At March 31, 2007, we held cash and cash equivalents of $205,048 and working capital of $2,997,518, as compared to cash and cash equivalents of $466,272 and working capital of $558,414 at June 30, 2006. At March 31, 2007, our cash position by geographic area is as follows:

In addition to our increase in working capital of $2,439,104, our current assets increased approximately $1,728,417 from June 30, 2006 to March 31, 2007. This increase was offset by decreases in total current liabilities of approximately $710,687 at March 31, 2007 as compared to June 30, 2006. The decrease in our current liabilities is primarily attributable to an increase in accounts payable of $2,475,647 which were offset by a decrease in accrued expenses of $1,803,539 and a decrease in liabilities of $1,141,476 in connection with the acquisition of JinKui in June 2006.

§ a decrease of $3,498 in due from related parties. At March 31, 2007 due from related parties was $0 as compared to $3,498 at June 30, 2006. This decrease is due the satisfaction of amounts due from related parties during the nine months ended March 31, 2007.

§ a decrease of $3,919 in restricted cash. At March 31, 2007 restricted cash was $258,368 as compared to $262,287 at June 30, 2006. This decrease in our restricted cash is attributable to letters of credit outstanding. The decrease represents normal business fluctuations in the amount of letters of credit the company has outstanding at any given date.

§ a decrease of $44,047 in land use rights, net of accumulated amortization. At March 31, 2007 land use rights net of accumulated amortization was $2,568,615 as compared to $2,524,568 at June 30, 2006.

§ a decrease of $62,880 of intangible assets, net of accumulated depreciation. At March 31, 2007 we reflected intangible assets, net of accumulated depreciation of $331,048 as compared to $393,928 at June 30, 2006.

As a result of the foregoing, our total assets increased $2,078,615 at March 31, 2007 from June 30, 2006.

Our total liabilities at March 31, 2007 decreased $662,687 from June 30, 2006. Principal changes in our total liabilities at March 31, 2007 from June 30, 2006 include the following;

§ an increase of $2,475,647 in accounts payable. At March 31, 2007 accounts payable was $5,877,086 as compared to $3,401,439 at June 30, 2006.

These increases were offset by the following:

§ a decrease of $181,876 in notes payable-current portion. At March 31, 2007 notes payable-current portion were $2,580,331 as compared to $2,762,207 at June 30, 2006. This decrease in notes payable long term was offset by an increase of $48,000 in notes payable-long term. At March 31, 2007 notes payable-long term were $48,000 as compared to $0 at June 30, 2006. Our notes payable is described in Note 5-Notes Payable to the consolidated financial statements appearing elsewhere in this quarterly report.

§ a decrease of $1,803,539 in accrued expenses. At March 31, 2007 accrued expenses were $238,574 as compared to $2,042,113 at June 30, 2006.

§ a decrease of $59,443 in advances from customers. At March 31, 2007 advances from customers were $ $9,251 as compared to $68,694 at June 30, 2006. Advances from customers decreased as a result of our decrease in revenues during the nine months ended March 31, 2007.

§ a decrease of $1,141,476 in liabilities associated with acquisition of JinKui. This liability associated with the acquisition is related to JinKui. During the nine months ended March 31, 2007, Dragon Nevada has satisfied this liability. On October 30, 2006 Dragon Nevada issued 8,095,574 shares of common stock with a fair value of $1,141,476 to JinKui. At March 31, 2007 liabilities associated with acquisitions were $0 as compared to $1,141,476 at June 30, 2006.

As a result of the foregoing, our total assets increased $2,078,615 at March 31, 2007 from June 30, 2006.

43

For the nine months ended March 31, 2007 our cash decreased to $205,048 from $466,272 at June 30, 2006 a decrease of $261,224 or approximately 56%. This decrease consisted of total cash used in operating activities of $576,542; net cash used in investing activities of $937,473; and net cash flow provided by financing activities of $1,203,124, and the effect of exchange rates on cash of $49,667.

