CALCULATION OF REGISTRATION FEE

| Title of each Class of Security being Registered | | Amount being Registered (1) | | | Proposed Maximum Offering Price Per Security | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| Common Stock, $0.0001 par value per share(2) | | | | (3)(4) | | | | (3) | | | | (3) | | | | (3) |

| Preferred Stock, $0.001 par value per share (2) | | | | (3)(4) | | | | (3) | | | | (3) | | | | (3) |

| Warrants (2) | | | | (3)(4) | | | | (3) | | | | (3) | | | | (3) |

| Debt securities | | | | (3)(4) | | | | (3) | | | | (3) | | | | (3) |

| Units | | | | (3)(4) | | | | (3) | | | | (3) | | | | (3) |

| Total Offering | | $ | 125,000,000 | | | | 100 | % | | $ | 125,000,000 | (2) | | $ | 8,912.50 | |

| | | | | | | | | | | | | | | | | |

| Common Stock, $0.0001 par value per share | | | 30,000 | (6) | | $ | 6.00 | (5) | | $ | 180,000 | | | $ | 12.84 | |

| Common Stock, $0.0001 par value per share | | | 1,000,000 | (7) | | | 10.99 | (8) | | | 10,990,000 | | | | 783.59 | |

| Total | | | | | | | | | | | | | | $ | 9,708.93 | (9) |

(1) This registration statement includes $125,000,000 of securities which may be issued by the registrant from time to time in indeterminate amounts and at indeterminate times. Securities registered hereunder may be sold separately, together or as units with other securities registered hereunder.

(2) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”).

(3) Not required to be included in accordance with General Instruction II.D. of Form S-3 under the Securities Act.

(4) Subject to footnote (1), there is also being registered hereunder such indeterminate amount of securities (including shares or other classes of the registrant’s stock that may be issued upon reclassification of unissued, authorized stock of the registrant) as may be issued in exchange for or upon conversion of, as the case may be, the other securities registered hereunder. No separate consideration will be received for any securities registered hereunder that are issued in exchange for, or upon conversion of, as the case may be, such other securities.

(5) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 and is based upon the exercise price of the warrants pursuant to which such shares are issuable.

(6) Reflects 30,000 shares of common stock underlying warrants that are being registered for resale by the Selling Stockholder named herein.

(7) Reflects 1,000,000 shares of common stock that are being registered by the Selling Stockholder named herein.

(8) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices of our common stock reported on the NASDAQ Capital Market on April 28, 2010.

(9) Paid herewith.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

This Registration Statement contains two prospectuses, as set forth below.

| | · | Offering Prospectus . A prospectus to be used for the offering and sale, from time to time in one or more offerings by the registrant of any combination of common stock, preferred stock, warrants, debt securities, or units having a maximum aggregate offering price not exceeding $125,000,000, which prospectus also includes 1,000,000 shares of common stock that may be offered by the Selling Stockholder named therein in a secondary offering of such shares simultaneously with an offering by the registrant under this registration statement. |

| | · | Resale Prospectus . A prospectus to be used for the resale by the Selling Stockholders of up to 1,030,000 shares of the Company’s common stock. |

The Resale Prospectus is substantively identical to the Offering Prospectus, except for the following principal points:

| | · | the outside and inside covers are different; |

| | · | the section entitled "About this Prospectus" on page 2 of the Offering Prospectus is not included; |

| | · | the section entitled “The Offering” on page 3 of the Offering Prospectus is different; |

| | · | the section entitled “Use of Proceeds” on page 16 of the Offering Prospectus is different; |

| | · | the section entitled “Ratio of Earnings to Fixed Charges” on page 17 of the Offering Prospectus is not included; |

| | · | the section entitled “Descriptions of the Securities We May Offer” beginning on page 17 of the Offering Prospectus is not included; |

| | · | a section entitled “ Selling Stockholders” is included; and |

| | · | the section entitled “Plan of Distribution” beginning on page 30 of the Offering Prospectus is different. |

The Registrant has included in this Registration Statement a set of alternate pages for the Resale Prospectus to reflect the foregoing differences.

The Offering Prospectus will exclude the alternate pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Offering Prospectus except for the addition or substitution of the alternate pages and will be used for the resale offering by the Selling Stockholders.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Prospectus | Subject to Completion, Dated May 5, 2010 |

CHINA INTEGRATED ENERGY, INC.

$125,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

1,000,000 Shares of Common Stock Offered by the Selling Stockholder Named Herein

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, debt securities, warrants, or units having a maximum aggregate offering price of $125,000,000. The Selling Stockholder named herein, may offer and sell up to 1,000,000 shares of our common stock owned by such Selling Stockholder under this prospectus. When we decide to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus supplement.

The prospectus supplement may also add, update or change information contained in or incorporated by reference into this prospectus. However, no prospectus supplement shall offer a security that is not registered and described in this prospectus at the time of its effectiveness. You should read this prospectus and any prospectus supplement, as well as the documents incorporated by reference or deemed to be incorporated by reference into this prospectus, carefully before you invest.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

Our common stock is traded on The NASDAQ Capital Market under the symbol “CBEH.” Each prospectus supplement will contain information, where applicable, as to our listing on The NASDAQ Capital Market or any other securities exchange of the securities covered by the prospectus supplement.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Investing in our securities involves various risks. See “Risk Factors” on page 15 for more information on these risks. Additional risks, if any, will be described in the prospectus supplement related to a potential offering under the heading “Risk Factors”. You should review that section of the related prospectus supplement for a discussion of matters that investors in such securities should consider.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2010

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may offer from time to time securities having a maximum aggregate offering price of $125,000,000 and the Selling Stockholder named herein may offer up to 1,000,000 shares of our common stock in a secondary offering of such shares simultaneously with an offering by us under this prospectus. Each time we offer securities, we will prepare and file with the SEC a prospectus supplement that describes the specific amounts, prices and terms of the securities we offer. The prospectus supplement also may add, update or change information contained in this prospectus or the documents incorporated herein by reference. You should read carefully both this prospectus and any prospectus supplement together with additional information described below under the caption “Where You Can Find More Information.”

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC as described below under “Where You Can Find More Information.”

You should rely only on the information contained or incorporated by reference in this prospectus or a prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

We may sell securities through underwriters or dealers, through agents, directly to purchasers or through a combination of these methods. We and our agents reserve the sole right to accept or reject in whole or in part any proposed purchase of securities. The prospectus supplement, which we will prepare and file with the SEC each time we offer securities, will set forth the names of any underwriters, agents or others involved in the sale of securities, and any applicable fee, commission or discount arrangements with them. See “Plan of Distribution.”

Unless otherwise mentioned or unless the context requires otherwise, when used in this prospectus, the terms “Company”, “we”, “us”, and “our” refer to China Integrated Energy, Inc. and its wholly-owned subsidiaries. “China” and the “PRC” refer to the People’s Republic of China.

