UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM 20-F |

| |

| | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 or |

| | |

| X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended February 28, 2009 or |

| | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 or |

| | |

| | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report _______________________ |

| | |

| Commission File Number 000-29948 |

| | STARFIELD RESOURCES INC. | |

| | (Exact name of registrant as specified in its charter) | |

| | | |

| | Alberta, Canada | |

| | (Jurisdiction of incorporation or organization) | |

| | | |

| | 130 Adelaide Street, Suite 2210, Toronto, Ontario, Canada M5H 3P5 | |

| | (Address of principal executive offices) | |

| | | |

| | Securities to be registered pursuant to Section 12(b) of the Act: | |

| | None | |

| | | |

| Securities registered pursuant to Section 12(g) of the Act: |

| | Common Shares, without par value | |

| | (Title of class) | |

| |

| |

| Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. Title of class ___None_________ |

| |

| Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 332,685,899 |

| |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x |

| |

If this report is an annual report or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o |

| |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): �� |

| |

| Large accelerated filer o | Accelerated filer x | Non-accelerated filer o |

| |

| Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

| |

| U.S. GAAP o | International Financial Reporting Standards as issued by the International Accounting Standards Board o | Other x |

| |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement the registrant has elected to follow. Item 17 x Item 18 o |

| |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x |

TABLE OF CONTENTS

| Part I | | 1 |

| | | |

| Item 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS. | 1 |

| Item 1.A. | Directors and Senior Management. | 1 |

| Item 1.B. | Advisers. | 1 |

| Item 1.C. | Auditors. | 1 |

| Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE. | 1 |

| Item 2.A. | Offer statistics. | 1 |

| Item 2.B. | Method and expected timetable. | 1 |

| Item 3. | KEY INFORMATION. | 1 |

| Item 3.A. | Selected financial data. | 1 |

| Item 3.B. | Capitalization and indebtedness. | 3 |

| Item 3.C. | Reasons for the offer and use of proceeds. | 3 |

| Item 3.D. | Risk factors. | 3 |

| Item 4. | INFORMATION ON THE COMPANY. | 6 |

| Item 4.A. | History and development of the company. | 6 |

| Item 4.B. | Business overview. | 7 |

| Item 4.C. | Organizational structure. | 7 |

| Item 4.D. | Property, plants and equipment. | 8 |

| Item 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS. | 22 |

| Item 5.A. | Operating results. | 22 |

| Item 5.B. | Liquidity and capital resources. | 27 |

| Item 5.C. | Research and development, patents and licenses, etc. | 30 |

| Item 5.D. | Trend information. | 30 |

| Item 5.E. | Off-balance sheet arrangements. | 30 |

| Item 5.F. | Tabular disclosure of contractual obligations. | 30 |

| Item 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 30 |

| Item 6.A. | Directors and senior management. | 30 |

| Item 6.B. | Compensation. | 33 |

| Item 6.C. | Board practices. | 35 |

| Item 6.D. | Employees. | 35 |

| Item 6.E. | Share ownership. | 36 |

| Item 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS. | 39 |

| Item 7.A. | Major shareholders. | 39 |

| Item 7.B. | Related party transactions. | 40 |

| Item 7.C. | Interests of experts and counsel. | 40 |

| Item 8. | FINANCIAL INFORMATION | 40 |

| Item 8.A. | Consolidated statements and other financial information. | 40 |

| Item 8.B. | Significant changes. | 40 |

| Item 9. | THE OFFER AND LISTING. | 40 |

| Item 9.A. | Offer and listing details. | 40 |

| Item 9.B. | Plan of distribution. | 42 |

| Item 9.C. | Markets. | 42 |

| Item 9.D. | Selling shareholders. | 42 |

| Item 9.E. | Dilution. | 42 |

| Item 9.F. | Expenses of the issue. | 42 |

| Item 10. | ADDITIONAL INFORMATION. | 42 |

| Item 10.A. | Share capital. | 42 |

| Item 10.B. | Memorandum and articles of association. | 42 |

| Item 10.C. | Material contracts. | 44 |

| Item 10.D. | Exchange controls. | 44 |

| Item 10.E. | Taxation. | 45 |

| Item 10.F. | Dividends and paying agents. | 46 |

| Item 10.G. | Statement by experts. | 46 |

| Item 10.H. | Documents on display. | 46 |

| Item 10.I. | Subsidiary information. | 46 |

| Item 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK. | 46 |

| Item 11.A. | Quantitative information about market risk. | 46 |

| Item 11.B. | Qualitative information about market risk. | 47 |

| Item 11.C. | Interim periods. | 47 |

| Item 11.D. | Safe harbor. | 47 |

| Item 11.E. | Small business issuers. | 48 |

| Item 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES. | 48 |

| Item 12.A. | Debt securities. | 48 |

| Item 12.B. | Warrants and rights. | 48 |

| Item 12.C. | Other securities. | 48 |

| Item 12.D. | American depositary shares. | 48 |

| Item 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES. | 48 |

| Item 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS. | 48 |

| Item 15. | CONTROLS AND PROCEDURES. | 48 |

| Item 15.A. | Disclosure controls and procedures. | 48 |

| Item 15.B. | Management’s annual report on internal control over financial reporting. | 48 |

| Item 15.C. | Attestation report of the registered public accounting firm. | 48 |

| Item 15.D. | Changes in internal control over financial reporting. | 49 |

| Item 15T. | CONTROLS AND PROCEDURES. | 49 |

| Item 16. | [RESERVED.] | 49 |

| Item 16A. | AUDIT COMMITTEE FINANCIAL EXPERT. | 49 |

| Item 16B. | CODE OF ETHICS. | 49 |

| Item 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. | 49 |

| Item 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES. | 49 |

| Item 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS. | 49 |

| Item 17. | FINANCIAL STATEMENTS. | 49 |

| Item 18. | FINANCIAL STATEMENTS. | 50 |

| Item 19. | EXHIBITS. | 50 |

| SIGNATURES | 51 |

NOTE TO US READERS - DIFFERENCES REGARDING THE DEFINITIONS OF RESOURCE AND RESERVE ESTIMATES IN THE U.S. AND CANADA

| | |

| Mineral Reserve | The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used in Starfield Resources Inc.’s (the “Registrant”) disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”), adopted by the CIM Council on November 23, 2003. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 under the Securities Act of 1933, as amended (the “Securities Act”). Under Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. |

| Mineral Resource | The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” used in the Registrant’s disclosure are Canadian mining terms that are defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards; however, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable. |

Accordingly, information contained in this report containing descriptions of the Registrant’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS. |

| Item 1.A. | Directors and Senior Management. |

No disclosure required.

No disclosure required.

No disclosure required.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE. |

| | Item 2.A.Offer statistics. |

Not Applicable

| Item 2.B. | Method and expected timetable. |

Not Applicable

| Item 3.A. | Selected financial data. |

The information in Table No. 1 was extracted from the more detailed financial statements and related notes included herein and should be read in conjunction with such financial statements and with the information appearing under the heading ITEM 5, “OPERATING AND FINANCIAL REVIEW AND PROSPECTS.” Table No. 1 is derived from the financial statements of the Company, which have been prepared in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”), the application of which, in the case of the Company, conforms in all material respects for the periods presented with US GAAP, except as disclosed in notes to the financial statements.