Net cash used in operating activities for the nine months ended March 31, 2007 was $576,542 as compared to net cash used in operating activities of $603,962 for the nine months ended March 31, 2006. For the nine months ended March 31, 2007, we used cash to fund increases in inventories of $870,399, a decrease in advances from customers of $59,443, increases in advances on purchases of $1,942,010, and increases in accrued expenses of $1,803,539. The decreases were offset by a net decrease in prepaid and other current assets of $410,429, a decrease in accounts receivables of $890,249, an increase in accounts payable of $2,475,647, and a decrease in other assets of $78,759. These items, combined with a net increase of non-cash items of $535,205 were offset by our net loss during the nine month period ended March 31, 2007.

In comparison for the nine months ended March 31, 2006, we used cash to fund an increase in accounts receivables and advances on purchases, the reduction in accrued expenses and advances from customers. The decreases were offset by an increase in accounts payable of $852,332. These items, combined with a net addition of our non-cash items of $3,579,334 were offset by our net loss during the nine month period ended March 31, 2006.

Net cash used in investing activities during the nine months ended March 31, 2007 was $940,971 as compared to net cash provided by investing activities of $11,966 for the nine months ended March 31, 2006. During the nine months ended March 31, 2007, we used cash for capital expenditures of $533,405 of which $465,022 was used to purchase equipment for our new manufacturing facility. During the nine months ended March 31, 2007 we increased our notes receivable by $420,484. Our notes payable is described in Note 5-Notes Payable to the consolidated financial statements appearing elsewhere in this quarterly report. We decreased our restricted cash balance by $12,918 to collateralize certain debt, ($3,919 decrease which was adjusted by $8,999 for the fluctuation in the currency).

During the nine months ended March 31, 2006, net cash provided by investing activities was $11,966 which was comprised of net cash used for capital expenditures of $389,594, which was offset by cash of $33,654 acquired in the acquisition of Yongxin in August 2005, $23,000, and a restricted cash balance of $367,906 to collateralize certain debt.

Ningbo Dragon has invested approximately $1,300,000 to construct a new facility. The Company recently completed construction on the new facility located at No. 201 Guangyuan Road, Investment Pioneering Park, Jiangbei District, Ningbo, 315033.

This facility consists of a total of 91,000 square feet consisting of approximately 20,000 square feet of office space, approximately 17,000 square feet of warehouse space; approximately 40,000 square feet for manufacturing, and approximately 14,400 square feet utilized as a dormitory for employees of the Company.

44

Net cash provided by financing activities during the nine months ended March 31, 2007 was $1,206,622, as compared to net cash provided by financing activities of $725,022 during the nine months ended March 31, 2006. During the nine months ended March 31, 2007, we received gross proceeds of $1,944,355 from notes payable offset by the satisfaction of notes payable of $2,078,231. On October 30, 2006, the Company received gross proceeds of $100,000 from the sale of 2,000,000 shares of common stock to H.K. Mingtai Investment Co., Ltd., a financial institution in China. The company also received net proceeds of $1,301,000 from the sale of 16,666,672 shares of its common stock, and common stock purchase warrants to purchase 16,666,672 shares of common stock exercisable at $.125 per share for a period of five years and common stock purchase warrants to purchase 8,333,340 shares of common stock exercisable at $.15 per share for a period of five years. The company received $1,000 for exercise of common stock purchase warrants.

From time to time, we need additional working capital for our operations. In 2006, Yonglongxin borrowed money pursuant to several lines of credit that we have established with two separate banks. We renewed pre-existing loans of $1,944,355 from the Bank of Agriculture with 6 to 12 month terms from November 2006 to November 2007, with an annual interest rate ranging from 6.138% to 7.344%. We repaid loans of $62,450 to Ningbo Commercial Bank (Tianyuan Branch) and $620,083 to Bank of Agriculture during the nine months ended March 31, 2007. All loans are renewable when they mature. We expect to generate sufficient cash flows from financing and operations to meet our debt services. We do not anticipate these loans will have material impact on our liquidity. We are current on all payments relating to these loans and expect to renew the loans upon maturity at terms and at interest rates comparable to our current loans.

