UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 23, 2007

INTERNATIONAL IMAGING SYSTEMS, INC.

(Exact name of registrant as specified in charter)

Delaware

(State or other jurisdiction of incorporation)

000-25413 (Commission File Number) | 65-0854589 (IRS Employer Identification No.) |

Dongxin Century Square 7th Floor

High-tech Development District

Xi’an, Shaanxi Province, PRC 710043

(Address of principal executive offices and zip code)

+86 29 8268 3920

(Registrant’s telephone number including area code)

31200 Via Colinas, Suite 200

Westlake Village, CA 91362

(Former Name and Former Address)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On October 23, 2007 (the “Closing Date”), International Imaging Systems, Inc., (the "Registrant") entered into a Share Exchange Agreement (the “Exchange Agreement”), with Baorun China Group Limited, a company organized under the laws of Hong Kong (“Baorun China”), Redsky Group Limited, a British Virgin Islands company ("Redsky"), Princeton Capital Group LLP, a New Jersey limited liability partnership ("PCG" and together with Redsky, the “Shareholders”), who together own shares constituting 100% of the issued and outstanding ordinary shares of Baorun China (the “Baorun Shares”), and those persons set forth on Schedule II thereto (the “Principal Acquiror Shareholders”). Pursuant to the terms of the Exchange Agreement, the Shareholders transferred to us all of the Baorun Shares in exchange for the issuance of 23,954,545 (the “Shares”) shares of our common stock (the “Share Exchange’). As a result of the Share Exchange, Baorun China became our wholly-owned subsidiary and the Shareholders acquired approximately 94.11% of our issued and outstanding stock.

In connection with the Share Exchange, we entered into a registration rights agreement (the “Insider Registration Rights Agreement”) to register for resale an aggregate of 2,623,769 shares of common stock, comprising (i) 1,123,769 shares of common stock of beneficially owned by those persons who were our officers, directors, owners of more than 5% of our shares of common stock or otherwise our affiliates prior to the closing of the Share Exchange, and (ii) 1,500,00 shares issued to PCG in the Share Exchange. We agreed to file the Insider Registration Statement to register such shares within 45 days of the Closing Date with the Securities and Exchange Commission (the “SEC”), and use our best efforts to have the Insider Registration Statement declared effective within 150 calendar days of the Closing Date, or if the Insider Registration Statement is subject to a full review and comments from the SEC, within 180 days following the Closing Date. We are required to keep the Insider Registration Statement contiuously effective under the Securities Act of 1933, as amended (the “Securities Act”) for the Effectiveness Period which continues until such date as is the earlier of the date when all of the securities covered by that registration statement have been sold or the date on which such securities may be sold without any restriction pursuant to Rule 144 (the “Effectiveness Period”). We will pay liquidated damages of .75% of the dollar amount of the shares registered in the Insider Registration Statement per month, payable in cash, up to a maximum of 7.5%, if the Insider Registration Statement is not filed or declared effective within the foregoing time periods or ceases to be effective prior to the expiration of the Effectiveness Period. However, no liquidated damages shall be paid with respect to any shares that we are not permitted to include in the Insider Registration Statement due to the SEC’s application of Rule 415.

Concurrent with the Share Exchange, we completed a private equity financing (the “Financing”) of $10,000,000 with one accredited investor (the “Investor”) pursuant to a securities purchase agreement (the “Purchase Agreement”), dated as of October 23, 2007. Net proceeds from the Financing were approximately $9,575,000. We sold to the Investor, 1,000,000 shares of our Series A Convertible Preferred Stock, par value $0.001 (the “Preferred Shares”) for a purchase price of $10.00 per share and issued: (i) a Series A-1 Warrant to purchase 3,409,091 shares of our common stock and (ii)a Series A-2 Warrant to purchase 2,272,728 shares of our common stock. Each of the Warrants has a term of 5 years. In connection with the Financing, we restated and amended the Certificate of Designation of the Relative Rights and Preferences of our Series A Convertible Preferred Stock in its entirety. Each Preferred Share is convertible into a number of fully paid and nonassessable shares of our common stock equal to the quotient of the liquidation preference amount per share ($10.00) divided by the conversion price, which initially is $2.20 per share, subject to certain adjustments, or approximately 4,545,455 shares of common stock initially if all of the Preferred Shares are converted.

In connection with the Financing, we entered into a registration rights agreement (the “Financing Registration Rights Agreement”), dated October 23, 2007. with the Investor in which we agreed to file a registration statement (the “Financing Registration Statement”) with the SEC to register the shares of common stock underlying the Preferred Shares (the “Conversion Shares”) on the day that is the 45th day following the later of (i) 60 days following the sale of all of the securities included in the Insider Registration Statement, and (ii) 6 months following the effective date of the Insider Registration Statement, or any subsequent registration statement with respect thereto, or such earlier date as permitted by the SEC. We have agreed to use our best efforts to have the Financing Registration Statement declared effective within 105 calendar days of the filing of the Financing Registration Statement, or 135 calendar days of such filing in the case of a full review by the SEC. We are required to keep the Financing Registration Statement continuously effective under the Securities Act until such date as is the earlier of the date when all of the securities covered by that registration statement have been sold or the date on which such securities may be sold without any restriction pursuant to Rule 144 (the “Financing Effectiveness Period”). We will pay liquidated damages of 1% of the dollar amount of the Preferred Shares sold in the Financing per month, payable in cash, up to a maximum of 10%, if the Financing Registration Statement is not filed or declared effective within the foregoing time periods or ceases to be effective prior to the expiration of the Financing Effectiveness Period. However, no liquidated damages shall be paid with respect to any Preferred Shares that we are not permitted to include in the Financing Registration Statement due to the SEC’s application of Rule 415. Further, we granted the Investor demand and piggy-back registration rights with respect to the (i) shares of common stock underlying the Warrants issued in the Financing, (ii) shares issuable to the Investor if we do not meet certain net income and cash from operations thresholds for the 2007 and 2008 fiscal years; and (iii) shares issuable to the Investor if the Company’s common stock is not listed on NASDAQ or a higher exchange by June 30th, 2009 (the “Listing Shares”).

