UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | | -OR- |

| |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2002 |

| |

| | | -OR- |

| |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED) for the transition period from to

Commission File Number: 000-30126 |

Acambis plc

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

England and Wales

(Jurisdiction of incorporation or organization)

Peterhouse Technology Park, 100 Fulbourn Road, Cambridge, CB1 9PT England

(Address of principal executive office)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

ORDINARY SHARES OF 10 PENCE EACH

(Title of Class)

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or

common stock as of the close of period covered by this Annual Report —

93,011,883 ordinary shares of 10p each as of December 31, 2002

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Indicate by check mark which financial statement item the Registrant has elected to follow:

TABLE OF CONTENTS

| | | | | | | | | | | | | | | | | | | | | |

| Our business | | | Financial information | | Corporate governance |

| |

| 1 | | Profits | | | 16 | | | Directors’ responsibilities | | | 49 | | | Board of Directors |

| 2 | | Products | | | 16 | | | Independent auditors’ report | | | 50 | | | Directors' report |

| 6 | | Prospects | | | 18 | | | Group profit and loss account | | | 51 | | | Corporate governance statement |

| | | | | | | | 18 | | | Group statement of total recognised | | | 54 | | | Remuneration report |

| 10 | | Responsibility | | | | | | gains and losses | | | 61 | | | Shareholder information |

| 12 | | Operating review | | | 19 | | | Group balance sheet | | | | | | | | |

| 14 | | Financial review | | | 20 | | | Company balance sheet | | | | | | | | |

| | | | | | | | 21 | | | Group cash flow statement | | | General information |

| | | | | | | | 22 | | | Notes to Group financial statements | | | | | | | | |

| | | | | | | | 42 | | | Further information required by Form 20-F | | | 63 | | | Company information and advisors |

| | | | | | | | 47 | | | Summarised Group statements | | | 64 | | | Index |

| | | | | | | | | | | | | | | | 65 | | | Cross-reference to Form 20-F |

Acambis is a UK public limited company with shares listed on the London Stock Exchange and, in the form of American Depositary Receipts, on Nasdaq. This is the Annual Report and Form 20-F for the year ended 31 December 2002. It contains the Annual Report and Financial Statements in accordance with UK regulations and incorporates the Annual Report on Form 20-F for the US Securities and Exchange Commission (“SEC”) to meet US regulations. A cross-reference for the Form 20-F is provided on the fold-out flap inside the back cover of this report. References to the Group and Acambis throughout this document relate to Acambis plc and all of its subsidiary and associated undertakings. References to the Company are to Acambis plc, the ultimate holding company.

Cautionary statement regarding

forward-looking statements

Under the safe harbour provisions of the US Private Securities Litigation Reform Act of 1995, the Company cautions investors that any forward-looking statements or projections made in this document are subject to risks and uncertainties that may cause actual results to differ materially from those projected. These forward-looking statements are based on estimates and assumptions made by the management of Acambis and are believed to be reasonable, though are inherently uncertain and difficult to predict. Actual results or experience could differ materially from the forward-looking statements. Factors that may affect the Group’s operations are discussed in the operating review, financial review and the corporate governance statement contained within this Annual Report and Form 20-F, and in documents as filed with the US Securities and Exchange Commission from time to time.

(4a)

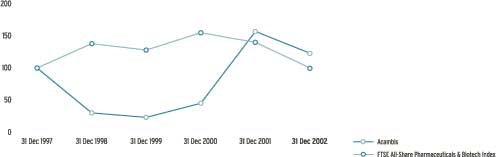

(4b) | | I am delighted to report that Acambis is now a profitable company, recording a pre-tax profit of £9.6m for the year ended 31 December 2002. This major milestone for the Group is the result of the significant progress we have made on the US Government’s smallpox vaccine contracts. We produced the first doses of smallpox vaccine for the Government stockpile within just 10 months of being awarded the contract. Such a development and production timescale is unprecedented, and was made possible by |

the continued dedication and enthusiasm of all our employees.

Now that we are profitable, our goal is to sustain profitability. Our strategy to achieve this is outlined in the “Prospects” section of this report. Most critically, we are focusing our resources on significant near-term revenue-generating opportunities. As part of this, we are enhancing the commercial strength of the Group, including establishing a focused marketing capability, to complement

our already strong research, development and manufacturing functions.

With a good balance of short, medium and long-term projects and the right infrastructure and resources to capitalise on the opportunities available, we are in a good position to remain profitable.

ALAN SMITH

Chairman

2

We have around300employees

based at locations in the UK and the US

Acambis is one of the world’s leading vaccines companies and is recognised internationally as the foremost producer of smallpox vaccines. We have around 300 employees based at locations in the UK and the US who provide not only research and development expertise but also all the key disciplines that are essential to a successful vaccines business — clinical operations, regulatory affairs, quality control, quality assurance, development, manufacturing, sales and marketing.

Our two major contracts with the US Government have established us as the world leader in the field of smallpox vaccines. Under these contracts, which date from September 2000 and November 2001, we have developed a new, second-generation smallpox vaccine and are contributing to a stockpile of smallpox vaccine sufficient to provide a dose of vaccine for every man, woman and child in the US. The stockpile, intended for emergency use, gives the US the ability rapidly to protect its population against this terrible disease if smallpox virus were used as a bioterrorist weapon.

Other governments have also recognised the need to establish a stockpile of smallpox vaccine, and 10 have already placed orders with us for the vaccine. Unusually, this product is being sold to governments even while the clinical trials are being conducted. We plan to submit the vaccine to the regulators for licensure in 2004.

We have added to our smallpox vaccine two related products, Modified Vaccinia Ankara (“MVA”) for the immunocompromised and vaccinia immune globulin (“VIG”) for treatment of reactions to the vaccine, to create a smallpox vaccine franchise. Together, these three products represent those required by governments looking to protect all their citizens against the threat of smallpox virus being used as a bioterrorist weapon.

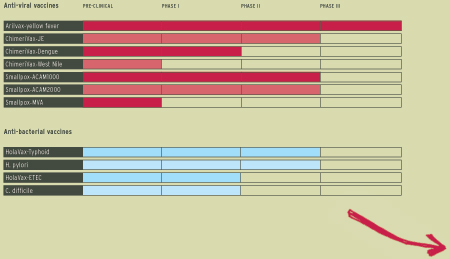

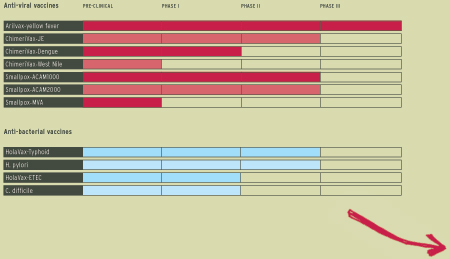

PRODUCTS IN CLINICAL DEVELOPMENT

Research and development

Our smallpox vaccine is just one product in a broad pipeline of vaccines that we are currently taking through clinical development. We have a total of nine anti-viral and anti-bacterial vaccines that are undergoing clinical trials. These vaccines either target diseases for which no vaccine currently exists or offer improvements over those vaccines currently available.

3

4

Clinical trials, quality control and the regulatory environment

When a new vaccine is developed, it needs to undergo rigorous testing to establish whether it is safe and how effective it is in generating the right response in the body’s natural immune system. As these products are intended for human use, the testing and licensure processes are highly regulated. It is critical to our success that we employ people with the right knowledge and experience to enable us to meet the requirements of the regulators. In recent times, both in response to the requirements of our smallpox vaccine project and as our other vaccines have progressed into latter stage clinical trials, we have increased our clinical operations and regulatory affairs teams, and also the quality assurance and quality control functions that oversee the processes and procedures involved in the development and manufacture of vaccines.

Control ofmanufacture

is critical to our success

Manufacturing

In the world of biological products such as vaccines, developing the manufacturing process is as important as the scientific research. Currently, there is a worldwide shortage of manufacturing capacity for biological products, which can impact timelines and product availability. Control of manufacture is, therefore, critical to our success.

We have been putting in place this strategically important manufacturing capability. We started to reactivate our US-based manufacturing facility early in 2001 and will complete the programme in 2003. Parts of the facility are already fully up and running, in particular the suites producing smallpox vaccine. Once complete, the facility will be capable of producing both anti-viral and anti-bacterial vaccines and will meet the manufacturing needs of many of our products. Recognising how critical this capability is to our business, we regularly review our requirements for manufacturing and the potential for expansion. For instance, we have recently started to put in place a small-scale manufacturing capability for our C. difficile project.

