The Vantagepoint Funds benefited from these market gains at levels indicative of their asset class and style focus.

A discussion of each Fund’s 2007 investment results follows, beginning on page 8.

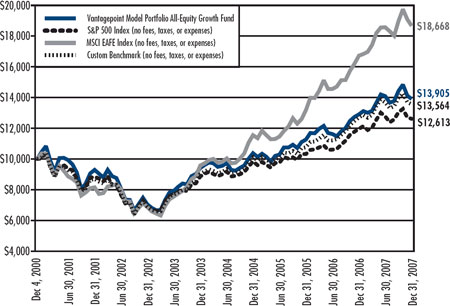

As mentioned above, U.S. domestic equity markets began 2007 by extending gains from the prior four years. As the year progressed, performance generally trended upward until mid-July. Mid-year, U.S. equity market volatility increased substantially and markets dipped in late July and early August, largely triggered by turmoil in the subprime mortgage market and the ensuing concerns that weakness would spread to other risk-based assets. The equity markets recovered to new highs in early October, followed by a downward drift through year-end as markets reflected the spreading impact of subprime issues, recession concerns and declining investor confidence. Corporate earnings growth for the broad market turned negative for the first time in several years. While the markets welcomed initial Federal Reserve interest rate cuts in the Fall, the third cut on December 11, 2007, of 0.25%, was met with general disappointment as investors generally felt the rate cut was insufficient to bolster the economic slump.

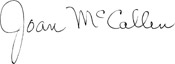

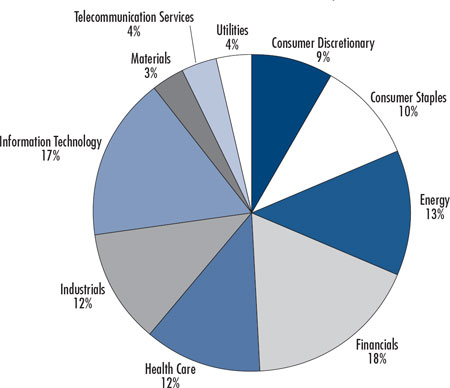

There was broad dispersion between equity market returns across different market segments and investment styles. Following an eight year preference for value-oriented stocks, growth-oriented stocks performed relatively better as their valuations appeared attractive. While growth stocks provided positive returns, with large-capitalization stocks leading mid- and small-capitalization

stocks, value stocks produced negative returns for the year. As a result of financial market stress in the latter half of the year, the Financial sector was hardest hit, producing a negative 16.20% return in 2007 (within the Russell 1000 Index). Consumer Discretionary and Homebuilding-related stocks were also among the hardest hit. Among sectors performing relatively well, Energy, Integrated Oils and Technology stocks were among the highest performers. These differences explain in large part the relative performance of individual investments and mutual funds in 2007.

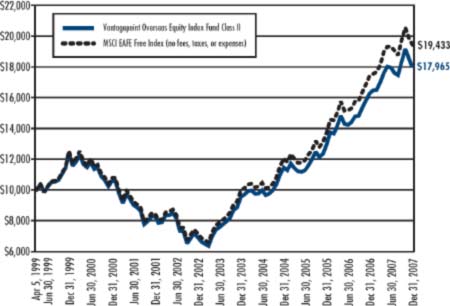

International Equity Returns Aided by Weaker Dollar

International markets followed a pattern of returns throughout the year similar to those of the U.S. market. International markets, measured by the Morgan Stanley Capital International (MSCI) Europe Australasia Far East (EAFE) Index, posted the fifth consecutive year of positive returns. They outperformed the U.S. equity market for the sixth consecutive year, albeit at lower absolute levels. For U.S. Dollar based investors, the majority of international returns during 2007 were due to the declining value of the U.S. dollar relative to foreign currencies. As a result, while the MSCI EAFE rose 11.63% in U.S. Dollar terms, the MSCI EAFE rose 3.97% in local currency terms, with the difference reflecting the declining value of the U.S. Dollar relative to other currencies. The Pacific Rim countries, excluding Japan, provided the highest returns with a positive 31.73%, followed by European markets with a positive 14.39%, and Japan lagging with a negative 4.14% return. Emerging markets, which are not reflected in the MSCI EAFE Index, generally led developed foreign markets as globalization and strong commodities prices bolstered emerging market economies across the globe.

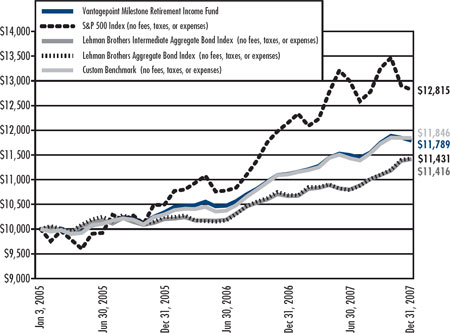

Bonds Benefit from Lower Interest Rates and Investor Risk Aversion

Bond market performance in 2007 was a tale of two halves. The first half of the year saw solid job growth, a short lived infla-tion scare, gradually higher U.S. Treasury rates and slightly wider sector spreads. While housing market problems began to more visibly impact the financial markets, the Federal Reserve maintained its hold on the Federal Funds target rate, reflecting its concern about inflationary pressures. The second half of 2007 saw slower job creation, the Federal Reserve’s move to provide more liquidity following escalating subprime issues, and significantly lower U.S. Treasury rates. Interest rates decreased and U.S. Treasury prices dramatically increased due to investors’ flight-to-quality, sparked by stock market volatility and weakness in the housing market, particularly the subprime mortgage market. The Federal Reserve cut the Federal Funds target rate three times starting with a 0.50% cut in September, which was quickly followed by two 0.25% moves during the fourth quarter, ending with a rate of 4.25%.

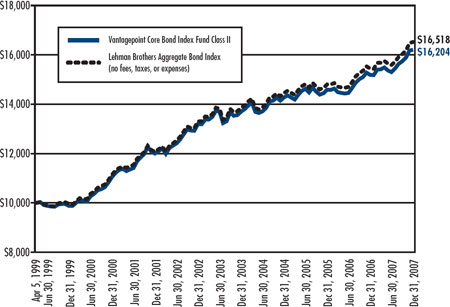

All major fixed income markets saw positive returns during the year aided by the decrease in U.S. Treasury rates, but the discrepancies among sectors were rather large. The Lehman Brothers Aggregate Bond Index returned 6.96% for the year, the Lehman Brothers Mortgage-Backed Index followed closely behind at 6.90%, and the Lehman Brothers Investment Grade Corporate Index returned 4.56%. Treasury Inflation Protected Securities provided meaningfully higher returns — 11.64% as measured by the Lehman Brothers U.S. TIPS Index — benefiting from investors’ inflation fears. Given short-term interest rate levels over the course of the year, shorter-term bonds and money market funds produced relatively attractive results in the 4-5% range. Lower quality and sectors associated with the subprime mortgage market, including Asset Backed and High Yield securities, provided meaningfully lower, albeit positive, returns. As in other capital market results, the dispersion of returns across segments of the bond market largely explains the relative performance of individual securities and fixed income mutual funds in 2007.

The Vantagepoint Funds’ 2007 Enhancements

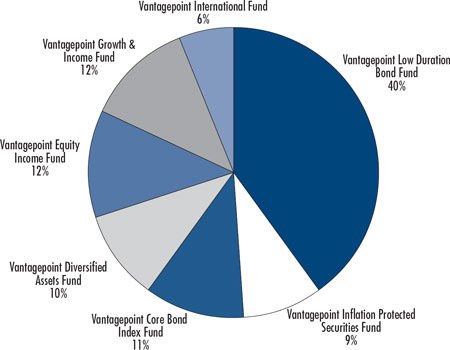

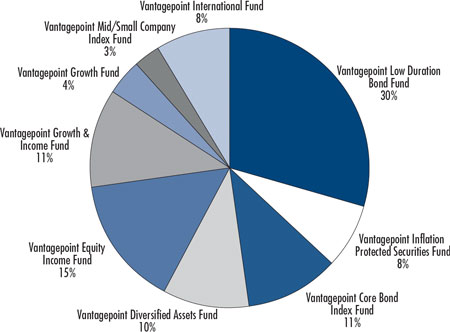

Consistent with The Vantagepoint Fund’s contribution to helping investors build retirement security for themselves and their families, The Vantagepoint Funds added three new funds during 2007, updated two existing funds, and increased the asset class and investment strategy diversification within the Model Portfolio Funds and the Milestone Funds.

In October, the Vantagepoint Select Value Fund, a mid-capitalization value equity fund with the objective of offering long-term growth from dividend income and capital appreciation, was funded. The Fund’s portfolio allocation is divided equally between three complementary subadvisers: Goldman Sachs Asset Management, L.P., WEDGE Capital Management L.L.P., and Systematic Financial Management, L.P.

The Vantagepoint Discovery Fund, a small-capitalization blend equity fund with the objective of offering long-term capital growth, was funded in October. The Fund’s portfolio allocation is divided equally between Wellington Management Company LLP, and Payden & Rygel.

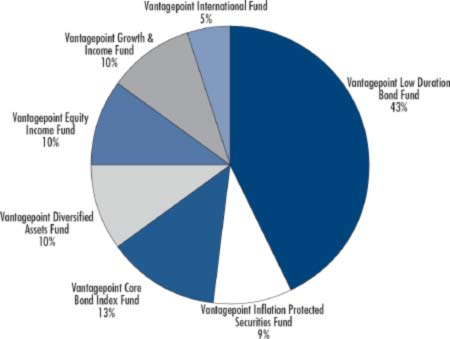

The Vantagepoint Diversified Assets Fund, a multi-strategy fund, with the objective of offering long-term capital growth, was funded in October and is available exclusively through the Model Portfolio Funds and the Milestone Funds. The Fund’s portfolio is allocated among four subadvisers: Drake Capital Management, LLC; Analytic Investors, LLC; Payden & Rygel; and Mellon Capital Management Corporation.

