|

Filed by Penseco Financial Services Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 |

|

Subject Company: Penseco Financial Services Corporation Commission File No. 000-23777 |

Penn

Security

Bank & Trust Est. 1902

Strength You Can Bank On

Peoples PNB

Neighborhood Bank

Your Bank for Life.

June 28, 2013

AGENDA

I. The merger: What is happening?

II. Reasons for the merger: Why are we merging?

III. What does this merger mean for our shareholders?

IV. What does this merger mean for our employees?

V. What does this merger mean for our customers?

VI. What does this merger mean for our communities?

VII. Time Frame

VIII. Questions and Answers

1

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for future financial or operating results and/or other matters regarding or affecting Penseco Financial Services Corporation, Penn Security Bank & Trust Company or its subsidiaries (collectively, the “Company” or “we”) that are considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). Such forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “intend” and “potential”. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the PSLRA.

The Company cautions you that a number of important factors could cause actual results to differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: prevailing economic and political conditions, particularly in our market area; credit risk associated with our lending activities; changes in interest rates, loan demand, real estate values and competition; changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; and other economic, competitive, governmental, regulatory and technological factors affecting the Company’s operations, pricing, products and services and other factors that may be described in the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission (“SEC”) from time to time.

In addition to these risks, acquisitions and business combinations-such as the business combination currently proposed with Peoples Financial Services Corp., present us with risks other than those presented by the nature of the business acquired. Acquisitions and business combinations may be substantially more expensive to complete than originally anticipated, and the anticipated benefits may be significantly harder-or take longer-to achieve than expected. As a regulated financial institution, our pursuit of attractive acquisition and business combination opportunities could be negatively impacted by regulatory delays or other regulatory issues. Regulatory and/or legal issues related to the pre-acquisition operations of an acquired or combined business may cause reputational harm to the Company following the acquisition or combination, and integration of the acquired or combined business with ours may result in additional future costs arising as a result of those issues.

The forward-looking statements are made as of the date of this presentation, and, except as may be required by applicable law or regulation, the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

2

I. The merger: What is happening?

Today our Board approved, and we signed, a definitive agreement to merge with and into Peoples Financial Services Corp. The combined organization, based on financial data as of March 31, 2013, would have approximately $1.6 billion in assets, and would be the largest Northeastern Pennsylvania-headquartered bank, as well as the 16th largest bank headquartered in Pennsylvania. Subject to consummation of the proposed merger (which, assuming the timely receipt of regulatory and shareholder approvals, we expect to occur in the fourth quarter of 2013):

Penseco shareholders will control 59% of the outstanding shares of the combined company and Peoples shareholders will control 41% of the outstanding shares of the combined company.

The combined bank will be named Peoples Security Bank and Trust Company.

