UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant R

Filed by a Party other than the Registrant £

Check the appropriate box:

£ Preliminary Proxy Statement | £ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

R Definitive Proxy Statement | |

£ Definitive Additional Materials | |

£ Soliciting Material Pursuant to §240.14a-12 | |

| GeoEye, Inc. |

| |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| £ | Fee paid previously with preliminary materials. |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

GeoEye, Inc.

2325 Dulles Corner Boulevard

Herndon, Virginia 20171

April 29, 2011

Dear Stockholder:

You are cordially invited to attend our 2011 Annual Meeting of Stockholders. The Annual Meeting will be held at 2325 Dulles Corner Boulevard, Herndon, Virginia 20171, on Thursday, June 2, 2011, at 9:00 a.m. Eastern Daylight Time.

At the Annual Meeting, you will be asked to vote on each of the four proposals set forth in the Notice of Annual Meeting of Stockholders and the Proxy Statement, which describe the formal business to be conducted at the Annual Meeting and follow this letter.

It is important that your shares are represented and voted at the Annual Meeting regardless of the size of your holdings. Whether or not you plan to attend the Annual Meeting, please vote electronically via the Internet or by telephone, if permitted by the broker or other nominee that holds your shares. If you receive a paper copy of the proxy materials, please complete, sign, date and return the accompanying proxy card. Voting electronically, by telephone or by returning your proxy card in advance of the Annual Meeting does not deprive you of your right to attend the Annual Meeting.

If you, or your designated representative or proxy, plan to attend our Annual Meeting in person, please follow the advance registration instructions on the back of this Proxy Statement, which will expedite your admission to the Annual Meeting. Additional details regarding requirements for admission to the Annual Meeting are described in the Proxy Statement under the heading “How can I attend the Annual Meeting in person?”

If you have any questions concerning the Annual Meeting and you are the stockholder of record of your shares, please contact our Corporate Secretary at (703) 480-7500. If your shares are held by a broker or other nominee (that is, in “street name”), please contact the broker or other nominee for questions concerning the Annual Meeting. If you are the stockholder of record of your shares and have questions regarding your stock ownership, please contact The Bank of New York Mellon at (877) 295-8616.

On behalf of the Board of Directors, thank you for your continued support. We look forward to greeting as many of you as possible at the Annual Meeting.

| | |

| | LT. GENERAL JAMES A. ABRAHAMSON, USAF (RET.) |

| | Chairman of the Board of Directors |

GeoEye, Inc.

2325 Dulles Corner Boulevard

Herndon, Virginia 20171

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2011

Dear Stockholder:

The 2011 Annual Meeting of Stockholders of GeoEye, Inc. (“Company”) will be held at 2325 Dulles Corner Boulevard, Herndon, Virginia 20171, on Thursday, June 2, 2011, at 9:00 a.m. Eastern Daylight Time.

At the Annual Meeting, stockholders will be asked to:

| | 1. | Elect nine directors to serve for a term of one year and until their successors are duly elected and qualified; |

| | 2. | Consider and vote upon a non-binding advisory vote on the compensation of the named executive officers of the Company (“Say on Pay”); |

| | 3. | Consider and vote upon a non-binding advisory vote on the frequency of the advisory vote on Say on Pay in future years; |

| | 4. | Consider and vote upon the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2011; and |

| | 5. | Transact such other business as may properly come before the meeting or any adjournment(s) or postponement(s) thereof. |

The Proxy Statement more fully describes these proposals.

The Board of Directors of the Company recommends that stockholders vote FOR the election of the Board of Directors nominees named in the Proxy Statement; FOR the approval, on an advisory basis, of the compensation of the named executive officers of the Company; FOR the approval, on an advisory basis, of an annual advisory vote on executive compensation; and FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2011.

Only stockholders of our common stock at the close of business on April 12, 2011, the record date, are entitled to notice of and to vote at the Annual Meeting and any adjournment(s) or postponement(s) thereof.

We will send a full set of proxy materials on or about May 4, 2011, and provide access to our proxy materials over the Internet, beginning on April 29, 2011, for the holders of record and beneficial owners of our common stock as of the close of business on the record date.

YOUR PROXY IS IMPORTANT TO US. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible to ensure that your shares will be represented at the Annual Meeting.

| | By Order of the Board of Directors, |

| | |

| | |

| | WILLIAM L. WARREN |

| | Executive Vice President, General Counsel and |

| | Corporate Secretary |

April 29, 2011

| | 1 |

| | | |

| | 5 |

| | | |

| | 9 |

| | | |

| | 9 |

| | 9 |

| | 10 |

| | 10 |

| | 12 |

| | 14 |

| | 15 |

| | 15 |

| | | |

| | 16 |

| | | |

| | 16 |

| | 19 |

| | 19 |

| | 21 |

| | 23 |

| | | |

| | 24 |

| | | |

| | 24 |

| | 25 |

| | 25 |

| | 26 |

| | 27 |

| | 28 |

| | 29 |

| | 30 |

| | | |

| | 31 |

| | 31 |

| | | |

| | 33 |

| | | |

| | 33 |

| | 33 |

| | 34 |

| | 35 |

| | 35 |

| | | |

| | 36 |

| | | |

| | 37 |

| | | |

| | 40 |

| | | |

| | 41 |

| | | |

| | 43 |

GEOEYE, INC.

2325 Dulles Corner Boulevard

Herndon, Virginia 20171

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

JUNE 2, 2011

We are providing you with this Proxy Statement in connection with the solicitation of proxies to be used at our 2011 Annual Meeting of Stockholders (“Annual Meeting”) of GeoEye, Inc. (“Company”). The Annual Meeting will be held at 2325 Dulles Corner Boulevard, Herndon, Virginia 20171, on Thursday, June 2, 2011, at 9:00 a.m. Eastern Daylight Time. This proxy statement contains important information regarding our Annual Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote and information about voting procedures. As used in this Proxy Statement, “we,” “us,” “our,” “GeoEye” or the “Company” refer to GeoEye, Inc., a Delaware corporation.

This solicitation is made by the Company on behalf of the Board of Directors of the Company (“Board”). Costs of this solicitation will be borne by the Company.

This Proxy Statement, the accompanying proxy card or voting instructions, and our Annual Report will be made available to our stockholders on or about April 29, 2011.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

When and where is the Annual Meeting?

The Annual Meeting will be held at 2325 Dulles Corner Boulevard, Herndon, Virginia 20171, on Thursday, June 2, 2011, at 9:00 a.m. Eastern Daylight Time.

What matters will be voted on at the Annual Meeting?

The following matters will be voted on at the Annual Meeting:

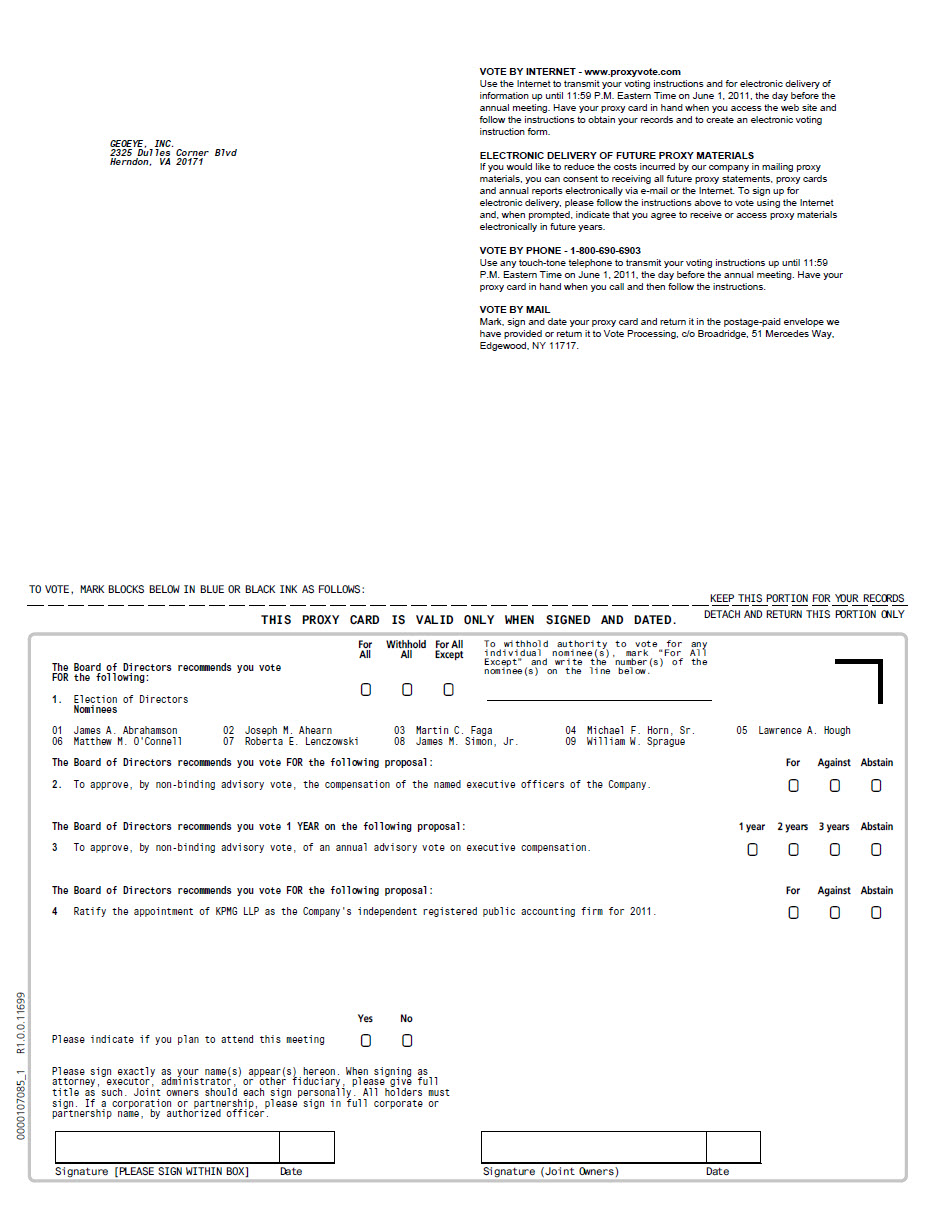

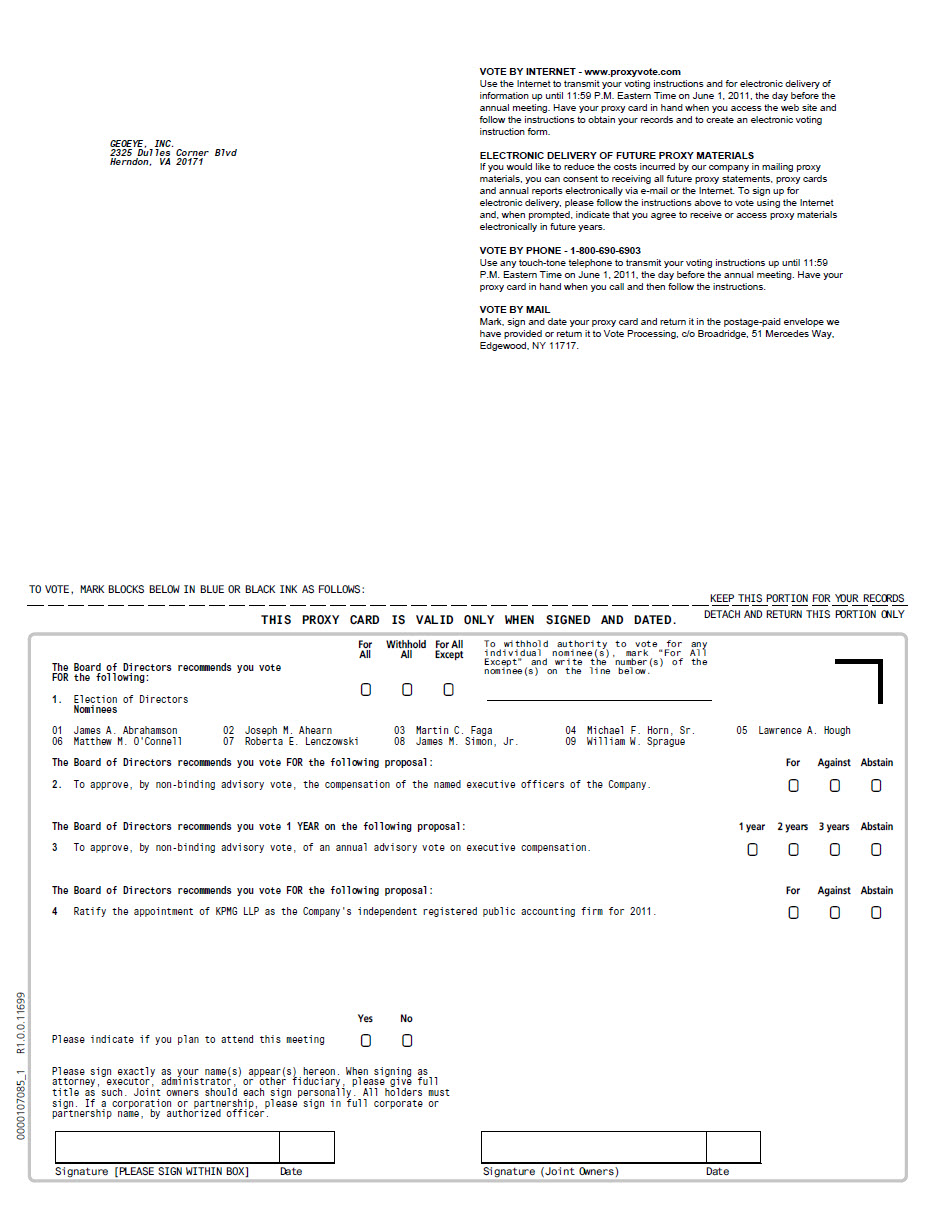

| | · | Proposal 1: Elect nine directors to serve for a term of one year and until their successors are duly elected and qualified; |

| | · | Proposal 2: Consider and vote upon a non-binding advisory vote on the compensation of the named executive officers of the Company (“Say on Pay”); |

| | · | Proposal 3: Consider and vote upon a non-binding advisory vote on the frequency of the advisory vote on Say on Pay in future years; |

| | · | Proposal 4: Consider and vote upon the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2011; and |

| | · | Transact such other business as may properly come before the meeting or any adjournment(s) or postponement(s) thereof. |

How does the Board of Directors recommend that I vote?

The Board recommends that you vote:

| | · | FOR Proposal 1, the election of the Board of Director nominees named in this Proxy Statement; |

| | · | FOR Proposal 2, the approval, on an advisory basis, of the compensation of the named executive officers of the Company; |

| | · | FOR Proposal 3, the approval, on an advisory basis, of an annual advisory vote on executive compensation; |

| | · | FOR Proposal 4, the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2011; and |

| | · | In the discretion of the named proxies regarding any other matters properly presented for a vote at the Annual Meeting. |

Who is entitled to vote at the Annual Meeting?

Holders of our common stock and shares of our preferred stock convertible into shares of common stock at the close of business on April 12, 2011, the record date, may vote at the Annual Meeting. We refer to the holders of our common stock and shares of our preferred stock convertible into shares of common stock as “stockholders” throughout this Proxy Statement. Each stockholder is entitled to one vote for each share of common stock held as of the record date.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholders of Record. You are a stockholder of record if at the close of business on the record date your shares were registered directly in your name with BNY Mellon Shareowner Services, our transfer agent.

Beneficial Owner. You are a beneficial owner if at the close of business on the record date your shares were held by a brokerage firm or other nominee and not in your name. Being a beneficial owner means that, like most of our stockholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee will be able to vote your shares with respect to some of the proposals, but not all. Please see “What if I did not specify how my shares are to be voted?” for additional information.

How can I attend the Annual Meeting in person?

If you are a stockholder of record at the close of business on the record date, you may attend the Annual Meeting in person. Individuals who are the beneficial owners of their common stock must bring with them to the Annual Meeting a legal proxy from the organization that holds their shares or a brokerage statement showing ownership of shares as of the close of business on the record date. Representatives of institutional stockholders must bring a legal proxy or other proof that they are representatives of a firm that held shares as of the close of business on the record date and are authorized to vote on behalf of the institution.

Anyone seeking admittance to the Annual Meeting who cannot prove ownership or representation as of the close of business on the record date may not be admitted. In addition, you must also bring with you a form of government-issued photo identification, such as a driver’s license, state-issued ID card or passport to gain entry to the Annual Meeting.

