UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended Dec. 31, 2024.

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________.

Commission file number 001-13643

ONEOK, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Oklahoma | 73-1520922 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 100 West Fifth Street, | Tulsa, | OK | 74103 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (918) 588-7000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value of $0.01 | OKE | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NoneIndicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒.

Aggregate market value of registrant’s common stock held by non-affiliates based on the closing trade price on June 30, 2024, was $47.3 billion.

On Feb. 17, 2025, the Company had 624,339,588 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive proxy statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held May 21, 2025, are incorporated by reference in Part III.

ONEOK, Inc.

2024 ANNUAL REPORT

TABLE OF CONTENTS

| | | | | | | | | | | |

TABLE OF CONTENTS

(CONTINUED) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

As used in this Annual Report, references to “we,” “our,” or “us” refer to ONEOK, Inc., an Oklahoma corporation, and its predecessors and subsidiaries, including Magellan, EnLink and Medallion, unless the context indicates otherwise.

The statements in this Annual Report that are not historical information, including statements concerning plans and objectives of management for future operations, economic performance or related assumptions, are forward-looking statements. Forward-looking statements may include words such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expect,” “forecasts,” “goal,” “guidance,” “intends,” “may,” “might,” “outlook,” “plans,” “potential,” “projects,” “scheduled,” “should,” “target,” “will,” “would” and other words and terms of similar meaning. Although we believe that our expectations regarding future events are based on reasonable assumptions, we can give no assurance that such expectations or assumptions will be achieved. Important factors that could cause actual results to differ materially from those in the forward-looking statements are described under Part I, Item 1A, Risk Factors.

GLOSSARY

The abbreviations, acronyms and industry terminology used in this Annual Report are defined as follows:

| | | | | |

| $2.5 Billion Credit Agreement | ONEOK’s $2.5 billion amended and restated revolving credit agreement, replaced by the $3.5 Billion Credit Agreement |

| $3.5 Billion Credit Agreement | ONEOK’s $3.5 billion amended and restated revolving credit agreement |

| AFUDC | Allowance for funds used during construction |

| Annual Report | Annual Report on Form 10-K for the year ended Dec. 31, 2024 |

| Bbl | Barrels, 1 barrel is equivalent to 42 United States gallons |

| BBtu/d | Billion British thermal units per day |

| Bcf | Billion cubic feet |

| Bcf/d | Billion cubic feet per day |

| BridgeTex | BridgeTex Pipeline Company, LLC, a 30% owned joint venture |

| Delaware Basin JV | Delaware G&P LLC, a joint venture in which EnLink owns a 50.1% interest |

| EBITDA | Earnings before interest expense, income taxes, depreciation and amortization |

| EnLink | EnLink Midstream, LLC, and after the EnLink Acquisition, Elk Merger Sub II, L.L.C., a wholly owned subsidiary of ONEOK |

| EnLink AR Facility | EnLink’s $500 million accounts receivable securitization facility |

| EnLink Acquisition | The transaction completed on Jan. 31, 2025, pursuant to which ONEOK acquired all of the publicly held EnLink Units in a tax-free transaction, pursuant to the EnLink Merger Agreement |

| EnLink Acquisitions | The EnLink Controlling Interest Acquisition and the EnLink Acquisition |

| EnLink Controlling Interest Acquisition | The transaction completed on Oct. 15, 2024, pursuant to which ONEOK acquired from GIP (i) approximately 43% of the outstanding EnLink Units and (ii) all of the outstanding limited liability company interests in EnLink Midstream Manager, LLC, pursuant to the EnLink Purchase Agreement |

| EnLink Merger Agreement | Agreement and Plan of Merger, dated as of Nov. 24, 2024, by and among ONEOK, Inc., Elk Merger Sub I, LLC., Elk Merger Sub II LLC., EnLink and EnLink Midstream Manager, LLC |

| EnLink Partners | EnLink Midstream Partners, LP, a wholly owned subsidiary of EnLink |

| EnLink Purchase Agreement | Purchase agreement of ONEOK, GIP III Stetson I, L.P., GIP III Stetson II, L.P. and EnLink Midstream Manager, LLC, dated Aug. 28, 2024 |

| EnLink Revolving Credit Facility | EnLink’s $1.4 billion unsecured credit facility, which includes a $500 million letter of credit subfacility |

| EnLink Units | Common units representing limited liability company interests in EnLink |

| EPS | Earnings per share of common stock |

| ESG | Environmental, social and governance |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FERC | Federal Energy Regulatory Commission |

| Fitch | Fitch Ratings, Inc. |

| GAAP | Accounting principles generally accepted in the United States of America |

| GHG | Greenhouse gas |

| GIP | Global Infrastructure Partners and certain of its managed fund vehicles, including GIP III Stetson I, L.P., GIP III Stetson II, L.P., GIP III Trophy GP 2, GIP III Trophy Acquisition |

| Guardian | Guardian Pipeline, L.L.C. |

| Guardian Term Loan Agreement | Guardian’s senior unsecured three-year $120 million term loan agreement dated June 2022 |

| Intermediate Partnership | ONEOK Partners Intermediate Limited Partnership, a wholly owned subsidiary of ONEOK |

| Magellan | Magellan Midstream Partners, L.P., a wholly owned subsidiary of ONEOK |

| Magellan Acquisition | The transaction completed on Sept. 25, 2023, pursuant to which ONEOK acquired all of Magellan’s outstanding common units in a cash-and-stock transaction, pursuant to the Merger Agreement |

| | | | | |

| Magellan Merger Agreement | Agreement and Plan of Merger of ONEOK, Otter Merger Sub, LLC and Magellan, dated May 14, 2023 |

| Matterhorn | Matterhorn Express, a 15% owned joint venture |

| MBbl/d | Thousand barrels per day |

| MDth/d | Thousand dekatherms per day |

| Medallion | GIP III Trophy Intermediate Holdings, L.P., and after the Medallion Acquisition, Medallion Parent Holdings, L.L.C., a wholly owned subsidiary of ONEOK |

| Medallion Acquisition | The transaction completed on Oct. 31, 2024, pursuant to which ONEOK (i) became general partner of Medallion and (ii) acquired all of the issued and outstanding limited Partner interests in Medallion from GIP |

| Medallion Purchase and Sale Agreement | Purchase and Sale Agreement of ONEOK, GIP III Trophy GP 2, LLC, GIP III Trophy Acquisition Partners, L.P., Medallion Management, L.P., dated Aug. 28, 2024 |

| MMBbl | Million barrels |

| MMBtu | Million British thermal units |

| MMcf/d | Million cubic feet per day |

| Moody’s | Moody’s Investors Service, Inc. |

| MVP | MVP Terminalling, LLC, a 25% owned joint venture |

| Natural Gas Act | Natural Gas Act of 1938, as amended |

| NGL(s) | Natural gas liquid(s) |

| Northern Border | Northern Border Pipeline Company, a 50% owned joint venture |

| NYMEX | New York Mercantile Exchange |

| NYSE | New York Stock Exchange |

| ONEOK | ONEOK, Inc. |

| ONEOK Partners | ONEOK Partners, L.P., a wholly owned subsidiary of ONEOK |

| Overland Pass | Overland Pass Pipeline Company, LLC, a 50% owned joint venture |

| POP | Percent of Proceeds |

| Purity NGLs | Marketable natural gas liquid purity products, such as ethane, ethane/propane mix, propane, iso-butane, normal butane and natural gasoline |

| Quarterly Report(s) | Quarterly Report(s) on Form 10-Q |

| Refined Products | The output from crude oil refineries, including products such as gasoline, diesel fuel, aviation fuel, kerosene and heating oil |

| RINs | Renewable Identification Numbers, which represent credits required for renewable fuel standard compliance |

| Roadrunner | Roadrunner Gas Transmission, LLC, a 50% owned joint venture |

| S&P | S&P Global Ratings |

| Saddlehorn | Saddlehorn Pipeline Company, LLC, a 40% owned joint venture |

| SCOOP | South Central Oklahoma Oil Province, an area in the Anadarko Basin in Oklahoma |

| SEC | Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| Series B Preferred Units | EnLink Partners’ Series B Cumulative Convertible Preferred Units |

| Series C Preferred Units | EnLink Partners’ Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

| Series E Preferred Stock | Series E Non-Voting, Perpetual Preferred Stock, par value $0.01 per share |

| STACK | Sooner Trend Anadarko Canadian Kingfisher, an area in the Anadarko Basin in Oklahoma |

| Term SOFR | The forward-looking term rate based on Secured Overnight Financing Rate (SOFR) |

| Viking | Viking Gas Transmission Company |

| Viking Term Loan Agreement | Viking’s senior unsecured three-year $60 million term loan agreement dated March 2023 |

