In the United States, reporting standards for auditors require the addition of an explanatory paragraph (following the opinion paragraph) when the financial statements are affected by conditions and events that cast doubt on the Company's ability to continue as a going concern, such as those described in Note 1 to the consolidated financial statements. Our report to the shareholders dated April 16, 2007 is expressed in accordance with Canadian reporting standards which do not require a reference to such conditions and events in the auditor's report when these are adequately disclosed in the financial statements.

Licensed Public Accountants Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

The accompanying notes are integral part of these consolidated financial statements.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)Consolidated Statements of Mineral Properties Cumulative from date of inception of exploration

For the years ended January 31 2007 2006 2005 phase

Gold Wedge Project

Opening balance $ 2,636,862 $ 1,460,443 $ 264,119 $

Property acquisition costs Travel Mine development costs Drilling General exploration Professional fees Consulting fees and payroll Office and general Analysis and assays Supplies, equipment and transportation

171,376 184,892 111,122 506,399 77,737 70,862 40,770 212,553 293,519 237,867 207,662 741,133

53,185 78,790 146,441 278,416 5,023 38,776 8,188 133,353 -33,740 29,513 72,636 1,377,706 243,297 619,528 2,324,926 335,767 79,701 -415,968 30,063 22,240 18,222 94,722 1,171,969 186,254 14,878 1,373,101

Activity during the period 3,516,345 1,176,419 1,196,324 6,153,207

Closing balance $ 6,153,207 $ 2,636,862 $ 1,460,443 $ 6,153,207

Pinon Project

Opening balance $ 762,285 $ 600,538 $ 511,043 $

Property acquisition costs Travel Drilling General exploration Professional fees Office and general Geologist Consulting fees and payroll Reclamation costs Analysis and assays Supplies, equipment and transportation

34,047 40,258 42,156 425,570 -801 1,201 11,850 8,333 72,780 2,259 130,600 ---7,765 ---66,273 15,296 2,698 7,983 43,707 -25,008 3,127 32,653 151,133 19,537 6,192 194,902 167,785 --167,785 9,380 382 26,577 66,871 -283 -283

Activity during the period 385,974 161,747 89,495 1,148,259

Closing balance $ 1,148,259 $ 762,285 $ 600,538 $ 1,148,259

The accompanying notes are integral part of these consolidated financial statements.

| Royal Standard Minerals Inc. |

|---|

| (Expressed in United States Dollars) |

|---|

| (An Exploration Stage Company) |

|---|

| Consolidated Statements of Mineral Properties |

|---|

| Cumulative |

|---|

| from date of |

|---|

| inception of |

|---|

| exploration |

|---|

| For the years ended January 31 | 2007 | 2006 | 2005 | phase |

|---|

| Railroad Project | | |

|---|

| Opening balance | $ 175,670 | $ 175,670 | $ | 122,732 | $ | - |

|---|

| Property acquisition costs | 40,143 | - | | 52,938 | | 215,813 |

|---|

| Activity during the period | 40,143 | - | | 52,938 | | 215,813 |

|---|

| Closing balance | $ 215,813 | $ 175,670 | $ | 175,670 | $ 215,813 |

|---|

| Fondaway Project Opening balance | $ 127,652 | $ 96,028 | $ | 43,999 | $ | - |

|---|

| Property acquisition costs | 35,126 | 31,624 | | 51,678 | 162,427 |

|---|

| Analysis and assays | - | - | | 351 | 351 |

|---|

| Activity during the period | 35,126 | 31,624 | | 52,029 | 162,778 |

|---|

| Closing balance | $ 162,778 | $ 127,652 | $ | 96,028 | $ 162,778 |

|---|

| Como Project | | |

|---|

| Opening balance | $ 108,050 | $ 86,330 | $ | 126,124 | $ | - |

|---|

| Property acquisition costs | - | - | | - | | 35,695 |

|---|

| Travel | - | - | | - | | 2,806 |

|---|

| Geologist | - | - | | - | | 5,098 |

|---|

| Consulting fees and payroll | - | - | | - | | 41,532 |

|---|

| Rent | - | 21,720 | | - | | 53,575 |

|---|

| Analysis and assays | - | - | | - | | 9,138 |

|---|

| Written off | - | - | | (39,794) | | (39,794) |

|---|

| Activity during the period | - | 21,720 | | (39,794) | | 108,050 |

|---|

| Closing balance | $ 108,050 | $ 108,050 | $ | 86,330 | $ 108,050 |

|---|

| The accompanying notes are integral part of these consolidated financial statements. | | |

|---|

| Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company) Consolidated Statements of Mineral Properties For the years ended January 31 2007 | Cumulative from date of inception of exploration 2006 2005 phase |

| Manhattan Project Opening balance $ - | $ 191,065 $ 172,031 $ - |

| Property acquisition costs -Travel -General exploration -Consulting fees and payroll -Analysis and assays -Written off - | --27,707 --28,253 1,458 19,034 63,219 --47,743 --25,601 (192,523) -(192,523) |

| Activity during the period - | (191,065) 19,034 - |

| Closing balance $ - | $ -$ 191,065 $ - |

| Other Projects Opening balance $ - | $ 54,053 $ 13,396 $ - |

| Cumulative expenditures from date of inception -Expenditures during the period -Written off - | --3,410,396 120,891 40,657 161,548 (174,944) -(3,571,944) |

| Activity during the period -Closing balance $ -TOTAL $ 7,788,107 | (54,053) 40,657 -$ -$ 54,053 $ -$ 3,810,519 $ 2,664,127 $ 7,788,107 |

The accompanying notes are integral part of these consolidated financial statements.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Consolidated Statements of Operations and Deficit

Cumulative from date of inception

For the years ended January 31 2007 2006 2005 June 26, 1996

Expenses

General and administrative (Note 16) Consulting fees and payroll Stock-option compensation (Note 10) General exploration Amortization

618,962 266,505 193,287 2,499,742 443,693 295,707 213,504 1,513,777 3,838,926 739,006 150,606 4,768,878 ---152,051 540,289 191,877 14,921 770,794

5,441,870 1,493,095 572,318 9,705,242

Loss before the following (5,441,870) (1,493,095) (572,318) (9,705,242)

Interest income Repayment of interest Write-off of advances to related company Write-off of mineral properties Gain on disposal of marketable securities Write-down of marketable securities Loss on sale in mineral property Foreign exchange (loss) gain

391,420 --410,034 ---(67,117) ---(75,506) -(367,467) (34,397) (3,798,864) ---47,988 ---(407,105) ---(474,187) (381,030) 249,505 131,306 (84,631)

Net loss (5,431,480) (1,611,057) (475,409) (14,154,630)

Deficit, beginning of period (9,463,890) (7,852,833) (7,377,424) (740,740)

Deficit, end of period $ (14,895,370) $ (9,463,890) $ (7,852,833) $ (14,895,370)

Basic and diluted loss per share (Note 11) $ (0.07) $ (0.03) $ (0.01)

The accompanying notes are integral part of these consolidated financial statements.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Consolidated Statements of Cash Flows

Cumulative from date of inception

For the years ended January 31 2007 2006 2005 June 26, 1996

Cash and cash equivalents provided by (used in):

Operating activities

Net loss $

Operating items not involving cash: Amortization Stock-option compensation Write-off of bad debt Write-off of mineral properties Loss on sale of mineral properties Gain on disposal of marketable securities Write-down of advances to related company Write-down of marketable securities

Changes in non-cash working capital: Sundry receivables and prepaids Accounts payable and accrued liabilities (5,431,480) $ (1,611,057) $ (475,409) $ (14,154,630)

540,289 191,877 14,921 770,794

3,838,926 739,006 150,606 4,768,878 --20,950 20,950 -367,467 34,397 3,798,864 ---474,187 ---(47,988)

---75,506 ---407,105

(140,566) (484) (69,012) (210,621) (19,576) 117,646 (2,091) 202,157

Cash (used in) operating activities (1,212,407) (195,545) (325,638) (3,894,798)

Financing activities

Issue of common shares, net of issue costs 15,380,240 4,025,421 2,065,648 30,110,481 Repayments from (loans to) related parties 3,956 (64,105) (62,237) (197,892)

Cash provided by financing activities 15,384,196 3,961,316 2,003,411 29,912,589

Investing activities

Funds held in trust Sale (purchase) of short-term investments Additions to mineral properties Purchase of equipment Purchase of marketable securities Proceeds on disposal of marketable

securities Proceeds on sale of mineral properties

--54,050 (20,950)

2,679 (436,378) -(433,699) (3,977,588) (1,513,859) (1,528,858) (12,726,297) (1,337,687) (1,413,136) -(2,827,187)

---(1,057,976)

