SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material § 240.14a-12

(Name of Registrant as Specified in Its Charter)

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | 2. | Form, Schedule or Registration Statement No.: |

[LETTERHEAD OF BCSB BANKCORP, INC.]

January 12, 2007

Dear Stockholder:

We invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of BCSB Bankcorp, Inc. (the “Company”) to be held at Baltimore County Savings Bank, F.S.B.’s Perry Hall office located at 4208 Ebenezer Road, Baltimore, Maryland on Wednesday, February 14, 2007, at 4:00 p.m., Eastern time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of Baltimore County Savings Bank, F.S.B. (the “Bank”), the Company’s wholly owned subsidiary. Directors and officers of the Company and the Bank will be present to respond to any questions the stockholders may have.

ON BEHALF OF THE BOARD OF DIRECTORS, WE URGE YOU TO SIGN, DATE AND RETURN THE ACCOMPANYING FORM OF PROXY AS SOON AS POSSIBLE EVEN IF YOU CURRENTLY PLAN TO ATTEND THE ANNUAL MEETING. Your vote is important, regardless of the number of shares you own. This will not prevent you from voting in person but will assure that your vote is counted if you are unable to attend the meeting.

On behalf of the Board of Directors and all the employees of the Company and the Bank, I wish to thank you for your continued support.

|

Sincerely, |

/s/ Joseph J. Bouffard Joseph J. Bouffard |

President and Chief Executive Officer |

____________________________________________________________________________________________________________

BCSB BANKCORP, INC.

4111 E. Joppa Road, Suite 300

Baltimore, Maryland 21236

____________________________________________________________________________________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on February 14, 2007

____________________________________________________________________________________________________________

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of BCSB Bankcorp, Inc. (the “Company”) will be held at Baltimore County Savings Bank, F.S.B.’s Perry Hall office located at 4208 Ebenezer Road, Baltimore, Maryland on Wednesday, February 14, 2007, at 4:00 p.m., Eastern time.

A Proxy Statement and Proxy Card for the Annual Meeting are enclosed.

The Annual Meeting is for the purpose of considering and acting upon the following matters:

| | 1. | The election of three directors of the Company for three-year terms and one director of the Company for a two-year term; |

| | 2. | The ratification of the appointment of Stegman & Company as the independent registered public accounting firm of the Company for the fiscal year ending September 30, 2007; and |

| | 3. | The transaction of such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on any one of the foregoing proposals at the Annual Meeting on the date specified above or on any date or dates to which, by original or later adjournment, the Annual Meeting may be adjourned. Stockholders of record at the close of business on December 29, 2006, are the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

You are requested to fill in and sign the enclosed proxy card which is solicited by the Board of Directors and mail it promptly in the enclosed envelope. The proxy will not be used if you attend and vote at the Annual Meeting in person.

|

BY ORDER OF THE BOARD OF DIRECTORS |

/s/ David M. Meadows David M. Meadows |

Secretary |

Baltimore, Maryland

January 12, 2007

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO INSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

OF

BCSB BANKCORP, INC.

4111 E. Joppa Road, Suite 300

Baltimore, Maryland 21236

|

ANNUAL MEETING OF STOCKHOLDERS February 14, 2007 |

This Proxy Statement is furnished to stockholders of BCSB Bankcorp, Inc. (the “Company”) in connection with the solicitation by the Board of Directors of the Company of proxies to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) which will be held at Baltimore County Savings Bank, F.S.B.’s Perry Hall office located at 4208 Ebenezer Road, Baltimore, Maryland on Wednesday, February 14, 2007, at 4:00 p.m., Eastern time, and at any adjournment thereof. The accompanying Notice of Annual Meeting and proxy card and this Proxy Statement are being first mailed to stockholders on or about January 12, 2007.

|

| VOTING AND REVOCABILITY OF PROXIES |

Stockholders who execute proxies retain the right to revoke them at any time. Unless so revoked, the shares represented by properly executed proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies may be revoked by written notice to David M. Meadows, Secretary of the Company, at the address shown above, by filing a later-dated proxy prior to a vote being taken on a particular proposal at the Annual Meeting or by attending the Annual Meeting and voting in person. The presence of a stockholder at the Annual Meeting will not in itself revoke such stockholder’s proxy.

Proxies solicited by the Board of Directors of the Company will be voted in accordance with the directions given therein.Where no instructions are indicated, proxies will be voted for the nominees for directors set forth below and for the other proposition stated. The proxy confers discretionary authority on the persons named therein to vote with respect to the election of any person as a director where the nominee is unable to serve or for good cause will not serve, and matters incident to the conduct of the Annual Meeting. If any other business is presented at the Annual Meeting, proxies will be voted by those named therein in accordance with the determination of a majority of the Board of Directors. Proxies marked as abstentions will not be counted as votes cast. Shares held in street name which have been designated by brokers on proxies as not voted will not be counted as votes cast. Proxies marked as abstentions or as broker non-votes, however, will be treated as shares present for purposes of determining whether a quorum is present.

|

| VOTING SECURITIES AND SECURITY OWNERSHIP |

The securities entitled to vote at the Annual Meeting consist of the Company’s common stock, par value $.01 per share (the “Common Stock”). Stockholders of record as of the close of business on December 29, 2006 (the “Record Date”) are entitled to one vote for each share of Common Stock then held. As of the Record Date, there were 5,913,743 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of at least a majority of the total number of shares of Common Stock outstanding and entitled to vote will be necessary to constitute a quorum at the Annual Meeting.

Persons and groups beneficially owning more than 5% of the Common Stock are required to file certain reports with respect to such ownership pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The following table sets forth information regarding the shares of Common Stock beneficially owned as of the Record Date by persons who beneficially own more than 5% of the Common Stock, each of the Company’s directors, the executive officers of the Company named in the Summary Compensation Table, set forth under “Proposal I — Election of Directors — Executive Compensation — Summary Compensation Table,” and all of the Company’s directors and executive officers as a group.

| | | | |

| | | Shares of Common Stock

Beneficially Owned at Record Date (1) | | Percent of

Class (2) |

Persons Owning Greater than 5%: | | | | |

Baltimore County Savings Bank, M.H.C. 4111 E. Joppa Road, Suite 300 Baltimore, Maryland 21236 | | 3,754,960 | | 63.5% |

| | |

BCSB Bankcorp, Inc. Employee Stock Ownership Plan et. al. 4111 E. Joppa Road Suite 300 Baltimore, Maryland 21236 | | 419,211(3) | | 7.1 |