PROSPECTUS SUMMARY

The following summary, because it is a summary, may not contain all the information that may be important to you. This prospectus incorporates important business and financial information about the Company that is not included in, or delivered with this prospectus. Before making an investment, you should read the entire prospectus carefully. You should also carefully read the risks of investing discussed under “Risk Factors” and the financial statements included in our other filings with the SEC, including in our Annual Report on Form 10-K, which we filed with the SEC on March 31, 2010. This information is incorporated by reference into this prospectus, and you can obtain it from the SEC as described below under the headings “Where You Can Find Additional Information About Us” and “Incorporation of Certain Documents by Reference.”

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. You may request a copy of these filings, excluding the exhibits to such filings which we have not specifically incorporated by reference in such filings, at no cost, by writing us at the following address: China Integrated Energy, Inc., Dongxin Century Square, 7th Floor, Hi-Tech Development District, Xi’an, Shaanxi Province, People’s Republic of China 710043. Our telephone number is +86-29-8268-3920.

The Offering

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a shelf registration process. Under this shelf registration process, we may sell any combination of:

| | · | debt securities, in one or more series; |

| | · | warrants to purchase any of the securities listed above; and/or |

| | · | units consisting of one or more of the foregoing. |

in one or more offerings up to a total dollar amount of $125,000,000.

This prospectus also includes 1,000,000 shares of common stock which may be offered by Redsky Group Limited in a secondary offering of such shares simultaneously with an offering by us under this prospectus. Our chairman and chief executive officer, Mr. Xincheng Gao, is the sole director, officer and stockholder of Redsky Group Limited.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that specific offering and include a discussion of any risk factors or other special considerations that apply to those securities. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find Additional Information About Us.”

Our Company

We are a leading non-state-owned integrated energy company in China engaged in three business segments, the wholesale distribution of finished oil and heavy oil products, the production and sale of biodiesel and the operation of retail gas stations. Our primary business segment is the wholesale distribution of finished oil and heavy oil products. We sell primarily gasoline, diesel and heavy oil in 14 provinces and municipalities through seven sales offices located in various regions of China. We also use four oil storage depots located in Shaanxi Province. Of the four oil storage depots, we own one, lease one and have the rights to use two of the depots through oil storage service agreements with the state-owned entities that own such depots. We also have access to a 2.65-kilometer railway line at our oil storage depot located in Tongchuan City, Shaanxi Province, which connects to the main railway. We are one of only four non-state-owned distributors in Shaanxi Province that are licensed to sell both finished oil and heavy oil products, and are a leading non-state-owned distributor in Shaanxi Province distributing all grades of gasoline, diesel and heavy oil. We currently enjoy convenient railway freight access enabling us to reach Sichuan, Guizhou and Yunnan Provinces. We distributed 158,100 tons and 279,000 tons of finished oil and heavy oil products in 2008 and 2009, respectively. As a high volume distributor, we experience high inventory turnover with minimum inventory exposure, and have therefore been able to maintain a stable margin in our distribution business despite the volatility of global oil prices. We plan to grow our wholesale distribution of finished oil and heavy oil business by increasing our coverage area and further penetrating our existing customers and territories.

We operate a 100,000-ton biodiesel production plant located in Tongchuan City, Shaanxi Province. We believe that we are one of the largest biodiesel producers in China measured by production capacity as of the end of 2009, and the only non-state-owned integrated biodiesel producer with a distribution license. We leverage our wholesale distribution channels to sell our biodiesel to our existing customers and to acquire new customers. We have been awarded three patents relating to the use of multiple feedstock interchangeably in biodiesel production. Our biodiesel feedstock includes non-edible seed oil, waste cooking oil and vegetable oil residue, most of which have limited alternative uses. Therefore, our biodiesel production is environmentally friendly and does not require valuable farmland to grow its feedstock. Our biodiesel can be blended with regular petro-diesel and used by existing diesel engines with no change in engine performance. We plan to increase our biodiesel production capacity by 50,000 tons in the next 12 months through construction of a new facility. We anticipate to complete construction of the new facility by the third quarter of 2010. As a result of the government’s support of bioenergy initiatives, we enjoy various tax incentives.

We also operate twelve retail gas stations located in Xi’an City and other areas in Shaanxi Province, for which we have entered into long-term leases. The average annual sales volume of each gas station is approximately 8,000 tons, equivalent to 2.7 million gallons. With our distribution license and stable finished oil supply, we generate more stable and higher margins from our retail gas stations than from our wholesale distribution of finished oil and heavy oil business, since we sell directly to retail end customers. We plan to continue to expand our portfolio of retail gas stations through leasing or acquisitions. We are continuously looking for high-traffic locations within and outside of Xi’an City to add to our retail gas station portfolio.

We have experienced substantial growth in recent years. Our sales increased to $289.6 million for year ended December 31, 2009 from $216.5 million in the same period of 2008, representing an increase of 33.8%. Our net income increased to $37.9 million for the year ended December 31, 2009 from $18.7 million in the same period of 2008, representing an increase of 102.7%.

Our executive offices are located at Dongxin Century Square, 7th Floor, Hi-Tech Development District, Xi’an, Shaanxi Province, PRC 710043. Our telephone number is 86-29-8268-3920. Our corporate website is www.cbeh.net.cn. Information contained on, or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this prospectus.

Our Strengths

The following competitive strengths have been the foundation of our strong performance, and we expect that they will facilitate our future growth:

Vertically integrated business model

We are a leading non-state-owned integrated energy company in China. In 2009, we distributed 279,000 tons of finished oil and heavy oil products, which made us a leading wholesale distributor of finished oil and heavy oil products in Shaanxi Province. We have significant biodiesel production capacity and are the only non-state-owned integrated biodiesel producer with a distribution license in China. We began our retail gas station operations in early 2008 and now operate twelve retail gas stations.

We believe our vertically integrated business model has the following benefits:

| | • | Our existing wholesale and retail distribution channels facilitate sale of our biodiesel without sacrificing margin to third-party distributors; |

| | • | We have a stable source of supply at lower cost for the production of biodiesel, better profitability, and enhanced control of our supply chain; and |

| | • | Blending biodiesel with petro-diesel gives us pricing flexibility and a competitive advantage to gain market share from traditional distributors. |

Secured access to abundant, diversified, and low-cost raw materials for biodiesel production

We have access to a stable and diversified source of biodiesel raw materials. In addition to non-edible seed oil, we also use waste cooking oil and vegetable oil residue as raw material for biodiesel production. We were awarded three patents for biodiesel production processes that enable us to use multiple sources of raw materials interchangeably. We have submitted eight additional patent applications, of which six have passed the preliminary examination and the other two have been accepted for review. We maintain a flexible procurement model in which we adjust the relative quantities of each type of raw material we purchase, depending on their respective purchase prices, to minimize our raw material costs. In 2009, non-edible seed oil, vegetable oil residue and waste cooking oil accounted for approximately 40%, 43% and 17% of our raw material costs relating to our biodiesel production, respectively.

