UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedJanuary 31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: ____________

Commission File Number000-28980

Royal Standard Minerals Inc.

(Exact name of Company as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

Canada

(Jurisdiction of incorporation or organization)

50 Richmond Street East, Suite 101, Toronto, Ontario M5C 1N7

(Address of principal executive offices)

George Duguay

50 Richmond Street East, Suite 101, Toronto, Ontario M5C 1N7

(416) 848-0105 george@dsacorp.ca

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| None | Not applicable |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares, without par value

(Title of Class)

i

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of January 31, 2012: 83,853,825 Common Shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of Securities Exchange Act of 1934.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] |

Indicated by check mark which basis of accounting the company has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued by the | Other [ ] |

| | International Accounting Standards Board [X] | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the company is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

ii

TABLE OFCONTENTS

| PART I | 3 |

| | Item 1. Identity of Directors, Senior Management and Advisers | 3 |

| | Item 2. Offer Statistics and Expected Timetable | 3 |

| | Item 3. Key Information | 3 |

| | | A. Selected financial data. | 3 |

| | | A. Capitalization and indebtedness. | 4 |

| | | B. Reasons for the offer and use of proceeds. | 4 |

| | | B. Risk factors. | 4 |

| | Item 4. Information on the Company | 4 |

| | | A. History and development of the Company. | 4 |

| | | B. Business overview. | 5 |

| | | C. Organizational structure. | 5 |

| | | D. Property, plants and equipment. | 5 |

| | Item 4A. Unresolved Staff Comments | 21 |

| | Item 5. Operating and Financial Review and Prospects | 21 |

| | | A. Operating results. | 21 |

| | | B. Liquidity and capital resources. | 22 |

| | | C. Research and development, patents and licenses, etc. | 24 |

| | | D. Trend information. | 24 |

| | | E. Off-balance sheet arrangements. | 24 |

| | | F. Tabular disclosures of contractual obligations. | 25 |

| | | G. Safe harbor. | 25 |

| | Item 6. Directors, Senior Management and Employees | 26 |

| | | A. Directors and senior management. | 26 |

| | | B. Compensation. | 28 |

| | | C. Board practices. | 34 |

| | | D. Employees. | 39 |

| | | E. Share ownership. | 39 |

| | Item 7. Major Shareholders and Related Party Transactions | 39 |

| | | A. Major shareholders. | 39 |

| | | B. Related party transactions. | 40 |

| | | C. Interests of experts and counsel. | 40 |

| | Item 8. Financial Information | 40 |

| | | A. Consolidated Statements and Other Financial Information. | 40 |

| | | B. Significant Changes. | 40 |

| | Item 9. The Offer and Listing | 42 |

| | | A. Offer and listing details. | 42 |

| | | B. Plan of distribution. | 43 |

| | | C. Markets. | 43 |

| | | D. Selling shareholders. | 43 |

| | | E. Dilution. | 43 |

| | | F. Expenses of the issue. | 44 |

| | Item 10. Additional Information | 44 |

| | | A. Share capital. | 44 |

| | | B. Memorandum and articles of incorporation. | 44 |

| | | C. Material contracts. | 49 |

| | | D. Exchange controls. | 49 |

i

| | | E. Taxation | 49 |

| | | F. Dividends and paying agents. | 55 |

| | | G. Statement by experts. | 55 |

| | | H. Documents on display. | 55 |

| | | I. Subsidiary Information. | 56 |

| | Item 11. Quantitative and Qualitative Disclosures about Market Risk | 56 |

| | Item 12. Description of Securities Other than Equity Securities | 58 |

PART II | 58 |

| | Item 13. Defaults, Dividend Arrearages and Delinquencies | 58 |

| | Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 58 |

| | Item 15. Controls and Procedures | 62 |

| | | A. Disclosure Controls and Procedures. | 62 |

| | | B. Management's Annual Report on Internal Control over Financial Reporting. | 62 |

| | | C. Attestation Report of the Registered Public Accounting Firm. | 62 |

| | | D. Changes in Internal Control over Financial Reporting. | 63 |

| | Item 16. [Reserved] | 63 |

| | Item 16A. Audit Committee Financial Expert | 63 |

| | Item 16B. Code of Ethics | 63 |

| | Item 16C. Principal Accountant Fees and Services | 63 |

| | Item 16D. Exemptions from the Listing Standards for Audit Committees | 64 |

| | Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 64 |

| | Item 16F. Change in Registrant's Certifying Accountant | 64 |

| | Item 16G. Corporate Governance | 65 |

| | Item 16H. Mine Safety Disclosure | 65 |

PART III | 65 |

| | Item 17. Financial Statements. | 65 |

| | Item 18. Financial Statements | 67 |

| | Item 19. Exhibits | 68 |

| | | SIGNATURES | 70 |

ii

EXPLANATORY NOTE

Royal Standard Minerals Inc. (together with its subsidiaries, the “Company,” “Royal Standard” or “RSM”) is a Canadian issuer eligible to file its annual report pursuant to Section 13(a) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 20-F. The Corporation is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the U.S. Securities Act of 1933, as amended (the “Securities Act”). Equity securities of the Company are accordingly under the Exchange Act exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

The Company prepares its consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). The Company’s consolidated financial statements, which are filed with this annual report on Form 20-F, may be subject to Canadian auditing and auditor independence standards. They may not be comparable to financial statements of United States companies.

Unless otherwise indicated, all dollar amounts in this report are presented in U.S. dollars. The exchange rate of Canadian dollars into United States dollars, on January 31, 2012, based upon the Bank of Canada noon exchange rate, was U.S.$1.00 = Cdn$1.0052.

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F and the exhibits attached hereto contain “forward-looking statements” within the meaning of applicable laws concerning the Company’s plans at its properties, plans related to its business and other matters. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral reserves and resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if any of the Goldwedge, Piñon, Fondaway, or Kentucky projects are developed, and in the case of mineral reserves or resources, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects,” “anticipates,” “plans,” “estimates” or “intends,” or the negative or other variations of these words or other comparable words or phrases or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements also include the potential for future growth, indications of potential for economic extraction, the extraction of material that the Company is able to process, the potential to increase throughput and resource estimates, exploration and development plans, and the execution of certain agreements including the terms of those agreements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

- precious metal and coal price fluctuations;

- volatility in the financial markets;

- operating hazards and risks;

- risks and uncertainties relating to the exploration and development of mineral properties;

- uncertainty attributable to the calculation of reserves, resources and metal recoveries;

- uncertainty of title to mining properties;

- risks associated with dilution;

1

risks related to environmental regulation and liability;

risks related to the possibility that the Company is a passive foreign investment company; and

uncertainty associated with U.S. investors enforcing in the United States civil liabilities of the Company and its directors and officers who are resident in Canada.

Some of the important risks and uncertainties that could affect the Company’s forward-looking statements are described further in “Item 3.D. Risk Factors.” Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against placing undue reliance on forward-looking statements.

RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used in the Company’s disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”), adopted by the CIM Council on November 23, 2003. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 under the Securities Act. Under Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” used in the Company’s disclosure are Canadian mining terms that are defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards; however, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this annual report on Form 20-F and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

2

PART I

Item 1.Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

A.Selected financial data.

The tables below present selected statement of operations and balance sheet data for Royal Standard Minerals Inc. as at and for the fiscal years ended January 31, 2012 and 2011. The selected financial data presented herein for the fiscal years ended January 31, 2011 and 2012 is prepared in accordance with International Financial Reporting Standards. The financial data includes the accounts of the Company and its wholly-owned subsidiaries, Kentucky Standard Energy Company, Inc., and Manhattan Mining Co., both United States Companies. See “Item 4. Information on the Company”.

Royal Standard Minerals Inc.