Off Balance Sheet Arrangements

As of the date of this report, we do not have any off-balance sheet arrangements that we are likely to have a current or future effect on our financial condition material to our shareholders. In the ordinary course of business, we enter into operating lease commitments, purchase commitments and other contractual obligations. These transactions are recognized in our financial statements in accordance with generally accepted accounting principles in the United States.

Recent Capital Raising Transactions

January 2007 Private Placement

On January 30, 2007 the Company entered into a subscription agreement (the “Subscription Agreement”) and related agreements (collectively with the Subscription Agreement, the “Agreements”) for the purchase of $1,500,000 units of securities. The Company entered into the Agreements with nine (9) accredited investors (the “Investors”) for an aggregate of $1,500,000 of financing of units of its securities consisting of 16,666,672 shares of common stock, common stock purchase warrants to purchase 16,666,672 shares of common stock exercisable at $.125 per share for a period of five years, and common stock purchase warrants to purchase 8,333,340 shares of common stock at an exercise price of $.15 per share for a period of five years.

45

The January 2007 Private Placement was conducted in two phases. On January 30, 2007, the Company completed an initial closing (the “Initial Closing”) of $750,000 of units of securities consisting of 8,333,336 shares of common stock, common stock purchase warrants to purchase 8,333,336 shares of common stock exercisable at $.125 per share for a period of five years, and common stock purchase warrants to purchase 4,166,670 shares of common stock shares of common stock exercisable at $.15 per share for a period of five years.

The second phase of the offering (the “Second Closing”) was held on February 27, 2007 for an additional $750,000 financing of units of its securities consisting of 8,333,336 shares of common stock, common stock purchase warrants to purchase 8,333,336 shares of common stock exercisable at $.125 per share for a period of five years and common stock purchase warrants to purchase 4,166,670 shares of common stock shares of common stock exercisable at $.15 per share for a period of five years. The Second Closing was conditioned upon Wellton International Fiber Corp. engaging an SEC approved auditor to prepare certain financial statements. Wellton International Fiber Corp. engaged an SEC approved auditor on February 22, 2007.

We paid a fee of $84,000 in cash to certain of the investors and issued common stock purchase warrants to purchase an aggregate of 1,555,558 shares of common stock exercisable at $.125 per share for a period of five years as a due diligence fee related to the January 2007 Private Placement. The recipients of the due diligence fee are as set forth below:

| | Total Due Diligence | | Fees Paid | |

Recipient | | Cash | | common stock purchase warrants @$.125 | |

Libra Finance | | $ | 9,075 | | 168,056 | |

Osher Capital, LLC | | | 32,175 | | 595,834 | |

Utica Advisors | | | 41,250 | | 763,890 | |

Robert Prager | | | 1,500 | | 27,778 | |

Totals: | | $ | 84,000 | | 1,555,558 | |

We also paid Skyebanc, Inc. an NASD member and broker-dealer, a finder’s fee of $5,500 and issued common stock purchase warrants to purchase 111,112 shares of common stock at an exercise price of $.125 for a period of five years.

We granted the purchasers a right of first refusal for a period of 24 months from the second closing date, February 27, 2007. In the event we should offer to sell common stock, debt or other securities to a third party (except in certain instances). The purchasers have the right to purchase the offered securities upon the same terms and conditions as we offered the securities to a third party. In addition, other than in the event of excepted issuances, during the 24 month period from the effective date of the registration statement to be filed in conjunction with this private placement so long as the purchasers still own any of the shares sold in such offering, (including the shares underlying the warrants), if we should issue any common stock or securities convertible into or exercisable for shares of common stock at a price per share of common stock or exercise price per share of common stock which is less than the purchase price of the shares paid by the purchasers in the offering, or less than the exercise price of the common stock purchaser warrants exercisable at $.125 per share, without the consent of each purchaser, then the purchaser’s have the right to elect to retroactively substitute any term or terms of such new offering in connection with which the purchaser has a right of first refusal for any term or terms of this unit offering and adjustments will be made accordingly.