We are strategically located in Shaanxi Province in the northwestern region of China, where the mountainous terrain and abundant sunlight are especially suitable for planting non-edible oil plants such as Chinese prickly ash, cornel and Chinese pistache. Shaanxi Province has one of the largest areas of cultivation of Chinese prickly ash in China. The local farmers in Shaanxi have planted 3.6 million mu, equivalent to 240,000 acres, of Chinese prickly ash and other non-edible oil plants which represents enough raw materials to produce over 430,000 tons of biodiesel. We have signed raw material purchasing contracts with local agriculture associations that organize local farmers to harvest and deliver the non-edible seed oil to us. The purchasing contracts obligate most of the associations to first offer to sell the feedstock to us. The Shaanxi Provincial Government plans to permit additional forestlands to be used solely for the planting of non-edible oil plants. We currently have secured access to non-edible seed oil for production of approximately 40,000 tons of biodiesel. We believe the abundant supply of feedstock currently available, in addition to the non-edible oil plants the government plans to permit farmers to cultivate, is sufficient for our current needs and will be sufficient for our increasing demands for raw materials after we increase our production capacity as planned.

We also have secured access to vegetable oil residue and waste cooking oil for production of approximately 60,000 tons of biodiesel through annual contracts with vegetable oil factories and waste cooking oil collecting centers.

We believe our biodiesel feedstock suppliers have a strong incentive to sell their products to us at competitive prices given that:

| • | There are very few alternative uses of non-edible oil seeds, vegetable oil residue and waste cooking oil; |

| | • | We are the only non-state-owned biodiesel producer with commercial scale in northwestern China; and |

| | • | We provide our suppliers with a legitimate means to dispose of waste cooking oil and vegetable oil residue. |

Established relationships with our suppliers and customers

We have been operating in the wholesale distribution of finished oil and heavy oil business since 1999 and have established strong relationships with our suppliers and customers. We believe that we have been one of the leading non-state-owned distributors of finished oil and heavy oil in Shaanxi Province. Our largest supplier, Shaanxi Yanchang Group, is the fourth largest oil company in China with over 10 million tons of refinery capacity. We have a long-standing relationship with Shaanxi Yanchang Group, which includes establishing supply and purchasing stations with three oil refineries owned by Shaanxi Yanchang Group in Shaanxi Province.

We focus on customer satisfaction and believe that we have consistently delivered high quality products and services to our customers. We believe we have established our reputation among our customers and are able to maintain long-term relationships with our customers, as evidenced by our customer retention rate and the increasing number of new customers. The total number of customers in our wholesale distribution of finished oil and heavy oil business segment has grown from 936 in 2008 to 1,180 in 2009. Our sales volume has also increased significantly over the past three years.

We believe that both our suppliers and customers prefer to work with us for the following reasons:

| | • | We are an established player with a large-scale operation and stable supply; |

| | • | We have a strong financial position and provide flexibility in payment terms; and |

| | • | We have a professional purchase and sales team, which are responsive to suppliers’ and customers’ needs. |

Early mover advantages

We were one of the first non-state-owned enterprises to engage in the wholesale distribution of finished oil and heavy oil products in Shaanxi Province. During the past 10 years, we have gradually built up our operational infrastructure, including extensive distribution channels, four oil storage depots, and convenient access to strategic railway lines. We have also obtained relevant licenses to conduct our wholesale distribution business, which has become increasingly more difficult for new entrants in our industry to obtain.

We believe that being an early mover in this industry has provided us the following advantages:

| | • | Sales network. We have sales offices in seven locations with 36 full-time salespersons covering 14 provinces and municipalities in China. |

| | • | Storage capability. We currently use four oil storage depots with total capacity of 59,000 m 3 . We own one of the oil storage depots, lease one oil storage depot and have the rights to use two oil storage depots through oil storage service agreements. |

| | • | Access to railway lines. We benefit from convenient access to railway lines that we use to transport and distribute our oil products from Shaanxi Province to Yunnan Province, Guizhou Province and Sichuan Province. We believe that we are currently the only enterprise in Shaanxi Province that has such a capability. |

| | • | Wholesale distribution license. In June 2000, we were granted a wholesale distribution license to distribute finished oil products by the State Economic and Trade Commission. We are now one of the only four non-state-owned distributors that are licensed to distribute both finished oil and heavy oil products in Shaanxi Province. |

We believe that our wholesale distribution license and the operational infrastructure we have built help us to compete effectively and also form a barrier for any prospective new entrants into our industry.

Experienced management team with proven track record

We have an experienced management team led by Mr. Xincheng Gao, our chairman, chief executive officer and president. Mr. Gao has extensive experience in the research and marketing of oil products. In 1999, Mr. Gao founded Xi’an Baorun Industrial Development Co., Ltd. (Xi’an Baorun Industrial) to process and distribute finished oil and heavy oil products. Prior to founding Xi’an Baorun Industrial, Mr. Gao worked in the Oil and Chemicals Department of Shaanxi Province and Zhongtian Oil and Chemical Group, responsible for research and development and marketing. With Mr. Gao’s vision and leadership, we have grown from a traditional distributor of finished and heavy oil products to a leading non-state-owned integrated energy company. Our sales have grown from $216.5 million in 2008 to $289.6 million in 2009, while net income has grown from $28.6 million (excluding $9.8 million of non-cash share based compensation expenses) to $37.9 million over the same period.

Most of the members of our senior management team have worked together since 2005 and have an average of 10 years of experience in the oil business. We believe our management team’s in-depth market knowledge and strong track record in the oil market in China will enable us to take advantage of the anticipated growth in demand in the energy market.

Continue to increase our biodiesel production capacity and improve control of the raw material supply

We plan to increase our biodiesel production capacity by 50,000 tons before the end of 2010 through construction of a new facility to supplement the demand for petro-diesel. We have begun construction to increase capacity in the fourth quarter of 2009. We anticipate $15 million in capital expenditures to accomplish this goal. We expect to benefit from the continued growth in overall energy consumption in China. We believe that we are one of the largest biodiesel producers in China based on production capacity at the end of 2009 and the only non-state-owned biodiesel producer with a distribution license. We continue to position ourselves as a leader in terms of capability, capacity and technology in this young biodiesel industry. Although we have secured abundant feedstock supply to support our current biodiesel production, we will continue to work with provincial and local agriculture administrations and environmental protection agencies for better cooperation and support for priority purchase of agricultural feedstock, waste cooking oil, and vegetable oil residue. We also will continue to work with leading universities and research institutes to develop alternative sources of feedstock to strengthen our supply chain and cost flexibility for biodiesel raw materials.

Strengthen our relationship with key suppliers for finished oil and heavy oil and diversify our supply base

Stability of supply chain is one of the critical elements of a successful wholesale distributor of finished oil and heavy oil. We have had a long-term strong working relationship with Shaanxi Yanchang Group, our largest finished oil and heavy oil products supplier. We will also continue to maintain good relationships with other oil suppliers to ensure favorable pricing terms and a stable supply of oil products. In addition, we are also focused on exploring opportunities with new suppliers with significant oil resources and better pricing in different regions to diversify our supply chain and enhance our sales margin. We have found new vendors in Shandong and Xinjian Provinces to support our customers in those regions.

Expand our wholesale and retail distribution network through both organic growth and potential acquisitions

With stable and abundant oil supply, we will continue to expand our wholesale distribution of finished oil and heavy oil products by increasing the number of our regional sales offices and sales staff in various territories to develop new markets and a wider customer base. We will also continue penetrating existing territories to develop new customers and meet increased demand from our existing customers as their businesses grow. We will continue scouting high traffic locations to expand our portfolio of retail gas stations to create additional sales and higher profitability for our overall distribution channels. We foresee industry consolidation and believe that we are well-positioned to benefit from such market trends. We are in the position to acquire distressed competitors with working capital difficulties, if and when opportunities are presented.

Continue application process to obtain oil import/export license

In 2008, we submitted an application for an oil import/export license. The approval process for this license is lengthy. We will continue working with the governmental agencies to obtain the license to broaden our business scope.

Enhance R&D efforts to improve biodiesel production technology and efficiency

We will continue investing resources and working closely with leading universities and research and development institutes that specialize in agricultural research to develop new technologies for more efficient and cost-effective biodiesel production. We will also continue to search for alternative feedstock to enhance the availability of raw materials and reduce costs of feedstock for biodiesel production.

Wholesale Distribution of Finished Oil and Heavy Oil Products

Oil supply

We sell on a wholesale basis a variety of oil products including gasoline, diesel, heavy oil and naphtha. Gasoline and diesel represent the majority of oil products consumed in China. Automobiles are the most important driver of gasoline consumption in China. Diesel is mainly used in vehicles and agricultural machines with diesel engines. Heavy oil is broadly used as fuel for ship boilers, heating furnaces, metallurgical furnaces and other industrial furnaces. Wholesale distribution of finished oil and heavy oil products accounted for approximately 67.6% of our total sales in 2009 and approximately 66.3% of our total sales in 2008

Based on volume, we purchased approximately 65.5% of our gasoline and diesel oil products from our top five suppliers in 2009. During 2009, based on cost, we purchased approximately 30.8% (compared to 52.0% in 2008) of our gasoline and diesel oil products from Shaanxi Yanchang Group, with whom we have had a strong relationship since establishing Xi’an Baorun Industrial, which included establishing supply and purchasing stations with three oil refineries that are owned by Shaanxi Yanchang Group in Shaanxi Province. While we depend on Shaanxi Yanchang Group for the majority of our gasoline and oil supply needs, we are actively seeking other sources of oil supply and believe that we can find alternative suppliers with comparable terms within a reasonable amount of time without any significant disruption in our operations.

Storage

We use four oil storage depots, which in the aggregate have the capacity to store approximately 59,000 m 3 of oil products. We constructed one oil storage depot located within our biodiesel production facility in Tongchuan City, Shaanxi Province, lease one oil storage depot and have the rights to use two state-owned oil storage depots through oil storage service agreements. The terms of the lease agreement and the oil storage service agreements range from two years to eight years and these agreements are renewable. Average annual rental and service expense of each oil storage depot is approximately RMB 0.7 million ($0.1 million). Two of the state-owned depots are located on railways that provide us convenient access for distributing our products. We also have access to a 2.65-kilometer railway track connecting the oil storage depots located within our biodiesel production facility to the main railway in Tongchuan City, Shaanxi Province.

Sales and Marketing

We developed a stable sales network for our products in 14 provinces, including Shaanxi, Henan, Hebei, Shandong, Shanxi, Hunan, Hubei, Jiangxi, Guizhou, Yunnan, Fujian and Xinjiang; and two municipalities, Beijing and Shanghai. We now employ 36 full-time salespersons in sales offices located in Chengdu City, Yingbuo City in Shandong Province and the cities of Yanglian, Lingtong, Shangqiao, Chengxiang, and Yongpin in Shaanxi Province. As our business expands, we intend to further expand our sales network and develop more sales channels. For our wholesale distribution of finished oil and heavy oil business segment, we plan to increase our distribution to an additional two provinces in the next 18 months, adding additional salespersons and establishing more regional sales offices. We plan to increase our sales volume through increasing our distribution footprint and further penetrating existing customers and business territories.

Customers

We currently sell our finished oil and heavy oil products to regional distributors in China that supply to retail service stations and directly to end users through our retail gas stations. We have adopted different terms for payment based upon the financial strength of the customer. For example, we have entered into agreements with PetroChina, SINOPEC, and other state-owned enterprises whereby we deliver products to agreed-upon locations and these customers agree to pay us after delivery. However, we require partial pre-payment in advance and cash on delivery from our customers that operate distributorships or own and operate private gas stations. These customers typically pay 10% to 15% of the total purchase price of the products to be delivered in advance, and when delivery takes place, they pay the remaining amounts owed. In 2008 and 2007, there was no customer that accounted for 10% or more of our sales. We did not experience any uncollectible accounts receivable or bad debt write-offs over the past three years.

For the year ended December 31, 2008 and 2009, our top five customers purchased approximately $49.3 million and $113.2 million of our products, representing approximately 22.8% and 39.1% of our sales during the period, respectively. China Petroleum and Chemical Corporation Chuanyu Trading Co., Ltd., our largest customer, accounted for approximately 26.6% of our sales in 2009.

Competition

We are one of the only four non-state-owned enterprises licensed to distribute both finished oil and heavy oil products in Shaanxi Province. Although barriers to entry in our industry are high due to stringent licensing requirements and the need for significant storage capacity for products, we face competition from companies located in other provinces and within Shaanxi Province that also engage in the wholesale distribution of finished and heavy oils. Such companies may have greater financial resources, sales resources, storage capacity and transportation capacity than we do, and may have exclusive supply and purchase arrangements with suppliers as a result of long-term relationships.

In addition to SINOPEC and PetroChina, we estimate that we have approximately ten major non-state-owned competitors in Shaanxi Province that also distribute finished oil products similar to ours, including Shaanxi Dongda Petro-Chemical Co., Ltd., Shaanxi Dayun Petrochemical Material Co., Ltd. and Baoji Huahai Industry Corp.

