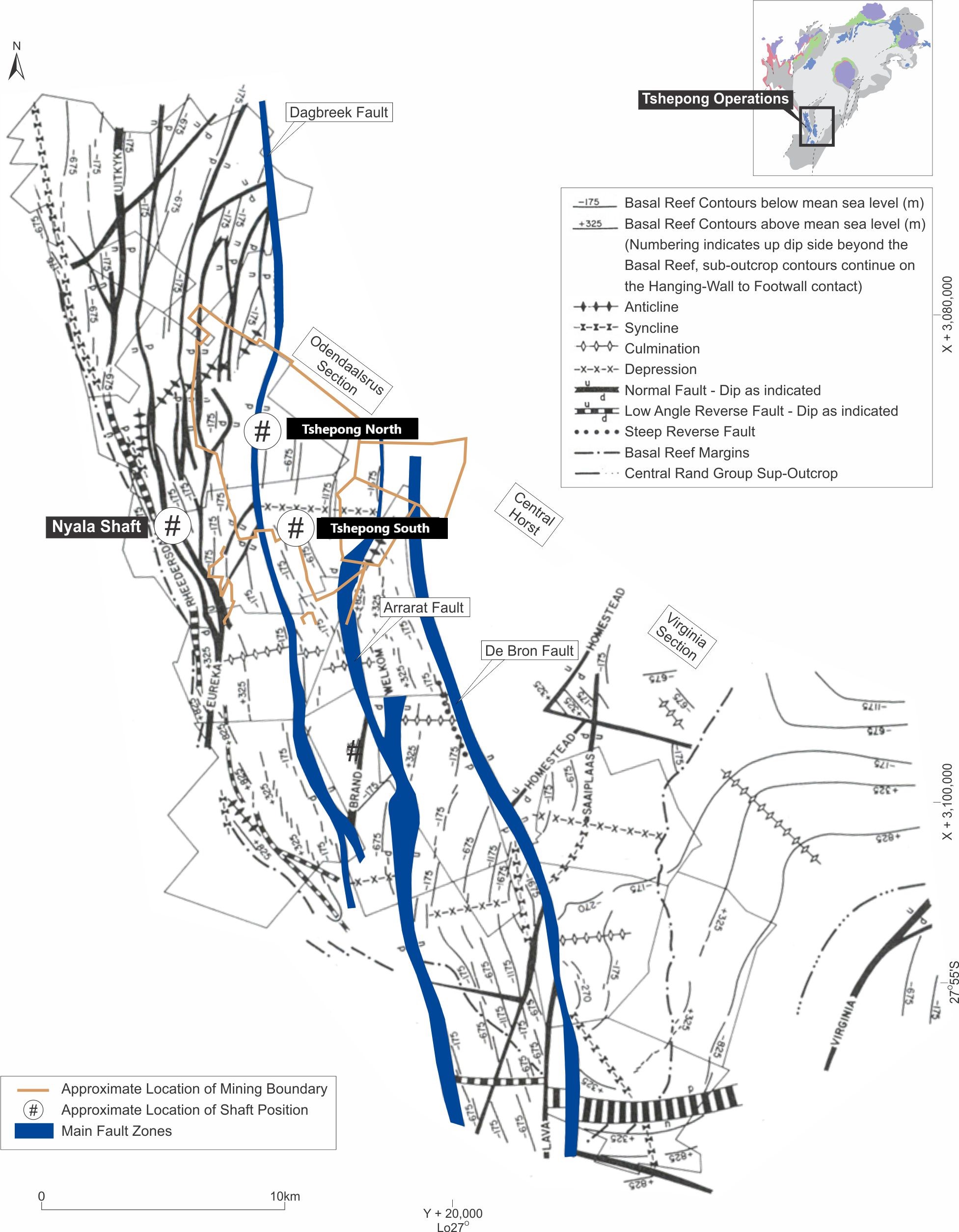

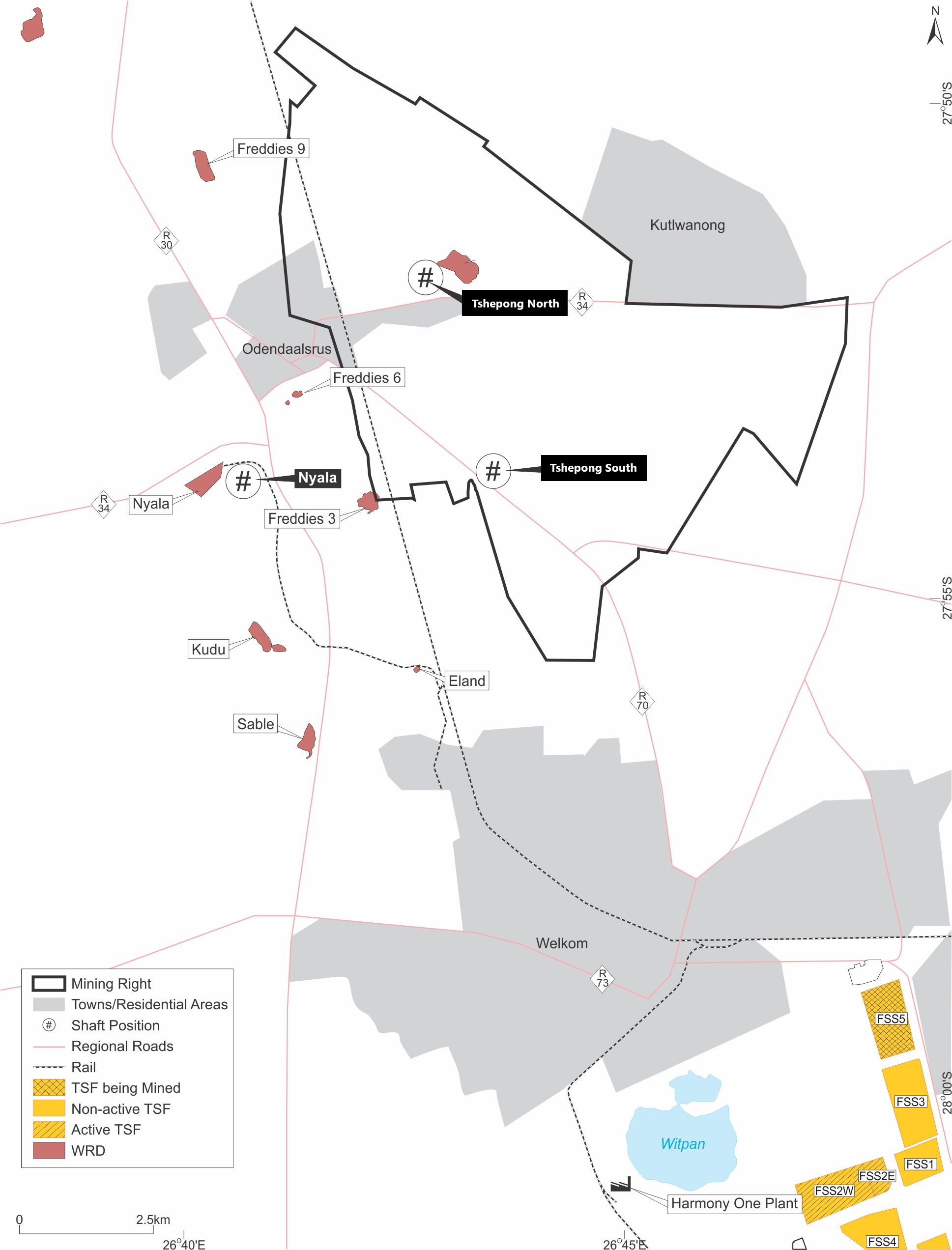

The mines are located in the Free State Province of South Africa, approximately 250km southwest of Johannesburg and 15km to the north of the town of Welkom (Figure 3-1).Tshepong South is situated adjacent to the south of Tshepong North, and is located at a latitude of 27°54’1.27”S and longitude of 26°43’30.05”E.

3.1Mineral Tenure

South African Mining Law is regulated by the MPRDA which is the predominant piece of legislation dealing with acquisitions or rights to conduct reconnaissance, prospecting and mining. There are several other pieces of legislation which deal with such ancillary issues such as royalties (the Mineral and Petroleum Resources Royalty Act, 2008), title registration (the Mining Titles Registration Act, 1967), and health and safety (the Mine Health and Safety Act, 1996).

Tshepong South Mine is in the legal entity called Freegold (Harmony)(Pty) Ltd. Mineral royalties are payable to SARS by the legal entity and are calculated using a specific formula to determine the Royalty percentage. The Gross sales and EBIT (which are defined terms in the Royalty Act) are inputs into this formula. The minimum royalty rate is 0.5% of gross sales and the maximum rate is 5%. The royalty formula to determine the Royalty rate to be applied is: Formula: Y = 0.5 + [EBIT/(GS x 12.5)] x 100. Mineral royalty payments to SARS are up to date.

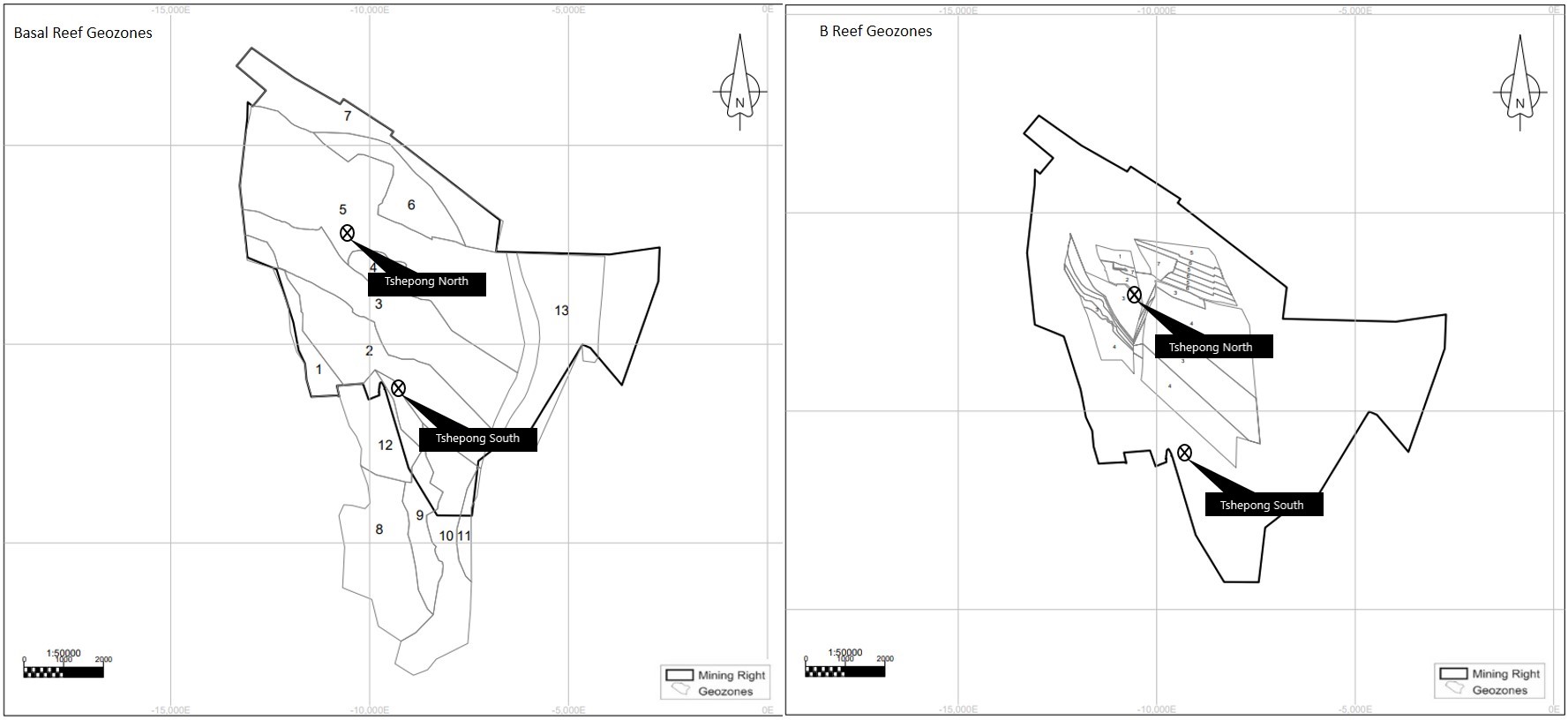

The current mining right for Tshepong (Tshepong South and Tshepong North) encompasses an area of 10,798.74ha (Figure 3-2). Harmony holds several mining rights in the Free State goldfields which have been successfully converted and executed as new order mining rights, some of which are still to be registered at the Mineral and Petroleum Resources Titles Office (“MPRTO”). The mining right for Tshepong South is presented in Table 3-1.

