Exhibit 99.6

ARRIS RESOURCES INC.

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

FOR

AN ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

IN RESPECT OF AN ARRANGEMENT

BETWEEN

ARRIS RESOURCES INC.

AND

INCANA INVESTMENTS INC.

May 19, 2009

| | |

TABLE OF CONTENTS | |

| Page |

NOTICE TO UNITED STATES SHAREHOLDERS | 1 |

INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS | 1 |

INFORMATION CONTAINED IN THIS CIRCULAR | 2 |

GLOSSARY OF TERMS | 3 |

SUMMARY | 6 |

| THE MEETING | 6 |

| THE ARRANGEMENT | 6 |

| EFFECT OF THE ARRANGEMENT ON ARRIS RESOURCES SHARE COMMITMENTS | 6 |

| RECOMMENDATION AND APPROVAL OF THE BOARD OF DIRECTORS | 7 |

| REASONS FOR THE ARRANGEMENT | 7 |

| CONDUCT OF MEETING AND SHAREHOLDER APPROVAL | 7 |

| COURT APPROVAL | 7 |

| INCOME TAX CONSIDERATIONS | 8 |

| RIGHT TO DISSENT | 8 |

| STOCK EXCHANGE LISTINGS | 8 |

| INFORMATION CONCERNING THE COMPANY AND INCANA AFTER THE ARRANGEMENT | 8 |

| SELECTED UNAUDITED PRO–FORMA CONSOLIDATED FINANCIAL INFORMATION FOR THE COMPANY | 9 |

| SELECTED UNAUDITED PRO–FORMA CONSOLIDATED FINANCIAL INFORMATION FOR INCANA | 9 |

| RISK FACTORS | 9 |

GENERAL PROXY INFORMATION | 10 |

| SOLICITATION OF PROXIES | 10 |

| CURRENCY | 10 |

| RECORD DATE | 10 |

| APPOINTMENT OF PROXYHOLDERS | 10 |

| VOTING BY PROXYHOLDER | 10 |

| REGISTERED SHAREHOLDERS | 11 |

| BENEFICIAL SHAREHOLDERS | 11 |

| REVOCATION OF PROXIES | 12 |

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 12 |

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 12 |

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 13 |

| OUTSTANDING ARRIS RESOURCES SHARES | 13 |

| PRINCIPAL HOLDERS OF ARRIS RESOURCES SHARES | 13 |

VOTES NECESSARY TO PASS RESOLUTIONS | 13 |

ELECTION OF DIRECTORS | 13 |

| CORPORATE CEASE TRADE ORDERS AND BANKRUPTCIES | 14 |

EXECUTIVE COMPENSATION | 14 |

| COMPENSATION DISCUSSION AND ANALYSIS | 14 |

| OPTION–BASED AWARDS | 15 |

| SUMMARY COMPENSATION TABLE | 15 |

| OUTSTANDING OPTION-BASED AWARDS | 15 |

| TERMINATION AND CHANGE OF CONTROL BENEFITS | 15 |

| COMPENSATION OF DIRECTORS | 16 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 16 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 16 |

