OMB APPROVAL

OMB Number: 3235-0288

Expires: December 31, 2012

Estimated average burden

Hours per response: 2645.00

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

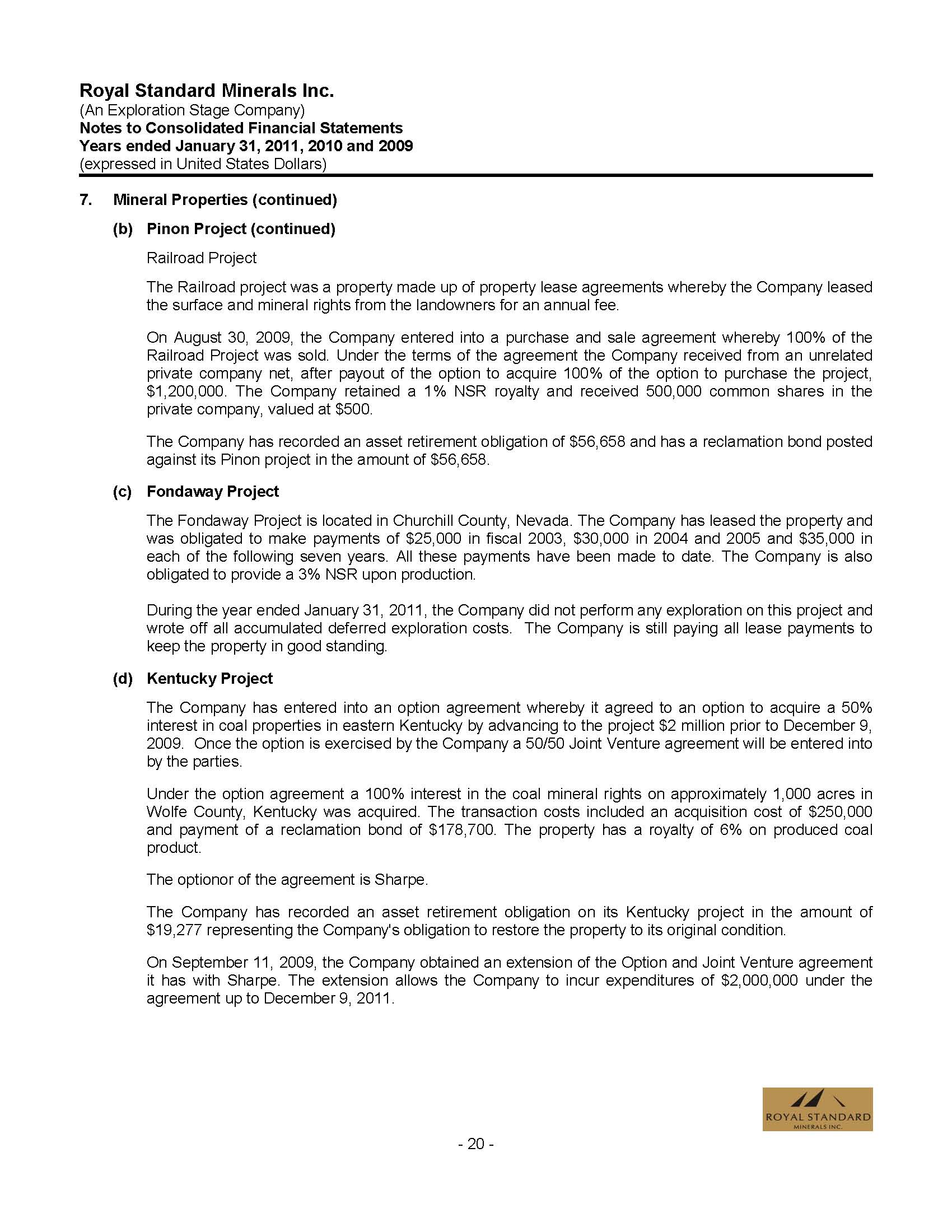

WASHINGTON, D.C. 20549

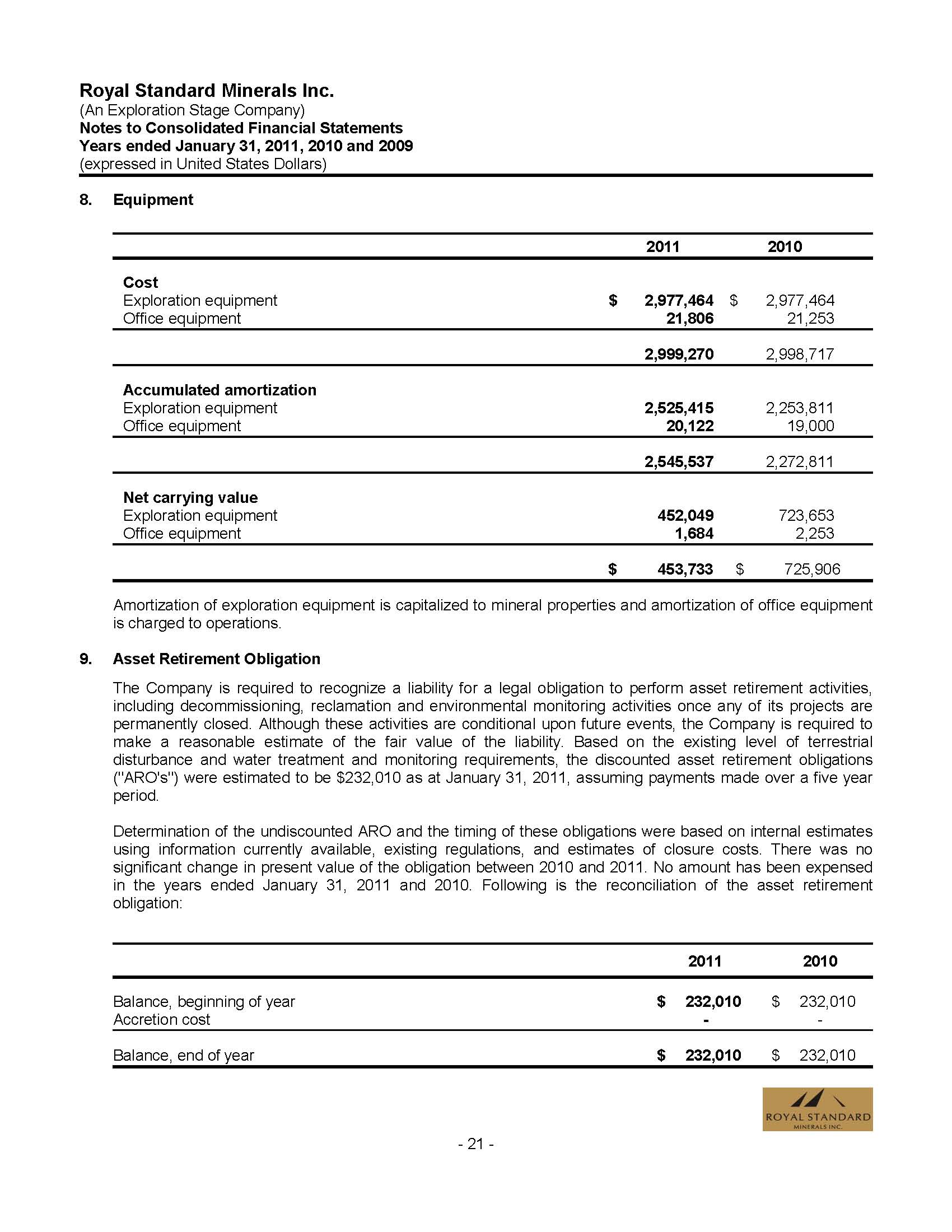

FORM 20-F

(Mark One)