Tshepong South is wholly owned by Harmony, including the associated mineral rights. Harmony commenced acquiring the assets through the acquisition of AngloGold Ashanti Limited (“AngloGold Ashanti”) Free State operations in 2001, together with ARMGold. ARMGold was subsequently incorporated into Harmony in 2003, giving Harmony 100% ownership and control of Tshepong South.

Table 3-1: Summary of mining rights for Tshepong South

| | | | | | | | | | | | | | | | | |

| License Holder | License Type | Reference No. | Effective Date | Expiry Date | Area (ha) |

| Freegold (Harmony) (PTY) LTD | Mining Right | FS30/5/1/284MR | 11-Dec-2007 | 10-Dec-2029 | 10798.74 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

There are no known legal proceedings (including violations or fines) against the Company which threatens its mineral rights, tenure, or operations.

3.2Property Permitting Requirements

All relevant underground mining and surface permits, and any other permit related to the work conducted on the property have been obtained and are valid. An application to renew and amend the water use license applications (WULA) was submitted to the respective regulator as per Table 1-5.

Harmony has access to all the properties it requires to conduct its current mining activities. The surface lease and surface right areas are sufficient in size and nature to accommodate the required surface infrastructure to facilitate current and planned mining operations.

Effective Date: June 30, 2024

7

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Harmony monitors complaints and litigation against the Company as part of its risk management systems, policies and procedures. There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its mineral rights, tenure or operations.

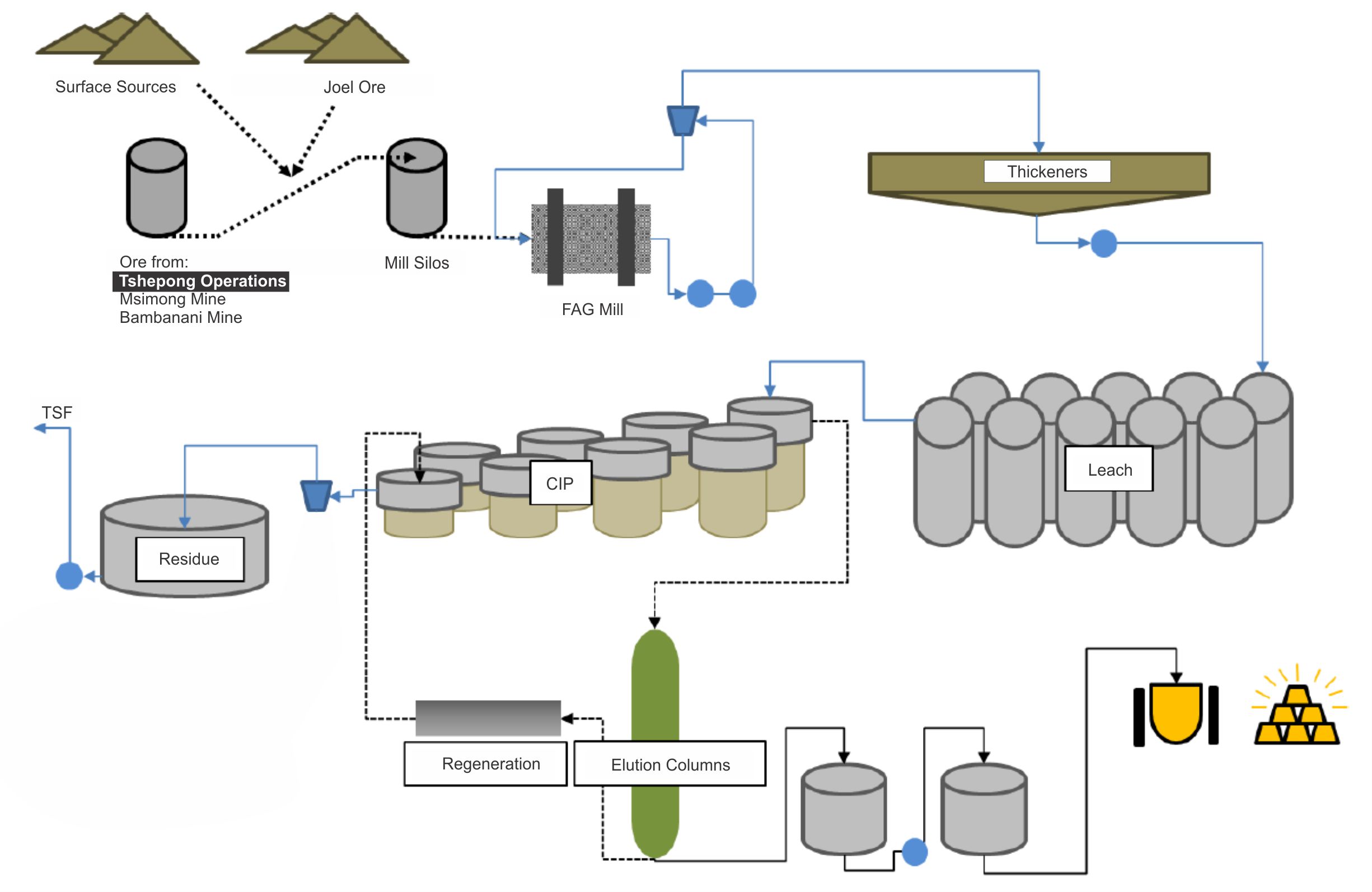

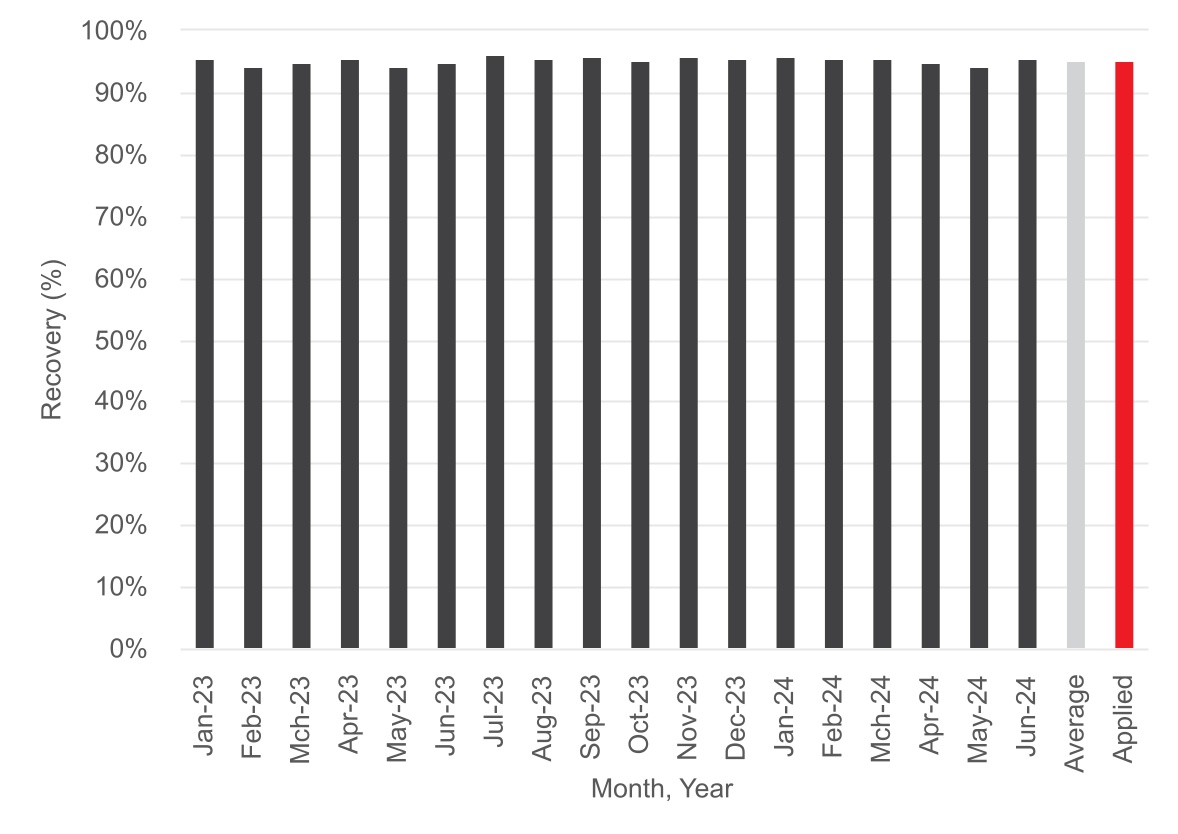

Figure 3-1: Location of Tshepong South in the Free State Goldfield

Figure 3-2: Mineral Tenure for Tshepong South

Effective Date: June 30, 2024

8

Technical Report Summary for

Tshepong South, Free State Province, South Africa

4Accessibility, Climate, Local Resources, Infrastructure and Physiography

Section 229.601(b)(96)(iii)(B)(4) (i-iv)

4.1Accessibility

Access to Tshepong South is accessible via the local R70 road between Welkom and Odendaalsrus (Figure 3-1). The area has well-established rail links and an airfield within close proximity.

Entry into the mining area is restricted by security fencing, security guards, booms and lockable gates at the main entrance. In addition, a communication system and access control system monitors personnel entering and leaving the mine property.

4.2Physiography and Climate

The mine lease area (Tshepong South) is flat with an average height of around 1,344m above mean sea level (“amsl”). There are no prominent topographical landmarks in the area. The topography has been affected by the presence of slimes dams, waste rock dumps and solid waste disposal sites.

Tshepong South is situated in the Free State Goldfield, a semi-arid region with an annual rainfall of between 400mm and 600mm. Local thunderstorms and showers are responsible for most of the precipitation during summer, from October to March, peaking in January. Hail is sometimes associated with thunderstorms.

The seasonal fluctuations in mean temperatures between the warmest and the coldest months vary between an average minimum of 7.7°C in winter to a maximum of 37°C in summer. The month of July is generally the coldest month with the hottest month typically being February.

Tshepong South is not restricted by climatic or seasonal variability.

4.3Local Resources and Infrastructure

The surrounding areas of Welkom and Odendaalsrus are well developed in terms of access and mining-related infrastructure, which supports the numerous operational gold mines in the area. The regional infrastructure includes national and provincial paved road networks, power transmission and distribution networks, water supply networks and communication infrastructure.

As part of the Social Labour Plan members from the surrounding community are trained and skilled on a rotational basis and placed back in the community to create a talent pool of available people that are available as needed. Higher skilled and senior positions are managed and maintained through talent pools and succession planning.

Availability of consumables is handled through the IMS (Internal Material Supply) system as part of the on-site Finance department. Lead times are taken into account and material and supplies ordered and delivery scheduled to ensure a constant supply to the shaft.

Tshepong South operates a single vertical shaft for man and materials. Rock is transported from the underground working via a RailVeyorTM system to the Nyala Shaft for hoisting.

Tshepong South ore is transported, by rail, from Nyala shaft to the Harmony One Plant in Welkom for processing (Figure 3-2).

Tshepong South is powered by electricity from Eskom Holdings State Owned Company (“SOC”) Limited.

Effective Date: June 30, 2024

9

Technical Report Summary for

Tshepong South, Free State Province, South Africa

5History

Section 229.601(b)(96)(iii)(B)(5) (i-ii)

5.1Historical Ownership and Development

Tshepong South “Phakisa” was formerly known as FSG 4, Freddies 4 and Tshepong South. Tshepong South development commenced in October 1993 and shaft sinking was started in February 1994. In 1995, shaft sinking was halted on 59 Level due to the prevailing low gold price. Operations at Tshepong South recommenced in September 1996 and sinking was completed to 75 Level, before being halted again in 1999.