MANAGEMENT CONTRACTS | 16 |

-ii-

| | |

APPOINTMENT OF AUDITOR | 16 |

AUDIT COMMITTEE | 17 |

| COMPOSITION OF THE AUDIT COMMITTEE | 17 |

| RELEVANT EDUCATION AND EXPERIENCE | 17 |

| AUDIT COMMITTEE OVERSIGHT | 17 |

| RELIANCE ON CERTAIN EXEMPTIONS | 17 |

| PRE–APPROVAL POLICIES AND PROCEDURES | 17 |

| EXTERNAL AUDITOR SERVICE FEES (BY CATEGORY) | 18 |

| EXEMPTION | 18 |

CORPORATE GOVERNANCE | 18 |

| BOARD OF DIRECTORS | 18 |

| DIRECTORSHIPS | 18 |

| ORIENTATION AND CONTINUING EDUCATION | 18 |

| ETHICAL BUSINESS CONDUCT | 18 |

| NOMINATION OF DIRECTORS | 19 |

| COMPENSATION | 19 |

| OTHER BOARD COMMITTEES | 19 |

| ASSESSMENTS | 19 |

THE ARRANGEMENT | 19 |

| GENERAL | 19 |

| REASONS FOR THE ARRANGEMENT | 19 |

| RECOMMENDATION OF DIRECTORS | 20 |

| FAIRNESS OF THE ARRANGEMENT | 20 |

| DETAILS OF THE ARRANGEMENT | 20 |

| AUTHORITY OF THE BOARD | 23 |

| CONDITIONS TO THE ARRANGEMENT | 23 |

| SHAREHOLDER APPROVAL | 24 |

| COURT APPROVAL OF THE ARRANGEMENT | 24 |

| PROPOSED TIMETABLE FOR ARRANGEMENT | 25 |

| INCANA SHARE CERTIFICATES AND CERTIFICATES FOR NEW SHARES | 25 |

| RELATIONSHIP BETWEEN THE COMPANY AND INCANA AFTER THE ARRANGEMENT | 25 |

| EFFECT OF ARRANGEMENT ON OUTSTANDING ARRIS RESOURCES SHARE COMMITMENTS | 25 |

| RESALE OF NEW SHARES AND INCANA SHARES | 25 |

| EXPENSES OF ARRANGEMENT | 27 |

INCOME TAX CONSIDERATIONS | 27 |

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 27 |

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 31 |

APPROVAL OF THE INCANA STOCK OPTION PLAN | 37 |

| STOCK OPTION PLAN OF INCANA | 37 |

| PURPOSE OF THE INCANA STOCK OPTION PLAN | 37 |

| GENERAL DESCRIPTION AND EXCHANGE POLICIES | 38 |

RIGHTS OF DISSENT | 38 |

| DISSENTERS' RIGHTS | 38 |

RISK FACTORS | 39 |

| GENERAL AND INDUSTRY RISKS | 39 |

| SECURITIES OF INCANA AND DILUTION | 39 |

| COMPETITION | 40 |

| CONFLICTS OF INTEREST | 40 |

| NO HISTORY OF EARNINGS OR DIVIDENDS | 40 |

| POTENTIAL PROFITABILITY DEPENDS UPON FACTORS BEYOND THE CONTROL OF INCANA | 40 |

| PROPERTY APPROVALS, PERMITS, ZONING, AND COMPLIANCE | 40 |

-iii-

| | |

| DEPENDENCY ON A SMALL NUMBER OF MANAGEMENT PERSONNEL | 40 |

| SUPPLY AND DEMAND | 41 |

| DEVELOPMENT AND CONSTRUCTION COSTS | 41 |

THE COMPANY AFTER THE ARRANGEMENT | 41 |

| NAME, ADDRESS AND INCORPORATION | 41 |

| DIRECTORS AND OFFICERS | 41 |

| BUSINESS OF THE COMPANY – THREE-YEAR HISTORY | 41 |

| BUSINESS OF THE COMPANY FOLLOWING THE ARRANGEMENT | 42 |

| BUSINESS OVERVIEW | 42 |

| DESCRIPTION OF SHARE CAPITAL | 43 |

| CHANGES IN SHARE CAPITAL | 43 |

| DIVIDEND POLICY | 43 |

| TRADING PRICE AND VOLUME | 43 |

| SELECTED UNAUDITED PRO–FORMA CONSOLIDATED FINANCIAL INFORMATION OF THE COMPANY | 44 |

| THE COMPANY'S YEAR–END AUDITED FINANCIAL STATEMENTS | 45 |

| MATERIAL CONTRACTS | 45 |

INCANA AFTER THE ARRANGEMENT | 45 |

| NAME, ADDRESS AND INCORPORATION | 45 |

| INTERCORPORATE RELATIONSHIPS | 45 |

| SIGNIFICANT ACQUISITION AND DISPOSITIONS | 45 |

| TRENDS | 45 |

| GENERAL DEVELOPMENT OF INCANA'S BUSINESS | 46 |

| INCANA'S BUSINESS HISTORY | 46 |

| SELECTED UNAUDITED PRO–FORMA FINANCIAL INFORMATION OF INCANA | 46 |

| DIVIDENDS | 47 |

| BUSINESS OF INCANA | 47 |

| LIQUIDITY AND CAPITAL RESOURCES | 49 |

| RESULTS OF OPERATIONS | 49 |

| AVAILABLE FUNDS | 49 |

| ADMINISTRATION EXPENSES | 50 |

| SHARE CAPITAL OF INCANA | 50 |

| FULLY DILUTED SHARE CAPITAL OF INCANA | 51 |

| PRIOR SALES OF SECURITIES OF INCANA | 51 |

| OPTIONS AND WARRANTS | 51 |

| PRINCIPAL SHAREHOLDERS OF INCANA | 52 |

| DIRECTORS AND OFFICERS OF INCANA | 52 |

| MANAGEMENT OF INCANA | 53 |

| CORPORATE CEASE TRADE ORDERS OR BANKRUPTCIES | 53 |

| PENALTIES OR SANCTIONS | 53 |

| PERSONAL BANKRUPTCIES | 53 |

| CONFLICTS OF INTEREST | 53 |

| EXECUTIVE COMPENSATION OF INCANA | 54 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS OF INCANA | 54 |

| INCANA'S AUDITOR | 54 |

| INCANA'S MATERIAL CONTRACTS | 54 |

| PROMOTERS | 54 |

TRANSFER AGENT AND REGISTRAR | 54 |

LEGAL PROCEEDINGS | 54 |

ADDITIONAL INFORMATION | 54 |

EXPERTS | 55 |

OTHER MATTERS | 55 |

APPROVAL OF INFORMATION CIRCULAR | 55 |

-iv-

| |

CERTIFICATE OF THE CORPORATION | 56 |

AUDITOR'S CONSENT | 57 |

| |

Schedule A: | Form of Resolutions |

Schedule B: | The Arrangement Agreement |

Schedule C: | The Interim Order |

Schedule D: | Dissent Procedures |

Schedule E: | Pro–Forma Unaudited Consolidated Balance Sheet of Arris Resources Inc. as at December 31, 2008 |

Schedule F: | Pro–Forma Unaudited Consolidated Balance Sheet of InCana as at December 31, 2008 |

Schedule G: | Consolidated Audited Financial Statements of Arris Resources Inc. for the Year Ended December 31, 2008 |

Schedule H: | Arris Resources Stock Option Plan |

Schedule I: | Arris Resources Audit Committee Charter |

Schedule J: | Arris Resources Change of Auditor Notices |

Schedule K: | Arris Resources Inc. Management's Discussion and Analysis for the Year Ended December 31, 2008 |

ARRIS RESOURCES INC.

1250 West Hastings Street

Vancouver, British Columbia V6E 2M4

Telephone No. (604) 687-0879 / Facsimile No. (604) 408-9301

Email: admin@arrisresources.com

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

To: The Shareholders of Arris Resources Inc.

TAKE NOTICE that pursuant to an order of the Supreme Court of British Columbia dated May 21, 2009, an annual general and special meeting (the "Meeting") of shareholders (the "Arris Resources Shareholders") of Arris Resources Inc. (the "Company") will be held at 1250 West Hastings Street, Vancouver, British Columbia, on June 19, 2009, at 10:00 a.m. (Vancouver time), for the following purposes:

1.

to receive and consider the consolidated financial statements of the Company for the fiscal year ended December 31, 2008, and the report of the auditors thereon;

2.

to elect directors of the Company for the ensuing year;

3.

to appoint an auditor for the Company for the ensuing year and to authorize the directors to fix the auditor's remuneration;

4.

to consider and, if thought fit, pass, with or without variation, a special resolution approving an arrangement (the "Plan ofArrangement") under Division 5 of Part 9 of theBusiness Corporations Act (British Columbia) (the "Act") which involves, among other things, the distribution to the Arris Resources Shareholders shares of InCana Investments Inc. ("InCana"), currently a wholly–owned subsidiary of the Company, all as more fully set forth in the accompanying management information circular (the "Circular") of the Company;

5.

to consider and, if thought fit, pass, with or without variation, an ordinary resolution to approve, ratify and affirm a stock option plan for InCana; and

6.

to transact such other business as may properly come before the Meeting or at any adjournment(s) or postponement(s) thereof.

AND TAKE NOTICE that Arris Resources Shareholders who validly dissent from the Arrangement will be entitled to be paid the fair value of their Arris Resources Shares subject to strict compliance with the provisions of the interim order (as set forth herein), the Plan of Arrangement and sections 237 to 247 of the Act. The dissent rights are described in Schedule"D" of the Circular. Failure to comply strictly with the requirements set forth in the Plan of Arrangement and sections 237 to 247 of the Act may result in the loss of any right of dissent.

The Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice. Also accompanying this Notice and the Circular is a form of proxy for use at the Meeting. Any adjourned meeting resulting from an adjournment of the Meeting will be held at a time and place to be specified at the Meeting. Only Arris Resources Shareholders of record at the close of business on May 4, 2009, will be entitled to receive notice of and vote at the Meeting.

Registered Arris Resources Shareholders unable to attend the Meeting are requested to date, sign and return the enclosed form of proxy and deliver it in accordance with the instructions set out in the proxy and in the Circular. If you are a non–registered Arris Resources Shareholder and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or the other intermediary. Failure to do so may result in your shares of the Company not being voted at the Meeting.

Dated at Vancouver, British Columbia, this 19th day of May, 2009.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ "Lucky Janda"

Lucky Janda

President

No. S - 093700

VANCOUVER REGISTRY

IN THE SUPREME COURT OF BRITISH COLUMBIA

BETWEEN:

ARRIS RESOURCES INC.

PETITIONER

AND

IN THE MATTER OF AN ARRANGEMENT AMONG

ARRIS RESOURCES INC., INCANA INVESTMENTS INC. AND THE SHAREHOLDERS

OF ARRIS RESOURCES INC.

NOTICE OF HEARING OF PETITION

TO:

THE SHAREHOLDERS OF ARRIS RESOURCES INC.

AND TO:

INCANA INVESTMENTS INC.

NOTICE IS HEREBY GIVEN that a Petition has been filed by Arris Resources Inc. (the "Petitioner") in the Supreme Court of British Columbia for approval of a plan of arrangement (the "Arrangement"), pursuant to theBusiness Corporations Act,S.B.C. 2002, Chapter 57, as amended.

AND NOTICE IS FURTHER GIVEN that by an Interim Order of the Supreme Court of British Columbia, pronounced May 21, 2009, the Court has given directions as to the calling of an annual and special meeting of the holders of common shares in the capital of the Petitioner (the "Shareholders"), for the purpose,inter alia, of considering and voting upon the Arrangement and approving the Arrangement.

AND NOTICE IS FURTHER GIVEN that an application for a Final Order approving the Arrangement and for a determination that the terms and conditions of the Arrangement are fair to the Shareholders shall be made before the presiding Judge in Chambers at the Courthouse, 800 Smithe Street, Vancouver, British Columbia on June 22, 2009, at 9:45 a.m. (Vancouver time), or so soon thereafter as counsel may be heard (the "Final Application").

IF YOU WISH TO BE HEARD, any Shareholder affected by the Final Order sought may appear (either in person or by counsel) and make submissions at the hearing of the Final Application if such person has filed with the Court at the Court Registry, 800 Smithe Street, Vancouver, British Columbia, an Appearance in the form prescribed by the Rules of Court of the Supreme Court of British Columbia and delivered a copy of the filed Appearance,

together with all materials on which such person intends to rely at the hearing of the Final Application, including an outline of such person's proposed submissions, to the Petitioner at its address for delivery set out below by or before 10:00 a.m. (Vancouver time) on June 17, 2009.