---690,859 ---11,747

Cash (used in) investing activities (5,312,596) (3,363,373) (1,474,808) (16,363,503)

Change in cash and cash equivalents 8,859,193 402,398 202,965 9,654,288

Cash and cash equivalents, beginning of period 795,095 392,697 189,732

Cash and cash equivalents, end of period $ 9,654,288 $ 795,095 $ 392,697 $ 9,654,288 (Note 2(b))

The accompanying notes are integral part of these consolidated financial statements.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

1. The Company and Operations

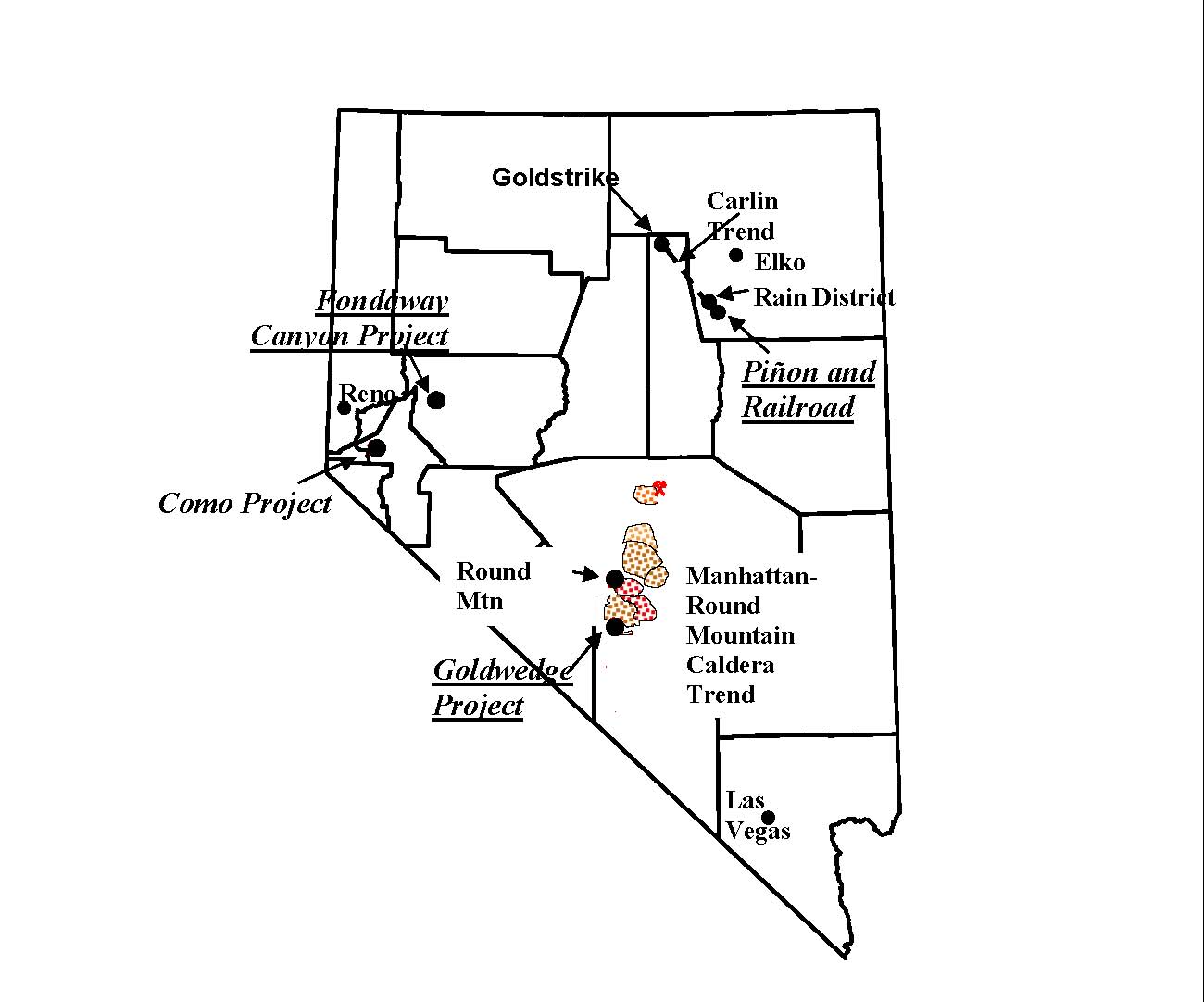

Royal Standard Minerals Inc. (the "Company") is a publicly held company, engaged in the acquisition, exploration and development of gold and silver resource properties. The Company is continued under the New Brunswick Business Corporations Act and its common shares are listed on the TSX Venture Exchange and traded on the OTC Bulletin Board. The Company is in the exploration stage and has adopted the Accounting Guideline 11 as required by the Canadian Institute of Chartered Accountants ("CICA") Handbook. The date of inception has been deemed to be June 26, 1996, the date on which the Company acquired all of the outstanding common shares of Southeastern Resources Inc. ("SRI").

The business of mining and exploring for minerals involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The recoverability of the carrying value of the exploration properties and the Company's continued existence is dependent upon the preservation of its interest in the underlying properties, the discovery of economically recoverable reserves, the achievement of profitable operations, or the ability of the Company to raise alternative financing, if necessary, or alternatively upon the Company's ability to dispose of its interests on an advantageous basis. Changes in future conditions could require material write-downs of the carrying values.

These financial statements have been prepared on the basis of accounting principles applicable to a going concern, which contemplates the realization of its assets and the settlement of its liabilities in the normal course of operations. The Company's ability to continue its operations is dependent upon obtaining necessary financing to complete the development of its properties and/or the realization of the proceeds from the sale of one or more of its properties. These financial statements do not include adjustments related to the carrying values and classifications of assets and liabilities that would be necessary should the Company be unable to continue in business.

2. Significant Accounting Policies

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in Canada.

A summary of the differences between accounting principles generally accepted in Canada ("Canadian GAAP") and those generally accepted in the United States ("US GAAP") which affect the Company is contained in Note 17.

The preparation of financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Significant areas requiring the use of management estimates relate to the determination of the recoverability of mineral property costs, the asset retirement obligation, the valuation allowance of future tax asset, and the calculation of stock-based compensation expense. Actual results could differ from those estimates.

The significant accounting policies are as follows:

(a) Principles of consolidation

These consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Southeastern Resources Inc., Pinon Exploration Corporation, Standard Energy Inc., and Manhattan Mining Co., all United States companies.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

2. Significant Accounting Policies (Continued)

(b) Cash and cash equivalents

Cash and cash equivalents are carried in the consolidated balance sheets at cost and they are comprised of cash on hand, term deposits held with banks and other short-term liquid investments generally with original maturities of three months or less.

| 2007 | | 2006 | | 2005 |

|---|

| Cash Money Market deposits | $ | 322,693 9,331,595 | $ | 186,828 608,267 | $ | 392,697 - |

|---|

| Cash and cash equivalents $ | 9,654,288 | $ | 795,095 | $ | 392,697 |

|---|

(c) Equipment

Equipment is recorded at cost less accumulated amortization. Amortization is provided using the declining balance method using the following rates:

Exploration equipment -25% to 30%

Office equipment -20%

Equipment is assessed for future recoverability or impairment on an annual basis by estimating future net undiscounted cash flows and residual value or by estimating replacement values. When the carrying amount of equipment exceeds the estimated net recoverable amount, the asset is written down to fair value with a charge to income in the period that such determination is made.

(d) Mineral properties

All costs related to the acquisition, exploration and development of mineral properties are capitalized by property. Costs includes any cash consideration and advance royalties paid. Properties acquired under option agreements, whereby payments are made at the sole discretion of the Company, are recorded in the accounts when the payments are made.

If the economically recoverable precious metal reserves are developed, capitalized costs of the related property will be reclassified as mining assets and amortized using the unit production method. When a mineral property is abandoned, all related costs are written-off to operations. If, after management review, it is determined that the carrying amount of a mineral property is impaired, that property is written-down to its estimated net realizable value. A mineral property is reviewed for impairment when events or changes in circumstances indicate that its carrying amount may not be recoverable.

The amounts shown for mineral properties do not necessarily represent present or future values. Their recoverability is dependent upon the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development, and future profitable production or proceeds from the disposition thereof.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

2. Significant Accounting Policies (Continued)

(e) Asset retirement obligation

Section 3110 of the CICA Handbook requires the recognition of a liability for obligations relating to the retirement of property, plant and equipment and obligations arising from acquisition, construction, development or normal operations of those assets. The Company recognizes the fair value of a liability for an asset retirement obligation ("ARO") in the year in which a reasonable estimate of the fair value can be made. The estimates are based principally on legal and regulatory requirements. It is quite possible that the Company's estimates of its ultimate reclamation and closure liabilities associated with any mine or facility built will change as a result of changes in regulations, changes in the extent of environmental remediation required, changes in the means of reclamation or changes in cost estimates. Consequently, changes resulting from revisions to the timing or the amount of the original estimated of undiscounted cash flows will be recognized as an increase or a decrease to the carrying amount of the liability and related long-lived asset. The liability will be increased for the passage of time and reported as an operating expense (accretion cost).

