UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report : April 25, 2003

CTI Diversified Holdings, Inc.

(Exact name of registrant as specified in its chapter)

| Delaware | 000-30095 | 33-0921967 |

| (State or other jurisdiction | (Commission File | (IRS Employer |

| of incorporation) | Number) | Identification No.) |

| 8709-50 Street, Edmonton, Alberta, Canada | T6E 5H4 |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code:604-646-6638

c/o 614-East 21 Ave., Vancouver, B.C, Canada V5V 1R7

(Former address, if changed since last report)

- 2 -

ITEM 5. OTHER EVENTS

1. Change in management of Company.

On February 28, 2003, Mr. Donald E. Farnell resigned as acting chief financial officer of CTI Diversified Holdings, Inc. (the "Company"). On March 5, 2003, Mr. Alfred Comeau and Mr. Terry Mereniuk were appointed directors of the Company. On March 31, 2003, Mr. Farnell resigned his positions as a director, chairman of the board, president and chief executive officer of the Company. On March 31, 2003, he also resigned his positions as director, chairman of the board, president and chief executive officer of Sentry Telecom Systems, Inc., a subsidiary of the Company, and as director, president and chief executive officer of Cobratech Industries, Inc., another subsidiary of the Company.

On April 9, 2003, Mr. John Anderson, a director of the Company, was appointed president and chief executive officer of the Company and Mr. Terry Mereniuk, a director of the Company, was appointed chief financial officer. On April 24, 2003, Mr. John Anderson was appointed secretary/treasurer.