(An Exploration Stage Enterprise)

Consolidated Financial Statement Data

For the Years Ended January 31

(Expressed in US Currency)

| | | 2012 | | | 2011 | |

| | | | | | | |

| Revenue | $ | 0 | | $ | 0 | |

| | | | | | | |

| Finance Income | $ | 4,291 | | $ | 3,221 | |

| Expenses | | ($6,455,989 | ) | | ($1,636,066 | ) |

| Net loss for theyear | | ($6,451,698 | ) | | ($1,632,845 | ) |

| | | | | | | |

| Deficit, beginningof year | | ($38,101,796 | ) | | ($36,468,951 | ) |

| | | | | | | |

| Loss per commonshare: | | | | | | |

| Basic anddiluted | | | | | | |

| loss per share | | ($0.08 | ) | | ($0.02 | ) |

| Weighted AverageShares | | | | | | |

| Outstanding | | 83,853,825 | | | 83,853,825 | |

3

| Balance Sheet | | January 31, 2012 | | | January 31,2011 | |

| Current Assets | $ | 935,828 | | $ | 215,315 | |

| Equipment, net | $ | 2,084,336 | | $ | 453,733 | |

| Total Assets | $ | 3,653,198 | | $ | 1,206,908 | |

| Current Liabilities | $ | 6,120,109 | | $ | 935,688 | |

| Net Assets | | ($5,810,547 | ) | $ | 39,210 | |

A.Capitalization and indebtedness.

Not applicable.

B.Reasons for the offer and use of proceeds.

Not applicable.

B.Risk factors.

The operations of the Company involve a number of substantial risks and the securities of the Company are highly speculative in nature. See the risk factors found under “Risk Factors” included in Item 17 of this Form 20-F.

Item 4.Information on the Company

A.History and development of the Company.

Royal Standard Minerals Inc. was incorporated pursuant to the laws of Canada by articles of incorporation dated December 10, 1986 under its former name, Ressources Minieres Platinor Inc. ("Resources"). On April 30, 1996, Royal Standard shareholders approved the acquisition of all the issued and outstanding shares of Southeastern Resources, Inc. ("Southeastern") in a reverse take-over transaction. Pursuant to this transaction, articles of amendment were filed effective May 14, 1996, pursuant to which the name of the Company was changed to its current form of name and its shares issued and outstanding at that time were consolidated on a 7.5:1 basis. On June 28, 1996, the Common Shares commenced trading on the Montreal Exchange. On January 4, 2002 the Company was continued from the laws of Canada (Canada Business Corporations Act, “CBCA”) to the laws of the Province of New Brunswick (Business Corporations Act (New Brunswick)). On February 17, 2004 under the laws of the Province of New Brunswick the articles were amended to provide for an unlimited number of common shares and an unlimited number of special shares. On July 23, 2007, the Company was continued from the laws of the Province of New Brunswick to the laws of Canada, under the CBCA, and the articles of continuance provided for an unlimited number of common shares and an unlimited number of preferred shares. The Company’s Common Shares are quoted on the United States Over-the-Counter Bulletin Board (“OTC Bulletin Board”), under the symbol “RYSMF”.

The registered office of the Company is located at 50 Richmond Street East, Suite 101, Toronto, Ontario M5C 1N7. The Company’s two wholly-owned subsidiaries, Manhattan Mining Co. and Kentucky Standard Energy Company, Inc., have offices at One Main Street, Manhattan, Nevada, 89022 and 11945 North Big Creek Road, Hadfield, Kentucky, 41514, respectively.

For a description of certain of the Company’s principal capital expenditures and divestitures, see “Item 4.D. Property, plants and equipment.”

4

B.Business overview.

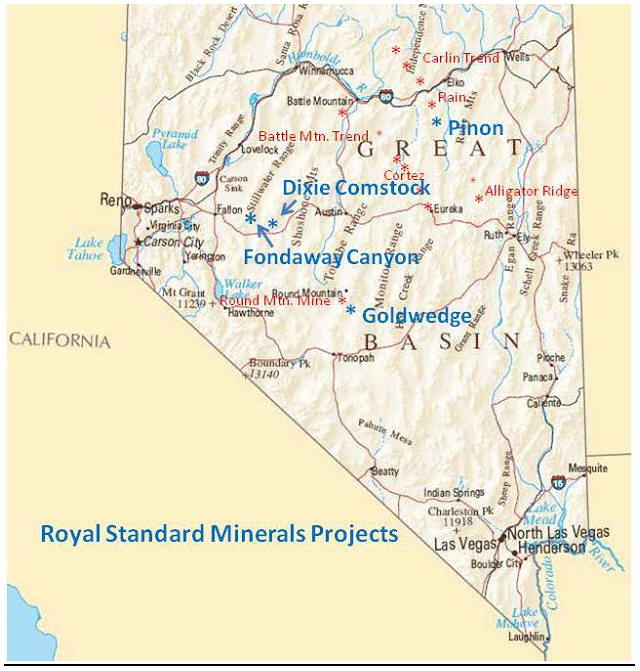

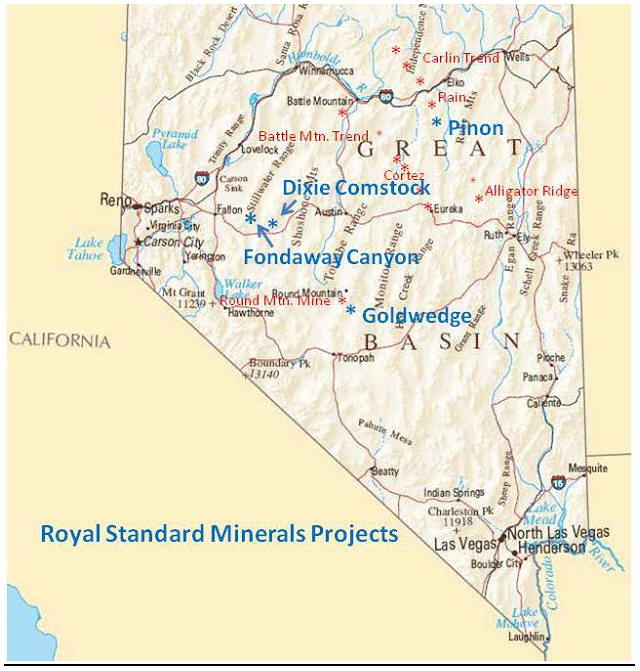

Royal Standard is a mineral exploration company primarily engaged in locating, acquiring, exploring and developing gold and precious metal deposits in the State of Nevada. The Company owns a 100% interest in five projects in three separate gold-silver districts in Nevada. These projects include the Goldwedge Project in Nye County, the Piñon and Railroad Projects in Elko County and the Fondaway Canyon and Dixie-Comstock Projects in Churchill County.

At the present time, the Company's activities include exploratory searches for gold ore in Nevada and coal in Kentucky. The Company continues evaluating the potential for economic extraction of known deposits of ore grade material on the Company's mineral exploration properties. The Company has not generated any revenues from operations at this time. See “Item 3.D. Risk Factors. On April 16, 2012, the Company announced the commissioning of its mill at its flagship Goldwedge Project. The gravity process plant has been commissioned and is permitted to process four hundred metric tons of gold ore per day.

C.Organizational structure.

The Company has two wholly-owned subsidiaries, Manhattan Mining Co., a company incorporated under the laws of the State of Nevada, and Kentucky Standard Energy Company, Inc., a company incorporated under the laws of the State of Kentucky.

D.Property, plants and equipment.

The registered office of Royal Standard Minerals Inc. is located at 50 Richmond Street East, Suite 101, Toronto, Ontario M5C 1N7. The Company’s wholly-owned subsidiary Manhattan Mining Co. also has an office at One Main Street, Manhattan, Nevada, 89022 and the Company’s wholly-owned subsidiary Kentucky Standard Energy Company, Inc. also has an office at 11945 North Big Creek Road, Hadfield, Kentucky, 41514.

5

Goldwedge Project

General Information

The Goldwedge Project is located in the Manhattan Mining District, section 18, T8N, R43E, Mount Diablo Meridian, approximately one mile west of the town of Manhattan in Nye County, Nevada and about eight (8) miles south of the Round Mountain mine. Located within the southern Toquima Range of central Nevada, the elevation ranges from 6,800 feet to 7,800 feet. The topography is gently rising to rolling and ruggedly steep along the north-south trending mountain range. The deposit occurs under a gravel covered dry drainage valley north of paved highway 377. The town of Tonopah is 50 miles south of the deposit and is considered the most favorable location for accommodations. Tonopah is also the county seat for Nye County.

6

The Goldwedge Project deposit occurs at the intersection of north and northwest trending faults. In the deposit area, the north trending Reliance fault is mineralized within the Ordovician Zanzibar limestone and siltstone. The target mineralization occurs within multiple high angle structures over a width of between 100-200 feet primarily within the Zanzibar limestone. Results of approximately 75 drill holes, primarily within the central zone over a strike length of 1,000+ feet and 100'-500' of vertical extent, indicate continuous gold oxide mineralization of potential mineable thickness and quality.