We entered into an escrow agreement with the Investor (the “Escrow Agreement”), pursuant to which Redsky initially placed 4,545,455 shares of common stock (the “Escrow Shares”) it received in the Share Exchange in an escrow account. The Escrow Shares are being held as security for the achievement of $0.27 per share in each of our audited net income and cash from operations results for the fiscal year 2007 ( the “2007 Performance Threshold”) and $0.45 per share in each of our net income and cash from operations results for the fiscal year 2008 (the “2008 Performance Threshold”). If we achieve the 2007 Performance Threshold and the 2008 Performance Threshold, the Escrow Shares will be released back to Resdky. If either the 2007 Performance Threshold or 2008 Performance Threshold is not achieved, an aggregate number of Escrow Shares (such number to be determined by the formula set forth in the Escrow Agreement) will be distributed pro-rata to the investors, until such time that the Escrow Agreement terminates, Investors, based upon our actual audited net income and cash from operations for the fiscal years 2007 and 2008. Pursuant to the Escrow Agreement, within 5 business days after release of any of the Escrow Shares to the Investors, Redsky shall deliver that number of additional shares of common stock as is necessary to maintain 100% of the number of original Escrow Shares in the Escrow Account at all times.With respect to the 2007 and 2008 Perfomrance Targets, net income shall be defined in accordance with US GAAP and reported by us in our audited financial statements for each of 2007 and 2008, plus any amounts that (1) may have been recorded as charges or liabilities on the 2007 and 2008 financial statements, respectively, due to the application of EITF No. 00-19 that are associated with (i) any outstanding Warrants, (ii) the transactions contemplated by this escrow agreement, and (iii) any issuance under a performance based stock incentive plan that was in existence on the Closing Date, and (2) any and all expenses incurred by us in connection with the consummation of the transactions contemplated by the Purchase Agreement and the Share Exchange Agreement. Upon the termination of the Escrow agreement, any and all Escrow shares remaining in the Escrow account shall be returned to the Registrant.

In connection with the Financing, we also entered into an Investor and Public Relations Agreement with the Investor. Pursuant to this agreement, $200,000 of the proceeds of the Financing was deposited into an escrow account for use by us in investor and public relations.

We are a party to separate Lock-Up Agreements between the Investor and Redsky, Gao Xincheng, Li Gaihong and Chen Jun (the “Restricted Persons”), under which the Restricted Persons have agreed with the Investor not to sell any shares of our common stock that such Restricted Persons presently own or may acquire after the Closing Date during the period commencing on the Closing Date and expiring on the date that is twelve months following the effective date of the Financing Registration Statement (the “Lock-up Period”); provided that, each Restricted Person also agrees that it shall not sell more than one-tenth (1/10) of the shares of our common stock he/she owns for a period of twenty four (24) months following the Lock-up Period.

A copy of the Exchange Agreement, the Purchase Agreement, the Form of Warrant, the Insider Registration Rights Agreement, the Financing Registration Rights Agreement, the Share Escrow Agreement and the Certificate of Designation, a form of the Lock-up Agreements are incorporated herein by reference and are filed as Exhibits 2.1, 10.1, 4.1, 10.2, 10.3, 10.4, 4.3 and 4.4, respectively, to this Form 8-K. The description of the transactions contemplated by the Exchange Agreement and the Purchase Agreement, and our obligations under the Insider Registration Rights Agreement, the Financing Registration Rights Agreement, the Share Escrow Agreement and the Warrant set forth herein do not purport to be complete and is qualified in its entirety by reference to the full text of the exhibits filed herewith and incorporated by this reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

On the Closing Date, we consummated the transactions contemplated by the Exchange Agreement, pursuant to which we acquired all of the issued and outstanding shares of stock of Baorun China in exchange for the issuance in the aggregate of 23,954,545 shares of our common stock to the Shareholders resulting in Baorun China becoming our wholly-owned subsidiary.

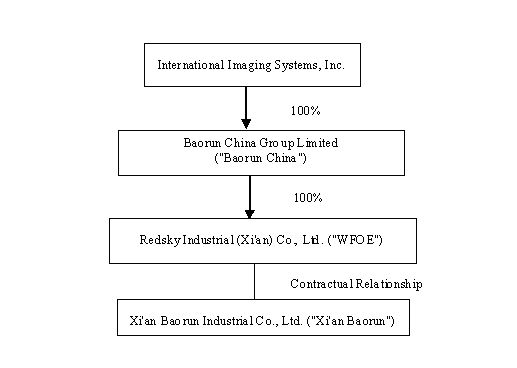

Our current corporate structure is set forth below:

Business

Business Overview

Prior to the Share Exchange, we were a public “shell” company with nominal assets. We were incorporated in the State of Delaware in July 1998 and until January 2007 engaged in the business of marketing pre-owned, brand name photocopy machines and employee leasing. In September 2006 our management at that time sold a majority interest in our shares to several purchasers that acted as an agent for serveral purchasers. As of January 1, 2007, under our new management we began to pursue an acquisition strategy, whereby we sought to acquire undervalued business with a history of operating revenues in markets that provide room for growth.

As a result of the Share Exchange, we are engaged in the development, exploration, production and distribution of bio-diesel and wholesale and processing of heavy oil and finished oil products. By utilizing several scientific innovations and technologies, we are able to make use of vegetable oils, animal oils, and the excess waste oils and waste extracts to produce environmentally-friendly bio-diesel products.

In October 2007, Baorun China, our wholly-owned subsidiary in Hong Kong, formed Redsky Industrial (Xi’an) Co., Ltd. (“Redsky China”) in the People's Republic of China. We operate our oil businesses in China primarily through Xi’an Baorun Industrial Development Co., Ltd. (“Xi’an Baorun”), which is based in China and wholly-owned by Chinese citizens, including our Chief Executive Officer and director, Mr. Gao Xincheng, who owns 70% of Xi’an Baorun. We do not have an equity interest in Xi’an Baorun. In order to meet domestic ownership requirements under Chinese law, which restrict foreign companies from operating in the finished oil industry, Redsky China executed a series of exclusive contractual agreements. These contractual agreements allow us to, among other things, secure significant rights to influence Xi’an Baorun’s business operations, policies and management, approve all matters requiring shareholder approval, and the right to receive 100% income earned by Xi’an Baorun. In addition, to ensure that Xi’an Baorun and its shareholders perform their obligations under these contractual arrangements, the shareholders have pledged to Redsky China all of their equity interests in Xi’an Baorun. At such time that current restrictions under PRC law on foreign ownership of Chinese companies engaging in the finished oil industry in China are lifted, Redsky China may exercise its option to purchase the equity interests in Xi’an Baorun directly.

