Filed Pursuant to Rule 424(b)(1)

under the Securities Act of 1933

Registration Number 333-130542

1,725,000 Shares

AMERICASBANK CORP.

Common Stock

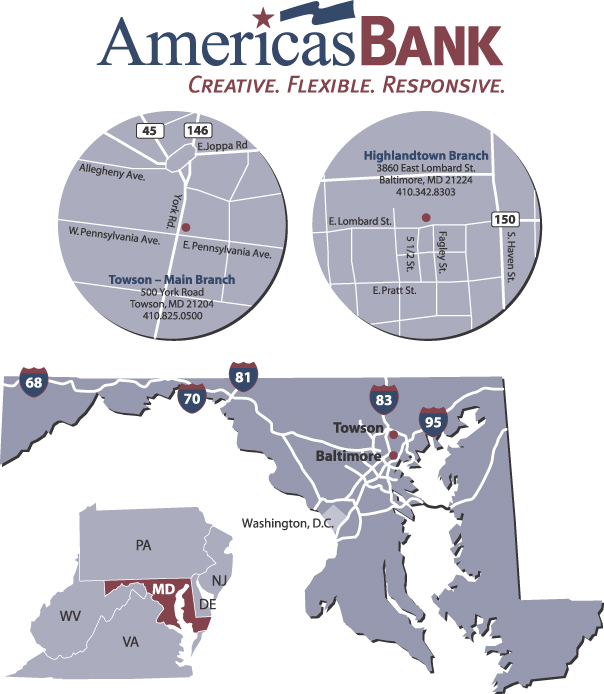

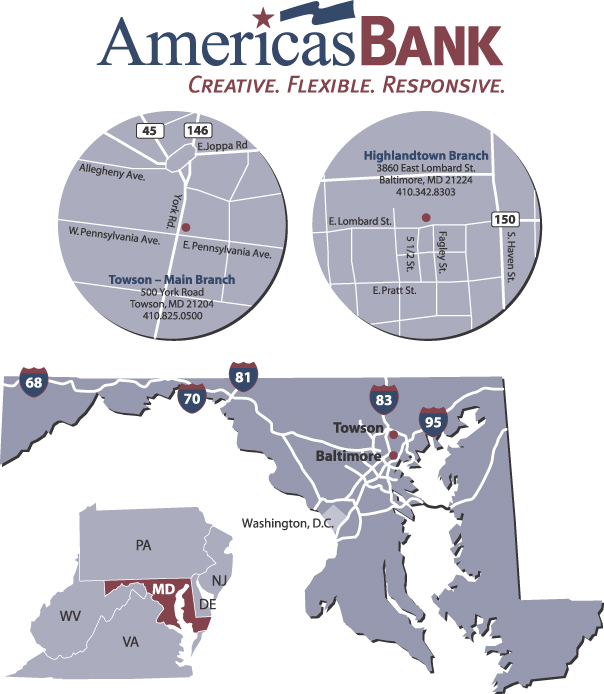

We are a single-bank holding company that owns all of the capital stock of AmericasBank, a Maryland-chartered commercial bank that commenced operations on December 1, 1997. AmericasBank is headquartered in Towson, Maryland, which is the county seat for Baltimore County, Maryland. AmericasBank also has a branch office in the Highlandtown area of the city of Baltimore, and a mortgage origination office in Towson, Maryland.

We are offering 1,725,000 shares of our common stock.

Our common stock is quoted on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “AMAB.” We have applied to have our common stock qualified for listing on the NASDAQ Capital Market under the symbol “AMAB” and to have that listing effective immediately after the closing of the offering or as soon as possible thereafter. However, NASDAQ may not approve the listing, and an active trading market for our common stock may not develop or be sustained after the offering. The last trade of our common stock reported on the OTCBB was $7.00 per share on March 1, 2006.

These shares are offered by our underwriter, as our selling agent, on a best efforts basis and subject to certain other conditions, including the right to reject any order in whole or in part. Because the offering is being conducted on a best efforts basis, the underwriter is not required to sell any minimum number or dollar amount of the shares and is not obligated to purchase the shares if they are not sold to the public. Funds received by the underwriter from investors in the offering will be deposited at, and held by, an independent escrow agent in a non-interest bearing account pending closing. Other than approval by the underwriter, there are no conditions to the release of the funds from escrow. We anticipate that delivery of the shares will be made on or about March 10, 2006.

Investing in our common stock involves risks. You should read the “Risk Factors” section beginning on page 8 of this prospectus before buying shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of the common stock or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of common stock offered are not deposit accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| | | | | | |

| | | Offering Price

| | Underwriting

Commissions(1)

| | Proceeds to Us(2)

|

| | | |

Per Share | | $7.00 | | $0.42 | | $6.58 |

| | | |

Total(3) | | $12,075,000 | | $724,500 | | $11,350,500 |

| (1) | Payable to McKinnon & Company, Inc., our underwriter. We have agreed to indemnify the underwriter against certain liabilities, including certain liabilities under the Securities Act of 1933, as amended. See “Plan of Distribution.” |

| (2) | Before deducting expenses of the offering payable by us estimated at approximately $250,000. See “Use of Proceeds.” |

| (3) | Totals assure the sale of the entire 1,725,000 shares being offered. |

McKinnon & Company, Inc.

The date of this prospectus is March 6, 2006.

AMERICASBANK CORP.

AMERICASBANK

|

| |

PROSPECTUS SUMMARY This summary highlights information about AmericasBank Corp. and the offering. You should read the entire prospectus carefully, including the financial statements and notes to the financial statements. You should also consider carefully the information set forth under the heading “Risk Factors” before making any investment decision on our common stock. On August 3, 2005, our board of directors approved a reverse stock split of our common stock whereby every four shares of common stock were converted into one share with fractional shares resulting from the split converted to cash. The split was effective at 12:01 a.m. on August 23, 2005. All share amounts and dollar amounts per share in this prospectus with regard to the common stock have been adjusted to reflect the reverse split, unless otherwise noted. Who We Are We are AmericasBank Corp., a bank holding company that owns AmericasBank, a Maryland-chartered commercial bank that began operations in December 1997 with $3.0 million in capital and one office located in the Highlandtown area of the city of Baltimore, Maryland. In 1999, we opened a Towson office that became our headquarters. We incurred losses in every year since our inception and in August 2001 we agreed to enter into and operate under a Written Agreement with the Federal Reserve Bank of Richmond and the Maryland Division of Financial Regulation. In July and August 2003, we hired a new management team consisting of: Mark H. Anders, our president and chief executive officer, A. Gary Rever, our chief financial officer, and John D. Muncks, our senior lending officer. Mr. Anders, our president and chief executive officer, has been integrally involved in the turnaround of three community banks located in our market area during the last 14 years. Prior to joining us, Mr. Anders was the president and chief executive officer of BankAnnapolis, a $200 million commercial bank formerly known as Annapolis National Bank, from October 1999 to August 2002. Mr. Anders hired a new management group, worked closely with regulators to terminate its supervisory agreement and implemented a marketing campaign that made BankAnnapolis one of the most recognized and fastest growing banks in the Annapolis market. From October 1995 to January 1999, Mr. Anders was the president and chief executive officer of Sterling Bancorp and its subsidiary bank, Sterling Bank & Trust Co., a commercial bank in Baltimore, Maryland. Mr. Anders was hired following a failed merger and the resignation of the bank’s president. Mr. Anders engineered the sale of Sterling to Mason-Dixon Bancshares, Inc. in January 1999. From September 1991 to September 1995, Mr. Anders was a senior executive at Towson, Maryland based Bank of Maryland, a commercial bank with asset quality and capital issues operating under a regulatory agreement at the time of his hire. Mr. Anders was hired as the bank’s senior credit officer and ultimately became responsible for all line functions within the bank. Bank of Maryland was sold to Mason-Dixon Bancshares, Inc. in May 1995. Mr. Rever, our chief financial officer, formerly worked with Mr. Anders as chief financial officer at Bank of Maryland where he was responsible for all staff functions including operations, human resources, facilities and branch administration. Mr. Rever retained his responsibilities at Bank of Maryland following its sale to Mason-Dixon Bancshares, Inc. in May 1995 and in 1998 consolidated the operating functions of Mason-Dixon’s subsidiary banks into a service corporation to eliminate redundancies and reduce costs. Mr. Rever became president of the service corporation and served in that position through Mason-Dixon’s acquisition by BB&T Corporation in July 1999. From July 1999 until June 2000, Mr. Rever worked to facilitate Mason-Dixon’s operations into BB&T Corporation. Prior to joining us, Mr. Rever was the chief financial officer of Avatech Solutions, Inc., a provider of design automation and data management solutions, from August 2000 to August 2003. Mr. Muncks, our senior lending officer, is a career commercial banker and most recently was a member of the regional executive management group of then Baltimore, Maryland based Signet Bank - Maryland, where he served in both senior lending and credit capacities. Mr. Muncks retired from banking following Signet’s acquisition by First Union in 1998. From 2000 to 2003, Mr. Muncks was a principal in an electric sign business, which he has since sold. |