RSM has evaluated all of the pertinent drill data as part of a detailed inventory of the deposit geometry, size and overall grade.

The Goldwedge Project is one of several gold deposits in the area and is considered one of the best known projects in the district for development. Management believes the property also has excellent exploration potential for future growth.

A mining and milling permit by the Nevada Division of Environmental Protection (“NDEP”) has been issued. The Company has completed refurbishment of the on-site processing plant which was used for the test mining and processing that took place between 2007 and 2008. Commissioning of the plant was announced in April 2012.

Historical Activity Summary

In 2004 the Company secured all the necessary mine, mill (plant) and water use permits and rights from the State of Nevada. Also, in 2004 the Company constructed an underground portal and developed a 700 foot (underground) decline and cross cut to test one of the gold mineralized structures within a 100+ wide structural zone (Phase 1 of underground development program). Additionally, RSM completed the surface facilities necessary to process the material to be mined onsite to include silt ponds, ore pad and the onsite gold processing plant. The Company acquired a full production scale gold recovery (gravity) plant that was intended to be utilized to process the mined material as part of the test mining program.

On June 29, 2005 the Company entered into a 5-year Purchase Option Agreement with a private individual for all of his patented and unpatented mining claims in the Manhattan Mining District located in Nye County, Nevada. The land package totals approximately 1600 acres (4 patented, 70 unpatented claims). This property position adjoins the Company's Goldwedge property. The land package includes a number of exploration targets which are of interest to the Company.

The second phase of the underground development program, which commenced in 2007, included further development of the existing decline and additional crosscuts to identify, locate and assess mineralized zones at greater depth. Groundwater inflow hampered decline development as it progressed; a dewatering well and pumping facility was put in place in 2008 to lower the water table. As of 2008 approximately 5,000 feet of underground development had been completed, including 10 crosscuts intersecting the mineralized zones.

During Phases 1 and 2 of the underground development program, the surface processing facilities were installed and tested (2005) and modified (during 2006-2007) to improve recoveries. The process plant includes primary crushing and grinding facilities that feed a gravity recovery system.

Project activities in 2009 concentrated on acquiring the necessary permits with the various state and federal agencies to handle water disposal through the permit of a Rapid Infiltration Basin on the Company's properties. Project work included plant modifications as part of an effort to increase the daily throughput of gold bearing material as part of the milling process.

7

2011 Activity

In 2011 the Company completed construction of the Rapid Infiltration Basins (RIB), dewatered the previously completed underground development and resumed phase 2 of the underground development program. This phase of the development included the exploration of mineralized zones concurrently with advancing decline development. An 11 foot diameter ventilation shaft was excavated with raise bore equipment to enable future mine development and production as well as provide a secondary escapeway. Level development was concentrated on developing along the strike of mineralized zones to assess continuity and grade as well as prepare areas for future test stoping.

The Company contracted Northern Nevada Mining & Milling Services LLC for further construction and modification to the existing processing plant on site. The plant has been modified over the last year to replace the two smaller ball mills in the grinding circuit with a larger single 8’ x 9’ ball mill.

Recent and Current Activities

In early 2012 the ventilation raise was shotcreted, a ladderway to surface installed and bulkhead and fans installed. This alternate entry and exit to surface now in place is fully functional as a secondary escapeway and is necessary prior to further underground development.

Underground electrical infrastructure and ventilation system upgrades were performed in February and early March 2012 to meet regulatory requirements and to enable uninterrupted development. In April, an international engineering consulting firm was engaged to perform a geotechnical assessment on site and provide recommendations for ground support for both ongoing development work and future production.

Staffing levels in the underground mining, technical and administrative departments were increased, with implementation of additional shifts planned in the near future. Diamond drilling crews for both surface and underground work have been hired.

Ramp development is ongoing and approaching the next planned elevation for level access. Ore development faces continue to be identified and developed. A surface stockpile in excess of two thousand tons has been established. Mineralized material is trucked to surface, sampled and analyzed for gold values at the Company’s onsite assay laboratory which was recently refurbished and has now been approved by the NDEP. Additionally, for compliance with future NI 43-101 requirements the Company sends samples to independent accredited laboratories offsite for independent analyses.

Commissioning of the process plant was announced in April 2012. Modifications to improve throughput and recoveries are being implemented.

Surface and underground diamond drilling is underway.

Land Positions

The project area includes staked U.S. Department of the Interior Bureau of Land Management (“BLM”) lands; options of BLM claims owned by others and patented mining claims owned by the Company. All payments, maintenance fees, option payments and taxes to state and federal authorities are current under state and federal guidelines.

The land position controlled by RSM on the Goldwedge Project area is shown below:

8

| Claim Name | Claim Type | BLM Serial # or Patent # |

| Goldwedge | Unpatented | NMC 96294 -96297 |

| Goldwedge 1-3 | Unpatented | NMC 96294-96297 |

| Orpahnt | Patents | 4095 |

| Copper Farm-Eldorado #2 | Patents | 2876 |

| GW 1-34 | Unpatented | NMC 826458-826460, 824432, 824436,826461-826476, 829859-829863, 834113-824114 |

Location of Claims | # of Claims/Acres/Owner | Importance to Development |

Goldwedge Deposit | 4 Claims/50 Acres/Hill | 90% of known deposit, 3% NSR, - 5-year lease term, renewable |

North Plunge of Goldwedge Deposit and 1.5 miles of Mineralized Caldera Margin Trend (RSM owns 100% of Unpatented Claims) | 34 Claims/450 Acres/RSM | Largest deep and unexplored mineralized caldera margin |

South End of Goldwedge Deposit and East Caldera Margin Trend (RSM owns 100% of Patent Claim | 1 Claim/20.03 Acres/RSM (Orphant Patent) | Approximately 5% of known deposit, Private Land for Decline and Plant Site, and 1,500 feet of mineralized caldera trend, facility site plan, 1% NSR |

9

10

Wm. Michael Donovan Jr., Professional Land Surveyor #2617, surveyed the land holdings in the immediate vicinity of the deposit to determine the exact land boundaries in relation to the gold deposit. This surveying was completed in 2001 following the staking of the unpatented claims by the Company in the same year.

11

The Company has recorded an asset retirement obligation on its Goldwedge Project in the amount of $168,276, representing the estimated costs, on a discounted basis, of the Company's obligation to restore the property site to its original condition.

Project Expenditures

During the year ending January 31, 2012, expenses on the Goldwedge Project were $2,748,949 with cumulative expenditures to January 31, 2012 of $19,632,659. A table of detailed expenditures follows:

| | | | | | | | | | | | Cumulative from | |

| | | January 31, | | | January 31, | | | January 31, | | | date of inception of | |

| For the years ending | | 2012 | | | 2011 | | | 2010 | | | exploration phase | |

| Goldwedge Project | | | | | | | | | | | | |

| Opening balance | $ | 16,874,710 | | $ | 16,087,544 | | $ | 15,177,300 | | | 0 | |

| Property acquisition costs | $ | 10,000 | | $ | 40,492 | | $ | 430,028 | | $ | 1,202,167 | |

| Travel | $ | 71,292 | | $ | 65,983 | | $ | 6,914 | | $ | 469,552 | |

| Mine development costs | $ | 397,626 | | $ | 42,312 | | $ | 10,671 | | $ | 1,486,726 | |

| Drilling | $ | 40, 206 | | | 0 | | | ($202 | ) | $ | 988,999 | |

| General exploration | | 0 | | | 0 | | | 0 | | $ | 133,353 | |

| Professional fees | $ | 113,442 | | $ | 65,550 | | $ | 7,528 | | $ | 259,156 | |

| Consulting | $ | 1,238, 299 | | $ | 240,392 | | $ | 282,548 | | $ | 6,460,402 | |

| Office and general | $ | 393,149 | | $ | 84,314 | | $ | 118,112 | | $ | 2,151,769 | |

| Analysis and assays | $ | 7,392 | | $ | 2,225 | | $ | 7,983 | | $ | 165,227 | |

| Supplies, equipment and transportation | $ | 353,312 | | | ($9,010 | ) | $ | 54,153 | | $ | 4,031,053 | |

| Depreciation | $ | 124,231 | | $ | 254,908 | | $ | 322,524 | | $ | 2,605,270 | |

| Less: Proceeds from sale of exploration ore | | 0 | | | 0 | | | ($330,015 | ) | | ($330,015 | ) |

| Activity during the period | $ | 2,748,949 | | $ | 787,166 | | $ | 910,244 | | $ | 19,623,659 | |

| Closing balance | $ | 19,623,659 | | $ | 16,874,710 | | $ | 16,087,544 | | $ | 19,623,659 | |

Future Programs

Underground development as well as surface and underground drilling will be directed towards further delineation and expansion of the resources on this property as well as optimization of the gravity recovery plant. Preliminary scoping for addition of a CIP circuit to further increase recoveries is in progress. All of this work will be supervised by the CEO and carried out by experienced miners and plant employees currently working for the Company. Consultants will be utilized in special instances to assist management with specific technical issues.