| XBRL | eXtensible Business Reporting Language |

PART I

ITEM 1. BUSINESS

GENERAL

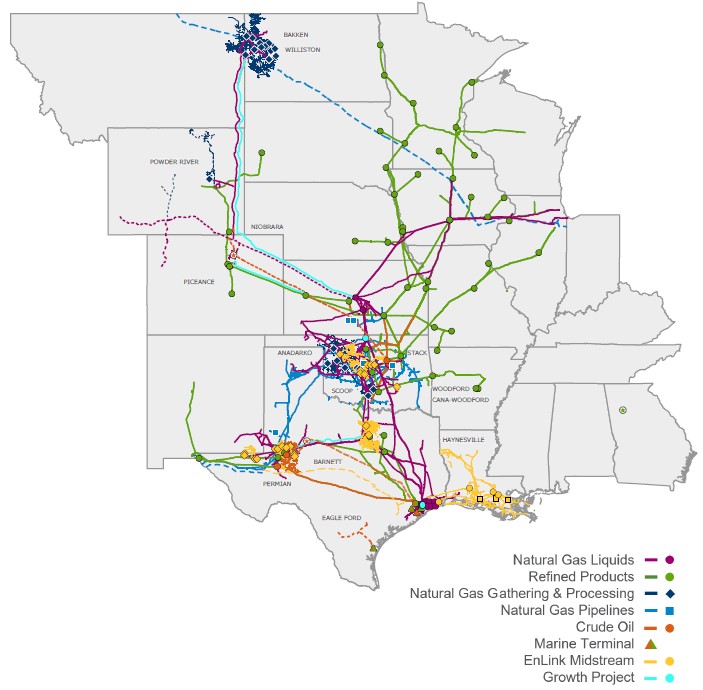

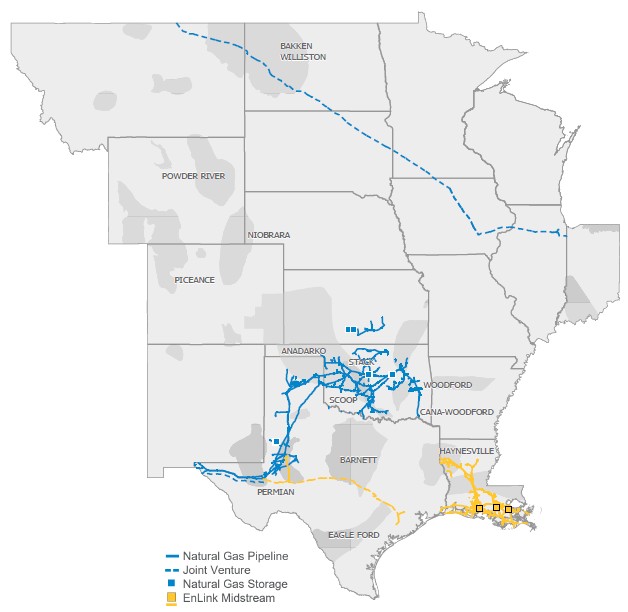

We are incorporated under the laws of the state of Oklahoma, and our common stock is listed on the NYSE under the trading symbol “OKE.” We deliver energy products and services vital to an advancing world. We are a leading midstream service provider of gathering, processing, fractionation, transportation, storage and marine export services. As one of the largest diversified energy infrastructure companies in North America, we are delivering energy that makes a difference in the lives of people in the U.S. and around the world. Through our now approximately 60,000-mile pipeline network, we transport the natural gas, NGLs, Refined Products and crude oil that help meet domestic and international energy demand, contribute to energy security and provide safe, reliable and responsible energy solutions needed today and into the future.

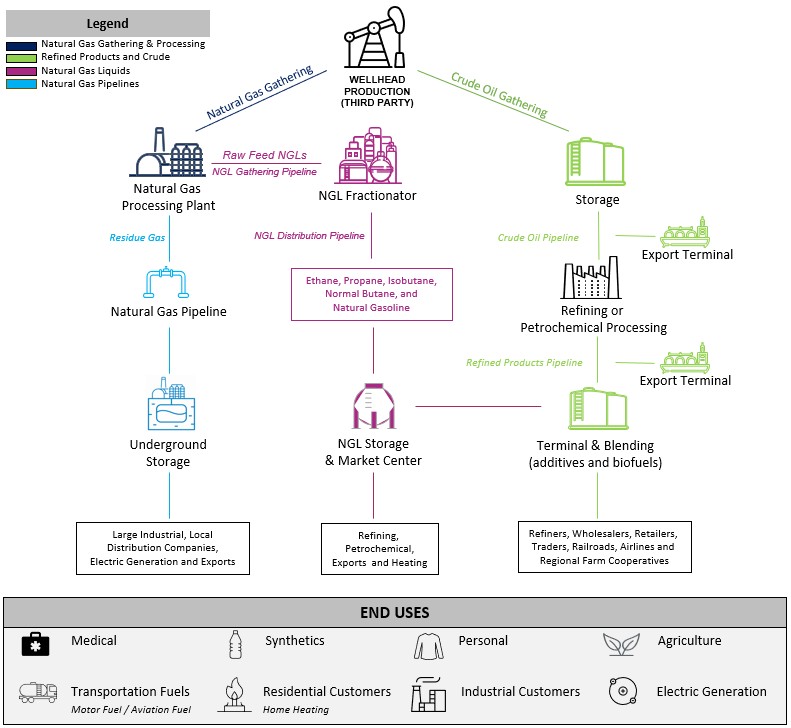

Midstream Value Chain

The midstream value chain is a vital part of the energy industry. After crude oil and natural gas are produced from upstream wells, we use our extensive infrastructure to process and transport these raw materials, readying them for end use. For transportation of crude oil, natural gas, Refined Products and NGLs, pipelines are generally the most reliable, lowest cost, least carbon intensive and safest alternative for intermediate and long-haul movements between markets and end users.

EXECUTIVE SUMMARY

EnLink Controlling Interest Acquisition - On Aug. 28, 2024, we entered into the EnLink Purchase Agreement with GIP to acquire GIP’s interest in EnLink consisting of approximately 43% of the outstanding EnLink Units for $14.90 in cash per unit and 100% of the outstanding limited liability company interests in the managing member of EnLink for $300 million, for total cash consideration of $3.3 billion. On Oct. 15, 2024, we completed the EnLink Controlling Interest Acquisition. We used a portion of the proceeds from our September 2024 underwritten public offering of $7.0 billion senior unsecured notes to fund this acquisition. This acquisition meaningfully increases our scale and integrated value chain within the growing Permian Basin while expanding and extending our asset bases in the Mid-Continent, North Texas and Louisiana regions. We expect to achieve significant synergies by combining our complementary asset positions. The operations of EnLink are reported across all four of our existing segments.

EnLink Acquisition - On Nov. 24, 2024, we entered into the EnLink Merger Agreement to acquire all of the publicly held EnLink Units in an all stock, tax-free transaction. On Jan. 31, 2025, we completed the EnLink Acquisition. Pursuant to the EnLink Merger Agreement, each common unit of EnLink was exchanged for a fixed ratio of 0.1412 shares of ONEOK common stock, including EnLink Units that were exchanged for all previously outstanding Series B Preferred Units immediately prior to closing. We issued 41 million shares of common stock, with a fair value of $4.0 billion as of the closing date of the EnLink Acquisition. EnLink is now a wholly owned subsidiary.

For additional information on the EnLink Acquisitions, see Part II, Item 8, Note B of the Notes to Consolidated Financial Statements in this Annual Report. In addition, see Part 1, Item 1A “Risk Factors” for further discussion of related risks.

Medallion Acquisition - On Aug. 28, 2024, we entered into the Medallion Purchase and Sale Agreement with GIP to acquire all of the equity interests in Medallion for a purchase price of $2.6 billion, subject to customary adjustments, and inclusive of the purchase of additional interests in a Medallion joint venture owned by a separate third party. On Oct. 31, 2024, we completed the Medallion Acquisition. We used a portion of the proceeds from our September 2024 underwritten public offering of $7.0 billion senior unsecured notes to fund this acquisition. This acquisition expands our midstream services for crude oil and condensate in West Texas, specifically in the Midland Basin. Medallion’s operations are reported in our Refined Products and Crude segment.

For additional information on the Medallion Acquisition, see Part II, Item 8, Note B, of the Notes to Consolidated Financial Statements in this Annual Report. See Part 1, Item 1A “Risk Factors” for further discussion of risks related to the Medallion Acquisition.

Joint Ventures - On Feb. 4, 2025, we entered into definitive agreements to form joint ventures with MPLX LP (MPLX) to construct a 400 MBbl/d liquified petroleum gas export terminal in Texas City, Texas, and a new 24-inch pipeline from our Mont Belvieu, Texas, storage facility to the new terminal. Texas City Logistics LLC, the export terminal joint venture, is owned 50% by us and 50% by MPLX, with MPLX constructing and operating the facility. MBTC Pipeline LLC, the pipeline joint venture, is owned 80% by us and 20% by MPLX, and we will construct and operate the pipeline. We expect to invest approximately $1.0 billion in these projects.

Interstate Natural Gas Pipeline Divestiture - On Nov. 19, 2024, we entered into a definitive agreement with DT Midstream, Inc. to sell three of our wholly owned interstate natural gas pipeline systems for total cash consideration of $1.2 billion. On Dec. 31, 2024, we completed the sale and recognized a gain of $227 million. This transaction aligns and enhances our capital allocation priorities within our integrated value chain.

Gulf Coast NGL Pipelines Acquisition - In June 2024, we completed the acquisition of a system of NGL pipelines from Easton Energy, a Houston-based midstream company, for approximately $280 million. This acquisition in our Natural Gas Liquids segment includes approximately 450 miles of liquids products pipelines located in the strategic Gulf Coast market centers for NGLs, Refined Products and crude oil. A portion of the Easton assets are connected to our Mont Belvieu assets. We expect to add connections to our Houston-based assets beginning in mid-2025 through the end of 2025.