Below is a summary of the contractual agreements entered into by us and the shareholders of Xi’an Baorun:

Exclusive Business Cooperation Agreement

Pursuant to an Exclusive Business Cooperation Agreement entered into by and between Redsky China and Xi’an Baorun on October 19, 2007, Redsky China has the exclusive right to provide to Xi’an Baorun complete technical support, business support and related consulting services, which include, among others, technical services, business consultations, equipment or property leasing, marketing consultancy and product research. Xi’an Baorun agrees to pay an annual service fee to Redsky China equal to a certain percentage of Xi’an Baorun’s audited total amount of operational income each year. This agreement has a ten-year term, subject to renewal and early termination in accordance with the terms therein.

Exclusive Option Agreements

Under Exclusive Option Agreements entered into by and among Redsky China, each of the three shareholders of Xi’an Baorun and Xi’an Baorun October 19, 2007, the shareholders of Xi’an Baorun, irrevocably grant to Redsky China or its designated person an exclusive option to purchase, to the extent permitted by PRC law, a portion or all of their respective equity interests in Xi’an Baorun for a purchase price to be designated by Redsky China to the extent allowed by applicable PRC laws and regulations. Redsky or its designated person has the sole discretion to decide when to exercise the option, whether in part or in full. Each of these agreements has a ten-year term, subject to renewal at Redsky China’s election.

Equity Pledge Agreements

Under the Equity Pledge Agreements entered into by and among Redsky China, Xi’an Baorun and each of the three shareholders of Xi’an Baorun October 19, 2007, the shareholders of Xi’an Baorun pledge, all of their equity interests in Xi’an Baorun to guarantee Xi’an Baorun’s performance of its obligations under the Exclusive Business Cooperation Agreement. If Xi’an Baorun or any of its shareholders breaches his/her respective contractual obligations under this agreement, or upon the occurrence of one of the events regarded as an event of default under each such agreement, Redsky China, as pledgee, will be entitled to certain rights, including the right to dispose of the pledged equity interests. The shareholders of Xi’an Baorun agree not to dispose of the pledged equity interests or take any actions that would prejudice Redsky China's interest, and to notify Redsky China of any events or upon receipt of any notices which may affect Redsky China' interest in the pledge. Each of the equity pledge agreements will be valid until all the payments due under the Exclusive Business Cooperation Agreement have been fulfilled.

Incentive Option Agreements

On October 19, 2007, Redsky entered into an Incentive Option Agreement with Mr. Gao Xincheng, whereby Redsky granted an incentive option to Mr. Gao to purchase, 3,000 ordinary shares of Redsky at an exercise price of $1.00 per share for a total aggregate consideration of $3,000. Mr. Gao has been granted the incentive options for the contributions that Mr. Gao has made and will continue to make to Redsky. Upon exercise of all of the options by Mr. Gao, Redsky shall repurchase the share of Redsky owned by the current sole stockhoder, and Mr. Gao shall become the sole stockholder of Redsky.

Industry and Market Overview

China Oil Markets

We believe that oil is the lifeline of the modern economy. The changes in oil prices have changed the growth rate of the world economy. Global prices for gasoline and diesel fuels have been rising in the past few years as oil prices continue to increase and supply concerns accelerate. The rapid economic development in China has resulted in a continuing rise in energy demand. The demand for oil in China has greatly exceeded the supply, which has caused China to become increasingly dependent on importing oil. We believe that the huge demand for oil and related products has provided a great opportunity for us. The following table depicts the demand for oil and oil supply in China in 2005, and the projections for 2010 through 2020.

| | | 2005 | | 2010 | | 2015 | | 2020 | |

| Oil Demand (1,000 tons) | | | 270,000 | | | 310,000 | | | 350,000 | | | 400,000 | |

| Oil Supply (1,000 tons) | | | 175,000 | | | 180,000 | | | 190,000 | | | 180,000 | |

| Shortage (1,000 tons) | | | 96,000 | | | 130,000 | | | 160,000 | | | 220,000 | |

| Importation (%) | | | 36 | % | | 41.9 | % | | 45.7 | % | | 55 | % |

Source: 2006 Report on China Oil Market Analysis and Forecast.

China Bio-diesel Markets

The rise in global oil prices, and global warming and other environmental awareness issues are increasing the demand for fuels derived from renewable resources. Technological innovations and the desire to reduce reliance on oil have motivated the production, research and development of the bio-diesel industry.

China’s bio-diesel industry is still underdeveloped, which we believe provides significant oportunities for us in this market. The following table depicts the forecast of production and sales of bio-diesel in China from 2005 to 2020:

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2020 | |

| Output (1,000 tons) | | | 80 | | | 100 | | | 300 | | | 600 | | | 900 | | | 2,000 | | | 20,000 | |

| Sales (1,000 USD) | | | 87,053 | | | 108,813 | | | 326,440 | | | 652,880 | | | 979,307 | | | 2,176,240 | | | 21,762,453 | |

| Output Growth Rate | | | | | | 25 | % | | 200 | % | | 100 | % | | 50 | % | | 122 | % | | 900 | % |

Source 2005-2010 Report on China Bio-diesel Industry Prospects and Market Forecas.

The Demand for bio-diesel in China is directly related to the consumption rate of oil. China is now the second largest oil consumer in the world behind the United States, consuming approximately seven million barrels of oil per day, and China’s need for petroleum continues to grow rapidly. Today, the Chinese government and an increasing number of governments around the world are encouraging the introduction of bio-diesel fuel into their transport fuel mix to reduce harmful carbon dioxide emissions, improve air quality, and lessen dependence on imported fuels.

In February 2005, China enacted the Renewable Energy Law, which aims to promote the development and utilization of renewable energy, improve the energy structure, diversify energy supplies, safeguard energy security, protect the environment and realize the sustainable development of the economy and society. This legislation states that fuel retail businesses must begin to include “biological liquid fuel” in their sales or they will suffer imposed fines as China is seeking to reduce its dependence on fossil fuels in its diesel transportation vehicles.

Products

Oil Products.

We manufacture and sell a variety of oil products including gasoline, mineral-diesel, heavy oil, slurry and naphtha.

Bio-diesel.