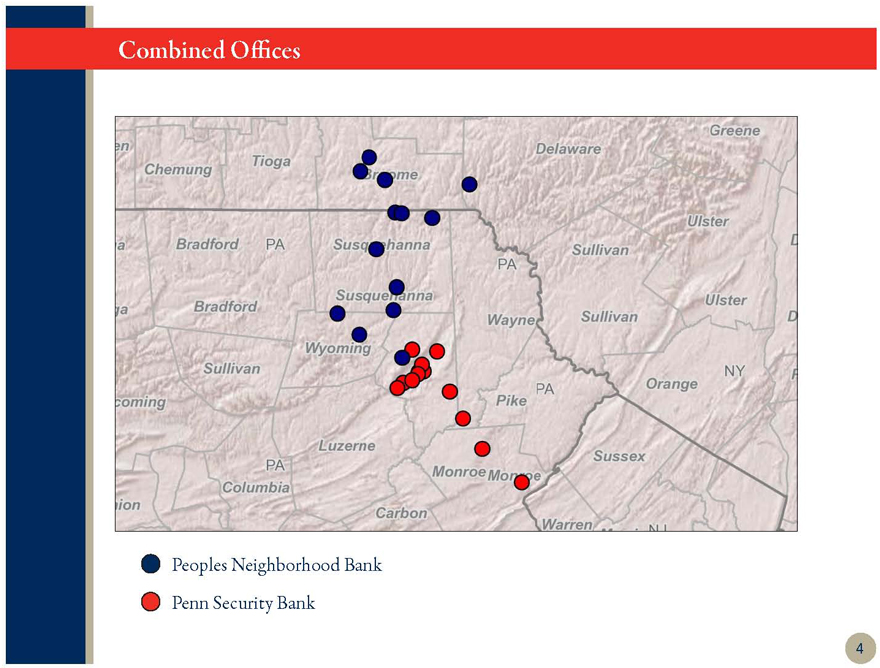

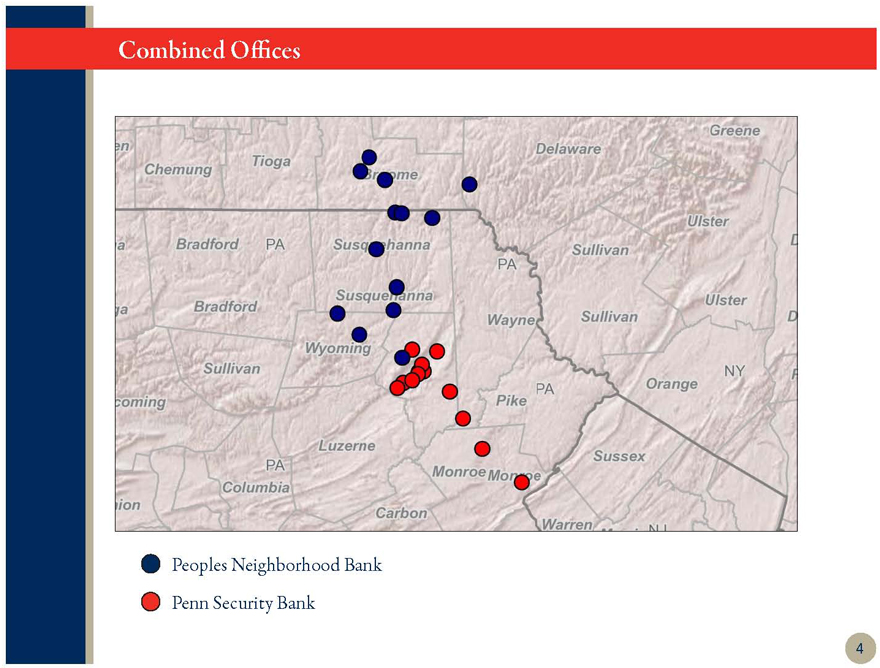

The combined bank will have 25 community offices with no overlap of branches.

The combined company will be headquartered in Scranton, PA with IT and Deposit Operations located in Hallstead, PA.

The Chairman of the Board will be the current Chairman of the Peoples Board, William E. Aubrey II, President & CEO of Gertrude Hawk Chocolates. The Board will be comprised of 14 Board Members: 8 from the Penseco Financial Services Corporation Board and 6 from the Peoples Financial Services Corp. Board.

The President and CEO of the new company will be Craig W. Best, current President & CEO of Penn Security Bank and Trust Company. Alan W. Dakey will continue as President & CEO of Peoples Neighborhood Bank through the closing of this transaction. He will then assist with the integration of the two companies through a consulting engagement.

3

Combined Offices

Chemung

Bradford

Bradford

Sullivan

PA

Columbia

Tioga

PA

Susquehanna

Susquehanna

Wyoming

Luzerne

Carbon

Monroe

Delaware

PA

Wayne

PA

Pike

Monroe

Sullivan

Sullivan

Orange

Sussex

Warren

Greene

Ulster

Ulster

NY

Peoples Neighborhood Bank Penn Security Bank

4

II. Reasons for the merger: Why are we merging?

After careful consideration, the Boards of Directors of the Company and Peoples agreed that a merger of the two banks represents an exciting opportunity to grow our business and expand our impact on the Northeastern Pennsylvania and Southern New York communities. In particular, the Company’s board considered the following, among other, factors:

A. Improved Profitability and Valuation - The combined company should be larger, stronger, and we expect it to be more profitable than either company is independently.

