UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2008

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from __________ to __________

Commission File No. 000-25413

China Bio Energy Holding Group Co., Ltd.

( Exact Name of Registrant as Specified in its Charter)

| Delaware | | 65-0854589 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

Dongxin Century Square, 7th Floor Hi-Tech Development District Xi’an, Shaanxi Province, People’s Republic of China | | 710043 |

| | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Issuer’s telephone number: 86 29 8268 9320

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicated by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of common stock, par value $0.0001 per share, held by non-affiliates of the issuer, based on the last sale price of the common stock, as reported by the OTC Bulletin Board on June 30, 2008, was $27,000,000. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant’s common stock are deemed to be affiliates. Such determination should not be deemed an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

As of March 15, 2009, there were 27,169,091 shares of the issuer’s common stock, par value $0.0001 per share, outstanding.

TABLE OF CONTENTS

| | | Page |

| | | |

| PART I | | 1 |

| | | |

| Item 1. | Description of Business. | 1 |

| | | |

| Item 1A. | Risk Factors. | 12 |

| | | |

| Item 1B. | Unresolved Staff Comments. | 20 |

| | | |

| Item 2. | Description of Property. | 20 |

| | | |

| Item 3. | Legal Proceedings. | 21 |

| | | |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 21 |

| | | |

| PART II | | 22 |

| | | |

| Item 5. | Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 22 |

| | | |

| Item 6. | Selected Financial Data. | 23 |

| | | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 24 |

| | | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 29 |

| | | |

| Item 8. | Financial Statements and Supplementary Data. | 29 |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 30 |

| | | |

| Item 9A(T). | Controls and Procedures. | 30 |

| | | |

| Item 9B. | Other Information. | 30 |

| | | |

| PART III | | 31 |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 31 |

| | | |

| Item 11. | Executive Compensation. | 33 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 36 |

| | | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 37 |

| | | |

| Item 14. | Principal Accountant Fees and Services. | 37 |

| | | |

| PART IV | | 38 |

| | | |

| Item 15. | Exhibits. | 38 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors, including the risks outlined under Risk Factors contained in Item 1A of this Form 10-K, may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

PART I

| Item 1. | Description of Business. |

Company Overview and Structure

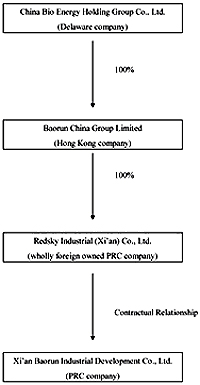

We are engaged in three business segments, the development, exploration, production and distribution of bio-diesel, the wholesale distribution and processing of heavy oil and finished oil products, and the sale of gasoline and diesel at retail gas stations. Through certain contractual agreements between our wholly owned indirect subsidiary, Redsky Industrial (Xi’an) Co., Ltd. (“Redsky Industrial”), and Xi’an Baorun Industrial Development Co., Ltd. (“Baorun Industrial”). Redsky Industrial, a registered wholly foreign owned enterprise (“WFOE”) in the People’s Republic of China, is a subsidiary of Baorun China Group Limited (“Baorun Group)”, our direct wholly owned subsidiary.

Our corporate organizational structure is as follows:

Contractual Agreements with Baorun Industrial

Baorun Industrial is based in China and wholly owned by Chinese citizens, including our Chairman, Chief Executive Officer and President, Mr. Gao Xincheng, who owns 70% of Baorun Industrial. We do not have an equity interest in Baorun Industrial. In order to meet domestic ownership requirements under Chinese law, which restricts foreign companies from operating in the finished oil industry, Redsky Industrial executed a series of exclusive contractual agreements with Baorun Industrial, which allow us to, among other things, secure significant rights to influence Baorun Industrial’s business operations, policies and management, approve all matters requiring shareholder approval, and give us the right to include 100% of the income earned by Baorun Industrial as part of our consolidated financial statements. In addition, to ensure that Baorun Industrial and its shareholders perform their obligations under these contractual arrangements, the shareholders have pledged to Redsky Industrial all of their equity interests in Baorun Industrial. At such time that current restrictions under PRC law on foreign ownership of Chinese companies engaging in the finished oil industry in China are lifted, Redsky Industrial may exercise its option to purchase the equity interests in Baorun Industrial directly.

Since Baorun Group owns Redsky Industrial, which effectively controls Baorun Industrial, Baorun Industrial is deemed a subsidiary of Baorun Group, a legal subsidiary of the Company. Based on Baorun Industrial’s contractual relationship with Redsky Industrial as set forth in the Exclusive Business Cooperation Agreement, we have determined that a variable interest entity has been created in accordance with FASB Interpretations - FIN 46(R): Consolidation of Variable Interest Entities (as amended) (“FIN 46(R)”). Under FIN 46(R), Baorun Industrial is to be presented as a consolidated subsidiary of the Company.

The contractual agreements entered into by us and the shareholders of Baorun Industrial include:

Exclusive Business Cooperation Agreement

Pursuant to an Exclusive Business Cooperation Agreement entered into between Redsky Industrial and Baorun Industrial on October 19, 2007, as amended on March 24, 2008, Redsky Industrial has the exclusive right to provide to Baorun Industrial complete technical support, business support and related consulting services, which include, among others, technical services, business consultations, equipment or property leasing, marketing consultancy and product research. Baorun Industrial has agreed to pay an annual service fee to Redsky Industrial equal to 100% of the annual net income of Baorun Industrial. This agreement has a ten-year term, subject to renewal at the option of Redsky Industrial and early termination. Redsky has the right to terminate this agreement for any reason upon 30 days written notice Baorun Industrial only has the right to terminate in the event of the gross negligence of, or fraudulent acts by Redsky Industrial.

Exclusive Option Agreements

Under Exclusive Option Agreements dated October 19, 2007 entered into among Redsky Industrial, each of the three shareholders of Baorun Industrial and Baorun Industrial, the shareholders of Baorun Industrial, irrevocably granted to Redsky Industrial or its designated person an exclusive option to purchase, to the extent permitted by PRC law, a portion or all of their respective equity interests in Baorun Industrial for a purchase price to be designated by Redsky Industrial. Redsky Industrial or its designated person has the sole discretion to decide when to exercise the option, whether in part or in full. Each of these agreements has a ten-year term, subject to renewal at Redsky Industrial’s election.

Equity Pledge Agreements

Under the Equity Pledge Agreements dated October 19, 2007, entered into among Redsky Industrial, Baorun Industrial and each of the three shareholders of Baorun Industrial, the shareholders of Baorun Industrial pledged their equity interests in Baorun Industrial to guarantee Baorun Industrial’s performance of its obligations under the Exclusive Business Cooperation Agreement. If Baorun Industrial or any of its shareholders breaches his/her respective contractual obligations under the agreement, or upon the occurrence of an event of default, Redsky Industrial is entitled to certain rights, including the right to dispose of the pledged equity interests. The shareholders of Baorun Industrial agreed not to dispose of the pledged equity interests or take any actions that would prejudice Redsky Industrial’s interest. Each of the Equity Pledge Agreements will be valid until all the payments due under the Exclusive Business Cooperation Agreement have been fulfilled. Since the Exclusive Business Cooperation Agreement may be renewed at Redsky Industrial’s option, the equity pledge will remain in effect with each such renewal of the Exclusive Business Cooperation Agreement, and until all payments due under the Exclusive Business Cooperation are paid in full by Baorun Industrial.