| | |

Directors: | | | | |

H. Adrian Cox | | 39,244 | | * |

Henry V. Kahl | | 36,604 | | * |

William M. Loughran | | 38,036 | | * |

John J. Panzer, Jr. | | 66,844 | | * |

P. Louis Rohe | | 41,444 | | * |

Michael J. Klein | | 15,465 | | * |

William J. Kappauf, Jr. | | 8,646 | | * |

Joseph J. Bouffard | | — | | |

| | |

Named Executive Officers: | | | | |

David M. Meadows | | 9,074 | | * |

Bonnie M. Klein | | 15,752 | | * |

| | |

All directors and executive | | 271,109 | | 4.5 |

officers of the Company as a group (10 persons) | | | | |

(1) | In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Common Stock if he or she has or shares voting or investment power with respect to such Common Stock. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct, and the named individuals and group exercise sole voting and investment power over the shares of the Common Stock. The listed amounts include 15,000, 15,500, 6,000, 6,000, 13,750, 6,000, 6,000, 3,000, 3,000 and 74,250, shares that Directors Cox, Kahl, Loughran, Panzer, Jr., Rohe, Klein and Kappauf, Named Executive Officers Meadows and Klein and all directors and executive officers of the Company as a group, respectively, have the right to acquire upon the exercise of options exercisable within 60 days of the Record Date. The listed amounts do not include shares with respect to which Directors Henry V. Kahl, H. Adrian Cox and William J. Kappauf, Jr. have voting power by virtue of their positions as trustees of the trusts holding 175,076 shares under the Company’s Employee Stock Ownership Plan (the “ESOP”) and 128,686 shares under the Baltimore County Savings Bank, F.S.B. (the “Bank”) Deferred Compensation Plan (the “DCP”), nor 47,000 shares as to which such individuals, along with Director Michael J. Klein, share dispositive power by virtue of their positions as directors of Baltimore County Savings Bank Foundation, Inc. (the “Foundation”), nor 19,364 shares with respect to which Directors Kahl, Cox, Panzer have voting power by virtue of their positions as trustees of the Management Recognition Plan (“MRP”) trust. ESOP shares are held in a suspense account for future allocation among participants as the loan used to purchase the shares is repaid. Shares held by the ESOP trust and allocated to the accounts of participants are voted in accordance with the participants’ instructions, and unallocated shares are voted in the same ratio as ESOP participants direct the voting of allocated shares or, in the absence of such direction, in the ESOP trustees’ best judgment. As of the Record Date, 160,060 shares had been allocated. Shares held by the DCP trust are voted in the same proportion as are the shares held by the ESOP trust. The shares held by the MRP trust are voted in the same proportion as the ESOP trustees vote the shares held in the ESOP trust. Shares held by the Foundation are voted in the same ratio as all other shares of Common Stock are voted. The shares held by the DCP trust are held for the benefit of directors in the following amounts: Mr. Cox, 14,432 shares; |

2

| Mr. Kahl, 13,212 shares; Mr. Loughran, 8,958, shares; Mr. Panzer 37,827 shares; Mr. Rohe, 12,911 shares; Mr. Klein, 5,317 shares; and Mr. Kappauf, 646 shares. Such directors bear the economic risk associated with such shares. |

(2) | Based on a total of 5,913,743 shares of Common Stock outstanding at the Record Date. |

(3) | Includes 175,076 shares owned by the ESOP, 128,686 shares owned by the DCP, 49,085 shares owned by the Bank’s 401(k) Plan, 19,364 shares owned by the MRP trust and 47,000 shares owned by the Foundation. Henry V. Kahl, H. Adrian Cox and William J. Kappauf, Jr., who serve as directors of the Company, serve as trustees of the ESOP and the DCP. Such individuals share voting power over shares held by the ESOP and the DCP and share dispositive power over shares held by the DCP trust. Such individuals and Company Director Michael J. Klein serve as four of the Foundation’s nine directors and share dispositive power over shares held by the Foundation. Henry V. Kahl, H. Adrian Cox and John J. Panzer, Jr. who serve as directors of the Company, serve as trustees of the MRP trust. The trustees of the MRP trust share voting and dispositive power over the shares held by the MRP trust. The Bank is the trustee of the 401(k) Plan assets invested in Common Stock, and in their capacities as directors of the Bank, Messrs. Kahl, Cox and Kappauf share voting and dispositive power over shares held by the 401(k) Plan. In their individual capacity, such individuals disclaim beneficial ownership of shares held by the ESOP, the DCP, the MRP trust, the 401(k) Plan and the Foundation. |

* | Less than 1% of outstanding Common Stock. |

|

| PROPOSAL I — ELECTION OF DIRECTORS |

General

The Company’s Board of Directors is composed of eight members, all of whom are independent under the listing standards of Nasdaq, except Joseph J. Bouffard and William M. Loughran. The Company’s Charter requires that directors be divided into three classes, as nearly equal in number as possible, with approximately one-third of the directors elected each year. At the Annual Meeting, three directors will be elected for terms expiring at the 2010 annual meeting of stockholders, and one director will be elected for a term expiring at the 2009 annual meeting of stockholders. The Board of Directors has nominated H. Adrian Cox, William M. Loughran and John J. Panzer, Jr. to serve as directors for three-year terms and Joseph J. Bouffard to serve as a director for a two-year term. All four nominees currently are members of the Board. Under Federal law and the Company’s Bylaws, directors are elected by a plurality of the votes at a meeting at which a quorum is present.

It is intended that the persons named in the proxies solicited by the Board of Directors will vote for the election of the named nominees. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the size of the Board may be reduced to eliminate the vacancy. At this time, the Board knows of no reason why any of the nominees might be unavailable to serve.

The following table sets forth, for each nominee for director and continuing director of the Company, his age, the year he first became a director of the Bank, which is the Company’s principal operating subsidiary, and the expiration of his term as a director. All such persons were appointed as directors in 1998 in connection with the incorporation and organization of the Company, except that Mr. Michael J. Klein was appointed a director of the Company and the Bank on November 28, 2001, William J. Kappauf was appointed a director of the Company and the Bank on March 27, 2002 and Joseph J. Bouffard was appointed a director of the Company and the Bank on November 27, 2006. Each director of the Company also is a member of the Boards of Directors of the Bank and Baltimore County Savings Bank, M.H.C. (the “MHC”).

3

| | | | | | |

Name | | Age at

September 30,

2006 | | Year First

Elected as

Director of

the Bank | | Current

Term to Expire |

|

| BOARD NOMINEES FOR TERMS TO EXPIRE IN 2010 |

| | | |

H. Adrian Cox | | 62 | | 1987 | | 2007 |

William M. Loughran | | 61 | | 1991 | | 2007 |

John J. Panzer, Jr. | | 64 | | 1991 | | 2007 |

|

| BOARD NOMINEE FOR A TERM TO EXPIRE IN 2009 |

| | | |

Joseph J. Bouffard | | 56 | | 2006 | | 2009(1) |

|

| DIRECTORS CONTINUING IN OFFICE |

| | | |

Henry V. Kahl | | 63 | | 1989 | | 2008 |

P. Louis Rohe | | 84 | | 1955 | | 2008 |

Michael J. Klein | | 51 | | 2001 | | 2008 |

William J. Kappauf, Jr. | | 60 | | 2002 | | 2009 |

(1) | Mr. Bouffard was appointed to the class of directors with terms expiring at the 2009 annual meeting of stockholders. However, under the Company’s Bylaws, a director appointed to fill a vacancy may serve only until the next election of directors by the stockholders. |

Set forth below is biographical information concerning the Company’s directors. Unless otherwise stated, all directors have held the positions indicated for at least the past five years.