Harmony acquired Tshepong South as part of the acquisition from AngloGold Ashanti’s Free State operations (previously known as Freegold), which completed in September 2003. Sinking and equipping was completed to a depth of 2,427m in 2006.

Tshepong South and Tshepong North were merged into Tshepong operations by Harmony in 2017 and split into separate operations in 2023.

The historical ownership and associated activities related to Tshepong are summarized in Table 5-1.

Table 5-1: Summary of historical ownership changes and activities of Tshepong South

| | | | | |

| Year | Asset History Highlights |

| Tshepong South |

| 1994 | Shaft sinking began. |

| 2002 | Harmony (as part of a 50:50 joint venture with ARMGold) acquired Phakisa from AngloGold Ashanti. |

| 2003 | The Phakisa Shaft Project began development. ARMGold and Harmony merged. |

| 2005 | Phakisa shaft completed and shaft equipping underway. |

| 2008 | Phakisa started production with full-scale production planned by June 2011. |

| 2009 | Five ice plants commissioned, improving ventilation and cooling. |

| 2011 | Phakisa reached full production. |

| 2017 | Tshepong and Phakisa merged into Tshepong operations |

| 2023 | Tshepong and Phakisa operations split into separate operations. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

5.2Historical Exploration

A total of nine surface holes were drilled into Tshepong South. Two surface holes UT3 and EV10 had B-Reef intersection values of 845 cmg/t and 1429cmg/t respectively. Strong linear B-Reef value trends running from Tshepong North Mine into Tshepong South Mine were also identified where an expected value of the area averaged 1291cmg/t. A high level capital exploration drilling project for B-Reef was approved in August 2016 for Tshepong South Mine. Eight drill holes were planned, totaling 5,180m at a total cost of ZAR5.5m. The exploration drilling program was successfully concluded in October 2020, with the planned eight holes drilled in the target area which confirmed the extension of the Tshepong North B-Reef payshoot.

5.3Previous Mineral Resource and Mineral Reserve Estimates

The previous in-situ Mineral Resource estimates for Tshepong South were declared as at June 30, 2023 by Harmony, according to the SK 1300 TRS documentation. The previous Mineral Resource estimates, exclusive of Mineral Reserves, are summarized in Table 5-2. These have been superseded by the current estimate prepared by Harmony in Section 11 of this TRS.

Effective Date: June 30, 2024

10

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Table 5-2: Summary of the previous Tshepong South Mineral Resources as at June 30, 2023 (Exclusive of Mineral Reserves)

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 5.661 | 13.02 | 73 695 |

| Indicated | 6.680 | 11.67 | 77 950 |

| Total / Ave. Measured + Indicated | 12.341 | 12.29 | 151 645 |

| Inferred | 25.090 | 10.67 | 267 678 |

| IMPERIAL |

| Mineral Resource Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 6.241 | 0.380 | 2.369 |

| Indicated | 7.363 | 0.340 | 2.506 |

| Total / Ave. Measured + Indicated | 13.604 | 0.350 | 4.875 |

| Inferred | 27.657 | 0.311 | 8.606 |

Table 5-3: Summary of the previous Tshepong South Mineral Reserves as at June 30, 2023

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proven | 2.882 | 7.79 | 22 466 |

| Probable | 0.563 | 7.06 | 3 972 |

| Total / Ave. Proven + Probable | 3.445 | 7.67 | 26 438 |

| IMPERIAL |

| Mineral Reserve Category | Tons (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proven | 3.177 | 0.227 | 0.722 |

