UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 15, 2007

AKESIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Nevada | | 000-27409 | | 84-1409219 |

(State or other jurisdiction of incorporation or organization) | | Commission file number | | (I.R.S. Employer identification number) |

888 Prospect Street, Suite 320, La Jolla, CA 92037

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (858) 454-4311

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

License Agreement with The University of British Columbia

On March 15, 2007, Akesis Pharmaceuticals, Inc., a Delaware corporation (“Akesis Delaware”) and a wholly owned subsidiary of Akesis Pharmaceuticals, Inc., a Nevada corporation (“Akesis Nevada” and collectively with Akesis Delaware,“we” or the“Company”), entered into a License Agreement (the“License Agreement”) with The University of British Columbia (the “UBC”). Pursuant to this License Agreement, Akesis Delaware obtained an exclusive license to use, commercialize and sublicense certain patented technology (and improvements thereon) owned by UBC relating to the treatment of diabetes and other related disorders (the“Licensed Technology”). Included in the Licensed Technology is bis(ethylmaltolato)oxovanadium(iv) (“BEOV”), a novel vanadium compound that has shown considerable potential as a treatment for patients with type 2 diabetes.

Pursuant to the License Agreement, we agreed to pay to UBC an initial license fee and an initial expense reimbursement based on amounts previously paid by UBC in connection with the patenting of the Licensed Technology. In addition, we agreed to pay certain annual maintenance fees and, in the event of our achievement of specified developmental and commercial milestones, certain additional milestone payments. Finally, we will be obligated to make certain royalty payments to UBC in the event that we successfully commercialize the products we propose to develop.

In addition to the foregoing, we are obligated pursuant to the terms of the License Agreement to use commercially reasonable efforts to develop and commercialize the Licensed Technology. We must also indemnify, hold harmless and defend UBC from and against all third-party claims, damages, liabilities and expenses arising out of our breach of the License Agreement, our failure to comply with applicable laws, any negligence or wrongdoing committed by us, the exercise of our rights with respect to the Licensed Technology and the development, marketing and sale of products involving the Licensed Technology. Lastly, we have agreed to bear the cost of all patent prosecution and enforcement actions with respect to the Licensed Technology during the term of the License Agreement.

Subject to applicable law, the License Agreement will terminate automatically if we initiate (or become the subject of) bankruptcy proceedings. In addition, UBC may terminate the License Agreement upon notice to us in the event that we become insolvent, take steps to liquidate or dissolve the Company, fail to pay undisputed amounts due under the License Agreement for a period of 90 days after being notified of such failure or fail to terminate any sublicense granted to a sublicensee that is in material breach of the terms of such sublicense. Likewise, either party may terminate the License Agreement upon notice to the other party if such other party materially breaches the License Agreement and fails to cure such material breach within specified periods. Finally, we may terminate the License Agreement at any time upon 90 days notice to UBC, provided that we will remain obligated to make royalty payments to UBC in accordance with the original terms of the License Agreement.

The foregoing description of the License Agreement is intended only as a summary of that document and is qualified in its entirety by reference to the full copy of the License Agreement, which is attached hereto as Exhibit 10.1 and which is hereby incorporated by reference herein.

QLT Letter Agreement

Prior to entering into the License Agreement with us, on December 20, 1996, UBC entered into a license agreement (the“Kinetek License Agreement”) with Kinetek Pharmaceuticals, Inc. (“Kinetek”), pursuant to which UBC licensed to Kinetek rights to use, commercialize and sublicense certain portions of the Licensed Technology. The Kinetek License Agreement was terminated on April 30, 2002, and Kinetek’s rights to such portions of the Licensed Technology likewise terminated as of that date.

In connection with our exclusive licensing of the Licensed Technology pursuant to the License Agreement, we determined that it was desirable to clarify our rights with respect to certain data and documentation relating to the Licensed Technology (collectively, the“Kinetek Data”) that was generated by Kinetek during the term of the Kinetek License Agreement. As a result, on March 15, 2007, we also entered into a letter agreement (the“QLT Letter Agreement”) with UBC and QLT Inc. (“QLT”), which acquired Kinetek in March 2004, relating to our rights to use, and our corresponding obligations to indemnify QLT for our use of, the Kinetek Data. In particular, pursuant to the terms of the QLT Letter Agreement, QLT has consented to the disclosure of the Kinetek Data to us by UBC

and to our use of the Kinetek Data in connection with regulatory filings relating to the Licensed Technology. In exchange, we have agreed to indemnify, hold harmless and defend QLT from and against all third-party claims, damages, liabilities and expenses arising out of our use of the Kinetek Data and the development and commercialization of the Licensed Technology.

The foregoing description of the QLT Letter Agreement is intended only as a summary of that document and is qualified in its entirety by reference to the full copy of the QLT Letter Agreement, which is attached hereto as Exhibit 10.2 and which is hereby incorporated by reference herein.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information reported under Item 5.02 with respect to the issuance of a stock option to Jay Lichter, Ph.D., our President, Chief Executive Officer and director, is hereby incorporated by reference into this Item 3.02.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On March 5, 2007, the Company’s board of directors approved the grant of a stock option to Jay Lichter, Ph.D., our President, Chief Executive Officer and director, contingent upon the Company’s entering into the License Agreement with UBC, to purchase an aggregate of 500,000 shares of our common stock (the“Contingent Option”). As a result, on March 15, 2007, the Company entered into a Stand-Alone Stock Option Agreement with Dr. Lichter relating to the Contingent Option.

