Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F:

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_______________

Anooraq Resources Corporation (the "Company" or "Anooraq") is incorporated in the Province of British Columbia, Canada. The condensed consolidated interim financial statements of the Company as at and for the three and nine months ended 30 September 2011 comprise the Company and its subsidiaries (together referred to as the “Group” and individually as “Group entities”) and the Group’s interests in associates and jointly controlled entities. Its principal business activity is the mining and exploration of Platinum Group Metals (“PGM”) through its mineral property interests. The Company focuses on mineral property interests located in the Republic of South Africa in the Bushveld Complex. Anooraq operates in South Africa through its wholly-owned subsidiary Plateau Resources (Proprietary) Limited (“Plateau”) which historically owned the Group’s various mineral property interests and conducted the Group’s business in South Africa.

The condensed consolidated financial statements are prepared on the basis that the Group will continue as a going concern which contemplates the realisation of assets and settlement of liabilities in the normal course of operations as they become due.

As a result of the acquisition of the operating mine in 2009, the Group secured various funding arrangements including securing a long-term credit facility, the Operating Cash Flow Shortfall Facility (“OCSF”), with Rustenburg Platinum Mines Limited (“RPM”) for an amount of $190.4 million (ZAR 1,470 million). The facility is used to fund operating cash and capital requirements for an initial period of three years. As at 30 September 2011, the Group utilised $131.6 million (ZAR 1,016 million), excluding interest, thereof to fund operating requirements from 1 July 2009 as the mining operations are not currently generating sufficient cash flows to fund operations and operational projects. The Group has no obligation to repay significant interest and capital on its outstanding loans and borrowings during 2011 and 2012.

As a result of securing the financial resources and long-term funding, management expects that cash flows from the mining operations and the OCSF will be sufficient to meet immediate ongoing operating and capital cash requirements of the Group.

The accounting policies applied by the Group in these condensed consolidated interim financial statements are the same as those applied by the Group in its consolidated financial statements as at and for the year ended 31 December 2010, except for the following standards and interpretations, applicable to the Group, adopted in the current financial period:

There was no significant impact on these condensed consolidated interim financial statements as a result of adopting these standards and interpretations.

Capital work-in-progress consists of mine development and infrastructure costs relating to the Bokoni mine and will be transferred to property, plant and equipment when the relevant projects are commissioned.

Capital work-in-progress is funded through cash generated from operations and available loan facilities.

The carrying value of the Group’s loans and borrowings changed during the period as follows:

On 28 April 2011, the Senior Term Loan Facility with Standard Chartered Bank (“SCB”) and FirstRand Bank acting through its division, Rand Merchant Bank (“RMB”) was ceded to Anglo Platinum Limited (“Anglo”) through its subsidiary, Rustenburg Platinum Mines Limited (“RPM”). The outstanding interest rate swap was settled with funding obtained from RPM.

The debt ceded to RPM has similar terms as the Senior Term Loan Facility except for certain revisions. The revised terms of the loan is a reduction in the interest rate from a 3 month JIBAR plus applicable margin (4.5%) and mandatory cost (11.735% at 31 December 2010) to 3 month JIBAR plus 4% (9.585% at 30 September 2011). The total facility has been increased from $107 million (ZAR 750 million) to $132.7 million (ZAR 930 million). The commencement of re-payments has been deferred by one year from 31 January 2013 to 31 January 2014. RPM has also waived the loan covenants on the debt until 30 June 2012.

Transaction costs capitalised of $4 million (ZAR 28 million) were written off to finance expense on the cession of the Senior Term Loan Facility.

Administration costs include the reclassification of the hedge reserve on settlement of the interest rate swap. The amount expensed was $2.6 million (ZAR18.6 million).

The Group has two reportable segments as described below. These segments are managed separately based on the nature of operations. For each of the segments, the Group’s CEO (the Group’s chief operating decision maker) reviews internal management reports monthly. The following summary describes the operations in each of the Group’s reportable segments:

The majority of operations and functions are performed in South Africa. An insignificant portion of administrative functions are performed in the Company’s country of domicile.

The CEO considers earnings before net finance expense, income tax, depreciation and amortisation (“EBITDA”) to be an appropriate measure of each segment’s performance. Accordingly, the EBITDA for each segment is included in the segment information. All external revenue is generated by the Bokoni Mine segment.

There have been no events that have occurred after the reporting date that would have a material impact on the reported results.

The basic and diluted loss per share for the three and nine months ended 30 September 2011 was 4 cents (2010: 4 cents) and 14 cents (2010: 8 cents) respectively.

The calculation of basic loss per share for the three months ended 30 September 2011 of 4 cents (2010: 4 cents) is based on the loss attributable to owners of the Company of $14,926,427 (2010: $15,495,792) and a weighted average number of shares of 424,764,699 (2010: 424,660,916).

The calculation of basic loss per share for the six months ended 30 September 2011 of 14 cents (2010: 8 cents) is based on the loss attributable to owners of the Company of $58,853,342 (2010: $33,319,336) and a weighted average number of shares of 424,764,699 (2010: 424,660,916).

Share options were excluded in determining diluted weighted average number of common shares as their effect would have been anti-dilutive.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

TA B L E O F C O N T E N T S

| 1.1 | Date | 2 |

| 1.2 | Overview | 4 |

| 1.3 | Market trends and outlook | 11 |

| 1.4 | Discussion of Operations | 12 |

| 1.5 | Liquidity | 15 |

| 1.6 | Capital resources | 16 |

| 1.7 | Off-Balance sheet arrangements | 17 |

| 1.8 | Transactions with related parties | 17 |

| 1.9 | Summary of quarterly results | 18 |

| 1.10 | Proposed transactions | 19 |

| 1.11 | Critical accounting estimates | 19 |

| 1.12 | Changes in accounting policies including initial adoption | 22 |

| 1.13 | Financial instruments and risk management | 22 |

| 1.14 | Other MD&A requirements | 29 |

| 1.15 | Internal controls over financial reporting procedures | 29 |

| 1.16 | Disclosure of outstanding share data | 30 |

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

1.1 Date

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited interim condensed consolidated financial statements for the three and nine months ended September 30, 2011 and the annual consolidated financial statements of Anooraq Resources Corporation (“Anooraq” or the “Company”) for the years ended December 31, 2010 and 2009, prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, which are publicly available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and on the U.S. Securities and Exchange Commission’s (“SEC”) Electronic Document Gathering and Retrieval System (“EDGAR”) at www.sec.gov.

Anooraq has prepared this MD&A with reference to National Instrument 51-102 “Continuous Disclosure Obligations” of the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, Anooraq is permitted to prepare this MD&A in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States.

Certain statements in this MD&A constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws. Investors should carefully read the cautionary note in this MD&A regarding forward-looking statements and should not place undue reliance on any such forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”.

As of January 1, 2009, Anooraq adopted IFRS and the following disclosure, as well as its associated unaudited interim condensed consolidated financial statements, has been prepared in accordance with IFRS as issued by the International Accounting Standards Board.

This MD&A is prepared as of November 14, 2011.

All dollar figures stated herein are expressed in Canadian dollars (“$”), unless otherwise specified.