| Probable | 0.620 | 0.206 | 0.128 |

| Total / Ave. Proven + Probable | 3.797 | 0.224 | 0.850 |

5.4Past Production

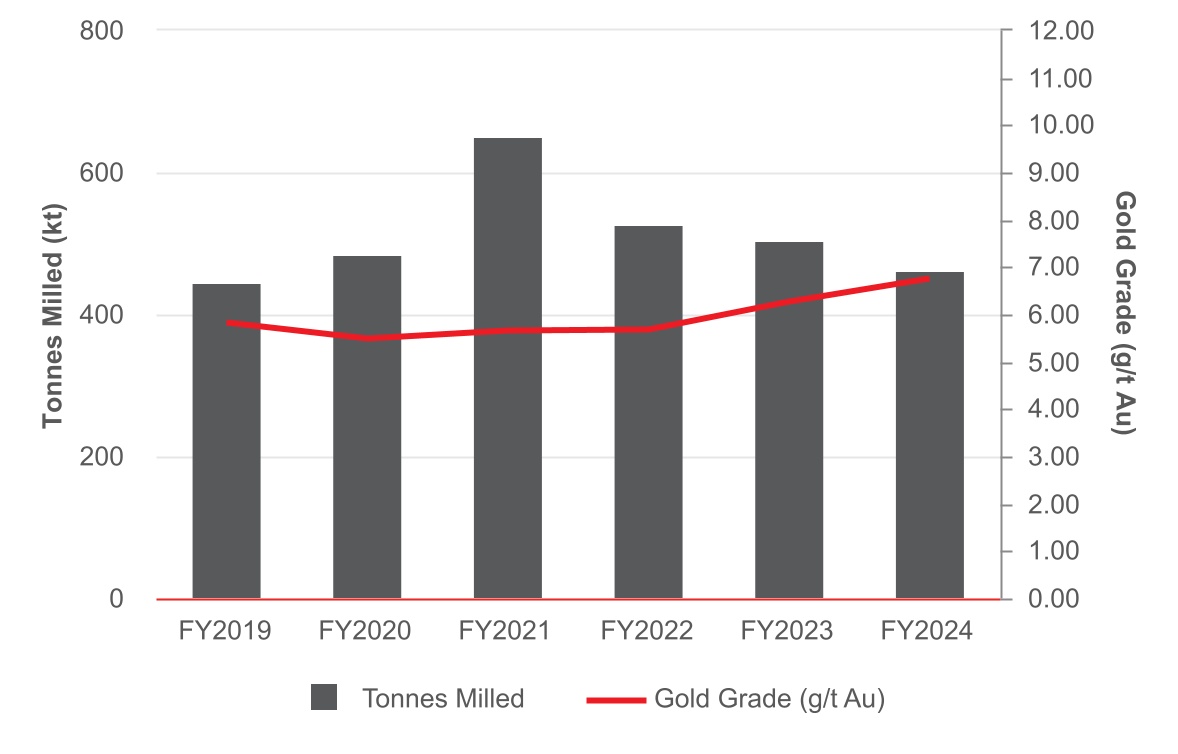

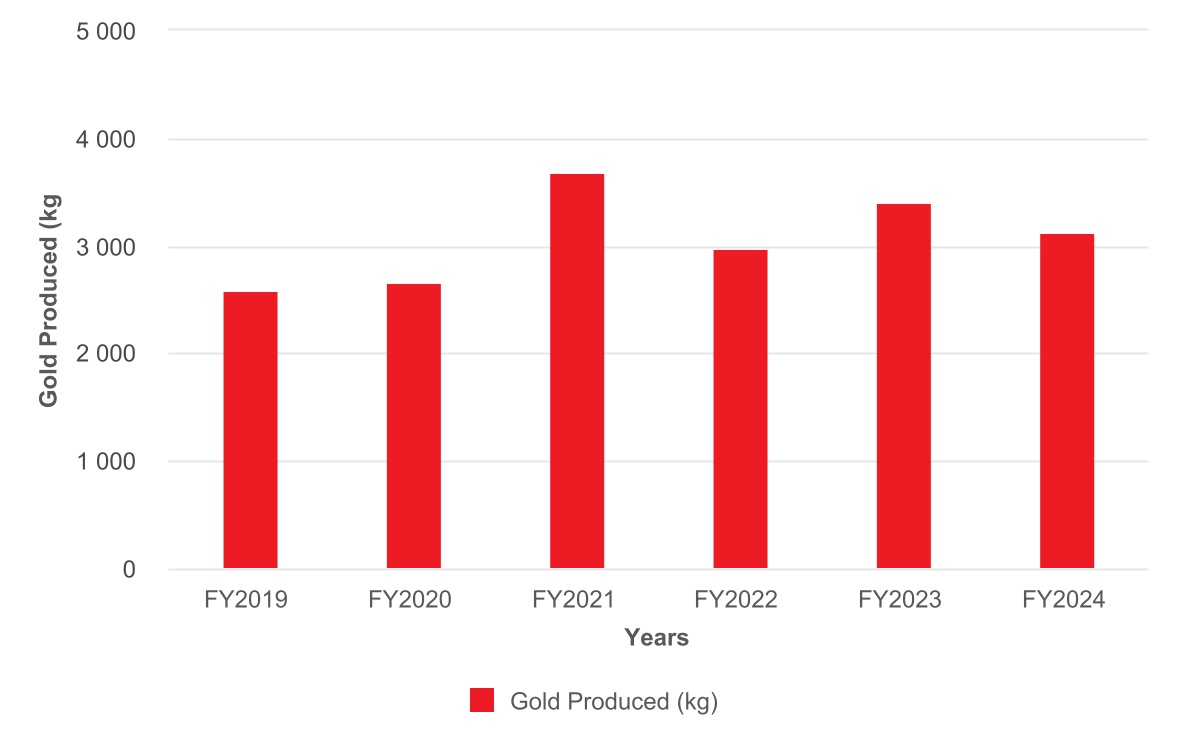

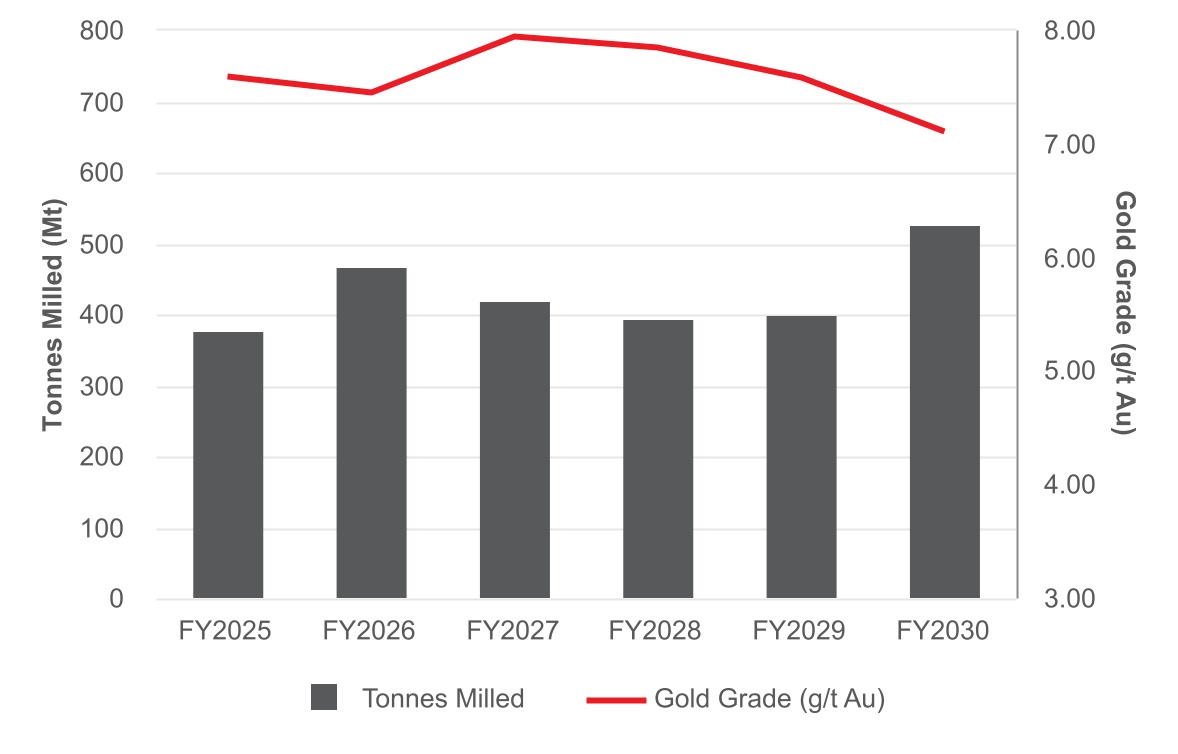

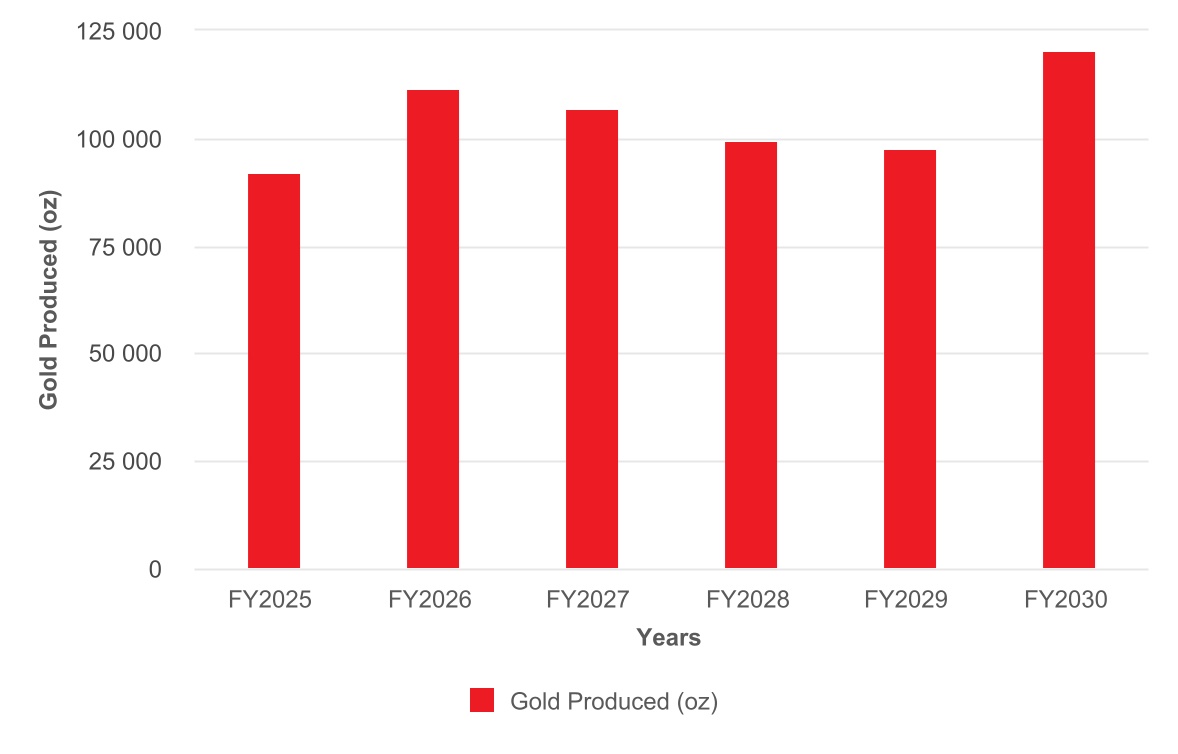

The annual Financial Year’s tonnage, grade and gold production for Tshepong South is presented in Figure 5-1 and Figure 5-2. The reader should note that the figures are reported separately from Tshepong North and the Financial year period runs from July to June the following year (12 months).

Effective Date: June 30, 2024

11

Technical Report Summary for

Tshepong South, Free State Province, South Africa

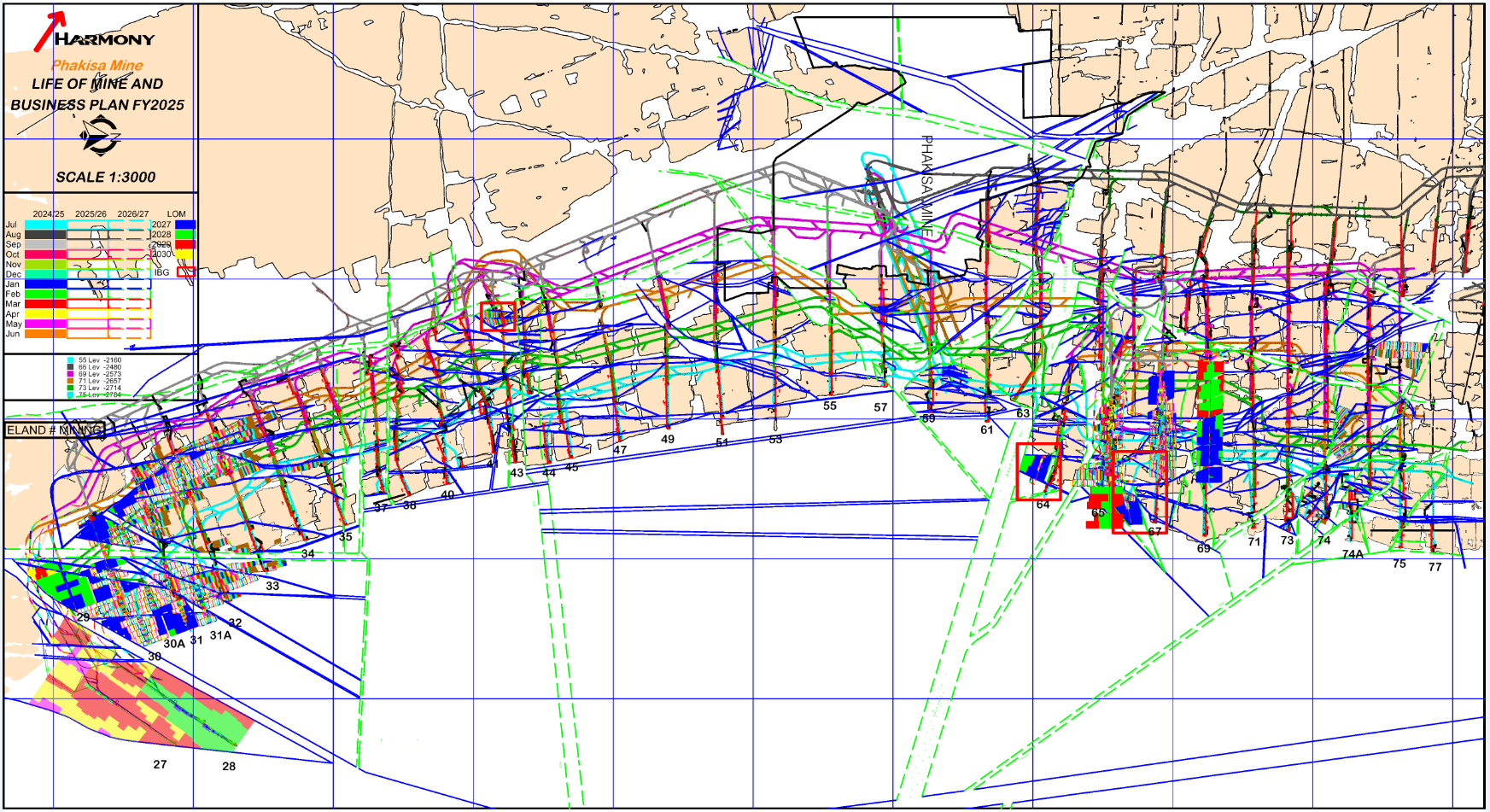

Figure 5-1: Graph of past production – Tonnes and grade

Figure 5-2: Graph of past metal production

Effective Date: June 30, 2024

12

Technical Report Summary for

Tshepong South, Free State Province, South Africa

6Geological Setting, Mineralization and Deposit

Section 229.601(b)(96)(iii)(B)(6) (i-iii)

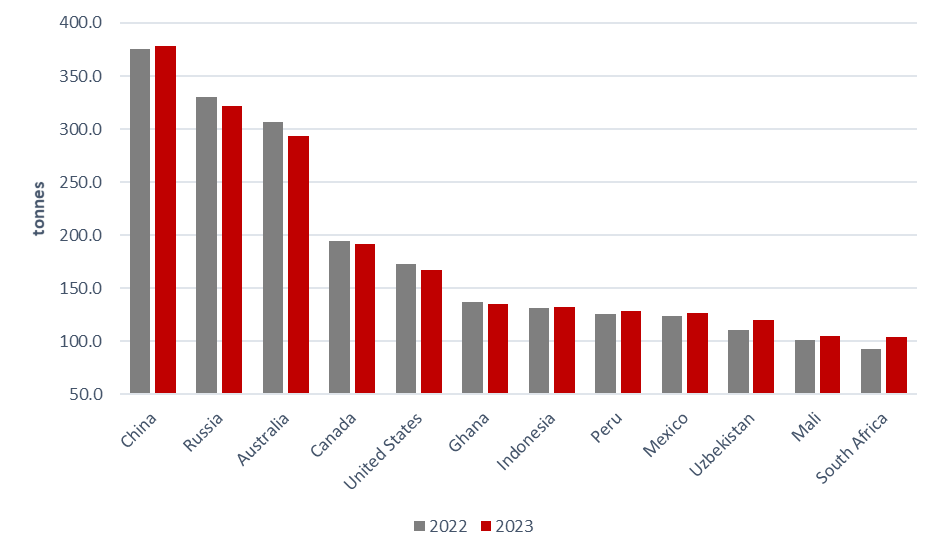

6.1Regional Geology

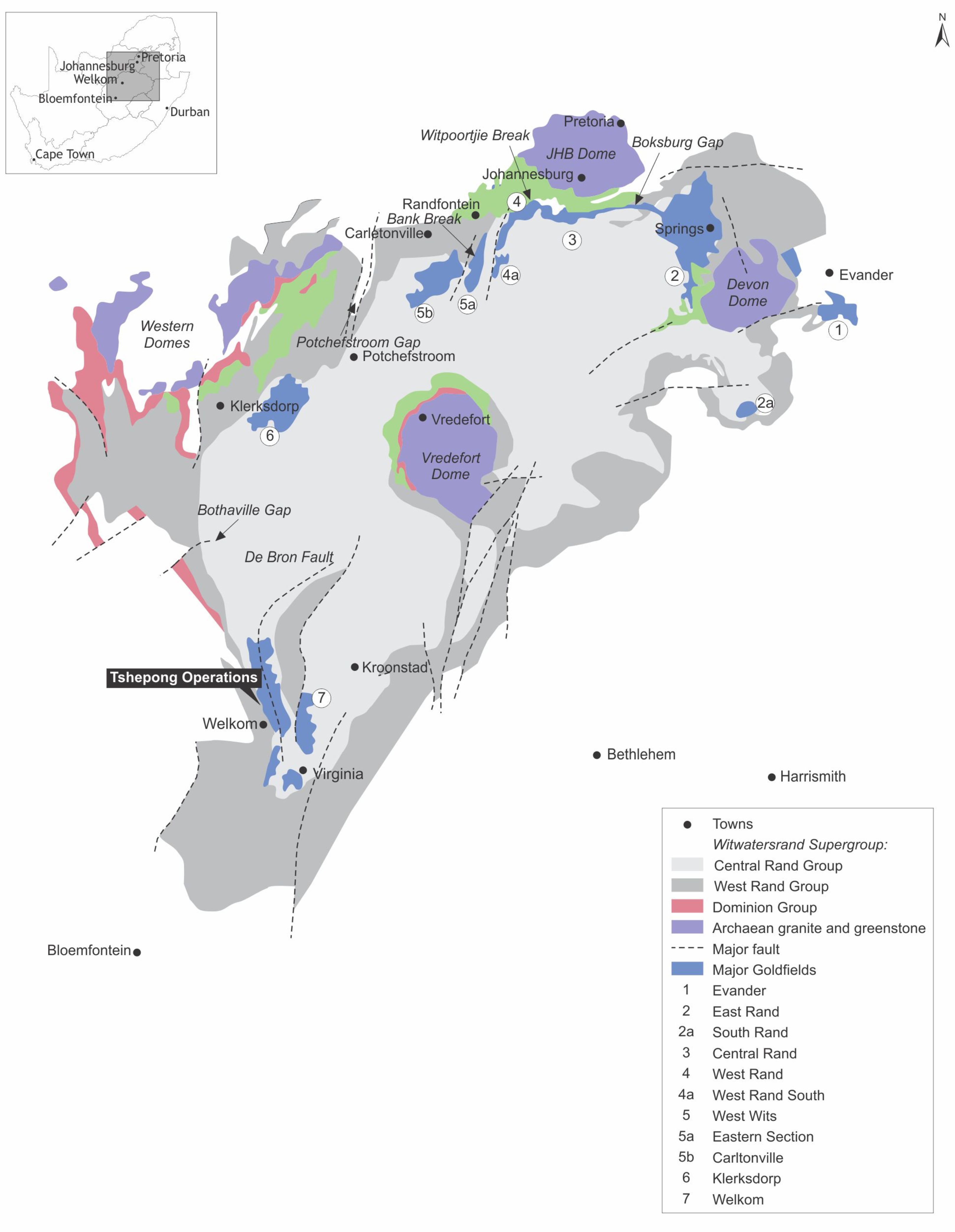

Tshepong South is located on the southwestern margin of the Archean Witwatersrand Basin, one of the prominent gold provinces in the world. The Witwatersrand Basin is an approximately 7,000m thick terrigenous sequence comprising mainly arenaceous and argillaceous, together with minor rudaceous, lithologies deposited in a fluvio-deltaic environment in the center of the Archaean Kaapvaal Craton of South Africa (Robb and Meyer, 1995). The regional geology of the Witwatersrand Basin is shown in Figure 6-1.