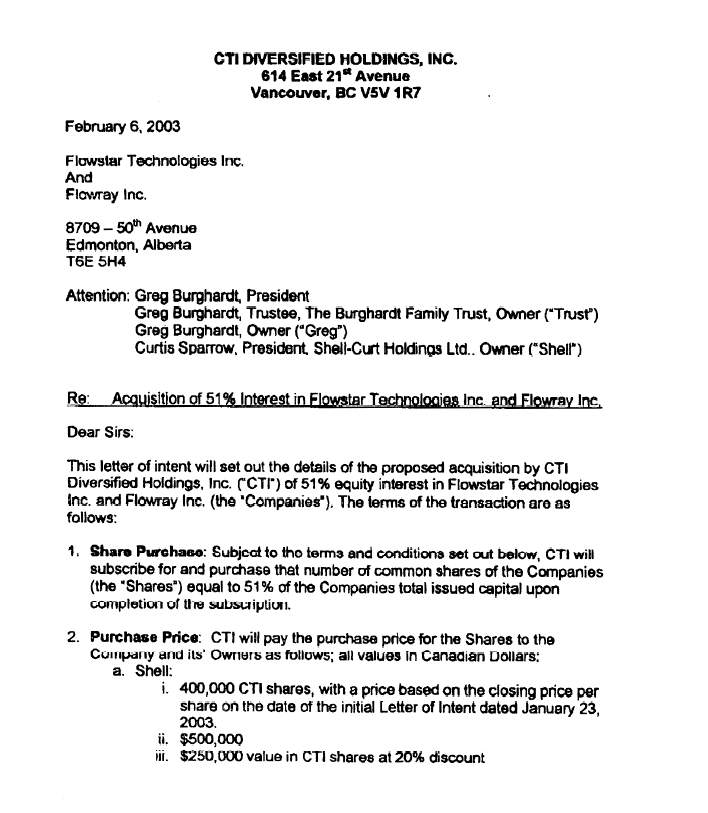

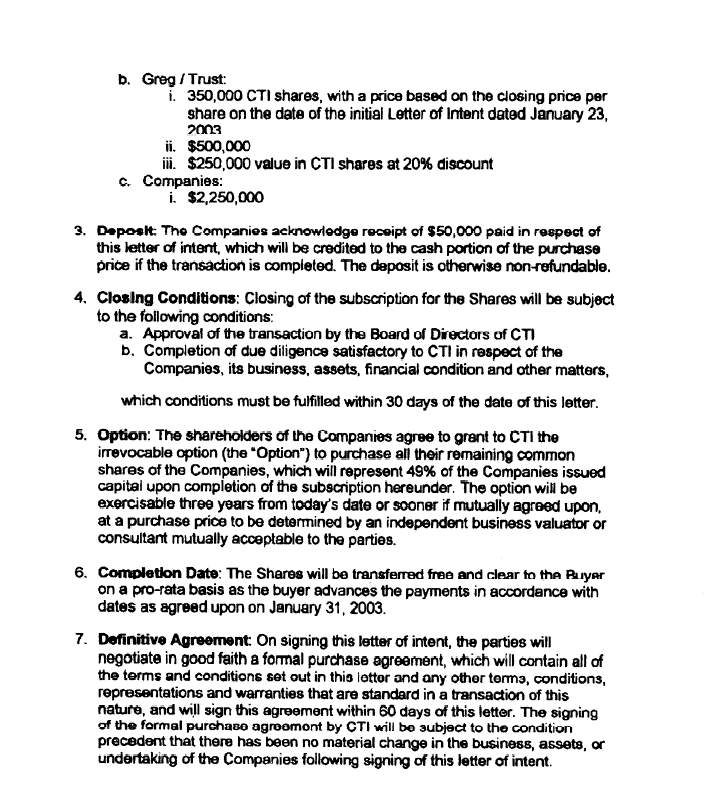

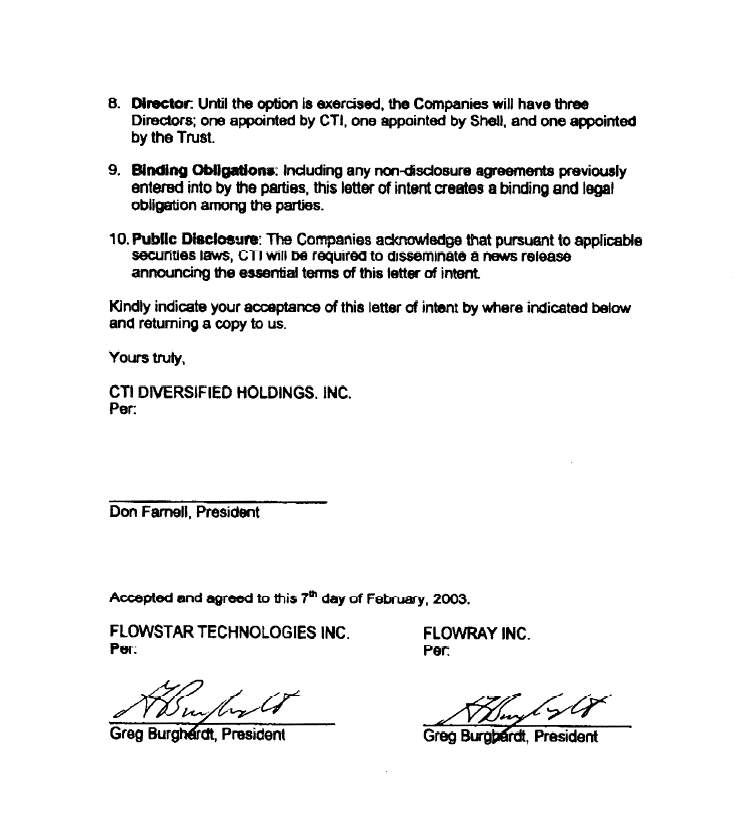

2. Details of intended acquisition by Company of up to 51% of Flowray and Flowstar.

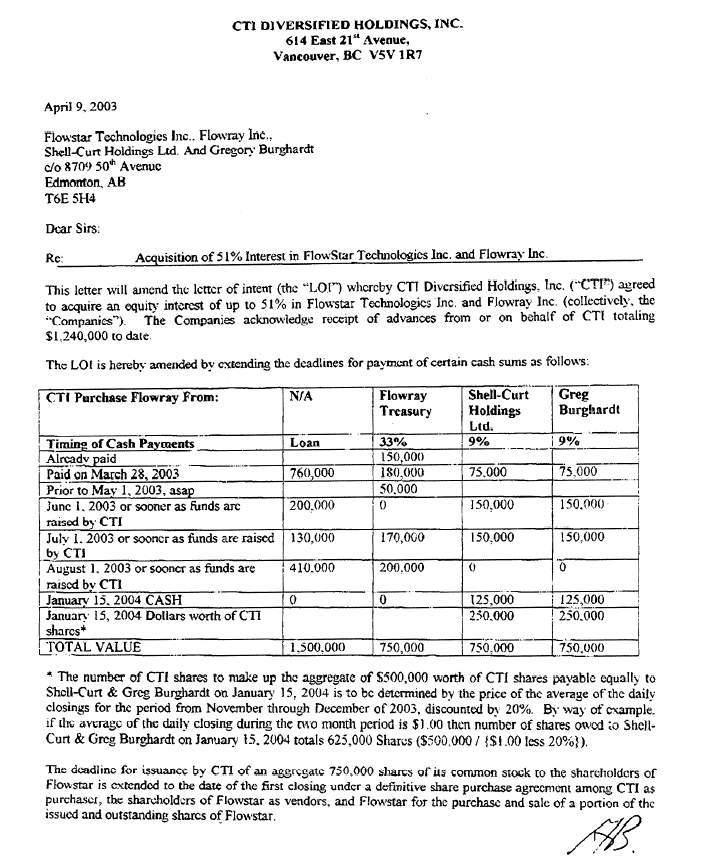

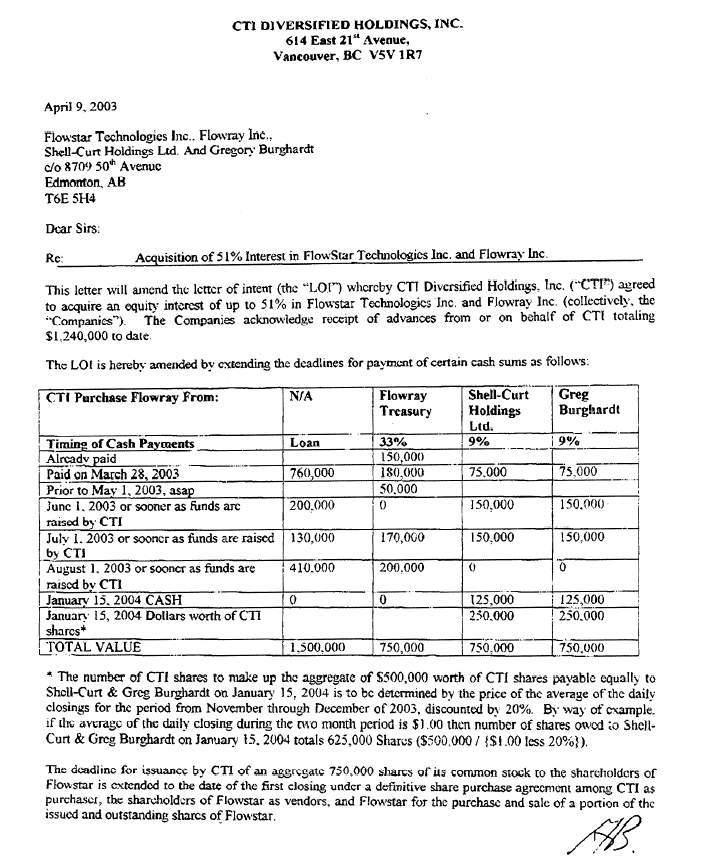

Further to the Company's news release dated March 27, 2003 and the letter of intent dated February 6, 2003 among the Company, Flowray Inc. (“Flowray”) and Flowstar Technologies Inc. (“Flowstar”), as amended and extended on April 9, 2003, the Company has agreed to acquire up to 51% of the issued and outstanding share capital of both Flowray and Flowstar by way of transfer of previously issued shares from the current shareholders of the companies and by purchase of shares from treasury of Flowray. The current shareholders of Flowray and Flowstar are Gregory Burghardt and Shell-Curt Holdings Ltd., each of whom own 50% of the current issued share capital of Flowray and Flowstar.

The consideration to be paid by the Company pursuant to the acquisition includes:

| 1. | the issuance to the shareholders of Flowstar of an aggregate 750,000 shares of common stock ofthe Company at a deemed price of $0.13 per share in exchange for the transfer of 51% of the issued shares of Flowstar; |

| | |

| 2. | the payment by the Company of an aggregate CDN$750,000 cash to Flowray in consideration of the issuance of treasury shares to the Company; |

| | |

| 3. | the payment by the Company of an aggregate CDN$1,000,000 cash to the shareholders of Flowray in consideration of the transfer of certain of their shares of Flowray; and |

| | |

| 4. | the issuance to the shareholders of Flowray and Flowstar of such number of additional shares ofcommon stock of the Company equal in value to CDN$500,000 calculated at the average marketprice for two months prior to the date of issuance and discounted by 20%. |

The acquisition of 51% of Flowray and Flowstar may complete in stages, with each stage being subject to fulfillment of certain closing conditions. The first closing of the transactions contemplated by the letter of intent will not occur until the parties have signed a formal share purchase and subscription agreement and all closing conditions have been fulfilled or waived by the parties. The Company may make the cash payments in instalments required to be paid on or before certain deadlines over the period ending January 15, 2004. The Company will issue the first block of 750,000 shares on the first closing date. The second block of shares worth CDN$500,000 is due on or before January 15, 2004. All shares of common stock to be issued to the shareholders of Flowray and Flowstar are to be registered or qualified for sale under applicable securities laws within 120 days of the date of issuance.

The Company has also agreed to advance to Flowray and Flowstar CDN$1,500,000 by way of loan. The loan will be secured by a general security agreement signed by the borrowers in favour of the Company and will bear interest at 5% per annum. The loan may be repaid depending upon the cash flow of

- 3 -

Flowray and Flowstar and at the discretion of the boards of directors of the borrowers. See section 3 below for particulars regarding an interim loan advanced by the Company to Flowstar and Flowray. On the first closing date, the boards of directors of each of Flowray and Flowstar will be comprised of three directors, two of whom will be nominated by the Company and one of whom will be nominated by Gregory Burghardt and Shell-Curt Holdings Ltd.

Upon the Company acquiring 51% of the issued shares of Flowray and Flowstar, the Company will have the right and option to purchase the remaining 49% of the issued shares of Flowray or Flowstar or both from Gregory Burghardt and Shell-Curt Holdings Ltd. at the fair market value, based on a valuation prepared by an independent certified business valuator. The Company's option to purchase the remaining 49% may be exercised at any time without an expiry date. If Gregory Burghardt and Shell-Curt Holdings Ltd. receive an offer from a third party to purchase their remaining 49% interest in Flowstar or Flowray, the Company will have the right of first refusal to purchase the 49%interest on the same terms as the offer.

3. Interim Loan advanced to Flowray Inc. and Flowray Technologies Inc.

The Company has entered into a Memorandum of Agreement dated March 27, 2003 with Flowray Inc. ("Flowray") and Flowstar Technologies Inc. ("Flowstar") pursuant to which the Company has advanced funds totalling CDN$1,290,000 by way of loan to Flowray and Flowstar for operating purposes. Flowray and Flowstar, as borrowers, have provided the Company with a promissory note for each advance. The borrowers have agreed to pay interest to the Company on the promissory notes at the rate of 5% per annum, calculated monthly on the last day of each month, not in advance, from the date of each promissory note on the outstanding balance. The promissory notes are due as follows: 25% of the outstanding balance of the promissory notes on March 30, 2004, a further 25% on September 30, 2004, a further 25% on March 30, 2005, and the balance together with all accrued interest on September 30, 2005. As security for the repayment of the promissory notes, Flowray and Flowstar have provided the Company with a general security agreement dated March 27, 2003, which grants the Company a security interest in all of the present and after-acquired personal property of the borrowers. The Company's security interest has been registered under thePersonal Property Security Act (Alberta) as a first charge and lien on all of the borrowers’ personal property. Gregory Burghardt, President, director and a shareholder of each of Flowray and Flowstar, has agreed to postpone his rights as holder of security interests and security agreements on the personal property of the borrowers to all rights and security interests of the Company. Notwithstanding the postponement, Gregory Burghardt is entitled to repayment of shareholders loans up to CDN$65,032.70 advanced previously to the borrowers, and reimbursement from the borrowers of expenses incurred in the ordinary course of business.

Of the loan funds of CDN$1,290,000 already advanced by the Company to Flowray and Flowstar, CDN$760,000 will remain a loan to Flowray and Flowstar and the balance of the loan will be applied or set off against the purchase price for the acquisition of Flowray shares by the Company as described in section 2 above. In addition to the loan of CDN$760,000, the Company has agreed to advance by way of further loan to Flowray and Flowstar the sum of CDN$740,000, for a total loan of CDN$1,500,000 as described in section 2 above.

4. Source of proceeds to Company for loans made to Flowray and Flowstar.

The Company obtained the funds that were advanced to Flowray and Flowstar from AHC Holdings Inc., a private Alberta company wholly owned by Comeau Industries Ltd., of which Alfred Comeau, of Edmonton, Alberta, Canada is a majority shareholder. Pursuant to a loan agreement dated January 28, 2003, as amended February 6, 2003, AHC agreed to make available by way of loan to the Company up to CDN$2,000,000. As at April 14, 2003, the Company had drawn down an aggregate CDN$1,437,661.83

- 4 -

pursuant to the loan facility. All advances under the loan are secured by promissory notes. The Company has agreed to pay interest to AHC on the principal of the loan and all overdue interest at the rate of 15% per annum, to the date of repayment. The principal and all accrued and unpaid interest are due on December 31, 2005. As a bonus for the loan, the Company issued AHC a warrant to purchase up to 1,000,000 shares of common stock of the Company exercisable at a price of $0.15 per share until March 6, 2006. The Company also issued a warrant to Terry Mereniuk, of Edmonton, Alberta, in consideration of his services to the Company in facilitating the loan from AHC. The warrant entitles Terry Mereniuk to purchase up to 500,000 shares of common stock of the Company exercisable at a price of $0.15 per share until March 6, 2006.

On March 5, 2003, the Company appointed both Alfred Comeau and Terry Mereniuk to the Board of Directors.

5. Business of Flowstar and Flowray.

Flowray and Flowstar are private companies incorporated in the province of Alberta in Canada. Since inception, Flowray has been developing a new system for measuring the flow of gas in upstream petroleum production applications. This system is known as the "DCR-900" (DCR stands for Digital Chart Recorder). The DCR-900 system consists of a turbine based flow measurement signal generating device, a flow computer "head", and a temperature and pressure probe. This system has recently received approval from the Canadian Standards Association (CSA) and has received independent verification of accuracy from Southwest Research Institute. The first batch of DCR-900 units is now being installed in customer applications.

Flowstar has secured the right to manufacture, market and distribute the products that have been developed by Flowray, in exchange for a 10% royalty on sales. Flowstar also represents and distributes independent third party products, and is positioning itself to be a leading supplier of flow measurement equipment to the petroleum industry.