We believe we have the following advantages over our competitors in this market:

| | • | Oil wholesale distribution license. In June 2000, we were granted a wholesale distribution license to distribute finished oil products by the State Economic and Trade Commission. We are now one of the only four non-state-owned distributors that are licensed to distribute both finished oil and heavy oil products in Shaanxi Province. |

| | • | Supply advantage. Shaanxi Yanchang Group, one of the four largest qualified crude oil and gas exploration enterprises in China, is our largest oil supplier. In Shaanxi Province, we are one of the only few entities that have established supplying and purchasing stations with Shaanxi Yanchang Group. |

| | • | Railway access. We benefit from convenient access to a railway line in Shaanxi Province to distribute our oil products. We believe we are currently the only enterprise in Shaanxi Province that has railway access to distribute oil products directly to Yunnan, Guizhou and Sichuan Provinces. |

| | • | Storage capability. We have an aggregate oil depot storage capacity of 59,000 m 3 . Aside from the need for strong funding support, new entrants to this industry must also have significant storage capacity to be able to compete, which is a barrier to entry for new competitors. |

Production and Sale of Biodiesel

Production

In 2006, we built a 10,000 square meter biodiesel production facility with annual design capacity of 100,000 tons. We commenced production at this facility in October 2007. The production of biodiesel is achieved through the effective performance of all equipment necessary for production. Initial production in 2008 required adjustments to equipment and a full debugging process. Our achievable utilization rate, after taking into account required periodic maintenance, is 90%. We plan to increase production capacity by 50,000 tons through construction of a new facility in the next 12 months. We anticipate to complete construction of the new biodiesel production facility by the third quarter of 2010.

Raw Material Supply

We have access to a range of biodiesel raw materials. Besides non-edible seed oil, we can also use waste cooking oil and vegetable oil residue as raw material for biodiesel production. We have signed raw material purchasing contracts with local associations such as Tongchuan City Chinese Prickly Ash Association, the Forestry Bureau of Yongshou County, the Forest and Fruits Production Managing Station of Danfeng County, the Forestry Bureau of Ningqiang County and the Forestry Bureau of Liuba County, some of which are governmental entities. These associations organize local farmers to plant and harvest oil plants. The purchasing contracts obligate most of the associations to first offer to sell the feedstock to us. If the supply of feedstock is greater than our demand, they can then sell any remaining feedstock to other companies.

Shaanxi Province is one of the largest cultivators of Chinese prickly ash, an oil plant, in China. Together, the local farmers in Shaanxi Province have planted approximately 2,560,000 mu (equivalent to 173,000 acres) of Chinese prickly ash, 850,000 mu (equivalent to 57,000 acres) of cornel and 150,000 mu (equivalent to 10,000 acres) of Chinese pistache. Even though we could satisfy all of our current feedstock demands solely with Chinese prickly ash, we diversify our feedstock supply with other oil plants, waste cooking oil and vegetable oil residue, because the costs of these raw materials are lower than Chinese prickly ash. There is also significant acreage of wild oil plants that grow throughout Shaanxi Province. However, because the feedstock available from the local associations currently satisfies our supply demands, we do not rely on any supplies of wild oil plants for our production needs. We believe that the abundant supply of feedstock currently available in Shaanxi Province is sufficient for our current needs and will be sufficient for our expanded demands for raw material once we expand our biodiesel production facility or acquire a new facility.

We have established cooperation relationships with two pre-processing factories for oil extraction from non-edible oil seeds or oil plant seeds.

Sales and Marketing

We continue to leverage our distribution infrastructure to sell our biodiesel to existing customers and to acquire new customers. The main advantages of biodiesel over petro-diesel are pricing, efficiency, safety (due to a higher flash point) and the fact that biodiesel is environmentally friendly. Our targeted markets are power plants, marine transportation companies, seaport operations and other industrial customers which consume large volumes of diesel fuel.

Customers

We primarily target oil product trading companies in China (i.e., sales subsidiaries of SINOPEC and PetroChina) and end users (i.e., gas stations, electric power companies and shipping companies) as our customers. Approximately 20% of the biodiesel we produce is blended with petro-diesel and sold to next tier oil distributors and gas stations. The remaining 80% is sold to power plants and marine transportation companies. We do not believe that our sales are affected by seasonality.

Competition

Currently, we are the only non-state owned biodiesel producer with a distribution license in China. We may face significant competition from current and future companies that intend to compete in the biodiesel market. In the area of biodiesel fuel production, we are not aware of the existence of any significant competitors in Shaanxi Province. However, we face competition from companies in other geographic areas in China and foreign competitors that export their biodiesel to China.

We believe that we have the following advantages over our competitors in this market:

| • | Stable supply of feedstock. We have a stable source of various types of feedstock for biodiesel production, such as Chinese pistache and Chinese prickly ash. Some local governments have agreed to first offer their feedstock to us. We have also entered into agreements with four Xi’an City EPA-designated waste cooking oil processing companies to secure needed waste cooking oil at favorable prices. |

| • | Production capacity. We estimate that the production output of biodiesel in China will be approximately 800,000 tons in 2010. Gushan Environmental Energy and our company are currently the only two companies in China with annual production capacity of at least 100,000 tons. We plan to increase our biodiesel production capacity by 50,000 tons through construction of a new facility prior to the end of 2010. To that end we began construction to increase capacity during the fourth quarter of 2009. |

| • | Stable distribution channels. We have established sales networks and channels and strong industrial relationships with our customers. Under the Measures on the Administration of the Finished Oil Market , only companies that obtain a Finished Oil Wholesale Distribution License are permitted to distribute biodiesel on a wholesale basis. Because Xi’an Baorun Industrial has a Finished Oil Wholesale Distribution License, we are able to produce and distribute biodiesel on a wholesale basis while other biodiesel producers must rely on distributors that have obtained Finished Oil Wholesale Distribution Licenses to distribute their products. Since biodiesel and petro-diesel share the same market, we can distribute our biodiesel through our existing distribution channels to reduce costs. |

Operation of Retail Gas Stations

We sell all grades of gasoline and diesel at our twelve retail gas stations. Our customers include automobile, bus and truck drivers. Our competitors are other privately owned and state-owned gas stations. Our advantages are that (i) as a well-established finished oil distributor, we have a stable and sufficient oil supply to support our retail gas station operations at a higher margin; (ii) we sell blended diesel with a blending ratio of 15.0% of biodiesel and 85.0% of petro-diesel to end customers at the same price as petro-diesel, which provides us with additional profitability from our retail gas station operations, and (iii) we maintain competitive pricing to attract customers. We will seek to continue to expand our retail gas station portfolio.

Other Business Information

Research and Development

| | • | On December 18, 2005, we entered into an agreement with Xi’an Petroleum University for the technology transfer of operating processes for blending finished oil products, related chemical formula and related composition. The contract is valid for ten years. |

| • | On February 20, 2006, we entered into an agreement with Xi’an Petroleum University for research and development of biodiesel production. We own the patent for any biodiesel production technology that results from this arrangement. |

| • | On September 4, 2006, we entered into an agreement with Beijing Qingda Kema Technology Co., Ltd. for research and development of biodiesel production processes, chemical composition of catalyst, and transfer of technical know-how to us. |

| • | On January 4, 2007, we entered into an agreement with Northwest A & F University for research and development and technical assistance for improvement of processing raw materials, including waste cooking oil, non-edible seed oil and cooking oil residue, for biodiesel production. |

We own three utility model patents and have submitted eight other patent applications, of which six invention patent applications have passed preliminary examination and two utility model patent applications have been accepted for review. In practice, we propose the subject matter to be researched and pursuant to these agreements we entrust our research and development partners to perform the research and analysis and provide advanced technology services. We incurred approximately $55,000 and $38,000 in research and development expenditures for 2008 and 2009, respectively.

Intellectual Property

Our core technologies consist of: (i) know-how technologies to improve the quality of finished oil and heavy oil products, and (ii) three utility model patents related to biodiesel production. We do not have patent protection for our know-how technologies and our eight patent applications are pending approval from the SIPO.

Between 2006 and 2009, we filed the following 11 patent applications listed below with the SIPO, all of which are related to our biodiesel production. The SIPO has approved the first three applications for utility model patents, allowed the next six invention patent applications to pass preliminary examination and accepted the remaining two utility model patent applications for review.

| | • | Application No. 200820221671.0 for a new gas-liquid distributor of material filling tower |

| | • | Application No. 200620137855.X for a new reaction vessel for preparing biodiesel and composite diesel |

| | • | Application No. 200620137854.5 for a new reaction equipment for preparing biodiesel |

| | • | Application No. 200610152508.9 for a biodiesel processing technique |

| | • | Application No. 200610152506.X for a new composite catalyst for preparing biodiesel |

| | • | Application No. 200610152507.4 for a new technology for processing biodiesel with catalyst or splitting decomposition in liquid or gas face |

| | • | Application No. 200810017853.0 for a new technique for disposing biodiesel esterification reaction equipment with inert metal lead |

| | • | Application No. 200810017849.4 for a new method for preparing biodiesel with supercritical technology |

| | • | Application No. 20081001784.8 for a new technique for producing biodiesel and its byproducts with molecular distillation |

| | • | Application No. 200820028705.4 for an anti-corrosion device for biodiesel esterification reaction |

| | • | Application No. 200820221682.9 for a new kind of material filling tower. |

We have patent protection for each of our utility model patents for a period of ten years from the date of filing. If our invention patents are approved, they will be valid for a period of 20 years from the date of filing. Upon expiration, the renewal process requires us to re-apply for patent protection.

We developed technologies for the production of biodiesel jointly with the Xi’an Petroleum University and Northwest A & F University. We developed our proprietary technology for the production of biodiesel jointly with Beijing Qingda Kema Technology Co., Ltd. and we were permitted to use this technology under a contract dated September 4, 2006. We have the right to use the oil mixing technology developed by Xi’an Petroleum University for ten years under a contract entered into on December 18, 2005.

We maintain property insurance for some of our premises and accidental liability insurance. We do not have any business liability, interruption or litigation insurance coverage for our operations in China. Although it is available, insurance companies in China offer limited business insurance products. We have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to purchase such insurance. Therefore, we are subject to business and product liability exposure. Business or product liability claims or potential regulatory actions could materially and adversely affect our business and financial condition. We maintain director and officer liability insurance for our directors and executive officers.

Environmental Matters

We believe that we are in compliance with present environmental protection requirements in all material respects. Our production processes generate noise, waste water, gaseous wastes and other industrial wastes. We have installed various types of anti-pollution equipment in our facilities to reduce, treat, and where feasible, recycle the wastes generated in our production process. Our operations are subject to regulation and periodic monitoring by local environmental protection authorities.

Employees

As of December 31, 2009, we had 229 full-time employees. Among them, 69 of our employees worked at our Xi’an headquarters; 53 at our biodiesel production facility in Tongchuan City; 35 at our oil storage depots and 72 at our retail gas stations;. We believe we have good relationships with our employees.

Our History and Corporate Structure

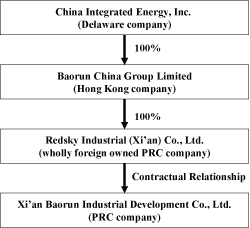

The following diagram illustrates our corporate structure .

Company History

We were incorporated in the State of Delaware in July 1998 under the corporate name “A.M.S. Marketing, Inc.” and in October 2003, we changed our name to “International Imaging Systems, Inc.” Until January 2007, we were engaged in the business of marketing pre-owned, brand name photocopy machines and employee leasing. We then began to pursue an acquisition strategy to acquire an undervalued business that demonstrated room for growth.

We acquired Baorun China Group Limited, or Baorun Group, pursuant to a Share Exchange Agreement, dated October 23, 2007 with Baorun Group, Redsky Group and Princeton Capital Group LLP, or Princeton Capital Group, Castle Bison, Inc. and Stallion Ventures, LLC. Together, Redsky Group and Princeton Capital Group owned shares constituting 100% of the issued and outstanding ordinary shares of Baorun Group. Pursuant to the terms of the Share Exchange Agreement, Redsky Group and Princeton Capital Group transferred to us all of their shares in Baorun Group in exchange for the issuance of 22,454,545 shares of our common stock to Redsky Group and 1,500,000 shares of our common stock to Princeton Capital Group. As a result of this share exchange, Baorun Group became our wholly owned subsidiary, and Redsky Group and Princeton Capital Group acquired an aggregate of approximately 94.11% of our common stock.

On November 15, 2007, through a merger of a wholly owned subsidiary, China Bio Energy Holding Group Co., Ltd., our corporate name was changed from “International Imaging Systems, Inc.” to “China Bio Energy Holding Group Co., Ltd.” On September 17, 2009, we changed our name to “China Integrated Energy, Inc.”

Corporate Structure

We are engaged in three business segments: (1) the wholesale distribution of finished oil and heavy oil products; (2) the production and sale of biodiesel; and (3) the operation of retail gas stations. We operate our business through certain contractual agreements between Redsky Industrial and Xi’an Baorun Industrial. Redsky Industrial is our indirect wholly owned subsidiary that is a registered wholly foreign owned enterprise in the PRC. Xi’an Baorun Industrial is based in Xi’an, Shaanxi Province, and owned by three Chinese citizens, including our chairman, chief executive officer and president, Mr. Xincheng Gao, who owns a 70% equity interest in Xi’an Baorun Industrial.

Contractual Agreements with Xi’an Baorun Industrial

We do not own any equity interest in Xi’an Baorun Industrial. In order to meet domestic ownership requirements under PRC law, which restricts foreign companies from operating in the finished oil and biodiesel industry, Redsky Industrial executed a series of exclusive contractual agreements with Xi’an Baorun Industrial, which allow us, among other things, to secure significant rights to influence Xi’an Baorun Industrial’s business operations, policies and management, to approve all matters requiring stockholder approvals, and give us the right to include 100% of the annual net income earned by Xi’an Baorun Industrial as part of our consolidated financial statements. In addition, to ensure that Xi’an Baorun Industrial and its stockholders perform their obligations under these contractual arrangements, the stockholders have pledged to Redsky Industrial all of their equity interests in Xi’an Baorun Industrial. If and when the current restrictions under PRC law on foreign ownership of Chinese companies engaging in the finished oil and biodiesel industry in China are lifted, Redsky Industrial may exercise its option to purchase the equity interests in Xi’an Baorun Industrial directly.

Since Baorun Group owns Redsky Industrial, which effectively controls Xi’an Baorun Industrial, Xi’an Baorun Industrial is deemed a subsidiary of Baorun Group, which is our legal subsidiary. Based on Xi’an Baorun Industrial’s contractual relationship with Redsky Industrial as set forth in the Exclusive Business Cooperation Agreement (as described below), we have determined that Xi’an Baorun Industrial should be deemed to be our VIE in accordance with FASB Interpretations — FIN 46(R): Consolidation of Variable Interest Entities (as amended) (FIN 46(R)). Under FIN 46(R), Xi’an Baorun Industrial is to be presented as our consolidated subsidiary.

The contractual agreements Redsky Industrial entered into with Xi’an Baorun Industrial and its stockholders include the following:

Exclusive Business Cooperation Agreement

Pursuant to an Exclusive Business Cooperation Agreement entered into between Redsky Industrial and Xi’an Baorun Industrial on October 19, 2007, as amended on March 24, 2008, Redsky Industrial has the exclusive right to provide complete technical support, business support and related consulting services, which include, among others, technical services, business consultations, equipment or property leasing, marketing consultancy and product research. Xi’an Baorun Industrial has agreed to pay the service fee on a monthly basis to Redsky Industrial equal to 100% of the monthly net income of Xi’an Baorun Industrial. This agreement is subject to renewal at the option of both Redsky Industrial and Xi’an Baorun Industrial. Redsky Industrial has the right to early termination of this agreement for any reason upon a 30 days’ prior written notice. Xi’an Baorun Industrial only has the right to early termination of this agreement in the event of the gross negligence of, or fraudulent acts by Redsky Industrial.

Exclusive Option Agreements

Under the Exclusive Option Agreements dated October 19, 2007 entered into among Redsky Industrial, each of the three stockholders of Xi’an Baorun Industrial and Xi’an Baorun Industrial, the stockholders of Xi’an Baorun Industrial have irrevocably granted to Redsky Industrial or its designated person, an exclusive option to purchase, to the extent permitted by PRC law, a portion or all of their respective equity interests in Xi’an Baorun Industrial for a purchase price either to be designated by Redsky Industrial or to be determined based on the evaluation of the equity interests required by PRC law. Redsky Industrial or its designated person has the sole discretion to decide when to exercise the option, whether in part or in full. Each of these agreements has a ten-year term, subject to renewal at Redsky Industrial’s election.

Equity Pledge Agreements

Under the Equity Pledge Agreements dated October 19, 2007, entered into among Redsky Industrial, Xi’an Baorun Industrial and each of the three stockholders of Xi’an Baorun Industrial, the stockholders of Xi’an Baorun Industrial have pledged their equity interests in Xi’an Baorun Industrial to guarantee Xi’an Baorun Industrial’s performance of its obligations under the Exclusive Business Cooperation Agreement. If Xi’an Baorun Industrial fails to perform its payment obligations under the Exclusive Business Cooperation Agreement, or if Xi’an Baorun Industrial or any of its stockholders breaches his/her respective contractual obligations under the agreement, or upon the occurrence of an event of default, Redsky Industrial is entitled to certain rights, including the right to dispose of the pledged equity interests. The stockholders of Xi’an Baorun Industrial have agreed not to dispose of the pledged equity interests or take any actions that would prejudice Redsky Industrial’s interests. Each of the Equity Pledge Agreements will be valid until all the payments due under the Exclusive Business Cooperation Agreement have been paid by Xi’an Baorun Industrial and Xi’an Baorun Industrial no longer has any obligations under the Exclusive Business Cooperation Agreement. Since the Exclusive Business Cooperation Agreement may be renewed at Redsky Industrial’s option, the equity pledge will remain in effect with each such renewal of the Exclusive Business Cooperation Agreement, and until all payments due under the Exclusive Business Cooperation are paid in full by Xi’an Baorun Industrial.

Irrevocable Powers of Attorney

Under the irrevocable powers of attorney, each of the three stockholders of Xi’an Baorun Industrial has granted to Redsky Industrial the power to exercise all voting rights of such stockholder in stockholders’ meetings, including, but not limited to, the power to determine the sale, pledge or transfer of, or otherwise dispose of all or part of such stockholder’s equity interests in, and to appoint and elect the directors, the legal representative (chairperson), chief executive officer and other senior management of Xi’an Baorun Industrial.

RISK FACTORS

Investing in our securities involves risk. The prospectus supplement applicable to a particular offering of securities will contain a discussion of the risks applicable to an investment in the Company and to the particular types of securities that we are offering under that prospectus supplement. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in the applicable prospectus supplement and the risks described in our Annual Report on Form 10-K and any updates to our risk factors in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus or any accompanying prospectus supplement, including the documents that we incorporate by reference, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. Any forward-looking statements are based on our current expectations and projections about future events and are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,” “estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could” or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the risk factors described herein and those included in any accompanying prospectus supplement or in any document incorporated by reference into this prospectus.

You should read this prospectus and any accompanying prospectus supplement and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we concurrently expect. You should assume that the information appearing in this prospectus, any accompanying prospectus supplement and any document incorporated herein by reference is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus, any accompanying prospectus supplement and any document incorporated herein by reference, and particularly our forward-looking statements, by these cautionary statements.

USE OF PROCEEDS

Except as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities covered by this prospectus for general corporate purposes, which may include, but is not limited to, working capital, capital expenditures, research and development expenditures and acquisitions of new technologies or businesses. The precise amount, use and timing of the application of such proceeds will depend upon our funding requirements and the availability and cost of other capital. Additional information on the use of net proceeds from an offering of securities covered by this prospectus may be set forth in the prospectus supplement relating to the specific offering.

We will not receive any portion of the net proceeds by the Selling Stockholder from the sale of its shares.

| | | YEAR ENDED DECEMBER 31, |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | 2009 |

| Ratio of Earnings to Fixed Charges | | | 20.7 | | | | 27.5 | | | | 32.9 | | | | 14.2 | | 18.6 |

DESCRIPTIONS OF THE SECURITIES WE MAY OFFER

The descriptions of the securities contained in this prospectus, together with any applicable prospectus supplement, summarize all the material terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement relating to a particular offering the specific terms of the securities offered by that prospectus supplement. We will indicate in the applicable prospectus supplement if the terms of the securities differ from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, material United States federal income tax considerations relating to the securities.

We may sell from time to time, in one or more offerings:

| | · | shares of our common stock; |

| | · | shares of our preferred stock; |

| | · | debt securities, in one or more series; |

| | · | warrants to purchase any of the securities listed above; and/or |

| | · | units consisting of one or more of the foregoing. |

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

Capital Stock

General

The following description of common stock and preferred stock, together with the additional information we include in any applicable prospectus supplement, summarizes the material terms and provisions of the common stock and preferred stock that we may offer under this prospectus but is not complete. For the complete terms of our common stock and preferred stock, please refer to our certificate of incorporation, as may be amended from time to time, any certificates of designation for our preferred stock, and our bylaws, as amended from time to time. The Delaware General Corporation Law may also affect the terms of these securities. While the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the specific terms of any series of these securities in more detail in the applicable prospectus supplement. If we so indicate in a prospectus supplement, the terms of any common stock or preferred stock we offer under that prospectus supplement may differ from the terms we describe below.

As of March 31 2010, our authorized capital stock consisted of 89,000,000 shares, consisting of 79,000,000 shares of common stock par value $.0001 per share, and 10,000,000 shares of preferred stock, par value $.001 per share of which 1,000,000 shares have been designated as Series A Preferred Stock, and 7,000,000 shares have been designated as Series B Preferred Stock. The authorized and unissued shares of common stock and the authorized and undesignated shares of preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of our stockholders is so required, our board of directors will not seek stockholder approval for the issuance and sale of our common stock or preferred stock.

Common Stock

As of March 31, 2010, there were 33,569,091 shares of common stock issued and outstanding. Each holder of shares of common stock is entitled to one vote per share at stockholders’ meetings.

Dividend Rights

Subject to the rights of the holders of preferred stock, as discussed below, the holders of outstanding common stock are entitled to receive dividends out of funds legally available at the times and in the amounts that the Board of Directors may determine.

Voting Rights

Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Cumulative voting for the election of directors is not provided for in our certificate of incorporation, as amended and restated. Any action other than the election of directors shall be authorized by a majority of the votes cast, except where the Delaware General Corporation Law prescribes a different percentage of votes and/or exercise of voting power.

No Preemptive or Similar Rights

Holders of our common stock do not have preemptive rights, and shares of our common stock are not convertible or redeemable.

Right to Receive Liquidation Distributions

Subject to the rights of the holders of preferred stock, as discussed below, upon our dissolution, liquidation or winding-up, our assets legally available for distribution to our stockholders are distributable ratably among the holders of common stock.

Preferred Stock

We have 10,000,000 authorized shares of preferred stock par value $0.001 per share, of which 1,000,000 shares are designated as series A preferred stock and are issued and outstanding as of the date of this prospectus; and of which 7,000,000 shares are designated as series B preferred stock, of which 2,115,753 shares are issued and outstanding as of March 31, 2010.

Our board of directors may also divide the shares of preferred stock into series and fix and determine the relative rights and preferences of the preferred stock, such as the designation of series and the number of shares constituting such series, dividend rights, redemption and sinking fund provisions, liquidation and dissolution preferences, conversion or exchange rights and voting rights, if any. Issuance of preferred stock by our board of directors will result in such shares having dividend and/or liquidation preferences senior to the rights of the holders of our common stock and could dilute the voting rights of the holders of our common stock. Once designated by our board of directors, each series of preferred stock will have specific financial and other terms that will be described in a prospectus supplement. The description of the preferred stock that is set forth in any prospectus supplement is not complete without reference to the documents that govern the preferred stock. These include our certificate of incorporation, as amended, and any certificates of designation that our board of directors may adopt. Prior to the issuance of shares of each series of preferred stock, the board of directors is required by the Delaware General Corporation Law and our certificate of incorporation to adopt resolutions and file a certificate of designations with the Secretary of State of the State of Delaware. The certificate of designations fixes for each class or series the designations, powers, preferences, rights, qualifications, limitations and restrictions, including, but not limited to, some or all of the following:

| | · | the number of shares constituting that series and the distinctive designation of that series, which number may be increased or decreased (but not below the number of shares then outstanding) from time to time by action of the board of directors; |

| | · | the dividend rate and the manner and frequency of payment of dividends on the shares of that series, whether dividends will be cumulative, and, if so, from which date; |

| | · | whether that series will have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights; |

| | · | whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the board of directors may determine; |

| | · | whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption; |

| | · | whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; |

| | · | whether or not the shares of the series will have priority over or be on a parity with or be junior to the shares of any other series or class in any respect; |

| | · | the rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights or priority, if any, of payment of shares of that series; and |

| | · | any other relative rights, preferences and limitations of that series. |

All shares of preferred stock offered hereby will, when issued, be fully paid and nonassessable, including shares of preferred stock issued upon the exercise of preferred stock warrants or subscription rights, if any.

Although our board of directors has no intention at the present time of doing so, it could authorize the issuance of a series of preferred stock that could, depending on the terms of such series, impede the completion of a merger, tender offer or other takeover attempt.

Options/Warrants

As of March 31, 2010, we had outstanding options to purchase a total of 2,852,000shares of our Common Stock, and outstanding warrants to purchase a total of 4,007,273 shares of our Common Stock.

Warrants

The following description, together with the additional information we may include in any applicable prospectus supplement, summarizes the material terms and provisions of the warrants that we may offer under this prospectus and any related warrant agreement and warrant certificate. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the specific terms of any series of warrants in more detail in the applicable prospectus supplement. If we indicate in the prospectus supplement, the terms of any warrants offered under that prospectus supplement may differ from the terms described below. Specific warrant agreements will contain additional important terms and provisions and will be incorporated by reference as an exhibit to the registration statement which includes this prospectus.

General

We may issue warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. We may issue warrants independently or together with common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate from these securities.

We will evidence each series of warrants by warrant certificates that we may issue under a separate agreement. We may enter into a warrant agreement with a warrant agent. Each warrant agent may be a bank that we select which has its principal office in the United States. We may also choose to act as our own warrant agent. We will indicate the name and address of any such warrant agent in the applicable prospectus supplement relating to a particular series of warrants.

We will describe in the applicable prospectus supplement the terms of the series of warrants, including:

| | · | the offering price and aggregate number of warrants offered; |

| | · | if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each such security or each principal amount of such security; |

| | · | if applicable, the date on and after which the warrants and the related securities will be separately transferable; |