The Goldwedge Project requires further capital investment to move the project towards production. Various funding opportunities will be pursued.

This project is an advanced exploration project without known reserves and the proposed program is exploratory in nature. See “Item 3.D. Risk Factors.”

The Goldwedge Project forms part of the Manhattan/Round Mountain Caldera program, the Company's most advanced district play. The project area is located southeast of the town of Round Mountain, Nevada east of State route 376. The town of Manhattan is located approximately 15 miles south of Round Mountain. The Manhattan Project is located approximately 7 miles east of route 376 on route 377 and 1.5 miles west of the town of Manhattan.

12

The land position in the Manhattan Mining District is comprised of 70 unpatented and 6 patented lode-mining claims. An underground development program to include drill testing the extensions of the Goldwedge deposit in addition to the evaluation of several additional lode and placer properties that the Company controls in the district could significantly increase the historic gold resource estimates.

Piñon Project-Carlin Trend South

General Information

The Piñon Project located at the southeast end of the famous "Carlin Gold Trend" about 10 miles south of Newmont's Rain mine, 25 miles southwest of Elko, Nevada. The main access from Elko is west on Interstate 80 to Carlin (25 miles) then south on State Highway 51 for 22 miles to the Trout Creek access road. The project area is 7 miles east along a well-maintained BLM gravel-dirt road. There is no infrastructure in the vicinity of the property; the nearest power line is 7 miles to the west along State Highway 51.

13

The Carlin Trend is one of the most prolific gold trends in the world and has produced more than 50 million ounces of gold. The property is located within a region of known mineralization, which supports the potential for expanding the known gold deposits and making new discoveries. Much of the district wide exploration was undertaken prior to the start of the 1990's. Since the mid-1990's the cumulative knowledge of "Carlin-type" gold deposits has expanded tremendously. This expanded knowledge can be used to re-interpret all historic exploration data, which may identify new exploration targets at the property. Also, during the past 10+ years numerous high-grade gold deposits have been discovered along the Carlin Trend that can be mined using underground techniques. Many of these deeper deposits are associated with surface oxidized gold deposits. Essentially no significant deeper exploration has been conducted under the Piñon deposit, or at other places on the property. The exploration opportunity offers the possibility for discovery of additional gold deposits at Piñon.

The Webb Formation is mineralized above the Devils Gate limestone. However, higher-grade mineralization has been encountered at very shallow depths, mineralized oxide zones occur along a 1,300 feet strike length and occur less than 90 feet below the surface.

The Pinon deposit occurs in the basal Missippian Age Webb Formation. The basal Webb Formation is composed of calcareous siltstone and limestone that has been folded along a southeast plunging anticline. Gold mineralization continues into the underlying Devonian Age Devils Gate Limestone where karst collapse breccia has developed in the underlying limestone along the unconformity contact with the underlying Devils Gate Limestone. The gold resource is strata-bound over the fold crest and is exposed at the surface. The mineralized rock has been silicified, decalcified and argillized.

A second gold resource occurs north and adjacent to the larger Pinon Main Zone resource and trends north along a fault zone. A deeper zone of brecciation and mineralization occurs on the south end of the Pinon Main Zone resource and is currently considered to be a hydrothermal karst breccia. A coring program is required to better understand the geometry of this breccia. The current defined resource at Pinon occurs on the Company’s land holdings.

The Piñon property currently consists of a contiguous land block of 39 unpatented mining lode claims - claim fractions that are located in surveyed Township 30 North, Range 53 East, Section 22, (Mount Diablo Meridian), Elko County, Nevada. The current Piñon land position covers an area of approximately 2,720 acres (approx. 1101 hectares). All payments, maintenance fees to federal and state authorities are current. Landowner option payments are also current and in good standing for this land position. Included in the land block are the following claims:

| County Recordation |

Claim Name | BLM Serial # | Book | Page | Acres |

TC-1 thru TC-10 | NMC 125638 thru NMC 133862 | 304 | 6 thru 15 | 180 |

TC-11 | NMC 133862 | 309 | 114 | 20 |

TC-12 thru TC-28 | NMC 148871 thru NMC 148887 | 329 | 58 THRU 74 | 320 |

TC-29 thru TC-39 | NMC 403761 thru NMC 403771 | 588 | 426 thru 436 | 200 |

The TC claim group is under (100%) control by the company. The TC claims are located on federal public domain lands that are managed (both surface and mineral estates) by the Bureau of Land Management ("BLM"). Initially staked in 1979, this ground was previously open to mineral location with no significant restrictions. Location certificates for all claims staked in the group were filed and recorded with the BLM and the Elko County Recorder's Office in Elko according to federal and state laws/regulations.

14

The TC claim group is surrounded by private fee lands containing a complicated mixture of severed surface and mineral estates that were previously controlled in part by the Piñon Joint Venture through various lease-option agreements. These lands have since been dropped by the joint venture. An ownership summary for several of the more important sections is shown below.

T30N, R53E

Section 21: All (640 acres)

Surface estate

J. Tomera Ranch (100%)

Mineral estate

J. Tomera family (50%)

Rudnick Trust (16.6%)

L&R Rudnick family (16.6%)

Section 27: NE1/4 NW1/4 , NE1/4, NE1/4 SE1/4 (640 acres)

Surface estate

Pereira Trust (100%)

Mineral estate

Pereira Trust (50%)

O. Rudnick family (16.67%)

Rudnick Trust (8.33%)

Section 27: NW1/4 NW1/4 , S1/2 NW1/4, SW1/4, NW1/4 SE1/4, S1/2 SE1/4 (640 acres)

Surface estate

J. Tomera Ranch (100%)

Mineral estate

J. Tomera family (50%)

O. Rudnick family (16.67%)

Rudnick Trust (8.33%)

R. Rudnick family (8.3%)

The Piñon Project is made up of a number of lease agreements to lease certain properties in Elko County, Nevada. The Company is obligated to incur certain payments and exploration expenditures to keep the leases in good standing. The lessors retain a 5% net smelter return royalty.

The Railroad Project was made up of two lease agreements to lease certain properties in Elko County, Nevada. The Company was obligated to incur payments of $8,000 to keep one lease in good standing and pay $1,765,000 to exercise the option to purchase the leased property under the other agreement by August 31, 2009 to keep the leases in good standing. The lessors would retain a 5% net smelter return royalty. On August 31, 2009 the option was exercised to acquire 100% of this project and the property was sold for $2,965,000 to an unrelated private company for net proceeds of $1.2 million, a 1% NSR royalty and 500,000 common shares of the private company. The sale of this property resulted in a gain on the sale of $583,199.

15

Approximately 600 shallow drill holes have been completed on six near surface gold-silver deposits. The Company has recorded an asset retirement obligation in the amount of $28,724 on the Piñon Project, representing the estimated costs, on a discounted basis, of the Company's obligation to restore the property site to its original condition as required by the State of Nevada regulatory authorities.