Flowray and Flowstar have no significant tangible assets. The intellectual property assets of Flowray include a US provisional patent application filed on or about March 3, 2003 for the technology comprised in the DCR-900 system. Flowray also has an exclusive worldwide marketing agreement with Hoffer Flow Controls Inc. for a gas turbine they manufacture under a private label arrangement with Flowstar. Flowray also holds the intellectual property for liquid based totalizers, burner igniters, and Windows® based gas flow calculation software, all of which Flowstar markets. Flowstar also markets a line of liquid turbines for which there is no intellectual property as the patents expired long ago.

Flowray has given Cal-Scan Services Ltd. ("Cal-Scan"), a private Canadian company, a right of first refusal to engineer, supply or manufacture the DCR-900 product according to Flowray's specifications. One of the shareholders of Flowray and Flowstar is also a principal of Cal-Scan. Cal-Scan is also the owner of a trade secret, which is incorporated in the design of Flowray's DCR-900 system. For each DCR-900 unit purchased from Cal-Scan, Flowray has agreed to pay Cal-Scan the sum of CDN$200 as a fee for use of the trade secret. Details of Cal-Scan's trade secret will be provided to a mutually agreeable trust agent, to be held in escrow and not disclosed to Flowray, except if any of the following events occur:

| | a) | Cal-Scan is adjudged bankrupt; |

| | | |

| | b) | Cal-Scan refuses to perform any manufacturing or engineering of the DCR-900 productand refuses to allow a third party or Flowray to manufacture the produce or refuses tosupervise a third party or Flowray to continue the engineering of the product. |

Flowray has also granted Cal-Scan an irrevocable, sole license, for a nominal fee, to use Flowray's technology as it relates to flow measurement using differential pressure orifice plate systems, in oil field production well testing. Cal-Scan's license will permit it to manufacture, market, and sell flow measurement products, or sub-license or assign these rights, in markets other than turbine based flow measurement. The term of Cal-Scan's license will continue for the life of Flowray’s patent. If Flowray fails to purchase at least 100 units within the first two years from January 1, 2003, 200 units in year three

- 5 -

and 300 per year thereafter, then Cal-Scan's license to use Flowray's technology will be extended to its entire subject matter without any restriction on the market. If Flowray becomes adjudged bankrupt, Flowray has agreed to assign to Cal-Scan all its rights to the flow measurement technology, including patents and patent applications.

Finally, Flowray has granted Cal-Scan a distributorship for the DCR-900 product. Any cost savings resulting from revisions to the product will be split equally between Flowray and Cal-Scan.

EXHIBITS

Loan Agreement dated January 28, 2003 between the Company and AHC Holdings Ltd.

Addendum to the Loan Agreement dated February 6, 2003 providing AHC a warrant to purchase 1,000,000 shares of the Company’s common stock at $0.15 per share as a bonus for providing the Loan.

Finder’s Fee Agreement dated January 28, 2003 between the Company and Terry Mereniuk, under which Mr. Mereniuk was granted a warrant to purchase 500,000 shares of the Company’s common stock for $0.15 per share.

Share Purchase Warrants dated March 6, 2003 issued to Terry Mereniuk and AHC Holdings Ltd.

Letter of Intent to purchase a 51% equity interest in Flowstar and Flowray dated February 6, 2003.

Amendment to the Letter of Intent dated April 9, 2003 extending deadlines for certain cash payments.

Loan Agreement between the Company and Flowray and Flowstar dated March 27, 2003.

General Security Agreement between Flowray and Flowstar and the Company dated March 27, 2003.

Postponement Agreement of Gregory Burghardt dated March 27, 2003.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | CTI Diversified Holdings, Inc. |

| | |

| | “John Anderson” |

| | (Signature) |

| | |

| Date April 25, 2003 | John Anderson, President & CEO |

| | (Print name and title of signing officer) |

LOAN AGREEMENT

AHC Holdings Inc., of 52023 Range Road 231, Sherwood Park, Alberta, T8B 1A2 (the “Lender”) hereby agrees to advance by way of loan to CTI Diversified Holdings, Inc. (“CTI”), of 614 East 21st Avenue, Vancouver, British Columbia, V5V 1R7, the aggregate principal sum of CDN$2,000,000. The Lender agrees to advance CDN$1,000,000 of such loan funds not later than February 7, 2003 or such other date as the Lender and CTI may mutually agree upon, and the balance of CDN$1,000,000 not later than April 30, 2003 or such other date as the Lender and CTI may mutually agree upon. CTI will pay interest to the Lender on all amounts advanced by the Lender and on overdue interest at the rate of 15% per annum to the date of repayment, calculated and compounded monthly on the last day of the month, not in advance from the date of advance. Accrued interest will be payable annually not later than January 28 of each year or upon repayment of the principal amount, whichever is earlier. The principal amount will become due and repayable by CTI to the Lender on such date as the Lender and CTI may mutually agree upon.

At any time and from time to time, CTI may, at its option, prepay all or any of the principal amount and accrued interest outstanding under this Loan Agreement.

The parties may not amend this Agreement except by document in writing signed by both parties.

The parties will sign any other documents and do any other things necessary to carry out the intent of this Agreement.

This Loan Agreement will be governed by and construed in accordance with the laws of Alberta. The parties agree to attorn to the exclusive jurisdiction of the courts of the Bahamas.

This Agreement will be binding on and enure to the benefit of the Borrower, the Lender, and their respective heirs, executors, administrators, successors, and assigns.

DATED this 28th day of January, 2003.

AHC HOLDINGS INC.

Per:

/s/ Alf Comeau

Alf Comeau, President

CTI DIVERSIFIED HOLDINGS, INC.

Per:

/s/ Don Farnell

Don Farnell, President

ADDENDUM TO LOAN AGREEMENT

Pursuant to a loan agreement dated January 28, 2003 (the “Loan Agreement”), AHC Holdings Inc., of 52023 Range Road 231, Sherwood Park, Alberta, T8B 1A2 (the “Lender”) agreed to advance by way of loan to CTI Diversified Holdings, Inc. (“CTI”), of 614 East 21st Avenue, Vancouver, British Columbia, V5V 1R7, the aggregate principal sum of CDN$2,000,000. In consideration of the loan, CTI has agreed to issue to the Lender a non-transferable share purchase warrant entitling the Lender to purchase up to 1,000,000 shares of common stock of CTI at a price of US$0.15 per share exercisable until January 28, 2006, in the form that accompanies this Addendum. The Lender agrees to complete, execute and deliver to CTI the Schedules “A” and “B” attached to this Addendum.

The parties will sign any other documents and do any other things necessary to carry out the intent of this Addendum.

This Addendum will be binding on and enure to the benefit of CTI, the Lender, and their respective heirs, executors, administrators, successors, and assigns.

DATED this 6th day of February, 2003.

Per:

/s/ Alf Comeau

Alf Comeau, President

CTI DIVERSIFIED HOLDINGS, INC.

Per:

/s/ Don Farnell

Don Farnell, President

SCHEDULE “A”

ACCREDITED INVESTOR QUESTIONNAIRE

IN THE MATTER OF CTI DIVERSIFIED HOLDINGS, INC.(the “Issuer”)

AND THESECURITIES ACT (Alberta) (the “Act”)

The undersigned (the “Purchaser”), in connection with the issuance by the Issuer to the Purchaser of the share purchase warrant dated January 28, 2003 (the “Warrant”), makes the following representations and warranties to the Issuer:

1. the Purchaser is an “accredited investor”, as defined in Multilateral Instrument 45-103 Capital Raising Exemptions, by reason of the fact that the undersigned Purchaser is (please place an “X” on the appropriate line or lines):

| _________ | (a) | a Canadian financial institution, or an authorized foreign bank listed in ScheduleIII of theBank Act(Canada); |

| | | |

| _________ | (b) | the Business Development Bank of Canada incorporated under theBusinessDevelopment Bank of Canada Act(Canada); |

| | | |

| _________ | (c) | an association under theCooperative Credit Associations Act(Canada) located inCanada; |

| | | |

| _________ | (d) | a subsidiary of any person or company referred to in paragraphs (a) to (c), wherethe person or company owns all of the voting securities of the subsidiary, exceptthe voting securities required by law to be owned by directors of that subsidiary; |

| | | |

| _________ | (e) | a person or company registered under the securities legislation, or under thesecurities legislation of another jurisdiction of Canada, as an adviser or dealer,other than a limited market dealer registered under theSecurities Act(Ontario); |

| | | |

| _________ | (f) | an individual registered or formerly registered under the securities legislation, orunder the securities legislation of another jurisdiction of Canada, as arepresentative of a person or company referred to in paragraph (e); |

| | | |

| _________ | (g) | the government of Canada or a province, or any crown corporation or agency ofthe government of Canada or a province; |

| | | |

| _________ | (h) | a municipality, public board or commission in Canada; |

| | | |

| _________ | (i) | any national, federal, state, provincial, territorial or municipal government of orin any foreign jurisdiction, or any agency of that government; |

| | | |

| _________ | (j) | a pension fund that is regulated by either the Office of the Superintendent ofFinancial Institutions (Canada) or a provincial pension commission or similarregulatory authority; |

| | | |

| _________ | (k) | a registered charity under theIncome Tax Act(Canada); |

2

| _________ | (l) | an individualwho,either alone or jointly with aspouse, beneficially owns,directly orindirectly, financial assets having anaggregate realizable value thatbefore taxes, but net of any related liabilities, exceeds $1,000,000; |