Bio-diesel refers to a clean burning alternative fuel, produced from domestic, renewable resources. Bio-diesel is a methylesters (sometimes called “fatty acid methyl esters”) that is made through a chemical process called transesterification whereby glycerin is separated from fat or vegetable oil. The vegetable oil or fat can be castor oil, rapeseed oil, soybean oil, peanut oil, corn oil or cotton seed oil, animal oils, waste scraps from the refinery of the above oils and used cooking oil.

Bio-diesel contains no petroleum, but it can be blended at any level with petroleum diesel to create a bio-diesel blend. It can be used in compression-ignition (diesel) engines with little or no modifications. Bio-diesel has many benefits:

| | · | Excellent environmental performance. |

| | · | Compatibility with existing diesel engines. |

| | · | Better lubrication to extend the life time of engines. |

| | · | From renewable energy sources. |

Gas Station.

We own and operate a gas station located in Xi’an, Shaanxi Province whereby we sell our oil products and bio-diesel to end users.

Competition; Competitive Advantages and Strategies

Oil Products.

We estimate that we have approximately ten major competitors in the Shaanxi Province that produce and distribute oil products similar to us, including Shaanxi Dongda Petro-Chemical Co., Ltd., Shaanxi Dayun Petrochemical Material Co., Ltd. and Baoji Huahai Industry Corp.

We believe we have the following advantages over our competitors in this market:

| | · | Qualification. We have obtained a distribution license from the Ministry of Commerce for the distribution of heavy oil and finished oil products. |

| | · | Supply advantage. Shaanxi Yan Chang Oil (Group) Co., Ltd., one of the largest four qualified raw oil and gas exploration enterprises in China, is the largest oil supplier to us. |

| | · | Advanced oil mixing technology. By applying our advanced oil mixing technology, the quality of our oil products has been greatly enhanced. |

| | · | Special railway. We use three exclusive lines of railway to distribute our oil products. We are the only enterprise in Shaanxi Province that has the capability to distribute oil products to Yunnan Province, Guizhou Province and Sichuan Province directly and to other geographic areas in China in a timely manner. |

| | · | Strong Storage Capability. Our oil depot storage capability reaches 37,000 steres. |

| | · | Gas Station. We own and operate our own gas station, where we are able to sell our oil products. |

Bio-diesel Fuels.

In the area of bio-diesel fuel production, we are not aware of the existence of any significant competitors in Shaanxi Province.

However, we face competition from competitors in other geographic areas in China and foreign competitors if such competitors choose to export their bio-diesel to China.

We believe that we have the following advantages over our competitors in this market:

| | · | Lower Cost of Supply. We have a rich and stable resource of feedstock for bio-diesel production, such as castor bean, Chinese pistache, Chinese prickly ash and Chinese pine. We are in partnership with local governments and farmers to establish our own feedstock supply base of 67,000 acres of which 8,400 acres has been completed. Our ability to produce our own supply of resources reduces supply costs. |

| | · | Advanced Technologies and Equipments. By employing our own proprietary processing technology and equipment, our processing efficiency is greatly enhanced resulting in reduced processing costs. |

| | · | Higher Quality. While China has not yet set forth standards for bio-diesel products, we employ the German and United States standards to develop and produce our bio-diesel products, which are recognized as high quality and acceptable in our industry worldwide. In addition, we believe that we maintain high quality bio-diesel, as a result of, employing our proprietary technologies, research and development efforts in connection with several universities and institutions and high quality feedstock. |

| | · | Manufacturing Capability. We estimate that the demand for bio-diesel in China will be 20,000,000 tons by the end of 2010. However, we are one of only two companies with annual output over 100,000 tons so far. We believe that we have an opportunity to become the largest bio-diesel producer in China once our 300,000 ton manufacturing facilities are completed. |

| | · | Lower Price. The cost of feedstock accounts for 75% of the total cost of the bio-diesel production. Relying on our own feedstock supply base, our bio-diesel costs are much lower than other competitors. Reduced supply costs enables us to offer our products at a lower price compared to our competitors which we believe will put us in a position ahead of our competitors for a larger share of the market. |

| | · | Strong Industrial Relationship. Since we have been engaged in the oil trade business for many years, we have established strong industrial relationships with our customers. |

| | · | Excellent Research and Development Capabilities. We have kept long term cooperative relationships with many top Chinese universities and institutions to engage in the research and development of new bio-diesel products including Tsinghua University, Xi’an Communication University, Xi’an Oil University, Northwest University of Forestry and Agricultural, Northwestern Chemical Research Institution and Luoyang Chemical Engineering Design Institute. |

Growth Strategy

We currently have a number of initiatives in place to drive future growth.

| | · | Expanding bio-diesel fuel production capacity. In 2006, we built our 10,000 square-meter bio-diesel production facility with annual output capability of 100,000 tons, located in Tongchuan City, Shaanxi Province. We plan to expand such facility so that its annual output capability can reach 300,000-500,000 tons. |

| | · | Expanding distribution channels of oil products and bio-diesel. In February 2007, we acquired a gas station located in Xi’an, Shaanxi Province. We plan to acquire thirty gas stations in the Shaanxi Province over the next three years. |

| | · | Importation of oil products. We are in the process of applying for the license from the government necessary for engaging in the importation of oil products from overseas. China’s booming economy has fueled the increase of demand for oil products in China. In China, the government has been implementing guiding prices for oil products. As oil import tariffs falllower and the globalization of oil trade goes further, we believe that China’s oil trading companies will have more opportunities. When international oil prices are lower than China’s guiding price, those companies with importing licenses are able to purchase oil from overseas at relatively lower prices than in China, and are then able to increase their profits in sales. Additionally, as China’s oil market becomes more and more dependent on imports, we believe that an importing licenses would bring us more business opportunities and resources, and help enhance trading volume, build customer networks and increase our market share. |

| | · | Enhancing proprietary technology. We plan to enhance our technology through continuous innovations, research and development efforts. |

| | · | Establishing more feedstock planting bases. We plan to set up eight feedstock planting bases in Ankang City and Hanzhong City, in the Shaanxi Province. Currently, we have established four raw material bases in Danfeng, Ningqiang, Liuba, Tongchuan, respectively. One of our bases, Xi’an Weiyang District Limin Environmental Chemical Plant, is now under environmental evaluation, and we anticipate it will start running soon in November 2007 We anticipate that the other raw material bases will be established prior to June 30, 2008. |

| | · | Acquisition of oil extracting plants. We plan to acquire 10-12 oil extracting plants in local areas for pre-process of feedstock for bio-diesel production. Hancheng City Golden Sun Prickly Ash Oil and Spicery Co.,Ltd.and Tongchuan City Hongguang oil processing plant have already become rough processing bases, and the we anticipate that the acquisition of oil processing plants will be consummated about prior to September 30,2008. |

