| | unaudited | |

| In CHF millions | | Share capital | | | Additional paid-in

capital | | | Retained earnings | | | Treasury

stock | | | Fair value

and other reserves | | | Total shareholders’ equity | |

| | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2000 | | 1 839 | | | 2 395 | | | 4 559 | | | (1 | ) | | (222 | ) | | 8 570 | |

| Effect of adopting IAS 39 | | – | | | – | | | (3 | ) | | – | | | 101 | | | 98 | |

Balance at January 1, 2001, restated | | 1 839 | | | 2 395 | | | 4 556 | | | (1 | ) | | (121 | ) | | 8 668 | |

| | – | | | – | | | – | | | – | | | (128 | ) | | (128 | ) |

| | – | | | – | | | – | | | – | | | (312 | ) | | (312 | ) |

| Losses not recognized in income statement | | – | | | – | | | – | | | – | | | (440 | ) | | (440 | ) |

| Capital reduction | | (589 | ) | | – | | | – | | | – | | | – | | | (589 | ) |

| Dividend paid | | – | | | – | | | (809 | ) | | – | | | – | | | (809 | ) |

| Net income | | – | | | – | | | 5 753 | | | – | | | – | | | 5 753 | |

Balance at September 30, 2001 | | 1 250 | | | 2 395 | | | 9 500 | | | (1 | ) | | (561 | ) | | 12 583 | |

| | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2001 | | 1 250 | | | 2 395 | | | 8 711 | | | (2 | ) | | (285 | ) | | 12 069 | |

| | – | | | – | | | – | | | – | | | 14 | | | 14 | |

| | – | | | – | | | – | | | – | | | (113 | ) | | (113 | ) |

| Losses not recognized in income statement | | – | | | – | | | – | | | – | | | (99 | ) | | (99 | ) |

| Capital reduction | | (529 | ) | | – | | | – | | | – | | | – | | | (529 | ) |

| Share buy-back | | 125 | | | (1 823 | ) | | (2 316 | ) | | – | | | – | | | (4 264 | ) |

| Dividend paid | | (728 | ) | | – | | | – | | | – | | | – | | | (728 | ) |

| Net income | | – | | | – | | | 1 211 | | | – | | | – | | | 1 211 | |

Balance at September 30, 2002 | | 596 | | | 572 | | | 6 878 | | | (2 | ) | | (384 | ) | | 7 660 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Notes to the Consolidated Interim Statements

1 Accounting principles

The unaudited consolidated interim statements have been drawn up in accordance with International Accounting Standard (IAS) 34 “Interim Financial Reporting". The same accounting principles apply as were used for the consolidated financial statements for 2001.

Certain amounts for the previous year have been reclassified to facilitate comparison.

2 Results by segment

As a result of organizational changes, the segments have been redefined compared to the previous year. The previous segments “Fixnet Retail and Network” and “Fixnet Wholesale and Carrier Services” have been combined with Bluewin AG, Swisscom Directories AG and Telecom FL AG, which were part of the segment “Other” in the previous year, to form the new segment “Fixnet". Additionally, revenue from access services for business customers is included in the “Fixnet” segment in 2002; in 2001 this revenue was reported in “Enterprise Solutions". Last year’s figures have been restated to reflect the new structure.

The “Fixnet” segment covers national and international traffic for residential customers, access charges for residential and business customers as well as value-added services and customer premises equipment. Additionally the segment covers utilization of the Swisscom fixed network by other national and inter-national telecoms providers and the Wholesale activities of international subsidiaries in Europe and the USA. The segment also comprises Bluewin AG, Swisscom Directories AG, Telecom FL AG, payphone services, operator services and the cards business.

"Mobile” covers the provision of mobile telephony, data and value-added services and wholesale network utilization charges.

"Enterprise Solutions” covers national and international traffic and value-added services for business customers. The segment also contains leased lines, tele-housing, hosting and communication solutions for business customers.

The “debitel” segment reflects the business activities of the debitel Group.

The segment “Other” covers mainly Swisscom Systems AG, Swisscom IT Services AG, Swisscom Broadcast AG and Billag AG.