The Petitioner's address for delivery is:

SANGRA MOLLER LLP

1000 Cathedral Place

925 West Georgia Street

Vancouver, B.C. V6C 3L2

Attention: Gary S. Gill

IF YOU WISH TO BE NOTIFIED OF ANY ADJOURNMENT OF THE FINAL APPLICATION, YOU MUST GIVE NOTICE OF YOUR INTENTION by filing and delivering the form of "Appearance" as aforesaid. You may obtain a form of "Appearance" at the Court Registry, 800 Smithe Street, Vancouver, British Columbia, V6Z 2E1.

AT THE HEARING OF THE FINAL APPLICATION the Court may approve the Arrangement as presented, or may approve it subject to such terms and conditions as the Court deems fit.

IF YOU DO NOT FILE AN APPEARANCE and attend either in person or by counsel at the time of such hearing, the Court may approve the Arrangement, as presented, or may approve it subject to such terms and conditions as the Court shall deem fit, all without any further notice to you. If the Arrangement is approved, it will significantly affect the rights of the Shareholders.

A copy of the said Petition and other documents in the proceedings will be furnished to any member of the Petitioner upon request in writing addressed to the solicitors of the Petitioner at its address for delivery as set out above.

It is not known whether the matter will be contested and it is estimated that the hearing will take 15 minutes to be heard.

/s/ "Rod A. Talaifar"

SOLICITOR FOR THE PETITIONER

This Notice of Hearing was prepared by Rod A. Talaifar of the law firm of Sangra Moller LLP whose place of business is 1000 Cathedral Place, 925 West Georgia, Vancouver, British Columbia V6C 3L2

| |

| No. S – 093700 Vancouver Registry |

|

|

|

IN THE SUPREME COURT OF BRITISH COLUMBIA |

|

BETWEEN: |

|

ARRIS RESOURCES INC. |

|

PETITIONER |

|

AND |

|

IN THE MATTER OF AN ARRANGEMENT AMONG ARRIS RESOURCES INC., INCANA INVESTMENTS INC., AND THE SHAREHOLDERS OF ARRIS RESOURCES INC. |

|

|

|

|

NOTICE OF HEARING OF PETITION |

|

|

Gary S. Gill Sangra Moller LLP 1000 Cathedral Place 925 West Georgia St. Vancouver, B.C. V6C 3L2 Tel: 604-692-3022 Fax: 604-669-8803 6918 002 |

ARRIS RESOURCES INC.

1250 West Hastings Street

Vancouver, British Columbia V5E 2M4

Telephone No. (604) 687-0879 / Facsimile No. (604) 408-9301

Email: admin@arrisresources.com

This Circular is furnished in connection with the solicitation of proxies by management of Arris Resources for use at the annual general and special meeting of shareholders of the Company to be held on June 19, 2009.

Unless the context otherwise requires, capitalized terms used herein and not otherwise defined shall have the meanings set forth in the Glossary of Terms in this Circular.

In considering whether to vote for the approval of the Arrangement, Arris Resources Shareholders should be aware that there are various risks, including those described in the Section entitled "Risk Factors" in this Circular. Arris Resources Shareholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether to approve the Arrangement.

NOTICE TO UNITED STATES SHAREHOLDERS

THE SECURITIES ISSUABLE IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY IN ANY STATE, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The InCana Shares to be issued under the Arrangement have not been registered under the U.S. Securities Act and are being issued in reliance on the exemption from registration set forth in Section 3(a)(10) thereof on the basis of the approval of the Court as described under "The Arrangement — Resale of New Shares and InCana Shares" in this Circular. The solicitation of proxies is not subject to the requirements of Section 14(a) of the U.S. Exchange Act by virtue of an exemption applicable to proxy solicitations by foreign private issuers as defined in Rule 3b–4 of the U.S. Exchange Act. Accordingly, this Circular has been prepared in accordance with applicable Canadian disclosure requirements. Residents of the United States should be aware that such requirements differ from those of the United States applicable to proxy statements under the U.S. Exchange Act.

Information concerning any properties and operations of the Company, including any to be transferred to InCana as part of the Arrangement, has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable to similar information for United States companies.

Financial statements included or incorporated by reference herein have been prepared in accordance with generally accepted accounting principles in Canada and are subject to auditing and auditor independence standards in Canada, and reconciled to accounting principles generally accepted in the United States. Arris Resources Shareholders should be aware that the reorganization of the Company pursuant to the Plan of Arrangement as described herein may have tax consequences in both the United States and Canada. Such consequences for Arris Resources Shareholders who are resident in, or citizens of, the United States may not be described fully herein. See "Income Tax Considerations — Certain Canadian Federal Income Tax Considerations" and "Income Tax Considerations — Certain United States Federal Income Tax Considerations" in this Circular.

The enforcement by Arris Resources Shareholders of civil liabilities under the United States federal securities laws may be affected adversely by the fact that Arris Resources and InCana are incorporated or organized under the laws of a foreign country, that some or all of their officers and directors and the experts named herein are residents of a foreign country and that all of the assets of the Company and InCana are located outside the United States.

INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS

Except for statements of historical fact contained herein, the information presented in this Circular constitutes "forward–looking statements" or "information" (collectively "statements"). These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

-2-

In some cases, forward-looking statements can be identified by terminology such as "may", "will", "expect", "plan", "anticipate", "believe", "intend", "estimate", "predict", "forecast", "outlook", "potential", "continue", "should", "likely", or the negative of these terms or other comparable terminology. Although management believes that the anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve assumptions, known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or InCana to differ materially from anticipat ed future results, performance or achievements expressed or implied by such forward-looking statements and information. Factors that could cause actual results to differ materially from those set forth in the forward-looking statements and information include, but are not limited, risks related to our limited operating history and history of no earnings; competition from other real estate investment or development companies; changes to government regulations; dependence on key personnel; general economic conditions; local real estate conditions, including the development of properties in close proximity to the Property or other properties we may acquire; timely sale of newly-developed units or properties; the uncertainties of real estate development and acquisition activity, including the receipt of all necessary permits and approvals InCana may require for the construction and development of the Property or other properties InCana may acquire; interest rates; availability of equity and debt financing; increased development and construction costs, including costs of labor, equipment, electricity and environmental compliance or other production inputs; and other risks factors described from time to time in the documents filed by us with applicable securities regulators, including in this Circular under the heading "Risk Factors".

Forward–looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update any forward–looking statement if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

INFORMATION CONTAINED IN THIS CIRCULAR

The information contained in this Circular is given as at May 19, 2009, unless otherwise noted.

No person has been authorized to give any information or to make any representation in connection with the Arrangement and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by the Company.

This Circular does not constitute the solicitation of an offer to purchase any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation is not authorized or in which the person making such solicitation is not qualified to do so or to any person to whom it is unlawful to make such solicitation.

Information contained in this Circular should not be construed as legal, tax or financial advice and Arris Resources Shareholders are urged to consult their own professional advisers in connection therewith.

Descriptions in the body of this Circular of the terms of the Arrangement Agreement and the Plan of Arrangement are merely summaries of the terms of those documents. Arris Resources Shareholders should refer to the full text of the Arrangement Agreement and the Plan of Arrangement for complete details of those documents. The full text of the Arrangement Agreement is attached to this Circular as Schedule "B" and the Plan of Arrangement is attached as Exhibit II to the Arrangement Agreement.