H. Adrian Cox is an insurance agent with Rohe and Rohe Associates, Inc. in Baltimore, Maryland. Mr. Cox also is employed as a real estate agent with Century 21 Horizon Realty, Inc. in Baltimore, Maryland.

William M. Loughran was named Executive Vice President of the Bank effective January 1, 2005. He also serves as Executive Vice President of the Company and Baltimore County Savings Bank, M.H.C. (the “MHC”). Prior to being named Executive Vice President, he served as Senior Vice President of the Bank in charge of lending operations. Mr. Loughran joined the Bank in 1973.

John J. Panzer, Jr. has been a self-employed builder of residential homes since 1971.

Joseph J. Bouffard was named President of the Company, the Bank and the MHC effective November 27, 2006. Joseph J. Bouffard served as President and Chief Executive Officer of Patapsco Bancorp, Inc. and The Patapsco Bank until October 30, 2006. He joined The Patapsco Bank’s predecessor, Patapsco Federal Savings and Loan Association in April 1995 as its President and Chief Executive Officer and became President and Chief Executive Officer of Patapsco Bancorp, Inc. upon the formation of that company in 1996. Previously, Mr. Bouffard was Senior Vice President of The Bank of Baltimore, and its successor, First Fidelity Bank from 1990 to 1995. Prior to that, he was President of Municipal Savings Bank, FSB in Towson, Maryland. He is a current Board member of the Maryland Financial Bank and a former Board member of the Dundalk Community College Foundation and the Maryland Bankers Association. He is also a former chairman of the Board of Governors of the Maryland Mortgage Bankers Association, Treasurer of the Neighborhood Housing Services of Baltimore and a charter member and Treasurer of the Towson Towne Rotary Club.

Henry V. Kahl is an Assessor Supervisor with the State of Maryland Department of Assessments & Taxation in Baltimore, Maryland.

4

P. Louis Rohe has been retired for approximately 12 years. Prior to his retirement, Mr. Rohe was an attorney. He has been a director of the Bank since its incorporation in 1955.

Michael J. Klein is Vice President of Klein’s Super Markets, a family owned chain of supermarkets, with locations throughout Harford County, Maryland. Mr. Klein is also Vice President and partner in several other family owned businesses including Forest Hill Lanes, Inc., Colgate Investments, LLP and Riverside Parkway, LTD.

William J. Kappauf, Jr. is Director of Cash Management of Baltimore Gas & Electric Company, Baltimore, Maryland. He is a certified public accountant.

Executive Officers Who Are Not Directors

The following sets forth information with respect to executive officers of the Company who do not serve on the Board of Directors.

| | | | |

Name | | Age as of the

Record Date | | Title |

| | |

David M. Meadows | | 50 | | Executive Vice President, General Counsel and Secretary of the Company and the Bank |

| | |

Bonnie M. Klein | | 51 | | Senior Vice President and Treasurer of the Company and the Bank |

David M. Meadows was named Vice President, General Counsel and Secretary of the Company and the Bank effective January 4, 1999 and Executive Vice President of the Company and the Bank effective November 27, 2006. He served as President and Chief Executive Officer of the Company and the Bank on an interim basis from July 24, 2006 through November 26, 2006. Previously, he was a Partner in the law firm of Moore, Carney, Ryan and Lattanzi, L.L.C.

Bonnie M. Klein joined the Bank in 1975 and has served in various capacities of increasing responsibility since then. She was named Vice President and Treasurer of the Company and the Bank effective January 4, 1999 and Senior Vice President of the Company and the Bank effective January 1, 2005. She is a Certified Public Accountant.

Meetings and Committees of the Board of Directors

The Boards of Directors of the Company and the Bank meet monthly and may have additional special meetings. During the year ended September 30, 2006, the Board of Directors of the Company met 12 times and the Board of Directors of the Bank met 17 times. All directors attended at least 75% in the aggregate of the total number of Company Board of Directors meetings held during the year ended September 30, 2006 and the total number of meetings held by committees on which he served during such fiscal year.

Audit Committee.The Company has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board of Directors’ Audit Committee consists of Directors Kahl, Cox, Panzer and Kappauf. The members of the Audit Committee are “independent,” as “independent” is defined in Rule 4200(a)(15) of the National Association of Securities Dealers listing standards. The Company’s Board of Directors has determined that one member of the Audit Committee, William J. Kappauf, Jr., qualifies as an “audit committee financial expert” as defined in Section 401(h) of Regulation S-K promulgated by the Securities Exchange Commission. Director Kappauf is “independent,” as such term is defined in Item 7(d)(3)(iv)(A) of Schedule 14A under the Exchange Act. The Committee met five times during the year ended September 30, 2006 to examine and approve the audit report prepared by the independent registered public accounting firm of the Company, to review and recommend the independent registered public accounting firm to be engaged by the Company and to review internal accounting controls. The Company’s Board of Directors has adopted a written

5

charter for the Audit Committee. A copy of the Audit Committee Charter is attached to this Proxy Statement as Appendix A.

Compensation Committee.The Bank Board of Directors’ Compensation Committee consists of Directors Cox, Kahl, Rohe, Panzer, Klein and Kappauf. The Compensation Committee evaluates the compensation and benefits of the directors, officers and employees, recommends changes, and monitors and evaluates employee performance. The Compensation Committee reports its evaluations and findings to the full Board of Directors and all compensation decisions are ratified by the full Board of Directors. The Compensation Committee met once during the fiscal year ended September 30, 2006.

Nominating Committee. The Board of Directors’ Nominating Committee nominates directors to be voted on at the Annual Meeting and recommends nominees to fill any vacancies on the Board of Directors. The Nominating Committee consists of Directors Henry V. Kahl, William J. Kappauf, Jr. and Michael J. Klein. The members of the Nominating Committee are “independent directors” as defined in Nasdaq listing standards. The Board of Directors has adopted a Charter for the Nominating Committee. The Nominating Committee Charter is not available on the Company’s website, but was included as an appendix to the Company’s proxy statement prepared in connection with the Company’s 2005 annual meeting of stockholders. The Nominating Committee met once during the year ended September 30, 2006.

It is the policy of the Nominating Committee to consider director candidates recommended by security holders who appear to be qualified to serve on the Company’s Board of Directors. Any stockholder wishing to recommend a candidate for consideration by the Nominating Committee as a possible director nominee for election at an upcoming annual meeting of stockholders must provide written notice to the Nominating Committee of such stockholder’s recommendation of a director nominee no later than October 1 preceding the annual meeting of stockholders. Notice should be provided to: Corporate Secretary, BCSB Bankcorp, Inc., 4111 E. Joppa Road, Suite 300, Baltimore, Maryland 21236. Such notice must contain the following information:

| | • | | The name of the person recommended as a director candidate; |

| | • | | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| | • | | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| | • | | As to the stockholder making the recommendation, the name and address, as he or she appears on the Company’s books, of such stockholder; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address, along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| | • | | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In its deliberations, the Nominating Committee considers a candidate’s personal and professional integrity, knowledge of the banking business and involvement in community, business and civic affairs, and also considers whether the candidate would provide for adequate representation of the Bank’s market area. Any nominee for director made by the Nominating Committee must be highly qualified with regard to some or all the attributes listed in the preceding sentence. In searching for qualified director candidates to fill vacancies in the Board, the Nominating Committee solicits the Company’s then current directors for the names of potential qualified candidates. Moreover, the Nominating Committee may ask its directors to pursue their own business contacts for the names of potentially qualified candidates. The Nominating Committee would then consider the potential pool of director candidates, select a candidate based on the candidate’s qualifications and the Board’s needs, and conduct a thorough

6

investigation of the proposed candidate’s background to ensure there is no past history that would cause the candidate not to be qualified to serve as a director of the Company. In the event a stockholder has submitted a proposed nominee, the Nominating Committee would consider the proposed nominee in the same manner in which the Nominating Committee would evaluate nominees for director recommended by directors.