Table No. 1 Selected Financial Data (CDN$ in 000, except per share data) | |

| | | Year Ended 2/28/09 | | | Year Ended 2/29/08 | | | Year Ended 2/28/07 | | | Year Ended 2/28/06 | | | Year Ended 2/28/05 | |

| General and Administrative Expenses | | $ | 3,455 | | | $ | 5,132 | | | $ | 3,113 | | | $ | 2,340 | | | $ | 1,932 | |

| Net Income (Loss) | | $ | (3,142 | ) | | $ | (11,840 | ) | | $ | (2,100 | ) | | $ | (2,696 | ) | | $ | (1,922 | ) |

| Basic and diluted Earnings (Loss) Per Share | | $ | (0.01 | ) | | $ | (0.04 | ) | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.02 | ) |

| Net Income (Loss) US GAAP | | $ | (28,347 | ) | | $ | (25,010 | ) | | $ | (21,484 | ) | | $ | (14,731 | ) | | $ | (11,830 | ) |

| Basic and diluted EPS (Loss) US GAAP | | $ | (0.09 | ) | | $ | (0.08 | ) | | $ | (0.11 | ) | | $ | (0.11 | ) | | $ | (0.11 | ) |

| Wtg. Avg. No. Shares US GAAP | | | 319,325 | | | | 298,702 | | | | 189,474 | | | | 139,439 | | | | 108,333 | |

| Dividends Per Share | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Dividends Per Share US GAAP | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Wtg. Avg. No. Shares Cdn GAAP | | | 319,325 | | | | 298,702 | | | | 189,474 | | | | 139,439 | | | | 108,333 | |

Working Capital(1) | | $ | 4,145 | | | $ | 10,819 | | | $ | (1,913 | ) | | $ | 803 | | | $ | 840 | |

| Mineral Properties | | $ | 105,379 | | | $ | 76,664 | | | $ | 63,581 | | | $ | 46,375 | | | $ | 34,051 | |

| Long Term Debt | | $ | 9 | | | $ | 69 | | | $ | 185 | | | Nil | | | Nil | |

| Long Term Debt (US GAAP) | | $ | 9 | | | $ | 69 | | | $ | 185 | | | Nil | | | Nil | |

| Shareholder’s Equity | | $ | 105,042 | | | $ | 85,996 | | | $ | 60,942 | | | $ | 45,553 | | | $ | 34,855 | |

| Capital Shares | | $ | 120,918 | | | $ | 102,513 | | | $ | 72,516 | | | $ | 56,768 | | | $ | 43,249 | |

| Capital Shares (US GAAP) | | $ | 129,116 | | | $ | 109,961 | | | $ | 78,998 | | | $ | 61,655 | | | $ | 46,761 | |

| Total Assets | | $ | 111,046 | | | $ | 90,315 | | | $ | 65,064 | | | $ | 48,923 | | | $ | 35,689 | |

| Total Assets (US GAAP) | | $ | 8,361 | | | $ | 13,651 | | | $ | 1,483 | | | $ | 2,549 | | | $ | 1,638 | |

| | (1) | Current assets less current liabilities |

Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

Table No. 2 sets forth the exchange rates for the Canadian Dollar at the end of five most recent fiscal years ended February 28th or 29th, the average rates for the period, and the range of our high and low rates for the period.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

Table No. 2 U.S. Dollar/Canadian Dollar | |

| Period | | Average | | | High | | | Low | | | Close | |

| April 2009 | | $ | 1.22 | | | $ | 1.26 | | | $ | 1.19 | | | $ | 1.19 | |

| March 2009 | | $ | 1.26 | | | $ | 1.30 | | | $ | 1.22 | | | $ | 1.26 | |

| February 2009 | | $ | 1.25 | | | $ | 1.27 | | | $ | 1.21 | | | $ | 1.27 | |

| January 2009 | | $ | 1.22 | | | $ | 1.27 | | | $ | 1.18 | | | $ | 1.24 | |

| December 2008 | | $ | 1.23 | | | $ | 1.30 | | | $ | 1.20 | | | $ | 1.22 | |

| November 2008 | | $ | 1.22 | | | $ | 1.29 | | | $ | 1.15 | | | $ | 1.24 | |

Fiscal Year Ended 2/28/09 | | $ | 1.10 | | | $ | 1.30 | | | $ | 0.98 | | | $ | 1.27 | |

| Fiscal Year Ended 2/29/08 | | $ | 1.05 | | | $ | 1.18 | | | $ | 0.92 | | | $ | 0.98 | |

| Fiscal Year Ended 2/28/07 | | $ | 1.14 | | | $ | 1.19 | | | $ | 1.10 | | | $ | 1.17 | |

| Fiscal Year Ended 2/28/06 | | $ | 1.19 | | | $ | 1.26 | | | $ | 1.14 | | | $ | 1.14 | |

| Fiscal Year Ended 2/28/05 | | $ | 1.28 | | | $ | 1.40 | | | $ | 1.18 | | | $ | 1.23 | |

| Item 3.B. | Capitalization and indebtedness. |

No disclosure required.

| Item 3.C. | Reasons for the offer and use of proceeds. |

No disclosure required.

The securities of the Company are highly speculative and subject to a number of risks. These risks might impede the Company from reaching its business objectives, which include successfully exploring and developing further mineral resources. It should be noted that the following risk factors are not an exhaustive list and other risk factors may apply.

The Company Has Engaged in Exploration and Has No History of Development Activities

The Company has no history of development of its Resource Property. The Company may experience higher costs than budgeted and unexpected delays. The Company must also continue to locate and retain qualified personnel to conduct its exploration work. Further adverse changes in any one of such factors or the failure to locate and retain such personnel will have an adverse effect on the Company, its business and results of operations.

The Company Currently Depends on a Single Property

The Company’s only material mineral property is the Ferguson Lake Property. Unless the Company acquires or develops additional properties or projects, the Company will be solely dependent upon the operation of the Resource Property for its revenue and profits, if any.

The Mining Industry Is Speculative and of a Very High Risk Nature

Mining activities are speculative by their nature and involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The Company’s drilling activities are in the advanced exploration stage, and such advanced exploration is subject to the risk that previously reported inferred mineralization is not economic. If this occurs, the Company’s existing resources may not be sufficient to support a profitable mining operation.

The Company’s mining activities are subject to a number of factors beyond its control, including, intense industry competition and changes in economic conditions (including some operating costs, such as electrical power). Its operations are subject to all the hazards normally incidental to exploration, development and production of base and precious metals, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. An adverse change in any one of such factors, hazards and risks would have a material adverse effect on the Company, its business and results of operations. This might result in the Company not meeting its business objectives.

The Exploration Work Conducted on the Resource Property May Not Result in the Discovery of Commercial Quantities of Nickel, Copper, Cobalt, Platinum or Palladium deposits.

Problems, such as unusual and unexpected rock formations, environmental pollution, flooding, cave-ins, and industrial accidents, are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, the Company would be unable to complete its business plan and any funds spent on such exploration will probably be lost.

Going Concern; The Company is Experiencing Negative Cash Flow

The Company’s ability to continue as a going concern is dependent on its ability to successfully develop and operate the Resource Property and secure additional financing. The Company currently has limited cash on hand and no revenue from operations. Since it is experiencing negative cash flow, its cash reserves are being depleted. The success of the Company’s business will depend upon its ability to generate cash flow from operations to a point where it becomes profitable. Presently, the Company must obtain additional funds through the sale of equity and/or debt capital. Alternatively, the Company could offer an interest in its mining properties to be earned by another party or to obtain project or operating financing from financial institutions, neither of which is currently intended. Accordingly, if the Company cannot commence commercial operations, increase its’ cash flow and become profitable, it will have to raise additional funds. If such funds are not available on acceptable terms, there would be a material adverse effect on the Company, its business and results of operations, and it may not achieve its business objectives.

The Mining Industry Is Competitive

The mineral exploration and mining business is competitive in all phases of exploration, development and production. The Company competes with a number of other entities in the search for and acquisition of mineral properties, many of whom have more advanced properties that are better able to attract equity investments and other capital. As a result of this competition, the Company may be unable to acquire attractive properties in the future on terms it considers acceptable or to recruit and retain qualified employees, which could have an adverse effect of the Company, its business and results of operations.

The Company is Dependent on Various Key Personnel

The Company’s success is dependent upon the performance of key personnel. The Company does not maintain life insurance for key personnel and the loss of the services of senior management or key personnel could have a material and adverse effect on the Company, its business and results of operations.