4

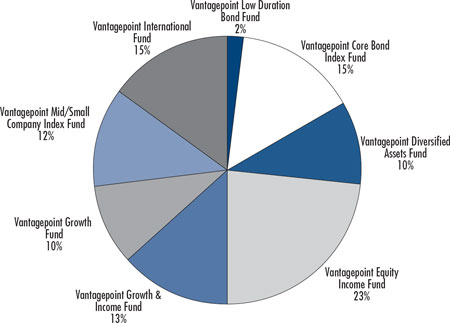

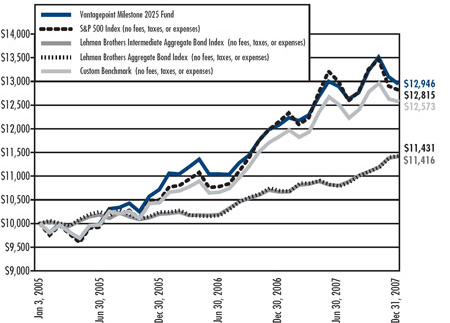

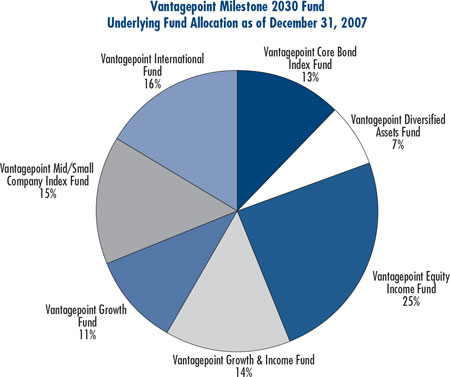

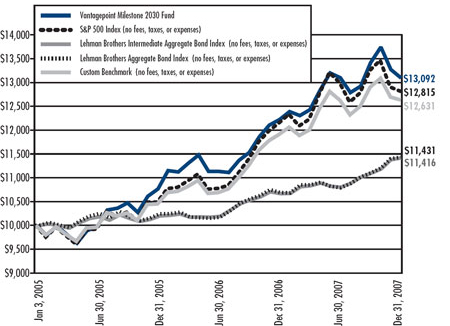

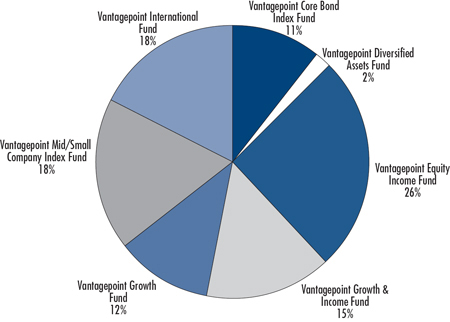

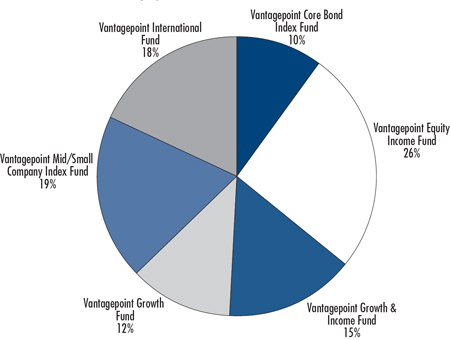

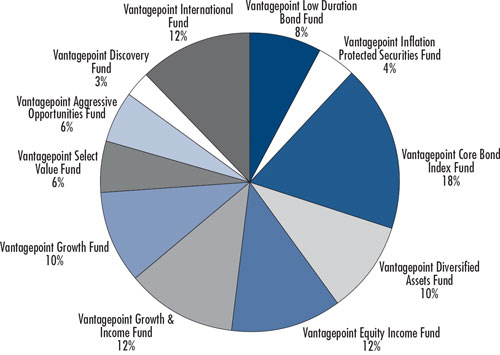

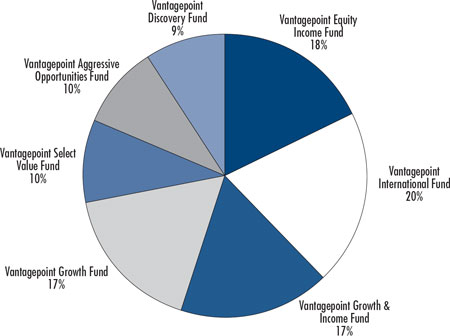

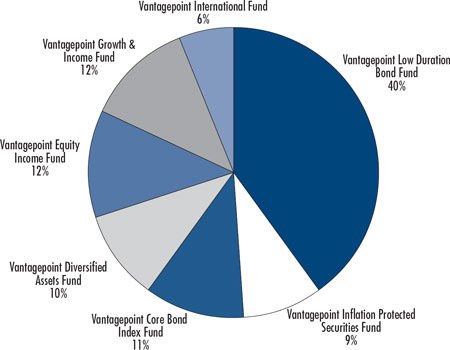

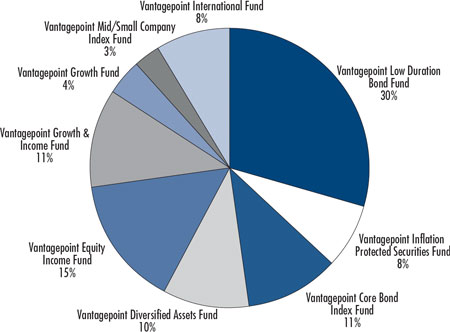

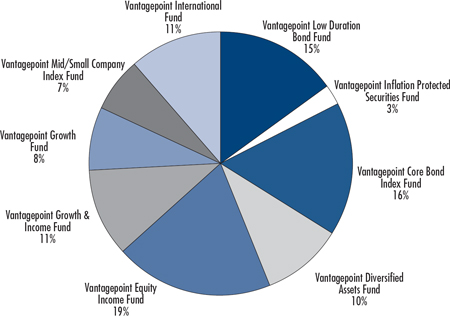

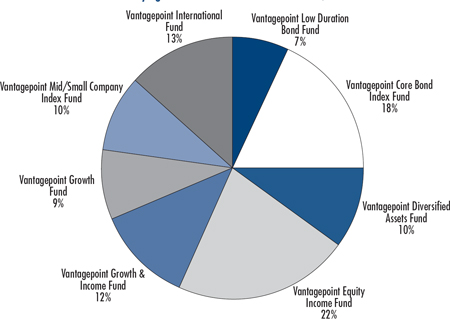

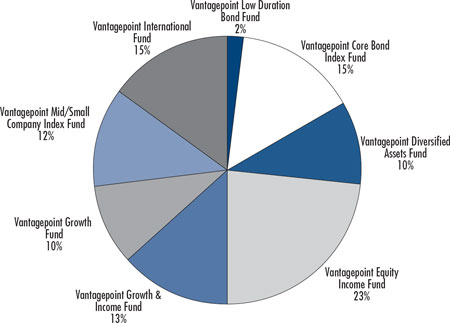

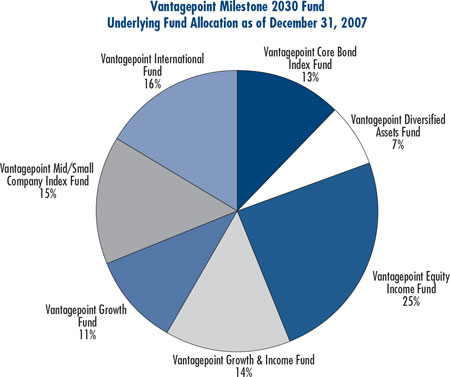

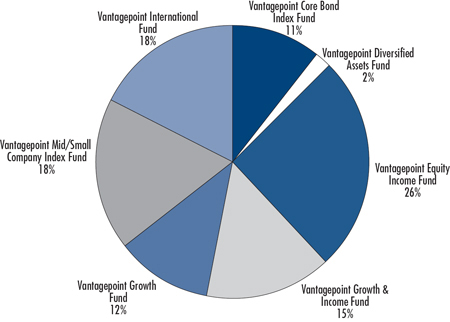

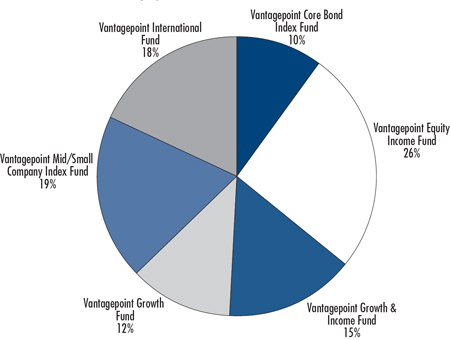

Concurrent with the October commencement of operations of the three new Vantagepoint Funds, the Vantagepoint Model Portfolio Funds’ and the Vantagepoint Milestone Funds’ portfolios were re-optimized to include allocations to the above three new Funds, as appropriate for each Milestone Fund and Model Portfolio Fund.

In May, the Vantagepoint US Government Securities Fund was transitioned to become the Vantagepoint Inflation Protected Securities Fund, with the same objective of offering current income, but with a new strategy. As such, the Fund became primarily invested in inflation adjusted fixed income securities that seek to offer inflation protection. The Fund’s subadviser line-up was altered coincident with the change, and at year-end was comprised of Pacific Investment Management Company and BlackRock Financial Management, Inc.

Also in May, the name of the Vantagepoint Short-Term Bond Fund changed to the Vantagepoint Low Duration Bond Fund and it underwent a change to its principal investment strategy to better reflect the type of bonds in which the Fund invests. The Fund’s investment objective remained unchanged.

We continue to seek to manage The Vantagepoint Funds with the goal of producing above-average results over the longer-term, with below-average volatility over the shorter-term. By using independent third-party subadvisers to manage certain Funds’ assets, we have the flexibility to seek managers who we believe show potential to provide consistency of style and results. Investors can feel comfortable that The Vantagepoint Funds are managed with the ultimate goal in mind – investor success.

Sincerely,

Vantagepoint Investment Advisers, LLC

The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. This information is intended for educational purposes only and is not to be construed as investment advice, nor does it have regard to the individual investment objectives, financial situation or the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or using any investment strategies discussed here and should understand that statements regarding future prospects may not be realized. Investors should note that returns, if any, from investing in securities, will fluctuate and that each security price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not an indicator of future performance. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC and member FINRA/SIPC. 1-800-669-7400.

5

Shareholder Expenses

As a shareholder of a Vantagepoint Fund, you incur ongoing expenses, such as advisory fees, investor services fees, fund services fees and other fund expenses. The following example is intended to help you understand your ongoing expenses (in dollars and cents) of investing in a fund and to compare these expenses with the ongoing expenses of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2007 to December 31, 2007.

Actual Expenses

The first section in the example below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number for your fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section in the example below provides information about the hypothetical account values and hypothetical expenses based on each fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | |

ACTUAL | | | | HYPOTHETICAL |

| | | | | |

Beginning

Account

Value

7/01/07 | | Ending

Account

Value

12/31/07 | | 2007

Annualized

Expense

Ratio | | Expenses

Paid

During

Period* | | Vantagepoint

Funds | | Beginning

Account

Value

7/01/07 | | Ending

Account

Value

12/31/07 | | 2007

Annualized

Expense

Ratio | | Expenses

Paid

During

Period* |

| | | | | | | | | | | | | | | | | |

$1,000.00 | | $ | 1,023.20 | | 0.62% | | $3.18 | | Money Market*** | | $1,000.00 | | $1,022.20 | | 0.62% | | $3.18 |

$1,000.00 | | $ | 1,033.20 | | 0.65% | | $3.35 | | Low Duration Bond | | $1,000.00 | | $1,022.00 | | 0.65% | | $3.33 |

$1,000.00 | | $ | 1,094.90 | | 0.71% | | $3.77 | | Inflation Protected Securities | | $1,000.00 | | $1,021.70 | | 0.71% | | $3.64 |

$1,000.00 | | $ | 999.40 | | 0.74% | | $3.75 | | Asset Allocation | | $1,000.00 | | $1,021.60 | | 0.74% | | $3.79 |

$1,000.00 | | $ | 945.90 | | 0.87% | | $4.29 | | Equity Income | | $1,000.00 | | $1,020.90 | | 0.87% | | $4.46 |

$1,000.00 | | $ | 984.40 | | 0.80% | | $4.02 | | Growth & Income | | $1,000.00 | | $1,021.30 | | 0.80% | | $4.10 |

$1,000.00 | | $ | 1,014.20 | | 0.87% | | $4.44 | | Growth | | $1,000.00 | | $1,020.90 | | 0.87% | | $4.46 |

$1,000.00 | | $ | 941.50 | | 1.04% | | $1.71 | | Select Value** | | $1,000.00 | | $1,006.70 | | 1.04% | | $1.77 |

$1,000.00 | | $ | 947.00 | | 1.02% | | $5.03 | | Aggressive Opportunities | | $1,000.00 | | $1,020.20 | | 1.02% | | $5.22 |

$1,000.00 | | $ | 935.40 | | 1.07% | | $1.76 | | Discovery** | | $1,000.00 | | $1,006.70 | | 1.07% | | $1.82 |

$1,000.00 | | $ | 1,028.10 | | 1.10% | | $5.65 | | International | | $1,000.00 | | $1,019.80 | | 1.10% | | $5.63 |

$1,000.00 | | $ | 999.30 | | 1.04% | | $1.77 | | Diversified Assets** | | $1,000.00 | | $1,006.70 | | 1.04% | | $1.77 |

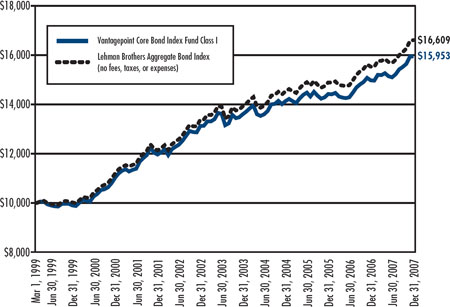

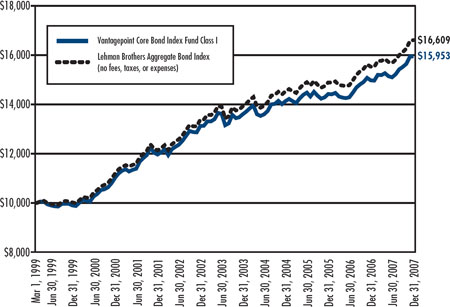

$1,000.00 | | $ | 1,056.90 | | 0.44% | | $2.29 | | Core Bond Index Class I | | $1,000.00 | | $1,023.10 | | 0.44% | | $2.26 |

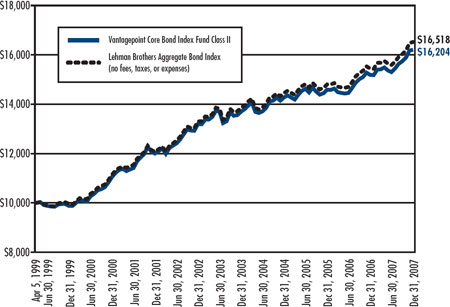

$1,000.00 | | $ | 1,058.90 | | 0.24% | | $1.25 | | Core Bond Index Class II | | $1,000.00 | | $1,024.30 | | 0.24% | | $1.23 |

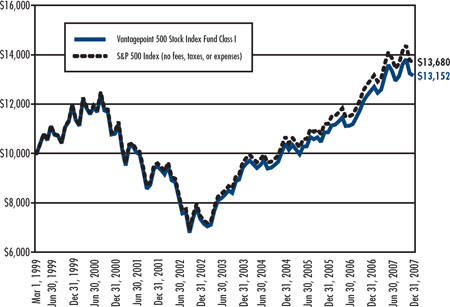

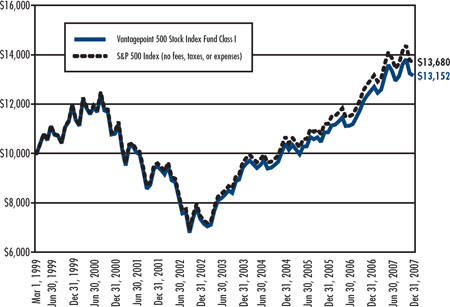

$1,000.00 | | $ | 984.80 | | 0.45% | | $2.26 | | 500 Stock Index Class I | | $1,000.00 | | $1,023.00 | | 0.45% | | $2.31 |

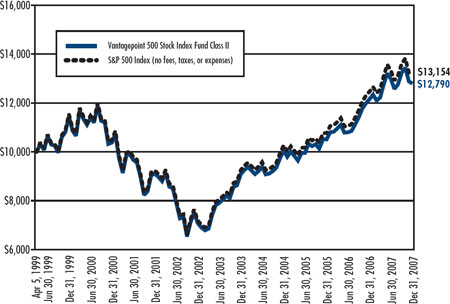

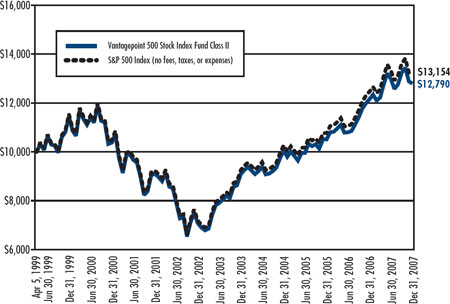

$1,000.00 | | $ | 984.70 | | 0.25% | | $1.26 | | 500 Stock Index Class II | | $1,000.00 | | $1,024.20 | | 0.25% | | $1.28 |

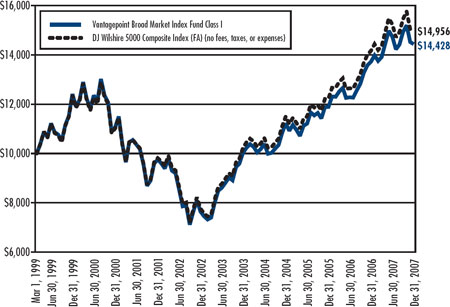

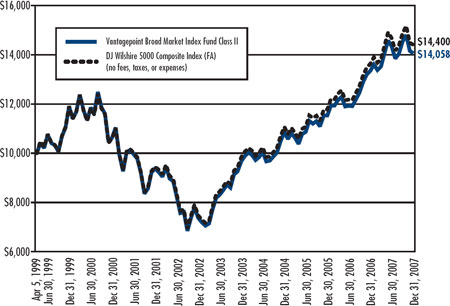

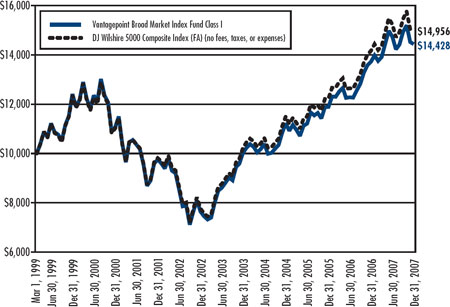

$1,000.00 | | $ | 979.30 | | 0.44% | | $2.21 | | Broad Market Index Class I | | $1,000.00 | | $1,023.10 | | 0.44% | | $2.26 |

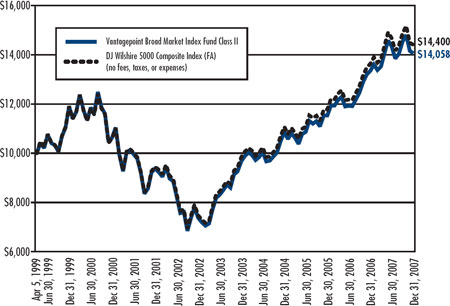

$1,000.00 | | $ | 980.70 | | 0.24% | | $1.20 | | Broad Market Index Class II | | $1,000.00 | | $1,023.10 | | 0.24% | | $1.23 |