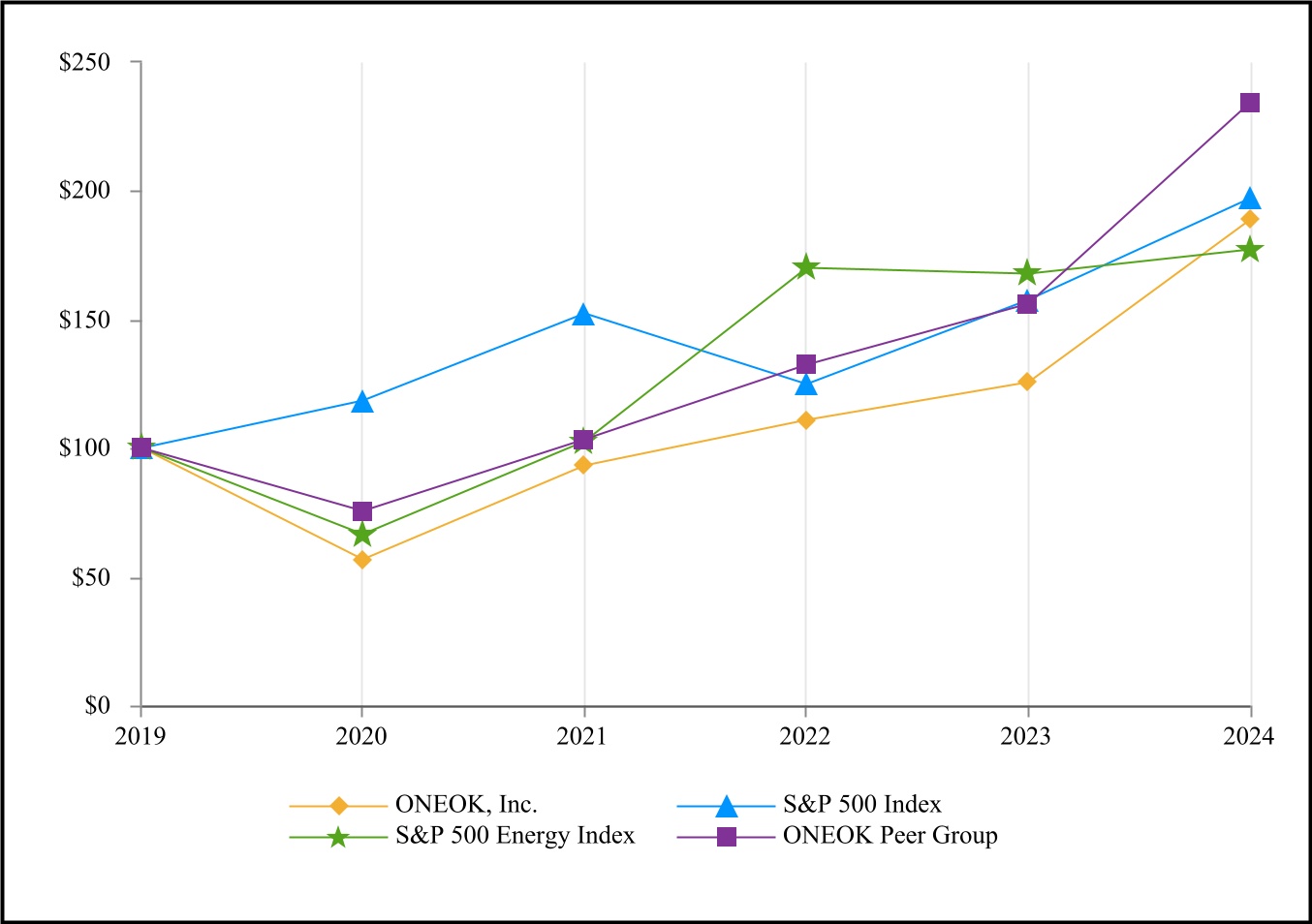

Business Update and Market Conditions - Over the past year, we experienced significant growth across our value chain due to our recent acquisitions. Earnings increased in 2024, compared with 2023, due primarily to a full year of earnings from the new Refined Products and Crude segment, higher NGL and natural gas processing volumes in the Rocky Mountain region and the impact of the interstate pipeline divestiture in the Natural Gas Pipelines segment. Our extensive and integrated assets are located in, and connected with, some of the most productive shale basins, as well as refineries and demand centers, in the United States. Although the energy industry has experienced many commodity cycles, we have positioned ourselves to reduce

exposure to direct commodity price volatility. Each of our four reportable segments are primarily fee-based, and our consolidated earnings were approximately 90% fee-based in 2024.

Capital Allocation - We continue to focus on maintaining prudent financial strength and flexibility. In January 2025, our Board of Directors increased our quarterly dividend to $1.03 per share, an increase of 4% compared with the same quarter in the prior year. In January 2024, our Board of Directors authorized a share repurchase program to buy up to $2.0 billion of our outstanding common stock. As of Dec. 31, 2024, we repurchased $172 million of our outstanding common shares under the program. As of Dec. 31, 2024, we also had $733 million of cash and cash equivalents on hand and $2.5 billion of available capacity under our $2.5 Billion Credit Agreement.

Sustainability and Social Responsibility - Through our participation in the 2024 S&P Global Corporate Sustainability Assessment, we qualified for inclusion in the S&P Global Sustainability Yearbook for the fifth consecutive year, scoring within the top 15% of the Oil and Gas Storage and Transportation industry. Additionally, in 2024, we received an MSCI ESG Rating of AAA, and our ESG Risk Rating, as assessed by Morningstar Sustainalytics, was in the top 20% of the refiners and pipelines industry.

Natural Gas Gathering and Processing - In our Natural Gas Gathering and Processing segment, earnings increased in 2024, compared with 2023, due to higher volumes in the Rocky Mountain region, as well as the impact of the EnLink Controlling Interest Acquisition from the period of Oct. 15, 2024, to Dec. 31, 2024.

In our Natural Gas Gathering and Processing segment, we have a capital project to relocate a 150 MMcf/d processing plant to the Permian Basin from North Texas, which we expect to be in service in the first quarter of 2026.

NGLs - In our Natural Gas Liquids segment, earnings decreased in 2024, compared with 2023, due primarily to the insurance settlement gain in 2023 related to the Medford incident, which was offset partially by higher volumes in the Rocky Mountain region and the impact of the EnLink Controlling Interest Acquisition from the period of Oct. 15, 2024, to Dec. 31, 2024.

In December 2024, we announced that we completed construction of our 125 MBbl/d MB-6 NGL fractionator and the looping of the West Texas NGL pipeline. Additional pump stations, which are expected to be completed in mid-2025, will further increase system capacity to 740 MBbl/d, more than doubling our NGL capacity out of the Permian Basin. In January 2025, we completed construction of our Elk Creek pipeline expansion project, which is partially in service. Upon supply of full power, expected in mid-2025, we will have capacity of 435 MBbl/d to transport growing volumes in the Rocky Mountain region, which will bring our total pipeline capacity out of the Rocky Mountain region to 575 MBbl/d.

In August 2024, we announced plans to rebuild our 210 MBbl/d NGL fractionator in Medford, Oklahoma. Rebuilding at Medford provides strategic benefits that include expansion options that will allow our integrated system to accommodate volume growth from the Permian Basin and the Rocky Mountain and Mid-Continent regions. The Medford fractionator will also produce butane and natural gasoline for incremental Refined Products and diluent blending opportunities in the Mid-Continent region.

Natural Gas Pipelines - In our Natural Gas Pipelines segment, earnings increased in 2024, compared with 2023, due primarily to the impact of the interstate pipeline divestiture and increased transportation services, as well as the impact of the EnLink Controlling Interest Acquisition from the period of Oct. 15, 2024, to Dec. 31, 2024.

We recently reactivated previously idled storage facilities with 3 Bcf of working gas storage capacity in Texas. In addition, we are in the process of expanding our storage injection capabilities in Oklahoma, which we expect to be complete in the second quarter of 2025. As a result of the EnLink Acquisitions, we have access to additional natural gas storage assets in Texas and Louisiana.

Refined Products and Crude - This reportable business segment was added in 2023 in conjunction with the Magellan Acquisition. Our 2023 results include the impact of the Magellan Acquisition from the period of Sept. 25, 2023, to Dec. 31, 2023. Earnings in this segment increased in 2024 due primarily to a full year of operating results following the Magellan Acquisition and due to the recent acquisitions of EnLink and Medallion. Our 2024 results include the impact of the EnLink Controlling Interest Acquisition from the period of Oct. 15, 2024, to Dec. 31, 2024, and the impact of the Medallion Acquisition from the period of Nov. 1, 2024, to Dec. 31, 2024. In 2024, we benefited from mid-year tariff increases of Refined Products. Additionally, our optimization and marketing earnings have remained strong due to favorable commodity market conditions.

At the end of the first quarter 2024, we completed the expansion of our Refined Products pipeline to El Paso, Texas. This expansion provides additional Refined Products supply to growing markets in Texas, New Mexico, Arizona and Mexico.

In July 2024, we announced plans to expand our Refined Products pipeline capacity, connecting Mid-Continent and Gulf Coast supply with the greater Denver area, to meet growing demand and increase connectivity with the Denver International Airport (DIA). The project includes construction of a new 230-mile, 16-inch diameter pipeline from Scott City, Kansas, to DIA and the addition or upgrading of certain pump stations along the existing Refined Products pipeline system. Total system capacity will increase by 35 MBbl/d and will have additional expansion capabilities. This project is fully subscribed under long-term contracts.