1

|

| |

In March 2004, we raised $5.0 million in capital by selling shares of our common stock to our shareholders and the public, which substantially increased our legal lending limit and allowed us to grow and obtain “well capitalized” status as defined by our regulators. With this new capital infusion, we hired additional staff and launched strategies to accelerate the growth of our earning assets, improve our net interest margin, and increase our noninterest revenue while controlling our noninterest expense. Our turnaround plan is beginning to show positive results as evidenced by the sequential improvement in the net loss reported for each quarter in 2005, and we expect to achieve quarterly profitability in the first quarter of 2006. Effective October 12, 2005, the Federal Reserve Bank of Richmond and the Maryland Division of Financial Regulation determined that AmericasBank Corp. and AmericasBank had returned to a satisfactory condition and terminated the Written Agreement. See “Supervision and Regulations – Current Regulatory Matters” on page 86 for more information about the Written Agreement and its termination. Performance Highlights Aided by the capital infusion in March 2004, we have seen steady improvement in our operating results beginning in the fourth quarter of 2004. Our operating results for all periods include expenses for stock-based compensation under Statement of Financial Accounting Standards No. 123,Accounting for Stock-Based Compensation, because we have performance-based options. Most of our peer institutions will not begin to accrue expenses for stock-based compensation until the first quarter of 2006 because we have performance-based options. See Note 2 in the Notes to Consolidated Financial Statements. Some of our highlights include: • We reduced the net loss for the nine months ended September 30, 2005 to $315,078, a reduction of $875,366 from the $1,190,444 loss for the nine months ended September 30, 2004. Our loss per basic and diluted common share for the nine month period ended September 30, 2005 was $(0.33) per share compared to $(1.62) per share for the nine months ended September 30, 2004. • We reduced our net loss for the three months ended September 30, 2005 to $11,101 or $(0.01) per share, a decrease of $411,699 compared to our net loss of $422,800 or $(0.46) per share for the three months ended September 30, 2004. • Our net interest income increased 135.0% to $512,703 for the three months ended September 30, 2005 from $218,132 for the three months ended September 30, 2004, and increased 130.0% to $1,271,233 for the nine months ended September 30, 2005 from $552,713 for the nine months ended September 30, 2004. • We increased our total assets to $71,307,715 at September 30, 2005, a $31,175,616 or 77.7% increase from $40,132,099 at December 31, 2004. From September 30, 2004 to September 30, 2005, total assets increased by $35,307,139 or 98.1%, from $36,000,576. • We increased loans and leases, net of allowance to $45,897,697 at September 30, 2005, a $14,652,535 or 46.9% increase from $31,245,162 at December 31, 2004. From September 30, 2004 to September 30, 2005, total loans and leases, net of allowance, increased by $22,599,627 or 97.0%, from $23,298,070. • We increased our total deposits to $65,938,331 at September 30, 2005, a $31,368,038 or 90.7% increase from $34,570,293 at December 31, 2004. From September 30, 2004 to September 30, 2005, total deposits increased $35,612,933 or 117.4%, from $30,325,398. Noninterest bearing deposits increased to $11,309,272 at September 30, 2005, a 408.0% increase from $2,226,222 at December 31, 2004. From September 30, 2004 to September 30, 2005, noninterest bearing deposits increased by $9,508,666 or 528.1%, from $1,800,606. |

2

|

• We improved our net interest margin to 3.36% for the nine months ended September 30, 2005, compared to 2.61% for the nine months ended September 30, 2004. Our net interest margin was 2.82% for the year ended December 31, 2004, compared to 2.39% for the year ended December 31, 2003. • We increased our noninterest revenue principally due to an increase in mortgage banking gains and fees. Noninterest revenue increased to $387,153 for the nine months ended September 30, 2005, a $270,246 or 231.2% increase from $116,907 for the nine months ended September 30, 2004. Strategy Our investment strategy is to be a high-performing community bank that provides above average investment returns to its shareholders while maintaining a low to moderate risk profile. Our planning horizon is ten years, starting in March 2004, when we raised $5.0 million in capital. Currently, we expect to reach quarterly profitability in the first quarter of 2006, to achieve peak efficiency within two to three years after that and to generate the core deposit base and expand the sources of fee income required for high performance within another five years. The essence of our strategy will be to stay within the traditional community bank model of serving the communities where we operate by promoting business entrepreneurship and home ownership while concentrating on products and services where we can effectively differentiate ourselves from our competitors and from the larger financial service companies operating in our market area. Our goal for the next one to five years is to accelerate the growth of our earning assets, principally our loan portfolio, to generate higher levels of net interest income while expanding our sources of noninterest revenue and maintaining control over our noninterest expenses and credit quality. We plan to do this by continuing to hire experienced, commissioned residential mortgage lenders to generate mortgage loans and other loans secured by one-to-four family properties. We expect that the majority of mortgage loans originated by this group will be brokered or sold in the secondary market for a fee or at a profit. However, this group should also generate loans for our loan portfolio. These loans may be to owner occupants or to investors and include: adjustable rate mortgages; acquisition, development and construction loans; bridge loans; and home equity loans and lines of credit secured by secondary liens. We have chosen to concentrate our loan activities in these loan classes for the following reasons: (i) the loans are generally well secured; (ii) the market is large and diverse and less susceptible to valuation cycles compared to other loan classes; (iii) the risk adjusted loan yields and the opportunities to generate fee income are attractive; and (iv) the loans in these classes are cost effective to originate, underwrite and manage when compared to other types of commercial and consumer loans. We plan to expand our loan activities to include a diversified portfolio of commercial and commercial mortgage loans; however, our commercial banking activities will, at least over the next several years, target primarily high volume depository clients that can help build our core deposit base. Expanding our core deposit base, which we define as interest and noninterest bearing checking accounts, savings accounts and money market accounts, is expected to allow us to improve our net interest margin. Location and Market Area We consider our primary market area to be Northern Baltimore County, Maryland and the Highlandtown area of the city of Baltimore. Our secondary market area includes the Baltimore Metropolitan Area, consisting of Baltimore City and the surrounding counties of Anne Arundel, Baltimore, Carroll, Harford, Howard, and Frederick County, Maryland and south-central Pennsylvania. Baltimore County enjoys corporate strength and diversity. Home to over 20,000 businesses, including headquarters for companies such as Black & Decker, AAI Corporation and McCormick & Company, the County offers a thriving economy and an attractive standard of living. Baltimore County’s business community is balanced across industry sectors with major operations for GM Powertrain, T. Rowe Price, Lockheed Martin, Procter & Gamble and MBNA. |

3

|

| |

Our market enjoys the benefits of its close proximity to the Washington D.C. market. Baltimore is well positioned along the I-95 corridor and is seeing solid increases in business growth (particularly in the service and tech sectors). Our headquarters are within 15 miles of the BWI Thurgood Marshall Airport and 45 miles of Ronald Reagan Washington National Airport. Maryland has the third highest median household income in the country, largely driven by its proximity to the federal government in Washington, D.C. The regional economy is perennially strong and diverse, boasts consistently high job growth and low unemployment and is increasingly small business oriented. Baltimore County is home to two of the federal government’s largest headquarters, the U.S. Social Security Administration and Centers for Medicare & Medicaid Services. The region also has a vibrant biotechnology and medical industry, including six major hospitals operating in our primary market. The medical industry, information technology, and tourism are all major growth industries for the region. The Port of Baltimore is one of the largest ports in the country. The region has over 25 colleges and universities including some of the highest ranked in the country. Our main banking office and principal executive offices are located at 500 York Road, Towson, Maryland 21204, and we have a branch office in the Highlandtown area of the city of Baltimore. We also have a mortgage origination office in Towson. Our telephone number is (410)-823-0500 and our website address is www.americasbank.com. Information on the website is not incorporated by reference into this prospectus and is not a part of this prospectus. |

4

| | |

| |

| THE OFFERING |

| | |

| Common Stock Offered | | 1,725,000 shares of common stock. |

| | |

| Best Efforts Offering | | This is a best efforts offering, in which the underwriter will use its best efforts to sell the shares of common stock we are offering. The underwriter is not required to sell any minimum number or dollar amount of shares of common stock. |

| | |

| Common Stock Outstanding | | As of the date of this prospectus, we had 941,702 shares of common stock outstanding. Assuming the sale of all 1,725,000 shares in the offering, we would have 2,666,702 shares of common stock issued and outstanding. This number excludes outstanding warrants and options, which specifically consist of: |

| | |

| | | • Currently exercisable and unexercisable options to purchase 301,875 shares of common stock at $8.00 per share (issued to senior management and other employees); |

| | |

| | | • Currently exercisable options to purchase 3,995 shares of common stock at an average exercise price of $40.42 and with exercise prices ranging from $28.00 to $48.00 per share (issued to current directors); and |

| | |

| | | • Currently exercisable warrants to purchase 292,765 shares of common stock at an average exercise price of $29.25 and with exercise prices ranging from $12.80 per share to $52.00 per share. |

| | |

| Use of Proceeds | | We intend to invest substantially all of the net offering proceeds in AmericasBank to support its loan growth and business expansion activities. Our management will have broad discretion in determining the specific timing and use of the offering proceeds. See “Use of Proceeds.” |

| | |

| Current Ownership by Our Management | | Our directors and executive officers currently beneficially own approximately 239,904 shares of our common stock or 23.38% of our outstanding common stock. See “Security Ownership of Certain Beneficial Owners and Management.” Some of our directors and executive officers have indicated to us informally that they intend to purchase additional shares of common stock in the offering. |

| | |

| Market for Our Common Stock | | Our common stock is currently quoted for trading on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “AMAB”. We have applied to have our common stock qualified for listing on the NASDAQ Capital Market under the symbol “AMAB” and to have that listing effective immediately after the closing of the offering or as soon as possible thereafter. However, NASDAQ may not approve the listing, and an active trading market for our common stock may not develop or be sustained after the offering. |

| | |

| Risk Factors | | You should carefully read the “Risk Factors” section in this prospectus before making any investment decision or purchasing any shares of common stock. |

5

|

| |

SUMMARY FINANCIAL DATA The following table sets forth summary consolidated financial information for AmericasBank Corp. We derived the information for the three years ended December 31, 2004 from our audited consolidated financial statements. We derived the financial information for the nine-month period ended September 30, 2005 and 2004 from our unaudited consolidated financial statements. In our opinion, we have included all adjustments, consisting solely of normal recurring adjustments, necessary for a fair presentation of results for the selected financial information and other financial data presented herein. This information should be read together with “Management’s Discussion And Analysis Of Financial Condition And Results Of Operations” and our financial statements and the related notes included elsewhere in this prospectus. Results for past periods are not necessarily indicative of results that may be expected for any future period, and results for the nine-month period ended September 30, 2005 are not necessarily indicative of results that may be expected for the full year ending December 31, 2005. The financial data for all periods has been restated for retroactive adoption of the fair value recognition provisions of SFAS 123, Accounting for Stock-Based Compensation as further described in note 2 of our audited consolidated financial statements. |

6

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Nine Months Ended September 30,

| | | Year Ended December 31,

| |

| | | 2005

| | | 2004

| | | 2004

| | | 2003

| | | 2002

| |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 1,271,233 | | | $ | 552,713 | | | $ | 855,230 | | | $ | 612,638 | | | $ | 494,670 | |

Provision for loan and lease losses | | | 35,000 | | | | 20,000 | | | | 20,000 | | | | 75,000 | | | | 78,000 | |

Noninterest revenue | | | 387,153 | | | | 116,907 | | | | 210,517 | | | | 304,625 | | | | 246,526 | |

Noninterest expenses | | | 1,938,464 | | | | 1,840,064 | | | | 2,579,082 | | | | 1,961,024 | | | | 1,663,417 | |

Income taxes | | | — | | | | — | | | | — | | | | — | | | | — | |

Net loss | | $ | (315,078 | ) | | $ | (1,190,444 | ) | | $ | (1,533,335 | ) | | $ | (1,118,761 | ) | | $ | (1,000,221 | ) |

Per Share and Shares Outstanding Data: | | | | | | | | | | | | | | | | | | | | |

Basic net loss per common share | | $ | (0.33 | ) | | $ | (1.62 | ) | | $ | (1.95 | ) | | $ | (7.37 | ) | | $ | (7.25 | ) |

Diluted net loss per common share | | $ | (0.33 | ) | | $ | (1.62 | ) | | $ | (1.95 | ) | | $ | (7.37 | ) | | $ | (7.25 | ) |

Cash dividends declared | | | — | | | | — | | | | — | | | | — | | | | — | |

Book value per common share at period end | | $ | 5.51 | | | $ | 6.03 | | | $ | 5.73 | | | $ | 7.75 | | | $ | 13.92 | |

Tangible book value per common share at period end (1) | | $ | 5.20 | | | $ | 6.00 | | | $ | 5.42 | | | $ | 7.60 | | | $ | 13.72 | |

Common shares outstanding, period end | | | 941,702 | | | | 916,515 | | | | 941,702 | | | | 197,765 | | | | 147,750 | |

Average common shares outstanding, basic | | | 941,702 | | | | 732,893 | | | | 785,082 | | | | 151,860 | | | | 137,925 | |

Average common shares outstanding, diluted | | | 941,702 | | | | 732,893 | | | | 785,082 | | | | 151,860 | | | | 137,925 | |

| | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 71,307,715 | | | $ | 36,000,576 | | | $ | 40,132,099 | | | $ | 27,065,027 | | | $ | 22,404,444 | |

Total loans, net | | | 45,897,697 | | | | 23,298,070 | | | | 31,245,162 | | | | 15,424,848 | | | | 13,159,755 | |

Total deposits | | | 65,938,331 | | | | 30,325,398 | | | | 34,570,293 | | | | 25,408,838 | | | | 20,279,668 | |

Stockholders’ equity | | $ | 5,184,807 | | | $ | 5,528,895 | | | $ | 5,395,804 | | | $ | 1,532,637 | | | $ | 2,058,341 | |

| | | | | | |

Performance Ratios: | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | (0.80 | )% | | | (5.30 | )% | | | (4.79 | )% | | | (4.07 | )% | | | (4.57 | )% |

Return on average equity | | | (8.07 | )% | | | (33.17 | )% | | | (32.64 | )% | | | (55.12 | )% | | | (41.96 | )% |

Net interest margin | | | 3.36 | % | | | 2.61 | % | | | 2.82 | % | | | 2.39 | % | | | 2.41 | % |

| | | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

Allowance to period-end loans | | | 0.76 | % | | | 1.32 | % | | | 0.99 | % | | | 1.75 | % | | | 1.88 | % |

Non-performing loans to allowance for loan and lease losses | | | 177.94 | % | | | 11.22 | % | | | 55.77 | % | | | 12.72 | % | | | 17.62 | % |

Non-performing assets to total assets | | | 0.87 | % | | | 0.16 | % | | | 0.44 | % | | | 0.29 | % | | | 0.20 | % |

Net chargeoffs (recoveries) to average loans | | | 0.00 | % | | | (0.10 | )% | | | (0.10 | )% | | | 0.34 | % | | | 0.65 | % |

| | | | | | |

Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

Total risk-based capital ratio | | | 12.84 | % | | | 24.51 | % | | | 19.94 | % | | | 9.61 | % | | | 13.73 | % |

Tier I risk-based capital ratio | | | 11.98 | % | | | 23.25 | % | | | 18.77 | % | | | 8.36 | % | | | 12.47 | % |

Tier I leverage capital ratio | | | 7.97 | % | | | 17.51 | % | | | 13.19 | % | | | 5.40 | % | | | 8.81 | % |

Total equity to total assets | | | 7.27 | % | | | 15.36 | % | | | 13.45 | % | | | 5.66 | % | | | 9.19 | % |

(1) Excludes unamortized premium paid for the loans and deposits purchased from Rushmore Trust & Savings, FSB in 1997, and goodwill from the purchase of certain assets of uvm Mortgage Marketing, Inc. in October, 2004. | |

7

RISK FACTORS

An investment in our common stock involves risk, and you should not invest in our common stock unless you can afford to lose some or all of your investment. You should carefully read the risks described below, together with all of the other information included in this prospectus, before you decide to buy any of our common stock. Our business, prospects, financial condition and results of operations could be harmed by any of the following risks.