Additional information about Anooraq, including Anooraq’s Annual Information Form for the fiscal year ended December 31, 2010 (“AIF”), which is included in the Annual Report of Anooraq on Form 40-F, can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This MD&A includes certain statements that may be deemed “forward-looking statements”. All statements in this MD&A, other than statements of historical facts, that address the proposed Bokoni Group restructure (as defined below) and refinancing of the Senior Debt (as defined below), potential acquisitions, future production, reserve potential, exploration drilling, exploitation activities and events or developments that Anooraq expects, are forward-looking statements. These statements appear in a number of different places in this MD&A and can be identified by words such as “anticipates”, “estimates”, “projects”, “expects”, “intends”, “believes”, “plans”, “will”, “could”, “may”, or their negatives or other comparable words. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Anooraq’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. Anooraq believes that such forward looking statements are based on material factors and reasonable assumptions, including assumptions that: the Bokoni Group restructure (as defined below) and

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

refinancing of the Senior Debt (as defined below) will complete on favourable terms and in a timely manner; the Bokoni Mine will increase production levels from the previous years; the Ga-Phasha, Boikgantsho, Kwanda and Platreef Projects exploration results will continue to be positive; contracted parties provide goods and/or services on the agreed timeframes; equipment necessary for construction and development is available as scheduled and does not incur unforeseen breakdowns; no material labor slowdowns or strikes are incurred; plant and equipment functions as specified; geological or financial parameters do not necessitate future mine plan changes; and no geological or technical problems occur.

Forward-looking statements, however, are not guarantees of future performance and actual results or developments may differ materially from those projected in forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include the failure to implement the Bokoni Group restructure (as defined below) and refinancing of the Senior Debt (as defined below) on favourable terms, or at all, fluctuations in market prices, the levels of exploitation and exploration successes, changes in and the effect of government policies with respect to mining and natural resource exploration and exploitation, continued availability of capital and financing, general economic, market or business conditions, failure of plant, equipment or processes to operate as anticipated, accidents, labor disputes, industrial unrest and strikes, political instability, insurrection or war, the effect of HIV/AIDS on labor force availability and turnover, and delays in obtaining government approvals. These factors and other risk factors that could cause actual results to differ materially from those in forward-looking statements are described in further detail under Item 6 “Risk Factors” in Anooraq’s AIF.

Anooraq advises investors that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to Anooraq or persons acting on its behalf. Anooraq assumes no obligation to update its forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law. Investors should carefully review the cautionary statements and risk factors contained in this and other documents that Anooraq files from time to time with, or furnishes to, applicable Canadian securities regulators and the SEC.

Cautionary Note to Investors Concerning Estimates of Measured and Indicated Resources

This MD&A uses the terms “measured resources” and “indicated resources”. Anooraq advises investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. Investors are cautioned not to assume that any part or all of mineral deposits in these categories, not already classified as reserves, will ever be converted into reserves. In addition, requirements of Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) for identification of “reserves” are not the same as those of the SEC, and reserves reported by us in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors should refer to the disclosure under the heading “Resource Category (Classification) Definitions” in Anooraq’s AIF.

Cautionary Note to Investors Concerning Estimates of Inferred Resources

This MD&A uses the term “inferred resources”. Anooraq advises investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of economic studies, except in rare cases. Investors are cautioned not to assume that any part or all of an inferred resource exists, or is economically or legally mineable. Investors should refer to the disclosure under the heading “Resource Category (Classification) Definitions” in Anooraq’s AIF.

Anooraq Resources Corporation is engaged in mining, exploration and development of platinum group metals (“PGM”) mineral deposits located in the Bushveld Igneous Complex (“BIC”), South Africa. The BIC is the world’s largest platinum producing geological region, producing in excess of 75% of the annual primary platinum supply to international markets.

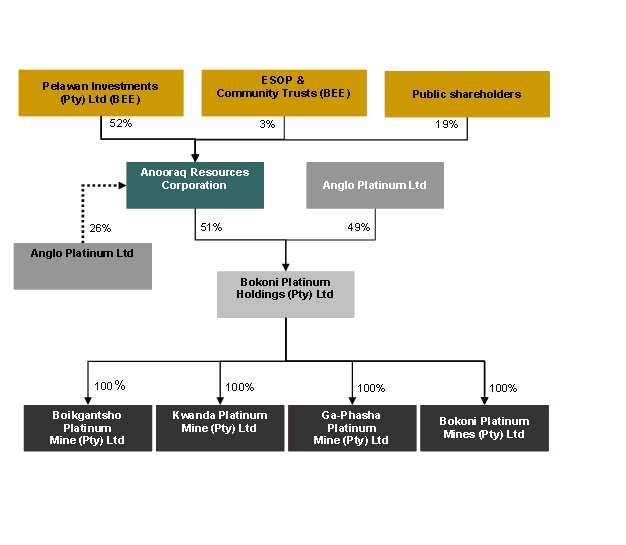

Effective July 1, 2009, the Company transformed from an exploration and development company into a PGM producer. Anooraq, through its wholly owned South African subsidiary Plateau Resources (Proprietary) Limited (“Plateau”), acquired an indirect 51% controlling interest and management control of Bokoni Platinum Mines (Proprietary) Limited (“Bokoni”) (formerly Lebowa Platinum Mine) and several PGM projects, including the advanced stage Ga-Phasha PGM Project (“Ga-Phasha Project”), the Boikgantsho PGM Project (“Boikgantsho Project”), and the early stage Kwanda PGM project (“Kwanda Project”) collectively, with Anooraq and its subsidiaries, the “Anooraq Group”. These controlling interests were acquired through Plateau acquiring 51% of the shareholding of Bokoni Platinum Holdings (Proprietary) Limited (“Bokoni Holdco”), the holding company of Bokoni and the other project companies (“Bokoni Group”) on July 1, 2009, referred to as “the Bokoni Transaction”.

Anooraq’s objective is to become a significant PGM group with a substantial and diversified PGM asset base, including producing and exploration assets. The acquisition of the controlling interest in Bokoni Holdco is the first stage of advancing the Anooraq Group’s PGM production strategy and has resulted in the Anooraq Group controlling a significant mineral resource base of approximately 200 million PGM ounces, the third largest PGM mineral resource base in South Africa. Of this, approximately 102 million PGM ounces is directly attributable to Anooraq. On implementation of the Bokoni Transaction, Anooraq assumed management control over the Bokoni Group operations. Anglo Platinum Limited (“Anglo Platinum”), a subsidiary of Anglo American plc, through its wholly owned subsidiary Rustenburg Platinum Mines Limited (“RPM”), retained a 49% non-controlling interest in Bokoni Holdco. The resultant Anooraq Group simplified corporate structure is depicted below:

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

Anooraq Resources Corporate Structure

The above corporate structure is illustrated on a fully diluted share basis, post conversion of the B preference shares.

Plateau is an indirect wholly owned South African subsidiary of Anooraq. Plateau owns the 51% shareholding in Bokoni Holdco.

The following are key financial performance highlights for the Anooraq Group for the three months ended September 30, 2011 (“Q3 2011”):

| · | Anooraq had an operating loss of $14.5 million and a loss before tax of $34.4 million for Q3 2011, compared to an operating loss of $16.0 million and a loss before tax of $34.7 million for the three months ended September 30, 2010 (“Q3 2010”). The reduced operating loss is the result of increased production, offset by escalating production costs at the Bokoni mine. |