See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report for more information on our capital projects, results of operations, liquidity and capital resources.

BUSINESS STRATEGY

Our mission is to deliver energy products and services vital to an advancing world. Our vision is to create exceptional value for our stakeholders by providing solutions for a transforming energy future. Our business strategy is focused on:

•Zero incidents - We commit to developing processes to drive a zero-incident culture for the well-being of our employees, contractors and communities. Safety and environmental responsibility continue to be primary areas of focus for us.

•Highly engaged workforce - We strive to be an employer of choice and continue to focus on attracting, selecting and retaining talent, advancing an inclusive, diverse and engaged culture and developing individuals and leaders.

•Sustainable business model - We aim to maintain prudent financial strength and flexibility while operating a safe, reliable and resilient asset base. We seek to maintain investment-grade credit ratings and a strong balance sheet. We expect our internally generated cash flows will allow us to fund high-return capital projects in our existing operating regions, grow our dividend, reduce debt and fund our $2.0 billion share repurchase program. We aim to focus on capital projects that provide value-added products and services that contribute to long-term growth, profitability and business diversification. We continue to actively seek out opportunities that will complement our extensive assets and expertise.

•Maximizing total shareholder return - We plan to grow earnings through high-return capital projects that will allow us to increase our dividend and repurchase shares under our $2.0 billion share repurchase program. We seek consistent and strong returns on invested capital will allow us to reward our shareholders and provide the means and opportunity to serve our additional stakeholders, including employees and the communities in which we operate.

NARRATIVE DESCRIPTION OF BUSINESS

We report operations in the following four business segments:

•Natural Gas Gathering and Processing;

•Natural Gas Liquids;

•Natural Gas Pipelines; and

•Refined Products and Crude.

Natural Gas Gathering and Processing

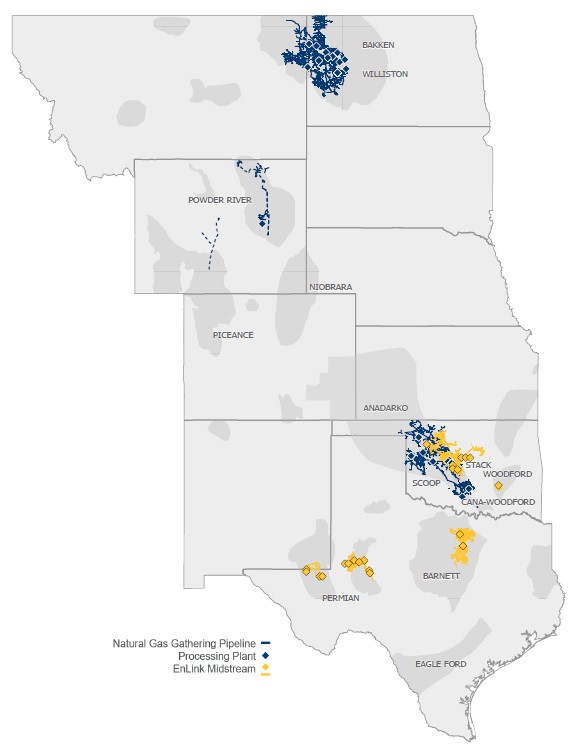

Overview of Operations - In our Natural Gas Gathering and Processing segment, raw natural gas is typically gathered at the wellhead, compressed and transported through pipelines to our processing facilities. Most raw natural gas produced at the wellhead also contains a mixture of NGL components, including ethane, propane, iso-butane, normal butane and natural gasoline. Gathered wellhead natural gas is directed to our processing plants to remove NGLs resulting in residue natural gas (primarily methane). Residue natural gas is then recompressed and delivered to natural gas pipelines, storage facilities and end users. The NGLs separated from the raw natural gas are delivered through NGL pipelines to fractionation facilities for further processing. Some of the heavier NGLs may separate upstream of processing and fractionation and are sold as condensate at NGL or crude oil markets. Our Natural Gas Gathering and Processing segment provides these midstream services to producers in the regions listed below.

Rocky Mountain region - The Williston Basin is located in portions of North Dakota and Montana and includes the oil-producing, NGL-rich Bakken Shale and Three Forks formations. We have more than 3 million dedicated acres in the Williston Basin.

The Powder River Basin is primarily located in Eastern Wyoming, which includes the NGL-rich Niobrara, Frontier, Turner and Mowry formations.

Mid-Continent region - The Mid-Continent region includes the natural gas and oil-producing Anadarko Basin, which includes the NGL-rich SCOOP and STACK areas, Cana-Woodford Shale, Woodford Shale, Springer Shale, Meramec, Granite Wash, Cherokee and Mississippian Lime formations of Oklahoma. We have more than 600,000 dedicated acres in the Anadarko Basin, excluding EnLink. As a result of the EnLink Acquisitions, we have more than doubled our presence in the Mid-Continent region by expanding our existing presence in the Cana-Woodford Shale, Woodford Shale and STACK area, while also beginning to operate in the Arkoma-Woodford Shale.

Permian Basin region - The Permian Basin is a large, natural gas-rich sedimentary basin composed of the Midland Basin, located in West Texas, and the Delaware Basin, located in West Texas and Southeastern New Mexico. As a result of the EnLink Acquisitions, we have a meaningful presence in the Permian Basin, providing gathering and processing services in the Midland and Delaware Basins.

North Texas region - The North Texas region is located in the Barnett Shale, one of the largest onshore natural gas fields in the United States. As a result of the EnLink Acquisitions, we now provide gathering and processing services in the Barnett Shale.

Property - Our Natural Gas Gathering and Processing segment includes the following assets, which are wholly owned, except where noted, and exclude EnLink, which is shown separately below:

•13,500 miles of natural gas gathering pipelines; and

•Natural gas processing plants with 1.9 Bcf/d of processing capacity in the Rocky Mountain region and 1.0 Bcf/d in the Mid-Continent region, which were 84% and 77% utilized in 2024 and 2023, respectively. In addition, we have up to 150 MMcf/d of processing capacity in the Mid-Continent region through a long-term processing services agreement with an unaffiliated third party.

We calculate utilization rates using a weighted-average approach, adjusting for the dates that assets were placed in or removed from service.

The following are the Natural Gas Gathering and Processing segment assets added as a result of the EnLink Acquisitions:

•9,000 miles of natural gas gathering pipelines (includes gross mileage of a consolidated, partially owned subsidiary); and

•Natural gas processing plants with 1.4 Bcf/d of processing capacity in the Mid-Continent region, 1.7 Bcf/d of processing capacity in the Permian Basin region (includes gross operating capacity of a consolidated, partially owned subsidiary), 0.8 Bcf/d of processing capacity in the North Texas region.

Sources of Earnings - Earnings for this segment are derived primarily from the following types of service contracts:

•Fee with POP contracts with no producer take-in-kind rights - We purchase raw natural gas and charge contractual fees for providing midstream services, which include gathering, treating, compressing and processing the producers’ natural gas. After performing these services, we sell the commodities and remit a portion of the commodity sales proceeds to the producers less our contractual fees. This type of contract represented 76% and 72% of supply volumes in this segment, excluding EnLink, for 2024 and 2023, respectively.

•Fee with POP contracts with producer take-in-kind rights - We purchase a portion of the raw natural gas stream, charge fees for providing the midstream services listed above, return certain commodities to the producer, sell the remaining commodities and remit a portion of the commodity sales proceeds to the producer less our contractual fees. This type of contract represented 19% of supply volumes in this segment, excluding EnLink, for both 2024 and 2023. EnLink’s service contracts are primarily fee with POP contracts with producer take-in-kind rights to certain commodities.

•Fee-only - Under this type of contract, we charge a fee for the midstream services we provide based on volumes gathered, processed, treated and/or compressed. Our fee-only contracts represented 5% and 9% of supply volumes in this segment, excluding EnLink, for 2024 and 2023, respectively.

For commodity sales, we contract to deliver residue natural gas, condensate and/or unfractionated NGLs to downstream customers at a specified delivery point. Our sales of NGLs are primarily to our affiliate in the Natural Gas Liquids segment.

Unconsolidated Affiliates - Our unconsolidated affiliates in this segment are not material.

See Note O of the Notes to Consolidated Financial Statements in this Annual Report for additional discussion of our unconsolidated affiliates.

Government Regulation - The FERC traditionally has maintained that a natural gas processing plant is not a facility for the transportation or sale of natural gas in interstate commerce and, therefore, is not subject to jurisdiction under the Natural Gas Act. Although the FERC has made no specific declaration as to the jurisdictional status of our natural gas processing operations or facilities, our natural gas processing plants are primarily involved in extracting NGLs and, therefore, are exempt from FERC jurisdiction. The Natural Gas Act also exempts natural gas gathering facilities from the jurisdiction of the FERC. We believe our natural gas gathering facilities, upstream of our natural gas processing plants, meet the criteria used by the FERC for non-jurisdictional natural gas gathering facility status. Interstate transmission facilities remain subject to FERC jurisdiction. The FERC has historically distinguished between these two types of facilities, either interstate or intrastate, on a fact-specific basis. We transport residue natural gas from certain of our natural gas processing plants to interstate pipelines in accordance with Section 311(a) of the Natural Gas Policy Act of 1978, as amended. The states where we operate have statutes regulating, to varying degrees, the gathering of natural gas in those states. In each state, regulation is applied on a case-by-case basis if a complaint is filed against the gatherer with the appropriate state regulatory agency.