– 3 –

GLOSSARY OF TERMS

The following is a glossary of general terms and abbreviations used in this Circular:

"Act" means theBusiness Corporations Act (British Columbia), S.B.C. 2002, c. 57, as may be amended or replaced from time to time;

"Arrangement" means the arrangement under the Arrangement Provisions pursuant to which the Company proposes to reorganize its business and assets, and which is set out in detail in the Plan of Arrangement;

"Arrangement Agreement" means the agreement dated effective May 19, 2009 between the Company and InCana, a copy of which is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

"Arrangement Provisions" means Part 9, Division 5 of the Act;

"Arrangement Resolution" means the special resolution to be considered by the Arris Resources Shareholders to approve the Arrangement, the full text of which is set out in Schedule "A" to this Circular;

"Arris Resources" means Arris Resources Inc.;

"Arris Resources Class A Shares" means the renamed and redesignated Arris Resources Shares described in §3.1(b)(i) of the Plan of Arrangement;

"Arris Resources Class A Preferred Shares" means the class "A" preferred shares without par value which will be created and issued pursuant to §3.1(b)(iii) of the Plan of Arrangement;

"Arris Resources Shareholder" means a holder of Arris Resources Shares;

"Arris Resources Share Commitments" means an obligation of Arris to issue New Shares and to deliver InCana Shares to the holders of Arris Resources Options and Arris Resources Warrants which are outstanding on the Effective Date, upon the exercise of such stock options and warrants;

"Arris Resources Shares" means the common shares without par value in the authorized share structure of the Company, as constituted on the date of the Arrangement Agreement;

"Arris Resources Stock Option Plan" means the share purchase option plan of the Company dated May 21, 2008;

"Arris Resources Stock Options" means the common share purchase options issued pursuant to the Arris Resources Stock Option Plan which are outstanding on the Effective Date;

"Arris Resources Warrants" means the common share purchase warrants of the Company outstanding on the Effective Date;

"Assets" means the assets of the Company to be transferred to InCana pursuant to the Arrangement, being the Property and $100,000;

"Beneficial Shareholder" means an Arris Resources Shareholder who is not a Registered Shareholder;

"Board" means the board of directors of the Company;

"Business Day" means a day which is not a Saturday, Sunday or statutory holiday in Vancouver, British Columbia;

"Circular" means this management information circular;

"Company" means Arris Resources Inc.;

"Computershare" means Computershare Trust Company of Canada;

-4-

"Court" means the Supreme Court of British Columbia;

"Dissenting Shareholder" means an Arris Resources Shareholder who validly exercises rights of dissent under the Arrangement and who will be entitled to be paid fair value for his, her or its Arris Resources Shares in accordance with the Interim Order and the Plan of Arrangement;

"Dissenting Shares" means the Arris Resources Shares in respect of which Dissenting Shareholders have exercised a right of dissent;

"Effective Date" means the date upon which the Arrangement becomes effective;

"Exchange" means the Canadian National Stock Exchange;

"Exchange Factor" means the number arrived at by dividing 15,043,372 by the number of issued Arris Resources Shares as of the close of business on the Share Distribution Record Date;

"Final Order" means the final order of the Court approving the Arrangement;

"InCana" means InCana Investments Inc., a private company incorporated under the Act;

"InCana Commitment" means the covenant of InCana to issue InCana Shares to the holders of Arris Resources Share Commitments who exercise their rights thereunder after the Effective Date, and are entitled pursuant to the corporate reorganization provisions thereof to receive New Shares and InCana Shares upon such exercise;

"InCana Stock Option Plan" means the proposed common share purchase option plan of InCana, which is subject to Arris Resources Shareholder approval;

"InCana Option Plan Resolution" means an ordinary resolution to be considered by the Arris Resources Shareholders to approve the InCana Option Plan, the full text of which is set out in Schedule "A" to this Circular;

"InCana Shareholder" means a holder of InCana Shares;

"InCana Shares" means the common shares without par value in the authorized share structure of InCana, as constituted on the date of the Arrangement Agreement;

"Interim Order" means the interim order of the Court pursuant to the Act in respect of the Arrangement dated May 21, 2009, a copy of which is attached to this Circular as Schedule "C";

"Intermediaries" refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders;

"Listing Date" means the date the InCana Shares are listed on the Exchange;

"Meeting" means the annual general and special meeting of the Arris Resources Shareholders to be held on June 19, 2009, and any adjournment(s) or postponement(s) thereof;

"New Shares" means the new class of common shares without par value which the Company will create pursuant to §3.1(b)(ii) of the Plan of Arrangement and which, immediately after the Effective Date, will be identical in every relevant respect to the Arris Resources Shares;

"Notice of Meeting" means the notice of annual general and special meeting of the Arris Resources Shareholders in respect of the Meeting;

"Plan of Arrangement" means the plan of arrangement attached as Exhibit II to the Arrangement Agreement, which Arrangement Agreement is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

-5-

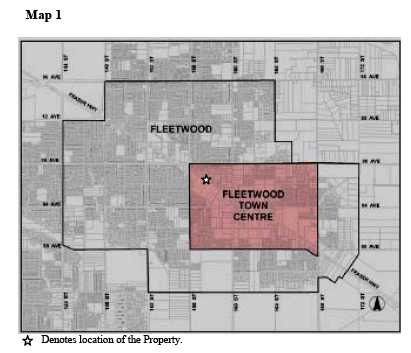

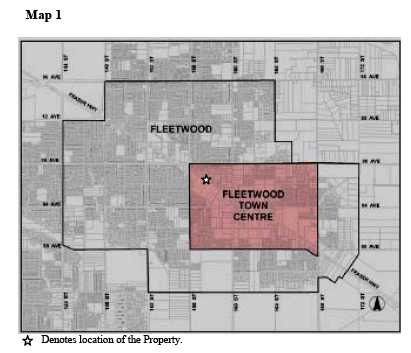

"Property" means the single family residential zoned property located at 8679, 158th Street in Surrey, British Columbia, approximately 35 kilometers from Vancouver, British Columbia, which property is to be transferred by Arris Resources to InCana pursuant to the Arrangement;

"Proxy" means the form of proxy accompanying this Circular;

"Registered Shareholder" means a registered holder of Arris Resources Shares as recorded in the shareholder register of the Company maintained by Computershare;

"Registrar" means the Registrar of Companies under the Act;

"SEC" means the United States Securities and Exchange Commission;

"SEDAR" means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

"Share Distribution Record Date" means the close of business on the day which is four Business Days after the date of the Meeting or such other day as agreed to by the Company and InCana, which date establishes the Arris Resources Shareholders who will be entitled to receive InCana Shares pursuant to the Plan of Arrangement;

"Tax Act" means theIncome Tax Act (Canada), as may be amended, or replaced, from time to time;

"U.S. Exchange Act" means the United StatesSecurities Exchange Act of 1934, as may be amended, or replaced, from time to time; and

"U.S. Securities Act" means the United StatesSecurities Act of 1933, as may be amended, or replaced, from time to time.

– 6 –

SUMMARY

The following is a summary of the information contained elsewhere in this Circular concerning a proposed reorganization of the Company by way of the Arrangement. This Circular also deals with the election of directors, the appointment of an auditor and the approval of the InCana Option Plan, which matters are not summarized in this summary. Certain capitalized words and terms used in this summary are defined in the Glossary of Terms above. This summary is qualified in its entirety by the more detailed information and financial statements appearing or referred to elsewhere in this Circular and the schedules attached hereto.

The Meeting

The Meeting will be held at 1250 West Hastings Street, Vancouver, British Columbia, on June 19, 2009 at 10:00 a.m. (Vancouver time). At the Meeting, the Arris Resources Shareholders will be asked, in addition to voting on the election of directors and the appointment of an auditor, to consider and, if thought fit, to pass the Arrangement Resolution approving the Arrangement among the Company, InCana and the Arris Resources Shareholders. The Arrangement will consist of the distribution of InCana Shares to the Arris Resources Shareholders. Arris Resources Shareholders will also be requested to consider and, if thought fit, to pass the InCana Option Plan Resolution approving the InCana Option Plan.