Project Expenditures

During the year ended January 31, 2012, expenditures on the Piñon Project were $71,188 with cumulative expenditures to January 31, 2012 of $2,159,700. During 2010, the expenditures relating to the Railroad Project in the amount of $617,300 were applied against the proceeds received. These costs were incurred in connection with various activities performed by the Company on a discretionary basis. A table of detailed expenditures follows:

| | | | | | | | | | | | Cumulative from | |

| | | January 31, | | | January 31, | | | January31, | | | date of inception of | |

| For the years ending | | 2012 | | | 2011 | | | 2010 | | | exploration phase | |

| Piñon Project | | | | | | | | | | | | |

| Opening balance | $ | 2,088,512 | | $ | 2,001,517 | | $ | 1,931,122 | | $ | 0 | |

| Property Acquisition costs | $ | 69,571 | | $ | 102,706 | | $ | 54,013 | | $ | 782,494 | |

| Travel | | 0 | | | 0 | | | 0 | | $ | 78,326 | |

| Drilling | | 0 | | | 0 | | | 0 | | $ | 130,600 | |

| General exploration | | 0 | | | 0 | | | 0 | | $ | 7,765 | |

| Professional fees | | 0 | | | 0 | | $ | 19,668 | | $ | 85,941 | |

| Office and general | | 0 | | | 0 | | | 0 | | $ | 98,120 | |

| Geologist | | 0 | | | 0 | | | 0 | | $ | 32,653 | |

| Consulting, wages andsalaries | $ | 1,617 | | | ($15,711 | ) | $ | 258 | | $ | 645,241 | |

| Reclamation costs | | 0 | | | 0 | | | 0 | | $ | 167,785 | |

| Analysis and assays | | 0 | | | 0 | | | 0 | | $ | 74,042 | |

| Supplies, equipment andtransportation | | 0 | | | 0 | | | ($3,544 | ) | $ | 56,733 | |

| Activity during the period | $ | 71,188 | | $ | 86,995 | | $ | 70,395 | | $ | 2,159,700 | |

| Closing balance | $ | 2,159,700 | | $ | 2,088,512 | | $ | 2,001,517 | | $ | 2,159,700 | |

| | | | | | | | | | | | | |

| Railroad Project | | | | | | | | | | | | |

| Opening balance | | 0 | | | 0 | | $ | 460,013 | | | 0 | |

| Property acquisition costs | | 0 | | | 0 | | $ | 5,980 | | $ | 465,993 | |

| Professional fees | | 0 | | | 0 | | $ | 123,580 | | $ | 123,580 | |

| Consulting, wages andsalaries | | 0 | | | | | $ | 27,727 | | $ | 27,727 | |

| Sale of Property | | 0 | | | 0 | | | ($617,300 | ) | | ($617,300 | ) |

| Activity during the period | | 0 | | | 0 | | | ($460,013 | ) | | 0 | |

| Closing balance | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

16

Future Programs

Any future work will involve twinning of historic drilling to bring historic data to 43-101 standard. Subsequent modelling will allow a decision to be made on further exploration or development.

The property is without known reserves and the proposed program is exploratory in nature. See “Item 3.D. Risk Factors.”

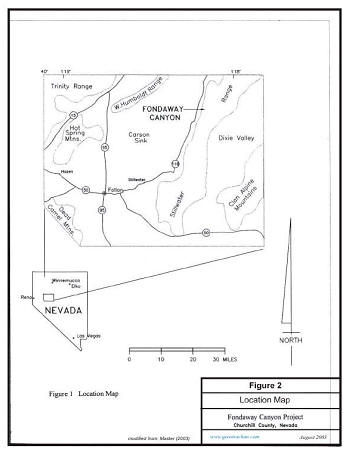

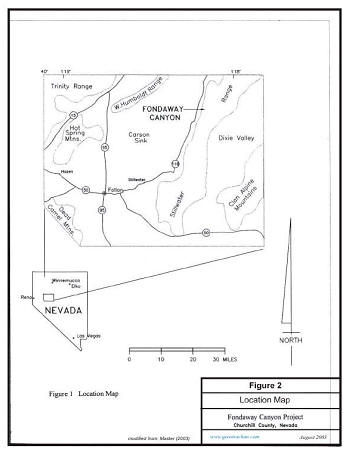

Fondaway Canyon Project

The 100% controlled Fondaway Canyon gold project is located in Churchill County, Nevada in the Stillwater range. The Fondaway property is accessible from Fallon east along U.S. Highway 50, then north on Hwy 116 to the settlement of Stillwater, then north on an improved gravel road for 30 miles along the front range of the Stillwater Mountains to Fondaway Canyon. The elevation of the property ranges from 5000 to 6000 feet. Access east into Fondaway Canyon is steep but adequate with existing mine roads. The Fondaway deposit is located on the west flank of the Stillwater Range in Sections 1 and 2, T22N, R33E, and Sections 5 and 6, T22N, R34E.

The Fondaway Canyon property consists of 148 contiguous unpatented lode-mining claims (approximately 3000 acres) on BLM land held under a lease agreement assigned from Nevada Contact Inc. (NCI) to the Company. Eighteen claims were staked by NCI, quitclaimed to the owner, and included in the assignment to the Company. The lease terms include a 3% net smelter return royalty to the owner Richard Fisk and advanced royalty payments of $25,000 per year. The annual payments graduated to $35,000 in 2006 and years following. Details of the option agreement are as follows:

17

| Required Cash Payments toOptionors | | Royalty | Exercise of Option |

Commencing in fiscal 2003. $25,000 in year one, $30,000 in years two and three and $35,000 each of the next seven years apply to the purchase price | | 3% NSR | July 2013 $600,000 |

All of the maintenance filing fees are current and in good standing.

Nearly-vertical, east-west trending mineralized shear zones host the Half Moon, Paperweight, Hamburger Hill and South Pit gold resources that are hosted within a Mesozoic sedimentary package. The Mesozoic sedimentary package has been intruded by a Mesozoic-Tertiary aged intrusive. The vertical extent tested by historic drilling of the higher grade gold mineralized shear zones is greater than 1,000 feet. Horizontal continuation of gold mineralization at the Paperweight and Hamburger Hill mineralized shear zone is 3,700 feet with widths commonly 5'-20+ feet. Records indicate that 568 holes have been drilled for a total estimated footage of 200,000 feet of RC drilling and 22,000 feet of core drilling: 455 reverse circulation, 49 core and 64 air track holes over a strike length of approximately 12,000 feet. Tenneco Minerals Inc., the most active company, drilled approximately 350 holes (130,000 feet) and drove a 500' adit for sulfide metallurgical sampling during the period 1987-1996. Tenneco also operated a small oxide gold open pit mine for a short time during this period. Nevada Contact Inc. (“NCI”) acquired the property in 2001 and drilled 11 reverse circulation holes. The Company acquired the property from NCI in early 2003 as part of a property swap with NCI retaining a 1% NSR overriding royalty in the Fondaway Canyon property and $25,000 advance minimum royalty payments to the claim holder until 2006 at which time the payments increase to $35,000 per year that includes a 3% NSR royalty until buyout. There is a buyout option of $600,000 for the owners' interest.

Estimates of prior expenditures on this property are approximately $5-6 million. The largest portion of these expenditures was contributed by Tenneco Minerals and Tundra Mines LTD. This work included extensive drilling, development of a small open pit production project and an advanced exploration adit on the property.

Project Expenditures

During the year ended January 31, 2012, expenditures on the Fondaway Project were $37,297, with cumulative expenditures to January 31, 2012 of $435,110. These costs were incurred in connection with various activities performed by the Company on a discretionary basis. The Company will continue to pay all lease payments to keep this project in good standing. A table of detailed expenditures follows:

| | | | | | | | | | | | Cumulative from date | |

| | | January 31, | | | January 31, | | | January 31, | | | of inception of | |

| For the years ending | | 2012 | | | 2011 | | | 2010 | | | exploration phase | |

| Fondaway Project | | | | | | | | | | | | |

| Opening balance | $ | 397,813 | | $ | 339,776 | | $ | 302,279 | | $ | 0 | |

| Property Acquisition costs | $ | 35,000 | | $ | 58,037 | | $ | 37,497 | | $ | 413,537 | |

| Travel | | 0 | | | 0 | | | 0 | | $ | 15,646 | |

| Drilling | | 0 | | | 0 | | | 0 | | $ | 351 | |

| Office and General | $ | 2,297 | | | 0 | | | 0 | | $ | 2,297 | |

| Analysis and assays | | 0 | | | 0 | | | 0 | | $ | 3,279 | |

| Activity during the period | $ | 37,297 | | $ | 58,037 | | $ | 37,497 | | $ | 435,110 | |

| Closing balance | $ | 435,110 | | $ | 397,813 | | $ | 339,776 | | $ | 435,110 | |

18

Future ProgramsThe Company does not anticipate performing exploration activities until additional funding is obtained. The Company will maintain its 2013 lease payment obligations and claim renewal fees.

The property is without known reserves and any proposed program would be exploratory in nature. See “Item 3.D. Risk Factors.”