To expedite your admission to the Annual Meeting, please follow the advance registration instructions in the back of this Proxy Statement.

How do I vote and what are the voting deadlines?

Stockholders of Record. If you are a stockholder of record, there are several ways for you to vote your shares:

| | · | By Mail. You may submit your vote by completing, signing and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received no later than Wednesday, June 1, 2011, the day prior to the Annual Meeting, to be voted at the Annual Meeting. |

| | · | By telephone or over the Internet. You may vote your shares by telephone or via the Internet by following the instructions provided on the proxy card or voting instructions. If you vote by telephone or via the Internet, you do not need to return a proxy card by mail. Internet and telephone voting are available 24 hours a day. Votes submitted by telephone or through the Internet must be received by 11:59 p.m. Eastern Daylight Time on Wednesday, June 1, 2011, the day prior to the Annual Meeting, to be counted. |

| | · | In person at the Annual Meeting. You may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you also submit your proxy card or voting instructions or vote by telephone or via the Internet by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Beneficial Owners. If you are a beneficial owner of your shares, you should have received voting instructions from the broker or other nominee holding your shares. You should follow the instructions on the proxy card or the voting instructions provided by your broker or nominee to instruct your broker or other nominee on how to vote your shares. The availability of telephone and Internet voting will depend on the voting process of the broker or nominee. Shares held beneficially may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker or nominee giving you the right to vote the shares.

Can I revoke or change my vote after I submit my proxy?

Stockholders of Record. If you are a stockholder of record, you may revoke your vote at any time before the final vote at the Annual Meeting by:

| | · | signing and returning a new proxy card with a later date; |

| | · | submitting a later dated vote by telephone or via the Internet since only your latest telephone or Internet proxy received by 11:59 p.m. Eastern Daylight Time on June 1, 2011, the day prior to the Annual Meeting, will be counted; |

| | · | attending the Annual Meeting in person and voting again; or |

| | · | delivering a written revocation to our Corporate Secretary at GeoEye, Inc., 2325 Dulles Corner Boulevard, Herndon, Virginia 20171, before the Annual Meeting. |

Beneficial Owners. If you are a beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions for changing your vote.

What will happen if I do not vote my shares?

Stockholders of Record. If you are the stockholder of record of your shares and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under the applicable rules, your broker or nominee does not have discretion to vote your shares on non-routine matters such as Proposals 1, 2 and 3. However, your broker or nominee does have discretion to vote your shares on routine matters such as Proposal 4.

What if I do not specify how my shares are to be voted?

Stockholders of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

| | · | FOR Proposal 1, the election of the Board of Director nominees named in this Proxy Statement; |

| | · | FOR Proposal 2, the approval, on an advisory basis, of the compensation of the named executive officers of the Company; |

| | · | FOR Proposal 3, the approval, on an advisory basis, of an annual advisory vote on executive compensation; |

| | · | FOR Proposal 4, the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2011; and |

| | · | In the discretion of the named proxies regarding any other matters properly presented for a vote at the Annual Meeting. |

Beneficial Owners. If you are a beneficial owner and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the applicable rules, brokers and other nominees have the discretion to vote on routine matters such as Proposal 4, but do not have discretion to vote on non-routine matters such as Proposals 1, 2 and 3. Therefore, if you do not provide voting instructions to your broker or other nominee, your broker or other nominee may only vote your shares on Proposal 4 and any other routine matters properly presented for a vote at the Annual Meeting.

What constitutes a quorum, and why is a quorum required?

We need a quorum of stockholders to hold our Annual Meeting. A quorum exists when at least a majority of the outstanding shares entitled to vote at the close of business on the record date is represented at the Annual Meeting either in person or by proxy. As of the close of business on April 12, 2011, the record date, we had 22,697,861 shares of common stock outstanding and entitled to vote at the Annual Meeting, and 80,000 shares of preferred stock convertible into 2,688,347 shares of common stock. This means that there will be 25,386,208 total shares of common stock outstanding and entitled to vote at the Annual Meeting. Accordingly, 12,693,105 shares of common stock must be represented in person or by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum if you submit a proxy or vote at the Annual Meeting. Abstentions and broker non-votes (as described below) will also count towards the quorum requirement. If there is no quorum, the Chairman of the Board may adjourn the Annual Meeting to another date and time.

What is the effect of a broker non-vote?

Brokers or other nominees who hold shares of our common stock for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the Annual Meeting. A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, a broker non-vote will not affect our ability to obtain a quorum and will not otherwise affect the outcome of the vote on a proposal that requires the approval of a majority of the votes present in person or represented by proxy and entitled to vote (Proposals 1, 2, 3 and 4).

What is the vote required for each proposal?

| Proposal | | Vote Required | | Broker Discretionary Voting Allowed |

| Proposal 1 – Election of nine directors | | Majority of the shares entitled to vote and present in person or represented by proxy | | No |

| | | | | |

| Proposal 2 – Advisory vote on executive compensation | | Majority of the shares entitled to vote and present in person or represented by proxy | | No |

| | | | | |

| Proposal 3 – Advisory vote on frequency of advisory vote on executive compensation | | Majority of the shares entitled to vote and present in person or represented by proxy, but in the event that no option receives a majority of the shares entitled to vote and present in person or represented by proxy, the Board will consider the option that receives the most votes | | No |

| | | | | |

| Proposal 4 – Ratification of auditors for fiscal year 2011 | | Majority of the shares entitled to vote and present in person or represented by proxy | | Yes |

| | | | | |

With respect to Proposals 2 and 4, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on these two proposals, the abstention will have the same effect as an AGAINST vote.

With respect to Proposal 1, you may vote FOR all nominees, WITHHOLD your vote as to all nominees, or FOR all nominees except those specific nominees from whom you WITHHOLD your vote. Each nominee is required to receive more FOR votes in favor of re-election to the Board than votes cast as WITHHOLD.

With respect to Proposal 3, you may vote FOR Every Year, FOR Every Two Years, FOR Every Three Years, or ABSTAIN.

What happens if the Annual Meeting is adjourned or postponed?

Your proxy will still be effective and will be voted at the rescheduled Annual Meeting. You will still be able to change or revoke your proxy until it is voted.

Who is paying for the costs of this proxy solicitation?

We will bear the expense of soliciting proxies. Proxies may also be solicited in person, by telephone or electronically by Company personnel who will not receive additional compensation for such solicitation. Copies of proxy materials and the Annual Report will be supplied to brokers and other nominees for the purpose of soliciting proxies from beneficial owners, and we will reimburse such brokers or other nominees for their reasonable expenses.

How can I find the results of the Annual Meeting?

Preliminary results will be announced at the Annual Meeting. Final results will be posted on the Company’s Web site, http://www.geoeye.com, in its About Us/Investor Relations section under “2011 Annual Meeting” and will also be published in a current report on Form 8-K to be filed with the U.S. Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

May stockholders ask questions at the Annual Meeting?

Yes. Representatives of the Company will answer questions of general interest at the end of the Annual Meeting.

Can stockholders exercise dissenters’ rights of appraisal with respect to any proposal at the meeting?

Stockholders have no rights under Delaware law, the Company’s Certificate of Incorporation or the Company’s Bylaws to exercise dissenters’ rights of appraisal with respect to any of the matters to be voted upon at the Annual Meeting.

PROPOSAL 1 – ELECTION OF DIRECTORS

Our stockholders will be asked to consider nine nominees for election to our Board to serve for a one-year term until the 2012 Annual Meeting of Stockholders. The persons named as proxies in the accompanying form of proxy intend to vote in favor of the election of the nine nominees for director designated below to serve until the next annual meeting of stockholders and until their respective successors are duly elected and qualified. With the exception of Mr. Ballhaus, each of the nominees was elected by the stockholders at last year’s annual meeting. It is expected that each of these nominees will be able to serve, but if any such nominee is unable to serve, the proxies may vote for another person nominated by the Nominating and Governance Committee and approved by the Board. Mr. Ballhaus, listed below, is designated by the holders of our preferred stock for appointment to the Board.

Information Regarding Nominees (as of April 29, 2011)

Lt. General James Abrahamson, USAF (Ret) (Director) (Chairman of the Board)

Age 77, has been a member of the Board since April 1998 and has served as Chairman of the Board since November 2001. Lt. General Abrahamson also served as Chairman of the Nominating and Governance Committee from January 2005 through June 2008 and remains a member of that Committee. He also serves as a member of the Audit Committee and as an ex officio member of the Strategy Committee. In addition to his directorship at GeoEye, Lt. General Abrahamson serves as chairman and chief executive officer of StratCom, LLC and SkySpectrum LLC, privately held companies associated with the development of stratospheric airships for civil and military applications. Lt. General Abrahamson is also the chairman of Global Relief Technologies, Inc., a privately held company dedicated to improving disaster management and recovery through the use of high technology.

Lt. General Abrahamson has significant private sector and government leadership experience, including having served as director of the Department of Defense’s Strategic Defense Initiative, as NASA associate administrator for Space Flight, as Oracle’s chairman of the board, and as the president of the Transportation Sector for Hughes Aircraft Company. He also has over 30 years of service in the U.S. Air Force, including as program manager for satellite programs and space programs. Lt. General Abrahamson’s unique insight into the space industry, extensive government experience and leadership positions in the military and the private sector provide him with a unique perspective, which he brings to our Board.

Public Directorships: Lt. General Abrahamson serves as the vice chairman of MSGI, Inc. since July 2010.

Joseph M. Ahearn (Director)

Age 56, has been a member of the Board since December 2003, has served as Chairman of the Audit Committee from January 2004 to June 2008 and remains a member of the Audit Committee. He also has served as a member of the Compensation Committee since April 2006. Mr. Ahearn has served as chairman and chief executive officer of Faneuil, Inc., a privately held corporation, since 2007 and as senior vice president for MacAndrews & Forbes Holdings Inc. since December 2005. From September 2005 to December 2005, Mr. Ahearn served as vice president, special projects for Panavision Inc. and from August 2004 to September 2005, he served as managing director of Qorval, Inc.

Mr. Ahearn brings a wealth of management, accounting and audit-related experience to GeoEye and its Board, having served as chief executive officer of Marvel Entertainment and its predecessor company, ToyBiz, and by conducting audit and consulting work at Arthur Andersen and Touche Ross for more than ten years. He has extensive experience dealing with accounting principles and financial reporting. The Board has determined that he is an “audit committee financial expert” as determined by the Board in accordance with Item 407(d)(5) of Regulation S-K.

Public Directorships: Mr. Ahearn does not currently hold, nor in the past five years has he held, any other public directorships.

Martin C. Faga (Director)

Age 69, has been a member of the Board and a member of the Strategy Committee since August 1, 2006, acting Chairman of the Strategy Committee since May 6, 2010, and a member of the Compensation Committee since June 2008. Since April 9, 2010, Mr. Faga has been a director of Segovia Global IP Services, Inc., a wholly owned subsidiary of Inmarsat plc, a British mobile satellite company. Since 2009, Mr. Faga has served as a director of Thomson Reuters Special Services, a wholly owned subsidiary of Thomson Reuters Corp. Since May 2000, Mr. Faga has been a trustee on the Board of Trustees for the MITRE Corporation (“MITRE”), a non-profit organization for which he previously served as president and chief executive officer from May 2000 through June 2006. Since 2004, Mr. Faga has served as a director for the Association for Intelligence Officers, a non-profit organization. Since 2006, he has served as a director, secretary and member of the executive committee for the Space Foundation, a non-profit organization. Since 2007, he has served as a director and member of the special security agreement board for Olive Group North America, a privately-held company.

Mr. Faga gained significant knowledge into the satellite imagery industry as the former director of the National Reconnaissance Office (1989-1993), a federal agency engaged in satellite imagery operations. His technical background, professional experience and service with MITRE, operating research centers and developing strategic initiatives, are valuable resources to our Board.

Public Directorships: Mr. Faga is a director and a member of the compensation and nominating and governance committees of Alliant Techsystems (since 2006), and he has served as a director and member of the compensation committee at Electronic Data Systems from 2006 to 2008.

Michael F. Horn, Sr. (Director)

Age 74, has been a member of the Board since December 2007, and a member of both the Audit Committee and the Strategy Committee since January 2008. Mr. Horn became Chairman of the Audit Committee in June 2008. Since January 2004, Mr. Horn has served as an auditor and consultant for various private and publicly held companies. Mr. Horn also serves on the board of United Energy Technology, Inc., a privately held company.

Mr. Horn brings more than 40 years of executive financial management, audit and consulting experience, including 35 years with KPMG LLP, where he served as a partner for 28 years. Mr. Horn’s experience and insight as an auditor and consultant is extremely beneficial to the Board and Audit Committee. Based on his experience and expertise, the Board has determined that Mr. Horn is an “audit committee financial expert” as determined by the Board in accordance with Item 407(d)(5) of Regulation S-K.

Public Directorships: Mr. Horn does not currently hold, nor in the past five years has he held, any other public directorships.

Lawrence A. Hough (Director)

Age 67, has been a member of the Board since December 2003, Chairman of the Nominating and Governance Committee since June 2008, and a member of the Strategy Committee since June 2008. He previously served as chairman of the Compensation Committee from April 2006 to June 2008. Since January 2008, Mr. Hough has been the managing director of Stuart Mill Venture Partners, L.P. From January 1997 to the present, he has served as president and chief executive officer of Stuart Mill Capital, Inc. From June 2004 to May 2005, he served as chief executive officer of SynXis Corporation, having previously served as its chairman of the board from January 2004 to May 2004. Mr. Hough was president and chief executive officer of the Student Loan Marketing Corporation from 1990 to 1997.

Mr. Hough’s significant experience in operations and financial oversight gained from serving as president or managing director for various companies over several years, in addition to his memberships on various boards of directors and audit committees, provides him with the executive, operational and financial expertise that is vital to our Board. From 2008 to the present, he has served on the boards of Appistry, Inc.; Marrone Organics Innovations, Inc.; and Sypherlink, Inc., all privately held companies. From 1985 to the present, he has served on the board and the audit and executive committees of the Shakespeare Theatre, a non-profit organization; and since 2006, he has served as a trustee for the Levine School of Music, a non-profit organization.

Public Directorships: Mr. Hough served as a director of Goldleaf Financial Solutions, Inc. from 2005 to 2009 and was chairman of its nominating and governance committee. Mr. Hough served as a director of Collegiate Funding Services from 2003 to 2006 and was chairman of the audit committee. Both Goldleaf Financial Services, Inc. and Collegiate Funding Services were acquired in stock transactions, resulting in the discontinuation of their respective boards.

Roberta E. Lenczowski (Director)

Age 69, has been a member of the Board and of the Strategy Committee since August 2007 and a member of the Nominating and Governance Committee since June 2008. In 2010, she became the chairman of the newly chartered Risk Committee. In 2005, Ms. Lenczowski formed Roberta E. Lenczowski Consulting, a consulting company serving the geospatial intelligence community. From 2005 to the present, she has served as a consultant for various companies in the geospatial industry or related industries, including serving since May 2006 as an academic advisor on the academic advisory committee of Sanborn Map Company, a wholly owned subsidiary of Daily Mail and General Trust plc. From 2004 to 2005, Ms. Lenczowski served as the West senior executive with the National Geospatial-Intelligence Agency (“NGA”). From 2005 until November 2010, Ms. Lenczowski served as a director for TechniGraphics, a privately held company. From 2005 through the present, Ms. Lenczowski has been a director for the Leonard Wood Institute, a non-profit company. Since 2007, Ms. Lenczowski has served as a director for Fugro EarthData, Inc., a subsidiary company of Fugro N.V.

Ms. Lenczowski served the NGA for more than 28 years. At the American Society for Photogrammetry and Remote Sensing, she held several positions in the St. Louis region, ranging from director to president, and in March 2010, she was elected to the position of national vice president. Her experience, board memberships and professional affiliations provide her with unique insight into the remote sensing and satellite imagery field and the intelligence community, making her a valuable strategic advisor to the Company, uniquely qualified to chair the Risk Committee and an important member of our Board.

Public directorships: Ms. Lenczowski does not currently hold, nor in the past five years has she held, any other public directorships.

Matthew M. O’Connell (Director)

Age 58, has been a member of the Board since October 2001 and has served as GeoEye’s President and Chief Executive Officer since 2001. From 2008 to the present, Mr. O’Connell has served as a director and member of the audit committee for the U.S. Geospatial Intelligence Foundation, a non-profit organization, and as a director on the Advisory Board of GIS Development, an Indian media and conferences group. He also serves on the National Oceanic and Atmospheric Administration’s Advisory Committee on Commercial Remote Sensing, and the Department of the Interior’s National Geospatial Advisory Committee. In October 2007, Mr. O’Connell was presented with the U.S. Geospatial Intelligence Foundation’s Industry Leader award. In June 2007, Mr. O’Connell was named “Entrepreneur of the Year” by Ernst and Young for Communications in the Washington, D.C. region.