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

| · | The net loss (after tax) was $27.9 million for Q3 2011 as compared to a net loss (after tax) of $28.1 million for Q3 2010. The reduced loss is mainly as a result of higher production, offset by escalating production costs and higher administrative and financing costs. |

| · | The basic and diluted loss per share for Q3 2011 was $0.04 as compared to $0.04 for Q3 2010. The basic and diluted loss per share is based on the loss attributable to the owners of the company of $14.9 million for Q3 2011 as compared to $15.5 million for Q3 2010. |

| · | During Q3 2011 the Bokoni mine produced 33,499 platinum, palladium, rRhodium and gold (“4E”) ounces as compared to 28,868 4E ounces during Q3 2010. The higher 4E ounces produced contributed to the reduced operating loss. |

| · | Anooraq had cash outflows of $3.4 million for Q3 2011 as compared to cash inflows of $0.2 million for Q3 2010, which is a net decrease of $3.6 million. |

| · | During the three months ended March 31, 2011 (“Q1 2011”) Anooraq and Anglo Platinum entered into discussions surrounding a potential transaction. The discussions involved a strategic review by the parties of the Bokoni Holdco assets, capital and financing structures, with a view to effecting a group restructure and refinancing transaction (the “Bokoni Group restructure”). Pursuant to these discussions Anooraq has unwound its interest rate hedge transaction with Standard Chartered Bank (“SCB”) and Anglo Platinum has taken cession of Anooraq’s senior loan obligations (the “Senior Debt”) with SCB and Rand Merchant Bank (“RMB”), a division of FirstRand Bank Limited. SCB and RMB (the “Senior Lenders”) agreed with Anooraq and Anglo Platinum that Anglo Platinum’s subsidiary, RPM will acquire the outstanding debt and related future funding obligations from the Senior Lenders in full, effective as of April 28, 2011, with definitive agreements relating to the Senior Debt to be finalized with Anglo Platinum. The outstanding amount of debt acquired by RPM was $92.3 million (ZAR 643 million). RPM also provided funding of $3.7 million to the Company for the costs associated with the unwinding of the interest rate hedge. |

Black Economic Empowerment

Pelawan Investments (Pty) Ltd (“Pelawan”), Anooraq’s majority shareholder, is a broad based Black Economic Empowerment (“BEE”) entity. Through the Pelawan shareholding, Anooraq remains compliant with the BEE equity requirements as contemplated by South African legislation and its associated charters regarding BEE equity holding requirements.

Environmental Matters

The South African National Environmental Management Act 107 of 1998 (“NEMA”), which applies to all prospecting and mining operations, requires that these operations be carried out in accordance with generally accepted principles of sustainable development. It is a NEMA requirement that an applicant for a mining right must make prescribed financial provision for the rehabilitation or management of negative environmental impacts, which must be reviewed annually. The financial provisions deal with anticipated costs for:

| · | Planned decommissioning and closure |

| · | Post closure management of residual and latent environmental impacts |

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

In respect of Bokoni (discussed in section 1.2.1), an external assessment to determine the environmental closure liability was undertaken in July 2010. As at September 30, 2011, the total environmental rehabilitation liability for Bokoni, in current monetary terms (undiscounted), was estimated to be $11.8 million.

Annual contributions are made to a dedicated environmental trust fund to fund the estimated cost of rehabilitation during and at the end of the mine’s life.

As at September 30, 2011, the amount invested in the environmental trust fund was $2.9 million (ZAR 22.2 million) as compared to $3.1 million (ZAR 21.4 million) as at June 30, 2011. The reason for the decrease is as a result of the weakening ZAR:$ exchange rate. The shortfall of $8.9 million between the funds invested in the environmental trust fund and the estimated rehabilitation cost is covered through a guarantee from Anglo Platinum.

Anooraq’s mining and exploration activities are subject to extensive environmental laws and regulations. These laws and regulations are continually changing and are generally becoming more restrictive. The Anooraq Group has incurred, and expects to incur in future, expenditures to comply with such laws and regulations, but cannot predict the full amount of such future expenditures. Estimated future reclamation costs are based principally on current legal and regulatory requirements.

1.2.1 Bokoni Mine

Bokoni is an operating mine located on the north eastern limb of the BIC, to the north of and adjacent to the Ga-Phasha Project. The Bokoni property consists of two “new order” mining licenses covering an area of 15,459.78 hectares. The mining operation consists of a vertical shaft and three decline shaft systems to access underground mine development on the Merensky and UG2 reef horizons. Bokoni has installed road, water and power infrastructure, as well as two processing concentrators, sufficient to meet its operational requirements up to completion of its first phase growth plans in 2014. Bokoni has an extensive shallow ore body, capable of supporting a life-of-mine plan in excess of 50 years. Current mining operations are being conducted at shallow depths, on average 200m below surface. This benefits the Bokoni mine’s operations in that there are no major refrigeration (and consequent power) requirements at shallower mining depths.

Bokoni’s production for Q3 2011 averaged 100,974 tonnes milled per month (“tpm”) of ore from its UG2 and Merensky reef horizons, an increase of 14% over Q2 2011 production. UG2 production is mined exclusively from the Middelpunt Hill shaft (“MPH”) which consists of 4 adits and 2 underground levels. Merensky ore is produced from three shafts, namely: Vertical shaft, UM2 shaft and Brakfontein shaft. The Vertical shaft, which started in 1973, is the oldest of the three shafts and currently accounts for the bulk of the Merensky production. Production at Vertical shaft is expected to be maintained at 35,000 tpm for the medium term. Merensky production from the UM2 shaft is expected to be maintained at its current production levels of 10,000 tpm over the next three years. The new Brakfontein shaft is in a ramp up phase and is planned to increase from its current production levels of 30,000 tpm, to a steady state production level of 120,000 tpm by 2018 (previously 2016 – extended as a result of a change in the life of mine plan). On completion of the initial ramp up phase to 2016, it is anticipated that Bokoni will produce 160,000 tpm of ore (240,000 PGM ounces per annum) consisting of 120,000 tpm from the Merensky reef and 40,000 tpm from the UG2 reef.

Given the magnitude of Bokoni’s ore body, lying open at depth with its numerous attack points, management is of the view that Bokoni has the potential to be developed into a 375,000 tpm (570,000 PGM ounces per annum) steady state operation in the medium to longer term.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

The older Vertical and UM2 shafts make use of conventional mining methods for narrow tabular ore bodies. Ore broken in stopes is transported laterally by means of track bound equipment and then hoisted through a vertical shaft system at Vertical shaft and an incline shaft system at UM2 shaft. Bokoni will invest in maintenance of infrastructure at Vertical shaft to sustain mining at current rates for the next four to five years. Additional opportunities, such as vamping, will be employed to supplement volumes from these shafts. Further opportunities to increase the life-of-mine of these shafts will also be investigated in the short to medium term.

The new Brakfontein shaft is being developed on a semi-mechanized basis, using a hybrid mining method, whereby ore broken in stopes is loaded directly onto a strike conveyor belt and taken out of the mine through a main decline conveyer belt system. This results in less human intervention in the hoisting process and a resultant lower unit operating cost of production. Development of haulages and crosscuts are effected by means of mechanized mining methods, and stoping is conducted using hand held electric drilling machines.

The MPH shaft is in the process of converting the transport of broken ore from its current mechanized hauling system to a conveyor belt transport system similar to that of Brakfontein shaft. Vamping opportunities in the older adit areas are being investigated to supplement underground mining production.

Bokoni, at the current metal prices and United States Dollar (“US$”) exchange rate against the South African Rand (“ZAR”), is cash flow negative at an operational level (before depreciation and interest expense) as a result of the ramp up phase of the mine and operational issues (underperformance at certain shafts) currently being experienced. Bokoni plans to become cash flow positive after capital expenditure towards the end of 2011 if production levels increase and the commodity prices for the PGM basket and US$ exchange rate against the ZAR continue at current levels.

Management of the Bokoni Operations

Plateau and RPM entered into a shareholders’ agreement (the “Bokoni Holdco Shareholders Agreement”) to govern the relationship between Plateau and RPM, as shareholders of Bokoni Holdco, and to provide management to Bokoni Holdco and its subsidiaries, including Bokoni.

Plateau is entitled to nominate the majority of the directors of Bokoni Holdco and Bokoni, and has undertaken that the majority of such nominees will be Historically Disadvantaged Persons (“HDPs”) in South Africa. Anooraq has given certain undertakings to Anglo Platinum in relation to the maintenance of its status as an HDP controlled group pursuant to the Bokoni Holdco Shareholders Agreement.