With respect to nominating an existing director for re-election to the Board of Directors, the Nominating Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Board Policies Regarding Communications With the Board of Directors and Attendance at Annual Meetings. The Board of Directors maintains a process for stockholders to communicate with the Board of Directors. Stockholders wishing to communicate with the Board of Directors should send any communication to Corporate Secretary, BCSB Bankcorp, Inc., 4111 E. Joppa Road, Suite 300, Baltimore, Maryland 21236. All communications that relate to matters that are within the scope of the responsibilities of the Board and its Committees are to be presented to the Board no later than its next regularly scheduled meeting. Communications that relate to matters that are within the responsibility of one of the Board Committees are also to be forwarded to the Chair of the appropriate Committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities, such as customer complaints, are to be sent to the appropriate officer. Solicitations, junk mail and obviously frivolous or inappropriate communications are not to be forwarded, but will be made available to any director who wishes to review them.

Directors are expected to prepare themselves for and to attend all Board meetings, the Annual Meeting of Stockholders and the meetings of the Committees on which they serve, with the understanding that on occasion a director may be unable to attend a meeting. All of the Company’s directors attended the Company’s 2006 Annual Meeting of Stockholders.

Executive Compensation

Summary Compensation Table.The following table sets forth the cash and noncash compensation for the last fiscal year awarded to or earned by the executive officers of the Company in fiscal 2006 that exceeded $100,000 for services rendered in all capacities to the Company, the Bank and their affiliates.

| | | | | | | | | | | | | | |

| | | | | Long-Term Compensation | | All Other

Compensation |

| | | Annual Compensation | | Awards | |

Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual

Compensation (1) | | Restricted

Stock

Awards | | Securities

Underlying

Options (#) | |

Gary C. Loraditch | | 2006 | | $219,150 | | $ — | | — | | — | | — | | $296,135(3) |

Former President (2) | | 2005 | | 266,664 | | — | | — | | — | | — | | 24,442 |

| | 2004 | | 255,102 | | 38,591 | | — | | — | | — | | 24,714 |

| | | | | | | |

William M. Loughran | | 2006 | | $186,953 | | $ — | | — | | — | | — | | $15,783(3) |

Executive Vice President | | 2005 | | 185,153 | | — | | — | | — | | — | | 20,038 |

| | 2004 | | 180,908 | | 27,529 | | — | | — | | — | | 23,632 |

| | | | | | | |

David M. Meadows | | 2006 | | $150,325 | | $ — | | — | | — | | — | | $7,911(3) |

Executive Vice President, | | 2005 | | 136,538 | | — | | — | | — | | — | | 15,111 |

General Counsel and | | 2004 | | 134,738 | | 13,499 | | — | | — | | — | | 17,301 |

Secretary (4) | | | | | | | | | | | | | | |

| | | | | | | |

Bonnie M. Klein | | 2006 | | $130,550 | | $ — | | — | | — | | — | | $7,165(3) |

Senior Vice President and | | 2005 | | 127,782 | | — | | — | | — | | — | | 13,761 |

Treasurer | | 2004 | | 119,444 | | 11,514 | | — | | — | | — | | 14,977 |

7

(1) | Executive officers of the Company receive indirect compensation in the form of certain perquisites and other personal benefits. The amount of such benefits received by the named executive officer in fiscal 2006 did not exceed the lesser of 10% of the executive officer’s salary and bonus or $50,000. |

(2) | Mr. Loraditch resigned from his positions as President of the Company, the Bank and the MHC effective July 24, 2006. |

(3) | Amounts include $3,867, $2,541, $2,397 and $1,899 in matching contributions made under the Bank’s 401(k) Plan for the benefit of Messrs. Loraditch, Loughran and Meadows and Ms. Klein, respectively, car allowances in the amounts of $8,000 and $6,000 for the benefit of Messrs. Loraditch and Loughran, respectively, $8,419, $7,242, $5,514 and $5,266 in stock allocated to the accounts of Messrs. Loraditch, Loughran, Meadows and Ms. Klein, respectively, under the ESOP, based upon the average of the high and low sales price of the Common Stock of $12.795 as of September 30, 2006, and $275,849 paid to Mr. Loraditch pursuant to an Agreement and General Release among the Company, the Bank, the MHC and Mr. Loraditch, pursuant to which agreement Mr. Loraditch resigned from employment and as a director of the Company, the MHC and the Bank. |

(4) | Mr. Meadows served as Acting President and Chief Executive Officer from July 24, 2006 through November 26, 2006. |

Fiscal Year-End Option Values. The following table sets forth information concerning the value as of September 30, 2006 of options held by the executive officers named in the Summary Compensation Table set forth above. No options were granted to or exercised by the named executive officers during fiscal 2006.

| | | | | | | | |

| | | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End | | Value of Unexercised

In-the-Money Options At Fiscal Year-End (1) |

Name | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Gary C. Loraditch | | 16,000 | | — | | $56,400 | | $— |

William M. Loughran | | 6,000 | | — | | 8,520 | | — |

David M. Meadows | | 3,000 | | — | | 4,260 | | — |

Bonnie M. Klein | | 3,000 | | — | | 4,260 | | — |

(1) | Calculated based on the product of: (a) the number of shares subject to options, and (b) the difference between the fair market value of underlying Common Stock at September 30, 2006, determined based on the closing sale price of the Common Stock of $12.795 as quoted on the Nasdaq Market, and the exercise prices of the options. |

Change-in-Control Severance Agreements. The Bank’s Severance Agreements with Officers Loughran, Meadows and Klein (collectively, the “Employees”) have a term ending on the earlier of (a) 36 months after their renewal on December 20, 2006, and (b) the date on which the Employee terminates employment with the Bank. On each annual anniversary date from the date of commencement of the Severance Agreements, the term of the Severance Agreements may be extended for additional one-year periods beyond the then effective expiration date upon a determination by the Board of Directors that the performance of these individuals has met the required performance standards and that such Severance Agreements should be extended. An Employee becomes entitled to collect severance benefits under the Severance Agreement in the event of the Employee’s (a) voluntary termination of employment (i) within 30 days following a change of control, or (ii) within 30 days of certain specified events that both occur during the Covered Period (defined below) and constitute a Change in Duties, or (b) involuntary termination of employment for any reason other than “for Cause” during the period that begins 12 months before a change in control and ends 18 months after a change in control (the “Covered Period”).