46

Any subsequent adjustments in the exercise price of the common stock purchase warrants will not result in additional shares of common stock of Dragon Nevada being issued.

We agreed to file a registration statement covering the shares of common stock underlying the securities issued. In the event the registration statement is not filed within 75 days after February 27, 2007, and the registration statement is not declared effective by July 27 2007, we will be required to pay liquidated damages in an amount equal to 2% for each 30 days (or such lesser pro-rata amount for any period of less than 30 days) of the purchase price of the outstanding shares and exercise price of the warrant shares owned of record by such holder which are subject to such non-registration event, but not to exceed in the aggregate 12% of the aggregate purchase price or $180,000. The transaction documents also provide for the payment of liquidated damages to the investors in certain events, including our failure to maintain an effective registration statement covering the resale of the common shares issuable upon conversion or exercise of the securities.

We agreed not to file any registration statements without the consent of the purchasers in the offering until the sooner of 24 months from the effective date of the registration statement of which this prospectus is a part or until all the shares, including the shares underlying the warrants, have been resold or transferred by the purchasers pursuant to the registration statement or Rule 144 of the Securities Act of 1933, without regard to volume limitations. During this same exclusion period, we also agreed not to issue any equity, convertible debt or other securities convertible into common stock or equity of our company without the prior written consent of the purchasers.

47

DESCRIPTION OF BUSINESS

Dragon International Group Corp. (“we,” “our,” “us,” “Dragon” or the “Company”) is a holding company that, through its subsidiary companies, manufactures and distributes assorted industrial paper and packaging products. Our operations are conducted through subsidiaries located in China. We are a manufacturer and distributor of a variety of paper products and packaging materials. Ningbo Dragon established in 1997, is located in Ningbo, of the Zhejiang Province in China, approximately 200 miles south of Shanghai. The main consumers of our products are packaging companies for the tobacco industry, cosmetics industry, pharmaceutical industry, as well as the wine and spirits, and the beverage industry. Our products are used both as a finished product and as well as a raw material to manufacture a variety of paper products and packaging materials.

Although we operate various entities, we identify our products under one product segment. The various entities combine their various resources to support the manufacture and distribution of paper and pulp related products.

Dragon International Group Corp. (“we,” “our,” “us,” “Dragon” “Dragon Nevada” or the “Company”) is a holding company that, through its subsidiary companies, manufactures and distributes assorted industrial paper and packaging products. All of our operations are located in the People's Republic of China (the “PRC”).