Pursuant to the Bokoni Holdco Shareholders Agreement, the board of directors of Bokoni Holdco, which is controlled by Anooraq, has the right to call for shareholder contributions, either by way of a shareholder loan or equity. If a shareholder should default on an equity cash call, the other shareholder may increase its equity interest in Bokoni Holdco by funding the entire cash call, provided that, until the expiry of a period from the closing date of the Bokoni Transaction until the earlier of (i) the date on which the BEE credits attributable to the Anglo Platinum group and/or arising as a result of the Bokoni Transaction become legally secure, and (ii) the date on which 74% of the scheduled principal repayments due by Plateau pursuant to the Senior Debt facility are made in accordance with the debt repayment profile of the Senior Debt facility (the "Initial Period"), Plateau's shareholding in Bokoni Holdco cannot be diluted for default in respect of equity contributions.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

On April 28, 2011, the Senior Debt Lenders, SCB and RMB, agreed with Plateau and Anglo Platinum that Anglo Platinum’s subsidiary RPM would acquire the outstanding amounts from the Senior Lenders in full, as Anglo Platinum indicated that it is willing to provide funding on more flexible terms and conditions and with more favourable pricing going forward. Pursuant to a broader refinancing transaction contemplated between Anglo Platinum and the Anooraq Group, effective April 28, 2011, RPM assumed all of the rights and obligations of SCB and RMB under the Senior Debt facility (See the discussion in Section 1.5 – Liquidity).

Pursuant to the terms of the shared services agreements, Anglo Platinum provides certain services to Bokoni at a cost that is no greater than the costs charged to any other Anglo American plc group company for the same or similar services. It is anticipated that, as Anooraq builds its internal capacity and transforms into a fully operational PGM producer, these services will be phased out and will be replaced either with internal or third party services. The Anooraq Group, through Plateau, provides certain management services to Bokoni pursuant to service agreements entered into with effect from July 1, 2009.

Sale of Concentrate

Bokoni produces a metal-in-concentrate, all of which is sold to RPM pursuant to a sale of concentrate agreement entered into between Bokoni and RPM. This agreement has an initial five year term to July 1, 2014 and Plateau has the right to extend this agreement for a further five year term to July 1, 2019.

Pursuant to the sale of concentrate agreement, RPM receives metal-in-concentrate from Bokoni and pays for such metal based upon a formula equal to a percentage of the spot prices for the various metals contained in the concentrate delivered, including precious and base metals, less certain treatment charges and penalties (if applied).

In addition, the Bokoni Holdco shareholders agreement also governs the initial sale of concentrate from the Ga-Phasha Project upon commencement of production.

1.2.2 Ga-Phasha Project

An updated mineral resource estimate for the Ga-Phasha project was previously disclosed in the MD&A for the year ended December 31, 2010 and is available on www.sedar.com. In 2011, management will focus on reviewing and updating the planning and economic parameters for a feasibility study.

1.2.3 Platreef Exploration Properties, Northern Limb

Anooraq holds interests in mineral rights (or “farms”) covering 37,000 hectares that make up the Central Block, the Rietfontein Block and the Boikgantsho and Kwanda Projects (see below), collectively, known as the Platreef Properties.

Rietfontein Block

The Anooraq Group has entered into a settlement agreement (the “Settlement Agreement”) effective December 11, 2009 with Ivanhoe Nickel & Platinum Ltd. (“Ivanplats”) to replace and supersede the 2001 agreement relating to the Rietfontein property located on the northern limb of the BIC. The Settlement Agreement settles the arbitration process relating to disagreements with respect to the

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

exploration activities undertaken at the Rietfontein property. Salient terms of the Settlement Agreement are as follows:

| · | Both parties abandon their respective claims under dispute forming the subject matter of arbitration. |

| · | The existing joint venture (“JV”) between the parties is amended such that the current Rietfontein JV is extended to incorporate a defined area of Ivanplats’ adjacent Turfspruit mineral property. Both parties retain their existing prospecting rights in respect of mineral properties in their own names but make these rights and technical information available to the extended JV (“the Extended JV”). |

| · | Anooraq will be entitled to appoint a member to the Extended JV technical committee and all technical programmes going forward will be carried out with input from Anooraq. |

| · | Anooraq is awarded a 6% free carried interest in the Extended JV, provided that the Extended JV contemplates an open pit mining operation, incorporating the Rietfontein mineral property. Anooraq has no financial obligations under the Extended JV terms and Ivanplats is required to fund the entire exploration programme to feasibility study with no financial recourse to Anooraq. On delivery of the feasibility study, Anooraq may elect to either: |

| - | retain a participating interest of 6% in the Extended JV and finance its pro rata share of the project development going forward; or |

| - | relinquish its participating interest of 6% in the Extended JV in consideration for a 5% net smelter return royalty in respect of mineral products extracted from those areas of the Rietfontein mineral property forming part of the Extended JV mineral properties. |

Central Block

The Central Block consists of five farms or portions thereof, comprising a portion of Dorstland 768LR, Hamburg 737 LR, Elandsfontein 766 LR, Molokongskop 780 LR and Noord Holland 775 LR.

The Anooraq Group is currently evaluating its approach to properties on the Central Block, which may include potential joint venture relationships with third party exploration companies.

Kwanda Project

The Anooraq Group intends to continue its existing prospecting programs at the Kwanda mineral properties in 2011 at a cost of approximately $0.2 million per annum.

1.2.4 Boikgantsho Project

Management has commenced a prefeasibility study of the Boikgantsho project. The prefeasibility will occur in phases, with phase 1 focusing on re-logging of a significant portion of the exploration drill holes. On completion of the re-logging exercise, management was informed that there was no correlation between the lithologies logged and the mineralized horizons. Furthermore, some lithologies were incorrectly identified. Management decided that a new geological model should be constructed and this necessitated that all the boreholes should be re-logged in order to develop a robust geological model that would include a correlation between lithology and mineralization.

The re-logging of all the boreholes has resulted in a change of scope of the project. The re-logging was completed during Q2 2011. The additional cost for the re-logging is approximately $0.1 million (ZAR1.1 million) resulting in the project cost for phase 2 increasing to $1.5 million (ZAR11.3 million).

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

A preliminary geological model was completed in Q1 2011. Management has commenced a prefeasibility study.

1.3 Market Trends and Outlook

Quarterly Trends

Q3 2011 market trends continued similar to Q2 2011 with another quarter of volatility for PGM based stocks within the context of highly volatile world markets, fuelled by the Eurozone debt crisis and general uncertainty in economic growth prospects, through continued mixed economic data throughout the period. Sovereign risk concerns, primarily surrounding Eurozone sovereign credit risk, stimulated primarily by the Greek debt crisis, continues to place speculation on the future of Eurozone consumer demand, which has a continuing negative impact on fundamentals surrounding the PGM demand thesis. Towards the end of Q3 2011 we witnessed a significant downward trend in PGM spot prices, largely exacerbated by investor sell offs in Exchange Traded Funds (“ETFs”) and, in particular, Palladium ETFs.

From a South African PGM producer perspective, the reduction in spot PGM prices has, to some extent, been offset by a weakening Rand to the US dollar during the period. However, the net result of decreasing metal prices with a weakening Rand has meant that the Rand PGM basket price for South African producers has remained relatively static through the quarter, which is a concern against the backdrop of a 10% average wage inflation increase in the South African PGM industry and other inflationary cost pressures, including increasing power charges.

Outlook

The biggest short term influence on the PGM markets will be the outcome of the current discussions surrounding the Eurozone debt crisis and the proposed solution to such crisis. With a number of Eurozone economies facing significant debt challenges and having to adopt austerity packages relating to spending, this may have a negative influence on the Eurozone demand thesis for consumer goods and credit. This may have a direct negative impact on auto demand and platinum demand for usage in the Eurozone economies, which hold a bias for platinum usage in diesel auto catalysts, as the Eurozone is 60% dominated by diesel car engines. With China and the US consumer spending in the auto space still playing a dominant role, the US and Chinese economic data will impact trend outlooks for consumer spending and manufacturing in the auto space.