| | | |

| _________ | (m) | an individual whose net income before taxes exceeded $200,000 in each of thetwo most recent years or whose net income before taxes combined with that of aspouseexceeded $300,000 in each of the two mostrecent years and who, ineither case,reasonably expects to exceed that netincome level in the currentyear; |

| | | |

| _________ | (n) | a corporation,limited partnership, limited liabilitypartnership, trust or estate,other than a mutual fund or non-redeemable investment fund, that had net assetsof at least $5,000,000 as shown on its mostrecently prepared financialstatements; |

| | | |

| _________ | (o) | a mutual fund or non-redeemable investment fund that, in the local jurisdiction,distributes its securities under a prospectus for which the regulator has issued areceipt; |

| | | |

| _________ | (p) | a mutual fund or non-redeemable investment fund that, in the local jurisdiction,distributes its securities under a prospectus for which the regulator has issued areceipt; |

| | | |

| _________ | (q) | an entity organized in a foreign jurisdiction that is analogous to any of the entitiesreferred to in paragraphs (a) through (e) and paragraph (j) in form and function;or |

| | | |

| _________ | (r) | a person or company in respect of which all of the owners of interests, direct orindirect, legal or beneficial, are persons that are accredited investors. |

or

2. the Purchaser is (please place an “X” on the appropriate line or lines):

| _________ | (a) | a director, senior officer or control person of the Issuer, or of an affiliate of theIssuer; |

| | | |

| _________ | (b) | a spouse, parent, grandparent, brother, sister or child of a director, senior officeror control person of the Issuer, or of an affiliate of the Issuer, namely |

| | | ______________________________________________________________ |

| | | (name of director, senior officer or control person) |

| | | |

| _________ | (c) | a close personal friend of a director, senior officer or control person of the Issuer,or ofan affiliate of theIssuer,namely |

| | | _____________________________________________________________ |

| | | (name of director, senior officer or control person) |

| | | |

| _________ | (d) | a close businessassociate of a director, senior officer orcontrolperson of theIssuer, orof an affiliate of theIssuer,namely |

| | | _____________________________________________________________ |

| | | (name of director, senior officer or control person) |

3

| _________ | (e) | a person or company that is wholly-owned by any combination of persons orcompanies described in paragraphs 2.(a) to 2.(d); |

3. the Purchaser is, as defined in BC Instrument 45-507Trades to Employees, Executives and Consultants (please place an “X” on the appropriate line or lines):

| _________ | (a) | an “employee” or “employee administrator”; |

| | | |

| _________ | (b) | an “executive” or “executive administrator”; |

| | | |

| _________ | (c) | a “consultant”, “consultant company” or “consultant partnership” (other than an“associated consultant” or an “investor consultant”); |

of the Issuer or of an affiliated entity of the Issuer.

The representations, warranties, statements and certification made in this Certificate are true and accurate as of the date of this Certificate and will be true and accurate as of the date of issuance to the Purchaser of the Warrant. If any such representation, warranty, statement or certification becomes untrue or inaccurate prior to the date of issuance of the Warrant, the undersigned Purchaser shall give the Issuer immediate written notice thereof.

The Purchaser acknowledges that the Issuer will be relying on this Certificate in connection with issuance of the Warrant.

The statements made in this Certificate are true.

DATED January 28, 2003.

| | ____________________________________________ |

| | (Signature) |

| | |

| | AHC HOLDINGS INC. |

| | (Print Name) |

| | |

| | ____________________________________________ |

| | (Address) |

| | |

| | ____________________________________________ |

| | (City/Province/Postal Code) |

| | |

| | ____________________________________________ |

| | (Area Code/Telephone Number) |

SCHEDULE “B”

INVESTMENT LETTER

The undersigned,AHC HOLDINGS INC., an Alberta corporation (the “Purchaser”), in connection with the issuance to the Purchaser of the share purchase warrant (“Warrant”) dated February 28, 2003 by CTI Diversified Holdings, Inc., a Delaware corporation (the “Company”), pursuant signs and delivers this Investment Letter to the Company.

The Purchaser understands that the Company is relying on this information in determining to offer securities (the “Securities”) to the undersigned in a manner exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The Purchaser represents and warrants to and covenants and agrees with the Company as follows:

| (a) | The Purchaser is not a “U.S. person” under Rule 902(k) of Regulation S under theSecurities Act, and is not acquiring the Securities for the account or benefit of any U.S. person orperson in the United States; and the Purchaser, if a natural person, is over 21 years of age and: |

| | (i) | the Purchaser was outside the United States at the time of signing and delivery ofthis Investment Letter and the Subscription Agreement; |

| | | |

| | (ii) | no offers to sell the Securities were made by any person to the Purchaser whilethe Purchaser was in the United States. |

| | | |

| (b) | The Purchaser: (i) has adequate means of providing for its current needs and possiblepersonal contingencies, and has no need for liquidity of its investment, (ii) can bear the economicrisk of losing its entire investment, (iii) has such knowledge and experience in financial andbusiness matters that it is capable of evaluating the relative risks and merits of its investment inthe Securities, (iv) has had an opportunity to ask questions of and receive answers from theCompany’s senior management concerning the Company and its business prospects, affairs, andrisks, and (v) all documents, books, and records of the Company requested, if any, by thePurchaser pertaining to its investment in the Securities have been made available for inspection ordelivery to it and it has read or reviewed and is familiar with and understands the same. |

| | |

| (c) | THE PURCHASER RECOGNIZES, UNDERSTANDS, AND ACKNOWLEDGESTHAT THERE ARE SUBSTANTIAL RESTRICTIONS ON THE TRANSFERABILITY OFTHE SECURITIES, AND THE PURCHASER MAY HAVE TO HOLD THE SECURITIESINDEFINITELY AND MAY NOT BE ABLE TO LIQUIDATE THE INVESTMENT IN THECOMPANY WHEN IT WISHES TO DO SO, IF AT ALL, BECAUSE, AMONG OTHERTHINGS, THERE IS A LIMITED TRADING MARKET FOR THE COMPANY’S COMMONSTOCK. IN ADDITION, PURSUANT TO REGULATION “S” UNDER THE SECURITIESACT, THE PURCHASER GENERALLY IS PROHIBITED FROM OFFERING OR SELLINGTHE SECURITIES WITHIN THE UNITED STATES OR TO OR FOR THE ACCOUNT ORBENEFIT OF ANY U.S. PERSONS FOR AT LEAST ONE YEAR FROM THE CLOSING OFTHIS OFFERING. |

2

| (d) | The Securities are being acquired solely for the Purchaser’s own benefit and account. |

| | |

| (e) | If the Purchaser decides to offer, sell, or otherwise transfer any of the Securities, it willnot offer, sell, or otherwise transfer any of the Securities directly or indirectly, unless: |

| | |

| | (i) | the sale is to the Company; |

| | | |

| | (ii) | the sale is made outside the United States in a transaction meeting therequirement of Rule 904 of Regulation S under the Securities Act and incompliance with applicable local laws and regulations; |

| | | |

| | (iii) | the sale is made pursuant to the exemption from the registration requirementsunder the Securities Act provided by Rule 144 thereunder and in accordance withany applicable state securities or “Blue Sky” laws; or |

| | | |

| | (iv) | the Securities are sold in a transaction that does not require registration under theSecurities Act or any applicable state laws and regulations governing the offerand sale of securities, and it has prior to such sale furnished the Company with anopinion of counsel to that effect in form and substance reasonably satisfactory tothe Company. |

| | | |

| (f) | The Purchaser understands that the stock certificates representing the Securities will beara legend in substantially the following form described in Section 5 below. |

| | |

| (g) | The Purchaser agrees not to engage in any hedging transactions involving the Securitiesunless the Purchaser does so in compliance with the Securities Act. |

| | |

| (h) | The Purchaser has full power and authority to sign and deliver this Investment Letter andto perform its obligations hereunder and this Investment Letter is a legally binding obligation inaccordance with its terms. |

| | |

| (i) | The Purchaser has carefully read this Investment Letter and, to the extent it believesnecessary, has discussed with its counsel the representations, warranties, and agreements that it ismaking herein and the limitations on resale of the Securities. |

2. Acquiring Entirely for Own Account

The Purchaser represents and warrants that it is acquiring the Securities solely for its own account for investment and not with a view to or for sale or distribution of the Securities or any portion thereof and without any present intention of selling, offering to sell, or otherwise disposing of or distributing the Securities or any portion thereof in any transaction other than a transaction complying with the registration requirements of the Securities Act and any and all applicable state securities or “Blue Sky” laws or pursuant to an exemption therefrom. The Purchaser also represents that the entire legal and beneficial interest of the Securities that it is purchasing is being purchased for, and will be held for, the Purchaser’s account only, and neither in whole nor in part for any other person or entity.

3. Information Concerning the Company

The Purchaser acknowledges that it has received all information that it deems necessary and appropriate to enable it to evaluate the financial risk inherent in acquiring the Securities, including the documents and

3

materials reasonably necessary to evaluate an investment in the Company. The Purchaser further acknowledges that it has received satisfactory and complete information concerning the business and financial condition of the Company in response to all inquiries in respect thereof.