The Company’s Activities might Suffer Losses from or Liabilities for Risks which are not Insured

Hazards, such as unusual or unexpected geological formations and other conditions, are inherent in mineral exploration and development. The Company may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The occurrence of such liabilities could have a material, adverse effect on the Company’s financial position and results of operation.

The Company currently carries general commercial liability, tenant’s legal liability, building, contents and contractors equipment insurance, as well as directors’ and officers’ insurance. Additionally, all contractors carry their own general and equipment liability insurance. Although the Company intends to maintain liability insurance in an amount which it considers adequate, the nature of these risks is such that liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or the Company might not elect to insure itself against such liabilities due to high premium costs or other reasons.

The Company’s insurance will not cover all the potential risks associated with a mining company’s operations. The Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. The Company might also become subject to liability for environmental occurrences, pollution or other hazards for which it may not be insured against, or for which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial condition and results of operations.

There is Uncertainty of the Nature and Amount of the Company’s Resources

While the Company has carried out, and will carry out on an annual basis, estimates of its mineral resources, this should not be construed as a guarantee that such estimates are accurate. If such estimates prove to be materially inaccurate, the Company’s revenues, operations and financial condition could be materially adversely affected.

The Company may Experience Uncertainty in Marketing the Nickel, Copper, Platinum, Palladium and Cobalt which it may Potentially Mine

The Company’s future revenues are expected to be in large part derived from the mining and sale of nickel, copper, platinum, palladium and cobalt. The price of these metals fluctuate and are affected by numerous factors beyond the Company’s control, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and increased production due to new mine development and improved mining and production methods. Any unfavorable change in these factors could cause the Company’s revenues, operations and financial condition to be materially adversely affected.

The Company’s Activities are Subject to Extensive Governmental Regulation and Permitting Requirements

Exploration, development and mining of minerals are subject to extensive federal, provincial and local laws and regulations governing acquisition of the mining interests, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, water use, land use, land claims of First Nations and local people, environmental protection and remediation, endangered and protected species, mine safety and other matters. These laws and regulations are administered by various governmental authorities including the Governments of Canada, Nunavut and the Kivalliq Designated Inuit Organizations.

In addition, the current and future operations of the Company, from current exploration through future development activities and production, require permits, licenses and approvals from some of these governmental authorities. The Company has obtained all government licenses, permits and approvals necessary for the operation of its business to date, however, additional licenses, permits and approvals may be required. The failure to obtain any licenses, permits or approvals that may be required, or the revocation of existing ones would have a material and adverse effect on the Company, its business and results of operations.

The Company’s Activities are Subject to Aboriginal Consultation and Accommodation

In 1993, Canada entered into the Nunavut Land Claims Agreement with the Inuit of the Nunavut Settlement Area, which resulted in the creation of the Nunavut Territory. Pursuant to that agreement, in order for the Company to proceed with exploitation of minerals from its properties, it may be required to enter into an Inuit Impact and Benefit Agreement (“IIBA”). The terms of such an IIBA are uncertain, as they would be the product of future negotiations between the Company and the Kivalliq Inuit Association.

Although the Company reviewed its title to properties in which it has a material interest, there is no guarantee that title to such properties will not be challenged or impugned. Title to, and the area of, resource claims may be disputed. The Company’s interests may be subject to prior unregistered agreements or transfers, aboriginal land claims, aboriginal rights, treaty rights, and title may be affected by undetected defects. Although a land claim agreement has been reached between the Inuit and the Canadian government, no modern agreement has been reached with any First Nation or Métis group which might have an interest in the area of the Company’s properties. There may be valid challenges to the title of the Company’s properties, which, if successful, could impair future development of the properties and/or the Company’s operations.

The Company’s Activities are Subject to Environmental Risks

All phases of the Company’s operations are subject to federal, provincial and local environmental regulation in the various jurisdictions in which it operates, which could potentially make operations expensive or prohibit them all together. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulations or the failure to comply with such regulations, may adversely affect the Company’s operations, its business and results of operations.

The Company’s Directors and Officers may have Conflicts of Interest

Certain of the directors and officers of the Company also serve as directors, officers and/or significant shareholders of other companies involved in natural resource exploration and development. Such directors and officers may have a conflict of interest with respect to the interests of these other entities and the Company, which could have a material adverse affect on the Company, its business or results of operations.

Certain Groups are Opposed to Mining

In North America there are organizations opposed to mining. The Company believes it has the support of representatives from the local communities and Inuit people nearest the Ferguson Lake Property and from various levels of the federal government and the Nunavut government having jurisdiction over the Resource Property. Although the Company intends to comply with all environmental laws and permitting obligations in conducting its business, there is a risk that those opposed to its operation at the Ferguson Lake Property will attempt to interfere with the Company’s operations, whether by legal process, regulatory process or otherwise. Such interference could have a negative impact on the Company’s ability to operate its properties in the manner that is most efficient or appropriate, if at all, and any such impact could materially adversely affect the financial condition and results of operations of the Company.

| ITEM 4. | INFORMATION ON THE COMPANY. |

| Item 4.A. | History and development of the Company. |

Starfield is a Canadian-based natural resource exploration company. The Company was incorporated on April 22, 1994, under the Business Corporations Act (Alberta), and changed its name to Starfield Resources Inc. in 1997. On October 27, 2006, the Company filed articles of continuance in British Columbia, which are filed as an exhibit to the Company’s filings with the SEC. The Company is also governed by the Business Corporations Act (British Columbia) and a reporting issuer in the provinces of British Columbia, Alberta and Ontario and in the North West Territories. The Company’s registered office is located at 2900-550 Burrard Street, Vancouver, British Columbia V6C 0A3, and the head office is located at 130 Adelaide Street West, Suite 2210, Toronto, Ontario M5H 3P5. In December 1999, the Company acquired a 100% interest in certain mineral claims in the Ferguson Lake area of the Nunavut Territory, Canada known as the “Resource Property” or the “Ferguson Lake Property” and a five-kilometer area of influence around the claims.

The Ferguson Lake Property covers more than 0.6 million acres. Since 1999, the Company has completed more than 151,000 metres of diamond drilling in 410 holes. The Company has received a National Instrument 43-101 report on the Ferguson Lake Property entitled Preliminary Assessment of the Ferguson Lake Project, Nunavut Territory, Canada dated April 30, 2008 and authored by Graham G. Clow, P.Eng, R. Dennis Bergen, P.Eng, Jason J. Cox, P.Eng, G. Bryn Harris, Ph.D., FIMM and James G. Lavigne, P.Geo., M.Sc. (the “2008 Report”). The 2008 Report updates the resource estimates provided in the report dated July 15, 2007. The 2008 Report and earlier reports are filed on SEDAR (www.sedar.com). The Company, which was listed on the TSX Venture Exchange, applied to list its common shares on the TSX. That application was approved, and on April 24, 2007 the Company’s common shares began trading on the TSX under the symbol “SRU”.

Capital Expenditures

Fiscal 2007: $16.4 million for mineral property exploration and acquisition of equipment.

Fiscal 2008: $13.1 million for mineral property exploration and acquisition of equipment.

Fiscal 2009: $25.0 million for mineral property exploration and acquisition of equipment.

| Item 4.B. | Business overview |

The Company is an advanced exploration company focused on the Ferguson Lake nickel-copper-platinum-palladium-cobalt property located in Nunavut, Canada. The Company’s overall business objective is to explore, develop and commence production on the Ferguson Lake Property. Significant exploration and diamond drilling was undertaken during the year. The diamond drilling was primarily designed to upgrade the confidence in the existing copper-nickel-cobalt sulphide mineralization through a series of interspaced and extended drill holes. Additionally, as in the fiscal 2008 program, a portion of the drilling was extended beneath the massive sulphide resource in an effort to further define the geometry and continuity of the low-sulphide platinum group metals (“PGM”) occurrence. The massive sulphide mineralization comprising the West Zone is currently being remodelled, and at the same time existing data is being utilized to construct the initial model for the low sulphide PGM mineralization located in the footwall, below the West Zone.