The Witwatersrand Basin hosts the Witwatersrand Supergroup, which either conformably or unconformably overlies the metamorphosed volcanic and minor clastic sediments of the Dominion Group (Tucker et al., 2016). The Dominion Group overlies the older granite-greenstone basement.

The majority of the Witwatersrand Supergroup is capped by the volcano-sedimentary sequence of the Ventersdorp Supergroup through an angular unconformity. The Ventersdorp Supergroup is in turn overlain by the dolomitic and quartizitic sequence of the Transvaal Supergroup, and sediments of the Karoo Supergroup (Tucker et al., 2016). Several suites of dykes and sills cut across the Archaean basement and the Witwatersrand, Ventersdorp, Transvaal and Karoo supergroups, and form important geological time-markers.

The Witwatersrand Supergroup is sub-divided into the basal West Rand Group (“WRG”) and overlying CRG (Robb and Robb, 1998). The WRG extends over an area of 43,000km2 and is up to 5,150m thick. It is sub-divided in three subgroups, namely, from bottom upwards, the Hospital Hill Subgroup; Government Subgroup and Jeppestown Subgroup. The stratigraphic succession of the WRG mainly consists of shale sediments, with occasional units of banded iron formation and conglomerate.

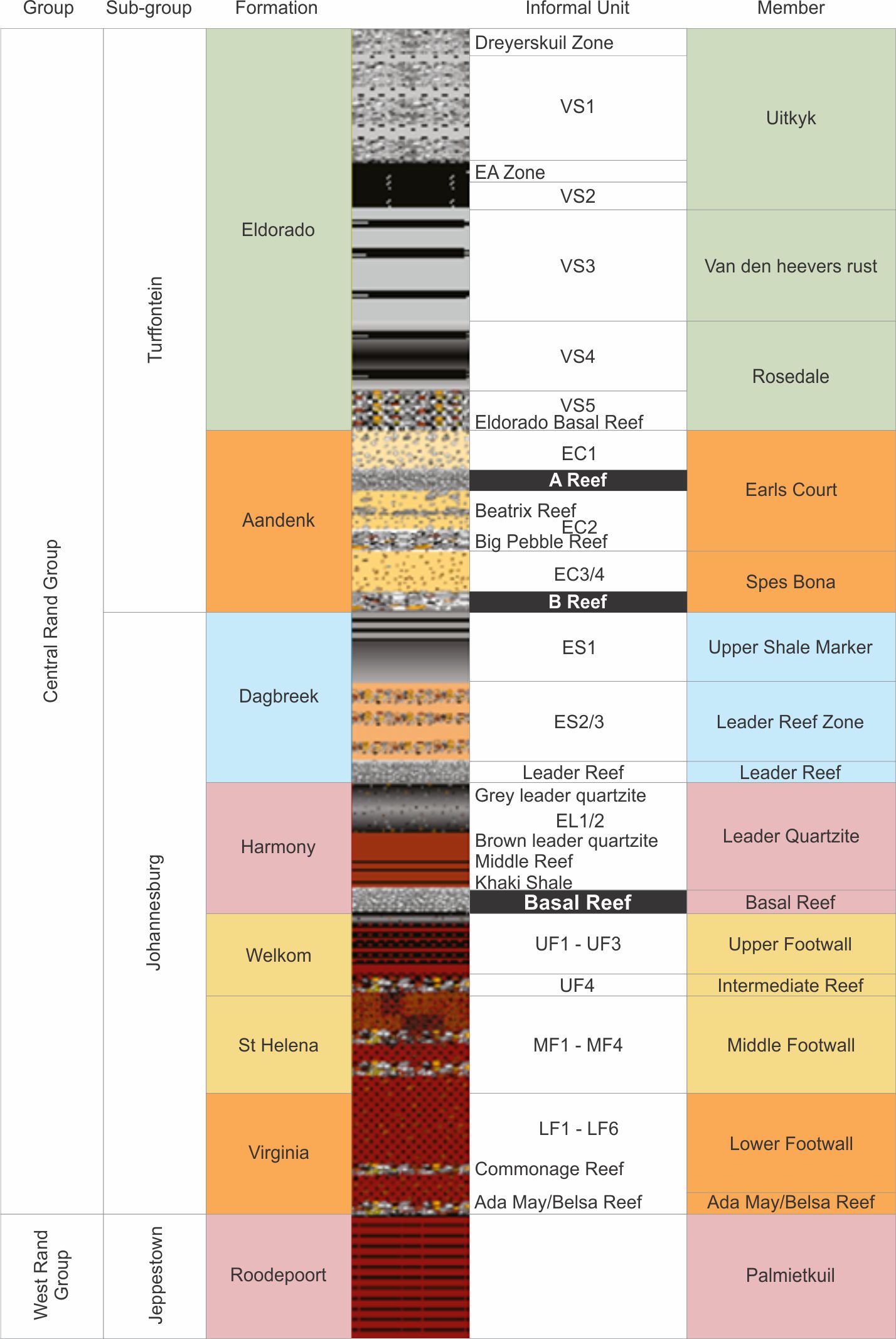

The CRG is up to 2,880m thick and covers an area of up to 9,750km2, with a basal extent of c.290km x 150km. It is sub-divided into the lower Johannesburg Subgroup and upper Turffontein Subgroup as shown in Figure 6-2. These subgroups are separated by the Booysens Shale Formation. The stratigraphic succession of the CRG comprises coarse-grained fluvio-deltaic sedimentary rocks.

The major gold bearing conglomerates are mostly confined to the CRG, and these conglomerate horizons are known as reefs. The most important reefs within the CRG are at six stratigraphic positions, three within the Johannesburg Sub-group and three within the Turffontein Sub-group. The reefs are mined in seven major goldfields, and a few smaller occurrences, which extend for over 400km in what has been called “The Golden Arc”. This arc is centered on the prominent Vredefort Dome, as shown in Figure 6-1, which is thought to be a major meteorite impact site in the center of the Witwatersrand Basin (Therriault et al., 1997). The goldfields, as shown in Figure 6-1, include: East Rand, South Rand, Central Rand, West Rand, West Wits, Klerksdorp, Free State (Welkom), and Evander.

6.2Local Geology

Tshepong South is located within the Free State Goldfield (Figure 6-1). The stratigraphic column of the Free State Goldfield is presented in Figure 6-2. The Johannesburg Subgroup comprises the Virginia, St Helena, Welkom, Harmony and Dagbreek formations.

The Free State Goldfield forms a triangle between the towns of Allanridge, Welkom and Virginia. The area is host to several gold mines, all of which produce gold from auriferous bearing reefs situated within sediments of the Central Rand Group of the Witwatersrand Sequence (Figure 6-2). Most of the presently exploitable reefs are situated within five stratigraphically separate placers including the Basal/Steyn, Saaiplaas Leader, B, Kimberley and Eldorado, with the majority of tonnage derived from the Basal/ Steyn and Saaiplaas Leader.

The Witwatersrand and overlying Ventersdorp lavas were deposited in a basin with significant and continual down warping to accommodate the sediments and lavas. During Platburg times, the basin underwent a significant rifting and tilting event, resulting in the region being split by significant faults. These faults are generally westerly dipping, with downthrows to the west, and strata dipping generally to the east.

Effective Date: June 30, 2024

13

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 6-1: Regional geology of the Witwatersrand Basin

Effective Date: June 30, 2024

14

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 6-2: Simplified stratigraphy of the Free State Goldfield

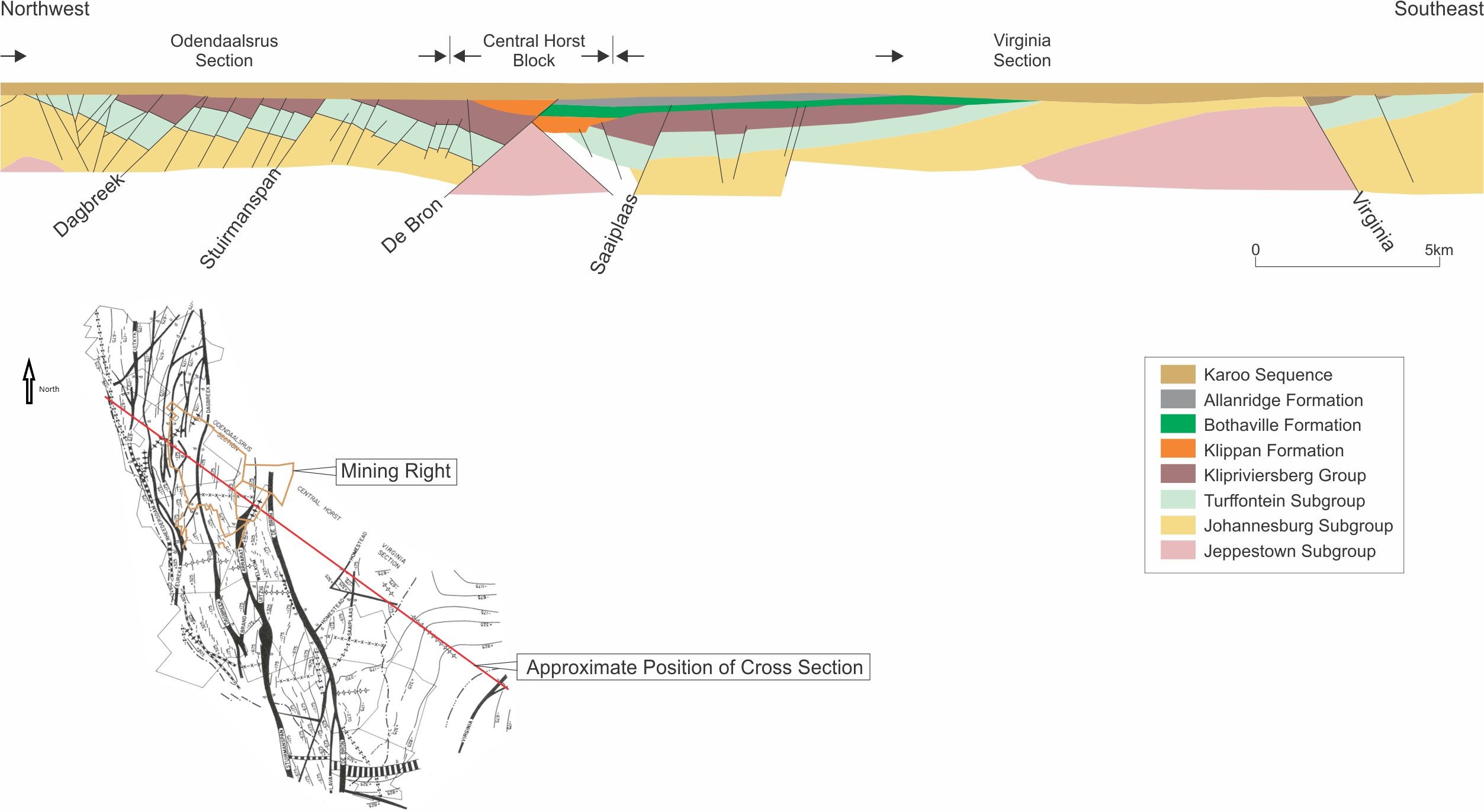

The general orientation of the Witwatersrand Supergroup succession in the Free State Goldfield is interpreted as north-trending within a syncline that is plunging to the north (Figure 6-3). The syncline is cut by two major faults resulting in the formation of three major fault bounded blocks:

•Odendaalsrus Section to the west of the De Bron fault;

•the Central Horst between the De Bron and Homestead faults; and

•the Virginia Section to the east of the Homestead Fault.