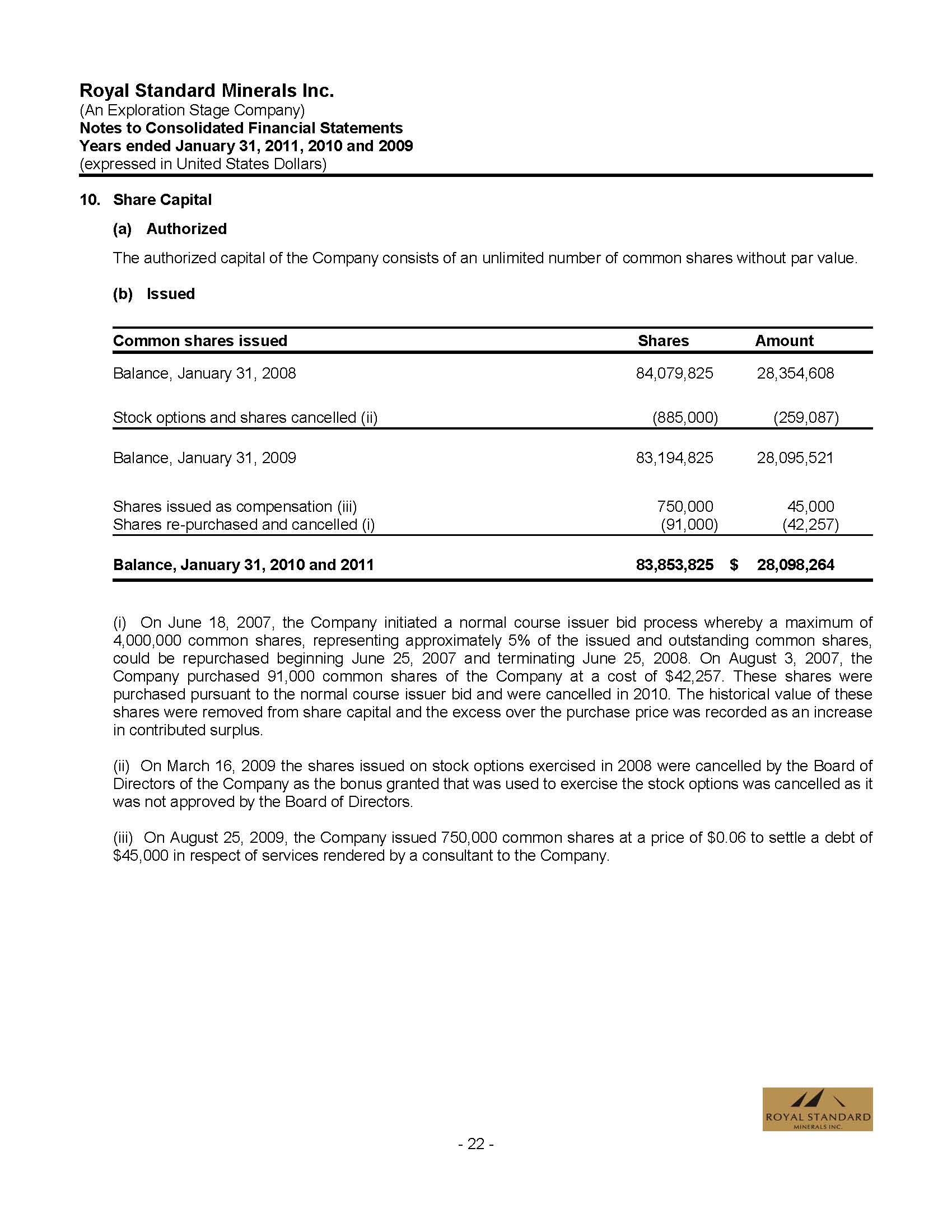

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

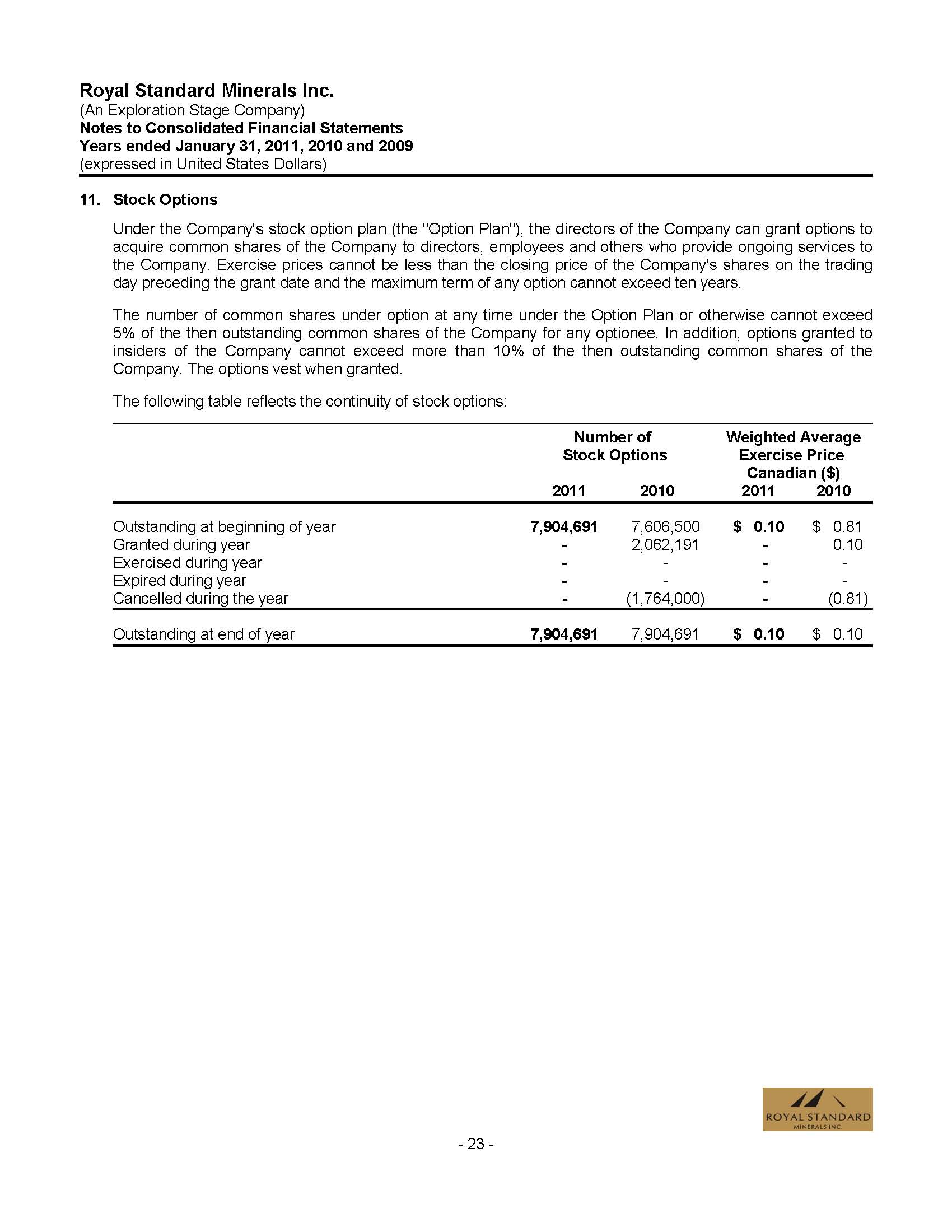

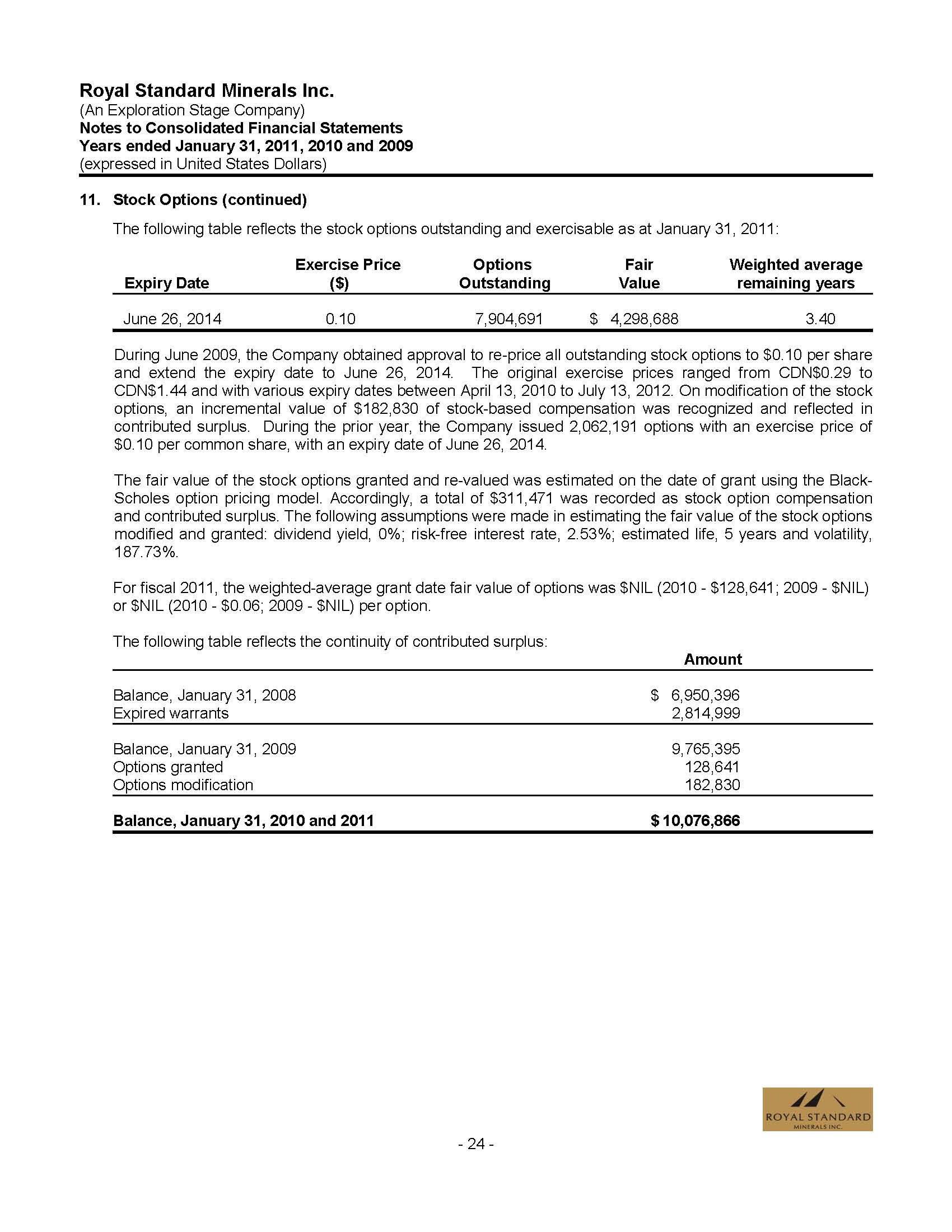

OR

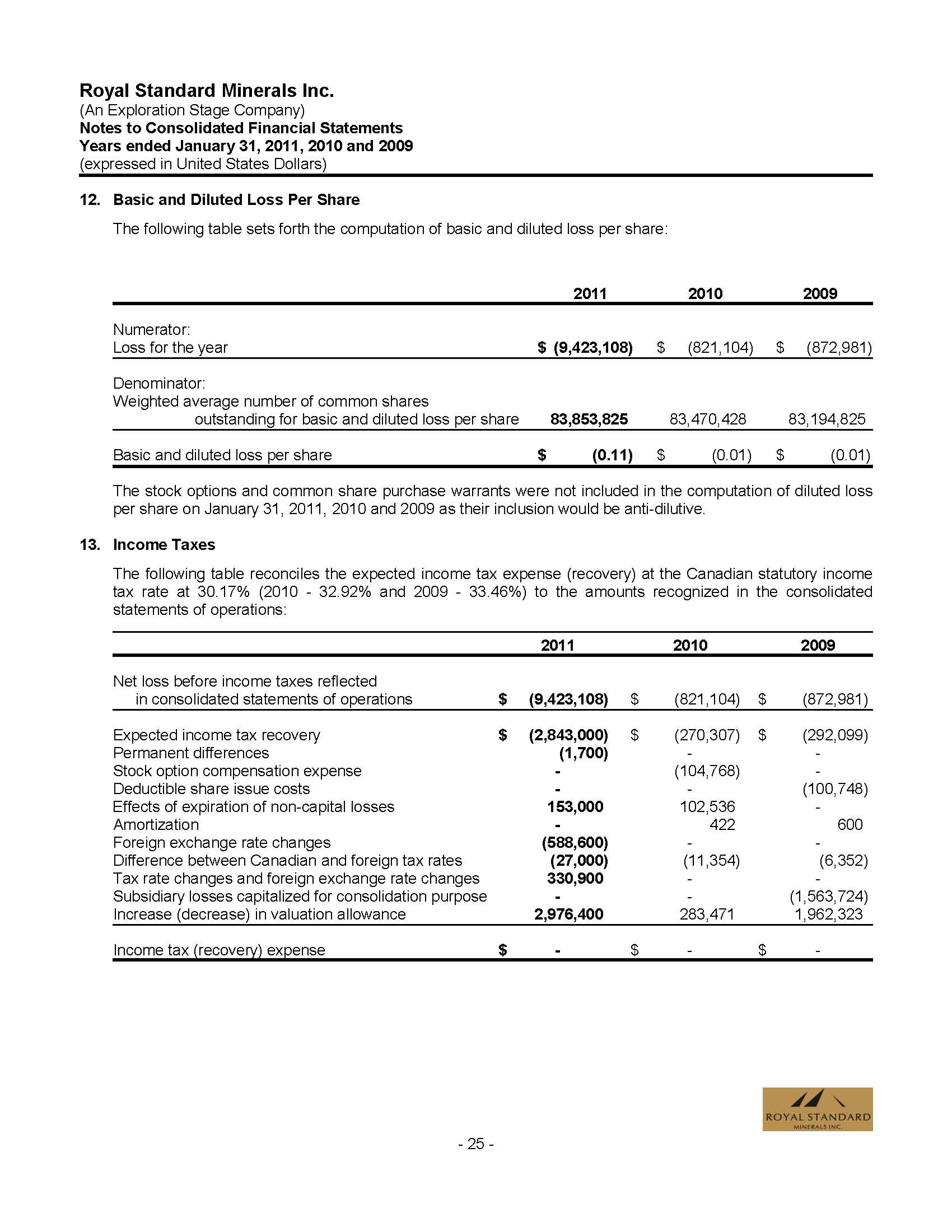

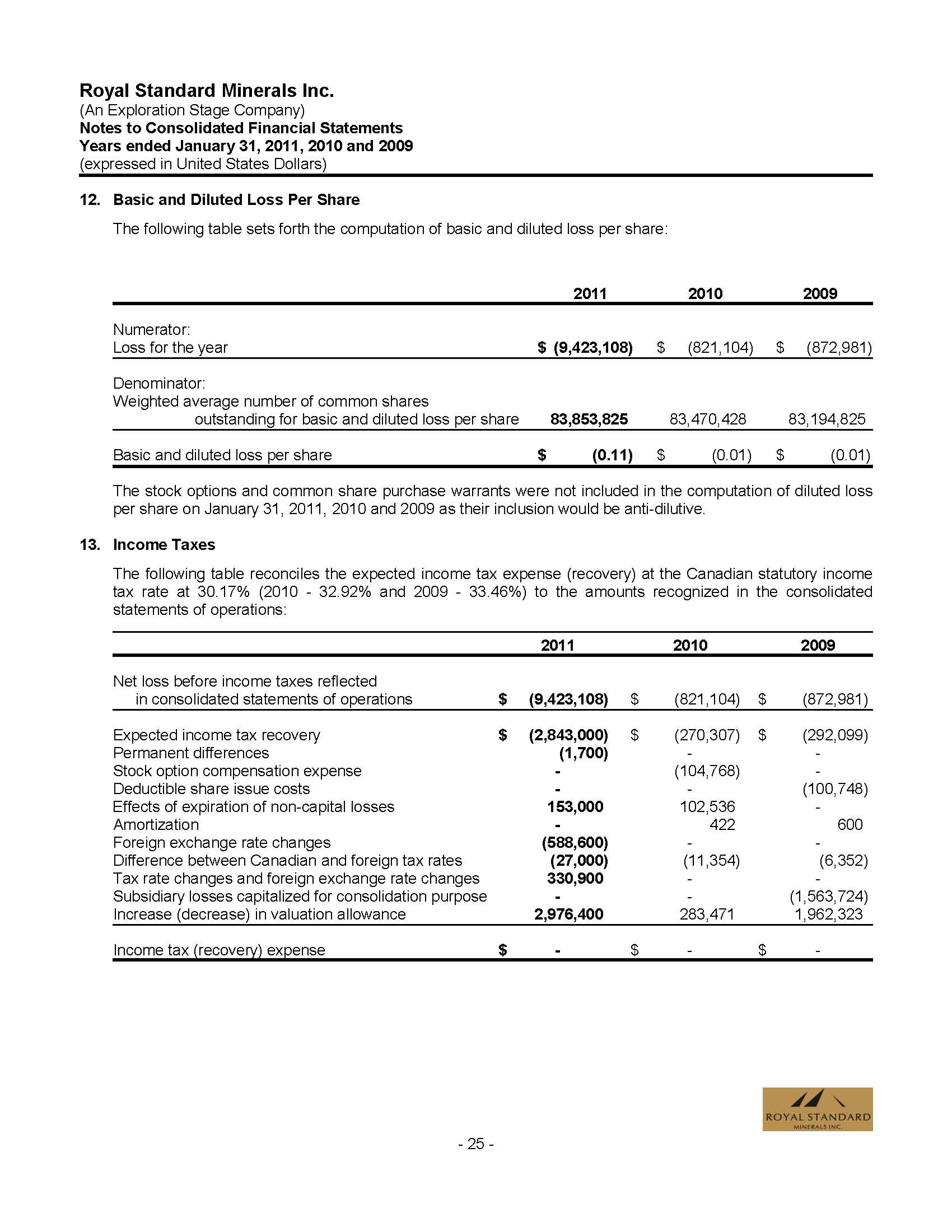

| X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

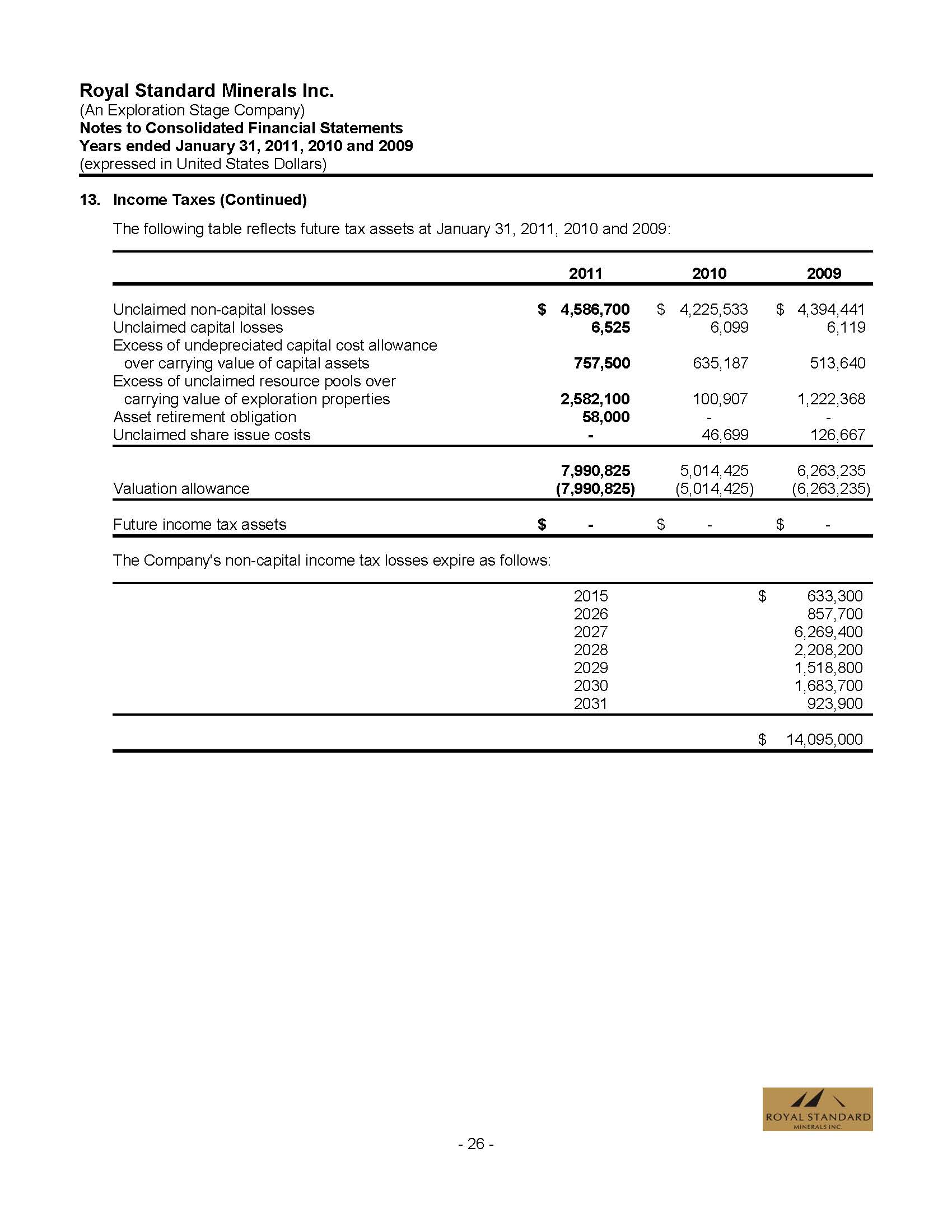

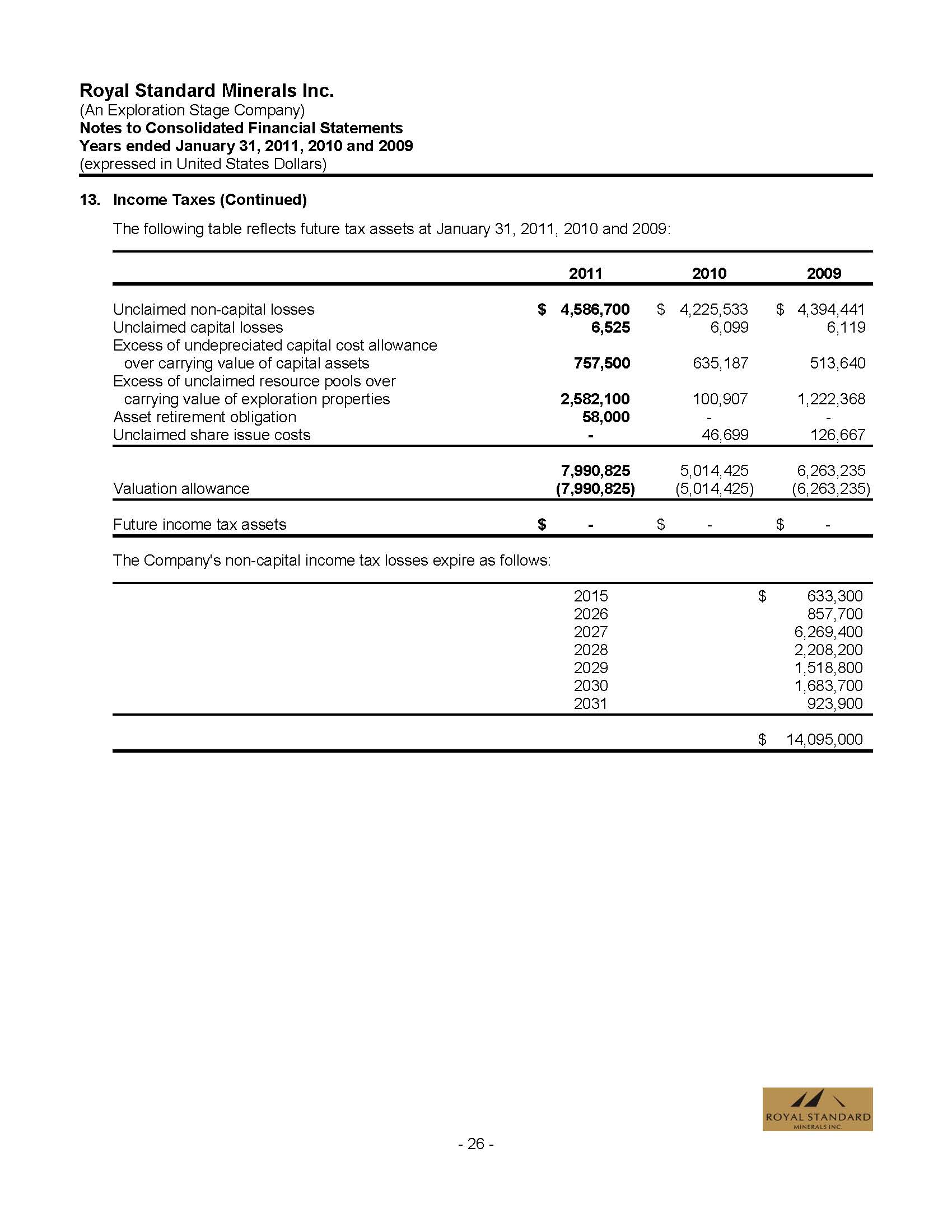

For the fiscal year ended January 31, 2011

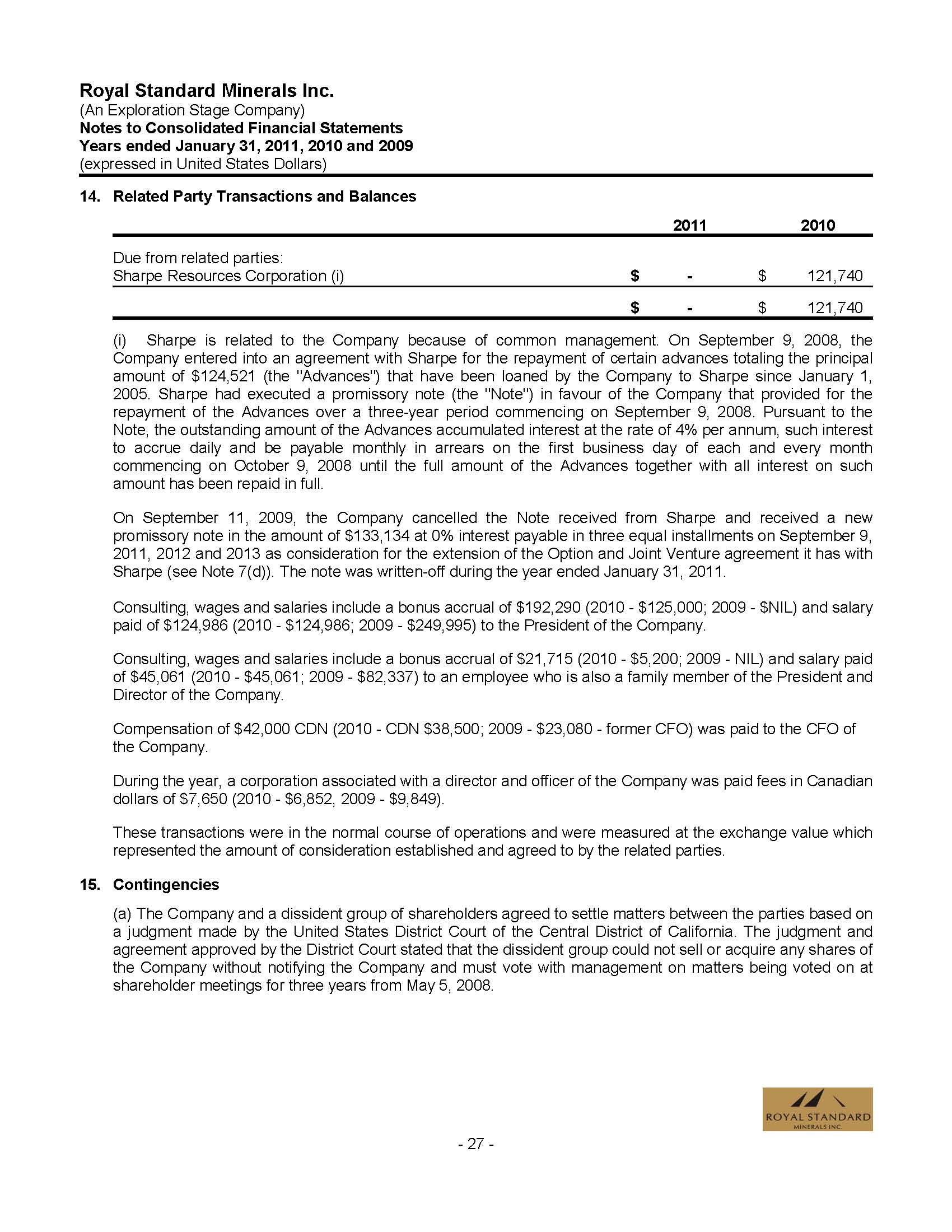

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

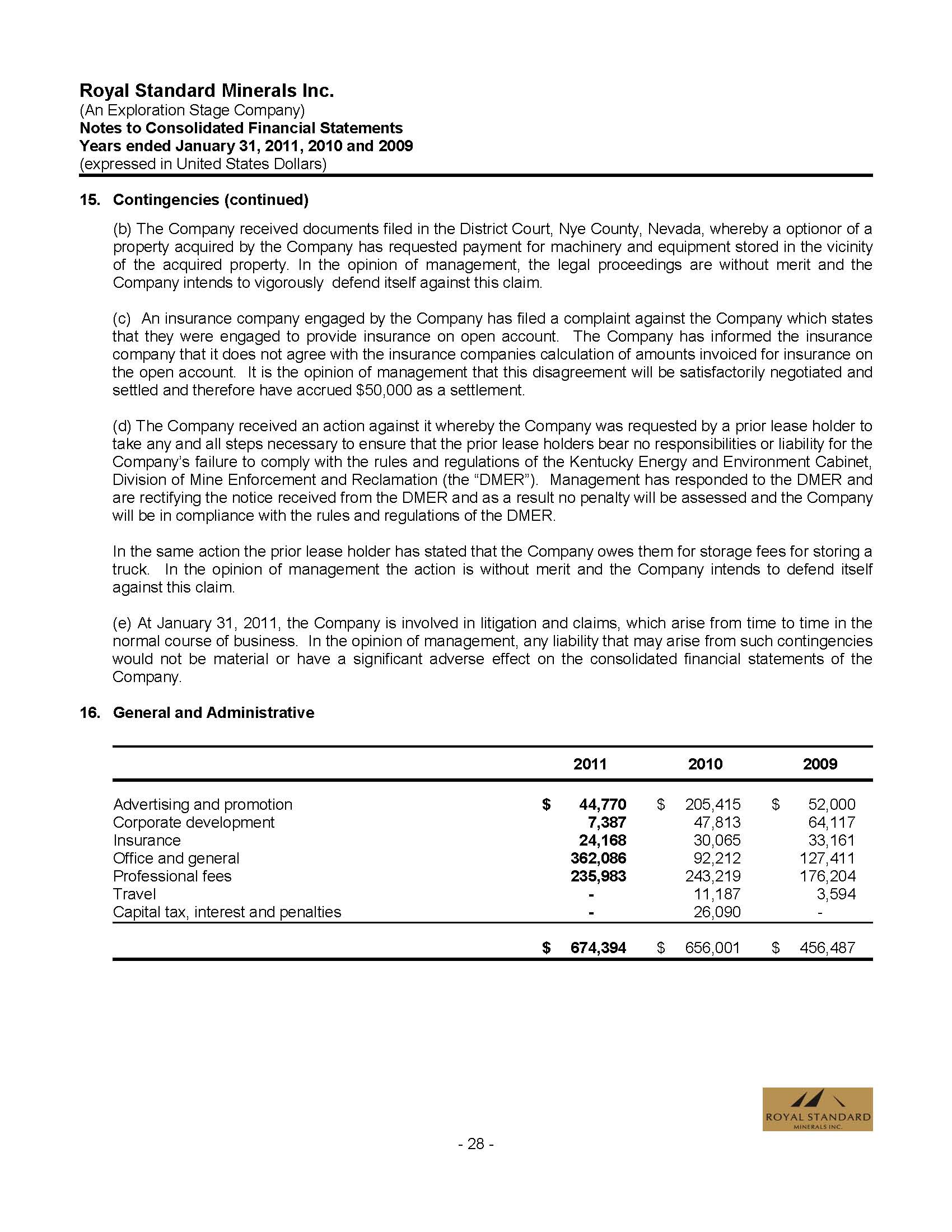

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to .

Commission file number: 001-28980

ROYAL STANDARD MINERALS INC.

(Exact name of Registrant as specified in its charter)

(Translation of Registrant's name into English)

CANADA

(Jurisdiction of incorporation or organization)

3258 MOB NECK ROAD HEATHSVILLE, VIRGINIA 22473

(Address of principal executive offices)

Roland M. Larsen, Phone 804-580-8107, rolandlarsen@hughes.net, 3258 Mob Neck Road, Heathsville, VA, 22473

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act. |

| |

Title of each class ____________________________________ ____________________________________ | Name of each exchange on which registered ____________________________________ ____________________________________ |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act. |

COMMON SHARES |

(Title of Class) |

SEC 1852 (09-10) | Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number |

Page 1

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

83,853,825 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

______Yes __X___No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934.

__X__Yes ____No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

______Yes __X___No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

______Yes _____No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check Below)

Large accelerated filer _____ Accelerated filer _____ Non-accelerated filer __X___

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ________ International Financial Reporting Standards as Issued Other ____X___ By the International Accounting Standards Board ________

If "Other" has been checked in response to the previous questions, indicate by check mark which financial statement item the registrant has elected to follow.

___X___ Item 17 ________Item 18

If this is an annual report, indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

______Yes __X___No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

______Yes _____No

Page 2

Index

| PART I | | |

|---|

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 5 |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 5 |

| ITEM 3 | KEY INFORMATION | 5 |

| A. | Selected financial data | 5 |

| B. | Capitalization and indebtedness | 6 |

| C. | Reasons for the offer and use of proceeds | 6 |

| D. | Risk factors | 6 |

| ITEM 4 | INFORMATION ON THE COMPANY | 9 |

| A. | History and development of the company | 9 |

| B. | Business overview | 9 |

| C. | Organizational structure | 16 |

| D. | Property, plants and equipment | 16 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 32 |

| A. | Operating results | 32 |

| B. | Liquidity and capital resources | 33 |

| C. | Research and development, patents and licenses, etc. | 35 |

| D. | Trend information | 35 |

| E. | Off balance sheet arrangements | 35 |

| F. | Tabular disclosures of contractual obligations | 35 |

| G. | Safe harbor | 36 |

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 36 |

| A. | Directors and senior management | 36 |

| B. | Compensation | 39 |

| C. | Board practices | 44 |

| D. | Employees | 48 |

| E. | Share ownership | 49 |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 49 |

| A. | Major shareholders | 49 |

| B. | Related party transactions | 49 |

| C. | Interests of experts and counsel | 50 |

| ITEM 8 | FINANCIAL INFORMATION | 50 |

| A. | Consolidated statements and other financial information | 50 |

| B. | Significant changes | 50 |

| ITEM 9 | THE OFFER AND LISTING | 52 |

| A. | Offer and listing details | 52 |

| B. | Plan of distribution | 53 |

| C. | Markets | 53 |

| D. | Selling shareholders | 53 |

| E. | Dilution | 53 |

| F. | Expenses of the issue | 53 |

| ITEM 10 | ADDITIONAL INFORMATION | 53 |

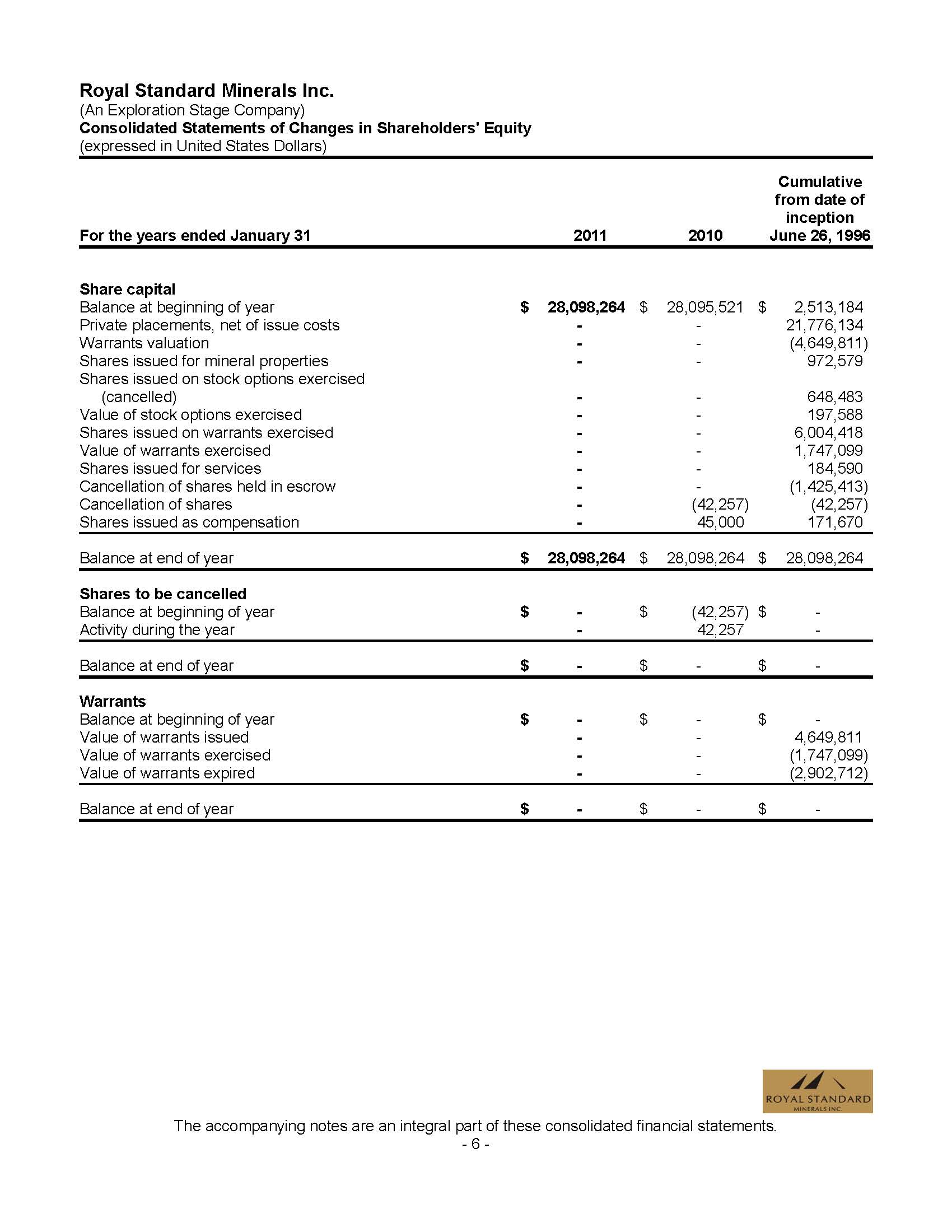

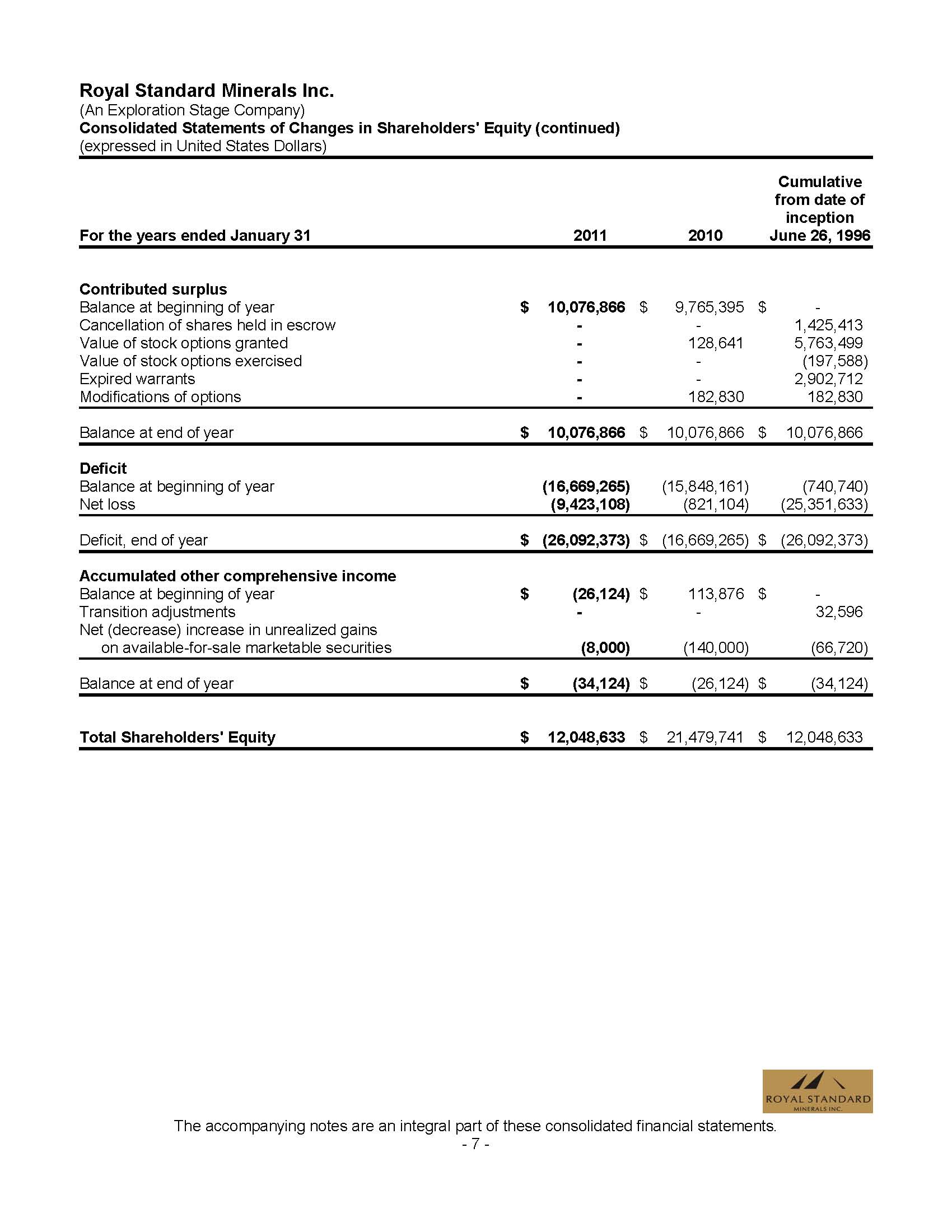

| A. | Share capital | 53 |

| B. | Memorandum and articles of association | 54 |

| C. | Material contracts | 54 |

| D. | Exchange controls | 54 |

| E. | Taxation | 56 |

| F. | Dividends and paying agents | 57 |

| G. | Statement by experts | 57 |

| H. | Documents on display | 57 |

| I. | Subsidiary information | 57 |

Page 3

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 57 |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 59 |

| PART II | | |

| ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 59 |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 59 |

| ITEM 15 | CONTROLS AND PROCEDURES | 59 |

| A | DISCLOSURE CONTROLS AND PROCEDURES | 59 |

| B | MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROLS OVER | 59 |

| C | ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING | 60 |

| D | CHANGES IN CONTROL OVER FINANCIAL REPORTING | 60 |

| ITEM 16 | [RESERVED] | 60 |

| ITEM 16A | AUDIT COMMITTEE FINANCIAL REPORT | 60 |

| ITEM 16B | CODE OF ETHICS | 60 |

| ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 60 |

| ITEM 16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 61 |

| ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 61 |

| ITEM 16F | CHANGES IN REGISTRANT'S CERTIFYING ACCOUNTANTS | 61 |

| ITEM 16G | CORPORATE GOVERNANCE | 61 |

| PART III | | |

| ITEM 17 | FINANCIAL STATEMENTS | 61 |

| MANAGEMENT'S DISCUSSION & ANALYSIS | 104 |

| ITEM 18 | FINANCIAL STATEMENTS | 137 |

| ITEM 19 | EXHIBITS | 137 |

| | |

| SIGNATURES | 137 |

Page 4

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable

Item 2. Offer Statistics and Expected Timetable

Not Applicable

Item 3. Key Information

A. Selected financial data.

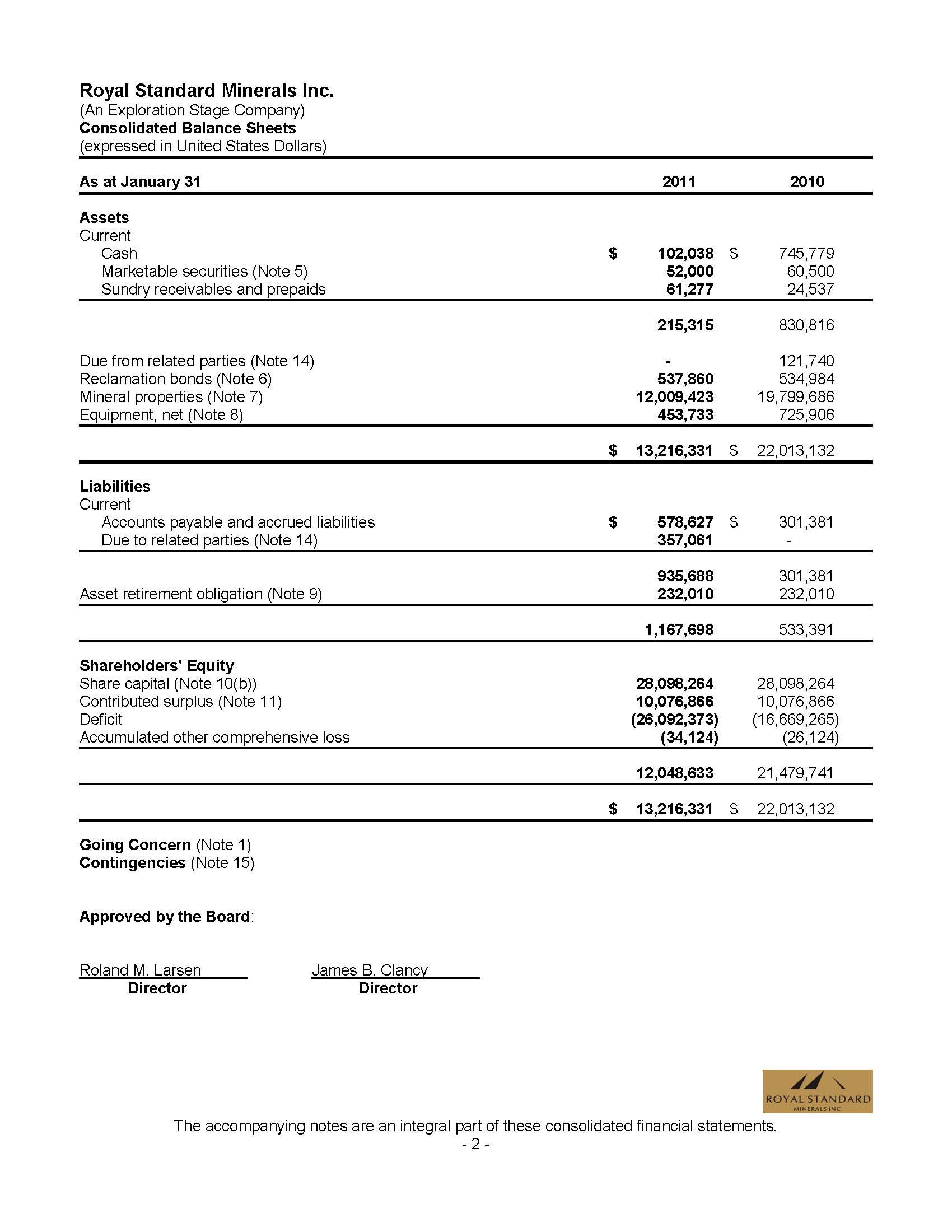

The table below presents selected statement of operations and balance sheet data for Royal Standard Minerals Inc. as at and for the fiscal years ended January 31, 2011, 2010, 2009, 2008, and 2007. The selected financial data presented herein is prepared in accordance with accounting principles generally accepted in Canada ("Canadian GAAP") and include the accounts of the Company and its wholly-owned subsidiaries, Kentucky Standard Energy Company Inc., and Manhattan Mining Co., both United States Companies.