Irrevocable Powers of Attorney

Under irrevocable powers of attorney, each of the stockholders of Baorun Industrial has granted to Redsky Industrial the power to exercise all voting rights of such stockholder in stockholders’ meetings, including, but not limited to, the power to determine the sale or transfer of all or part of such stockholder’s equity interest in, and appoint and elect the directors, the legal representative (chairperson), chief executive officer and other senior management of Baorun Industrial. No payments are required to be made under these irrevocable powers of attorney.

Incentive Option Agreements

On October 19, 2007, Redsky Group entered into an Incentive Option Agreement with Mr. Gao Xincheng, our Chairman, Chief Executive Officer and President, whereby Redsky Group granted an incentive option to Mr. Gao to purchase 3,000 ordinary shares of Redsky Group at an exercise price of $1.00 per share for a total aggregate consideration of $3,000. In connection with the Share Exchange, Redsky Group was issued 22,454,545 shares of our common stock. In August 2008, Mr. Gao exercised the option. Pursuant to the terms of the option agreement upon Mr. Gao’s exercise of the option,, Redsky Group repurchased the shares of Redsky Group then owned by its sole stockholder and as a result, Mr. Gao became the sole stockholder of Redsky Group.

Company Background

We acquired Baorun Group pursuant to a Share Exchange Agreement, dated October 23, 2007, with Baorun Group, Redsky Group Limited (“Redsky Group”), a British Virgin Islands company, Princeton Capital Group LLP, Castle Bison, Inc. and Stallion Ventures, LLC. Together, Redsky Group and Princeton Capital Group owned shares constituting 100% of the issued and outstanding ordinary shares of Baorun Group. Pursuant to the terms of the Share Exchange Agreement, Redsky Group and Princeton Capital Group transferred to us all of their shares in Baorun Group in exchange for the issuance of 22,454,545 shares of our common stock to Redsky Group and 1,500,000 shares of our common stock to Princeton Capital Group. As a result of this share exchange, Baorun Group became our wholly owned subsidiary and Redsky Group and Princeton Capital Group acquired an aggregate of approximately 94.11% of our common stock.

We were incorporated in the State of Delaware in July 1998 under the corporate name “AMS Marketing Inc.” and in October 2003, we changed our name to “International Imaging Systems, Inc.” Until January 2007 we were engaged in the business of marketing pre-owned, brand name photocopy machines and employee leasing. We then began to pursue an acquisition strategy to acquire an undervalued business with a history of operating revenues in markets that provide room for growth. Pursuant to such strategy in October 2007, we acquired the business of Baorun Industrial. On November 15, 2007, through a merger of our newly-formed wholly owned subsidiary, China Bio Energy Holding Group Co., Ltd., our corporate name was changed to “China Bio Energy Holding Group Co., Ltd.” We believe that our new name more appropriately reflects our new business operations.

Business Overview

We currently operate four oil depots, a 2.65 kilometer special transportation rail track used for distribution of finished oil and bio-diesel, and one 100,000 ton bio-diesel production plant located in Tongchuan, Shaanxi Province, China. All of our sales are generated from customers in China. Currently, our products are sold in Shaanxi, Henan, Hebei, Shangdong, Shanxi, Hunan, Hubei, Jiangxi, Sichuan, Guizhou, Fujian and Yunnan provinces, Beijing, Shanghai and Xinjiang Autonomous Region.

Material Opportunities and Challenges

The recent decrease in oil prices has put downward pressure on our oil distribution and retail gas station revenues. However as a distributor, we have maintained a stable margin in revenue from both oil distribution and retail gas stations. Since bio-diesel is sold at a similar price to regular petroleum diesel, overall bio-diesel revenues have also been impacted. However, our bio-diesel profit margins have largely remained the same due to the decline in raw material prices. In 2008, the price of waste cooking oil, which currently constitutes over 50% of the raw materials used by us, dropped nearly 50%. The price of non-edible seeds, another raw material, has also declined by 20%. An important reason for this decrease is that many smaller biodiesel producers were forced to close recently due to their lack of distribution channels and economy of scale, which prevented them from competing effectively in this market. Additionally, since our patented technology allows us to utilize different proportions of waste oil and/or non-edible seeds in our manufacturing process, we are able to optimize gross margins based on raw material input prices

Recent Developments in the PRC

For the past 9 years, China's fuel prices have been controlled by the National Development and Reform Commission (NDRC) and not set by market supply and demand. Effective January 1, 2009, the Chinese government implemented a new pricing regime for refined oil products, aimed to link domestic oil prices more closely to changes in the global crude oil prices in a controlled manner.

In January 2009, the average sales price for our oil products, which includes gasoline, diesel and heavy oil decreased 22.3% to $641 per ton (equivalent to approximately $1.77 per gallon of gasoline and $2.04 per gallon of petro-diesel), compared to an average price of $825 per ton (equivalent to approximately $2.28 per gallon of gasoline and $2.62 per gallon of petro-diesel), during the year 2008. This decrease is substantially less than the drop in world crude oil prices during the same period because the NDRC had held the domestic prices at lower levels during 2008.

In January 2009, the Chinese government halved sales tax to 5% on purchases of cars with engines under 1.6 liters. The tax cut is aimed at boosting domestic auto purchases which will likely increase overall domestic oil consumption and provide a stimulus for the steel sector. We believe that the sales tax cut on purchases of vehicles with small engines will drive more fuel consumption in 2009.

NDRC, the Ministry of Finance and other governmental departments are formulating relevant policies such as subsidies, refund of Value Added Taxes (“VAT”), relief on consumption tax, corporate tax, and fuel tax to encourage bio-diesel consumption. As a result, we are exempt from the fuel tax and corporate income taxes. We are also exempted from the corporate income tax through the end of calendar year 2010,

Our management plans to focus on growing our biodiesel production, our distribution business, and expanding the footprint of our retail service stations. On the distribution and retail side, we benefit from our advantageous location, well-established supplier relationships as well as an extensive distribution network that has valuable railway access to reach remote parts of China that other distribution companies cannot currently reach. We plan to strengthen our outreach in certain key distribution areas. We also plan to add another five to seven retail gas stations through acquisition or lease in 2009, which will benefit our overall distribution profit margins.

We also plan to expand our current bio-diesel production capacity of 100,000 tons to 150,000 tons, either through strategic acquisitions or through a new build-out in 2009. The Company anticipates $15 million in capital expenditures to accomplish this goal. China Bio Energy has secured enough raw materials to supply 150,000 tons of capacity, but will also continue to work towards securing more long-term sources of raw materials.

Management believes the increase in sales volume from these initiatives will not only offset the impact of current decrease in fuel prices but also favorably impact overall profits.