The Corporation has recently completed flying a combined DigHEM electro-magnetic survey and Horizontal Magnetic Gradiometer to further delineate possible diamond and gold targets in the vicinity of the Y Lake Trend. Although the results are still pending, the survey is expected to identify high potential geologic structures or horizons at a higher degree of resolution than the previous airborne survey. Surveying was completed by the beginning of May with a preliminary interpretation available in due course, typically 8 to 10 weeks after completion of the survey. Pending the results of this airborne survey, additional ground reconnaissance work, rock-chip sampling of targeted areas and closely spaced follow-up till sampling would be the next step. Additional diamond drilling will also take place if warranted.

Competitive Conditions

Competition in the mineral exploration and production industry is intense. The Company competes with other mineral exploration companies, many of whom have greater financial resources and technical facilities for the acquisition and development of, and production from, mineral concessions, claims, leases and other interests, as well as for the recruitment and retention of qualified employees and consultants. Based on the Company’s management’s assessment, the Company’s competitors include other small to medium sized metallic mineral exploration companies that are looking for similar resource properties. Companies actively exploring in the Ferguson Lake area include, among others, De Beers Canada Exploration Inc., Rio Tinto and BHP Billiton Diamonds Inc.

Material Effects of Government Regulations

The Company’s current and anticipated future operations, including further exploration and/or production activities require permits from numerous Canadian federal, provincial and territorial governmental authorities. Such operations are subject to various laws governing land use, the protection of the environment, mining production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations.

Environmental legislation is evolving in a manner such that standards, enforcement, fines and penalties for non-compliance are increasingly stringent. Companies and their directors, officers and employees carry a heightened degree of responsibility in respect of environmental assessments. The cost of compliance with changes in government regulations has the potential to reduce the profitability of future operations.

| Item 4.C. | Organizational structure. |

The Company was incorporated under the Business Corporations Act (Alberta, Canada) on April 22, 1994, registered in the province of British Columbia as an extra-provincial company on April 22, 1998 and in the Nunavut Territory, Canada as an extra-territorial corporation on March 18, 2003. The Alberta registration was discontinued and continued in British Columbia on October 27, 2006. The Company’s major business activity is the exploration and future development of mineral properties, particularly its Ferguson Lake nickel-copper-cobalt-platinum-palladium project in Nunavut, Canada. All of the Company’s properties are located in Canada.

The Company does not belong to any groups and does not have any subsidiaries.

| Item 4.D. | Property, plant and equipment. |

The Company’s executive offices are located at 130 Adelaide Street West, Suite 2210, Toronto, Ontario, Canada M5H 3P5. Its registered office is located at 2900-550 Burrard Street, Vancouver, British Columbia V6C 0A3.

Project Description and Location

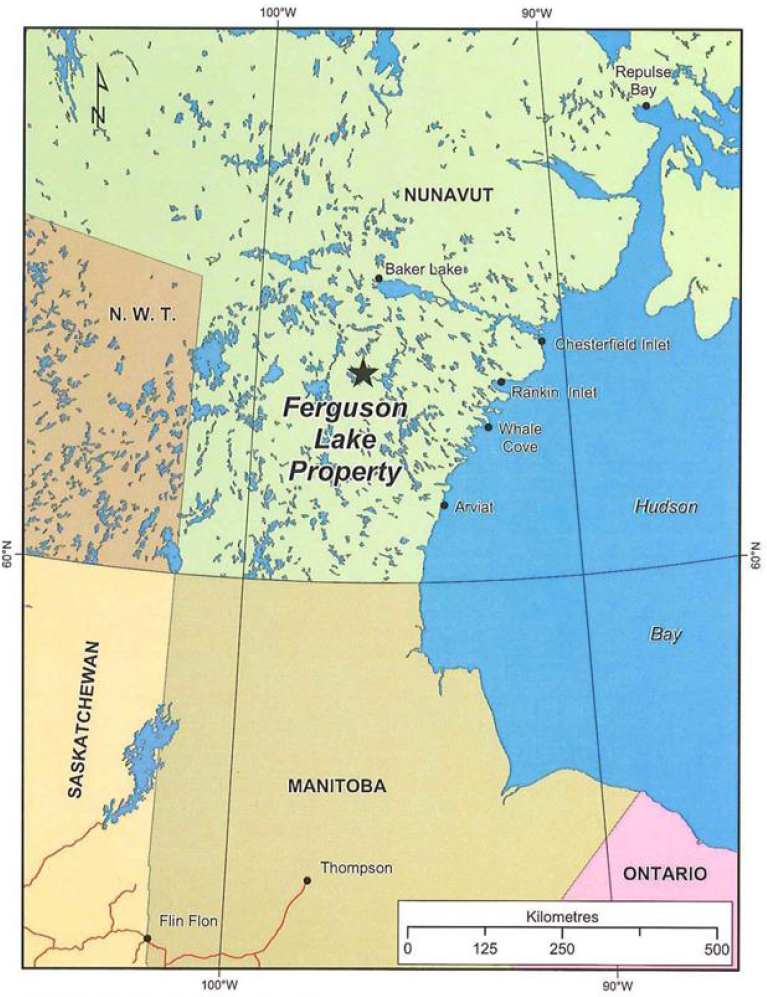

The Ferguson Lake Property consists of 266 mineral claims comprising an area of 252,929 hectares (625,000 acres) in the Kivalliq region of southern Nunavut Territory some 240 kilometres west of Rankin Inlet and 160 kilometres south-southwest of Baker Lake. erguson Lake, central to the large property area, is midway between Yathkyed and Kaminuriak Lakes. The Ferguson Lake Property measures 125 kilometres in an east-west direction and approximately 80 kilometres north-south. These mineral claims are issued pursuant to the Canada Mining Regulations, C.R.C.C. 1516.

All of the mineral claims are contiguous and extend east, west, south and northwest of Ferguson Lake between latitudes 62° 30’ and 63° 15’ North and longitudes 96° 00’ and 98° 15’ West.

In 2006 and 2007, the Company contracted McElhanney Associates Land Surveying Ltd., a Canada Land Surveyor, to conduct Canadian Legal Survey (“CLS”) work at the Ferguson Lake Property so that certain mineral claims could be converted to mining leases as required under the Canada Mining Regulations. The work entailed a detailed CLS of the key mineral claims hosting the mineral resources at the Ferguson Lake Property. The CLS was completed in 2007.

The Mining Recorder administers most of the subsurface rights of Crown Lands in Nunavut and grants the mining lease status of mineral claims. Mining application and registry is an ongoing process. The Company’s mining claims are in good order and are maintained as such.

Parts of the current Resource Property were initially located in 1997 by way of one Prospecting Permit covering the northwest quarter of NTS map-area, and three contiguous mineral claims. Additional mineral claims were located in 1998 and 1999 to cover the area of the Prospecting Permit which expired February 1, 2000. A number of these claims were allowed to lapse following detailed prospecting in 2001. The mineral claims acquired by the Company prior to 2003 included the area of a former Mining Lease previously held by Canadian Nickel Company, Ltd., a subsidiary of Vale Inco Ltd (formerly Inco Limited, “Inco”).

Most of the mineral claims comprising the expanded property area were located between January and November of 2005.

Mineral claims in Nunavut are valid for two years from the recording date and may be renewed for an additional year by completing representation (assessment) work in the amount of $4.00/acre within the initial two-year period. Annual work in the amount of $2.00/acre is required to renew the claims beyond the third year. Representation work for the various mineral claims has been routinely filed on an annual basis since 1999.

Land use permits, including an Exploration Permit, Right of Way for winter transport, a Water Licence, and a Commercial Lease, enable exploration work to be conducted over the entire property area. These permits have been issued or renewed by the Kivalliq Inuit Association for parts of the Resource Property covering Inuit owned lands and by Indian and Northern Affairs Canada for Crown lands. Preliminary environmental studies, conducted by Rescan Environmental Services Ltd. on behalf of the Company, have been ongoing since 1999.