(f) Stock-based compensation plans

The fair value of the stock options granted is determined using the Black-Scholes option pricing model and management's assumptions as disclosed in Note 10 and recorded as stock-based compensation expense over the vesting period of the stock-options, with the offsetting credit recorded as an increase in contributed surplus.

If the stock options are exercised, the proceeds are credited to share capital and the fair value at the date of grant is reclassified from contributed surplus to share capital.

(g) Income taxes

Future income tax assets and liabilities are determined based on temporary differences between the accounting and tax base of the assets and liabilities, and are measured using the tax rates expected to be in effect when these temporary differences are likely to reverse. The amount of future income tax assets recognized is limited to the amount of the benefit that is more likely than not to be realized, and a valuation allowance is applied against any future tax asset if it is more likely than not that the asset will not be realized.

(h) Loss per common share

Basic loss per share is computed by dividing the loss for the period by the weighted average number of common shares outstanding during the period, including contingently issuable shares which are included when the conditions necessary for issuance have been met. Diluted earnings per share is calculated in a similar manner, except that the weighted average number of common shares outstanding is increased to include potentially issuable common shares from the assumed exercise of common share purchase options and warrants, if dilutive. The number of additional shares included in the calculation is based on the treasury stock method for options and warrants.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

2. Significant Accounting Policies (Continued)

(i) Foreign currency translation

The Company uses the United States Dollar as its reporting currency, as the majority of its transactions are denominated in this currency and the operations of its subsidiaries are considered to be of an integrated nature.

Monetary assets and liabilities of the parent company denominated in Canadian funds are translated into United States funds at period end rates of exchange. Other assets and liabilities and share capital of the parent company are translated at historical rates. Revenues and expenses of the parent company are translated at the average exchange rate for the period. Gains and losses on foreign exchange are recorded in operations in the current period.

(j) Marketable securities

Marketable securities are carried at the lower of cost and market.

(k) Short-term investments

Short-term investments are liquid investments with a maturity greater than three months but less than one year.

(l) Financial instruments, Equity and Comprehensive Income

The Company's financial instruments consist of cash and cash equivalents, short-term investment, marketable securities, sundry receivables, and accounts payable. The carrying values of these financial instruments approximate their fair market values due to the relatively short periods to maturity or capacity for prompt liquidation of these instruments. The company's operating cash flows are substantially independent of changes in market interest rates.

The Accounting Standard Board issued new accounting standards, effective for financial statements relating to fiscal years beginning on or after October 1, 2006, dealing with the recognition, measurement and disclosure of financial instruments, hedges and comprehensive income. Consistent with US and international reporting requirements, these standards require that certain gains and losses be recorded in a separate statement as comprehensive income. Fair value is considered the most relevant measure for financial instruments, which are any contracts that give rise to a financial asset of one party and a financial liability or equity instrument of another party. The company intends to adopt these policies effective February 1, 2007 and will report comprehensive income, equity and financial instruments in accordance with the relevant sections of the CICA Handbook (sections 1530, 3251, and 3855, respectively).

In addition to disclosing a new comprehensive income statement, the primary effect on the Company will be that all financial instruments will be measured at fair value. The Company will be required to separately disclose available-for-sale financial assets, which are those non-derivative financial assets that are designated as available for sale, or that are not classified as loans and receivables, held-to-maturity investments, or held for trading.

Any gains and losses arising from a change in the fair value of a financial asset or financial liability that is classified as held for trading (including assets previously disclosed as marketable securities, but excluding hedges) will be recognized in net income in the periods in which they arise. Certain gains and losses on financial assets classified as available for sale will be recognized in other comprehensive income until the financial asset is no longer recognized or becomes impaired.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

3. Marketable Securities

Marketable securities consist of common shares of Sharpe Resources Corporation ("Sharpe"), a publicly held Canadian company engaged in the exploration for precious metals in the United States. Sharpe Resources is considered to be related to the Company because of common management. The market value of the shares at January 31, 2007 was $118,720 (2006 -$226,538; 2005 -$96,684).

The shares are carried at the lower of cost and quoted market values.

4. Reclamation Bond

The Company has posted reclamation bonds for its mining projects, as required by the State of Nevada, to secure clean-up costs if the projects are abandoned or closed.

5. Mineral Properties

| Name of Mineral Property | | 2007 | | 2006 | | 2005 |

|---|

| Gold Wedge project (i) Pinion project (ii) Railroad project Fondaway project Como project (iii) Manhattan project Other projects | $ | 6,153,207 1,148,259 215,813 162,778 108,050 -- | $ | 2,636,862 762,285 175,670 127,652 108,050 -- | $ | 1,460,443 600,538 175,670 96,028 86,330 191,065 54,053 |

| $ | 7,788,107 | $ | 3,810,519 | $ | 2,664,127 |

(i) Gold Wedge Project

On June 29, 2005 the Company entered into a 5-year purchase option agreement with a private individual for all of his patented and unpatented mining claims in the Manhattan Mining District located in Nye County, Nevada. The land package totals approximately 1600 acres (4 patented, 700 unpatented claims). This property position adjoins the Company's Goldwedge Mine. The land package includes a number of exploration targets which are of interest to the Company. In addition, the Company's option includes the Dixie Comstock claim group located in Churchill County, Nevada. The Dixie Comstock is a 1500 acre property containing an epithermal gold system that has been explored by a number of other major mining companies over the past 20 years. It is considered to be an attractive advanced exploration project. The Company is currently engaged in the completion of a 43-101 property report. The Company agreed to pay $35,000 upon the execution of the Agreement. Annual option payments of $48,000 are to be applied to a total purchase price of $600,000 – there are no royalties.

The Company has recorded an asset retirement obligation on its Gold Wedge Project, representing the estimated costs of the Company's obligation to restore the Gold Wedge properties to their original condition as required by the State of Nevada regulatory authorities. As such, the Company has recorded an asset retirement obligation in the amount of $181,767, the amount of the reclamation bond posted by the Company with the State of Nevada.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

5. Mineral Properties (Continued)

(ii) Pinon Project

Pinon Project -Cord Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of five years. The lessors will retain a 5% net smelter royalty.

Pinon Project -Tomera Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of seven years. The lessors will retain a 5% net smelter royalty.

In addition, the Company entered into an irrevocable lease agreement with the surface and minerals rights owners of the Tomera Lease properties.

Pinon Project -Mustang Canyon

In July 2005, the Company signed an Exploration and Option Agreement with Metallic Nevada Inc. ("Metallic") to explore the Mustang Canyon Project in Esmeralda County, Nevada for a period of five years. Metallic has granted to the Company a mining lease on 27 unpatented lode mining claims located in Esmeralda County, Nevada.

The agreement gives the Company the exclusive option to acquire 50% interest in the Mustang Canyon Project by spending $20,000 per year in exploration expenditures with the objective to identify a measured resource by June 30, 2010. Upon identification of a measured resource and completion of a 43-101 report, the Company will acquire an undivided 50% interest in the project.

The Company may terminate the Agreement at any time after spending the initial $20,000, by providing 30 days written notice to Metallic. When the Company has exercised its option to acquire a 50% interest in the project, Metallic and the Company will establish a Joint Venture in respect to the project, on a 50/50 basis. Further expenditures on the Mustang Canyon Project will then be made by the Joint Venture. The Company will be the operator of the Joint Venture as long as it has at least a 50% interest therein.

Pinon Project -Darkstar Lease

In July 2006, the Company entered into a mining lease agreement to lease certain properties near the proposed Pinon minesite in Elko County, Nevada for a period of five years. The Darkstar gold property is located less than 2 miles from the Pinon property. The Company agreed to pay $6,400 on execution of the Agreement. The Company is committed to pay Annual option payments of $7,600 in 2007, $8,960 in 2008, $10,240 in 2009 and $11,520 in 2010. The lessor will also retain a 5% net smelter royalty.

(iii) Como Project

On December 2003, the Company entered into a mining lease agreement to lease certain properties located in Lyon County, Nevada. The Company agreed to pay $25,000 upon execution of the Agreement. The Company was committed to pay an annual option of $25,000 in 2005. Future payments are $20,000 in 2008 and $25,000 in 2009.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

5. Mineral Properties (Continued)

(iii)Como Project (Continued)

On September 15, 2004, the Company granted an option (the "Option") to Sharpe to acquire a 60% interest in the Company's gold project located in Lyon County, Nevada (the "Project"), in consideration for which Sharpe has issued 2,000,000 common shares to the Company at a deemed value of $78,125 ($100,000 CDN). To exercise the option, Sharpe was required to maintain the unpatented and patented mining claims on the Project, and to pay all required options, annual advanced minimum royalty payments and deliver a completed positive feasibility study in compliance with National Instrument 43-101 in respect of the Project. On December 5, 2006, Sharpe withdrew from this project without any further financial obligations.

Nevada Projects

In fiscal 2003 and 2002, the Company entered into certain option agreements to purchase up to 100% interest in patented and unpatented lode mining claims in Nye, Elko and Lyon Counties, Nevada. Detail of the payments required to maintain its option rights and to exercise its option is as follows:

Required Option Payments Royalty (1) Exercise of Option

Gold Wedge -Nye County

Commencing in fiscal 2002, $5,000 each in first two 3% NSR July 2006 -$200,000

years; $10,000 in third year, $15,000 in the fourth year

and $20,000 each in the fifth and sixth years.

Manhattan -Nye County

Commencing in fiscal 2002, $1,000 per month from 5% NSR August 2006 -$500,000

August 2001 to August 2002: $2,000 per month from

September 2002 to July 2006.

This project was discontinued and all exploration

expenditures were written-off in 2005.

Fondaway -Canyon Churchill County

Commencing in fiscal 2003, $25,000 in year one, 3% NSR July 2013 -$600,000

$30,000 in years two and three and $35,000 each

of the next seven years.

Como -Lyon County

Commencing in fiscal 2003, $25,000 in years one and 4% NSR May 2008 -$1,000,000

two covering years three and four, $20,000 in year five,

$25,000 in year six.

Railroad -Elko County

Commencing in fiscal 2003, $15,000 in the first year 5% NSR August 2008 -$2,000,000

and increases by $5,000 each of the next six years.

(1) NSR -Net Smelter Royalty

During the year ended January 31, 2006, the Company wrote-off $192,523 of exploration expenditures relating to the Manhattan, Nye County project and $174,944 relating to smaller projects that the Company was evaluating. Total exploration expenditures written-off amounted to $367,467 during the year ended January 31, 2006. There were no similar write-offs in 2007.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

- Equipment

- Asset retirement obligation

| 2007 | 2006 | | 2005 |

|---|

| Cost | | | |

|---|

| Exploration equipment | $ 2,808,573 | $ 1,475,201 | $ | 62,065 |

|---|

| Office equipment | 21,253 | 16,936 | | 16,936 |

|---|

| 2,829,826 | 1,492,137 | | 79,001 |

|---|

| Accumulated amortization | | | | |

|---|

| Exploration equipment | 759,636 | 220,669 | | 34,537 |

|---|

| Office equipment | 13,798 | 12,474 | | 6,729 |

|---|

| 773,434 | 233,143 | | 41,266 |

|---|

| Net carrying value | | | | |

|---|

| Exploration equipment | 2,048,937 | 1,254,532 | | 27,528 |

|---|

| Office equipment | 7,455 | 4,462 | | 10,207 |

|---|

| $ 2,056,392 | $ 1,258,994 | $ | 37,735 |

|---|

The Company is required to recognize a liability for a legal obligation to perform asset retirement activities, including decommissioning, reclamation and environmental monitoring activities once any of its projects are permanently closed. Although these activities are conditional upon future events, the Company is required to make a reasonable estimate of the fair value of the liability. Based on the existing level of terrestrial disturbance and water treatment and monitoring requirements, the undiscounted asset retirement obligation ("ARO's") were estimated to be $250,930 as at January 31, 2007, assuming payments made over a five year period.

Determination of the undiscounted ARO and the timing of these obligations were based on internal estimates using information currently available, existing regulations, and estimates of closure costs. Following is the reconciliation of the asset retirement obligation:

2007 2006 2005

Balance, beginning of year $ 131,767 $ 131,767 $ 131,767 Accretion cost 50,000 -

Balance, end of year $ 181,767 $ 131,767 $ 131,767

The discount rate used when estimating the fair value of the ARO is a credit-adjusted risk-free interest rate with the same maturity as the removal obligation. The Company used a credit-adjusted risk-free interest rate of 5% to calculate the present value of the ARO, which was $181,767.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

8. Share Capital Authorized

The authorized capital of the Company consists of an unlimited number of common shares without par value.

Issued

Changes in the Company's share capital were as follows:

| Common shares issued | Shares | | Amount |

| Balance at January 31, 2004 | 34,141,338 | $ | 7,221,581 |

| Shares issued for cash, less issue costs of $360,964 | 7,395,000 | | 1,486,784 |

| Warrant valuation | - | | (428,918) |

| Shares issued to broker as compensation | 349,680 | | 91,117 |

| Shares issued on warrants exercised | 1,257,500 | | 318,352 |

| Fair value of warrants exercised | - | | 90,345 |

| Balance at January 31, 2005 | 43,143,518 | | 8,779,261 |

| Shares issued for cash, less issue costs of $295,750 | 12,131,000 | | 3,117,705 |

| Warrant valuation | - | | (1,132,581) |

| Shares issued to brokers as compensation | 127,000 | | 35,553 |

| Shares issued on warrants exercised | 2,221,060 | | 692,984 |

| Fair value of warrants exercised | - | | 255,491 |

| Shares issued on stock options exercised | 200,000 | | 64,824 |

| Fair value of stock options exercised | - | | 19,433 |

| Balance at January 31, 2006 | 57,822,578 | | 11,832,670 |

| Shares issued after January 31, 2006 | 100,000 | | 119,325 |

| Shares issued for cash, less issue costs of $879,172 | 12,975,967 | | 12,407,590 |

| Warrant valuation | - | | (2,847,058) |

| Shares issued on stock options exercised | 1,250,000 | | 332,784 |

| Fair value of stock options exercised | - | | 178,155 |

| Shares issued on warrants exercised | 6,126,730 | | 2,639,865 |

| Fair value of warrants exercised | - | | 740,133 |

| Balance, January 31, 2007 | 78,275,275 | $ | 25,403,464 |

On February 3, 2004, the Company closed a private placement offering of 1,075,000 units at a price of CDN $0.25 per unit for gross proceeds of $200,935 ($268,750 CDN). Each unit consists of one common share and one-half common share purchase warrant ("Warrant"). Each warrant will entitle the holder to subscribe for one additional common share at a price of CDN $0.30 until February 2, 2005.

On February 17, 2004, articles of amendment were filed to authorize the issuance of an unlimited number of special shares without par value.

On April 16, 2004, the Company closed a private placement offering of 6,320,000 units at a price of CDN $0.35 per unit for gross proceeds of $1,646,813 ($2,212,000 CDN). Each unit consists of one common share and one-half common share purchase warrant. Each warrant entitled the holder to subscribe for one additional common share at a price of CDN $0.50 until April 15, 2006.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

8. Share Capital (Continued)

Canaccord Capital Corporation ("Canaccord") acted as an agent of the private placement offering of 6,320,000 and was paid the following fees:

- (i)

- An Agent's fee consisting of an 8% commission of the proceeds, paid in cash of $89,572 CDN and issuance of 249,680 in Agent's units. Each Agent's unit consists of one common share and one-half Agent's common share purchase warrant (Agent's Warrant"). Each Agent's Warrant entitled the holder to subscribe for one common share at a price of $0.50 per Agent's Warrant until April 15, 2006.

- (ii)

- A Corporate Finance fee of 100,000 Corporate Finance units; and an Administration fee of $5,584 ($7,500 CDN). Each Corporate Finance unit consists of one common share and one half Corporate Finance warrant. Each Corporate Finance warrant entitled the holder to subscribe for one common share at a price of $0.50 per Corporate Finance warrant until April 15, 2006.

(iii) The Agent's fee also included 1,264,000 Agent's Warrants equal to 20% of the number of units issued on the private placement. Each Agent's Warrant entitled the holder to subscribe for one common share at a price of $0.50 per Agent Warrant until April 15, 2006.

The fair value of the common share purchase warrants and agent's warrants issued in fiscal 2005 were estimated using the Black-Scholes pricing model based on the following assumptions:

- (i)

- Warrants issued on private placement Dividend yield 0%, expected volatility 55%, risk -free interest rate 4.5% and an expected life of 12 months. Value assigned to 537,500 warrants is $34,379 ($45,688 CDN).

- (ii)

- Warrants issued on private placement Dividend yield 0%, expected volatility 55%, risk -free interest rate 4.5% and an expected life of 24 months. Value assigned to 3,160,000 warrants is $374,270 ($502,440 CDN).

(iii) Agent's warrants Dividend yield 0%, expected volatility 55%, risk -free interest rate 4.5% and an expected life of 24 months. Value assigned to 1,438,840 compensation warrants is $170,416 ($228,776 CDN).

On March 31, 2005, the Company completed a private placement by issuing 8,750,000 units at a price of $0.35 CDN for gross proceeds of $2,531,829 ($3,062,500 CDN). Each unit consists of one common share and one-half common share purchase warrant. Each warrant will entitle the holder to subscribe for one additional share at a price of $0.50 CDN per share until March 31, 2007.

Canaccord, the agent acting for the offering, as partial compensation for their services, received 82,000 common shares and 1,353,500 Warrants. Each warrant entitling Canaccord to acquire one additional common share of the Company at an exercise price of $0.50 CDN until March 31, 2007.

On April 26, 2005, the Company issued 1,500,000 units at a price of $0.35 CDN for gross proceeds of $426,615 ($525,000 CDN). Each unit consists of one common share and one-half common share purchase Warrant. Each warrant will entitle the holder to subscribe for one additional share at a price of $0.50 CDN per share until April 26, 2007.

Haywood Securities Inc. ("Haywood") and Canaccord (the "Agents") acted as agents in this round of financing. As partial compensation for their services, the Agents received 45,000 common shares and 247,500 Warrants. Each warrant entitled the Agents to acquire one additional common share of the Company at an exercise price of $0.50 CDN until April 26, 2007.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

8. Share Capital (Continued)

On April 29, 2005, the Company issued 50,000 units at a price of $0.35 CDN per unit for gross proceeds of $14,296 ($17,500 CDN). Each unit consists of one common share and one-half common share purchase Warrant. Each warrant entitled the holder to subscribe for one additional share at a price of $0.50 CDN per share until April 29, 2007.

On May 5, 2005, the Company completed another private placements by issuing 1,831,000 units at a price of $0.35 CDN for gross proceeds of $495,808 ($640,850 CDN). Each unit consists of one common share and one-half common share purchase warrant. Each warrant entitled the holder to subscribe for one additional share at a price of $0.50 CDN per share until May 5, 2007.

The fair value of the common share purchase warrants and agent warrants issued in fiscal 2006 were estimated using the Black-Scholes pricing model based on the following assumptions:

- (i)

- Warrants issued on private placement -8,750,000 units Dividend yield 0%, expected volatility 109%, risk -free interest rate 3.22% and an expected life of 24 months. Value assigned to 4,375,000 warrants is $625,723 ($756,875 CDN).

- (ii)

- Warrants issued on private placement -1,500,000 units Dividend yield 0%, expected volatility 109%, risk -free interest rate 3.06% and an expected life of 24 months. Value assigned to 750,000 warrants is $104,183 ($129,750 CDN).

(iii) Warrants issued on private placement -50,000 units Dividend yield 0%, expected volatility 109%, risk -free interest rate 3.06% and an expected life of 24 months. Value assigned to 25,000 warrants is $3,436 ($4,325 CDN).

- (iv)

- Warrants issued on private placement -1,831,000 units Dividend yield 0%, expected volatility 150%, risk -free interest rate 3.02% and an expected life of 24 months. Value assigned to 915,500 warrants is $171,279 ($213,311 CDN).

- (v)

- Agent warrants -8,750,000 units Dividend yield 0%, expected volatility 109%, risk -free interest rate 3.22% and an expected life of 24 months. Value assigned to 1,353,500 agent warrants is $193,580 ($234,155 CDN).

- (vi)

- Agent warrants -1,500,000 units Dividend yield 0%, expected volatility 109%, risk -free interest rate 3.06% and an expected life of 24 months. Value assigned to 247,500 agent warrants is $34,380 ($42,817 CDN).

On April 27, 2006, the Company completed a private placement of 12,975,967 units of the Company at $1.15 CDN per unit raising gross proceeds of $13,286,762 ($14,922,362 CDN). Each unit consists of one common share of the Company and one-half of one common share purchase warrant. Each common share purchase warrant is exercisable at $1.75 CDN into one common share of the Company until April 26, 2008.

The fair value of the common share purchase warrants was estimated, on the date of closing, using the Black-Scholes option pricing model, with the following assumptions: dividend yield 0%, expected volatility of 98%, risk-free interest rate of 4.13% and an expected life of 24 months. The value assigned to the warrants is $2,847,058 ($3,198,582 CDN).

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

9. Warrants

The following table reflects the fair value of share purchase warrants and broker's warrants currently outstanding:

| Expiry | Price ($) CDN | Number | Value ($) |

|---|

| March 31, 2007 | 0.50 | 4,084,287 | $ 584,714 |

|---|

| April 26, 2007 | 0.50 | 136,500 | 20,896 |

|---|

| April 29, 2007 | 0.50 | 25,000 | 3,436 |

|---|

| May 5, 2007 | 0.50 | 485,500 | 90,831 |

|---|

| April 26, 2008 | 1.75 | 6,487,996 | 2,847,058 |

|---|

| | 11,219,283 | $ 3,546,935 |

|---|

10. Stock Options

Under the Company's stock option plan (the "Option Plan"), the directors of the Company can grant options to acquire common shares of the Company to directors, employees and others who provide ongoing services to the Company. Exercise prices cannot be less than the closing price of the Company's shares on the trading day preceding the date and the maximum term of any option cannot exceed ten years.

The number of common shares under option at any time under the Option Plan or otherwise cannot exceed 5% of the then outstanding common shares of the Company for any optionee. In addition, options granted to insiders of the Company cannot exceed more than 10% of the then outstanding common shares of the Company. The options vest when granted.

The following table reflects the continuity of stock options:

Number of Weighted Average Stock Options Exercise Price CDN ($)

2007 2006 2005 2007 2006 2005

| Outstanding at beginning of year | 5,670,000 | 4,185,000 | 3,410,000 | $ | 0.33 | $ | 0.28 | $ | 0.26 |

|---|

| Granted during year | 3,423,500 | 2,380,000 | 775,000 | | 1.41 | | 0.49 | | 0.36 |

|---|

| Exercised during year | (1,250,000) | (200,000) | - | | (0.49) | | (0.38) | | - |

|---|

| Cancelled or expired during year | (17,000) | (695,000) | - | | (1.44) | | (0.24) | | - |

|---|

| Outstanding at end of year | 7,826,500 | 5,670,000 | 4,185,000 | $ | 0.79 | $ | 0.33 | $ | 0.28 |

|---|

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

10. Stock Options (continued)

The following table reflects the stock options outstanding and exercisable as at January 31, 2007:

Exercise Price Options Black-Scholes Expiry Date CDN ($) Outstanding Value

| April 25, 2007 | 0.26 | 960,000 | $ | - |

|---|

| May 13, 2007 | 0.40 | 555,000 | | - |

|---|

| December 12, 2008 | 0.27 | 220,000 | | 40,340 |

|---|

| May 4, 2009 | 0.36 | 675,000 | | 127,386 |

|---|

| April 13, 2010 | 0.39 | 800,000 | | 238,022 |

|---|

| May 16, 2010 | 0.29 | 1,080,000 | | 232,098 |

|---|

| January 20, 2011 | 0.87 | 130,000 | | 90,731 |

|---|

| May 2, 2011 | 1.44 | 3,123,000 | | 3,676,901 |

|---|

| October 13, 2011 | 0.75 | 283,500 | | 162,005 |

|---|

7,826,500 $ 4,699,250

On May 4, 2004, 775,000 stock options were granted to employees and directors of the Company. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the stock options was estimated on the date of grant using the Black-Scholes option pricing model. Accordingly, $150,606 ($206,150 CDN) was recorded as stock option compensation and contributed surplus. The following assumptions were made in estimating the fair value of the stock options: dividend yield, 0%; risk-free interest rate, 4.5%; estimated life, 5 years and volatility, 55%.

On April 13, 2005, 1,000,000 stock options were granted to employees and directors of the Company. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the stock options was estimated on the date of grant using the Black-Scholes option pricing model. Accordingly, $297,528 ($368,000 CDN) was recorded as stock option compensation and contributed surplus. The following assumptions were made in estimating the fair value of the stock options: dividend yield, 0%; risk-free interest rate, 3.70%; estimated life, 5 years and volatility, 166.65%.

On May 16, 2005, 1,080,000 stock options were granted to employees and directors of the Company. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the stock options was estimated on the date of grant using the Black-Scholes option pricing model. Accordingly, $232,098 ($294,840 CDN) was recorded as stock option compensation and contributed surplus. The following assumptions were made in estimating the fair value of the stock options: dividend yield, 0%; risk-free interest rate, 3.56%; estimated life, 5 years and volatility, 166.63%.

On January 20, 2006, 300,000 stock options were granted to directors of the Company. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the stock options was estimated on the date of grant using the Black-Scholes option pricing model. Accordingly, $209,380 ($241,500 CDN) was recorded as stock option compensation and contributed surplus. The following assumptions were made in estimating the fair value of the stock options: dividend yield, 0%; risk-free interest rate, 3.89%; estimated life, 5 years and volatility, 155.46%.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

10. Stock Options (Continued)

On May 2, 2006 the Company granted 3,140,000 stock options to certain directors and a consultant. The options are exercisable at $1.44 CDN within a period of 5 years. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the options was estimated using the Black-Scholes option pricing model, with the following assumptions: dividend yield 0%, expected volatility of 145%, risk-free interest rate of 4.36% and an expected life of 5 years. The value assigned to the options is $3,699,045 ($4,094,560 CDN).

On October 13, 2006, the Company granted options to purchase 283,500 common shares of the Company to directors and a consultant. The options are exercisable at $0.75 CDN and expire within a period of 5 years. These stock options were fully vested on the date of grant and the fair value was charged to the statements of operations and deficit. The fair value of the options was estimated using the Black-Scholes option pricing model, with the following assumptions: dividend yield 0%, expected volatility of 129%, risk-free interest rate of 4.00% and an expected life of 5 years. The value assigned to the options is $162,005 ($183,992 CDN).

For fiscal 2007, the weighted-average grant date fair value of these options was $3,861,050 (fiscal 2006 -$739,006; fiscal 2005 -$110,438) or $1.25 (fiscal 2006 -$0.31; fiscal 2005 -$0.14) per share.

The following table reflects the continuity of contributed surplus: Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

| Amount |

|---|

| Balance, January 31, 2004 | $ | 1,477,780 |

|---|

| Options granted | | 150,606 |

|---|

| Balance, January 31, 2005 | | 1,628,386 |

|---|

| Expired warrants | | 16,907 |

|---|

| Options granted | | 739,006 |

|---|

| Options exercised | | (19,433) |

|---|

| Balance, January 31, 2006 | | 2,364,866 |

|---|

| Options granted | | 3,861,050 |

|---|

| Options exercised | | (178,155) |

|---|

| Options cancelled | | (22,124) |

|---|

| Balance, January 31, 2007 | $ | 6,025,637 |

|---|

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

11. Basic and Diluted Loss Per Share

The following table sets forth the computation of basic and diluted loss per share:

2007 2006

2005

Numerator: Loss for the year $ (5,431,480) $ (1,611,057) $ (475,409)

Denominator: Weighted average number of common share outstanding for basic and diluted loss per share 73,771,233 53,907,094 41,090,912

Basic and diluted loss per share $ (0.07) $ (0.03) $ (0.01)

The stock options and common share purchase warrants were not included in the computation of diluted loss per share on January 31, 2007, 2006 and 2005 as their inclusion would be anti-dilutive.

12. Income Taxes

The following table reconciles the expected income tax expense (recovery) at the Canadian statutory income tax rate to the amounts recognized in the consolidated statements of operations:

2007 2006 2005

Net loss before income taxes reflected in consolidated statements of operations $ (5,431,480) $ (1,611,057) $ (475,409)

| Expected income tax (recovery) $ | (1,961,850) | $ | (581,914) | $ | (174,095) |

| Write-off of mineral properties | - | | 132,729 | | 12,596 |

| Deductible share issue costs | (147,480) | | (81,049) | | (40,612) |

| Stock option compensation expense | 1,386,620 | | 266,929 | | 54,399 |

| Amortization | 195,153 | | 69,306 | | 5,464 |

| Unrealised foreign exchange loss (gain) | 137,627 | | (90,121) | | (48,084) |

| Subsidiary losses capitalized for consolidation purpose | (477,262) | | - | | (32,835) |

| Difference between Canadian and foreign tax rates | 6,343 | | 2,404 | | 1,730 |

| Taxable benefits not recognized | 860,849 | | 281,716 | | 221,437 |

Income tax (recovery) expense $ -$ -$

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

12. Income Taxes (Continued)

The following table reflects future tax assets at January 31, 2007, 2006 and 2005:

| | | 2007 | | 2006 | | 2005 |

|---|

| Unclaimed non-capital losses | | $ | 2,045,208 | $ | 1,290,242 | $ | 1,011,064 |

| Unclaimed capital losses | | | 7,991 | | 16,421 | | 15,184 |

| Excess of undepreciated capital | cost allowance | | | | | | |

| over carrying value of capital | assets | | 276,422 | | 118,216 | | 20,712 |

| Excess of unclaimed resource pools over | | | | | | |

| carrying value of mineral properties | | 551,169 | | 834,748 | | 453,543 |

| Unclaimed share issue costs | | 418,785 | | 261,945 | | 116,362 |

| 3,299,575 | 2,521,572 1,616,865 |

| Valuation allowance | (3,299,575) | (2,521,572) (1,616,865) |

| Future income tax assets | $ - | $ -$ - |

At January 31, 2007, the Company had unclaimed Canadian and foreign resource pools of $9,647,100 (CDN $11,376,300) consisting of Canadian Exploration Expenditure of $1,053,200 (CDN $1,242,000), Canadian Development Expenses of $254,400 (CDN $300,000), Foreign Resource Expenses of $8,339,500 (CDN $9,834,300), unclaimed share issue costs of $1,159,400 (CDN $1,367,300) and unclaimed non-capital losses carried forward of $5,726,400 (CDN $6,720,600), which will expire as follows:

| 2008 | $ | 210,100 |

|---|

| 2009 | | 285,100 |

| 2010 | | 551,200 |

| 2011 | | 601,700 |

| 2015 | | 692,300 |

| 2026 | | 943,000 |

| 2027 | | 2,443,000 |

| $ | 5,726,400 |

|---|

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

13. Related Party Transactions

2007 2006 2005

Due from related parties: The President and Director of the Company (i) $ 17,402 $ 18,049 $ 11,095 Sharpe Resources Corporation (ii) 104,984 108,293 51,142

$ 122,386 $ 126,342 $ 62,237

- (i)

- This advance is unsecured, non-interest bearing and has no set terms of repayment.

- (ii)

- Sharpe is related to the Company because of common management. This advance is unsecured, non-interest bearing and has no set terms of repayment.

Consulting fees include a bonus of $170,000 (2006 -$nil; 2005 -$nil) and salary of $252,621 (2006 -$96,192; 2005 -$nil)) paid to the President of the Company.

Consulting fees include salary of $48,923 (2006 -$nil; 2005 -$nil) paid to an employee who is also a family member of the President and Director of the Company.

Compensation of $12,155 (2006 -$nil; 2005 -$nil) was paid to the CFO of the Company.

These transactions were in the normal course of operations and were measured at the exchange value which represented the amount of consideration established and agreed to by the related parties.

14. Contingencies

On October 11, 2006 the Company received a document purporting to constitute a requisition from a group of shareholder of the Company ("the Dissident Group") alleging that they hold more than 10% of the Company's shares. The documents received requested that a shareholders meeting be called to consider the removal and replacement of the existing board of directors of the Company.

The board of directors of the Company has reviewed these documents with the benefit of outside advice and has serious concerns with respect to whether such documents constitute a valid requisition under the New Brunswick Corporations Act.

While reserving all of its rights in this regard, the board of directors of the Company has called a meeting of shareholders in response to the purported requisition received from the Dissident Group at which the constitution of the Company's board of directors will be considered.

On October 28, 2006 the Company filed an action in the United States District Court for the Central District of California against the persons and entities who have identified themselves as belonging the Dissident Group. The Company alleges that the defendants violated section 13(d) of the Securities Exchange Act of 1934, 15

U.S.C. 78m(d), by failing to file a Schedule 13-D. On May 17, 2007, the Court ordered the striking of the defendants' answer and the Clerk of the Court entered defendants' default. A hearing on the Company's motion for entry of judgment is scheduled to be held by the Court on June 18, 2007.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

14. Contingencies (Continued)

There is pending action against Messrs. Luke Norman and Timothy Master, two former employees of the Company. The September 25, 2006 complaint alleges that while employed by the Company and thereafter, contrary to their duties to the Company, Norman and Master participated in a pattern of behavior which included the dissemination of misleading or incorrect information, interference with corporate operations, communications with shareholders without proper authority, soliciting votes from shareholders contrary to securities law, conspiring against management in an attempt to impair the business of the Company. In November 2006 Mr. Norman filed a counter complaint against the Company without specifying damages. In the opinion of the management this complaint is without merit.

The Company is seeking injunctive relief restraining Norman and Master from further communicating the alleged slander and misinformation regarding the Company. In addition to the injunctive relief, the Company seeks to recover damages for conspiracy to injure, defamation, slander, and special damages for breach of fiduciary duty.

15. Commitments

- (i)

- On January 1, 2006, the Company entered into a management employment agreement with the President of the Company for management and consulting services for $250,000 per annum which expires in January 1, 2011. On January 1, 2007 and on each January 1 during the term of the agreement, the compensation may be increased by 10% per annum. This agreement can be renewed for an additional five year.

- (ii)

- On October 23, 2006, the Company entered into an agreement with a company for investors' relation services for $7,500 per month which expires in October 31, 2007.

(iii) On October 25, 2006 (amended to be effective November 1, 2006), the Company entered into an employment agreement with the CFO for $5,000 per month which expires October 31, 2007. In addition, the Company is committed to issue options to purchase 100,000 shares of the Company as per the employment agreement. The options are exercisable at $0.60 until November 1, 2011. The fair value of the stock options is estimated to be $33,300 using the Black-Scholes option pricing model. The following assumptions were made in estimating the fair value of the stock options: dividend yield, 0%; risk-free interest rate, 3.91%; estimated life, 2.5 years and volatility, 92%.

- (iv)

- The Company is obligated to incur an additional $45,000 in option costs before the end of fiscal 2009 pursuant to the agreement of the Como Project.

- (v)

- The Company is obligated to incur an additional $144,000 in option costs before July 1, 2009 pursuant to the agreement of the Gold Wedge Project.

- (vi)

- The Company is obligated to incur an additional $120,000 in option costs before the end of fiscal 2010 pursuant to the agreement of the Railroad Project.

(vii) The Company is obligated to incur an additional $80,000 in exploration expenditures before June 30, 2010 pursuant to the agreement of the Mustang Canyon Project.

(viii) The Company is obligated to incur an additional $260,000 in exploration expenditures and $38,320 in option costs before July 31, 2011 pursuant to the agreement of the Darkstar gold property.

(ix) The Company is obligated to incur an additional $175,000 in option costs before the end of fiscal 2012 pursuant to the agreement of the Fondaway Project.

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

16. Office and General

2007 2006 2005

Advertising and promotion $ Bad debts Corporate development Insurance Office and general Professional fees Travel

155,775 $ 110,236 $ 2,400 --38,610 85,380 27,762 24,243 37,758 31,108 13,425 67,652 40,582 67,319 268,156 46,887 26,924 4,241 9,930 20,366

$ 618,962 $ 266,505 $ 193,287

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP

The Company's consolidated financial statements have been prepared in accordance with Canadian GAAP. These principles, as they pertain to the Company's consolidated financial statements differ from US GAAP as follows:

Under Canadian GAAP, the Company accounts for its exploration costs as described in Note 2(d), whereas under US GAAP, exploration costs cannot be capitalized and are expensed as incurred. Had the Company's consolidated balance sheets as at January 31, 2007 and 2006 been prepared using US GAAP, such balance sheets would be presented as follows:

2007 2006

| Assets | | | | |

|---|

| Current | | | | |

| Cash and cash equivalents | $ | 9,654,288 | $ | 795,095 |

| Short-term investments | | 433,699 | | 436,378 |

| Available for sale securities | | 118,720 | | 226,537 |

| Sundry receivables and prepaids | | 141,827 | | 1,261 |

| Due from related parties | | 122,386 | | 126,342 |

| Reclamation bond Equipment, net Mineral properties -acquisition costs Mine development | | 10,470,920 181,767 2,056,392 468,107 739,048 | | 1,585,613 131,767 1,258,994 187,415 445,529 |

| $ | 13,916,234 | $ | 3,609,318 |

| Liabilities Current Payables and accruals Asset retirement obligation | $ | 202,157 181,767 | $ | 221,733 131,767 |

| | 383,924 | | 353,500 |

| Shareholders' Equity | | |

|---|

| Capital stock | 24,822,439 | 11,251,645 |

|---|

| Shares to be issued | - | 119,325 |

|---|

| Warrants | 3,546,935 | 1,440,009 |

|---|

| Additional paidin capital | 5,879,511 | 2,218,739 |

|---|

| Cumulative foreign currency translation adjustments | (84,632) | 296,398 |

|---|

| Cumulative adjustments to marketable securities | (374,510) | (266,692) |

|---|

| Deficit accumulated during the exploration stage | (20,257,433) | (11,803,606) |

|---|

13,532,310 3,255,818

$ 13,916,234 $ 3,609,318

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

US GAAP requires the presentation of a statement of comprehensive income, which includes in addition to revenue and expenses, those comprehensive income items recorded directly in equity on the balance sheet.

The cumulative-from-inception statements of operations and comprehensive income (loss), cash flows and changes in shareholder's equity under US GAAP are as follows:

Statements of Operations and Comprehensive Income (Loss): Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

| Cumulative |

|---|

| from inception | | 2007 | 2006 | 2005 |

|---|

| Expenses | | | | |

|---|

| General and administrative | $ 2,499,742 | $ | 618,962 | $ | 266,505 | $ | 193,287 |

|---|

| Consulting fees and payroll | 1,513,777 | | 443,693 | | 295,707 | | 213,504 |

|---|

| Stock option compensation | 4,768,878 | | 3,838,926 | | 739,006 | | 150,606 |

|---|

| General exploration | 11,084,177 | | 3,403,377 | | 880,915 | | 1,523,204 |

|---|

| Depreciation | 770,794 | | 540,289 | | 191,877 | | 14,921 |

|---|

| 20,637,368 | | 8,845,247 | | 2,374,010 | | 2,095,522 |

|---|

| Loss before the following | (20,637,368) | | (8,845,247) | | (2,374,010) | | (2,095,522) |

|---|

| Write-down of advances to | | | | |

|---|

| related company | (75,506) | | - | - | - |

|---|

| Gain on disposal of marketable | | | | | |

|---|

| securities | 47,988 | | - | - | - |

|---|

| Interest income | 410,034 | | 391,420 | - | - |

|---|

| Repayment of interest | (67,117) | | - | - | - |

|---|

| Gain on sale of 60% interest in | | | | | |

|---|

| mineral property | 78,124 | | - | - | 78,124 |

|---|

| Net loss before income taxes | (20,243,845) | | (8,453,827) | (2,374,010) | (2,017,398) |

|---|

| Income taxes | - | | - | - | - |

|---|

| Net loss | (20,243,845) | | (8,453,827) | (2,374,010) | (2,017,398) |

|---|

| Comprehensive income items: | | | | |

|---|

| Foreign currency translation | | | | | |

|---|

| gains (losses) | (84,632) | | (381,030) | 249,505 | 131,306 |

|---|

| Recovery of (write-down) of | | | | | |

|---|

| marketable securities | (374,510) | | (107,817) | 140,412 | - |

|---|

| Comprehensive loss | $ (20,702,987) | $ | (8,942,674) $ | (1,984,093) $ | (1,886,092) |

|---|

| Net loss per common share | | | | |

|---|

| Basic and diluted | $ | (0.11) $ | (0.04) $ | (0.05) |

|---|

| Comprehensive loss per common share | | | | |

|---|

| Basic and diluted | $ | (0.12) $ | (0.04) $ | (0.05) |

|---|

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

Statements of Changes in Shareholders' Equity: The changes in common stock since the commencement of the Company's exploration stage as required by US GAAP are as follows:

Amount Under Shares US GAAP

| Issued to former shareholders of SRI Held by other shareholders | 8,154,614 488,041 | $ 1,318,566 467,467 |

|---|

| Outstanding at June 26, 1996 | 8,642,655 | 1,786,033 |

|---|

| Shares issued for mineral properties | 1,400,000 | 667,204 |

|---|

| Shares issued for services | 200,000 | 126,465 |

|---|

| Shares issued on warrants exercised | 580,577 | 361,823 |

|---|

| Shares issued for cash | 500,000 | 329,936 |

|---|

| Outstanding at January 31, 1997 | 11,323,232 | 3,271,461 |

|---|

| Shares issued for mineral properties | 200,000 | 134,250 |

|---|

| Flow-through shares issued for cash | 300,000 | 216,763 |

|---|

| Shares issued for cash, less issue costs of $481,480 | 7,228,066 | 2,129,061 |

|---|

| Shares issued for services | 70,000 | 58,125 |

|---|

| Outstanding at January 31, 1998 | 19,121,298 | 5,809,660 |

|---|

| Share issue costs | - | (5,919) |

|---|

| Outstanding at January 31, 1999 | 19,121,298 | 5,803,741 |

|---|

| Shares issued for cash, less issue costs of $4,092 | 951,494 | 61,578 |

|---|

| Outstanding at January 31, 2000 | 20,072,792 | 5,865,319 |

|---|

| Shares issued for cash, less issue costs of $54,246 | 3,043,667 | 377,614 |

|---|

| Outstanding at January 31, 2001 | 23,116,459 | 6,242,933 |

|---|

| Shares issued on warrants exercised | 951,494 | 123,052 |

|---|

| Cancellation of shares held in escrow | (4,836,615) | (1,279,287) |

|---|

| Outstanding at January 31, 2002 | 19,231,338 | 5,086,698 |

|---|

| Shares issued for cash, less issue costs of $55,258 | 7,000,000 | 600,427 |

|---|

| Shares issued on stock options exercised | 910,000 | 88,290 |

|---|

| Issued in exchange for mineral properties | 1,000,000 | 171,125 |

|---|

| Balance at January 31, 2003 | 28,141,338 | 5,946,540 |

|---|

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

Statements of Changes in Shareholders' Equity (Continued):

Amount Under Shares US GAAP

| Balance at January 31, 2003 Shares iIssued for cash, less issue costs of $266,372 Warrant valuation | 28,141,338 6,000,000 - | 5,946,540 845,292 (151,276) |

|---|

| Balance at January 31, 2004 | 34,141,338 | 6,640,556 |

|---|

| Shares issued for cash, less issue costs of $360,964 | 7,395,000 | 1,486,784 |

|---|

| Warrant valuation | - | (428,918) |

|---|

| Shares issued to broker as compensation | 349,680 | 91,117 |

|---|

| Shares issued on warrants exercised | 1,257,500 | 318,352 |

|---|

| Fair value of warrants exercised | - | 90,345 |

|---|

| Balance at January 31, 2005 | 43,143,518 | 8,198,236 |

|---|

| Shares issued for cash, less issue costs of $295,750 | 12,131,000 | 3,117,705 |

|---|

| Warrant valuation | - | (1,132,581) |

|---|

| Shares issued to broker as compensation | 127,000 | 35,553 |

|---|

| Shares issued on warrants exercised | 2,221,060 | 692,984 |

|---|

| Fair value of warrants exercised | - | 255,491 |

|---|

| Shares issued on stock options exercised | 200,000 | 64,824 |

|---|

| Fair value of stock options exercised | - | 19,433 |

|---|

| Balance at January 31, 2006 | 57,822,578 | 11,251,645 |

|---|

| Shares issued after January 31, 2006 | 100,000 | 119,325 |

|---|

| Shares issued for cash, less issue costs of $879,172 | 12,975,967 | 12,407,590 |

|---|

| Warrant valuation | - | (2,847,058) |

|---|

| Shares issued on warrants exercised | 6,126,730 | 2,639,865 |

|---|

| Fair value of warrants exercised | - | 740,133 |

|---|

| Shares issued on stock options exercised | 1,250,000 | 332,784 |

|---|

| Fair value of stock options exercised | - | 178,155 |

|---|

Balance at January 31, 2007 78,275,275 $ 24,822,439

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

Other changes in shareholders' equity are presented as follows:

| Cumulative | | Deficit |

|---|

| foreign | Cumulative | accumulated |

|---|

| Additional | currency | adjustments | during the |

|---|

| paid in | translation | to marketable | development |

|---|

| Warrants | | capital | adjustments | securities | stage |

|---|

| Balance, January 31, 2004 | $ | 151,276 | $ | 1,331,654 | $ (84,413) | $ (407,106) | $ (7,412,198) |

|---|

| Warrant exercise, fair value | | (55,200) | | - | - | - | - |

|---|

| Issue of warrants, fair value | | 579,065 | | - | - | - | - |

|---|

| Warrant call | | (90,345) | | - | - | - | - |

|---|

| Stock options | | - | | 150,606 | - | - | - |

|---|

| Net (loss) income | | - | | - | - | - | (2,017,398) |

|---|

| Other comprehensive | | | | | | | |

|---|

| income items | | - | | - | 131,306 | - | - |

|---|

| Balance, January 31, 2005 | 584,796 | 1,482,260 | 46,893 | (407,106) | (9,429,596) |

| Warrant exercise, fair value | (255,941) | - | - | - | - |

| Issue of warrants, fair value | 1,132,581 | - | - | - | - |

| Warrant expiry, fair value | (21,427) | - | - | - | - |

| Stock options | - | 739,006 | - | - | - |

| Stock option exercise, | | | | | |

| fair value | - | (19,433) | - | - | - |

| Stock options expired, | | | | | |

| fair value | - | 16,907 | - | - | - |

| Net (loss) income | - | - | - | - | (2,374,010) |

| Other comprehensive | | | | | |

| income items | - | - | 249,505 | 140,413 | - |

| Balance, January 31, 2006 | | 1,440,009 | | 2,218,740 | | 296,398 | | (266,693) | (11,803,606) |

| Warrant exercise, fair value | | (740,132) | | - | | - | | - | - |

| Issue of warrants, fair value | | 2,847,058 | | - | | - | | - | - |

| Stock options | | - | | 3,838,926 | | - | | - | - |

| Stock option exercise, | | | | | | | | | |

| fair value | | - | | (178,155) | | - | | - | - |

| Net (loss) income | | - | | - | | - | | - | (8,453,827) |

| Other comprehensive | | | | | | | | | |

| income items | | - | | - | | (381,030) | | (107,817) | - |

| Balance, January 31, 2007 | $ | 3,546,935 | $ | 5,879,511 | $ | (84,632) | $ | (374,510) | $ (20,257,433) |

Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

Statement of Cash Flows: Royal Standard Minerals Inc. (Expressed in United States Dollars) (An Exploration Stage Company)

| Cumulative |

|---|

| from |

|---|

| Inception | | 2007 | | 2006 | | 2005 |

|---|

| Operating activities | | | | | | |

|---|

| Net loss | $ (20,243,845) | $ | (8,453,827) | $ | (2,374,010) | $ | (2,017,398) |

|---|

| Depreciation | 770,794 | | 540,289 | | 191,877 | | 14,921 |

|---|

| Stock option compensation | 4,768,878 | | 3,838,926 | | 739,006 | | 150,606 |

|---|

| Expenses settled by the issue | | | | | | | |

|---|

| of common shares | 184,610 | | - | | - | | - |

|---|

| Exploration expenditures settled | | | | | | | |

|---|

| by the issue of common shares | 2,199,799 | | - | | - | | - |

|---|

| Gain on disposal of marketable | | | | | | | |

|---|

| securities | (47,988) | | - | | - | | - |

|---|

| Write-down of advances to related | | | | | | | |

|---|

| company | 554,846 | | - | | - | | - |

|---|

| Increase in sundry receivables | | | | | | | |

|---|

| and prepaids | (141,827) | | (140,566) | | (484) | | (62,455) |

|---|

| (Increase) decrease in advances | | | | | | | |

|---|

| to related company | (677,231) | | 3,956 | | (64,105) | | - |

|---|

| Increase (decrease) in payables | | | | | | | |

|---|

| and accruals | 202,157 | | (19,576) | | 117,646 | | (2,091) |

|---|

| (12,429,807) | | (4,230,798) | | (1,390,070) | | (1,916,417) |

|---|

| Financing activities | | | | | | | |

|---|

| Issue of common shares, net of | | | | | | | |

|---|

| issue costs | 27,003,885 | | 15,380,240 | | 4,025,421 | | 1,991,200 |

|---|

| Asset retirement obligation | 181,767 | | 50,000 | | - | | 131,767 |

|---|

| 27,185,652 | | 15,430,240 | | 4,025,421 | | 2,122,967 |

|---|

Notes to Consolidated Financial Statements Years ended January 31, 2007, 2006 and 2005

17. Differences between Canadian GAAP and US GAAP (Continued)

Statement of Cash Flows (Continued):

Cumulative from Inception 2007 2006 2005

| Investing activities | | | | |

|---|

| Increase in short-term investments | (433,699) | 2,679 | (436,378) | - |

| Increase in funds held in trust | - | - | - | 75,000 |

| Purchase of equipment | (2,827,187) | (1,337,687) | (1,413,136) | - |

| Acquisition of mineral rights | (468,107) | (280,692) | (187,415) | - |

| Mine development costs | (739,048) | (293,519) | (445,529) | - |

| Purchase of marketable securities | (1,057,976) | - | - | (78,124) |

| Reclamation bond | (181,767) | (50,000) | - | (131,767) |

| Proceeds on disposal of marketable | | | | |

| securities | 690,859 | - | - | - |

| Foreign currency translation adjustments | (5,016,925) (84,632) | | (1,959,219) (381,030) | | (2,482,458) 249,505 | | (134,891) 131,306 |

|---|

| Cash and cash equivalents Net increase (decrease) Beginning of period | 9,654,288 - | | 8,859,193 795,095 | | 402,398 392,697 | | 202,965 189,732 |

|---|

| End of period | $ | 9,654,288 | $ | 9,654,288 | $ | 795,095 | $ | 392,697 |

|---|