"Corporate” includes the cost of the Group headquarters, the real estate companies and certain items of expense which are not directly attributable to specific segments.

15

| | unaudited | |

| In CHF millions | | | | | | | | | | | | | | | | | | | | | | | | |

| 30.09.2001 | | Fixnet | | | Mobile | | | Enterprise

Solutions | | | debitel | | | Other | | | Corporate | | | Elimination | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net revenue from external customers | | 3 668 | | | 2 327 | | | 1 107 | | | 2 852 | | | 547 | | | 71 | | | – | | | 10 572 | |

| Intersegment revenue | | 1 236 | | | 646 | | | 74 | | | – | | | 485 | | | 497 | | | (2 938 | ) | | – | |

Net revenue | | 4 904 | | | 2 973 | | | 1 181 | | | 2 852 | | | 1 032 | | | 568 | | | (2 938 | ) | | 10 572 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other operating income | | 54 | | | 4 | | | – | | | – | | | 16 | | | 68 | | | – | | | 142 | |

| Segment expenses | | (3 432 | ) | | (1 571 | ) | | (1 085 | ) | | (2 710 | ) | | (922 | ) | | (489 | ) | | 2 938 | | | (7 271 | ) |

Operating income before depreciation (EBITDA) | | 1 526 | | | 1 406 | | | 96 | | | 142 | | | 126 | | | 147 | | | – | | | 3 443 | |

Margin in % | | 31.1 | % | | 47.3 | % | | 8.1 | % | | 5.0 | % | | 12.2 | % | | 25.9 | % | | | | | 32.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | (790 | ) | | (213 | ) | | (23 | ) | | (36 | ) | | (170 | ) | | (77 | ) | | – | | | (1 309 | ) |

Operating income before goodwill amortization | | 736 | | | 1 193 | | | 73 | | | 106 | | | (44 | ) | | 70 | | | – | | | 2 134 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of goodwill | | (1 | ) | | – | | | – | | | (288 | ) | | – | | | – | | | – | | | (289 | ) |

Segment operating income (EBIT) | | 735 | | | 1 193 | | | 73 | | | (182 | ) | | (44 | ) | | 70 | | | – | | | 1 845 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain on partial sale of Swisscom Mobile AG | | | | | | | | | | | | | | | | | | | | | | | 3 837 | |

| Gain on sale of real estate | | | | | | | | | | | | | | | | | | | | | | | 555 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | | | | | | | | | | | | | | | | | | | | | 6 237 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | |

| | unaudited | |

| In CHF millions | | | | | | | | | | | | | | | | | | | | | | | | |

| 30.09.2002 | | Fixnet | | | Mobile | | | Enterprise

Solutions | | | debitel | | | Other | | | Corporate | | | Elimination | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net revenue from external customers | | 3 676 | | | 2 437 | | | 1 022 | | | 2 981 | | | 606 | | | 66 | | | – | | | 10 788 | |

| Intersegment revenue | | 1 167 | | | 634 | | | 63 | | | – | | | 464 | | | 470 | | | (2 798 | ) | | – | |

Net revenue | | 4 843 | | | 3 071 | | | 1 085 | | | 2 981 | | | 1 070 | | | 536 | | | (2 798 | ) | | 10 788 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other operating income | | 67 | | | 12 | | | – | | | 22 | | | 14 | | | 24 | | | – | | | 139 | |

| Segment expenses | | (3 427 | ) | | (1 570 | ) | | (1 044 | ) | | (2 882 | ) | | (912 | ) | | (476 | ) | | 2 798 | | | (7 513 | ) |

Operating income before depreciation (EBITDA) | | 1 483 | | | 1 513 | | | 41 | | | 121 | | | 172 | | | 84 | | | – | | | 3 414 | |

Margin in % | | 30.6 | % | | 49.3 | % | | 3.8 | % | | 4.1 | % | | 16.1 | % | | 15.7 | % | | | | | 31.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | (785 | ) | | (203 | ) | | (23 | ) | | (44 | ) | | (160 | ) | | (42 | ) | | – | | | (1 257 | ) |

Operating income before goodwill amortization | | 698 | | | 1 310 | | | 18 | | | 77 | | | 12 | | | 42 | | | – | | | 2 157 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of goodwill | | (3 | ) | | – | | | – | | | (205 | ) | | (17 | ) | | (1 | ) | | – | | | (226 | ) |

Segment operating income (EBIT) | | 695 | | | 1 310 | | | 18 | | | (128 | ) | | (5 | ) | | 41 | | | – | | | 1 931 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

16

3 Debt

| | | | | | unaudited | |

| In CHF millions | | 31.12.2001 | | | 30.09.2002 | |

| | | | | | | |

Long-term debt | | | | | | |

| Swiss Post loan | | 1 750 | | | 1 000 | |

| Financial liability from cross-border tax lease arrangements | | 1 600 | | | 1 596 | |

| Finance lease obligation | | 1 370 | | | 1 286 | |

| Other long-term debt | | 63 | | | 60 | |

Total | | 4 783 | | | 3 942 | |

| Less current portion | | (1 040 | ) | | (1 083 | ) |

Total long-term debt | | 3 743 | | | 2 859 | |

| |

|

| |

|

| |

Short-term debt | | | | | | |

| Current portion of long-term debt | | 1 040 | | | 1 083 | |

| Employee saving deposits | | 577 | | | 204 | |

| Short-term loans payable to affiliated companies | | 47 | | | 3 | |

| Other short-term debt | | 93 | | | 119 | |

Total short-term debt | | 1 757 | | | 1 409 | |

| |

|

| |

|

| |

In the third quarter of 2002, Swisscom entered into a cross border tax lease transaction with two foreign investors and received a fee of CHF 28 million, net of expenses. The transaction involved Swisscom placing USD 55 million (CHF 81 million) in trust to cover the debt obligation. Swisscom also entered into a non-refundable payment undertaking agreement in the amount of USD 388 million (CHF 573 million) with a financial institution with minimal credit risk. Swisscom concluded that these transactions lacked economic substance and did not record the debt or the corresponding asset. As Swisscom is not responsible for any performance under these arrangements, other than that which would be done in the normal course of business, Swisscom recognized the fee as income in the third quarter of 2002.

4 Share buy-back

Swisscom repurchased 7,346,739 of its own shares (9.99% of all outstanding shares) in March 2002 through a share buy-back program. Shareholders were granted one free put option per share. Shareholders were entitled to sell one share for every 10 put options at a strike price of CHF 580 less 35% withholding tax. Shares at a value of CHF 2,816 million were repurchased in the first quarter. On April 30, 2002, the Shareholders’ Meeting approved the reduction of the number of shares from 73,550,000 to 66,203,261. The Swiss Confederation holds 62.7% of share capital following the capital reduction.

5 Capital Reduction

On April 30, 2002 , the Shareholders’ meeting approved a capital reduction of CHF 8 per share respectively CHF 529 million. The amount was paid in the third quarter 2002.

17

6 Legal proceedings

On September 3, 2002, Swisscom was served with a Consolidated Class Action Complaint for alleged violations of US Federal Securities Law in connection with the IPO of the Californian Infonet Services Corporation in which Swisscom has an investment. The complaint was filed on behalf of public investors who purchased securities of Infonet Services Corporation during the period from December 16, 1999 through August 7, 2001. It was filed against Infonet, several of its current and former directors (including a former Swisscom employee), the selling shareholders (including Swisscom) and the underwriters of Infonet’s initial public offering. The complaint alleges that defendants made misrepresentations and omissions in Infonet’s Form S-1 registration statement and the accompanying prospectus for its inital public offering and in other statements during the class period. Swisscom is unable at this time to predict the outcome of this litigation. As of this date, S wisscom does not believe that this litigation could reasonably be expected to have a material adverse effect on its consolidated financial statements.