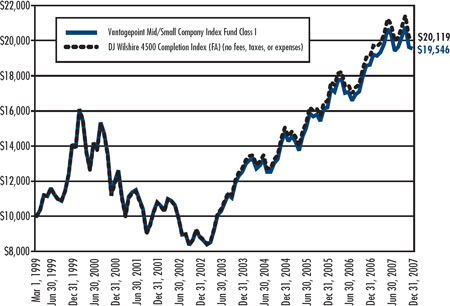

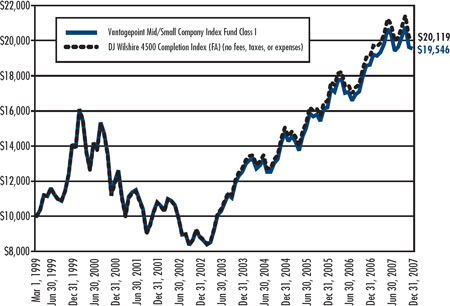

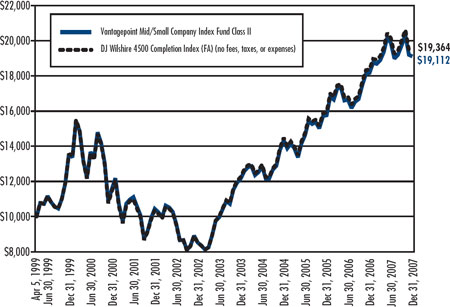

$1,000.00 | | $ | 960.80 | | 0.50% | | $2.48 | | Mid / Small Company Index Class I | | $1,000.00 | | $1,022.80 | | 0.50% | | $2.56 |

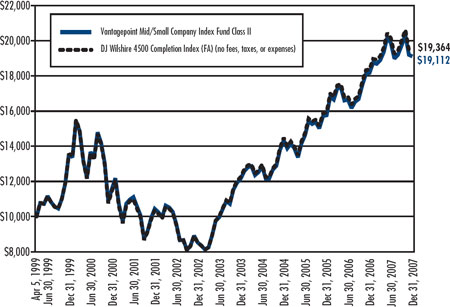

$1,000.00 | | $ | 961.90 | | 0.30% | | $1.49 | | Mid / Small Company Index Class II | | $1,000.00 | | $1,023.80 | | 0.30% | | $1.54 |

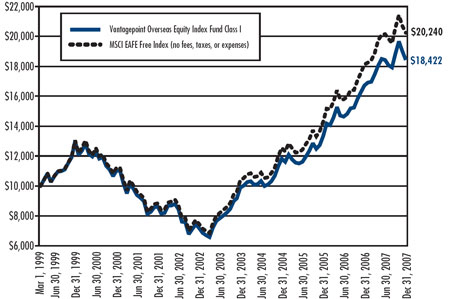

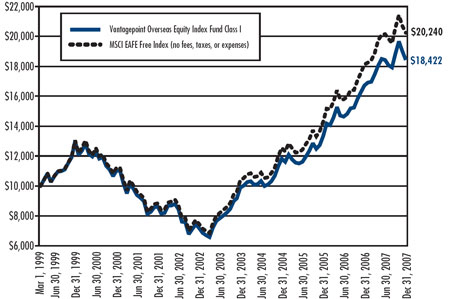

$1,000.00 | | $ | 999.50 | | 0.61% | | $3.09 | | Overseas Equity Index Class I | | $1,000.00 | | $1,022.30 | | 0.61% | | $3.13 |

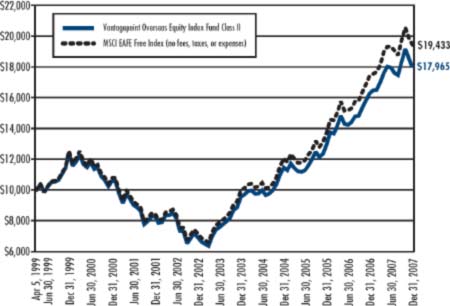

$1,000.00 | | $ | 1,000.30 | | 0.41% | | $2.08 | | Overseas Equity Index Class II | | $1,000.00 | | $1,023.30 | | 0.41% | | $2.10 |

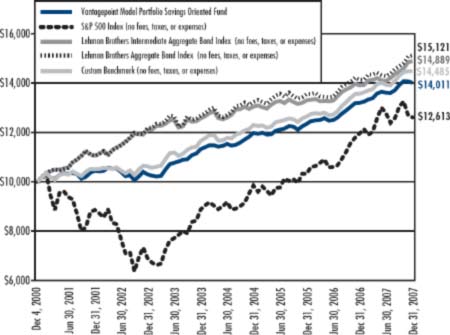

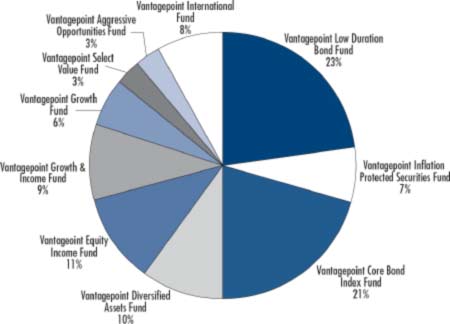

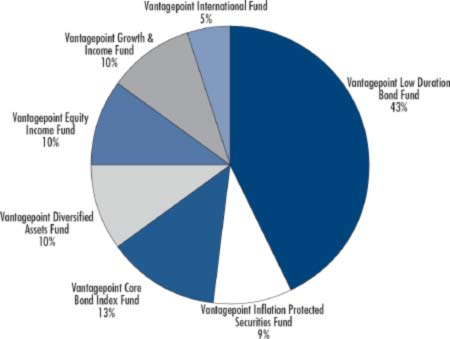

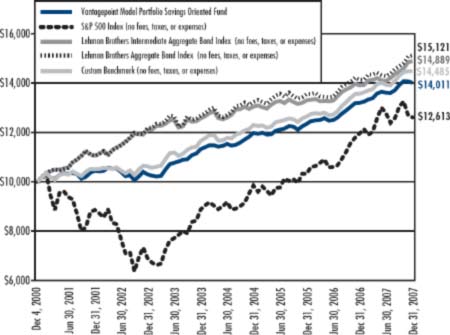

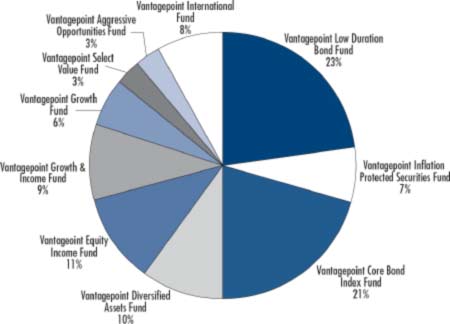

$1,000.00 | | $ | 1,029.80 | | 0.83% | | $4.27 | | Model Portfolio Savings Oriented*** | | $1,000.00 | | $1,021.10 | | 0.83% | | $4.25 |

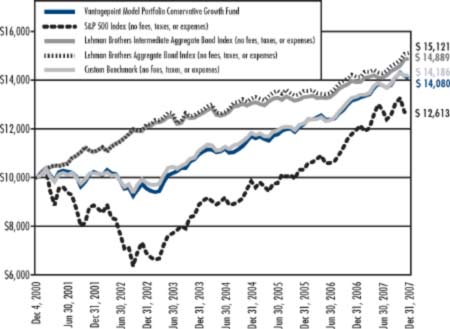

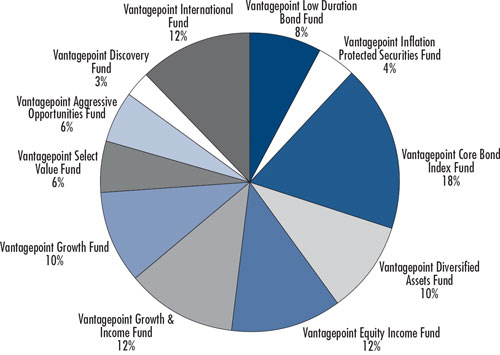

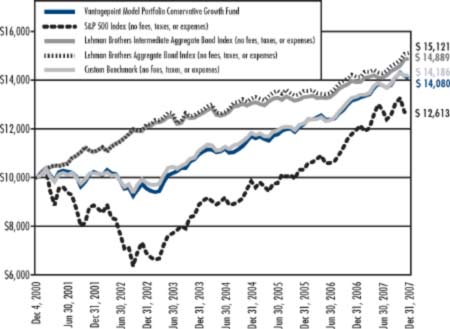

$1,000.00 | | $ | 1,021.00 | | 0.86% | | $4.40 | | Model Portfolio Conservative Growth*** | | $1,000.00 | | $1,021.00 | | 0.86% | | $4.40 |

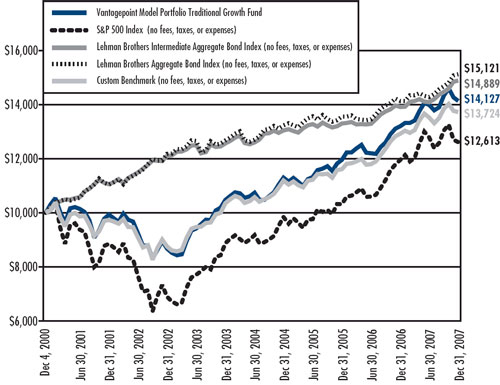

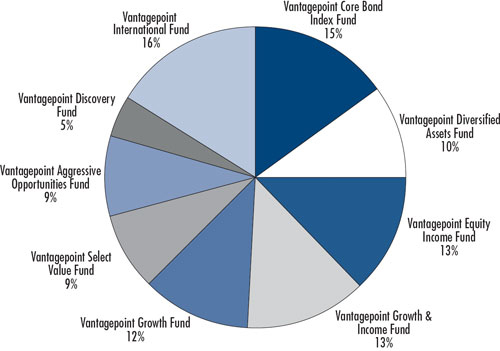

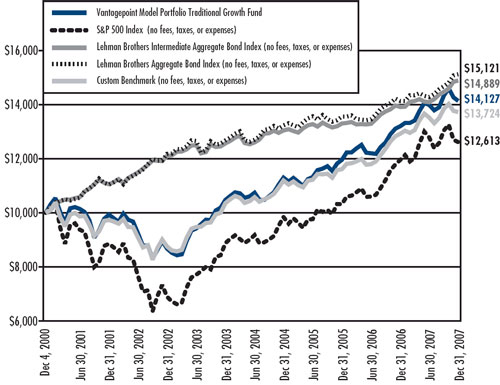

$1,000.00 | | $ | 1,009.90 | | 0.92% | | $4.69 | | Model Portfolio Traditional Growth*** | | $1,000.00 | | $1,020.70 | | 0.92% | | $4.71 |

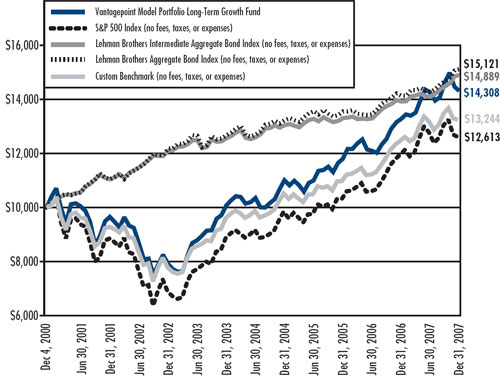

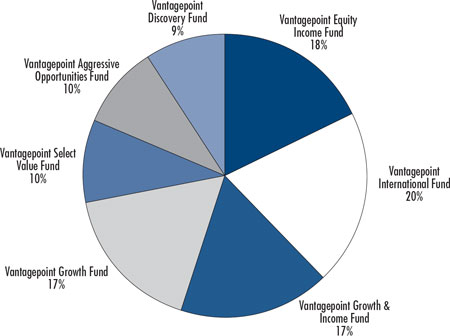

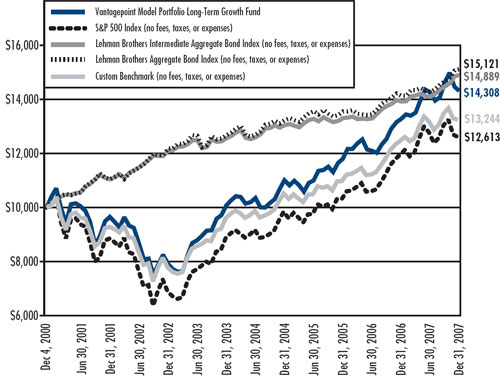

$1,000.00 | | $ | 1,002.70 | | 0.98% | | $4.97 | | Model Portfolio Long-Term Growth*** | | $1,000.00 | | $1,020.40 | | 0.98% | | $5.02 |

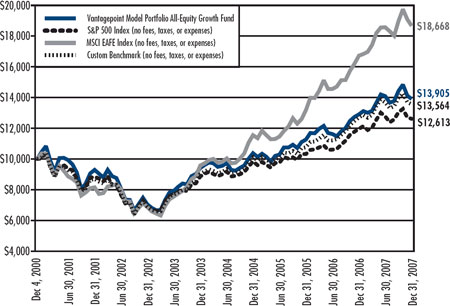

$1,000.00 | | $ | 986.70 | | 1.08% | | $5.44 | | Model Portfolio All-Equity Growth*** | | $1,000.00 | | $1,019.90 | | 1.08% | | $5.53 |

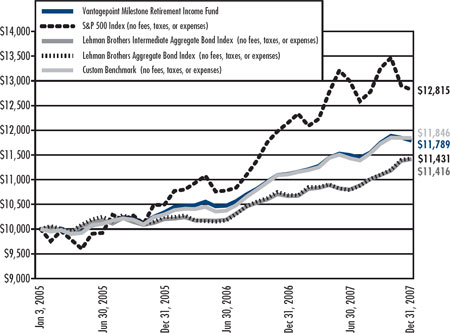

$1,000.00 | | $ | 1,025.40 | | 0.81% | | $4.16 | | Milestone Retirement Income*** | | $1,000.00 | | $1,021.20 | | 0.81% | | $4.15 |

6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ACTUAL | | | | HYPOTHETICAL |

| | | |

|

Beginning

Account

Value

7/01/07 | | Ending

Account

Value

12/31/07 | | 2007

Annualized

Expense

Ratio | | Expenses

Paid

During

Period* | | Vantagepoint

Funds | | Beginning

Account

Value

7/01/07 | | Ending

Account

Value

12/31/07 | | 2007

Annualized

Expense

Ratio | | Expenses

Paid

During

Period* | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

$1,000.00 | | $ | 1,020.10 | | | 0.88 | % | | $ | 4.51 | | | Milestone 2010*** | | $ | 1,000.00 | | $ | 1,020.90 | | | 0.88 | % | | $ | 4.51 | | |

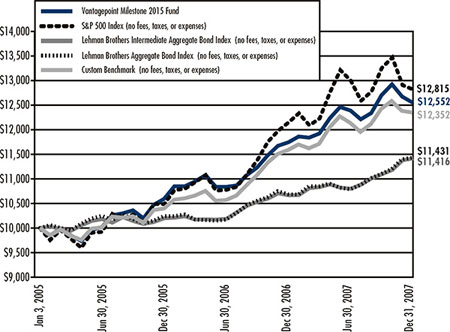

$1,000.00 | | $ | 1,013.10 | | | 0.90 | % | | $ | 4.59 | | | Milestone 2015*** | | $ | 1,000.00 | | $ | 1,020.80 | | | 0.90 | % | | $ | 4.61 | | |