Industry and Market Overview

China Oil Markets

Rapid economic development in China has resulted in increased energy demand. The demand for oil in China has exceeded the supply, which has caused China to become increasingly dependent on imported oil. We believe that the increased demand for oil and related products has provided a great opportunity for our oil products business. The following table is taken from the 2007 Report on China Oil Market Analysis and Forecast and depicts the most recent information with respect to the demand for oil and oil supply in China during 2007, and the projections from 2008 through 2020.

| | | 2007 | | 2008 | | 2010 | | 2015 | | 2020 | |

| Oil Demand (1,000 tons) | | | 345,937 | | 401,420 | | | 408,300 | | 453,850 | | | 492,220 | |

| Oil Supply (1,000 tons) | | | 186,657 | | 192,000 | | | 198,000 | | 200,000 | | | 200,000 | |

| Shortage (1,000 tons) | | | 159,280 | | 209,420 | | | 210,300 | | 253,850 | | | 292,220 | |

| Importation (%) | | | 46.04 | | 52.17 | | | 51.52 | | 55.93 | | | 59.37 | |

Source: 2007 Report on China Oil Market Analysis and Forecast.

China Bio-diesel Markets

The rise in global oil prices, global warming and other environmental awareness issues are increasing the demand in China for fuels derived from renewable resources. Technological innovations and the desire to reduce reliance on oil have motivated the production, research and development of the bio-diesel industry in China. However, China’s bio-diesel industry is still underdeveloped, which we believe provides opportunities for us in this market. The following table depicts the most recent information available about the production and sales of bio-diesel in China from 2005 through 2007 and forecasts for 2008 through 2020.

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2020 | |

| Output (1,000 tons) | | | 80 | | 100 | | 312 | | 600 | | 900 | | 2,000 | | 20,000 | |

| Sales (1,000 USD) | | | 87,053 | | 108,813 | | 339,440 | | 652,880 | | 979,307 | | 2,176,240 | | 21,762,453 | |

| Output Growth Rate | | | | | 25 | % | 212 | % | 100 | % | 50 | % | 122 | % | 900 | % |

Source 2005-2010 Report on China Bio-diesel Industry Prospects and Market Forecast.

The demand for bio-diesel in China is directly related to the consumption rate of oil. China is now the second largest oil consumer in the world behind the United States, consuming approximately seven million barrels of oil per day, and China’s need for petroleum continues to grow rapidly. Today, the Chinese government is encouraging the introduction of bio-diesel fuel into its transport fuel mix to reduce harmful carbon dioxide emissions, improve air quality, and lessen dependence on imported fuels.

In February 2005, China enacted the Renewable Energy Law, which aims to promote the development and utilization of renewable energy, improve the energy structure, diversify energy supplies, safeguard energy security, protect the environment and realize sustainable development of the economy and society. This legislation states that fuel retail businesses must begin to include “biological liquid fuel” in their sales or they will suffer imposed fines as China is seeking to reduce its dependence on fossil fuels in its diesel transportation vehicles.

Products

Oil Products

We sell a variety of oil products including gasoline, diesel, heavy oil, residual oil, slurry and naphtha. Gasoline and diesel represent the majority of oil products output and consumption in China, and automobiles are the most important driver of gasoline and diesel consumption in China. Diesel is mainly used in vehicles and agricultural machines with diesel engines. Heavy oil is broadly used as the fuel of ship boilers, heating furnaces, metallurgical furnaces and other industrial furnaces. Residual oil is the residue left after crude oil goes through vacuum distillation. Residual oil is usually utilized to manufacture petroleum coke, residual lubricating oil and asphalt or as a feedstock for cracking, the process of breaking down residual oil into light oil products such as gasoline. In the petrochemical industry, residual oil can be turned into compound gas or hydrogen through partial oxygenation, or used to make ethene through cracking reaction in a regenerative furnace. Residual oil can be also used as fuel. Slurry is a kind of heavy oil, which is the residue left after gasoline and diesel are extracted from crude oil. Naphtha is a type of light oil product, which is a necessary catalyst for manufacturing ethane and propane through cracking in tube furnaces, and producing benzene, toluene and xylene by catalytic reforming. Sales of our oil products accounted for approximately 77% of our total revenues in 2008.

Bio-diesel

Bio-diesel refers to a clean burning alternative fuel produced from domestic, renewable resources. Bio-diesel is a methyl ester (sometimes called “fatty acid methyl ester”) that is made through a chemical process called transesterification whereby glycerin is separated from fat or vegetable oil. The vegetable oil or fat can be castor oil, rapeseed oil, soybean oil, peanut oil, corn oil or cottonseed oil, animal oils, waste scraps from the refinery of the above oils and used cooking oil. Sales of bio-diesel accounted for approximately 23% of our total revenues in 2008..

Bio-diesel contains no petroleum, but it can be blended at any level with petroleum diesel to create a bio-diesel blend. It can be used in compression-ignition (diesel) engines with little or no modifications. Bio-diesel has many benefits, including:

| · | Excellent environmental performance; |

| · | Compatibility with existing diesel engines; |

| · | Better lubrication to extend the life time of engines; |

| · | From renewable energy sources; and |

Gas Station.

We own and operate 5 gas stations located in Xi’an, Shaanxi Province where we sell our oil products to end users.

Manufacturing of Bio-diesel

In 2006, we built a 10,000 square-meter bio-diesel production facility with annual output capability of 100,000 tons. We commenced production at this facility in October 2007. The table set forth below shows the current and anticipated utilization rate and output of this facility for the periods shown. There were constraints on our ability to reach full capacity of 100,000 tons by the year ended 2008. As a result of bio-diesel production enterprises being regulated as chemical production businesses, products must be processed strictly in accordance with established work procedures. The production of bio-diesel is achieved through the effective performance of all equipment necessary for production. Initial production has required adjustments to equipment and a full debugging process. The utilization rate reached 80% by December 2008, which is in line with utilization rates of other chemical production businesses over the same period.

| Period | | Utilization Ratio | | Output (in thousand ton) |

| October 2007 to December 2007 | | | 30 | % | 7.5 |

| January 2008 to June 2008 | | | 50 | % | 25 |

| July 2008 to December 2008 | | | 80 | % | 55 |

| 2009 | | | 100 | % | 100 |

We plan to expand our bio-diesel production level by reaching an estimated utilization rate of 100% at our existing facility by the second quarter of 2009 and, we anticipate that we can add an additional 50,000 ton of manufacturing capacity by expanding the existing facility or acquiring a new facility in 2009.

Our Suppliers

Gasoline and Diesel Oil Products

We purchase more than 78% of our gasoline and diesel oil products from five suppliers: During 2008, based on cost, we purchased approximately 52% compared to 58% in 2007 of our gasoline and diesel oil products from Shaan Xi Yanchang Oil (Group) Company, with whom we have had a long-standing relationship, which includes establishing supplying and purchasing stations with three oil refining factories that are owned by Shaan Xi Yanchang Oil (Group) Company. In Shaanxi Province, we are the only entity that has established supplying and purchasing stations with the Shaan Xi Yanchang Oil (Group) Company. While we depend on Shaan Xi Yanchang Oil Group for the majority of our supply needs, we are actively seeking other sources of oil supply and believe that we can find an alternative supplier with comparable terms within a reasonable amount of time without any significant disruption in our operations.

Raw Materials for Bio-Diesel Production

We have access to diversified bio-diesel raw materials. Besides oil plants, we also could use waste oil and acidized oil as raw material for bio-diesel production.