Sales and Marketing

We are one of the few licensed oil product distributors in the Shaanxi Province. Currently, we maintain 30% of the market share in the Shaanxi Province. In April 2004, we were granted a license to distribute finished oil products by the Ministry of Commerce of the People’s Republic of China. We are also one of thirteen enterprises that were recognized as qualified enterprises operating in the fuel business in Shaanxi Province by the Shaanxi Province Government. We have developed a stable sales network for current products in a number of provinces and municipalities including Shaanxi, Henan, Hebei, Shandong, Shanxi, Hunan, Hubei, Jiangxi, Guizhou, Yunnan, Beijing, Shanghai, Fujian and Xinjiang. As our business expands, we intend to further expand our sales network and develop more sales channels. We now employ 16 full-time salespersons.

Intellectual Property

Our core technologies consist of: (i) know-how technologies to improve the quality of heavy oil and finished oil products; and (ii) two utility model technologies and three inventions related to the bio-diesel production.

In September 2006, we filed, the following five applications with the State Intellectual Property Office of the PRC (“SIPO”), which were all accepted by SIPO:

· Application No. 200610152506.X for a new composite catalyst for preparing bio-diesel. On November 17, 2006, Xi’an Baorun received preliminary invention patent approval from SIPO for its proprietary bio-diesel compound activator.

· Application No. 200610152507.4 for a new technology for the processing bio-diesel with catalyst or splitting decomposition in liquid or gas face.

· Application No. 200610152508.9 for its bio-diesel processing technique.

· Application No. 200620137855.X for its new reaction vessel for preparing bio-diesel and composite diesel.

· Application No. 200620137854.5 for its new reaction equipment for preparing bio-diesel.

In addition, we own the rights to technologies developed jointly with various universities and research centers. We developed technologies for the production of bio-diesel jointly with the Xi’an Petroleum University and Northwest University of Forestry and Agriculture. We developed our proprietary technology for the production of bio-diesel jointly with the Beijing Qing Da Ke Ma Technology Co., Ltd. and ownership of the resultant technology was transferred to us by a contract dated September 4, 2006. We own the right to the oil mixing technology developed by Xi’an Petroleum University by a contract dated December 18, 2005.

Customers

We currently sell our oil products and bio-diesel to regional distributors in China that supply retail service stations and directly to end users through our retail service gas stations.

As of the fiscal year ended December 31, 2006, our top five customers - ranked by the dollar amount sold to each customer - contributed substantially to our revenues.

| | Name of Customer | | Products Sold | | Sales for the Period by Customer | | % of Sales for

the Period | |

| 1 | Zibo City Lin Zi Lu Hua Refined Chemicals Co., Ltd. | | naphtha | | $ | 6,300,000 | | 11.6 | % |

| | | | | | | | | | |

| 2 | Chuan Yu Branch of China Petroleum & Chemical Sales Corporation | | gasoline | | $ | 12,640,000 | | 23 | % |

| | | | | | | | | | |

| 3 | Shouguang City Lian Meng Petroleum & Chemical Co., Ltd. | | long residuum | | $ | 9,620,000 | | 12.7 | % |

| | | | | | | | | | |

| 4 | Shangdong Jin Cheng Petrochemical Group Co. Ltd. | | diesel | | $ | 8,240,000 | | 15 | % |

| | | | | | | | | | |

| 5 | Hubei Hong Xin Petrochemical Industrial Co., Ltd. | | diesel | | $ | 6,170,000 | | 11.3 | % |

| | | | | | | | | | |

| | Total Top Five Customers | | | | $ | 40,270,000 | | 73.6 | % |

| | | | | | | | | | |

| | Total Company Results | | | | $ | $54,430,000 | | 100 | % |

Regulation

We carry on our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction, that may cause environmental waste, to adopt effective measures to control and properly dispose of waste gases, waste water, industrial waste, dust and other environmental waste materials. Fines may be levied against producers who cause pollution.

In accordance with the requirement of the Environmental Protection Law, we have installed the necessary environmental protection equipment, adopted advance environmental protection technologies, established responsibility systems for environmental protection, and reported to and registered with the relevant local environmental protection department. We have complied with the relevant law and have never paid a fee for excessive discharge pollutants.

Under PRC dangerous chemical laws and regulations, all dangerous chemical manufacturing facilities are required to obtain a Safe Production Permit. We obtained such permit in April 2007. The permit is valid for a period of three years and will be renewed for additional periods of three years. In order to renew the Safe Production Permit, the subject facility must not have had any death accidents and must pass the periodical inspections by the local work safety administration authorities during the three year period.

In addition, our business is in an industry that is subject to PRC finished oil products laws and regulations. These laws and regulations require enterprises engaged in the wholesaling of finished oil products including gasoline, diesel and bio-diesel to obtain a the Wholesaling Business License. We have obtained such license which is a long term one. Pursuant to the Administrative Measures on the Finished Oil Market promulgated by the Ministry of Commerce of PRC in 2006, the provincial level government authority inspects the enterprises annually which have acquired a Finished Oil Wholesale Business License and submits the inspection results to Ministry of Commerce. The enterprises which fail the annual inspection have the opportunity to cure such violations in a limited period of time; otherwise, the approval authority shall revoke their Finished Oil Wholesale Business Licenses. For the annual inspection, the governmental authority reviews the following items: (i) the execution and performance of the finished oil supply agreements; (ii) the operation results for the previous year; (iii) whether the finished oil distributor and the basic facilities comply with the technique requirements of the aforesaid Measures; and (iv) finished oil quality, quantity, fire protection, safe production, environmental protection. However, there are no provisions regarding renewal set forth in the Measures.

We anticipate that the PRC government will release an official standard for bio-diesel fuels in the near future. We will seek to qualify our products for the Bio-diesel Standard when it is released. We believe that our products are well positioned to qualify due to the early production of bio-diesel as well as our longstanding history of being in operation since 1999, among other things.