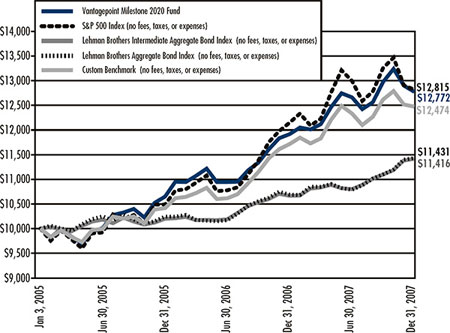

$1,000.00 | | $ | 1,008.70 | | | 0.93 | % | | $ | 4.73 | | | Milestone 2020*** | | $ | 1,000.00 | | $ | 1,020.60 | | | 0.93 | % | | $ | 4.76 | | |

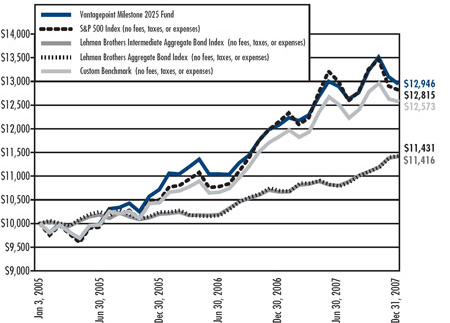

$1,000.00 | | $ | 1,004.00 | | | 0.95 | % | | $ | 4.82 | | | Milestone 2025*** | | $ | 1,000.00 | | $ | 1,020.50 | | | 0.95 | % | | $ | 4.86 | | |

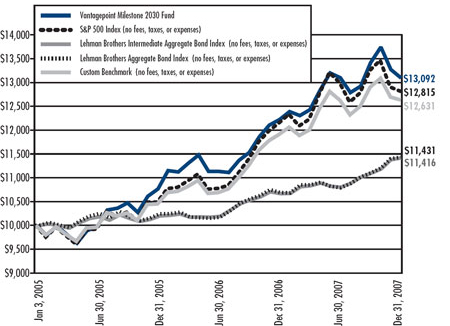

$1,000.00 | | $ | 999.60 | | | 0.97 | % | | $ | 4.92 | | | Milestone 2030*** | | $ | 1,000.00 | | $ | 1,020.40 | | | 0.97 | % | | $ | 4.97 | | |

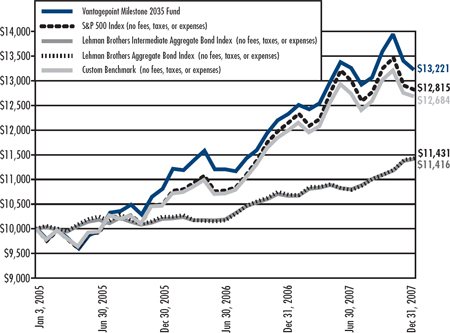

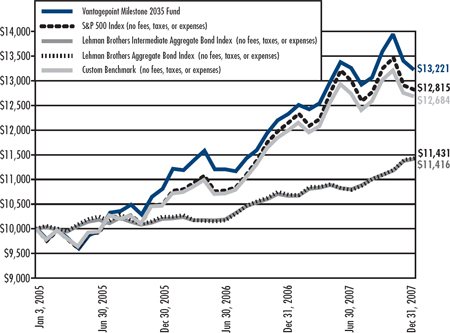

$1,000.00 | | $ | 996.80 | | | 0.99 | % | | $ | 5.01 | | | Milestone 2035*** | | $ | 1,000.00 | | $ | 1,020.30 | | | 0.99 | % | | $ | 5.07 | | |

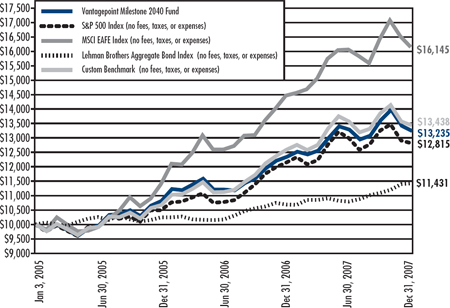

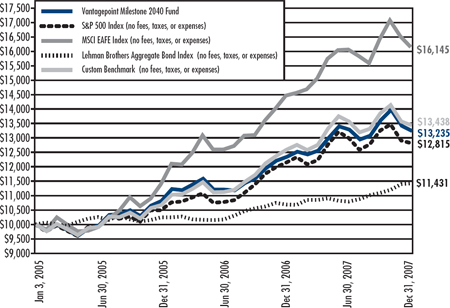

$1,000.00 | | $ | 996.20 | | | 0.99 | % | | $ | 5.01 | | | Milestone 2040*** | | $ | 1,000.00 | | $ | 1,020.30 | | | 0.99 | % | | $ | 5.07 | | |

| |

| |

* | Expenses are calculated using each Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value over the period, multiplied by [number of days in most recent fiscal half-year divided by total number of days in fiscal year e.g. 185/365] (to reflect the one-half year period). |

| |

** | Commenced operaions on October 30, 2007. |

| |

*** | This fund invests in one or more other mutual funds. The annualized expense ratio includes this fund’s proportionate share of the expense ratio of such other mutual fund(s). |

7

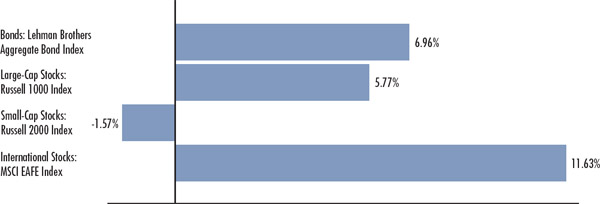

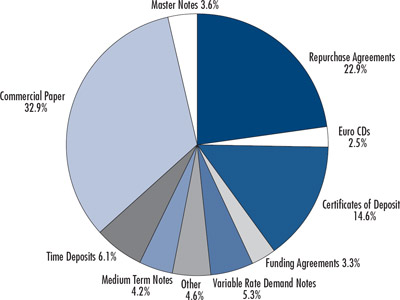

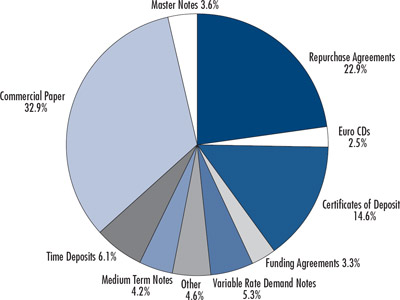

Vantagepoint Money Market Fund

The Vantagepoint Money Market Fund’s objective is to seek maximum current income, consistent with maintaining liquidity and a stable share price of $1.00. The principal investment strategy is to invest substantially all of its assets in the AIM Short-Term Investments Trust Liquid Assets Portfolio, a registered money market mutual fund, which invests in high-quality, U.S. dollar denominated short-term debt obligations. The underlying portfolio of the AIM Short-Term Investments Trust Liquid Assets Portfolio consists of certificates of deposit, bankers’ acceptances and time deposits from U.S. and foreign banks, commercial paper, master notes, securities issued by the U.S. Government and its agency, municipal securities, and repurchase agreements.

Performance

The Vantagepoint Money Market Fund’s total return for the year was 4.75%. The Fund’s unmanaged market benchmark, the 30-day U.S. Treasury Bill, returned 4.66%, while the Fund’s peer group benchmark, the MFR Prime Retail Average, returned 4.58%.

Commentary

The major U.S. fixed income sectors provided positive returns for the year 2007, with U.S. Treasury and higher quality securities outperforming higher risk sectors.

Interest rates increased modestly during the first half of 2007 and generally declined in the second half of the year, beginning early in the third quarter. Investor preference for higher quality securities, particularly U.S. Treasuries, increased, as market values for riskier securities, particularly subprime mortgage related securities, declined, as housing prices continued to decline and economic concerns increased.

In response to increasing economic concerns, stable core inflation, and the increased volatility in security markets, the Federal Reserve lowered the Federal Funds interest rate three times in the second half of the year. The three reductions lowered the Federal Funds rate by a total of one percent, from 5.25% to 4.25%. Interest rates decreased more for shorter-term securities than for longer-term, resulting in a steeper yield curve. The two-year U.S. Treasury yield decreased from 4.81% at the beginning of 2007 to 3.05% at year end, and the ten-year U.S. Treasury yield decreased from 4.70% to 4.02%, with all of the decrease occurring in the second half of the year, following modest increases during the first half of the year.

The Fund’s yield declined during the year in response to the Fed’s rate reductions. The Fund closed the year with a 7-day effective yield of 4.31% and a 7-day current yield of 4.22%, down from a 7-day effective yield of 4.85% and a 7-day current yield of 4.74%, respectively, at the end of 2006.

The Fund’s 0.09% outperformance relative to its benchmark in 2007 was due to the Fund’s credit exposure, as yields for non-Treasury Bills, e.g., commercial paper yields were generally higher than 30-day Treasury Bill yields. The Fund’s 0.17% outperformance relative to the MFR Prime Retail Average was due primarily to the Fund’s below-average expense ratio.

The Fund’s underlying investment, the AIM Short-Term Investments Trust Liquid Assets Portfolio, strives to maintain a weighted average maturity of 90 days or less. At the end of 2007, this fund’s weighted average maturity was 36 days, down from 38 days at the beginning of the year. During 2007, this underlying fund eliminated all exposure to structured investment vehicles. The underlying fund also reduced its exposure to asset-backed securities, repurchase agreements and variable rate demand notes, while increasing its exposure to certificates of deposit and commercial paper.

8

Vantagepoint Money Market Fund

Portfolio Holdings as of December 31, 2007*

* These are the reported holdings of the underlying portfolio of the AIM Short-Term Investments Trust Liquid Assets Portfolio.

9

|

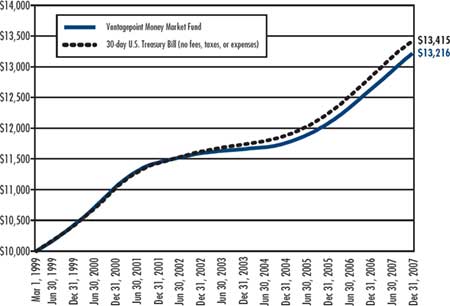

Vantagepoint Money Market Fund vs. 30-day U.S. Treasury Bill:

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: lbbotson Associates

| |

Vantagepoint Money Market Fund

Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 4.75% |

| |

Three Years | 3.98% |

| |

Five Years | 2.66% |

| |

Since Inception | 3.20% |

| |

Fund Inception Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns will fluctuate. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While the Fund seeks to maintain a stable net asset value of $1 per share, there is no guarantee that it will do so and it is still possible to lose money by investing in the Fund. All returns reflect reinvested dividends but do not include the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s market benchmark is the 30-day U.S. Treasury Bill, an unmanaged benchmark that does not reflect the cost of portfolio management or trading. The Fund’s portfolio differs significantly from the market index, which is a single security.

10

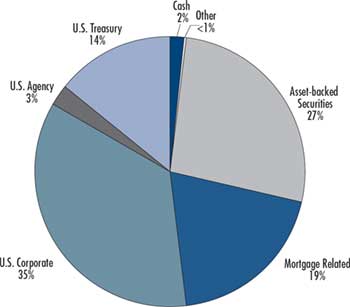

Vantagepoint Low Duration Bond Fund

The Vantagepoint Low Duration Bond Fund’s objective is to seek total return that is consistent with preservation of capital. The principal investment strategy is to invest, under normal market conditions, at least 80% of assets in bonds of varying maturities. The Fund also normally invests at least 65% of its assets in debt securities with more than one year to maturity, and seeks to maintain a maximum portfolio effective duration of three years.

Performance

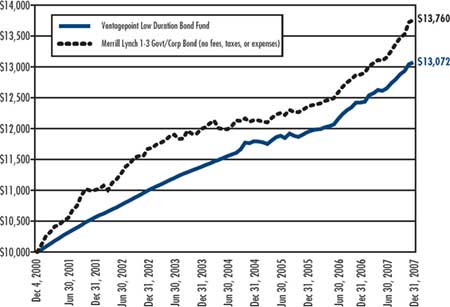

The Fund’s total return was 5.24% in 2007. The Fund’s market benchmark, the Merrill Lynch 1-3 Year Government/ Corporate Bond Index, returned 6.87%. The Morningstar Short-Term Bond Funds Category Average, a group of mutual funds with similar investment objectives, returned 4.29%.

Commentary

In May 2007 the Fund’s name became Low Duration Bond Fund, having previously been named the Short-Term Bond Fund. The Fund’s principal investment strategy was changed to better reflect the types of bonds in which the Fund invests. The Fund’s objective was not changed.

The major U.S. fixed income sectors provided positive returns for the year 2007, with U.S. Treasury and higher quality securities outperforming higher risk sectors.

U.S. Treasury rates increased modestly during the first half of the year, generally resulting in negative fixed income market returns in the second quarter, as the economy produced job growth and concerns rose regarding the possibility of increased inflation. The Fund maintained a positive return in the second quarter due primarily to its low duration.

In contrast, rates generally declined in the second half of the year, beginning early in the third quarter. While declining interest rates generally increase the market value of fixed income securities, increased delinquency and default rates for subprime mortgages, along with rating agency downgrades of certain securities, led to significantly reduced market values for mortgage related securities and increased market volatility. Investor preference for higher quality securities, particularly U.S. Treasuries, increased as market values for riskier securities, particularly subprime mortgage-related securities declined, as housing prices continued to decline and economic concerns increased.

In response to increasing economic concerns, stable core inflation, and the increased volatility in security markets, the Federal Reserve lowered the Federal Funds interest rate three times in the second half of the year. The three reductions lowered the Federal Funds rate by a total of one percent, from 5.25% to 4.25%. Interest rates decreased more for shorter-term securities than for longer-term, resulting in a steeper yield curve. The two-year U.S. Treasury yield decreased from 4.81% at the beginning of 2007 to 3.05% at year end, and the ten-year U.S. Treasury yield decreased from 4.70% to 4.02%, with all of the decrease occurring in the second half of the year, following modest increases during the first half of the year. However, the Fund’s absolute performance for 2007 benefited from the general decline in interest rates.

The Fund’s relative overweight exposure to the Financial sector, asset-backed securities, and collateralized mortgage obligations led to underperformance versus the Fund’s market benchmark during the period. Yield curve steepening also negatively impacted the Fund as a result of the Fund’s barbelled maturity structure, while a slightly longer duration was a positive contributor to relative performance. The impact of Fund expenses also detracted from relative performance as benchmark returns do not reflect expenses.

Given market factors, the Fund outperformed the average of its peer group, the Morningstar Short-Term Bond Funds Category, primarily as a result of its concentration at the high end of the credit quality spectrum and its below-average expense ratio.