By passing the Arrangement Resolution, the Arris Resources Shareholders will also be giving authority to the Board to use its best judgment to proceed with and cause the Company to complete the Arrangement without any requirement to seek or obtain any further approval of the Arris Resources Shareholders.

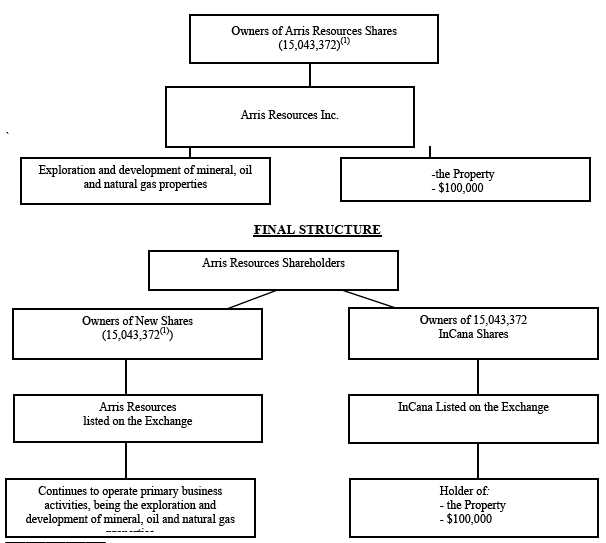

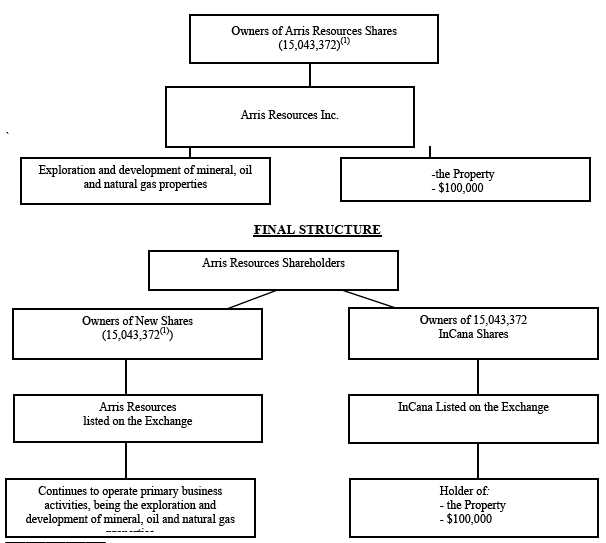

The Arrangement

The Company is a publicly traded resources company with onshore petroleum and natural gas rights and oil interests in Alberta, Canada and an interest in twenty-two mineral claims in British Columbia, Canada. The Arrangement has been proposed to facilitate the separation of the Company's primary business activities from the development of the Property. The Company believes that separating Arris Resources into two public companies offers a number of benefits to shareholders. First, the Company believes that after the separation, each company will be better able to pursue its own specific operating strategies without being subject to the financial constraints of the other business. After the separation, each company will also have the flexibility to implement its own unique growth strategies, allowing both organizations to refine and refocus their business mix. Additionally, because the resulting businesses will be focused in their respective ind ustries, they will be more readily understood by public investors, allowing each company to be in a better position to raise capital and align management and employee incentives with the interests of shareholders.

Pursuant to the Arrangement, Arris Resources will transfer to InCana $100,000 and all of Arris Resources' interest in and to the Property in exchange for 15,043,372 InCana Shares, which shares will be distributed to the Arris Resources Shareholders who hold Arris Resources Shares on the Share Distribution Record Date.

Each Arris Resources Shareholder as of the Share Distribution Record Date, other than a Dissenting Shareholder, will, immediately after the Arrangement, hold one New Share in the capital of the Company and itspro–rata share of the InCana Shares to be distributed under the Arrangement for each currently held Arris Resources Share. The New Shares will be identical in every respect to the present Arris Resources Shares. See "The Arrangement – Details of the Arrangement".

Effect of the Arrangement on Arris Resources Share Commitments

As of the Effective Date, the Arris Resources Share Commitments will be exercisable, in accordance with the corporate reorganization provisions of such securities, into New Shares and InCana Shares on the basis that the holder will receive, upon exercise, a number of New Shares that equals the number of Arris Resources Shares that would have been received upon the exercise of the Arris Resources Share Commitments prior to the Effective Date, and a number of InCana Shares that is equal to the number of New Shares so acquired. InCana has agreed, pursuant to the InCana Commitment, to issue InCana Shares upon exercise of the Arris Resources Share Commitments and the Company is obligated, as the agent of InCana, to collect and pay to InCana a portion of the proceeds received for each Arris Resources Share Commitment so exercised, with the balance of the exercise price to be retained by Arris Resources. Any entitlement to a fraction of an InCana Share resulting from the exercise of Arris Resources Share Commitments will be cancelled without compensation.

-7-

Recommendation and Approval of the Board of Directors

The directors of the Company have concluded that the terms of the Arrangement are fair and reasonable to, and in the best interests of, the Company and the Arris Resources Shareholders. The Board has therefore approved the Arrangement and authorized the submission of the Arrangement to the Arris Resources Shareholders and the Court for approval. The Board recommends that Arris Resources Shareholders vote FOR the approval of the Arrangement. See "The Arrangement– Recommendation of Directors".

Reasons for the Arrangement

The decision to proceed with the Arrangement was based on the following primary determinations:

1.

the Company's primary focus is the exploration and development of its petroleum and natural gas properties and oil interests in Alberta, Canada and the Company's mineral claims in British Columbia, Canada. This focus will hinder the development of the Property. The formation of InCana to hold the Property will facilitate separate development strategies for the Property required to move the Property forward;

2.

following the Arrangement, management of the Company will be free to focus entirely on its primary business activities, and new management for InCana will be established which has knowledge and expertise specific to InCana's industry;

3.

the formation of InCana and the distribution of 15,043,372 InCana Shares to the Arris Resources Shareholders pursuant to the Arrangement will give the Arris Resources Shareholders a direct interest in a new real estate development company that will focus on and pursue the development of the Propertyas well as potentially acquiring additional properties in high-growth locations;

4.

as a separate real estate development company, InCana will have direct access to public and private capital markets and will be able to issue debt and equity to fund improvements and development of the Property and to finance the acquisition and development of any new properties InCana may acquire on a priority basis; and

5.

as a separate real estate development company, InCana will be able to establish equity based compensation programs to enable it to better attract, motivate and retain directors, officers and key employees, thereby better aligning management and employee incentives with the interests of shareholders.

See "The Arrangement – Reasons for the Arrangement".

Conduct of Meeting and Shareholder Approval

The Interim Order provides that in order for the Arrangement to proceed, the Arrangement Resolution must be passed, with or without variation, by at least 66 and 2/3rds of the eligible votes cast with respect to the Arrangement Resolution by Arris Resources Shareholders present in person or by proxy at the Meeting. See "The Arrangement – Shareholder Approval".

Court Approval

The Arrangement, as structured, requires the approval of the Court. Prior to the mailing of this Circular, the Company obtained the Interim Order authorizing the calling and holding of the Meeting and providing for certain other procedural matters. The Interim Order does not constitute approval of the Arrangement or the contents of this Circular by the Court.

The Notice of Hearing of Petition for the Final Order is attached to the Notice of Meeting. In hearing the petition for the Final Order, the Court will consider, among other things, the fairness of the Arrangement to the Arris Resources Shareholders. The Court will also be advised that based on the Court's approval of the Arrangement, the Company and InCana will rely on an exemption from registration pursuant to Section 3(a)(10) of the U.S. Securities Act for the issuance of the New Shares and InCana Shares to any United States based Arris Resources Shareholders. Assuming approval of the Arrangement by the Arris Resources Shareholders at the Meeting, the hearing for the Final Order is scheduled to take place at 9:45 a.m. (Vancouver time) on June 22, 2009, at the Courthouse located at 800 Smithe Street, Vancouver, British Columbia, or at such other date and time as the Court may direct. At this hearing, any Arris Resources Shareholder or director, creditor , auditor or other interested party of the Company who wishes to participate or to be represented or who wishes to present evidence or argument may do so, subject to filing an appearance and satisfying certain other requirements. See "The Arrangement – Court Approval of the Arrangement".

-8-

Income Tax Considerations

Canadian Federal income tax considerations for Arris Resources Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary herein entitled "Income Tax Considerations – Certain Canadian Federal Income Tax Considerations", and certain United States Federal income tax considerations for Arris Resources Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary entitled "Income Tax Considerations – Certain U.S. Federal Income Tax Considerations".

Arris Resources Shareholders should carefully review the tax considerations applicable to them under the Arrangement and are urged to consult their own legal, tax and financial advisors in regard to their particular circumstances.

Right to Dissent

Arris Resources Shareholders will have the right to dissent from the Plan of Arrangement as provided in the Interim Order, the Plan of Arrangement and sections 237 to 247 of the Act. Any Arris Resources Shareholder who dissents will be entitled to be paid in cash the fair value for their Arris Resources Shares held so long as such Dissenting Shareholder: (i) does not vote any of his, her or its Arris Resources Shares in favour of the Arrangement Resolution, (ii) provides to the Company written objection to the Plan of Arrangement to the Company's head office at 1250 West Hastings Street, Vancouver, British Columbia V6E 2M4, at least two (2) days before the Meeting or any postponement(s) or adjournment(s) thereof, and (iii) otherwise complies with the requirements of the Plan of Arrangement and section 237 to 247 of the Act. See "Right to Dissent".

Stock Exchange Listings

The Arris Resources Shares are currently listed and traded on the Exchange and will continue to be listed on the Exchange following completion of the Arrangement. The closing of the Arrangement is conditional on the Exchange approving the listing of the InCana Shares on the Exchange.

Information Concerning the Company and InCana After the Arrangement

Following completion of the Arrangement, the Company will continue to carry on its primary business activities. The Arris Resources Shares will continue to be listed on the Exchange. Each Arris Resources Shareholder will continue to be a shareholder of the Company with each currently held Arris Resources Share representing one New Share in the capital of the Company, and each Arris Resources Shareholder on the Share Distribution Record Date will receive itspro–rata share of the 15,043,372 InCana Shares to be distributed to such Arris Resources Shareholders under the Arrangement. See "The Company After the Arrangement" for a summary description of the Company assuming completion of the Arrangement, including selectedpro–formaunaudited financial information for the Company.

Following completion of the Arrangement, InCana will be a public company, the shareholders of which will be the holders of Arris Resources Shares on the Share Distribution Record Date. InCana will have all of Arris Resources' interest in the Property and will have $100,000 in cash. Closing of the Arrangement is conditional upon the InCana Shares being listed on the Exchange. See "InCana After the Arrangement" for a description of the Property, corporate structure and business, including selectedpro–formaunaudited financial information of InCana assuming completion of the Arrangement.

-9-

Selected UnauditedPro–FormaConsolidated Financial Information for the Company

The following selected unauditedpro–formaconsolidated financial information for the Company is based on the assumptions described in the notes to the Company's unauditedpro–formaconsolidated balance sheet as at December 31, 2008, attached to this Circular as Schedule "E". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement occurred on December 31, 2008.

| | |

| | Pro–formaas at |

| | December 31, 2008 on |

| | completion of the |

| | Arrangement |

| | (unaudited) |

| |

| Cash and cash equivalents | $ | 258,316 |

| Amounts receivable | | 1,353 |

| Prepaid expenses | | 18,655 |

| Short term investment | | 320,000 |

| Equipment | | 7,257 |

| Mineral property | | 295,612 |

| Oil and gas property | | 150,000 |

| Total assets | $ | 1,051,193 |

| |

| Accounts payable and accrued liabilities | $ | 2,094 |

| Due to related party | | 74,941 |

| Shareholders' equity | | 974,158 |

| Total liabilities and shareholders' equity | $ | 1,051,193 |

Selected UnauditedPro–Forma Consolidated Financial Information for InCana

The following selected unauditedpro–formaconsolidated financial information for InCana is based on the assumptions described in the notes to the InCana unauditedpro–formaconsolidated balance sheet as at December 31, 2008, attached to this Circular as Schedule "F". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement had occurred on December 31, 2008.

| | | | | |

| | | | | Pro–formaas at |

| | | | | December 31, 2008 |

| | As of | | on completion of |

| | December 31, 2008 | | the Arrangement |

| | (unaudited) | | (unaudited) |

| |

| Cash | $ | 1 | | $ | 100,001 |

| Total assets | $ | 1 | | $ | 100,001 |

Risk Factors

In considering whether to vote for the approval of the Arrangement, Arris Resources Shareholders should be aware that there are various risks, including those described in the Section entitled "Risk Factors" in this Circular. Arris Resources Shareholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether to approve the Arrangement.

– 10 –

GENERAL PROXY INFORMATION

Solicitation of Proxies

This Circular is furnished in connection with the solicitation of proxies by management of Arris Resources for use at the Meeting, and at any adjournment(s) or postponement(s) thereof.

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors or officers of the Company. The Company will bear all costs of this solicitation. The Company has arranged for Intermediaries to forward the meeting materials to Beneficial Shareholders held of record by those Intermediaries and the Company may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

Currency

In this Circular, except where otherwise indicated, all dollar amounts are expressed in the lawful currency of Canada.

Record Date

The Board has fixed May 4, 2009 as the record date (the "Record Date") for determination of persons entitled to receive notice of and to vote at the Meeting. Only Arris Resources Shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy in the manner and subject to the provisions described herein will be entitled to vote or to have their Arris Resources Shares voted at the Meeting.

Appointment of Proxyholders

The individual(s) named in the accompanying form of proxy are management's representatives. If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than the person(s) designated in the Proxy, who need not be a shareholder of the Company, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another proper proxy and, in either case, delivering the completed Proxy to the office of Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof.

Voting by Proxyholder

The person(s) named in the Proxy will vote or withhold from voting the Arris Resources Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Arris Resources Shares will be voted accordingly. The Proxy confers discretionary authority on the person(s) named therein with respect to:

(a)

each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors;

(b)

any amendment to or variation of any matter identified therein; and

(c)

any other matter that properly comes before the Meeting.

As at the date hereof, the Board knows of no such amendments, variations or other matters to come before the Meeting, other than the matters referred to in the Notice of Meeting. However, if other matters should properly come before the Meeting, the Proxy will be voted on such matters in accordance with the best judgment of the person(s) voting the Proxy.

In respect of a matter for which a choice is not specified in the Proxy, the person(s) named in the Proxy will vote the Arris Resources Shares represented by the Proxy for the approval of such matter.

-11-

Registered Shareholders

Registered Shareholders may wish to vote by Proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a Proxy may do so by completing, dating and signing the enclosed form of Proxy and returning it to the Company's transfer agent Computershare Investor Services Inc. by mail to Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof, or in such other manner as may be provided for in the Proxy.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold Arris Resources Shares in their own name. Beneficial Shareholders should note that the only Proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of Arris Resources Shares).

If Arris Resources Shares are listed in an account statement provided to a shareholder by a broker, then in almost all such cases those Arris Resources Shares will not be registered in the shareholder's name on the records of the Company. Such Arris Resources Shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such Arris Resources Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

There are two kinds of Beneficial Shareholders, those who object to their name being made known to the issuers of securities which they own (called "OBOs" for objecting beneficial owners) and those who do not object to the issuers of the securities they own knowing who they are (called "NOBOs" for non – objecting beneficial owners).

The Company is taking advantage of those provisions of National Instrument 54–101 – "Communication of Beneficial Owners of Securities" of the Canadian Securities Administrators, which permits it to deliver proxy–related materials directly to its NOBOs. As a result, NOBOs can expect to receive a scannable voting instruction form ("VIF"). These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile to the number provided in the VIF. In addition, Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Arris Resources Shares represented by the VIFs it receives.

This Circular, with related material, is being sent to both Registered and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name and address and information about your Arris Resources Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary who holds your Arris Resources Shares on your behalf.

By choosing to send these materials to you directly, the Company (and not the Intermediary holding your Arris Resources Shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your VIF as specified in your request for voting instructions that you receive.

Beneficial Shareholders who are OBOs should carefully follow the instructions of their Intermediary in order to ensure that their Arris Resources Shares are voted at the Meeting.

The form of proxy that will be supplied to Beneficial Shareholders by the Intermediaries will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the Intermediary on how to vote on behalf of the Beneficial Shareholder. Most Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. in the United States and Broadridge Financial Solutions Inc., Canada, in Canada (collectively "BFS"). BFS mails a VIF in lieu of a Proxy provided by the Company. The VIF will name the same person(s) as the Proxy to represent Beneficial Shareholders at the Meeting. Beneficial Shareholders have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the person(s) designated in the VIF, to represent them at the Meeting. To exercise this right, Beneficial Shareholders sho uld insert the name of the desired representative in the blank space provided in the VIF. The completed VIF must then be returned to BFS in the manner specified and in accordance with BFS's instructions. BFS then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Arris Resources Shares to be represented at the Meeting. If you receive a VIF from BFS, you cannot use it to vote Arris Resources Shares directly at the Meeting. The VIF must be completed and returned to BFS in accordance with its instructions, well in advance of the Meeting in order to have the Arris Resources Shares voted.

-12-

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Arris Resources Shares registered in the name of your Intermediary, you, or a person designated by you, may attend at the Meeting as proxyholder for your Intermediary and vote your Arris Resources Shares in that capacity. If you wish to attend the Meeting and indirectly vote your Arris Resources Shares as proxyholder for your Intermediary, or have a person designated by you to do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the VIF provided to you and return the same to your Intermediary in accordance with the instructions provided by such Intermediary, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend the Meeting and vote your Arris Resources Shares.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a proxy may revoke it by:

(a)

executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder's authorized attorney in writing, or if the Registered Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare or at the registered office of the Company at Suite 1000 – 925 West Georgia Street, Vancouver, British Columbia V6C 3L2, at any time up to and including the last Business Day that precedes the date of the Meeting or, if the Meeting is adjourned or postponed, the last Business Day that precedes any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or

(b)

personally attending the Meeting and voting the Registered Shareholder's Arris Resources Shares.

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year–end of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting, other than the election of directors, the appointment of the auditor and as may be otherwise set out herein.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no informed person of the Company, proposed director of the Company or any associate or affiliate of an informed person or proposed director, has any material interest, direct or indirect, in any transaction since the commencement of the Company's most recently completed financial year or in any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

-13-

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Outstanding Arris Resources Shares

The Company is authorized to issue an unlimited number of Arris Resources Shares. As at May 19, 2009, there were 15,043,372Arris Resources Shares issued and outstanding, each carrying the right to one vote.

Principal Holders of Arris Resources Shares

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Arris Resources Shares carrying more than 10% of the voting rights attached to all outstanding Arris Resources Shares.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as ordinary resolutions and an affirmative vote of 66 and 2/3rds of the votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as special resolutions.

If there are more nominees for election as directors than there are vacancies to fill, those nominees receiving the greatest number of votes will be elected. If the number of nominees for election as directors is equal to the number of vacancies to be filled, all such nominees will be declared elected.

ELECTION OF DIRECTORS

Directors of Arris Resources are elected for a term of one year. The term of office of each of the nominees proposed for election as a director will expire at the Meeting, and each of them, if elected, will serve until the close of the next annual general meeting, unless such director resigns or otherwise vacates office before that time. Under Arris Resources articles and pursuant to the Act, the number of directors cannot be fewer than three. Arris Resources currently has four directors.

The following are the nominees proposed for election as directors of Arris Resources together with the number of Arris Resources Shares, Arris Resources Stock Options and Arris Resources Warrants that are beneficially owned, directly or indirectly, or over which control or direction is exercised, by each nominee. Each of the nominees has agreed to stand for election and management of the Company is not aware of any intention of any of them not to do so. If, however, one or more of them should become unable to stand for election, it is expected that one or more other persons would be nominated at the Meeting for election and, in that event, the persons designated in the form of proxy will vote in their discretion for a substitute nominee.

| | | | | |

Name and place of residence | Principal occupation | Director since | Number of common shares | Number of options | Number of warrants |

Lucky Janda(1) Richmond, BC President and Director | Independent businessman with over 20 years experience in public companies and real estate development | April 8, 2008 | 120,000 | 575,000(2)(3) | 40,000 |

Harpreet Janda(4) Richmond, BC Chief Financial Officer, Secretary andDirector | Account executive with Purolator Courier | May 26, 2006 | Nil | 575,000(3)(5) | Nil |

Sandeep Poonia(4)(6) Richmond, BC Director | Independent businessman and real estate developer | June 17, 2008 | 80,000 | 50,000(3) | 40,000 |

Parmjeet Johal(4) North Vancouver, BC Director | Independent businessman and pharmacy owner | June 29, 2006 | Nil | 50,000(3) | Nil |

_______________

NOTES:

(1)

Mr. Janda was appointed as a director of the Company on April 8, 2008, upon the resignation of Deepen Ram.

(2)

These options are held indirectly by Mr. Janda through a British Columbia private company.

(3)

The Company issued 1,250,000 options in April 2009, at an exercise price of US$0.15 per option, which options expire five years from the date of grant.

(4)

Member of the audit committee of the Company.

(5)

525,000 of these options are held indirectly by Mr. Janda through a British Columbia private company.

(6)

Mr. Poonia was appointed as a director of the Company on June 19, 2008.

-14-

Arris Resources' management recommends that shareholders vote in favour of the election of the proposed nominees as directors of Arris Resources for the ensuing year. Unless you give instructions otherwise, the Management Proxyholders intend to vote FOR the nominees named in this Circular.

Corporate Cease Trade Orders and Bankruptcies

No director or officer of Arris Resources is, or has been within the past ten years, a director or executive officer of any company (including Arris Resources) that, while such person was acting in that capacity: (i) was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days; (ii) was subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or (iii) became bankrupt, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. Furthermore, no director or officer of Arris Resources has within the past ten years become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

EXECUTIVE COMPENSATION

The following Statement of Executive Compensation is prepared in accordance with applicable securities legislation. The purpose of this Statement of Executive Compensation is to provide disclosure of all compensation earned by directors and certain executive officers in connection with their position as an officer of or consultant to the Company.

Compensation Discussion and Analysis

The Board determines the executive compensation policy for the executives of the Company. The Board's objective is to ensure that executive compensation is market competitive, while at the same time reflecting the Company's current state of development and overall financial status. The Board also seeks to ensure that the Company's executive compensation policy is aligned with the near– and long–term interests of the shareholders of the Company. In determining compensation, the Board relies on discussions with the Company's management, and does not utilize any formal performance goals or benchmarks. In general, a Named Executive Officers' (as hereinafter defined) compensation may consist of two components:

·

salary or wages; and

·

stock option grants.

The objectives and reasons for this system of compensation are generally to allow the Company to remain competitive compared to its peers in attracting experienced personnel. The salaries are set out on a basis of a review and comparison of salaries paid to executives at similar companies, with an overarching view to the Company's current state of development and overall financial status.

-15-

Stock option grants are designed to reward the Named Executive Officers for success on a similar basis as the shareholders of the Company, while at the same time reducing the amount of salary and wages the Company may otherwise need to pay to the Named Executive Officers.

Option–Based Awards

Stock option grants are made on the basis of the number of stock options currently held, position, overall individual performance, anticipated contribution to the Company's future success and the individual's ability to influence corporate and business performance. The purpose of granting such stock options is to assist the Company in compensating, attracting, retaining and motivating the officers, directors and employees of the Company and to closely align the personal interest of such persons to the interest of the shareholders, while at the same time reducing the overall cash compensation that would otherwise be payable to the Named Executive Officers.

The recipients of incentive stock options and the terms of the stock options granted are determined from time to time by the Board. The exercise price of the stock options granted is generally determined by the market price at the time of grant and in accordance with the Arris Resources Stock Option Plan and the rules and policies of the Exchange.

Summary Compensation Table

The following table sets forth all annual and long–term compensation for services in all capacities to Arris Resources during the financial year ended December 31, 2008, in respect of each of the individuals who acted as the Chief Executive Officer and the Chief Financial Officer of the Company or acted in a similar capacity during the most recently completed financial year and the other three most highly compensated executive officers of Arris Resources whose individual total compensation for the most recently completed financial year exceeded $150,000, and any individual who would have satisfied this criteria but for the fact that individual was not serving as such an executive officer at the end of the most recently completed financial year (the "Named Executive Officers").

| | | | | | | | | |

Name and principal position | Year ended December 31, | Salary ($) | Share based awards ($) | Option based awards

($) | Non-equity incentive plan compensation | Pension value

($) | All other compensation

($) | Total compensation

($) |

Annual incentive plan

($) | Long–term incentive plan

($) |

Lucky Janda(1) President | 2008 | Nil | N/A | Nil | N/A | N/A | N/A | N/A | Nil |

Curt Huber(2) President | 2008 | Nil | N/A | Nil | N/A | N/A | N/A | N/A | Nil |

Harpreet Janda Chief Financial Officer | 2008 | Nil | N/A | Nil | N/A | N/A | N/A | N/A | Nil |

_______________

NOTES:

(1)

Mr. Janda was appointed as the President and a director of the Company effective April 8, 2009, upon the resignation of Curt Huber.

(2)

Mr. Huber resigned as the President and as a director of the Company effective April 8, 2009.

Outstanding Option-Based Awards

There were no option-based awards outstanding at the end of the most recently completed financial year granted to the Named Executive Officers.

Termination and Change of Control Benefits

The Company does not have any contract, agreement, plan or arrangement that provides for payments to a Named Executive Officer at, following or in connection with any termination, resignation, retirement, a change in control of the Company or a change in a Named Executive Officers' responsibilities.

-16-

Compensation of Directors

Arris Resources has no arrangements, standard or otherwise, pursuant to which directors are compensated by Arris Resources for their services in their capacity as directors, or for committee participation, involvement in special assignments or for services as a consultant or expert during the most recently completed financial year or subsequently, up to and including the date of this Information Circular.

No compensation was paid and no stock options were granted to the directors of the Company for the most recently completed financial year

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The shareholder's of the Company have adopted the Arris Resources Stock Option Plan for its directors, officers, employees, management companies and consultants. The purpose of the Arris Resources Stock Option Plan is to provide incentive to directors, officers, employees, management companies and consultants who provide services to the Company, while at the same time reducing the cash compensation the Company would otherwise have to pay.

The Arris Resources Stock Option Plan provides that options to purchase Arris Resources Shares may be granted to eligible persons on terms determined within the limitations set out in the Arris Resources Stock Option Plan. The maximum number of Arris Resources Shares to be reserved for issuance at any one time under the Arris Resources Stock Option Plan (including any options granted by the Company prior to the adoption of the Plan) is ten (10%) percent of the issued and outstanding Arris Resources Shares from time to time at the date of grant of the options. As at the date hereof, an aggregate of 1,504,337 Arris Resources Shares are available for issuance under the Arris Resources Stock Option Plan. The exercise price for an option granted under the Arris Resources Stock Option Plan may not be less than that permitted by the Exchange. Options granted may be subject to vesting requirements. Options will be granted for a period which may not ex ceed five years from the date of the grant and will generally expire within ninety (90) days upon the participant ceasing to be a director, officer, employee, management company or consultant of the Company, and generally within thirty (30) days of the participant ceasing to act as an employee engaged in investor relations activities. The Option Plan is subject to the rules and policies of the Exchange. As of the date hereof, there were 1,250,000 options outstanding under the Arris Resources Stock Option Plan.

The following table sets forth information relating to Arris Resources Stock Option Plan as at December 31, 2008:

| | | |

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted–average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans |

Equity compensation plans approved by security holders | Nil | N/A | 1,504,337 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As at the date hereof, no individual who is or was a director, executive officer, employee or former director, executive officer or employee of the Company was indebted to the Company or any of its subsidiaries or indebted to another entity that is or has been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries.

MANAGEMENT CONTRACTS

To the best of the knowledge of the directors and officers of the Company, management functions of the Company are not, to any substantial degree, performed by a person other than the directors and executive officers of the Company.

APPOINTMENT OF AUDITOR

Management of theCompany will recommend at the Meeting that Arris Resources Shareholders appoint DeVisser Gray LLP, Chartered Accountants, as auditors of the Company, to hold office until the next annul meeting of shareholders of the Company, and authorize the directors to fix their remuneration. DeVisser Gray LLP, Chartered Accountants were appointed as auditors of the Company by the Board effective November 20, 2008. UHI LDMB Advisors Inc., Chartered Accountants are the former auditors of the Company and resigned as auditors of the Company effective November 20, 2008.

-17-

As required by National Instrument 51–102 – "Continuous Disclosure Obligations" ("NI 51–102"), attached as Schedule "J" hereto are copies of the following materials which were filed with the securities regulatory authorities in connection with the change of auditor:

1.

cover letter of the Company dated November 20, 2008;

2.

notice of change of auditor of the Company dated November 20, 2008;

3.

letter from UHI LDMB Advisors Inc., Chartered Accountants as former auditors of the Company; and

4.

letter from DeVisser Gray LLP, Chartered Accountants as successor auditors of the Company.

AUDIT COMMITTEE

Composition of the Audit Committee

Messrs. Sandeep Poonia, Parmjeet Johal and Harpreet Janda (Chairman) are the members of Arris Resources' audit committee (the "Audit Committee"). At present, two of the Audit Committee members, namely Sandeep Poonia and Parmjeet Johal, are considered "independent" as that term is defined in National Instrument 52-110 – "Audit Committees" ("NI–52-110"). Harpreet Janda is not considered independent as he is the Chief Financial Officer of the Company.

All three of the Audit Committee members have the ability to read and understand financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by Arris Resources financial statements.

Relevant Education and Experience

All of the Audit Committee members are senior–level businessmen with extensive experience in financial matters. Each Audit Committee member has a broad understanding of accounting principles used to prepare financial statements and varied experience as to general application of such accounting principles, as well as the internal controls and procedures necessary for financial reporting, garnered from working in their individual fields of endeavour. In addition, each of the members of the Audit Committee have knowledge of the role of an audit committee in the realm of reporting companies from their years of experience as directors of public companies other than the Company.

Audit Committee Oversight

At no time since the commencement of the Company's most recently completed financial year was a recommendation of the Audit Committee to nominate or compensate an external auditor not adopted by the Board.

Reliance on Certain Exemptions

At no time since the commencement of the Company's most recently completed financial year has the Company relied on the exemption in Section 2.4 of NI 52–110 (De Minimis Non–audit Services) or an exemption from NI 52–110, in whole or in part, granted under Part 8 (Exemptions).

Pre–approval Policies and Procedures

The Audit Committee has adopted specific policies and procedures for the engagement of non–audit services as set out in the Audit Committee's charter attached hereto as Schedule "I".

-18-

External Auditor Service Fees (By Category)