In the event an Employee becomes entitled to receive severance benefits, the Employee will (i) be paid an amount equal to (i) 2.99 times the annualized base salary paid to the Employee in the immediately preceding 12-month period (excluding board fees and bonuses), and (ii) will receive either cash in an amount equal to the cost to the Employee of obtaining all health, life, disability and other benefits which the Employee would have been eligible to participate in through the second annual anniversary date of his termination of employment or continued participation in such benefit plans through the second annual anniversary date of his termination of employment, to the extent the Employee would continue to qualify for participation therein. The Severance Agreements provide that within 10 business days of a change of control, the Bank shall fund, or cause to be funded, a trust in the amount necessary to pay amounts owed to the Employees as a result of the change of control. The amount to be paid to an

8

Employee from this trust upon his or her termination is determined according to the procedures outlined in the Severance Agreements, and any money not paid to the Employee is returned to the Bank.

These provisions may have an anti-takeover effect by making it more expensive for a potential acquiror to obtain control of the Company. In the event that one of these Employees prevails over the Bank in a legal dispute as to the Severance Agreement, he or she will be reimbursed for legal and other expenses.

Director Compensation

Fees. The Chairman of the Board of Directors receives a monthly retainer of $1,200 per month, and all other nonemployee directors receive $1,000 per month. Each nonemployee director also receives a fee of $400 per each regular and special Board and committee meeting attended. Directors who serve as officers of the Company or the Bank do not receive additional compensation for their service as directors.

Deferred Compensation Plan. The Bank maintains a Deferred Compensation Plan (the “DCP”) for directors and selected executive officers. Prior to each plan year, each non-employee director may elect to defer receipt of all or part of his future fees (including retainers), and any other participant may elect to defer receipt of up to 25% of salary or 100% of bonus compensation. On each September 30 beginning with 1998, each director participant who has between three and 12 years of service as a director will have his account credited with $6,222. A director participant who, after the DCP’s effective date, completes three years of service as a director, will have his account credited with $24,000 on the September 30 following completion of three years of service. The participant is entitled to elect to contribute deferred amounts into Company Stock and will be paid out by delivering only Company Stock to the participants, or they can defer their fees or compensation into a phantom investment vehicle with the investment return of certain measurement funds, the return on which is based upon the return on selected mutual funds. Each participant may make an election to receive Common Stock distributions and/or cash distributions, as the case may be, either in a lump sum or in annual installments over a period up to ten years. During the year ended September 30, 2006, the Bank credited $6,222 under the DCP to each of Directors Kappauf and Klein.

The Bank has established a grantor trust and may, at any time or from time to time, make additional contributions to the trust. In the event of a change in control, the Bank will contribute to the trust an amount sufficient to provide the trust with assets having an overall value equal to the aggregate account balances under the Plan. The trust’s assets are subject to the claims of the Bank’s general creditors and are available for eventual payments to participants.

Management Incentive Compensation Plan. The Bank’s Board of Directors adopted the Management Incentive Compensation Plan (the “MICP”), effective November 10, 2004, amending and restating the Incentive Compensation Plan originally adopted by the Board of Directors on October 1, 1994. The MICP is administered by the Executive Committee, which is appointed by the Bank’s Board of Directors. Under the MICP, each eligible employee receives annual cash bonus awards based on the Bank’s performance under criteria specified in the MICP. In addition, pursuant to the terms of the MICP, participants may defer some or all of their award into the DCP. During the year ended September 30, 2006, no bonuses were awarded to any participants under the MICP.

Stock Benefit Plans.Directors are also eligible to receive awards under the Company’s stock option plan and MRP, which became effective on July 15, 1999. During the year ended September 30, 2006, directors did not receive any awards under the option plan or the MRP.

Reimbursement for Tax Advice. The Bank’s Board of Directors has also adopted a policy to reimburse designated directors and officers for expenses they incur in connection with professional tax, estate planning or financial advice they obtain related to the benefits they receive under the stock and non-stock related benefit plans of the Bank and the Company. Reimbursements are limited to $1,000 for each eligible individual during any fiscal year, with a one-time allowance not to exceed $5,000 for estate planning expenses. The level of annual reimbursements may be increased to $2,000 on a one-time basis in the event of a change in control of the Company. No reimbursements were made by the Bank during the year ended September 30, 2006.

9

Transactions with Management

The Bank offers loans to its directors and officers. These loans currently are made in the ordinary course of business with the same collateral, interest rates and underwriting criteria as those of comparable transactions prevailing at the time and do not involve more than the normal risk of collectibility or present other unfavorable features. Under current law, the Bank’s loans to directors and executive officers are required to be made on substantially the same terms, including interest rates, as those prevailing for comparable transactions and must not involve more than the normal risk of repayment or present other unfavorable features. Furthermore, all loans to such persons must be approved in advance by a disinterested majority of the Board of Directors. At September 30, 2006, the Bank had $1.0 million in loans outstanding to directors and executive officers.

See “—Compensation Committee Interlocks and Insider Participation” for information regarding a transaction between the Bank and a limited liability company of which a director is a member.

Compensation Committee Report on Executive Compensation

Overview and Philosophy. The Company’s executive compensation policies are established by the Compensation Committee of the Board of Directors (the “Committee”) composed of six outside directors. The Committee is responsible for developing the Company’s executive compensation policies. The Company’s President, under the direction of the Committee, implements the Company’s executive compensation policies. The Committee’s objectives in designing and administering the specific elements of the Company’s executive compensation program are as follows:

| | • | | To link executive compensation rewards to increases in stockholder value, as measured by favorable long-term operating results and continued strengthening of the Company’s financial condition. |

| | • | | To provide incentives for executive officers to work towards achieving successful annual results as a step in achieving the Company’s long-term operating results and strategic objectives. |

| | • | | To correlate, as closely as possible, executive officers’ receipt of compensation with the attainment of specified performance objectives. |

| | • | | To maintain a competitive mix of total executive compensation, with particular emphasis on awards related to increases in long-term stockholder value. |

| | • | | To attract and retain top performing executive officers for the long-term success of the Company. |

| | • | | To facilitate stock ownership through the granting of stock options and other stock awards. |

In furtherance of these objectives, the Committee has determined that there should be various components of executive compensation: base salary, a cash bonus, and a stock option plan, a restricted stock plan, a 401(k) plan and ESOP designed to provide long-term incentives through the facilitation of stock ownership in the Company.

Base Salary. The Committee makes recommendations to the Board concerning executive compensation on the basis of surveys of salaries paid to executive officers of other savings bank holding companies, non-diversified banks and other financial institutions similar in size, market capitalization and other characteristics. The Committee’s objective is to provide for base salaries that are competitive with those paid by the Company’s peers.