Our first product is being

submitted for licensure

in2003

Commercialisation

The next important step for us is to increase our ability to successfully commercialise the products we develop and manufacture. Historically, biotechnology companies have tended to out-license the rights to sell the products they develop to pharmaceutical companies in return for the pharmaceutical company funding the costs of development. For this, the biotechnology company typically received a small royalty on the sales. Acambis is in the fortunate position that we have the in-house capability and resources, including sufficient funds, to enable us to develop the products ourselves, thereby retaining greater value within the company. In some cases, we might look to partner a product if we believe a partner can target areas of the world or specific distribution channels more effectively than we can. In other areas, though, we are looking to establish our own sales teams and have recently put in place a sales and marketing function to manage this new stage in our development. With our first product being submitted for licensure in 2003, we are building on the significant strengths we have already established to turn Acambis from a development company into one that is capable of both developing and selling vaccines.

5

6

Smallpox vaccine sales made us a profitable company in 2002. This was principally driven by the major $428m (c.£270m) contract we have with the US Centers for Disease Control and Prevention (“CDC”), under which revenues are expected to be recognised between 2002 and 2005, with the majority (between $240m (c.£150m) and $280m (c.£175m) under United Kingdom generally accepted accounting principles) expected in 2003. This is an exceptional contract as it is of a size that is unlikely to be matched anywhere in the world for smallpox vaccine. The result is that shareholders can expect to see an exceptional spike in revenues and profits in 2003.

To grow revenues and profits from 2004 onwards, our focus is on maximising our near-term revenue-generating opportunities whilst maintaining a broad research and development (“R&D”) pipeline for the medium and longer term. We see four main value drivers for Acambis going forward:

1the opportunities surrounding our smallpox vaccine franchise which can generate additional revenues from 2003 onwards;

2the establishment of a travel vaccines franchise, initially in the US through the planned launch of Arilvax® in 2004 and followed by ChimeriVax-JE during 2006;

3near-term revenue-generating opportunities both from within our existing pipeline, such as ChimeriVax- West Nile, and new opportunities; and

4sustained long-term growth from the continued progression of products in our development pipeline.

We are already recognised as the world’s

leading producerof smallpox vaccine

| | | Smallpox vaccine franchise |

| | | We are already recognised as the world’s leading producer of smallpox vaccine through our contracts with the US and other governments and have been working to leverage this position by establishing a strong smallpox vaccine franchise. This will enable us to offer governments a portfolio of three related products required to protect their citizens against the threat of smallpox: |

| a) | | smallpox vaccine for the majority; |

| b) | | Modified Vaccinia Ankara (“MVA”) for the immunocompromised; and |

| c) | | vaccinia immune globulin (“VIG”), which is a treatment available for use in the rare event of severe reactions to the vaccine. |

| | | We see a number of additional opportunities for our smallpox vaccine. |

| | | The US Government’s strategy is to have a stockpile of smallpox vaccines for every member of the US population. |

That represents around 290 million doses. It is envisaged that Acambis will maintain the US stockpile through the replacement of expired doses, thereby providing a steady revenue stream to Acambis over the medium to long-term.

Following completion of the US Government orders to create the initial stockpile, we will be in a position to supply other governments. With a number of governments, we are seeing interest in agreeing “placeholder” orders that enable them to order a relatively small number of doses in the short-term to provide an instant emergency stockpile, with a view to placing additional, larger orders when supply and budgets allow. In addition to the US, we have signed contracts with 10 governments to date.

Day by day, the strength of our position in supplying governments increases both as additional production capability becomes available with the fulfilment of the US’s requirements and as new clinical data on the vaccine is produced from our clinical trial programme. Having already secured several contracts, we are aggressively pursuing further orders in conjunction with our marketing partner, Baxter.

7

8

We plan to submit our vaccine to both the US and European regulatory authorities in 2004. If approved, we would then have the world’s only licensed second-generation smallpox vaccine. This would strengthen our competitive position with governments and also open up the opportunity for sales to private individuals, for which we have seen considerable interest. The latter is another opportunity for us and we are currently exploring how best to maximise our position.

MVA

There is a proportion of the population that is more at risk of suffering adverse reactions to the smallpox vaccine because they have compromised immune system disorders such as HIV, eczema or other allergies. MVA is a more attenuated form of the current generation of smallpox vaccines and, as such, should reduce the risk of side effects in “at risk” people who would otherwise be unable to be vaccinated against smallpox. In addition to being used as a vaccine in its own right, MVA could also be used as a pre-vaccine to prime the immune systems of these “at risk” individuals ahead of receiving the regular vaccine.

We intend to tender for the contract to supply the US Government with 30 million doses of MVA for an emergency stockpile. This represents a significant opportunity for us and, as with the smallpox vaccine, we also intend to market MVA vaccine to other governments.

VIG

VIG can be used to treat adverse reactions that may arise as a result of vaccination against smallpox. It is produced by our partner, Cangene Corporation (“Cangene”), by vaccinating professional plasma donors with smallpox vaccine and collecting the antibodies they generate. Acambis has an exclusive marketing partnership with Cangene to sell Cangene’s VIG in markets outside North America and Israel.

Today, we are the only company with all three smallpox-related products. This puts us in a uniquely strong position for selling to governments around the world that are implementing bio-defence programmes.

Travel vaccines

The adult vaccine market, of which travel vaccines are a part, is expected to be one of the fastest-growing segments of the vaccines sector over the next decade. In many cases in this market, there is either no licensed vaccine available or, where a vaccine is already licensed, ours is differentiated by potential improvements in safety, efficacy or routes of administration. In the US, travel vaccines represent a strong market that is well served through travel clinics.

We are in the process of completing a paediatric trial on Arilvax®, a yellow fever vaccine to which we have US marketing rights, with results expected to be available in April 2003. We plan to submit a Biologics License Application to the US Food and Drug Administration around the middle of this year. If Arilvax® is approved, we can begin to establish a presence in this field and capitalise on it with the other travel vaccines in our development pipeline.

Our next travel vaccine is ChimeriVax-JE, which could be available during 2006. Process development and manufacturing scale-up for ChimeriVax-JE is almost complete

Today, we are the

only company

with all three smallpox-related products

and we will be conducting a bridging trial with this new material during 2003 to confirm that it produces clinical results equivalent to those seen with the material used in previous trials. We plan to begin the Phase III trial in the first quarter of 2004.

The other travel vaccines we have in development would follow thereafter. These include oral vaccines against typhoid fever and travellers’ diarrhoea caused by enterotoxigenic E. coli (“ETEC”). A bridging study will be carried out for HolaVax-Typhoid during 2003, and a challenge study of HolaVax-ETEC is underway.

Other near-term revenue-generating opportunities

We are also focusing on near-term revenue-generating opportunities, both those within our existing portfolio and also some new opportunities.

Internally, we are already directing significant resources to our programme to develop a vaccine against West Nile virus. This virus has become a major problem since it arrived in the US in 1999. In 2002, the virus spread to a total of 41 US States, where 3,873 cases of West Nile infection were diagnosed and there were 246 deaths. We have been developing a vaccine for three years and, in the first half of this year, we plan to become the first company to take a West Nile vaccine into human clinical trials. Results from these trials should be available in the second half of this year. The scale of this problem and the need to provide an effective counter-measure means that there is considerable demand to make available a safe, efficacious vaccine as quickly as possible. This level of demand and the impetus for rapid progression of the vaccine’s development have encouraged us to take steps to accelerate the clinical testing and manufacture of the vaccine.

We are also actively exploring other revenue-generating opportunities that could contribute to near-term revenue and profits growth. We are focusing our efforts on opportunities that complement our areas of expertise and strategic focus.

R&D pipeline

Sustained growth of the Company in the medium to long-term will come from the new opportunities offered by our broad R&D pipeline of products. In addition to those referred to above, we continue to progress our dengue project with our partner Aventis Pasteur, and our H. pylori and C. difficile programmes. We also have a number of other opportunities currently at the research stage that could contribute to our strong development pipeline.