See further discussion in the “Regulatory, Environmental and Safety Matters” section.

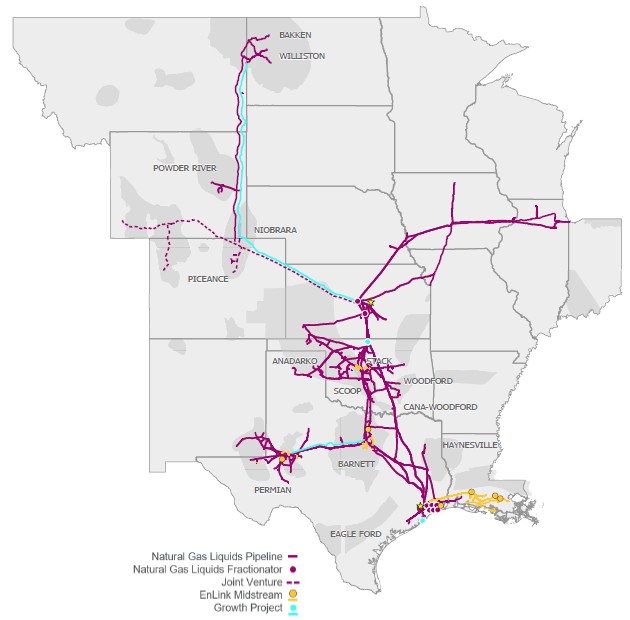

Natural Gas Liquids

Overview of Operations - In our Natural Gas Liquids segment, NGLs extracted at our own and third-party natural gas processing plants are gathered by our NGL gathering pipelines. Gathered NGLs are directed to our downstream fractionators to be separated into Purity NGLs. Purity NGLs are stored or distributed to our customers, such as petrochemical companies, propane distributors, diluent users, ethanol producers, refineries and exporters.

We provide midstream services to producers of NGLs in the Rocky Mountain region, Mid-Continent region, Permian Basin and Gulf Coast region (including Louisiana) and deliver those products to the market. Our primary markets include the Mid-Continent in Conway, Kansas, the Gulf Coast in Mont Belvieu, Texas, Louisiana and the upper Midwest. The majority of the pipeline-connected natural gas processing plants in the Williston Basin, Oklahoma, Kansas and the Texas Panhandle as well as a large number in the Permian Basin, Barnett Shale, East Texas and Louisiana regions are connected to our NGL gathering

systems. Through our NGL gathering and distribution pipelines, and fractionation, terminal and storage facilities, we provide needed midstream services while connecting key supply and demand areas.

Property - Our Natural Gas Liquids segment includes the following assets, which are wholly owned, except where noted, and exclude EnLink, which is shown separately below:

•9,300 miles of gathering pipelines;

•4,800 miles of distribution pipelines;

•NGL fractionators with combined operating capacity of 960 MBbl/d (includes interests in our proportional share of operating capacity), including 310 MBbl/d in the Mid-Continent region and 650 MBbl/d in the Mont Belvieu, Texas area, which were 92% and 98% utilized in 2024 and 2023, respectively;

•one isomerization unit with operating capacity of 10 MBbl/d;

•one ethane/propane splitter with operating capacity of 40 MBbl/d;

•NGL storage facilities with operating storage capacity of 30 MMBbl; and

•eight Purity NGLs terminals.

We completed the construction of our 125 MBbl/d MB-6 fractionator, which is included in the assets listed above. We are in the process of reconstructing our 210 MBbl/d fractionator in Medford, Oklahoma, which is excluded from the assets listed above.

In addition, we have access to 6 MMBbl of combined NGL storage capacity at facilities in Kansas and Texas and 60 MBbl/d of

NGL fractionation capacity in the Gulf Coast through service agreements.

The following are the Natural Gas Liquids segment assets added as a result of the EnLink Acquisitions:

•800 miles of gathering pipelines (includes gross mileage of a consolidated, partially owned subsidiary);

•NGL fractionators with combined operating capacity of 235 MBbl/d; and

•NGL storage facility with operating storage capacity of approximately 10 MMBbl.

See “Recent Developments” in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report for more information on our capital projects.

Sources of Earnings - Earnings for our Natural Gas Liquids segment are derived primarily from fee-based services and commodity sales and purchases. We purchase NGLs and condensate from third parties, as well as from our Natural Gas Gathering and Processing segment. We also sell NGLs to our affiliate in the Refined Products and Crude segment. Our business activities are categorized as follows:

•Exchange services - We utilize our assets to gather, transport, treat and fractionate NGLs, converting them into marketable Purity NGLs, and deliver them to a market center or customer-designated location. Some of these exchange volumes are under contracts with minimum volume commitments that provide a minimum level of revenues regardless of volumetric throughput. Our exchange services activities are primarily fee-based and include some rate-regulated tariffs; however, we also capture certain product price differentials through the fractionation process.

•Transportation and storage services - We transport Purity NGLs and certain Refined Products, primarily under regulated tariffs. Tariffs specify the maximum rates we may charge our customers and the general terms and conditions for transportation service on our pipelines. Our storage activities consist primarily of fee-based NGL storage services at our Mid-Continent and Gulf Coast storage facilities.

•Optimization and marketing - We utilize our assets, contract portfolio and market knowledge to capture location, product and seasonal price differentials through the purchase and sale of unfractionated NGLs and Purity NGLs. We transport Purity NGLs between the Mid-Continent region, upper Midwest and Gulf Coast regions to capture the location price differentials between market centers. Our marketing activities also include utilizing our NGL storage facilities to capture seasonal price differentials and serving marine, truck and rail markets. Our isomerization activities capture the price differential when normal butane is converted into the more valuable iso-butane at our isomerization unit in Conway, Kansas.

In the majority of our exchange services contracts, we purchase the unfractionated NGLs at the tailgate of the processing plant and deduct contractual fees related to the transportation and fractionation services we must perform before we can sell them as Purity NGLs. To the extent we hold unfractionated NGLs in inventory, the related contractual fees are not recognized until the unfractionated inventory is fractionated and sold.

Unconsolidated Affiliates - We have a 50% ownership interest in Overland Pass, which operates an interstate NGL pipeline system extending 760 miles, originating in Wyoming and Colorado and terminating in Kansas. Our other unconsolidated affiliates in this segment are not material.

See Note O of the Notes to Consolidated Financial Statements in this Annual Report for additional discussion of unconsolidated affiliates.

Government Regulation - The operations and revenues of our NGL pipelines are regulated by various state and federal government agencies. Our interstate NGL pipelines are regulated under the Interstate Commerce Act, which gives the FERC jurisdiction to regulate the terms and conditions of service, rates, including depreciation and amortization policies, and initiation of service. Certain aspects of our intrastate NGL pipelines that provide common carrier service are subject to the jurisdiction of various state agencies in the states where we operate.

See further discussion in the “Regulatory, Environmental and Safety Matters” section.

Natural Gas Pipelines

Overview of Operations - In our Natural Gas Pipelines segment, we receive residue natural gas from third parties and our own natural gas processing plants and interconnecting pipelines. Residue natural gas is transported or stored for end users, such as large industrial customers, natural gas and electric utilities serving commercial and residential consumers and can ultimately reach international markets through liquified natural gas exports and cross border pipelines.

Our assets are connected to key supply areas and demand centers, including export markets in Mexico via Roadrunner and supply areas in Canada and the United States via our interstate and intrastate natural gas pipelines and Northern Border, which enables us to provide essential natural gas transportation and storage services. Growing demand from data centers and continued demand from local distribution companies, electric-generation facilities and large industrial companies support low-cost expansions that position us well to provide additional services to our customers when needed.

Intrastate Pipelines and Storage - Our intrastate natural gas pipeline and storage assets are located in Oklahoma, Texas and Kansas. Our Oklahoma intrastate pipeline and storage assets have access to major natural gas production areas in the Mid-Continent region. Our Texas intrastate pipeline and storage assets have access to major natural gas producing formations in the Texas Panhandle. These assets provide shippers access to western markets, several markets to the southeast along the Gulf Coast, including the Houston Ship Channel, the Mid-Continent market to the north and exports to Mexico. Our storage facilities provide 61 Bcf of working gas storage capacity. Additionally, as a result of the EnLink Acquisitions, we also have intrastate pipeline and storage assets in Louisiana and North Texas. Our intrastate pipeline and storage companies primarily include:

•ONEOK Gas Transportation, which transports natural gas throughout the state of Oklahoma and has access to the major natural gas production areas in the Mid-Continent region, which include the SCOOP and STACK areas and the Cana-Woodford Shale, Woodford Shale, Springer Shale, Meramec, Granite Wash and Mississippian Lime formations. ONEOK Gas Transportation is connected to our ONEOK Gas Storage facilities in Oklahoma, which provide 50 Bcf of working gas storage capacity;

•ONEOK WesTex Transmission, which transports natural gas throughout the western portion of the state of Texas, including the Waha Hub area where other pipelines may be accessed for transportation to western markets, exports to Mexico, several markets to the southeast along the Gulf Coast, including the Houston Ship Channel and the Mid-Continent market to the north. It has access to major natural gas producing formations in the Texas Panhandle, including the Granite Wash formation and Delaware and Midland Basins in the Permian Basin. ONEOK WesTex Transmission is connected to our ONEOK Texas Gas Storage facilities, which provide 8 Bcf of working gas storage capacity;

•Bridgeline Pipeline, acquired with the EnLink Acquisitions, which provides transportation and storage services to a variety of customers including South Louisiana industrial companies, power companies, utilities and Gulf Coast LNG facilities;

•Louisiana Intrastate Gas (LIG) Pipeline, acquired with the EnLink Acquisitions, which is a natural gas pipeline system providing a fully integrated wellhead to burner tip value chain that includes local gathering, processing, transmissions and treating services to Louisiana producers. The LIG Pipeline has access to the Haynesville shale producing area and connects to several other natural gas pipelines, providing additional system supply, and to the Jefferson Island storage facility; and

•Acacia Pipeline, acquired with the EnLink Acquisitions, which provides transportation services to connect production from the Barnett Shale to markets in North Texas.