Pursuant to the Stand-Alone Stock Option Agreement relating to the Contingent Option, Dr. Lichter may purchase vested shares at a per share exercise price equal to $0.51, which is the average closing price of the Company’s common stock for the 10 days prior to and including March 15, 2007. Shares subject to the Contingent Option will vest monthly over the 31 months following the date of the Stand-Alone Stock Option Agreement. The issuance of the Contingent Option was exempt from registration by virtue of Section 4(2) of the Securities Act of 1933, as amended.

The foregoing description of the Stand-Alone Stock Option Agreement is intended only as a summary of that document and is qualified in its entirety by reference to the form of Stand-Alone Stock Option Agreement, which is attached as Exhibit 10.3 to the Company’s Current Report on Form 8-K/A filed on October 24, 2006 and which is hereby incorporated by reference herein.

Explanatory Note Regarding Changes to Our Business

Our entering into the License Agreement and the QLT Letter Agreement is anticipated to cause certain important changes to our business. In particular, the addition of BEOV—which we will hereafter refer to as AKP-020—to the Company’s product portfolio substantially accelerates the Company’s clinical programs and gives the Company a proprietary drug candidate that may be useful for the treatment of type 2 diabetes. In addition, by virtue of the License Agreement and the QLT Letter Agreement, we will gain access to data that includes information relating to Phase I clinical trials for AKP-020 and the extended related correspondence with the U.S. Food and Drug Administration (the“FDA”). This data should allow the Company to rapidly enter the clinic, under FDA oversight, and to administer AKP-020 to human patients.

The initial human Phase I data for AKP-020 showed that AKP-020 has advantages over unpatented vanadyl sulfate (the original compound in AKP-111) with respect to dosing, pharmacokinetics and bioavailability, without any signs of toxicity. This data set also includes extensive positive safety and efficacy studies of AKP-020 in rodents and dogs. In addition to the advanced clinical stage of AKP-020, we believe that the other components of the Licensed Technology strongly compliment our pre-existing portfolio of compounds.

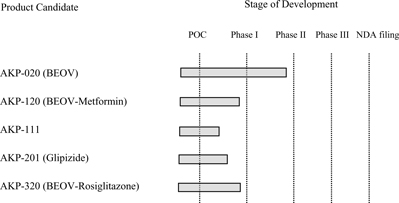

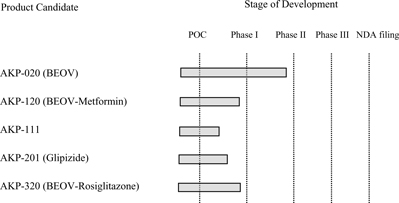

The table below illustrates how the addition of AKP-020 changes the priority of the Company’s product development pipeline:

As a result of the foregoing, the Company’s initial product focus is shifting away from AKP-111, our triple combination product, and towards AKP-020 and AKP-120, our BEOV monotherapy and BEOV-metformin combination therapy, respectively. Given the existing data on AKP-020, we expect our AKP-020 program to enter the clinic before AKP-120. We anticipate that this will happen later in 2007, once the appropriate FDA filings are completed and approved, though we may elect to perform additional Phase I studies for AKP-020 in healthy and/or diabetic patients.

Press Release

On March 19, 2007, we issued a press release announcing our entering into the License Agreement. A copy of this press release is attached hereto as Exhibit 99.1.

Forward-Looking Statements

Statements contained in this Current Report on Form 8-K relating to the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future, including, without limitation, statements relating to the anticipated changes in the Company’s business, the clinical development of the Company’s proprietary drug candidates and the potential commercialization of the Company’s proprietary drug candidates, are forward-looking statements. The Company’s actual results could differ materially from those projected in these forward-looking statements. In particular, the Company may not successfully develop or commercialize any of its proprietary drug candidates when currently anticipated or at all. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006. The Company disclaims any intention or obligation to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| Item 9.01 | Financial Statements and Exhibits. |

| | | | |

(d) | | Exhibits. |

| | |

| | 10.1 | | License Agreement, dated as of March 15, 2007, by and between Akesis Delaware and UBC (1) |

| | |

| | 10.2 | | Letter Agreement, dated as of March 15, 2007, by and among the Company, UBC and QLT |

| | |

| | 99.1 | | Press Release, dated as of March 19, 2007, announcing the Company’s entering into the License Agreement |

| (1) | Certain parts of this exhibit have not been disclosed, but have been filed separately with the Secretary of the Securities and Exchange Commission and are subject to a confidential treatment request pursuant to 17 C.F.R. §§ 200.80(b)(4) and 240.24b-2. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| AKESIS PHARMACEUTICALS, INC. |

| |

| By: | | /s/ Jay Lichter, Ph.D |

| | Jay Lichter, Ph.D. |

| | President and Chief Executive Officer |

Date: March 21, 2007