We have signed raw material purchasing contracts with local associations such as the Forestry Bureau of Yongshou County, the Forest and Fruits Production Managing Station of Danfeng County, the Forestry Bureau of Ningqiang County and the Forestry Bureau of Liuba County, some of which are governmental entities. These associations organize local farmers to plant oil plants. The associations are then responsible for collecting the oil plant seeds and delivering them to our pre-processing factories. The purchasing contracts obligate the associations to first offer to sell the feedstock to us at the lowest rates. If the supply of feedstock is greater than our demands, they can then sell any remaining feedstock to other companies.

Shaanxi Province is the second largest cultivator of prickly ash, an oil plant, in China. Together, the local farmers in Shaanxi Province have planted approximately 2,460,000 acres of prickly ash, 850,000 acres of cornel and 150,000 acres of pistacia chinensis. Even though we could satisfy all of our current feedstock demands solely with prickly ash, we diversify our feedstock supply with other oil plants, waste oil and acified oil because the costs of these raw materials are lower than prickly ash. There is also significant acreage of wild oil plants that grow throughout Shaanxi Province. However, because the feedstock available from the local associations currently satisfies our supply demands, we do not rely on any supplies of wild oil plants for our production needs. Further, at our bio-diesel manufacturing facility, we have the ability to recycle approximately 48,000 tons of waste oil annually. In addition to manufacturing bio-diesel from oil plant seeds, the recycling of waste oil after rough processing permits us to manufacture an additional 43,200 tons of bio-diesel annually from the waste oil, based on a 90% oil extracting rate.

According to the Chamber of Forestry of Shaanxi Province, the government of Shaanxi Province plans to allow more than 20 million acres of forestlands to be used as farmland solely for the planting of oil plants. Approximately half of this acreage is already currently being used to plant oil crops. It takes approximately three to five years for such crops to grow to be harvested. We believe that the abundant supply of feedstock currently available in Shaanxi Province, along with government plans to convert forestlands to farmlands for the cultivation of oil plants, is sufficient for our current needs and will be sufficient for our expanded demands for raw material once we complete the expansion of our bio-diesel manufacturing facility.

We have established cooperation relationships with two pre-processing factories for rough processing, which is the extraction of plant oil from oil plant seeds. We have acquired three oil extracting plants for pre-processing of feedstock.

We have set up Xi’an Waste Oil Disposition Center in cooperation with Xi’an Weiyang District Limin Environmental Chemical Plant and Xi’an Environment Protection Bureau and can recycle approximately 48,000 tons of waste oil annually. The recycling of waste oil after rough processing permits us to manufacture an additional 43,200 tons of bio-diesel annually from the waste oil, based on a 90% oil extracting rate. We have also established Huangbao Waste Oil Disposition Center near our bio-diesel facility which will become operational in May 2008. We believe that the production of recycled waste oil for use in our bio-diesel manufacturing will increase annually due to the establishment of these waste oil disposition centers.

Research and Development

As a result of long-term technology cooperation agreements with scientific institutions and universities, we own oil mixing and processing technologies, two utility model patents and three invention patents. In practice, we propose the subject matter to be researched and pursuant to these agreements we entrust our R&D partners to perform the research and analysis and provide advanced technology services. We have been researching technology that would enable us to extract linolenic acid from prickly ash seeds. The next step in this research is referred to as deep R&D where the focus is now on extracting a purer form of linolenic acid from prickly ash seeds. If successful, we believe that this technology could reduce the costs associated with producing bio-diesel by approximately 50%. This Company has continued this research project, and incurred approximately $55,000 R&D expenditure in 2008.

Competition; Competitive Advantages and Strategies

We are one of the few licensed oil product distributors in Shaanxi Province. Based on the amount of oil products we purchase from Shaanxi Yan Chang Oil (Group) Co., Ltd., one of the largest oil suppliers in China, we rank third among our competitors and we currently maintain 18% of the market share in Shaanxi Province. Although barriers to entry in our industry are high due to stringent licensing requirements in Shaanxi Province and the need for significant storage capacity for product, we face competition from companies located in other provinces and within Shanxi Province that also engage in manufacturing and distribution of finished and heavy oil. Such companies may have greater financial resources, research and development, manufacturing and sales resources that we do, and may have exclusive supply and purchase arrangements with customers as a result of long-term relationships. Currently, we are the only licensed manufacturer and distributor of bio-diesel in Shaanxi Province, as a result of which we may also face significant competition from current and future companies that intend to compete in that market.

Oil Products

We estimate that we have approximately ten major competitors in Shaanxi Province in China that also produce and distribute oil products similar to ours, including Shaanxi Dongda Petro-Chemical Co., Ltd., Shaanxi Dayun Petrochemical Material Co., Ltd. and Baoji Huahai Industry Corp. We are one of ten licensed oil product distributors in Shaanxi Province. In April 2004, we were granted a license to distribute finished oil products by the Ministry of Commerce of the People’s Republic of China. We are also one of 13 enterprises that were recognized as qualified enterprises operating in the fuel business in Shaanxi Province by the Shaanxi Province Government.

We believe we have the following advantages over our competitors in this market:

| | · | Oil Distribution License. Under Chinese Oil Products Market Managing Regulations, the distribution of bio-diesel is listed in the market management of finished oil. .. Only companies who obtain an Oil Distribution License are permitted to distribute bio-diesel. Because Baorun Industrial has an Oil Distribution License, we could distribute as well as manufacture the bio-diesel we produce while other bio-diesel manufacturers must distribute their product through other companies that have obtained Oil Distribution Licenses. |

| | | |

| | · | Supply advantage. Shaanxi Yan Chang Oil (Group) Co., Ltd., one of the four largest qualified crude oil and gas exploration enterprises in China, is one of our largest oil suppliers. In Shaanxi Province, we are the only entity that has established supplying and purchasing stations with the Shaanxi Yan Chang Oil (Group) Co., Ltd. |

| | | |

| | · | Special railway. We have the exclusive right to use three railway lines in Shaanxi Province to distribute our oil products. We are the only enterprise in Shaanxi Province that has the capability to distribute oil products to Yunnan Province, Guizhou Province and Sichuan Province directly and to other geographic areas in China. |

| · | Strong Storage Capability. Our oil depot storage capability reaches 37,000 cubic meters. Aside from the need for strong funding support for newcomers to this industry, new entrants must also have significant storage capacity to be able to compete, which is a great barrier to entry for new competitors. |

Bio-diesel Fuels

In the area of bio-diesel fuel production, we are not aware of the existence of any significant competitors in Shaanxi Province. However, we face competition from competitors in other geographic areas in China and foreign competitors, if such foreign competitors choose to export their bio-diesel to China.