The majority of exploration work completed since 1999 has been directed to several mineral zones east and west of Ferguson Lake.

The Company is not aware of any environmental, infrastructure, or permitting issues which would adversely affect the potential viability of the Ferguson Lake Property. The Company can not provide any assurance that agencies or government departments will approve future mine production at the Ferguson Lake Property.

The Company is in compliance and in accordance with applicable agency requirements and government regulators’ requirements and continues to operate the Ferguson Lake Property by holding all necessary permits, which are in good standing, or holding extensions to existing permits or pursuing applications being processed with the applicable authority. The Company has paid all application fees, costs, rents and securities deposits relating to these permits, extensions or applications.

Acquisition of Property Interest

The Company entered into an option agreement in February 1999 to purchase a 100% interest in the mineral claims comprising part of the Ferguson Lake Property (the “Original Ferguson Lake Property”) from a syndicate of the vendors (the “Ferguson Lake Syndicate”) in exchange for an initial cash payment, the issuance of common shares and scheduled work commitments. The issuance of additional common shares to the Ferguson Lake Syndicate was based on incurred exploration expenditures. The Company’s current 100% earned interest in the Original Ferguson Lake Property is subject to a 3% net smelter royalty (“NSR”) on potential future mineral production, a 3% gross overriding royalty on any diamond production and a $25,000 annual advance royalty payment. The Company has the right to purchase 1% of the NSR for $1 million for a period of 180 days following receipt of a positive feasibility study on the Original Ferguson Lake Property recommending commercial production. Subsequent to the purchase of the Original Ferguson Lake Property, the Company staked certain other claims that comprise the Ferguson Lake Property, and these additional staked claims are not subject to the NSR.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access to the Ferguson Lake Property is by air from Rankin Inlet, Baker Lake, Thompson, or Churchill, all of which have scheduled airline service and offer a number of facilities. In 2008, the Company completed construction of an approximately 800 m dirt airstrip capable of handling wheel equipped aircraft.

Limited supplies and services are available in Rankin Inlet and Baker Lake, and the staging points for recent programs have been Thompson, Manitoba, 765 kilometres south of Ferguson Lake, and Yellowknife, Northwest Territories, 900 kilometres west. Both of these communities, with populations of about 15,000, are accessible from southern Canada by highway, have scheduled airline service and are major exploration and mining supply centres.

Previous and current programs involved shipping supplies, equipment and fuel by larger aircraft to an ice airstrip established on Ferguson Lake, and fuel and other supplies have also been transported to the Resource Property by winter Cat train from Baker Lake, Rankin Inlet, and Arviat. Communications in this remote area are made possible by satellite, which provides for telephone and high speed internet connections.

A subarctic climate is characterized by long winters (October through April) with mean temperatures of -30 degrees C; a short summer season with mean temperatures in the 15 degrees C range extends from July through mid-September. Mineral exploration is most conveniently carried out during the summer months and between March and May when geophysical surveys and diamond drilling can make use of ice-covered lakes.

There is little or no infrastructure in this remote part of Canada other than abundant water supplies. The Nunavut government has been studying the possibility of extending an all-weather road into the territory from northern Manitoba. The potential route would be approximately 150 kilometres east of Ferguson Lake, making a “spur road” to Ferguson Lake a reasonable possibility. Diesel generated electrical power has been used for past mining operations in the general area, including at Cullaton Lake which is 200 kilometres south of Ferguson Lake. Annual re-supply to the communities of Rankin Inlet, Arviat and Baker Lake is done by commercial barge service from Churchill Manitoba or Montreal, Quebec. Daily flights into Rankin Inlet from Southern Canada bring routine supplies and passenger service.

The area is one of low relief, featuring numerous smaller lakes and a few large river systems, notably Kazan and Ferguson Rivers. Yathkyed and Ferguson Lakes are 141 and 114 metres above sea level, respectively, and maximum elevations in the surrounding area range from 200 to 275 metres. Elevations within the current property area average less than 200 metres and range from slightly less than 100 metres at the Resource Property’s eastern boundary to 290 metres north of Yathkyed Lake. The orientations of Ferguson Lake and a number of smaller lakes reflect the dominant south-easterly glacial movement. Bedrock is fairly well exposed on numerous low hills and ridges in contrast to lower areas where bedrock may be obscured by between 6 and 25 metres of glacial debris. The terrain is typical of the barren grounds; the tree line is 150 km south of Ferguson Lake and vegetation consists principally of moss, lichen, dwarf birch and Labrador tea. Wildlife includes caribou, arctic fox, musk ox and barren ground grizzly bear.

Regional Geology

The Ferguson Lake Property is situated in the Western Churchill Province, an Archean craton which is divided into the lithologically distinct Rae and Hearne domains by the northeast-trending Snowbird Tectonic Zone.

Ferguson Lake, 100 km east of the Snowbird Tectonic Zone, is more precisely within the northwestern Hearne. The northwestern Hearne domain is bounded by northeast-trending, regional shear zones including the Tulemalu Fault Zone (part of the Snowbird Tectonic Zone) on the north and by the northeastern extension of the Tyrrell Shear Zone on the southeast.

The Ferguson Lake area includes the most northerly extension of the northeast-trending Yathkyed greenstone belt, mainly present as strongly deformed, gneissic Archean supracrustal and intrusive rocks and variably deformed Proterozoic plutons and dykes. The deformed sequences are metamorphosed to upper amphibolite facies, and protoliths of the older supracrustal rocks are comparatively rare. Where seen, they consist principally of mafic metavolcanics with cherty iron formations and lesser intermediate to felsic metavolcanics and clastic metasedimentary rocks.

The Western Churchill Province, because of its diverse geological environments which span a 1.5-billion-year interval, is host to a variety of mineral deposit types. Known mineral deposits, prospects and occurrences include mafic-ultramafic-related magmatic nickel-copper-cobalt-PGM, orogenic (mesothermal) lode gold, volcanic hosted massive sulphides, syngenetic and epigenetic uranium deposits and prospects, quartz-carbonate veins containing precious metals and diamonds associated with Phanerozoic kimberlite intrusions.

Property Geology

The oldest rocks in the southern and northeastern parts of the Ferguson Lake Property consist of east to northeast trending, mafic and intermediate volcanic rocks of Archean age that have undergone upper amphibolites grade metamorphism, and represent the northeastern continuation of the Yathkyed greenstone belt. These supracrustal rocks, which contain sulphide, oxide and silicate banded iron formations in a number of localities, are interlayered with more widespread quartz-feldspar-biotite-(hornblende) gneiss and paragneiss, and all units have been intruded by Archean tonalities, granite gneisses and smaller, complex, coarse-grained pegmatite bodies. A variety of younger (Proterozoic) dykes, sills and irregular intrusions cut the older rocks.

Pronounced layering in the supracrustal rocks trends east-northeast to northeast and dips moderately to steeply north. Medium to coarse grained, massive to weakly foliated gabbros, containing +60% hornblende and termed hornblendites in earlier reports, mainly occur within, and are conformable with, the layering in amphibolite-hornblende-biotite gneiss sequences. Petrographic studies suggest that these hornblende-rich gabbros, which are the principal host rocks for known base metal sulphides and PGM, may be metamorphic products of original tholeiitic mafic or ultramafic (pyroxenite-peridotite) intrusions.

All of the foregoing are cut by younger (mid-Proterozoic) gabbros and diabases and by late Proterozoic syenites, quartz-feldspar porphyries and fine-grained, locally biotite-rich mafic dykes.

Younger syenites, part of the Martell Syenites, and distinctly post-mineral mafic dykes, are also evident in many of the diamond drill holes completed to date. Larger bodies of this syenite occur near the east shore of Ferguson Lake and a larger body underlying Uligattilik Hill borders the Resource Property’s eastern boundary.