The Central Horst was uplifted, and the Central Rand Group rocks eroded away prior to deposition of the Ventersdorp Supergroup and therefore comprises West Rand quartzites. The western margin of Tshepong South mining right area is also affected by the Tribute fault (~270m) and Arrarat Fault (~180m) to the far south-east of the shaft.

A cross section through the fault bounded blocks is presented in Figure 6-4.

Effective Date: June 30, 2024

15

Technical Report Summary for

Tshepong South, Free State Province, South Africa

6.3Property Geology

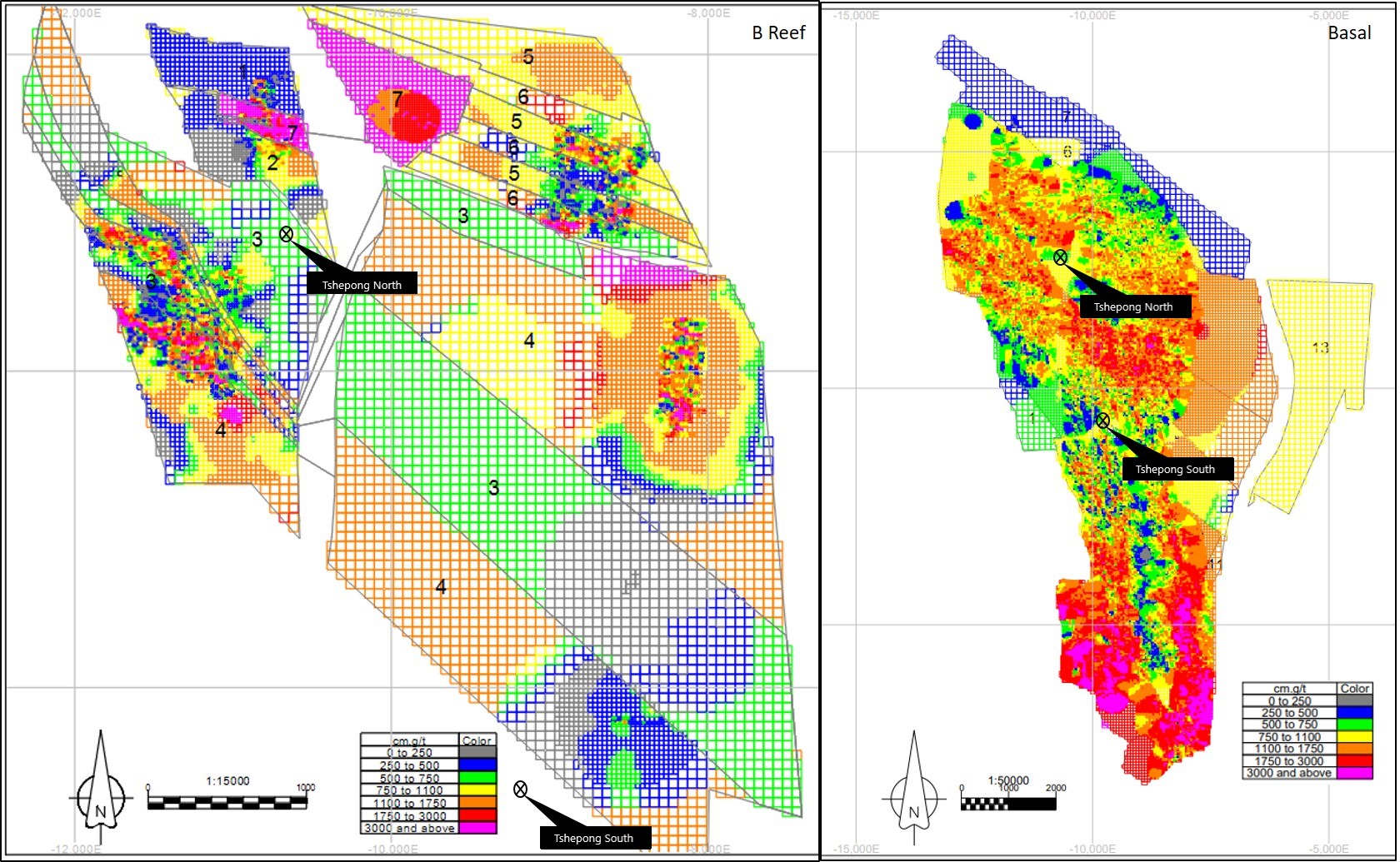

The principal gold-bearing orebody is the stratiform and strata-bound Basal Reef (or Basal Reef Zone (“BRZ”)) (Figure 6-2). A secondary reef, the B-Reef, lying between 140m and 160m stratigraphically above the Basal Reef, contributes less than 20% to the mining production at Tshepong South Mine.

6.3.1Basal Reef Lithology

The Basal Reef comprises a thin conglomerate, overlain by clean ‘placer’ quartzites. The Basal Reef is underlain by a thick series of siliceous and argillaceous quartzites comprising the Welkom Formation and overlain by shales and quartzites of the Harmony Formation, both of the Johannesburg Sub-group of the CRG. The Basal Reef sits unconformably on the Welkom Formation (Figure 6-2).

The Upper Cycle Black Chert facies Basal Reef prevails in the South of Tshepong South’s area and consists of a slightly polymictic (yellow shale specks present), matrix-supported medium-pebble conglomerate with a more gradational contact absent of carbon, where mineralization is associated with fine disseminated and buck-shot pyrite. The conglomerate is slightly thicker compared to the Lower Cycle, but is also overlain by barren reef quartzite, the entire package being characteristically from 40cm to 60cm thick. The lower Khaki Shale is up to 1m thick.

There are two facies of Basal Reef on Tshepong South, namely; the Lower Cycle Black Chert facies in the north and the Upper Cycle Black Chert facies in the south. The reef package ranges from 100cm to 160cm thick.

The Lower Cycle Black Chert facies predominates in the north with a northwest / southeast value trend. The reef consists of an oligomictic small pebble matrix-supported conglomerate lag with fly-speck carbon contact. The rest of the reef package constitutes barren siliceous fine-grained reef quartzite. The entire reef package reaches up to 160cm thick and is overlain by 1cm to 30cm of lower khaki shale. This in turn is overlain by the approximately 3-4m thick waxy brown leader quartzite, above which lies the 3-4m thick upper khaki shale.

6.3.2B-Reef Lithology

The B-Reef at Tshepong South is located about 140m stratigraphically above the Basal Reef and varies in thickness from 10cm to 170cm. The conglomerate varies in character depending on the facies, with B1 being a small to medium pebble conglomerate and usually no more than 30cm thick with abundant carbon. The B2 facies is a small pebble lag in an argillaceous quartzite, with little to no mineralization. B3 facies is a 20cm to 150cm thick conglomerate, mature, well packed, with pebble sizes varying from small to cobble size, very polymictic, normally with abundant pyrite and some carbon. This is the most common facies.

The lowest unit is a basal lag (Zone A), overlying Doornkop Quartzite Formation. Where this unit is developed (or preserved), it may be a highly mineralized oligomictic or polymictic conglomerate, with visible gold, buckshot pyrite and carbon mineralization. This unit may carry gold values of many thousands of cmg/t and represents a potentially rewarding exploration target.

The unit overlying the Zone A may be either Zone B, which comprises a mildly erosive pebbly quartzite formation, and/or the stratigraphically younger Zone C, which is a polymictic conglomerate with low values and is erosional into the underlying A and B zones.

Effective Date: June 30, 2024

16

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 6-3: Structural geology of the Free State Goldfields

Effective Date: June 30, 2024

17

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 6-4: Tshepong South Cross Section

Source: Modified after Tucker et al. (2016)

Effective Date: June 30, 2024

18

Technical Report Summary for

Tshepong South, Free State Province, South Africa

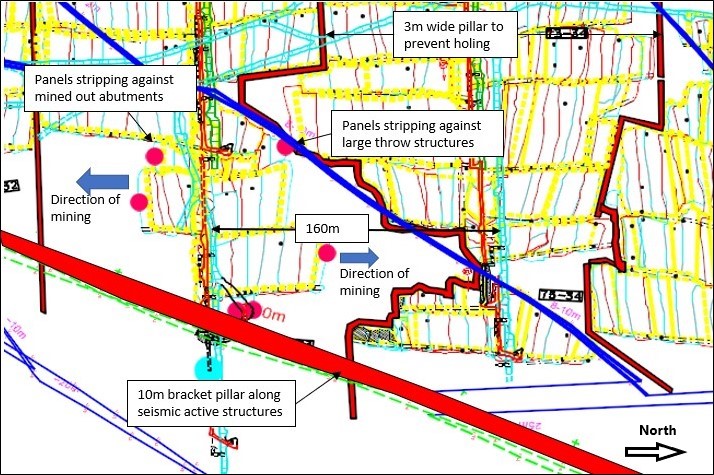

6.3.3Structure

At Tshepong South, there are several major faults and dykes present interpreted from surface drill holes and intersected in the development and stoping. Among these are the Enrico, Zero, Zindaba, Eland, Savannah and Enkeldoorn Dykes, as well as the Tribute and Tshepong South Faults. The easterly limit of the ore body is not clearly defined but appears to cut off at approximately 3,000m below surface on a major component of the north-south striking Arrarat Fault.

Two principal age-based divisions in Tshepong South’s intrusive structures have been identified, namely; Ventersdorp and post-Ventersdorp eras. Various subdivisions within each of these two categories have also been observed.

Yellow porphyry, acicular and quartz diorite dykes are found in the Ventersdorp suite of intrusives, while Karoo dolerites and lamprophyres occur in the post-Ventersdorp suite of intrusives. These intrusives tend to utilise any plane of weakness in their passage. It is therefore not unusual to find an intrusive infill along the various fault planes and other faults within the mine area. Accompanying gouge material, showing slicken-siding along the contacts of the intrusions, indicates that movement has taken place after these rocks were intruded.

6.4Mineralization

The gold mineralization in the Witwatersrand deposits is believed to have followed an episode of deep burial, fracturing and alteration. The mineralization model is that Archean gold bearing hydrothermal fluid was introduced into the conglomerates and circulated throughout in hydrothermal cells. The fluids precipitated gold and other elements through reactions that took place at elevated temperatures along the reef horizons, which was the more favorable fluid conduit.

The generic mineralization model for Tshepong South Basal Reef is based on structurally controlled fluid flow within a conglomerate hosted lithology. Fluid flow is dependent on the permeability of the host rock mass during mineralization. Fluid flow, permeability and subsequent gold mineralization are believed to be controlled by four key factors, including:

•stratigraphy;

•the presence or absence of mineralization age thrust faulting;

•sedimentology; and

•precipitation agent

It is the QP's view, the sedimentological parameters are more influential and predictive for gold distribution on a regional scale.

The gold mineralization is related to the facies-type, and the mineralization characteristics within the facies are similar between Tshepong North and Tshepong South and are hence simply described by facies in the section to follow.

6.4.1Basal Reef

Within the Lower Cycle Black Chert facies, mineralization is characterized by a fine disseminated interstitial pyrite, together with a carbon contact. Mineralization is associated with the carbon contact and conglomerate, although some concentration is also found just below the upper reef contact. At the top of the reef is a granular textured often gritty quartzite with fine pyrite stringers about 10cm thick.