Cash Bonus. The executive officers of the Company are eligible to receive a formula-based annual bonus pursuant to the MCIP. The Company’s executive officers can receive a maximum bonus of 22.5% of base salary for

10

senior vice presidents, 30.0% of base salary for executive vice presidents and 37.5% of base salary for the President and Chief Executive Officer. The actual bonus compensation awarded is based on the achievement of three critical minimum performance measures, which include two compliance factors and an individual performance rating, and four key Company performance factors: return on assets, return on equity, nonperforming loans and efficiency ratio. Each performance factor is weighted equally (25%) and has defined thresholds set by the board of directors. The formula is not subject to the discretion of the Committee.

Equity Compensation. The Committee believes that equity compensation is also an important element of compensation because it provides executives with incentives linked to the performance of the Common Stock. The Company awards stock options under its stock option plan and restricted stock under the MRP and maintains the ESOP as a means of providing employees the opportunity to acquire a proprietary interest in the Company and to link their interests with those of the Company’s stockholders. Options are granted with an exercise price equal to the market value of the Common Stock on the date of grant, and thus acquire value only if the Company’s stock price increases. Although there is no specific formula, in determining the level of options granted or restricted stock awards made under the MRP, the Committee takes into consideration an executive’s position, duties and responsibilities, the value of their services to the Company, the Bank and the MHC and other relevant factors. No options or restricted stock were awarded to executive officers for fiscal year ended September 30, 2006. No options held by any executive officer of the Company were repriced during the past fiscal year. Stock is allocated annually to all employees including executive officers, under the ESOP in accordance with the terms of that plan.

Compensation of the President. The Committee determines the President’s compensation on the basis of several factors. In determining the President’s base salary, the Committee conducted surveys of compensation paid to chief executive officers of similarly situated savings banks and non-diversified banks and other financial institutions of similar size. The Committee believes that the President’s base salary was generally competitive with or below the average salary paid to executives of similar rank and expertise at banking institutions which the Committee considered to be comparable. For the fiscal year ended September 30, 2006, the President did not received bonus compensation computed under the formula set forth in the MICP. Effective July 24, 2006, Mr. Gary C. Loraditch resigned as President of the Company and the Bank, and the Board of Directors appointed Mr. David M. Meadows to serve as President and Chief Executive Officer of the Company and the Bank on an interim basis. While he served in these positions, Mr. Meadows’ salary rate was increased to an amount that was $60,000 below that of Mr. Loraditch’s salary on an annual basis.

The Committee believes that the Company’s executive compensation program serves the Company and its shareholders by providing a direct link between the interests of executive officers and those of shareholders generally and by helping to attract and retain qualified executive officers who are dedicated to the long-term success of the Company.

|

MEMBERS OF THE COMPENSATION COMMITTEE |

|

H. Adrian Cox |

Henry V. Kahl |

P. Louis Rohe |

John J. Panzer, Jr. |

Michael J. Klein |

William J. Kappauf, Jr. |

Compensation Committee Interlocks and Insider Participation

The Company and the Bank had no “interlocking” relationships that existed during the year ended September 30, 2006 in which (i) any executive officer of the Company or the Bank served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity (other than the Bank and the Company), one of whose executive officers served on the Compensation Committee of the Company or the Bank, (ii) any executive officer of the Company or the Bank served as a director of another entity, one of whose executive officers served on the Compensation Committee of the Company or the Bank, or (iii) any executive officer of the Company or the Bank served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity (other than the Company and

11

the Bank), one of whose executive officers served as a member of the Company or the Bank’s Board of Directors. No member of the Compensation Committee of the Company or the Bank was (a) an officer or employee of the Company or the Bank or any of its subsidiaries during the fiscal year ended September 30, 2006, (b) a former officer of the Company or the Bank or any of its subsidiaries, or (c) an insider (i.e., director, officer, director or officer nominee, greater than 5% stockholder, or immediate family member of the foregoing) of the Company and directly or indirectly engaged in transactions with the Company, the Bank, or any subsidiary involving more than $60,000 during the fiscal year ended September 30, 2006, except Director Michael J. Klein is a member holding a 20% ownership interest in Colgate Investments, LLC, a limited liability company that owns real property that the Bank leases for a branch office site. The Bank paid $65,000 in rent to Colgate Investments, LLC during the year ended September 30, 2006. The remaining 80% of Colgate Investments, LLC is owned by Mr. Klein’s immediate family members.

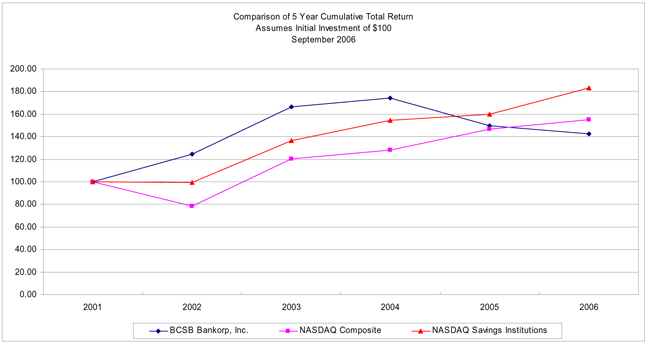

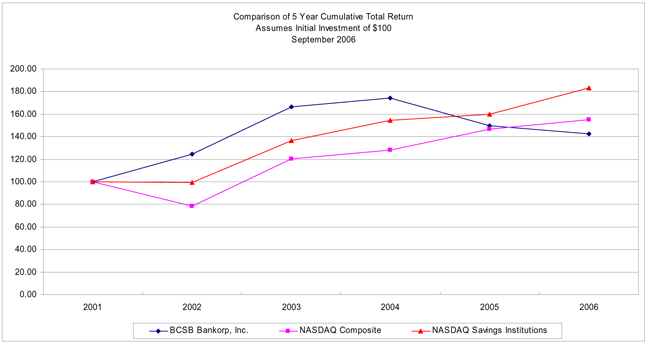

Comparative Stock Performance Graph

The graph and table which follow show the cumulative total return on the Common Stock during the period from September 30, 2001 through September 30, 2006 with (1) the total cumulative return of all companies whose equity securities are traded on the Nasdaq Stock Market and (2) the total cumulative return of savings institutions and savings institution holding companies traded on the Nasdaq Stock Market. The comparison assumes $100 was invested on September 30, 2001 in the Common Stock and in each of the foregoing indices and assumes reinvestment of dividends. The stockholder returns shown on the performance graph are not necessarily indicative of the future performance of the Common Stock or of any particular index.

CUMULATIVE TOTAL STOCKHOLDER RETURN

COMPARED WITH PERFORMANCE OF SELECTED INDEXES

September 30, 2001 through September 30, 2006

| | | | | | | | | | | | |

| | | 9/30/01 | | 9/30/02 | | 9/30/03 | | 9/30/04 | | 9/30/05 | | 9/30/06 |

COMPANY | | $100.00 | | $124.79 | | $166.33 | | $173.98 | | $149.44 | | $142.61 |

NASDAQ | | 100.00 | | 78.49 | | 120.23 | | 128.30 | | 146.52 | | 155.06 |

NASDAQ SAVINGS INSTITUTIONS | | 100.00 | | 99.34 | | 136.31 | | 154.35 | | 159.99 | | 183.06 |

12

|

PROPOSAL II — RATIFICATION OF APPOINTMENT OF INDEPENDANT REGISTERED PUBLIC ACCOUNTING FIRM |

The appointment of the independent registered public accounting firm must be approved by a majority of the votes cast by the stockholders of the Company at the Annual Meeting. The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of the independent registered public accounting firm.

