UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2007

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-27409

AKESIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | |

| Nevada | | 84-1409219 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

888 Prospect Street, Suite 320 La Jolla, California | | 92037 |

| (Address of principal executive offices) | | (Zip Code) |

(858) 454-4311

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act.)

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| | | | | | | | |

| | | Class | | | | Outstanding at May 15,

2007 | | |

| | Common Stock | | | | 22,580,884 shares | | |

Transitional Small Business Disclosure Format: Yes ¨ No x

AKESIS PHARMACEUTICALS, INC.

Form 10-QSB

Table of Contents

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Akesis Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheet (Unaudited)

| | | | |

| | | March 31,

2007 | |

Assets | | | | |

| |

Current assets: | | | | |

| |

Cash and cash equivalents | | $ | 3,594,569 | |

| |

Prepaid insurance and other current assets | | | 62,211 | |

| | | | |

| |

Total current assets | | | 3,656,780 | |

| |

Debt issuance costs, net | | | 74,845 | |

| | | | |

| |

Total assets | | $ | 3,731,625 | |

| | | | |

| |

Liabilities and Stockholders’ Equity | | | | |

| |

Current liabilities: | | | | |

| |

Accounts payable | | $ | 143,381 | |

| | | | |

| |

Total current liabilities | | | 143,381 | |

| | | | |

| |

Total liabilities | | | 143,381 | |

| | | | |

| |

Commitments and contingencies (Note 4) | | | — | |

| |

Stockholders’ equity: | | | | |

| |

Preferred stock, $0.001 par value, 10,000,000 shares authorized; none issued and outstanding as of March 31, 2007 | | | — | |

| |

Common stock, $0.001 par value, 50,000,000 shares authorized: 22,580,884 shares issued and outstanding at March 31, 2007 | | | 22,581 | |

| |

Additional paid-in capital | | | 11,385,761 | |

| |

Accumulated deficit | | | (7,820,098 | ) |

| | | | |

| |

Total stockholders’ equity | | | 3,588,244 | |

| | | | |

| |

Total liabilities and stockholders’ equity | | $ | 3,731,625 | |

| | | | |

See accompanying notes.

3

Akesis Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

For the Three Months Ended March 31, 2007 and 2006

| | | | | | | | |

| | | Three months ended March 31, | |

| | | 2007 | | | 2006 | |

Revenue | | $ | — | | | $ | — | |

| | | | | | | | |

Operating costs and expenses: | | | | | | | | |

| | |

Selling, general and administrative | | | 496,237 | | | | 552,254 | |

| | |

Research and development | | | 143,415 | | | | — | |

| | | | | | | | |

| | |

Total expenses | | | 639,652 | | | | 552,254 | |

| | | | | | | | |

| | |

Loss from operations | | | (639,652 | ) | | | (552,254 | ) |

| | |

Interest income/(expense), net | | | 29,545 | | | | 1,803 | |

| | | | | | | | |

| | |

Loss before income taxes | | | (610,107 | ) | | | (550,451 | ) |

| | |

Provision for income taxes | | | 945 | | | | 1,800 | |

| | | | | | | | |

| | |

Net loss | | $ | (611,052 | ) | | $ | (552,251 | ) |

| | | | | | | | |

| | |

Net loss per common share—basic and diluted | | $ | (0.3 | ) | | $ | (0.04 | ) |

| | | | | | | | |

| | |

Weighted-average common shares outstanding—basic and diluted | | | 22,580,884 | | | | 15,228,552 | |

| | | | | | | | |

See accompanying notes.

4

Akesis Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

For the Three Months Ended March 31, 2007 and 2006

| | | | | | | | |

| | | Three months ended

March 31, | |

| | | 2007 | | | 2006 | |

Cash flows from operating activities: | | | | | | | | |

| | |

Net loss | | $ | (611,052 | ) | | $ | (552,251 | ) |

| | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| | |

Depreciation and amortization | | | 6,914 | | | | 1,162 | |

| | |

Stock-based compensation | | | 140,681 | | | | 321,504 | |

| | |

Warrants issued for employee termination cost | | | — | | | | 35,000 | |

| | |

Warrants issued for private placement fees | | | — | | | | 18,965 | |

| | |

Changes in assets and liabilities: | | | | | | | | |

| | |

Other current assets | | | (59,660 | ) | | | (86,113 | ) |

| | |

Debt issuance costs, net | | | 3,703 | | | | — | |

| | |

Accounts payable | | | 2,913 | | | | (25,534 | ) |

| | | | | | | | |

| | |

Net cash used in operating activities | | | (516,501 | ) | | | (287,267 | ) |

| | |

Cash flows from investing activities: | | | | | | | | |

| | |

Net cash used in investing activities | | | — | | | | — | |

| | | | | | | | |

| | |

Cash flows from financing activities: | | | | | | | | |

| | |

Proceeds from stock issuances | | | — | | | | 352,857 | |

| | | | | | | | |

| | |

Net cash provided by financing activities | | | — | | | | 352,857 | |

| | |

Net increase (decrease) in cash and cash equivalents | | | (516,501 | ) | | | 65,590 | |