In VIA’s view, the Fund’s subadvisers, Payden & Rygel and STW Fixed Income Management Ltd., have different, but complementary, approaches to short-term bond investing.

11

| |

Subadviser Data | |

| |

Payden & Rygel | |

| |

| |

Founded: | 1983 |

Investment Style: | Broad-based short duration bond management |

| |

STW Fixed Income Management Ltd. |

| |

| |

Founded: | 1977 |

Investment Style: | Short duration bond management |

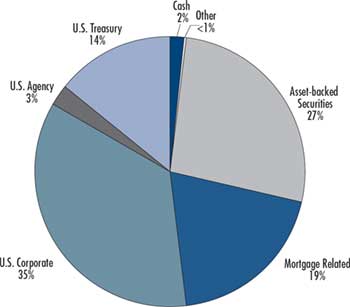

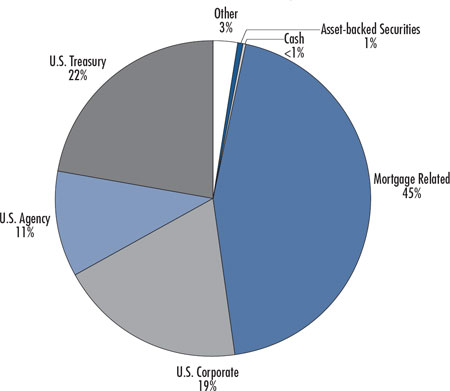

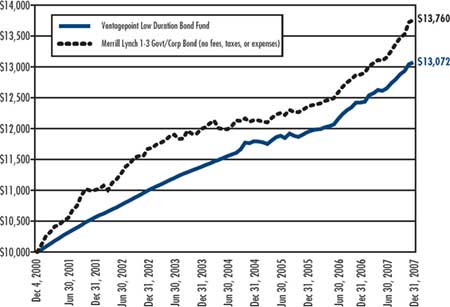

Vantagepoint Low Duration Bond Fund

Asset Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

12

|

Vantagepoint Low Duration Bond Fund vs. Merrill Lynch 1-3 Government/Corporate Bond Index:

Growth of $10,000 Invested December 4, 2000* |

| |

Source for Benchmark Returns: lbbotson Associates

| |

Vantagepoint Low Duration Bond Fund

Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 5.24% |

| |

Three Years | 3.49% |

| |

Five Years | 3.52% |

| |

Since Inception | 3.87% |

| |

Fund Inception Date | December 4, 2000 |

* On November 8, 2004, the Fund underwent changes to its investment objective, strategies and investment subadvisers. Performance prior to November 8, 2004, should not be considered representative of the performance of the Fund as currently managed. While the Fund’s goal is to achieve long-term investment results similar to those achieved prior to November 8, 2004, there is no assurance that the Fund will be able to do so. On May 1, 2007, the Fund underwent changes to its name and principal investment strategy. Performance prior to May 1, 2007, should not be considered representative of the Fund as currently managed.

Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. All returns reflect reinvested dividends but do not include the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/ SIPC. 800-669-7400.

The Fund’s benchmark is the Merrill Lynch 1-3 Year Government/Corporate Bond Index (“Merrill 1-3”). The Merrill 1-3 tracks the performance of U.S. dollar-denominated investment grade Government and corporate public debt issued in the U.S. domestic bond market with maturities ranging between 1 and 3 years. The index is unmanaged and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the market index.

13

Vantagepoint Inflation Protected Securities Fund

The Vantagepoint Inflation Protected Securities Fund’s objective is to offer current income. The principal investment strategy is to invest, under normal circumstances, at least 80% of its net assets in inflation adjusted U.S. and non-U.S. fixed income securities. The Fund will, under normal circumstances, invest at least 50% of its net assets in U.S. Treasury inflation protected securities.

Performance

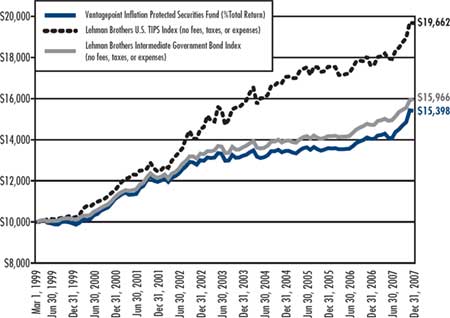

The Fund’s total return was 9.64% in 2007. The Fund’s market benchmark is the Lehman Brothers U.S. TIPS Index.* The Lehman Brothers U.S. TIPS Index returned 11.64% and the Fund’s former market benchmark, Lehman Brothers

Intermediate Government Bond Index, returned 8.46%. The Morningstar Inflation-Protected Bond Fund Category Average, a group of mutual funds with similar investment objectives, returned 9.86%. Its former peer group of mutual funds with similar investment objectives, the Morningstar Intermediate Government Bond Funds Category Average, returned 6.09%.

Commentary

On May 1, 2007, the Fund underwent changes to its name, principal investment strategies and its subadvisers. Before May 1, 2007, the Inflation Protected Securities Fund was named the US Government Securities Fund and invested at least 80% of its assets in securities issued by the U.S. Treasury, U.S. Government agencies, and U.S. Government-sponsored enterprises, including mortgage-backed securities. The Fund now invests at least 80% of its net assets in inflation adjusted U.S. and non-U.S. fixed income securities.

The major U.S. fixed income sectors provided positive returns for the year 2007, with U.S. Treasury and higher quality securities outperforming higher risk sectors.

U.S. Treasury rates increased modestly during the first half of the year, generally resulting in negative fixed income market returns in the second quarter, as the economy produced job growth and concerns increased regarding the possibility of increased inflation. The Fund’s return was modestly positive for the first half of the year.

In contrast, rates generally declined in the second half of the year, beginning early in the third quarter, and market volatility increased. Declining interest rates generally increase the market value of fixed income securities. Investor preference for higher quality securities, particularly U.S. Treasuries, increased as market values for riskier securities, particularly subprime mortgage-related securities, declined, as housing prices continued to decline and economic concerns increased.

In response to increasing economic concerns, stable core inflation, and the increased volatility in security markets, the Federal Reserve lowered the Federal Funds interest rate three times in the second half of the year. The three reductions lowered the Federal Funds rate by a total of one percent, from 5.25% to 4.25%. Interest rates decreased more for shorter-term securities than for longer-term, resulting in a steeper yield curve. The two-year U.S. Treasury yield decreased from 4.81% at the beginning of 2007 to 3.05% at year end, and the ten-year U.S. Treasury yield decreased from 4.70% to 4.02%, with all of the decrease occurring in the second half of the year, following modest increases during the first half of the year.

The yield difference between similar maturity nominal U.S. Treasuries and high quality inflation protected securities, including Treasury Inflation Protected Securities (TIPS), widened. In general, a widening yield spread between securities of similar quality may, in VIA’s view, signal that inflation-related concerns have increased. TIPS are one type of inflation protected security in which the Fund may invest, and the Fund may invest in other inflation protected securities. The five-year maturity U.S. Treasury bonds began the year with a yield advantage of 2.23% over the five-year TIPS, and ended the year with a yield advantage of 2.34%.

The Fund’s performance benefited from three market trends noted above: increasing investor preference for higher quality securities such as U.S. Treasuries, the general decline in market interest rates and the increased difference between the yields for U.S. Treasuries and inflation protected securities. However, the Fund underperformed its new benchmark for 2007 because it was not invested primarily in inflation protected securities until May 1, 2007.

The Fund has two subadvisers, Pacific Investment Management Company (“PIMCO”) and BlackRock Financial Management, Inc. (“BlackRock”). BlackRock was funded and began active management in the fourth quarter. BlackRock provides the Fund with additional diversification benefits, as VIA believes its investment style complements that of PIMCO’s.

* Prior to May 1, 2007, the Fund compared its performance to the Lehman Brothers Intermediate Government Bond Index, an unmanaged market value weighted index of U.S. Government fixed rate debt securities with maturities between one and 10 years. The Fund changed the index to which it compares its performance because the Lehman Brothers U.S. TIPS Index is considered to better reflect the market sectors in which the Fund invests following the change of the Fund’s investment strategy.

14

| |

Subadviser Data | |

| |

Pacific Investment Management Company |

| |

| |

Founded: | 1971 |

Investment Style: | Fixed-Income – Inflation Protected Securities |

| |

BlackRock Financial Management, Inc. |

| |

| |

Founded: | 1988 |

Investment Style: | Fixed-Income – Inflation Protected Securities |

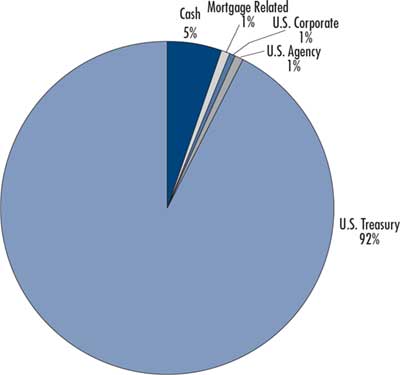

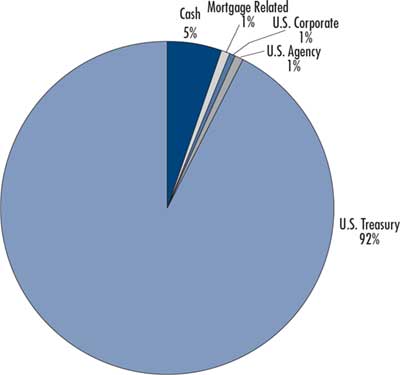

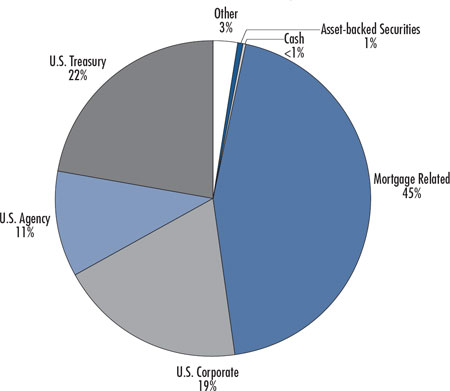

Vantagepoint Inflation Protected Securities Fund

Asset Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

15

|

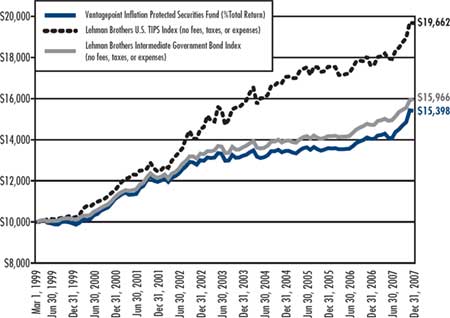

Vantagepoint Inflation Protected Securities Fund vs. Lehman Brothers U.S. TIPS Index

and Lehman Brothers Intermediate Government Bond Index:

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: lbbotson Associates

| |

Vantagepoint Inflation Protected Securities Fund

Average Annual Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 9.64% |

| |

Three Years | 4.62% |

| |

Five Years | 3.45% |

| |

Ten Years | 5.17% |

| |

Fund Inception Date | July 1, 1992 |

| |

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund at that time and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/ SIPC. 800-669-7400.

The Lehman Brothers U.S. TIPS Index consists of all U.S. Treasury inflation protected securities rated investment grade or better, having at least one year to final maturity and at least $250 million par amount outstanding. An index is not available for direct investment, is unmanaged, and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities held in the indexes.

On May 1, 2007, the Fund underwent changes to its name, principal investment strategies, and investment subadvisers. Performance prior to May 1, 2007 should not be considered representative of the performance of the Fund as currently managed.

16

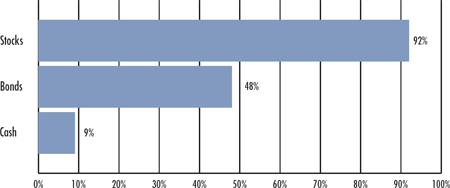

Vantagepoint Asset Allocation Fund

The Vantagepoint Asset Allocation Fund’s objective is to offer long-term capital growth at a lower level of risk than an all-equity portfolio. The principal investment strategy is to tactically allocate assets among common stocks, U.S. Treasury securities and investment grade short-term debt instruments in proportions determined by the subadviser based on relative expected returns and risk for each asset class. Under normal circumstances, the Fund invests 40% to 70% of its assets in common stocks; however, the Fund’s investments in common stocks may range from as little as 0% to as much as 100% of Fund assets. The Fund invests the rest of its assets in short-term debt instruments and U.S. Treasury obligations.

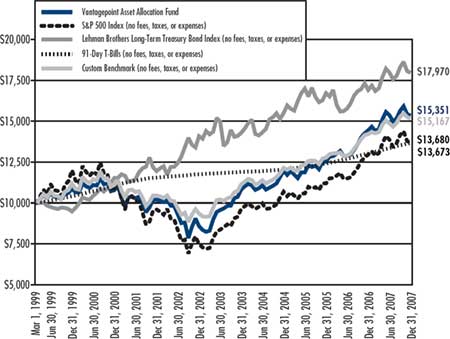

Performance

The Fund’s total return was 6.25% for 2007. The Fund’s market benchmarks, the S&P 500 Index, the Lehman Brothers Long-Term Treasury Bond Index, and 91-Day U.S. Treasury Bills, returned 5.49%, 9.81% and 5.00%, respectively, for the year. The Fund’s custom benchmark, a blend of 65% S&P 500 Index, 25% Lehman Brothers Long-Term Treasury Bond Index and 10% 91-Day U.S. Treasury Bills, returned 6.72%. The Fund’s peer group benchmark, the Morningstar Moderate Allocation Funds Category Average, a group of mutual funds with similar investment objectives, returned 5.99%.

Commentary

U.S. stocks generally provided positive returns for the fifth consecutive year, although not uniformly between investment styles and across market capitalizations. In the second half of the year, increasing softness in employment, credit availability, housing, and manufacturing contributed to dampened investor confidence and led to increased volatility in the U.S. equity markets. Increasing investor preference for lower risk assets throughout the second half of the year was reflected in generally higher returns for larger capitalization stocks compared to mid- and smaller-capitalization stocks.

The major U.S. fixed income sectors provided positive returns for the year, with U.S. Treasury and higher quality securities outperforming higher risk sectors.

U.S. Treasury rates increased modestly during the first half of the year, generally resulting in negative fixed income market returns in the second quarter, as the economy produced job growth and concerns increased regarding the possibility of increased inflation.

In contrast, rates generally declined in the second half of the year, beginning early in the third quarter. While declining interest rates generally increase the market value of fixed income securities, increased delinquency and default rates for subprime mortgages, along with rating agency downgrades of certain securities, led to significantly reduced market values for mortgage-related securities and increased market volatility. The Federal Reserve lowered the Federal Funds interest rate three times in the second half of the year as economic concerns increased. The three reductions lowered the Federal Funds rate by a total of one percent, from 5.25% to 4.25%. The two-year U.S. Treasury yield decreased from 4.81% at the beginning of 2007 to 3.05% at year end, and the ten-year U.S. Treasury yield decreased from 4.70% to 4.02%, with all of the decrease occurring in the second half of the year, following modest increases during the first half of the year.