A structural mapping program in the areas of two of the principal mineralized zones, East and West Zones, indicated that most of the Archean rocks were subjected to high grade metamorphism and deformation. Intricate folding of the gneissic rocks and the hornblendites (gabbros) has produced antiform and synform structures which are particularly evident in the area east of Ferguson Lake. The East and West mineralized zones have in the past been interpreted as being within the south limb of a recumbent, doubly-plunging synform or canoe-shaped structure modified by numerous faults and shear zones which offset the various lithologic units.

Mineralization

The various mineral zones identified to date in that part of the Resource Property bordering Ferguson Lake are magmatic nickel-copper sulphide deposits which also contain cobalt and PGM values. Nickel-copper-cobalt-PGM mineralization at Ferguson Lake is hosted mainly by fine- to coarse-grained gabbros which include hornblendites. Three of the mineral zones (East, Central (lake) and West) are at least spatially related to the same east-northeast trending gabbro unit which is between 10 and 600 metres thick and has been traced by intermittent exposures and by diamond drilling over a strike length of more than 12 km east and west of Ferguson Lake. This and the other gabbro units hosting the several other mineral zones dip moderately to steeply north and are generally conformable with enclosing hornblende-rich gneisses.

Better grades of base and precious metals mineralization are present within massive to semi-massive sulphide lenses, pods and stringers which consist of between 80% and 90% pyrrhotite intergrown with very fine-grained pentlandite, lesser chalcopyrite and minor pyrite. Rounded magnetite grains, up to one cm in size, are a common constituent of the sulphide lenses. Better grades are contained within zones having thicknesses of between two and tens of metres.

The most significant drilling results obtained by the Company to date have been from the East and West Zones. Better grades of nickel-copper-cobalt-PGM mineralization within and marginal to the host gabbro intrusion in both of these zones are contained in lenses and pods of massive and semi-massive sulphides which have a lateral extent of 350 metres in the East Zone II to more than 4,000 metres in the West Zone. Two or more parallel lenses, separated by between 5 and 100 metres of lower grade sulphide mineralization and/or unmineralized hostrock, are evident in many of the holes drilled on the West Zone.

Other mineral zones identified east of Ferguson Lake include M Zone, discovered in 2000 and situated 1 kilometre southeast of the East Zone II. This zone was tested by ten inclined holes to test a blind, gently north-dipping Versatile Time Domain Electromagnetic (“VTEM”) conductor. The drilling confirmed that the conductive zone was due to the presence of sulphide minerals within a gabbro, a setting similar to the other known mineral zones. Assay results were not particularly impressive. Further surface geophysical surveys were conducted over this zone in 2004 and three additional holes, drilled to test a new interpretation of geophysical signatures, returned results similar to those obtained from earlier drilling.

Anomaly 51, also known as the Pointed Lake Zone, consists of a northeast-trending, gossanous gabbro approximately 50 metres wide. It is exposed along more than 2,500 metres of strike length, and is located one kilometre south of M Zone. This zone, which contains pods and stringers of massive pyrrhotite with lesser chalcopyrite and pyrite, particularly in its western half, was tested over 1,700 metres of strike length by 1,094 metres of diamond drilling in nine widely-spaced, inclined diamond drill holes in the 1950s. Several holes contained narrow intervals of copper-nickel mineralization; better grades of nickel, copper and cobalt are associated with narrow intervals (0.15 to 2.29 metres) of massive pyrrhotite and pyrite hosted by. No PGM results were reported. Nickel values were generally higher than copper as opposed to results from other zones at Ferguson Lake.

This zone (and its potential extensions) was further tested in 2000 and 2004 by eight holes which were drilled in several locations to test isolated VTEM conductors north and east of the area previously drilled. Only narrow sulphide intervals were encountered.

1999-2004 Exploration Programs

Since 1999, the principal focus of previous and current work has been directed to the West Zone, which has been traced by intermittent bedrock exposures, geophysical surveys and by a considerable amount of diamond drilling over a zone length of several kilometres. The zone has been tested by 72 Inco holes (10,833 metres) between 1951 and 1955 and by more than 95,000 metres of drilling in 234 holes by Starfield since 1999.

Between 1999 and 2004, during which time the West Zone was tested by more than 150 holes plus five wedge holes (for a total of 62,000 metres) drilled over 3 kilometres of strike length. Much of this drilling was designed to expand the zone both to depth and along strike with a number of deeper holes testing the deeper, western part of the zone between sections 52+00W and 68+00W in 2001. As shown in the resource study, most of these holes intersected intervals of several metres containing massive sulphides consisting of copper, nickel, cobalt and PGMs.

Much of the drilling undertaken on the West Zone between 2002 and 2004 was directed to definition drilling in 74 relatively shallow holes (20,200 metres) in the eastern part of the zone between sections 39+00W and 51+000W to better define near-surface sulphide mineralization.

The nature and scope of the 2002 - 2004 drilling programs consisted of collaring drill holes between existing holes such that this part of the West Zone has now been drilled on sections at an average of 30 metre spacings or less. Most holes intersected two or three (and in some cases, up to six), parallel sulphide lenses containing grades of at least 1% combined copper plus nickel, and over minimum hole lengths of 2 metres. Intervals of lower (or zero) grades between the parallel massive sulphide lenses consisting of nickel, copper, cobalt and PGMs. Most of the inclined holes drilled to date are essentially normal to the moderately north-dipping sulphide lenses, and apparent true widths of the various sulphide lenses range from 2 metres to a maximum of 45 metres, with an overall average of 7 metres. The down-dip extent of the various sulphide lenses is variable, and ranges from 20 to 250 metres. Many of the drill sections feature a well mineralized sulphide lens in one hole that may or may not continue through holes drilled up or down-dip of the mineralized lens.

Although most of the exploration effort west of Ferguson Lake has been devoted to the continued evaluation of the West Zone, several other mineralized targets proximal to the West Zone have also undergone limited exploration. Those zones of apparent lesser importance include the West Zone South, which is intermittently exposed over a strike length of approximately one kilometer and is associated with a gossanous gabbro. The West Zone South represents a mineralized target that is subparallel to the West Zone located approximately one kilometer to its south. Previous select surface sampling returned anomalous PGM values.

The South Discovery Zone, a sulphide-bearing gabbro unit some 3 kilometres southwest of 119 Zone has an exposed northeast strike length of 800 metres and is offset by two parallel, northwest-striking faults. Two holes drilled to test the central part of the zone in 1999 intersected 1.5 to 2 metres intervals of anomalous nickel, copper, cobalt and PGMs.

Near the western shore of Ferguson Lake, hole 11310 cut 13.5 metres grading 0.78% copper, 0.88% nickel and 1.44 grams/tonne PGM (palladium and platinum) plus a lower 5.8 metre interval containing 1.36% copper, 0.50% nickel and 0.69 grams/tonne PGM. As a result a further two holes were drilled through ice-covered Ferguson Lake by the Company in the spring of 2000 in an attempt to further test this part of the zone some 40 metres down-dip of the previous intersections. The first hole was abandoned in lake-bottom sediments; the second hole intersected gabbro host rocks over three intervals, but base and precious metals value were low. This zone was further tested by ten holes in 2003 and 2004 as part of the definition drilling program undertaken in the eastern part of the West Zone. A degree of continuity of grades in sulphide lenses was identified and a part of this zone has been incorporated into the revised resource estimates for the West Zone.

2005 to 2008 Exploration Summary

In 2005, the Company’s exploration work included 16,861 metres of diamond drilling in 29 holes plus surface and airborne geophysical surveys. Ten deep holes (11,213 metres) were drilled on three sections to test the “gap” between the 119 Zone and the known western limits of the West Zone. The 119 Zone itself was tested by an additional two holes (2,116 metres). A total of 17 holes (3,523 metres) were completed in the West Zone “Pit Area”. Eight holes were drilled in an attempt to further define footwall PGM mineralization, while the remaining nine holes (1,140 metres) were drilled at various azimuths to provide information on the continuity and consistency of base and precious metal grades for a geostatistical study.