| | |

Cash and cash equivalents at beginning of period | | | 4,111,070 | | | | 388,551 | |

| | | | | | | | |

| | |

Cash and cash equivalents at end of period | | $ | 3,594,569 | | | $ | 454,141 | |

| | | | | | | | |

| | |

Supplemental Disclosures of Cash Flow Information: | | | | | | | | |

| | |

Income taxes paid | | $ | 945 | | | $ | 1,800 | |

See accompanying notes.

5

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Basis of Presentation

Akesis Pharmaceuticals, Inc., a Nevada corporation (“we” or “us” or the “Company”), has prepared the unaudited condensed consolidated financial statements in this quarterly report in accordance with the instructions to Form 10-QSB adopted under the Securities Exchange Act of 1934. Certain information and note disclosures normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to such rules and regulations. These unaudited condensed consolidated financial statements should be read with our audited consolidated financial statements and the accompanying notes included in our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2006. In our opinion, all adjustments (consisting only of normal recurring adjustments) necessary to present a fair statement of our financial position as of March 31, 2007, and the results of operations for the three-month periods ended March 31, 2007 and 2006, have been made. The results of operations for the three-month periods ended March 31, 2007 and 2006 are not necessarily indicative of the results for the fiscal year ending December 31, 2007 or any future periods.

2. The Company and Recapitalization

One of our predecessors, Akesis Pharmaceuticals, Inc., a Delaware corporation (“Akesis Delaware”), was incorporated on April 27, 1998, for the purpose of direct marketing to consumers an established over-the-counter product for lowering blood glucose levels in the treatment of diabetes. Effective December 9, 2004, pursuant to the Agreement and Plan of Merger and Reorganization, dated as of September 27, 2004 (the “Merger Agreement”), among Akesis Delaware, another of our predecessors, Liberty Mint, Ltd., a Nevada corporation (“Liberty”), and Ann Arbor Acquisition Corporation, a wholly owned subsidiary of Liberty (“MergerSub”), MergerSub merged with and into Akesis Delaware, with Akesis Delaware as the surviving corporation and wholly owned subsidiary of Liberty. Effective January 11, 2005, the combined company changed its name to Akesis Pharmaceuticals, Inc. and its trading symbol to AKES.OB.

Although Liberty acquired Akesis Delaware as a result of the transaction, Akesis Delaware stockholders held a majority of our common stock following the transaction. Accordingly, for accounting purposes, the acquisition was a “reverse acquisition” and Akesis Delaware was the “accounting acquiror.” Therefore, the transaction was accounted for as a recapitalization of Akesis Delaware and recorded based on the fair value of Liberty’s net tangible assets acquired by Akesis Delaware. No goodwill or other intangible assets were recorded.

Despite the legacy businesses of our predecessors, we are currently a pharmaceutical company with a portfolio of innovative prospective treatments for diabetes and other related metabolic disorders. We possess issued U.S. patents for both prescription and over-the-counter treatments, which uniquely combine anti-diabetic trace minerals with certain classes of diabetes oral agents. Our products have demonstrated preliminary evidence of lowering and controlling blood glucose levels in patients with Type 2 diabetes.

3. Summary of Significant Accounting Policies

Principles of consolidation

The acquisition of Akesis Delaware by Liberty has been accounted for as a recapitalization as described in Note 2. Since Akesis Delaware is the surviving entity, the accompanying consolidated financial statements reflect its historical results of operations prior to the acquisition. The accounts of the Company and Akesis Delaware have been consolidated as of December 9, 2004, the effective date of the acquisition.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of expenses during the reporting period. Actual results could differ from those estimates.

Business risk and concentrations of credit risk

The Company’s business is in the healthcare industry and it plans to sell products that may not be successful in the marketplace. Financial instruments which potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents, including money market accounts. Substantially all of our cash and cash equivalents are maintained with one financial institution in the United States. Deposits held with that financial institution exceed the amount of insurance provided on such deposits. Those deposits may be redeemed upon demand and, therefore, bear minimal risk.

6

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)—(Continued)

Fair value of financial instruments

The carrying amounts of cash and cash equivalents, prepaid assets and accounts payable approximate fair market value because of the short maturity of those instruments.