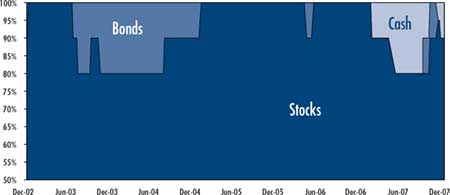

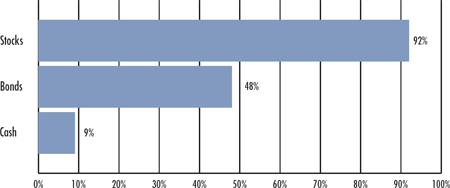

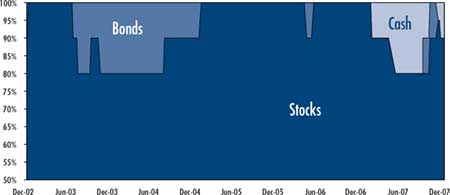

The Fund’s overweight allocation to stocks throughout the year detracted from relative performance, as the Fund slightly underperformed its custom benchmark. However, the Fund slightly outperformed its Morningstar peer group for the period. The Fund began 2007 with a 100% allocation to stocks. Due to market volatility, there were several asset mix shifts throughout the year. The weighting for stocks briefly reached its lowest level since 2003 at 80% in May, and shifted back to the 90% level as the subadviser sought to capture expected returns. Bond and cash exposure fluctuated between 0% and 20% of the Fund during the year. The Fund ended the year at 90% stocks, 0% bonds, and 10% cash.

The year-end 90% allocation to stocks reflects the subadviser’s expectation of favorable stock opportunities relative to those from bonds and cash. Should conditions change that outlook, VIA believes the Fund has the ability to quickly alter its allocation between stocks, bonds and cash for the benefit of the Fund’s investors.

17

| |

Subadviser Data | |

| |

Mellon Capital Management Corporation |

| |

| |

Founded: | 1983 |

Investment Style: | Tactical asset allocation |

Vantagepoint Asset Allocation Fund

Allocation of Assets for the 5 Years Ended December 31, 2007

|

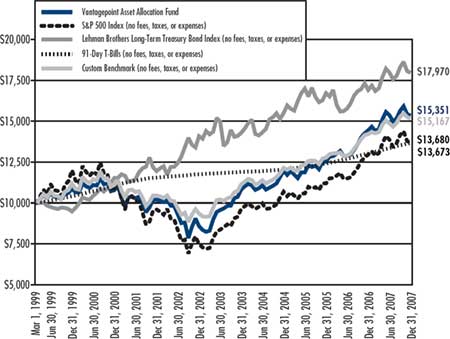

Vantagepoint Asset Allocation Fund vs. S&P 500 Index vs. Lehman Brothers Long-Term

Treasury Bond Index vs. 91-Day T-Bills vs. Custom Benchmark:

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: lbbotson Associates

18

| |

Vantagepoint Asset Allocation Fund

Average Annual Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 6.25% |

| |

Three Years | 8.66% |

| |

Five Years | 12.32% |

| |

Ten Years | 6.48% |

| |

Fund Inception Date | December 1, 1974 |

| |

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s custom blended benchmark is comprised of 65% S&P 500 Index, 25% Lehman Brothers Long-Term Treasury Bond Index and 10% 91-Day Treasury Bills. The S&P 500 Index consists of 500 companies representing larger capitalization stocks traded in the U.S. The Lehman Brothers Long-Term Treasury Bond Index consists of all Treasury obligations with maturities of 10 years or greater. The indexes are unmanaged and do not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the indexes.

19

Vantagepoint Equity Income Fund

The Vantagepoint Equity Income Fund seeks long-term capital growth with consistency derived from dividend yield. The principal investment strategy is to invest, under normal circumstances, at least 80% of its net assets in equity securities. The Fund seeks to invest primarily in the common stocks of companies that are expected to pay dividends at above-market levels. The Fund may invest across companies of all sizes but generally focuses on large-capitalization companies, which tend to have the most stable long-term earnings and dividend-paying records. The Fund may also invest in investment and below investment grade bonds, convertible securities and securities of foreign issuers.

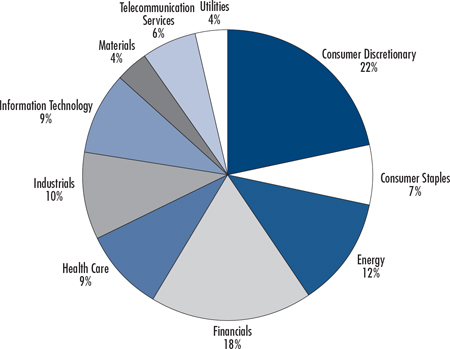

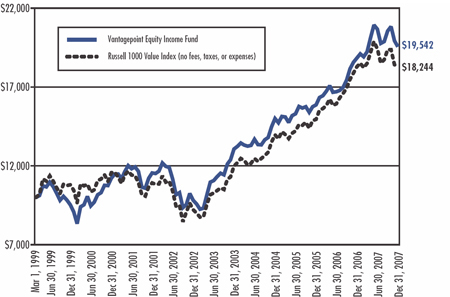

Performance

The Vantagepoint Equity Income Fund’s total return was 3.76% in 2007. Its market benchmark, the Russell 1000 Value Index, lost 0.17%, while the Morningstar Large Value Funds Category Average, a group of mutual funds with similar investment objectives, returned 1.42%.

Commentary

U.S. stocks generally provided positive returns, for the fifth consecutive year, although not uniformly between investment styles and across market capitalizations. In the second half of the year, increasing softness in employment, credit availability, housing, and manufacturing contributed to dampened investor confidence and led to increased volatility in the U.S. equity markets. Increasing investor preference for lower risk assets throughout the second half of the year was reflected in generally higher returns for larger capitalization stocks compared to smaller capitalization stocks. Larger and mid capitalization stocks generally outperformed smaller capitalization stocks; and, investors showed a general preference for growth oriented stocks as their valuations appeared increasingly attractive relative to value oriented stocks.

The Fund outperformed its market benchmark and peer group universe for 2007. Relative strength in the Financials, Consumer Discretionary, Information Technology, and Healthcare sectors aided Fund performance the most for the year ended December 31, 2007:

| | |

| • | The Fund’s allocation to the Financials sector, in addition to strong stock picking, was the most significant contributor to relative performance. The Fund was invested in sub-sectors having less exposure to the credit and subprime mortgage-related markets. While every Financials sub-sector posted a loss for the year, the Fund’s aggregate loss in the Financials sector was approximately one half of that suffered by the benchmark. |

| | |

| • | The Fund’s overweight to the underperforming Consumer Discretionary sector was offset by strong stock selection, resulting in a modestly positive return to the Fund, contrasted to significantly negative performance within the benchmark. The Fund’s investments in Household Durables, Hotels and Restaurants and Leisure sub-sectors contributed to relative performance. |

| | |

| • | The Information Technology sector contributed to relative performance, primarily as the result of good stock picking. On a relative basis, the Fund’s holdings outperformed the benchmark’s holdings in most sub-sectors. |

| | |

Fund holdings in several sectors underperformed during the year relative to the benchmark, detracting from overall performance: |

|

| • | The Telecommunications Services sector generated weak relative performance due primarily to poor stock selection. Share price weakness in the Wireless sub-sector and Diversified Telecommunications sector were the primary contributors to underperformance. |

| | |

| • | Stock selection in the Materials sector detracted from relative performance. |

| | |

| • | Fund holdings in the Energy sector contributed strongly on an absolute basis, while being a moderate detractor on a relative basis due to the Fund’s underweight position. |

Benefiting from its multi-management structure, the Fund has achieved a favorable performance record versus the benchmark and its large value peer universe. However, past performance is not a guarantee of future returns. The Fund’s subadvisers continue to seek out those undervalued investment options offering attractive value opportunities to build overall portfolio strength for long-term shareholders.

20

| |

Subadviser Data

| |

Barrow, Hanley, Mewhinney & Strauss, Inc. |

| |

Founded:

|

1979

|

Investment Style:

| Contrarian value |

Southeastern Asset Management, Inc.

|

| |

Founded:

|

1975

|

Investment Style: | Special situations value |

T. Rowe Price Associates, Inc.

|

| |

Founded:

|

1937

|

Investment Style: | Relative yield value |

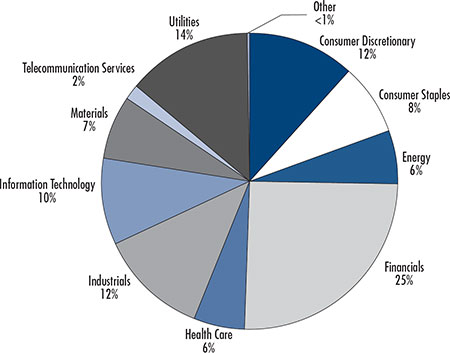

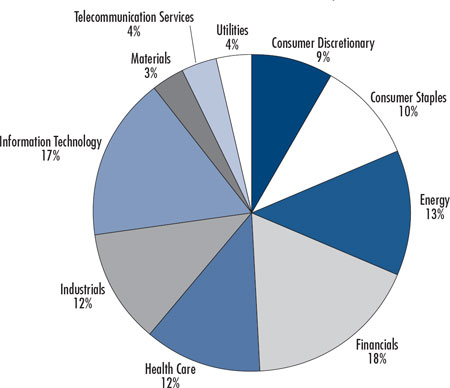

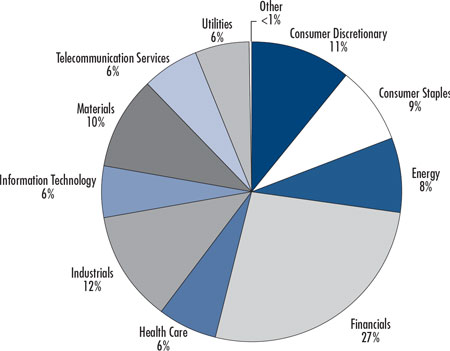

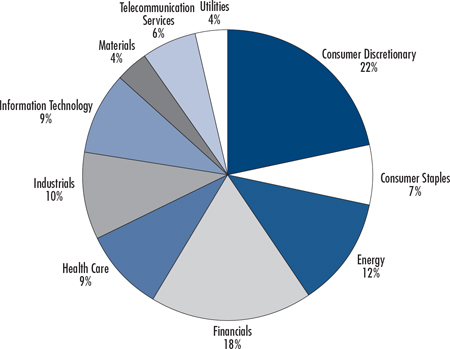

Vantagepoint Equity Income Fund

Sector Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

21

|

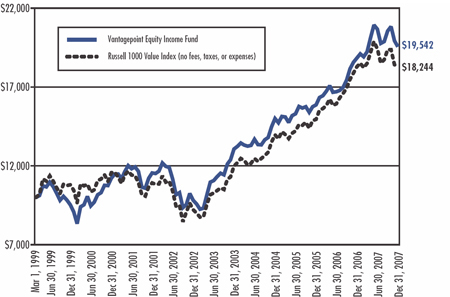

Vantagepoint Equity Income Fund vs. Russell 1000 Value Index: |

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: Ibbotson Associates

| |

Vantagepoint Equity Income Fund |

Average Annual Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 3.76% |

| |

Three Years | 9.22% |

| |

Five Years | 14.76% |

| |

Ten Years | 8.08% |

| |

Fund Inception Date | April 1, 1994 |

| |

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s market benchmark, the Russell 1000 Value Index, consists of a subset of the Russell 1000 Index that includes stocks with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the market index.

22

Vantagepoint Growth & Income Fund

The Vantagepoint Growth & Income Fund’s objective is to offer long-term capital growth and current income. The principal investment strategy is to invest primarily in common stocks that the Fund’s subadvisers believe offer the potential for capital appreciation and, secondarily, current income by investing in dividend-paying stocks. The Fund may also invest in bonds, convertible securities and the securities of foreign issuers.

Performance

The Fund’s total return was 5.98% in 2007. The S&P 500 Index, the Fund’s market benchmark, gained 5.49%. The Morningstar Large Blend Funds Category Average, a group of mutual funds with similar investment objectives, advanced 6.16%.

Commentary

U.S. stocks generally provided positive returns, for the fifth consecutive year, although not uniformly between investment styles and across market capitalizations. In the second half of the year, increasing softness in employment, credit availability, housing, and manufacturing contributed to dampened investor confidence and led to increased volatility in the U.S. equity markets. Increasing investor preference for lower risk assets throughout the second half of the year was reflected in generally higher returns for larger capitalization stocks compared to smaller capitalization stocks. Larger and mid-capitalization stocks generally outperformed smaller capitalization stocks; and, investors showed a general preference for growth oriented stocks as their valuations appeared increasingly attractive relative to value oriented stocks.

For the year, the Fund outperformed its market benchmark and performed in-line with peers. The relative strength in the Consumer Discretionary, Materials, Financials and Industrials sectors aided Fund performance for most of the year:

| | |

| • | While the Consumer Discretionary sector was weak in 2007, reflecting the slowdown in the economy, the Fund outperformed within the sector through good stock selection, principally in Internet and Catalog companies, and by an underweight in Media companies. |

| | |

| • | The Materials sector was one the strongest sectors in terms of absolute performance, and the Fund outperformed by overweighting Chemical companies. |

| | |

| • | The Financials sector was the weakest for the year in terms of absolute performance. Relative outperformance primarily reflected minimized holdings of the Financial Services and Commercial Banking companies most affected by weakness in the credit markets. |

| | |

| • | Stock selection in the Industrials sector contributed to performance, primarily from robust Construction companies’ performance, and provided both absolute return and relative outperformance. |

| | |

While adding to the Fund’s overall return, the Fund’s underweight positions in both the Energy and Consumer Staples sectors represented the greatest detractors from relative performance: |

| | |

| • | The Energy sector produced the highest return within the benchmark, buoyed by high energy prices. Fund holdings generated strong returns on an absolute basis, but were a moderate detractor versus the benchmark due to an underweight position. |

| | |

| • | The Consumer Staples sector performed well, as is expected during periods of economic slowdown. The Fund’s slight sector underweight detracted from relative performance, while contributing to absolute performance. |

The Fund blends three complementary styles of investing – value, growth and core. Three subadvisers implement this blended strategy, each managing one of the three styles, with a view towards providing favorable results with more consistency over time than a single style fund.