Interstate Natural Gas Pipeline Divestiture - On Nov. 19, 2024, we entered into a definitive agreement with DT Midstream, Inc. to sell three of our wholly owned interstate natural gas pipeline systems, including Guardian and Viking, located in the Upper Midwest, and Midwestern Gas Transmission Company, located between Tennessee and the Chicago Hub near Joliet, Illinois. On Dec. 31, 2024, we completed the sale of these assets.

Interstate Pipelines - Sabine Pipeline was acquired with the EnLink Acquisitions and is an interstate natural gas pipeline that transports natural gas between Port Arthur, Texas, and the Henry Hub located in Erath, Louisiana. The Sabine Pipeline also owns and operates the Henry Hub, the official delivery mechanism and pricing point for Chicago Mercantile Exchange’s NYMEX natural gas futures.

Property - Our Natural Gas Pipelines segment includes the following wholly owned assets and exclude EnLink, which is shown separately below:

•5,200 miles of natural gas pipelines, which were 97% and 96% subscribed in 2024 and 2023, respectively; and

•seven underground natural gas storage facilities with 61 Bcf of total active working natural gas storage capacity which were 75% and 76% subscribed in 2024 and 2023, respectively.

Our storage includes two underground natural gas storage facilities in Oklahoma, two underground natural gas storage facilities in Kansas and three underground natural gas storage facilities in Texas.

The following are the Natural Gas Pipeline segment assets added as a result of the EnLink Acquisitions:

•3,200 miles of natural gas pipelines; and

•four underground natural gas storage facilities with approximately 13 Bcf of total active working natural gas storage capacity.

Sources of Earnings - Earnings for our Natural Gas Pipelines segment are derived primarily from fee-based services and our business activities are categorized as follows:

•Transportation services - Our regulated natural gas transportation services contracts are based upon rates stated in the respective tariffs, which have generally been established through shipper specific negotiation, discounts and negotiated settlements. The rates are filed with FERC or the appropriate state jurisdictional agencies. In addition, customers typically are assessed fees, such as a commodity charge, and we may retain a percentage of natural gas in-kind for our compression services. Our transportation earnings are primarily fee-based and utilize the following types of contracts:

◦Firm service - Customers reserve a fixed quantity of pipeline capacity for a specified period of time, which obligates the customer to pay regardless of usage. Under this type of contract, the customer pays a monthly fixed fee and incremental fees, known as commodity charges, which are based on the actual volumes of

natural gas they transport or store. Under the firm service contract, the customer generally is guaranteed access to the capacity they reserve.

◦Interruptible service - Under interruptible service transportation agreements, the customer may utilize available capacity after firm service requests are satisfied. The customer is not guaranteed use of our pipelines unless excess capacity is available.

•Storage services - Our storage earnings are primarily fee-based and utilize the following types of contracts:

◦Firm service - Customers reserve a specific quantity of storage capacity, including injection and withdrawal rights, and generally pay fixed fees based on the quantity of capacity reserved plus an injection and withdrawal fee based on actual usage. Our firm storage contracts typically have terms longer than one year.

◦Park-and-loan service - An interruptible storage service offered to customers providing the ability to park (inject) or loan (withdraw) natural gas into or out of our storage, typically for monthly or seasonal terms. Customers reserve the right to park or loan natural gas based on a specified quantity, including injection and withdrawal rights when capacity is available.

•Optimization and marketing - As a result of the EnLink Acquisitions, we also derive earnings from providing natural gas marketing and optimization for our customers.

Unconsolidated Affiliates - Our Natural Gas Pipelines segment includes the following unconsolidated affiliates:

•50% ownership interest in Northern Border, which owns a FERC-regulated interstate pipeline that transports natural gas from the Montana-Saskatchewan border near Port of Morgan, Montana, and the Williston Basin in North Dakota to a terminus near North Hayden, Indiana.

•50% ownership interest in Roadrunner, a bidirectional pipeline, which has the capacity to transport 570 MMcf/d of natural gas from the Permian Basin in West Texas to the Mexican border near El Paso, Texas, and has capacity to transport approximately 1.0 Bcf/d of natural gas from the Delaware Basin to the Waha Hub area. We are the operator of Roadrunner.

•As a result of the EnLink Acquisitions, 15% ownership interest in Matterhorn, a bidirectional pipeline, which has capacity to transport 2.5 Bcf/d of natural gas from the Waha Hub to Katy, Texas.

See Note O of the Notes to Consolidated Financial Statements in this Annual Report for additional discussion of unconsolidated affiliates.

Government Regulation - Interstate - Our interstate natural gas pipelines are regulated under the Natural Gas Act, which gives the FERC jurisdiction to regulate virtually all aspects of this business, such as transportation of natural gas, rates and charges for services, construction of new facilities, depreciation and amortization policies, acquisition and disposition of facilities and the initiation and discontinuation of services.

Intrastate - Our intrastate natural gas pipelines in Oklahoma, Kansas, Louisiana and Texas are subject to rate regulation by state regulators and by the FERC under the Natural Gas Policy Act of 1978, as amended, for certain services where we deliver natural gas into FERC-regulated natural gas pipelines. While we have flexibility in establishing natural gas transportation rates with customers, there is a maximum rate that we can charge our customers in Oklahoma and Kansas and for the services regulated by the FERC. In Texas and Kansas, natural gas storage may be regulated by the state and by the FERC for certain types of services. In Oklahoma, natural gas storage operations are not subject to rate regulation by the state, and we have market-based rate authority from the FERC for certain types of intrastate services.

See further discussion in the “Regulatory, Environmental and Safety Matters” section.

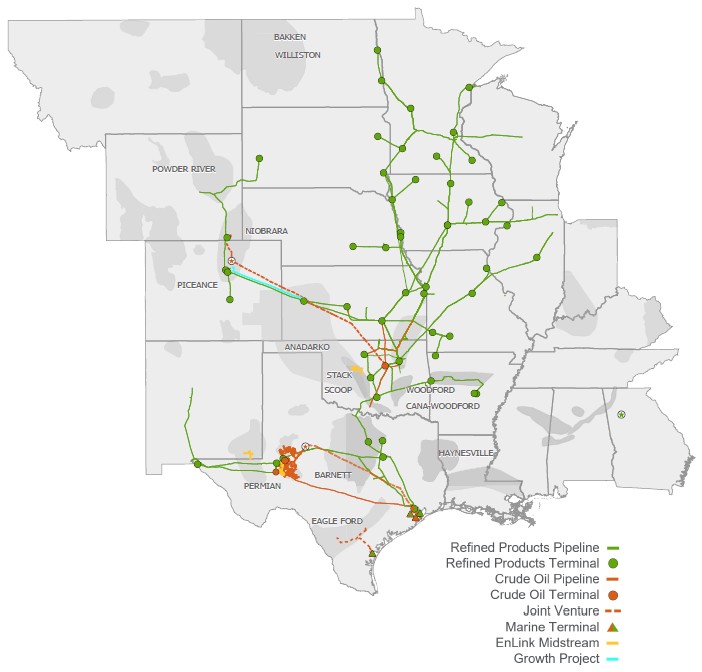

Refined Products and Crude

Overview of Operations - Our Refined Products and Crude segment is principally engaged in the transportation, storage and distribution of Refined Products and crude oil. As a result of the EnLink Acquisitions and the Medallion Acquisition, we are also engaged in the gathering of crude oil. Crude oil pipelines gather and transport crude oil to refineries, export facilities and demand centers. Throughout our distribution system, terminals play a key role in facilitating product movements and marketing by providing storage, distribution, blending and other ancillary services. Products transported on our Refined Products pipeline system include gasoline, distillates, aviation fuel and certain NGLs. Shipments originate on our Refined Products pipeline system from direct connections to refineries or through interconnections with other pipelines or terminals for transportation and ultimate distribution to retail fueling stations, convenience stores, travel centers, railroads, airports and other end users.

Our Refined Products pipeline system is one of the longest common carrier pipeline systems for Refined Products in the United States, extending from the Texas Gulf Coast and covering a 15-state area across the central and western United States. Our crude oil assets are strategically located to transport and store crude oil and are connected to multiple trading and demand centers. We have existing crude oil pipelines in Kansas and Oklahoma, and from the Permian Basin in West Texas to our East Houston terminal. Our Houston distribution system connects our East Houston terminal through several interchanges to various points, including multiple refineries throughout the Houston area and crude oil import and export facilities. Our Cushing terminal primarily receives and distributes crude oil via the multiple pipelines that terminate in and originate from the Cushing hub. Our Corpus Christi terminal provides terminalling services and includes our splitter.