Legal Proceedings

We are not aware of any significant pending legal proceedings against us.

Property

The following table summaries the location of real property we own or lease.

Item | | Address | | Leased/Owned |

| 1 | | 2-20702, Dongxin City Garden, Xi’an, Shaanxi, China | | Owned |

| | | | | |

| 2 | | Suite 1105, Floor 11, Building One, Dongxin Century Square, Xi’an, Shaanxi Province, China | | Owned |

| | | | | |

| 3 | | Suite 1305, Floor 11, Building One, Da Hua Garden, Xi’an, Shaanxi Province, China | | Owned |

| | | | | |

| 4 | | Suite 1105, Floor 11, Building One, Da Hua Garden, Xi’an, Shaanxi Province, China | | Owned |

| | | | | |

| 5 | | Suite B-901, Zhong Fu New Village Plaza, Xi’an, Shaanxi Province, China | | Owned |

| | | | | |

| 6 | | Space within the Northwest Fire-resistant Materials Factory, Tongchuan, Shaanxi Province, China | | Leased |

| | | | | |

| 7 | | Suite 10719 and 10720, Dongxin Century Square, Xi’an, Shaanxi Province, China | | Owned |

We entered into a lease agreement with Northwest Fire-resistant Materials Factory in April 2006 whereby we were granted a use right to a piece of land, located in Tongchuan City, Shaanxi Province for building our oil exportation auxiliary facilities. We pay rent of 150,000 RMB annually which is paid in three installments for each year during the term of the lease agreement. This agreement has a term of ten years commencing in July 2007 and ending in June 2016. We believe our facilities are suitable and adequate for our current needs.

Employees

We have 73 employees. We are compliant with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

Risk Factors

Risks Related to Our Business

We have a limited operating history.

Our limited operating history and the early stage of development of the industry in which we operate makes it difficult to evaluate our business and future prospects. Although our revenues have grown rapidly, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in operating losses.

We will continue to encounter risks and difficulties in implementing our business model, including potential failure to:

| | · | increase awareness of our products, protect our reputation and develop customer loyalty; |

| | · | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| | · | maintain adequate control of our expenses; and |

| | · | anticipate and adapt to changing conditions in the markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

A significant portion of our sales is concentrated in a few major customers; the loss of any would have a material adverse impact on our revenues.

Our five largest customers accounted for approximately 74% of our sales in 2006. If not replaced, loss of any of these customers could significantly reduce our revenues.

Our reliance upon third party suppliers for feedstock may hinder our ability to be profitable.

We are dependent upon our relationships with third parties for our feedstock supply. We have agreements with five major feedstock suppliers. These suppliers provided approximately 84% of our feedstock in 2006. Should any of these suppliers terminate their supply relationships with us, or enter into the finished oil products business in competition with us, we may be unable to procure sufficient amounts of feedstock and our profitability may be limited. In addition, our suppliers may not perform their obligations as agreed, and we may be unable to specifically enforce our agreements. Competition for vegetable oil may result in higher prices and lower profit margins from the sale of our products. If we are unable to obtain adequate quantities of feedstock at economically viable prices, our business could be unprofitable and investors may lose their entire investment in us.

The price increase of raw materials, such as fat or vegetable oil, could increase the cost of our products and reduce our profit margin.

Fat, vegetable oil and various agricultural and botanic products are the major materials for our bio-diesel business. In the last two years, the prices of these raw materials have fluctuated substantially as have other raw materials due to the increasing demand in China resulting from its rapid economic development. Although we have managed to minimize the impact of such fluctuation in the past, there is no assurance that we will be able to do so in the future. If the price for these raw materials increases more significantly, our profit margin could decrease considerably we may not be able to maintain our profitability.

Our ability to operate at a profit is partially dependent on market prices for the petroleum and bio-diesel fuels. If the petroleum and bio-diesel prices drop significantly, we will be unable to maintain profitability.

Our results of operations and financial condition will be affected by the selling prices for petroleum and bio-diesel fuel products. Prices are subject to and determined by market forces over which we have no control. The amount of our revenues depends on the market prices for petroleum and bio-diesel fuels.

The markets in which we operate are highly competitive and fragmented and we may not be able to maintain market share.

We operate in highly competitive markets and expect competition to persist and intensify in the future. Our competitors are mainly domestic leaders in the energy and bio-diesel markets in China. We face the risk that new competitors with greater resources than us will enter our markets.

Our future success substantially depends on our ability to significantly increase both our manufacturing/storage capacity and output.

Our future success depends on our ability to significantly increase both our manufacturing/storage capacity and output. If we are unable to do so, we may be unable to expand our business, decrease our costs, maintain our competitive position and improve our profitability. Our ability to establish additional manufacturing/storage capacity and increase output is subject to significant risks and uncertainties, including:

| | · | the ability to raise significant additional funds to purchase and prepay for raw materials or to build additional manufacturing facilities, which we may be unable to obtain on reasonable terms or at all; |

| | | |

| · | delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as increases in raw materials prices and problems with equipment vendors; |

| | | |

| · | delays or denial of required approvals by relevant government authorities; |

| · | diversion of significant management attention and other resources; and |

| | | |

| · | failure to execute our expansion plan effectively. |

If we are unable to establish or successfully operate additional manufacturing/storage capacity or to increase manufacturing output, or if we encounter any of the risks described above, we may be unable to expand our business as planned. Moreover, we cannot assure you that if we do expand our manufacturing/storage capacity and output we will be able to generate sufficient customer demand for our finished oil and bio-diesel to support our increased production levels.

Key employees are essential to growing our business.

Gao Xincheng, Chief Executive Officer and President and other senior management personnel are essential to our ability to continue to grow our business. Mr. Gao has established relationships within the industries in which we operate. If he were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue.

In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

If we need additional financing, which may not be available to find such financing on satisfactory terms or at all.

Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, future product opportunities with collaborators, future licensing opportunities and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders' interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

If we fail to adequately protect or enforce our intellectual property rights, or to secure rights to patents of others, the value of our intellectual property rights could diminish.

Our success, competitive position and future revenues will depend in part on our ability to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing the proprietary rights of third parties.

To date, we have filed five patent applications to the State Intellectual Property Office of the PRC. However, we cannot predict the degree and range of protection patents will afford us against competitors. Third parties may find ways to invalidate or otherwise circumvent our proprietary technology. Third parties may attempt to obtain patents claiming aspects similar to our patent applications. If we need to initiate litigation or administrative proceedings, such actions may be costly whether we win or lose.

