Exhibit 99.4

ARRIS RESOURCES INC.

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

FOR

A SPECIAL MEETING OF SHAREHOLDERS

IN RESPECT OF AN ARRANGEMENT

BETWEEN

ARRIS RESOURCES INC.

AND

CLI RESOURCES INC.

AND

QMI SEISMIC INC

AND

ARRIS HOLDINGS INC.

AND IN ADDITION,

SHAREHOLDERS WILL BE ASKED

TO VOTE ON THE APPROVAL OF A

FORWARD SPLIT OF ARRIS RESOURCES SHARES

November 5, 2009

TABLE OF CONTENTS

Page

| |

| NOTICE TO UNITED STATES SHAREHOLDERS | 1 |

| INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS | 2 |

| INFORMATION CONTAINED IN THIS CIRCULAR | 2 |

| GLOSSARY OF TERMS | 3 |

| SUMMARY | 8 |

| THEMEETING | 8 |

| THEARRANGEMENT | 8 |

| EFFECT OF THEARRANGEMENT ONARRISRESOURCESSHARECOMMITMENTS | 9 |

| RECOMMENDATION ANDAPPROVAL OF THEBOARD OFDIRECTORS | 9 |

| REASONS FOR THEARRANGEMENT | 9 |

| CONDUCT OFMEETING ANDSHAREHOLDERAPPROVAL | 10 |

| COURTAPPROVAL | 10 |

| INCOMETAXCONSIDERATIONS | 11 |

| RIGHT TODISSENT | 11 |

| STOCKEXCHANGELISTINGS | 11 |

| INFORMATIONCONCERNING THECOMPANY ANDCLI AFTER THEARRANGEMENT | 11 |

| INFORMATIONCONCERNING THECOMPANY ANDQMI AFTER THEARRANGEMENT | 11 |

| INFORMATIONCONCERNING THECOMPANY AND AHIAFTER THEARRANGEMENT | 11 |

| SELECTEDUNAUDITEDPRO–FORMACONSOLIDATEDFINANCIALINFORMATION FOR THECOMPANY | 12 |

| SeLECTEDUNAUDITEd Pro–Forma Consolidated Financial Information for CLI | 13 |

| SELECTEDUNAUDITEDPRO–FORMACONSOLIDATEDFINANCIALINFORMATION FORQMI | 13 |

| Selected Unaudited Pro–Forma Consolidated Financial Information for AHI | 13 |

| RISKFACTORS | 14 |

| APPROVAL OF FORWARD SPLIT | 14 |

| GENERAL PROXY INFORMATION | 15 |

| SOLICITATION OFPROXIES | 15 |

| CURRENCY | 15 |

| RECORDDATE | 15 |

| APPOINTMENT OFPROXYHOLDERS | 15 |

| VOTING BYPROXYHOLDER | 15 |

| REGISTEREDSHAREHOLDERS | 16 |

| BENEFICIALSHAREHOLDERS | 16 |

| REVOCATION OFPROXIES | 17 |

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 17 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 17 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 18 |

| OUTSTANDINGARRISRESOURCESSHARES | 18 |

| PRINCIPALHOLDERS OFARRISRESOURCESSHARES | 18 |

| VOTES NECESSARY TO PASS RESOLUTIONS | 18 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | |

| THE ARRANGEMENT | 18 |

| GENERAL | 18 |

| REASONS FOR THEARRANGEMENT | 18 |

| RECOMMENDATION OFDIRECTORS | 20 |

| FAIRNESS OF THEARRANGEMENT | 20 |

| DETAILS OF THEARRANGEMENT | 20 |

| AUTHORITY OF THEBOARD | 23 |

-ii-

| |

| CONDITIONS TO THEARRANGEMENT | 24 |

| SHAREHOLDERAPPROVAL | 24 |

| COURTAPPROVAL OF THEARRANGEMENT | 25 |

| PROPOSEDTIMETABLE FORARRANGEMENT | 25 |

| CLI, QMIANDAHI SHARECERTIFICATES ANDCERTIFICATES FORNEWSHARES | 25 |

| RELATIONSHIPBETWEEN THECOMPANY ANDCLIANDQMI AND AHIAFTER THEARRANGEMENT | 25 |

| EFFECT OFARRANGEMENT ONOUTSTANDINGARRISRESOURCESSHARECOMMITMENTS | 26 |

| RESALE OFNEWSHARES ANDCLIANDQMI AND AHI SHARES | 26 |

| EXPENSES OFARRANGEMENT | 27 |

| INCOME TAX CONSIDERATIONS | 27 |

| CERTAINCANADIANFEDERALINCOMETAXCONSIDERATIONS | 27 |

| CERTAINU.S. FEDERALINCOMETAXCONSIDERATIONS | 32 |

| APPROVAL OF THE CLI AND QMI STOCK OPTION PLAN | 38 |

| STOCKOPTIONPLAN OFCLI | 38 |

| STOCKOPTIONPLAN OFQMI | 38 |

| STOCKOPTIONPLAN OF AHI | 38 |

| Purpose of the CLI Stock Option Plan | 38 |

| PURPOSE OF THEQMI STOCKOPTIONPLAN | 38 |

| PURPOSE OF THE AHI STOCK OPTION PLAN | 38 |

| GENERALDESCRIPTION ANDEXCHANGEPOLICIES | 38 |

| RIGHTS OF DISSENT | 42 |

| DISSENTERS' RIGHTS | 42 |

| RISK FACTORS | 42 |

| GENERAL ANDINDUSTRYRISKS | 43 |

| SECURITIES OFCLI, QMIANDAHIANDDILUTION | 43 |

| COMPETITION | 44 |

| CONFLICTS OFINTEREST | 45 |

| NOHISTORY OFEARNINGS ORDIVIDENDS | 45 |

| POTENTIALPROFITABILITYDEPENDSUPONFACTORSBEYOND THECONTROL OFCLI | 45 |

| Potential Profitability Depends Upon Factors Beyond the Control of QMI | 45 |

| POTENTIAL PROFITABILITY DEPENDS UPON FACTORS BEYOND THE CONTROL OF AHI | 41 |

| REGULATIONS, PERMITS,ANDCOMPLIANCE | 46 |

| DEPENDENCY ON ASMALLNUMBER OFMANAGEMENTPERSONNEL | 46 |

| SUPPLY ANDDEMAND | 46 |

| DEVELOPMENT ANDCONSTRUCTIONCOSTS | 46 |

| THE COMPANY AFTER THE ARRANGEMENT | 47 |

| NAME, ADDRESS ANDINCORPORATION | 47 |

| DIRECTORS ANDOFFICERS | 47 |

| BUSINESS OF THECOMPANY– THREE-YEAR HISTORY | 47 |

| BUSINESS OF THECOMPANYFOLLOWING THEARRANGEMENT | 48 |

| BUSINESSOVERVIEW | 48 |

| DESCRIPTION OFSHARECAPITAL | 48 |

| CHANGES INSHARECAPITAL | 48 |

| DIVIDENDPOLICY | 49 |

| TRADINGPRICE ANDVOLUME | 49 |

| SELECTEDUNAUDITEDPRO–FORMACONSOLIDATEDFINANCIALINFORMATION OF THECOMPANY | 50 |

| THECOMPANY'SYEAR–ENDAUDITEDFINANCIALSTATEMENTS | 50 |

| MATERIALCONTRACTS | 51 |

| CLI AFTER THE ARRANGEMENT | 51 |

| NAME, ADDRESS ANDINCORPORATION | 51 |

| INTERCORPORATERELATIONSHIPS | 51 |

| SIGNIFICANTACQUISITION ANDDISPOSITIONS | 51 |

-iii-

| |

| TRENDS | 51 |

| GENERALDEVELOPMENT OFCLI'SBUSINESS | 52 |

| CLI'SBUSINESSHISTORY | 52 |

| SELECTEDUNAUDITEDPRO–FORMAFINANCIALINFORMATION OFCLI | 52 |

| DIVIDENDS | 53 |

| BUSINESS OFCLI | 53 |

| LIQUIDITY ANDCAPITALRESOURCES | 54 |

| RESULTS OFOPERATIONS | 54 |

| AVAILABLEFUNDS | 54 |

| ADMINISTRATIONEXPENSES | 55 |

| SHARECAPITAL OFCLI | 55 |

| FULLYDILUTEDSHARECAPITAL OFCLI | 56 |

| PRIORSALES OFSECURITIES OFCLI | 56 |

| OPTIONS ANDWARRANTS | 56 |

| PRINCIPALSHAREHOLDERS OFCLI | 57 |

| DIRECTORS ANDOFFICERS OFCLI | 57 |

| MANAGEMENT OFCLI | 57 |

| CORPORATECEASETRADEORDERS ORBANKRUPTCIES | 58 |

| PENALTIES ORSANCTIONS | 58 |

| PERSONALBANKRUPTCIES | 58 |

| CONFLICTS OFINTEREST | 58 |

| EXECUTIVECOMPENSATION OFCLI | 58 |

| INDEBTEDNESS OFDIRECTORS ANDEXECUTIVEOFFICERS OFCLI | 59 |

| CLI'SAUDITOR | 59 |

| CLI'SMATERIALCONTRACTS | 59 |

| PROMOTERS | 59 |

| QMI AFTER THE ARRANGEMENT | 60 |

| NAME, ADDRESS ANDINCORPORATION | 60 |

| INTERCORPORATERELATIONSHIPS | 60 |

| SIGNIFICANTACQUISITION ANDDISPOSITIONS | 60 |

| TRENDS | 60 |

| GENERALDEVELOPMENT OFQMI BUSINESS | 60 |

| QMI'SBUSINESSHISTORY | 61 |

| SELECTEDUNAUDITEDPRO–FORMAFINANCIALINFORMATION OFQMI | 61 |

| DIVIDENDS | 62 |

| BUSINESS OFQMI | 62 |

| LIQUIDITY ANDCAPITALRESOURCES | 62 |

| RESULTS OFOPERATIONS | 63 |

| AVAILABLEFUNDS | 63 |

| ADMINISTRATIONEXPENSES | 63 |

| SHARECAPITAL OFQMI | 64 |

| FULLYDILUTEDSHARECAPITAL OFQMI | 65 |

| PRIORSALES OFSECURITIES OFQMI | 65 |

| OPTIONS ANDWARRANTS | 65 |

| PRINCIPALSHAREHOLDERS OFQMI | 65 |

| DIRECTORS ANDOFFICERS OFQMI | 66 |

| MANAGEMENT OFQMI | 66 |

| CORPORATECEASETRADEORDERS ORBANKRUPTCIES | 67 |

| PENALTIES ORSANCTIONS | 67 |

| PERSONALBANKRUPTCIES | 67 |

| CONFLICTS OFINTEREST | 67 |

| EXECUTIVECOMPENSATION OFQMI | 67 |

| INDEBTEDNESS OFDIRECTORS ANDEXECUTIVEOFFICERS OFQMI | 67 |

| QMI'SAUDITOR | 68 |

| QMI'SMATERIALCONTRACTS | 68 |

| PROMOTERS | 68 |

-iv-

| |

| AHI AFTER THE ARRANGEMENT | 68 |

| NAME, ADDRESS ANDINCORPORATION | 68 |

| INTERCORPORATERELATIONSHIPS | 68 |

| SIGNIFICANTACQUISITION ANDDISPOSITIONS | 68 |

| TRENDS | 68 |

| GENERALDEVELOPMENT OFAHI BUSINESS | 69 |

| AHI'SBUSINESSHISTORY | 69 |

| SELECTEDUNAUDITEDPRO–FORMAFINANCIALINFORMATION OFAHI | 69 |

| DIVIDENDS | 69 |

| BUSINESS OFAHI | 69 |

| LIQUIDITY ANDCAPITALRESOURCES | 70 |

| RESULTS OFOPERATIONS | 70 |

| AVAILABLEFUNDS | 70 |

| ADMINISTRATIONEXPENSES | 55 |

| SHARECAPITAL OFAHI | 55 |

| FULLYDILUTEDSHARECAPITAL OFAHI | 56 |

| PRIORSALES OFSECURITIES OFAHI | 56 |

| OPTIONS ANDWARRANTS | 56 |

| PRINCIPALSHAREHOLDERS OFAHI | 73 |

| DIRECTORS ANDOFFICERS OFAHI | 73 |

| MANAGEMENT OFAHI | 73 |

| CORPORATECEASETRADEORDERS ORBANKRUPTCIES | 74 |

| PENALTIES ORSANCTIONS | 74 |

| PERSONALBANKRUPTCIES | 74 |

| CONFLICTS OFINTEREST | 74 |

| EXECUTIVECOMPENSATION OFAHI | 74 |

| INDEBTEDNESS OFDIRECTORS ANDEXECUTIVEOFFICERS OFAHI | 59 |

| AHI'SAUDITOR | 59 |

| AHI'SMATERIALCONTRACTS | 59 |

| PROMOTERS | 59 |

| TRANSFER AGENT AND REGISTRAR | 74 |

| LEGAL PROCEEDINGS | 75 |

| ADDITIONAL INFORMATION | 75 |

| EXPERTS | 75 |

| ARRIS RESOURCES INC SHARE FORWARD SPLIT | 76 |

| OTHER MATTERS | 77 |

| APPROVAL OF INFORMATION CIRCULAR | 77 |

| CERTIFICATE OF THE CORPORATION | 77 |

| AUDITOR'S CONSENT | 79 |

-v-

| |

| Schedule A: | Form of Resolutions |

| Schedule B: | The Arrangement Agreement |

| Schedule C: | The Interim Order |

| Schedule D: | Dissent Procedures |

| Schedule E: | Pro–FormaUnaudited Consolidated Balance Sheet of Arris Resource Inc. as at September 30, 2009 |

| Schedule F: | Pro–FormaUnaudited Consolidated Balance Sheet of CLI as at September 30, 2009 |

| Schedule G: | Pro–FormaUnaudited Consolidated Balance Sheet of QMI as at September 30, 2009 |

| Schedule H: | Pro–FormaUnaudited Consolidated Balance Sheet of AHI as at September 30, 2009 |

| Schedule I | Consolidated Audited Financial Statements of Arris Resource Inc. for the Year Ended December 31, 2008 |

| Schedule J | QMI Manufacturing Representation Agreement |

| Schedule K | Interim Financial Statements of Arris Resources Inc. as at September 30, 2009 |

ARRIS RESOURCES INC.

1250 West Hastings Street

Vancouver, British Columbia V6E 2M4

Telephone No. (604) 687-0879 / Facsimile No. (604) 408-9301

Email: info@arrisresources.com

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

To: The Shareholders of Arris Resource Inc.

TAKE NOTICE that pursuant to an order of the Supreme Court of British Columbia dated November 5, 2009, a special meeting (the "Meeting") of shareholders (the "Arris Resources Shareholders") of Arris Resource Inc. (the "Company") will be held at 1250 West Hastings Street, Vancouver, British Columbia, on December 8, 2009, at 10:00 a.m. (Vancouver time), for the following purposes:

1.

to consider and, if thought fit, pass, with or without variation, a special resolution approving an arrangement (the "Plan ofArrangement") under Division 5 of Part 9 of theBusiness Corporations Act (British Columbia) (the "Act") which involves, among other things, the distribution to the Arris Resources Shareholders shares of CLI Resources Inc. ("CLI"), currently a wholly–owned subsidiary of the Company, all as more fully set forth in the accompanying management information circular (the "Circular") of the Company, the distribution to the Arris Resources Shareholders shares of QMI Seismic Inc.. ("QMI"), currently a wholly–owned subsidiary of the Company, all as more fully set forth in the accompanying management information circular (the "Circular") of the Company and the distribution to the Arri s Resources Shareholders shares of AHI Holdings Inc. ("AHI"), currently a wholly–owned subsidiary of the Company, all as more fully set forth in the accompanying management information circular (the "Circular") of the Company;

2.

the Company split its issued and outstanding common shares on a 1:5 ratio;

3.

to consider and, if thought fit, pass, with or without variation, an ordinary resolution to approve, ratify and affirm a stock option plan for CLI and QMI and AHI; and

4.

to approve the change of name of the Company conditional upon approval of the Board of Directors

5.

to transact such other business as may properly come before the Meeting or at any adjournment(s) or postponement(s) thereof.