In the Upper Cycle Black Chert Facies, mineralization is associated with the carbon contact and conglomerate, although some concentration is also found just below the upper reef contact. It does not have such a well-developed carbon contact as the Lower Cycle facies and is often of lower grade.

6.4.2B-Reef

The B1 facies has abundant carbon and gold as associated with the carbon. The B2 facies has little to no gold mineralization, while the B3 facies normally has abundant pyrite and some carbon. Free gold can be found in association with the flyspeck carbon in the B3 facies and the carbon seams in the B1 facies.

Effective Date: June 30, 2024

19

Technical Report Summary for

Tshepong South, Free State Province, South Africa

6.4.3Alteration

Alteration is evident in the Basal Reef and B-Reef at Tshepong South and is a result of the hydrothermal fluids that infiltrated the reef and have overprinted on the original mineral assemblage. The reefs contain authigenic sulphides such as pyrite, and other minerals associated with alteration such as chlorite. Gold associations with these mineral assemblages indicate a strong correlation of gold mobilization and redistribution at the time of the hydrothermal fluid influx.

While alteration is an important part of the mineralization, alteration is not used for the identification, modelling or mining of the reefs.

6.5Deposit Type

Tshepong South’s deposits are classed a meta-sedimentary gold deposit. Folding and basin edge faulting have been important controls for sediment deposition and gold distribution patterns within the Witwatersrand Basin and fold trends have been employed in the economic evaluation of various reef horizons.

6.6Commentary on Geological Setting, Mineralization and Deposit

The regional geological setting, local and property geology, mineralization and deposit-type for Tshepong South is well established, through many decades of exploration and mining. Reliable geological models, maps and cross sections are available that support the interpretations and inform the Mineral Resource estimates.

Effective Date: June 30, 2024

20

Technical Report Summary for

Tshepong South, Free State Province, South Africa

7Exploration

Section 229.601(b)(96)(iii)(B)(7) (i-vi)

Geological data has been obtained through initial surface drilling, followed by underground drilling, mapping and channel (chip) sampling.

Tshepong South is undergoing B-Reef exploration drilling to identify any potential continuation of the current pay shoots connecting Tshepong South and Tshepong North mines. Footwall development began at Tshepong South during FY20 and will be used as a drilling platform to confirm and delineate the anticipated B-Reef channel.

7.1Geophysical Surveys

Initial exploration included a historical geophysical seismic survey to obtain information of subsurface rock formations and geological structures using shock wave reflections and surface diamond core drilling. The current Mineral Resource model is no longer informed by the geophysical seismic survey and the model relies only on borehole information and underground mapping information.

7.2Topographic Surveys

As an underground operation, topographic surveys are not material to the Mineral Resource estimates.

7.3Underground Mapping

Face and reef development mapping is undertaken by a team comprising a Sampler or Geologist and an assistant. Face tapes are setup along gullies and the stope face and secured with reference to the latest survey pegs installed in the workplaces. Reef position and other lithological and stratigraphic information is collected and measured relative to the reference tapes. The information is captured in a notebook.

Once at surface, the person responsible transfers the information from the notebook to the applicable survey plan, a mapping report is then produced for each mapped workplace. The mapping reports depict the geological information graphically relative to the survey measurement points. Data from the mapping is also incorporated into the geological models.

Approximately 80-90% of all workplaces are inspected by members of the Geosciences team monthly to ensure that suitable mapping information coverage is achieved.

7.4Channel Sampling Methods and Sample Quality

Channel sampling of underground panels is carried out on a monthly basis. Sampling is conducted perpendicular to the channel contact across the exposed channels. The section lines demarcating the width of the sample are drawn parallel to the reef waste contact while those demarcating the length of the sample are drawn at right angles to the reef waste contact and are marked 10cm apart. The samples are chipped out between these section lines.

Sampling of the Basal Reef stoping channels are undertaken at the advancing face on a grid spacing of 5m x 6m at Tshepong South, while the grid spacing for the B-Reef is at 3m x 3m, to counteract the highly channelized nature of the B-Reef. The sampling process is audited monthly and annually by the Geoscience Manager. Development sampling is on a smaller grid at 4m x 4m for Basal and 2m x 2m for B-Reef. Development sampling is done in addition to the face sampling. The results are captured into the information system and plotted on a development sampling sheet.

Measured taken to ensure sample integrity during collection are as follows:

After samplers arriving from underground to surface samples been put in a steel pipe that goes into a locked bin before crushing out to lamps room so no one can take samples out of shaft area. Sampler crew supervisor will then unlock the bin and count all the samples in the afternoons. The sample crew supervisor will then check that all the samples that he counted must correspond with the samples captured by all samplers on the Assay analyses form check by Valuator.

The sample crew supervisor then makes out a waybill for all the samples and await the driver to transport samples and himself to Lab.He also locks all samples in a locked sample box while traveling to the lab.

Effective Date: June 30, 2024

21

Technical Report Summary for

Tshepong South, Free State Province, South Africa

On arrival at assay lab samples been unlocked from sample box and placed into each sample dish and been counted again and confirmed by lab supervisor by signing on assay analysis form.

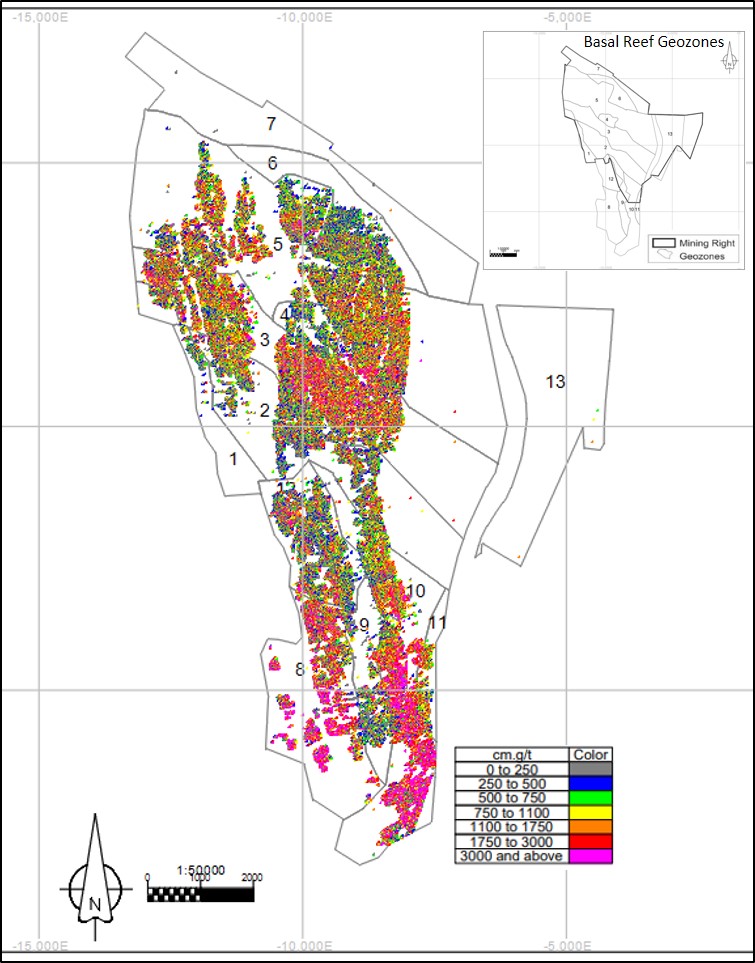

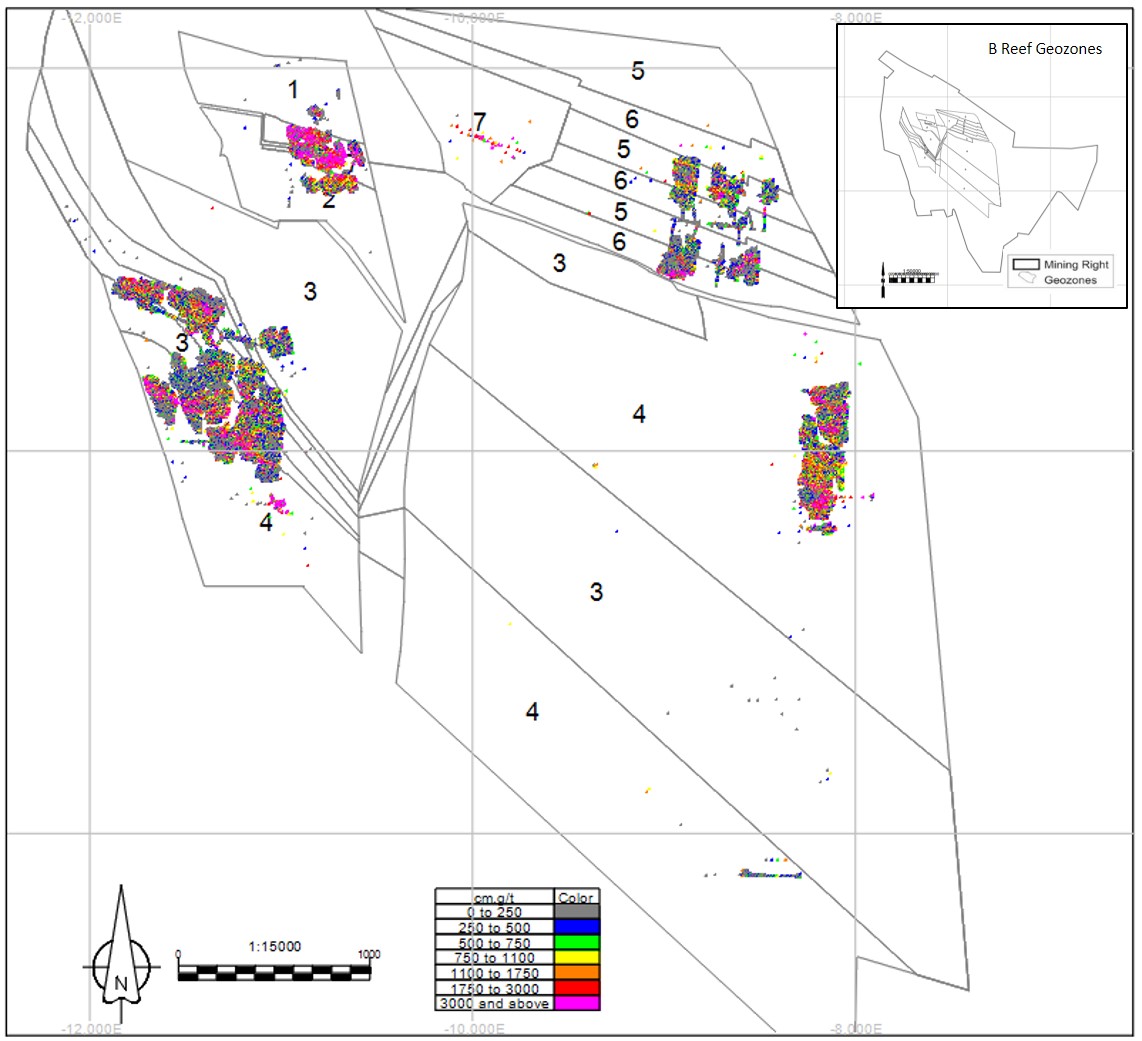

The location of samples collected from the Basal and B-Reef, to date, are shown in Figure 7-1 and Figure 7-2.

A total of 1479 gold samples on average are taken monthly, 1357 Basal Reef and 123 B-Reef.

The channel sample data for B/Reef indicates reef width ranging from 18.0cm to 297.0cm, and grades ranging from 14cmgt to 5216cmgt.

The channel sample data for Basal Reef indicates reef width ranging from 8.0cm to 198.0cm, and grades ranging from 2cmgt to 19103cmgt.

7.5Surface Drilling Campaigns, Procedures, Sampling, Recoveries and Results

Most surface drill holes used in the estimation of the current Mineral Resources were drilled by AngloGold Ashanti, or its forebears, before Harmony acquired Tshepong South.