A summary of the differences between accounting principles generally accepted in Canada ("Canadian GAAP") and those generally accepted in the United States ("US GAAP") which affect the Company is contained in Note 21 of the Consolidated Financial Statements included with this report.

Royal Standard Minerals Inc.

(An Exploration Stage Enterprise)

Consolidated Financial Statement Data

For the Years Ended January 31

(Expressed in US Currency)

| 2011 | 2010 | 2009 | 2008

(Restated1) | 2007

(Restated1) |

|---|

Statement of Operations | | | | |

|---|

| Revenue | $0 | $0 | $0 | $0 | $0 |

|---|

| Interest Income | $3,221 | $9,630 | $115,822 | $396,294 | $391,420 |

|---|

| Expenses | ($741,275) | ($1,412,913) | ($783,238) | ($2,270,313) | ($4,902,903) |

|---|

| Net loss for the year | ($9,423,108) | ($821,104) | ($872,981) | ($1,180,034) | ($4,511,483) |

|---|

Deficit, beginning of

year | ($16,669,265) | ($15,848,161 | ($14,975,180) | ($14,810,739) | ($9,760,289) |

|---|

| Deficit, end of year | ($26,092,373) | ($16,669,265) | ($15,848,161) | ($14,975,180) | ($14,135,735) |

|---|

| Loss per common share: | | | | | |

|---|

Basic and diluted

loss per share | ($0.11) | ($0.01) | ($0.01) | ($0.01) | ($0.07) |

|---|

Weighted Average

Shares Outstanding | 83,853,825 | 83,470,428 | 83,194,825 | 82,983,768 | 73,771,233 |

|---|

Page 5

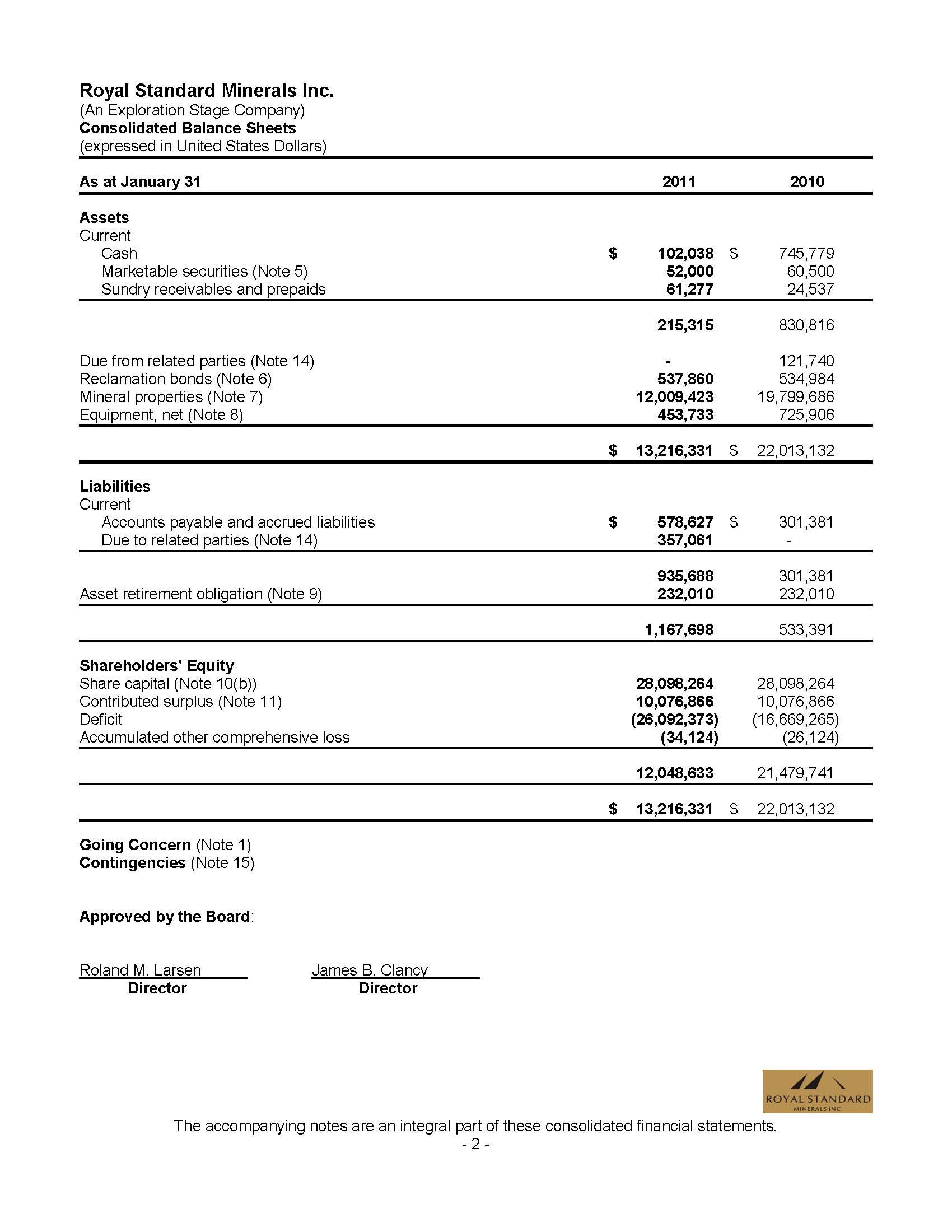

| Balance Sheet | January 31, 2011 | January 31, 2010 | January 31, 2009 | January 31, 2008

(Restated1) | January 31, 2007

(Restated1) |

|---|

| Current Assets | $215,315 | $830,816 | $1,947,791 | $8,006,287 | $10,438,324 |

|---|

| Exploration Properties | $12,009,423 | $19,799,686 | $19,007,396 | $13,895,392 | $8,547.743 |

|---|

| Equipment, net | $453,733 | $725,906 | $1,059,744 | $1,483,690 | $2,056,392 |

|---|

| Total Assets | $13,216,331 | $22,013,132 | $22,506,672 | $23,588,555 | $21,224,226 |

|---|

| Current Liabilities | $935,688 | $301,381 | $190,288 | $220,737 | $202,157 |

|---|

| Net Assets | $12,048,633 | $21,479,741 | $22,084,374 | $23,164,632 | $20,840,302 |

|---|

1 During the preparation of the consolidated financial statements for the year ended January 31, 2009, it was determined that foreign exchange gains and losses should be recorded in the statement of operations as the Company uses the United States Dollar as its functional and reporting currency, as the majority of its transactions are denominated in this currency and the operations of its subsidiaries are considered to be of an integrated nature. The effect of this restatement as at January 31, 2008 and 2007 has been to decrease net loss by $1,180,034 and increase net loss by $381,030 respectively and a decrease in accumulated other comprehensive income by $1,180,034 and an increase in accumulated other comprehensive income by $381,030 respectively. There was no impact on total shareholders' equity as a result of the change. The effect of the change reduced net loss per share by $0.01 to $0.01 per share for the year ended January 31, 2008 and increased the net loss per share by $0.01 to $0.01 per share for the year ended January 31, 2007.

Currency Exchange Rates

Except where otherwise indicated, all dollar figures in this annual report on Form 20-F, including the financial statements, refer to United States currency. The following table sets forth, for the periods indicated, certain exchange rates certified by the Federal Reserve Bank of New York for customs purposes as required by section 522 of the amended Tariff Act of 1930. These rates are also those required by the SEC for the integrated disclosure system for foreign private issuers. The information is based on data collected by the Federal Reserve Bank of New York from a sample of market participants. The data are noon buying rates in New York for cable transfers payable in foreign currencies and represent the number of Canadian dollars per one US dollar.

| | Year Ended December 31 |

|---|

| 20111 | 2010 | 2009 | 2008 | 2007 |

|---|

| High for the Period | 1.0020 | 1.0776 | 1.2995 | 1.2971 | 1.1852 |

|---|

| Low for the Period | 0.9486 | 0.9960 | 1.0289 | 0.9717 | 0.9168 |

|---|

| Average for the Period | 0.9765 | 1.0298 | 1.1412 | 1.0659 | 1.0734 |

|---|

| Rate at the end of the Period | 0.9688 | 1.0009 | 1.0461 | 1.2240 | 0.9881 |

|---|

1 Based on the period beginning 1/1/11 and ending on 5/31/11.

B. Capitalization and indebtedness.

Not Applicable

C. Reasons for the offer and use of proceeds.

Not Applicable

D. Risk factors.

The operations of Royal Standard involve a number of substantial risks and the securities of Royal Standard are highly speculative in nature. The following risk factors should be considered:

Page 6

Absence of Public Market

Trading of the Common Shares of Royal Standard has been sporadic and very limited and no assurance can be given that an active trading market will develop or be sustained. Investment in Royal Standard is, therefore, not suitable for any investors who may have to liquidate their investments on a timely basis and should only be considered by investors who are able to make a long term investment in Royal Standard.

Risk Inherent to Royal Standard's Proposed Mining Activities

- Royal Standard is engaged in the business of acquiring and exploring mineral properties in the hope of locating an economic deposit or deposits of minerals. The property interests of the Company are in the exploration stage only and are without a known body of commercial ore. There can be no assurance that the Company will generate any revenues or be profitable or that the Company will be successful in locating an economic deposit of minerals.

- There are a number of uncertainties inherent in any exploration and development program, including the location of economic ore bodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits, and the construction of mining and processing facilities. Substantial expenditures will be required to pursue such exploration and development activities. Assuming discovery of an economic ore body and depending on the type of mining operation involved, several years may elapse from the initial stages of development until commercial production is commenced. New mining operations frequently experience unexpected problems during the exploration and development stages and during the initial production phase. In addition, preliminary reserve estimates may prove inaccurate. Accordingly, there can be no assurance that the Company's current exploration and development programs will result in any commercial mining operations.

- The Company may become subject to liability for cave-ins and other hazards of mineral exploration against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. Payment of such liabilities would reduce funds available for acquisition of mineral prospects or exploration and development and would have a material adverse effect on the financial position of the Company.

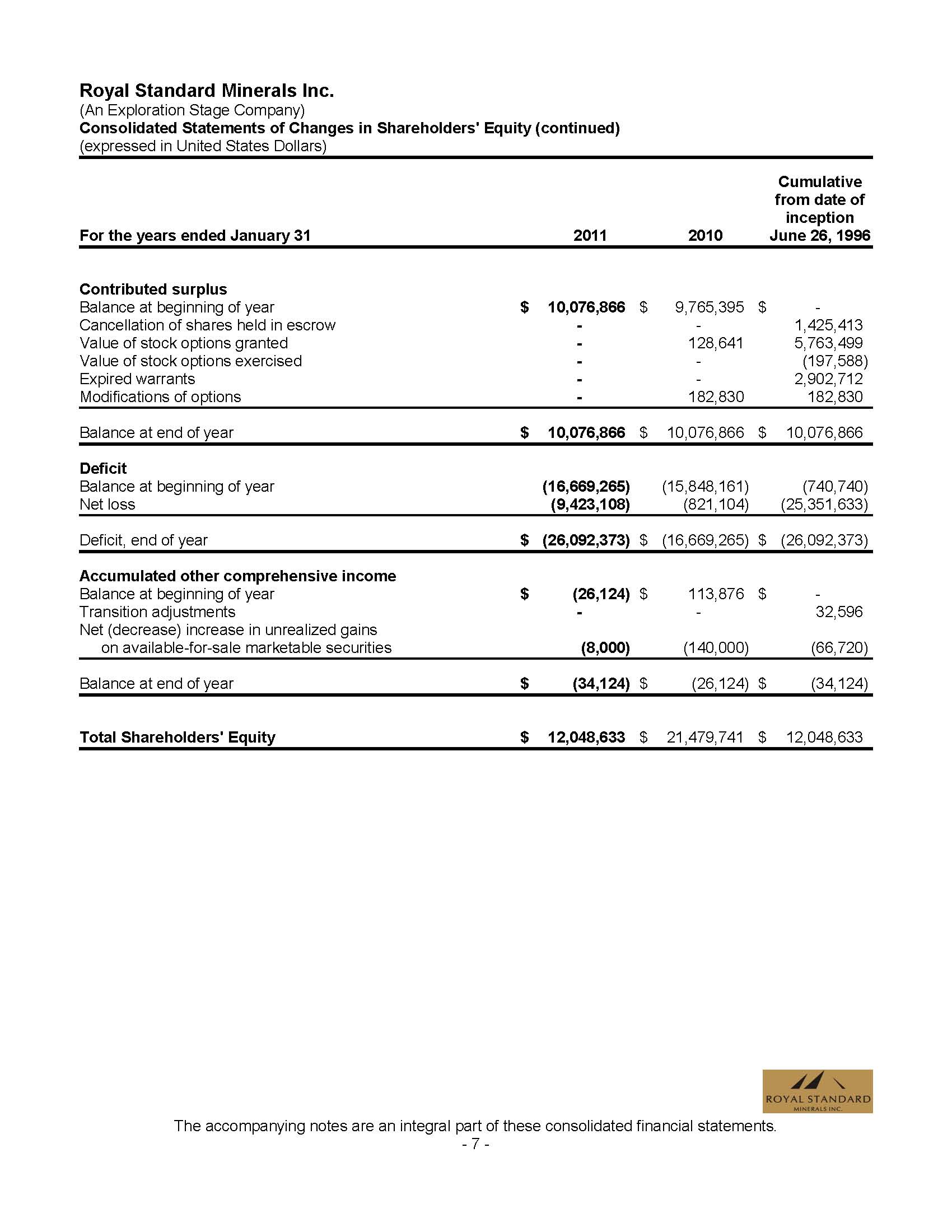

History of Losses

At January 31, 2011, the Company had an accumulated deficit of U.S. $26,092,373 and a working capital deficiency of $720,373. There can be no assurance that the Company will ever achieve revenues from operations or that its operations will ever be profitable.

Additional Capital

The terms of the Company's rights to its properties require that the Company expend significant funds on exploratory and other pre-production activities. Should the Company fail to make these expenditures on a timely basis, it would forfeit its rights to the particular projects, including the sums expended through the dates of such forfeitures. The Company's present capital resources are not sufficient to fund these costs. There can be no assurance that the Company will be able to raise additional capital on acceptable terms or at all. In any event, any additional issuance of equity would be dilutive to the Company's current shareholders.

No History of Operations

The Company is an exploration stage enterprise with no history of prior operations and no earnings. There can be no assurance that the Company's operations will become profitable in the future. The success of the Company will be dependent on the expertise of its management, the quality of its properties, and its ability to raise the necessary capital to carry out its business plan.

Page 7

If financing is unavailable for any reason, the Company will be unable to acquire and retain its mineral concessions and carry out its business plan.

Regulatory and Economic Factors

Any exploration operations carried on by the Company are subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labor standards. In addition, the profitability of any mining prospect is affected by the market for minerals which is influenced by many factors including changing production costs, the supply and demand for minerals, the rate of inflation, the inventory of mineral producers, the political environment and changes in international investment patterns.

Competition

There is significant competition for the acquisition of properties producing or capable of producing gold and precious minerals. The Company may be at a competitive disadvantage in acquiring additional mining properties since it must compete with other individuals and companies, many of which have greater financial resources and larger technical staffs than the Company. As a result of this competition, the Company may be unable to acquire attractive mining properties on terms it considers acceptable.

Title to Properties

The validity of unpatented mining claims on public lands, which constitute most of the property holdings is often uncertain and may be contested and subject to title defects.

Conflict of Interest

Certain directors and officers of the Company are also directors and officers of other natural resource and base metal exploration and development companies. As a result, conflicts may arise between the obligations of these directors to the Company and to such other companies.

Dependence on Key Personnel

The Company's success will be dependent upon the services of its President and Chief Executive Officer, Mr. Roland Larsen.

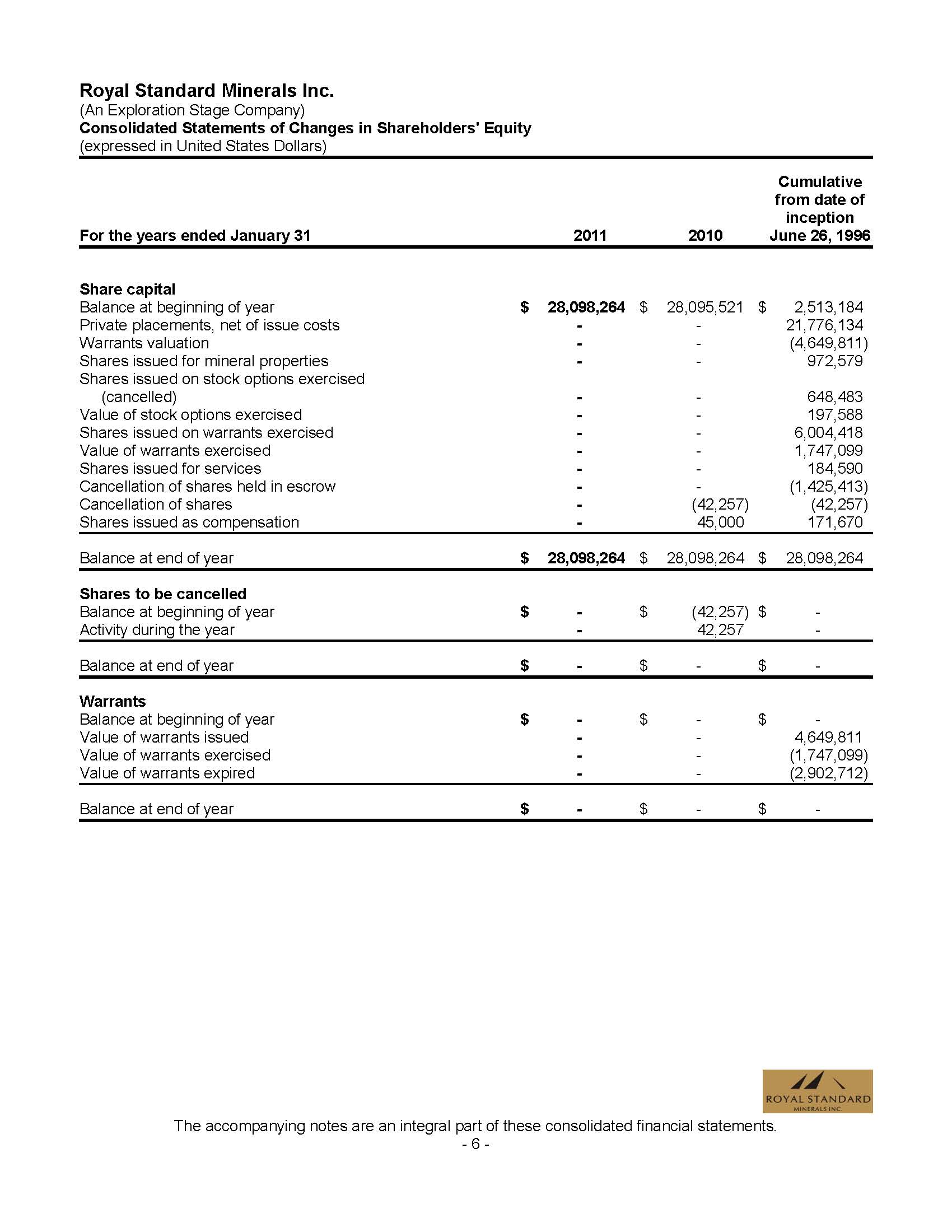

Effect of Outstanding Warrants and Options; Negative Effect of Substantial Sales

As of January 31, 2011, the Company had outstanding options to purchase an aggregate of 7,904,691 Common Shares. There were no warrants outstanding as of January 31, 2011. All of the foregoing securities represent the right to acquire Common Shares of the Company during various periods of time and at various prices. Holders of these securities are given the opportunity to profit from a rise in the market price of the Common Shares and are likely to exercise its securities at a time when the Company would be able to obtain additional equity capital on more favorable terms. Substantial sales of Common Shares pursuant to the exercise of such options and warrants could have a negative effect on the market price for the Common Shares.

Dividends

The Company does not anticipate paying dividends in the foreseeable future.

Page 8

Item 4. Information on the Company

A. History and development of the company.

Royal Standard Minerals Inc. herein referred to as "Royal Standard" or the "Company", was incorporated pursuant to the laws of Canada by articles of incorporation dated December 10, 1986 under its former name, Ressources Minieres Platinor Inc. ("Ressources"). On April 30, 1996, Royal Standard shareholders approved the acquisition of all the issued and outstanding shares of Southeastern Resources, Inc. ("Southeastern") in a reverse take-over transaction. Pursuant to this transaction, articles of amendment were filed effective May 14, 1996, pursuant to which the name of Royal Standard was changed to its current form of name and its shares issued and outstanding at that time were consolidated on a 7.5:1 basis. On June 28, 1996, the Common Shares commenced trading on the Montreal Exchange. On January 4, 2002 the Company was continued from the laws of Canada (Canada Business Corporations Act) to the laws of the Province of New Brunswick (New Brunswick Corporations Act). On February 17, 2004 under the laws of the Province of New Brunswick the articles were amended to provide for an unlimited number of common shares and an unlimited number of special shares. On July 23, 2007 the Company was continued from the laws of the Province of New Brunswick to the laws of Canada, Canadian Business Corporations Act (CBCA). The Company currently trades on the United States Over-the-Counter Bulletin Board symbol RYSMF.

The registered office of Royal Standard is located at 360 Bay Street, Suite 500, Toronto, Ontario M5H, 2V6 and the principal office of Royal Standard is located at 3258 Mob Neck Road, Heathsville, Virginia 22473. The Company also has an office at One Main Street, Manhattan, Nevada, 89022.