Cash and cash equivalents

Cash equivalents consist of highly liquid investments with original maturities of three months or less when purchased.

Property and equipment

Property and equipment are stated at cost and depreciated using the straight-line method over the estimated useful lives of the related assets ranging from 3 to 5 years. Maintenance and repairs are charged to expense as incurred, and improvements and betterments are capitalized. When assets are retired or otherwise disposed of, the cost and accumulated depreciation and amortization are removed from the accounts and any resulting gain or loss is reflected in operations in the period realized.

Income taxes

Income taxes are accounted for in accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (“SFAS No. 109”). Under this method, deferred tax assets and liabilities are determined based on the difference between the financial statement and tax basis of assets and liabilities and net operating loss and credit carryforwards using enacted tax rates in effects for the year in which the differences are expected to reverse. Valuation allowances are established when necessary to reduce deferred tax assets to the amounts expected to be realized.

Revenue recognition

Product sales are recognized upon shipment to the customer and when payment is probable or collected immediately.

Research and development

Research and development costs are expensed as incurred. Such costs include the cost of in-licensed technology, consultants, supplies and clinical trials.

Stock-based compensation

In December 2004, the Financial Accounting Standards Board (the “FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123(R)”), which is a revision of SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS No. 123”). SFAS No. 123(R) requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values and does not allow the previously permitted pro forma disclosure as an alternative to financial statement recognition. SFAS No. 123(R) supersedes Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” and related interpretations and amends SFAS No. 95, “Statement of Cash Flows”. The Company adopted SFAS No. 123(R) effective with the acquisition of Akesis Delaware by Liberty on December 9, 2004. In March 2005, the Securities and Exchange Commission (the “SEC”) issued Staff Accounting Bulletin No. 107 (“SAB 107”) relating to SFAS No. 123(R), which among other things, expanded the coverage of SFAS No. 123(R) to include share-based payments to outside directors. The Company has applied the provisions of SAB 107 in its adoption of SFAS No. 123(R).

Compensation costs for all share-based awards to employees and outside directors are measured based on the grant date fair value of those awards and is recognized over the period during which the employee or outside director is required to perform service in exchange for the award (generally over the vesting period of the award). The cost of share-based compensation awards is recognized during the period based on the value of the portion of share-based payment awards that is ultimately expected to vest during the period, and is amortized under the multiple option methodology prescribed by SFAS No. 123(R).

As share-based compensation expense recognized in the consolidated statement of operations for the quarters ended March 31, 2007 and 2006 is based on awards ultimately expected to vest, it has been reduced for estimated forfeitures. SFAS No. 123(R) requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The estimation of the number of stock awards that will ultimately be forfeited requires judgment, and to the extent

7

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)—(Continued)

actual results or updated estimates differ from the Company’s current estimates, such amounts are required by SFAS No. 123(R) to be recorded as a cumulative adjustment in the period in which estimates are revised.

We have no awards with market or performance conditions. Excess tax benefits, as defined by SFAS No. 123(R), will be recognized as an addition to additional paid-in capital. The adoption of the SFAS No. 123(R) fair value method resulted in a non-cash stock-based compensation charge of $140,681 and $321,504 on the Company’s reported results of operations for the quarters ended March 31, 2007 and 2006, respectively.

Prior to the adoption of SFAS No. 123(R), no stock options had been issued by Akesis Delaware to employees. However, stock options were issued by Akesis Delaware prior to the recapitalization to non-employees and were recorded at their fair value in accordance with SFAS No. 123 and Emerging Issues Task Force No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services”. Such stock options to non-employees were periodically re-measured as the stock options vested, and no re-measurement issues having a material impact on the financial statements were identified.

Stock offering costs

Expenses incurred in connection with common stock issuances are recorded as a reduction to additional paid-in capital on the condensed consolidated balance sheets. Such expenses consist of third-party related offering expenses.

Debt issuance costs

Debt issuance costs incurred to obtain debt financing are deferred and included on the consolidated balance sheets. The costs are amortized over the term of the debt. The amortization expense is included in interest expense on the consolidated statements of operations.

Net loss per share

Basic and diluted net loss per share is computed in accordance with SFAS No. 128, “Earnings per Share.” Basic loss per share includes no dilution and is computed by dividing net loss by the weighted-average number of shares of common stock outstanding for the period. Diluted loss per share reflects the potential dilution of securities that could share in the Company’s earnings, such as common stock equivalents which may be issued upon exercise of outstanding common stock options. Diluted loss per share is identical to basic loss per share for all periods reported because inclusion of common stock equivalents would be anti-dilutive.