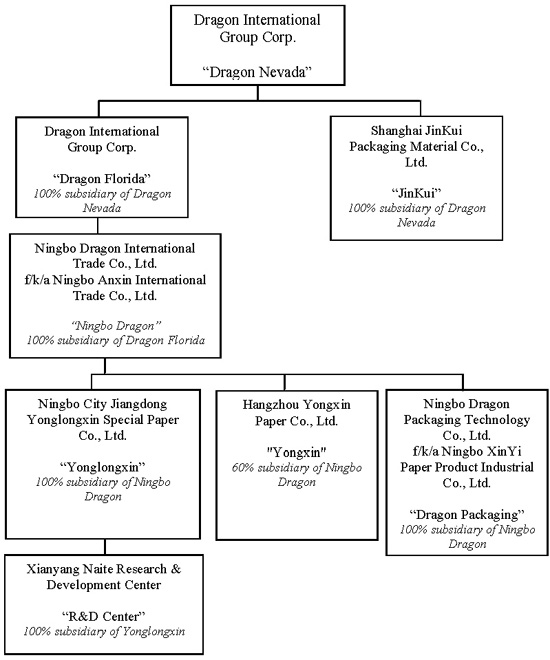

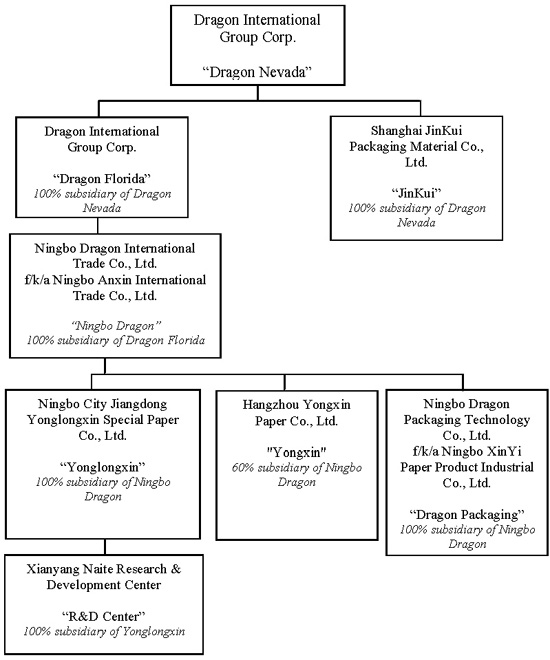

Dragon Nevada’s subsidiaries include:

- Dragon International Group Corp., a Florida corporation (“Dragon Florida”) is a wholly owned subsidiary of Dragon Nevada. Dragon Nevada acquired a 100% interest in Dragon Florida on October 4, 2004.

- Ningbo Dragon International Trade Co., Ltd., (“Ningbo Dragon”), formerly known as Ningbo Anxin International Trade Co., Ltd., was created on August 29, 1997. Ningbo Dragon is a wholly owned subsidiary of Dragon Florida. Dragon Florida acquired a 70% interest in Ningbo Dragon on June 21, 2004. On December 31, 2004 Dragon Nevada acquired the remaining 30% interest in Ningbo Dragon.

- Ningbo City Jiangdong Yonglongxin Special Paper Co., Ltd. (“Yonglongxin”) was created as a wholly owned subsidiary of Ningbo Dragon on November 8, 1999. Xianyang Naite Research and Development Center (“R&D Center”) was acquired by Yonglongxin on August 1, 2005.

- Ningbo Dragon Packaging Technology Co., Ltd., (“Dragon Packaging”) formerly known as Ningbo XinYi Paper Product Industrial Co., Ltd., is a wholly owned subsidiary of Ningbo Dragon. Ningbo Dragon acquired a 100% interest in Dragon Packaging on June 1, 2005.

- Hangzhou Yongxin Paper Co., Ltd., (“Yongxin”) is a subsidiary, of which Ningbo Dragon International Trade Co., Ltd., (“Ningbo Dragon”), holds a 60% interest. Ningbo Dragon acquired a 60% interest on July 1, 2005

- Shanghai JinKui Packaging Material Co., Ltd. (“JinKui”) is a wholly owned subsidiary of Dragon Nevada. Dragon Nevada acquired a 100% interest in JinKui on June 30, 2006.

48

Below is an organization chart of Dragon Nevada:

Our operations are conducted through Ningbo Dragon International Trade Co., Ltd. (“Ningbo Dragon”), our wholly owned subsidiary. Ningbo Dragon, established in 1997, is located in the Zhejiang Province of Ningbo in China, approximately 200 miles south of Shanghai. Ningbo Dragon is involved in the pulp and paper packaging material industry, operating as a manufacturer and distributor of paper and integrated packaging paper products. Ningbo Dragon, through a subsidiary, holds an ISO9000 certificate and national license to import and export products. In addition to its own operations, Ningbo Dragon operates four subsidiaries, including: (i) Ningbo City Jiangdong Yonglongxin Special Paper Co., Ltd. (“Yonglongxin”) which holds an ISO9000 certificate and operates a civil welfare manufacturing facility

49