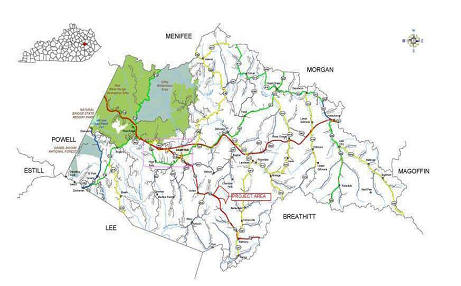

Kentucky Project

In an effort to achieve diversity within its natural resource portfolio on November 19, 2008, the Company and Sharpe Resources Corporation (“Sharpe”) entered into an option agreement whereby the Company agreed to an option to acquire a 50% interest in coal properties in Kentucky by advancing to the project $2 million prior to December 9, 2009. Once the option is exercised by the Company a 50/50 Joint Venture agreement will be entered into between the Company and Sharpe at which time all expenditures incurred and revenues earned from the coal projects will be shared 50% by the Company and 50% by Sharpe.

Under the terms of the option agreement a 100% interest in a surface mine coal project in Wolfe County, Kentucky was acquired. The transaction costs included $250,000 to acquire the project and $178,700 for a reclamation bond to cover the state of Kentucky reclamation requirements for this property. The property consists of approximately 1,000 acres of coal mineral rights under lease and includes an approved Kentucky Mining Permit, I.D. No. 919-0066.

On September 11, 2009 this option agreement was amended to allow the Company to acquire its 50% interest in the properties by advancing to the project $2 million by December 9, 2011. As consideration for this amendment the Company cancelled the promissory note receivable from Sharpe held by the Company and received a new note from Sharpe in the amount of $120,409 on September 9, 2009 repayable in three equal installments on September 9, 2011, 2012, and 2013. During 2011, the Company wrote off the promissory note receivable.

On December 7, 2011, the Company exercised its option. Pursuant to the terms of the agreement, the Company requested Sharpe to provide additional cash to the Kentucky Project, to match that of the Company, which had exceeded $2,000,000. As of the date hereof, Sharpe has not responded. The Company is currently reviewing its options for the Kentucky Project.

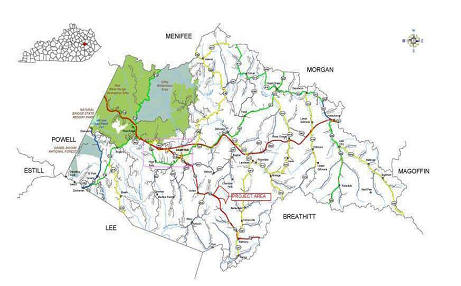

The Kentucky Project is approximately 5 miles southeast of the Town of Campton adjacent to paved highway 15 and is situated in Wolfe County at an elevation of 900 feet. The topography is gently rising to rolling and moderately steep terrain that reflects a dendritic drainage pattern of valleys and ridges that occur at the head of these drainages. The ridge elevations within the project area are on the order of 900-1,250 above sea level with the valley floors in the 900-1000 feet above sea level. The area is covered with a hard wood forest that is well supplied with regular rainfall and ample vegetation. Electrical power was installed from a nearby power line crossing the property from the Licking River Electric Cooperative. The nearest large city is Lexington, Kentucky located approximately 70 miles northwest of the project area.

19

Within Wolfe County, the Company holds mining interests on seven properties, containing six coal seams capable of production, namely, in order from the bottom sequence to the top: 1) Vires, 2) Grassy, 3) Cannel City, 4) Whitesburg, 5) Fire Clay and 6) Fire Clay Rider, hereinafter known as the Seams. The Seams range in thickness from 12 inches up to nearly 30 inches within the leasehold boundary. These are all surface-minable seams. The Campton mine is made up of seven (7) separately owned land parcels having coal mining rights by any mining methods, aggregating 974 acres. Of the 974 acres, 272.19 acres are permitted for surface mining.

| Original Owner or Lessor | Area (Acres) | Mining Types | Kentucky Seams | Royalty Rate |

| David Rudd | 280 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Kevin and Tara Patton | 85 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Earl Patton | 150 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| William and Maggie Hutton | 90 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Elizabeth and Taylor Caldwell | 109 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Pauline Caldwell | 110 +/- | C/Area | All Seams | 6% F.O.B. Pit |

| Wick & Phyllis Clemons | 150 +/- | C/Area | All Seams | 6% F.O.B. Pit |

C/Area = Contour and Auger/Area or Mountain-top Removal;

F.O.B. = Freight on Board sales prices, with deductions for freight and sales commissions

The Company has recorded an asset retirement obligation in the amount of $95,315 on its Kentucky Project, representing the estimated costs of the Company's obligation to restore the property site to its original condition as required by the State of Kentucky regulatory authorities.

Project Expenditures

During the year ended January 31, 2012, expenditures on the Kentucky Project were $96,922 with cumulative expenditures to January 31, 2012 of $1,580,478, which together with expenditures which indirectly were made for the benefit of the Kentucky Project totals in excess of $2 million. These costs were incurred in connection with various activities performed by the Company on a discretionary basis. A detailed table of expenditures follows:

20

| | | | | | | | | | | | Cumulative from | |

| | | January 31, | | | January 31, | | | January 31, | | | date of inception of | |

| For the years ending | | 2012 | | | 2011 | | | 2010 | | | exploration phase | |

| Kentucky Project | | | | | | | | | | | | |

| Opening balance | $ | 1,483,556 | | $ | 1,370,849 | | $ | 1,136,682 | | | 0 | |

| Property Acquisitioncosts | | 0 | | | ($300 | ) | $ | 300 | | $ | 418,000 | |

| Travel | $ | 12,764 | | $ | 62 | | $ | 12,162 | | $ | 38,815 | |

| Reclamation Costs | | 0 | | $ | 444 | | $ | 2,925 | | $ | 22,646 | |

| Professional fees | $ | 2,400 | | $ | 17,786 | | $ | 29,673 | | $ | 98,539 | |

| Consulting, wages andsalaries | $ | 46,300 | | $ | 49,150 | | $ | 43,694 | | $ | 302,972 | |

| Office and general | $ | 12,794 | | $ | 15,223 | | $ | 35,825 | | $ | 124,497 | |

| Supplies, equipment &transportation | $ | 10,552 | | $ | 13,646 | | $ | 93,508 | | $ | 424,511 | |

| Rent | | 0 | | | 0 | | $ | 750 | | $ | 94,010 | |

| Amortization | | 0 | | | 0 | | | 0 | | | 0 | |

| Depreciation | $ | 12,112 | | $ | 16,696 | | $ | 15,330 | | $ | 56,488 | |

| Activity during theperiod | $ | 96,922 | | $ | 112,707 | | $ | 234,167 | | $ | 1,580,478 | |

| Closing balance | $ | 1,580,478 | | $ | 1,483,556 | | $ | 1,370,849 | | $ | 1,580,478 | |

Future Programs

The Company is currently reviewing its options regarding this joint venture.

Item 4A.Unresolved Staff Comments

Not applicable.

Item 5.Operating and Financial Review and Prospects

A.Operating results.

Royal Standard is an exploration and pre-development stage enterprise and is in the process of exploring its resource properties and has not determined whether the properties contain economically recoverable reserves. The recovery of the amounts shown for the resource properties and the related deferred expenditures is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration and, upon future profitable production.

As Royal Standard is an exploration and pre-development stage enterprise, it currently has no producing properties and no operating income or cash flow, other than interest earned on funds invested in short-term deposits. (See “Item 3.D. - Risk Factors”.)

Year Ended January 31, 2012 Compared to the Year Ended January 31, 2011

The Company's net loss totaled $6,451,698 for the year ended January 31, 2012, with basic and diluted losses per share of $0.08. This compares with net loss of $1,632,845 with basic and diluted losses per share of $0.02 for the year ended January 31, 2011. The increase of $4,818,853 in net loss was principally due to increased exploration activities at the Goldwedge property, professional legal fees for various activities and claims during the year and the fair value of the stock options granted during the year ended January 31, 2012.

21

Year Ended January 31, 2011 Compared to the Year Ended January 31, 2010

The Company's net loss totaled $1,632,845 for the year ended January 31, 2011, with basic and diluted losses per share of $0.02. This compares with a net loss of $821,104 with basic and diluted losses per share of $0.01 for the year ended January 31, 2010. In 2010, the Company’s exploration and evaluation expenditures were capitalized under Canadian Generally Accepted Accounting Principles. The increase of $811,741 in net loss was principally due to exploration activities expensed during the year, the write down of advances made to a related party offset by decreases in consulting, wages, salaries and a gain on disposal of marketable securities in the year ended January 31, 2011.