Our success also depends on the skills, knowledge and experience of our scientific and technical personnel, consultants, advisors, licensors and contractors. To help protect our proprietary know-how and inventions for which patents may be unobtainable or difficult to obtain, we rely on trade secret protection and confidentiality agreements. If any of our intellectual property is disclosed, our value would be significantly impaired, and our business and competitive position would suffer.

If we infringe the rights of third parties, we could be prevented from selling products, forced to pay damages and compelled to defend against litigation.

If our products, methods, processes and other technologies infringe proprietary rights of other parties, we could incur substantial costs, and may have to obtain licenses (which may not be available on commercially reasonable terms, if at all), redesign our products or processes, stop using the subject matter claimed in the asserted patents, pay damages, or defend litigation or administrative proceedings, which may be costly whether it wins or loses. All of the above could result in a substantial diversion of valuable management resources.

We believe we have taken reasonable steps, including comprehensive internal and external prior patent searches, to ensure we have freedom to operate and that our development and commercialization efforts can be carried out as planned without infringing others’ proprietary rights. However, we cannot guarantee that no third party patent has been filed or will be filed that may contain subject matter of relevance to our development, causing a third party patent holder to claim infringement. Resolving such issues has traditionally resulted, and could in our case result, in lengthy and costly legal proceedings, the outcome of which cannot be predicted accurately.

We have never paid cash dividends and is not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We dos not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

We do not have a majority of independent directors serving on our board of directors, which could present the potential for conflicts of interest.

We do not have a majority of independent directors serving on our board of directors. In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our stockholders, generally, and the controlling officers, stockholders or directors.

Our legal right to lease certain properties could be challenged by property owners or other third parties, which could prevent us from continuing to utilize those storage vessels and manufacturing factory or could increase the costs associated with utilizing those storage vessels and manufacturing factory.

We do not hold any land-use rights with respect to the manufacturing factory or oil storage facilities on which our bio-diesel manufacturing factory and finished oil storage vessels are located. Instead, our business model relies on leases with third parties who either own the properties or lease the properties from the ultimate property owner. We cannot assure you that the title to properties we currently lease will not be challenged. There may be challenges to the title of the properties which, if successful, could impair the development or operations of our storage or manufacturing on such properties. In addition, we are subject to the risk of potential disputes with property owners. Such disputes, whether resolved in our favor or not, may divert management attention, harm our reputation or otherwise disrupt our business.

In several instances, where our immediate lessors are not the ultimate owners of land or storage space, no consent was obtained from the owners to sublease the land or storage space to us. A lessor’s failure to duly obtain the title to the property or to receive any necessary approvals from the ultimate owner or the primary lease holder, as applicable, could potentially invalidate our lease or result in the renegotiation of such lease leading to less favorable terms. Moreover, we cannot assure you that the building ownership or leasehold in connection with our storage or manufacturing operations will not be subject to similar third-party challenges.

Our lessors’ failure to comply with lease registration and other compliance requirements under PRC law may subject these lessors or us to fines or other penalties that may negatively affect our ability to utilize storage vessels or bio-diesel manufacturing factory.

We are subject to a number of land- and property-related legal requirements. For instance, under PRC law, all lease agreements are required to be registered with the local housing bureau and any lease of available military real estate should adopt standard military lease agreement and such lease agreement wouldn’t become effective unless approved by military real estate administrative authorities. Currently, none of the lessors of the storage vessels we operate and manage had obtained registrations or approval of their leases from the relevant authorities as required and we continue to request these lessors to obtain registrations under our lease agreements with them. The failure of our lessors to register lease agreements as required by law or to get the lease approved may subject these lessors or us to fines or other penalties which may negatively affect our ability to operate those storage vessels covered under those leases.

Accidents or injuries in our finished oil storage vessels or bio-diesel manufacturing factory may adversely affect our reputation and subject us to liability.

There are inherent risks of accidents or injuries when working in finished oil storage vessels or bio-diesel manufacturing factory. Death and accidents could prevent us from renewing our Safety Production Permit. One or more accidents or injuries at any of our finished oil storage vessels or bio-diesel manufacturing factory could adversely affect our safety reputation among customers and potential customers and increase our costs by requiring us to take additional measures to make our safety precautions even more visible and effective. If accidents or injuries occur at any of our finished oil storage vessels or bio-diesel manufacturing factory, we may be held liable for costs related to the injuries. Our current property and liability insurance policies may not provide adequate coverage and we may be unable to renew our insurance policies or obtain new insurance policies without increases in cost or decreases in coverage levels.

We have limited insurance coverage.

We don’t carry property insurance that covers the assets that we own at our leased storage space and manufacturing factory that actually owned by our lessors. Although we require our lessors to purchase customary insurance policies, we cannot guarantee that they will adhere to such requirements. If we were held liable for amounts and claims exceeding the limits of our insurance coverage or outside the scope of our insurance coverage, our business, results of operations and financial condition may be materially and adversely affected. In addition, we do not have any business disruption insurance coverage for our operations to cover losses that may be caused by natural disasters or catastrophic events, such as SARS or avian flu. Any business disruption or natural disaster may result in our incurring substantial costs and diversion of our resources.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

As a public company, we will have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Lack of experience as officers of publicly-trade companies of our management team may hinder our ability to comply with Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, have required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Associated With Doing Business In China

There are substantial risks associated with doing business in China, as set forth in the following risk factors.

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under our current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

We derive a substantial portion of ours sales from China.

Substantially all of our sales are generated from China. We anticipate that sales of our products in China will continue to represent a substantial proportion of our total sales in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand of our products, among other things, which in turn would have a material adverse effect on our business and financial condition.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese renminbi into foreign currencies and, if Chinese renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of renminbi to the U.S. dollar had generally been stable and the renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese renminbi to the U.S. dollar. Under the new policy, Chinese renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. As a result of this policy change, Chinese renminbi appreciated approximately 2.5% against the U.S. dollar in 2005 and 3.3% in 2006. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese renminbi against the U.S. dollar. We can offer no assurance that Chinese renminbi will be stable against the U.S. dollar or any other foreign currency.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese renminbi into foreign currency for current account items, conversion of Chinese renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese renminbi to fund our business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations

Our ability to implement our planned development is dependent on many factors, including the ability to receive various governmental permits.