B. Business overview.

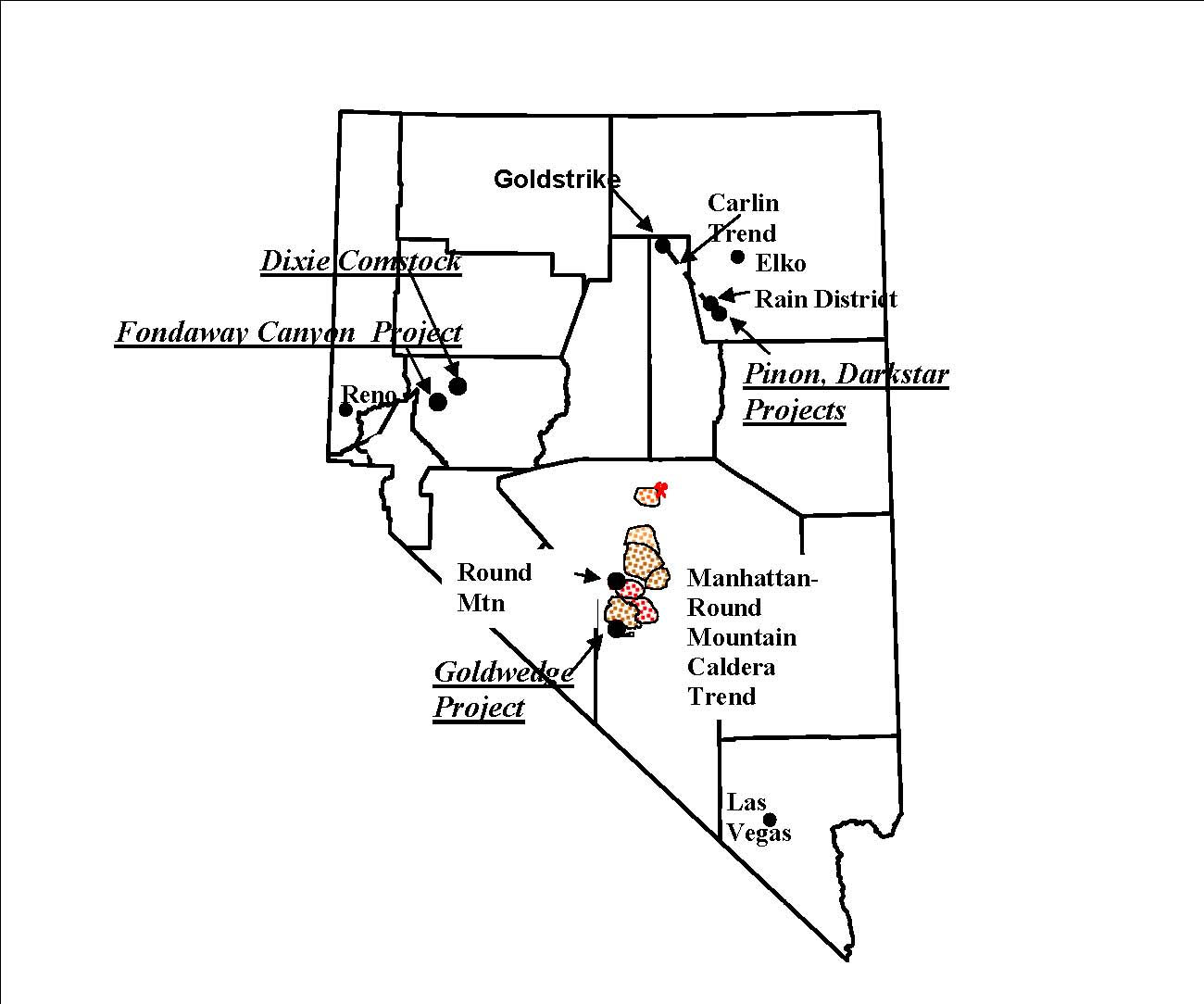

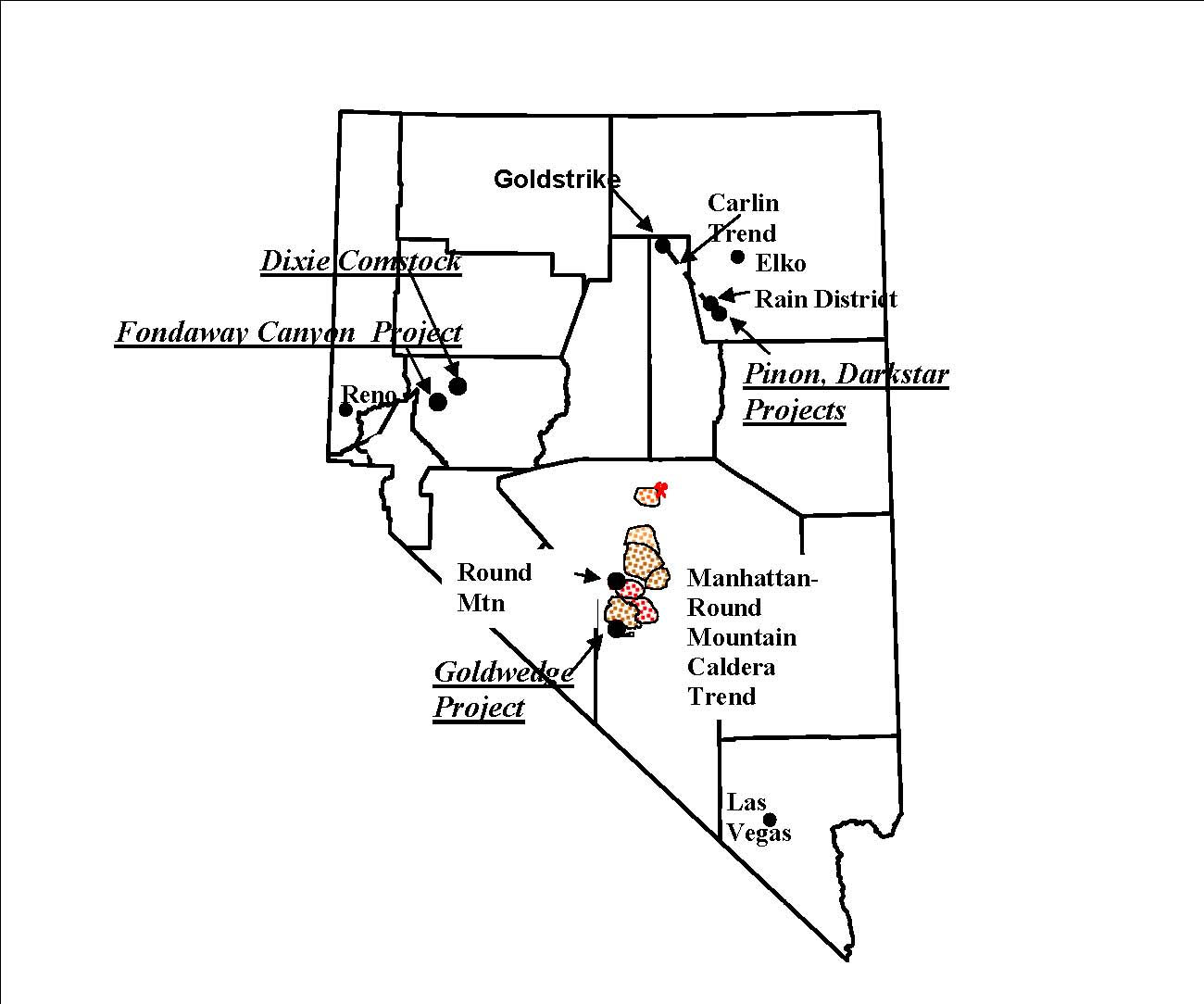

Royal Standard is a mineral exploration company engaged in locating, acquiring exploring and the development of gold and precious metal deposits in the state of Nevada and coal in the state of Kentucky. The Company owns a 100% interest in eight (6) projects in three (3) gold-silver districts in Nevada. These projects include the Goldwedge project in Nye County, Manhattan District project, the Pinon and Dark Star projects in Elko County, the Fondaway Canyon, Dixie-Comstock projects in Churchill County and the Campton project in Wolfe County, Kentucky.

At the present time, the Company's activities are limited to exploratory searches for ore and energy minerals. The Company has not generated any revenues from operations at this time. The Company is evaluating the potential for economic extraction of known deposits of ore grade material on the Company's mineral exploration properties. See Item # 3.D. - Risk Factors.

Page 9

Goldwedge Project

The Goldwedge, one of several gold deposits in the area, is considered one of the best known projects in the district for development of an underground mine. The property contains very good exploration potential for future growth. Based upon the results of approximately 75 drill holes primarily within the central zone over a strike length of 1,000+ feet and 100'-500' of vertical extent reveal continuous gold oxide mineralization of potential mineable thickness and quality. RSM has analyzed all of the drill data as part of a detailed geologic inventory of the deposit.

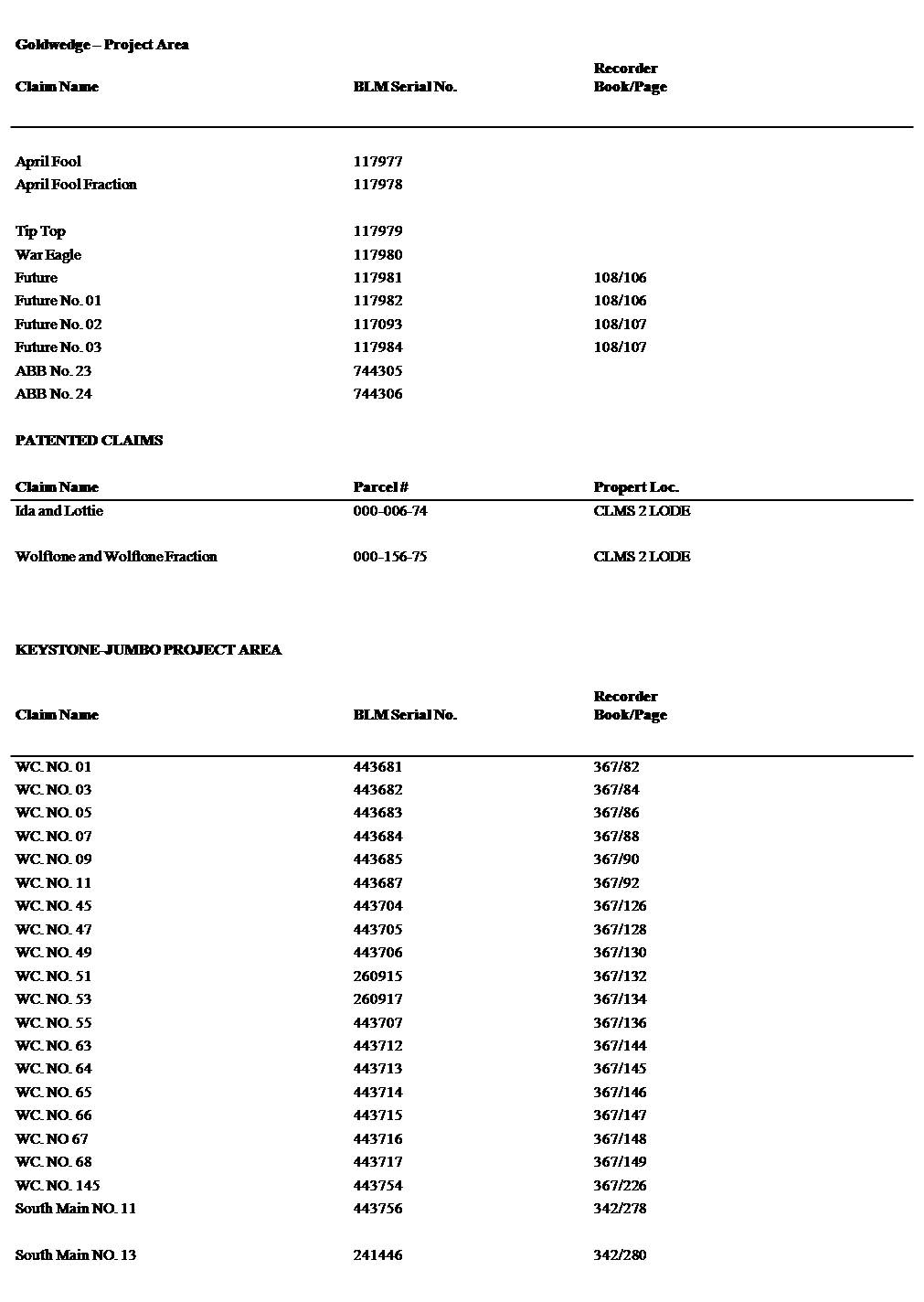

The project ownership includes staked BLM lands; options of BLM claims owned by others and patented mining claims owned by the Company. All payments, maintenance fees, option payments and taxes to state and federal authorities are current under state and federal guidelines.

The Goldwedge deposit occurs at the intersection of north and northwest trending faults. In the deposit area, the north trending Reliance fault is mineralized within the Ordovician Zanzibar limestone and siltstone. The target mineralization occurs within multiple high angle structures over a width of between 100-200 feet primarily within the Zanzibar limestone. RSM has evaluated all of the pertinent drill data as part of a detailed inventory of the deposit geometry, size and overall grade. The current exploration model suggests that the Goldwedge deposit and the

Page 10

extensions may contain an economically significant gold resource at depth near the contact with the Manhattan Caldera margin.

The Gold Wedge project represents the most advanced project located in the Manhattan district about eight (8) miles south of the Round Mountain mine and has been issued a mine and mill permit by the Nevada Department of Environmental Protection (NDEP). The Company has completed construction of a processing plant on site which includes primary and secondary crushing facilities that feed a gravity recovery system. In addition, a heap leach pad, silt and fresh water ponds have been completed. Testing of the various mineral processing functions commenced during April 2007 using previously extracted stockpiles of low grade gold feed material to process into gold dore' using the Company's smelter. The Company has also commenced the underground development program which includes the exploration of defined mineralized zones concurrently with the second phase of decline development. The program has concentrated on the development of a spiral decline as a means to better explore the deposit at depth. As part of the program a series of crosscuts were constructed at specific intervals to effectively assess the potential mineralized zones. All material is sampled daily and analyzed for gold onsite at the Company assay laboratory.

On June 29, 2005 the Company entered into a 5-year Purchase Option Agreement with a private individual for all of his patented and unpatented mining claims in the Manhattan Mining District located in Nye County, Nevada. The land package totals approximately 1600 acres (4 patented, 70 unpatented claims). This property position adjoins the Company's Gold Wedge property. The land package includes a number of exploration targets which are of interest to the Company. In addition, the Company's option includes the Dixie-Comstock claim group located in Churchill County, Nevada. The Dixie- Comstock is a 1500 acre property containing a gold system that has been explored by a number of major mining companies over the past 20 years. It is considered to be an attractive advanced exploration project. Annual option payments of $48,000 are to be applied to a total purchase price of $600,000. This option was exercised prior to August 31, 2009 and as a result this property is 100% owned by the Company.

The Company has recorded an asset retirement obligation on its Gold Wedge Project in the amount of $156,075, representing the estimated costs of the Company's obligation to restore the property site to its original condition and which is equal to the amount of the reclamation bond posted by the Company with the State of Nevada.

Currently NV Energy, a commercial electric supplier, services this site. The Company has all of the necessary water rights secured from the State of Nevada.