Altogether, this adds up to a significant number of opportunities that we are currently pursuing, any of which can make an important contribution to our plans for continuing as a profitable company and achieving growth in revenues and profits from the 2004 baseline onwards. These are exciting times for Acambis. Having established firm foundations in the elements of our business that we consider to be key to our success, we are ideally placed to exploit the opportunities before us and maximise the value we generate for shareholders.

9

| | | |

| | | |

| THE MANAGEMENT TEAM | | 10 |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | BOARD OF DIRECTORS | |

| | |  |

| | | Executive Directors

1 Gordon Cameron,Chief

Financial Officer and President of

Acambis Inc. |

| | | 2 Nicolas Higgins,Chief Business

Officer |

| | | 3 Dr Thomas Monath,Chief

Scientific Officer |

| | | 4 Dr John Brown,Chief Executive

Officer |

| | | |

| | | |

| | | |

AS WE OUTLINED IN THE “PROSPECTS” SECTION OF THIS REPORT, WE HAVE AMBITIOUS PLANS FOR THE CONTINUED GROWTH OF ACAMBIS. TO ENSURE THAT WE CAN ACHIEVE OUR OBJECTIVES, A STRONG INFRASTRUCTURE NEEDS TO EXIST, INCLUDING A BALANCED BOARD OF DIRECTORS, A HIGH-QUALITY, EXPERIENCED SENIOR MANAGEMENT TEAM, ROBUST CORPORATE GOVERNANCE STRUCTURES AND A COMMITMENT TO OUR CORPORATE SOCIAL RESPONSIBILITIES.

Board of Directors

During the last year, we continued to enhance our Board of Directors with the appointment of Dr Thomas Monath, our Chief Scientific Officer, to the Board. Today, we have four Executive Directors and four Non-executive Directors. We are seeking to strengthen the Non-executive Director representation on the Board.

During the year, we promoted Elizabeth Brown to the role of Company Secretary, who took over the role from our Chief Financial Officer, Gordon Cameron. This change was to give greater independence to the role by assigning it to an individual who does not also hold a position on the Board. Miss Brown has been with Acambis since 1996 and also heads up the UK finance function.

Senior management

During the last two years, we have strengthened the senior management team through a number of appointments and promotions:

| • | | Clinical Operations and Regulatory Affairs:Dr Philip Bedford, who has been with Acambis since 1997, was promoted to Senior Vice President, Clinical Operations and Regulatory Affairs, reflecting the increasing importance of this team. |

| • | | Commercial:Stephen Atkinson was promoted to Vice President, Commercial Development in March 2002. He has been with Acambis since 1993. |

| • | | Government contracts:Roger McAvoy (previously Chief of the Acquisition Law Division at the Electronic Systems Center of the US Air Force Material Command) joined in 2001 as Vice President, Government Contracts and Legal Affairs. |

| • | | Manufacturing:Dr Joe Caldwell joined us in 2002 as our Senior Vice President, Operations, with responsibility for manufacturing. He was previously Managing Director of UK-based manufacturer Evans Vaccines and worked for GlaxoSmithKline for 25 years. |

| • | | Marketing:In November 2002, Dr Christian Loucq, who has previously worked with European vaccines company Rhein Biotech, and the predecessors to GlaxoSmithKline and Aventis Pasteur, joined as Vice President, Sales & Marketing to establish that function. |

| • | | Research:Dr Mike Darsley was promoted to Vice President, Bacterial Research. He joined Acambis in 1996. Dr Dennis Trent (previously Principal Scientist at Aventis Pasteur) was recruited as Vice President, Viral Research. |

Corporate social responsibility

The issue of corporate social responsibility (“CSR”) has continued to increase in importance and the Board recognises this as a significant issue for the Group to address. We believe that we are already strong in a number of key areas relating to CSR, including:

| • | | transparency and accountability in our communication with shareholders; |

| • | | equal and fair treatment of our employees; |

| • | | rigorous implementation of health and safety policies and working practices; |

| • | | involvement in both our industry and the communities in which our operations are based; and |

| • | | responsible management of our impact on the environment. |

| | | Work is underway, and will continue during 2003, to assess our current position, to formalise the relevant policies, structures and procedures, and to initiate a system of reporting to shareholders our activities. We anticipate being able to provide our first report on CSR in our 2003 Annual Report. |

| | | | | |

| Non-executive Directors |

| |

| 1 | | Alan Smith,Chairman |

| | 2 | | Alan Dalby,Non-executive Director |

| | 3 | | Michael Lytton,Non-executive Director |

| | 4 | | Victor Schmitt,Non-executive Director |

| |

| |  |

11

OPERATING REVIEW

Smallpox vaccine update

US Government contracts

We have two contracts with the US Centers for Disease Control and Prevention (“CDC”). Contract 1 dates from September 2000 and relates to the ACAM1000 smallpox vaccine. Contract 2 dates from November 2001 and relates to the ACAM2000 smallpox vaccine. Under these contracts, we have strict confidentiality obligations that limit our ability to give details on the status, quantity or timing of delivery of smallpox vaccine. We are, however, delighted to be able to report that we are well on course to complete delivery of 155 million doses of ACAM2000 smallpox vaccine to the CDC in the first half of 2003. In addition, the ACAM1000 programme is proceeding in line with the CDC’s expectations and requirements.

Other government contracts

We have the world’s most advanced second-generation smallpox vaccines. Marketing of ACAM2000 to governments around the world is being carried out in conjunction with our strategic partner and major shareholder, Baxter Healthcare Corporation (“Baxter”). We have seen considerable interest among governments, and have 10 contracts in place to date in addition to the US Government contract. Of these, six are with European governments. These are small in comparison with the US contracts. They are expected to have a positive impact on earnings in 2003.

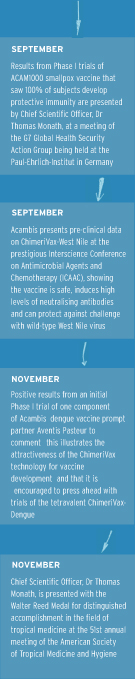

ACAM2000 trial results

On 11 March 2003, we published results from a Phase I trial of ACAM2000. The trial tested the safety, tolerability and immunogenicity of ACAM2000 in adult subjects who had not previously been inoculated against smallpox. All 100 subjects in the open-label trial were vaccinated with ACAM2000.

The currently accepted indication of protective immunogenicity in the case of smallpox vaccination is the development of a pock-mark on the skin, known as a “take”. This was the primary endpoint of the trial. A “take” was seen in 99% of the subjects. A secondary endpoint was the development of a neutralising antibody response, which occurred in 96% of subjects. No vaccine-associated serious adverse events were observed. Under our fast-track development programme, Phase II trials of ACAM2000 are

| | | | | |

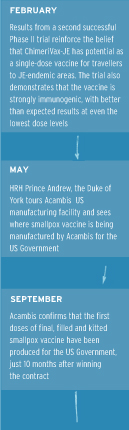

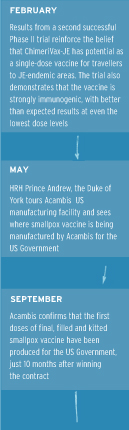

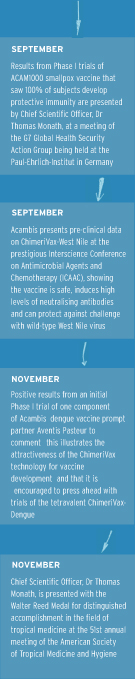

| 2002 HIGHLIGHTS | 12 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |  |

already well underway and we anticipate that the Phase III trials will begin later this year.

MVA

As announced on 25 February 2003, we have been awarded a $9.2m contract by the US National Institute of Allergy and Infectious Diseases, to develop a Modified Vaccinia Ankara (“MVA”) vaccine. MVA is a weakened form of the current generation of smallpox vaccines and, as such, should allow the safe inoculation of “at risk” people with weakened immune systems, who would otherwise be unable to be vaccinated against smallpox.

For this contract, Acambis is acting as the prime contractor and Baxter is our subcontractor, enabling us to leverage each other’s strengths and capabilities. Under this initial contract, we will develop the vaccine, manufacture several thousand doses and conduct a Phase I clinical trial in healthy adults.