23

| |

Subadviser Data | |

Capital Guardian Trust Company

|

| |

Founded:

|

1968

|

Investment Style: | Selected opportunities |

| |

T. Rowe Price Associates, Inc. |

| |

Founded:

|

1937

|

Investment Style: | Blue chip growth |

| |

Wellington Management Company, LLP |

| |

Founded:

|

1928

|

Investment Style: | Yield-focused value |

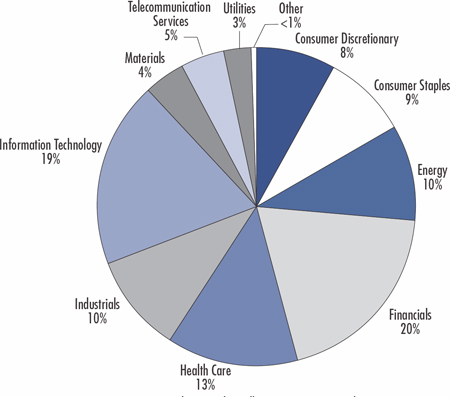

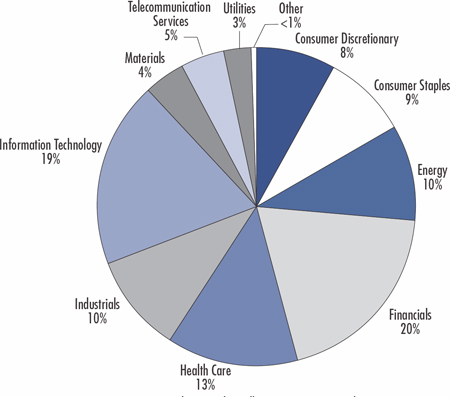

Vantagepoint Growth & Income Fund

Sector Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

24

|

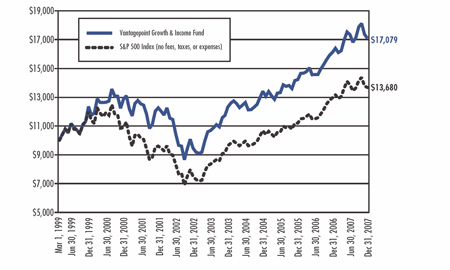

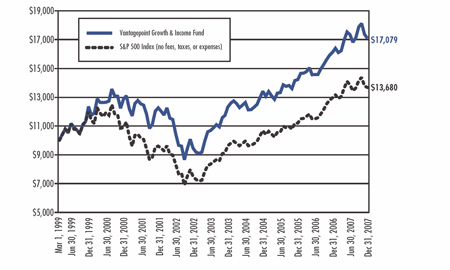

Vantagepoint Growth & Income Fund vs. S&P 500 Index: |

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: Ibbotson Associates

| |

Vantagepoint Growth & Income Fund |

Average Annual Total Return for the periods ended December 31, 2007* |

| |

| |

One Year | 5.98% |

| |

Three Years | 8.38% |

| |

Five Years | 12.58% |

| |

Since Inception | 9.03% |

| |

Fund Inception Date | October 2, 1998 |

| |

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s market benchmark, the S&P 500 Index, consists of 500 companies representing larger capitalization stocks traded in the U.S. The index is unmanaged and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the market index.

25

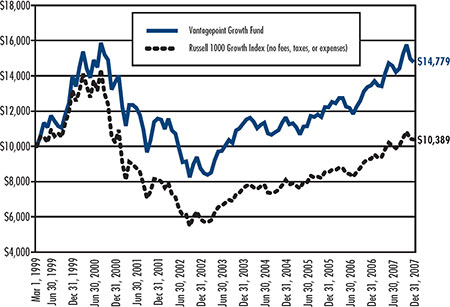

Vantagepoint Growth Fund

The Vantagepoint Growth Fund’s objective is to offer long-term capital growth. The principal investment strategy is to invest primarily in common stocks that are considered by the Fund’s subadvisers to have above-average potential for growth. The Fund may also invest in bonds, convertible securities and securities of foreign issuers.

Performance

The Vantagepoint Growth Fund’s total return was 9.81% in 2007. The Fund’s market benchmark, the Russell 1000 Growth Index, gained 11.81% for the year; the Morningstar Large Growth Category Average, a group of mutual funds with similar investment objectives and the Fund’s peer group benchmark, returned 13.35%.

Commentary

U.S. stocks generally provided positive returns, for the fifth consecutive year, although not uniformly between investment styles and across market capitalizations. Investors showed a general preference for growth oriented stocks as their valuations appeared increasingly attractive relative to value oriented stocks; and, larger and mid-capitalization stocks generally outperformed smaller capitalization stocks. In the second half of the year, increasing softness in employment, credit availability, housing, and manufacturing contributed to dampened investor confidence and led to increased volatility in the U.S. equity markets. Increasing investor preference for lower risk assets throughout the second half of the year was reflected in generally higher returns for larger capitalization stocks compared to smaller capitalization stocks.

The Fund underperformed both its market benchmark and its large-capitalization growth peer group category average in 2007. Financial, Healthcare and Energy stocks adversely impacted performance, while Technology, Industrial and Consumer Discretionary stocks contributed to the Fund’s return:

| | |

| • | Financial sector stocks underperformed as the subprime mortgage crisis impacted Real Estate Management firms and Mortgage Finance companies in addition to Commercial Banks and Diversified Financial companies. |

| | |

| • | Healthcare sector stocks lagged the overall market’s performance. Several leading Biotechnology stocks experienced adverse Federal Drug Administration rulings and slowing sales of key drugs, while Healthcare Providers suffered from an uncertain future due to the upcoming presidential election in 2008. |

| | |

| • | Energy stocks experienced another strong year as oil approached $100 a barrel. While the Fund’s Energy holdings outpaced the benchmark and peers, an underweight position relative to the benchmark hindered performance. |

| | |

| • | The Technology sector was the largest contributor to absolute returns for the Fund in 2007. The Software and Computer industries benefited from increased capital spending by corporations, and Internet Software stocks extended their strong 2006 performance. |

| | |

| • | The Fund’s Industrial holdings were a positive source of return for the Fund. Several of the Fund’s alternative energy stocks experienced sizable returns as rising oil prices prompted investment in renewable energy sources. Construction and Engineering stocks were also a source of outperformance. |

| | |

| • | While the Consumer Discretionary sector was the weakest performing sector for the market, the Fund earned a positive return through strong stock selection, avoiding Leisure and traditional Retail stocks and focusing on Consumer Service and Internet Retail stocks. |

At year-end, the Fund’s investment management strategies continue to complement one another by providing five different styles of growth investing. This multi-management approach seeks to position the Fund for attractive long-term investment opportunities.

26

| |

Subadviser Data | |

| |

Goldman Sachs Asset Management, L.P. |

| | |

|

Founded: | 1988 |

Investment Style: | Structured growth |

| |

Legg Mason Capital Management, Inc. |

| | |

|

Founded: | 1982 |

Investment Style: | Opportunistic growth |

| |

Peregrine Capital Management, Inc. | |

| | |

|

Founded: | 1984 |

Investment Style: | Concentrated growth |

| |

Tukman Grossman Capital Management, Inc. |

| | |

|

Founded: | 1980 |

Investment Style: | Contrarian growth |

| |

Westfield Capital Management Company, LLC |

| | |

|

Founded: | 1989 |

Investment Style: | Thematic growth |

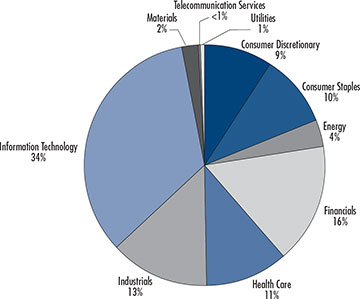

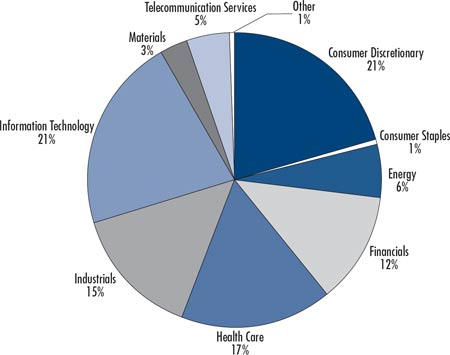

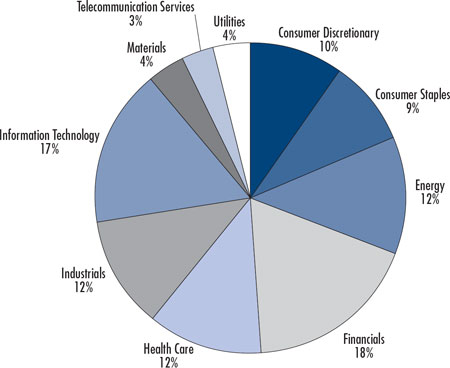

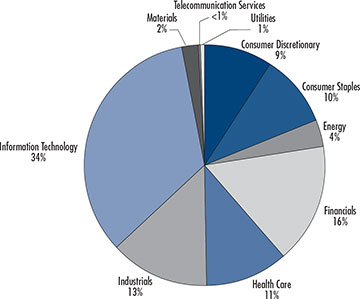

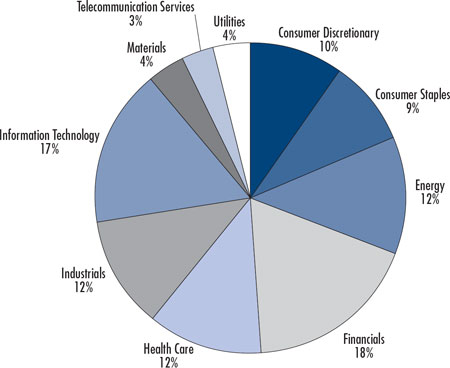

Vantagepoint Growth Fund

Sector Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

27

|

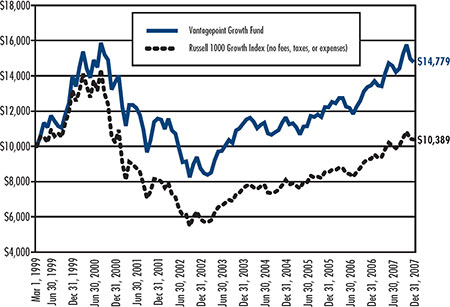

Vantagepoint Growth Fund vs. Russell 1000 Growth Index: |

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: Ibbotson Associates

| |

Vantagepoint Growth Fund | |

Average Annual Total Return for the periods ended December 31, 2007* |

| |

|

One Year | 9.81% |

|

Three Years | 8.26% |

|

Five Years | 11.02% |

|

Ten Years | 5.56% |

|

Fund Inception Date | April 1, 1983 |

|

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s market benchmark, the Russell 1000 Growth Index consists of a subset of the Russell 1000 Index that includes stocks with higher price-to-book ratios and higher forecasted growth values. The index is unmanaged and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the market index.

28

Vantagepoint Select Value Fund

The Vantagepoint Select Value Fund’s objective is to offer long-term growth from dividend income and capital appreciation. The principal investment strategy is to invest, under normal circumstances, primarily in common stocks of mid-capitalization U.S. companies that the Fund’s subadvisers believe present attractive investment opportunities at favorable prices in relation to intrinsic worth of the issuer. The Fund may also invest in preferred stocks, stocks of foreign issuers and convertible securities.

Performance

Because the Fund has not been in operation for a full calendar year, no performance information is included in this annual report.

| |

Subadviser Data | |

| |

Goldman Sachs Asset Management, L.P. |

| | |

|

Founded: | 1988 |

Investment Style: | Quantitative structured value |

| |

WEDGE Capital Management, L.L.P. |

| | |

|

Founded: | 1984 |

Investment Style: | Concentrated traditional value |

| |

Systematic Financial Management, L.P. |

| | |

|

Founded: | 1982 |

Investment Style: | Relative value |

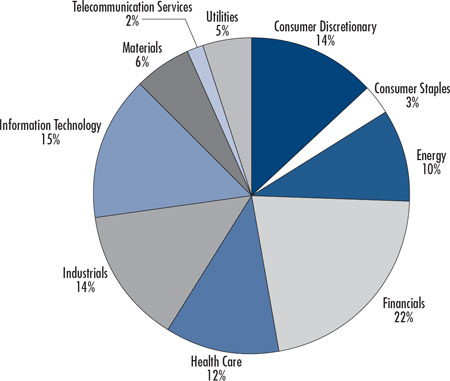

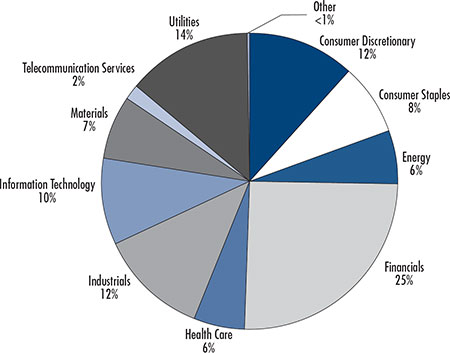

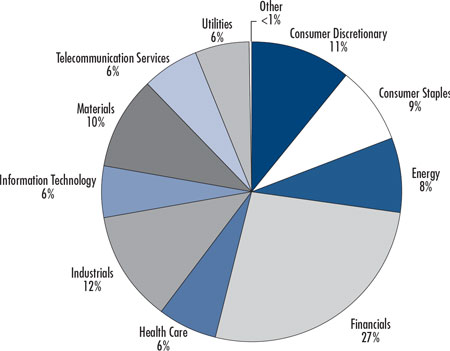

Vantagepoint Select Value Fund

Sector Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

29

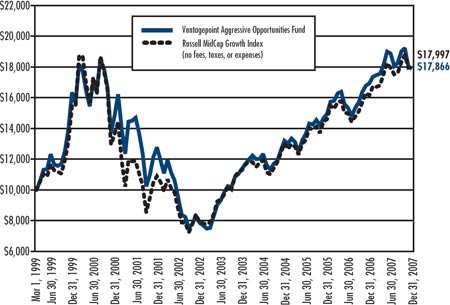

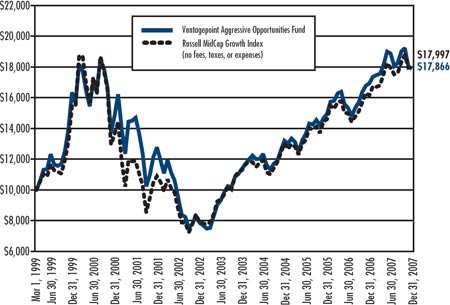

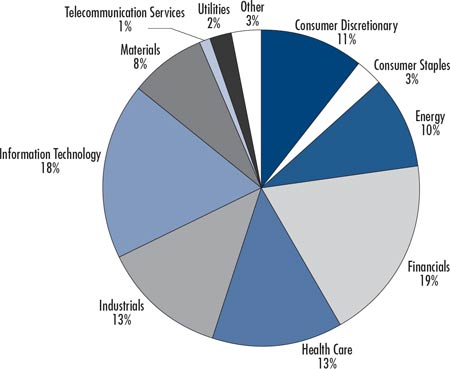

Vantagepoint Aggressive Opportunities Fund

The Vantagepoint Aggressive Opportunities Fund’s objective is to offer high long-term capital appreciation. The principal investment strategy is to invest, under normal circumstances, primarily in common stocks of small- to medium-capitalization U.S. and foreign companies that the Fund’s subadvisers believe offer the opportunity for high capital appreciation. The Fund may also invest in debt instruments, preferred stock, foreign stocks and bonds, convertible securities and derivatives such as futures and options.