4. Restricted Securities

The Purchaser acknowledges that the Company has hereby disclosed to the Purchaser in writing:

| (a) | The Securities have not been registered under the Securities Act or the securities laws of any stateof the United States, and the Securities must be held indefinitely unless a transfer of them issubsequently registered under the Securities Act or an exemption from such registration is available;and |

| | |

| (b) | The Company will make a notation in its records of the above described restrictions on transfer andof the legend described below. |

5. Legend

The Purchaser agrees that all of the Securities will have endorsed thereon a legend to the following effect:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”). THESE SECURITIES MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH RULE 904 OF REGULATION S UNDER THE 1933 ACT, (C) IN COMPLIANCE WITH THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS UNDER THE 1933 ACT PROVIDED BY RULE 144 OR RULE 144A THEREUNDER, IF AVAILABLE, AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS, OR (D) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE 1933 ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND THE HOLDER HAS, PRIOR TO SUCH SALE, FURNISHED TO THE COMPANY AN OPINION OF COUNSEL, OF RECOGNIZED STANDING, OR OTHER EVIDENCE OF EXEMPTION, REASONABLY SATISFACTORY TO THE COMPANY. HEDGING TRANSACTIONS INVOLVING THE SECURITIES REPRESENTED HEREBY MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT.”

6. Transfers

The Company agrees to refuse to register any transfer of the Securities not made in (i) accordance with Regulation S, (ii) pursuant to registration under the Securities Act, or (iii) pursuant to an available exemption from registration under the Securities Act.

4

7. Counterparts

This Investment Letter may be signed by the parties in counterparts, each of which so signed will be deemed to be an original, and the counterparts together will constitute one and the same instrument despite the date of signing and will be deemed to bear the later date of any counterparts.

Dated this 28th day of Jaruary, 2003.

| | ______________________________________________ |

| | (Name of Purchaser – please print) |

| | |

| | By:___________________________________________ |

| | (Authorized Signature) |

| | |

| | ______________________________________________ |

| | (Official Capacity or Title – please print) |

| | |

| | ______________________________________________ |

| | (Please print name of individual whose signature appearsabove if different than the name of the Purchaser printedabove) |

FINDER’S FEE AGREEMENT

THIS AGREEMENT dated for reference the 28th day of January, 2003

BETWEEN:

| | CTI DIVERSIFIED HOLDINGS, INC., a company having a head office located at 614 East 21stAvenue, Vancouver, British Columbia V5V 1R7 |

| | |

| | (the “Company”) |

OF THE FIRST PART

AND:

| | TERRY MERENIUK, of 9023 – 146a Street, Edmonton, Alberta T5R0X2 |

| | |

| | (the “Finder”) |

OF THE SECOND PART

WHEREAS:

A. The Company has arranged a loan of $2,000,000 (the “Loan”) from AHC Holdings Inc. (the “Lender”);

B. The Finder introduced the Lender to the Company and, in consideration thereof, the Company has agreed to pay to the Finder a fee on the terms and conditions set forth in this Agreement;

NOW THEREFORE THIS AGREEMENT WITNESSES that, for valuable consideration, the receipt and sufficiency of which are acknowledged by the parties, the parties agree as follows:

| 1. | The Company has agreed to pay to the Finder a fee (the “Finder’s Fee”) payable by theissuance of a non-transferable share purchase warrant in the form that accompanies thisAgreement (the“Warrant”) to purchase up to 500,000 shares of common stock of theCompany at a price of US$0.15 per share exercisable until January 28, 2006. |

| | |

| 2. | The provisions of thisAgreement will enure to the benefit of and be binding on theCompany and the Finder and their respective successors and assigns. |

| | |

| 3. | This Agreement will be construed and enforced in accordance with, and the rights of theparties will be governed by, the laws of British Columbia. |

2

IN WITNESS WHEREOF the parties have signed this Agreement as of the date written on the first page of this Agreement.

CTI DIVERSIFIED HOLDINGS, INC.

Per:

/s/ Don Farnell

Don Farnell , President

/s/ Terry Mereniuk

TERRY MERENIUK

THIS WARRANT AND THE SHARES DELIVERABLE ON EXERCISE OF THE WARRANT HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THIS WARRANT MAY NOT BE EXERCISED UNLESS THE UNDERLYING SHARES HAVE BEEN REGISTERED UNDER THE 1933 ACT AND THE APPLICABLE SECURITIES LEGISLATION OF ANY STATE OR AN EXEMPTION FROM THOSE REGISTRATION REQUIREMENTS IS AVAILABLE.

CTI DIVERSIFIED HOLDINGS, INC.

NON-TRANSFERABLE WARRANT

TO PURCHASE SHARES OF COMMON STOCK

| 500,000 Common Shares | Void after |

| Par Value of U.S. $0.0001 | March 6, 2006. |

This is to certify that, for value received,TERRY MERENIUK (the “Warrant Holder”), of 9023 – 146A Street, Edmonton, Alberta, T5R 0X2, has the right to purchase fromCTI Diversified Holdings, Inc., a Delaware corporation (the “Company”), on and subject to the terms and conditions hereinafter referred to, up to500,000 fully paid and non-assessable shares of common stock of the Company having a par value of US$0.0001 per share (the “Shares”), or any greater or lesser number of shares that may be determined by application of the anti-dilution provisions of this Warrant. The Shares may be purchased at a price of US$0.15 per Share at any time up to 4:00 p.m. local time in Vancouver, British Columbia, on March 6, 2006. The right to purchase the Shares may be exercised in whole or in part by the Warrant Holder only at the price set forth above (the “Exercise Price”) within the time set forth above by:

| (a) | completing and signing the attached Subscription Form for the number of Shares that the WarrantHolder wishes to purchase, in the manner therein indicated; |

| | |

| (b) | surrendering this Warrant Certificate, together with the completed Subscription Form, toInterwest Transfer Company, Inc., 1981 E. 4800 South, Ste. 100, Salt Lake City, Utah 84117, (the“Transfer Agent”); |

| | |

| (c) | delivering an investor questionnaire and/or similar documents acceptable to the Companydemonstrating that the sale of the shares to be purchased is exempt from the registration andprospectus requirements of the applicable securities legislation in Canada and the registrationunder the Securities Act of 1933, as amended (the “1933 Act”), and any state securities law; and |

| | |

| (d) | paying the appropriate Exercise Price, in United States funds, for the number of Sharessubscribed for, either by certified cheque or bank draft or money order payable to the Company inVancouver, British Columbia, or any other address that the Company may advise by writtennotice to the address of the Warrant Holder. |

This Warrant and the Shares issuable on exercise of the Warrant have not been registered under the 1933 Act or the securities laws of any state of the United States, and this Warrant may not be exercised unless the Shares are registered under the 1933 Act and the securities laws of all applicable states of the United States or an exemption from registration requirements is available.

2

On surrender and payment, the Company will issue to the Warrant Holder, or to any other person or persons that the Warrant Holder may direct, the number of the Shares subscribed for and will deliver to the Warrant Holder, at the address set forth on the Subscription Form, a certificate or certificates evidencing the number of Shares subscribed for. If the Warrant Holder subscribes for a number of Shares that is less than the number of Shares permitted by this Warrant, the Company will forthwith cause to be delivered to the Warrant Holder a further Warrant Certificate in respect of the balance of the Shares referred to in this Warrant Certificate not then being subscribed for. The Shares so purchased will be deemed to be issued as of the close of business on the date on which this Warrant has been exercised by payment to the Company of the Exercise Price. No fractional shares will be issued on the exercise of this Warrant.

In the event of any subdivision of the common shares of the Company (as those common shares are constituted on the date hereof) into a greater number of common shares while this Warrant is outstanding, the number of Shares represented by this Warrant will thereafter be deemed to be subdivided in like manner and the Exercise Price adjusted accordingly, and any subscription by the Warrant Holder for Shares hereunder will be deemed to be a subscription for common shares of the Company as subdivided.

In the event of any consolidation of the common shares of the Company (as those common shares are constituted on the date hereof) into a lesser number of common shares while this Warrant is outstanding, the number of Shares represented by this Warrant will thereafter be deemed to be consolidated in like manner and the Exercise Price adjusted accordingly, and any subscription by the Warrant Holder for Shares hereunder will be deemed to be a subscription for common shares of the Company as consolidated.

In the event of any capital reorganization or reclassification of the common shares of the Company or the merger or amalgamation of the Company with another corporation at any time while this Warrant is outstanding, the Company will thereafter deliver, at the time of purchase of the Shares hereunder, the number of common shares the Warrant Holder would have been entitled to receive in respect of the number of the Shares so purchased had the right to purchase been exercised before the capital reorganization or reclassification of the common shares of the Company or the merger or amalgamation of the Company with another corporation.

If at any time while this, or any replacement, Warrant is outstanding:

| (a) | the Company proposes to pay any dividend of any kind on its common shares or make anydistribution to the holders of its common shares; |

| | |

| (b) | the Company proposes to offer for subscription pro rata to the holders of its common shares anyadditional shares of stock of any class or other rights; |

| | |

| (c) | the Company proposes any capital reorganization or classification of its common shares or themerger or amalgamation of the Company with another corporation; or |

| | |

| (d) | there is a voluntary or involuntary dissolution, liquidation, or winding-up of the Company, |

the Company must give to the Warrant Holder at least seven days prior written notice (the “Notice”) of the date on which the books of the Company are to close or a record is to be taken for the dividend, distribution, or subscription rights, or for determining rights to vote with respect to the reorganization, reclassification, consolidation, merger, amalgamation, dissolution, liquidation, or winding-up. The Notice will specify, in the case of any dividend, distribution, or subscription rights, the date on which holders of common shares of the Company will be entitled to exchange their common shares for securities

3

or other property deliverable on any reorganization, reclassification, consolidation, merger, amalgamation, sale, dissolution, liquidation, or winding-up, as the case may be. Each Notice will be delivered by hand, addressed to the Warrant Holder at the address of the Warrant Holder set forth above or at any other address that the Warrant Holder may from time to time specify to the Company in writing.