For the quarters ended March 31, 2007 and 2006, the following options and warrants to purchase shares of common stock were excluded from the computation of diluted net loss per share, as the inclusion of such shares would be anti-dilutive:

| | | | |

| | | Quarters Ended March 31, |

| | | 2007 | | 2006 |

Stock options | | 1,590,000 | | 1,262,499 |

Stock warrants | | 1,726,300 | | 258,300 |

Effect of new accounting standards

In June 2006, the FASB issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109, “Accounting for Income Taxes”. This Interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This Interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, and disclosure. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adoption of FIN 48 did not have a material impact on the consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”). SFAS No. 157 provides guidance for using fair value to measure assets and liabilities and requires expanded information about the extent to which companies measure assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value measurements on earnings. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value.

8

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)—(Continued)

The standard does not expand the use of fair value in any new circumstances. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. We are in the process of evaluating the adoption of SFAS No. 157.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans” (“SFAS No. 158”), an amendment of SFAS No. 87, 88, 106, and 132(R). SFAS No. 158 requires, among other things, that a company (1) recognize a net liability or asset to report the funded status of their defined benefit pensions and other postretirement plans on its balance sheet and (2) measure benefit plan assets and benefit obligations as of the company’s balance sheet date. SFAS No. 158 is effective for calendar year-end companies with publicly traded equity securities as of December 31, 2006. We do not expect the adoption of SFAS No. 158 to affect future reporting or disclosures.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities—including an amendment of SFAS No. 115” (“SFAS No. 159”). SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS No. 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provisions of FASB Statement No. 157, “Fair Value Measurements”. We do not expect the adoption of SFAS No. 159 to affect future reporting or disclosures.

4. Commitments, Contingencies and Related Party Transactions

Leases

The Company leases an aggregate of approximately 300 square feet of office space located in La Jolla, California, and San Diego, California, pursuant to two leases, each on a month-to-month basis. The La Jolla office space is sublet from Avalon Ventures. One of the Company’s directors, Kevin Kinsella, is a managing member of Avalon Ventures. The San Diego office space is sublet from Sirion Therapeutics, Inc. (“Sirion”). Jay Lichter, the Company’s Chief Executive Officer and a member of the Board of Directors, is a former officer and current consultant to Sirion, and Kevin Kinsella is a current member of the Board of Directors of Sirion. In addition, from December 9, 2004 through July 31, 2006, the Company sublet approximately 900 square feet of office space in Carefree, Arizona from its former chief executive officer at his cost. The Board of Directors has determined that the rent charged to the Company for all three leases is fair and reasonable. The Company recorded rent expense during the three months ended March 31, 2007 and 2006 of $5,250 and $7,350, respectively.

Loan

In December 2006, the Company entered into a loan and security agreement with Square 1 Bank (the “Bank”) that provides for a loan of up to $1.0 million to finance general corporate purposes. The loan bears an interest rate equal to the Bank’s prime rate plus 0.75% and matures in December 2009. The agreement requires monthly interest payments on any outstanding principal balance, and any outstanding principal balance is amortized and payable over the term of the agreement beginning in June 2007. The Company has granted a security interest in substantially all of its tangible assets as collateral for the loans under the loan and security agreement, and the agreement imposes certain limitations on the Company’s ability to engage in certain transactions. At March 31, 2007, the Company had no borrowings under the loan and security agreement.

5. Stock-based Compensation

Stock-based compensation expense for the quarters ended March 31, 2007 and 2006 was $140,681 and $321,504, respectively. Since we have a net operating loss carryforward as of December 31, 2006, no excess tax benefits for the tax deductions related to share-based awards were recognized in the consolidated statement of operations. At the present time, we intend to issue new common shares upon the exercise of stock options. None of the share-based awards are classified as a liability as of March 31, 2007.

From time to time following the acquisition of Akesis Delaware by Liberty in December 2004, executive officers and an outside director have been issued nonstatutory stock options with a term of 10 years to acquire a total of 1,300,000 shares of common stock at exercise prices ranging from $0.51 to $1.50 per share. There are 1,300,000 shares of common stock subject to the currently outstanding options vesting on a monthly basis through various dates ending between December 12, 2008 and October 2, 2009, subject to the officers’ and director’s continued employment with and service to the Company on any such date. In addition, in the event of a change of control of the Company, then the officers and director shall fully vest in and have the right to exercise the options as to all of the shares of common stock subject to the options as to which the officers would not otherwise be vested or exercisable. During the three months ended March 31, 2007 and 2006 nonstatutory stock options to acquire 500,000 and zero shares of our common stock, respectively, were granted.

9

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)—(Continued)

The Company’s Board of Directors also authorized and reserved 1,500,000 shares of common stock pursuant to a 2005 Stock Plan in January 2005 for option grants to employees, directors and consultants. Currently outstanding options to acquire a total of 290,000 shares of our common stock have been granted pursuant to such 2005 Stock Plan to an outside director and certain consultants. The stock options are nonqualified stock options with a term of 10 years and an exercise price ranging from $1.94 to $0.51 per share. The options vest on a monthly basis through various dates ending between January 24, 2009 and March 15, 2010, subject to the director’s and consultants’ continued service to the Company on any such date. In addition, in the event of a change of control of the Company, then the director shall fully vest in and have the right to exercise the options as to all of the shares of common stock subject to the options as to which the director would not otherwise be vested or exercisable. During the three months ended March 31, 2007 and 2006 options to acquire 90,000 and zero shares of our common stock, respectively, were granted under the 2005 Stock Plan.

The fair value of each option award is estimated on the date of grant using the Black-Scholes method for option pricing, and is amortized over the vesting period of the option using the multiple option methodology in accordance with the provisions of SFAS No. 123(R). The key assumptions in the Black-Scholes model are as follows: expected volatility, annual expected termination rate, and risk-free interest rate. Expected volatilities are based on historical volatility of our common stock and other factors. The expected forfeiture rate of options granted is based on our management’s estimate since our operating history is too brief to have established historical rates for employee termination and option exercises. The risk-free interest rates are based on the U.S. Treasury yield for a period consistent with the expected term of the option in effect at the time of the grant.

The following is a summary of the status of the nonstatutory options and the options under the 2005 Stock Plan for the quarter ended March 31, 2007:

| | | | | | | | | | |

| | | Number

of Shares | | Weighted

Average

Exercise Price

Per Share | | Weighted

Average

Remaining

Contractual

Term

(in years) | | Aggregate

Intrinsic

Value

(in millions) |

Balance at December 31, 2006 | | 1,000,000 | | $ | 1.25 | | 9.06 | | $ | 1.4 |

Granted | | 590,000 | | $ | 0.51 | | 9.58 | | $ | 0.2 |

Exercised | | — | | | — | | | | | |

Expired | | — | | | — | | | | | |

Cancelled | | — | | | — | | | | | |

| | | | | | | | | | |

Balance at March 31, 2007 | | 1,590,00 | | $ | 0.98 | | 9.10 | | $ | 1.6 |

| | | | | | | | | | |

Exercisable at March 31, 2007 | | 423,166 | | $ | 1.28 | | 8.53 | | $ | 0.7 |

| | | | | | | | | | |

A summary of the status of our non-vested stock options as of March 31, 2007 and changes during the quarter then ended are presented below.

| | | | | | |

| | | Number

of shares | | | Average

Grant-

Date

Fair Value

Per Share |

Non-vested at December 31, 2006 | | 734,667 | | | $ | 0.98 |

Granted | | 590,000 | | | $ | 0.27 |

Vested | | (157,833 | ) | | $ | 0.96 |

Cancelled | | — | | | | — |

| | | | | | |

Non-vested at March 31, 2007 | | 1,166,834 | | | $ | 0.56 |

| | | | | | |

10

Akesis Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)—(Continued)

As of March 31, 2007, there was $0.6 million of total unrecognized compensation cost, related to non-vested stock options, which is expected to be recognized over a weighted-average period of approximately 2.44 years. The total fair value of shares vested during the quarters ended March 31, 2007 and 2006 was approximately $151,000 and $350,000, respectively.

6. Income Taxes

At December 31, 2006, Akesis Delaware had no federal income tax expense or benefit but did have federal tax net operating loss carryforwards of approximately $4.6 million. The federal net operating loss carryforwards will begin to expire in 2018, unless previously utilized. Pursuant to Internal Revenue Code Section 382 and 383, use of Akesis Delaware’s net operating loss carryforwards may be limited if a cumulative change in ownership of more than 50% occurs within a three-year period. No assessment has been made as to whether such a change in ownership has occurred. The Company incurred $945 and $1,800 of statutory minimum state tax expense for the three months ended March 31, 2007 and 2006, respectively.

On January 1, 2007, the Company adopted FIN 48. Under FIN 48, tax positions are evaluated for recognition using a more-likely-than-not threshold, and those tax positions requiring recognition are measured as the largest amount of tax benefit that is greater than 50 percent likely of being realized upon ultimate settlement with a taxing authority that has full knowledge of all relevant information.

11

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-QSB contains forward-looking statements that are based upon current expectations within the meaning of the Private Securities Reform Act of 1995. It is our intent that such statements be protected by the safe harbor created thereby and we disclaim any duty or obligation to update such statements. Forward-looking statements involve risks and uncertainties and our actual results and the timing of events may differ significantly from the results discussed in the forward-looking statements. Forward-looking statements include information concerning possible or assumed future results of our operations. Also, when we use words such as “believes,” “expects,” “anticipates” or similar expressions, we are making forward-looking statements. Examples of such forward-looking statements include, but are not limited to, statements about:

| | • | | Our capital requirements and resources; |

| | • | | Development of new products; |

| | • | | Intent to develop and sell products and services to companies in the pharmaceutical industry; |

| | • | | Technological change and uncertainty of new and emerging technologies; |

| | • | | Potential competitors or products; |

| | • | | Future employment of our key employees; |

| | • | | Development of strategic relationships; |

| | • | | Statements about potential future dividends; |

| | • | | Statements about protection of our intellectual property; and |

| | • | | Possible changes in legislation. |

Such forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this report. Except as required by federal securities laws, we are under no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

| Item 2. | Management’s Discussion and Analysis or Plan of Operation |

Introduction

We are currently a pharmaceutical company with a portfolio of innovative prospective treatments for diabetes and other related metabolic disorders. We possess issued U.S. patents for both prescription and over-the-counter treatments, which uniquely combine anti-diabetic trace minerals with certain classes of diabetes oral agents. Our products have demonstrated preliminary evidence of lowering and controlling blood glucose levels in patients with type 2 diabetes.

The following discussion of our plan of operation contains forward-looking statements that involve risks and uncertainties. As described above, our actual results may differ materially from the results discussed in the forward-looking statements.

Research and Development Projects

Historically, we focused the development of our proprietary compounds AKP-111, AKP-201 and AKP-310 as potential candidates for a combination product to treat diabetes and other related metabolic disorders. For instance, we previously completed an initial 81-individual open-label study of AKP-111, our triple combination product, which demonstrated a consistent improvement in glycated hemoglobin levels (which is an established long-term measure of blood glucose) compared to base line, after three months of treatment in a diabetic population.

More recently, in March 2007, we entered into a license agreement with the University of British Columbia (“UBC”), pursuant to which we obtained an exclusive license to use, commercialize and sublicense certain patented technology (and improvements thereon) owned by UBC relating to the treatment of diabetes and other related disorders (the “Licensed Technology”). Included in the Licensed Technology is bis(ethylmaltolato)oxovanadium(iv) (“BEOV”), a novel vanadium compound that has shown considerable potential as a treatment for patients with type 2 diabetes. The addition of BEOV—which we will hereafter refer to as AKP-020—to the Company’s product portfolio substantially accelerates the Company’s clinical programs and gives the Company a proprietary drug candidate that may be useful for the treatment of type 2 diabetes.

12

In addition, by virtue of the license, we will gain access to data that includes information relating to Phase I clinical trials for AKP-020 and the extended related correspondence with the U.S. Food and Drug Administration (the “FDA”). This data should allow the Company to rapidly enter the clinic, under FDA oversight, and to administer AKP-020 to human patients.

The initial human Phase I data for AKP-020 showed that AKP-020 has advantages over unpatented vanadyl sulfate (the original vanadium compound in AKP-111) with respect to dosing, pharmacokinetics and bioavailability, without any signs of significant new toxicities. This data set also includes extensive positive safety and efficacy studies of AKP-020 in rodents and dogs. In addition to the advanced clinical stage of AKP-020, we believe that the other components of the Licensed Technology strongly compliment our pre-existing portfolio of compounds.

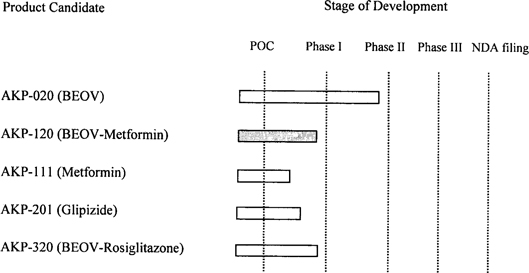

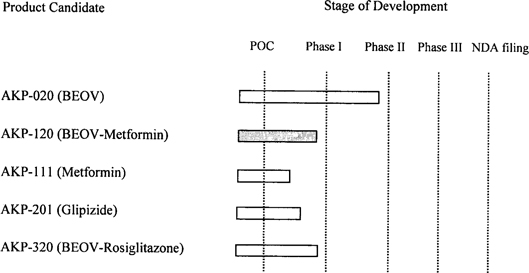

The table below illustrates how the addition of AKP-020 changes the priority of the Company’s product development pipeline:

As a result of the foregoing, the Company’s initial product focus is shifting away from AKP-111, our triple combination product, and towards AKP-020 and AKP-120, our BEOV monotherapy and BEOV-metformin combination therapy, respectively. Given the existing data on AKP-020, we expect our AKP-020 program to enter the clinic before AKP-120. We anticipate that this will happen later in 2007, once the appropriate FDA filings are completed and approved, though we may elect to perform additional Phase I studies for AKP-020 in healthy and/or diabetic patients. We also may elect to study AKP-020 in various animal models of diabetes, including rodents and non-human primates. We currently do not have an open dialog with the FDA. We continue to pursue our research projects for combination therapies with vanadium and chromium and also are expanding the therapy class beyond metformin to also include Actos and Avandia.

The risks and uncertainties associated with completing the development of our products on schedule, or at all, include the following, as well other risk factors contained in our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2006:

| | • | | Our products may not be shown to be safe and efficacious in the clinical trials; |

| | • | | We may be unable to obtain regulatory approval of our products or be unable to obtain such approval on a timely basis; |

| | • | | The intellectual property rights underlying our products may not be enforceable or may be found to infringe on the intellectual property rights of third parties; |

| | • | | We may be unable to recruit enough patients to complete the clinical trials in a timely manner; and |

| | • | | We may not have adequate funds to complete the development of our products even if we secure the additional amount of capital we have targeted if we have underestimated the cost of the clinical trials. |

If our products fail to achieve statistically significant results in the clinical trials, or we do not complete the clinical trials on a timely basis, our operations, financial position and liquidity could be severely impaired, including as follows:

| | • | | It could make it more difficult for us to consummate partnering opportunities in the pharmaceutical industry, or at all. |

13

| | • | | Our reputation among investors might be harmed, which could make it more difficult for us to obtain equity capital on attractive terms, or at all. |

Because of the many risks and uncertainties relating to the completion of clinical trials, consummation of partnering opportunities in the pharmaceutical industry, receipt of marketing approvals and acceptance in the marketplace, we cannot predict the period in which material cash inflows from our products will commence, if ever.

Cash Resources

We have financed our operations primarily through the sale of equity securities. We invest excess cash in investment securities that will be used to fund future operating costs. Cash, cash equivalents and investment securities totaled $3,594,569 at March 31, 2007, compared to $4,111,070 at December 31, 2006. We primarily fund current operations with our existing cash and investments. Cash used in operating activities for the three months ended March 31, 2007 totaling $516,501.

We had no revenues or other income sources for the three months ended March 31, 2007 to cover operating expenses, and we do not expect any revenues in the foreseeable future. Our current cash resources should enable us to continue operations based on our current level of commitments into the second half of 2008.

In December 2006, we entered into a loan and security agreement with Square 1 Bank that provides for a loan of up to $1.0 million to finance general corporate purposes. The loan bears an interest rate equal to the lender’s prime rate plus 0.75% and matures in December 2009. We have granted a security interest in substantially all of our tangible assets as collateral for the loans under the loan and security agreement. The agreement imposes certain limitations on our ability to engage in certain transactions. At March 31, 2007, we had no borrowings under the loan and security agreement, and we have no other long-term financial commitments.

In order to finance additional feasibility trials beyond the trial scheduled for 2007-2008 to further validate our products, we will need to raise a significant amount of capital. We will also need to raise additional capital to finance our future operating cash needs. We may seek to raise capital through the sale of equity or debt securities or the development of other funding mechanisms. In addition, we may seek to form a strategic partnership for the development and commercialization of our products.

Our actual capital requirements will depend upon numerous factors, including:

| | • | | the rate of progress and costs of our clinical trial and research and development activities; |

| | • | | actions taken by the FDA and other regulatory authorities; |

| | • | | the timing and amount of milestone or other payments we might receive from potential strategic partners; |

| | • | | our degree of success in commercializing our product candidates; |

| | • | | the emergence of competing technologies and products, and other adverse market developments; and |

| | • | | the costs of preparing, filing, prosecuting, maintaining and enforcing patent claims and other intellectual property rights. |

There can be no assurance that we will be able to obtain needed additional capital or enter into relationships with corporate partners on a timely basis, on favorable terms, or at all. Conditions in the capital markets in general, and the life science capital market specifically, may affect our potential financing sources and opportunities for strategic partnering.

| Item 3. | Controls and Procedures |

The certifications of our Chief Executive Officer and Chief Financial Officer, filed as Exhibits 31.1, 31.2 and 32.1, should be read in conjunction with this Item 3.

Evaluation of disclosure controls and procedures. Our Chief Executive Officer and our Chief Financial Officer evaluated the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Form 10-QSB. Based on this

14

evaluation, our Chief Executive Officer and our Chief Financial Officer have determined that our disclosure controls and procedures were not effective as of March 31, 2007 and that we have a material weakness in our internal control over financial reporting. This material weakness relates to our failure to implement a policy for routinely evaluating the assumptions and estimates that we use when calculating our non-cash stock-based compensation expenses in accordance with SFAS No. 123(R).

Remediation of Material Weaknesses. Since the time we determined that our disclosure controls and procedures were not effective and identified the material weakness in our internal control over financial reporting, we have devoted significant time to developing remedial measures to address these deficiencies. In particular, with oversight from our Audit Committee, we have formulated a remediation plan intended to address and eliminate the material weakness in our internal control over financial reporting, and we are committed to effectively implementing the plan as expeditiously as possible. Specifically, this plan includes the adoption and implementation of a new Company policy that requires management, with appropriate assistance from qualified experts, to evaluate the Company’s estimated forfeiture rate for purposes of SFAS No. 123(R) and to record any necessary adjustments resulting from any changes in such estimated forfeiture rate for each quarterly and annual reporting period.Notwithstanding the adoption and implementation of this policy, the material weakness in our internal control over financial reporting will not be deemed to have been eliminated until our remediation plan has been fully implemented, in operation for a sufficient period of time, tested by our management and concluded to be operating effectively. Despite the existence of the material weakness in our internal control over financial reporting, management believes that the consolidated financial statements included in this Form 10-QSB fairly present, in all material respects, our financial position, results of operations and cash flows for the periods presented.

Changes in internal control over financial reporting. Based on an evaluation performed by our Chief Executive Officer and Chief Financial Officer, we have concluded that there was no change in our internal control over financial reporting that occurred during the period covered by this Form 10-QSB that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

15

PART II-OTHER INFORMATION

| Item 1. | Legal Proceedings. |

None.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. |

Except as otherwise disclosed in its Current Reports on Form 8-K, the Company did not conduct any unregistered sales of equity securities during the fiscal quarter ended March 31, 2007.

| Item 3. | Defaults upon Senior Securities. |

None.

| Item 4. | Submission of Matters to a Vote of Security Holders. |

None.

| Item 5. | Other Information. |

None.

See attached Exhibit Index.

16

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | |

AKESIS PHARMACEUTICALS, INC. |

| |

| By: | | /s/ Jay B. Lichter |

| | Jay B. Lichter President and Chief Executive Officer |

| |

| Date: | | May 21, 2007 |

Akesis Pharmaceuticals, Inc. and Subsidiaries

Exhibit Index

| | |

Exhibit

Number | | Description |

| 2.1(1) | | Agreement and Plan of Merger and Reorganization dated September 27, 2004 by and among the Registrant, Ann Arbor Acquisition Corporation, and Liberty Mint, Ltd. |

| |

| 3.1(2) | | Articles of Incorporation, as amended, of the Registrant |

| |

| 3.2(2) | | Bylaws of the Registrant |

| |

| 4.1(3) | | Form of Warrant to Purchase Common Stock |

| |

| 4.2(3) | | Form of Warrant to Purchase Common Stock |

| |

| 4.3(4) | | Form of Warrant to Purchase Common Stock |

| |

| 10.1(5) | | License Agreement, dated as of March 15, 2007, by and between Akesis Pharmaceuticals, Inc., a Delaware corporation, and The University of British Columbia |

| |

| 10.2(5) | | Letter Agreement, dated as of March 15, 2007, by and among the Registrant, The University of British Columbia and QLT, Inc. |

| |

| 10.3(3) | | Form of Stand-Alone Stock Option Agreement for Jay B. Lichter, Ph.D. |

| |

| 31.1 | | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 31.2 | | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| 32.1 | | Certification of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| (1) | Incorporated by reference to the Registrant’s Form 8-K as filed with the SEC on September 28, 2004. |

| (2) | Incorporated by reference to the Registrant’s Form 10-K as filed with the SEC on March 24, 2005. |

| (3) | Incorporated by reference to the Registrant’s Form 8-K as filed with the SEC on January 6, 2006. |

| (4) | Incorporated by reference to the Registrant’s Form 8-K as filed with the SEC on April 4, 2006. |

| (5) | Incorporated by reference to the Registrant’s Form 8-K as filed with the SEC on March 21, 2007. |

| (6) | Incorporated by reference to the Registrant’s Form 8-K/A as filed with the SEC on October 24, 2006. |

17