Although the risk of strike action in South Africa having a potential negative impact on PGM production from the region has largely dissipated, certain South African PGM producers remain in talks with unionised labour which, if unsuccessfully concluded, could result in potential strike action in the South African PGM sector with consequent impact on production.

Based on current economic conditions, as discussed above, management believes that South African PGM producers will remain under pressure from a margin perspective in the near term, until consumer confidence and spending improves, especially in the Eurozone. To a large extent the PGM sector will remain reliant on emerging market economies (Brazil, Russia, India and China (“BRICs”)) for real demand growth in the short to medium term, until the traditional strong consumer demand economies of the United States and Europe return to economic indicator levels last seen in 2008, before the global financial crisis.

In the current economic environment management believes that it is imperative that the Company retain focus on cost containment and continue to improve on production volumes and trends in order to position the Company well for the next upward trend in the precious metals market which,

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

traditionally, is a late cycle recovery process.

1.4 Discussion of Operations

Tonnage and secondary development performance for Q3 2011 was higher than in Q3 2010. Though square metres mined for Q3 2011 was only marginally higher than Q3 2010, tons milled increased by 20% year on year. Performance at the concentrator slightly improved, with the recovered grade being 3% higher for Q3 2011 than for Q3 2010. The increase in tons milled and improved recoveries resulted in a Q3 2011 increase of 14% with respect to 4E ounces produced. Safety performance at the operations for Q3 2011 improved significantly as compared to Q3 2010. The number of lost time injuries decreased by 16% from Q3 2010 to Q3 2011. No fatal accidents were incurred during Q3 2011.

Though tons milled for the 9 months ended September 30, 2011 increased by 3% compared to the same period for 2010, 4E ounces produced was marginally lower.

The key production parameters for Bokoni for Q3 2011 and for the 9 months ended September 30, 2011 are depicted in the table below.

Bokoni Production Statistics:

| | | Q3 2011 | Q3 2010 | % Change | YTD 2011 | YTD 2010 | % Change | Total 2010 (12 months) |

| 4E oz produced | Oz | 33,499 | 28,829 | 16 | 84,309 | 85,349 | (1) | 116,164 |

| Tonnes milled | T | 302,923 | 252,862 | 20 | 789,780 | 765,843 | 3 | 1,044,084 |

| Built-up head grade | g/t milled,4E | 3.73 | 4.11 | (9) | 3.79 | 5.1 | (26) | 4.12 |

| UG2 mined to total output | % | 14.3 | 30.0 | (52) | 21.9 | 40.1 | (45) | 32.0 |

| Development meters | M | 2,600 | 2,840 | (8) | 7,451 | 8,771 | (15) | 10,292 |

| R/t operating cost/ton milled | ZAR/t | 1,086 | 1,034 | 5 | 1,165 | 964 | (21) | 989 |

| R/4E operating cost/4E oz | ZAR/4E oz | 9,820 | 9,057 | (8) | 10,910 | 8,644 | (26) | 8,888 |

| Total permanent labor (mine operations) | Number | 3,530 | 3,475 | 2 | 3,530 | 3,475 | 2 | 3,426 |

| Total contractors (mine operations) | Number | 1,536 | 1,199 | 28 | 1,536 | 1,199 | 28 | 1,690 |

Revenue

The mine concentrator milled 302,923 tonnes in Q3 2011, which is 20% higher than the 252,862 tonnes milled in Q3 2010. As a result of the higher tonnes milled, the mine produced more 4E ounces than in Q3 2010.

| · | Revenue from the sale of concentrate for Q3 2011 was $45.3 million (ZAR 327.6 million) compared to Q3 2010 of $34.5 million (ZAR 242.3 million). The increase in revenue of $10.8 million is mainly due to higher 4E ounces produced. |

| · | The PGM basket price for Q3 2011 was 18% higher than the basket price achieved for Q3 2010. The basket price for Q3 2011 was US$1,414 (ZAR 10,102) compared to US$1,202 (ZAR 8,804) for Q3 2010. |

Revenue for the 9 months ended September 30, 2011 was $111.9 million (ZAR 798.1 million)

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

compared to the 9 months ended September 30, 2010 of $105.0 million (ZAR 756.2 million). The increase in revenue of 7% is mainly as a result of the increase in PGM basket prices.

Cost of Sales

Cost of sales of $55.0 million for Q3 2011 was $10.5 million higher than Q3 2010’s cost of sales of $44.5 million. The main reasons were as follows:

| · | Labour costs for Q3 2011 increased by $3.1 million (16%) compared to Q3 2010. The increase in costs was due to the annual salary increases that took place in July 2011 and increased overtime hours. |

| · | Contractor costs for Q3 2011 increased by $3.0 million (134%) compared to Q3 2010. The increases was mainly due to: |

| o | Brakfontein – the appointment of FHL Contracting (Pty) Ltd and Highpoint Trading 663 CC to carry out re-development, sub-development, equipping, vamping and white area stoping and the increase in the development footprint out of capital into operating expenditure; |

| o | Middelpunt – the appointment of Fermel (Pty) Ltd to maintain the Load-Haul-Dump (LHD) fleet acquired during 2010; |

| o | Vertical – the appointment of Highpoint Trading 663 CC to carry out re-development and sub-development; and |

| o | UM2 – increase in mining activity with the continued use of Manniken (MMM) as contractors. |

| · | Store costs for Q3 2011 increased by $2.9 million (45%) compared to Q3 2010. The increase in costs was mainly attributable to an increase in square meters and development meters mined. During 2011, additional focus was placed on ensuring panels were available for stoping resulting in additional equipping costs. The remaining store cost increase was attributable to the concentrator which increased critical spares on liners and mechanical spares. |

On a cost per ton basis, production cost for Q3 2011 was US$149 (ZAR 1,086) per ton as compared to US$141 (ZAR 1,034) per ton for Q3 2010, a US$ increase of 6% (increase of 5% in ZAR, which is the functional currency of the Bokoni Mine). The increase is a result of the reasons discussed above.

Cost of sales of $157.4 million for the 9 months ended September 30, 2011 was $36.4 million higher than the $121.0 million for the 9 months ended September 30, 2010.

On as cost per ton basis, production cost for the 9 months ended September 30, 2011 was US$ 163 (ZAR 1,165) per ton as compared to US$ 134 (ZAR 964) per ton for the 9 months ended September 30, 2010, a US$ increase of 22% (increase of 21% in ZAR). This increase is a result of increases in labour cost (increases in rates and overtime hours), contractor cost (additional companies contracted to carry out re- and sub-developent) and stores cost.

Exchange rate

For presentation purposes currencies of the South African subsidiaries are converted from ZAR to $. The average ZAR to $ exchange rate for Q3 2011 was ZAR 7.29=$1, a weakening of 3.4% compared to the average exchange rate for Q3 2010 of ZAR 7.04=$1. The average ZAR to $ exchange rate for the 9 months ended September 30, 2011 was ZAR 7.14=$1, a strengthening of 1% compared to the average exchange rate for the 9 monthe ended September 30, 2010 of ZAR 7.20=$1.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

Finance expense

Finance expense for Q3 2011 was $20.1 million compared to $18.9 million in Q3 2010. The increase in the OCSF (as defined below) draw downs and compounded interest on the funding loan facilities contributed to the increased interest expense. The proceeds from the OCSF draw downs are used to fund operational costs and capital requirements. The finance expenses of $63.6 million for the 9 months ended September 30, 2011 was $17.1 million higher than the $46.5 million for the 9 months ended September 30, 2010.