Stegman & Company (“Stegman”) served as the Company’s independent registered public accounting firm for the 2006 fiscal year, and the Audit Committee of the Board of Directors has renewed the Company’s arrangements with Stegman to be the Company’s independent registered public accounting firm for the 2007 fiscal year, subject to ratification by the Company’s stockholders. A representative of Stegman will be present at the Annual Meeting to respond to stockholders’ questions and will have the opportunity to make a statement if he or she so desires. The representative will also be available to answer appropriate questions.

During the Company’s two fiscal years ended September 30, 2004 and 2003 and the subsequent interim period from October 1, 2004 through December 28, 2004 prior to Stegman’s engagement, neither the Company, nor any party at its behalf, consulted with Stegman regarding: (i) the application of accounting principles to a specified transaction, either completed or proposed; (ii) the type of audit opinion that might be rendered on the Company’s financial statements; (iii) any matter that was the subject of a disagreement with Beard Miller Company LLP (“Beard Miller”) on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure; or (iv) a “reportable event” as defined in Item 304(a)(1)(v) of Regulation S-K. Stegman’s reports on the Company’s financial statements for the fiscal years ended September 30, 2006 and 2005 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

On December 14, 2004, the Company engaged Stegman as its successor independent registered public accounting firm. On December 14, 2004, the Company advised Beard Miller of its decision not to reengage Beard Miller for auditing services. The engagement of Stegman and the decision not to renew the Company’s previous engagement of Beard Miller was approved by the Company’s Audit Committee on December 14, 2004 and became effective on December 28, 2004, the date on which Beard Miller completed its audit of the Company’s consolidated financial statements as of and for the year ended September 30, 2004.

During the Company’s two fiscal years ended September 30, 2004 and 2003 and the subsequent interim period from October 1, 2004 through December 28, 2004 preceding Stegman’s engagement, there were no disagreements with Beard Miller on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Beard Miller, would have caused Beard Miller to make reference to the subject matter of the disagreements in their report on the financial statements for such years.

|

| REPORT OF THE AUDIT COMMITTEE |

The Audit Committee of the Board of Directors (the “Audit Committee”) has:

| | 1. | Reviewed and discussed the audited financial statements for the fiscal year ended September 30, 2006 with management of the Company. |

| | 2. | Discussed with the Company’s independent registered public accounting firm the matters required to be discussed by Statement of Accounting Standards No. 61, as the same was in effect on the date of the Company’s financial statements; and |

| | 3. | Received the written disclosures and the letter from the Company’s independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as the same was in effect on the date of the Company’s |

13

| | | financial statements, and has discussed with the independent registered public accounting firm the independent registered public accounting firm’s independence. |

Based on the foregoing materials and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended September 30, 2006 be included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2006.

The Audit Committee has reviewed the non-audit services currently provided by the Company’s independent auditor and has considered whether the provision of such services is compatible with maintaining the independence of the Company’s independent registered public accounting firm.

|

Members of the Audit Committee |

|

Henry V. Kahl |

H. Adrian Cox |

John J. Panzer, Jr. |

William J. Kappauf, Jr. |

|

| AUDIT AND OTHER FEES PAID TO INDEPENDENT ACCOUNTANT |

The following table represents fees for professional audit services rendered by Stegman & Company for the audit of the annual financial statements of the Company for the years ended September 30, 2006 and 2005.

| | | | |

| | | 2006 | | 2005 |

Audit fees (1) | | $73,177 | | $69,419 |

Audit-Related Fees(2) | | 2,375 | | — |

Tax Services(3) | | 9,750 | | 8,060 |

All Other Fees | | — | | — |

(1) | Audit fees consist of fees for professional services rendered for the audit of the Company’s consolidated financial statements and review of financial statements included in the Company’s quarterly reports on Form 10-Q and services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements. |

(2) | Audit-related fees are for assurance and related services by the principal accountant that are related to the performance of audits or reviews of the Company’s financial statements and are not reported in the preceding Audit Fees category. The fees shown above were for due diligence services for potential acquisitions, technical accounting and reporting, consulting and research and employee benefit plan audits. |

(3) | Tax services fees consist of fees for compliance tax services, including tax planning and advice and preparation of tax returns. |

|

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

Pursuant to regulations promulgated under the Exchange Act, the Company’s officers and directors and all persons who own more than 10% of the Common Stock (“Reporting Persons”) are required to file reports detailing their ownership and changes of ownership in the Common Stock (collectively, “Reports”) and to furnish the Company with copies of all such Reports that are filed. Based solely on its review of such Reports or written representations that no such Reports were necessary that the Company received in the past fiscal year or with respect to the past fiscal year, management believes that during fiscal year 2006 all Reporting Persons have complied with these reporting requirements, except that Michael J. Klein filed one late Form 4 with respect to three transactions.

14

The Board of Directors is not aware of any business to come before the Annual Meeting other than those matters described above in this proxy statement and matters incident to the conduct of the Annual Meeting. However, if any other matters should properly come before the Annual Meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the determination of a majority of the Board of Directors.

The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Common Stock. In addition to solicitations by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telegraph or telephone without additional compensation therefor.

The Company’s 2006 Annual Report to Stockholders, including financial statements, is being mailed to all stockholders of record as of the close of business on the Record Date. Any stockholder who has not received a copy of such Annual Report may obtain a copy by writing to the Secretary of the Company. Such Annual Report is not to be treated as a part of the proxy solicitation materials or as having been incorporated herein by reference.

For consideration at the Annual Meeting, a stockholder proposal must be delivered or mailed to the Company’s Secretary no later than January 22, 2007. In order to be eligible for inclusion in the proxy materials of the Company for the Annual Meeting of Stockholders for the year ending September 30, 2007, any stockholder proposal to take action at such meeting must be received at the Company’s executive offices at 4111 E. Joppa Road, Suite 300, Baltimore, Maryland 21236 by no later than September 14, 2007. Any such proposals shall be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934, as amended.

|

BY ORDER OF THE BOARD OF DIRECTORS |

/s/ David M. Meadows David M. Meadows |

Secretary |

January 12, 2007

Baltimore, Maryland

|

| ANNUAL REPORT ON FORM 10-K |

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2006 AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WILL BE FURNISHED WITHOUT CHARGE TO EACH STOCKHOLDER AS OF THE RECORD DATE UPON WRITTEN REQUEST TO THE CORPORATE SECRETARY, BCSB BANKCORP, INC., 4111 JOPPA ROAD, SUITE 300, BALTIMORE, MARYLAND 21236.

15

Appendix A

BCSB BANKCORP, INC.

Baltimore County Savings Bank, FSB

AUDIT COMMITTEE CHARTER

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the financial statements of the Company, (2) the compliance by the Company with legal and regulatory requirements and (3) the independence and performance of the Company’s internal and external auditors.