The holding of this Warrant Certificate or the Warrants represented hereby does not constitute the Warrant Holder a member of the Company.

Nothing contained herein confers any right on the Warrant Holder or any other person to subscribe for or purchase any Shares of the Company at any time subsequent to 4:00 p.m. local time in Vancouver, British Columbia on March 6, 2006, and from and after that time, this Warrant and all rights hereunder will be void.

The Warrants represented by this Warrant Certificate are non-transferable. Any common shares issued pursuant to this Warrant will bear the following legend:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER UNITED STATES FEDERAL OR STATE SECURITIES LAWS AND MAY NOT BE OFFERED FOR SALE, SOLD OR OTHERWISE TRANSFERRED OR ASSIGNED FOR VALUE, DIRECTLY OR INDIRECTLY, NOR MAY THE SECURITIES BE TRANSFERRED ON THE BOOKS OF THE CORPORATION, WITHOUT REGISTRATION UNDER ALL APPLICABLE UNITED STATES FEDERAL OR STATE SECURITIES LAWS OR COMPLIANCE WITH AN APPLICABLE EXEMPTION THEREFROM, SUCH COMPLIANCE, AT THE OPTION OF THE CORPORATION, TO BE EVIDENCED BY AN OPINION OF THE HOLDER’S COUNSEL, IN FORM ACCEPTABLE TO THE CORPORATION, THAT NO VIOLATION OF SUCH REGISTRATION PROVISIONS WOULD RESULT FROM ANY PROPOSED TRANSFER OR ASSIGNMENT.”

Time will be of the essence hereof.

This Warrant Certificate is not valid for any purpose until it has been signed by the Company.

IN WITNESS WHEREOF, the Company has caused its common seal to be hereto affixed and this Warrant Certificate to be signed by one of its directors as of the 6th day of March, 2003.

CTI DIVERSIFIED HOLDINGS, INC.

Per:

/s/ Don Farnell

Don Farnell, President

SUBSCRIPTION FORM

| To: | CTI Diversified Holdings, Inc. (the “Company”) |

| And to: | The directors of the Company |

Pursuant to the Share Purchase Warrant made the 6th day of March, 2003, the undersigned subscribes and agrees to purchase ______________________ shares of common stock of the Company having a value of US$0.0001 (the “Shares”), at a price of US$0.15 per Share for the aggregate sum of US$__________________ (the “Subscription Funds”), and encloses herewith: (i) a certified cheque, bank draft, or money order payable to the Company in full payment of the Shares; and (ii) a completed accredited investor questionnaire (attached as Schedule A).

The undersigned requests that:

| (a) | the Shares be allotted to the undersigned; |

| | |

| (b) | the name and address of the undersigned as shown below be entered in the registers of membersand allotments of the Company; |

| | |

| (c) | the Shares be issued to the undersigned as fully paid and non-assessable common shares of theCompany; and |

| | |

| (d) | a share certificate representing the Shares be issued in the name of the undersigned. |

Dated this _______ day of ______________ , 200__.

DIRECTION AS TO REGISTRATION:

(Name and addressexactly as you wish them to appear on your share certificate and in the register of members.)

| Full Name(1): ____________________________________________________________________________________ |

| Full Address: ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| Signature of Subscriber(1): __________________________________________________________________________ |

If the name above differs from the name of the

Subscriber, then please complete the following

guarantee: | Signature of Subscriber guaranteed by:

______________________________________________

Authorized Signature Number |

(1)NOTE:The signature to this subscription form must correspond with the name as recorded on the Warrant Certificate in every particular without alteration or enlargement or any change whatever. The signature of the person signing this power must be guaranteed in a manner satisfactory to the Company’s transfer agent.

SCHEDULE “A”

ACCREDITED INVESTOR QUESTIONNAIRE

IN THE MATTER OF CTI DIVERSIFIED HOLDINGS, INC.(the “Issuer”)

AND THESECURITIES ACT (Alberta) (the “Act”)

The undersigned (the “Purchaser”), in connection with the acquisition of securities of the Issuer pursuant to the share purchase warrant dated March 6, 2003 (the “Warrant”), makes the following representations and warranties to the Issuer:

1. the Purchaser is an “accredited investor”, as defined in Multilateral Instrument 45-103 Capital Raising Exemptions, by reason of the fact that the undersigned Purchaser is (please place an “X” on the appropriate line or lines):

| _________ | (a) | a Canadian financial institution, or an authorized foreign bank listed in ScheduleIII of theBank Act(Canada); |

| | | |

| _________ | (b) | the Business Development Bank of Canada incorporated under theBusinessDevelopment Bank of Canada Act(Canada); |

| | | |

| _________ | (c) | an association under theCooperative Credit Associations Act(Canada) located inCanada; |

| | | |

| _________ | (d) | a subsidiary of any person or company referred to in paragraphs (a) to (c), wherethe person or company owns all of the voting securities of the subsidiary, exceptthe voting securities required by law to be owned by directors of that subsidiary; |

| | | |

| _________ | (e) | a person or company registered under the securities legislation, or under thesecurities legislation of another jurisdiction of Canada, as an adviser or dealer,other than a limited market dealer registered under theSecurities Act(Ontario); |

| | | |

| _________ | (f) | an individual registered or formerly registered under the securities legislation, orunder the securities legislation of another jurisdiction of Canada, as arepresentative of a person or company referred to in paragraph (e); |

| | | |

| _________ | (g) | the government of Canada or a province, or any crown corporation or agency ofthe government of Canada or a province; |

| | | |

| _________ | (h) | a municipality, public board or commission in Canada; |

| | | |

| _________ | (i) | any national, federal, state, provincial, territorial or municipal government of orin any foreign jurisdiction, or any agency of that government; |

| | | |

| _________ | (j) | a pension fund that is regulated by either the Office of the Superintendent ofFinancial Institutions (Canada) or a provincial pension commission or similarregulatory authority; |

| | | |

| _________ | (k) | a registered charity under theIncome Tax Act(Canada); |

2

| _________ | (l) | an individualwho,either alone or jointly with aspouse, beneficially owns,directly orindirectly, financial assets having anaggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000; |

| | | |

| _________ | (m) | an individual whose net income before taxes exceeded $200,000 in each of thetwo most recent years or whose net income before taxes combined with that of aspouseexceeded $300,000 in each of the two mostrecent years and who, ineither case,reasonably expects to exceed that netincome level in the currentyear; |

| | | |

| _________ | (n) | a corporation,limited partnership, limited liabilitypartnership, trust or estate,other than a mutual fund or non-redeemable investment fund, that had net assetsof at least $5,000,000 as shown on its mostrecently prepared financialstatements; |

| | | |

| _________ | (o) | a mutual fund or non-redeemable investment fund that, in the local jurisdiction,distributes its securities under a prospectus for which the regulator has issued areceipt; |

| | | |

| _________ | (p) | a mutual fund or non-redeemable investment fund that, in the local jurisdiction,distributes its securities under a prospectus for which the regulator has issued areceipt; |

| | | |

| _________ | (q) | an entity organized in a foreign jurisdiction that is analogous to any of the entitiesreferred to in paragraphs (a) through (e) and paragraph (j) in form and function;or |

| | | |

| _________ | (r) | a person or company in respect of which all of the owners of interests, direct orindirect, legal or beneficial, are persons that are accredited investors. |

or

2. the Purchaser is (please place an “X” on the appropriate line or lines):

| _________ | (a) | a director, senior officer or control person of the Issuer, or of an affiliate of theIssuer; |

| | | |

| _________ | (b) | a spouse, parent, grandparent, brother, sister or child of a director, senior officeror control person of the Issuer, or of an affiliate of the Issuer, namely |

| | | |

| | | (name of director, senior officer or control person) |

| | | |

| _________ | (c) | a close personal friend of a director, senior officer or control person of the Issuer,or ofan affiliate of theIssuer,namely |

| | | ________________________________________________________________________ |

| | | (name of director, senior officer or control person) |

| | | |

| _________ | (d) | a close businessassociate of a director, senior officer orcontrolperson of theIssuer, orof an affiliate of theIssuer,namely |

| | | ________________________________________________________________________ |

| | | (name of director, senior officer or control person) |

3

| _________ | (e) | a person or company that is wholly-owned by any combination of persons orcompanies described in paragraphs 2.(a) to 2.(d); |

3. the Purchaser is, as defined in BC Instrument 45-507Trades to Employees, Executives and Consultants (please place an “X” on the appropriate line or lines):

| _________ | (a) | an “employee” or “employee administrator”; |

| | | |

| _________ | (b) | an “executive” or “executive administrator”; |

| | | |

| _________ | (c) | a “consultant”, “consultant company” or “consultant partnership” (other than an“associated consultant” or an “investor consultant”); |

of the Issuer or of an affiliated entity of the Issuer.

The representations, warranties, statements and certification made in this Certificate are true and accurate as of the date of this Certificate and will be true and accurate as of the date of acquisition of any securities by the Purchaser upon exercise of the Warrant (a “Closing”). If any such representation, warranty, statement or certification becomes untrue or inaccurate prior to a Closing, the undersigned Purchaser shall give the Issuer immediate written notice thereof.

The Purchaser acknowledges that the Issuer will be relying on this Certificate in connection with the Warrant and any securities issued pursuant thereto.

The statements made in this Certificate are true.