B.Liquidity and capital resources.

The activities of the Company, principally the acquisition of properties prospective for gold and coal are financed through the completion of equity or debt financing, the exercise of stock options or the sale of exploration properties or marketable securities owned by the Company. For the year ended January 31, 2012, the cash resources of the Company increased by $527,515. The increase in cash resources is a result of the Gold Stream Facility provided by Waterton Global Value L.P. (“Waterton”). There is no assurance that future sales and equity or debt capital will be available to the Company in the amounts or at the times desired, or on terms that are acceptable to the Company, if at all. (“Item 3.D. - Risk Factors”.)

Year Ended January 31, 2012 Compared to the Year Ended January 31, 2011

As at January 31, 2012, the Company had $629,553 in cash (January 31, 2011: $102,038). The Company had a working capital deficiency of $5,184,281 as of January 31, 2012, compared to a working capital deficiency of $720,373 as of January 31, 2011. Working capital has decreased for the current period presented as a result of increased exploration expenditures, construction of the mill operations and the increase in professional legal fees. On May 8, 2012 the Company had secured an additional $2,000,000 loan extension from Waterton. This now brings the total funds provided by Waterton to $10,000,000.

As at January 31, 2012, the Company had current liabilities of $6,120,109 compared to $935,688 as at January 31, 2011. Current liabilities have increased due primarily to costs relating to the refurbishment of the mill, increased professional legal fees and the current portion of the Gold Stream Facility. The Company's cash and marketable securities as at January 31, 2012, were not sufficient to pay these liabilities.

On June 29, 2011, the Company's wholly owned subsidiary, Manhattan Mining Co. ("Manhattan") entered into a secured bridge loan agreement (the “Bridge Loan”) with Waterton Global Value, L.P. (“Waterton”) pursuant to which Waterton agreed to provide an $8,000,000 bridge loan (the “Credit Facility”) available to Manhattan. Of the total $8,000,000 Bridge Loan, $4,000,000 was available on closing and the remaining $4,000,000 after the satisfaction of certain covenants. Under the Bridge Loan agreement, the amounts drawn down under the Credit Facility would incur interest at 6% per annum, and the scheduled repayment date of the Credit Facility was 16 months after the initial closing date. In connection with the Credit Facility, Manhattan agreed to pay Waterton a structuring fee, and also provided Waterton with certain royalty interests relating to its Goldwedge Property. Manhattan and Waterton have also entered into a gold purchase agreement pursuant to which Waterton had agreed to purchase Manhattan’s production. The Credit Facility was secured by, amongst other items, the Company’s real property assets in Nevada.

22

On August 26, 2011, Manhattan amended its existing Bridge Loan with Waterton such that the Bridge Loan was transitioned into a more permanent senior secured gold stream debt facility (the “Gold Stream Facility”) amongst the parties. Under the Gold Stream Facility, Waterton will make $8,000,000 (the “Principal Amount”) available to Manhattan. The Principal Amount is repayable by Manhattan to Waterton in monthly payments commencing in August 2012 and ending in July 2013. Under the Gold Stream Facility, each monthly repayment of the Principal Amount will be made by the delivery by Manhattan to Waterton of gold bullion ounces where the number of ounces to be delivered shall be based on the spot price of gold on the business day immediately preceding the repayment date less an applicable discount or by the payment of the cash equivalent of such number of ounces. In addition, there is a profit participation formula which is triggered when the spot price of gold is in excess of $1,600 an ounce on the business day immediately preceding the repayment ("Profit Participation"). The Principal Amount will accrue interest at 9.0% per annum. The Gold Stream Facility is secured by, amongst other items, Manhattan's real property assets in Nevada.

The Company considers Profit Participation as an embedded derivative. As at January 31, 2012, the gross proceeds received under the Gold Stream Facility was $5,970,350, which was allocated to the embedded derivative based on the initial fair values of the embedded derivative determined when proceeds were received ($170,721), and then the residual value was allocated to the liability portion. The Company estimates the future cash flow needs in terms of Profit Participation using the gold future contract prices of repayment periods and discounted to the present value using 9% as annual discount rate. As of January 31, 2012, the Company estimates the gold future price during the repayment period from August 2012 to July 2013 to be $1,750 per ounce.

As consideration for entering into the Gold Stream Facility, a structuring fee equal to 2% of the aggregate amount of the Gold Stream Facility and an establishment fee of $80,000 was payable by Manhattan to Waterton in cash and Manhattan also granted Waterton certain royalty interests over its exploration stage projects. In addition, Manhattan and Waterton have agreed that Waterton shall have the right to purchase all of the gold produced by Manhattan from its Nevada projects at a price per ounce that will be equal to an agreed discount to the existing spot price of gold at the time of any such purchase. Bayfront Capital Partners Ltd. acted as placement agent in connection with the Gold Stream Facility in consideration for a placement fee equal to 4% of any Principal Amounts actually drawn by Manhattan under the Gold Stream Facility.

The Gold Stream Facility contains covenants for Manhattan such as, among other things, providing Waterton with updates on its operations, carrying on its business in accordance with prudent mining industry practices, and providing Waterton with certain rights of inspection. Until all amounts outstanding under the Gold Stream Facility have been repaid in full or otherwise satisfied in accordance with the terms of such facility, certain standard restrictive covenants shall apply to Manhattan limiting its ability to (without limitation): incur additional indebtedness, create liens on its assets or dispose of its assets. These negative covenants are subject to certain carve-outs that facilitate Manhattan's ability to operate its business efficiently. The Gold Stream Facility also includes certain event of default provisions pursuant to which, immediately and automatically upon the occurrence of an event of default, all amounts outstanding under the Gold Stream Facility would be automatically accelerated and immediately due and payable to Waterton.

At any time, without penalty, the Gold Stream Facility provides Manhattan the option to prepay in whole or in part, on five business days prior notice. Prepayments may be made in physical gold ounces or cash. The amount of any prepayment shall be calculated using the spot price of gold on the business day immediately preceding the prepayment.

23

As of January 31, 2012, the Company had met its capital commitment obligations to keep all of its property agreements in good standing.

Year Ended January 31, 2011 Compared to the Year Ended January 31, 2010

As at January 31, 2011, the Company had $102,038 in cash and cash equivalents (January 31, 2010: $745,779). The Company had a working capital deficiency of $720,373 as of January 31, 2011, compared to working capital of $529,435 as of January 31, 2010. Working capital has decreased for the current period presented as a result of funds spent on gold and coal projects and maintaining the Company's reporting issuer status and operating activities offset by the sale of the marketable securities for the amount of $275,695.

Current liabilities as at January 31, 2011 were of $935,688 compared to $301,381 as at January 31, 2010 due to the Company's inability to meet its current obligations. The current liabilities are primarily due to accruals for exploration expenditures, wages and general expenditures. The Company's cash and cash equivalents and short-term investments as at January 31, 2011, were not sufficient to pay these liabilities. As at January 31, 2011, the Company was attempting to secure a debt and/or equity financing in order to rectify the working capital deficiency that existed. On June 29, 2011, the Company announced that it has entered into a secured bridge loan agreement with Waterton Global Value, L.P. ("Waterton") pursuant to which Waterton has agreed to make an $8,000,000 bridge loan (the "Credit Facility") available to the Company.

C.Research and development, patents and licenses, etc.

See “Item 4.D – Property, plants and equipment.” and “Item 5.A. – Operating results”.

D.Trend information.

The economic crisis that started in the financial sector has continued to worsen and the Company is in the midst of a global recession. The mineral exploration business is undergoing massive scaling down. Capital investment in mineral exploration has dramatically declined with major new projects being cancelled and delayed, and producing properties are subject to shut downs and reduced production. Credit markets have become increasingly inaccessible and many exploration companies that, just one year ago, had large cash resources to invest in exploration activities are now struggling to finance day-to-day operations.

There are uncertainties regarding the price of commodities and the availability of equity and debt financing for the purpose of mineral exploration and development. The financial markets have made it difficult to raise new capital.

Current financial markets are likely to be volatile in Canada and the United States for the remainder of 2012 and potentially into 2013, reflecting ongoing concerns about the stability of the global economy and weakening global growth prospects. As well, concern about global growth has led to sustained drops in the commodity markets. Unprecedented uncertainty in the credit markets has also led to increased difficulties in borrowing or raising funds. As a result, the Company may have difficulties raising equity or debt financing for the purposes of project development. (See “Item 3.D. – Risk Factors” and “Item 5.A. – Operating results”.)