The US Government has also declared its intention to issue a “Request for Proposals” for a stockpile of 30 million doses of MVA later this year. Given our experience in delivering large quantities of vaccine to the US Government in a short period of time and having won one of the two initial contracts awarded, we are well placed to bid for this potentially valuable supply contract.

VIG

We announced on 11 March 2003 that Acambis has entered into an exclusive marketing partnership with Cangene Corporation (“Cangene”) to market its vaccinia immune globulin (“VIG”) product in markets outside North America and Israel. We will work together to make the product available to other countries. Cangene is currently supplying VIG under contract to the CDC.

VIG is used in treating severe reactions that may be brought on by the administration of smallpox vaccine. VIG is an antibody product manufactured from human plasma collected from individuals who have been vaccinated with a smallpox vaccine. Cangene is conducting clinical trials in order to obtain US Food and Drug Administration (“FDA”) licensure of the product.

Research and development update

Arilvax®

We are in the process of completing a paediatric trial in Peru on Arilvax® , a yellow fever vaccine, with results expected to be available in April. A Biologics License Application will be submitted to the FDA around the middle of this year.

ChimeriVax-JE

A second Phase II trial of our ChimeriVax-JE vaccine against Japanese encephalitis was successfully completed during the year. It showed that ChimeriVax-JE was well tolerated at all the dose levels tested and that 98% of subjects developed JE-neutralising antibodies within one month of vaccination. We have almost completed process development and manufacturing scale-up of the vaccine and will be conducting bridging trials with this new material during 2003 to confirm that it produces clinical results equivalent to those seen in trials using the original material. We plan to begin Phase III trials in the first quarter of 2004.

ChimeriVax-Dengue

We announced results from a successful initial Phase I trial of one of the four components (ChimeriVax-DEN2) that make up our ChimeriVax-Dengue vaccine against dengue fever. The 56-subject trial showed that ChimeriVax-DEN2 was well-tolerated at both of the dose levels tested, 100% of subjects developed neutralising antibodies to the homologous Dengue 2 virus serotype within one month of vaccination and 96% developed neutralising antibodies to a wild-type Dengue 2 virus. There were no serious adverse events. A Phase I trial of our tetravalent (four-component) ChimeriVax-Dengue vaccine will be undertaken in 2003.

ChimeriVax-West Nile

Data from pre-clinical trials of ChimeriVax-West Nile, our vaccine against West Nile virus, showed that the vaccine was safe and induced high levels of neutralising antibodies and demonstrated the ability of ChimeriVax-West Nile to protect against challenge with wild-type West Nile virus. A Phase I trial of our vaccine candidate will start in the first half of 2003, with results expected to be available in the second half of the year.HolaVax-Typhoid

Process development and manufacturing of our oral typhoid vaccine by our partners, Berna Biotech, is nearing completion and a clinical bridging trial will begin in the first half of 2003.

HolaVax-ETEC

A proof-of-principle challenge study is underway to test the effectiveness of the first of the five components of our HolaVax-ETEC vaccine against E. coli-related travellers’ diarrhoea in protecting vaccinated volunteer subjects when exposed to wild-type ETEC. The first of a series of Phase I trials to test the other four strains in our pentavalent vaccine began early in 2003.

H. pylori

Additional trials completed towards the end of 2002 put us in a position to identify the optimal vaccine candidate to take into further clinical development.

C. difficile

We are exploring two different products to prevent and/or treat C. difficile-associated diarrhoea. The passive treatment and active prophylactic vaccine both make use of a toxoid vaccine comprising inactivated C. difficile toxins. In a trial for the passive treatment, a lower level of antibody generation was seen than had been expected, resulting, we discovered, from the toxoid vaccine having lost some of its potency. We decided not to proceed further with the trial, but are now aggressively pursuing manufacture of new toxoid vaccine. We expect to return to clinical trials around the end of 2003.

DR JOHN BROWN

Chief Executive Officer

| | | | | |

|  | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | 13 |

| |

| | | |

(5a)

(5c)

(5d) | | Trading results

Revenue for the year increased significantly to £79.7m (2001 — £8.9m) and arose primarily from the two ongoing smallpox vaccine contracts with the CDC. Activity on these two contracts increased sharply in 2002 as we undertook manufacture of smallpox vaccine for the US Government stockpile. During the year, we also continued to receive revenues from Aventis Pasteur for our ChimeriVax-Dengue vaccine programme. |

| | | |

| | | 2002 saw a new category on the face of the profit and loss account for cost of sales, representing costs incurred on the two CDC contracts. Cost of sales in 2002 increased sharply to £49.2m (2001 — £5.1m) in line with the increased activity. The re-classification of 2001 costs from research and development (“R&D”) costs to cost of sales, which was made to reflect better the nature of the agreements with the CDC, amounted to £5.1m. |

| | | |

| | | Expenditure on R&D increased to £16.3m (2001 — £12.6m). During 2002, we expensed certain one-off start-up costs in relation to the reactivation of our manufacturing plant. In future periods, we anticipate that all costs relating to the manufacturing plant will be classified within cost of sales when the plant is fully utilised for production activities. In addition, expenditure on our internally funded projects increased marginally during the year as the products within our pipeline progressed through clinical development. |

| | | |

| | | In 2002, we received the first income from Baxter under the contract manufacturing agreement entered into between us in December 2000. £1.3m was received as a contribution to our commissioning costs incurred in activating our manufacturing facility. This income has been netted off against R&D costs. |

| | | |

| | | Administrative costs, including amortisation of goodwill, increased to £4.3m (2001 — £3.5m), reflecting increased headcount compared to 2001. Interest receivable reduced marginally to £0.7m (2001 — £0.9m) as a result of lower average levels of cash held throughout the period. Interest payable increased significantly to £1.2m (2001 — £0.2m) as a result of the lease-financing facility secured in December 2001 for the reactivation of our manufacturing plant. Under the terms of the agreement, interest on this |

| | | | | |

| | 14 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Revenue | |

| Revenue in 2002 increased by over 800% to £79.7m when comparing to the 2001 level of £8.9m. This sharp increase was as a result of the activity under both of the smallpox vaccine contracts with the CDC. | |

| |

| SOURCES OF REVENUE | |

|  | |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

facility was accrued during 2002. Repayment of interest will commence in 2003. During 2002, an exchange gain of £0.4m (2001 — loss of £0.1m) was recorded as a result of the revaluation of the amounts outstanding under our US dollar-denominated debt facility for our Arilvax® programme.

In accordance with Financial Reporting Standard 11, “Impairment of Fixed Assets and Goodwill”, in 2002 we recorded an exceptional loss of £0.1m (2001 — £0.4m) in respect of the impairment write-down of the investment held in Medivir AB. At 31 December 2002, the book value of the investment was £0.3m (2001 — £0.4m).

The pre-tax profit for 2002 was £9.6m (2001 — loss of £12.6m), the improvement achieved primarily as a result of increased revenues under our smallpox vaccine programmes.

The tax charge relating to 2002 was negligible due to the availability of tax losses within the Group. During 2003, we hope that we may be able to utilise the remaining brought-forward losses, lowering the effective tax rate.

Capital expenditure

Fixed asset additions for 2002 increased to £ 11.5m (2001 — £8.4m). £9.1m of the expenditure in 2002 related to the investment made to reactivate our manufacturing plant. This process was substantially complete at the end of 2002 and we therefore anticipate capital expenditure levels to be lower in 2003.

Balance sheet highlights

Cash/debtors

The cash balance of the Group (including short-term investments) at 31 December 2002 amounted to £11.8m (2001 — £22.2m). We received two significant payments two days after the year-end which, had they been received two days earlier, would have boosted the cash position significantly. These large post year-end receipts are reflected in the large debtors balance at 31 December 2002 of £59.0m (2001 — £13.8m). The decrease in cash over 2001 is a result of the major working capital requirements arising from the ACAM2000 CDC contract.

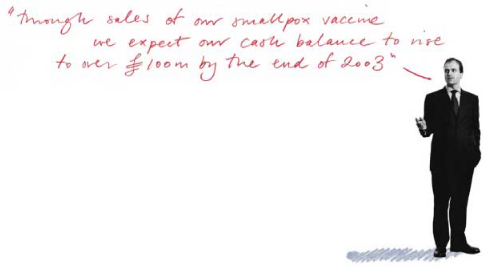

In June 2002, the third instalment of £7.0m in respect of its equity subscription was received from Baxter International, Inc., giving it a shareholding at that time of 16.9%. The final subscription of a further £7.0m was made on 27 March 2003, and has increased Baxter’s shareholding to 20.6%. We anticipate that the cash balance will rise significantly over the coming months as the proceeds from the CDC contracts increase and accelerate. We expect to have over £100m in cash by the end of the year.