We believe that we have the following advantages over our competitors in this market:

| | · | Lower Cost of Supply. We have a rich and stable source of feedstock for bio-diesel production, such as castor bean, Chinese pistache, Chinese prickly ash and Chinese pine. We are in partnership with local governments and farmers who have entered into contracts with us to first offer their feedstock to us at the lowest rates. |

| | · | Manufacturing Capability. We estimate that the demand for bio-diesel in China will be approximately 20,000,000 tons by the end of 2010. However, so far we and Gushan Environmental Energy are the only two companies in China with annual output over 100,000 tons. We plan to increase our bio-diesel production capacity through construction of a new facility over the next two or three years. |

| | | |

| | · | Stable Distribution Channels. With many years of operating experience, we have established stable sales networks and channels and strong industrial relationships with customers. Bio-diesel and petro diesel share the same market. We can distribute our bio-diesel through our existing distribution channels to reduce the cost. |

Growth Strategy

We currently have a number of initiatives in place to drive future growth.

| | · | Expanding bio-diesel fuel production capacity. In 2006, we built our 10,000 square-meter bio-diesel production facility with annual output capability of 100,000 tons, located in Tongchuan City, Shaanxi Province, which was put into production in October 2007. We plan to increase our bio-diesel production capacity through either acquisition of a bio-diesel manufacturing facility or expanding our existing facility. |

| | · | Expanding distribution channels of oil products and bio-diesel. In February 2007, we acquired a gas station located in Xi’an, Shaanxi Province. In 2008, we leased four more gas stations along heavy traffic high ways. We plan to acquire several gas stations over the next three years. |

| | · | Importation of oil products. We are in the process of applying for a license from the government to engage in the importation of oil products from overseas. China’s growing economy has fueled the increased demand for oil products in China. In China, the government has been implementing guiding prices for oil products. As oil import tariffs fall lower and the globalization of oil trade increases, we believe that China’s oil trading companies will have more opportunities. When international oil prices are lower than China’s guiding price, those companies with importing licenses are able to purchase oil from overseas at relatively lower prices than in China, and are then able to increase their profits from sales. Additionally, as China’s oil market becomes more and more dependent on imports, we believe that an importing license would bring us more business opportunities and resources, and help enhance trading volume, build customer networks and increase our market share. |

| | · | Enhancing proprietary technology. We plan to enhance our technology through innovation and research and development efforts or import new technology from overseas. |

| | · | Establishing more feedstock planting bases and a waste oil disposition center. We plan to set up eight feedstock planting bases in Ankang City and Hanzhong City in Shaanxi Province. Currently, we have established five raw material bases located in Danfeng, Ningqiang, Liuba, Tongchuan and Caotan Town, which includes Xi’an Weiyang District Limin Environmental Chemical Plant which became operational in October 2007. The construction of Huangbao Waste Oil Disposition Center near our biodiesel facility has been finished and become operational since May 2008. This waste oil disposition center can recycle approximately 24,000 tons of waste oil which can manufacture an additional 21,600 tons of bio-diesel annually, based on a 90% oil extracting rate. We have also contemplated to lease 200,000 acres of forestry to grow non-edible seeds to secure and stabilize supply chain of our bio-diesel productions. |

| | | |

| | · | Diversification of bio-diesel raw materials. Besides oil plants, we also could use waste oil and acidized oil as raw material for bio-diesel production. We have set up Xi’an Waste Oil Disposition Center in cooperation with Xi’an Weiyang District Limin Environmental Chemical Plant and Xi’an Environment Protection Bureau and can recycle approximately 48,000 tons of waste oil annually. The recycling of waste oil after rough processing permits us to manufacture an additional 43,200 tons of bio-diesel annually from the waste oil, based on a 90% oil extracting rate. We have also established Huangbao Waste Oil Disposition Center near our bio-diesel facility which will become operational in May 2008. The production of recycled waste oil for use in our bio-diesel manufacturing will increase annually due to the establishment of these waste oil disposition centers. |

| | | |

| | · | Acquisition of oil extracting plants. Currently, we have established cooperation relationships with each of Hancheng City Golden Sun Prickly Ash Oil and Spicery Co., Ltd. and Tongchuan City Hongguang oil processing plants for rough processing, which is the process to extract plant oil from oil plant seeds. We have acquired three oil extraction plants which are Shaanxi Xunyang Miaoping Oil Extraction Plants, Shaanxi Jingyang Sanqu Oil Processing Plant and Shaanxi Yulin Fuda Oil Processing Plant for rough processing. Currently we also have targeted several other targeted oil extracting plants for acquisition. |

Sales and Marketing

We have developed a stable sales network for our products in a number of provinces and municipalities including Shaanxi, Henan, Hebei, Shandong, Shanxi, Hunan, Hubei, Jiangxi, Guizhou, Yunnan, Beijing, Shanghai, Fujian and Xinjiang. We now employ 20 full-time salespersons. As our business expands, we intend to further expand our sales network and develop more sales channels.

Intellectual Property

Our core technologies consist of: (i) know-how technologies to improve the quality of heavy oil and finished oil products and (ii) two utility model technologies and three inventions related to the bio-diesel production. We do not have patent protection for our know-how technology.

In September 2006, we filed the following five patent applications with the State Intellectual Property Office of the PRC (“SIPO”), all of which are related to our bio-diesel production and all of which were accepted by SIPO:

| | · | Application No. 200610152506.X for a new composite catalyst for preparing bio-diesel. On November 17, 2006, Baorun Industrial received preliminary invention patent approval from SIPO for its proprietary bio-diesel compound activator. |

| | · | Application No. 200610152507.4 for a new technology for processing bio-diesel with catalyst or splitting decomposition in liquid or gas face. |

| | · | Application No. 200610152508.9 for a bio-diesel processing technique. |

| | · | Application No. 200620137855.X for a new reaction vessel for preparing bio-diesel and composite diesel. |

| | · | Application No. 200620137854.5 for new reaction equipment for preparing bio-diesel. |

We have patent protection on each of our patents for a period of five years. The renewal process only requires us to re-apply for such protection. There is little to no risk of revocation of such protection by the SIPO.

In addition, we own the rights to technologies developed jointly with various scientific institutions and research centers. We developed technologies for the production of bio-diesel jointly with the Xi’an Petroleum University and Northwest University of Forestry and Agriculture. We developed our proprietary technology for the production of bio-diesel jointly with the Beijing Qing Da Ke Ma Technology Co., Ltd. and ownership of the resultant technology was transferred to us by a contract dated September 4, 2006. We own the right to the oil mixing technology developed by Xi’an Petroleum University by a contract dated December 18, 2005.

Customers

Our primary target customers are oil product trading companies in China (i.e., sales subsidiaries of Sinopec and PetroChina) and terminal users (i.e., gas stations, electric power companies and shipping companies).

We currently sell our oil products to regional distributors in China that supply retail service stations and directly to end users through our retail service gas stations. Fifty percent of the bio-diesel we produced was mixed with petro-diesel and was sold to oil distributors. Fifty percent of the bio-diesel we produced was sold to the Tongchuan Huaneng Power Plant and Weihe Power Plant. We do not believe that our sales are affected by seasonality.

We have adopted different means for payment based upon the financial principles and customs of our respective clients. For example, we have entered into agreements with PetroChina, Sinopec, Tongchuan Huaneng Power Plant and other state-owned enterprises whereby we deliver products to agreed upon locations and these customers agree to pay us after delivery of a certain quantity of product. However, our customers that own and operate private gas stations, for example, typically pay 10% to 15% of the total purchase price of the products to be delivered in advance, and when delivery takes place, they pay the remaining amounts owed.

As of the fiscal year ended December 31, 2008, our top five customers purchased approximately $49.3 million of our products, representing approximately 22.8% of total sales during the period.