Of particular interest in terms of low-sulphide, footwall PGM mineralization is the 1 metre length of 12.38 grams per tonne palladium and 8.42 grams per tonne platinum encountered in hole FL05-218. Also of interest is the footwall PGM-enriched sulphide lens intercepts that were intersected below the main massive sulphide lenses in four holes, particularly, the 12.02 metre footwall massive sulphide intercept in hole FL04-220 which in addition to enhanced copper and nickel grades, includes 3.74 grams per tonne palladium and 0.31 grams per tonne platinum.

Geophysical surveys undertaken in 2005 included 9,624 line kilometres of helicopter-borne VTEM (Versatile Time Domain Electromagnetic) and magnetics, and surface and borehole time domain pulse electromagnetic surveys on various parts of the Resource Property by Crone Geophysics and Exploration Ltd. Other work completed in 2005 included ongoing metallurgical testwork on drill core samples directed to the recovery of base metals and platinum group elements.

Much of the 2006 exploratory program at Ferguson Lake was directed at detailed infill diamond drilling of the West Zone Pit, West Zone Mid and Pit Extension, West Zone Main and East Zone II. Some 24,330 metres of core was recovered from 110 holes. Two holes, totalling 211 metres, were drilled to collect samples for metallurgical work, and 19 shallow holes totalling 234 metres were drilled for geotechnical purposes. An additional six holes, totalling 657 metres, were drilled at azimuth grid north to test a south dipping magnetic anomaly (termed the Clarke Plate) located in the West Zone Pit Area. Diamond drilling at Ferguson Lake in 2006 aggregated 24,987 metres.

During the fiscal 2007 drilling season, much of the drilling effort was designed to upgrade more of the existing Infered Mineral Resource into the “Measured and Indicated” categories of resources throughout the West Zone utilizing a recommended closer drill spacing pattern. The 2007 drilling program was also designed to obtain more information about the low sulphide PGM mineralization located in the footwall of the West Zone. In addition to the 116 resource delineation holes, an additional 20 geotechnical holes totaling 246 metres were also completed in this program. This resulted in a record 136 holes drilled totalling 25,023 during the program.

The 2007 mineral resource estimate completed in early 2008, forms the basis of evaluation studies undertaken by Scott Wilson Roscoe Postle Associates Ltd. (“SWRPA”), and is discussed in detail later in this report. This mineral resources estimate utilized the Inco drill results as well as those of the Company’s during the period 1999-2007.

During the fall of 2007, the Company completed a 19 hole drill program in the Main West Zone of Ferguson Lake. This initiative targeted the low-sulphide, PGM style of mineralization hosted in the Ferguson Lake Sulphide Intrusive Complex. This potentially high-grade, low-sulphide mineralization was identified along strike during previous drilling. It is situated approximately 30 to 50 metres below the PGM-bearing massive sulphide Main West Zone lenses in the footwall gabbro unit. The massive sulphide base metal/PGM resource that is currently identified and qualified in Starfield’s NI 43-101 compliant July 2007 filing did not include this deeper, unique PGM mineralization.

In February 2008, the Company released complete fire-assay results from this PGM drill program. The results showed some high concentrations of PGMs. The data indicates significant mineralization at previously under-explored depths, but its extent and continuity are still not known.

Two areas where previous drilling had identified the potential high grade, low sulphide PGM were chosen as prospective targets to test the footwall mineralized horizon in greater detail. The fiscal 2008 drilling program focused on further definition of the geometry and continuity of the low sulphide PGM mineralization through the use of closely spaced drilling, both up and down dip and along strike.

Previous drilling has identified the presence of rhodium at Ferguson Lake (Hole FL02-132 contained a 0.1-metre interval assaying 2.58 grams per tonne). The indications of rhodium at Ferguson Lake were considered to be significant because of the strong price of this commodity. At the time of the release the price of Rhodium was US$9,380 per ounce, which is equivalent to just over US$300 per gram.

In March 2008, the Company announced results of check assays and rhodium assays of this diamond drilling program. The check assays for platinum and palladium verified the prior results and three intersections assayed positive for rhodium, as follows:

| | • | A 1.35 metre thick interval from hole FL07-363 assayed 0.012 grams per tonne of rhodium from a depth of 142.95 metres to 144.30 metres. |

| | • | A 0.75 metre thick interval from hole FL07-374 assayed 0.009 grams per tonne of rhodium from a depth of 254.00 metres to 254.75 metres. |

| | • | A 1.09 metre thick interval from hole Fl07-379 assayed 0.021 grams per tonne rhodium from a depth of 185.35 metres to 186.44 metres. |

Sampling Methods, Security and Analytical Procedures

Previous diamond drilling, core logging and sampling at the Ferguson Lake Property has been supervised and performed by John Nicholson, P.Geo., and Brian Game, P.Geo., both Qualified Persons in accordance with NI 43-101. Current diamond drilling, core logging and sampling at the Ferguson Lake Property are being supervised and performed by Don Cowan, MSc, P.Eng., and Ray Irwin, P.Geo., both Qualified Persons in accordance with NI 43-101.

In May 2007, the Company released a summary of its newly compiled National Instrument 43-101 2007 mineral resource for its Ferguson Lake property in Nunavut, Canada.

Jaime Lavigne, P.Geo., a Qualified Person, has updated the resource estimate to include fiscal 2007’s 116 resource definition diamond drill holes and 20 additional geotechnical holes.

NQ and BQ thin-wall sized core samples are logged and marked for sampling and subsequently halved by diamond saw, with one-half of the core comprising the sample and one-half retained as a rock record in core boxes stored for future reference at the Ferguson Lake camp. The one-half core comprising a sample is tagged, secured and bagged for air shipment from site to the sample preparation laboratories in Vancouver.

Pre-2008 samples are prepared at Acme Analytical Laboratories Ltd. in Vancouver, an ISO accredited laboratory which participates in proficiency testing and quality assurance and control procedures for sample preparation and analysis. Acme issues signed Certificates of Analysis and Assay Reports. The one-half drill core samples from sample intervals of generally one meter in length are crushed, riffle split and pulverized prior to analysis. Splits of massive sulphide samples weighing between 10-15 grams are then fire assayed for platinum and palladium. The doré bead is digested and then platinum and palladium are determined by ICP-ES (Group 6). The massive sulphide samples are also assayed for copper, nickel and cobalt, whereby 0.3g to 1.0g are digested by 4-acid digestion and then analyzed by ICP-ES (Group 7TD).

Low-sulphide PGM samples are analyzed at Acme, where a 30g sample is digested by aqua regia, and then ICP-MS analysis is conducted for a suite of 51 elements plus platinum and palladium (Group 1F-MS). This geochemical ultratrace method allows for a screening of the samples prior to assay determinations being implemented. All samples containing greater than 500ppb palladium and/or 100ppb platinum as determined by ICP-MS are then forwarded for 1AT (29.2g) fire assay determination for platinum and palladium (Group 6). All samples containing greater than 5,000ppm copper and/or 4,000ppm nickel are sent for 4-acid ICP-ES assay determinations (Group 7TD).

In the 2008 program, drill samples were prepared by either Acme Analytical Laboratories, Yellowknife, NWT or by ALS Chemex Laboratories, Yellowknife, NWT with analyses performed at the respective analytical facility located in Vancouver, BC. Check assays were routinely performed on every twentieth sample from each laboratory by SGS Mineral Services in Toronto, ON. All three labs are ISO accredited, meaning that they participate in proficient testing and quality assurance and control procedures for sample preparation and analysis. The 2008 analytical procedure was the same as previously described except that all samples found to contain platinum values greater than 100 ppb and/or palladium values greater than 500 ppb were subsequently fire assay checked using a 1 AT (29.2 g) sample.

Data Verification

Quality control of core samples is maintained by routinely analyzing a number of sample blanks, duplicates and control reference standards of a similar matrix and content as samples provided. Selected high-grade samples are routinely subjected to repeat assay determinations. Interlaboratory checks have been an ongoing part of the Ferguson Lake program since 1999. As noted in the previous section, the facilities of Acme Analytical Laboratories Ltd. have been used for project analyses since 2002, Bondar Clegg was the laboratory of record in 2000 and 2001 and check analyses during those years were performed by ALS Chemex. Between 2001 and 2007, most of the analytical work has been undertaken by Acme, while using ALS Chemex for necessary check analyses. As previously stated, during the 2008 Exploration Program, sample preparation and initial analyses were performed by either Acme Analytical Laboratories or ALS Chemex Laboratories with check analyses performed by SGS Mineral Services I Toronto, ON.

A number of interlaboratory checks of samples have been undertaken over the past several years. An example is the 2004 analytical work undertaken by ALS Chemex of 24 core sample pulps initially analyzed by Acme Laboratories. In summary, the results for copper are virtually identical, while Acme’s nickel values are in general almost 10% higher. Palladium values determined by the two laboratories correspond reasonably well, but there are apparent difficulties in reproducing consistently similar platinum values.

N.C. Carter, Ph.D., P.Eng., undertook a thorough review of 1950s Inco drilling results in late 1999 and has confidence in those results and in the sampling, preparation and analytical procedures used in the more recent drilling programs.

All sample results have been transmitted by the laboratory directly to the designated person at the Company who dispersed the results to the writers of the technical reports for initial review of results and the calculation of weighted average grades for the mineralized intervals encountered in the holes drilled to date. These data have been subsequently reported to the Company on a timely basis.

2008 Mineral Resource Estimates

The information under this heading “Mineral Resource Estimates” is extracted from the 2008 Report. James G. Lavigne estimated the Mineral Resource Estimates which were reported in the 2007 Report and adopted in the 2008 Report. The mineral resource estimates and geostatical analysis were reviewed by James G. Lavigne in the preparation of the 2008 Report, and the 2008 Report concludes that the Mineral Resource Estimate is in compliance with NI 43-101 and the definitions set out by the CIM Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council in December 2005.

Drill Hole Database. Mineral resources have been estimated for the Ferguson Lake Property exclusively from diamond drill hole data. No systematic excavations or surface sampling have been completed that contribute to the resource estimation database. A total of 540 diamond drill holes have been completed on the Resource Property, and include those drilled by Inco during the 1950’s and those drilled by the Company from the period 1999 to 2006, for total metres drilled of 157,219.

Sample and Assay Data. The assay database of mineralized samples used in the resource calculations now numbers a total of 24,371 samples. All of the drill core samples collected by the Company have been analyzed by assay methods for nickel, copper, cobalt, platinum and palladium. In addition, the Company has collected whole rock and trace element geochemical data on selected samples. The Inco samples were initially assayed only for nickel and copper. Subsequent to the Inco field programs at the Ferguson Lake Property (conducted to 1957), Inco re-assayed selected core samples for platinum, palladium, and gold. However, Inco has reported this precious metal data only as a total summation (i.e. platinum+palladium+gold equals total PGM). The total number of samples assayed account for a total of 26,896 metres of core analyzed.

Lithology. Logging by both Inco and the Company included the identification and documentation of rock types. This includes the major distinction between the intrusion, the country rocks to the intrusion, and massive sulphides. The country rocks are broken out into several types of amphibolites, gneisses, and granitic rocks. The intrusion is mainly described as gabbro with lesser hornblendite. Hornblendite is usually spatially associated with massive sulphide. Massive sulphide was broken out as a rock type in the lithological description of the core. Mafic to felsic dykes have been logged as cross cutting the country rocks and the intrusion.

Specific Gravity. During 2002, the specific gravity was determined on 100 core samples. The samples were selected grab samples of core collected to be representative of the major rock types including massive and semi-massive sulphide.

During 2006, the specific gravity has been determined on a total of 1,342 drill core samples at Acme Analytical Laboratories Ltd. during the course of sample processing for base and precious metal analyses. The specific gravity was determined during 2006 using the water immersion method.

Data Verification. In June 2007, R. Dennis Bergen, one of the authors of the 2008 Report visited the Ferguson Lake Property. During that visit, three core samples were collected from areas identified by the Company’s geologist as portions of the resource estimate. The samples collected are not representative of the whole deposit nor were there sufficient samples collected to provide a statistical comparison with the Company’s samples. The analyses undertaken did indicate the presence of copper, nickel, cobalt and palladium in quantities similar to those in the resource estimate, and the presence of palladium was noted.

In addition, during the period September 2006 to November 2006, the author of the 2007 Report visited the Ferguson Lake Property on two occasions for a total of fifteen days on site. During these visits, a number of 2006 as well as historical drill holes were examined and compared with drill log descriptions and assay data. It was concluded that the geological logging and sample descriptions are representative of the lithological units and distribution of sulphide mineralization. The sampling is appropriate for the deposit type, and the assay data is consistent with the sulphide abundance, textures, and mineralogy. Survey procedures used at the Ferguson Lake Property for drill hole location and down hole trajectory are completed to exploration industry standards. It was concluded on the basis of the field visits that the drill hole exploration data collection procedures utilized at the Ferguson Lake Property would support resource estimation to NI 43-101 standards.

The diamond drill programs have been managed for the Company since 1999 by Nicholson and Associates, a professional geological services company based in Vancouver and managed by Professional Geologists. Nicholson and Associates were responsible for data collection, data base management, drilling and analytical QA/QC, and data verification for the Ferguson Lake Property. The author has relied upon Nicholson and Associates for the provision of the verified database for resource modeling. Aspects of drilling, sample security, assaying, data handling and verification are contained in the appropriate sections of this report. Verification of Inco data has been referenced in the Carter Report.

Estimation Methodology

Standards and Scope

The mineral resource estimate for the Ferguson Lake Property has been prepared and reported here in compliance with NI 43-101 for Mineral Resources and Mineral Reserves. James G. Lavigne, Professional Geologist and Qualified Person as defined in NI 43-101, is responsible for the preparation and reporting of the resource estimate. As per NI 43-101, Mineral Reserves estimates can only be based on the results of a preliminary feasibility study or feasibility study of a mineral project. Thus, no reserves have been estimated for the Ferguson Lake Property. As per NI 43-101, Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

Description of Domains

Massive sulphide intersections on the Ferguson Lake Property cover a strike length of approximately 15 kilometres. For the purposes of resource estimation, the Resource Property has been divided into three domains; the East Zone, the Main West Zone, and the West Extension Zone. Drill spacing, and therefore the amount of geological and assay information, is variable across the zones, and, accordingly, different approaches to resource estimation have been utilized.

Main West Zone

The central domain, (the Main West Zone) has been the target of the most detailed drilling and past geostatistical studies, and is the area from which past indicated (and measured) resources have been reported. Drill hole spacing in the Main West Zone is variable from 25 metres in selected test areas of the zone to a maximum of approximately 100 metres. The Pit Area was the object of a past geostatistical resource study and estimation. The drill density and historical work in the West Main Zone supports resource estimation using a geostatistical block model methodology based on a geological interpretation of the intrusion and mineralization.

West Extension and the East Zones

Drilling in the West Extension Zone has intersected mineralization between approximately 600 and 1,200 metres below surface. Drilling has been completed on 200 metre spaced sections, with holes on section spaced irregularly, with an average of approximately 100 metres. All of the drilling in the West Extension Zone has been completed by the Company. Similarly, the East Zone is characterized by comparatively widely spaced drilling but does include clusters of more detailed drilling in specific target areas. The East Zone contains a higher proportion of Inco drill holes. Given the drill hole spacing, a detailed geological model was not created for the West Extension or the East Zones and a polygonal approach to estimation was utilized.

Main West Zone

Geological Model