Mr. O’Connell has had an extensive career in the finance industry and has overseen GeoEye through its reorganization, corporate restructuring, multiple acquisitions and its listing as the first commercial remote sensing corporation on NASDAQ. His entrepreneurial perspective, executive experience and strategic direction for the Company are essential to his membership on the Board.

Public Directorships: Mr. O’Connell served as a director of TVI Corporation from May 2005 to August 2007.

James M. Simon, Jr. (Director)

Age 63, has been a member of the Board since November 2005, a member of the Compensation Committee since April 2006 and Chairman of the Strategy Committee since June 2006. In January 2010, he was appointed chief strategist of the Worldwide Public Sector at The Microsoft Corporation. In 2004, he served as the founding director of The Microsoft Institute for Advanced Technology in Governments. From January 2003 to January 2005, he served as president and chief executive officer of Intelligence Enterprises, LLC and continues to serve as a partner presently.

A career Central Intelligence Agency officer, Mr. Simon was appointed by President Clinton and confirmed by the Senate in 1999 as the first assistant director of Central Intelligence for Administration, a position he held from January 2000 through January 2003. As deputy to the deputy director of Central Intelligence for Community Management, he was responsible for technology acquisition, setting policy for, and overseeing the budgets of the then fourteen agencies that comprised the intelligence community. After September 11, 2001, he was designated as the senior intelligence official for Homeland Security, establishing and chairing the Homeland Security Intelligence Council. Mr. Simon continues to serve on various government advisory boards.

Mr. Simon’s extensive public policy experience and his knowledge of the satellite imagery industry and the intelligence community are invaluable as he steers the strategic direction of GeoEye as Chairman of the Strategy Committee.

Public Directorships: Mr. Simon does not currently hold, nor in the past five years has he held, any other public directorships.

William W. Sprague (Director)

Age 53, has been a member of the Board since 1997 and Chairman of the Compensation Committee since June 2008, a committee on which he has served since April 2006. He was a member of the Audit Committee from January 2008 to May 2010, and is currently a member of the Risk Committee. Since December 2009, Mr. Sprague has served as the president, chief executive officer and director of Madison Williams and Company (“Madison Williams”). Madison Williams was formerly known as SMH Capital Markets, which until December 2009 was a division of Sanders Morris Harris Group Inc. (“SMHG”). Mr. Sprague served as president of SMH Capital Markets from January to December 2009. From April 2004 to December 2008, Mr. Sprague served as managing director, head of investment banking of SMHG.

Mr. Sprague has actively reviewed internal financial statements; has more than 28 years of experience as an investment banker; and has served as chairman of the board and chairman of the audit committee for several public companies. He has actively supervised and approved the preparation of financial statements, which were included in quarterly and annual filings with the SEC. His experience, expertise and financial and auditing backgrounds are invaluable as chairman of the Compensation Committee and as a member of our Board.

Public Directorships: Mr. Sprague does not currently hold, nor in the past five years has he held, any other public directorships.

William L. Ballhaus (Director)

Age 43, was appointed to our Board effective October 27, 2010, and is a member of the Audit Committee and Risk Committee. Pursuant to the terms of the private placement of 80,000 shares of the Company’s preferred stock with Cerberus Satellite LLC, an affiliate of Cerberus Capital Management, L.P. (collectively, “Cerberus”), Cerberus has the right to designate one director for appointment to the Company’s Board. As such designee, Mr. Ballhaus is not elected by the stockholders to serve on the Board.

Mr. Ballhaus was the chief executive officer and president at DynCorp International (“DynCorp”) from May 2008 until July 2010, and continues to serve as the vice chairman and a director of DynCorp. DynCorp was acquired and taken private by affiliates of Cerberus Capital Management L.P. in July 2010. Mr. Ballhaus currently serves as a strategic advisor to Cerberus Operations and Advisory Company LLC. From March 2007 to May 2008, he was president of the Network Systems business for the Electronics & Integrated Solutions Operating Group of BAE Systems Inc. From 2003 to 2007, he was president of BAE Systems Inc.’s National Security Solutions and Mission Solutions businesses. He serves on the United States Geospatial Intelligence Foundation Board of Directors and the UCLA Anderson School Board of Visitors. He serves as a director on a number of Cerberus portfolio company boards. He is a Fellow of the American Institute of Aeronautics and Astronautics and a Fellow of the British American Project.

Mr. Ballhaus’ experience in the intelligence community and his past experience serving as an executive and director of a publicly traded company provide him with the executive, operational and financial experience that is vital to our Board and makes him a valuable strategic advisor to the Company and an important member of the Board.

Public Directorships: Mr. Ballhaus was a director of DynCorp from May 2008 until July 2010.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU VOTE FOR ALL OF THE NOMINEES SET FORTH IN THIS PROXY STATEMENT.

Term of Office. All directors of the Company serve terms of one year and until the election and qualification of their respective successors.

Attendance at Board of Directors and Committee Meetings and 2010 Annual Meeting. The Board met 13 times in person or telephonically in 2010. All of the current members of the Board attended at least 85% of the Board meetings held during that portion of 2010 for which they held office. All but one of the directors of the Board were in attendance at the 2010 Annual Meeting of Stockholders held on June 3, 2010. Our director attendance policy is included in our Corporate Governance Guidelines, which is available through the About Us/Investor Relations/Corporate Governance section of the Company’s Web site located at www.geoeye.com and is available in print to any stockholder who requests it.

Communications with Directors. The Audit Committee and the non-management directors have established procedures to enable anyone who has a concern about the Company’s conduct or policies, or any employee who has a concern about the Company’s accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board, the non-management directors or the Audit Committee. Such communications may be confidential or anonymous, and may be submitted in writing to the Board of Directors of GeoEye, Inc., c/o Corporate Secretary, 2325 Dulles Corner Boulevard, Herndon, Virginia 20171.

In accordance with Marketplace Rule 4200(a)(15) of the NASDAQ Stock Market, the Board undertook its annual review of the independence of its directors on March 10, 2011. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company. During this review, the Board considered transactions and relationships between each director or members of his or her immediate family and the Company. The Board also considered whether there were any transactions or relationships between directors or members of their immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner or significant equity holder). The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the director is independent.

All members of the Audit, Compensation and Nominating and Governance Committees must meet the independence requirements of the NASDAQ Stock Market. Members of the Audit Committee must also satisfy a separate SEC independence requirement that provides that they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries other than compensation for service as a director on the Board.

As a result of this review, the Board affirmatively determined that each of the non-employee directors are independent of the Company and its management under independence tests established by the NASDAQ Stock Market and SEC rules.

In making these determinations, the Board considered the relationships and transactions described under the caption “Certain Relationships and Related Transactions” beginning on page 15.

Board Leadership Structure. The Board has separated the roles of the Chairman of the Board and the Chief Executive Officer (“CEO”) in recognition of the differences between the two roles and has not established a Lead Independent Director. The CEO is responsible for the day-to-day management of the Company, establishes the Company’s future strategy and sets the Company’s financial and operational goals, while the Chairman of the Board provides independent oversight of senior management and Board matters and serves as a liaison between the Board and the CEO. In addition, the Chairman provides guidance to the CEO, sets the Board’s agenda in consultation with the CEO and presides over meetings of the full Board. As Lt. General Abrahamson, our Chairman, is not an employee of the Company and is considered independent within the meaning of Marketplace Rules 4200(a)(15) and 4350(d)(2)(A) of the NASDAQ Stock Market and Rule 10A-3(b) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), the Company has not established a Lead Independent Director.

Risk Oversight. Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks a company faces and the steps management is taking to manage those risks, but also understanding the level of risk that is appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and establishing appropriate risk management practices. Our Board reviews our business strategy and management’s assessment of the related risk and discusses with management the appropriate level of risk for the Company.

Our Board administers its risk oversight function with respect to our operating risk as a whole and meets with management at least quarterly to receive updates with respect to our operations, business strategies and the monitoring of related risks. The Board also delegates oversight to the Audit, Compensation, Nominating and Governance, and Risk Committees to oversee selected elements of risk:

| | · | Our Audit Committee oversees financial risk exposures, including monitoring the integrity of the financial statements, internal controls over financial reporting and the independence of the independent auditor of the Company. The Audit Committee also assists the Board in fulfilling its oversight responsibility with respect to compliance with legal and regulatory matters related to the Company’s financial statements and meets quarterly with our financial management and independent auditors for updates on risks related to our financial reporting function. The Audit Committee also monitors our whistleblower hot line with respect to financial reporting matters. |

| | · | Our Nominating and Governance Committee oversees governance-related risks by working with management to establish corporate governance guidelines applicable to the Company, including recommendations regarding director nominees, Board leadership structure and membership on Board Committees. The Company’s Nominating and Governance Committee also oversees risk by working with management to adopt codes of conduct and business ethics designed to support the highest standards of business ethics. The Committee is briefed by our General Counsel’s office and others as to any alleged violations of our codes of conduct and business ethics. |

| | · | Our Compensation Committee oversees risk management by participating in the creation of compensation structures that create incentives that support an appropriate level of risk-taking behavior consistent with the Company’s business strategy. |

| | · | Our Risk Committee oversees major strategic, operational, technological, information security and external risks inherent to the business of the Company and the Company’s control and mitigation processes with respect to managing such risks. |

Our Board and Committees’ risk oversight responsibilities are discussed further in “Committees of the Board of Directors” below.

Committees of the Board of Directors

In May 2010, the Company separated the formerly named Strategy and Risk Committee into two committees, the Strategy Committee and Risk Committee, as described below. As of the date of this Proxy Statement, membership on the Committees of the Board of the Company is as follows:

| Audit | Compensation | Nominating and Governance | Strategy | Risk |

Michael F. Horn, Sr.* | William W. Sprague* | Lawrence A. Hough* | James M. Simon, Jr.* | Roberta E. Lenczowski* |

| James A. Abrahamson | Joseph M. Ahearn | James A. Abrahamson | Martin C. Faga** | William L. Ballhaus |

| Joseph M. Ahearn | Martin C. Faga | Roberta E. Lenczowski | Michael F. Horn, Sr. | William W. Sprague |

| William L. Ballhaus | James M. Simon, Jr. | | Lawrence A. Hough | |

| | | | Roberta E. Lenczowski | |

* Chairman of the Committee

** Acting Chairman of the Committee

Audit Committee. The Audit Committee currently consists of Mr. Horn, who is chairman of the Audit Committee, and Messrs. Abrahamson, Ahearn and Ballhaus, all of whom are independent directors as defined by the rules of the NASDAQ Stock Market and SEC rules. Seven meetings of the Audit Committee were held in person or telephonically during 2010. Messrs. Horn and Ahearn are each an “audit committee financial expert” as determined by the Board in accordance with Item 407(d)(5) of Regulation S-K, and are “independent” from the Company as defined within the meaning of Marketplace Rules 4200(a)(15) and 4350(d)(2)(A) of the NASDAQ Stock Market and Rule 10A-3(b) of the Exchange Act. The Audit Committee operates under a written charter, as amended, adopted by the Board. A copy of the Audit Committee Charter, as amended, is available through the About Us/Investor Relations section of the Company’s Web site located at www.geoeye.com and is available in print to any stockholder who requests it.

The Audit Committee assists the Board in fulfilling its oversight responsibilities as related to the Company’s risk management processes. The Board and Audit Committee oversee (i) the integrity of the Company’s financial statements and financial reporting process and the Company’s systems of internal accounting and financial controls; (ii) the performance of the internal audit function; (iii) the annual independent integrated audit of the Company’s consolidated financial statements and internal control over financial reporting, the engagement of the independent registered public accounting firm and the evaluation of the independent registered public accounting firm’s qualifications, independence and performance; (iv) business and financial risk processes and controls; (v) the Company’s compliance with legal and regulatory requirements, including the Company’s disclosure controls and procedures; and (vi) the fulfillment of the other responsibilities set out in the Audit Committee Charter, as adopted by the Board.

The Audit Committee receives regular reports from management regarding the Company’s assessment of risks. In addition, the Audit Committee reports regularly to the Board. The Audit Committee assists the Board in its focus on the Company’s general risk management strategy, and helps to ensure that risks undertaken by the Company are consistent with the business strategies approved by the Board. While the Board oversees the Company’s risk management, management is responsible for the day-to-day risk management processes and reports directly to both the Board and Audit Committee on a regular basis and more frequently as appropriate. The Board believes this division of responsibilities is the most effective approach for addressing the risks facing the Company.

Compensation Committee. The Compensation Committee currently consists of Mr. Sprague, who is chairman of the Compensation Committee, and Messrs. Ahearn, Faga and Simon, all of whom are independent directors as defined by the rules of the NASDAQ Stock Market and SEC rules. The Board has established a Compensation Committee to (i) review (in consultation with management or the Board), evaluate and recommend to the Board for approval the compensation plans, policies and programs of the Company, especially those regarding executive compensation and (ii) determine the compensation of the CEO and all other executive officers of the Company. The Compensation Committee periodically uses an independent consultant, Frederic W. Cook & Co., Inc., to assist it in fulfilling its responsibilities. The consultant reports directly to the Compensation Committee, and its activities in 2010 are further discussed in “Does the Company utilize compensation consultants or market survey data in determining compensation for named executive officers?” on page 18.

More specifically, the Compensation Committee annually reviews and approves corporate goals and objectives relevant to the CEO’s total direct compensation – that is, changes in base salary, bonus payments and equity awards. For other named executive officers, the Compensation Committee reviews their performance against these goals and objectives and, based on its evaluation, approves their total direct compensation. The details of the processes and procedures involved are described in the Compensation Discussion and Analysis (“CD&A”) beginning on page 16.

Four meetings of the Compensation Committee were held in person or telephonically during 2010. The Compensation Committee operates under a written charter adopted by the Board. A copy of the Compensation Committee Charter is available through the About Us/Investor Relations section of the Company’s Web site located at www.geoeye.com and is available in print to any stockholder who requests it.

Nominating and Governance Committee. The Board has established a Nominating and Governance Committee, which currently consists of Mr. Hough, who is chairman of the Nominating and Governance Committee, Lt. Gen. Abrahamson and Ms. Lenczowski, all of whom are independent directors as defined by the rules of the NASDAQ Stock Market and SEC rules. The functions of the Nominating and Governance Committee include recommending candidates for annual election to the Board, to fill vacancies on the Board that may arise, and senior management succession. The Nominating and Governance Committee is not limited to any specific process in identifying candidates and will consider candidates suggested by other members of the Board, as well as candidates recommended by stockholders, provided such recommendations are submitted in writing ninety days in advance of the anniversary of the preceding year’s annual meeting of stockholders. Such recommendations should include the name and address and other pertinent information about the candidate as is required to be included in the Company’s Proxy Statement. Recommendations should be submitted to the Corporate Secretary of the Company.

As described in the Company’s Corporate Governance Guidelines, consideration is given to assuring that the Board, as a whole, considers diversity in its broadest sense, including persons diverse in geography, gender and ethnicity as well as representing diverse experiences, skills and backgrounds. We believe a diverse group can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment. The Board and Nominating and Governance Committee take into account many factors in recommending candidates for a director position. These factors include, but are not limited to, the ability to make independent analytical inquiries; general understanding of marketing, finance, accounting and other elements relevant to the success of a publicly traded company in today’s business environment; understanding of the Company’s business on a technical level; and other board service and educational and professional background. In addition, each candidate nominee must possess fundamental qualities of intelligence, honesty, good judgment, high ethics and standards of integrity, fairness and responsibility. The Board and the Nominating and Governance Committee evaluate each individual candidate by considering all appropriate factors as a whole. The Company’s approach favors active deliberation rather than using rigid formulas to assign relative weights to these factors.

The Nominating and Governance Committee is also responsible for ensuring that the Company adheres to good corporate governance principles and for developing and implementing the Company’s (i) Corporate Governance Guidelines that apply to all of its directors and management and (ii) Code of Business Conduct and Ethics for all of its directors and employees. The Nominating and Governance Committee is also charged with the task of ensuring the Company’s compliance with all NASDAQ Stock Market requirements. Three meetings of the Nominating and Governance Committee were held in person or telephonically during 2010. The Nominating and Governance Committee operates under a written charter adopted by the Board. Copies of the Nominating and Corporate Governance Committee charter, the Corporate Governance Guidelines and the Code of Business Conduct and Ethics are available through the Investor Relations section of the Company’s Web site located at www.geoeye.com and are available in print to any stockholder who requests it.

Strategy Committee. The Board has established a Strategy Committee, which currently consists of Mr. Simon, who is chairman of the Strategy Committee, Messrs. Faga, Horn and Hough and Ms. Lenczowski, all of whom are independent directors as defined by the rules of the NASDAQ Stock Market and SEC rules. In May 2010, Mr. Faga was appointed acting chairman of the Strategy Committee while Mr. Simon was on leave from such duties. Lt. Gen. Abrahamson continues to serve in an ex officio capacity. The Strategy Committee is responsible for future strategic business planning and researching future industry trends that affect the Company’s strategic goals. Five meetings of the Strategy Committee were held in person or telephonically during 2010.

Risk Committee. The Board has established a Risk Committee, which currently consists of Ms. Lenczowski, who is chairman of the Risk Committee, and Messrs. Ballhaus and Sprague, all of whom are independent directors as defined by the rules of the NASDAQ Stock Market and SEC rules. The Risk Committee is responsible for assessing and providing oversight to management relating to the identification and evaluation of major strategic, operational, technological, information security and external risks inherent to the business of the Company and the control processes with respect to managing such risks. The Risk Committee receives regular reports from management regarding the Company’s risk management processes and assists the Board in its oversight of the Company’s risk management. Two meetings of the Risk Committee were held in person or telephonically during 2010.

The following table lists our executive officers who are not directors as of April 29, 2011.

| Name | Age | Title |

| Joseph F. Greeves | 54 | Executive Vice President and Chief Financial Officer |

| William Schuster | 59 | Chief Operating Officer |

| William L. Warren | 45 | Executive Vice President, General Counsel and Corporate Secretary |

| Brian E. O’Toole | 47 | Chief Technology Officer |

| Christopher R. Tully | 54 | Senior Vice President Sales |

| Jeanine Montgomery | 49 | Vice President, Accounting and Corporate Controller |

Joseph F. Greeves (Executive Vice President and Chief Financial Officer)

Mr. Greeves joined the Company as Executive Vice President and Chief Financial Officer in June 2009. Mr. Greeves has a strong public accounting background and more than 20 years experience as a chief financial officer. During his career, he has served as chief financial officer for four publicly traded companies, where he focused on working with entrepreneurs and management teams to build businesses, raise capital and grow stockholder value. Prior to joining the Company, Mr. Greeves served for almost seven years as executive vice president and chief financial officer of Managed Object Solutions Inc. Before joining Managed Objects, he consulted for Lazard Technology Partners as its chief financial officer executive in residence. Prior to that, Mr. Greeves was senior vice president and chief financial officer for OPNET Technologies Inc. Prior to that, he served as the chief financial officer for Fusion Systems Corporation and Ogden Environmental and Energy Services Co., a division of Ogden Corporation.

William Schuster (Chief Operating Officer)

William Schuster joined the Company as Chief Operating Officer in December 2004. Prior to joining the Company, Mr. Schuster served as president of Integrated Systems for BAE Systems. Prior to BAE, Mr. Schuster served at Harris Corporation as vice president of programs within the Government Communications System Division and was vice president of the Space Applications Operation at Loral Space and Range Systems. Prior to that, Mr. Schuster worked at the Central Intelligence Agency for nearly 22 years.

William L. Warren (Executive Vice President, General Counsel and Secretary)

William Warren joined the Company as Vice President, General Counsel and Corporate Secretary in January 2004 and was promoted to his current position in January 2011. Prior to joining the Company, Mr. Warren practiced law in the Northern Virginia and Washington, D.C. offices of Latham & Watkins LLP, an international law firm, for several years. Prior to joining Latham & Watkins, Mr. Warren was an associate in the New York office of Baker Botts LLP. Mr. Warren is admitted to practice in Virginia, New York and the District of Columbia.

Brian E. O’Toole (Chief Technology Officer)

Brian O’Toole joined the Company as Chief Technology Officer in August 2008 and is responsible for developing, managing and expanding the Company’s technology, products and solutions in geospatial intelligence and location-based services. From June 2005 through August 2007, Mr. O’Toole served as vice president, Product Management at Overwatch Textron Systems. From January 2000 to June 2005, he served as president and co-founder of ITspatial, which he subsequently sold to Overwatch.

Christopher R. Tully (Senior Vice President Sales)

Chris Tully joined the Company as Senior Vice President Sales in March 2010. Prior to joining the Company, from 2008 until 2010, Mr. Tully served as executive vice president and chief sales officer for Kastle Systems LLC, where he worked with the CEO to build the business, establish a national sales presence and expand into new markets. Before joining Kastle Systems, from 2004 until 2008, he was senior vice president of Sales & Customer Service at CoStar Group, Inc., an international provider of information and marketing services. Prior to that, Mr. Tully was group vice president of Sales at GTSI Corporation, where he was responsible for a 200-person sales organization serving federal, state and local government clients. Mr. Tully began his career with Xerox Corporation.

Jeanine Montgomery (Vice President, Accounting and Corporate Controller)

Jeanine Montgomery joined the Company as Vice President, Accounting and Corporate Controller in September 2008 and is our principal accounting officer. Ms. Montgomery has more than twenty-five years of financial and accounting management experience in government contracting, digital technology and staffing services. Ms. Montgomery manages all of GeoEye’s accounting operations, regulatory reporting and SEC compliance and its tax operations. Prior to joining GeoEye, Ms. Montgomery served as assistant controller at USA Mobility from 2005 until August 2008. Ms. Montgomery is a licensed Certified Public Accountant in Virginia and is a member of the American Institute of Certified Public Accountants.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information available to the Company as of April 29, 2011, with respect to shares of its common stock and preferred stock convertible into shares of common stock held by (i) each director of the Company; (ii) the Chief Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers of the Company for the year ended December 31, 2010; (iii) all directors and executive officers of the Company, as a group; and (iv) holders of 5% or more of our common stock.

Our non-employee directors receive a portion of their total compensation for Board service in the form of deferred stock units (“DSUs”). Under SEC rules, DSUs are not included in calculating beneficial ownership of our common stock because the holder does not have voting or investment power with respect to the DSUs or the underlying shares. Nonetheless, we consider disclosure of the DSU ownership to be relevant to investors because the payment ultimately received by the holder of the DSUs is in the form of common stock. Accordingly, the following table includes a column reflecting the number of vested DSUs owned by each non-employee director, even though the underlying shares are not included in the shares reported as beneficially owned or the related percentage ownership calculations.

As of April 12, 2011, 22,697,861 shares of our common stock and 80,000 shares of preferred stock convertible into 2,688,347 shares of common stock were issued and outstanding. For the purposes of determining the percentage of shares beneficially owned, there are 25,386,208 total shares of common stock effectively issued and outstanding.

| Name and Business Address of Beneficial Owner | | Number of Shares Beneficially Owned(2) | | Percentage Owned(3) | | Deferred Stock Units(4) |

| Directors and Executive Officers(1) | | | | | | | | | |

| Matthew M. O’Connell | | 308,241 | (5) | | 1.21 | % | | | |

| Joseph F. Greeves | | 19,555 | (6) | | * | | | | |

| William Schuster | | 35,662 | (7) | | * | | | | |

| William L. Warren | | 50,347 | (8) | | * | | | | |

| Brian E. O’Toole | | 30,421 | (9) | | * | | | | |

| | | | | | | | | | |

| James A. Abrahamson | | 0 | | | * | | | 11,721 | |

| Joseph M. Ahearn | | 5,000 | | | * | | | 11,721 | |

| Martin C. Faga | | 5,000 | | | * | | | 11,721 | |

| Michael F. Horn | | 10,500 | | | * | | | 10,596 | |

| Lawrence A. Hough | | 14,292 | | | * | | | 11,721 | |

| Roberta E. Lenczowski | | 0 | | | * | | | 5,963 | |

| James M. Simon, Jr. | | 7,318 | | | * | | | 11,721 | |

| William W. Sprague | | 0 | | | * | | | 11,721 | |

| William L. Ballhaus | | 0 | | | * | | | 0 | |

| All directors and executive officers as a group (16 persons) | | 504,222 | | | 1.97 | % | | | |