Governmental Regulation

We carry on our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction that may cause environmental waste to adopt effective measures to control and properly dispose of waste gases, waste water, industrial waste dust and other environmental waste materials. Fines may be levied against producers who cause pollution. Currently we do not anticipate any material capital expenditures for environmental compliance for 2008, unless required by the government during the course of its annual inspections.

In accordance with the requirement of the environmental protection laws of the PRC, we have installed the necessary environmental protection equipment, adopted advance environmental protection technologies, established responsibility systems for environmental protection and reported to and registered with the relevant local environmental protection department. We believe that we have complied with such relevant environmental laws and have never paid a fee for excessive discharge pollutants.

Under PRC dangerous chemical laws and regulations, all dangerous chemical manufacturing facilities are required to obtain a Safe Production Permit. We obtained such permit in April 2007. The permit is valid for a period of three years and is renewable for additional periods of three years. In order to renew the Safe Production Permit, the subject facility must not have had any fatal accidents and must pass periodic inspections by local work safety administration authorities during the three year period.

In addition, our business is in an industry that is subject to PRC finished oil products laws and regulations. These laws and regulations require enterprises engaged in the wholesaling of finished oil products, including gasoline, diesel and bio-diesel, to obtain a Wholesaling Business License. We have obtained such license. Pursuant to the Administrative Measures on the Finished Oil Market promulgated by the Ministry of Commerce of the PRC in 2006, the provincial level government authority conducts annual inspections of the enterprises which have acquired a Finished Oil Wholesale Business License and submits the inspection results to the Ministry of Commerce. If we pass the annual inspection, the Wholesaling Business License will continue to be valid and we can continue to conduct our current business. The enterprises which fail the annual inspection have the opportunity to cure such violations in a limited period of time; otherwise, the approval authority will revoke the Finished Oil Wholesale Business License. For the annual inspection, the governmental authority reviews the following items: (i) the execution and performance of the finished oil supply agreements; (ii) the operation results for the previous year; (iii) whether the finished oil distributor and the basic facilities comply with the technical requirements of the Administrative Measures on the Finished Oil Market; and (iv) finished oil quality, quantity, fire protection, safe production and environmental protection. However, there are no provisions regarding renewal set forth in the Administrative Measures.

With respect to environmental issues that may impact the construction of our bio-diesel factory, we have complied with the necessary procedures to commence construction. The governmental authorities reviewed the environmental impact report prepared by a professional institution that we engaged prior to the commencement of construction. After the construction was finished, we obtained environmental approvals from the government authorities in January 2008.

We anticipate that the PRC government will release an official standard for bio-diesel fuels in the near future. We will seek to qualify our products for the bio-diesel standard when it is released. We believe that our products are well positioned to qualify due to our early production of bio-diesel as well as our longstanding history of being in operation since 1999, among other things.

Employees

We have about 200 full-time employees. We are in compliance with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

Recent Developments in 2008

Private Placement of Convertible Debenture

On October 14, 2008, we completed a private placement to an institutional investor of a non-interest bearing convertible debenture in an aggregate amount of $9,000,000, which was convertible into 2,465,753 shares of Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”) of the Company (the “2008 Financing”). The entire principal amount of the Debenture automatically converted into 2,465,753 shares of Series B Preferred Stock on November 26, 2008, the date of the filing with the Secretary of the State of Delaware of an amendment to our Certificate of Incorporation to increase the authorized shares of our preferred stock from 1,000,000 shares to 10,000,000 shares and the filing of a certificate of designation of the Series B Preferred Stock.

At any time on or after the issuance of the shares of Series B Preferred Stock upon conversion of the Debenture, the shareholders of Series B Preferred Stock may, at their option, elect to convert all or any portion of the shares of Series B Preferred Stock held by them into shares of our common stock equal to (i) Series B Liquidation Preference Amount (as defined below), divided by (ii) the Conversion Price (as defined below) in effect as of the date of conversion. “Series B Liquidation Preference Amount” refers to an amount equal to $3.65 per share of the Series B Preferred Stock before any payment shall be made or any payment distributed to the shareholders of common stock or other junior stock in the event of liquidation, dissolution or winding up of the affairs of our affairs. “Conversion Price” refers to initially $3.65 per share, subject to adjustment for stock splits and combinations, as well as pursuant to anti-dilution protections set forth in the Certificate of Designation of the Series B Preferred Stock to be filed with the Secretary of State of Delaware. Pursuant to the terms of the Certificate of Designation when in effect, at no time may a holder of shares of Series B Preferred Stock convert shares of the Series B Preferred Stock if the number of shares of Common Stock to be issued pursuant to such conversion would cause the number of shares of Common Stock owned by such holder and its affiliates at such time, when aggregated with all other shares of Common Stock owned by such holder and its affiliates at such time, result in such holder and its affiliates beneficially owning in excess of 9.99% of the then issued and outstanding shares of Common Stock outstanding at such time. However, the holder is entitled to waive this cap upon 61 days notice to us.

“Make Good” Escrow Agreement

In connection with the 2008 Financing, we entered into an escrow agreement with the Investor and Redsky Group Limited, pursuant to which 2,465,753 shares of common stock owned by Redsky Group Limited (the “Escrow Shares”) were deposited into escrow to be held as security for the achievement by the Company of (i) $28,000,000 Net Income (as defined below), and (ii) fully diluted earnings per share of no less than $0.73 (the “Performance Thresholds”). If we achieve the Performance Thresholds, the Escrow Shares will be released to Redsky Group Limited. If we achieve no more than 50% of the Performance Thresholds, the Escrow Shares will be disbursed to the Investor. If we achieve more than 50% and less than 100% of the Performance Thresholds, the Escrow Agent will disburse to the Investor that number of Escrow Shares equal to two (2) times the percentage by which the Lowest Performance Threshold was not achieved. The “Lowest Threshold Percentage” means the percentage by which the lowest of the Performance Thresholds was not achieved. With respect to the Performance Thresholds, “Net Income” shall be defined in accordance with US GAAP and reported by us in our audited financial statements for 2008, plus any amounts that may have been recorded as non-cash charges or liabilities on the 2008 financial statements, respectively, due to the application of EITF No. 00-19 that are associated with (i) any outstanding warrants, (ii) the transactions contemplated by this escrow agreement, including, without limitation the release of any Escrow Shares to Redsky Group Limited, (iii) any issuance of shares of common stock or option grants under a performance based stock incentive plan that was in existence on the Closing Date, and (iv) the conversion of any shares of preferred stock. “Fully Diluted Earnings Per Share” means after tax Net Income divided by the number of shares of Common Stock outstanding on a fully diluted basis, which number of shares of Common Stock shall include, without limitation, (x) the number of shares of Common Stock issuable upon conversion of the Company’s then outstanding shares of Series A Preferred Stock and Series B Preferred Stock, and (y) the number of shares of Common Stock issuable upon the exercise of any then outstanding warrants, options or other securities convertible into shares of Common Stock of the Company, as of December 31, 2008.

Management Escrow Agreement

In connection with the 2008 Financing, we also entered into a Management Escrow Agreement with the Investor, pursuant to which $750,000 (the “Escrow Funds”) of the 2008 Financing proceeds were delivered into an escrow account, which funds will be released in installments of $250,000 upon the appointment of (i) a new Chief Financial Officer, (ii) a Vice President of Investor Relations, and (iii) upon the Company’s compliance with NASDAQ’s corporate governance requirements, including but not limited to appointing three persons to serve as “independent” directors (as such term is defined under the NASDAQ Stock Market rules) on our Board of Directors and forming the Audit Committee and the Compensation Committee of our Board of Directors. $250,000 of the Escrow Funds were released to us in January 2009 for meeting the NASDAQ corporate governance requirements and $250,000 of the Escrow Funds were released to us in March 2009 for appointing a Vice President of Investor Relations.

RISK FACTORS

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this Annual Report on Form 10-K before deciding to purchase our common stock. You should pay particular attention to the fact that we conduct all of our operations in China and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in other countries. Our business, financial condition or results of operations could be affected materially and adversely by any or all of these risks.

THE FOLLOWING MATTERS MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION, LIQUIDITY, RESULTS OF OPERATIONS OR PROSPECTS, FINANCIAL OR OTHERWISE. REFERENCE TO THIS CAUTIONARY STATEMENT IN THE CONTEXT OF A FORWARD-LOOKING STATEMENT OR STATEMENTS SHALL BE DEEMED TO BE A STATEMENT THAT ANY ONE OR MORE OF THE FOLLOWING FACTORS MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN SUCH FORWARD-LOOKING STATEMENT OR STATEMENTS.

Risks Related to Our Business

We rely on a limited number of third party suppliers for our supply of finished oil products and the loss of any such supplier, particularly our largest supplier, could have a material adverse effect on our operations.

We are dependent upon our relationships with third parties for our supply of finished oil products. We have agreements with five major suppliers. These suppliers provided more than 78% of finished oil products for the 2008 fiscal year, with one of the suppliers providing approximately 52%. Should any of these suppliers, and in particular our largest supplier, terminate their supply relationships with us, fail to perform their obligations as agreed, or enter into the finished oil products business in competition with us, we may be unable to procure sufficient amounts of finished oil products to fulfill our customer demand. If we are unable to obtain adequate quantities of finished oil products at economically viable prices, our customers could seek to purchase products from other suppliers, which could have a material adverse effect on our revenues.

Our ability to operate at a profit is partially dependent on market prices for the petroleum and biodiesel fuels. If the petroleum and biodiesel prices drop significantly, we may be unable to maintain our current profitability.

Our results of operations and financial condition are affected by the selling price of petroleum and bio-diesel fuel products. Prices are subject to and determined by market forces over which we have no control. The amount of our revenues depends on the market prices for petroleum and biodiesel fuels and the corresponding net income could be adversely impacted by such market prices.

Our future success substantially depends on our ability to significantly increase both our manufacturing/storage capacity and output.

Our future success depends on our ability to significantly increase both our manufacturing/storage capacity and our output. In particular, we intend to expand our biodiesel production capabilities within the next several years. Our ability to establish additional manufacturing/storage capacity and increase output is subject to significant risks and uncertainties, including:

• the ability to raise significant additional funds to purchase and prepay for raw materials or to build additional manufacturing facilities, which we may be unable to obtain on reasonable terms or at all;

• delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as increases in raw materials prices and problems with equipment vendors;

• delays or denial of required approvals by relevant government authorities;

• diversion of significant management attention and other resources; and

• failure to execute our expansion plan effectively.

If we are unable to establish or successfully operate additional manufacturing/storage capacity or to increase manufacturing output, or if we encounter any of the risks described above, we may be unable to expand our business and decrease costs to improve our profitability as planned. Even if we do expand our manufacturing/storage capacity and output, we may be unable to generate sufficient customer demand for our finished oil and biodiesel to support our increased production levels.

In the past we have derived a significant portion of our revenues from a small group of customers. If we were to become dependent again upon a few customers, such dependency could negatively impact our business, operating results and financial condition.

Previously, our customer base has been highly concentrated. Our top five customers accounted for approximately 40%, 74% and 63% of our revenues for the years ended December 31, 2006, 2005 and 2004, respectively. Although the top five customers have accounted for less than 25% of our revenues in 2008 and 2007, as our customer base may change from year-to-year, during such years that the customer base is highly concentrated, the loss of, or reduction of our sales to, any of such major customers could have a material adverse effect on our business, operating results and financial condition. See “Business — Customers” for a description of our largest customers.

Key employees are essential to growing our business.

Gao Xincheng, our Chief Executive Officer and President and other senior management personnel are essential to our ability to continue to grow our business. Mr. Gao has established relationships within the industries in which we operate. If he were no longer employed by us, our growth strategy might be hindered, which could limit our ability to increase revenue.

In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

The current economic and credit environment could have an adverse affect on demand for certain of our products and services, which would in turn have a negative impact on our results of operations, our cash flows, our financial condition, our ability to borrow and our stock price.

Commencing in late 2008, global market and economic conditions became, and continue to be, disrupted and volatile. Concerns over increased energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining residential real estate market in the U.S. have contributed to this increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil prices, declining business and consumer confidence and increased unemployment, have precipitated a global recession.

It is difficult to predict how long the current economic conditions will persist, whether they will deteriorate further, and which of our products, if not all of them, will be adversely affected. As a result, these conditions could adversely affect our financial condition and results of operations.

Stock markets, in general, have experienced in recent months, and continue to experience, significant price and volume volatility, and the market price of our common stock may continue to be subject to similar market fluctuations unrelated to our operating performance or prospects. This increased volatility, coupled with depressed economic conditions, could continue to have a depressing effect on the market price of our common stock.

If we need additional financing, we may not be able to find such financing on satisfactory terms or at all.

Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, future product opportunities with collaborators and future business combinations. Our future growth strategy includes the construction or acquisition of biodiesel facilities which will enable us to produce more biodiesel fuel. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders’ interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

If we fail to adequately protect or enforce our intellectual property rights, or to secure rights to patents of others, the value of our intellectual property rights could diminish.

Our success, competitive position and future revenues will depend in part on our ability to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing the proprietary rights of third parties.

To date, we have filed five patent applications with the State Intellectual Property Office of the PRC. However, we cannot predict the degree and range of protection patents will afford us against competitors. Third parties may find ways to invalidate or otherwise circumvent our proprietary technology. Third parties may attempt to obtain patents claiming aspects similar to our patent applications. If we need to initiate litigation or administrative proceedings, such actions may be costly whether we win or lose. To help protect our proprietary know-how and inventions for which patents may be unobtainable or difficult to obtain, such as our core technology for oil processing, we rely on trade secret protection and confidentiality agreements. If any of our intellectual property is disclosed, our value would be significantly impaired, and our business and competitive position would suffer.

A price increase in raw materials, such as fat or vegetable oil, could increase the cost of our products and reduce our profit margin for our biodiesel products.

Fat, vegetable oil and various agricultural and botanical products are the primary materials used in the production of our biodiesel. In the last two years, the price of these raw materials have fluctuated substantially as have other raw materials due to increased demand in China resulting from its rapid economic development. If the price for these raw materials continues to increase significantly, our profit margin for our biodiesel products could decrease considerably and we may not be able to maintain our profitability.

If we infringe the rights of third parties, we could be prevented from selling products, forced to pay damages and compelled to defend against litigation.

If our products, methods, processes and other technologies infringe proprietary rights of other parties, we could incur substantial costs, and may have to obtain licenses (which may not be available on commercially reasonable terms, if at all), redesign our products or processes, stop using the subject matter claimed in the asserted patents, pay damages, or defend litigation or administrative proceedings, which may be costly whether we win or lose. All of the above could result in a substantial diversion of valuable management resources.

We believe we have taken reasonable steps, including comprehensive internal and external prior patent searches, to ensure we have freedom to operate and that our development and commercialization efforts can be carried out as planned without infringing others’ proprietary rights. However, a third party patent may have been filed or will be filed that may contain subject matter of relevance to our development, causing a third party patent holder to claim infringement. Resolving such issues has traditionally resulted, and could in our case result, in lengthy and costly legal proceedings, the outcome of which cannot be predicted accurately.

Our legal right to lease certain properties could be challenged by property owners or other third parties, which could prevent us from continuing to utilize storage vessels and our biodiesel manufacturing factory, which are located on such properties, or could increase the costs associated with utilizing those storage vessels and manufacturing factory.

We do not hold any land-use rights with respect to the manufacturing factory or oil storage facilities on which our biodiesel manufacturing factory and finished oil storage vessels are located. Instead, our business model relies on leases with third parties who either own the properties or lease the properties from the ultimate property owner. There may be challenges to the title of the properties which, if successful, could impair the development or operations of our storage or manufacturing on such properties. In addition, we are subject to the risk of potential disputes with property owners. Such disputes, whether resolved in our favor or not, may divert management attention, harm our reputation or otherwise disrupt our business.

In several instances, where our immediate lessors are not the ultimate owners of land or storage space, no consent was obtained from the owners to sublease the land or storage space to us. A lessor’s failure to duly obtain the title to the property or to receive any necessary approvals from the ultimate owner or the primary lease holder, as applicable, could potentially invalidate our lease or result in the renegotiation of such lease leading to less favorable terms. The building ownership or leasehold in connection with our storage or manufacturing operations could be subject to similar third-party challenges.

Our lessors’ failure to comply with lease registration and other compliance requirements under PRC law may subject these lessors or us to fines or other penalties that may negatively affect our ability to utilize storage vessels or our biodiesel manufacturing factory.

We are subject to a number of land- and property-related legal requirements. For instance, under PRC law, all lease agreements are required to be registered with the local housing bureau and any lease of available military real estate should adopt a standard military lease agreement and such lease agreement would not become effective unless approved by military real estate administrative authorities. Currently, none of the lessors of the storage vessels we operate and manage had obtained registrations or approval of their leases from the relevant authorities as required and we continue to request these lessors to obtain registrations under our lease agreements with them. The failure of our lessors to register lease agreements as required by law or to get the lease approved may subject these lessors or us to fines or other penalties which may negatively affect our ability to operate the storage vessels covered under those leases.

Accidents or injuries in our finished oil storage vessels or biodiesel manufacturing factory may adversely affect our reputation and subject us to liability.

There are inherent risks of accidents or injuries when working in finished oil storage vessels or biodiesel manufacturing factories. Death and accidents could prevent us from renewing our Safety Production Permit. One or more accidents or injuries at any of our finished oil storage vessels or at our biodiesel manufacturing factory could adversely affect our safety reputation among customers and potential customers and increase our costs if we are required to take additional measures to make our safety precautions even more visible and effective. If accidents or injuries occur we may be held liable for costs related to the injuries. Our current insurance policy, which covers claims as a result of accidental injuries, may not provide adequate coverage and we may be unable to renew our insurance policies or obtain new insurance policies without increases in cost of our insurance premiums or decreases in coverage levels.

We may be unable to maintain an effective system of internal control over financial reporting, and as a result we may be unable to accurately report our financial results.

Our reporting obligations as a public company place a significant strain on our management, operational and financial resources and systems. If we fail to maintain an effective system of internal control over financial reporting, we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with SEC reporting and other regulatory requirements. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management, which could, among other things, adversely affect our stock price.

Our insurance may not cover all claims made against us.

Currently we have property and accidental injury insurance policies. If we were held liable for amounts and claims exceeding the limits of our insurance coverage or outside the scope of our insurance coverage, the costs to cover any such shortfalls could significantly reduce and put a strain on our available cash. In addition, we do not have any business disruption insurance coverage for our operations to cover losses that may be caused by natural disasters or catastrophic events, such as SARS or avian flu. Any business disruption or natural disaster may result in our incurring substantial costs and diversion of our resources.

Risks Associated With Doing Business In China

PRC laws and regulations restrict foreign investment in China’s finished oil products industry and we have entered into contractual agreements with Baorun Industrial to control and realize the benefits of the business. We are relying upon PRC laws and there is substantial uncertainty regarding the interpretation and application of current or future PRC laws and regulations.

Since we are deemed to be foreign persons or foreign-funded enterprises under PRC laws and cannot directly invest in companies operating in the finished oil production industry, we operate our businesses in China through Baorun Industrial, an operating company that is owned by PRC citizens and not by us. Accordingly, our Chinese subsidiary, Redsky Industrial, entered into a series of exclusive contractual agreements with Baorun Industrial. Although we believe we are in compliance with current PRC regulations, we cannot be sure that the PRC government would view these contractual arrangements to be in compliance with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. Because this structure has not been challenged or examined by PRC authorities, uncertainties exist as to whether the PRC government may interpret or apply the laws governing these arrangements in a way that is contrary to the opinion of our PRC counsel. If we, our wholly owned subsidiaries or Baorun Industrial, were found to be in violation of any existing PRC laws or regulations, the relevant regulatory authorities would have broad discretion to deal with such violation, including, but not limited to the following:

| • | shutting down servers or blocking websites; |

| • | requiring a restructure of ownership or operations; and/or |

| • | requiring the discontinuance of our businesses. |

Any of these or similar actions could cause significant disruption to our business operations or render us unable to conduct our business operations and may materially adversely affect our business, financial condition and results of operations.

The contractual agreements between Redsky Industrial and Baorun Industrial may not be as effective in providing operational control as direct ownership of Baorun Industrial and may be ineffective to permit consolidation of the financial results of the business.

We depend on Baorun Industrial, an operating company in which we have no equity ownership interest, for substantially all of our operations, revenues and net income, and must rely on contractual agreements to control and operate these businesses. Our contractual agreements with our wholly owned subsidiaries may not be as effective in providing and maintaining control over the operating company and its business operations as direct ownership of these businesses. For example, we may not be able to take control of Baorun Industrial upon the occurrence of certain events, such as the imposition of statutory liens, judgments, court orders, death or incapacity. Furthermore, if the operating company and its stockholders fail to perform as required under those contractual agreements, we will have to rely on the PRC legal system and the uncertainties that exist under PRC law to enforce those agreements. If we were unsuccessful in an enforcement action, it could result in the disruption of our business, damage to our reputation, diversion of our resources and significant costs. In addition, the PRC government may propose new laws or amend current laws that may be detrimental to our current contractual agreements with the operating company, which may in turn have a material adverse effect on our business operations.

Our operations and assets in China are subject to significant political and economic uncertainties.