In accordance with PRC laws and regulations, we are required to maintain various licenses and permits in order to operate our business including, without limitation, Safety Production Permits and Finished Oil Products Distribution License and Dangerous Chemical Distribution License. We are required to comply with applicable production safety standards in relation to our production processes. Our premises and equipment are subject to periodically inspections by the regulatory authorities for compliance with the dangerous chemical safety production laws and regulations and finished oil distribution laws and regulations. Failure to pass these inspections, or the loss of or suspend some or all of our production activities, which could disrupt our operations and adversely affect our business.

We may have limited legal recourse under PRC law if disputes arise under our contracts with third parties.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we can not assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

We may not be guaranteed of a continuance to receive the preferential tax treatment we currently enjoy, and dividends paid to us from our operations in China may become subject to income tax.

The rate of income tax on companies in China may vary depending on the availability of preferential tax treatment or subsidies based on their industry or location. The current maximum corporate income tax rate is 33%. The PRC government promulgated on March 16, 2007 the new Enterprise Income Tax Law that will be effective as of January 1, 2008. Pursuant to the new law, the enterprise income tax of 25% shall be apply to any enterprise. Although we were approved by the local tax authority to be exempted from the enterprise income tax for a period commencing in 2005 and ending in 2010, we do not know whether such new law may change the preferential treatment that was granted to us. Any loss or substantial reduction of the tax benefits enjoyed by us would reduce our net profit.

We have entered into contractual agreements with Xi’an Baorun to control and realize the benefits of the business. We are relying upon PRC laws and there is substantial uncertainty regarding the interpretation and application of current or future PRC laws and regulations.

Since we are deemed to be foreign persons or foreign-funded enterprises under PRC laws and cannot directly invest in companies operating in the finished oil production industry, we operate our businesses in China through Xi’an Baorun, an operating company that is owned by PRC citizens and not by us. We control Xi’an Baorun through a series of contractual arrangements. Although we believe we are in compliance with current PRC regulations, we cannot be sure that the PRC government would view these contractual arrangements to be in compliance with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. In the opinion of our PRC legal counsel, our current ownership structure and the contractual arrangements comply with all existing applicable PRC laws, rules and regulations after completion of certain registration procedures. Because this structure has not been challenged or examined by PRC authorities, uncertainties exist as to whether the PRC government may interpret or apply the laws governing these arrangements in a way that is contrary to the opinion of our PRC counsel. If we, our wholly-owned subsidiaries or Xi’an Baorun, were found to be in violation of any existing PRC laws or regulations, the relevant regulatory authorities would have broad discretion to deal with such violation, including, but not limited to the following:

· levying fines;

· confiscating income;

· revoking licenses;

· shutting down servers or blocking websites;

· requiring a restructure of ownership or operations; and/or

· requiring the discontinuance of our businesses.

Any of these or similar actions could cause significant disruption to our business operations or render us unable to conduct our business operations and may materially adversely affect our business, financial condition and results of operations.

The contractual agreements between Redsky China and Xi’an Baorun may not be as effective in providing operational control as direct ownership of these businesses and may be ineffective to permit consolidation of the financial results of the business.

We depend on Xi’an Baorun, an operating company in which we have no equity ownership interest, for substantially all of our operations, revenues and net income, and must rely on contractual agreements to control and operate these businesses. Although we have been advised by PRC legal counsel that after completion of certain registration procedures our contractual arrangements with the operating company are valid, binding and enforceable under PRC laws and regulations, these contractual agreements may not be as effective in providing and maintaining control over the operating company and its business operations as direct ownership of these businesses. For example, we may not be able to take control of Xi’an Baorun upon the occurrence of certain events, such as the imposition of statutory liens, judgments, court orders, death or incapacity. Furthermore, if the operating company and its shareholders fail to perform as required under those contractual agreements, we will have to rely on the PRC legal system to enforce those agreements, and due to the uncertainties that exist under PRC law about its structure, there is no guarantee that we will be successful in an enforcement action and any action could result in the disruption of our business, damage to our reputation, diversion of our resources and significant costs. In addition, the PRC government may propose new laws or amend current laws that may be detrimental to our current contractual agreements with the operating company, which may in turn have a material adverse effect on our business operations.

As stated above we do not have an equity interest in Xi’an Baorun, as current PRC regulations restrict ownership of companies operating in the finished oil industry to domestic Chinese entities. Accordingly, we have entered into a series of exclusive contractual agreements with Xi’an Baorun, through our acquisition of our Hong Kong subsidiary Baorun China, which has established Redsky China, a Chinese subsidiary, which ultimately entered into these contractual agreements with Xi’an Baorun. As a result of Redsky China’s contractual relationship with Xi’an Baorun, we have secured significant rights to influence Xi’an Baorun’s business operations, policies and management, to approve all matters requiring shareholder approval, and the right to receive 100% of income earned by Xi’an Baorun. In addition, to ensure that Xi’an Baorun and its shareholders perform certain obligations under their contractual arrangements, the Xi’an Baorun shareholders have pledged to Redsky China all of their equity interests in Xi’an Baorun. Based on these contractual relationship with Xi’an Baorun, we have determined a variable interest entity has been created in accordance with FASB Interpretations - FIN 46(R): Consolidation of Variable Interest Entities (as amended)(“FIN 46(R)”). Under FIN 46(R), we will present Xi’an Baorun as a subsidiary in our consolidated financial statements.

Changes in foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

The Renminbi is not a freely convertible currency currently, and the restrictions on currency exchanges may limit our ability to use revenues generated in RMB to fund our business activities outside the PRC or to make dividends or other payments in United States dollars. The PRC government strictly regulates conversion of RMB into foreign currencies. Over the years, foreign exchange regulations in the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In the PRC, the State Administration for Foreign Exchange, or the SAFE, regulates the conversion of the RMB into foreign currencies. Pursuant to applicable PRC laws and regulations, foreign invested enterprises incorporated in the PRC are required to apply for “Foreign Exchange Registration Certificates.” Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, etc.) can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE.

In addition, on October 21, 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fundraising and Reverse Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies (“Notice 75”), which became effective as of November 1, 2005. Notice 75 replaced the two rules issued by SAFE in January and April 2005.

According to Notice 75: