FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2005

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

| Investor Relations |

Press Release

ENDESA HOLDS ANALYST PRESENTATION IN MADRID

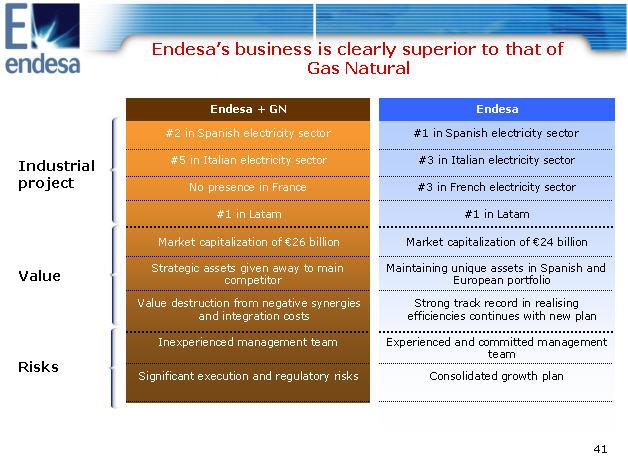

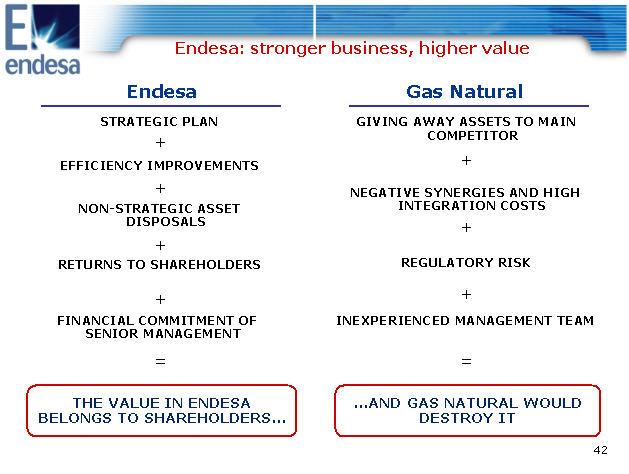

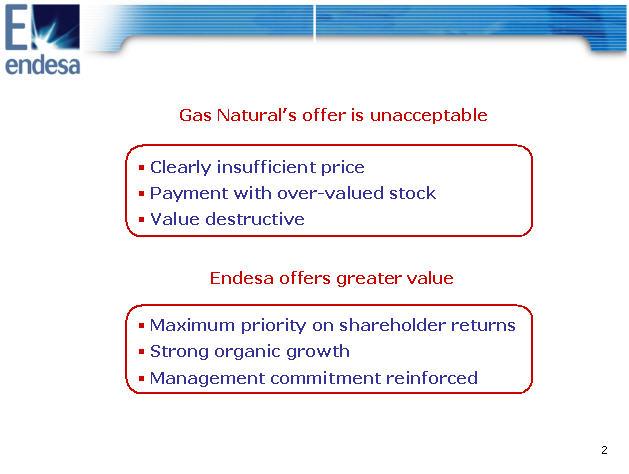

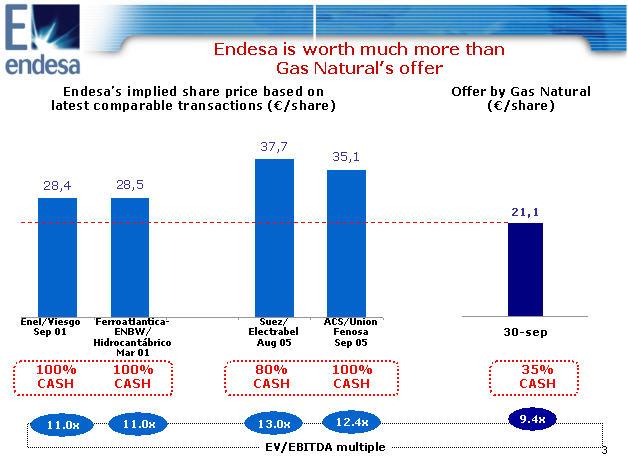

New York, October 3rd, 2005.- The following is an analyst presentation hosted today by Endesa's (NYSE:ELE) top management regarding its position to Gas Natural tender offer. It is also available for download from its corporate website at www.endesa.es

For additional information please contact Álvaro Pérez de Lema, North America Investor Relations Office, telephone # 212 750 7200

http://www.endesa.es

IMPORTANT LEGAL INFORMATION Investors are urged to read Endesa's Soliciation/Recommendation Statement on Schedule 14D-9 when it is filed with the U.S. Securities and Exchange Commission (the "SEC"), as it will contain important information. The Solicitation/Recommendation Statement and other public filings made from time to time by Endesa with the SEC are available without charge from the SEC's website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. Statements in this presentation other than factual or historical information are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements regarding Endesa's anticipated financial and operating results and statistics are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa's control or may be difficult to predict. Forward-looking statements could include, but are not limited to, statements regarding: (1) estimated future earnings; (2) anticipated increases in wind and CCGTs generation and market share; (3) expected increases in demand for gas and gas sourcing; (4) management strategy and goals; (5) estimated cost reductions and increased efficiency; (6) anticipated developments affecting tariffs, pricing structures and other regulatory matters; (7) anticipated growth in Italy, France and elsewhere in Europe; (8) estimated capital expenditures and other investments; (9) expected asset disposals; (10) estimated increases in capacity and output and changes in capacity mix; (11) repowering of capacity; and (12) macroeconomic conditions. For all of these-forward looking statements, Endesa claims the protection of the safe harbor for forward-looking statements contained in the U.S. Private Securities Litigation Reform Act of 1995. Endesa disclaims any obligation to revise or update any forward-looking statements in this presentation. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and Industry Conditions: materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; natural disasters; the impact of more stringent environmental regulations and the inherent environmental risks relating to our business operations; and the potential liabilities relating to our nuclear facilities. Transaction or Commercial Factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments; any delays in or failure to obtain necessary regulatory approvals (including environmental) to construct new facilities or repower or enhance our existing facilities; shortages or changes in the price of equipment, materials or labor; opposition of political and ethnic groups; adverse changes in the political and regulatory environment in the countries where we and our related companies operate; adverse weather conditions, which may delay the completion of power plants or substations, or natural disasters, accidents or other unforeseen events; and the inability to obtain financing at rates that are satisfactory to us. Political/Governmental Factors: political conditions in Latin America and changes in Spanish, European and foreign laws, regulations and taxes. Operating Factors: technical difficulties; changes in operating conditions and costs; the ability to implement cost reduction plans; the ability to maintain a stable supply of coal, fuel and gas and the impact of fluctuations on fuel and gas prices; acquisitions or restructurings; and the ability to implement an international and diversification strategy successfully. Competitive Factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. 43 |

IMPORTANT LEGAL INFORMATION

Investors are urged to read Endesa’s Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed with the U.S. Securities and Exchange Commission (the “SEC”), as it will contain important information. The Solicitation/Recommendation Statement and other public filings made from time to time by Endesa with the SEC are available without charge from the SEC’s website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. Statements in this presentation other than factual or historical information are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements regarding Endesa’s anticipated financial and operating results and statistics are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa’s control or may be difficult to predict. Forward-looking statements could include, but are not limited to, statements regarding: (1) estimated future earnings; (2) anticipated increases in wind and CCGTs generation and market share; (3) expected increases in demand for gas and gas sourcing; (4) management strategy and goals; (5) estimated cost reductions and increased efficiency; (6) anticipated developments affecting tariffs, pricing structures and other regulatory matters; (7) anticipated growth in Italy, France and elsewhere in Europe; (8) estimated capital expenditures and other investments; (9) expected asset disposals; (10) estimated increases in capacity and output and changes in capacity mix; (11) repowering of capacity; and (12) macroeconomic conditions. For all of these-forward looking statements, Endesa claims the protection of the safe harbor for forward-looking statements contained in the U.S. Private Securities Litigation Reform Act of 1995. Endesa disclaims any obligation to revise or update any forward-looking statements in this presentation. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and Industry Conditions: materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; natural disasters; the impact of more stringent environmental regulations and the inherent environmental risks relating to our business operations; and the potential liabilities relating to our nuclear facilities. Transaction or Commercial Factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments; any delays in or failure to obtain necessary regulatory approvals (including environmental) to construct new facilities or repower or enhance our existing facilities; shortages or changes in the price of equipment, materials or labor; opposition of political and ethnic groups; adverse changes in the political and regulatory environment in the countries where we and our related companies operate; adverse weather conditions, which may delay the completion of power plants or substations, or natural disasters, accidents or other unforeseen events; and the inability to obtain financing at rates that are satisfactory to us. Political/Governmental Factors: political conditions in Latin America and changes in Spanish, European and foreign laws, regulations and taxes. Operating Factors: technical difficulties; changes in operating conditions and costs; the ability to implement cost reduction plans; the ability to maintain a stable supply of coal, fuel and gas and the impact of fluctuations on fuel and gas prices; acquisitions or restructurings; and the ability to implement an international and diversification strategy successfully. Competitive Factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | ENDESA, S.A. |

|

|

|

| Dated: October 3rd, 2005 | By: | By: /s/ Álvaro Pérez de Lema |

| | Name: Álvaro Pérez de Lema |

| | Title: Manager of North America Investor Relations |