Risks Relating to Our Business

Our liquidity and our ability to increase our loan portfolio may be negatively affected by our lack of a credit facility.On July 12, 2002, the Federal Home Loan Bank of Atlanta rescinded AmericasBank’s line of credit because of its financial condition. Also, because of its financial position, AmericasBank has not been able to obtain an alternative line of credit. AmericasBank will seek to establish new credit relationships with the Federal Home Loan Bank of Atlanta and other commercial banks as our financial position and operating performance improves but it may not be successful. If AmericasBank is unable to obtain credit, it will have to maintain a higher level of liquid funds, which adversely affects its ability to maximize net interest income. The lack of credit may also adversely affect AmericasBank’s asset/liability management policy because AmericasBank is not able to lock in favorable rates on borrowed funds. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Supervision and Regulation.”

We may continue to incur losses. We are a single bank holding company and our business is owning all of the outstanding stock of AmericasBank. As a result, our operating results and financial position depend on the operating results and financial position of AmericasBank. For the nine-month period ending September 30, 2005, and for the years ended December 31, 2004, 2003 and 2002, AmericasBank Corp. incurred net losses of approximately $315,078, $1,533,335, $1,118,761 and $1,000,221, respectively. AmericasBank Corp. may not achieve quarterly profitability within the time frame anticipated by management – which is the first quarter of 2006 - or ever. Many factors could adversely affect our short and long term operating performance, including the failure to implement fully our business strategy, unfavorable economic conditions, increased competition, loss of key personnel and government regulation. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business of AmericasBank Corp. and AmericasBank – Investment and Business Strategy.”

We depend on the services of key personnel, including Mark H. Anders, A. Gary Rever and John D. Muncks. We cannot be certain that we will be able to retain such personnel or hire replacements, and the loss of Mr. Anders, Mr. Rever, Mr. Muncks or other key personnel could disrupt our operations and result in reduced earnings or additional losses. Our goal is to become a customer-focused and relationship-driven organization. We expect our ability to operate profitably will depend in a large part on the relationships maintained with our customers by our executives. We have entered into employment agreements with Mr. Anders, our president and chief executive officer, Mr. Rever, an executive vice president and our chief financial officer and Mr. Muncks, an executive vice president and our chief lending officer, but the existence of such agreements does not assure that we will be able to retain their services. The unexpected loss of the services of Mr. Anders, Mr. Rever, Mr. Muncks or other key personnel could have a material adverse effect on our operations and could result in our inability to achieve profitability. We have sought to mitigate this risk by including non-compete provisions in Mr. Anders, Mr. Rever and Mr. Muncks’ employment agreements. See “ Management – Employment Agreements.”

Also, our anticipated growth and success, in large part, will be due to the services provided by our mortgage banking officers and the employees of our residential mortgage division. The loss of services of one or more of these persons could have a material adverse effect on our operations and our business could suffer. With the exception of Jon A. Zemarel, senior vice president and the manager of our Towson mortgage office, who was the principal of uvm Mortgage Marketing, a mortgage brokerage business from which we purchased certain assets and assumed certain liabilities in October, 2004, our mortgage loan originators are not a party to any employment agreement with us and they could terminate their employment with us at any time and for any reason. Mr. Zemarel is under a five-year employment contract expiring in October 2009, which includes a non-compete provision. See “Business of AmericasBank Corp. and AmericasBank – Investment and Business Strategy.”

We may not be successful in implementing our strategic initiatives.Our ability to implement our strategic initiatives depends on, among other things, our ability to implement fully the expansion of our residential mortgage lending division and the success of that division as well as our ability to grow core deposits. Among other factors, the success of the residential mortgage lending division is dependent in large part on market interest rates and the economy in our market area, both of which are beyond our control. Our ability to grow our core deposit base depends on, among other things, our ability to market our products to new retail and commercial customers. We may not be successful in implementing our strategic initiatives and, even if implemented, the initiatives may not be successful. See “Business of AmericasBank Corp. and AmericasBank – Investment and Business Strategy.”

Because our mortgage banking revenue is sensitive to changes in economic conditions, decreased economic activity, a slowdown in the housing market or high interest rates may reduce our profits.Our ability to reduce our losses has resulted in large part from the growth of our mortgage banking operations. For the

8

nine months ended September 30, 2005, mortgage banking gains and fees increased $252,617 to $329,807, or 327.3%, from $77,190 for the nine months ended September 30, 2004. Maintaining a high level of fees and gains from this operation depends primarily on our ability to continue to originate mortgage loans. Production levels are sensitive to changes in economic conditions and can suffer from decreased economic activity, a slowdown in the housing market or higher interest rates. Generally, any sustained period of decreased economic activity or higher interest rates could adversely affect our mortgage originations and, consequently, reduce our income from mortgage banking activities. As a result, these conditions may adversely affect our net income.

If we experience greater loan and lease losses than anticipated, it will have an adverse affect on our ability to operate profitably.We believe that our current allowance for loan and lease losses is adequate and that the methodology we use to assess the adequacy of our allowance for loan and lease losses is sound. However, our monitoring, procedures and policies may not reduce certain lending risks and the estimates we use to assess the adequacy of our allowance for loan and lease losses may not cover actual losses. The reduction in our allowance for loan and leases losses as a percentage of total loans, which has declined from 1.75% at December 31, 2003, to 0.76% at September 30, 2005, is a result of the change in the composition of our loan portfolio and our strategy to concentrate our lending in loan classes with inherently lower collection risks because of the type of collateral securing the loan.

Because the risk inherent in our loan and lease portfolio may change from time to time, including our actual loan losses and the volume of adversely rated credits in our portfolio, the amount of our allowance for loan and lease losses as a percentage of gross loans may fluctuate. Greater than expected loan and lease losses or a change in the volume of adversely rated credits in our portfolio could result in an extraordinary provision expense to return the allowance to required levels, which, in turn, would reduce our earnings. In addition, systemic and pervasive loan and lease losses can cause insolvency and failure of a financial institution and, in such an event, our shareholders could lose their entire investment. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Provision for Loan and Lease Losses and Analysis of Loan and Lease Losses.”

Our profitability depends on our ability to manage our balance sheet to minimize the effects of interest rate fluctuation on our net interest margin. Our results of operations depend on the stability of our net interest margin, which is the difference in the yield we earn on our earning assets and our cost of funds, both of which are influenced by interest rate fluctuations. Interest rates, because they are influenced by, among other things, expectations about future events, including the level of economic activity, federal monetary and fiscal policy and geo-political stability, are not predictable or controllable. In addition, the interest rates we can earn on our loan and investment portfolios and the interest rates we pay on our deposits are heavily influenced by competitive factors. Community banks are often at a competitive disadvantage in managing their cost of funds compared to the large regional, super-regional or national banks that have access to the national and international capital markets. These factors influence our ability to maintain a stable net interest margin. For the nine months ended September 30, 2005, and for the year ended December 31, 2004, our net interest margin was 3.36% and 2.82%, respectively, which is below that of most banks.