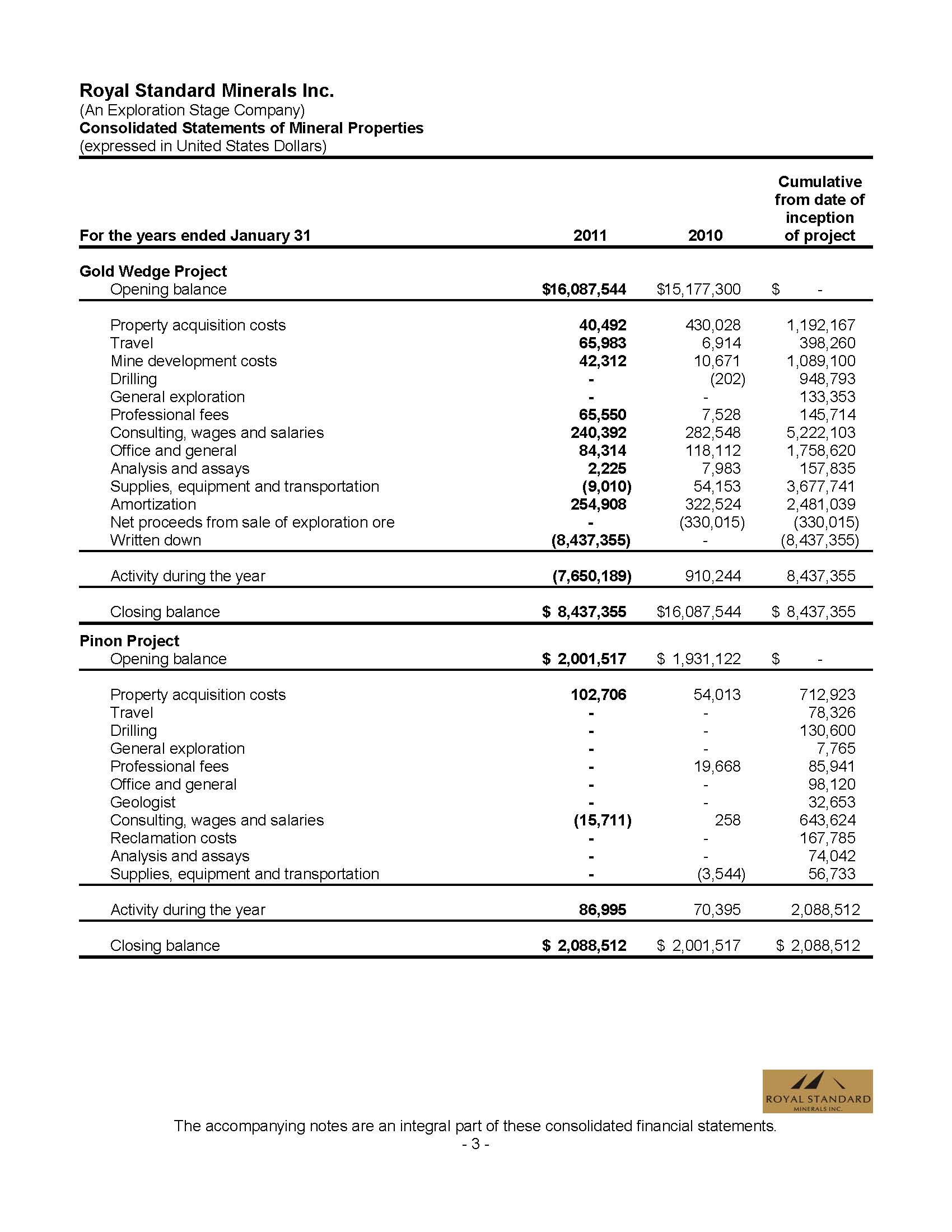

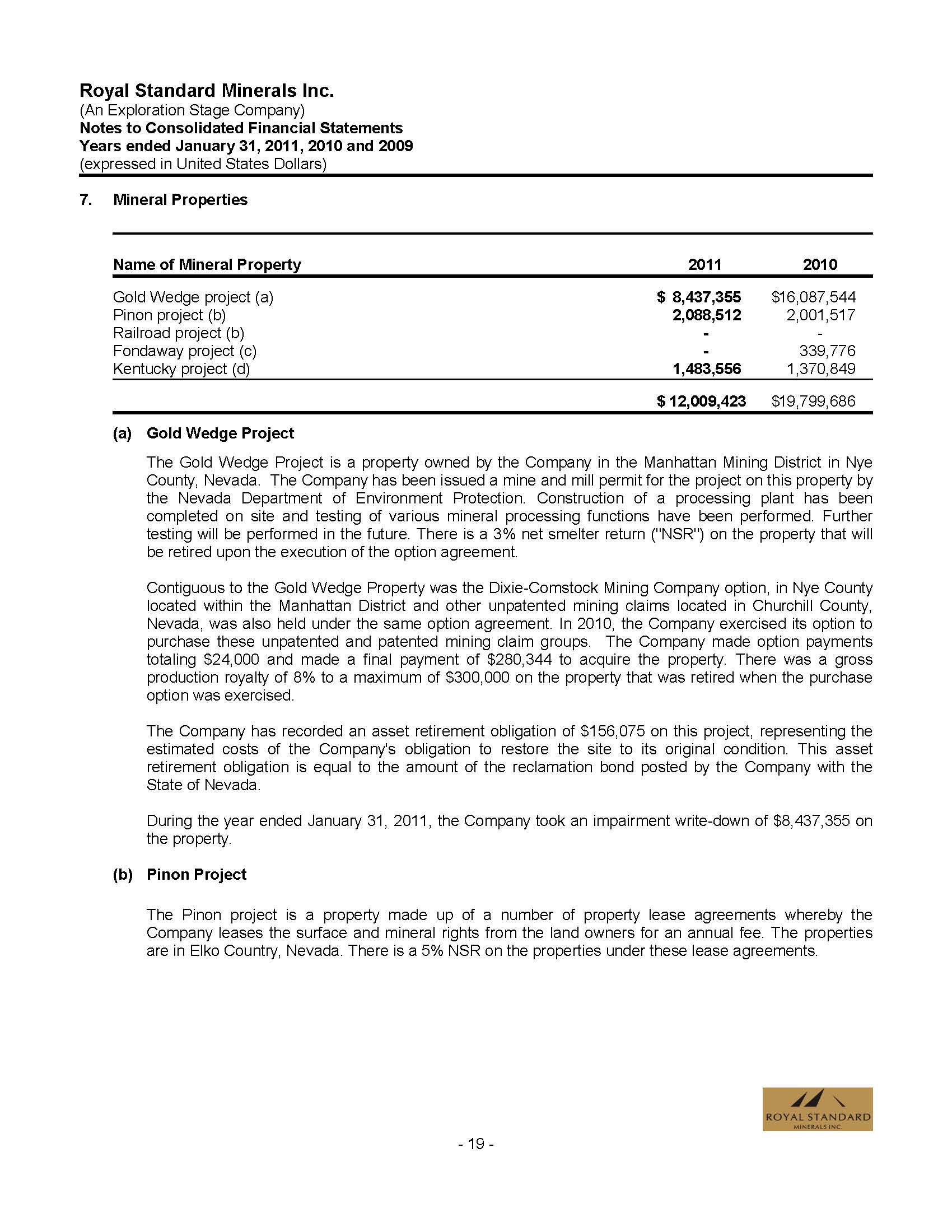

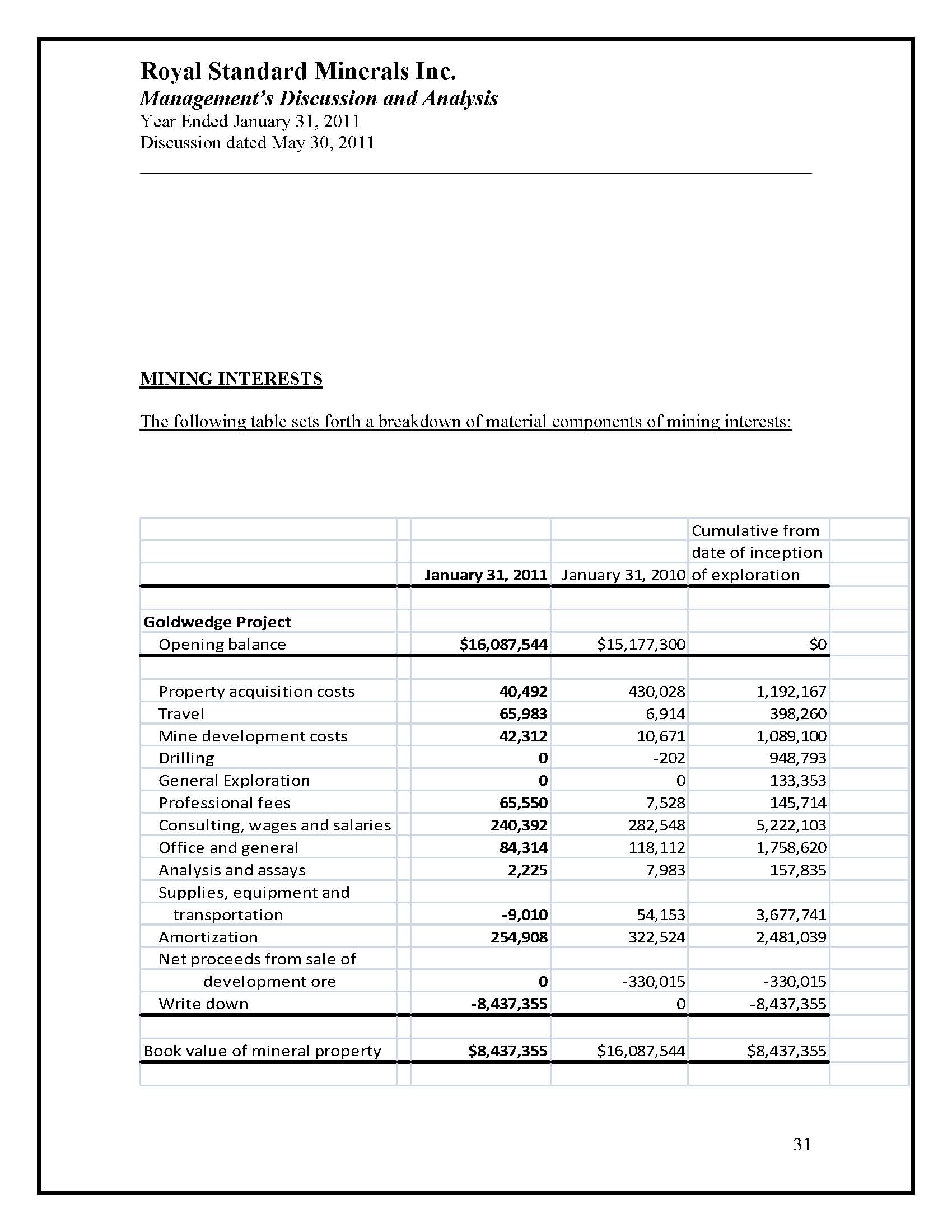

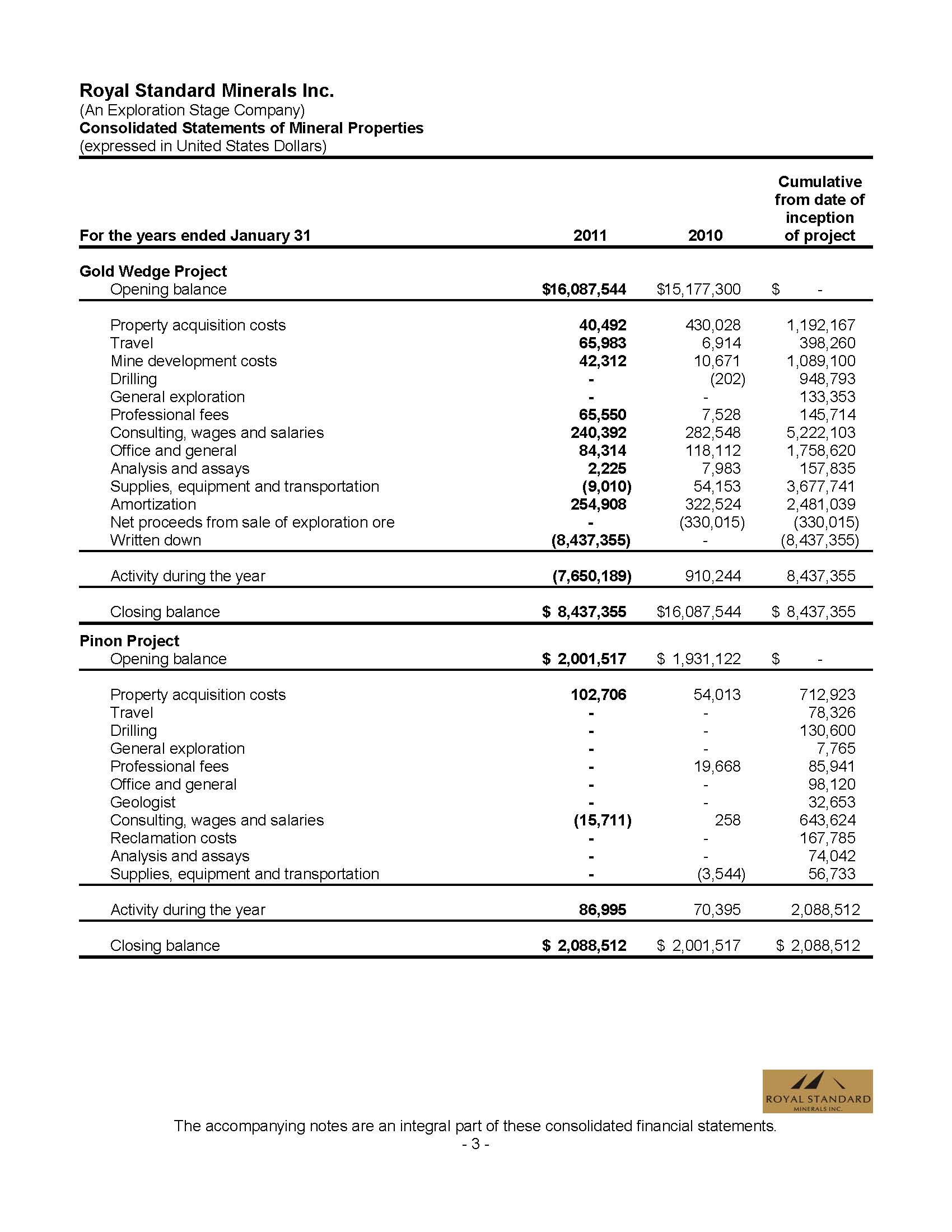

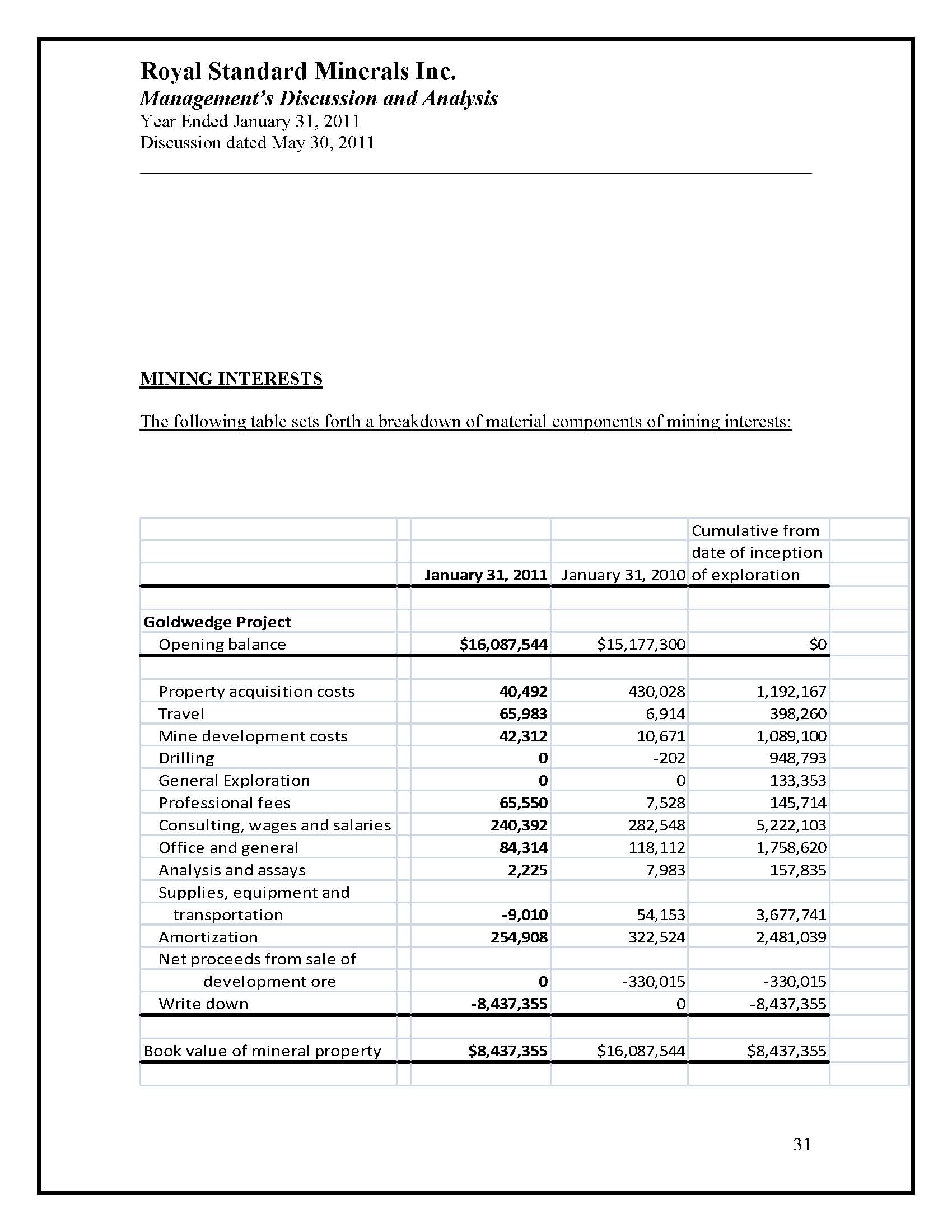

Project Expenditures

To January 31, 2011, cumulative net expenditures of $8,437,355 were incurred on the Goldwedge Project consisting of: (1) acquisition costs - $1,192,167; (2) travel - $398,260; (3) mine development costs - $1,089,100; (4)drilling - $948,793; (5) general exploration - $133,353 (6) $145,714 - professional fees; (7) consulting, wages and salaries - $5,222,103; (8) office and general - $1,758,620; (9) analysis and assays - $157,835; (10) supplies, equipment and transportation - $3,677,741; (11) amortization - $2,481,039; (12) net sale of exploration ore - $330,015; and (13) write down - $8,437,355. These costs were incurred in connection with various activities the Company performed on a discretionary basis. Although the deferred exploration expenditures on this project were written down by 50% the Company still considers

Page 11

this project a very good prospect and will continue to maintain the claims and continue to increase the projects value by incurring further exploration expenditures.

Future Programs

As the Company obtained financing on June 29, 2011, management anticipates advancing the production potential on the Gold Wedge project by incurring further exploration expenditures and upgrading the plant. The Company will maintain its 2012 claim renewal fees and will maintain and complete various operational permits with regulatory bodies.

This project is an advanced exploration project without known reserves and the proposed program is exploratory in nature.

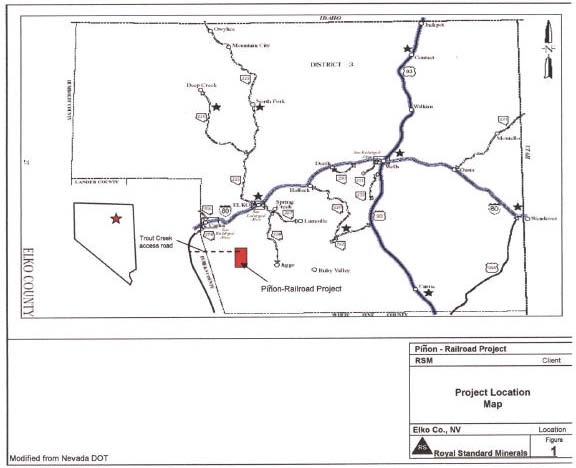

Pinon Project-Carlin Trend South

This project is located approximately 20 miles south of the town of Carlin, Nevada in Elko County, Nevada. The project land position is located east of Nevada state route 276 and extends for 10+ miles in a north-south direction south of the town of Carlin. The best access to the project is via I-80 to Carlin and south on route 276 to the property position.

The land position includes unpatented BLM lands, patented lands and fee lands. All payments, maintenance fees to federal and state authorities are current. Landowner option payments are also current and in good standing for this more than 10,000 acre land position.

The Pinon properties are located on the southern portion of the Carlin gold belt about 10 miles south of Newmont's Rain mine Since its inception, various joint-venture partners have spent more than $10 MM on the project.

The Pinon project is located on the southern portion of the Carlin Trend immediately south of Newmont's Rain gold district. The Carlin Trend is one of the most prolific gold trends in the world and has produced more than 50 million ounces of gold. The properties are located within a well-mineralized region, which supports the potential for expanding the known gold deposits and making new discoveries. Much of the district wide exploration was undertaken prior to the start of the 1980's and 1990's. Since the mid-1990's the cumulative knowledge of "Carlin-type" gold deposits has expanded tremendously. This expanded knowledge can be used to re-interpret all of the available data, which may identify new exploration targets on the ground controlled by RSM. Also, during the past 10+ years numerous high-grade gold deposits have been discovered along the Carlin Trend that can be mined using underground techniques. Many of these deeper deposits are associated with surface oxidized gold deposits. Essentially no significant deeper exploration has been conducted under the Pinon deposit, or at other places on the property. The exploration opportunity offers the possibility for discovery of additional gold deposits at Pinon-Railroad.

The Webb Formation is mineralized above the Devils Gate limestone at both deposits. At Rain, the mineralization occurs within and closely associated with the Rain Fault. On the southern portion of the property position, the Pinon Au-Ag project, the known mineralization has not been connected to a strongly mineralized fault. However, higher-grade economic mineralization has been encountered at very shallow depths, mineralized oxide zones occur along a 1,300 feet strike length and occur less than 90 feet below the surface.

Page 12

The Pinon project includes approximately 10,000 acres comprising unpatented BLM lode mining claims, patents and leased fee lands. The focus of RSM's current effort is to identify and develop near surface oxide gold-silver deposits. Approximately 600 shallow drill holes have been completed on 6 near surface gold-silver deposits. The depth extensions of these deposits are not well understood, as deeper drilling has not been sufficient to develop an acceptable understanding of this mineralization.

The Company has developed the necessary construction plans for the Pinon project including surface, heap leach facilities design and open pit modeling of the deposits. All of this work has been completed in preparation for the filing of a mining permit application with the US Bureau of Mines (BLM) and the Nevada Department of Environmental Protection (NDEP). A second objective is to update the feasibility studies for the Pinon near surface oxide deposits.

The Pinon project is made up of a number of lease agreements to lease certain properties in Elko County, Nevada. The Company is obligated to incur payments of $77,000 and incur exploration expenditures totaling $175,000 to keep the leases in good standing for the year ended January 31, 2011. The lessors will retain a 5% net smelter return royalty.

The Railroad project was made up of two lease agreements to lease certain properties in Elko County, Nevada. The Company was obligated to incur payments of $8,000 to keep one lease in good standing and pay $1,765,000 to exercise the option to purchase the leased property under the other agreement by August 31, 2009 to keep the leases in good standing. The lessors would retain a 5% net smelter return royalty.

On August 31, 2009 the option was exercised to acquire 100% of this project and the property was sold for $2,965,000 to an unrelated private company for net proceeds of $1.2 million, a 1% NSR royalty and 500,000 common shares of the private company. The sale of this property resulted in a gain on the sale of $583,199.

The Company has recorded an asset retirement obligation in the amount of $56,658on its Pinon Project, representing the estimated costs of the Company's obligation to restore the property site to its original condition as required by the State of Nevada regulatory authorities.

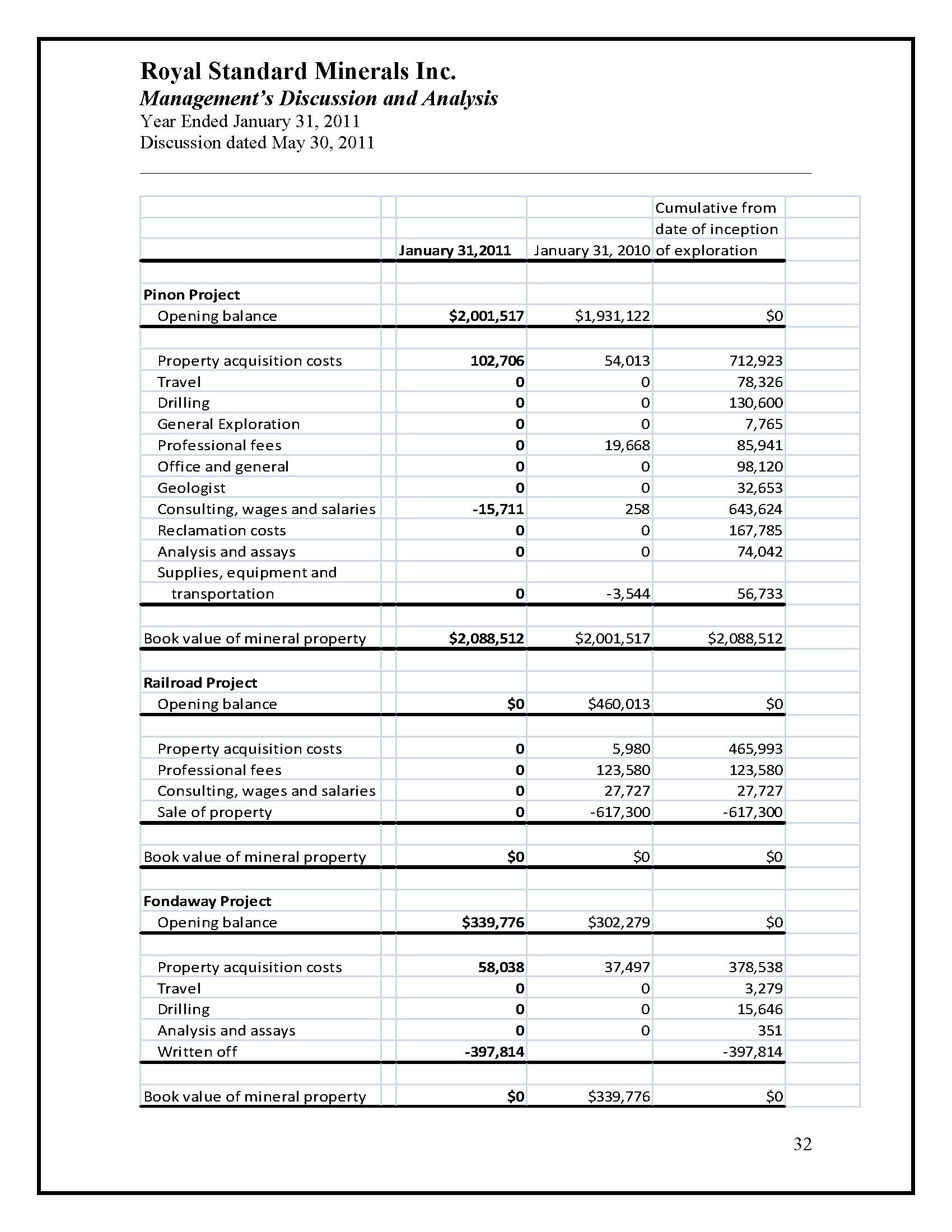

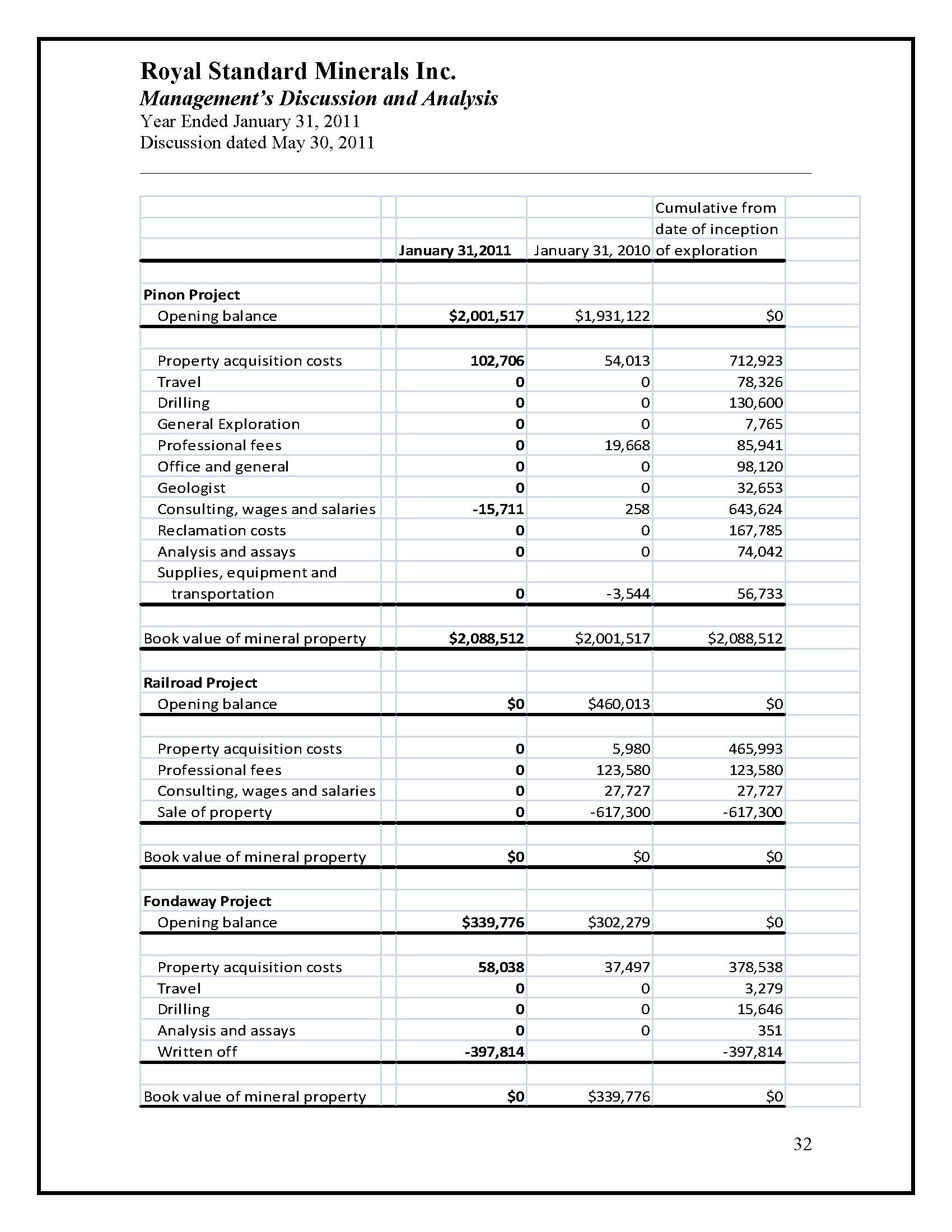

Project Expenditures

To January 31, 2011, cumulative expenditures of $2,088,512 were incurred on the Pinon Project consisting of: (1) property acquisition costs - $712,923; (2) travel - $78,326; (3) drilling - $130,600; (4) general exploration - $7,765; (5) professional fees - $85,941; (6) office and general

- $98,120; (7) geologist - $32,653; (8) consulting, wages and salaries - $643,624; (9) reclamation costs - $167,785 (10) analysis and assays - $74,042; and (11) supplies, equipment and transportation - $56,733. These costs were incurred in connection with various activities performed by the Company on a discretionary basis.

Future Programs

The Railroad project was successfully sold and the only other expenditures anticipated under the Pinon project are to keep the leases in good standing. If additional financing is obtained, the Company will actively pursue the completion and filing of a mining permit application with the BLM and NDEP on this project for the year ended January 31, 2012.

The property is without known reserves and the proposed program is exploratory in nature.

Page 13

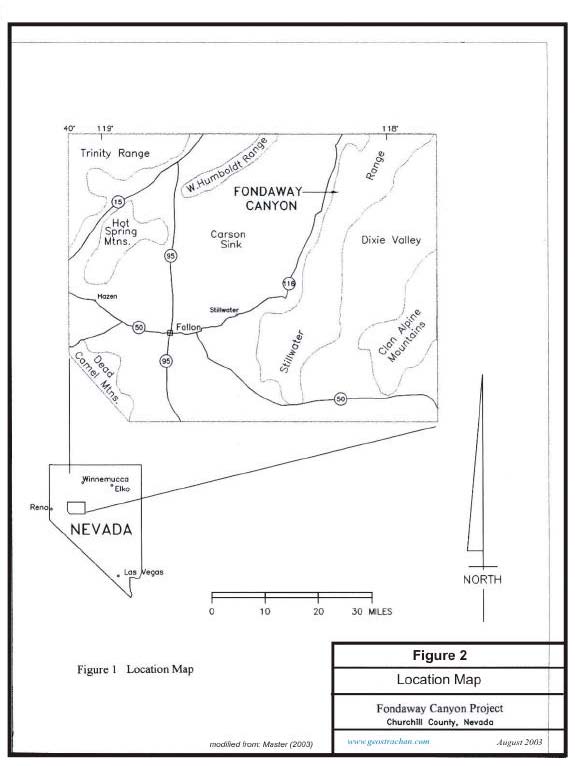

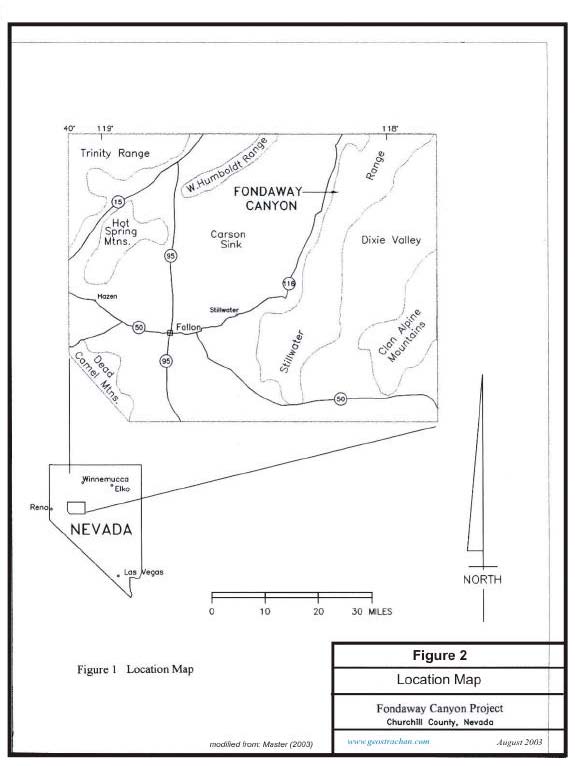

Fondaway Canyon Project

The 100% controlled Fondaway Canyon gold project is located in Churchill County, Nevada in the Stillwater range. The project is accessible east from Fallon, Nevada via State of Nevada route 116 an unpaved road. The Fondaway deposit is located on the west flank of the Stillwater Range at Fondaway Canyon.

The Fondaway Canyon gold property consists of 148 unpatented BLM lode mining claims (approximately 3,000 acres) located on the western slope of the Stillwater Range. This area is included with the Stillwater Wilderness area. All of the maintenance filing fees are current and in good standing. Nearly-vertical, east-west trending mineralized shear zones host the Half Moon, Paperweight, Hamburger Hill and South Pit gold resources that is hosted within a Mesozoic sedimentary package. The Mesozoic sedimentary package has been intruded by a Mesozoic-Tertiary aged intrusive.

The vertical extent tested by recent drilling of the higher grade gold mineralized shear zones is greater than 1,000 feet. Horizontal continuation of gold mineralization as at the Paperweight and Hamburger Hill mineralized shear zone is 3,700 feet with widths commonly between 5'-20+ feet. Drilling and assay records indicate that 568 holes have been drilled for a total estimated footage of 200,000 feet of RC drilling and 22,000 feet of core drilling to include 455 reverse circulation, 49 core holes and 64 air track holes over a strike length of approximately 12,000 feet. Tenneco Minerals Inc., the most active company, drilled approximately 350 holes (130,000 feet) and drove a 500' adit for sulfide metallurgical sampling during the period 1987-1996. Tenneco also operated a small oxide gold open pit mine for a short time during this period. Nevada Contact Inc. (NCI) acquired the property in 2001 and drilled 11 reverse circulation holes, RSM acquired the property from NCI in early 2003 as part of a property swap with NCI retaining a 1% NSR overriding royalty in the Fondaway Canyon property and $25,000 advance minimum royalty payments to the claim holder until 2006 at which time the payments increase to $35,000 per year that includes a 3% NSR royalty until buyout. There is a buyout option of $600,000 for the owners' interest.

Drill testing the Tenneco heap leach pad in 2007 did not provide positive results. Plans to further drill test the sulfide resource as part of a program to upgrade the indicated and inferred resources on the property are expected when all of the State of Nevada permits are approved to commence this project. This effort will involve drilling underground within the Tenneco adit along with a surface drilling program. A bulk sampling program for metallurgical analysis of the sulfide resource will also be included as part of an effort to develop a gold recovery process that will achieve the desired results.

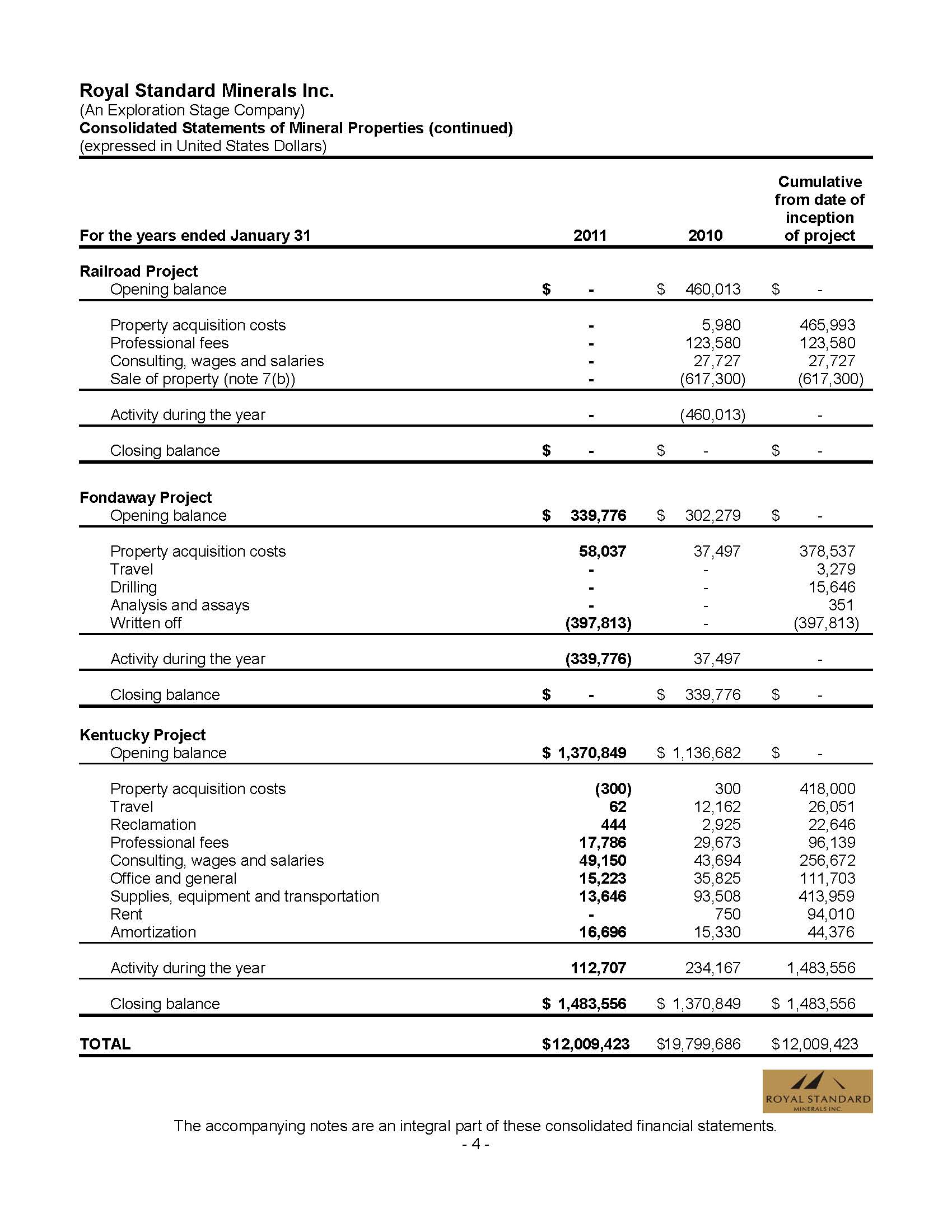

Project Expenditures

To January 31, 2011, cumulative expenditures of $397,813 were incurred on the Fondaway project consisting of: (1) property acquisition costs - $378,537; (2) travel - $3,279; (3) drilling - $15,646; and (4) analysis and assays $351. These costs were incurred in connection with various activities performed by the Company on a discretionary basis. As at January 31, 2011 the deferred exploration expenditures were written off resulting in a charge of $397,813 on the consolidated Statement of Operations. Although the exploration expenditures for this project were written off, the Company will continue to pay all lease payments to keep this project in good standing.

Page 14

Future Programs

If additional financing can be obtained, the Company is planning to perform exploration drilling and permitting work totaling approximately $640,000 for the year ended January 31, 2012 on the Fondaway project. However, if a financing is not obtained there will be no significant Company funded exploration program on the Fondaway project. The Company will maintain its 2012 lease payment obligations and claim renewal fees.

The property is without known reserves and the proposed program is exploratory in nature.

Manhattan/Round Mountain Caldera Program

The project area is located southeast of the town of Round Mountain, Nevada east of State route

376. The town of Manhattan is located approximately 15 miles south of Round Mountain. The Manhattan project is located approximately 7 miles east of route 376 on route 377 and 1.5 miles west of the town of Manhattan.

The Manhattan/Round Mountain Caldera program, the Company's most advanced district play, includes the Goldwedge advanced exploration program. The land position in the Manhattan Mining District is comprised of 70 unpatented and 6 patented lode-mining claims. An underground development program to include drill testing the extensions of the Goldwedge deposit in addition to the evaluation of several additional lode and placer properties that the Company controls in the district could significantly increase the gold resource estimates.

Freeport Gold, Tenneco (Echo Bay) recognized the potential of the district (to include the Goldwedge deposit that is currently under control by RSM) however, these deposits were not suited for open pit mining. At that time the large mining companies did not consider the underground development projects feasible. Although Sunshine Mining Co. considered an underground mine development in 1988 on the Goldwedge deposit, continued exploration by Crown Resources and others on the Company's claims indicated sections (5+'-30') of potentially mineable grades greater than 0.5 opt gold. The continued downturn in the gold market, tightened corporate budgets and high holding costs for the properties forced many companies to turn back the land positions to the claim owners. Currently, the Company controls approximately 4,000 feet of strike length. Approximately 1,000-1,200 feet of this strike length has been drill tested indicating positive results.

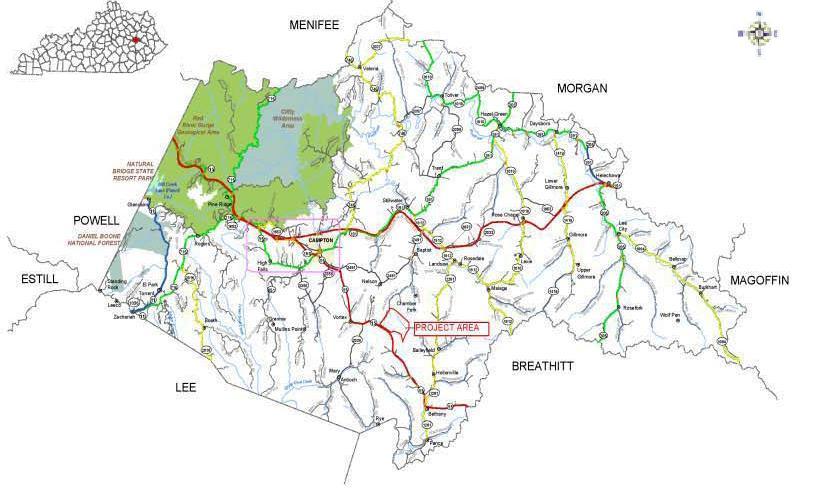

Kentucky Project

In an effort to achieve diversity within its natural resource portfolio on November 19, 2008, the Company and Sharpe Resources Corporation ("Sharpe") entered into an option agreement whereby the Company agreed to an option to acquire a 50% interest in coal properties in eastern Kentucky by advancing to the project $2 million prior to December 9, 2009. Once the option is exercised by the Company a 50/50 Joint Venture agreement will be entered into between the Company and Sharpe at which time all expenditures incurred and revenues earned from the coal projects will be shared 50 % by the Company and 50% by Sharpe.

Sharpe and the Company are related parties due to the fact that they have common management and directors.

Under the terms of the option agreement a 100% interest in a surface mine coal project in Wolfe County, Kentucky was acquired. The transaction costs included $250,000 to acquire the project

Page 15

and $178,700 for a reclamation bond to cover the state of Kentucky reclamation requirements for this property. The property consists of approximately 1,000 acres of coal mineral rights under lease and includes an approved Kentucky Mining Permit, I.D. No. 919-0066.

On September 11, 2009 this option agreement was amended to allow the Company to acquire its 50% interest in the properties by advancing to the project $2 million by December 9, 2011. As consideration for this amendment the Company cancelled the note receivable from Sharpe held by the Company and received a new note from Sharpe in the amount of $120,409 on September 9, 2009 repayable in three equal installments on September 9, 2011, 2012, and 2013.

The Campton Coal Project is approximately 5 miles southeast of the Town of Campton adjacent to a paved highway 15 and is situated in Wolfe County at an elevation of 900 feet. The topography is gently rising to rolling and moderately steep terrain that reflects a dendritic drainage pattern of valleys and ridges that occur at the head of these drainages. The ridge elevations within the project area are on the order of 900-1,250 above sea level with the valley floors in the 9001,000 feet above sea level. The area is covered with a hard wood forest that is well supplied with regular rainfall and ample vegetation. Electrical power was installed from a nearby power line crossing the property from the Licking Valley Electric Cooperative. The nearest large city is Lexington, Kentucky located approximately 70 miles northwest of the project area.

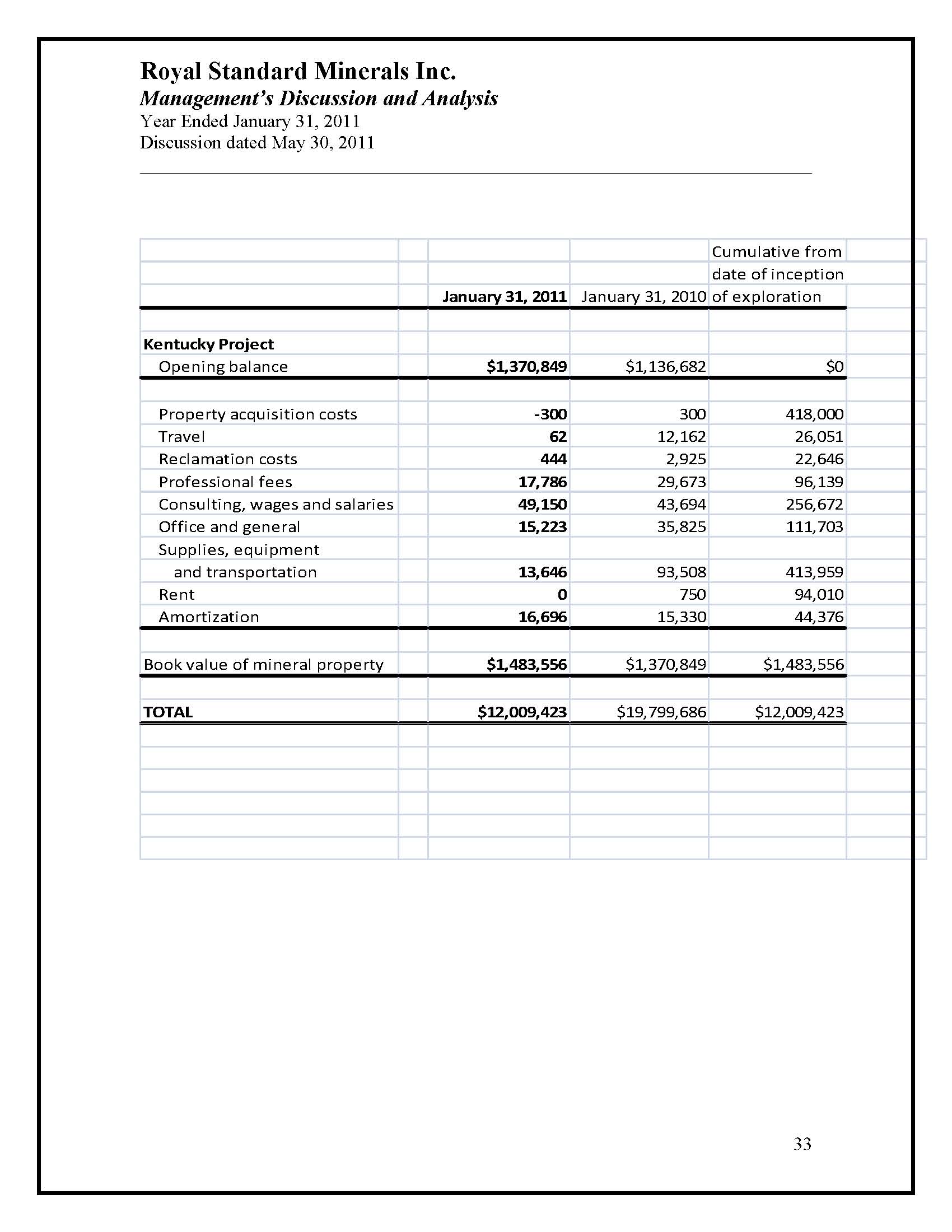

Project Expenditures

To January 31, 2011, cumulative expenditures of $1,483,556 were incurred on the Wolfe County, Kentucky project consisting of: (1) property acquisition costs - $418,000; (2) travel - $26,051; (3) professional fees - $96,139; (4) consulting, wages and salaries - $256,672; (5) office and general - $111,703; (6) supplies, equipment and transportation - $413,959; (7) rent - $94,010; (8) Reclamation costs - $22,646 and (9) amortization - $44,376. These costs were incurred in connection with various activities performed by the Company on a discretionary basis.

Future Programs

The Company has successfully negotiated an extension on this project and as a result has until December 9, 2011 to exercise its option. The Company is maintaining the agreements entered into for this project, however does not intend to make any significant expenditures until commodity prices strengthen, a financing can be successfully completed or some value can be obtained from the sale of the property.

C. Organizational structure.

The Company has one wholly owned subsidiary, Manhattan Mining Company and a 50% interest in Kentucky Standard Energy Company Inc., both United States Companies.

D. Property, plants and equipment.

The registered office of Royal Standard is located at 360 Bay Street, Suite 500, Toronto, Ontario M5H, 2V6 and the principal office of Royal Standard is located at 3258 Mob Neck Road, Heathsville, Virginia 22473. The Company also has an office at One Main Street, Manhattan, Nevada, 89022.

Page 16

Nevada Projects

Goldwedge Project

The Gold Wedge Project is located in the Manhattan Mining District, section 18, T8N, R43E, Mount Diablo Meridian, 1/2 mile west of the town of Manhattan in Nye County, Nevada, (Figure 1 below). Located within the southern Toquima Range of central Nevada, the elevation ranges from 6,800 feet to 7,800 feet. The topography is gently rising to rolling and ruggedly steep along the north-south trending mountain range. The resource occurs under a gravel covered dry drainage valley north of paved highway 377. The town of Tonopah is 50 miles south of the deposit and is considered the most favorable location for accommodations. Tonopah is also the county seat for Nye County.

Currently NV Energy, a commercial electric supplier, services this site. The Company has all of the necessary water rights secured from the State of Nevada.

Page 17

LOCATION MAP

Source: RSM 2003

Page 18

The Goldwedge, one of several gold deposits in the area, is considered one of the best known projects in the district for POTENTIAL development of an underground mine. The property contains excellent exploration potential for future growth. Based upon the results of approximately 75 drill holes primarily within the central zone over a strike length of 1,000+ feet and 100'-500' of vertical extent reveal continuous gold oxide mineralization of potential mineable thickness and quality. RSM has analyzed all of the drill data as part of a detailed geologic inventory of the deposit.

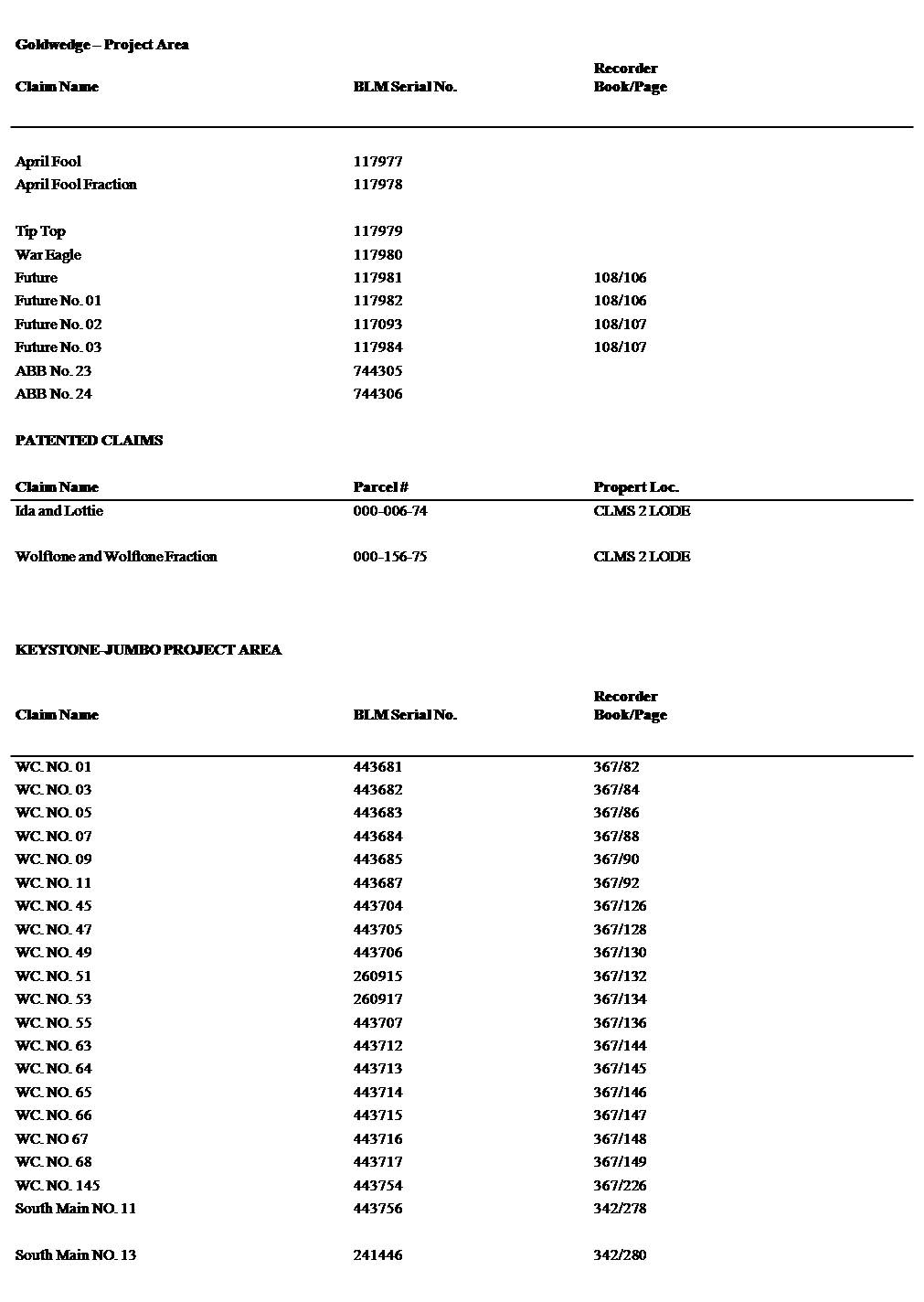

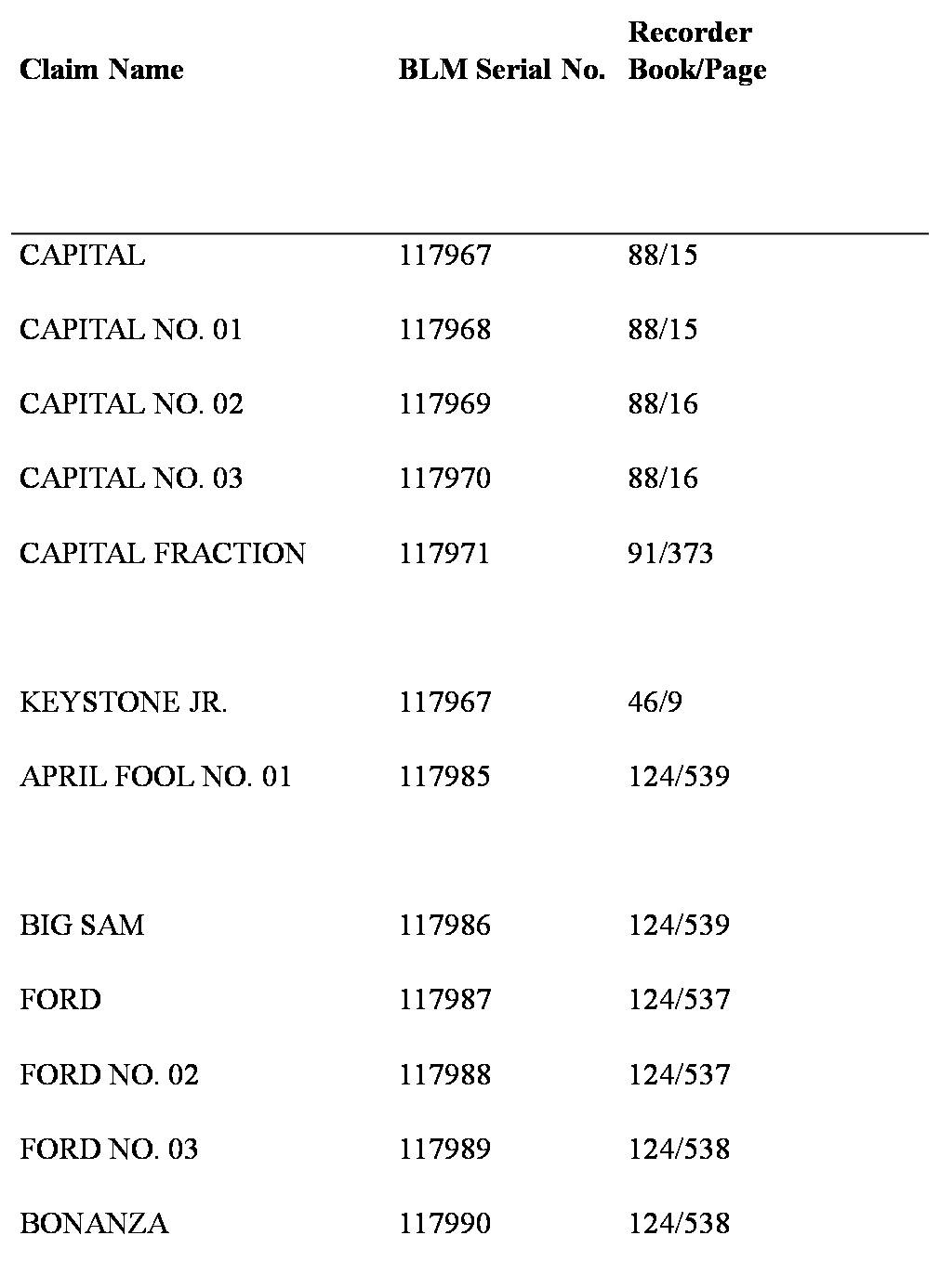

The project ownership includes staked BLM lands; options of BLM claims owned by others and patented mining claims owned by the Company. All payments, maintenance fees, option payments and taxes to state and federal authorities are current under state and federal guidelines. The land position controlled by RSM on the Goldwedge Project area is shown below:

| Claim Name | Claim Type | BLM Serial # or Patent # |

|---|

| Goldwedge | Unpatented | NMC 96294 -96297 |

| Goldwedge 1-3 | Unpatented | NMC 96294-96297 |

| Orpahnt | Patents | 4095 |

| Copper Farm-Eldorado #2 | Patents | 2876 |

| GW 1-34 | Unpatented | NMC 826458-826460, 824432, 824436,826461-826476, 829859, 829863, 834113 |

| Location of Claims | # of Claims/Acres/Owner | Importance to Development |

|---|

| Goldwedge Deposit (option to Purchase 100% for $200,000) | 4 Claims/50 Acres/Hill | 90% of known measured deposit and most of know indicated deposit, 3% NSR, - 5-year lease term, renewable |

| North Plunge of Goldwedge Deposit and 1.5 miles of Mineralized Caldera Margin Trend (RSM owns 100% of Unpatented Claims) | 34 Claims/450 Acres/RSM | Largest deep inferred and unexplored mineralized caldera margin |

| South End of Goldwedge Deposit and East Caldera Margin Trend (RSM owns 100% of Patent Claim | 1 Claim/20.03 Acres/RSM (Orphant Patent) | Approximately 5% of known deposit, Private Land for Decline and Plant Site, and 1,500 feet of mineralized caldera trend, facility site plan, 1% NSR |

Page 19

Goldwedge - Manhattan Project Area

Page 20

Wm. Michael Donovan Jr., Professional Land Surveyor #2617, surveyed the land holdings in the immediate vicinity of the deposit to determine the exact land boundaries in relation to the gold deposit.

The Goldwedge deposit occurs at the intersection of north and northwest trending faults. In the deposit area, the north trending Reliance fault is mineralized within the Ordovician Zanzibar limestone and siltstone. The target mineralization occurs within multiple high angle structures over a width of between 100-200 feet primarily within the Zanzibar limestone. RSM has evaluated all of the pertinent drill data as part of a detailed inventory of the deposit geometry, size and overall grade. The current exploration model suggests that the Goldwedge deposit and the extensions may contain an economically significant gold resource at depth near the contact with the Manhattan Caldera margin.

The first potential mine development program is the 100% owned Goldwedge deposit located within the Manhattan Mining District. The Goldwedge deposit is located approximately 8 miles south of the large Round Mountain gold mine. All mine and mill (plant) and water use permits were achieved in early, 2004. Also, in 2004 the Company constructed a 700 foot (underground) decline and cross cut to test one of the gold mineralized structures within a 100+ wide structural zone. Additionally, RSM completed the surface facilities necessary to process the material to be mined onsite to include silt ponds, ore pad and the onsite gold processing plant. The Company acquired a full production scale gold recovery (gravity) plant that will be utilized to process the mined material as part of the test mining program.

The underground bulk sampling and decline development program continued during 2007, although the underground effort was hampered by the effects of groundwater. As of 2008 the Company has completed approximately 5,000 feet of underground development to include decline development and a series of cross cuts have been completed. A dewatering well was drilled in 2008 to reduce and control the water levels within the mine. In 2007 the treatment of lower grade mined material continued with the processing this material through an onsite (gravity) plant. The surface facilities and the gold recovery plant were completed in 2005 and modified in 2006-2007 as a means to improve gold recoveries.

The program in 2009 was concentrated on acquiring the necessary permits with the various state and federal agencies to handle water disposal through the permit of a Rapid Infiltration Basin on

Page 21

the Company's properties. Project work included plant modifications as part of an effort to increase the daily throughput of gold bearing material as part of the milling process.

During the year ending January 31, 2011, expenses on the Goldwedge project were $787,166 and the Company took a 50% impairment write-down of $8,437,355 on the property bringing total RSM expenses on this project to $8,437,355. Future expenditures are expected to be an additional $3-5 million over the next two years concentrating on underground development, drilling and plant modifications.

For the years ending | January 31,

2011 | January 31,

2010 | January 31,

2009 | Cumulative from date of inception of exploration phase |

|---|

Gold Wedge Project

Opening balance |

$16,087,544 |

$15,177,300 |

$11,866,061 |

$0 |

|---|

| Property Acquisition costs | 40,492 | 430,028 | 121,785 | 1,192,167 |

|---|

| Travel | 65,983 | 6,914 | 35,222 | 398,260 |

|---|

| Mine development costs | 42,312 | 10,671 | 53,909 | 1,089,100 |

|---|

| Drilling | 0 | -202 | 64,356 | 948,793 |

|---|

| General exploration | 0 | 0 | 0 | 133,353 |

|---|

| Professional fees | 65,550 | 7,528 | 0 | 145,714 |

|---|

| Consulting | 240,392 | 282,548 | 1,228,118 | 5,222,103 |

|---|

| Office and general | 84,314 | 118,112 | 410,285 | 1,758,620 |

|---|

| Analysis and assays | 2,225 | 7,983 | 29,006 | 157,835 |

|---|

Supplies, Equipment and

transportation | (9,010) | 54,153 | 869,750 | 3,677,741 |

|---|

| Amortization | 254,908 | 322,524 | 498,808 | 2,481,039 |

|---|

Less: Proceeds from sale

Of development ore | 0 | (330,015) | 0 | (330,015) |

|---|

Written down | (8,437,355) | 0 | 0 | (8,437,355) |

|---|

Activity during the period | (7,650,189) | 910,244 | 3,311,239 | 8,437,355 |

|---|

| Closing balance | $8,437,355 | $16,087,544 | $15,177,300 | $8,437,355 |

|---|

The underground program has several objectives including a test mining program and the establishment of the appropriate mining methods that will be applied to the future development of the property.