Safety

No fatal accidents were recorded for Q3 2011. The Anooraq Group’s Lost Time Injury Frequency Rate (“LTIFR”) decreased to 1.66 in Q3 2011 from 1.33 in Q3 2010. Management remains committed to safety at the operations. Active engagement with the South African Department of Mineral Resources on safety matters continues.

Capital

Total capital expenditure for Q3 2011 was $5.9 million (as opposed to $7.1 million for Q3 2010), comprising 50% sustaining capital and 50% project expansion capital (as opposed to 2% sustaining capital and 98% project expansion capital for Q3 2010).

For the 9 months ended September 30, 2011 total capital expenditure was $21.9 million (as opposed to $19.2 million for the 9 months ended September 30, 2010), and this comprised of 47% sustaining capital and 53% project expansion capital (as opposed to 5% sustaining capital and 95% project expansion capital for the 9 months ended September 30, 2010).

Royalties: Implementation of the Mineral and Petroleum Resources Royalty Act, 2008 (Act no. 28 of 2008)

The Mineral and Petroleum Resources Royalty Act (the “Act”), imposes a royalty payable to the South African government based upon financial profits made through the transfer of mineral resources.

The royalty is based on a predetermined percentage applied to gross sales of unrefined metal produced. The predetermined percentage is equal to 0.5 + [(EBIT (earnings before interest and tax) x 9)/gross sales]. The percentage cannot be less than 0.5%.

The royalty is accounted for on a monthly basis in the accounting records of Bokoni Platinum Mines (Pty) Ltd.

The payments in respect of the royalty are due in three intervals:

| · | six months into the financial year (June 30) – calculation based on actual and estimated figures, and a first provisional payment based on this; |

| · | twelve months into the financial year (December 31) – calculation based on actual and estimated figures, and a second provisional payment based on this; and |

| · | six months after the financial year (June 30) – true up calculation done, and a final payment. |

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

The calculated royalty tax percentage for Bokoni was the minimum percentage of 0.5% (2010 0.5%), and the resulting royalty expense for Q3 2011 amounted to $0.2 million ($0.5 million for the 12 months of 2010). For the 9 months ended September 30, 2011 the royalty expense was $1.0 million as compared to $0.5 million for the 9 months ended Septembe 30, 2010.

Power Tariff Increases

The National Energy Regulator of South Africa released its decision on Eskom’s tariff increase applications during 2010. The effect of this decision is that power tariff increases in South Africa will be effected over a three year period as follows:

| 2010/2011 | : | 24.8% |

| 2011/2012 | : | 25.1% |

| 2012/2013 | : | 25.9% |

The net effect of this decision is that current power input costs at mining operations in South Africa will increase by approximately 100% over the three year period from April 1, 2010. Bokoni operations are currently mining at relatively shallow depths with no major refrigeration requirements needed for the next 30 years of mining. Power costs currently comprise between 5% (summer tariffs) and 8% (winter tariffs) of total operating costs at the mine operations. Accordingly, the recently announced power rate increases will increase operating costs by between 5% and 8% over a three year period from April 1, 2010. Bokoni continues to focus efforts on power usage reduction as part of the efficiency improvement initiatives currently being implemented at the operations.

1.5 Liquidity

At September 30, 2011, the Anooraq Group had positive working capital, excluding restricted cash, of $27.9 million compared to negative working capital of $64.1 million as at December 31, 2010. At December 31, 2010, the Anooraq Group did not meet certain covenants specified in the Senior Debt agreements. As a result, the related obligation was reflected as due in less than one year. During the first quarter of 2011, the Senior Lenders waived their rights and entitlements arising from the failure of the Anooraq Group to meet the specific covenants. Therefore, the Senior Debt was reclassified as long term debt at March 31, 2011 as there was no legal or constructive obligation to settle the debt within the next 12 months.

On April 28, 2011, the Senior Debt Lenders, SCB and RMB ceded the outstanding amounts under the Senior Debt Facility of $92.3 million to RPM. RPM also provided funding of $3.7 million to the Company to unwind the interest rate hedge. The terms of the ceded debt to RPM are similar to that of the Senior Debt Facility except for certain provisions. The revised terms of the loan is a reduction in the interest rate from a 3 month JIBAR plus applicable margin (4.5%) and mandatory costs (11.375% at December 31, 2010) to 3 month JIBAR plus 4% (9.585% at September 30, 2011). The total facility has been increased from $97.1 million (ZAR 750 million) to $120.4 million (ZAR 930 million). The commencement of re-payments has been deferred by one year from January 31, 2013 to January 31, 2014. RPM has waived the loan covenants of the debt until June 30, 2012.

The Anooraq Group has the following long-term contractual obligations as at September 30, 2011:

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

| | Payments due by period ($ million) |

| | Total | Less than one year | 2 to 3 years | 4 to 5 years | More than 5 years |

| Capital commitments | 9.7 | 9.7 | - | - | - |

Long-term debt (1) scheduled interest payments | 1,138.3 | 0.5 | 1.0 | 642.5 | 494.3 |

Operating lease commitments (2) (((2) | 0.3 | 0.3 | - | - | - |

Purchase obligations (3) | 14.5 | 2.9 | 6.4 | 5.2 | - |

| Total | 1,162.8 | 13.4 | 7.4 | 647.7 | 494.3 |

| (1) | The Company’s long-term debt obligations, which include scheduled interest payments, are denominated in ZAR. Payments and settlement on the obligation are denominated in ZAR. Long-term obligations have been presented at an exchange rate of $1 = ZAR 7.722. |

| (2) | The Company has routine market-related leases on its office premises in Johannesburg, South Africa. |

| (3) | The term “purchase obligation” means an agreement to purchase goods or services that is enforceable and legally binding on the Company that specifies all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. |

The Anooraq Group expects that the cash flows from the mining operations and the financing secured through the OCSF, combined with cash on hand, will be sufficient to meet the immediate ongoing operational and capital cash requirements of the Anooraq Group.

The Anooraq Group’s major cash commitments for the next year relate to its obligation to fund project expansion capital requirements at Bokoni. As noted earlier, Anooraq is in discussions with Anglo Platinum involving a strategic review of its asset, capital and financing structures, with a view of effecting a group restructure and refinancing transaction.

1.6 Capital Resources

Anooraq’s sources of capital are primarily debt.

The Anooraq Group’s access to capital sources is dependent upon general commodity and financial market conditions. The Anooraq Group has secured long-term funding to meet its operating and capital obligations through to the end of 2012. (See Section 1.13 – Financial Instruments and Risk Management – Debt Arrangements). The Anooraq Group’s cash balance as at September 30, 2011 was $15.8 million.

In addition to its cash resources, the Anooraq Group has access to various committed debt facilities from Anglo Platinum. All of the Anooraq Group’s debt facilities have been negotiated such that it is not obliged to commence with mandatory repayments of any loan capital amounts drawn and/or any refinancing of these loans during the holiday period through January 31, 2013, while it has management control at Bokoni. As discussed in section 1.5, management is in discussions with Anglo Platinum to initiate a refinancing to be implemented in the short-term.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

A summary of the Anooraq Group’s debt facilities as at September 30, 2011, is as follows:

| | Balance at September 30, 2011 | Total available facility | Un-utilized portion of facility |

| | $ million |

OCSF (1) | 158.2 | 190.4 | 58.8 |

| RPM funding loan | 173.4 | 236.1 | 62.7 |

| “A” preference share facility | 385.8 | 385.8 | - |

| RPM interest free loan | 3.7 | 3.7 | - |

| Other | 4.3 | 4.3 | - |

| Total | 725.4 | 820.3 | 134.9 |

| (1) | The balance of the OCSF includes interest, whereas the total available facility and un-utilized portion of the facility excludes interest. |

In addition to the facilities above, Anglo Platinum made available to Plateau a standby facility for up to a maximum of 29% of Bokoni cash flows, which Plateau may use to fund any cash flow shortfalls that may arise in funding any accrued and capitalized interest and fund repayment obligations under the Debt Facility during its term.