As a result of the EnLink Acquisitions and the Medallion Acquisition, we acquired crude oil gathering pipelines and crude oil storage facilities in the Permian Basin and the Mid-Continent region.

Property - Our Refined Products and Crude segment includes the following wholly owned assets, which exclude EnLink and Medallion, which are shown separately below:

•9,800 miles of Refined Products pipelines;

•1,100 miles of crude oil pipelines;

•53 Refined Products terminals;

•two marine terminals; and

•97 MMBbl of operating storage capacity.

The following are the Refined Products and Crude segment assets added as a result of the EnLink Acquisitions and the Medallion Acquisition:

•2,100 miles of crude oil gathering pipelines; and

•2 MMBbl of operating storage capacity.

We are in the process of constructing our greater Denver area pipeline expansion project. The project includes construction of a new 230-mile, 16-inch diameter pipeline from Scott City, Kansas, to Denver International Airport and the addition or upgrading of certain pump stations and will increase total system capacity by 35 MBbl/d and have additional expansion capabilities. This project is excluded from the assets listed above.

See “Recent Developments” in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report for more information on our capital projects.

Sources of Earnings - Earnings in this segment are derived primarily from transportation, storage and terminal services and product sales:

•Transportation services - We generate revenue from tariffs on volumes gathered and transported on our Refined Products and crude oil pipeline systems. These transportation tariffs vary depending upon where the product originates and where ultimate delivery occurs. Transportation fees are in published tariffs filed with the FERC or the appropriate state agency or established by negotiated rates.

•Storage and terminal services - We generate additional revenue from providing pipeline capacity and tank storage services, as well as providing services such as terminalling, ethanol and biodiesel unloading and loading, and additive injection, which are performed under short-term and long-term agreements.

•Optimization and marketing - At times, we obtain Refined Products and crude oil and utilize our assets, contract portfolio and market knowledge to capture location, product and seasonal price differentials through liquids blending and purchases and sales of product, including transmix, which is a mixture that forms when different Refined Products are transported in pipelines.

Unconsolidated Affiliates - Our Refined Products and Crude segment includes the following unconsolidated affiliates:

•a 30% ownership interest in BridgeTex, which owns an approximately 400-mile crude oil pipeline with transport capacity of up to 440 MBbl/d that connects Permian Basin crude oil to our East Houston terminal;

•a 40% ownership interest in Saddlehorn, which owns an undivided joint interest in an approximately 600-mile pipeline, with transport capacity of up to 290 MBbl/d of crude oil from the Denver-Julesburg Basin and Rocky Mountain region to storage facilities in Cushing, including our Cushing terminal; and

•a 25% ownership in MVP, which owns a Refined Products marine storage terminal along the Houston Ship Channel in Pasadena, Texas, including more than 5 MMBbl of storage, two ship docks and truck loading facilities.

Our other unconsolidated affiliates in this segment are not material.

See Note O of the Notes to Consolidated Financial Statements in this Annual Report for additional discussion of unconsolidated affiliates.

Government Regulation - Our interstate common carrier pipelines are subject to rate regulation by the FERC under the Interstate Commerce Act, the Energy Policy Act of 1992 and related rules and orders. Most of the tariff rates on our long-haul pipelines are established under market-based rate authority or via negotiated rates that generally allow for annual inflation-based adjustments. Some shipments on our pipeline systems are considered to be in intrastate commerce and are subject to certain regulations with respect to such intrastate transportation by state regulatory authorities in Colorado, Kansas, Minnesota, Oklahoma, Texas or Wyoming. In future rate or rulemaking proceedings, the FERC or state regulatory authorities could reduce rates prospectively, limit our ability to increase future rates or modify the way rates are currently established. In certain circumstances, a change could also require the payment of refunds to shippers.

See further discussion in the “Regulatory, Environmental and Safety Matters” section.

Market Conditions and Seasonality

Supply and Demand - Supply for each of our segments depends on crude oil and natural gas drilling and production activities, which are driven by the strength of the economy and impacts of geopolitical events; crude oil, natural gas, NGL and Refined

Products prices; the demand for each of these products from end users; changes in gas-to-oil ratios and the decline rate of existing production; refinery maintenance cycles; producer access to capital and investment in the industry; connections to pipelines and refineries; and producer firm commitments to transportation pipelines.

Demand for gathering and processing services is dependent on natural gas and crude oil production by producers in the regions in which we operate. Demand for NGLs and the ability of natural gas processors to sustain their operations successfully and economically affect the volume of unfractionated NGLs produced by natural gas processing plants, thereby affecting the demand for NGL gathering, transportation and fractionation services. Natural gas and Purity NGLs are affected by the demand associated with the various industries that utilize the commodities, such as butanes and natural gasoline used by the refining industry as blending stocks for motor fuel, denaturant for ethanol and diluents for crude oil. Ethane, propane, butanes and natural gasoline are also used by the petrochemical industry to produce chemical components, used for a range of products that improve our daily lives and promote economic growth, including health care products, recyclable food packaging, clothing, technology, building materials, industrial, manufacturing and energy infrastructure, lightweight vehicle components and batteries. Propane is also used to heat homes and businesses. Demand for Refined Products is influenced by many factors, including driving patterns, consumer preferences, economic conditions, population changes, government regulations, changes in vehicle fuel efficiency and the development of alternative energy sources. The demand for Refined Products in the market areas served by our pipeline system has historically been stable. Demand for shipments on our crude oil pipelines is driven primarily by crude oil production and takeaway demand in the regions in which we operate. Demand for natural gas, NGLs, Refined Products and crude oil is also impacted by global macroeconomic factors.

Commodity Prices - Our earnings are primarily fee-based in all of our segments; however, we are exposed to some commodity price risk. As part of our hedging strategy, we use commodity derivative financial instruments and physical-forward contracts to reduce the impact of price fluctuations related to natural gas, NGLs, Refined Products and crude oil. Our Natural Gas Gathering and Processing segment is exposed to commodity price risk as a result of retaining a portion of the commodity sales proceeds associated with our fee with POP contracts and our POP contracts with take-in-kind rights. Our Natural Gas Gathering and Processing segment follows a programmatic approach to hedging commodity price risk and expects to hedge approximately 75% of its monthly equity volumes over time. Under certain fee with POP contracts, our contractual fees and POP percentage may increase or decrease if production volumes, delivery pressures or commodity prices change relative to specified thresholds. In our Natural Gas Liquids segment, we are exposed to commodity price risk associated with changes in the price of NGLs; the location differential between the Conway, Kansas, upper Midwest region, Mont Belvieu, Texas, and Louisiana; and the relative price differential between natural gas, NGLs and individual Purity NGLs, which affect our NGL purchases and sales, our exchange services, transportation and storage services, and optimization and marketing financial results. NGL storage revenue may be affected by price volatility and forward pricing of NGL physical contracts versus the current price of NGLs on the spot market. We are also exposed to changes in the price of power, which can impact our fractionation and transportation costs. In our Natural Gas Pipelines segment, we are exposed to minimal commodity price risk associated with (i) changes in the price of natural gas, which impact our fuel costs and retained fuel in-kind received for our compression services; and (ii) the differential between forward pricing of natural gas physical contracts and the price of natural gas on the spot market, which may affect customer demand for our natural gas storage services. In our Refined Products and Crude segment, we are exposed to some commodity price risk, including product price and location differentials primarily from our optimization and marketing activities, as well as product retained during the operations of our pipelines and terminals. See additional discussion regarding our commodity price risk and related hedging activities under “Commodity Price Risk” in Part II, Item 7A, Quantitative and Qualitative Disclosures about Market Risk, in this Annual Report.

Seasonality - Cold temperatures usually increase demand for natural gas and certain Purity NGLs, such as propane, a heating fuel for homes and businesses. Warm temperatures usually increase demand for natural gas used in gas-fired electric generation for residential and commercial cooling, as well as agriculture-related equipment like irrigation pumps and crop dryers. Demand for butanes and natural gasoline, which are used by the refining industry as blending stocks for motor fuel, denaturant for ethanol and diluents for crude oil, are also subject to some variability during seasonal periods when certain government restrictions on motor fuel blending products change. Additionally, our liquids blending activities are limited by seasonal changes in gasoline vapor pressure specifications and by the varying quantity of the gasoline delivered to us. During periods of peak demand for a certain commodity, prices for that product typically increase.

Extreme weather conditions, seasonal temperature changes and the impact of temperature and humidity on the mechanical abilities of equipment impact the volumes of natural gas gathered and processed, NGL volumes gathered, transported and fractionated, and Refined Products and crude oil volumes transported and stored. Power interruptions and inaccessible well sites as a result of severe storms or freeze-offs, a phenomenon where water vapor from the well bore freezes at the wellhead or within the natural gas gathering system, may cause a temporary interruption in the flow of natural gas, NGLs, Refined Products and crude oil.

In our Natural Gas Pipelines segment, natural gas storage is necessary to balance the relatively steady natural gas supply with the seasonal demand of our local natural gas distribution and electric-generation customers as a result of the demand from their residential and commercial customers.