E.Off-balance sheet arrangements.

None.

24

F.Tabular disclosures of contractual obligations.

The Company's liabilities and obligations for the following five years as of January 31, 2012, are summarized below:

| | | | | | Less Than | | | | | | | | | More than 5 | |

| Contractual Obligations | | Total | | | 1 Year | | | 1-3 Years | | | 3-5 Years | | | Years | |

| | | | | | | | | | | | | | | | |

| Long-Term DebtObligations | $ | 7,960,465 | | $ | 3,980,232 | | $ | 3,980,233 | | | Nil | | | Nil | |

Goldwedge Project

In order to maintain property on the Goldwedge project, the Company has to pay claim renewal fees to the BLM of approximately $11,743.

Piñon Project

In order to maintain its lease agreements on the Piñon Project, the Company must make annual payments, exploration expenses and BLM claim maintenance fees.

Fondaway Project

In order to maintain the lease agreements on the Fondaway Project, the Company must make option payments of $35,000 and must pay claim renewal fees to BLM of approximately $22,278.

Management believes that the Company's cash and cash equivalents and short term investments are not sufficient to meet its expenditures for the next five years as the Company had a working capital deficiency balance of $5,184,281 as of January 31, 2012. As a result, the Company will be required to raise some capital during this period by way of an equity or debt financing, the exercise of options or the sale of an asset to meet its obligations. There is no guarantee that the five year time horizon that management has presented will be realized. See “Item 3.D. – Risk Factors”.

G.Safe harbor.

Not applicable.

25

Item 6.Directors, Senior Management and Employees

A.Directors and senior management.

Name and Residence | Position with the Company | Date First Elected a Director/

Held Office |

James B. Clancy(1)(2)(3)

Toronto, Ontario, Canada | Director | March 2009 |

John Fitzgerald(1)(2)(3)

Oakville, Ontario, Canada | Director | January 2012 |

Riyaz Lalani(2)(3)

Toronto, Ontario, Canada | Director | January 2012 |

Ken M. Strobbe(3)

Arizona, U.S.A. | Director | January 2012 |

Paul G. Smith(1)(2)(3)

Toronto, Ontario, Canada | Chairman and Director | March 2009 |

Philip Gross

London, U.K. | Interim President and Chief Executive Officer | October 2011 |

Ike Makrimichalos

Newmarket, Ontario, Canada | Chief Financial Officer | August 2011 |

George A. Duguay

Toronto, Ontario, Canada | Secretary | March 2009 |

Notes:

| | (1) | Member of the Audit Committee. |

| | (2) | Member of the Corporate Governance and Compensation Committee. |

| | (3) | Member of the Health, Safety, Environmental and Technical Committee. |

The following is a brief biography of each of the Company’s directors and executive officers:

James B. Clancy

Mr. Clancy has been Senior Advisor of SableRidge Capital Partners Inc. since March 2011 and President of Clancy Consultants Inc. since October 2009. Prior thereto, Mr. Clancy was Director-Finance for Techint E. & C. Canada, a federally incorporated private company,from March 2006 to October 2009. Mr. Clancy has been involved as General Manager and/or Chief Financial Officer in the pipeline construction industry in Canada and overseas for over thirty years. He has an Honours Commerce degree from the University of Toronto and is a member of the Canadian Institute of Chartered Accountants. Mr. Clancy presently sits on the board, and is Chairman, of the Audit Committee of Galantas Gold Corporation (a federal company listed on the TSX-V).

John Fitzgerald

Mr. Fitzgerald has over 20-years experience in the mining industry. Mr. Fitzgerald is Director of Mining at AuRico Gold Inc. (formerly, Northgate Minerals Corporation), an Ontario company. Prior thereto, Mr. Fitzgerald was: Associate Director at Scotia Capital Inc. company from 2010 to 2011; an independent consultant in Toronto and Brisbane, Australia from 2008 to 2010; Principal Adviser – Underground Mining with Rio Tinto Ltd., an Australian company in Brisbane from 2007 to 2008; and Manager, Engineering, at Barrick Gold Corporation, an Ontario company from 2004 to 2007; as well as engineer with various other mining companies from 1990. Mr. Fitzgerald holds a B. Eng. degree from Nottingham University and an MBA from Durham University, England.

26

Riyaz Lalani

Mr. Lalani is the Chief Operating Officer of Kingsdale Shareholder Services Inc., Canada’s largest and most active proxy solicitation and shareholder services advisory firm. He has been involved in, and led the client services teams tasked with, completing dozens of high profile client engagements, including hostile bids, complex M&A transactions and proxy contests. Mr. Lalani is frequently called upon to brief public issuers and their directors on shareholder engagement and corporate governance practices. Prior to joining Kingsdale, Mr. Lalani was employed by Acqua Capital Management LP (international asset management company) in New York and Toronto from 2003 to February 2010. Mr. Lalani worked in a variety of analytical, business development and operational roles at the firm, eventually heading up the overall research and operational efforts. Teamed with the Chief Investment Officer, he helped originate, negotiate and structure billions of dollars of direct and secondary market equity investments into small, mid and large cap public companies in North America, Asia, Europe and the Middle East. Mr. Lalani’s prior experience includes roles with two Canadian bank-owned investment dealers. He is also a director of Difference Capital Funding Inc. (formerly TriNorth Capital Inc.) (a federal company listed on the TSX-V) and was previously a director of URSA Major Minerals Incorporated (an Ontario company listed on the TSX).

Ken M. Strobbe

Mr. Strobbe has been a consultant since August 2011. He was employed at Barrick Gold Corporation, an Ontario company, as a Manager, Underground Projects, Capital Projects Group (January 2009 to August 2011) and Senior Engineer Operations, Corporate Group (May 2006 to January 2008) . From 2004 until 2006, Mr. Strobbe was a Production Planning Team Member, Integrated Business Systems at Placer Dome Inc. (now Barrick Gold Corporation). From 2001 until 2004, he was an Underground Supervisor and Production Planner at Placer Dome Canada’s Musselwhite Mine in Northern Ontario. Prior thereto, he held the position of Mine Engineer at the Lupin Mine (Echo Bay Mines Ltd., a mining company) and was a Senior Mine Engineer, Planning Engineer and Ventilation Engineer at the Giant Mine (Royal Oak Mines Ltd., a mining company). Mr. Strobbe has extensive experience in the areas of mine design, underground development and production planning and execution, and evaluating underground mining projects, including participation in scoping, pre-feasibility and feasibility studies. Mr. Strobbe holds a Bachelor of Applied Science (BASc.) in Mining Engineering from the University of British Columbia.

Paul G. Smith

Mr. Smith has been President, Chief Executive Officer since January 2009, Executive Vice President and Chief Financial Officer from December 2004 to December 2008 and a director of Equity Financial Holdings Inc. (listed on the TSX as (“Equity”), a financial services firm, whose principal subsidiary is Equity Financial Trust Company. Prior to Equity, Mr. Smith held management positions at BCE Inc., a federal company; served as Executive Assistant to the Prime Minister of Canada; and was an aide to the Minister of External Affairs and to the Minister of International Cooperation. He holds an MBA from INSEAD, an MPA from Carleton University, and undergraduate degrees (Accounting, Political Science) from the University of Ottawa. He is a graduate of the Directors Education Program of the Institute of Corporate Directors and holds the institute’s ICD.D designation. Mr. Smith is Chairman of the Board of VIA Rail Canada Inc., a position he has held since December, 2010, after serving as a director since 2006.

27

He is also a member of the board of directors of StorageVault Canada Inc., (a Canadian public company listed on the TSX-V).

Philip Gross

Mr. Gross possesses many years of experience in the commodities industry and has worked extensively in both the physical and financial aspects of the industry. Mr. Gross has previously worked for one of the largest global commodities supply chain management firms, where he was the Head of Non-Ferrous Metals. Mr. Gross managed the firm’s non-ferrous metals team from incubation to successful maturity and, ultimately, oversaw the firm’s relevant commercial operations in India, South Korea, Taiwan, Singapore, Venezuela, Brazil and Australia. Over the course of his career, Mr. Gross has assisted firms of various sizes in developing and sustaining their commodities portfolio management businesses.

Ike Makrimichalos