| | | | | | | | | | |

| 5% Holders | | | | | | | | | |

| Stephen Feinberg | | 4,671,347 | (10) | | 18.40 | % | | | |

| Fidelity Management & Research Company | | 3,007,760 | (11) | | 11.85 | % | | | |

| The Bank of New York Mellon Corporation | | 2,535,171 | (12) | | 9.99 | % | | | |

| Guggenheim Capital | | 1,867,288 | (13) | | 7.36 | % | | | |

| Security Investors, LLC | | 1,857,110 | (14) | | 7.32 | % | | | |

____________

| (1) | Unless otherwise indicated, the address of the named beneficial owner is c/o GeoEye, Inc., Dulles Corner Office Center, 2325 Dulles Corner Boulevard, Herndon, Virginia 20171. |

| (2) | Includes shares to which the individual has the right to acquire beneficial ownership within 60 days of April 12, 2011. |

| (3) | Does not include the DSUs owned by the non-employee directors, described in footnote #4 below. |

| (4) | In 2006, we adopted a program where each non-employee director receives an annual award of $50,000 in the form of DSUs on January 1 of each year. The number of DSUs awarded is based on the fair market value of the stock on the date of grant and vests 50% six months from the grant date and 50% twelve months from the grant date. The DSUs become payable in shares of common stock on the date that is six months following the non-employee director’s resignation, retirement from the Board or failure to be re-elected to the Board. Because of their commencement of service dates, Mr. Horn and Ms. Lenczowski were ineligible for the 2006 and 2007 grants. Grants for 2006 total 3,174 shares; grants for 2007 total 2,584 shares; grants for 2008 total 1,517 shares; grants for 2009 total 2,665 shares; grants for 2010 total 1,781 shares; and grants for 2011 total 1,180 shares. Because the DSUs do not constitute actual shares of outstanding common stock, a DSU holder does not possess voting or investment authority with respect to any common stock as a result of his or her ownership of a DSU. |

| (5) | Includes 120,530 shares issuable upon the exercise of outstanding options, which are exercisable within 60 days of April 12, 2011. |

| (6) | Includes 13,555 shares issuable upon the exercise of outstanding options, which are exercisable within 60 days of April 12, 2011. |

| (7) | Includes 23,633 shares issuable upon the exercise of outstanding options, which are exercisable within 60 days of April 12, 2011. |

| (8) | Includes 40,279 shares issuable upon the exercise of outstanding options, which are exercisable within 60 days of April 12, 2011. |

| (9) | Includes 22,046 shares issuable upon the exercise of outstanding options, which are exercisable within 60 days of April 12, 2011. |

| (10) | Includes reportable securities held by Cerberus Partners II, L.P., a Delaware limited partnership, and Cerberus Series IV Holdings, LLC, a Delaware limited liability company, and/or on behalf of certain of its investment advisory clients, as reported in its Schedule 13D, filed with the SEC on March 1, 2011. Also includes 80,000 shares of preferred stock held by Cerberus Satellite LLC on an as-converted-basis. The principal business office address for Mr. Feinberg is 299 Park Avenue, 22nd Floor, New York, New York 10171. |

| (11) | Includes reportable securities held by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC, as reported in its Schedule 13G/A (“SC 13G”), filed with the SEC on February 14, 2011. The principal business office address for Fidelity Management & Research Company is 82 Devonshire Street, Boston, MA 02109. The 80,000 shares of preferred stock held by Cerberus Satellite LLC on an as-converted-basis were included in the calculation to determine the percentage in the “Percentage Owned” column. |

| (12) | Includes reportable securities held by The Bank of New York Mellon Corporation, a New York corporation, and its affiliates, as reported in its Schedule 13G, filed with the SEC on February 4, 2011. The principal business office address for The Bank of New York Mellon Corporation is One Wall Street, 31st Floor, New York, New York 10286. The 80,000 shares of preferred stock held by Cerberus Satellite LLC on an as-converted-basis were included in the calculation to determine the percentage in the “Percentage Owned” column. |

| (13) | Includes reportable securities held by Guggenheim Capital, LLC, a Delaware limited liability company, and/or on behalf of certain of its investment advisory clients, as reported in its Schedule 13F-HR, filed with the SEC on February 14, 2011, for the period ending December 31, 2010. The principal business office address for Guggenheim Capital, LLC is 227 West Monroe, Suite 4900, Chicago, Illinois 60606. The 80,000 shares of preferred stock held by Cerberus Satellite LLC on an as-converted-basis were included in the calculation to determine the percentage in the “Percentage Owned” column. |

| (14) | Includes reportable securities held by Security Investors, LLC, a Kansas limited liability company, and/or on behalf of certain of its investment advisory clients, as reported in its Schedule 13G, filed with the SEC on February 14, 2011. Security Investors, LLC is registered with the SEC as an investment adviser under Section 203 of the Investment Advisers Act of 1940. The principal business office address for Security Investors, LLC is One Security Benefit Place, Topeka, Kansas 66636-0001. The 80,000 shares of preferred stock held by Cerberus Satellite LLC on an as-converted-basis were included in the calculation to determine the percentage in the “Percentage Owned” column. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own 10% or more of the Company’s common stock to file with the SEC initial reports of ownership and reports of changes in ownership of common stock. In 2010, the Company, on behalf of certain directors and officers, did not report in a timely manner the following transactions: (i) the exercise of a warrant on March 15, 2010, by Mr. O’Connell; (ii) the disposition of shares of common stock by Mr. Simon on October 14, 2010, in connection with a domestic relations order; (iii) the disposition of shares of common stock to the Company for payment of withholding taxes on March 17, 2010, and August 11, 2010, by Mr. O’Toole; and (iv) the acquisition of shares of restricted common stock by Ms. Montgomery on October 28, 2010, and the disposition of shares of common stock for payment of taxes upon vesting of restricted common stock on November 10, 2010.

Certain Relationships and Related Transactions

The Company reviews all relationships and transactions in which the Company and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Our current written policies and procedures for review, approval or ratification of relationships or transactions with related persons are set forth in our:

| | · | Code of Business Conduct and Ethics; |

| | · | Corporate Governance Guidelines; |

| | · | Nominating and Governance Committee Charter; and |

| | · | Audit Committee Charter. |

Our Corporate Governance Guidelines provide that the Nominating and Governance Committee will review annually the relationships that each director has with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company), in the course of making independence determinations under the NASDAQ standards. Directors are expected to avoid any action, position or interest that conflicts with the interests of the Company or gives the appearance of a conflict. If an actual or potential conflict of interest develops, the director should immediately report the matter to the Chairman of the Board. Any significant conflict must be resolved, or the director should resign. If a director has a personal interest in a matter before the Board, the director will disclose the interest to the Board, excuse himself or herself from discussion on the matter and not vote on the matter. The Corporate Governance Guidelines further provide that the Board is responsible for reviewing and, where appropriate, approving major changes in and determinations under the Company’s Corporate Governance Guidelines, Code of Business Conduct and Ethics and other Company policies. The Corporate Governance Guidelines also provide that the Board has the responsibility to ensure that the Company’s business is conducted with the highest standards of ethical conduct and in conformity with applicable laws and regulations.

In this Compensation Discussion and Analysis, or CD&A, we describe our compensation philosophy and the components of our compensation programs for the executive officers named in the Summary Compensation Table on page 24 and referred to in this proxy statement as our “named executive officers.” In addition, we review the material compensation decisions made with respect to fiscal year 2010 under those programs and the material factors considered by the Compensation Committee of our Board, or Compensation Committee, in making those decisions. Our named executive officers for 2010 were:

| Matthew M. O’Connell | President, Chief Executive Officer and Director |

| Joseph F. Greeves | Executive Vice President, Chief Financial Officer |

| William Schuster | Chief Operating Officer |

| William L. Warren | Executive Vice President, General Counsel and Corporate Secretary |

| Brian E. O’Toole | Chief Technology Officer |

Our Board, with assistance from the Compensation Committee, desires to provide our named executive officers with compensation that is fair, competitive and significantly based on performance. Our executive compensation programs are designed to achieve strong Company performance by linking executive pay to performance on both near-term and long-term bases, aligning the interests of executives and stockholders and utilizing compensation as a tool for attracting and retaining the high-caliber, entrepreneurial executives that we believe are critical to the Company’s long-term success.