Stock/creditors: amounts falling due within one year

Stock held at 31 December 2002 amounted to £48.3m (2001 — £nil). This balance principally represents work-in-progress and finished goods in relation to work being carried out under the ACAM2000 CDC contract. Payments for certain stock items do not take place until after delivery of the vaccine stocks to the US Government. This results in a substantial increase in trade creditors, included within the total Creditors: amounts falling due within one year, of £88.5m (2001 — £16.6m). The levels of both stock and trade creditors will reduce during the first half of 2003 as we complete deliveries of smallpox vaccine.Our adopted method for recognising revenue under the ACAM2000 contract with the CDC, the percentage of cost-to-completion method, continues to give rise to a significant difference between invoices submitted and amounts recognised as revenue. At the year-end, the amount recorded as deferred income (included within the total creditors number above) under the contract was around £21.1m (2001 — £3.9m).

Lease financing and overdraft facilities

During 2002, we did not make any drawdowns from the lease-financing facility secured via Baxter in December 2001 for the reactivation of our manufacturing plant. The balance on the facility at 31 December 2002 was £14.0m (2001 — £14.3m). During 2002, interest accrued on the facility was rolled into the outstanding balance. Interest accruing on the facility during 2003 will be repaid from cash. The balance on the Arilvax® overdraft facility at 31 December 2002 was £4.3m (2001 — £4.8m).

Employees

At 31 December 2002, Group headcount had increased to 291 (2001 — 178). The significant increase seen in 2002 was as a result of putting the appropriate level of resources in place at our manufacturing plant in making it a fully operational facility, and the need for further support within the clinical, quality and regulatory functions to manage the number of clinical trials now being performed by the Group. We anticipate that there will be some additional growth in employee numbers in each of the above areas during 2003 and Group headcount is expected to reach around 325 by the end of the year.

GORDON CAMERON

Chief Financial Officer

| | | | | |

| | |

| |

| Pre-tax profit | |

| The financial results for 2002 marked a turning point for Acambis with the announcement of our maiden pre-tax profit of £9.6m. This was principally as a result of the activity level seen on the second smallpox vaccine contract that we have with the CDC. The $428m (c.£270m) contract contributed almost $90m (c.£55m) to Acambis’ revenue in 2002. |

| |

| |

| Key financial indicators | |

| | | | | | | | | | |

| | | 2002 | | 2001 | |

| |

| |

| | Revenue | | £79.7m | | | £8.9m | |

| | Profit/(loss)

before tax | | £9.6m | | | £(12.6)m | |

| | Earnings/(loss) per

share – basic | | 10.0p | | | (13.7)p | |

| | Earnings/(loss) per

ADR – basic | | $ | 1.61 | | | $ | (1.99) | |

| | Operating cash outflow | | £(6.2)m | | | £(8.0)m | |

| | Cash at end of period (including short- term investments) | | £11.8m | | | £22.2m | |

| |

| | Although we reported our maiden pre-tax profit in 2002, operating cashflow was still negative in the year. This was as a result of the major working capital requirement under the second smallpox vaccine contract with the CDC. | |

| |

| | We expect that our cash balance at the end of 2003 will be over £100m. | |

15

| (17a) | | DIRECTORS’ RESPONSIBILITIES |

Financial statements, including adoption of going concern basis

Company law requires the Directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the Company and the Group and of the profit or loss of the Group for that period.

After making enquiries, the Directors have a reasonable expectation that the Company and the Group have adequate resources to continue in operational existence for the foreseeable future. For this reason, they continue to adopt the going concern basis in preparing the financial statements.

In preparing the financial statements, the Directors are required to:

| • | | select suitable accounting policies and then apply them consistently; |

| • | | make judgments and estimates that are reasonable and prudent; |

| • | | state whether applicable accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements; and |

| • | | prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Group will continue in business. |

The Directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the Company and the Group and enable them to ensure that the financial statements comply with the Companies Act 1985. They are also responsible for safeguarding the assets of the Company and the Group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity of the Group’s website. Uncertainty regarding legal requirements is compounded as information published on the internet is accessible in many countries with different legal requirements relating to the preparation and dissemination of financial statements.

| (17b) | | INDEPENDENT AUDITORS’ REPORT TO THE MEMBERS OF ACAMBIS PLC DIRECTORS’ RESPONSIBILITIES |

We have audited the financial statements which comprise the Group profit and loss account, the Group and Company balance sheets, the Group cash flow statement, the Group statement of total recognised gains and losses and the related notes numbered 1 to 29. We have also audited the disclosures required by Part 3 of Schedule 7A to the Companies Act 1985 contained in the Directors’ remuneration report (“the auditable part”).

Respective responsibilities of Directors and auditors

The Directors’ responsibilities for preparing the annual report, the Directors’ remuneration report and the financial statements in accordance with applicable United Kingdom law and accounting standards are set out in the statement of Directors’ responsibilities.

Our responsibility is to audit the financial statements and the auditable part of the Directors’ remuneration report in accordance with relevant legal and regulatory requirements, United Kingdom Auditing Standards issued by the Auditing Practices Board and United States Auditing Standards.

We report to you our opinion as to whether the financial statements give a true and fair view and whether the financial statements and the auditable part of the Directors’ remuneration report have been properly prepared in accordance with the Companies Act 1985. We also report to you if, in our opinion, the Directors’ report is not consistent with the financial statements, if the Group has not kept proper accounting records, if we have not received all the information and explanations we require for our audit, or if information specified by law regarding Directors’ remuneration and transactions is not disclosed.

We read the other information contained in the annual report and consider the implications for our report if we become aware of any apparent misstatements or material inconsistencies with the financial statements. The other information comprises only the sections entitled “Our business” (encompassing the chairman’s statement, the operating review and the financial review), “Further information required by Form 20-F”, “Summarised Group statements”, “Shareholder information”, “Board of Directors” and “General information” as well as the unaudited comments in the right margin adjacent to the financial statements, the Directors’ report, the unaudited part of the Directors’ remuneration report and the corporate governance statement.

We review whether the corporate governance statement reflects the Group’s compliance with the seven provisions of the Combined Code specified for our review by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the Board’s statements on internal control cover all risks and controls, or to form an opinion on the effectiveness of the Group’s corporate governance procedures or its risk and control procedures.

| | | | | |

| 16 |

| |

| |

| In this section of the report, this margin is being used to highlight key information or to explain aspects of the financial data. |

| |

| |

| |

| (A) | COMMENTARY |

| |

| The item that is referred to is indicated with the symbol shown on the left. Please note that the information contained in this column has not been audited, but is consistent with other information in the document that has been audited. |

| |

| |

| FORM 20-F |

| |

| Our principal listing is on the London Stock Exchange, but our shares are also quoted on the Nasdaq National Market as American Depository Receipts and we have a number of US shareholders. US-domestic companies file their annual business overview with their regulator, the US Securities and Exchange Commission, under a Form 10-K. A foreign issuer, such as Acambis, files its equivalent document under a Form 20-F. Since much of the information required in a Form 20-F is already contained in our Annual Report, we have combined the two documents and included a section that incorporates any additional information required over and above that provided in the Annual Report. |

| |

| | |

| |

| (1a) | For those US shareholders who are used to reading a Form 20-F, we have added a fold-out flap inside the back cover of the document that provides a cross-reference of Form 20-F items to the information in the Report. We have denoted this Form 20-F information by using this symbol on the left where the number denotes the specific item on the cross-reference. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THE INFORMATION CONTAINED IN THIS

COLUMN HAS NOT BEEN AUDITED. |

| |

| |

Basis of audit opinion

We conducted our audit in accordance with United Kingdom Auditing Standards issued by the Auditing Practices Board, and with generally accepted auditing standards in the United States. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements and the auditable part of the directors’ remuneration report. It also includes an assessment of the significant estimates and judgments made by the Directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the Group’s circumstances, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with sufficient evidence to give reasonable assurance that the financial statements and the auditable part of the Directors’ remuneration report are free from material misstatement, whether caused by fraud or other irregularity or error. In forming our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements.

Opinion

In our opinion:

| • | | the financial statements give a true and fair view of the state of affairs of the Company and the Group at 31 December 2002 and of the profit and cash flows of the Group for the year then ended; |

| • | | the financial statements have been properly prepared in accordance with the Companies Act 1985; |

| • | | those parts of the Directors’ remuneration report required prepared in accordance with the by Part 3 of Schedule 7A to the Companies Act 1985; and |

| • | | the consolidated financial statements present fairly, in all material respects, the financial position of Acambis plc and its subsidiaries at 31 December 2002, and the results of their operations and their cash flows for the year then ended in conformity with accounting principles generally accepted in the United Kingdom. |

The financial statements of Acambis plc as of 31 December 2001, and for each of the two years in the period ended 31 December 2001, were audited by other independent accountants who have ceased operations. Those independent accountants expressed an unqualified opinion on those financial statements in their report dated 15 April 2002.

Reconciliation to US GAAP

Accounting principles generally accepted in the United Kingdom vary in certain important respects from accounting principles generally accepted in the United States of America. The application of the latter would have affected the determination of consolidated net income for each of the three years in the period ended 31 December 2002 and the determination of consolidated shareholders’ equity at 31 December 2002 and 2001 to the extent summarised in note 29 to the consolidated financial statements.

PricewaterhouseCoopers LLP

Chartered Accountants and Registered Auditors

Abacus House

Castle Park

Cambridge CB3 0AN

UK

27 March 2003

| (17c) | | GROUP PROFIT AND LOSS ACCOUNT |

| | | | | | | | | | | | | | | | | | |

| | |

|

| | | | | | | | | | | 2001 | | 2000 |

| | | | | | | 2002 | | (restated) | | (restated) |

| (A) | | | Notes | £’000 | | £’000 | | £’000 |

| |

|

| (B) | Turnover | | | 2 | | | | 79,716 | | | | 8,914 | | | | 6,264 | |

| (A) | Cost of sales | | | | | | | (49,249 | ) | | | (5,063 | ) | | | (517 | ) |

| |

|

| | Gross profit | | | | | | | 30,467 | | | | 3,851 | | | | 5,747 | |

| | Research and development costs | | | | | | | (16,299 | ) | | | (12,594 | ) | | | (12,195 | ) |

| | Administrative costs (including amortisation of goodwill) | | | 3 | | | | (4,257 | ) | | | (3,499 | ) | | | (2,949 | ) |

| |

|

| | Group operating profit/(loss) | | | 4 | | | | 9,911 | | | | (12,242 | ) | | | (9,397 | ) |

| | Share of loss of joint venture | | | 14(d | ) | | | (171 | ) | | | (410 | ) | | | (2,138 | ) |

| |

|

| | Total operating profit/(loss) before exceptional items (Group and joint venture) | | | | | | | 9,740 | | | | (12,652 | ) | | | (11,535 | ) |

| | Exceptional items: | | | | | | | | | | | | | | | | |

| | Profit on disposal of fixed asset investment | | | | | | | – | | | | – | | | | 221 | |

| | Profit on sale of discontinued operations | | | | | | | – | | | | – | | | | 414 | |

| | Amounts written off fixed asset investment | | | 5 | | | | (85 | ) | | | (423 | ) | | | (670 | ) |

| |

|

| | Profit/(loss) on ordinary activities before finance charges | | | | | | | 9,655 | | | | (13,075 | ) | | | (11,570 | ) |

| |

|

| | Interest receivable | | | | | | | 685 | | | | 857 | | | | 983 | |

| | Interest payable and similar charges | | | 6 | | | | (1,211 | ) | | | (214 | ) | | | (216 | ) |

| | Exchange gain/(loss) on foreign currency borrowings | | | 18 | | | | 449 | | | | (126 | ) | | | (271 | ) |

| |

|

| (B) | Profit/(loss) on ordinary activities before taxation | | | 7 | | | | 9,578 | | | | (12,558 | ) | | | (11,074 | ) |

| |

|

| (C) | Taxation | | | 10 | | | | (3 | ) | | | 131 | | | | – | |

| |

|

| | Profit/(loss) on ordinary activities after taxation (being retained profit/(loss) for the financial year) | | | | | | | 9,575 | | | | (12,427 | ) | | | (11,074 | ) |

| |

|

| | Earnings/(loss) per ordinary share (basic) | | | 11 | | | | 10.0 | p | | | (13.7 | )p | | | (13.9 | )p |

| | Earnings/(loss) per ordinary share (fully diluted) | | | 11 | | | | 9.7 | p | | | (13.7 | )p | | | (13.9 | )p |

| |

|

| | | A statement of movements on reserves is given in note 22.

The accompanying notes are an integral part of this Group profit and loss account.

All amounts in 2002 arise from continuing operations (see note 4). |

(17d)

| | GROUP STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 31 December |

| | | | | | | | | | | | | |

| | |

|

| | 2002 | | 2001 | | 2000 |

| | £’000 | | £’000 | | £’000 |

|

| Profit/(loss) for the year | | | 9,575 | | | | (12,427 | ) | | | (11,074 | ) |

| Gain/(loss) on foreign currency translation | | | 1,276 | | | | (314 | ) | | | (817 | ) |

|

| Total recognised gains and losses for the year | | | 10,851 | | | | (12,741 | ) | | | (11,891 | ) |

|

| | | The accompanying notes are an integral part of this Group statement of total recognised gains and losses. |

| | | | | |

| 18 |

| |

| |

| (A) | Cost of sales — restatement |

| The Group has begun to classify the costs directly attributable to funded research and vaccine manufacture programmes as cost of sales, rather than research and development expenditure. This is because the Directors believe this classification more appropriately reflects the nature of the arrangements into which the Group has entered. In the three financial years shown, cost of sales represent only those costs incurred on the two CDC smallpox vaccine contracts. The restatement of 2001 and 2000 costs from R&D costs to cost of sales amounted to £5.1m and £0.1m respectively. There is no impact on net profit. |

| |

| (B) | Turnover and profit |

| The increase in turnover and the recording of a maiden profit in 2002 has principally been driven by the second smallpox vaccine contract with the US Government agency, the Centers for Disease Control and Prevention (“CDC”). |

| |

| (C) | | Taxation |

| The tax charge relating to 2002 was negligible due to the availability of tax losses within the Group. We hope that when the remaining tax losses can be utilised, this will have the effect of lowering the effective tax rate. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THE INFORMATION CONTAINED IN THIS COLUMN HAS NOT BEEN AUDITED. |

| |

| (17e | ) | GROUP BALANCE SHEET

At 31 December |

| | | | | | | | | | | | | | |

| | | |

| |

| | | | | | | | 2002 | | | 2001 | |

| | | | Notes | | | £'000 | | | £'000 | |

| |

|

| | Fixed assets | | | | | | | | | | | | |

| | Intangible assets: goodwill | | | 12 | | | | 13,641 | | | | 14,845 | |

| | Tangible assets | | | 13 | | | | 19,988 | | | | 12,255 | |

| | Investment in joint ventures: | | | 14 | | | | | | | | | |

| | — share of gross assets | | | | | | | – | | | | 915 | |

| | — share of gross liabilities | | | | | | | – | | | | (848 | ) |

| |

|

| | | | | | | | | – | | | | 67 | |

| | Other investments | | | 14 | | | | 1,100 | | | | 1,640 | |

| |

|

| | | | | | | | | 34,729 | | | | 28,807 | |

| |

|

| | Current assets | | | | | | | | | | | | |

(D) | Stock | | | 15 | | | | 48,343 | | | | – | |

(E) | Debtors: amounts receivable within one year | | | 16 | | | | 54,040 | | | | 7,542 | |

| | Debtors: amounts receivable after one year | | | 17 | | | | 4,925 | | | | 6,235 | |

| | Short-term investments | | | | | | | 105 | | | | 120 | |

(F) | Cash at bank and in hand | | | | | | | 11,672 | | | | 22,093 | |

| |

|

| | | | | | | | | 119,085 | | | | 35,990 | |

| |

|

(G) | Creditors: amounts falling due within one year | | | 18 | | | | (88,460 | ) | | | (16,603 | ) |

| |

|

| | Net current assets | | | | | | | 30,625 | | | | 19,387 | |

| |

|

| | Total assets less current liabilities | | | | | | | 65,354 | | | | 48,194 | |

| | Creditors: amounts falling due after one year | | | 19 | | | | (18,897 | ) | | | (20,534 | ) |

| | Provisions for liabilities and charges | | | | | | | | | | | | |

| | Investment in joint ventures: | | | 14 | (d) | | | | | | | | |

| | — share of assets | | | | | | | 941 | | | | – | |

| | — share of liabilities | | | | | | | (1,147 | ) | | | – | |

| |

|

| | | | | | | | | (206 | ) | | | – | |

| |

|

| | Net assets | | | | | | | 46,251 | | | | 27,660 | |

| |

|

| | Capital and reserves | | | | | | | | | | | | |

| | Called-up share capital | | | 21 | | | | 9,901 | | | | 9,308 | |

| | Share premium account | | | 22 | | | | 87,745 | | | | 80,598 | |

| | Profit and loss account | | | 22 | | | | (51,395 | ) | | | (62,246 | ) |

| |

|

| | Shareholders’ funds — all equity | | | 23 | | | | 46,251 | | | | 27,660 | |

| |

|

| | | The accompanying notes are an integral part of this Group balance sheet. |

| |

| (D) | Stock

2002 is the first year that Acambis has recognised stock on the balance sheet. This largely reflects work-in-progress and finished goods under the second CDC smallpox vaccine contract.

|

|

| (E) | Debtors: amounts receivable within one year

This includes amounts invoiced but not received at the year-end of £46.1m, principally from the CDC.

|

| (F) | Cash at bank and in hand

Cash at the year-end was £11.7m. We received two significant payments two days after the year-end which, had they been received two days earlier, would have increased the cash position significantly. These large post year-end receipts are reflected in the large debtors balance at 31 December 2002 of £59.0m.

We expect to have over £100m in cash by the end of 2003.

|

| (G) | Creditors: amounts falling due within one year

The increase in trade creditors and deferred revenue has arisen principally from the second CDC smallpox vaccine contract.

|

| | |

| | THE INFORMATION CONTAINED IN THIS COLUMN HAS NOT BEEN AUDITED. | 19 |

| (17f | ) | COMPANY BALANCE SHEET |

| (A) | | At 31 December |

| | | | | | | | | | | | | |

| | |

| |

| | | | | | | 2002 | | | 2001 | |

| | | Notes | | | £’000 | | | £'000 | |

|

| Fixed assets | | | | | | | | | | | | |

| Investments | | | 14 | | | | 15,131 | | | | 15,586 | |

|

| Current assets | | | | | | | | | | | | |

| Debtors: amounts receivable within one year | | | 16 | | | | 589 | | | | 70 | |

| Debtors: amounts receivable after one year | | | 17 | | | | 71,643 | | | | 60,170 | |

| Short-term investments | | | | | | | - | | | | – | |

| Cash at bank and in hand | | | | | | | 12,217 | | | | 18,884 | |

|

| | | | | | | | 84,449 | | | | 79,124 | |

Creditors: amounts falling due within one year | | | 18 | | | | (429 | ) | | | (219 | ) |

|

| Net current assets | | | | | | | 84,020 | | | | 78,905 | |

|

| Total assets less current liabilities | | | | | | | 99,151 | | | | 94,491 | |

|

| Net assets | | | | | | | 99,151 | | | | 94,491 | |

|

| Capital and reserves | | | | | | | | | | | | |

| Called-up share capital | | | 21 | | | | 9,901 | | | | 9,308 | |

| Share premium account | | | 22 | | | | 87,611 | | | | 80,464 | |

| Profit and loss account | | | 22 | | | | 1,639 | | | | 4,719 | |

|

| Shareholders’ funds — all equity | | | | | | | 99,151 | | | | 94,491 | |

|

Signed on behalf of the Board

Dr John Brown,Chief Executive Officer

Gordon Cameron,Chief Financial Officer

27 March 2003

The accompanying notes are an integral part of this Company balance sheet.

20

| | |

| (A) | Company balance sheet

The Company information relates to Acambis plc, the holding company that owns the the principal ones of which are Acambis Research Limited in the UK and Acambis Inc. in the US. The Company’s accounts are consolidated with those of the subsidiaries to produce the Group’s accounts.

The structure of the principal trading subsidiaries of the Group is as follows:

THE INFORMATION CONTAINED IN THIS COLUMN HAS NOT BEEN AUDITED.

|

| | | | | | | | | | | | | | | | | | |

| (17g) | GROUP CASH FLOW STATEMENT

For the year ended 31 December |

| | | |

| |

| | | | | | | | 2002 | | | 2001 | | | 2000 | |

| | | | Notes | | | £000 | | | £000 | | | £000 | |

| |

|

| | Net cash outflow from operating activities | | | 24 | | | | (6,182 | ) | | | (7,959 | ) | | | (9,207 | ) |

| |

|

| | Returns on investments and servicing of finance | | | | | | | | | | | | | | | | |

| | Interest received | | | | | | | 685 | | | | 1,219 | | | | 852 | |

| | Interest paid | | | | | | | (94 | ) | | | (224 | ) | | | (207 | ) |

| | Interest element of finance lease payments | | | | | | | – | | | | – | | | | (5 | ) |

| |

|

| | Net cash inflow from returns on investments and servicing of finance | | | | | | | 591 | | | | 995 | | | | 640 | |

| |

|

| | Taxation | | | | | | | 131 | | | | – | | | | – | |

| |

|

| | Capital expenditure and financial investment | | | | | | | | | | | | | | | | |

(B) | Purchase of tangible fixed assets | | | | | | | (11,464 | ) | | | (8,427 | ) | | | (363 | ) |

| | Sale of tangible fixed assets | | | | | | | – | | | | – | | | | 7 | |

| | Funds advanced to joint venture | | | | | | | – | | | | (520 | ) | | | (2,332 | ) |

| | Proceeds from sale of trade investments | | | | | | | – | | | | – | | | | 221 | |

| |

|

| | Net cash outflow from capital expenditure and financial investment | | | | | | | (11,464 | ) | | | (8,947 | ) | | | (2,467 | ) |

| |

|

| | Acquisitions and disposals | | | | | | | | | | | | | | | | |

| | Disposal costs on sale of business | | | | | | | – | | | | – | | | | (243 | ) |

| |

|

| | Net cash outflow from acquisitions and disposals | | | | | | | – | | | | – | | | | (243 | ) |

| |

|

| | Net cash outflow before management of liquid resources and financing | | | | | | | (16,924 | ) | | | (15,911 | ) | | | (11,277 | ) |

| |

|

| | Management of liquid resources | | | 25 | | | | 5 | | | | 19,834 | | | | (1,894 | ) |

| |

|

| | Financing | | | | | | | | | | | | | | | | |

| | Net proceeds from issue of new shares | | | | | | | | | | | | | | | | |

(C) | — Baxter subscription | | | | | | | 6,954 | | | | 3,477 | | | | 9,458 | |

| | — Other | | | | | | | 786 | | | | 785 | | | | 890 | |

| | Overdraft facility | | | | | | | – | | | | – | | | | 2,502 | |

| | Exercise of options over issued shares held by ESOP | | | | | | | – | | | | – | | | | 43 | |

| | Capital element of finance lease payments | | | | | | | – | | | | (13 | ) | | | (73 | ) |

| | Proceeds from new finance lease commitment | | | | | | | – | | | | 12,738 | | | | – | |

| |

|

| | Net cash inflow from financing | | | | | | | 7,740 | | | | 16,987 | | | | 12,820 | |

| |

|

| | (Decrease)/increase in cash for the year | | | 25 | | | | (9,179 | ) | | | 20,910 | | | | (351 | ) |

| |

|

| | The accompanying notes are an integral part of this Group cash flow statement. |

(B) Purchase of tangible fixed assets

The expenditure in 2002 represents the continued investment being made to reactivate our manufacturing facility in the US. This process is now largely complete.

(C) Baxter subscription

Baxter’s 28m subscription in new Acambis shares is scheduled as follows:

| | | | | | | | | |

| | | | | | | Approximate |

| | | | | | | aggregate |

| Date | | Amount | | | shareholding |

|

| 2000 | | | £10.4m | | | | 10 | % |

| 2001 | | | £3.5m | | | | 13 | % |

| 2002 | | | £7.0m | | | | 17 | % |

| 2003 | | | £7.0m | | | | 21 | % |

On 27 March 2003, Baxter accelerated its fourth and final subscription, taking its shareholding to 20.6%.

THE INFORMATION CONTAINED IN THIS COLUMN HAS NOT BEEN AUDITED.

21

| (17h) | | NOTES TO GROUP FINANCIAL STATEMENTS |

| | | A summary of the more important accounting policies, which have been reviewed by the Board of Directors in accordance with Financial Reporting Standard (“FRS”) 18, “Accounting Policies”, and have been consistently applied, is set out below. FRS 19, “Deferred Tax”, has been adopted in the year, but has had no impact on the amounts included in the profit and loss account and balance sheet. |

| | | The preparation of our financial statements requires us to make estimates and judgments that affect the reported amount of net assets at the date of our financial statements and the reported amounts of revenues and expenses during the period. |

| | | The financial statements have been prepared under the historical cost convention and in accordance with the Companies Act 1985 and United Kingdom generally accepted accounting principles (“UK GAAP”). Where there are significant differences to United States generally accepted accounting principles (“US GAAP”) these have been discussed in note 29. |

| | | The Group financial statements include and consolidate the financial statements of Acambis plc and each of its subsidiary undertakings. Acquisitions made by the Group are accounted for under the acquisition method of accounting and the Group financial statements include the results of such subsidiaries from the relevant date of acquisition. Intra-group transactions and profits are eliminated fully on consolidation. The loss for the financial year, dealt with in the financial statements of the Company, was £1.6m (2001 — profit of £4.6m). Under the provisions of Section 230 of the Companies Act 1985, no profit and loss account is presented for the Company. |

| | | Group turnover comprises the value of sales (excluding VAT and similar taxes, trade discounts and intra-group transactions) and income derived from product sales, licence fees, contract research fees and development milestone payments receivable from third parties in the normal course of business. Revenue from product sales is recognised on delivery of the product. Non-refundable licence fees are recognised over the term of the licence. Where the Group is required to undertake research and development activities and the fee is creditable against services provided by the Group, that licence fee is deferred and recognised over the period over which the services are performed. Contract research fees are recognised in the accounting period in which the related work is carried out. Access fees and milestones receivable are recognised when they fall contractually due. |

| |

| | | Profit is recognised on long-term contracts when the final outcome can be assessed with reasonable certainty by including in the profit and loss account, turnover and related costs as contract activity progresses. Turnover is recognised according to the stage reached in the contract by reference to the costs incurred in relation to total estimated expected costs. |

| | | The second smallpox vaccine contract with the US Centers for Disease Control & Prevention (“CDC”) is a fixed fee arrangement requiring the delivery of products as well as a concurrent research and development (“R&D”) programme. This arrangement has been treated as a single long-term contract, whose elements have not been accounted for separately. Turnover and profits are recognised according to the stage reached in the contract, as described above. Manufacturing costs are deemed to be incurred on delivery of products; R&D costs are recognised as incurred. |

| | | The Group has classified costs which are directly attributable to funded research and vaccine manufacture programmes as cost of sales. Certain research and development costs were, in prior years, classified as R&D expenditure. The Directors believe that the new classification more appropriately reflects the nature of the arrangements the Group has entered into. This reclassification has been applied to the two CDC smallpox vaccine contracts. The financial information for 2001 and 2000 has been re-presented so that cost classifications are shown on a comparable basis. The monetary impact of this re-classification in 2001 and 2000 is £5.1m and £0.5m respectively, which was previously included within R&D costs. There is no impact on net profit. |

| | | R&D costs are written off in the period in which they are incurred. |

22

(A) Notes to Group financial statements

The notes to Group financial statements are intended to provide additional analysis and detail required to meet statutory obligations.

THE INFORMATION CONTAINED IN THIS COLUMN HAS NOT BEEN AUDITED.

| | | Grants, which are non-refundable, are intended to contribute towards specific costs and are recognised in line with the proportion of those costs incurred and are netted off against R&D costs. |

| | | All schemes are defined contribution schemes and pension contributions are charged to the profit and loss account in the year to which they relate. Any difference between amounts charged to the profit and loss account and contributions paid are shown in the balance sheet under prepayments or creditors falling due within one year. |

| | | Current tax, including UK corporation tax and foreign tax, is provided at amounts expected to be paid or recovered using the tax rates and laws that have been enacted or substantially enacted by the balance sheet date. Provision is made for all deferred tax assets and liabilities in accordance with FRS 19, using full provision accounting, when an event has taken place by the balance sheet date which gives rise to an increased or reduced tax liability in the future. Deferred tax is measured at the average tax rates that are expected to apply in the periods in which the timing differences are expected to reverse, based on tax rates and laws that have been enacted or substantially enacted by the balance sheet date. Deferred tax assets are recognised to the extent that they are regarded as recoverable. Deferred tax assets and liabilities are not discounted. |

| | | Intangible assets — goodwill |

| | | Goodwill arising on the acquisition of subsidiary undertakings, representing the excess of fair value of the consideration given over the fair value of the identified assets and liabilities acquired, is capitalised and written off on a straight-line basis over its useful economic life. The Directors are of the opinion that the useful economic life of goodwill will not exceed 15 years. The carrying values of goodwill and intangible assets are subject to review and any impairment is charged to the profit and loss account. |

| | | Fixed assets are stated at original historical cost, net of depreciation and any provision for impairment. Depreciation is provided on all tangible fixed assets at rates calculated to write off the cost of each asset on a straight-line basis over its expected useful life, or the period of the lease if shorter, to its residual value based on prices prevailing at the date of acquisition, as follows: |

| | | |

| Leasehold land and buildings | | — 15 years or term of lease if shorter |

| Laboratory and manufacturing equipment | | — 4 to 7 years |

| Office equipment | | — 3 to 5 years |

| | | The carrying values of tangible fixed assets are subject to review and any impairment is charged to the profit and loss account. The Group does not capitalise interest charges on loans to fund the purchase of tangible fixed assets. |

| | | Shares in the Company purchased for employee share options are held under trust and are included as a fixed asset investment until the interest in the shares is unconditionally transferred to the employees. Provision is made for any permanent impairment in the value of the shares held by the trust. The Group’s other fixed asset investments are shown at cost less any provision for impairment. |

| | | Joint venture undertakings |

| | | Joint ventures are dealt with under the gross equity method. The Group’s share of revenues and operating losses for the joint venture is included in the Group profit and loss account and the Group’s share of gross assets and liabilities is included in the Group balance sheet. |

| | | Bank deposits, which are not repayable on demand, are treated as short-term investments in accordance with FRS 1, “Cash flow statements”. Movements in such investments are included under “management of liquid resources” in the Group’s cash flow statement. |

| | | Stock, excluding long-term contracts |

| | | Stock is stated at the lower of cost and net realisable value. In general, cost is determined on a first-in-first-out basis and includes transport and handling costs. Where necessary, provision is made for obsolete, slow-moving and defective stock. |

| | | NOTES TO GROUP FINANCIAL STATEMENTS |

| | | Assets acquired under finance leases are included in the balance sheet as tangible fixed assets and are depreciated over the shorter of the lease period or their useful lives. The capital elements of future lease payments are recorded as liabilities, while the interest elements are charged to the profit and loss account over the period of the leases to give a constant charge on the balance of the capital repayments outstanding. The cost of operating leases is charged to the profit and loss account on a straight-line basis over the lease term, even if rental payments are not made on such a basis. |

| | | Transactions denominated in foreign currencies are recorded in the local currency at actual exchange rates as at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated at the rates ruling at the balance sheet date. Any gain or loss arising from a change in exchange rates subsequent to the date of the transaction is included as an exchange gain or loss in the profit and loss account. |

| | | Assets and liabilities of overseas subsidiary and joint venture undertakings are translated into sterling at rates of exchange ruling at the balance sheet date. The results and cash flows of overseas subsidiary and joint venture undertakings are translated into sterling using average rates of exchange. Exchange adjustments arising when the opening net assets and the losses for the year retained by overseas subsidiary and joint venture undertakings are translated into sterling are taken directly to reserves and reported in the statement of total recognised gains and losses. |