Dated this ______ day of __________________ , 200__.

| | ___________________________________________ |

| | (Signature) |

| | |

| | AHC HOLDINGS INC. |

| | (Print Name) |

| | |

| | ___________________________________________ |

| | (Address) |

| | |

| | ___________________________________________ |

| | (City/Province/Postal Code) |

| | |

| | ___________________________________________ |

| | (Area Code/Telephone Number) |

SCHEDULE “B”

INVESTMENT LETTER

(Capitalized terms not specifically defined herein will have the meaning

ascribed to them in the Share Purchase Warrant to which this Schedule is attached.)

The undersigned,AHC HOLDINGS INC., an Alberta corporation (the “Purchaser”), in connection with the acquisition of securities of CTI Diversified Holdings, Inc., a Delaware corporation (the “Company”), pursuant to the share purchase warrant (“Warrant”) dated March 6, 2003 signs and delivers this Investment Letter to the Company.

The Purchaser understands that the Company is relying on this information in determining to offer securities (the “Securities”) to the undersigned in a manner exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The Purchaser represents and warrants to and covenants and agrees with the Company as follows:

| (a) | The Purchaser is not a “U.S. person” under Rule 902(k) of Regulation S under theSecurities Act, and is not acquiring the Securities for the account or benefit of any U.S.person or person in the United States; and the Purchaser, if a natural person, is over 21years of age and: |

| |

| |

| |

| | | |

| | (i) | the Purchaser was outside the United States at the time of signing and delivery ofthis Investment Letter and the Subscription Agreement; |

| | |

| | | |

| | (ii) | no offers to sell the Securities were made by any person to the Purchaser whilethe Purchaser was in the United States. |

| | |

| | | |

| (b) | The Purchaser: (i) has adequate means of providing for its current needs and possiblepersonal contingencies, and has no need for liquidity of its investment, (ii) can bear theeconomic risk of losing its entire investment, (iii) has such knowledge and experience infinancial and business matters that it is capable of evaluating the relative risks and meritsof its investment in the Securities, (iv) has had an opportunity to ask questions of andreceive answers from the Company’s senior management concerning the Company andits business prospects, affairs, and risks, and (v) all documents, books, and records of theCompany requested, if any, by the Purchaser pertaining to its investment in the Securitieshave been made available for inspection or delivery to it and it has read or reviewed andis familiar with and understands the same. |

| | | |

| (c) | THE PURCHASER RECOGNIZES, UNDERSTANDS, AND ACKNOWLEDGESTHAT THERE ARE SUBSTANTIAL RESTRICTIONS ON THETRANSFERABILITY OF THE SECURITIES, AND THE PURCHASER MAY HAVETO HOLD THE SECURITIES INDEFINITELY AND MAY NOT BE ABLE TOLIQUIDATE THE INVESTMENT IN THE COMPANY WHEN IT WISHES TO DO |

2

| | SO, IF AT ALL, BECAUSE, AMONG OTHER THINGS, THERE IS A LIMITEDTRADING MARKET FOR THE COMPANY’S COMMON STOCK. IN ADDITION,PURSUANT TO REGULATION “S” UNDER THE SECURITIES ACT, THEPURCHASER GENERALLY IS PROHIBITED FROM OFFERING OR SELLING THESECURITIES WITHIN THE UNITED STATES OR TO OR FOR THE ACCOUNT ORBENEFIT OF ANY U.S. PERSONS FOR AT LEAST ONE YEAR FROM THECLOSING OF THIS OFFERING. |

| | | |

| (d) | The Securities are being acquired solely for the Purchaser’s own benefit and account. |

| | | |

| (e) | If the Purchaser decides to offer, sell, or otherwise transfer any of the Securities, it willnot offer, sell, or otherwise transfer any of the Securities directly or indirectly, unless: |

| | | |

| | (i) | the sale is to the Company; |

| | | |

| | (ii) | the sale is made outside the United States in a transaction meeting the requirementof Rule 904 of Regulation S under the Securities Act and in compliance withapplicable local laws and regulations; |

| | | |

| | (iii) | the sale is made pursuant to the exemption from the registration requirementsunder the Securities Act provided by Rule 144 thereunder and in accordance withany applicable state securities or “Blue Sky” laws; or |

| | | |

| | (iv) | the Securities are sold in a transaction that does not require registration under theSecurities Act or any applicable state laws and regulations governing the offer andsale of securities, and it has prior to such sale furnished the Company with anopinion of counsel to that effect in form and substance reasonably satisfactory tothe Company. |

| | | |

| (f) | The Purchaser understands that the stock certificates representing the Securities will beara legend in substantially the following form described in Section 5 below. |

| |

| | | |

| (g) | The Purchaser agrees not to engage in any hedging transactions involving the Securitiesunless the Purchaser does so in compliance with the Securities Act. |

| |

| | | |

| (h) | The Purchaser has full power and authority to sign and deliver this Investment Letter andto perform its obligations hereunder and this Investment Letter is a legally bindingobligation in accordance with its terms. |

| | | |

| (i) | The Purchaser has carefully read this Investment Letter and, to the extent it believesnecessary, has discussed with its counsel the representations, warranties, and agreementsthat it is making herein and the limitations on resale of the Securities. |

3

2. Acquiring Entirely for Own Account

The Purchaser represents and warrants that it is acquiring the Securities solely for its own account for investment and not with a view to or for sale or distribution of the Securities or any portion thereof and without any present intention of selling, offering to sell, or otherwise disposing of or distributing the Securities or any portion thereof in any transaction other than a transaction complying with the registration requirements of the Securities Act and any and all applicable state securities or “Blue Sky” laws or pursuant to an exemption therefrom. The Purchaser also represents that the entire legal and beneficial interest of the Securities that it is purchasing is being purchased for, and will be held for, the Purchaser’s account only, and neither in whole nor in part for any other person or entity.

3. Information Concerning the Company

The Purchaser acknowledges that it has received all information that it deems necessary and appropriate to enable it to evaluate the financial risk inherent in acquiring the Securities, including the documents and materials reasonably necessary to evaluate an investment in the Company. The Purchaser further acknowledges that it has received satisfactory and complete information concerning the business and financial condition of the Company in response to all inquiries in respect thereof.

4. Restricted Securities

The Purchaser acknowledges that the Company has hereby disclosed to the Purchaser in writing:

| (a) | The Securities have not been registered under the Securities Act or the securities laws ofany state of the United States, and the Securities must be held indefinitely unless a transferof them is subsequently registered under the Securities Act or an exemption from suchregistration is available; and |

| | |

| (b) | The Company will make a notation in its records of the above described restrictions ontransfer and of the legend described below. |

5. Legend

The Purchaser agrees that all of the Securities will have endorsed thereon a legend to the following effect:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”). THESE SECURITIES MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH RULE 904 OF REGULATION S UNDER THE 1933 ACT, (C) IN COMPLIANCE WITH THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS UNDER THE 1933 ACT PROVIDED BY RULE 144 OR RULE 144A THEREUNDER, IF AVAILABLE,

4

AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS, OR (D) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE 1933 ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND THE HOLDER HAS, PRIOR TO SUCH SALE, FURNISHED TO THE COMPANY AN OPINION OF COUNSEL, OF RECOGNIZED STANDING, OR OTHER EVIDENCE OF EXEMPTION, REASONABLY SATISFACTORY TO THE COMPANY. HEDGING TRANSACTIONS INVOLVING THE SECURITIES REPRESENTED HEREBY MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT.”

6. Transfers

The Company agrees to refuse to register any transfer of the Securities not made in (i) accordance with Regulation S, (ii) pursuant to registration under the Securities Act, or (iii) pursuant to an available exemption from registration under the Securities Act.

7. Counterparts

This Investment Letter may be signed by the parties in counterparts, each of which so signed will be deemed to be an original, and the counterparts together will constitute one and the same instrument despite the date of signing and will be deemed to bear the later date of any counterparts.

Dated this ______ day of __________________ , 200__.

| | _______________________________________________ |

| | (Name of Purchaser – please print) |

| | |

| | By: ____________________________________________ |

| | (Authorized Signature) |

| | |

| | _______________________________________________ |

| | (Official Capacity or Title – please print) |

| | |

| | _______________________________________________ |

| | (Please print name of individual whose signatureappears above if different than the name of thePurchaser printed above) |

THIS WARRANT AND THE SHARES DELIVERABLE ON EXERCISE OF THE WARRANT HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THIS WARRANT MAY NOT BE EXERCISED UNLESS THE UNDERLYING SHARES HAVE BEEN REGISTERED UNDER THE 1933 ACT AND THE APPLICABLE SECURITIES LEGISLATION OF ANY STATE OR AN EXEMPTION FROM THOSE REGISTRATION REQUIREMENTS IS AVAILABLE.

CTI DIVERSIFIED HOLDINGS, INC.