See a discussion of these debt facilities in Section 1.13 under the subheading “Debt Arrangements”. Also refer to Section 1.5 for a discussion of the cession of the Senior Debt.

Anooraq’s ability to raise new equity in the equity capital markets is subject to the mandatory requirement that Pelawan, its majority BEE shareholder, retain a 51% fully diluted shareholding in the Company up until January 1, 2015, as required by covenants given by Pelawan and Anooraq in favour of the Department of Mineral Resources (“DMR”), the South African Reserve Bank and Anglo Platinum. Under current circumstances, there is minimal availability for the Company to issue additional equity.

1.7 Off-Balance Sheet Arrangements

The Anooraq Group has not entered into any off-balance sheet transactions.

1.8 Transactions with Related Parties

The Anooraq Group concluded a number of agreements with respect to services at Bokoni with RPM, a wholly owned subsidiary of Anglo Platinum and 49% shareholder in Bokoni Holdco, on March 28, 2008. These agreements were amended on May 13, 2009 and include a limited off-take agreement whereby Bokoni sells the concentrate produced at the mine to RPM at market related prices.

Pursuant to the terms of various shared services agreements, the Anglo American plc group of companies provides certain operational services to Bokoni at a cost that is no greater than the costs charged to any other Anglo American plc group for the same or similar services.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

| | Transactions with RPM during the nine months ended September 30, 2011, as compared to the full year 2010, are summarized below: |

| | |

| | Concentrate sales | $111.8 million | (2010 – $148.3 million) |

| | | | |

| | Cost of sales* | $28.1 million | (2010 – $19.6 million) |

| | | | |

| | Administration expenses | $0 million | (2010 – $3.6 million) |

| | | | |

| | Finance expense | $55.6 million | (2010 – $62.8 million) |

| | | | |

| | (before interest capitalised) |

| | |

| | * - included in cost of sales are the following: |

| | |

| | Metal accounting services | $0.4 million | (2010 – $0.5 million) |

| | | | |

| | Supply chain services | $21.7 million | (2010 – $11.9 million) |

| | | | |

| | Treatment of Anglo ore | ($0.4) million | (2010 – ($1.0) million) |

| | | | |

| | Other | $6.4 million | (2010 – $8.2 million) |

| | | | |

| | | $28.1 million | (2010 – $19.6 million) |

| | | | |

| | The following balances were outstanding to/from RPM at September 30, 2011, as compared to December 31, 2010: |

| | |

| | Loans and Borrowings | $725.4 million | (2010 – $624.1 million) |

| | | | |

| | Trade and other payables | $3.5 million | (2010 – $2.5 million) |

| | | | |

| | Trade and other receivables | $31.6 million | (2010 – $33.3 million) |

1.9 Summary of Quarterly Results

$ Million * | Sep 30, 2011 | Jun 30, 2011 | Mar 31, 2011 | Dec 31, 2010 | Sep 30, 2010 | Jun 30, 2010 | Mar 31, 2010 | Dec 31, 2009 |

| Revenue | 45.3 | 35.9 | 30.7 | 43.2 | 34.5 | 38.4 | 32.2 | 34.8 |

| Cost of sales | (55.0) | (56.2) | (46.2) | (52.1) | (44.5) | (40.9) | (35.6) | (40.5) |

| Gross loss | (9.7) | (20.3) | (15.5) | (8.9) | (10.0) | (2.5) | (3.4) | (5.7) |

| | | | | | | | | |

| Loss for the period | (27.9) | (44.3) | (31.4) | (32.4) | (28.1) | (19.9) | (13.2) | (18.6) |

| | | | | | | | | |

| Basic and diluted loss per share ($) | (0.04) | (0.06) | (0.04) | (0.04) | (0.04) | (0.02) | (0.02) | (0.03) |

| | | | | | | | | |

| Weighted number of common shares outstanding (million) | 425 | 425 | 425 | 425 | 425 | 425 | 425 | 305 |

| * | Data for all presented periods was prepared in accordance with IFRS. |

Discussion of Last Eight Quarterly Results

Prior to July 1, 2009, Anooraq was regarded primarily as an exploration company. Therefore, Anooraq did not have any significant operating assets.

On July 1, 2009, Anooraq acquired 51% of the Bokoni Mine and also took management control. This was the first operating asset acquired by Anooraq that generated revenue. There was therefore a

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

significant increase in the asset base of the Anooraq Group as revenue generating assets were effectively acquired.

The Anooraq Group had the following initiatives identified for Bokoni Mine to be achieved in the first 18 months, to establish the foundation for its future growth profile:

| · | Restructure the labor force to have 60% of labor in direct ore mining and 40% in support services. This was achieved at the end of the first quarter of 2010. |

| · | To commence generating profits on an operational level. This has not yet been achieved. |

The Anooraq Group is continuing its efforts to grow production (Phase 1 expansion program) in order to achieve the Anooraq Group’s long-term goal of achieving a monthly production of 160,000 tonnes per month by 2016.

All of the above factors contributed to the increase in revenue from $0 in quarters prior to July 1, 2009 to $34.8 million for Q4 2009, and ultimately to revenue of $45.3 million for Q3 2011. Fluctuation in revenue between the quarters are mainly as a result of fluctuation in production, and also as a result of varying PGM basket prices and exchange rates.

The increased finance cost, as a result of the drawdowns on the OCSF facility and the continuing compounding of the interest on the loans and borrowings has contributed to the increase in the quarterly loss during the previous eight quarters.

1.10 Proposed Transactions

Except as described in this MD&A there are no reportable proposed transactions.

1.11 Critical Accounting Estimates

The Anooraq Group’s accounting policies are presented in note 4 of the audited financial statements for the year ended December 31, 2010, which have been publicly filed on SEDAR at www.sedar.com.

The preparation of the condensed consolidated financial statements in accordance with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Information about critical judgments in applying accounting policies that have the most significant effect on the amounts recognized in the consolidated financial statements is included in the notes to the financial statements for the year ended December 31, 2010 where applicable.

These estimates include:

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

Taxation

The Anooraq Group applies significant judgment in determining provisions for income taxes and deferred tax assets and liabilities.

Temporary differences arise between the carrying values of assets and liabilities for accounting purposes and the amounts used for tax purposes. These temporary differences result in tax liabilities being recognized and deferred tax assets being considered based on the probability of deferred tax assets being recoverable from future taxable income. A deferred tax asset is recognized to the extent that it is probable that future taxable profits will be available against which the deferred tax asset can be realized.

The Anooraq Group provides deferred tax using enacted or substantively enacted tax rates at the reporting date on all temporary differences arising between the carrying values of assets and liabilities for accounting purposes and the amounts used for tax purposes, unless there is a temporary difference that is specifically excluded in accordance with IFRS. The carrying value of the Anooraq Group’s net deferred tax assets assumes that the Anooraq Group will be able to generate sufficient future taxable income in applicable tax jurisdictions, based on estimates and assumptions.

Impairment of Mining Assets

The recoverable amount of mining assets, including goodwill relating to mining operations, is generally determined by utilizing discounted future cash flows. Factors such as the quality of the individual ore body and country risk are considered in determining the recoverable amount.

Key assumptions for the calculations of the mining assets' recoverable amounts are the forward platinum group metal prices and the annual life-of-mine plans. In determining the commodity prices to be used, management assesses the long-term views of several reputable institutions on the commodity prices and, based on this, derives the forward platinum group metals prices. The life-of-mine plans are based on proven and probable reserves and have been approved by the Anooraq Group.