The underground development as well as surface and underground drilling will be directed toward expanding the resources on this property as well as the completion and testing of the gravity recovery plant design. The plant has been modified over the past two years to include a two-ball mill circuit. The onsite plant has been modified over the two years with the grinding circuit that includes two 6' x 6' ball mills. Operation of this plant in 2008 indicates that subsequent to the test mining program there is a need to install a larger grinding facility in order to increase production throughput of the underground production.

The results of the last 12 months support further investment and a continuation of the mining and milling program for this project. The projected expenditures for the next 12 months are expected to be approximately $3-5 million. The allocated expenditures will be on underground development, drilling and plant modification to include the addition of another ball mill and other material handling improvements. All of this work will be supervised by the CEO and carried out by experienced miners and plant employees currently working for the Company. Consultants will

Page 22

be utilized in special instances to assist management with specific technical issues. In order to complete all of the planned activities in 2011 the Company will need to raise capital.

This project is an advanced exploration project without known reserves and the proposed program is exploratory in nature.

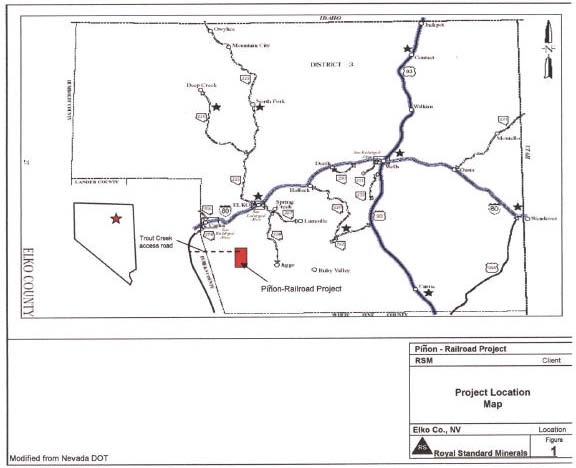

Pinon and Dark Star Projects-Carlin Trend South

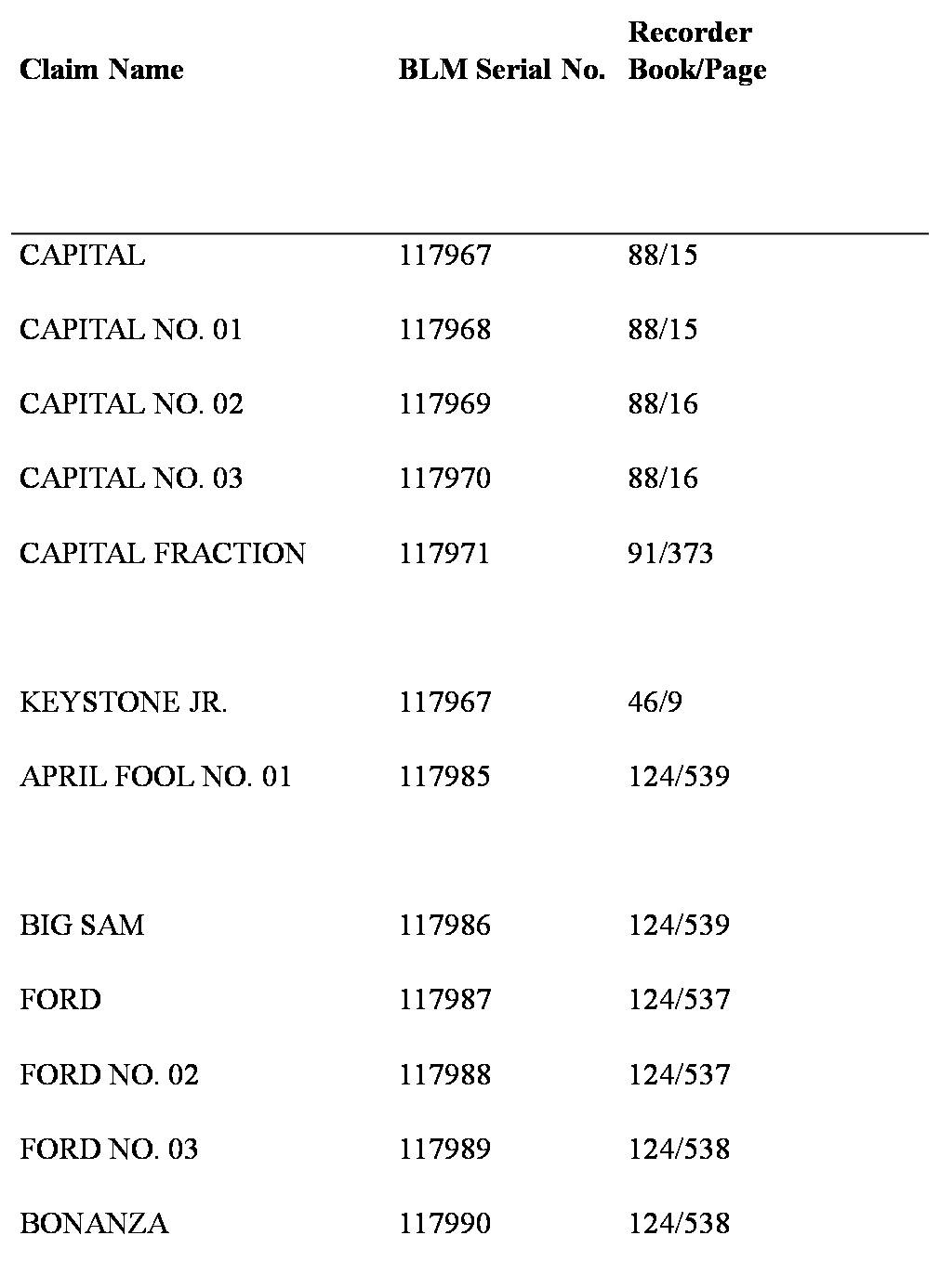

The Pinon property is located in the southeast end of the famous "Carlin Gold Trend" about 10 miles south of Newmont's Rain mine, 25 miles southwest of Elko, Nevada. The main access from Elko is west on Interstate 80 to Carlin (25 miles) then south on State Highway 51 for 22 miles to the Trout Creek access road. The project area is 7 miles east along a well-maintained BLM gravel-dirt road to the area of extensive drilling. There is no infrastructure in the vicinity of the property; the nearest power line is 7 miles to the west along State Highway 51.

The Pinon property currently consists of a contiguous land block of 39 unpatented mining lode claims - claim fractions that are located in surveyed Township 30 North, Range 53 East, Section 22, (Mount Diablo Meridian), Elko County, Nevada (Fig 5.). The current Pinon land position covers an area of approximately 2,720 acres (approx. 1101 hectares). The land position includes unpatented BLM lands, patented lands and fee lands. All payments, maintenance fees to federal and state authorities are current. Landowner option payments are also current and in good

Page 23

standing for this more than 18,000 acre land position. Included in the land block are the following claims:

-

| | County Recordation | |

| Claim Name | BLM Serial # | Book | Page | Acres |

| TC-1 thru TC-10 | NMC 125638 thru NMC 133862 | 304 | 6 thru 15 | 180 |

| TC-11 | NMC 133862 | 309 | 114 | 20 |

| TC-12 thru TC-28 | NMC 148871 thru NMC 148887 | 329 | 58 THRU 74 | 320 |

| TC-29 thru TC-39 | NMC 403761 thru NMC 403771 | 588 | 426 thru 436 | 200 |

The TC claim group is under (100%) control by RSM. The TC claims are located on federal public domain lands that are managed (both surface and mineral estates) by the Bureau of Land Management ("BLM"). Initially staked in 1979, this ground was previously open to mineral location with no significant restrictions. Location certificates for all claims staked in the group were filed and recorded with the BLM and the Elko County Recorder's Office in Elko according to federal and state laws/regulations.

The TC claim group is surrounded by private fee lands containing a complicated mixture of severed surface and mineral estates that were previously controlled in part by the Pinon Joint Venture through various lease-option agreements. These lands have since been dropped by the joint venture. An ownership summary for several of the more important sections is shown below.

T30N, R53E

Section 21: All (640 acres)

Surface estate

J. Tomera Ranch (100%)

Mineral estate

J. Tomera family (50%)

Etcheverry family (16.7%)

Rudnick Trust (16.6%)

L&R Rudnick family (16.6%)

Section 27: NE1/4 NW1/4 , NE1/4, NE1/4 SE1/4 (640 acres)

Surface estate

Pereira Trust (100%)

Mineral estate

Pereira Trust (50%)

Etcheverry family (16.67%)

O. Rudnick family (16.67%)

Rudnick Trust (8.33%)

Section 27: NW1/4 NW1/4 , S1/2 NW1/4, SW1/4, NW1/4 SE1/4, S1/2 SE1/4 (640 acres)

Surface estate

J. Tomera Ranch (100%)

Mineral estate

J. Tomera family (50%)

Etcheverry family (16.67%)

O. Rudnick family (16.67%)

Rudnick Trust (8.33%)

R. Rudnick family (8.3%)

Page 24

The Pinon properties are located on the southern portion of the Carlin gold belt about 10 miles south of Newmont's Rain mine Since its inception, various joint-venture partners have spent more than $15 MM on the project.

The Pinon and Railroad projects are located on the southern portion of the Carlin Trend approximately 5 miles south of Newmont's Rain gold district. The Carlin Trend is one of the most prolific gold trends in the world and has produced more than 50 million ounces of gold. The properties are located within a well-mineralized region, which only adds to the potential for expanding the known gold deposits and making new discoveries. Much of the district wide exploration was undertaken prior to the start of the 1980's and 1990's. Since the mid-1990's the cumulative knowledge of "Carlin-type" gold deposits has expanded tremendously. This expanded knowledge can be used to re-interpret all of the available data, which may identify new exploration targets on the ground controlled by RSM. Also, during the past 10+ years numerous high-grade gold deposits have been discovered along the Carlin Trend that can be mined using underground techniques. Many of these deeper deposits are associated with surface oxidized gold deposits. Essentially no deeper exploration has been conducted under the Pinon and Railroad deposits, or at other places on the property. The exploration opportunity offers the possibility for discovery of additional gold deposits at Pinon-Railroad.

The Webb Formation is mineralized above the Devils Gate limestone at both deposits. At Rain, the mineralization occurs within and closely associated with the Rain Fault. On the southern portion of the property position, the Pinon Au-Ag project, the known mineralization has not been connected to a strongly mineralized fault. However, higher-grade economic mineralization has been encountered at very shallow depths, mineralized oxide zones occur along a 1,300 feet strike length and occur less than 90 feet below the surface.

The Pinon and Darkstar projects include approximately 8,000 acres comprising unpatented BLM lode mining claims, patents and leased fee lands. The focus of RSM's current effort is to identify and develop near surface oxide gold-silver deposits. Approximately 300 shallow drill holes have been completed on 4 near surface gold-silver deposits. The depth extensions of these deposits are not well understood, as deeper drilling has not been sufficient to develop an acceptable understanding of this mineralization.

The Company has developed preliminary construction plans for the Pinon-Darkstar project including surface, heap leach facilities design and open pit modeling of the deposits. The near term objective is to proceed with achieving a mining permit for the Pinon and Darkstar projects.

Project Expenditures

To January 31, 2011, cumulative expenditures of $2,088,512 have been incurred on the Pinon Project. During 2009, the expenditures relating to the Railroad Project in the amount of $617,300 were applied against the proceeds received resulting in cumulative expenditures of the Pinon Project to be $2,001,517. These costs were incurred in connection with various activities performed by the Company on a discretionary basis.

Page 25

For the years ending | January 31,

2011 | January 31,

2010 | January 31,

2009 | Cumulative from date of inception of exploration phase |

|---|

Pinon Project

Opening balance | $2,001,517 | $1,931,122 | $1,451,428 | $0 |

|---|

| Property Acquisition costs | 102,706 | 54,013 | 111,617 | 712,923 |

|---|

| Travel | 0 | 0 | 51,498 | 78,326 |

|---|

| Drilling | 0 | 0 | 0 | 130,600 |

|---|

| General exploration | 0 | 0 | 0 | 7,765 |

|---|

| Professional fees | 0 | 19,668 | 0 | 85,941 |

|---|

| Office and general | 0 | 0 | | 98,120 |

|---|

| Geologist | 0 | 0 | 0 | 32,653 |

|---|

Consulting, wages and

salaries |

(15,711) |

258 |

256,585 |

643,624 |

|---|

| Reclamation costs | 0 | 0 | 0 | 167,785 |

|---|

| Analysis and assays | 0 | 0 | 0 | 74,042 |

|---|

Supplies, Equipment and

transportation |

0 |

-3,544 |

59,994 |

56,733 |

|---|

| Activity during the period | 86,995 | 70,395 | 479,694 | 2,088,512 |

|---|

| Closing balance | $2,088,512 | $2,001,517 | $1,931,122 | $2,088,512 |

|---|

| |

|---|

Railroad Project | |

|---|

| Opening balance | $0 | $460,013 | $331,446 | $0 |

|---|

| Property Acquisition costs | 0 | 5,980 | 128,567 | 465,993 |

|---|

| Professional fees | 0 | 123,580 | 0 | 123,580 |

|---|

Consulting, wages and

salaries | | 27,727 | 0 | 27,727 |

|---|

| Sale of Property | 0 | -617,300 | 0 | -617,300 |

|---|

| Activity during the period | 0 | -460,013 | 128,567 | 0 |

|---|

| Closing balance | $0 | $0 | $460,013 | $0 |

|---|

Future Programs

The Railroad project was successfully sold and the only other expenditures anticipated under the Pinon project are to keep the leases in good standing. If a financing is obtained, the Company will actively pursue the completion and filing of a mining permit application with the BLM and NDEP on this project for the year ended January 31, 2012.

The property is without known reserves and the proposed program is exploratory in nature.

Fondaway Canyon Project

The 100% controlled Fondaway Canyon gold project is located in Churchill County, Nevada in the Stillwater range. The Fondaway property is accessible from Fallon east along U.S. Highway 50, then north on Hwy 116 to the settlement of Stillwater, then north on an improved gravel road for 30 miles along the front range of the Stillwater Mountains to Fondaway Canyon. The elevation of the property ranges from 5000 to 6000 feet. Access east into Fondaway Canyon is

Page 26

steep but adequate with existing mine roads. The Fondaway deposit is located on the west flank of the Stillwater Range in Sections 1 and 2, T22N, R33E, and Sections 5 and 6, T22N, R34E.

Sierra Pacific Power Co can supply power to the property. RSM has the current water rights to the property.

Page 27

The Fondaway Canyon property consists of 148 contiguous unpatented lode-mining claims (approximately 3000 acres) on BLM land held under a lease agreement assigned from Nevada Contact Inc. (NCI) to Royal Standard Minerals Inc. (RSM). Eighteen claims were staked NCI, quitclaimed to the owner, and included in the assignment to RSM. The lease terms include a 3% net smelter return royalty to the owner Richard Fisk and advanced royalty payments of $25,000 per year. The annual payments graduated to $35,000 in 2006 and years following. Details of the option agreement are as follows:

| Required Cash Payments to Optionors | Royalty | Exercise of Option |

|---|

| Commencing in fiscal 2003. $25,000 in year one, $30,000 in years two and three and $35,000 each of the next seven years apply to the purchase price | 3% NSR | July 2013 $600,000 |

All of the maintenance filing fees are current and in good standing.

Nearly-vertical, east-west trending mineralized shear zones host the Half Moon, Paperweight, Hamburger Hill and South Pit gold resources that is hosted within a Mesozoic sedimentary package. The Mesozoic sedimentary package has been intruded by a Mesozoic-Tertiary aged intrusive.

The vertical extent tested by recent drilling of the higher grade gold mineralized shear zones is greater than 1,000 feet. Horizontal continuation of gold mineralization as at the Paperweight and Hamburger Hill mineralized shear zone is 3,700 feet with widths commonly between 5'-20+ feet. Drilling and assay records indicate that 568 holes have been drilled for a total estimated footage of 200,000 feet of RC drilling and 22,000 feet of core drilling to include 455 reverse circulation, 49 core holes and 64 air track holes over a strike length of approximately 12,000 feet. Tenneco Minerals Inc., the most active company, drilled approximately 350 holes (130,000 feet) and drove a 500' adit for sulfide metallurgical sampling during the period 1987-1996. Tenneco also operated a small oxide gold open pit mine for a short time during this period. Nevada Contact Inc. (NCI) acquired the property in 2001 and drilled 11 reverse circulation holes, RSM acquired the property from NCI in early 2003 as part of a property swap with NCI retaining a 1% NSR overriding royalty in the Fondaway Canyon property and $25,000 advance minimum royalty payments to the claim holder until 2006 at which time the payments increase to $35,000 per year that includes a 3% NSR royalty until buyout. There is a buyout option of $600,000 for the owners' interest, option payments apply to the purchase price.

Drill testing of the Tenneco leach pad was unsuccessful in terms of any support to continue to further evaluate the potential to do anything with the leach pad. RSM plans are to further drill test the sulfide resource as part of a program to upgrade the indicated and inferred resources on the property. This program will involve drilling underground within the Tenneco adit along with a surface drilling program. A bulk sampling program for metallurgical analysis of the sulfide resource will also be included as part of an effort to develop a gold recovery process that will achieve the desired results. This effort is subject to achieving the necessary state of Nevada permits.

Estimates of prior expenditures on this property are approximately $5-6 million. The largest portion of these expenditures was contributed by Tenneco Minerals and Tundra Mines LTD. This work included extensive drilling, development of a small open pit production project and an advanced exploration adit on the property.

Page 28

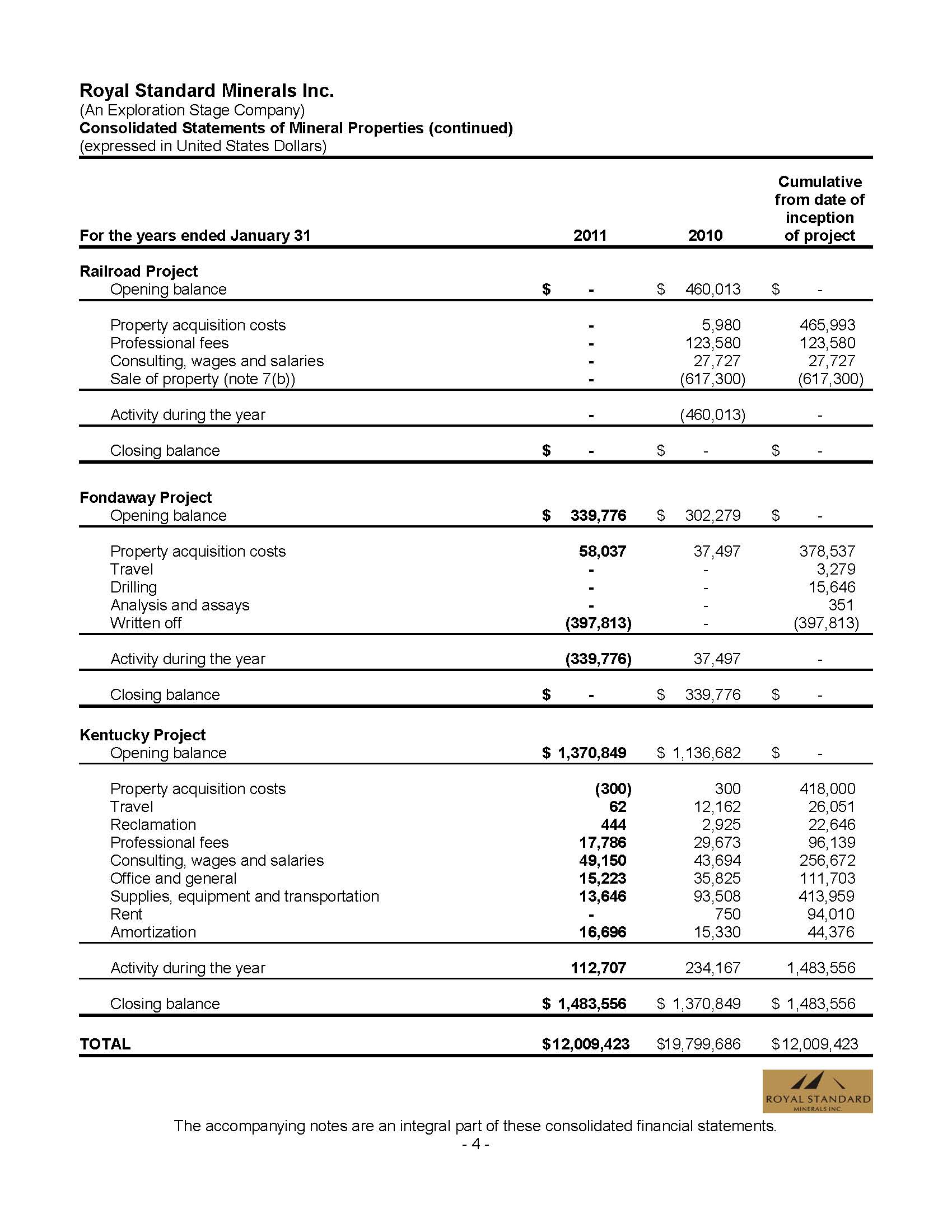

Project Expenditures

To January 31, 2011, cumulative expenditures of $397,813 were incurred on the Fondaway project. These costs were incurred in connection with various activities performed by the Company on a discretionary basis. As at January 31, 2011 the deferred exploration expenditures were written off resulting in a charge of $397,813 on the consolidated Statement of Operations. Although the exploration expenditures for this project were written off, the Company will continue to pay all lease payments to keep this project in good standing. A table of detailed expenditures follows:

For the years ending | January 31,

2011 | January 31,

2010 | January 31,

2009 | Cumulative from date of inception of exploration phase |

|---|

Fondaway Project

Opening balance | $339,776 | $302,279 | $246,457 | $0 |

|---|

| Property Acquisition costs | 58,037 | 37,497 | 55,822 | 378,537 |

|---|

| Travel | | 0 | 0 | 15,646 |

|---|

| Drilling | | 0 | 0 | 351 |

|---|

| Analysis and assays | | 0 | 0 | 3,279 |

|---|

| Written off | (397,813) | 0 | 0 | (397,813) |

|---|

| Activity during the period | (339,776) | 37,497 | 55,822 | 0 |

|---|

| Closing balance | $0 | $339,776 | $302,279 | $0 |

|---|

Future Programs

If a financing can be obtained, the Company is planning to perform exploration drilling and permitting work totaling approximately $640,000 for the year ended January 31, 2012 on the Fondaway project. However, if a financing is not obtained there will be no significant Company funded exploration program on the Fondaway project. The Company will maintain its 2011 lease payment obligations and claim renewal fees.

The property is without known reserves and the proposed program is exploratory in nature.

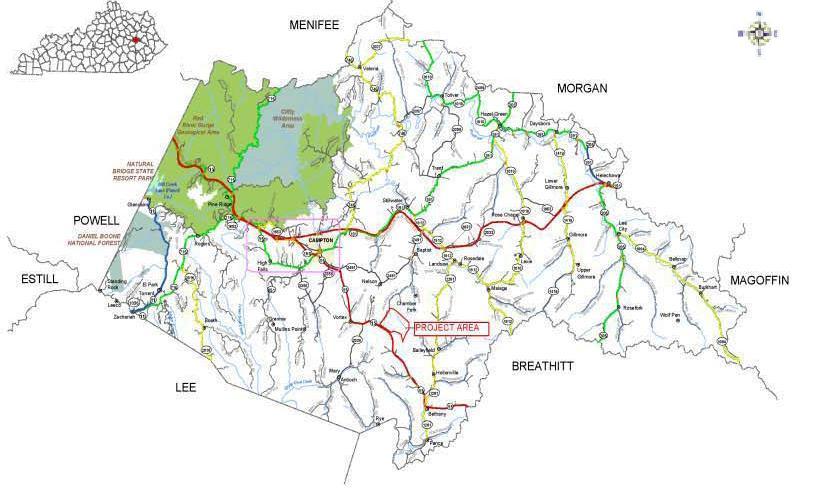

Kentucky Project

In an effort to achieve diversity within its natural resource portfolio on November 19, 2008, the Company and Sharpe Resources Corporation ("Sharpe") entered into an option agreement whereby the Company agreed to an option to acquire a 50% interest in coal properties in eastern Kentucky by advancing to the project $2 million prior to December 9, 2009. Once the option is exercised by the Company a 50/50 Joint Venture agreement will be entered into between the Company and Sharpe at which time all expenditures incurred and revenues earned from the coal projects will be shared 50 % by the Company and 50% by Sharpe.

Sharpe and the Company are related parties due to the fact that they have common management and directors.

Under the terms of the option agreement a 100% interest in a surface mine coal project in Wolfe County, Kentucky was acquired. The transaction costs included $250,000 to acquire the project and $178,700 for a reclamation bond to cover the state of Kentucky reclamation requirements for

Page 29

this property. The property consists of approximately 1,000 acres of coal mineral rights under lease and includes an approved Kentucky Mining Permit, I.D. No. 919-0066.

On September 11, 2009 this option agreement was amended to allow the Company to acquire its 50% interest in the properties by advancing to the project $2 million by December 9, 2011. As consideration for this amendment the Company cancelled the note receivable from Sharpe held by the Company and received a new note from Sharpe in the amount of $120,409 on September 9, 2009 repayable in three equal installments on September 9, 2011, 2012, and 2013.

The Campton Coal Project is approximately 5 miles southeast of the Town of Campton adjacent to a paved highway 15 and is situated in Wolfe County at an elevation of 900 feet. The topography is gently rising to rolling and moderately steep terrain that reflects a dendritic drainage pattern of valleys and ridges that occur at the head of these drainages. The ridge elevations within the project area are on the order of 900-1,250 above sea level with the valley floors in the 9001,000 feet above sea level. The area is covered with a hard wood forest that is well supplied with regular rainfall and ample vegetation. Electrical power was installed from a nearby power line crossing the property from the Licking River Electric Cooperative. The nearest large city is Lexington, Kentucky located approximately 70 miles northwest of the project area.