B. Improved Ability to Grow Organically - Size and scale should enable the new company to invest more in new markets, employees, technology, products, and marketing.

C. Increased Opportunity for Inorganic Growth - The ability to acquire more banks or

branches should increase dramatically with our size and strength.

D. More Diverse Revenue Stream - The opportunities for Wealth Management and Merchant Services should significantly increase with access to the Marcellus Shale activity.

E. Improved Shareholder Liquidity - With a larger market capitalization and planned listing on NASDAQ, we expect higher trading volume and increased liquidity for shareholders.

5

III. What does this merger mean for our shareholders?

More reliable value – With a larger shareholder base and market capitalization, we anticipate that our stock price will more accurately reflect our underlying financial performance, which has been strong.

Improved liquidity – With a larger market capitalization, a planned listing on NASDAQ, and a commitment to maintain a strong dividend, we expect to see a meaningful increase in our daily trading volume.

Improved profitability – Economies of scale should drive cost efficiencies, and cross– pollenization of revenue channels should improve combined company performance.

6

IV. What does this merger mean for our employees?

Expanded career opportunities – Increased size and scale of company creates ability to expand lines of business or enter new business lines.

Ability to increase training investment – Increased scope and complexity of a larger company necessitates increased, continual investment in our employees.

7

V. What does this merger mean for our customers?

Added convenience – Addition of 12 offices and 12 ATMs provides more customer touch points and improved regional branding. Wider product and service offering – Increased lending limit and sharing of best practices should result in a better customer experience.

Ability to upgrade technology – Cost savings from core systems can be channeled into mobile and internet applications.

8

VI. What does this merger mean for our communities?

Largest headquartered bank in NEPA – expected to have $1.6 billion in pro forma assets

Major force in economic development for NEPA

Commerce – in 2012, the two companies collectively spent approximately $8.5 million with 965 local companies

Employees – the new company is expected to employ approximately 383 banking professionals

Contributions – in 2012, the two companies combined contributed approximately $763,000 to local charities and nonprofit organizations

Financing – in 2012, the two companies extended over $380 million in credit to local residents and businesses