We seek to maintain a neutral position in terms of the volume of assets and liabilities that mature or re-price during any period so that we may reasonably predict our net interest margin; however, interest rate fluctuations, loan prepayments, loan production and deposit flows are constantly changing and influence our ability to maintain this neutral position. Generally speaking, our earnings will be more sensitive to fluctuations in interest rates the greater the variance in the volume of assets and liabilities that mature or re-price in any period. The extent and duration of the sensitivity will depend on the cumulative variance over time, the velocity and direction of interest rates, and whether Americas Bank is more asset sensitive or liability sensitive. Accordingly, we may not be successful in maintaining this neutral position and, as a result, our net interest margin may suffer, which will negatively impact our earnings. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Analysis of Financial Condition.”

Our large percentage of residential real estate loans for investment properties (one-to-four family and multi family) may increase the risk of credit losses, which would negatively affect our financial results.At September 30, 2005, $13,623,489 of our gross loans, or 29.4%, were loans to small builders, home improvement contractors, or investors to acquire and develop, through new construction or rehabilitation, residential properties for

9

resale or to hold as investment properties. This type of lending is more speculative and involves a higher degree of credit risk than the same type of lending for owner occupied properties. We intend for our residential real estate loans for investment properties to increase both in the aggregate and as a percentage of gross loans. Such lending may involve a concentration of credit to a single borrower, a group of related borrowers, or on properties located in close proximity to each other that could be similarly affected by market conditions in that locale. The quality of this portfolio tends to be more volatile depending on the supply and demand for residential real estate in general and expectations about future market appreciation in particular. A downturn in the local real estate market could adversely affect our customers’ ability to pay on time and could affect the underlying liquidation value of our collateral, which in turn could adversely affect us. In addition, the experience level of the investors we finance varies and some may not react as quickly or effectively to a market downturn, exacerbating the severity of any problems and increasing our risk. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations” and “Business AmericasBank Corp. and AmericasBank – Residential Mortgage Lending.”

We have increased and plan further growth in deposits in a specific market niche, which creates an industry concentration and a customer concentration.We have made a special effort to obtain noninterest bearing deposits from title agencies. These deposits are held for short periods of time by title agencies pending the disbursement of funds in mortgage loan or mortgage loan refinancing transactions. Deposits from title agencies represented 76.6% of our total noninterest bearing deposits at September 30, 2005, which creates a real estate industry concentration. In addition, there is a customer concentration since five title agencies account for approximately 13.1% of our total deposits at September 30, 2005. These deposits can fluctuate greatly during any given month and from month to month depending on transaction scheduling and overall market conditions, and like all deposits, are subject to seasonal and cyclical market fluctuations and are particularly sensitive to slow real estate markets. In order to meet the withdrawal needs of these customers, we monitor our liquidity on a daily basis. While we have benefited from this market niche, we are exposed to liquidity and concentration risks attendant to changes in real estate markets, which could adversely impact our overall performance and financial position. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Analysis of Financial Condition – Deposits.”

Our legal lending limit may limit our growth. We are limited in the amount we can lend to a single borrower by the amount of our capital. Generally, under current law, we may lend up to 15% of our unimpaired capital and surplus to any one borrower. As of September 30, 2005, we were able to lend approximately $767,000 to any one borrower. This amount is significantly less than that of many of our competitors and may discourage potential borrowers who have credit needs in excess of our legal lending limit from doing business with us. Our legal lending limit also impacts the efficiency of our lending operation because it tends to lower our average loan size, which means we have to generate a higher number of transactions to achieve the same portfolio volume. We can accommodate larger loans by selling participations in those loans to other financial institutions, but this strategy is not efficient or always available. We may not be able to attract or maintain customers seeking larger loans or may not be able to sell participations in such loans on terms we consider favorable. See “Supervision and Regulation.”

Our residential mortgage lending activities exposes us to repurchase liability and other risks to our business.Our objective is to systemically grow a high quality, diversified loan portfolio that affords us the opportunity to generate attractive yields on a risk adjusted basis and to earn higher levels of noninterest revenue through fees and service charges. In the short term, to generate noninterest revenue, we intend to focus our efforts on conforming and nonconforming fixed-rate conventional and government insured residential mortgage loans that can be sold in the secondary market on a servicing released basis. Secondary market activity is conducted either as a broker, where the loan is funded at settlement by an investor and the bank earns a fee, or as correspondent lender where the bank has been delegated underwriting authority from an investor, funds the loan at settlement and thereafter sells the loan to that investor and recognizes a gain on the sale.

Among other things, as a correspondent lender, we are exposed to repurchase liability for documentation defects and, for a limited time, payment performance. We also are required to refund the income that we earn on the sale of a loan if that loan is paid-off within 120 days from the time it is purchased. This contingent liability, also known as a prompt prepayment refund, is most likely to occur during periods when long-term mortgage rates contract quickly, motivating people to refinance their mortgage multiple times to lower their mortgage payments. In addition, the investors to whom we sell or broker loans evaluate our financial performance, the underlying

10

performance of the loans we broker and sell to them, and the quality of our administrative functions in determining whether we qualify for their lending programs. Either party on short notice may cancel the correspondent lending and broker agreements.

We intend to focus our loan origination activities on “prime” or “A” rated borrowers, and to act as a correspondent lender when feasible because the fees and income that can be generated as a correspondent lender are typically greater than when we act as a broker. However, there are greater compliance requirements and risks associated with acting as a correspondent lender. We do not intend to be an active player in the sub-prime lending markets, although we will originate loans to borrowers who only qualify for sub-prime loans. Generally, sub-prime loans will be brokered to the secondary market to reduce repurchase liability in the event of early payment defaults.

Because of our lending activities in this area, any obligations that we have to repurchase a large number of loans or make prompt repayment refunds could have a material adverse effect on our operations and could result in our inability to achieve profitability. Also, our business could be adversely affected if any of the investors to whom we sell or broker loans terminate their relationships with us and we are not able to enter into new relationships with other investors. See “Business of AmericasBank Corp. and AmericasBank.”

We face substantial competition which could adversely affect our growth and operating results. We operate in a competitive market for financial services and face intense competition from other financial institutions both in making loans and in attracting deposits. Many of these financial institutions have been in business for many years, are significantly larger, have established customer bases, have greater financial resources and legal lending limits than we do, and are able to offer certain services that we are not able to offer. See “Business of AmericasBank Corp. and AmericasBank – Competition.”

Our operations depend upon third party vendors that perform services for us. We outsource many of our operating and banking functions, including our data processing function, our item processing and the interchange and transmission services for our ATM network. As such, our success and our ability to expand our operations depend on the services provided by these third parties. Disputes with these third parties can adversely affect our operations. We may not be able to engage appropriate vendors to adequately service our needs and the vendors that we engage may not be able to perform successfully. See “Business of AmericasBank Corp. and AmericasBank.”

Our ability to operate profitably may be dependent on our ability to implement various technologies into our operations. The market for financial services, including banking services and consumer finance services, is increasingly affected by advances in technology, including developments in telecommunications, data processing, computers, automation, Internet-based banking and telebanking. Our ability to compete successfully in our markets may depend on the extent to which we are able to exploit such technological changes. If we are not able to afford such technologies, properly or timely anticipate or implement such technologies, or properly train our staff to use such technologies, our business, financial condition or operating results could be adversely affected. See “Business of AmericasBank Corp. and AmericasBank – Other Banking Products.”

We may lose some of our net operating loss carryforwards as a result of the offering.At December 31, 2004, we had net operating loss carryforwards of approximately $5,232,241 available to offset future taxable income. Under the Internal Revenue Code, the right to this benefit becomes limited if, at any time within a three-year period, holders of more than 5% of our capital stock, in the aggregate, increase their ownership of our common

11

stock by more than 50% of our outstanding capital stock in the aggregate. Essentially, the pool of shareholders who own more than 5% of our capital stock cannot own more than 50% of our outstanding capital stock in the aggregate without limiting our ability to utilize our loss carryforwards. As of the date of this prospectus, holders of more than 5% of our capital stock owned approximately 34% of our outstanding capital stock in the aggregate. If our ability to utilize our net operating losses is limited, our operations may be adversely affected as we would be required to utilize liquid assets to pay income taxes on earnings, if any, and not to fund our operations.

If the leasing companies to which we have extended credit in connection with our lease portfolio were to declare bankruptcy, we could be adversely affected.In the ordinary course of business, we have made non-recourse loans to two leasing companies totaling, as of September 30, 2005 and December 31, 2004, approximately $2,219,776 and $3,751,607, or 4.79% and 11.84%, respectively, of our loan portfolio. Each loan is secured by an assignment of the leasing company’s interest in a full pay-out lease, an assignment of the lease payments under that lease, delivery of the original lease documents and a security interest in the underlying equipment. The leasing companies service these leases, and the lessee makes payment directly to the leasing companies, which forwards the lease payments to us. Because of their structure, throughout this report we have described these loans as commercial finance leases. See “Business of AmericasBank Corp. and AmericasBank – Lending Activities - Commercial Finance Leasing.”

In addition to the normal collection risk related to this type of financing, if either leasing company were to file for bankruptcy, the bankruptcy trustee or a secured lender of the leasing company could take actions to delay AmericasBank’s receipt of payments arising from the full pay-out leases or could raise arguments that AmericasBank is not properly perfected or does not have priority with respect to its rights in the full pay-out leases, the payments arising out of them and/or the underlying equipment. Ultimately, AmericasBank believes it would be successful in any such litigation, because of, among other reasons, our possession (and thereby perfection) of the original lease documents. However, because of the size of the portfolio to our total loan and lease portfolio, any delay or denial in our receipt of funds from the lessees or ability to exercise all rights and remedies against the lessees could have a material adverse effect on our financial condition and operations.

Because AmericasBank serves a limited market area in Maryland, we could be more adversely affected by economic downturns in our market area than our larger competitors which are more geographically diverse.Our current primary market area consists of Northern Baltimore County, Maryland and the Highlandtown area of the city of Baltimore. Our secondary market area includes the Baltimore Metropolitan area, consisting of Baltimore City and the surrounding counties of Anne Arundel, Baltimore, Carroll, Harford, Howard and Frederick County, Maryland and south-central Pennsylvania. However, broad geographic diversification is not currently part of our community bank focus. As a result, if our primary or secondary market areas suffer economic downturns, our business and financial condition may be more severely affected by such circumstances. Our larger bank and financial service competitors serve more geographically diverse market areas, parts of which may not be affected by the same economic conditions that may exist in our market areas. See “Business of AmericasBank Corp. and AmericasBank – Location and Market Area.”

We may require additional capital. Management may decide to obtain additional capital in the future to support the continued growth of AmericasBank Corp. or AmericasBank. Any additional capital, if available at all, may be on terms which are not favorable to us and may result in dilution to shareholders. If adequate capital is not available, we may be required to curtail or limit our strategies for growth. See “Use of Proceeds” and “Dilution.”

12

Regulatory Risks

Our need to comply with extensive and complex government regulation could have an adverse effect on our business.The banking industry is subject to extensive regulation by state and federal banking authorities. Many of the banking regulations we are governed by are intended to protect depositors, the public or the insurance funds maintained by the Federal Deposit Insurance Corporation, not shareholders. Banking regulations affect our lending practices, capital structure, investment practices, dividend policy and many other aspects of our business. These requirements may constrain our rate of growth and changes in regulations could adversely affect us. The burden imposed by these federal and state regulations may place banks in general, and AmericasBank specifically, at a competitive disadvantage compared to less regulated competitors. In addition, the cost of compliance with regulatory requirements could adversely affect our ability to reduce losses or operate profitably. See “Supervision and Regulation” for more information about applicable banking laws and regulations.

In addition, because federal regulation of financial institutions changes regularly and is the subject of constant legislative debate, we cannot forecast how federal regulation of financial institutions may change in the future nor the impact those changes may have on our operations. Although Congress in recent years has sought to reduce the regulatory burden on financial institutions with respect to the approval of specific transactions, we fully expect that the financial institution industry will remain heavily regulated in the near future and that additional laws or regulations may be adopted further regulating specific banking practices.

The costs of being a public company are proportionately higher for small companies like us due to the requirement of the Sarbanes-Oxley Act.The Sarbanes-Oxley Act of 2002 and the related rules and regulations promulgated by the Securities and Exchange Commission have increased the scope, complexity, and cost of corporate governance, reporting, and disclosure practices. These regulations are applicable to our company. We expect to experience increasing compliance costs, including costs related to internal controls and the requirement that our auditors attest to and report on management’s assessment of our internal controls, as a result of the Sarbanes-Oxley Act. The regulations are expected to be applicable to us sometime in 2007. These necessary costs are proportionately higher for a company of our size and will affect our profitability more than that of some of our larger competitors.

AmericasBank may be subject to action by the U.S. Department of Housing and Urban Development as a result of violations of the Real Estate Settlement Procedures Act.As part of an examination in 2001, the Federal Reserve Bank of Richmond identified violations by AmericasBank of the Real Estate Settlement Procedures Act. The Federal Reserve Bank of Richmond referred the Real Estate Settlement Procedures Act violations to the U.S. Department of Housing and Urban Development as is required under applicable law. To date, the U.S. Department of Housing and Urban Development has taken no action against AmericasBank. If the Department of Housing and Urban Development were to take an action against AmericasBank as a result of the violations identified by the Federal Reserve Bank of Richmond, it could have a material adverse effect on our operations.

Risks Relating to the Offering

Because our stock is not guaranteed or insured by any governmental agency, you could lose your entire investment.The shares of common stock offered in the offering are not savings accounts or deposits, are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and involve investment risk, including the possible loss of your entire investment. See “Supervision and Regulation.”

We will have broad discretion over the use of the net proceeds of this offering and may not allocate the proceeds in the most profitable manner. Our management will have broad discretion in determining the specific timing and use of 100% of the offering proceeds. Until utilized, we anticipate that we will invest the net offering proceeds in liquid assets. We have not otherwise made a specific allocation for the use of the net proceeds. Therefore, our management will have broad discretion as to the timing and specific application of the net proceeds, and investors will not have the opportunity to evaluate the economic, financial and other relevant information that we will use in applying the net proceeds. Although we intend to use the net proceeds to serve our best interests, our application may not ultimately reflect the most profitable application of the net proceeds. See “Use of Proceeds.”

13

There is a limited trading market for our common stock; it may be difficult to sell your shares after you have purchased them.Our common stock is quoted on the OTC Bulletin Board under the symbol AMAB. We have applied to have our common stock qualified for listing on the NASDAQ Capital Market under the symbol “AMAB” and to have that listing effective immediately after the closing of the offering or as soon as possible thereafter. However, NASDAQ may not approve the listing either because we do not meet the public float requirement or for other reasons which are not apparent to us as of the date of this prospectus. Currently, we have a public float of approximately 782,062 shares and the NASDAQ rules require that we have a public float of at least 1,000,000 shares. While we are offering 1,725,000 shares in this offering, we may not sell enough to meet the public float requirements after the offering. Also, in general, as part of the listing approval process, NASDAQ has significant discretion in determining whether to list an issuer’s shares on the NASDAQ Capital Market.

Being quoted on the OTC Bulletin Board or listed on the NASDAQ Capital Market has and we believe will facilitate transactions between buyers and sellers; however, it cannot guarantee an active trading market or liquidity in our common stock. Sellers of large positions of common stock may not be able to execute transactions timely or at a desired price level. For the 12 months ended November 30, 2005, our average daily trading volume was approximately 998 shares or 0.1% of the total shares outstanding and this trading volume may not increase as a result of this offering. Even if a more active market develops after the offering, such a market may not continue, and you may not be able to sell your shares at or above the offering price. You should carefully consider the potential lack of liquidity of your investment in our common stock when making your investment decision. See “Market for Common Stock.”

This is a best efforts offering and you may be one of only a small number of investors in the offering. As a result, we may use a substantial percentage of the offering proceeds to pay for offering expenses and not to implement our business plans.This is a best efforts offering with no minimum number of shares that must be sold. The underwriter will use its best efforts to sell the common stock that we are offering and there is no firm commitment by the underwriter to sell any minimum dollar amount or number of shares. To the extent that the underwriter sells significantly less than the total number of shares that we are offering through this prospectus, you may be one of only a small number of investors in this offering, and we may use a substantial percentage of the offering proceeds to pay for the offering expenses, and not for the purposes identified under the caption “Use of Proceeds.” Any funds received from investors in the offering will be available to us regardless of the number of shares sold in this offering and will not be refunded to the investor. For example, if we sell only 10% of the shares that we are offering, or 172,500 shares, at the public offering price of $7.00, we would have gross offering proceeds of $1,207,500. Under that scenario, we estimate that we would use approximately 26.70% of that amount to pay the underwriter’s commission and estimated expenses of the offering. See “Use of Proceeds” and “Plan of Distribution.”

We do not intend to pay cash dividends in the foreseeable future.We are a separate and distinct legal entity from AmericasBank. Because our business currently is limited to owning all of the outstanding shares of capital stock of AmericasBank, our payment of dividends on the common stock generally will be funded only from dividends received from AmericasBank, which dividends are dependent on, among other things, AmericasBank’s profitability. In addition, the payment of dividends may be made only if we and AmericasBank are in compliance with certain applicable regulatory requirements governing the payment of dividends by each of them. In general, under Maryland law, AmericasBank will not be able to pay dividends so long as it has an accumulated deficit. As of November 30, 2005, AmericasBank has an accumulated deficit of approximately $5.9 million. We expect that earnings, if any, will be used initially for operating capital and we do not foresee payment of any dividends in the near future or ever.THE SHARES SHOULD NOT BE PURCHASED BY PERSONS WHO NEED OR DESIRE DIVIDEND INCOME FROM THIS INVESTMENT.See “Dividend Policy.”Our management owns, will own or has the opportunity to own a substantial portion of our common stock, and their interests may conflict with yours. Our directors and executive officers currently own 109,671 shares (representing approximately 11.65% of the outstanding shares) and beneficially own 239,904 shares of our common stock (representing 23.38% of the outstanding shares, on a fully diluted basis). The exercise price on the convertible securities that they own (options and warrants) is greater than the offering price in the offering and 180,563 of the 200,625 options granted to Messrs. Anders, Rever and Munks have not vested. If these directors and executive officers do not purchase any shares in the offering, they will own approximately 5.24% of the shares (11.02% beneficially) if all of the shares are sold. They would own a proportionately greater percentage if less than all of the shares are sold. See “Stock Ownership of Management and Principal Holders.” We expect that at least some of our directors and executive

14

officers will purchase shares in the offering. Because of the percentage of stock held by our directors and executive officers, these persons could influence the outcome of any matter submitted to a vote of our shareholders. The interests of our directors and executive officers may not align precisely with your interest as a holder of our common stock. See “Description of Capital Stock” for more information about shareholder voting and other charter provisions.

Our stock value may suffer from anti-takeover provisions that may impede potential takeovers.Provisions in our corporate documents and in Maryland corporate law may make it difficult and expensive to pursue a tender offer, change in control or takeover attempt of us. As a result, you may not have an opportunity to participate in such a transaction, and the trading price of our stock may not rise to the level of other institutions that are more vulnerable to hostile takeovers. Anti-takeover provisions include, but are not limited to:

| | • | | The election of members of our board of directors to staggered three-year terms; |

| | • | | The absence of cumulative voting by shareholders in the election of directors; |

| | • | | Provisions governing nominations of directors by shareholders and provisions governing the submission of shareholder proposals; |

| | • | | Our ability to issue preferred stock and additional shares of common stock without shareholder approval; and |

| | • | | Directors may only be removed for cause. |

These provisions also will make it more difficult for an outsider to remove our current board of directors or management. See “Description of Capital Stock” for a description of anti-takeover provisions in our corporate documents and under Maryland law.

You will experience immediate dilution in net tangible book value per share from the offering price.The offering price of the common stock in this offering is higher than the book value per share of the common stock. Consequently, investors in this offering will incur immediate dilution. See “Dilution” for more information about the dilution to investors in the offering.

If we issue additional stock in the future, your percentage of ownership will be reduced. As a shareholder of AmericasBank Corp., you will not have preemptive rights with respect to the issuance of additional shares of common stock or the issuance of any other class of stock. This means that if we decide to issue additional shares of stock, you will not automatically be entitled to purchase additional shares to maintain your percentage of ownership. In addition, if we sell additional shares in the future, it is possible that those shares may be issued on terms more favorable than the terms of the offering, which terms could, among other things, have voting or conversion rights that would adversely affect the voting power of the common stock. Also, we have issued warrants and options and will issue additional options to purchase shares of our common stock. The exercise of these warrants or options would further dilute your ownership interest in us. See “Description of Capital Stock” for more information about shareholder voting and other charter provisions.

15

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the matters discussed under the captions “Prospectus Summary,” “Risk Factors,” “Recent Developments,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business of AmericasBank Corp. and AmericasBank” and elsewhere in this prospectus include forward-looking statements. These forward-looking statements include statements regarding profitability, liquidity, allowance for loan and lease losses, interest rate sensitivity, market risk and financial and other goals. Forward-looking statements often use words such as “believe,” “expect,” “plan,” “may,” “will,” “should,” “project,” “contemplate,” “ anticipate,” “forecast,” “intend” or other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. The forward-looking statements we use in this prospectus are subject to significant risks, assumptions and uncertainties, including among other things, the following important factors that could affect the actual outcome of future events:

| | • | | Fluctuations in market rates of interest and loan and deposit pricing, which could negatively affect our net interest margin, asset valuation and income and expense projections; |

| | • | | Lack of adequate liquidity to fund loan growth; |

| | • | | Additional charge-offs in our loan portfolio; |

| | • | | Adverse changes in the overall national economy as well as adverse economic conditions in our market areas; |

| | • | | Competitive factors within the financial services industry; |

| | • | | Changes in regulatory requirements and/or restrictive banking legislation; and |

| | • | | Other factors described in the “Risk Factors” section of this prospectus. |

Because of these and other uncertainties, our actual results and performance may be materially different from results indicated by these forward-looking statements. You should not put undue reliance on any forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this prospectus. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of these statements in light of new information or future events.

16

RECENT DEVELOPMENTS

The following information sets forth selected consolidated financial information and other data of AmericasBank Corp. as of the dates indicated. In our opinion, all adjustments, consisting solely of normal recurring adjustments, necessary for a fair presentation of results as of and for the year ended December 31, 2005 have been included. The selected consolidated financial information and other data insofar as it relates to the year ended December 31, 2004 is derived from our audited consolidated financial statements. You should also read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus. Results for past periods are not necessarily indicative of results that may be expected for any future period.

AmericasBank Corp. and Subsidiary

Consolidated Balance Sheets

| | | | | | | | |

December 31,

| | 2005

| | | 2004(1)

| |

| | | (Unaudited) | | | | |

| Assets | | | | | | | | |

Cash and due from banks | | $ | 1,957,870 | | | $ | 866,960 | |

Federal funds sold and Federal Home Loan Bank deposit | | | 18,440,881 | | | | 4,356,587 | |

Securities available for sale | | | 30,000 | | | | 348,182 | |

Federal Home Loan Bank and Federal Reserve Bank stock at cost | | | 238,500 | | | | 132,550 | |

Loans held for sale | | | 1,223,616 | | | | 1,617,048 | |

Loans and leases, less allowance of $366,910 and $315,127 | | | 48,989,605 | | | | 31,245,162 | |

Premises and equipment | | | 1,005,561 | | | | 963,560 | |

Accrued interest receivable | | | 263,039 | | | | 140,898 | |

Goodwill | | | 266,985 | | | | 266,985 | |

Intangible assets | | | 24,222 | | | | 28,222 | |

Other assets | | | 305,785 | | | | 165,945 | |

| | |

|

|

| |

|

|

|

| | | $ | 72,746,064 | | | $ | 40,132,099 | |

| | |

|

|

| |

|

|

|

| Liabilities and Stockholders’ Equity | | | | | | | | |

Deposits | | | | | | | | |

Noninterest-bearing | | $ | 7,998,387 | | | $ | 2,226,222 | |

Interest-bearing | | | 59,177,095 | | | | 32,344,071 | |

| | |

|

|

| |

|

|

|

Total deposits | | | 67,175,482 | | | | 34,570,293 | |

Other liabilities | | | 314,531 | | | | 166,002 | |

| | |

|

|

| |

|

|

|

| | | | 67,490,013 | | | | 34,736,295 | |

| | |

|

|

| |

|

|

|

Stockholders’ equity | | | | | | | | |

Common stock, par value $.01 per share; 30,000,000 shares authorized, issued and

outstanding 941,702, shares | | | 9,417 | | | | 9,417 | |

Preferred stock, par value $.01 per share; 5,000,000 shares authorized, issued and

outstanding 0 shares | | | — | | | | — | |

Additional paid-in capital | | | 11,634,984 | | | | 11,449,191 | |

Accumulated deficit | | | (6,388,350 | ) | | | (6,080,564 | ) |

Accumulated other comprehensive income | | | — | | | | 17,760 | |

| | |

|

|

| |

|

|

|

| | | | 5,256,051 | | | | 5,395,804 | |

| | |

|

|

| |

|

|

|

| | | $ | 72,746,064 | | | $ | 40,132,099 | |

| | |

|

|

| |

|

|

|

| (1) | The December 31, 2004 consolidated balance sheet has been restated for retroactive adoption of the fair value recognition provisions of SFAS 123,Accounting for Stock-Based Compensation, as amended, as discussed in Note 2 to the consolidated financial statements. |

17

AmericasBank Corp. and Subsidiary

Consolidated Statements of Operations

| | | | | | | | |

Years ended December 31,

| | 2005

| | | 2004(1)

| |

| | | (Unaudited) | | | | |

Interest revenue | | | | | | | | |

Loans and leases, including fees | | $ | 3,037,462 | | | $ | 1,449,372 | |

Federal funds sold and Federal Home Loan Bank deposit | | | 446,113 | | | | 119,093 | |

Preferred trust securities | | | 7,417 | | | | 30,000 | |

Mortgage-backed securities | | | — | | | | 155 | |

Other | | | 12,665 | | | | 8,384 | |

| | |

|

|

| |

|

|

|

Total interest revenue | | | 3,503,657 | | | | 1,607,004 | |

| | |

|

|

| |

|

|

|

Interest expense | | | | | | | | |

Deposits | | | 1,685,153 | | | | 779,527 | |

| | |

|

|

| |

|

|

|

Net interest income | | | 1,818,504 | | | | 827,477 | |

Provision for loan and lease losses | | | 52,000 | | | | 20,000 | |

| | |

|

|

| |

|

|

|

Net interest income after provision for loan and lease losses | | | 1,766,504 | | | | 807,477 | |

| | |

|

|

| |

|

|

|

Noninterest revenue | | | | | | | | |

Service charges on deposit accounts and other fees | | | 84,467 | | | | 58,707 | |

Mortgage banking gains and fees | | | 484,898 | | | | 179,563 | |

| | |

|

|

| |

|

|

|

Total noninterest revenue | | | 569,365 | | | | 238,270 | |

| | |

|

|

| |

|

|

|

Noninterest expenses | | | | | | | | |

Salaries | | | 1,176,913 | | | | 1,308,652 | |

Employee benefits | | | 309,735 | | | | 251,049 | |

Occupancy | | | 176,231 | | | | 143,344 | |

Furniture and equipment | | | 116,787 | | | | 101,704 | |

Other | | | 863,989 | | | | 774,333 | |

| | |

|

|

| |

|

|

|

Total noninterest expenses | | | 2,643,655 | | | | 2,579,082 | |

| | |

|

|

| |

|

|

|

Loss before income taxes | | | (307,786 | ) | | | (1,533,335 | ) |

Income taxes | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Net loss | | $ | (307,786 | ) | | $ | (1,533,335 | ) |

| | |

|

|

| |

|

|

|

Loss per common share - basic and diluted | | $ | (0.33 | ) | | $ | (1.95 | ) |

| (1) | Certain reclassifications have been made to the 2004 audited consolidated financial statements to conform to the presentation of the 2005 unaudited consolidated financial statements. Also, results for the year ended December 31, 2004, have been restated for retroactive adoption of the fair value recognition provisions of SFAS 123,Accounting for Stock-Based Compensation, as amended, as discussed in Note 2 to the consolidated financial statements. |

18

Selected Ratios:

| | | | | | |

| | | 2005

| | | 2004

| |

| | | (Unaudited) | | | | |

Performance Ratios: | | | | | | |

Return on average assets | | (0.53 | )% | | (4.79 | )% |

Return on average equity | | (5.89 | )% | | (32.64 | )% |

Net interest margin | | 3.29 | % | | 2.73 | % |

Asset Quality Ratios: | | | | | | |

Allowance to period-end loans | | 0.74 | % | | 0.99 | % |

Non-performing loans to allowance for loan and lease losses | | 169.73 | % | | 55.77 | % |

Non-performing assets to total assets | | 0.86 | % | | 0.44 | % |

Net chargeoffs (recoveries) to average loans | | 0.00 | % | | (0.10 | )% |

Capital Ratios: | | | | | | |

Total risk-based capital ratio | | 11.32 | % | | 19.94 | % |

Tier I risk-based capital ratio | | 10.54 | % | | 18.77 | % |

Tier I leverage capital ratio | | 6.95 | % | | 13.19 | % |

Total equity to total assets | | 7.23 | % | | 13.45 | % |

Financial Condition

Total assets increased $32,613,965 (81.3%) to $72,746,064 at December 31, 2005 from $40,132,099 at December 31, 2004. Loans and leases, net of allowance, at December 31, 2005 were 48,989,605, an increase of $17,744,443 or 56.8% above the $31,245,162 reported at December 31, 2004. The investment securities portfolio was $30,000 at December 31, 2005, a decrease of $318,182 from $348,182 at December 31, 2004. Federal funds sold and Federal Home Loan Bank deposits increased to $18,440,881 at December 31, 2005, from the $4,356,587 balance at December 31, 2004, primarily as a result of increases in deposits, as described below.

Total deposits increased by $32,605,189 or 94.3% to $67,175,482 at December 31, 2005 from $34,570,293 at December 31, 2004. Interest-bearing deposits increased $26,833,024 or 83.0% to $59,177,095 at December 31, 2005, from $32,344,071 at December 31, 2004. Noninterest bearing deposits increased $5,772,165 or 259.3% from $2,226,222 at December 31, 2004, to $7,998,387 at December 31, 2005. Interest bearing deposits increased primarily as a result of the offering of premium rate certificates of deposit through an Internet-based service and through print advertising in local newspapers. The increase in noninterest bearing deposits was primarily from new accounts opened for title agencies.

The allowance for loan and lease losses was $366,910 or 0.74% of total loans and leases at December 31, 2005, compared to $315,127 or 0.99% of total loans and leases at December 31, 2004. The decline in the allowance as a percentage of total loans is due to the growth of our loan portfolio and the change in the composition of our loans. A primary focus of our lending activities are loans secured by a first lien on a one-to-four family property and home equity loans. These types of loans accounted for 60.93% and 56.52% of total loans at December 31, 2005 and December 31, 2004, respectively. Management believes that such loans traditionally have an inherently lower risk of loss than other types of loans. The concentration of loans to investors secured by residential properties increases the risk of loss. Management allocates a higher reserve percentage for loans to investors as compared to residential loans that are owner occupied in assessing the allowance for loan and lease losses; however, to date, there is no historical precedent for the reserve percentages. At December 31, 2005, we had no exposure to foreign countries or foreign borrowers. Management believes that the allowance for loan and lease losses is adequate.

Our non-performing loans were $622,671 or 1.26% of gross loans and leases at December 31, 2005, compared to $175,742 or 0.55% of gross loans and leases at December 31, 2004. The substantial increase in

19

nonaccrual loans and leases was related to one loan in which we held an approximately 10% participation. Our loan balance to this borrower was $587,761 at December 31, 2005.

Total stockholders equity was $5,256,051 at December 31, 2005, a decrease of $139,753 from the $5,395,804 reported at December 31, 2004.