AND TAKE NOTICE that Arris Resources Shareholders who validly dissent from the Arrangement will be entitled to be paid the fair value of their Arris Resources Shares subject to strict compliance with the provisions of the interim order (as set forth herein), the Plan of Arrangement and sections 237 to 247 of the Act. The dissent rights are described in Schedule"D" of the Circular. Failure to comply strictly with the requirements set forth in the Plan of Arrangement and sections 237 to 247 of the Act may result in the loss of any right of dissent.

The Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice. Also accompanying this Notice and the Circular is a form of proxy for use at the Meeting. Any adjourned meeting resulting from an adjournment of the Meeting will be held at a time and place to be specified at the Meeting. Only Arris Resources Shareholders of record at the close of business on October 15, 2009, will be entitled to receive notice of and vote at the Meeting.

Registered Arris Resources Shareholders unable to attend the Meeting are requested to date, sign and return the enclosed form of proxy and deliver it in accordance with the instructions set out in the proxy and in the Circular. If you are a non–registered Arris Resources Shareholder and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or the other intermediary. Failure to do so may result in your shares of the Company not being voted at the Meeting.

Dated at Vancouver, British Columbia, this 5th day of November, 2009.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ "Lucky Janda"

Lucky Janda

President

ARRIS RESOURCES INC.

1250 West Hastings Street

Vancouver, British Columbia V5E 2M4

Telephone No. (604) 687-0879 / Facsimile No. (604) 408-9301

Email: info@arrisresources.com

This Circular is furnished in connection with the solicitation of proxies by management of Arris Resources for use at a special meeting of shareholders of the Company to be held on December 8, 2009.

Unless the context otherwise requires, capitalized terms used herein and not otherwise defined shall have the meanings set forth in the Glossary of Terms in this Circular.

In considering whether to vote for the approval of the Arrangement, Arris Resources Shareholders should be aware that there are various risks, including those described in the Section entitled "Risk Factors" in this Circular. Arris Resources Shareholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether to approve the Arrangement.

NOTICE TO UNITED STATES SHAREHOLDERS

THE SECURITIES ISSUABLE IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY IN ANY STATE, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The CLI and QMI and AHI Shares to be issued under the Arrangement have not been registered under the U.S. Securities Act and are being issued in reliance on the exemption from registration set forth in Section 3(a)(10) thereof on the basis of the approval of the Court as described under "The Arrangement — Resale of New Shares and CLI and QMI and AHI Shares" in this Circular. The solicitation of proxies is not subject to the requirements of Section 14(a) of the U.S. Exchange Act by virtue of an exemption applicable to proxy solicitations by foreign private issuers as defined in Rule 3b–4 of the U.S. Exchange Act. Accordingly, this Circular has been prepared in accordance with applicable Canadian disclosure requirements. Residents of the United States should be aware that such requirements differ from those of the United States applicable to proxy statements under the U.S. Exchange Act.

Information concerning any properties and operations of the Company, including any to be transferred to CLI and QMI and AHI as part of the Arrangement, has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable to similar information for United States companies.

Financial statements included or incorporated by reference herein have been prepared in accordance with generally accepted accounting principles in Canada and are subject to auditing and auditor independence standards in Canada, and reconciled to accounting principles generally accepted in the United States. Arris Resources Shareholders should be aware that the reorganization of the Company pursuant to the Plan of Arrangement as described herein may have tax consequences in both the United States and Canada. Such consequences for Arris Resources Shareholders who are resident in, or citizens of, the United States may not be described fully herein. See "Income Tax Considerations — Certain Canadian Federal Income Tax Considerations" and "Income Tax Considerations — Certain United States Federal Income Tax Considerations" in this Circular.

The enforcement by Arris Resources Shareholders of civil liabilities under the United States federal securities laws may be affected adversely by the fact that Arris Resources, CLI and QMI and AHI are incorporated or organized under the laws of a foreign country, that some or all of their officers and directors and the experts named herein are residents of a foreign country and that all of the assets of the Company, CLI and QMI and AHI are located outside the United States.

-2-

INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS

Except for statements of historical fact contained herein, the information presented in this Circular constitutes "forward–looking statements" or "information" (collectively "statements"). These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

In some cases, forward-looking statements can be identified by terminology such as "may", "will", "expect", "plan", "anticipate", "believe", "intend", "estimate", "predict", "forecast", "outlook", "potential", "continue", "should", "likely", or the negative of these terms or other comparable terminology. Although management believes that the anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve assumptions, known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or CLI or QMI or AHI to differ materially fro m anticipated future results, performance or achievements expressed or implied by such forward-looking statements and information. Factors that could cause actual results to differ materially from those set forth in the forward-looking statements and information include, but are not limited, risks related to our limited operating history and history of no earnings; competition from other real estate investment or development companies; changes to government regulations; dependence on key personnel; general economic conditions; local real estate conditions, including the development of properties in close proximity to the Property or other properties we may acquire; timely sale of newly-developed units or properties; the uncertainties of real estate development and acquisition activity, including the receipt of all necessary permits and approvals CLI and QMI and AHI may require development of the Property and Distribution Agreement or other properties or distribution agreements CLI and QMI and AHI may acquire; interest rates; availability of equity and debt financing; increased development costs, including costs of labor, equipment, electricity and environmental compliance or other production inputs; and other risks factors described from time to time in the documents filed by us with applicable securities regulators, including in this Circular under the heading "Risk Factors".

Forward–looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update any forward–looking statement if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

INFORMATION CONTAINED IN THIS CIRCULAR

The information contained in this Circular is given as at November 5, 2009, unless otherwise noted.

No person has been authorized to give any information or to make any representation in connection with the Arrangement and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by the Company.

This Circular does not constitute the solicitation of an offer to purchase any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation is not authorized or in which the person making such solicitation is not qualified to do so or to any person to whom it is unlawful to make such solicitation.

Information contained in this Circular should not be construed as legal, tax or financial advice and Arris Resources Shareholders are urged to consult their own professional advisers in connection therewith.

Descriptions in the body of this Circular of the terms of the Arrangement Agreement and the Plan of Arrangement are merely summaries of the terms of those documents. Arris Resources Shareholders should refer to the full text of the Arrangement Agreement and the Plan of Arrangement for complete details of those documents. The full text of the Arrangement Agreement is attached to this Circular as Schedule "B" and the Plan of Arrangement is attached as Exhibit II to the Arrangement Agreement.

– 3 –

GLOSSARY OF TERMS

The following is a glossary of general terms and abbreviations used in this Circular:

"Act" means theBusiness Corporations Act (British Columbia), S.B.C. 2002, c. 57, as may be amended or replaced from time to time;

"AHI" means Arris Holdings Inc., a private company incorporated under the Act;

"AHI Commitment" means the covenant of AHI to issue AHI Shares to the holders of Arris Resources Share Commitments who exercise their rights there under after the Effective Date, and are entitled pursuant to the corporate reorganization provisions thereof to receive New Shares and AHI Shares upon such exercise;

"AHI Stock Option Plan" means the proposed common share purchase option plan of AHI, which is subject to Arris Resources Shareholder approval;

"AHI Option Plan Resolution" means an ordinary resolution to be considered by the Arris Resources Shareholders to approve the AHI Option Plan, the full text of which is set out in Schedule "A" to this Circular;

"AHI Shareholder" means a holder of AHI Shares;

"AHI Shares" means the common shares without par value in the authorized share structure of AHI, as constituted on the date of the Arrangement Agreement;

"Arrangement" means the arrangement under the Arrangement Provisions pursuant to which the Company proposes to reorganize its business and assets, and which is set out in detail in the Plan of Arrangement;

"Arrangement Agreement" means the agreement dated effective November 24, 2009 between the Company and QMI and CLI and AHI, a copy of which is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

"Arrangement Provisions" means Part 9, Division 5 of the Act;

"Arrangement Resolution" means the special resolution to be considered by the Arris Resources Shareholders to approve the Arrangement, the full text of which is set out in Schedule "A" to this Circular;

"Arris Resources" means Arris Resource Inc.;

"Arris Resources Class A Shares" means the renamed and redesignated Arris Resources Shares described in §3.1(b)(i) of the Plan of Arrangement;

"Arris Resources Class A Preferred Shares" means the class "A" preferred shares without par value which will be created and issued pursuant to §3.1(b)(iii) of the Plan of Arrangement;

"Arris Resources Shareholder" means a holder of Arris Resources Shares;

"Arris Resources Share Commitments" means an obligation of Arris to issue New Shares and to deliver CLI and QMI and AHI Shares to the holders of Arris Resources Options and Arris Resources Warrants which are outstanding on the Effective Date, upon the exercise of such stock options and warrants;

"Arris Resources Shares" means the common shares without par value in the authorized share structure of the Company, as constituted on the date of the Arrangement Agreement;

"Arris Resources Stock Options" means the common share purchase options issued pursuant to the Arris Resources Stock Option Plan which are outstanding on the Effective Date;

"Arris Resources Warrants" means the common share purchase warrants of the Company outstanding on the Effective Date;

-4-

"Assets" means the assets of the Company to be transferred to CLI pursuant to the Arrangement, being the five mineral claims under option at the Gladys Lake Property; in addition to the assets of the Company to be transferred to QMI pursuant to the Arrangement, being the Distribution Agreement for India and other countries to be determined; in addition to the assets of the Company to be transferred to AHI pursuant to the Arrangement, being the equity investments;

"Beneficial Shareholder" means an Arris Resources Shareholder who is not a Registered Shareholder;

"Board" means the board of directors of the Company;

"Business Day" means a day which is not a Saturday, Sunday or statutory holiday in Vancouver, British Columbia;

"Circular" means this management information circular;

"CLI" means CLI Resources Inc., a private company incorporated under the Act;

"CLI Commitment" means the covenant of CLI to issue CLI Shares to the holders of Arris Resources Share Commitments who exercise their rights there under after the Effective Date, and are entitled pursuant to the corporate reorganization provisions thereof to receive New Shares and CLI Shares upon such exercise;

"CLI Stock Option Plan" means the proposed common share purchase option plan of CLI, which is subject to Arris Resources Shareholder approval;

"CLI Option Plan Resolution" means an ordinary resolution to be considered by the Arris Resources Shareholders to approve the CLI Option Plan, the full text of which is set out in Schedule "A" to this Circular;

"CLI Shareholder" means a holder of CLI Shares;

"CLI Shares" means the common shares without par value in the authorized share structure of CLI, as constituted on the date of the Arrangement Agreement;

"Company" means Arris Resource Inc.;

"Computershare" means Computershare Trust Company of Canada;

"Court" means the Supreme Court of British Columbia;

"Dissenting Shareholder" means an Arris Resources Shareholder who validly exercises rights of dissent under the Arrangement and who will be entitled to be paid fair value for his, her or its Arris Resources Shares in accordance with the Interim Order and the Plan of Arrangement;

"Dissenting Shares" means the Arris Resources Shares in respect of which Dissenting Shareholders have exercised a right of dissent;

“Distribution Agreement” means the distribution agreement for earthquake sensor and related products, between QMI Manufacturing Inc and Arris Resource Inc. which distribution agreement is to be transferred by Arris Resources to QMI pursuant to the Arrangement;

"Effective Date" means the date upon which the Arrangement becomes effective;

"Exchange" means the Canadian National Stock Exchange;

"Exchange Factor" means the number arrived at by dividing 17,583,372 by the number of issued Arris Resources Shares as of the close of business on the Share Distribution Record Date;

"Final Order" means the final order of the Court approving the Arrangement;

-5-

"Interim Order" means the interim order of the Court pursuant to the Act in respect of the Arrangement dated November 5, 2009, a copy of which is attached to this Circular as Schedule "C";

"Intermediaries" refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders;

"Listing Date" means the date the CLI Resources Inc. and QMI Seismic Inc. and AHI Holdings Inc. shares are listed on the Exchange;

"Meeting" means the special meeting of the Arris Resources Shareholders to be held on December 8, 2009, and any adjournment(s) or postponement(s) thereof;

"New Shares" means the new class of common shares without par value which the Company will create pursuant to §3.1(b)(ii) of the Plan of Arrangement and which, immediately after the Effective Date, will be identical in every relevant respect to the Arris Resources Shares;

"Notice of Meeting" means the notice of special meeting of the Arris Resources Shareholders in respect of the Meeting;

"Plan of Arrangement" means the plan of arrangement attached as Exhibit II to the Arrangement Agreement, which Arrangement Agreement is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

"Property" means the five mineral claims, which are located near Gladys Lake, approximately 50 kilometers northeast of Atlin, British Columbia, which property is to be transferred by Arris Resources to CLI pursuant to the Arrangement;

"Proxy" means the form of proxy accompanying this Circular;

"QMI" means QMI Seismic Inc., a private company incorporated under the Act;

"QMI Commitment" means the covenant of QMI to issue QMI Shares to the holders of Arris Resources Share Commitments who exercise their rights there under after the Effective Date, and are entitled pursuant to the corporate reorganization provisions thereof to receive New Shares and QMI Shares upon such exercise;

"QMI Stock Option Plan" means the proposed common share purchase option plan of QMI, which is subject to Arris Resources Shareholder approval;

"QMI Option Plan Resolution" means an ordinary resolution to be considered by the Arris Resources Shareholders to approve the QMI Option Plan, the full text of which is set out in Schedule "A" to this Circular;

"QMI Shareholder" means a holder of QMI Shares;

"QMI Shares" means the common shares without par value in the authorized share structure of QMI, as constituted on the date of the Arrangement Agreement;

"Registered Shareholder" means a registered holder of Arris Resources Shares as recorded in the shareholder register of the Company maintained by Computershare;

"Registrar" means the Registrar of Companies under the Act;

"SEC" means the United States Securities and Exchange Commission;

"SEDAR" means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

"Share Distribution Record Date" means the close of business on the day which is four Business Days after the date of the Meeting or such other day as agreed to by the Company and CLI, QMI and AHI, which date establishes the Arris Resources Shareholders who will be entitled to receive CLI, QMI and AHI Shares pursuant to the Plan of Arrangement;

-6-

"Tax Act" means theIncome Tax Act (Canada), as may be amended, or replaced, from time to time;

"U.S. Exchange Act" means the United StatesSecurities Exchange Act of 1934, as may be amended, or replaced, from time to time; and

"U.S. Securities Act" means the United StatesSecurities Act of 1933, as may be amended, or replaced, from time to time.

GLOSSARY OF MINING TERMS

The following is a glossary of technical terms and abbreviations used in this Circular:

"geology/geological" means the study of the Earth's history and life, mainly as recorded in rocks;

"Indicated Mineral Resource"1means that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed;

"Inferred Mineral Resource"1means that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes;

"intrusive/intrusions" means an igneous rock that invades older rocks;

"km" means kilometer;

"Measured Mineral Resource"1that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity;

"Mineral Reserve"2means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining,

1Cautionary Note to U.S. Shareholders.While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated MineralResource" and "Inferred Mineral Resource" are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, certain information contained in this Circular concerning descriptions of miner alization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC. "Inferred Mineral Resource" have a great amount of uncertainty as to their existence and there is great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "Inferred Mineral Resource" will ever be upgraded to a higher category.Investors are cautioned not to assume that any part or all of an "Inferred Mineral Resource" exists, or is economically or legally mineable.

2The term "Mineral Reserve" is a Canadian mining term as defined in accordance with Nl 43–101 under the guidelines set out in the CIM standards. In the United States, a mineral reserve is defined as part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made.

processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined;

"Mineral Resource"1means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge;

-7-

"mineralization" means the concentration of metals and their chemical compounds within a body of rock;

"Molybdenum" means a molybdenite-bearing quartz vein or veins

– 8 –

SUMMARY

The following is a summary of the information contained elsewhere in this Circular concerning a proposed reorganization of the Company by way of the Arrangement. This Circular also deals with the election of directors, the appointment of an auditor and the approval of the CLI and QMI and AHI Option Plan, which matters are not summarized in this summary. Certain capitalized words and terms used in this summary are defined in the Glossary of Terms above. This summary is qualified in its entirety by the more detailed information and financial statements appearing or referred to elsewhere in this Circular and the schedules attached hereto.

The Meeting

The Meeting will be held at 1250 West Hastings Street, Vancouver, British Columbia, on December 8, 2009 at 10:00 a.m. (Vancouver time). At the Meeting, the Arris Resources Shareholders will be asked, to consider and, if thought fit, to pass the Arrangement Resolution approving the Arrangement among the Company, CLI, QMI and AHI and the Arris Resources Shareholders. The Arrangement will consist of the distribution of CLI and QMI and AHI Shares to the Arris Resources Shareholders. Arris Resources Shareholders will also be requested to consider and, if thought fit, to pass the CLI and QMI and AHI Option Plan Resolution approving the CLI and QMI and AHI Option Plan.

By passing the Arrangement Resolution, the Arris Resources Shareholders will also be giving authority to the Board to use its best judgment to proceed with and cause the Company to complete the Arrangement without any requirement to seek or obtain any further approval of the Arris Resources Shareholders.

In addition, by ordinary resolution, Arris Shareholders will be asked to approve a forward split of the Company’s common stock.

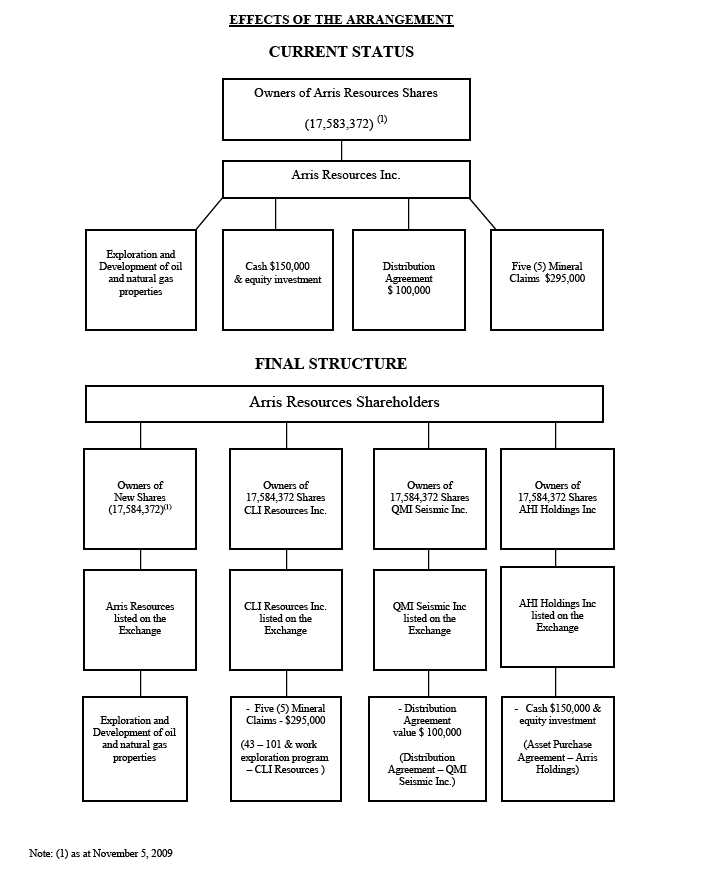

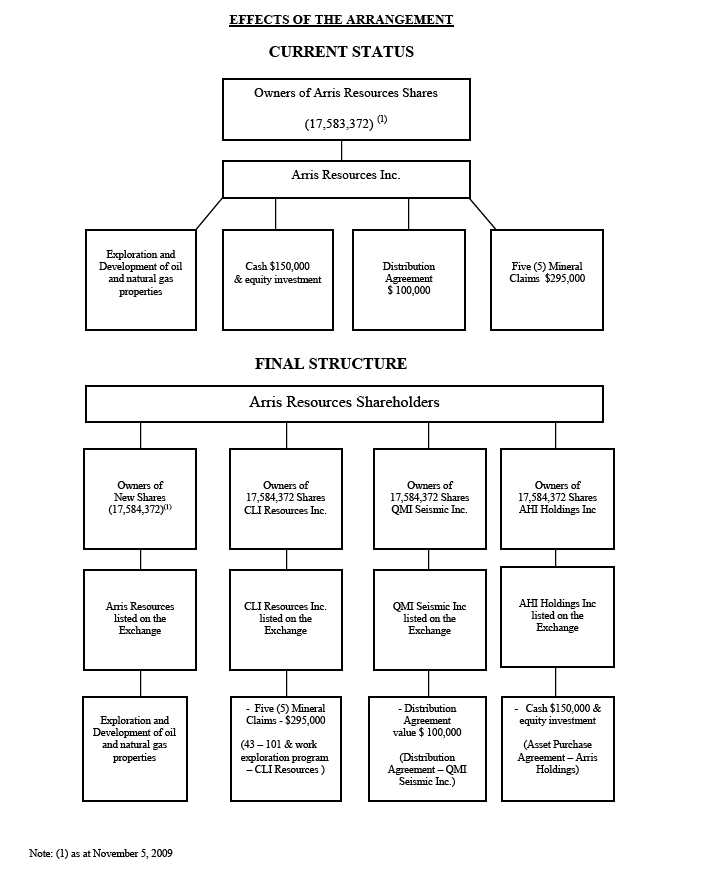

The Arrangement

The Company is a publicly traded resources company with onshore petroleum and natural gas rights and oil interests in Alberta, Canada and,

a) an interest in five mineral claims in British Columbia, Canada and,

b) an agreement with a British Columbia manufacturing company to distribute its earth quake sensor products in India and,

c) equity investments.

The Arrangement has been proposed to facilitate the separation of the Company's primary business activities from the exploration and development of the mineral Property at Gladys Lake and the Distribution Agreement and the equity investments. The Company believes that separating Arris Resources into four public companies offers a number of benefits to shareholders.

i) First, the Company believes that after the separation, each company will be better able to pursue its own specific operating strategies without being subject to the financial constraints of the other business.

ii) After the separation, each company will also have the flexibility to implement its own unique growth strategies, allowing both organizations to refine and refocus their business mix.

iii) Additionally, because the resulting businesses will be focused in their respective industries, they will be more readily understood by public investors, allowing each company to be in a better position to raise capital and align management and employee incentives with the interests of shareholders.

Pursuant to the Arrangement,

a) Arris Resources will transfer to CLI all of Arris Resources' interest in and to the Mineral Resource in exchange for 17,583,372 CLI Shares, which shares will be distributed to the Arris Resources Shareholders who hold Arris Resources Shares on the Share Distribution Record Date and

-9-

b) Arris Resources will transfer to QMI all of Arris Resources' interest in and to the Distribution Agreement in exchange for 17,583,372 QMI Shares, which shares will be distributed to the Arris Resources Shareholders who hold Arris Resources Shares on the Share Distribution Record Date,

c) Arris Resources will transfer to AHI all of Arris Resources' interest in and to the equity investments in exchange for 17,583,372 AHI Shares, which shares will be distributed to the Arris Resources Shareholders who hold Arris Resources Shares on the Share Distribution Record Date,

Each Arris Resources Shareholder as of the Share Distribution Record Date, other than a Dissenting Shareholder, will, immediately after the Arrangement, hold one New Share in the capital of the Company and itspro–rata share of the CLI and QMI and AHI Shares to be distributed under the Arrangement for each currently held Arris Resources Share. The New Shares will be identical in every respect to the present Arris Resources Shares. See "The Arrangement – Details of the Arrangement".

Effect of the Arrangement on Arris Resources Share Commitments

1) As of the Effective Date, the Arris Resources Share Commitments will be exercisable, in accordance with the corporate reorganization provisions of such securities, into New Shares and CLI and QMI and AHI Shares on the basis that the holder will receive, upon exercise, a number of New Shares that equals the number of Arris Resources Shares that would have been received upon the exercise of the Arris Resources Share Commitments prior to the Effective Date, and a number of CLI and QMI and AHI Shares that is equal to the number of New Shares so acquired.

2) CLI and QMI and AHI have agreed, pursuant to the CLI and QMI and AHI Commitments, to issue CLI and QMI and AHI Shares upon exercise of the Arris Resources Share Commitments and the Company is obligated, as the agent of CLI and QMI and AHI, to collect and pay to CLI and QMI and AHI a portion of the proceeds received for each Arris Resources Share Commitment so exercised, with the balance of the exercise price to be retained by Arris Resources.

3) Any entitlement to a fraction of a CLI or a QMI and AHI Share resulting from the exercise of Arris Resources Share Commitments will be cancelled without compensation.

Recommendation and Approval of the Board of Directors

The directors of the Company have concluded that the terms of the Arrangement are fair and reasonable to, and in the best interests of, the Company and the Arris Resources Shareholders. The Board has therefore approved the Arrangement and authorized the submission of the Arrangement to the Arris Resources Shareholders and the Court for approval. The Board recommends that Arris Resources Shareholders vote FOR the approval of the Arrangement. See "The Arrangement– Recommendation of Directors".

Reasons for the Arrangement

The decision to proceed with the Arrangement was based on the following primary determinations:

1.

the Company's primary focus is the exploration and development of its petroleum and natural gas properties and oil interests in Alberta, Canada. This focus will hinder the development of the Company's mineral claims in British Columbia, Canada and the company’s distribution agreement for seismic products in India.. The formation of CLI to hold the Property, the formation of QMI to hold the Distribution Agreement and the formation of AHI to manage the equity investments will facilitate separate development strategies for the Property, for the Distribution Agreement and for the equity investments moving forward;

2.

following the Arrangement, management of the Company will be free to focus entirely on its primary business activities, and new management for CLI and QMI and AHI will be established, which has knowledge and expertise specific to CLI's and QMI’s and AHI’s industry sectors;

-10-

3.

the formation of CLI and the distribution of 17,583,372 CLI Shares to the Arris Resources Shareholders pursuant to the Arrangement will give the Arris Resources Shareholders a direct interest in a new mineral development company that will focus on and pursue the development of the Property;

4.

the formation of QMI and the distribution of 17,583,372 QMI Shares to the Arris Resources Shareholders pursuant to the Arrangement will give the Arris Resources Shareholders a direct interest in a new distribution company that will focus on and pursue the development of the Distribution Agreement;

5.

the formation of AHI and the distribution of 17,583,372 AHI Shares to the Arris Resources Shareholders pursuant to the Arrangement will give the Arris Resources Shareholders a direct interest in a new company that will focus on and pursue the development of the equity investments;

6.

as a separate mineral development company, CLI will have direct access to public and private capital markets and will be able to issue debt and equity to fund improvements and development of the Property and to finance the acquisition and development of any new properties CLI may acquire on a priority basis; and

7.

as a separate distribution company, QMI will have direct access to public and private capital markets and will be able to issue debt and equity to fund improvements and development of the Distribution Agreement and to finance the acquisition and development of any new distribution agreements QMI may acquire on a priority basis; and

8.

as a separate investment company, AHI will have direct access to public and private capital markets and will be able to issue debt and equity to fund improvements and development of the equity investments and to finance the acquisition and development of any new equity investments AHI may acquire on a priority basis; and

9.

as a separate mineral development company, CLI will be able to establish equity based compensation programs to enable it to better attract, motivate and retain directors, officers and key employees, thereby better aligning management and employee incentives with the interests of shareholders.

10.

as a separate distribution company, QMI will be able to establish equity based compensation programs to enable it to better attract, motivate and retain directors, officers and key employees, thereby better aligning management and employee incentives with the interests of shareholders.

11.

as a separate investment company, AHI will be able to establish equity based compensation programs to enable it to better attract, motivate and retain directors, officers and key employees, thereby better aligning management and employee incentives with the interests of shareholders.

See "The Arrangement – Reasons for the Arrangement".

Conduct of Meeting and Shareholder Approval

The Interim Order provides that in order for the Arrangement to proceed, the Arrangement Resolution must be passed, with or without variation, by at least 66 and 2/3rds of the eligible votes cast with respect to the Arrangement Resolution by Arris Resources Shareholders present in person or by proxy at the Meeting. See "The Arrangement – Shareholder Approval".

Court Approval

The Arrangement, as structured, requires the approval of the Court. Prior to the mailing of this Circular, the Company obtained the Interim Order authorizing the calling and holdings of the Meeting and providing for certain other procedural matters. The Interim Order does not constitute approval of the Arrangement or the contents of this Circular by the Court.

The Notice of Hearing of Petition for the Final Order is attached to the Notice of Meeting. In hearing the petition for the Final Order, the Court will consider, among other things, the fairness of the Arrangement to the Arris Resources Shareholders. The Court will also be advised that based on the Court's approval of the Arrangement, the Company and CLI and QMI and AHI will rely on an exemption from registration pursuant to Section 3(a)(10) of the U.S. Securities Act for the issuance of the New Shares and CLI Shares and QMI and AHI Shares to any United States based Arris Resources Shareholders. Assuming approval of the Arrangement by the Arris Resources Shareholders at the Meeting, the hearing for the Final Order is scheduled to take place at 9:45 a.m. (Vancouver time) on December 11, 2009, at the Courthouse located at 800 Smithe Street, Vancouver, British Columbia, or at such other date and time as the Court may direct. At this hearing, any Arris Resour ces Shareholder or director, creditor, auditor or other interested party of the Company who wishes to participate or to be represented or who wishes to present evidence or argument may do so, subject to filing an appearance and satisfying certain other requirements. See "The Arrangement – Court Approval of the Arrangement".

-11-

Income Tax Considerations

Canadian Federal income tax considerations for Arris Resources Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary herein entitled "Income Tax Considerations – Certain Canadian Federal Income Tax Considerations", and certain United States Federal income tax considerations for Arris Resources Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary entitled "Income Tax Considerations – Certain U.S. Federal Income Tax Considerations".

Arris Resources Shareholders should carefully review the tax considerations applicable to them under the Arrangement and are urged to consult their own legal, tax and financial advisors in regard to their particular circumstances.

Right to Dissent

Arris Resources Shareholders will have the right to dissent from the Plan of Arrangement as provided in the Interim Order, the Plan of Arrangement and sections 237 to 247 of the Act. Any Arris Resources Shareholder who dissents will be entitled to be paid in cash the fair value for their Arris Resources Shares held so long as such Dissenting Shareholder: (i) does not vote any of his, her or its Arris Resources Shares in favour of the Arrangement Resolution, (ii) provides to the Company written objection to the Plan of Arrangement to the Company's head office at 1250 West Hastings Street, Vancouver, British Columbia V6E 2M4, at least two (2) days before the Meeting or any postponement(s) or adjournment(s) thereof, and (iii) otherwise complies with the requirements of the Plan of Arrangement and section 237 to 247 of the Act. See "Right to Dissent".

Stock Exchange Listings

The Arris Resources Shares are currently listed and traded on the Exchange and will continue to be listed on the Exchange following completion of the Arrangement. The closing of the Arrangement is conditional on the Exchange approving the listing of the CLI Shares, QMI and AHI Shares on the Exchange.

Information Concerning the Company and CLI After the Arrangement

Following completion of the Arrangement, the Company will continue to carry on its primary business activities. The Arris Resources Shares will continue to be listed on the Exchange. Each Arris Resources Shareholder will continue to be a shareholder of the Company with each currently held Arris Resources Share representing one New Share in the capital of the Company, and each Arris Resources Shareholder on the Share Distribution Record Date will receive itspro–rata share of the 17,583,372 CLI Shares to be distributed to such Arris Resources Shareholders under the Arrangement. See "The Company After the Arrangement" for a summary description of the Company assuming completion of the Arrangement, including selectedpro–formaunaudited financial information for the Company.

Following completion of the Arrangement, CLI will be a public company, the shareholders of which will be the holders of Arris Resources Shares on the Share Distribution Record Date. CLI will have all of Arris Resources' interest in the Property. Closing of the Arrangement is conditional upon the CLI Shares being listed on the Exchange. See "CLI After the Arrangement" for a description of the Property, corporate structure and business, including selectedpro–formaunaudited financial information of CLI assuming completion of the Arrangement.

-12-

Information Concerning the Company and QMI After the Arrangement

Following completion of the Arrangement, the Company will continue to carry on its primary business activities. The Arris Resources Shares will continue to be listed on the Exchange. Each Arris Resources Shareholder will continue to be a shareholder of the Company with each currently held Arris Resources Share representing one New Share in the capital of the Company, and each Arris Resources Shareholder on the Share Distribution Record Date will receive itspro–rata share of the 17,583,372 QMI Shares to be distributed to such Arris Resources Shareholders under the Arrangement. See "The Company After the Arrangement" for a summary description of the Company assuming completion of the Arrangement, including selectedpro–formaunaudited financial information for the Company.

Following completion of the Arrangement, QMI will be a public company, the shareholders of which will be the holders of Arris Resources Shares on the Share Distribution Record Date. QMI will have all of Arris Resources' interest in the Distribution Agreement. Closing of the Arrangement is conditional upon the QMI Shares being listed on the Exchange. See "QMI After the Arrangement" for a description of the Distribution Agreement, corporate structure and business, including selectedpro–formaunaudited financial information of QMI assuming completion of the Arrangement.

Information Concerning the Company and AHI After the Arrangement

Following completion of the Arrangement, the Company will continue to carry on its primary business activities. The Arris Resources Shares will continue to be listed on the Exchange. Each Arris Resources Shareholder will continue to be a shareholder of the Company with each currently held Arris Resources Share representing one New Share in the capital of the Company, and each Arris Resources Shareholder on the Share Distribution Record Date will receive itspro–rata share of the 17,583,372 AHI Shares to be distributed to such Arris Resources Shareholders under the Arrangement. See "The Company After the Arrangement" for a summary description of the Company assuming completion of the Arrangement, including selectedpro–formaunaudited financial information for the Company.

Following completion of the Arrangement, AHI will be a public company, the shareholders of which will be the holders of Arris Resources Shares on the Share Distribution Record Date. AHI will have all of Arris Resources' interest in the Distribution Agreement. Closing of the Arrangement is conditional upon the AHI Shares being listed on the Exchange. See "AHI After the Arrangement" for a description of the Equity Investments, corporate structure and business, including selectedpro–formaunaudited financial information of AHI assuming completion of the Arrangement.

Selected UnauditedPro–FormaConsolidated Financial Information for the Company

The following selected unauditedpro–formaconsolidated financial information for the Company is based on the assumptions described in the notes to the Company's unauditedpro–formaconsolidated balance sheet as at September 30, 2009, attached to this Circular as Schedule "E". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement occurred on September 30, 2009.

| | | |

| | | Pro–formaas at | |

| | | September 30, 2009 | |

| | | on completion of the | |

| | | Arrangement | |

| | | (unaudited) | |

| |

| Cash and cash equivalents | $ | 106,621 | (1) |

| Amounts receivable | | 5,005 | |

| Short term investment | | 640,515 | |

| Equipment | | 4,909 | |

| Mineral property | | 295,612 | |

| Oil and gas property | | 150,000 | |

| Total assets | $ | 1,202,662 | |

| |

| Accounts payable and accrued liabilities | $ | 32,345 | |

| Due to related party | | 22,441 | |

| | | |

| Shareholders' equity | | 1,147,876 | |

| Total liabilities and shareholders' equity | $ | 1,202,662 | |

(1) Subsequent to September 30th, 2.5 million Warrants were exercised for $335,000 and 40,000 options were exercised for $5,000.

-13-

Selected UnauditedPro–Forma Consolidated Financial Information for CLI

In connection with the Arrangement, CLI Resources intends to complete a non-brokered private placement (the “Private Placement” of 2,000,000 flow-through common shares at a price per share of $0.05 for aggregate gross proceeds of $100,000.

The following selected unauditedpro–formaconsolidated financial information for CLI is based on the assumptions described in the notes to the CLI unauditedpro–formaconsolidated balance sheet as at September 30, 2009, attached to this Circular as Schedule "F". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement had occurred on September 30, 2009.

| | | | | |

| | | | | | Pro–formaas at |

| | | | | | September 30, 2009 |

| | | As of | | | on completion of |

| | | September 30, 2009 | | | the Arrangement |

| | | (unaudited) | | | (unaudited) |

| |

| Cash | $ | 1 | | $ | 100,000 |

| |

| Five (5) mineral claims | | nil | | | 295,612 |

| Total assets | $ | 1 | | $ | 395,612 |

Selected UnauditedPro–Forma Consolidated Financial Information for QMI

In connection with the Arrangement, QMI Seismic intends to complete a non-brokered private placement (the “Private Placement” of 2,000,000 common shares at a price per share of $0.05 for aggregate gross proceeds of $100,000.

The following selected unauditedpro–formaconsolidated financial information for QMI is based on the assumptions described in the notes to the QMI unauditedpro–formaconsolidated balance sheet as at September 30, 2009, attached to this Circular as Schedule "G". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement had occurred on September 30, 2009.

| | | | |

| | | | | Pro–formaas at |

| | | | | September 30, 2009 |

| | | As of | | on completion of |

| | | September 30, 2009 | | the Arrangement |

| | | (unaudited) | | (unaudited) |

| |

| Cash | $ | 1 | $ | 100,000 |

| |

| Distribution Agreement | | nil | $ | 100,000 |

| Total assets | $ | 1 | $ | 200,000 |

Selected UnauditedPro–Forma Consolidated Financial Information for AHI

In connection with the Arrangement, Arris Resources Inc will transfer an Equity Portfolio (Maxtech - $220,515 & ONA Power $420,000 = $640,515) plus $ 150,000 to AHI.

The following selected unauditedpro–formaconsolidated financial information for AHI is based on the assumptions described in the notes to the AHI unauditedpro–formaconsolidated balance sheet as at September 30, 2009, attached to this Circular as Schedule "H". Thepro–formaconsolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement had occurred on September 30, 2009.

-14-

| | | | |

| | | | | Pro–formaas at |

| | | | | September 30, 2009 |

| | | As of | | on completion of |

| | | September 30, 2009 | | the Arrangement |

| | | (unaudited) | | (unaudited) |

| |

| Cash | $ | 1 | $ | 150,000 |

| |

| Equity Portfolio | | nil | $ | 640,515 |

| Total assets | $ | 1 | $ | 790,515 |

Risk Factors

In considering whether to vote for the approval of the Arrangement, Arris Resources Shareholders should be aware that there are various risks, including those described in the Section entitled "Risk Factors" in this Circular. Arris Resources Shareholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether to approve the Arrangement.

Approval of a Forward Split of Shares

Shareholders of the Company will be asked to pass the following ordinary resolution:

“BE IT Resolved, as an ordinary resolution, that:

1.

all of the common shares without par value in the capital of the Company, both issued and unissued, be split, subject to the determination of the directors, into common shares without par value, every one (1) old common share for five (5) new common shares or such lesser ratio as may be approved by the Directors and the CNSX.

2.

any one director of the Corporation, be and is hereby authorized to execute and deliver and file all such notices, documents and instruments, including the required Notice of Alterations and to do such further acts, as he in his discretion may deem necessary to give full effect to this resolution;

3.

the board of directors of the Company is hereby authorized at any time in its absolute discretion, toapprove the change of name of the Company conditional upon approval of the Board of Directors; and

4.

the board of directors of the Company is hereby authorized at any time in its absolute discretion, to determine whether or not to proceed with the foregoing without further approval, ratification or confirmation by the shareholders of the Company.”

– 15 –

GENERAL PROXY INFORMATION

Solicitation of Proxies

This Circular is furnished in connection with the solicitation of proxies by management of Arris Resources for use at the Meeting, and at any adjournment(s) or postponement(s) thereof.

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors or officers of the Company. The Company will bear all costs of this solicitation. The Company has arranged for Intermediaries to forward the meeting materials to Beneficial Shareholders held of record by those Intermediaries and the Company may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

Currency

In this Circular, except where otherwise indicated, all dollar amounts are expressed in the lawful currency of Canada.

Record Date

The Board has fixed October 15, 2009 as the record date (the "Record Date") for determination of persons entitled to receive notice of and to vote at the Meeting. Only Arris Resources Shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy in the manner and subject to the provisions described herein will be entitled to vote or to have their Arris Resources Shares voted at the Meeting.

Appointment of Proxy holders

The individual(s) named in the accompanying form of proxy are management's representatives. If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than the person(s) designated in the Proxy, who need not be a shareholder of the Company, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another proper proxy and, in either case, delivering the completed Proxy to the office of Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof.

Voting by Proxy holder

The person(s) named in the Proxy will vote or withhold from voting the Arris Resources Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Arris Resources Shares will be voted accordingly. The Proxy confers discretionary authority on the person(s) named therein with respect to:

(a)

each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors;

(b)

any amendment to or variation of any matter identified therein; and

(c)

any other matter that properly comes before the Meeting.

As at the date hereof, the Board knows of no such amendments, variations or other matters to come before the Meeting, other than the matters referred to in the Notice of Meeting. However, if other matters should properly come before the Meeting, the Proxy will be voted on such matters in accordance with the best judgment of the person(s) voting the Proxy.

In respect of a matter for which a choice is not specified in the Proxy, the person(s) named in the Proxy will vote the Arris Resources Shares represented by the Proxy for the approval of such matter.

-16-

Registered Shareholders

Registered Shareholders may wish to vote by Proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a Proxy may do so by completing, dating and signing the enclosed form of Proxy and returning it to the Company's transfer agent Computershare Investor Services Inc. by mail to Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof, or in such other manner as may be provided for in the Proxy.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold Arris Resources Shares in their own name. Beneficial Shareholders should note that the only Proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of Arris Resources Shares).

If Arris Resources Shares are listed in an account statement provided to a shareholder by a broker, then in almost all such cases those Arris Resources Shares will not be registered in the shareholder's name on the records of the Company. Such Arris Resources Shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such Arris Resources Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

There are two kinds of Beneficial Shareholders, those who object to their name being made known to the issuers of securities which they own (called "OBOs" for objecting beneficial owners) and those who do not object to the issuers of the securities they own knowing who they are (called "NOBOs" for non – objecting beneficial owners).

The Company is taking advantage of those provisions of National Instrument 54–101 – "Communication of Beneficial Owners of Securities" of the Canadian Securities Administrators, which permits it to deliver proxy–related materials directly to its NOBOs. As a result, NOBOs can expect to receive a scanable voting instruction form ("VIF"). These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile to the number provided in the VIF. In addition, Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Arris Resources Shares represented by the VIFs it receives.

This Circular, with related material, is being sent to both Registered and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name and address and information about your Arris Resources Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary who holds your Arris Resources Shares on your behalf.

By choosing to send these materials to you directly, the Company (and not the Intermediary holding your Arris Resources Shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your VIF as specified in your request for voting instructions that you receive.

Beneficial Shareholders who are OBOs should carefully follow the instructions of their Intermediary in order to ensure that their Arris Resources Shares are voted at the Meeting.

The form of proxy that will be supplied to Beneficial Shareholders by the Intermediaries will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the Intermediary on how to vote on behalf of the Beneficial Shareholder. Most Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. in the United States and Broadridge Financial Solutions Inc., Canada, in Canada (collectively "BFS"). BFS mails a VIF in lieu of a Proxy provided by the Company. The VIF will name the same person(s) as the Proxy to represent Beneficial Shareholders at the Meeting. Beneficial Shareholders have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the person(s) designated in the VIF, to represent them at the Meeting. To exercise this right, Beneficial Shareholders sho uld insert the name of the desired representative in the blank space provided in the VIF. The completed VIF must then be returned to BFS in the manner specified and in accordance with BFS's instructions. BFS then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Arris Resources Shares to be represented at the Meeting. If you receive a VIF from BFS, you cannot use it to vote Arris Resources Shares directly at the Meeting. The VIF must be completed and returned to BFS in accordance with its instructions, well in advance of the Meeting in order to have the Arris Resources Shares voted.

-17-

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Arris Resources Shares registered in the name of your Intermediary, you, or a person designated by you, may attend at the Meeting as proxy holder for your Intermediary and vote your Arris Resources Shares in that capacity. If you wish to attend the Meeting and indirectly vote your Arris Resources Shares as proxy holder for your Intermediary, or have a person designated by you to do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the VIF provided to you and return the same to your Intermediary in accordance with the instructions provided by such Intermediary, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend the Meeting and vote your Arris Resources Shares.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a proxy may revoke it by:

(a)

executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder's authorized attorney in writing, or if the Registered Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare or at the registered office of the Company at Suite 1000 – 925 West Georgia Street, Vancouver, British Columbia V6C 3L2, at any time up to and including the last Business Day that precedes the date of the Meeting or, if the Meeting is adjourned or postponed, the last Business Day that precedes any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or

(b)

personally attending the Meeting and voting the Registered Shareholder's Arris Resources Shares.

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year–end of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting, other than the election of directors, the appointment of the auditor and as may be otherwise set out herein.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no informed person of the Company, proposed director of the Company or any associate or affiliate of an informed person or proposed director, has any material interest, direct or indirect, in any transaction since the commencement of the Company's most recently completed financial year or in any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

-18-

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Outstanding Arris Resources Shares

The Company is authorized to issue an unlimited number of Arris Resources Shares. As at October 15, 2009, there were 17,583,372 Arris Resources Shares issued and outstanding, each carrying the right to one vote.

Principal Holders of Arris Resources Shares

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Arris Resources Shares carrying more than 10% of the voting rights attached to all outstanding Arris Resources Shares.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as ordinary resolutions and an affirmative vote of 66 and 2/3rds of the votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as special resolutions.

THE ARRANGEMENT

General

The Arrangement has been proposed to facilitate the separation of the Company's primary business activities from development of the Mineral Property, the Distribution Agreement. Pursuant to the Arrangement,

i) a separate company "CLI Resources Inc.", currently a wholly-owned subsidiary of the Company, will acquire the mineral Assets for aggregate consideration of 17,583,372 CLI Shares and,

ii) “QMI Seismic Inc”, currently a wholly-owned subsidiary of the Company, will acquire the Distribution Agreement for the aggregate consideration of 17,583,372 QMI Shares.

iii) “Arris Holdings Inc”, currently a wholly-owned subsidiary of the Company, will acquire the Equity Investments for the aggregate consideration of 17,583,372 AHI Shares.

Following the Arrangement, the Company will continue to carry on its primary business activities. Each Arris Resources Shareholder will, immediately after the Effective Date, hold one New Share for each Arris Resources Share held immediately prior to the Arrangement, which will be identical in every respect to the present Arris Resources Shares, and each Arris Resources Shareholder on the Share Distribution Record Date will receive itspro–rata share of the 17,583,372 CLI Shares, will receive itspro–rata share of the 17,583,372 QMI Shares that are acquired by the Company and will receive itspro–rata share of the 17,583,372 AHI Shares that are acquired by the Company in exchange for the Assets described herein. See "Details of the Arrangement" and "CLI After the Arrangement” — Selected UnauditedPro–formaFinancial Information of CLI"; "Details of the Arrangement" and " ;QMI After the Arrangement — Selected UnauditedPro–formaFinancial Information of QMI"; as well as, "Details of the Arrangement" and "AHI After the Arrangement — Selected UnauditedPro–formaFinancial Information of AHI".

Reasons for the Arrangement

The Board has determined that the Company should concentrate its efforts on its primary business activities. To this end, the Board approved a reorganization of the Company pursuant to the Arrangement as described in this Circular.

The Board is of the view that the Arrangement will benefit the Company and the Arris Resources Shareholders. This conclusion is based on the following primary determinations:

1.

the Company's primary focus is the exploration and development of its petroleum and natural gas properties and oil interests in Alberta, Canada. This focus will hinder the development of the Company's mineral claims in British Columbia, Canada, the Company’s Distribution Agreement for seismic products in India and the Company’s Equity Investments. The formation of CLI, QMI and AHI to hold the Mineral Property, the Distribution Agreement and the Equity Investments will facilitate separate development strategies required to move the Property, the Distribution Agreement and the Equity Investments going forward;

-19-

2.