NON-TRANSFERABLE WARRANT

TO PURCHASE SHARES OF COMMON STOCK

| 1,000,000 Common Shares | Void after |

| Par Value of U.S. $0.0001 | March 6, 2006. |

This is to certify that, for valuereceived,AHC HOLDINGS INC.(the “Warrant Holder”), of 52023Range Road 231, Sherwood Park,Alberta, T8B 1A2, has the right to purchase fromCTI DiversifiedHoldings, Inc., a Delaware corporation (the “Company”), on and subject to the terms and conditionshereinafter referred to, up to1,000,000fully paid and non-assessable shares of common stock of the Company having a par value of US$0.0001 per share (the “Shares”), or any greater or lesser number ofshares that may be determined by application of the anti-dilution provisions of this Warrant. The Sharesmay be purchased at a price of US$0.15 per Share at any time up to 4:00 p.m. local time in Vancouver,British Columbia, on March 6, 2006.The right to purchase the Shares may be exercised in whole or inpart by the Warrant Holder only at the price set forth above (the “Exercise Price”) within the time set forth above by: |

| (a) | completing and signing the attached Subscription Form for the number of Shares that the WarrantHolder wishes to purchase, in the manner therein indicated; |

| | |

| (b) | surrendering this Warrant Certificate, together with the completed Subscription Form, toInterwest Transfer Company, Inc., 1981 E. 4800 South, Ste. 100, Salt Lake City, Utah 84117, (the“Transfer Agent”); |

| | |

| (c) | delivering an investor questionnaire and/or similar documents acceptable to the Companydemonstrating that the sale of the shares to be purchased is exempt from the registration andprospectus requirements of the applicable securities legislation in Canada and the registrationunder the Securities Act of 1933, as amended (the “1933 Act”), and any state securities law; and |

| | |

| (d) | paying the appropriate Exercise Price, in United States funds, for the number of Sharessubscribed for, either by certified cheque or bank draft or money order payable to the Company inVancouver, British Columbia, or any other address that the Company may advise by writtennotice to the address of the Warrant Holder. |

This Warrant and the Shares issuable on exercise of the Warrant have not been registered under the 1933 Act or the securities laws of any state of the United States, and this Warrant may not be exercised unless the Shares are registered under the 1933 Act and the securities laws of all applicable states of the United States or an exemption from registration requirements is available.

2

On surrender and payment, the Company will issue to the Warrant Holder, or to any other person or persons that the Warrant Holder may direct, the number of the Shares subscribed for and will deliver to the Warrant Holder, at the address set forth on the Subscription Form, a certificate or certificates evidencing the number of Shares subscribed for. If the Warrant Holder subscribes for a number of Shares that is less than the number of Shares permitted by this Warrant, the Company will forthwith cause to be delivered to the Warrant Holder a further Warrant Certificate in respect of the balance of the Shares referred to in this Warrant Certificate not then being subscribed for. The Shares so purchased will be deemed to be issued as of the close of business on the date on which this Warrant has been exercised by payment to the Company of the Exercise Price. No fractional shares will be issued on the exercise of this Warrant.

In the event of any subdivision of the common shares of the Company (as those common shares are constituted on the date hereof) into a greater number of common shares while this Warrant is outstanding, the number of Shares represented by this Warrant will thereafter be deemed to be subdivided in like manner and the Exercise Price adjusted accordingly, and any subscription by the Warrant Holder for Shares hereunder will be deemed to be a subscription for common shares of the Company as subdivided.

In the event of any consolidation of the common shares of the Company (as those common shares are constituted on the date hereof) into a lesser number of common shares while this Warrant is outstanding, the number of Shares represented by this Warrant will thereafter be deemed to be consolidated in like manner and the Exercise Price adjusted accordingly, and any subscription by the Warrant Holder for Shares hereunder will be deemed to be a subscription for common shares of the Company as consolidated.

In the event of any capital reorganization or reclassification of the common shares of the Company or the merger or amalgamation of the Company with another corporation at any time while this Warrant is outstanding, the Company will thereafter deliver, at the time of purchase of the Shares hereunder, the number of common shares the Warrant Holder would have been entitled to receive in respect of the number of the Shares so purchased had the right to purchase been exercised before the capital reorganization or reclassification of the common shares of the Company or the merger or amalgamation of the Company with another corporation.

If at any time while this, or any replacement, Warrant is outstanding:

| (a) | the Company proposes to pay any dividend of any kind on its common shares or make anydistribution to the holders of its common shares; |

| | |

| (b) | the Company proposes to offer for subscription pro rata to the holders of its common shares anyadditional shares of stock of any class or other rights; |

| | |

| (c) | the Company proposes any capital reorganization or classification of its common shares or themerger or amalgamation of the Company with another corporation; or |

| | |

| (d) | there is a voluntary or involuntary dissolution, liquidation, or winding-up of the Company, |

the Company must give to the Warrant Holder at least seven days prior written notice (the “Notice”) of the date on which the books of the Company are to close or a record is to be taken for the dividend, distribution, or subscription rights, or for determining rights to vote with respect to the reorganization, reclassification, consolidation, merger, amalgamation, dissolution, liquidation, or winding-up. The Notice will specify, in the case of any dividend, distribution, or subscription rights, the date on which holders of common shares of the Company will be entitled to exchange their common shares for securities

3

or other property deliverable on any reorganization, reclassification, consolidation, merger, amalgamation, sale, dissolution, liquidation, or winding-up, as the case may be. Each Notice will be delivered by hand, addressed to the Warrant Holder at the address of the Warrant Holder set forth above or at any other address that the Warrant Holder may from time to time specify to the Company in writing.

The holding of this Warrant Certificate or the Warrants represented hereby does not constitute the Warrant Holder a member of the Company.

Nothing contained herein confers any right on the Warrant Holder or any other person to subscribe for or purchase any Shares of the Company at any time subsequent to 4:00 p.m. local time in Vancouver, British Columbia on March 6, 2006, and from and after that time, this Warrant and all rights hereunder will be void.

The Warrants represented by this Warrant Certificate are non-transferable. Any common shares issued pursuant to this Warrant will bear the following legend:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER UNITED STATES FEDERAL OR STATE SECURITIES LAWS AND MAY NOT BE OFFERED FOR SALE, SOLD OR OTHERWISE TRANSFERRED OR ASSIGNED FOR VALUE, DIRECTLY OR INDIRECTLY, NOR MAY THE SECURITIES BE TRANSFERRED ON THE BOOKS OF THE CORPORATION, WITHOUT REGISTRATION UNDER ALL APPLICABLE UNITED STATES FEDERAL OR STATE SECURITIES LAWS OR COMPLIANCE WITH AN APPLICABLE EXEMPTION THEREFROM, SUCH COMPLIANCE, AT THE OPTION OF THE CORPORATION, TO BE EVIDENCED BY AN OPINION OF THE HOLDER’S COUNSEL, IN FORM ACCEPTABLE TO THE CORPORATION, THAT NO VIOLATION OF SUCH REGISTRATION PROVISIONS WOULD RESULT FROM ANY PROPOSED TRANSFER OR ASSIGNMENT.”

Time will be of the essence hereof.

This Warrant Certificate is not valid for any purpose until it has been signed by the Company.

IN WITNESS WHEREOF, the Company has caused its common seal to be hereto affixed and this Warrant Certificate to be signed by one of its directors as of the 6hth day of March, 2003.

CTI DIVERSIFIED HOLDINGS, INC.

Per:

/s/ Don Farnell

Don Farnell, President

SUBSCRIPTION FORM

| To: | CTI Diversified Holdings, Inc. (the “Company”) |

| And to: | The directors of the Company |

Pursuant to the Share Purchase Warrant made the 6th day of March, 2003, the undersigned subscribes for and agrees to purchase ____________________________ shares of common stock of the Company having a par value of US$0.0001 (the “Shares”), at a price of US$0.15 per Share for the aggregate sum of US$__________ (the “Subscription Funds”), and encloses herewith: (i) a certified cheque, bank draft, or money order payable to the Company in full payment of the Shares; and (ii) a completed accredited investor questionnaire (attached as Schedule A).

The undersigned requests that:

| (a) | the Shares be allotted to the undersigned; |

| | |

| (b) | the name and address of the undersigned as shown below be entered in the registers of membersand allotments of the Company; |

| | |

| (c) | the Shares be issued to the undersigned as fully paid and non-assessable common shares of theCompany; and |

| | |

| (d) | a share certificate representing the Shares be issued in the name of the undersigned. |

Dated this _______ day of ______________ , 200__.

DIRECTION AS TO REGISTRATION:

(Name and addressexactly as you wish them to appear on your share certificate and in the register of members.)

| Full Name(1): ____________________________________________________________________________________ |

| Full Address: ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| ____________________________________________________________________________________ |

| Signature of Subscriber(1): __________________________________________________________________________ |

If the name above differs from the name of the

Subscriber, then please complete the following

guarantee: | Signature of Subscriber guaranteed by:

______________________________________________

Authorized Signature Number |

(1)NOTE:The signature to this subscription form must correspond with the name as recorded on the Warrant Certificate in every particular without alteration or enlargement or any change whatever. The signature of the person signing this power must be guaranteed in a manner satisfactory to the Company’s transfer agent.

SCHEDULE “A”

ACCREDITED INVESTOR QUESTIONNAIRE

IN THE MATTER OF CTI DIVERSIFIED HOLDINGS, INC.(the “Issuer”)

AND THESECURITIES ACT (Alberta) (the “Act”)

The undersigned (the “Purchaser”), in connection with the acquisition of securities of the Issuer pursuant to the share purchase warrant dated March 6, 2003 (the “Warrant”), makes the following representations and warranties to the Issuer:

1. the Purchaser is an “accredited investor”, as defined in Multilateral Instrument 45-103 Capital Raising Exemptions, by reason of the fact that the undersigned Purchaser is (please place an “X” on the appropriate line or lines):

| _________ | (a) | a Canadian financial institution, or an authorized foreign bank listed in ScheduleIII of theBank Act(Canada); |

| | | |

| _________ | (b) | the Business Development Bank of Canada incorporated under theBusinessDevelopment Bank of Canada Act(Canada); |

| | | |

| _________ | (c) | an association under theCooperative Credit Associations Act(Canada) located inCanada; |

| | | |