During the 2010 fiscal year, the Anooraq Group calculated the recoverable amounts based on updated life-of-mine plans using a discount rate that is based on the real post-tax weighted average cost of capital (“WACC”) of 9.67%. The WACC is based on the risk free rate as at December 31, 2010, a market risk premium, a Beta factor (risk of a particular industry relative to the market as a whole), an Alpha (company specific risk premium), the post-tax cost of debt and the debt-equity ratio.

Refer to note 7 of the audited financial statements for the year ended December 31, 2010 for details of key assumptions used in the 2010 impairment testing.

Cash flows used in the impairment calculations are based on life-of-mine plans which exceed five years. As per management assessment, no impairment was required for the year ended December 31, 2010 and for the six months ended June 30, 2011. This remains management’s conclusion at September 30, 2011. Management used consensus price and rate assumptions based on the forward views of several analysts as at December 31, 2010. Cash generating units are based on individual subsidiaries within the Anooraq group.

Should management's estimate of the future not reflect actual events, impairments may be identified. Factors affecting the estimates include:

| | • | changes to proven and probable ore reserves; |

| | • | the grade of the ore reserves may vary significantly from time to time; |

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

| | • | differences between actual commodity prices and commodity price assumptions; |

| | • | unforeseen operational issues at the mine; and |

| | • | changes in capital, operating, mining, processing and reclamation cost assumptions. |

Exposure and liabilities with regards to rehabilitation costs

Estimated environmental obligations, comprising pollution control, rehabilitation and mine closure, are based on the Anooraq Group's environmental management plans in compliance with current technological, environmental and regulatory requirements.

Management used a South African inflation rate of 5.2% over a period of 20 years in the calculation of the estimated net present value of the rehabilitation liability. The discount rate used for the calculation was 8.4% based on the future long-term view on government bonds.

Fair value of share based payments

The fair values of options granted and share appreciation rights are determined using Black-Scholes and binomial valuation models. The significant inputs into the models are: vesting period, risk free interest rate, volatility, price on date of grant and dividend yield. Refer to note 35 of the audited financial statements for the year ended December 31, 2010 for details on the share option and share appreciation schemes and assumptions used.

Inventory – Stockpiles

Stockpiles are measured by estimating the number of tonnes added and removed from the stockpile, the number of contained PGM ounces based on assay data and the estimated recovery percentage based on the expected processing method. Stockpile tonnages are verified by periodic surveys. The stockpile inventory at September 30, 2011 amounted to $0.7 million.

Assessment of contingencies

Contingencies will only realize when one or more future events occur or fail to occur. The exercise of significant judgment and estimates of the outcome of future events are required during the assessment of the impact of such contingencies.

Mineral resources and reserves

Mineral reserves are estimates of the amount of ounces that can be economically and legally extracted from the Anooraq Group's properties. In order to calculate the mineral reserves, estimates and assumptions are required about a range of geological, technical and economic factors, including quantities, grades, production techniques, recovery rates, production costs, commodity prices and exchange rates.

Estimating the quantities and/or grade of the reserves requires the size, shape and depth of the ore bodies to be determined by analyzing geological data such as the logging and assaying of drill samples. This process may require complex and difficult geological judgments and calculations to interpret the data.

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

Because the economic assumptions used to estimate the mineral reserves changes from year to year, and because additional geological data is generated during the course of operations, estimates of the mineral reserves may change from year to year. Changes in the proven and probable reserves may affect the Anooraq Group's financial results and financial position in a number of ways, including:

| | | asset carrying values may be affected due to changes in estimated cash flows; |

| | | depreciation and amortization charged to profit or loss may change as they are calculated on the units-of production method; and |

| | | environmental provisions may change as the timing and/or cost of these activities may be affected by the change in mineral reserves. |

At the end of each financial year, the estimate of proven and probable mineral reserve is updated. Depreciation of mining assets is prospectively adjusted, based on these changes.

1.12 Changes in Accounting Policies including Initial Adoption

Changes in accounting policies

The accounting policies applied by the Anooraq Group in the condensed consolidated interim financial statements for the period ended September 30, 2011 are the same as those applied by the Anooraq Group in the consolidated financial statements as at and for the year ended December 31, 2010 (available on SEDAR and EDGAR), except for the following standards and interpretations adopted in the current financial year:

| IAS 24 (revised), Related Party Disclosures |

| Various improvements to IFRS 2010 |

There was no significant impact on the condensed consolidated interim financial statements as a result of adopting these standards and interpretations.

New standards not yet adopted

The following standards and interpretations are issued but not yet effective and applicable to the Anooraq Group:

| · | IFRS 9, Financial instruments |

| · | Presentation of Items of Other Comprehensive Income (Amendments to IAS 1) |

| · | IFRS 10, Consolidated Financial Statements |

| · | IFRS 11, Joint Arrangements |

| · | IFRS 12, Disclosure of Interests in Other Entities |

| · | IFRS 13, Fair Value Measurement |

1.13 Financial Instruments and Risk Management

Financial instruments

The Anooraq Group’s financial instruments consist primarily of the following financial assets: cash and cash equivalents, trade and other loans and receivables. The Anooraq Group’s financial instruments consist primarily of the following financial liabilities: loans and borrowings, trade and

Anooraq Resources Corporation

Management Discussion and Analysis of Financial Condition and Result of Operations for the three and nine months ended September 30, 2011

other payables and certain derivative instruments. Financial instruments are initially measured at fair value when the Anooraq Group becomes a party to their contractual arrangements. Transaction costs are included in the initial measurement of financial instruments, with the exception of financial instruments classified as at fair value through profit or loss.

Financial assets

The Anooraq Group’s financial assets consist primarily of cash and cash equivalents and trade and other receivables.

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They arise when the Anooraq Group provides money, goods or services directly to a debtor with no intention of trading the receivable. Loans and receivables are subsequently measured at amortized cost using the effective interest rate method. They are included in current assets, except for those with maturities greater than 12 months after the balance sheet date, which are classified as non-current assets. Loans and receivables include trade and other receivables (excluding VAT and prepayments) and restricted cash.

Cash and cash equivalents are defined as cash on hand, deposits held at call with banks and short-term highly liquid investments with original maturities of three months or less. Cash and cash equivalents exclude restricted cash (discussed below).

Restricted cash consists of cash held through investments in the Employee Share Option Plan Trust.

Trade and other receivables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method, less provision for impairment. A provision for impairment of receivables is established when there is objective evidence that the Anooraq Group will not be able to collect all amounts due according to the original terms of receivables. Significant financial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial reorganization, and default or delinquency in payments are considered indicators that the trade receivable is impaired. The amount of the provision is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the effective interest rate. The carrying amount of the asset is reduced through the recognition of a provision for impairment (allowance account) and the amount of the loss is recognized in the income statement. When a trade receivable is uncollectible, it is written off against the allowance account for trade receivables. Subsequent recoveries of amounts previously written off are credited in the income statement.

Non-derivative financial liabilities

Loans and borrowings are initially recognized at fair value net of transaction costs incurred and subsequently measured at amortized cost, comprising original debt less principal payments and amortization, using the effective yield method. Loans and borrowings are classified as current liabilities unless the Anooraq Group has an unconditional right to defer settlement of the liability for at least 12 months after the reporting date. Trade and other payables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest rate method.

Derivative financial instruments

The Anooraq Group held derivative financial instruments to hedge its interest rate risk exposures up to 28 April 2011, whereafter the interest rate hedge has been unwound. The Anooraq Group currently holds no derivative instruments to hedge its exposure to interest rate risk.

Anooraq Resources Corporation