Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

IPAA OGIS West 2004

San Francisco, CA

September 28, 2004

Forward Looking Statements

This presentation includes certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this presentation, other than statements of historical facts, that address the future direction, management and control of the Company, capital expenditures, and events or developments that the Company expects or believes are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include oil and gas prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. These risks are presented in detail in our filings with the Securities and Exchange Commission. The Company has no obligation to update the statements contained in this presentation or to take action that is described herein or otherwise presently planned.

[LOGO]

2

Table Of Contents

3

Introduction – Petrohawk Energy Corporation

• Houston-based E&P company formed in June 2003

• Initial capitalization -$60 million, December 2003

• Significant management investment – 10%

• Search for non-price driven opportunities

• Principals have a proven track record of creating shareholder value

• Acquisitions

• Exploration

• Property portfolio management

• Capital markets

• Closed recap of Beta Oil & Gas, Inc. – May 25, 2004

• $60 million investment

• Public platform for future growth

• Current market cap ~ $110 million

• Monetize at an appropriate time

• Provide superior returns to partners and shareholders

4

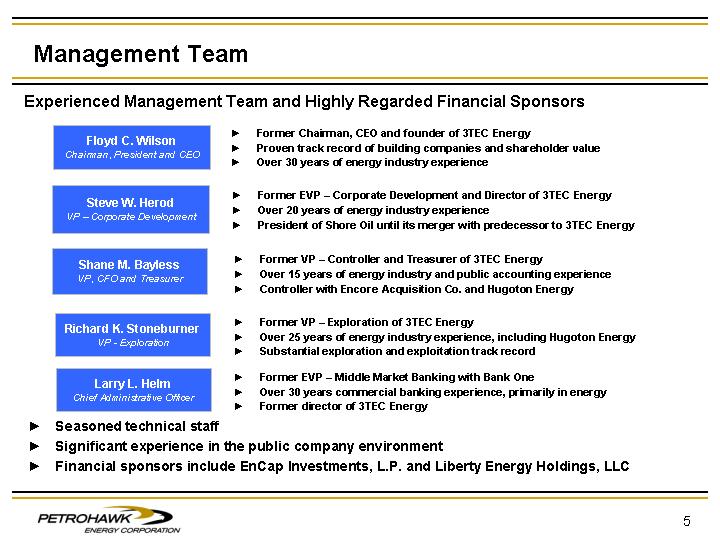

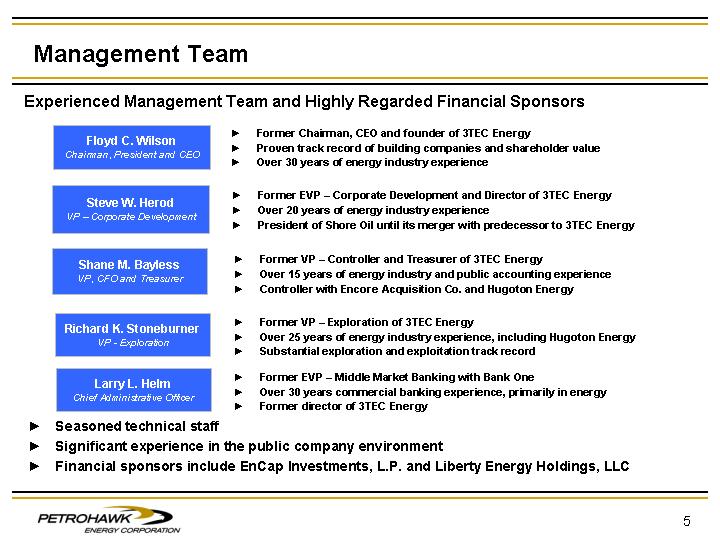

Management Team

Experienced Management Team and Highly Regarded Financial Sponsors

Floyd C. Wilson

Chairman, President and CEO | • | Former Chairman, CEO and founder of 3TEC Energy |

• | Proven track record of building companies and shareholder value |

• | Over 30 years of energy industry experience |

| | |

Steve W. Herod

VP – Corporate Development | • | Former EVP – Corporate Development and Director of 3TEC Energy |

• | Over 20 years of energy industry experience |

• | President of Shore Oil until its merger with predecessor to 3TEC Energy |

| | |

Shane M. Bayless

VP, CFO and Treasurer | • | Former VP – Controller and Treasurer of 3TEC Energy |

• | Over 15 years of energy industry and public accounting experience |

• | Controller with Encore Acquisition Co. and Hugoton Energy |

| | |

Richard K. Stoneburner

VP - Exploration | • | Former VP – Exploration of 3TEC Energy |

• | Over 25 years of energy industry experience, including Hugoton Energy |

• | Substantial exploration and exploitation track record |

| | |

Larry L. Helm

Chief Administrative Officer | • | Former EVP – Middle Market Banking with Bank One |

• | Over 30 years commercial banking experience, primarily in energy |

• | Former director of 3TEC Energy |

• Seasoned technical staff

• Significant experience in the public company environment

• Financial sponsors include EnCap Investments, L.P. and Liberty Energy Holdings, LLC

5

Board of Directors

David Miller | • | EnCap Investments, L.P. |

| | |

Marty Phillips | • | EnCap Investments, L.P. |

| | |

Daniel Rioux | • | Liberty Energy Holdings |

| | |

Jimmy Irish | • | Thompson & Knight |

| | |

Tucker Bridwell | • | Mansefeldt Investment Corp. |

| | |

Robert Stone | • | Whitney Bank |

| | |

Floyd Wilson | • | Petrohawk Energy Corporation |

6

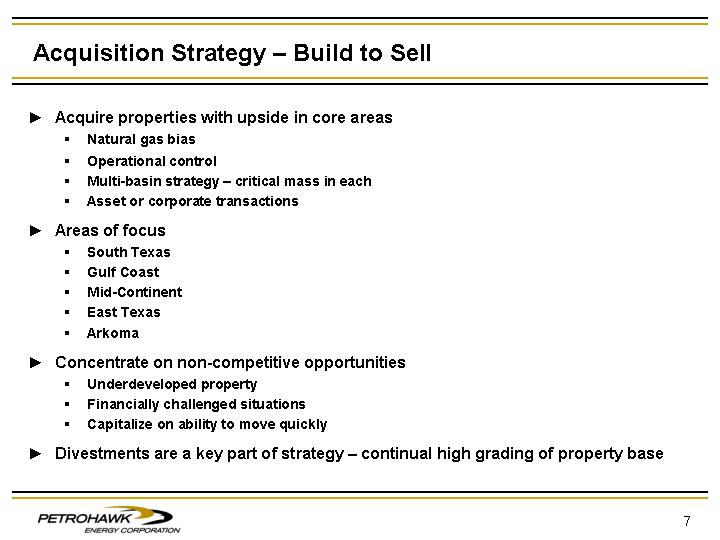

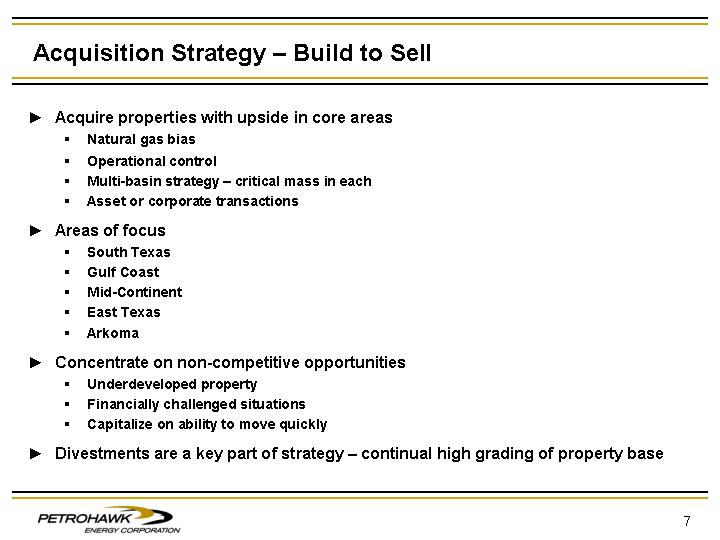

Acquisition Strategy – Build to Sell

• Acquire properties with upside in core areas

• Natural gas bias

• Operational control

• Multi-basin strategy – critical mass in each

• Asset or corporate transactions

• Areas of focus

• South Texas

• Gulf Coast

• Mid-Continent

• East Texas

• Arkoma

• Concentrate on non-competitive opportunities

• Underdeveloped property

• Financially challenged situations

• Capitalize on ability to move quickly

• Divestments are a key part of strategy – continual high grading of property base

7

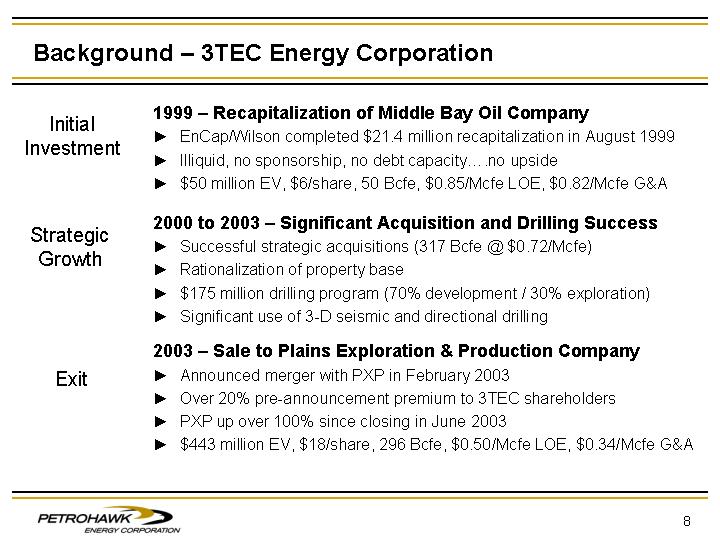

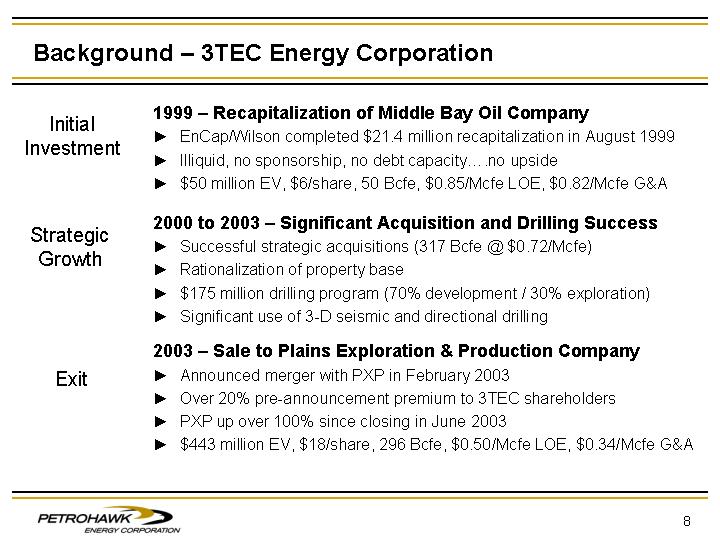

Background – 3TEC Energy Corporation

Initial

Investment | | 1999 – Recapitalization of Middle Bay Oil Company |

• | EnCap/Wilson completed $21.4 million recapitalization in August 1999 |

• | Illiquid, no sponsorship, no debt capacity....no upside |

• | $50 million EV, $6/share, 50 Bcfe, $0.85/Mcfe LOE, $0.82/Mcfe G&A |

| | |

Strategic

Growth | | 2000 to 2003 – Significant Acquisition and Drilling Success |

• | Successful strategic acquisitions (317 Bcfe @ $0.72/Mcfe) |

• | Rationalization of property base |

• | $175 million drilling program (70% development / 30% exploration) |

• | Significant use of 3-D seismic and directional drilling |

| | |

Exit | | 2003 – Sale to Plains Exploration & Production Company |

• | Announced merger with PXP in February 2003 |

• | Over 20% pre-announcement premium to 3TEC shareholders |

• | PXP up over 100% since closing in June 2003 |

• | $443 million EV, $18/share, 296 Bcfe, $0.50/Mcfe LOE, $0.34/Mcfe G&A |

8

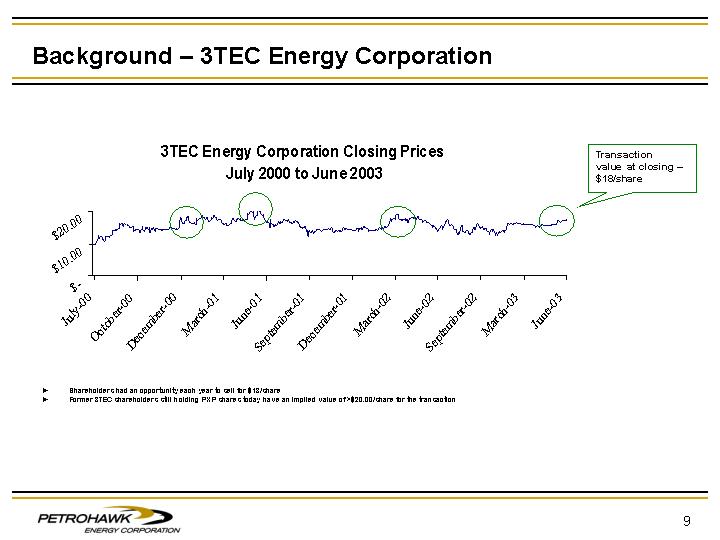

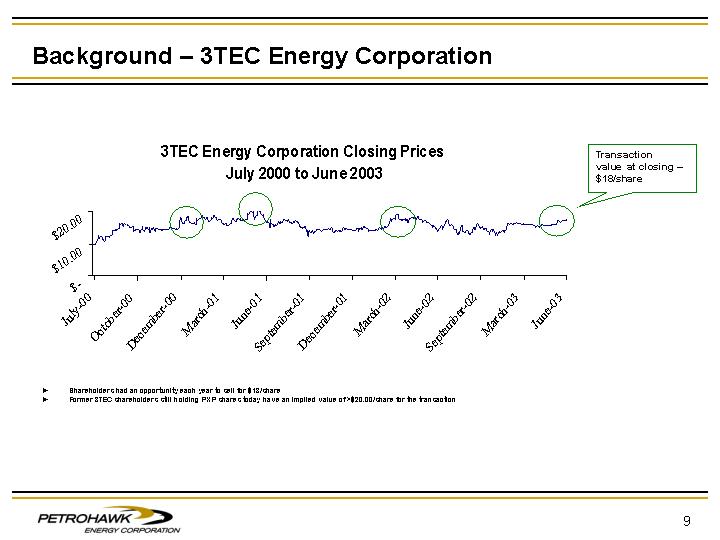

Background – 3TEC Energy Corporation

[CHART]

• Shareholders had an opportunity each year to sell for $18/share

• Former 3TEC shareholders still holding PXP shares today have an implied value of >$20.00/share for the transaction

9

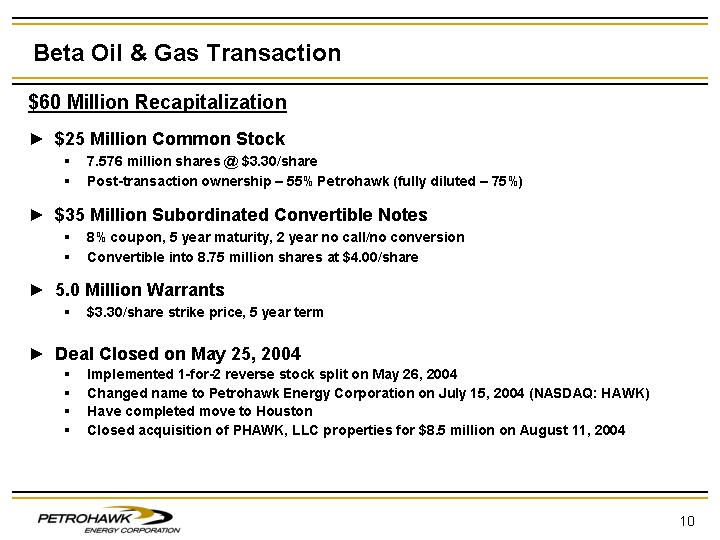

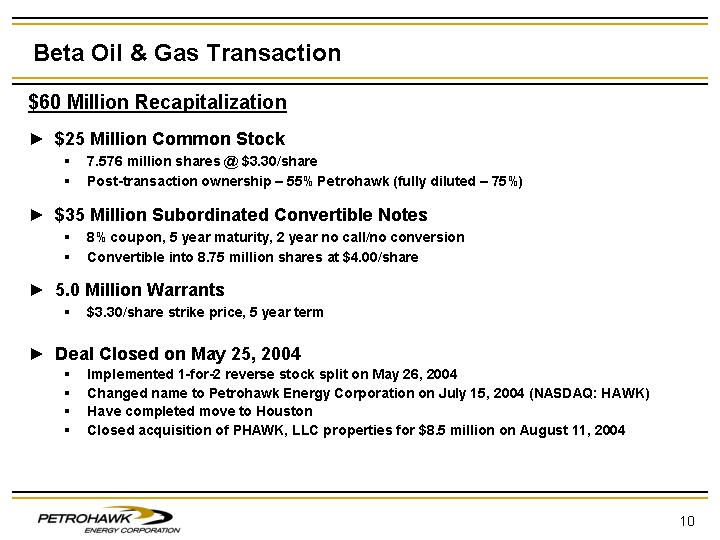

Beta Oil & Gas Transaction

$60 Million Recapitalization

• $25 Million Common Stock

• 7.576 million shares @ $3.30/share

• Post-transaction ownership – 55% Petrohawk (fully diluted – 75%)

• $35 Million Subordinated Convertible Notes

• 8% coupon, 5 year maturity, 2 year no call/no conversion

• Convertible into 8.75 million shares at $4.00/share

• 5.0 Million Warrants

• $3.30/share strike price, 5 year term

• Deal Closed on May 25, 2004

• Implemented 1-for-2 reverse stock split on May 26, 2004

• Changed name to Petrohawk Energy Corporation on July 15, 2004 (NASDAQ: HAWK)

• Have completed move to Houston

• Closed acquisition of PHAWK, LLC properties for $8.5 million on August 11, 2004

10

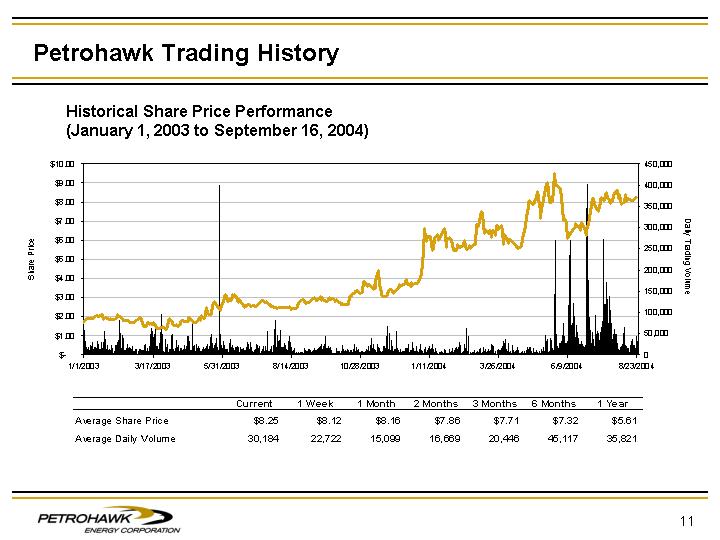

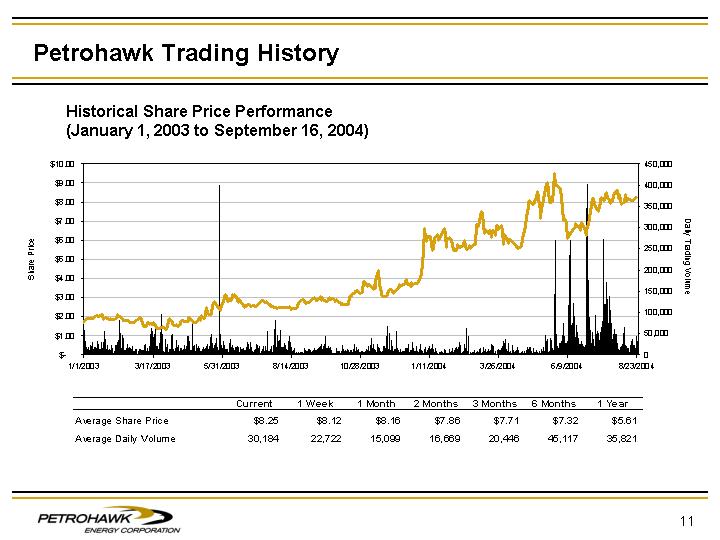

Petrohawk Trading History

Historical Share Price Performance

(January 1, 2003 to September 16, 2004)

[CHART]

| | Current | | 1 Week | | 1 Month | | 2 Months | | 3 Months | | 6 Months | | 1 Year | |

Average Share Price | | $ | 8.25 | | $ | 8.12 | | $ | 8.16 | | $ | 7.86 | | $ | 7.71 | | $ | 7.32 | | $ | 5.61 | |

Average Daily Volume | | 30,184 | | 22,722 | | 15,099 | | 16,669 | | 20,446 | | 45,117 | | 35,821 | |

| | | | | | | | | | | | | | | | | | | | | | |

11

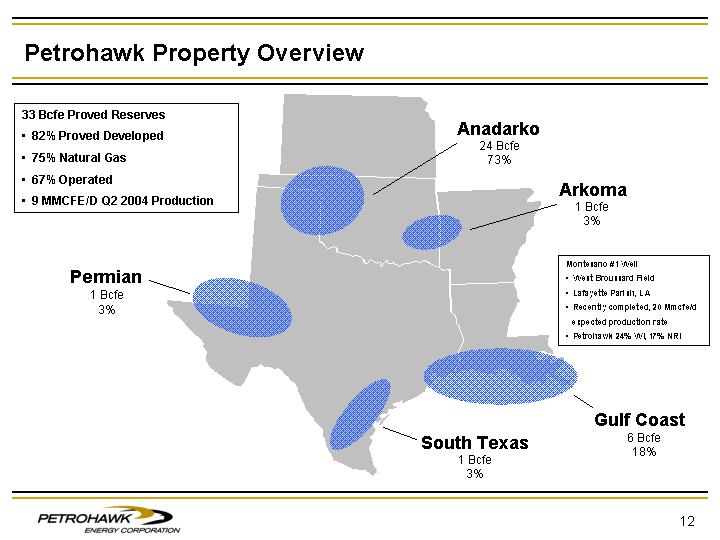

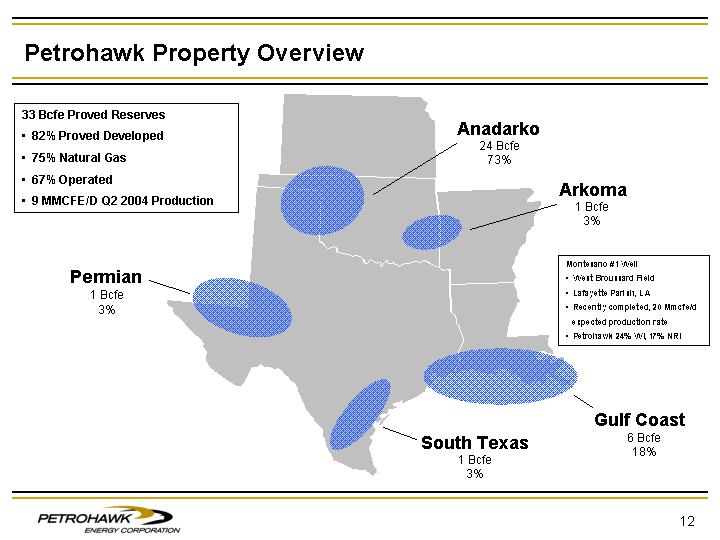

Petrohawk Property Overview

33 Bcfe Proved Reserves

• 82% Proved Developed

• 75% Natural Gas

• 67% Operated

• 9 MMCFE/D Q2 2004 Production

[CHART]

Montesano #1 Well

• West Broussard Field

• Lafayette Parish, LA

• Recently completed, 20 Mmcfe/d expected production rate

• Petrohawk 24% WI, 17% NRI

12

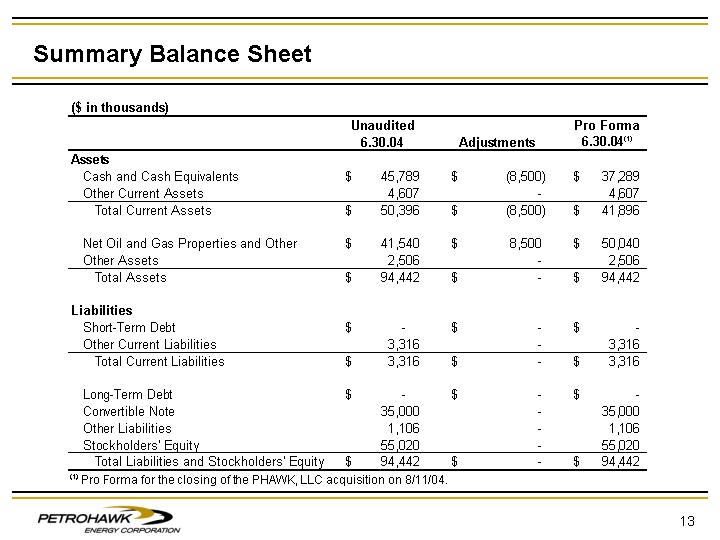

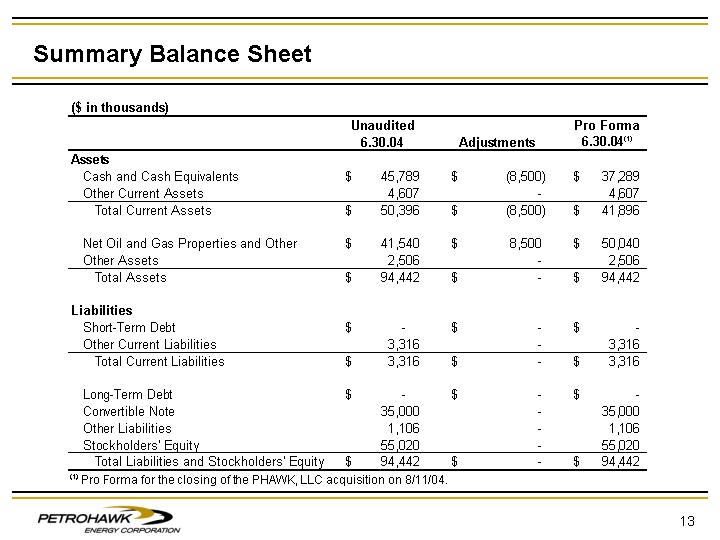

Summary Balance Sheet

| | Unaudited | | | | Pro Forma | |

($ in thousands) | | 6.30.04 | | Adjustments | | 6.30.04(1) | |

Assets | | | | | | | |

Cash and Cash Equivalents | | $ | 45,789 | | $ | (8,500 | ) | $ | 37,289 | |

Other Current Assets | | 4,607 | | — | | 4,607 | |

Total Current Assets | | $ | 50,396 | | $ | (8,500 | ) | $ | 41,896 | |

| | | | | | | |

Net Oil and Gas Properties and Other | | $ | 41,540 | | $ | 8,500 | | $ | 50,040 | |

Other Assets | | 2,506 | | — | | 2,506 | |

Total Assets | | $ | 94,442 | | $ | — | | $ | 94,442 | |

| | | | | | | |

Liabilities | | | | | | | |

Short-Term Debt | | $ | — | | $ | — | | $ | — | |

Other Current Liabilities | | 3,316 | | — | | 3,316 | |

Total Current Liabilities | | $ | 3,316 | | $ | — | | $ | 3,316 | |

| | | | | | | |

Long-Term Debt | | $ | — | | $ | — | | $ | — | |

Convertible Note | | 35,000 | | — | | 35,000 | |

Other Liabilities | | 1,106 | | — | | 1,106 | |

Stockholders’ Equity | | 55,020 | | — | | 55,020 | |

Total Liabilities and Stockholders’ Equity | | $ | 94,442 | | $ | — | | $ | 94,442 | |

(1) Pro Forma for the closing of the PHAWK, LLC acquisition on 8/11/04.

13

Summary

• An excellent platform

• Will have capacity for $100 - - $150 million in cash acquisitions

• Limited production hedges

• Significant development drilling program underway

• Experienced company builders

• Successful 3-D exploration drilling history

• Conservative financial managers

• Successful execution of divestment strategy

• Potential to add meaningful value with appropriate level of risk capital exposure

• Create opportunity for significant near-term value appreciation

• Acquisition, exploration and public company expertise

• Deliver attractive/familiar story to Wall Street

• Spark immediate interest

• Ability to access significant additional capital

14

Conclusion

• Strong management team with proven track record in value creation

• Transaction experience, financial expertise, technical focus

• Positive recognition – well known in industry and investment community

• Balance sheet discipline

• Meaningful economic interest

• Natural gas focus – Hugoton, 3TEC and Petrohawk

• Strong fundamentals

• Attractive cost structure

• Search for opportunities not related to commodity prices

• Continued industry consolidation

• Internally generated deal flow

• Organic growth from drilling

• Successful divestment/property upgrade strategy

• FOCUS ON THE EXIT!!

15

[LOGO]

NASDAQ: HAWK

16