Within Wolfe County, the Company holds mining interests from seven properties, containing six coal seams capable of production, namely, in order from the bottom sequence to the top: 1) Vires, 2) Grassy, 3) Cannel City, 4) Whitesburg, 5) Fire Clay and 6) Fire Clay Rider, hereinafter known as the Seams. The Seams range in thickness from 12 inches up to nearly 30 inches within the leasehold boundary. These are the surface-minable coals, with no standard room and pillar or long-wall section method deep-mineable coal present, as known to date. The Campton mine is

Page 30

made up of seven (7) separately owned land parcels having coal mining rights by all methods, aggregating 974 acres. Of the 1,000 acres, 272.19 acres are permitted for surface mining.

| Original Owner or Lessor | Area (Acres) | Mining Types | Kentucky Seams | Royalty Rate |

| David Rudd | 280 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Kevin and Tara Patton | 85 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Earl Patton | 150 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| William and Maggie Hutton | 90 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Elizabeth and Taylor Caldwell | 109 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Pauline Caldwell | 110 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Wick & Phyllis Clemons | 150 +/- | C/Area | All Seams | 6% F.O.B. Pit |

C/Area = Contour and Auger/Area or Mountain-top Removal;

F.O.B. = Freight on Board sales prices, with deductions for freight and sales commissions

Project Expenditures

To January 31, 2011, cumulative expenditures of $1,483,556 were incurred on the Wolfe County, Kentucky project. These costs were incurred in connection with various activities performed by the Company on a discretionary basis.

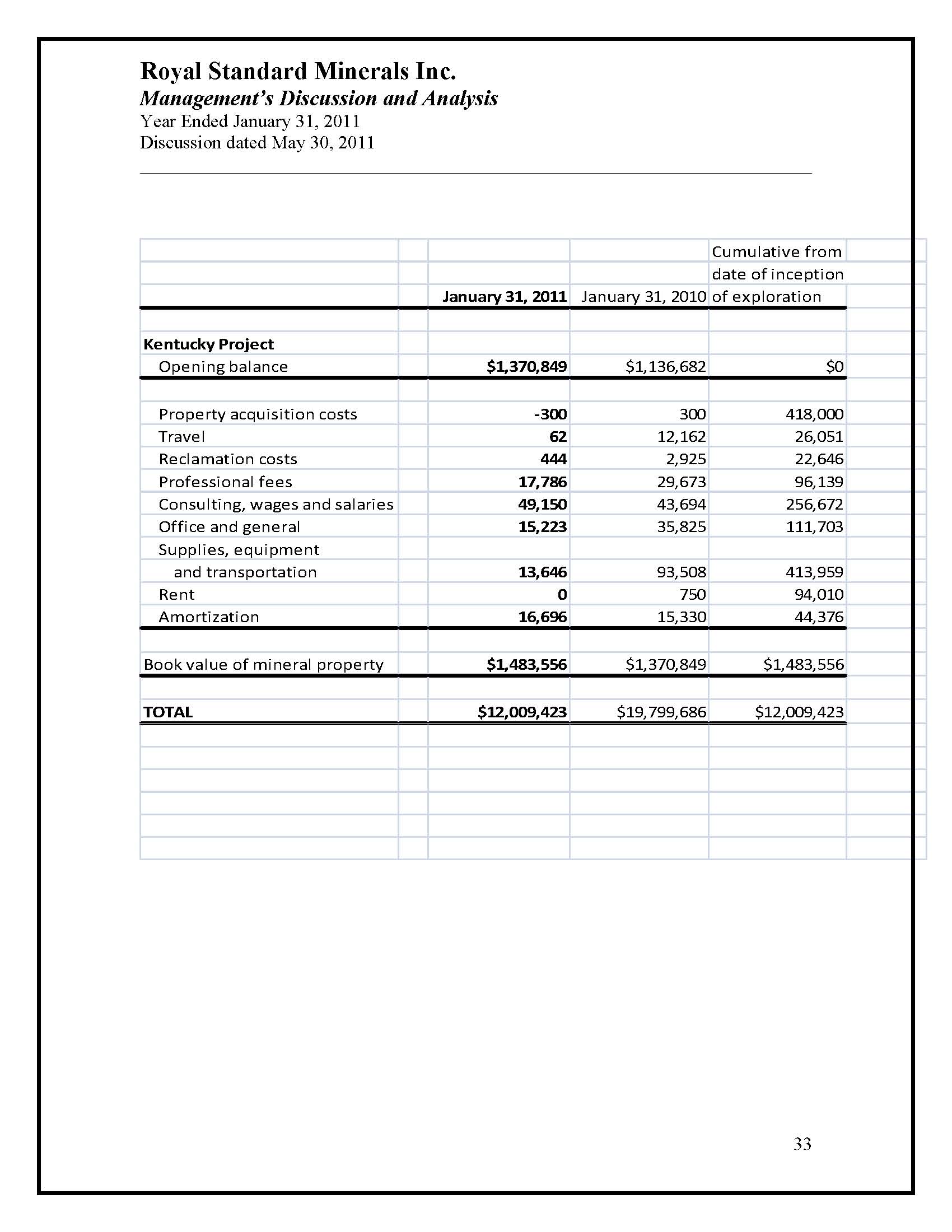

For the years ending | January 31,

2011 | January 31,

2010 | January 31,

2009 | Cumulative from date of inception of exploration phase |

|---|

| | | | |

|---|

Kentucky Project

Opening balance | $1,370,849 | $1,136,682 | $0 | $0 |

|---|

| Property Acquisition costs | (300) | 300 | 418,000 | 418,300 |

|---|

| Travel | 62 | 12162 | 13,827 | 25,989 |

|---|

| Reclamation Costs | 444 | 2,925 | 19,277 | 22,202 |

|---|

| Professional fees | 17,786 | 29,673 | 48,680 | 78,353 |

|---|

Consulting, wages and

salaries | 49,150 | 43,694 | 163,828 | 207,522 |

|---|

| Office and general | 15,223 | 35,825 | 60,655 | 96,480 |

|---|

Supplies, equipment &

transportation | 13,646 | 93,508 | 306,805 | 400,313 |

|---|

| Rent | 0 | 750 | 93,260 | 94,010 |

|---|

| Amortization | 16,696 | 15,330 | 12,350 | 27,680 |

|---|

| Activity during the period | 112,707 | 234,167 | 1,136,682 | 1,370,849 |

|---|

| Closing balance | $1,483,556 | $1,370,849 | $1,136,682 | $1,370,849 |

|---|

Page 31

Future Programs

The Company has successfully negotiated an extension on this project and as a result has until December 9, 2011 to exercise its option on this project. The Company is maintaining the agreements entered into for this project, however does not intend to make any significant expenditures on this project until commodity prices strengthen, a financing can be successfully completed or some value can be obtained from the sale of this property.

Item 5. Operating and Financial Review and Prospects

A. Operating results.

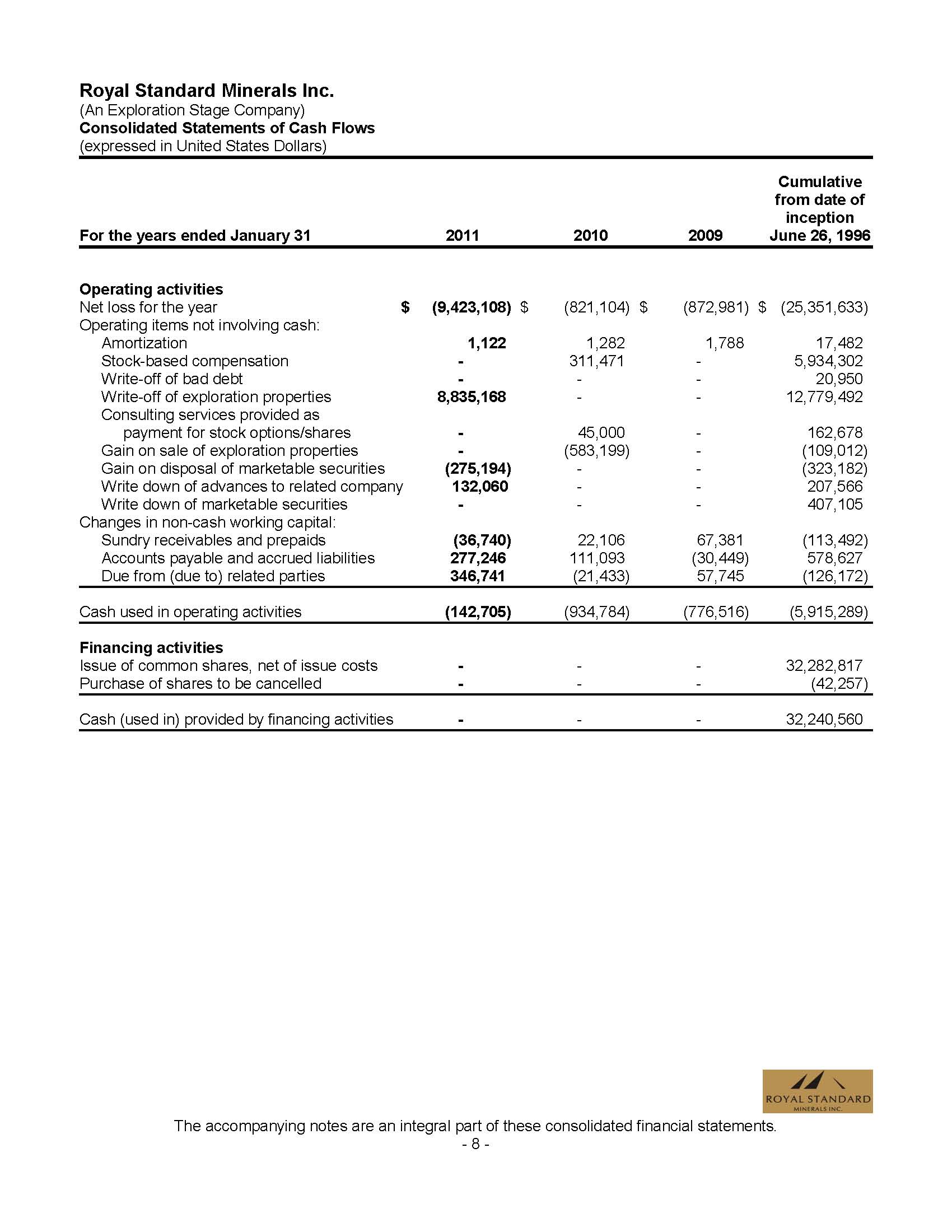

Royal Standard is an exploration and pre-development stage enterprise and is in the process of exploring its resource properties and has not determined whether the properties contain economically recoverable reserves. The recovery of the amounts shown for the resource properties and the related deferred expenditures is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration and, upon future profitable production.

Royal Standard is an exploration-pre-development stage enterprise and, as such, currently has no producing properties and no operating income or cash flow, other than interest earned on funds invested in short-term deposits (see Item 3.D. - Key Information - Risk Factors).

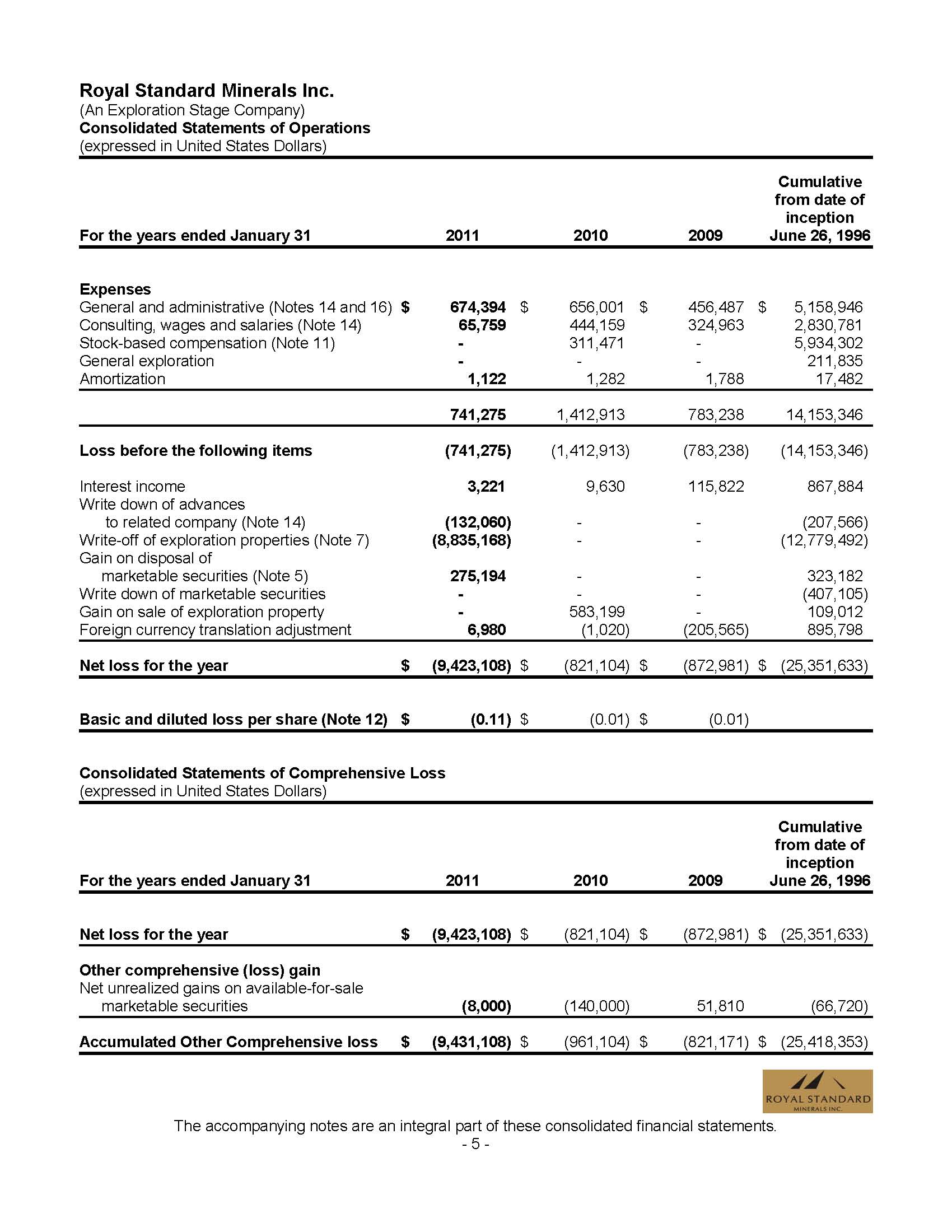

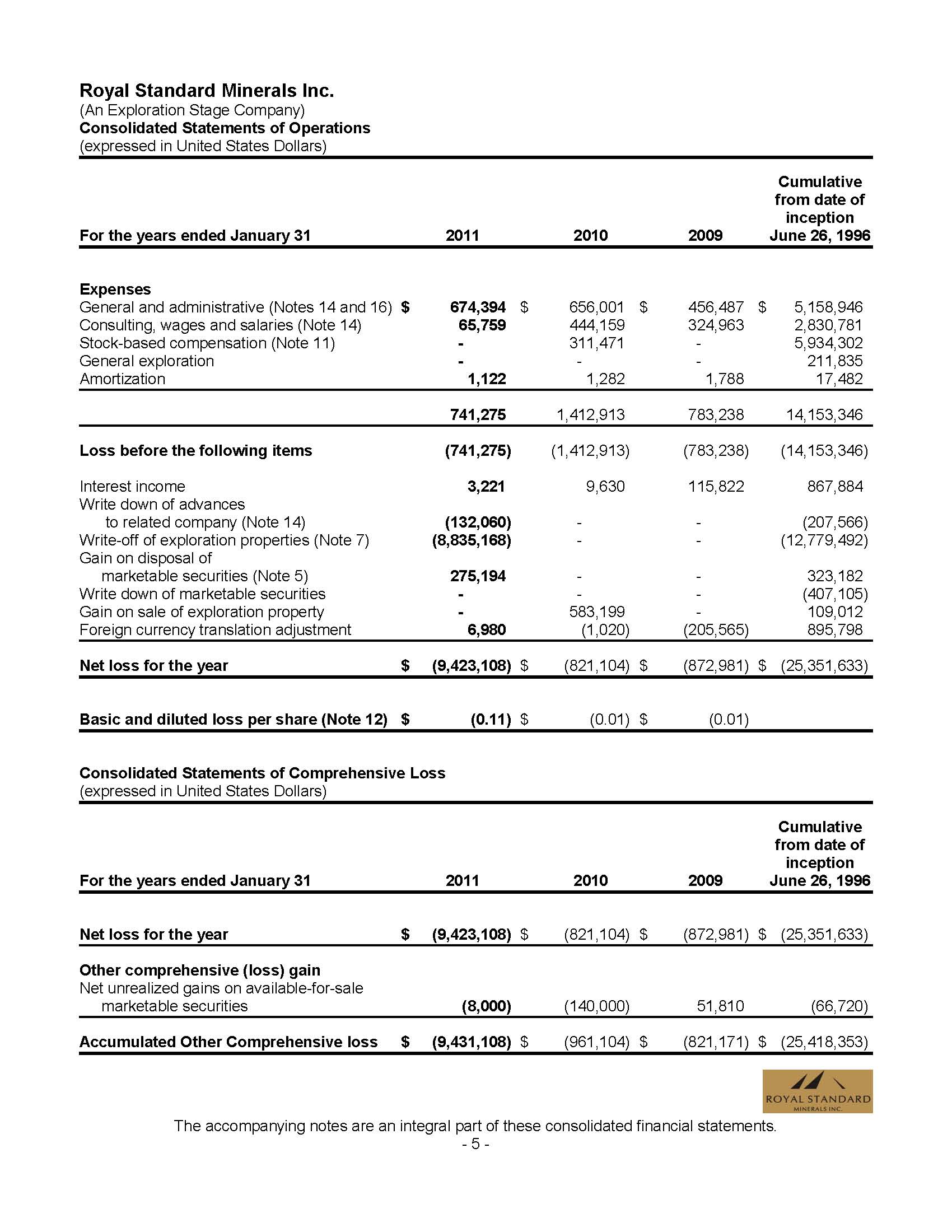

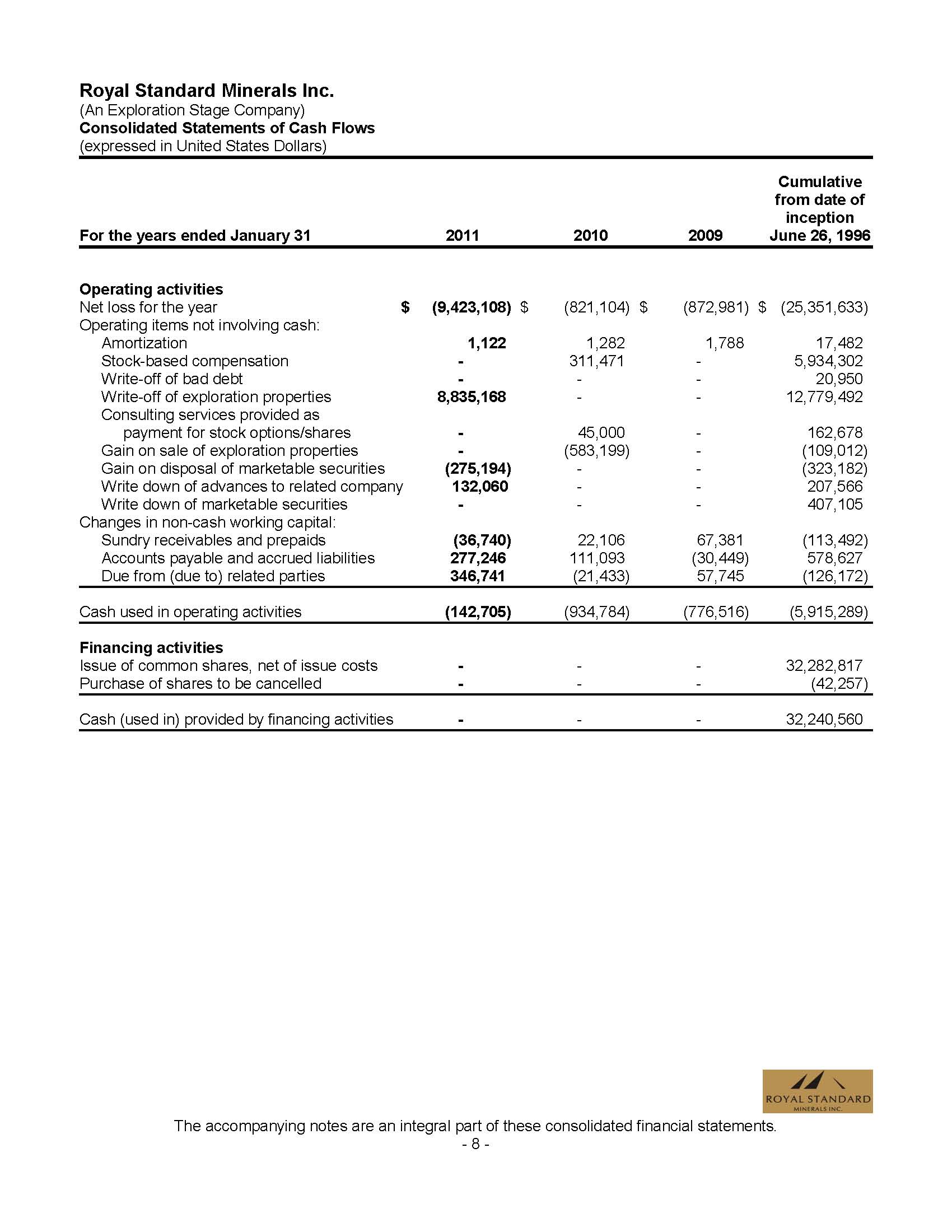

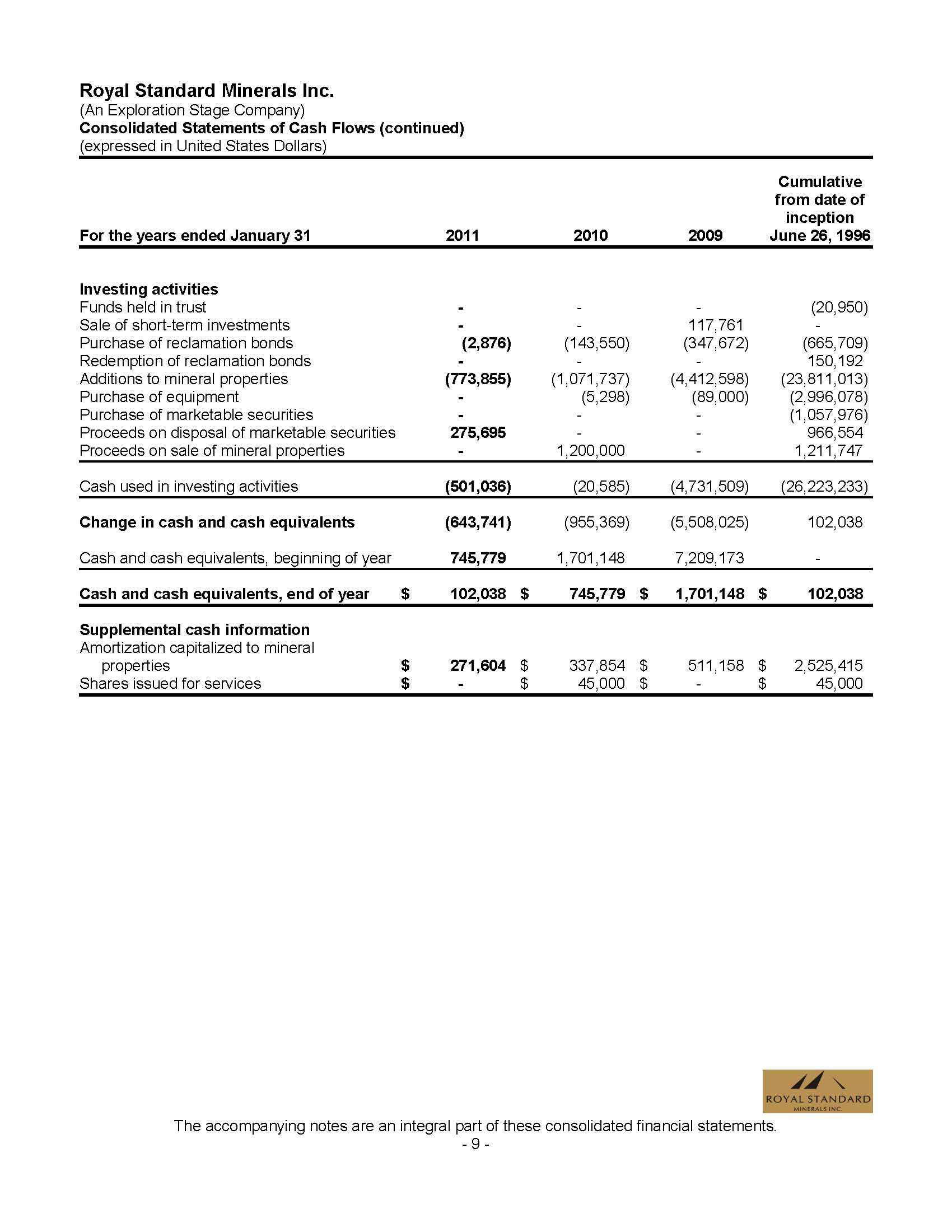

Year Ended January 31, 2011 Compared to the Year Ended January 31, 2010

The Company's net loss totaled $9,423,108 for the year ended January 31, 2011, with basic and diluted losses per share of $0.11. This compares with net loss of $821,104 with basic and diluted losses per share of $0.01 for the year ended January 31, 2010. The increase of $8,602,004 in net loss was principally due to a decrease in consulting, wages and salaries, the write down of exploration properties, the write down of advances made to a related party and a gain on disposal of marketable securities in the year ended January 31, 2011.

Year Ended January 31, 2010 Compared to the Year Ended January 31, 2009

The Company's net loss totaled $821,104 for the year ended January 31, 2010, with basic and diluted losses per share of $0.01. This compares with net loss of $872,981 with basic and diluted losses per share of $0.01 for the year ended January 31, 2009. The decrease of $41,877 in net loss was principally due to an increase in general and administrative expenditures, consulting, wages and salaries, a stock-based compensation addition offset by the gain on sale of the Railroad Project property in the year ended January 31, 2010.

Year Ended January 31, 2009 Compared to the Year Ended January 31, 2008