Effective Date: June 30, 2024

22

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 7-1: Location of channel samples collected from the Basal Reef

Effective Date: June 30, 2024

23

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 7-2: Location of channel samples collected from the B-Reef

7.5.1Drilling Methods

The surface diamond core drilling has been undertaken using a thin-walled core barrel (AXT size core barrel) that delivers 35.51mm core. A single mother hole is drilled, typically with multiple deflection holes drilled from it.

The grid spacing of the surface drilling is determined on a per project basis, with deflections from wedges spaced at up to 100m intervals and is often required to be complemented by underground drill hole intersections. The accuracy of the surface drilling intersection positions from drill holes that are from 2,000m to 3,000m in depth is the major limiting factor of achieving the planned grid. Long surface drill holes often deflect and controlling direction over that depth has always been challenging in the South African gold mining context.

7.5.2Collar and Downhole Surveys

The drill holes are surveyed to confirm both collar position and trajectory. Drill hole collar and downhole surveys are conducted on all surface drill holes.

Surface drill hole collars are surveyed by the internal Land Survey Department. Underground drill hole collars are checked against layouts issued to diamond drilling.

Effective Date: June 30, 2024

24

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Downhole surveying is conducted by DownHole Survey, based in Fochville. A magnetic tool is used to record X, Y, Z and inclination points every 3 meters, with the hole collar being the base. The survey is provided as a spreadsheet containing the relevant information at the specific intervals. The point data can be imported directly to Deswik™ and printed to scale, which makes tracing onto a plan quick and accurate.

7.5.3Logging Procedures

Upon arrival at the core yard located on-site, drill core is marked at every meter interval. The core is then orientated so that the low point of bedding is coincident with the edge of the angle iron. The cut line is defined by the low point of the bedding at the base of the reef zone, when viewed as per convention, from left to right in the direction of increasing depth, is drawn parallel to the core. The core is then rotated through 90° and a yellow line is then drawn parallel to the core, to define the retention half core.

All drill cores are photographed prior to logging and sampling. The geologist conducts the core logging.

Drill core logging is quantitative and qualitative. The following information is recorded:

•lithology;

•packing density;

•roundness;

•sorting;

•contact type, grain/pebble size;

•sediment maturity; and

•mineralization; and alteration.

The geologist responsible for logging the core stores the original paper record. Core logging is also stored electronically using both DeswikTM and Datamine FusionTM software. Internal peer reviewing is undertaken on the interpretation of the stratigraphy and spatial correlation of drill holes.

Observations are captured on the diamond drilling database by geologists. The logs are checked by the Senior Geologist prior to sampling. Logging procedures are conducted as per the Harmony company standards, which are used on all underground mines and are best practice and have been in place since 2001.

7.5.4Drilling Results

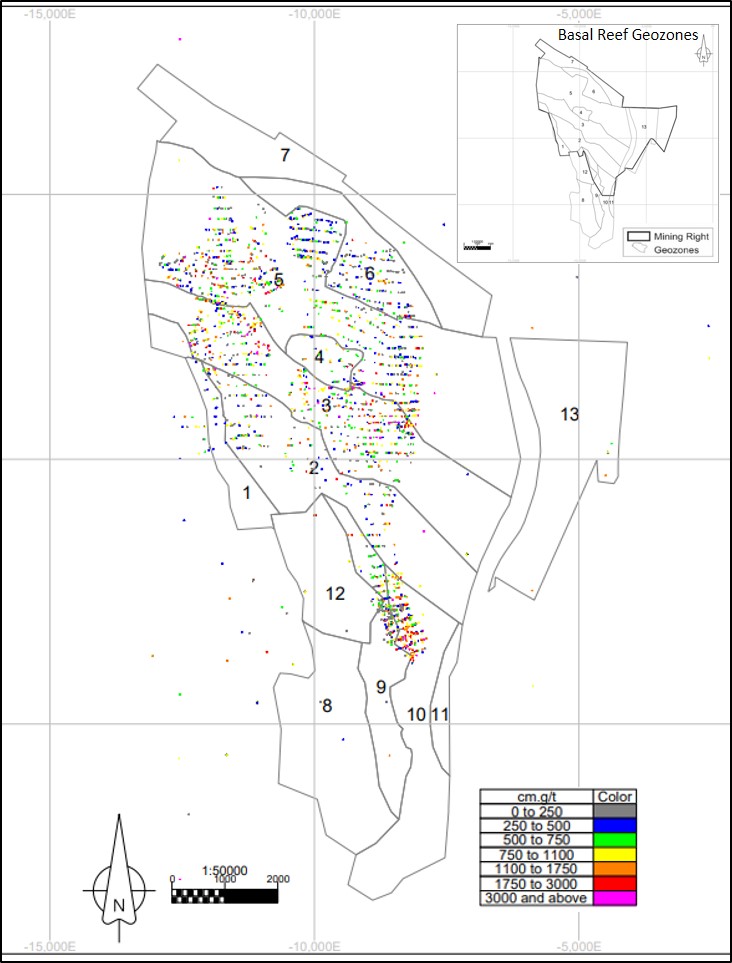

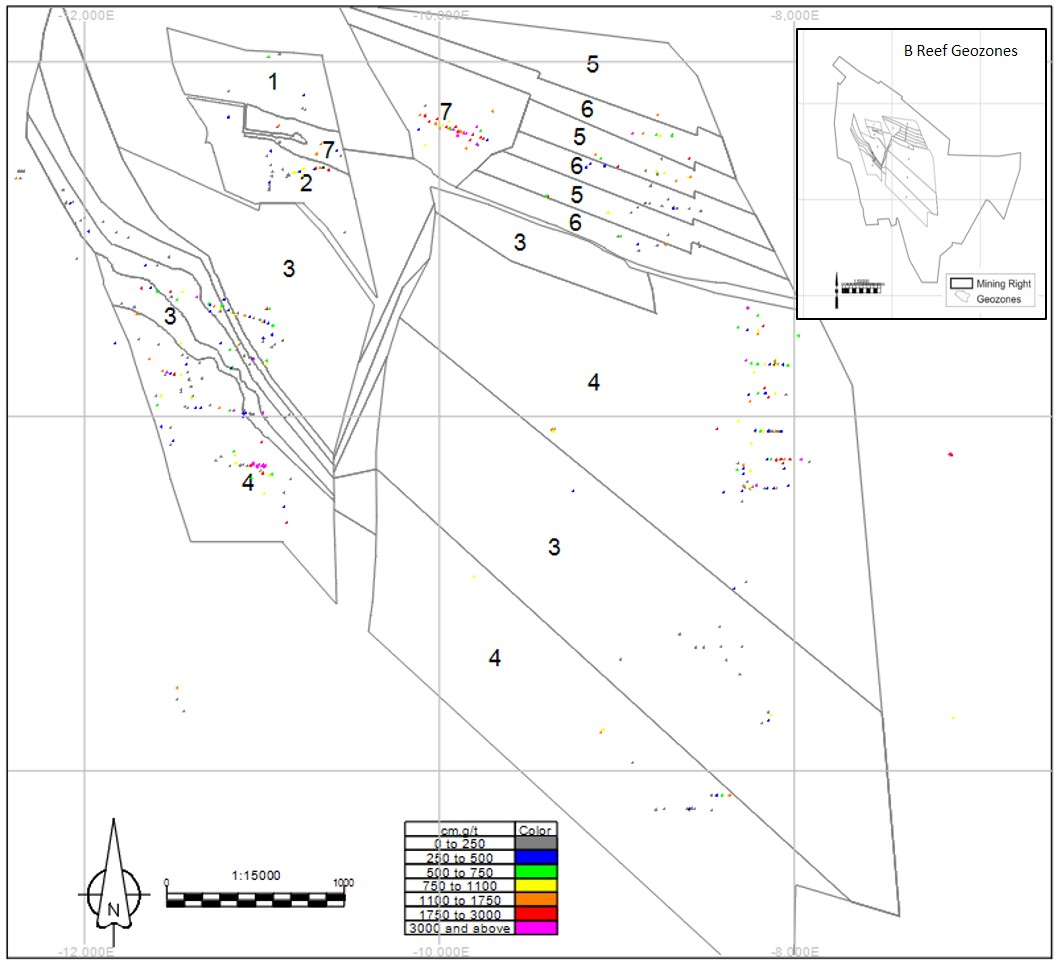

The location of the surface and underground drill holes intersecting the Basal and B-Reefs are presented in Figure 7-3 and Figure 7-4. There are no recent surface drilling results (Table 7-1 and Table 7-2), all drilling dates back to previous project owners and is pre-2017. The results have been included into the geological modelling and Mineral Resource estimation process. These drill holes were drilled to a depth of 2,373m below the surface.

The Basal borehole data indicates reef widths ranging from 2cm to 336cm with an average width of 64cm, and gold grade ranging from 0.2 g/t to 438.53 g/t.

The B Reef borehole data indicates reef width ranging from 8cm to 352cm with an average width of 118cm and gold grade ranging from 0.04 g/t to 78.12 g/t.

Effective Date: June 30, 2024

25

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 7-3: Location of surface and underground drill holes on the Basal Reef

Effective Date: June 30, 2024

26

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Figure 7-4: Location of surface and underground drill holes on the B-Reef

Table 7-1: Summary of surface and underground drilling for Tshepong South

| | | | | | | | | | | | | | |

| Year | Company | No. Drill Holes | Surface (m) | Underground (m) |

| 2018 | Harmony | 129 | — | 11 081 |

| 2019 | Harmony | 105 | — | 7 305 |

| 2020 | Harmony | 58 | — | 4 265 |

| 2021 | Harmony | 113 | — | 7 190 |

| 2022 | Harmony | 32 | — | 2 132 |

| 2023 | Harmony | 108 | — | 8 145 |

| 2024 | Harmony | 93 | — | 7 809 |

| Total | 638 | — | 47 927 |

7.5.5Core Recovery

Upon delivery to the core yard, and prior to logging and sampling, the drill core is checked to ensure 100% core recovery. Core recovery is determined by dividing the measured length of the recovered core by the total length of the core run.

An intersection is complete and representative if core recovery is greater than 99%. Drill holes with poor recovery are not sampled. Extra caution is taken during the drilling process to ensure maximum core recovery on reef intersections, to prevent sample bias.

Reef intersection “acceptability” is categorised as per the criteria summarized in Table 7-2 and is determined by geologists based on, amongst others, drill core condition and faulting. The acceptability is verified for each reef intersection before the assay results are used for Mineral Resource estimation.

Effective Date: June 30, 2024

27

Technical Report Summary for

Tshepong South, Free State Province, South Africa

Records of recoveries over 42 060m of drilled core were available and indicated an average core recovery of 90%.

Table 7-2: Drill hole acceptance criteria

| | | | | |

| Category | Comment |

| Acceptable | 100% core recovery in the reef zone, or very minor loss due to reef chipping. No evidence of faulting within the reef horizon or at either contact with hanging wall or footwall lithologies. |

| Minimum value | Light to moderate disking of core in the core barrel due to drilling and/or ground conditions. Visual observations indicate that the conglomerate portion of the reef is usually more prone to disking, resulting in possible gold loss. |

| Faulted minimum value | If the fault loss is considered to be minor, this term may be used if the geologist is certain that only low-value internal quartzite is missing from the intersection. |

| Not acceptable | Heavy disking of core which may indicate core loss, partial known core loss due to grinding. Also faulting of any description within the reef zone. |

| |

| |

| |

| |

| |

7.5.6Sample Length and True Thickness

Mineralization of the reefs is perpendicular to or at an angle to the drill holes. As such, all drill hole reef intersection widths are corrected to true thickness for gold value calculation.

7.6Underground Drilling Campaigns, Procedures and Sampling

Underground exploration drilling has been ongoing throughout the operational life of Tshepong South as the mine deepens. Most of the surface boreholes used in the estimation of the current Mineral Resources were drilled by AngloGold Ashanti before Harmony acquired the mine.

7.6.1Drilling Methods

Underground diamond core drilling is conducted using hydraulic driven and pneumatic drill rigs, which typically delivers an AXT size core (35.51mm). These are short drill holes rarely exceeding 200m in length.