The members of the Audit Committee shall meet the independence and experience requirements of applicable laws, regulations and the NASDAQ Stock Market, Inc. The Audit Committee shall consist of a minimum of three (3) outside directors, and a maximum of six (6) outside directors. The members of the Audit Committee shall be appointed by the Board to serve a one year term.

The Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee. The Audit Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any member of, or consultants to, the Committee.

The Audit Committee shall make regular reports to the Board. The Audit Committee shall meet at least quarterly and shall make regular reports to the Board. Additional meetings shall be scheduled as considered necessary by the Committee or its chairman.

The Audit Committee shall:

| | 1. | Review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. |

| | 2. | Review the annual audited financial statements with management, including major issues regarding accounting and auditing principles and practices as well as the adequacy of internal controls that could significantly affect the Company’s financial statements. |

| | 3. | Review an analysis prepared by management and the independent auditor of significant financial reporting issues and judgements made in connection with the preparation of the Company’s financial statements. |

| | 4. | Periodically consult with the independent auditor, outside of the presence of management, about the internal controls and the completeness and accuracy of the Company’s financial statements. |

| | 5. | Review with management and the independent auditor the Company’s quarterly financial statements prior to the filing of its Form 10-Q. |

| | 6. | Meet periodically with management to review the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. |

A-1

| | 7. | Review major changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditor, internal auditors or management. |

| | 8. | Review any significant disagreement between Management, the Independent Accounting Firm and the Internal Auditor in connection with the preparation of the financial statements, including any disagreements which, if not satisfactorily resolved, could have caused them to issue a nonstandard report on the Bank’s financial statements. |

| | 9. | Nominate and appoint the independent auditor, which firm is ultimately accountable to the Audit Committee and the Board. |

| | 10. | Approve the fees to be paid to and compensate the independent auditor. |

| | 11. | Receive periodic reports from the independent auditor regarding the auditor’s independence consistent with Independence Standards Board Standard 1, discuss such reports with the auditor, and if so determined by the Audit Committee, take or recommend that the full Board take appropriate action to oversee the independence of the auditor. |

| | 12. | Evaluate together with the Board the performance of the independent auditor, and if so determined by the Audit Committee, recommend that the Board replace the independent auditor. |

| | 13. | Review the appointment and replacement of the internal auditor and meet with the internal auditor on a regular basis, reviewing periodic reports of the internal auditor on a regular basis. |

| | 14. | The Committee should review the Company’s internal audit policy on a periodic basis to determine its adequacy. |

| | 15. | Obtain reports from management that the Company’s affiliated entities are in conformity with applicable legal requirements. The Committee shall review and, if found appropriate, approve all “related” party transactions in accordance with Item 404 of SEC Regulation S-K, and applicable Nasdaq listing requirements. |

| | 16. | Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. |

| | 17. | Review and resolve with the independent auditor any problems or difficulties the auditor may have encountered and any management letter provided by the auditor and the Company’s response to that letter. Such review should include: |

| | (a) | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to required information |

| | (b) | Any changes required in the planned scope of the internal audit. |

| | 18. | Prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company’s annual proxy statement. |

| | 19. | Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations. |

| | 20. | Review with the Company’s General Counsel legal matters that may have a material impact on the financial statements, the Company’s compliance policies and any material reports or inquiries received from regulators or governmental agencies. |

| | 21. | Meet at least annually with the chief financial officer and the independent auditor in separate executive sessions. |

| | 22. | Be provided funding by the Company for payment of: (i) compensation to the independent auditor, (ii) compensation for any advisors employed by the audit |

A-2

| | committee and (iii) ordinary administrative expenses of the audit committee that are necessary or appropriate in carrying out it duties. |

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent auditor. It is not the duty of the Audit Committee to assure compliance with laws and regulations.

On August 13, 2003, the Audit Committee established procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and (ii) the confidential anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

A-3

ANNUAL MEETING OF STOCKHOLDERS OF

BCSB BANKCORP, INC.

February 14, 2007

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

ê Please detach along perforated line and mail in the envelope provided.ê

| | | | | | |

The Board of Directors recommends a vote “FOR” the listed nominees and the other proposition stated. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx |

| | | | | | | | | | | | | | | | | | | | | | |

1. The election as directors of all nominees listed below (except as marked to the contrary below). | | | | 2. | | Proposal to ratify the appointment of Stegman & Company as independent registered public accounting firm of the Company for the fiscal year ending September 30, 2007. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ | | |

| | | | NOMINEES: | | | | | | | | | | | | | | | | |

¨ | | FOR ALL NOMINEES | | ¨ H. Adrian Cox | | Term expiring in 2010 | | | | | | | | | | | | | | |

| | | | ¨ William M. Loughran | | Term expiring in 2010 | | | | | | Should the undersigned be present and elect to vote at the Annual Meeting or at any adjournment thereof, then the power of said attorneys and prior proxies shall be deemed terminated and of no further force and effect. The undersigned may also revoke his or her proxy by filing a subsequent proxy or notifying the Secretary of his or her decision to terminate his or her proxy. |

¨ | | WITHHOLD AUTHORITY FOR ALL NOMINEES | | ¨ John J. Panzer, Jr. ¨ Joseph J. Bouffard | | Term expiring in 2010 Term expiring in 2009 | | | | | |

¨ | | FOR ALL EXCEPT | | | | | | | | | | | |

| | (See instructions below) | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | The undersigned acknowledges receipt from the Company prior to the execution of this proxy of a Notice of Annual Meeting and a Proxy Statement dated January 12, 2007. |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:n | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | | | | | | | | | | | | | |

| | ¨ | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Signature of Stockholder | | | | Date: | | | | | | | | Signature of Stockholder | | | | Date: | | |

Note:Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

REVOCABLE PROXY

BCSB BANKCORP, INC.

Baltimore, Maryland

ANNUAL MEETING OF STOCKHOLDERS

February 14, 2007

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints the Board of Directors, with full powers of substitution, to act as attorneys and proxies for the undersigned, to vote all shares of the common stock of BCSB Bankcorp, Inc. which the undersigned is entitled to vote at the Annual Meeting of Stockholders, to be held at Baltimore County Savings Bank, F.S.B.’s Perry Hall office located at 4208 Ebenezer Road, Baltimore, Maryland, on Wednesday, February 14, 2007, at 4:00 p.m., Eastern time (the “Annual Meeting”), and at any and all adjournments thereof, as follows:

THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE NOMINEES AND FOR THE OTHER PROPOSITION STATED. IF ANY OTHER BUSINESS IS PRESENTED AT THE ANNUAL MEETING, INCLUDING MATTERS RELATING TO THE CONDUCT OF THE ANNUAL MEETING, THIS PROXY WILL BE VOTED BY THOSE NAMED IN THIS PROXY IN ACCORDANCE WITH THE DETERMINATION OF A MAJORITY OF THE BOARD OF DIRECTORS. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE ANNUAL MEETING.

(Continued and to be signed on the reverse side)