18

Shareholder information

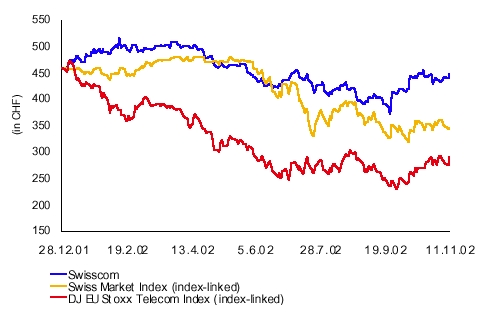

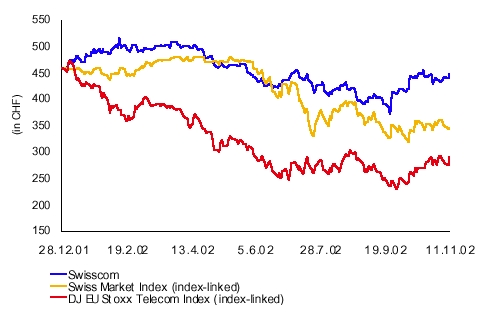

Swisscom share price on the Swiss Exchange virt-x

31.12.01 - 30.09.02 | | virt-x | | | NYSE | |

| Closing price at 31.12.01 | | CHF 460.00 | | | USD 27.75 | |

| Closing price at 30.09.02 | | CHF 409.50 | | | USD 27.55 | |

| Year high | | CHF 519.00 | | | USD 30.95 | |

| Year low | | CHF 360.00 | | | USD 24.38 | |

| Total trading volume | | 25 137 070 | | | 6 506 800 | |

| Daily average | | 131 608 | | | 34 611 | |

| Total volume in millions | | CHF 11 664.33 | | | USD 188.20 | |

| Daily average in millions | | CHF 61.07 | | | USD 1.00 | |

Share information

In order to reduce its capital Swisscom purchased in the first half of 2002 for CHF 4.3 billion the quantity of 7,346,739 (9.99%) registered shares in the form of treasury stock. The titles acquired through the share buy-back program were cancelled in the 3rd quarter 2002. The share capital now amounts to 66,203,261 registered shares of which, the Swiss Confederation owns 62.7%. Due to this transaction the ratios per share have improved – ceteris paribus.

On 13th August 2002 the nominal value per share was reduced as decided at the Shareholders’ Meeting. Swisscom disbursed the sum of CHF 8 per share to the shareholders. Now the nominal value per share amounts to CHF 9.

Financial calendar

| March 26, 2003 | Annual results 2002 |

| May 6, 2003 | Shareholders’ Meeting, Zurich |

| May 9, 2003 | Dividend payment |

| May 14, 2003 | Interim report 1st quarter 2003 |

| August 20, 2003 | Results 1st half 2003 |

| November 20, 2003 | Interim report 3rd quarter 2003 |

19

Stock markets

Swisscom shares are traded on the pan-European blue chip platform virt-x under the symbol “SCMN” (security no. 874 251) and in the form of American depositary shares (ADS) at a ratio of 1:10 on the New York Stock Exchange under the symbol “SCM” (security number 949 527).

Stock Exchange | | Bloomberg | | | Reuters | | | Telekurs | |

| London (9.00 a.m. - 5.30 p.m.) | | SCMN VX | | | SCMN.VX | | | SCMN.VTX | |

| New York (9.30 a.m.-4.00 p.m.) | | SCM US | | | SCM.N | | | SCM | |

20

The Consolidated Financial Statements are available in English, German and French. The German version is binding.

Forward-looking statements

This communication contains statements that constitute “forward-looking statements". In this communication, such forward- looking statements include, without limitation, statements relating to our financial condition, results of operations and business and certain of our strategic plans and objectives. Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behavior of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s past and future filings and reports filed with the U.S. Security and Exchange Commission and posted on our websites. Readers are cautioned not to put undue reliance on for ward-looking statements, which speak only of the date of this communication. Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| | | Contact details |

| | | Swisscom AG |

| | | Group Communications |

| | | CH-3050 Bern |

| | T | +41 31 342 36 78 |

| | F | +41 31 342 27 79 |

| | E | swisscom@swisscom.com |

| |

| | | Investor Relations |

| | | Swisscom AG |

| | | Investor Relations |

| | | CH-3050 Bern |

| | T | +41 31 342 25 38 |

| | F | +41 31 342 64 11 |

| | E | investor.relations@swisscom.com |

21