9

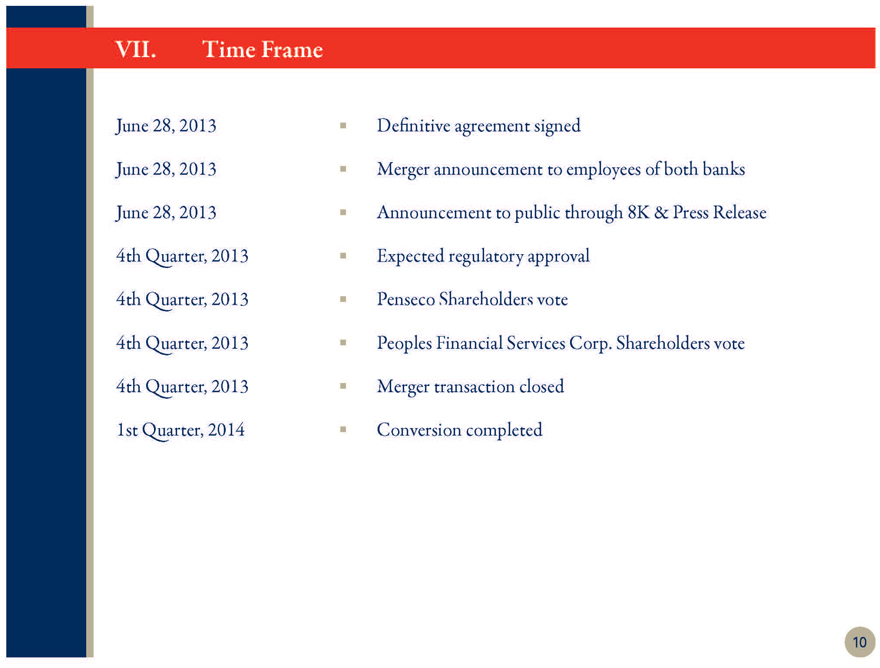

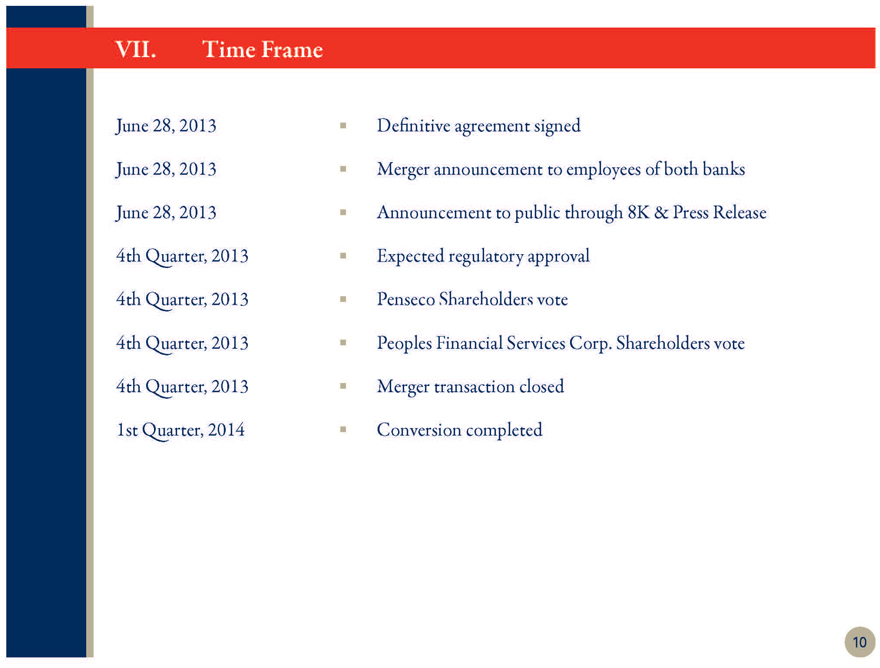

VII. Time Frame

June 28, 2013 Definitive agreement signed

June 28, 2013 Merger announcement to employees of both banks

June 28, 2013 Announcement to public through 8K & Press Release

4th Quarter, 2013 Expected regulatory approval

4th Quarter, 2013 Penseco Shareholders VIII. Timevote Frame

4th Quarter, 2013 Peoples Financial Services Corp. Shareholders vote

4th Quarter, 2013 Merger transaction closed

1st Quarter, 2014 Conversion completed

10

Additional Information About the Merger:

Peoples Financial Services Corp. will be filing a registration statement, which will include a joint proxy statement/prospectus of Penseco Financial Services Corporation and Peoples Financial Services Corp., and other relevant documents concerning the merger with the SEC. WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SEC’s website, http://www.sec.gov/. In addition, documents filed with the SEC by Penseco Financial Services Corporation will be available free of charge by written request to Mr. Patrick M. Scanlon, Senior Vice President, Finance Division Head, Penn Security Bank & Trust Company, 150 North Washington Avenue, Scranton, Pennsylvania 18503 or oral request to Mr. Scanlon at (570) 346-7741, extension 2316.

Documents filed with the SEC by Peoples Financial Services Corp. will be available free of charge by written request to Mr. Alan W. Dakey, President and CEO, or Mr. Scott A. Seasock, Senior Vice President and Chief Financial Officer, 82 Franklin Avenue, Hallstead, PA 18822, or oral request to Mr. Dakey or Mr. Seasock at (570) 879-0571.

The directors, executive officers, and certain other members of management and employees of Penseco Financial Services Corporation and Peoples Financial Services Corp. are participants in the solicitation of proxies in favor of the merger from the shareholders of Penseco Financial Services Corporation and Peoples Financial Services Corp. Information about the directors and executive officers of Penseco Financial Services Corporation is set forth in its Annual Report on Form 10-K filed on March 14, 2013 for the year ended December 31, 2012 (including the definitive proxy statement filed on April 1, 2013 and incorporated by reference therein). Additional information regarding the interests of such participants, as well as information about the directors and executive officers of Peoples Financial Services Corp., will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC if and when they become available.

14