Competition - We compete for natural gas, NGL, Refined Products and crude oil volumes with other midstream companies, major integrated oil companies and independent exploration and production companies that have gathering and processing assets, fractionators, pipelines, terminals and storage facilities. The factors that typically affect our ability to compete for natural gas, NGL, Refined Products and crude oil volumes are:

•quality and quantity of services provided;

•producer drilling activity;

•proceeds remitted and/or fees charged under our contracts;

•proximity of our assets to natural gas, NGL, Refined Products and crude oil supply areas and markets;

•proximity of our assets to alternative energy production;

•location of our assets relative to those of our competitors;

•efficiency and reliability of our operations;

•receipt and delivery capabilities for natural gas, NGLs, Refined Products and crude oil that exist in each pipeline system, plant, fractionator, terminal and storage location;

•the petrochemical industry’s level of capacity utilization and feedstock requirements;

•current and forward natural gas, NGLs, Refined Products and crude oil prices; and

•cost of and access to capital.

We have remained competitive by executing strategic acquisitions; making capital investments to access and connect new supplies with end-user demand; increasing gathering, processing, fractionation and pipeline capacity; increasing storage, withdrawal and injection capabilities; and improving operating efficiency. Our and our competitors’ infrastructure projects may affect commodity prices and could displace supply volumes from the Mid-Continent and Rocky Mountain regions and the Permian Basin where our assets are located. We believe our assets are located strategically, connecting diverse supply areas to market and demand centers.

Customers - Our Natural Gas Gathering and Processing, Natural Gas Liquids and Refined Products and Crude segments derive fees for services from major and independent crude oil and natural gas producers. Our Natural Gas Liquids segment’s customers also include other NGL and natural gas gathering and processing companies. Our downstream commodity sales customers are primarily petrochemical, refining and marketing companies, utilities, large industrial companies, natural gasoline distributors, propane distributors, exporters and municipalities. Our Refined Products and Crude segment’s customers also include crude oil producers, refiners, wholesalers, retailers, traders, railroads, airlines and regional farm cooperatives. End markets for Refined Products deliveries are primarily retail gasoline stations, truck stops, farm cooperatives, railroad fueling depots, military bases and commercial airports. Our Natural Gas Pipeline segment’s assets primarily serve local distribution companies, electric-generation facilities, large industrial companies, municipalities, producers, processors and marketing companies. Our utility customers generally require our services regardless of commodity prices. See discussion regarding our customer credit risk under “Counterparty Credit Risk” in Part II, Item 7A, Quantitative and Qualitative Disclosures about Market Risk, in this Annual Report.

Other

Through ONEOK Leasing Company, L.L.C. and ONEOK Parking Company, L.L.C., we own a 17-story office building (ONEOK Plaza) and a parking garage in downtown Tulsa, Oklahoma, where our headquarters are located. ONEOK Leasing Company, L.L.C. primarily operates our headquarters office building. ONEOK Parking Company, L.L.C. owns and operates a parking garage adjacent to our headquarters. We have a wholly owned captive insurance company, which was formed in 2022.

REGULATORY, ENVIRONMENTAL AND SAFETY MATTERS

We are subject to a variety of historical preservation and environmental and safety laws and/or regulations that affect many aspects of our present and future operations. Regulated activities include, but are not limited to, those involving air emissions, storm water and wastewater discharges, handling and disposal of solid and hazardous waste, wetland and waterway preservation, wildlife conservation, cultural resource protection, hazardous materials transportation, cleanup of spills or releases of hazardous substances and pipeline and facility construction. These laws and regulations require us to obtain and/or comply with a wide variety of environmental clearances, registrations, licenses, permits and other approvals. Failure to comply with these laws, regulations, licenses and permits may expose us to fines, penalties, reputational harm, claims or lawsuits from third parties, and/or interruptions in our operations that could be material to our results of operations or financial condition. We may

also incur material costs for cleanup of spills or releases of hazardous substances. In addition, emissions controls and/or other regulatory or permitting mandates under the Federal Clean Air Act, as amended (Clean Air Act), and other similar federal and state laws could require unexpected capital expenditures at our facilities. We cannot ensure that existing environmental statutes and regulations will not be revised or that new regulations will not be adopted or become applicable to us. We also cannot ensure that existing permits will not be revised or cancelled, potentially impacting facility construction activities or ongoing operations.

Air and Water Emissions - The Clean Air Act, the Federal Water Pollution Control Act Amendments of 1972, as amended (Clean Water Act), the Oil Pollution Act of 1990 and analogous state laws and/or regulations impose restrictions and controls regarding the release of pollutants into the air and water in the United States. Under the Clean Air Act, a federal operating permit is required for sources of significant air emissions. We may be required to incur certain capital expenditures for air pollution-control equipment in connection with obtaining or maintaining permits and approvals for sources of air emissions. The Clean Water Act imposes substantial potential liability for pollutants discharged into waters of the United States and requires remediation of waters affected by such discharge. The Oil Pollution Act aims at preventing and responding to oil spills in U.S. waters and shorelines.

GHG Emissions - In 2023, GHG emissions were approximately 3.7 million metric tons of carbon dioxide equivalents of Scope 1 emissions and 3.1 million metric tons of carbon dioxide equivalents of Scope 2 emissions. Scope 1 emissions originate from the combustion of fuel in our equipment, such as compressor engines and heaters, as well as fugitive methane emissions. Scope 2 emissions are generated from purchased power sources.

In 2021, we announced a companywide absolute GHG emissions reduction target of 2.2 million metric tons of carbon dioxide equivalents from our combined Scope 1 and Scope 2 GHG emissions by 2030 for our legacy ONEOK assets. The target represents a 30% reduction in combined operational Scope 1 and location-based Scope 2 GHG emissions attributable to ONEOK assets as of Dec. 31, 2019. As of Dec. 31, 2024, we have achieved reductions totaling approximately 1.7 million metric tons of the targeted 2.2 million metric tons of carbon dioxide equivalents, primarily as a result of methane emissions mitigation, system utilization and optimizations, electrification of certain natural gas compression equipment and lower carbon-based electricity in states in which we operate. GHG emission reductions as reported may be modified, updated, changed or supplemented based on available information. For the years ended Dec. 31, 2024, 2023 and 2022, we did not have any material dedicated capital expenditures specifically for climate-related projects, nor did we purchase or sell carbon credits or offsets. Progress to date on our goal has been accomplished through routine capital projects and asset optimizations that were primarily performed for operational improvements that inherently improved our emissions profile. We continue to anticipate several potential pathways toward achieving our emissions reduction target. In 2025, we intend to work towards further reductions in our emissions toward our target through improved methane management practices and system optimization that will not require material capital expenditures. We do not anticipate purchasing or selling carbon credits or offsets in 2025.

We currently participate in Our Nation’s Energy (ONE) Future Coalition to voluntarily report methane emission reductions and to calculate our methane intensity for our natural gas transmission and storage assets. We continue to focus on maintaining low methane gas release rates through expanded implementation of improved practices to limit the release of natural gas during pipeline and facility maintenance and operations.

We are a participant in the American Petroleum Institute’s The Environmental Partnership and are enrolled in environmental performance programs that are designed to further reduce emissions using proven, cost-effective controls.

Regulation

United States Department of Transportation Pipeline and Hazardous Materials Safety Administration (PHMSA) - On Jan. 17, 2025, the PHMSA issued a final rule, which has been submitted to the Federal Register underscoring to pipeline and pipeline facility operator’s requirements to minimize methane emissions in the Protecting our Infrastructure of Pipelines and Enhancing Safety (PIPES) Act of 2020. The PIPES Act directs pipeline operators to update their inspection and maintenance plans to address the elimination of hazardous leaks and to minimize natural gas releases from pipeline facilities. The updated plans must also address the replacement or remediation of pipeline facilities that historically have been known to experience leaks. We have completed and continue to update our pipeline maintenance procedures to identify and reduce methane leaks.

United States Environmental Protection Agency (EPA) - The EPA’s Mandatory Greenhouse Gas Reporting Rule requires annual GHG emissions reporting from our affected facilities and the carbon dioxide emission equivalents for all hydrocarbon liquids produced by us as if all products were combusted, even if they are used otherwise. The additional cost to gather and report this emission data did not have, and we do not expect it to have, a material impact on our results of operations, financial position or cash flows.

In 2024, the EPA finalized its rule targeting oil and gas section emissions of greenhouse gases (primarily methane) and volatile organic compounds (VOCs). The rule includes (i) new source performance standards codified in 40 C.F.R. Part 60 Subpart OOOOb for new sources (i.e., facilities that commence construction, reconstruction, or modification after Dec. 6, 2022), (ii) emission guidelines codified in 40 C.F.R. Part 60 Subpart OOOOc that states must use to develop performance standards for existing sources (i.e., facilities that existed on or before Dec. 6, 2022). This final rule was challenged in court by states and industry stakeholders, which litigation is ongoing. In addition, in January 2025, the new administration issued an executive order directing the heads of all federal agencies to identify and begin the processes to suspend, revise or rescind all agency actions that are unduly burdensome on the identification, development or use of domestic energy resources. Consequently, future implementation and enforcement of the final rule remain uncertain. At this time, we do not anticipate a material impact to our planned capital, operations and maintenance costs resulting from compliance with the current or pending regulations and proposed EPA actions. However, the EPA and/or state regulators may issue additional regulations, responses, amendments and/or policy guidance, which could alter our present expectations.