Performance

The Vantagepoint Aggressive Opportunities Fund’s total return was 5.53% in 2007. The Fund’s market benchmark, the Russell MidCap Growth Index, gained 11.43%, while the Morningstar Mid-Cap Growth Funds Category Average, a group of mutual funds with similar investment objectives, returned 15.09%.

Commentary

U.S. stocks generally provided positive returns, for the fifth consecutive year, although not uniformly between investment styles and across market capitalizations. Larger and mid-capitalization stocks generally outperformed smaller capitalization stocks; and, investors showed a general preference for growth oriented stocks as their valuations appeared increasingly attractive relative to value oriented stocks. In the second half of the year, increasing softness in employment, credit availability, housing, and manufacturing contributed to dampened investor confidence and led to increased volatility in the U.S. equity markets. Increasing investor preference for lower risk assets throughout the second half of the year was reflected in generally higher returns for larger capitalization stocks compared to smaller capitalization stocks.

The Fund underperformed its market benchmark and peer group category average, while producing the fifth consecutive calendar year of positive absolute performance. Fund overweight allocations to the Information Technology and Healthcare sectors aided performance. Stock selection in the Financials, Energy and Industrial sectors detracted from relative performance:

| |

• | An overweight to the Information Technology sector and stock selection resulted in strong absolute and relative performance. Merger and acquisition activity in the Internet Software and Service industry benefited Fund performance. |

| |

• | Strong stock selection and an overweight position in Healthcare related stocks added to positive absolute and relative performance. In particular, Healthcare Providers and Service industry holdings were supported by valuation expansion, fundamental performance, and premium acquisition buyouts. |

| |

• | An underweight allocation to the Industrial sector and stock selection detracted from relative performance, while providing a positive absolute return. |

| |

• | Strong stock selection in the Energy sector contributed to absolute performance. |

| |

• | An overweight exposure to the Financials sector detracted from performance. |

The Aggressive Opportunities Fund experienced a minor portfolio reallocation among three of its subadvisers during October 2007. This adjustment reduced the Fund’s exposure to small-capitalization stocks. The reallocation resulted in Fund characteristics more closely correlated to the Fund’s market benchmark, the Russell MidCap Growth Index.

In VIA’s view, the Fund’s four subadvisers, which employ distinct, yet complementary investing styles, remain committed to their respective strategies. This multi-management approach seeks to position the Fund for attractive long-term investment opportunities.

30

| |

Subadviser Data | |

| |

Legg Mason Capital Management, Inc. |

| |

|

Founded: | 1982 |

Investment Style: | Opportunistic growth |

| |

T. Rowe Price Associates, Inc. |

| |

|

Founded: | 1937 |

Investment Style: | Emerging growth |

| |

TimesSquare Capital Management, LLC |

| |

|

Founded: | 2004 |

Investment Style: | Growth opportunities |

| |

Southeastern Asset Management, Inc. |

| |

|

Founded: | 1975 |

Investment Style: | Special situations |

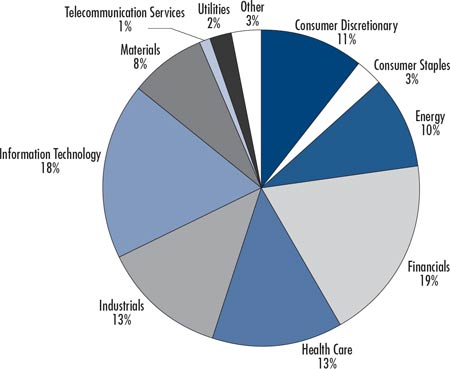

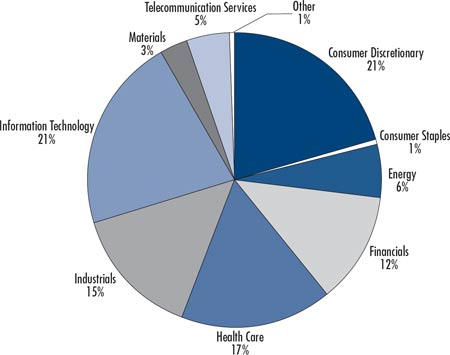

Vantagepoint Aggressive Opportunities Fund

Sector Allocation as of December 31, 2007

Due to rounding, pie chart allocations may not equal 100%.

31

|

Vantagepoint Aggressive Opportunities Fund vs. Russell MIDCAP Growth Index: |

Growth of $10,000 Invested March 1, 1999* |

| |

Source for Benchmark Returns: Ibbotson Associates

| |

Vantagepoint Aggressive Opportunities Fund |

Average Annual Total Return for the periods ended December 31, 2007* |

| |

|

One Year | 5.53% |

| |

Three Years | 10.64% |

| |

Five Years | 17.84% |

| |

Ten Years | 6.84% |

| |

Fund Inception Date | October 1, 1994 |

| |

Fund Registration Date | March 1, 1999 |

* Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance information for periods prior to March 1, 1999, when the Fund began operating, is of a commingled fund that had the same investment objectives and policies as the Fund and was advised by an affiliate of the Fund’s adviser. This past performance was adjusted at the time of the Fund’s registration to reflect the expenses of the Fund. The commingled fund was not a registered mutual fund so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the commingled fund’s performance may have been lower. All returns assume reinvested dividends and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please consult the current prospectus carefully before investing any money. The Vantagepoint Funds are distributed by ICMA-RC Services, LLC, a wholly owned broker-dealer subsidiary of ICMA-RC, and member FINRA/SIPC. 800-669-7400.

The Fund’s market benchmark, the Russell MidCap Growth Index is a subset of the Russell MidCap Index that includes companies with higher price-to-book ratios and higher forecasted growth values. The index is unmanaged and does not reflect the costs of portfolio management or trading. The Fund’s portfolio may differ significantly from the securities in the market index.

32

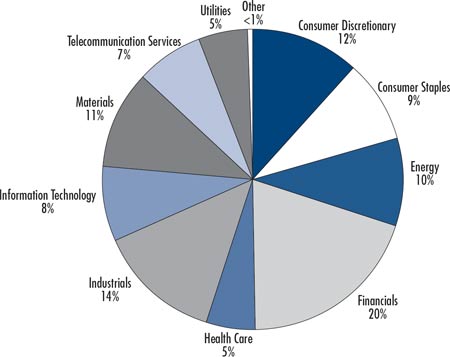

Vantagepoint Discovery Fund

The Vantagepoint Discovery Fund’s objective is to offer long-term capital growth. The principal investment strategy is to invest, under normal circumstances, in a combination of U.S. common stocks of small capitalization companies, Russell 2000 Index futures contracts and fixed income securities.

Performance

Because the Fund has not been in operation for a full calendar year, no performance information is included in the annual report.

Subadviser Data

| |

Wellington Management Company, LLP |

| |

|

Founded: | 1928 |

Investment Style: | Diversified small-cap blend |

| |

Payden & Rygel | |

| | |

| |

Founded: | 1983 |

Investment Style: | Enhanced index |

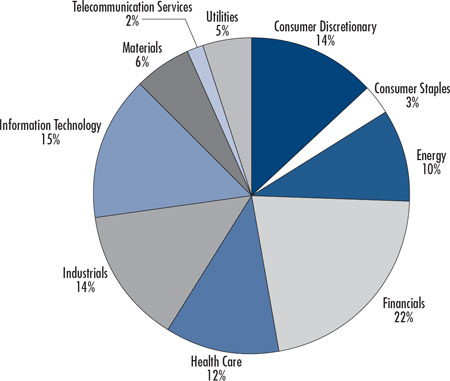

Vantagepoint Discovery Fund

Sector Allocation as of December 31, 2007*

*The Sector Allocation reflected in this pie chart was calculated using the

actual equity securities held by the Fund and blending them with the

sectors represented in the Russell 2000 Index futures held by this Fund.

Due to rounding, pie chart allocations may not equal 100%.

33

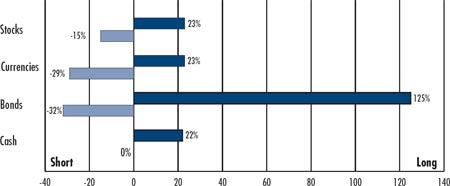

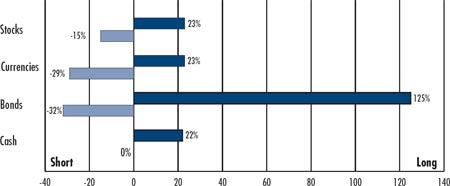

Vantagepoint Discovery Fund Asset Class Exposure

as of December 31, 2007*

* Portfolio exposures represent the market value of physical securities and the measurement of exposure through the derivative instruments held by the Fund as a percent of the Fund’s net assets. For the purpose of displaying this allocation information, exposure through derivatives is measured based on the value of the underlying assets, rate or index represented by the derivative. This measurement is different from the valuation used for the purposes of calculating the Fund’s net asset value. This measurement method is intended to reflect the “economic exposure ” of the derivative – effectively, the market exposure, to the Fund. This may result in a total percentage reflected in the chart that exceeds 100%.

34

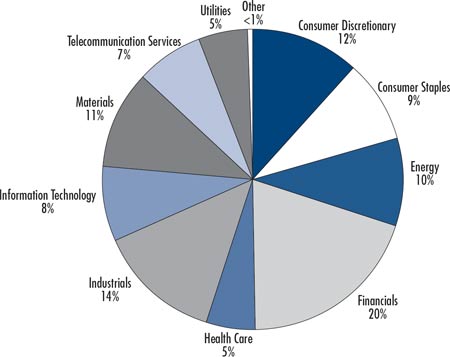

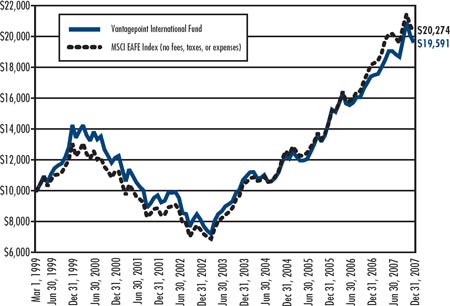

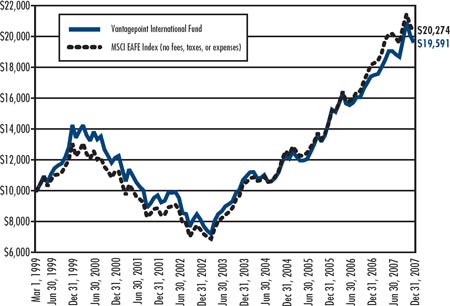

Vantagepoint International Fund

The Vantagepoint International Fund’s objective is to offer long-term capital growth and diversification by country. The principal investment strategy is to invest primarily in the common stocks of companies headquartered outside the United States. The Fund will invest, under normal circumstances, at least 80% of its assets in foreign equity securities. The Fund may also invest in U.S. or foreign bonds, U.S. stocks, convertible securities and derivatives, including futures and options.

Performance

The Vantagepoint International Fund’s total return was 12.46% in 2007. The Fund’s market benchmark, the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index, returned 11.63%. The Morningstar Foreign Large Blend Category Average, a group of mutual funds with similar investment objectives, returned 12.71%.

Commentary

International stocks as measured by the MSCI EAFE Index, provided positive returns, producing the fifth consecutive year of double-digit gains in U.S. Dollar terms, and the sixth consecutive year outperforming U.S. stocks as measured by the S&P 500 Index. Emerging market stocks led developed markets stocks for the seventh consecutive year, while growth stocks outperformed value stocks for the first time since calendar year 1999. International large-capitalization stocks outperformed small-capitalization stocks, continuing the outperformance that began in 2006 following seven years of small-capitalization stock outperformance.

Greater Asia produced positive results in U.S. Dollar denominated terms; however, Japan was a negative contributor to Fund performance in absolute and relative terms. Greater Europe produced positive absolute results for the Fund, with continental Europe outperforming the United Kingdom. However, Fund holdings in Greater Europe underperformed the benchmark. Fund exposures in Canada, China, and Mexico were significant contributors to Fund performance through both stock performance and currency valuation changes.

Market gains were achieved in all but one sector, with eight of the ten sectors realizing returns in excess of 10%. Material stocks surpassed all others as global economic growth created increased demand for chemicals and commodities.

The Fund’s outperformance relative to its market benchmark was also partially explained by its modest, opportunistic growth bias. This bias hindered performance in recent years when the market favored value-oriented stocks and strategies.

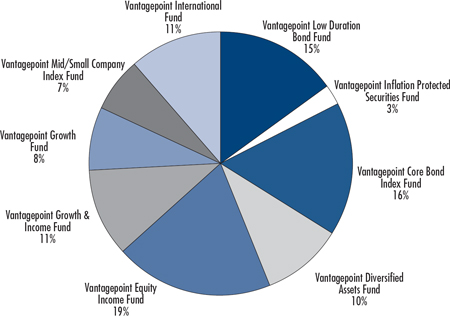

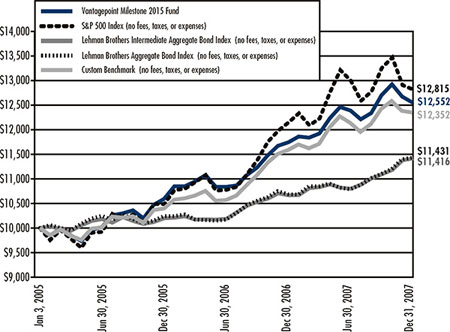

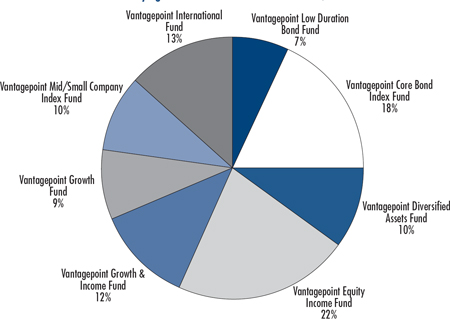

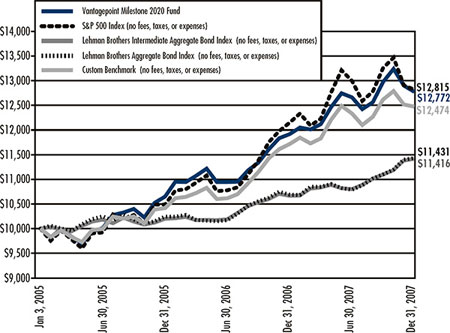

The International Fund experienced a minor restructuring during September 2007, as a result of continued asset allocation research and manager due diligence. The modest reallocation of assets across the Fund’s four subadvisers had the effect of reducing the Fund’s exposure to Japan and simultaneously increasing smaller market-cap stock exposure.